Execution Version CHAR1\1753057v8 _______________ _________________________________________________ FARMER MAC MORTGAGE SECURITIES CORPORATION as Bond Purchaser GLADSTONE LENDING COMPANY, LLC as Issuer FEDERAL AGRICULTURAL MORTGAGE CORPORATION as...

Execution Version CHAR1\1753057v8 _______________ _________________________________________________ XXXXXX MAC MORTGAGE SECURITIES CORPORATION as Bond Purchaser GLADSTONE LENDING COMPANY, LLC as Issuer FEDERAL AGRICULTURAL MORTGAGE CORPORATION as Guarantor ____________________________________ AMENDED AND RESTATED AGVANTAGE® BOND PURCHASE AGREEMENT ____________________________________ Dated as of December 10, 2020 ________________________________________________________________

CHAR1\1753057v8 AMENDED AND RESTATED AGVANTAGE BOND PURCHASE AGREEMENT AMENDED AND RESTATED AGVANTAGE BOND PURCHASE AGREEMENT, dated as of December 10, 2020, among XXXXXX MAC MORTGAGE SECURITIES CORPORATION (the “Purchaser”), a wholly owned subsidiary of FEDERAL AGRICULTURAL MORTGAGE CORPORATION, a federally-chartered instrumentality of the United States and an institution of the Farm Credit System (“Xxxxxx Mac” or the “Guarantor”); GLADSTONE LENDING COMPANY, LLC, a Delaware limited liability company (the “Issuer”); and Xxxxxx Mac, as Guarantor. RECITALS WHEREAS Issuer wishes from time to time to issue and sell AgVantage Bonds to the Purchaser, and the Purchaser wishes from time to time to purchase such AgVantage Bonds from Issuer, all on the terms and subject to the conditions herein provided; and WHEREAS Xxxxxx Mac is an instrumentality of the United States formed to provide for a secondary market for agricultural real estate mortgages and rural utilities loans, and Issuer is a limited liability company that intends to originate and service agricultural mortgage loans as contemplated in this Agreement; and WHEREAS the Issuer believes it to be in its best interests to issue and sell AgVantage Bonds to obtain funding from Xxxxxx Mac; and WHEREAS Xxxxxx Mac, the Purchaser and Issuer have agreed that the AgVantage Bonds will be guaranteed by Xxxxxx Mac and secured by the pledge of loans secured by first liens on agricultural real estate, as provided herein; and WHEREAS, Xxxxxx Mac, the Purchaser and Issuer previously entered into an AgVantage Bond Purchase Agreement dated as of December 5, 2014 (the “Existing Agreement”) pursuant to which Issuer has sold AgVantage Bonds to the Purchaser; and WHEREAS, Xxxxxx Mac, the Purchaser and Issuer desire to combine, amend and restate the Existing Agreement in this Amended and Restated AgVantage Bond Purchase Agreement effective as of December 10, 2020 to govern all aspects of the terms and conditions governing the rights and obligations of the parties with respect to all AgVantage Bonds issued by Issuer under the Existing Agreement as well as any additional AgVantage Bonds issued by Issuer in the future from time to time under this Amended and Restated AgVantage Bond Purchase Agreement. NOW, THEREFORE, in consideration of the mutual agreements herein contained, Xxxxxx Mac, the Purchaser and Issuer agree as follows: ARTICLE I DEFINITIONS SECTION 1.01. Definitions. As used in this Agreement, the following terms shall have the following meanings:

2 CHAR1\1753057v8 “Agreement” means this Amended and Restated AgVantage Bond Purchase Agreement, as the same may be amended, restated, extended, supplemented or otherwise modified in writing from time to time. “AgVantage Bonds” or “Bonds” means the debt instruments substantially in the form of Annex A hereto issued and sold under this Agreement, or any one or more of them as the context may require, and shall include the Existing Bonds. “Bond Documents” means the Bonds, this Agreement, any Pricing Agreements and the Pledge Agreement. “Bond Interest Rate” means the rate of interest applicable to any particular Bond, as set forth in the applicable Pricing Agreement. “Bond Specific Payment Default” means an Event of Default triggered solely by a payment default of one or more AgVantage Bonds under Section 7.01(a) of this Agreement when no other facts and circumstances exist that have caused an Event of Default under Section 7.01 (other than Section 7.01(a)) to occur and be continuing. “Borrower” means a limited liability company or other entity organized and domiciled under the laws of any state in the United States of America that is principally-owned by the Operating Partnership and affiliated with Issuer (unless otherwise approved by Xxxxxx Mac) and that owns the agricultural real estate securing one or more loans made by Issuer to such Borrower. “Business Day” means any day other than a Saturday, a Sunday, or a day on which any of the Federal Reserve Bank of New York, Xxxxxx Mac’s office in Washington, DC or Issuer’s main office in McLean, Virginia is not open for business. “Capitalized Interest” means interest that is added to the cost of a long-term asset rather than expensed. “Certificate of Pledged Collateral” has the meaning given to that term in the Pledge Agreement. “Change of Control” means Gladstone Management Corporation, a Maryland corporation, or a sub-adviser thereof ceases to be the investment adviser to the REIT and, indirectly, to Gladstone Land Partners, LLC, a Delaware limited liability company, the Operating Partnership or the Issuer at any time during the term of the Bonds. “Closing Date” means the date of the funding of each issuance of AgVantage Bonds hereunder, which date shall be set forth in the applicable Pricing Agreement. “Collateral” has the meaning given to that term in the Pledge Agreement. “Collateral Agent” means Xxxxxx Mac, as collateral agent under the Pledge Agreement, or its successor, as appointed pursuant to the terms set forth in Article 3 of the Pledge Agreement.

3 CHAR1\1753057v8 “Control Party” means (i) the Guarantor, so long as no Guarantor Default has occurred and is continuing, or (ii) the holders of the AgVantage Bonds for so long as a Guarantor Default has occurred and is continuing. “Dollar” or “$” means the lawful money of the United States of America. “EBITDA” means, without duplication, earnings before interest, taxes, depreciation, amortization and aggregate preferred dividend payments to the extent required to be reflected as debt on the REIT’s Financial Statements. “Environmental Laws” means any and all applicable current and future federal, state and local laws and any consent decrees, concessions, permits, grants, franchises, licenses, agreements or other restrictions of a governmental authority or common law causes of action relating to: (a) protection of the environment or natural resources from, or emissions, discharges, releases or threatened releases of, any materials, including Hazardous Materials, in the environment including ambient air, surface, water, ground water or land, (b) the generation, handling, use, labeling, disposal, transportation, reclamation and remediation of Hazardous Materials; (c) human health or safety; (d) the protection of endangered or threatened species; and (e) the protection of environmentally sensitive areas. “Environmental Liability” means any liability, contingent or otherwise (including any liability for damages, costs of environmental remediation, fines, penalties or indemnities), of Issuer or any affiliate of Issuer resulting from or based upon (a) violation of any Environmental Law; (b) the generation, use, handling, transportation, storage, treatment, disposal or permitting or arranging for the disposal of any Hazardous Materials; (c) exposure to any Hazardous Materials; (d) the release or threatened release of any Hazardous Materials; or (e) any contract, agreement or other consensual arrangement pursuant to which liability is assumed or imposed with respect to any of the foregoing. “Equity Offering Proceeds” means the amount of net proceeds of any offerings or issuances of common equity securities (including proceeds from issuances of senior common stock but excluding proceeds from issuances of preferred term stock that is required to be accounted for as debt under GAAP) completed by the REIT after the date hereof, as set forth in the offering documents for any such offerings or issuances; provided, however, that to the extent any amount of such net proceeds are used to retire or redeem any existing or outstanding class or series of equity or debt securities issued by the REIT, or to repay debt otherwise incurred, directly or indirectly, by the REIT, as set forth in the offering documents for any such offerings or issuances, then the Equity Offering Proceeds shall be reduced by that amount; provided further, that to the extent the offering documents for any such offerings or issuances do not clearly identify, in the reasonable judgment of Xxxxxx Mac, the amount of net proceeds used to retire or redeem any existing or outstanding class or series of equity or debt securities issued by the REIT, or to repay debt otherwise incurred, directly or indirectly, by the REIT, then Issuer shall cause the REIT to provide such information as is reasonably requested by Xxxxxx Mac to enable Xxxxxx Mac to perform an accurate calculation of the amount of Equity Offering Proceeds resulting from an offering or issuance of equity securities completed by the REIT. “Event of Default” has the meaning given to that term in Section 7.01.

4 CHAR1\1753057v8 “Existing Bonds” means the bonds set forth on Annex B. “Existing Pricing Agreements” means the pricing agreements set forth on Annex B. “Final Issuance Date” means the earlier of: (a) May 31, 2023; and (b) such date as Xxxxxx Mac determines that a Material Adverse Change has occurred. “Final Maturity Date” means December 31, 2030, or such other date as agreed to by the parties. “Financial Covenants” has the meaning given to that term in Section 5.02. “Financial Statements”, in respect of a Fiscal Year, means the publicly filed consolidated financial statements (including footnotes) of the REIT prepared in accordance with U.S. generally accepted accounting principles for that Fiscal Year as audited by independent certified public accountants selected by the REIT, and in respect of a Fiscal Quarter, means the publicly filed unaudited interim consolidated financial statements of the REIT prepared in accordance with U.S. generally accepted accounting principles for that Fiscal Quarter. “Fiscal Quarter” means each fiscal quarter of the REIT, as such may be changed from time to time, which at the date hereof commence on January 1, April 1, July 1, and October 1 of each calendar year and end on March 31, June 30, September 30, and December 31 of the same calendar year, respectively. “Fiscal Year” means the fiscal year of the REIT, as such may be changed from time to time, which at the date hereof commences on January 1 of each calendar year and ends on December 31 of the same calendar year. “Fixed Charge Coverage Ratio” means the ratio of (a) the sum of, without duplication, the REIT’s (i) aggregate EBITDA as presented in the Financial Statements, for the prior four Fiscal Quarters for which Financial Statements are available, which includes the most recently reported quarter, (ii) aggregate Non-Cash Expenses as presented in the Financial Statements, for the prior four Fiscal Quarters for which Financial Statements are available, which includes the most recently reported quarter, and (iii) aggregate nonrecurring losses (or minus nonrecurring gains) that were accounted for in the calculation of the REIT’s EBITDA as presented in the Financial Statements, for the prior four Fiscal Quarters for which Financial Statements are available, which includes the most recently reported quarter, to (b) the sum of the REIT’s (i) aggregate interest expense as presented in the Financial Statements, for the prior four Fiscal Quarters for which Financial Statements are available, which includes the most recently reported quarter, (ii) aggregate Capitalized Interest, for the prior four Fiscal Quarters for which Financial Statements are available, which includes the most recently reported quarter, (iii) aggregate preferred dividend payments as presented in the Financial Statements, to the extent required to be reflected as debt on the REIT’s Financial Statements, for the prior four Fiscal Quarters for which Financial Statements are available, which includes the most recently reported quarter, (iv) aggregate Lease Payments, for the prior four Fiscal Quarters for which Financial Statements are available, which includes the most recently reported quarter, and (v) aggregate principal amount of all regularly scheduled principal payments on outstanding debt for borrowed money, for the prior four Fiscal Quarters for which Financial Statements are available, which includes the most recently reported quarter.

5 CHAR1\1753057v8 “Goodwill” shall be the aggregate value of the intangible assets held by the REIT, as of the end of each Fiscal Quarter or the Fiscal Year, as applicable, as presented in the Financial Statements, excluding the Intangible Assets. “Guaranteed Obligations” has the meaning given to that term in Section 9.01. “Guarantor Default” means a default by the Guarantor under its obligations pursuant to Article IX which is existing and continuing. “Hazardous Materials” means (a) any explosive or radioactive substances, materials or wastes, (b) any hazardous or toxic substances, materials or wastes, defined or regulated as such in or under, or that could reasonably be expected to give rise to liability under, any applicable Environmental Law, including, asbestos or asbestos containing materials, infectious or medical waste, polychlorinated biphenyls, radon gas, urea-formaldehyde insulation, gasoline or petroleum (including crude oil or any fraction thereof) or petroleum products and (c) all other substances, materials or wastes of any nature regulated under or with respect to which liability or standards of conduct are imposed pursuant to any Environmental Law. “Indemnitee” has the meaning given to that term in Section 8.11(b). “Intangible Assets” means intangible real property assets that are recorded as part of the acquisition of a real property asset, including leasing costs (consisting of leasing commissions and legal fees), in-place lease values and customer relationships, to the extent that such values are included in the line item “Lease intangibles, net” on the consolidated balance sheet of the REIT’s Financial Statements. “Interest Payment Date” means the dates set forth in the Pricing Agreement for Bonds as the interest payment dates therefor; provided, however, that if any such date is not a Business Day, such Interest Payment Date that would otherwise be such date will be the next Business Day following such date. “Land Asset Fair Value Adjustment” means the difference between (i) the then current aggregate fair value of all of the farm properties directly or indirectly owned by the REIT, as reported in the MD&A Section under the Net Asset Value disclosure in the REIT’s quarterly filings with the Securities and Exchange Commission (“SEC”), representing the value of such properties based on independent third-party appraisals, the purchase price paid for recently purchased properties not included in the previous Fiscal Quarter’s Financial Statements, or the REIT’s internal valuation process, as applicable, and (ii) the net cost basis of all of the farm properties directly or indirectly owned by the REIT representing the initial acquisition price (including the costs allocated to both tangible assets and Intangible Assets) plus subsequent improvements and capitalized costs associated with such properties, and adjusted for accumulated depreciation and amortization, as such value is set forth in the applicable Financial Statements of the REIT. In the absence of the Net Asset Value disclosure within the REIT’s quarterly filing, or the absence of a quarterly filing, the aggregate fair value of such farm properties shall be that as found in the REIT’s most recent SEC filing, updated for any appraisals performed since the time of said filing or the addition of any new properties acquired since the time of such filing, which properties, if any, will be included at their respective purchase price(s).

6 CHAR1\1753057v8 “Lease Payments” means payments related to capital leases, as presented, as of the end of each Fiscal Quarter or the Fiscal Year, as applicable, as presented in the Financial Statements. “Leverage Ratio” means the ratio of the REIT’s Total Debt to the REIT’s Total Assets. “Material Adverse Change” means a material adverse change in (i) the financial condition or business of Issuer, the Operating Partnership, or the REIT since the end of the REIT’s most recently completed Fiscal Year for which audited Financial Statements are available and have been provided to Xxxxxx Mac, unless such material adverse change has otherwise been set forth in documents, certificates or financial information furnished to Xxxxxx Mac or publicly filed prior to the date of this Agreement, or (ii) the Issuer’s ability to perform any of its respective obligations under any Bond Document (as applicable). “Minimum Required Collateralization Level” has the meaning given to that term in the Pledge Agreement. “Non-Cash Expenses” means any expenses that were accounted for in the calculation of the REIT’s EBITDA that did not, and are not expected to, result in a disbursement of cash. Non- Cash Expenses may include, but are not limited to, stock-based compensation expense and any other compensation for products or services paid in stock of the REIT or units of the Issuer. The REIT or the Issuer shall inform Xxxxxx Mac of the items included in the Non-Cash Expenses calculation to the extent requested by Xxxxxx Mac. “Nonperforming Assets” means the sum of the unpaid principal balance of all loans owned by Issuer that are 90 or more days delinquent, in foreclosure, or in bankruptcy. “Nonperforming Asset Rate” means the ratio of Nonperforming Assets to the unpaid principal balance of all loans owned by Issuer. “Notice of Requested Borrowing” has the meaning set forth in Section 2.01 hereof. “Operating Partnership” means Gladstone Land Limited Partnership. “Permitted Liens” has the meaning given to that term in the Pledge Agreement. “Person” means an individual, a corporation, a partnership, an association, a trust or any other entity or organization, including a government or political subdivision or an agency or instrumentality thereof. “Pledge Agreement” means the Amended and Restated Pledge and Security Agreement dated as of the date hereof, among Issuer, the Purchaser, Xxxxxx Mac and the Collateral Agent, as the same may be amended, restated, extended, supplemented or otherwise modified in writing from time to time in accordance with the terms thereof. “Pricing Agreement” means the Pricing Agreement for each issuance of Bonds among Xxxxxx Mac, the Purchaser and Issuer substantially in the form of Schedule II attached hereto and shall include the Existing Pricing Agreements.

7 CHAR1\1753057v8 “Qualified Collateral” has the meaning given to that term in the Pledge Agreement. “Qualified Loans” has the meaning given to that term in the Pledge Agreement. “REIT” means the Gladstone Land Corporation, a Maryland corporation, and the consolidated parent company of Issuer. “Related Parties” means, with respect to any Person, such Person’s affiliates and the partners, directors, officers, employees, agents, trustees, administrators, managers, advisors and representatives of such Person and of such Person’s affiliates. “Stockholders’ Equity” shall be the stockholders’ equity of the REIT, as of the end of each Fiscal Quarter or the Fiscal Year, as applicable, as presented in the Financial Statements. “Total Assets” means the sum of (a) the Land Asset Fair Value Adjustment and (b) the total assets as of the end of each Fiscal Quarter or the Fiscal Year, as applicable, as presented in the Financial Statements. “Total Debt” means the total interest-bearing debt of the REIT (including any preferred term stock that is required to be accounted for as debt under GAAP) as of the end of each Fiscal Quarter or the Fiscal Year, as applicable, as presented in the Financial Statements. SECTION 1.02. Principles of Construction. Unless the context shall otherwise indicate, the terms defined in Section 1.01 hereof include the plural as well as the singular and the singular as well as the plural. The words “hereafter”, “herein”, “hereof”, “hereto” and “hereunder”, and words of similar import, refer to this Agreement as a whole and not to any particular Article, Section or other subdivision. The words “include”, “includes” and “including” shall be construed to be followed by the words “without limitation.” References to Exhibits, Articles, Annexes, Sections, Schedules, paragraphs, subparagraphs and clauses shall be construed as references to the Exhibits, Articles, Annexes, Sections, Schedules, paragraphs, subparagraphs and clauses of this Agreement. All accounting terms used and not expressly defined herein shall have the meanings given to them in accordance with United States generally accepted accounting principles, and the term “generally accepted accounting principles” shall mean such accounting principles which are generally accepted at the date or time of any computation or at the date hereof. The descriptive headings of the various articles and sections of this Agreement were formulated and inserted for convenience only and shall not be deemed to affect the meaning or construction of the provisions hereof. ARTICLE II PURCHASE OF BONDS SECTION 2.01. Purchase of Bonds; Minimum Denominations. The Purchaser from time to time in its sole discretion agrees to purchase Bonds, at 100% of their principal amount, before the Final Issuance Date, as requested by Issuer by written notice (each, a “Notice of Requested Borrowing”) and approved by Xxxxxx Mac in an aggregate principal amount, for all Bonds outstanding hereunder at any one time, not in excess of $225,000,000, subject to satisfaction of the conditions set forth herein and agreement between the parties hereto as to the terms of the

13 CHAR1\1753057v8 Agreement, to consummate the transactions contemplated hereby and thereby and to perform each of its obligations hereunder and thereunder; (c) Issuer has taken all necessary limited liability company and other action to authorize the execution and delivery of this Agreement, each of the other Bond Documents and the applicable Pricing Agreement, the consummation by Issuer of the transactions contemplated hereby and thereby and the performance by Issuer of its obligations hereunder and thereunder; (d) this Agreement, each of the other Bond Documents and each applicable Pricing Agreement have been duly authorized, executed and delivered by Issuer and constitute the legal, valid and binding obligations of Issuer, enforceable against Issuer in accordance with their respective terms, subject to: (i) applicable bankruptcy, reorganization, insolvency, moratorium and other laws of general applicability relating to or affecting creditors’ rights generally; and (ii) the application of general principles of equity regardless of whether such enforceability is considered in a proceeding in equity or at law; (e) no approval, consent, authorization, order, waiver, exemption, variance, registration, filing, notification, qualification, license, permit or other action is required to be obtained, given, made or taken, as the case may be, with, from or by any regulatory body, administrative agency or governmental authority having jurisdiction over Issuer or any third party under any agreement to which Issuer is a party to authorize the execution and delivery by Issuer of this Agreement, any of the other Bond Documents or the applicable Pricing Agreement, or the consummation by Issuer of the transactions contemplated hereby or thereby or the performance by each of Issuer of each of its obligations hereunder or thereunder; (f) neither the execution or delivery by Issuer of this Agreement, any of the other Bond Documents or the applicable Pricing Agreement nor the consummation by Issuer of any of the transactions contemplated hereby or thereby nor the performance by Issuer of its obligations hereunder or thereunder, including, without limitation, the pledge of the Collateral to Xxxxxx Mac, conflicts with or will conflict with, violates or will violate, results in or will result in a breach of, constitutes or will constitute a default under, or results in or will result in the imposition of any lien or encumbrance pursuant to any term or provision of the articles of incorporation or the bylaws of Issuer or any provision of any existing law or any rule or regulation currently applicable to Issuer or any judgment, order or decree of any court or any regulatory body, administrative agency or governmental authority having jurisdiction over Issuer or the terms of any mortgage, indenture, contract or other agreement to which Issuer is a party or by which Issuer or any of each of its properties is bound; (g) there is no action, suit, proceeding or investigation before or by any court or any regulatory body, administrative agency or governmental authority presently pending or, to the actual knowledge of Issuer, threatened with respect to Issuer, this Agreement, any of the other Bond Documents or the applicable Pricing Agreement challenging the validity or enforceability of this Agreement, any of the other Bond Documents or the

16 CHAR1\1753057v8 (e) the commencement by Issuer, the Operating Partnership or the REIT of proceedings to be adjudicated a bankrupt or insolvent, or the consent by Issuer, the Operating Partnership or the REIT to the institution of bankruptcy or insolvency proceedings against it, or the filing by Issuer, the Operating Partnership or the REIT of a petition or answer or consent seeking reorganization or relief under the Federal Bankruptcy Act or any other applicable Federal or State law or law of the District of Columbia, or the consent by Issuer, the Operating Partnership or the REIT to the filing of any such petition or to the appointment of receiver, liquidator, assignee, trustee, sequestrator (or similar official) of Issuer, the Operating Partnership or the REIT or of any substantial part of its property, or the making by Issuer, the Operating Partnership or the REIT of an assignment for the benefit of creditors, or the admission by Issuer, the Operating Partnership or the REIT in writing of its inability to pay its debts generally as they become due, or the taking of limited liability company action by Issuer, the Operating Partnership or the REIT in furtherance of any such action; (f) a failure by Issuer to maintain the Minimum Required Collateralization Level, if Issuer does not cure such action, occurrence or event within 30 Business Days of the earlier of (i) receipt of written notice from Xxxxxx Mac requesting that it be cured, or (ii) the first day on which Issuer becomes aware of such failure; (g) a failure or breach by the REIT to comply with any of the Financial Covenants set forth herein, provided that the REIT shall have thirty (30) calendar days following written identification by Xxxxxx Mac as to related failure or breach to cure the same; (h) the occurrence of a Change of Control without Xxxxxx Mac’s prior written consent; (i) a default past any applicable cure period under any mortgage, deed of trust, indenture, instrument or agreement under which there may be issued or by which there may be secured or evidenced any indebtedness for money borrowed by the REIT or any subsidiary of the REIT, whether such indebtedness now exists or is created after the date hereof, if the principal amount of such indebtedness, together with the principal amount of any other such indebtedness under which there has been a default, exceeds $50,000,000; or (j) any final judgment or order (not covered by insurance) for the payment of money in excess of $50,000,000 in the aggregate for all such final judgments or orders (treating any deductibles, self-insurance or retention as not so covered) shall be rendered against the REIT or any subsidiary of the REIT and shall not be paid or discharged, and there shall be any period of sixty (60) consecutive calendar days following entry of the final judgment or order that causes the aggregate amount for all such final judgments or orders outstanding and not paid or discharged against the REIT or any subsidiary of the REIT to exceed $50,000,000 during which a stay of enforcement of such final judgment or order, by reason of a pending appeal or otherwise, shall not be in effect.

17 CHAR1\1753057v8 SECTION 7.02. Acceleration. Upon the occurrence, and during the continuance, of an Event of Default, Xxxxxx Mac may, upon written notice to that effect to Issuer, declare the entire principal amount of, and accrued interest on, the Bonds at the time outstanding to be immediately due and payable. Notwithstanding the foregoing, if a Bond Specific Payment Default has occurred and is continuing with respect to one or more Bonds, Xxxxxx Mac agrees to forbear from enforcing its rights in the Qualified Loans supporting other Bonds issued hereunder for which there is no Bond Specific Payment Default, which forbearance shall be for a period of 30 calendar days after the Bond Specific Payment Default has occurred, during which time Issuer shall have the opportunity to cure such item. SECTION 7.03. Remedies Not Exclusive. Upon the occurrence, and during the continuance, of an Event of Default, Xxxxxx Mac shall be entitled to take such other action as is provided for by law, in this Agreement, or in any of the other Bond Documents, including injunctive or other equitable relief. ARTICLE VIII MISCELLANEOUS SECTION 8.01. GOVERNING LAW. (a) EXCEPT AS SET FORTH IN SECTION 9.01 HEREOF, THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, FEDERAL LAW. TO THE EXTENT FEDERAL LAW INCORPORATES STATE LAW, THAT STATE LAW SHALL BE THE LAWS OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS MADE AND PERFORMED THEREIN. (b) EACH PARTY TO THIS AGREEMENT SUBMITS FOR ITSELF AND IN CONNECTION WITH ITS PROPERTIES, GENERALLY AND UNCONDITIONALLY, TO THE NONEXCLUSIVE JURISDICTION OF THE UNITED STATES FEDERAL COURT LOCATED IN THE CITY OF NEW YORK, BOROUGH OF MANHATTAN, FOR PURPOSES OF ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. EACH PARTY TO THIS AGREEMENT IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY LAW, ANY OBJECTION WHICH IT MAY NOW OR HEREAFTER HAVE TO THE LAYING OF THE VENUE OF ANY SUCH PROCEEDING BROUGHT IN SUCH A COURT AND ANY CLAIM THAT ANY SUCH PROCEEDING BROUGHT IN SUCH A COURT HAS BEEN BROUGHT IN AN INCONVENIENT FORUM. EACH PARTY TO THIS AGREEMENT HEREBY CONSENTS TO PROCESS BEING SERVED IN ANY SUIT, ACTION OR PROCEEDING WITH RESPECT TO THIS AGREEMENT, OR ANY DOCUMENT DELIVERED PURSUANT HERETO, BY THE MAILING OF A COPY THEREOF, BY REGISTERED OR CERTIFIED MAIL, POSTAGE PREPAID, RETURN RECEIPT REQUESTED, TO ITS RESPECTIVE ADDRESS SPECIFIED AT THE TIME FOR NOTICES UNDER THIS AGREEMENT OR TO ANY OTHER ADDRESS OF WHICH IT SHALL HAVE GIVEN WRITTEN NOTICE TO THE OTHER PARTY HERETO. THE FOREGOING SHALL NOT LIMIT THE ABILITY OF

20 CHAR1\1753057v8 thereof (whether or not the transactions contemplated hereby or thereby shall be consummated) and (ii) all reasonable and documented out of pocket expenses incurred by the Purchaser, the Collateral Agent or Xxxxxx Mac (including the fees, charges and disbursements of any counsel for the Purchaser, the Collateral Agent or Xxxxxx Mac), in connection with the enforcement or protection of its rights (A) in connection with this Agreement and the other Bond Documents, including its rights under this Section, or (B) in connection with the Bonds purchased hereunder, including all such out of pocket expenses incurred during any workout, restructuring or negotiations in respect of such Bonds. (b) Indemnification by the Issuer. The Issuer shall indemnify the Purchaser, the Collateral Agent (and any sub-agent thereof) and Xxxxxx Mac, and each Related Party of any of the foregoing Persons (each such Person being called an “Indemnitee”) against, and hold each Indemnitee harmless from, any and all losses, claims, damages, liabilities and related expenses (including the fees, charges and disbursements of any counsel for any Indemnitee) incurred by any Indemnitee or asserted against any Indemnitee by any Person (including the Issuer or any affiliate of the Issuer and the expense of investigation) other than such Indemnitee and its Related Parties arising out of, in connection with, or as a result of (i) the execution or delivery of this Agreement, any other Bond Document or any agreement or instrument contemplated hereby or thereby, the performance by the parties hereto of their respective obligations hereunder or thereunder or the consummation of the transactions contemplated hereby or thereby, (ii) the issuance of any Bond by Issuer or the use or proposed use of the proceeds therefrom, (iii) any actual or alleged presence or release of Hazardous Materials on or from any property owned or operated by the Issuer or any of its affiliates, or any Environmental Liability related in any way to the Issuer or any of its affiliates, or (iv) any actual or prospective claim, litigation, investigation or proceeding relating to any of the foregoing, whether based on contract, tort or any other theory, whether brought by a third party or by the Issuer or any of its affiliates, and regardless of whether any Indemnitee is a party thereto; provided that such indemnity shall not, as to any Indemnitee, be available to the extent that such losses, claims, damages, liabilities or related expenses (x) result from a dispute solely between Indemnitees and not (1) involving any action or inaction by the Issuer or any of its affiliates or (2) relating to any action of such Indemnitee in its capacity as Collateral Agent, (y) are determined by a court of competent jurisdiction by final and nonappealable judgment to have resulted from the gross negligence or willful misconduct of such Indemnitee or (z) result from a claim brought by the Issuer or any of its affiliates against an Indemnitee for breach in bad faith of such Indemnitee's obligations hereunder or under any other Bond Document, if the Issuer or such affiliate has obtained a final and nonappealable judgment in its favor on such claim as determined by a court of competent jurisdiction. (c) Waiver of Consequential Damages, Etc. To the fullest extent permitted by applicable law, the Issuer shall not assert, and hereby waives, any claim against any Indemnitee, on any theory of liability, for special, indirect, consequential or punitive damages (as opposed to direct or actual damages) arising out of, in connection with, or as a result of, this Agreement, any other Bond Document or any agreement or instrument contemplated hereby, the transactions contemplated hereby or thereby, any Bond or the use of the proceeds thereof. No Indemnitee referred to in this Section 8.11 shall be liable for

22 CHAR1\1753057v8 represented thereby, and all demands whatsoever, and covenants that the guarantee will not be discharged except upon complete irrevocable payment of the principal and interest obligations represented by the Bonds. (c) The Guarantor shall be subrogated to and is hereby assigned all rights of the holder of the Bonds against Issuer and the proceeds of the Qualified Collateral, all in respect of any amounts paid by the Guarantor pursuant to the provisions of the guarantee contained in this Article IX. Each holder shall execute and deliver to the Guarantor in each holder’s name such instruments and documents as the Guarantor may reasonably request in writing confirming or evidencing such subrogation and assignment. (d) No reference herein shall alter or impair the guarantee, which is absolute and unconditional, of the due and punctual payment of principal of, and interest on, the Bonds, on the dates such payments are due. (e) The guarantee is not an obligation of, and is not a guarantee as to principal or interest by the Farm Credit Administration, the United States or any other agency or instrumentality of the United States (other than the Guarantor). (f) The guarantee shall be governed by, and construed in accordance with, Federal law. To the extent Federal law incorporates state law, that state law shall be the laws of the State of New York applicable to contracts made and performed therein. SECTION 9.02. Control by the Guarantor. If the Guarantor is the Control Party, the Guarantor shall be considered the holder of all Bonds outstanding for all purposes under the Pledge Agreement and shall be permitted to take any and all actions permitted to be taken by the holder thereunder. The Control Party will have the sole right to direct the time, method and place of conducting any proceeding for any remedy available to the Collateral Agent or any holder with respect to the Bonds or exercising any power conferred on the Collateral Agent with respect to the Bonds provided that: (a) such direction shall not be in conflict with any rule of law or with the Pledge Agreement; (b) the Collateral Agent shall have been provided with indemnity from the Control Party reasonably satisfactory to it; and (c) the Collateral Agent may take any other action deemed proper by such Collateral Agent that is not inconsistent with such direction, provided, however, that the Collateral Agent need not take any action which it determines might expose it to liability. [SIGNATURE PAGE FOLLOWS]

Sch. I – pg. 1 CHAR1\1753057v8 SCHEDULE I TO BOND PURCHASE AGREEMENT Addresses for Notices 1. The addresses referred to in Section 8.03 hereof, for purposes of delivering demands, instructions, notices or other communications, are as follows: If to the Purchaser or Xxxxxx Mac: Federal Agricultural Mortgage Corporation 0000 X Xxxxxx, XX, 0xx Xxxxx Xxxxxxxxxx, XX 00000 Fax: 000-000-0000 Email: Xxxxxxxx@xxxxxxxxx.xxx Attention of: Director – Investments and Institutional Business Development With a copy to: Federal Agricultural Mortgage Corporation 0000 X Xxxxxx, XX, 0xx Xxxxx Xxxxxxxxxx, XX 00000 Fax: 000-000-0000 Email: Xxxxxxxx@xxxxxxxxx.xxx Attention of: Capital Markets Group With a copy also to: Federal Agricultural Mortgage Corporation 0000 X Xxxxxx, XX, 0xx Xxxxx Xxxxxxxxxx, XX 00000 Fax: 000-000-0000 Email: xxxxx@xxxxxxxxx.xxx Attention of: General Counsel If to Issuer: Gladstone Lending Company, LLC c/o Gladstone Land Corporation 0000 Xxxxxxxxxx Xxxxx, Xxxxx 000 XxXxxx, Xxxxxxxx 00000 Fax: 000-000-0000 Attn: Xxxxxxx Xxxxxxx With copy to: Gladstone Lending Company, LLC

Sch. I – pg. 2 CHAR1\1753057v8 c/o Gladstone Land Corporation 0000 Xxxxxxxxxx Xxxxx, Xxxxx 000 XxXxxx, Xxxxxxxx 00000 Fax: 000-000-0000 Attn: Xxxxx Xxxxxxx and Xxx Xxxxxxxx With a copy also to: Xxxx Xxxxx & Xxxx PLC 000 Xxxxxxx Xxxxx, Xxxxx 0000 Xxxxxxx, XX 00000 Fax: 000-000-0000 Attention: Xxxxxx X. XxXxxxxx, Xx.

Sch. II – pg. 1 CHAR1\1753057v8 SCHEDULE II TO AGVANTAGE BOND PURCHASE AGREEMENT FORM OF PRICING AGREEMENT The Federal Agricultural Mortgage Corporation, a federally chartered instrumentality of the United States and an institution of the Farm Credit System (“Xxxxxx Mac”), Xxxxxx Mac Mortgage Securities Corporation, a wholly owned subsidiary of Xxxxxx Mac (the “Purchaser”), and Gladstone Lending Company, LLC (“Issuer”), a Delaware corporation, agree that, on ____________ __, 20__ (the “Closing Date”), the Purchaser will purchase from Issuer and Issuer will sell to the Purchaser $________ aggregate principal amount of [Fixed Rate] [Floating Rate] AgVantage Bonds (the “Bonds”) with the following terms: Bond Interest Rate: [If interest on such Floating Rate Bonds is calculated based on the London Interbank Offered Rate for U.S. Dollar deposits (“LIBOR”) and if LIBOR shall be less than zero, such rate shall be deemed zero for purposes of this Pricing Agreement. Xxxxxx Mac does not warrant, nor accept responsibility, nor any liability with respect to the administration, submission or any other matter related to the rates in the definition of “LIBOR” or with respect to any comparable or successor rate thereto. Notwithstanding the foregoing, if interest on such Floating Rate Bonds is calculated based on LIBOR and if Xxxxxx Mac determines that a Benchmark Transition Event (as defined on Schedule I hereto) has occurred, or upon an Early Opt-In Election (as defined on Schedule I hereto), then LIBOR shall be replaced by the Benchmark Replacement (as defined on Schedule I hereto) in accordance with the procedures set forth in Schedule I hereto.] [Initial Bond Interest Rate: ] [Floating Rate Index: ] [Interest Rate Margin: ] [Interest Rate Reset Dates: ] Interest Payment Dates: Interest Periods: [The Bonds may not be prepaid at any time.][The Bonds may not be prepaid prior to ___________ __, 20__. On or after __, 20__ the Bonds may be prepaid on the scheduled call dates set forth herein, in whole [only] [or in part], at the option of Issuer, according to the terms of the Bond Purchase Agreement (as defined below).][The Bonds may be prepaid in whole [only] [or in part] at any time.] [Scheduled call dates: ] Maturity Date:

Sch. II – pg. 2 CHAR1\1753057v8 The Bonds shall be obligations of Issuer. The issuance and sale of the Bonds by Issuer to the Purchaser shall (i) be conditional upon the successful completion by Xxxxxx Mac of a separate offering of debt securities on the Closing Date, the proceeds of which it is contemplated will be used by the Purchaser to finance the purchase of the Bonds and (ii) occur under the terms and conditions of the Amended and Restated AgVantage Bond Purchase Agreement, dated as of December 10, 2020, among Xxxxxx Mac, the Purchaser and Issuer (as amended, restated, extended, supplemented or otherwise modified in writing from time to time, the “Bond Purchase Agreement”). All of the provisions contained in the Bond Purchase Agreement are hereby incorporated by reference in their entirety and shall be deemed to be a part of this Pricing Agreement to the same extent as if such provisions had been set forth in full herein. Capitalized terms used herein and not defined herein shall have the meanings given to those terms in the Bond Purchase Agreement. This Pricing Agreement may be executed in two or more counterparts. In the event of any inconsistency between the terms of this Pricing Agreement and the Bond Purchase Agreement, the terms of this Pricing Agreement shall apply.

Sch. II – pg. 3 CHAR1\1753057v8 Agreed to this __ day of _________________, 20__. Federal Agricultural Mortgage Corporation By: ___________________________________ Name: Title: Xxxxxx Mac Mortgage Securities Corporation By: ___________________________________ Name: Title: Gladstone Lending Company, LLC, a Delaware limited liability company By: Gladstone Land Limited Partnership, a Delaware limited partnership, its sole member and manager By: Gladstone Land Partners, LLC, a Delaware limited liability company, its General Partner By: Gladstone Land Corporation, a Maryland corporation, its Manager By: ___________________________________ Name: Title:

Sch. II – pg. 4 CHAR1\1753057v8 SCHEDULE I TO PRICING AGREEMENT BENCHMARK REPLACEMENT SETTING (a) Benchmark Replacement. Notwithstanding anything to the contrary herein or in any other Bond Document, if a Benchmark Transition Event or an Early Opt-in Election, as applicable, and its related Benchmark Replacement Date have occurred prior to the Reference Time in respect of any setting of the then-current Benchmark, then (x) if a Benchmark Replacement is determined in accordance with clause (1) or (2) of the definition of “Benchmark Replacement” for such Benchmark Replacement Date, such Benchmark Replacement will replace such Benchmark for all purposes hereunder and under any Bond Document in respect of such Benchmark setting and subsequent Benchmark settings without any amendment to, or further action or consent of any other party to, the Bond Purchase Agreement or any other Bond Document and (y) if a Benchmark Replacement is determined in accordance with clause (3) of the definition of “Benchmark Replacement” for such Benchmark Replacement Date, such Benchmark Replacement will replace such Benchmark for all purposes hereunder and under any Bond Document in respect of any Benchmark setting at or after 5:00 p.m. (New York City time) on the fifth (5th) Business Day after the date notice of such Benchmark Replacement is provided to the Issuer without any amendment to, or further action or consent of any other party to, the Bond Purchase Agreement or any other Bond Document so long as Xxxxxx Mac has not received, by such time, written notice of objection to such Benchmark Replacement from the Issuer. (b) Benchmark Replacement Conforming Changes. In connection with the implementation of a Benchmark Replacement, Xxxxxx Mac will have the right to make Benchmark Replacement Conforming Changes from time to time and, notwithstanding anything to the contrary herein or in any other Bond Document, any amendments implementing such Benchmark Replacement Conforming Changes will become effective without any further action or consent of any other party to the Bond Purchase Agreement or any other Bond Document. (c) Notices; Standards for Decisions and Determinations. Xxxxxx Mac will promptly notify the Issuer of (i) any occurrence of a Benchmark Transition Event or an Early Opt-in Election, as applicable, and its related Benchmark Replacement Date, (ii) the implementation of any Benchmark Replacement, (iii) the effectiveness of any Benchmark Replacement Conforming Changes, (iv) the removal or reinstatement of any tenor of a Benchmark pursuant to clause (d) below and (v) the commencement or conclusion of any Benchmark Unavailability Period. Any determination, decision or election that may be made by Xxxxxx Mac pursuant to this Schedule titled “Benchmark Replacement Setting,” including any determination with respect to a tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection, will be conclusive and binding absent manifest error and may be made in its or their sole discretion and without consent from any other

Sch. II – pg. 6 CHAR1\1753057v8 “Benchmark Replacement” means, for any Available Tenor, the first alternative set forth in the order below that can be determined by Xxxxxx Mac for the applicable Benchmark Replacement Date: (1) the sum of: (a) Term SOFR and (b) the related Benchmark Replacement Adjustment; (2) the sum of: (a) Daily Simple SOFR and (b) the related Benchmark Replacement Adjustment; (3) the sum of: (a) the alternate benchmark rate that has been selected by Xxxxxx Mac as the replacement for the then-current Benchmark for the applicable Corresponding Tenor giving due consideration to (i) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (ii) any evolving or then-prevailing market convention for determining a benchmark rate as a replacement for the then-current Benchmark for U.S. dollar-denominated syndicated or bilateral credit facilities at such time and (b) the related Benchmark Replacement Adjustment; provided that, in the case of clause (1), such Unadjusted Benchmark Replacement is displayed on a screen or other information service that publishes such rate from time to time as selected by Xxxxxx Mac in its reasonable discretion. If the Benchmark Replacement as determined pursuant to clause (1), (2) or (3) above would be less than the Floor, the Benchmark Replacement will be deemed to be the Floor for the purposes of this Pricing Agreement and the other Bond Documents. “Benchmark Replacement Adjustment” means, with respect to any replacement of the then-current Benchmark with an Unadjusted Benchmark Replacement for any applicable interest period and Available Tenor for any setting of such Unadjusted Benchmark Replacement: (1) for purposes of clauses (1) and (2) of the definition of “Benchmark Replacement,” the first alternative set forth in the order below that can be determined by Xxxxxx Mac: (a) the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) as of the Reference Time such Benchmark Replacement is first set for such interest period that has been selected or recommended by the Relevant Governmental Body for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for the applicable Corresponding Tenor; (b) the spread adjustment (which may be a positive or negative value or zero) as of the Reference Time such Benchmark Replacement is first set for such interest period that would apply to the fallback rate for a derivative transaction referencing the ISDA

Sch. II – pg. 7 CHAR1\1753057v8 Definitions to be effective upon an index cessation event with respect to such Benchmark for the applicable Corresponding Tenor; and (2) for purposes of clause (3) of the definition of “Benchmark Replacement,” the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by Xxxxxx Mac for the applicable Corresponding Tenor giving due consideration to (i) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body on the applicable Benchmark Replacement Date or (ii) any evolving or then-prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar denominated syndicated or bilateral credit facilities; provided that, in the case of clause (1) above, such adjustment is displayed on a screen or other information service that publishes such Benchmark Replacement Adjustment from time to time as selected by Xxxxxx Mac in its reasonable discretion. “Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of “Business Day” in the Bond Purchase Agreement, timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, length of lookback periods, the applicability of breakage provisions, and other technical, administrative or operational matters) that Xxxxxx Mac decides may be appropriate to reflect the adoption and implementation of such Benchmark Replacement and to permit the administration thereof by Xxxxxx Mac in a manner substantially consistent with market practice (or, if Xxxxxx Mac decides that adoption of any portion of such market practice is not administratively feasible or if Xxxxxx Mac determines that no market practice for the administration of such Benchmark Replacement exists, in such other manner of administration as Xxxxxx Mac decides is reasonably necessary in connection with the administration of this Pricing Agreement and the other Bond Documents). “Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark: (1) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of such Benchmark (or the published component

Sch. II – pg. 8 CHAR1\1753057v8 used in the calculation thereof) permanently or indefinitely ceases to provide all Available Tenors of such Benchmark (or such component thereof); (2) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein; or (3) in the case of an Early Opt-in Election, the sixth (6th) Business Day after the date notice of such Early Opt-in Election is provided to the Issuer, so long as Xxxxxx Mac has not received, by 5:00 p.m. (New York City time) on the fifth (5th) Business Day after the date notice of such Early Opt-in Election is provided to the Issuer, written notice of objection to such Early Opt-in Election from the Issuer. For the avoidance of doubt, (i) if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination and (ii) the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (1) or (2) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then-current Available Tenors of such Benchmark (or the published component used in the calculation thereof). “Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark: (1) a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); (2) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the Board of Governors of the Federal Reserve System, the Federal Reserve Bank of New York, an insolvency official with jurisdiction over the administrator for such Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such component), which states that the administrator of such Benchmark (or such component) has ceased

Sch. II – pg. 9 CHAR1\1753057v8 or will cease to provide all Available Tenors of such Benchmark (or such component thereof) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); or (3) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that all Available Tenors of such Benchmark (or such component thereof) are no longer representative. For the avoidance of doubt, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set forth above has occurred with respect to each then-current Available Tenor of such Benchmark (or the published component used in the calculation thereof). “Benchmark Unavailability Period” means the period (if any) (x) beginning at the time that a Benchmark Replacement Date pursuant to clauses (1) or (2) of that definition has occurred if, at such time, no Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Bond Document in accordance with this Schedule titled “Benchmark Replacement Setting” and (y) ending at the time that a Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Bond Document in accordance with this Schedule titled “Benchmark Replacement Setting.” “Corresponding Tenor” with respect to any Available Tenor means, as applicable, either a tenor (including overnight) or an interest payment period having approximately the same length (disregarding business day adjustment) as such Available Tenor. “Daily Simple SOFR” means, for any day, SOFR, with the conventions for this rate (which will include a lookback) being established by Xxxxxx Mac in accordance with the conventions for this rate selected or recommended by the Relevant Governmental Body for determining “Daily Simple SOFR” for business loans; provided, that if Xxxxxx Mac decides that any such convention is not administratively feasible for Xxxxxx Mac, then Xxxxxx Mac may establish another convention in its reasonable discretion. “Early Opt-in Election” means, if the then-current Benchmark is LIBOR, the occurrence of: (1) a determination by Xxxxxx Mac that at least five currently outstanding U.S. dollar-denominated syndicated or bilateral credit facilities at such time contain (as a result of amendment or as originally executed) a SOFR-based rate (including SOFR, a term SOFR or any other rate based upon SOFR) as a benchmark rate (and such credit facilities are identified in

Sch. II – pg. 10 CHAR1\1753057v8 the notice to the Issuer described in clause (2) and are publicly available for review), and (2) the election by Xxxxxx Mac to trigger a fallback from LIBOR and the provision by Xxxxxx Mac of written notice of such election to the Issuer. “Floor” means the benchmark rate floor, if any, provided in this Pricing Agreement initially (as of the execution of this Pricing Agreement, the modification, amendment or renewal of this Pricing Agreement or otherwise) with respect to LIBOR. “ISDA Definitions” means the 2006 ISDA Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time by the International Swaps and Derivatives Association, Inc. or such successor thereto. “Reference Time” with respect to any setting of the then-current Benchmark means (1) if such Benchmark is LIBOR, 11:00 a.m. (London time) on the day that is two London banking days preceding the date of such setting, and (2) if such Benchmark is not LIBOR, the time determined by Xxxxxx Mac in its reasonable discretion. “Relevant Governmental Body” means the Board of Governors of the Federal Reserve System or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Board of Governors of the Federal Reserve System or the Federal Reserve Bank of New York, or any successor thereto. “SOFR” means, with respect to any Business Day, a rate per annum equal to the secured overnight financing rate for such Business Day published by the SOFR Administrator on the SOFR Administrator’s Website on the immediately succeeding Business Day. “SOFR Administrator” means the Federal Reserve Bank of New York (or a successor administrator of the secured overnight financing rate). “SOFR Administrator’s Website” means the website of the Federal Reserve Bank of New York, currently at xxxx://xxx.xxxxxxxxxx.xxx, or any successor source for the secured overnight financing rate identified as such by the SOFR Administrator from time to time. “Term SOFR” means, for the applicable Corresponding Tenor as of the applicable Reference Time, the forward-looking term rate based on SOFR that has been selected or recommended by the Relevant Governmental Body. “Unadjusted Benchmark Replacement” means the applicable Benchmark Replacement excluding the related Benchmark Replacement Adjustment.

Annex A – pg. 1 CHAR1\1753057v8 ANNEX A [FORM OF BOND] GLADSTONE LENDING COMPANY, LLC [__% Fixed][Floating] Rate Senior AgVantage Bond due ______________ __________________, 20__ FOR VALUE RECEIVED, the undersigned, GLADSTONE LENDING COMPANY, LLC (the “Issuer”), hereby promises to pay to XXXXXX MAC MORTGAGE SECURITIES CORPORATION, a wholly owned subsidiary of Xxxxxx Mac (as defined below) (the “Purchaser”), or registered assigns, the principal sum of ________________ MILLION DOLLARS ($___,000,000.00) on ____________________________, together with interest computed from the date hereof according to the terms of the Bond Purchase Agreement (as defined below). Payments of principal and interest on this Bond are to be made in lawful money of the United States of America at such place as shall have been designated by written notice to Issuer from the registered holder of this Bond as provided in the Bond Purchase Agreement referred to below. This Bond is issued pursuant to an Amended and Restated AgVantage Bond Purchase Agreement, dated as of December 10, 2020, as well as the Pricing Agreement for $_______ [__% Fixed][Floating] Rate Bonds dated as of ___________ __, 20__ (together, as amended, restated, extended, supplemented or otherwise modified in writing from time to time, the “Bond Purchase Agreement”), among the Issuer, the Purchaser and Federal Agricultural Mortgage Corporation (“Xxxxxx Mac”), and is entitled to the benefits thereof. This Bond is also entitled to the benefits of the Amended and Restated Pledge and Security Agreement, dated as of December 10, 2020, as from time to time amended, supplemented or otherwise modified in writing, among the Issuer, the Purchaser, Xxxxxx Mac and the Collateral Agent named therein. Capitalized terms used herein and not defined herein shall have the meanings given to those terms in the Bond Purchase Agreement. This Bond is a registered Bond and, upon surrender of this Bond for registration of transfer or exchange, accompanied by a written instrument of transfer duly executed by the registered holder hereof or such holder’s attorney duly authorized in writing, a new Bond will be issued to, and registered in the name of, the transferee. Prior to due presentment for registration of transfer, Issuer may treat the person in whose name this Bond is registered as the owner hereof for the purpose of receiving payment and for all other purposes, and Issuer will not be affected by any notice to the contrary. This Bond is the obligation of the Issuer. [This Bond may not be prepaid at any time.][This Bond may not be prepaid prior to _____________ __, 20__. On or after ____________ __, 20__ this Bond may be prepaid at any time, in whole [only] [or in part], at the option of Issuer, according to the terms of the Bond Purchase Agreement and provided that, if such optional prepayment is made on a date other than

Annex A – pg. 2 CHAR1\1753057v8 an Interest Payment Date, accrued interest on the principal amount hereof that is being prepaid shall be payable through and excluding the date such optional prepayment is made.][This Bond is prepayable at any time by Issuer, in whole [only] [or in part] at the option of Issuer on the terms set forth in the Bond Purchase Agreement.] If an Event of Default, as defined in the Bond Purchase Agreement, occurs and is continuing, the principal of this Bond may be declared due and payable in the manner, at the price and with the effect provided in the Bond Purchase Agreement. This Bond shall be construed and enforced in accordance with, and the rights of Issuer and the holder hereof shall be governed by, the laws of the State of New York, excluding choice-of- law principles of the law of the State of New York that would require the application of the laws of another jurisdiction. GLADSTONE LENDING COMPANY, LLC, a Delaware limited liability company By: GLADSTONE LAND LIMITED PARTNERSHIP, a Delaware limited partnership, its sole member and manager By: GLADSTONE LAND PARTNERS, LLC, a Delaware limited liability company, its General Partner By: GLADSTONE LAND CORPORATION, a Maryland corporation, its Manager By: ___________________________________ Name: Title:

Annex B – pg. 1 CHAR1\1753057v8 ANNEX B EXISTING BONDS AND EXISTING PRICING AGREEMENTS Xxxxxx Mac Bond ID Amount Interest Rate Closing Date Maturity Date 2015-5 $3,210,000.00 3.29% 12/22/2015 12/22/2022 2016-1 $4,431,000.00 2.98% 3/3/2016 2/24/2023 2016-2 $11,100,000.00 3.08% 3/3/2016 2/24/2023 2016-3 $1,020,000.00 2.87% 8/22/2016 8/22/2023 2017-2 $8,100,000.00 3.63% 1/12/2017 1/12/2024 2017-3 $8,100,000.00 3.53% 1/12/2017 1/12/2023 2017-4 $8,100,000.00 3.36% 1/12/2017 1/12/2022 2017-5 $3,225,000.00 4.05% 8/30/2017 8/30/2024 2018-1 $1,260,000.00 4.47% 3/13/2018 3/13/2028 2018-2 $10,356,000.00 4.45% 7/30/2018 7/24/2025 2018-3 $7,050,000.00 4.06% 8/17/2018 8/17/2021 2018-4 $4,110,000.00 4.57% 9/13/2018 9/13/2028 2019-1 $3,285,000.00 2.61% 12/11/2019 12/11/2020 2019-2 $10,568,000.00 2.61% 12/11/2019 12/11/2020 2020-1 $8,100,000.00 2.66% 1/10/2020 1/12/2024

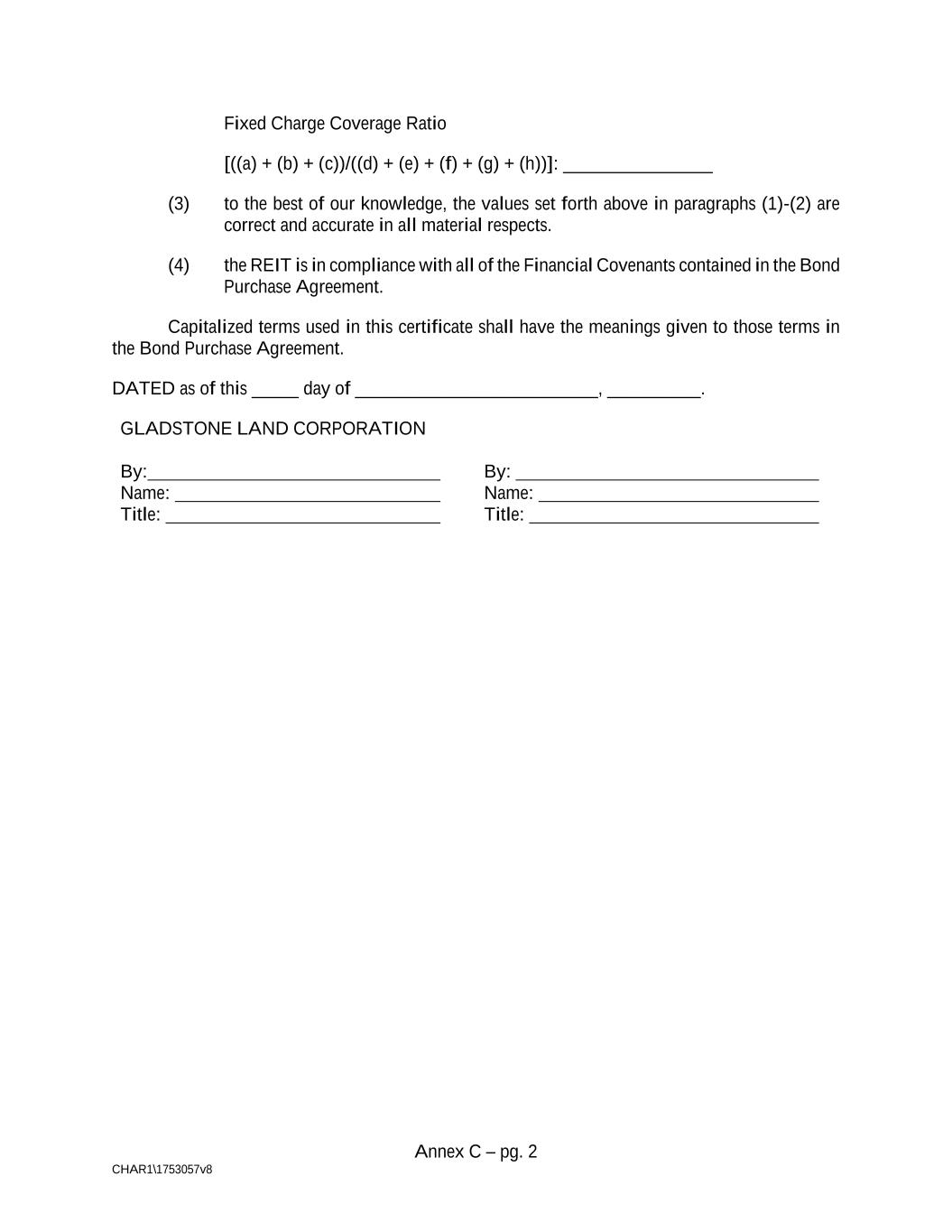

Annex C – pg. 1 CHAR1\1753057v8 ANNEX C FORM OF REIT OFFICERS’ CERTIFICATE We, ___________________________, and ___________________________, of Gladstone Land Corporation, a Maryland corporation (the “REIT”), in connection with that certain Amended and Restated AgVantage Bond Purchase Agreement dated as of December 10, 2020, among Gladstone Lending Company, LLC, an indirectly owned subsidiary of the REIT, Xxxxxx Mac Mortgage Securities Corporation, and Federal Agricultural Mortgage Corporation (as amended, restated, extended, supplemented or otherwise modified in writing from time to time, the “Bond Purchase Agreement”), hereby certify on behalf of the REIT that as of the end of the most recent Fiscal Quarter: (1) the REIT’s Leverage Ratio is as follows: a. Total Debt b. Total Assets [(i) + (ii)]: i. Land Asset Fair Value Adjustment: ii. Total assets: Leverage Ratio [(a) / (b)]: ___________________________ (2) the REIT’s Fixed Charge Coverage Ratio is as follows: a. Aggregate EBITDA: b. Aggregate Non-Cash Expenses: c. Aggregate nonrecurring losses (or minus nonrecurring gains): d. Aggregate interest expense: e. Aggregate Capitalized Interest: f. Aggregate preferred dividend payments to the extent required to be reflected as debt on the REIT’s Financial Statements: g. Aggregate Lease Payments: h. Aggregate principal amount of all regularly scheduled principal payments on outstanding debt for borrowed money:

Annex C – pg. 2 CHAR1\1753057v8 Fixed Charge Coverage Ratio [((a) + (b) + (c))/((d) + (e) + (f) + (g) + (h))]: ________________ (3) to the best of our knowledge, the values set forth above in paragraphs (1)-(2) are correct and accurate in all material respects. (4) the REIT is in compliance with all of the Financial Covenants contained in the Bond Purchase Agreement. Capitalized terms used in this certificate shall have the meanings given to those terms in the Bond Purchase Agreement. DATED as of this _____ day of __________________________, __________. GLADSTONE LAND CORPORATION By: Name: Title: By: Name: Title:

Annex D – pg. 1 CHAR1\1753057v8 ANNEX D FORM OF ISSUER OFFICERS’ CERTIFICATE Officers’ Certificate TO: Federal Agricultural Mortgage Corporation We, ________________, and ________________, of Gladstone Land Corporation, the Manager of Gladstone Land Partners, LLC, the General Partner of Gladstone Land Limited Partnership, the Sole Member and Manager of Gladstone Lending Company, LLC (“Issuer”), pursuant to the Amended and Restated AgVantage Bond Purchase Agreement dated as of December 10, 2020, among Issuer, Xxxxxx Mac Mortgage Securities Corporation, and Federal Agricultural Mortgage Corporation (as amended, restated, extended, supplemented or otherwise modified in writing from time to time, the “Bond Purchase Agreement”), hereby certify on behalf of Issuer that as at the date hereof: (1) Issuer is an institution organized as a Delaware limited liability company with the appropriate expertise, experience and qualifications to make agricultural mortgage loans to the Borrowers; (2) no Material Adverse Change has occurred; (3) the representations and warranties of Issuer contained in Section 5.02 of the Bond Purchase Agreement are true and correct in all material respects except with respect to representations or warranties that relate to an earlier date or time, in which case such representations and warranties were true and correct as of such earlier date or time; (4) no Event of Default exists; and (5) Issuer has caused the REIT to provide a certification by any president, vice president, chief financial officer or treasurer of the REIT to Xxxxxx Mac, substantially in the form of Annex C attached to the Bond Purchase Agreement, regarding the REIT’s compliance with the Financial Covenants contained therein. Capitalized terms used in this certificate shall have the meanings given to those terms in the Bond Purchase Agreement. DATED as of this _____ day of ____________________, ____. By: Name: Title: By: Name: Title:

Sch. A – pg. 1 CHAR1\1753057v8 ANNEX E QUALIFIED LOAN REPORT

Sch. A – pg. 1 CHAR1\1753057v8 Schedule A Pledged Collateral Issuer Name: Dated: Bond Number: Loan Number Borrower Last Name Relationship ID Note Type (see note 1) Loan Origination Date Maturity Date Amortization Term (months) Payment Frequency (see note 2) Current Unpaid Principal Balance Original Loan Amount Current Note Rate Loan Delinquency Status (see note 3) Index Type (see note 4) Adjustable Reset Interval (in months) Next Reset Date Collateral Value (see note 5) Collateral Property State Collateral Property County Collateral Property Type Notes: 1. F= Fixed, A=Adjustable 2. 1 = monthly, 2 = quarterly, 4 = semi-annually, 12= annually 3. 0=Current, 1<30 days delinquent, 2<60 days delinquent, etc. 4. Index - 1 YR CMT, 3 YR CMT, 5 YR CMT, 7 YR CMT, 10 YR CMT, 3 month LIBOR, 6 month LIBOR, 12 month LIBOR, PRIME, INTERNAL (lender’s own internal rate); Leave cell blank if not indexed 5. Original collateral value, or updated, if available 6. Loan numbers of identified relationships (cross collateralized, junior lien, wrapped, etc.); Data should be comma or tab delimited if multiple relationships exist. 7. Type of relationship identified (cross collateralized, junior lien, wrapped, etc.)

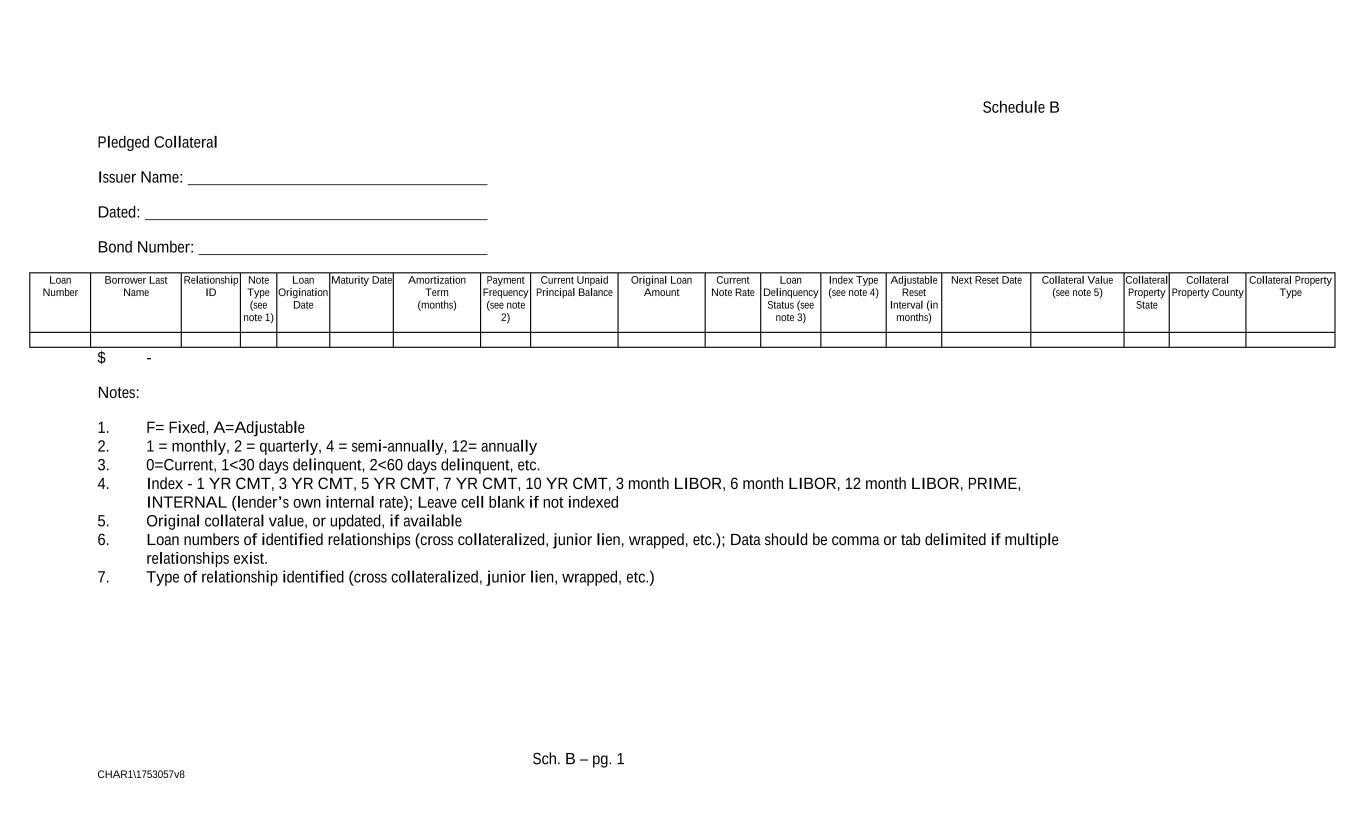

Sch. B – pg. 1 CHAR1\1753057v8 Schedule B Pledged Collateral Issuer Name: Dated: Bond Number: Loan Number Borrower Last Name Relationship ID Note Type (see note 1) Loan Origination Date Maturity Date Amortization Term (months) Payment Frequency (see note 2) Current Unpaid Principal Balance Original Loan Amount Current Note Rate Loan Delinquency Status (see note 3) Index Type (see note 4) Adjustable Reset Interval (in months) Next Reset Date Collateral Value (see note 5) Collateral Property State Collateral Property County Collateral Property Type $ - Notes: 1. F= Fixed, A=Adjustable 2. 1 = monthly, 2 = quarterly, 4 = semi-annually, 12= annually 3. 0=Current, 1<30 days delinquent, 2<60 days delinquent, etc. 4. Index - 1 YR CMT, 3 YR CMT, 5 YR CMT, 7 YR CMT, 10 YR CMT, 3 month LIBOR, 6 month LIBOR, 12 month LIBOR, PRIME, INTERNAL (lender’s own internal rate); Leave cell blank if not indexed 5. Original collateral value, or updated, if available 6. Loan numbers of identified relationships (cross collateralized, junior lien, wrapped, etc.); Data should be comma or tab delimited if multiple relationships exist. 7. Type of relationship identified (cross collateralized, junior lien, wrapped, etc.)

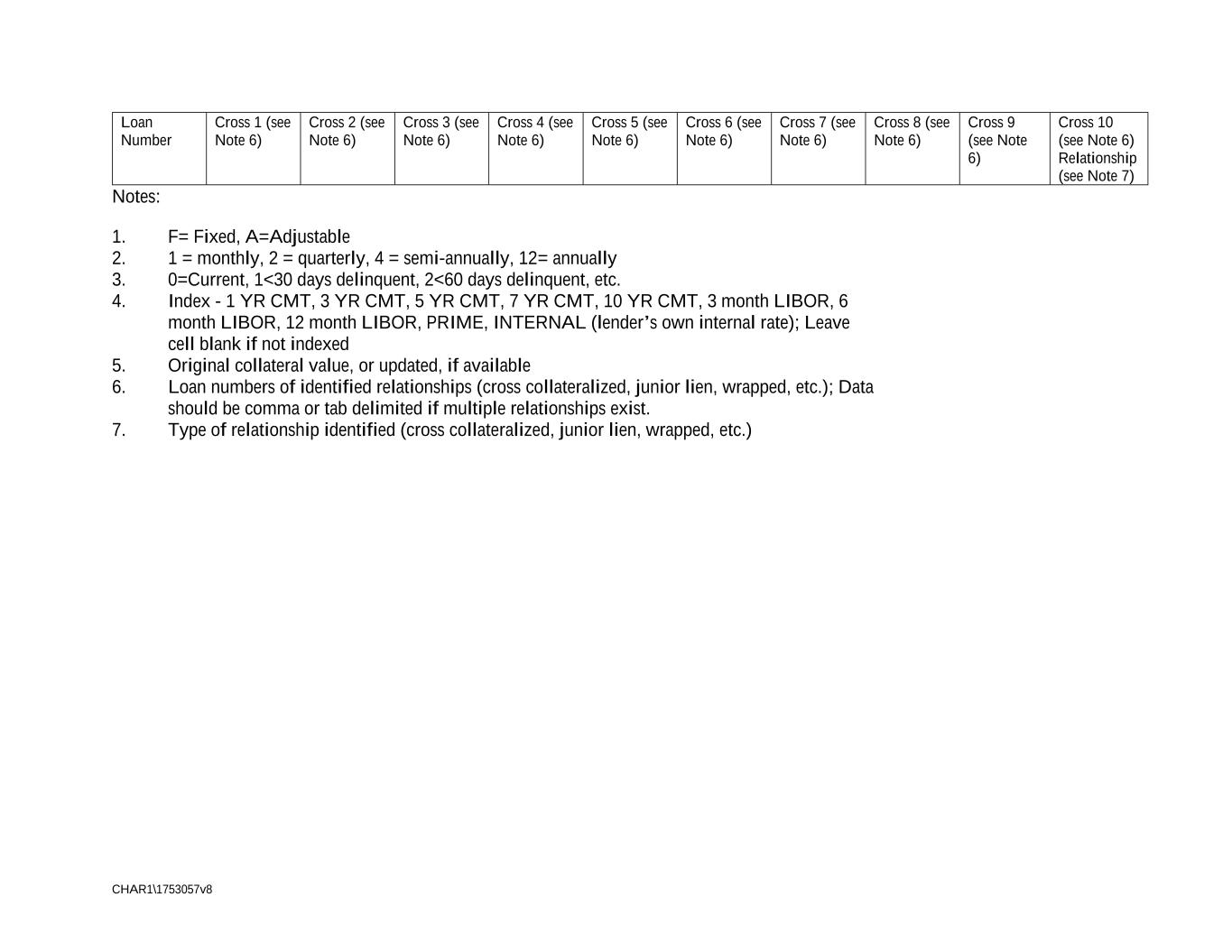

CHAR1\1753057v8 Loan Number Cross 1 (see Note 6) Cross 2 (see Note 6) Cross 3 (see Note 6) Cross 4 (see Note 6) Cross 5 (see Note 6) Cross 6 (see Note 6) Cross 7 (see Note 6) Cross 8 (see Note 6) Cross 9 (see Note 6) Cross 10 (see Note 6) Relationship (see Note 7) Notes: 1. F= Fixed, A=Adjustable 2. 1 = monthly, 2 = quarterly, 4 = semi-annually, 12= annually 3. 0=Current, 1<30 days delinquent, 2<60 days delinquent, etc. 4. Index - 1 YR CMT, 3 YR CMT, 5 YR CMT, 7 YR CMT, 10 YR CMT, 3 month LIBOR, 6 month LIBOR, 12 month LIBOR, PRIME, INTERNAL (lender’s own internal rate); Leave cell blank if not indexed 5. Original collateral value, or updated, if available 6. Loan numbers of identified relationships (cross collateralized, junior lien, wrapped, etc.); Data should be comma or tab delimited if multiple relationships exist. 7. Type of relationship identified (cross collateralized, junior lien, wrapped, etc.)