RETAIL LEASE AGREEMENT BETWEEN HART FOUNDRY SQUARE IV, LLC, as Landlord

Exhibit 10.12

BETWEEN

▇▇▇▇ FOUNDRY SQUARE IV, LLC,

as Landlord

AND

as Tenant

▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇

RETAIL LEASE

BASIC LEASE INFORMATION

Date: | January 24, 2018 | |||

Landlord: | ▇▇▇▇ FOUNDRY SQUARE IV, LLC, a Delaware limited liability company | |||

Tenant: | SLACK TECHNOLOGIES, INC., a Delaware corporation | |||

Building: | The building located at ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇, commonly known as Foundry Square IV | |||

Premises: | Suite 100 of the Ground Floor | |||

Rentable Area of Premises: | Approximately 3,425 rentable square feet | |||

Scheduled Delivery Date: | May 1, 2018 | |||

Rent Commencement Date: | Four (4) calendar months from the Delivery Date, as such date may be extended as provided in Section 2(d) | |||

Expiration Date: | The last day of the one hundred twentieth (120th) Lease Month following the Rent Commencement Date, subject to adjustment as provided in Section 1 (f) | |||

Base Rent: | Year of Lease | Annual Rent | Annual | Monthly |

Term | per sq. ft. | Rent | Rent | |

Year 1 | $82.00 | $280,850.00 | $23,404.17 | |

Year 2 | $84.46 | $289,275.50 | $24,106.29 | |

Year 3 | $86.99 | $297,953.77 | $24,829.48 | |

Year 4 | $89.60 | $306,892.38 | $25,574.36 | |

Year 5 | $92.29 | $316,099.15 | $26,341.60 | |

Year 6 | $95.06 | $325,582.12 | $27,131.84 | |

Year 7 | $97.91 | $335,349.59 | $27,945.80 | |

Year 8 | $100.85 | $345,410.08 | $28,784.17 | |

Year 9 | $103.88 | $355,772.38 | $29,647.70 | |

Year 10 | $106.99 | $366,445.55 | $30,537.13 | |

Subject to Section 3(c), Base Rent for the first full calendar month | ||||

following the Rent Commencement Date is abated. | ||||

Base Year: | 2018 | |||

Tenant’s Expense Share: | 1.4283% | |||

Tenant’s Tax Share: | 1.4283% | |||

- i -

Permitted Use of Premises: | High quality retail use promoting and showcasing Tenant’s products and offerings, subject to Section 6, including apparel, electronics and technology applications and accessories, as well as in-store presentations and events showcasing Tenant’s brand and technology partners. | |||

Minimum Days and Hours Open for Business: | 9:00 a.m. through 6:00 p.m., Monday through Friday, subject to Section 6. | |||

Tenant’s Address for Notices: | Prior to the Commencement Date: | |||

155 5th Street San Francisco, CA 94103 Attn: Chief Executive Officer | ||||

From and after Commencement Date: | ||||

Slack Technologies, ▇▇▇. ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇ 94105 Attn: Chief Executive Officer | ||||

in each case with a copy to: | ||||

Shartsis ▇▇▇▇▇▇ LLP One Maritime Plaza, 18th Floor San Francisco, CA 94111 Attn: ▇▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇ | ||||

Landlord’s Address for Notices: | ▇▇▇▇ Foundry Square IV, LLC c/o ▇▇▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ ▇▇▇▇: Asset Manager | |||

With a copy to: | ||||

▇▇▇▇ Foundry Square IV, LLC c/o CBRE, ▇▇▇. ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ ▇▇▇▇: Property Manager | ||||

Address for Payment of Rent: | ▇▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇, ▇▇▇ ▇▇▇▇▇ Network ▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇-▇▇▇▇ | |||

Extension Options: | Two (2) extension terms of five (5) years each | |||

- ii -

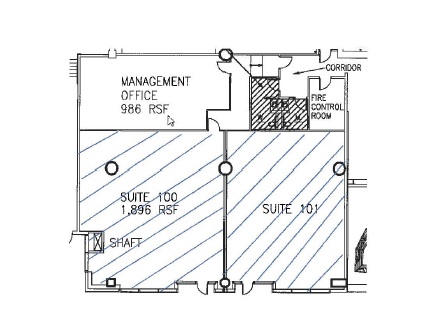

Exhibit(s) and Schedules: | Exhibit A: | Floor Plan |

Exhibit B: | Building Rules | |

Exhibit C: | Work Letter and Construction Agreement | |

Exhibit D: | Commencement Date Memorandum | |

Exhibit E: | Tenant Estoppel | |

Real Estate Brokers: | CBRE, Inc., representing Landlord, and Colliers International, representing Tenant | |

Tenant Improvement Allowance: | $171,250.00 based on $50.00 per rentable square foot of the Premises as reimbursement for Approved Tenant Improvement Costs in accordance with Exhibit C. | |

The provisions of the Lease identified above in parentheses are those provisions where references to particular Basic Lease Information appear. Each such reference shall incorporate the applicable Basic Lease Information. In the event of any conflict between any Basic Lease Information and the Lease, the latter shall control.

TENANT | LANDLORD |

▇▇▇▇ FOUNDRY SQUARE IV, LLC, | |

a Delaware corporation | a Delaware limited liability company |

By: /s/ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇ | By: /s/ ▇▇▇▇▇▇ ▇▇▇▇▇ |

Name: ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇ | Name: ▇▇▇▇▇▇ ▇▇▇▇▇ |

Its: Chief Executive Officer | Its: Senior Vice President |

- iii -

TABLE OF CONTENTS

Pages | ||

22 | ||

24 | ||

27 | ||

▇▇ | ||

30 | ||

30 | ||

30 | ||

30 | ||

33 | ||

36 | ||

36 | ||

37 | ||

37 | ||

37 | ||

39 | ||

Exhibit A: Floor Plan

Exhibit B: Building Rules

Exhibit C-l: Work Letter and Construction Agreement

Exhibit D: Commencement Date Memorandum

- i -

RETAIL LEASE

THIS RETAIL LEASE (this “Lease”), dated January ___, 2018, for purposes of reference only, is made and entered into by and between ▇▇▇▇ FOUNDRY SQUARE IV, LLC, a Delaware limited liability company (“Landlord’’), and SLACK TECHNOLOGIES, INC., a Delaware corporation (“Tenant”).

WITNESSETH:

Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the premises described in Section 1(b) below for the term and subject to the terms, covenants, agreements and conditions hereinafter set forth, to each and all of which Landlord and Tenant hereby mutually agree.

1. Terms. Unless the context otherwise specifies or requires, the following terms shall have the meanings herein specified:

(a) “Building” shall mean the building or buildings described in the Basic Lease Information, and the parcel or parcels of land on which such building or buildings are situated, together with all other improvements and other real property located on such parcel or parcels, as well as any property interest in the area of the streets bounding the parcel described in the Basic Lease Information, and all other improvements on or appurtenances to said parcel or said streets.

(b) “Business Day” shall mean the days Monday through Friday, excluding Holidays. “Holidays” shall mean the dates of observation of New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, Christmas Day and other locally or nationally recognized holidays on which federally insured national banks doing business in the State of California are required or permitted under applicable laws to close for business

(c) “Common Areas” shall mean all areas and facilities outside the Premises and within the exterior boundary line of the Project, excluding areas within the Building, that are, from time to time, provided and designated by Landlord for the non-exclusive use of Landlord, Tenant, other tenants of the Project and their respective employees, guests and invitees, including, without limitation, sidewalks, landscaping, court yards and exterior stairs and walkways.

(d) “Default Rate” shall mean the lesser of: (1) four percent (4%) over the prime rate as quoted in The Wall Street Journal as the base rate charged by the nation’s largest banks on corporate loans as of the date such Rent payment was due; or (2) ten percent (10%) per annum. Notwithstanding the foregoing, the aggregate liability for any interest accruing under this Lease shall not exceed the limits, if any, imposed by applicable Laws. Any interest paid in excess of such limits shall be credited to Tenant by application of the amount of excess interest paid against any outstanding Rent obligations in any order that Landlord elects. If the amount of excess interest paid exceeds the amount of outstanding Rent, such excess portion shall be refunded to Tenant by Landlord. To ascertain whether any interest payable exceeds the limits imposed, any non-principal payment (including late charges) shall be considered to the extent permitted by Law to be an expense or a fee, premium or penalty, rather than interest.

(e) “Delivery Date” shall mean the later to occur of (i) the Scheduled Delivery Date, and (ii) the actual date of delivery of possession of the Premises by Landlord in Ready for Occupancy Condition.

(f) “Expiration Date” shall, initially be based on the date provided in the Basic Lease Information, and shall be subject to adjustment as follows: (i) once the Phase II Premises Commencement Date is determined under the Office Lease, the Expiration Date shall be adjusted to be coterminous with the Expiration Date of the Office Lease, (ii) if the Phase II Premises Commencement Date does not occur, by October 15, 2018 (as such date is extended under the terms of the Office Lease), and Tenant elects to terminate

the Office Lease, this Lease shall terminate coterminously with the termination of the Office Lease, and such date shall be deemed the Expiration Date under this Lease.

(g) “FF&E” shall mean any and all of Tenant’s furnishings, equipment, and trade fixtures installed in the Premises

(h) “Force Majeure” shall mean any event of (i) civil commotion, terrorism or threat thereof, act of a public enemy, war, riot, sabotage, blockade or embargo, and (ii) lightning, earthquake, fire, storm, hurricane, tornado, flood, washout, explosion or act of God

(i) “Lease Month” shall mean a full calendar month. If the Rent Commencement Date is other than the first day of a calendar month, said partial month shall be disregarded solely for purposes of calculating the number of Lease Months in the Term, and the first Lease Month shall be the first full calendar month following the Rent Commencement Date. Notwithstanding anything to the contrary in the foregoing, (i) Base Rent for any partial calendar month in which the Rent Commencement Date occurs shall be prorated based on a 30-day month, and (ii) the period of time from the Delivery Date to the Rent Commencement Date shall be determined based on the actual passage of a month from the day of the month on which the Delivery Date occurs to the next calendar month of the same date.

(j) “Normal Business Hours” for the Building shall mean 8:00 a.m. to 6:00 p.m. Mondays through Fridays, exclusive of holidays.

(k) “Office Lease” shall mean that certain Office Lease Agreement dated December 22, 2017, as amended, entered into by Landlord and Tenant for other premises of the Building.

(l) “Permitted Use” shall mean the permitted use described in the Basic Lease Information, as more particularly described in, and subject to the limitations and restrictions of, Section 6.

(m) “Premises” shall mean the portion of the Building located on the Ground Floor of the Building referenced in the Basic Lease Information and generally shown on the floor plan attached to this Lease as Exhibit A. Landlord and Tenant agree that the Premises consist of the number of square feet of rentable area set forth in the Basic Lease Information. All the outside walls and windows of the Premises and any space in the Premises used for shafts, stacks, pipes, conduits, ducts, electric or other utilities, sinks or other Building facilities, and the use thereof and access thereto through the Premises for the purposes of operation, maintenance and repairs, are reserved to Landlord.

(n) “Project” shall mean that certain office/retail project with a Street address of ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, commonly known as the “Foundry Square IV,” together with any buildings, improvements and land on adjacent parcels that Landlord may, in the future, elect to own or operate jointly with the Buildings and designate as Common Area.

(o) “Ready for Occupancy Condition” shall mean (1) broom clean, and (2) all Building mechanical and utility systems serving the Premises are in good working order and condition.

(p) “Specialized Alterations” shall mean any of the following as and to the extent installed by Tenant: (i) trade fixtures, (ii) plumbing and HVAC lines exclusively serving the Premises, (iii) unique architectural design elements that alter the general use of the Premises for general retail use, including ceiling tiles and wall coverings, and (iv) any retail signage installed by Tenant within or outside of the Premises, including all electrica1lines and connections supporting the same.

(q) “Tenant Parties” shall mean Tenant, any Permitted Transferee of Tenant, and each of their respective agents, employees, contractors and invitees.

2

To the extent a term is defined or described in the Basic Lease Information, such term shall incorporate the definition and/or description set forth in the Basic Lease Information.

2. Lease Term; Condition of Premises.

(a) The Lease term (the “Lease Term”) shall commence on the Delivery Date and, unless ended sooner as herein provided, shall expire on the Expiration Date. Landlord and Tenant hereby agree to confirm the actual Delivery Date and Expiration Date by executing and delivering to each other counterparts of a Commencement Date Memorandum in the form of Exhibit D attached hereto, but the Lease Term shall commence on the Delivery Date and end on the Expiration Date whether or not such memorandum is executed. From the Delivery Date through the Rent Commencement Date, Tenant’s occupancy of the Premises shall be on and subject to all of the covenants in this Lease, all of which shall be binding on and apply to Tenant during such occupancy, except that Tenant’s obligation to pay Base Rent and any Additional Rent chargeable to Tenant under Section 3(a)(ii) shall commence on the Rent Commencement Date.

(b) If Landlord for any reason whatsoever cannot deliver possession of the Premises to Tenant on the Scheduled Delivery Date, this Lease shall not be void or voidable, no obligation of Tenant shall be affected hereby and Landlord shall not be liable to Tenant for any loss or damage resulting therefrom; provided that any Monthly Rental shall only commence as of, and shall be prorated for the period beginning from, the date Landlord actually delivers possession of the Premises to Tenant in the condition required by this Lease.

(c) Landlord shall deliver possession of the Premises to Tenant in Ready for Occupancy Condition; provided, however, with respect to the portion of the Premises formerly known as Suite 101 (in which the previous tenant in occupancy conducted business therein as a dentist), prior to delivery of the Premises to Tenant Landlord shall cause to be removed, at Landlord's sole cost and expense, any of said previous tenant's furniture, trade fixtures and equipment (including specialized dentistry equipment), together with any associated plumbing serving any such trade fixtures or specialized equipment (“Landlord’s Demolition Work”), but leaving in place the restrooms and fixtures in said space and associated plumbing serving said restrooms. Except for the completion of Landlord’s Demolition Work, (i) Landlord shall have no obligation to construct or install any improvements in the Premises, and (ii) Tenant’s possession of the Premises shall constitute Tenant’s acknowledgment that the Premises are in all respects in the condition in which Landlord is required to deliver the Premises to Tenant under this Lease and that Tenant has examined the Premises and is fully informed to Tenant’s satisfaction of the physical and environmental condition and the utility of the Premises for its business purposes. Tenant acknowledges that Landlord, its agents and employees and other persons acting on behalf of Landlord have made no representation or warranty of any kind in connection with any matter relating to the physical or environmental condition, value, fitness, use or zoning of the Premises upon which Tenant has relied directly or indirectly for any purpose, except as specifically set forth in this Lease.

(d) Subject to terms of the Work Letter and Construction Agreement attached to this Lease as Exhibit C-1 (the “Work Letter”), Tenant shall be entitled to improve the Premises with Tenant Improvements suitable for the conduct of Tenant’s Permitted Use.

(e) Landlord and Tenant acknowledge that all references in this Lease to specific figures of RSF and Tenant’s Share shall be final and binding on Landlord and Tenant and that such acknowledgment is supported by adequate consideration; provided, however, that if Tenant exercises any Option (as defined below in Section 36), Landlord shall have the right, but not the obligation, to remeasure the Premises and the Building to recalculate references to RSF and Tenant’s Share in this Lease, as determined by Landlord’s architect in accordance with the then current standard of measurement developed by the American National Standard Institute of Building Owners and Managers Association International (ANSI/BOMA), in connection with the exercise of any Option.

3

3. Rent.

(a) Rent. Tenant shall pay to Landlord the following amounts as rent for the Premises:

(i) Base Rent. Tenant shall pay to Landlord Base Rent for the Premises on the Rent Commencement Date and thereafter on or before the first day of each calendar month of the Lease Term, subject to abatement as expressly provided in this Lease.

(ii) Additional Rent. During each calendar year after the Base Year, Tenant shall pay to Landlord as “Additional Rent” Tenant’s Share of increases in Property Taxes and Operating Expenses (as such terms are defined below) incurred by Landlord in the operation of the Project over the Project Taxes and Operating Expenses incurred by Landlord in the operation of the Project during the applicable Base Year.

(iii) Utility Rent. Tenant shall pay to Landlord Utility Rent. “Utility Rent” shall mean all charges incurred for the use and consumption of the utilities provided in Sections 7(a) and 7(e) of this Lease. Landlord may estimate the Utility Rent monthly, by meter readings, and invoice Tenant therefor, in arrears. All Utility Rent charges shall be due and payable monthly, together with the next payment of Base Rent (as defined below) that is not less than twenty-one (21) days following Landlord’s invoice for such charges. Landlord’s failure to ▇▇▇▇ Tenant for any such amounts shall not waive Landlord’s right to ▇▇▇▇ Tenant for such amounts at a later time, provided that, except if due to the delayed or any restated invoices received from the utility provider, Tenant shall not be responsible for invoices submitted to Tenant for payment more than three (3) months in arrears. Tenant’s right to object to Utility Rent shall be subject to the same audit rights in Section 4(h) below. Utility Rent does not include charges for utilities consumed in connection with Common Area which are separately billed as an element of Operating Expenses as provided in Section 4(b) of this Lease.

(iv) Janitorial Rent. Tenant shall pay to Landlord Janitorial Rent. “Janitorial Rent” shall mean all charges incurred by Landlord for the provision of janitorial services in connection with Tenant’s use of the Premises as provided in Section 7(a) of this Lease. All Janitorial Rent charges shall be due and payable monthly, together with the next payment of Base Rent (as defined below) that is not less than twenty-one (21) days following Landlord’s invoice for such charges; provided, however, that no Janitorial Rent shall be due in connection with janitorial services procured by and paid for by Tenant directly. Landlord’s failure to ▇▇▇▇ Tenant for any such amounts shall not waive Landlord’s right to ▇▇▇▇ Tenant for such amounts at a later time. Tenant’s right to object to Janitorial Rent shall be subject to the same audit rights in Section 4(h) below.

All sums of money required to be paid by Tenant to Landlord under this Lease are deemed to be obligations in the nature of rent whether or not such obligations are expressly so designated, and are collectively referred to herein as “Rent.” Except as expressly provided in this Lease, all Rent shall be payable to Landlord as provided in this Section 3, without any invoice, notice, or other demand therefor, and without any abatement, deduction, credit or offset whatsoever, except as expressly provided for in this Lease. All Rent shall be paid by check in lawful money of the United States of America to Landlord (or to any other person designated by Landlord in a notice to Tenant) at Landlord’s Notice Address for the payment of Rent, or by ACH wire transfer pursuant to a notice from Landlord to Tenant of Landlord’s wire transfer instructions. No payment shall be made in cash. Tenant shall not pay any Rent more than one (1) month in advance without the prior written consent of Landlord and any Holder of which Tenant has notice and whose consent to such payment is required. Tenant shall pay Landlord, as Additional Rent, in addition to any interest and late charges payable by Tenant, the sum of One Hundred Dollars ($100.00) for each check that is returned to Landlord for non-sufficient funds or that is otherwise dishonored. If any check of Tenant is dishonored, any or all subsequent

4

payments of Rent shall, at Landlord’s option, be made by certified check or other form of guaranteed payment acceptable to Landlord.

(b) Late Payment Charges. Any amount due from Tenant to Landlord under this Lease which is not paid within ten (10) days of the date due, shall bear interest from the date such payment is due until paid (computed on the basis of a 365-day-year) at the Default Rate. The payment of such interest shall not excuse or cure a default by the Tenant hereunder.

(c) Base Rent Abatement. Notwithstanding anything to the contrary in Section 3(a)(i) above, Landlord agrees to waive payment of Base Rent for the first full Lease Month following the Rent Commencement Date. If the Rent Commencement Date occurs on a day other than the first day of the calendar month, Base Rent for the partial month in which the Rent Commencement Date occurs shall be due and payable on the Rent Commencement Date.

4. Operating Expenses: Taxes.

(a) Landlord’s Estimate. Prior to or promptly after the commencement of each calendar year following each applicable Base Year, Landlord shall give Tenant a good faith written estimate of the anticipated increases in Property Taxes and Operating Expenses over the applicable Base Year and of Tenant’s Share of such increases. Tenant shall pay such estimated amount to Landlord in equal monthly installments, in advance on or before the first day of each calendar month with the monthly installment of Base Rent payable under Section 3 above. If Landlord determines that its good faith estimate of Tenant’s Share of the increases in Property Taxes and Operating Expenses was incorrect, Landlord may provide Tenant with a revised written estimate. After receipt of the revised estimate, Tenant’s monthly payments shall be based on the revised written estimate. Within six (6) months after the end of each calendar year other than the Base Year, Landlord shall furnish to Tenant a statement showing in reasonable detail the actual increases over the Base Year in Property Taxes and Operating Expenses incurred by Landlord during the applicable calendar year and Tenant’s Share thereof and the payments made by Tenant with respect to such period (the “Landlord’s Statement”). If the Landlord’s Statement is timely delivered and shows that the amount paid by Tenant was less than Tenant’s Share of the actual increases in Property Taxes and Operating Expenses as to the Premises, Tenant shall pay the amount of the deficiency to Landlord within thirty (30) days after receiving the Landlord’s Statement. If the Landlord’s Statement shows Tenant has overpaid, provided no Event of Default is uncured at such time, the amount of the excess shall be credited against installments of Rent next coming due under this Lease; provided, however, if the Lease expires or is terminated prior to the distribution of the Landlord’s Statement for a given year, and further provided Tenant is not then in default under this Lease, Landlord shall refund any excess Additional Rent to Tenant within thirty (30) days after Tenant’s receipt of Landlord’s Statement, after first deducting the outstanding amount of Rent due, if any. Landlord and Tenant’s obligations to pay for or credit any increase or decrease in payments pursuant to this Lease shall survive the expiration or earlier termination of this Lease.

(b) Operating Expenses. For purposes of this Lease, the term “Operating Expenses” shall mean the actual costs of and expenses paid or incurred by Landlord for maintaining, operating, repairing, replacing and administering the Project, including all common areas and facilities, and shall include the following costs, by way of illustration but not limitation:

(i) Cost of all utilities, including surcharges, for the Building and Project, including the cost of water, gas, sewer, heat, light, power, steam and air conditioning, not actually paid directly by Tenant or any other tenant of the Building or third party;

5

(ii) Cost of all insurance which Landlord or Landlord’s lender deems necessary or appropriate;

(iii)License, permit, and inspection fees;

(iv)Cost of maintenance and service contracts (including without limitation, for security and management services, window cleaning, floor waxing, elevator maintenance and repair, landscaping, Common Area janitorial service, engineers and trash removal services);

(v) Labor costs, including wages and salaries of all employees engaged in the operation, management, maintenance and security of the Building and Project at or below the level of Building Manager, as reasonably allocated to the Building and Project;

(vi) All property management costs, including office rent for any property management office and professional property management fees, as such are allocated to the Premises in accordance with good property management practices;

(vii) | Cost of maintenance and repair of driveways and surface areas; |

(viii)Cost of supplies, materials, equipment, tools and the cost of capital replacements (as opposed to capital improvements) used in the operation, repair, replacement and maintenance of the Building and Project;

(ix) Cost of any capital improvements or modifications made to the Project by Landlord that are designated as Permitted Capital Expenses;

(x) Cost of implementation of environmental sustainability practices, including energy efficiency and waste management to the extent such are intended to reduce Operating Expenses;

(xi) Cost of operation, maintenance and repair of the parking garage for the Building, provided, however, if Landlord leases or contracts for the management of the parking garage to or with a third party operator, the foregoing costs shall be limited to the cost of capital improvements, repairs and modifications to the parking garage (amortized as hereinafter provided);

(xii) Project-related legal and accounting expenses incurred solely with respect to Landlord’s operation of the Project (and not incurred with respect to expenses excluded from Operating Expenses under Section 4(c) below); and

(xiii) All other expenses or charges which, in accordance with generally accepted management practices for commercial office projects comparable to the Project, would be considered a reimbursable expense of maintaining, operating, repairing, replacing or administering the Project.

Capital costs included in Operating Expenses shall be limited to Permitted Capital Expenses. As used herein, “Permitted Capital Expenses” shall mean and refer to capital improvements undertaken in (or capital assets acquired for) the Project or any portion thereof during or after the Base Year, to the extent such capital items (i) are primarily undertaken to effect savings in the cost of operations or maintenance of the Project or any portion thereof over the useful life thereof; (ii) are undertaken for the purpose of enhancing the security, health and safety of the occupants of the Project and are of a type and quality then currently found or then being adopted or implemented in commercial office projects comparable to the Project; or (iii) are incurred for purposes of compliance with or because required under any applicable Law, other than where a notice of violation has been served on Landlord as of any Commencement Date. Such Permitted Capital Expenses

6

shall be amortized over their useful life, together with interest at the actual interest rate incurred by Landlord; all other capital expenditures, improvements and repairs shall be excluded from Operating Expenses. In addition, however, capital costs included in Operating Costs shall also include the cost of any capital improvements made to or capital assets acquired for the Building during or after the Base Year to the extent that the cost of any such improvement or asset is less than ten thousand dollars ($10,000) or has a useful life of five (5) years or less. Capital costs included in Operating Expenses shall be amortized over the useful life of the improvements, as reasonably determined by Landlord, together with a return on capital at the current market rate per annum on the unamortized balance. Permitted Capital Expenses, to the extent first undertaken in the 2018 Base Year, shall be excluded from Operating Expenses in said Base Year.

(c) Exclusions. Notwithstanding anything to the contrary contained in Section 4(b) above, Operating Expenses shall not include: (i) costs required to be paid for directly by Tenant or any other tenant of the Building (including any janitorial service contracted for and paid by Tenant); (ii) the cost of additional or extraordinary services provided to other tenants of the Building, including, without limitation, above Building standard heating, ventilation and air conditioning and janitorial services; (iii) principal and interest payments and any other charges on loans secured by deeds of trust recorded against the Project and any costs associated with any refinancing of the Building (or any unsecured debt), including attorneys’ fees, environmental investigations or reports, points, fees and other lender costs and closing costs or amortization; (iv) any costs associated with the sale of the Building, including, without limitation, advertising, marketing, consulting and brokerage commissions; (v) executive salaries of off-site personnel employed by Landlord except for the charge (or pro rata share) of the Project employees otherwise permitted under Section 4(b) above; (vi) the cost of capital improvements (except for Permitted Capital Expenses) or rentals for items which if purchased, rather than rented, would constitute a capital improvement or equipment; (vii) the cost of repairs or other work to the extent (1) Landlord is reimbursed by insurance or condemnation proceeds, or (2) the same is required as a result of the active negligence of Landlord or its agents; (viii) costs and expenses incurred in connection with procuring tenants, including lease marketing and advertising expenses, concessions, lease takeover or rental assumption obligations, brokerage commissions, and professional and legal fees incurred in connection with lease negotiations, sublease and/or assignment negotiations and transaction with present or prospective tenants or other occupants of the Project; (ix) design and engineering fees and construction costs (including permit, license and inspection fees) incurred in connection with the leasing of specific space in the Building to tenants; (x) except for normal, budgeted legal and accounting costs attributed to the normal operation of the Building, legal and accounting fees, monetary damages, awards, judgments or settlement amounts incurred or paid by Landlord as a result of and for any leases or disputes with tenants, occupants or third parties relating to the Building; (xi) depreciation of the Building (except as otherwise set forth above as a Permitted Capital Expense); (xii) expenditures for repairing or replacing any defect in the design or construction of Building; (xiii) leasehold amortization or other non-cash items (except as set forth in Section 4(b) above); (xiv) costs arising from the presence or removal of any Hazardous Materials located in the Building or the Project including, without limitation, any costs incurred pursuant to the requirements or any governmental laws, ordinances, regulations or orders relating to health, safety or environmental conditions, regulations concerning asbestos, soil and ground water conditions or contamination regarding hazardous materials or substances; ( xv) any bad debt loss, rent loss, or reserves for bad debts or rent loss; (xvi) costs relating to maintaining Landlord’s legal existence, either as a corporation, partnership or other entity; (xvii) all costs of Landlord’s general corporate and general administrative and overhead expenses (except as to items specifically included in Operating Expenses above); (xviii) costs of goods and/or services rendered by affiliates of Landlord to the extent the same exceeds the cost of such goods and/or services rendered by unaffiliated third parties on a competitive bid basis for comparable buildings with institutional owners in San Francisco, California; (xix) management fees, whether paid to

7

Landlord or to an outside managing agent, in excess of the range of prevailing management fees per rentable square foot charged in comparable buildings with institutional owners in San Francisco, California; (xx) ground rent or payments under ground leases, if any; (xxi) costs incurred by Landlord to bring any portion of the Building into compliance with any applicable Laws or governmental or regulatory agency’s rules or regulations based on violations as of the Effective Date, and any fines or fees imposed or assessed against Landlord for Landlord’s failure to comply with any law or governmental or regulatory agency’s rules or regulations; (xxii) reserves of any kind, including replacement reserves, and reserves for bad debts or lost rent or any similar charge; (xxiii) costs incurred by Landlord in connection with rooftop communications equipment of Landlord; (xxiv) costs incurred in connection with the original construction of the Building or the Project or any addition to the Project or in connection with any renovation, alteration or major change in the Building or the Project including, but not limited to, the addition or deletion of floors; (xxv) any costs, fees, dues, contributions or similar expenses for industry associations or similar organizations; (xxvi) any compensation paid to clerks, attendants or other persons in commercial concessions operated by Landlord in the Building or Project; (xxvii) the entertainment expenses and travel expenses of Landlord, its employees, agents, partners and affiliates; (xxviii) any costs associated with the purchase or rental of furniture, fixtures or equipment for any management office, offices associated with the Project or for Landlord’s corporate or administrative offices; (xxix) costs incurred by Landlord due to the violation by Landlord of the terms and conditions of any contract or agreement relating to the original construction of the Building or any part thereof; (xxx) costs of traffic studies, environmental impact reports, transportation system management plans and reports, and traffic mitigation measures or due to studies or reports relating to the original construction of the Building; (xxx) any improvements installed or work performed or any other cost or expense incurred by Landlord in order to comply with the requirements for obtaining a certificate of occupancy for the Building or Project or any space therein in connection with the original construction of the Building; (xxxi) any fees, bond costs or assessments levied on the Project by any transit district (or any other governmental entity having the authority to impose such fees, bond costs or assessments for mass transit improvements) in connection with the original construction of the Building; and (xxxii) any costs or expenses relating to any provisions of any development agreements, owner’s participation agreement, conditional use permits, easements or other instruments entered into in connection with the original construction of the Building (collectively, the “Project Documents”), including any initial payments or costs made in connection with any child care facilities, traffic demand management programs, transportation impact mitigation fees, art programs, or parking requirements and programs. Nothing contained in this Section 4(c) shall restrict Landlord from passing through to Tenant as Operating Expenses all increases in assessments, special assessments, fees, bond costs, transportation impact mitigation fees, child-care facilities costs, or other similar charges that are first assessed or incurred after the original construction of the Building or that are assessed based on current occupancies, uses or impacts of the Project or any portion thereof or are assessed pursuant to requirements of the CC&Rs, including pursuant to the requirements of commercially reasonable modifications to the CC&Rs.

(d) Real Property Taxes. For purposes of this Lease, the term “Property Taxes” shall mean all assessment, license, fee, rent, tax, levy, interest, or tax (other than Landlord’s net income, estate, succession, inheritance, gift, excise, transfer or franchise taxes) charges, imposed by any authority having the direct or indirect power to tax, or by any city, county, state or federal government or any improvement or other district or division thereof, on the real property comprising the Project, including any land and improvements thereon, whether such tax is: (i) determined by the value or area of the Project or any part thereof (or any improvements now or hereafter made to the Project or any portion thereof by Landlord, Tenant or other tenants); (ii) upon any legal or equitable interest of Landlord in the Project or any part thereof; (iii) upon this transaction or any document to which tenant is a party creating or transferring any interest in

8

the Project; (iv) levied or assessed in lieu of, in substitution for, or in addition to, existing or additional taxes against the Project whether or not now customary or within the contemplation of the parties; or (v) assessed upon real property generally for the purpose of constructing or maintaining or reimbursing the cost of construction of any streets, utilities, or other public improvements. Notwithstanding anything to the contrary contained herein, Property Taxes shall not include any amounts payable by Tenant under Section 4(e) below. With respect to any taxes or assessments which may be levied against or upon the Project, or which under the Laws then in force may be evidenced by improvements or other bonds or may be paid in annual installments only the amount of such annual installment (with appropriate proration for any partial year) and interest due thereon shall be included within the computations of the annual taxes and assessments levied against the Project (but any credit given by the taxing authorities against any such installation arising from earlier payments or earlier funding or reserves shall be disregarded in the calculation of any such annual assessments). If Landlord receives a reduction in Real Property Taxes attributable to the Base Year as a result of commonly called Proposition 8 application, then Real Property Taxes for the Base Year shall be calculated as if no Proposition 8 reduction in Real Property Taxes were received.

(e) Other Taxes Payable by Tenant. In addition to, and notwithstanding anything to the contrary in, this Section 4, Tenant shall pay, prior to delinquency, one hundred percent (100%) of any(a) rent tax, gross receipts tax, sales or use tax, service tax, value added tax, or any other applicable tax based on Landlord’s receipt, or the payment by Tenant, of any Rent or services herein, including any taxes charged in connection with Tenant’s use of or payment of Rent for the parking facilities of the Building if not separately charged to Tenant; (b) taxes assessed upon or with respect to the possession, leasing, alteration, repair, use or occupancy by Tenant of the Premises or any portion of the Project;(c) [intentionally omitted]; (d) taxes assessed upon this transaction or any document to which Tenant is a party creating or transferring an interest or an estate in the Premises; and (e) any increase in taxes attributable to inclusion of value placed on Tenant’s personal property, trade fixtures, or Alterations. Without limiting the generality of the foregoing, any reassessment of the Project attributable to the Tenant Improvements constructed by Tenant pursuant to the Work Letter shall be chargeable entirely to Tenant. If any such taxes are chargeable or assessed against Landlord on a monthly basis, such taxes shall be due and payable together with Tenant’s payment of Base Rent, based on Landlord’s statement therefore given to Tenant by Notice at least twenty-one (21) days prior to the date Base Rent is due under this Lease. In the event that it shall not be lawful for Tenant to so reimburse Landlord, the Base Rent payable to Landlord under this Lease shall be revised to net to Landlord the same amount after imposition of any such tax upon Landlord as would have been received by Landlord under this Lease prior to the imposition of such tax .

(f) Cost Pools. Landlord reserves the right, in good faith, to establish classifications for the equitable allocation of Operating Expenses that are incurred for the direct benefit of specific types of tenants or users in the Building, and the specific buildings located within the Project (“Cost Pools”). Such Cost Pools may include, but shall not be limited to, general office tenants and retail tenants of the Building. Landlord’s determination of such allocations shall be made in a manner consistent with its good faith business judgment as to the management of the Project and shall be final and binding on Tenant. Tenant acknowledges that the allocation of Operating Expenses among Cost Pools does not affect all such items and is limited to specific items that are incurred or provided to tenants of Cost Pools which Landlord determines, in good faith, it would be inequitable to share, in whole or in part, among tenants of other Cost Pools in the Project.

(g) Operating Expense Adjustments. Notwithstanding any other provision to the contrary, it is agreed that if the Building is less than one-hundred percent (100%) occupied during any calendar year, an adjustment shall be made by Landlord with respect to such Operating Expenses that vary

9

with occupancy for such year so that Tenant’s Share of Operating Expenses shall be equivalent to the Operating Expenses calculated as though the Building had been one hundred percent (100%) occupied during such year. In addition, if the Operating Expenses in any year other than the Base Year increase due to a change of policy or practice in operating the Building, such as a determination to carry earthquake insurance or provide 24-hour security guard service, such increase shall be included in Operating Expenses only to the extent of the increase in cost over the projected costs that would have been included in Operating Expenses for the Base Year if such policy or practice had been in effect during the entire Base Year. Conversely, if the Operating Expenses in any year other than the Base Year decrease due to an elimination of the service underlying the Operating Expense, then the cost of such service shall be deleted from the Base Year Operating Expenses for purposes of determining the Operating Expenses payable for subsequent years that the service is not included; provided, however, in no event shall the amount payable by Tenant as an Expense Increase attributable to Operating Expenses decrease below zero. Adjustments to Operating Expenses and Property Taxes shall be determined separately, and a reduction in the aggregate amount of Operating Expenses or Property Taxes in any calendar year shall not be applied to reduce any increase otherwise applicable to the other category. Tenant shall not be entitled to any reduction, refund, offset, allowance or rebate in Base Rent due hereunder if Operating Expenses or Property Taxes for any calendar year following the applicable Base Year are less than Operating Expenses and Property Taxes incurred relating to Operating Expenses and/or Property Taxes, as applicable, during the applicable Base Year.

(h) Tenant’s Audit Right. If Tenant disputes the amount of Additional Rent stated in the Landlord’s Statement, Tenant, within six (6) months of receipt of Landlord’s Statement, may itself, through its own employees, or through a nationally recognized property management firm designated by Tenant and reasonably acceptable to Landlord (the “Approved Inspection Firm”), inspect Landlord’s books and records directly related to Operating Expenses and Property Taxes for the applicable calendar year only and, only in connection with the first such inspection during the Lease Term or in connection with comparing the Operating Expenses and Taxes for the applicable Base Year to a subsequent year, the Operating Expenses and Taxes for the applicable Base Year; provided, however, that Tenant is not entitled to request that inspection if Tenant is then in monetary default under this Lease (as to which notice has been previously given) or if Tenant has not paid all amounts required to be paid under the applicable Landlord Statement. As a condition to any such inspection, Tenant and, if applicable the Approved Inspection Firm, shall execute a confidentiality agreement, in form and substance reasonably acceptable to Tenant, agreeing to keep the results of any such inspection and the results thereof, confidential. Tenant may disclose the information obtained from such audit and examination to Tenant’s accountants, attorneys and others reasonably required by Tenant to perform, analyze and/or enforce such audit and examination and this Lease. Landlord shall provide Tenant’s designated representative, or the Approved Inspection Firm, access to Landlord’s books and records directly related to Operating Expenses and Property Taxes during Landlord’s regular business hours and upon reasonable prior notice at the Building management office in San Francisco. Tenant’s Approved Inspection Firm must not be retained on a contingency fee basis. Tenant shall have the right to copy and duplicate such information as Tenant may require. If Landlord disputes the results of an audit done by Tenant, Landlord shall send Tenant a notice thereof within ten (10) days after receipt of the results of such audit. To the extent Landlord disputes a portion of the results of such audit, Landlord shall credit the undisputed portion of the overcharge against the next monthly rent payments of Tenant or if the Term has expired or otherwise has been terminated, shall refund the undisputed portion of the overcharges to the Tenant. Following receipt of Landlord’s notice, either party may submit the dispute for arbitration, provided that Tenant shall continue to pay to Landlord all rent, including any adjustments pursuant to this Article, until a final decision is rendered pursuant to arbitration. If after Tenant’s or its Approved Inspection Firm’s inspection, Tenant still disputes the Landlord’s Statement, Landlord and Tenant shall for a period of thirty (30) days seek to agree on the amount subject to dispute,

10

and if no agreement is reached, then, either party may submit such dispute to binding arbitration by notice to the other party (“Arbitration Notice”). The failure of Tenant to provide an Arbitration Notice within sixty (60) days of Tenant’s delivery of the Tenant’s Approved Inspection Firm’s report to Landlord shall constitute a waiver by Tenant of its right to arbitrate hereunder, and except for such adjustments as have been agreed to by Landlord, Landlord’s Statement shall be conclusive and binding to Tenant. Within thirty (30) days of the Arbitration Notice, Landlord and Tenant shall jointly select an arbitrator, who shall be unaffiliated in any manner with either Landlord or Tenant and shall be a certified public accountant that shall have been active over the five (5) year period ending on the date of such appointment in the analysis of operating expenses in commercial office buildings in San Francisco. Neither Landlord nor Tenant shall consult with such arbitrator as to his or her opinion as to the disputed matters prior to the appointment. The determination of the arbitrator shall be limited solely to issues raised by Tenant’s Approved Inspection Firm’s report or by Landlord’s response to Tenant’s Approved Inspection Firm’s report . Such arbitrator may hold hearings and require such briefs as the arbitrator, in his or her sole discretion, determines is necessary. In addition, Landlord or Tenant may submit to the arbitrator with a copy to the other party within five (5) business days after the appointment of the arbitrator any data and additional information that such party deems relevant to the determination by the arbitrator and the other party may submit a reply in writing within five (5) business days after receipt of such data and additional information. The arbitrator shall conduct such evidentiary hearings as the arbitrator deems necessary or appropriate. The arbitrator shall, within thirty (30) days of his or her appointment, reach a decision as to the disputed matters in Tenant’s Approved Inspection Firm’s report, and shall notify Landlord and Tenant of such determination. The decision of the arbitrator shall be binding upon Landlord and Tenant. If Landlord and Tenant fail to agree upon and appoint such arbitrator, then the appointment of the arbitrator shall be made by JAMS. If Landlord and Tenant fail to agree upon other matters relating to the arbitration, then the rules of JAMS shall govern such arbitration. The cost of arbitration shall be paid by the substantially unsuccessful party, as determined by the arbitrator. The arbitration proceeding and all evidence given or discovered pursuant thereto shall be maintained in confidence by all parties. Judgment upon the award rendered by the arbitrator may be entered by either party into any court having jurisdiction, or application may be made to such court for a judicial recognition of the award or an order of enforcement thereof, as the case may be. If such arbitration reveals that Tenant has made an overpayment, Landlord shall credit the amount of the overpayment the next monthly rent payment of Tenant, or if the Term has expired or otherwise been terminated, refund such overpayment to Tenant. If the certification shows that the amount payable by Tenant attributable to Tenant’s Share of actual Property Taxes and Operating Expenses was less than reported in Landlord’s Statement, Tenant shall be credited against the next installment of Rent in the amount of any overpayment by Tenant, and, if the amount reported in Landlord’s Statement exceeded the amount determined by the certification as payable by Tenant attributable to Tenant’s Share of Property Taxes and Operating Expenses for the period subject to the certification by more than the greater of $7,500 or four percent (4%), Landlord shall reimburse Tenant for its actual and reasonable audit expenses incurred in aUditing such statement, and a reimbursement of attorneys’ fees incurred in determining and recovering the overpayment in addition to the credit, or when appropriate, a refund of the overpayment. Likewise, if the certification shows that the amount payable by Tenant attributable to Tenant’s Share of actual Property Taxes and Operating Expenses was greater than reported in Landlord’s Statement, Tenant shall pay Landlord the amount of any underpayment within thirty (30) days . If Tenant fails to timely exercise its audit rights in accordance with this Section 4(h), the failure shall be conclusively deemed to constitute Tenant’s approval of Landlord’s Statement for the calendar year in question. In no event shall this Section 4(h) be deemed to allow any review of any of Landlord’s books and records by any subtenant of Tenant. The provisions of this Section 4(h) are intended as the sole and exclusive remedy of Tenant for the resolution of disputes relating to Additional Rent stated in any Landlord’s Statement and shall survive the termination or expiration of this Lease for such period as hereinabove

11

provided for Tenant to exercise such right during the year prior to such termination or expiration of the Lease Term. Landlord’s failure to submit a Landlord’s Statement to Tenant within one (1) year after the expiration of any calendar year shall be deemed a conclusive waiver of Landlord’s right to any Additional Rent relating to such Landlord’s Statement for such year (except for Additional Rent due in connection with Property Taxes, to the extent that the associated delay was attributable to with a failure by the taxing authority to provide the assessment required to invoice Tenant for Additional Rent within such period of time). Landlord’s failure to submit a Landlord’s Statement shall not deprive Tenant of its right to recover from Landlord if Tenant’s estimated payments exceed the amounts actually due from Tenant for Operating Expenses or Property Taxes. Subject to the preceding sentence, the obligations of Landlord and Tenant with respect to any Additional Rent shall survive the expiration or any sooner termination of the Term.

5. Security Deposit.

(a) Landlord and Tenant acknowledge that Landlord holds a letter of credit issued by ▇▇▇▇▇ Fargo Bank to secure Tenant’s obligations under the Office Lease (the “Letter of Credit,” and the cash proceeds such thereof and other funds held by Landlord in accordance with Paragraph 6 of the Office Lease, being referred to therein as the “Security Deposit”). By its execution hereof, Tenant agrees that the Letter of Credit shall also serve as security for the faithful performance of all its obligations to be performed and observed by Tenant under this Lease, that Landlord may make a draw under the Letter of Credit based on a default under this Lease, and that the Security Deposit funds may be applied by Landlord as provided in this Lease.

(b) If Tenant fails to pay any Rent, or otherwise defaults with respect to any provision of this Lease, and such failure results in an Event of Default, Landlord may (but shall not be obligated to) draw on the Letter of Credit, and use, apply or retain all or any portion of the proceeds of a draw under the Letter of Credit (and said proceeds shall be deemed a Security Deposit) for the payment of any Rent in default or for the payment of any other sum to which Landlord may become entitled by reason of Tenant's default, or to compensate Landlord for any loss or damage which Landlord may suffer thereby, including any amounts Landlord is obligated or elects to spend in order to cure any such Events of Default or to mitigate its damages following an Event of Default or the termination of this Lease (including, without limitation, damages arising under California Civil Code Section 1951.2). Upon the occurrence of an event entitling Landlord to draw upon the Letter of Credit, Landlord shall be entitled to draw on the entire Letter of Credit, and apply any portion of the proceeds to cure said Event of Default, and hold the remainder as a Security Deposit under this Lease. If Landlord so uses or applies all or any portion of the Security Deposit or the proceeds of a draw under the Letter of Credit (and the Lease Term is still in effect), Tenant shall within ten (10) days after demand therefor deposit cash with Landlord in an amount sufficient to restore the Security Deposit and/or replace the Letter of Credit, to the full amount thereof stated in the Summary provided, however, that if Landlord has drawn upon the Letter of Credit such that Landlord is then holding any Security Deposit, upon Tenant’s reinstatement of the Letter of Credit in the required amount described herein, Landlord will immediately return to Tenant any Security Deposit then held by Landlord. Landlord’s application of all or any portion of the Security Deposit and/or the proceeds under the Letter of Credit to any obligation of Tenant hereunder shall not limit Landlord’s damages or constitute a waiver by Landlord of any claims against or obligations of Tenant, other than the specific monetary obligations to which the Security Deposit is applied, and then only to the extent such obligations are thereby satisfied. Landlord shall not be required to keep the Security Deposit separate from its general funds, Tenant shall not be entitled to interest thereon, and Tenant waives the benefit of any Law to the contrary. Tenant waives the provisions of California Civil Code Section 1950.7 (which restricts application of a security deposit only to those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by Tenant, or to clean premises) and all similar Laws now in force or subsequently adopted which restrict application of security deposits to specific purposes.

12

(c) The Security Deposit, or so much thereof as has not theretofore been applied by Landlord, without payment of interest or other increment for its use, and/or the Letter of Credit, as reduced by any draws thereunder made by Landlord pursuant to this Section 5, shall be returned to Tenant (or, at Landlord’s option, to the last assignee, if any, of Tenant’s interest hereunder) within thirty (30) days following the expiration of the Lease Term and after Tenant has vacated the Premises; provided, however, prior to the surrender and cancellation thereof, to the extent that Landlord reasonably anticipates substantial reconciliation expenses associated with calculation of Additional Rent for the final year of the Lease Term that are not invoiced to Tenant, Landlord may draw upon the Letter of Credit an amount up to Ten Thousand Dollars ($10,000.00) and hold such proceeds as a deposit on account of any amounts due from Tenant attributable to Tenant’s Share for the calendar year in which this Lease terminates or expires, and any unapplied funds so held by Landlord shall be refunded to Tenant within thirty (30) days following Tenant’s approval or deemed approval of Landlord’s Statement for the calendar year in which the Lease expiration or termination occurs. Landlord’s return of the Security Deposit and/or the Letter of Credit, as the case may be, shall not be construed as an admission that Tenant has performed all of its obligations under this Lease. No trust relationship is created herein between Landlord and Tenant with respect to the Security Deposit and/or the Letter of Credit. If Landlord disposes of its interest in the Premises, Landlord shall deliver or credit the Security Deposit or the Letter of Credit to Landlord’s successor in interest in the Premises and give Notice thereof to Tenant, and the transferring Landlord shall thereupon be relieved of further responsibility with respect to the Security Deposit, and Tenant shall look solely to the successor Landlord for any claims therefor. Upon request of Landlord, and in accordance with this Section 5, Tenant shall cooperate with Landlord, in causing the issuing bank of any Letter of Credit to acknowledge the transfer of the beneficiary’s rights thereunder to Landlord’s successor in interest.

(d) Within ten (10) business days following the due execution and delivery of this Lease, Tenant shall cause ▇▇▇▇▇ Fargo Bank to issue an amendment to the Letter of Credit evidencing the right of Landlord to draw the funds in the event of a default under this Lease in form and substance reasonably satisfactory to Landlord.

6. Use.

(a) The Premises shall be used only for the Permitted Use and shall be used for no other purpose without the prior written consent of Landlord, which consent shall not be unreasonably withheld. For purposes of example, and without otherwise limiting other activities that may be included in the Permitted Use, Tenant (subject to the other limitations of this Section 6) may screen videos or film in the Premises promoting Tenant’s products and services, and provide workshops and events that directly promote and provide technical assistance in the use of Tenant’s products and services. Tenant acknowledges that the Permitted Use is not exclusive. Tenant further acknowledges and agrees that it is not relying on the fact, nor does Landlord represent, that any specific tenant or occupant or number of tenants, or types of tenants, or occupants shall during the Term occupy any space in the Building or the Project. In connection with any request to modify or change such Permitted Use, Tenant acknowledges and agrees that any such retail use must be of the type typically found in and consistent with the character of comparable first class office buildings in the San Francisco, South of Market, metropolitan area at that time (but specifically excluding any “off-price” or “discount” operation or a store that sells irregular, seconds or factory damaged goods), taking into account ground floor visibility and proximity to the main entrance of the building; provided further that such proposed new use may not: (i) conflict with or violate any exclusive use rights or prohibited uses then in effect for the Building; (ii) conflict with, or be substantially similar to, the primary use of any then-existing tenant in the Building; (iii) violate any Requirements; or (iv) overburden any Building facilities, including but not limited to lighting, security, maintenance or common areas.

(b) As further consideration to Landlord to enter into this Lease, Tenant covenants and agrees as follows:

13

(i) Tenant shall not use any part or all of the Premises for the conduct of any adult entertainment business or a business primarily engaged in sexually explicit products or services.

(ii) Tenant shall not conduct or permit to be conducted in the Premises any sale by auction, or any fire, distress or bankruptcy sale.

(iii) Tenant shall not keep, display or sell, or suffer or permit the display or sale, of any merchandise outside the Premises, or otherwise obstruct any common areas or sidewalks in and about the Project.

(iv) Tenant shall not operate a restaurant or food or beverage market, or offer take-out food or beverage service (including any sale of alcoholic beverages, sale of coffee drinks or other hot or cold drinks, such as soda, juices or water), or sale of other food products; provided that the foregoing shall not prevent Tenant from offering such items in connection with specific events held at the Premises for Tenant’s customers, clients or invitees for on premises consumption

(v) Tenant shall not install any audio system on the exterior of the Premises or within the Premises if the same is primarily directed towards the outside of the Premises, or play music (live or recorded) in a manner that creates noise or disturbances that can be heard outside the Premises.

(vi) As soon as practicable and in any event within three (3) business days after any exterior glass in the Premises facing onto the street is broken or cracked, including a so-called “bull’s eye” break in the glass, Tenant shall, at its sole cost and expense, replace such glass with glass of the same kind and quality and, as may be necessary or desirable in connection with such replacement, repair or replace the frames for such glass. In the event that Tenant shall fail to so replace such glass and, if necessary, repair or replace such frames within said three (3)-day period, Landlord may at any time thereafter replace such glass and, if necessary, replace or repair such frames on Tenant’s behalf and Tenant shall promptly pay to Landlord, as additional rent, the reasonable cost incurred by Landlord in so doing.

(vii) At all times the business transacted in the Premises shall be conducted, and the appearance of the Premises (including lighting, displays, store front windows, and cleanliness) will be dignified and befitting the quality of the Project. The visual appearance of the interior of the Premises from the surrounding exterior area shall be clean, visually attractive and open, and in keeping with the quality historic image of the Project.

(viii) All deliveries to and from the Premises shall be made through the Premises of the loading dock area of the Building, and not through any other portion of the Building.

(c) Tenant acknowledges that Landlord and/or its authorized representatives have not made any warranties and/or representations as to the permitted use that can be made of the Premises under existing laws, ordinances, rules, regulations or codes (including zoning ordinances), and that responsibility for confirming any permitted use of the Premises is the sole responsibility of Tenant and is not a condition to the effectiveness of this Lease.

(d) Tenant shall, at Tenant’s expense, faithfully observe and comply with, and shall cause all Tenant Parties to so observe and comply with, (i) all laws, statutes, codes, rules, regulations, ordinances, requirements, guidelines and orders, now in force or hereafter promulgated or adopted, by any Governmental Authority (collectively, “Laws”) that are applicable to the particular use and occupancy of the Premises by Tenant, the conduct of Tenant’s business therein, and the use by Tenant or any Tenant Party of the Premises or any other portion of the Project; (ii) all recorded covenants, conditions and restrictions affecting the Project, whether presently existing or subsequently recorded (collectively, “CC&Rs”) written notice and a copy of which is provided to Tenant; and (iii) all current and future requirements of any applicable

14

fIre rating bureau or other body exercising similar functions (collectively, “Requirements”), in each case regardless of cost, the permanency of any required improvements to comply therewith and/or the ability of the parties hereto to contemplate the enactment of said Laws. Landlord shall not modify any presently existing CC&Rs or enter into new CC&Rs in any manner that would result in a material adverse effect or would result in a material impairment or loss of any of Tenant’s rights under or in the use or occupancy of the Premises by Tenant in accordance with this Lease. Tenant acknowledges and agrees that its obligation to comply with Laws includes compliance with all present or future programs intended to manage parking, transportation or traffIc in and around the Project, and in connection therewith, Tenant shall take responsible action for the transportation planning and management of all Tenant’s employees at the Project by working directly with Landlord, Governmental Authorities, and any applicable transportation-related committees and entities.

(e) Subject to permitted closures following a casualty or exercise by landlord of Landlord’s right to temporary close Common Areas necessary for access to the Premises, or for Permitted Closures (as hereinafter defIned), Tenant shall remain open for business continuously and uninterruptedly for the purpose or purposes specifIed herein during minimum hours of operation comparable to other retail tenants at the Building (which is currently 9:00 a.m. through 6:00 p.m., Monday through Friday, excluding Holidays) (the “Minimum Hours of Operation”). As used herein, “Holidays” shall mean the dates of observation of New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, Christmas Day and other locally or nationally recognized holidays on which federally insured national banks doing business in the State of California are required or permitted under applicable laws to close for business (“Holidays”) and “Permitted Closures” shall mean the cessation of business (i) for fixturing, remodeling, repairing or refurbishing the Premises (not to exceed thirty (30) days at any one time), or (ii) during any period of Force Majeure. Notwithstanding anything to the contrary in the foregoing, Tenant may elect to not operate in the Premises during the following periods: (i) the week between Christmas and New Years, and (ii) during the Thanksgiving week.

7. Utilities and Services. Subject to the terms and conditions of this Section 7, Landlord shall furnish the following services at a level of service comparable in quality to those customarily provided by landlords in buildings of a similar design in the area in which Project is located.

(a) Standard Utilities. Subject to interruptions beyond Landlord’s control, Landlord agrees to furnish or cause to be furnished to the Premises, the utilities and services described below, subject to the conditions and in accordance with the standards set forth below:

(i) | Electricity for light and power in the Premises |

(ii)During Normal Building Hours, heat, and air ventilation and conditioning (“HVAC”) for the comfortable occupancy of the Premises in accordance with standards of thermal environmental comfort (i.e., maintaining a temperature between 68 and 72 degrees Fahrenheit),air velocity, air quality, and ventilation consistent with other “Class A” office buildings in San Francisco, CA. The parties agree and understand that the HVAC will be provided during Normal Business Hours. Landlord agrees, for so long as Tenant (or any Permitted Transferee) is the sole occupant of the office space in the Building, that Landlord will implement changes in the Normal Business Hours for operating the Building upon reasonable advance written notice from Tenant (subject to compliance with applicable Laws); provided, however, that any and all costs and expenses incurred or payable by Landlord due to a change in or expansion of Normal Business Hours (including engineering, labor, property management, and any excess wear and tear on Building Systems) shall be at the sole cost of Tenant and shall be chargeable to Tenant as Additional Rent and not as an Operating Expense.

(iii)Hot and cold water for drinking, cleaning, and lavatory purposes only.

15

(iv)Janitorial services to the Premises in accordance with the Janitorial Specifications and Green Cleaning Policy attached hereto as Exhibit F (collectively, the “Janitorial Specifications”). At any time during the Lease Term and upon sixty (60) days prior written notice to Landlord, Tenant may independently contract for the provision of janitorial services for the Premises in which case Landlord’s obligations under this Section 7(a)(iv) shall be waived (and payment of Janitorial Rent shall be abated). Any such janitorial services obtained by Tenant shall be performed in accordance with the Janitorial Specifications, and any such janitorial services obtained by Tenant shall utilize exclusively union labor. If Landlord provides janitorial services to the Premises, and to the premises leased by Tenant under the Office Lease, an equitable allocation (on a square footage basis) of the total cost of janitorial services provided by Landlord to Tenant at the Building shall be made to the Premises for purposes of determining Janitorial Rent.

(b) Direct Billing for Utilities. It is the intent of Landlord to separately meter the Premises (either through existing submeters or through a Landlord installed meter (such as an E-monmeter) for electrical consumption, in which event Tenant shall pay for all charges for electricity consumption (including Excess HVAC and electricity for Supplemental Equipment) supplied to the Premises directly to Landlord as Utility Rent.

(c) Electrical Service Provider. Landlord shall have the sole right during the Lease Term to contract for electricity service from such providers of such services as Landlord shall elect (each being an “Electric Service Provider”). Tenant shall cooperate with Landlord, and the applicable Electric Service Provider, at all times and, as reasonably necessary, shall allow Landlord and such Electric Service Provider reasonable access to the Building’s electric lines, feeders, risers, wiring, and any other machinery within the Premises. Landlord shall endeavor to utilize the benefits of any energy efficiency program or incentive directly or indirectly applicable to Tenant’s consumption of energy or reduction in energy usage or similar matters to reduce the Operating Expenses of the Project. Notwithstanding the foregoing, if during the Term it becomes feasible for Tenant to directly contract with an Electric Service Provider, Landlord shall cooperate with Tenant to facilitate Tenant’s engagement of such Electric Service Provider.

(d) Electrical Service Disclosure; Certifications; Efficiency. Tenant acknowledges that current and future disclosures and information may be required by applicable Law in connection with Landlord’s lease of the Premises. Tenant shall provide Landlord any and all information reasonably requested by or on behalf of Landlord in connection with the utilities used at, and energy and water consumption from, the Premises and/or any other energy efficiency related information, as necessary for Landlord to comply with applicable Law and as necessary for Landlord to maintain or obtain energy efficiency and other certifications for the Building, including, without limitation, Energy Star, LEED, and other certifications. Tenant shall cooperate with Landlord in maintaining all such certifications and in maintaining maximum efficiency of the Building, including, without limitation, by taking reasonable steps to minimize its energy and water consumption within the Premises, minimizing Tenant’s waste, and participating in any recycling, waste management, energy efficiency, water conservation, and transportation management programs as may be instituted by Landlord from time to time.

(e) After-Hours HVAC; Excess Use. Tenant’s use of electricity shall not exceed the capacity of the feeders , risers or wiring serving the Premises. Tenant shall not, without Landlord’s prior written consent, use heat-generating machines or equipment in the Premises, other than normal fractional horsepower office machines or equipment, or lighting, other than Building’s standard lights, that individually or collectively may affect the temperature otherwise maintained by the Building’s existing HVAC system, require dedicated HVAC services or increase the amount of HVAC normally furnished to the Premises (any such dedicated or increased HVAC being referred to herein as “Excess HVAC”), or, except as provided above, are operated by Tenant substantially on a continuous or semi-continuous basis during any hours other than Normal Business Hours (any such heat-generating machines and equipment being referred to herein as

16

“Supplemental Equipment”). Upon request, Landlord shall make available, at Tenant’s expense, after hours HVAC. The minimum use of after-hours HVAC and the cost thereof shall be reasonably determined by Landlord, and confirmed in writing to Tenant as the same may change from time to time. If Tenant uses, and Landlord elects to provide, water, electricity, heat, or HVAC in excess of that required to be supplied by Landlord under this Section 7 (including the use of Excess HVAC services or the use of Supplemental Equipment) or uses the Premises outside of Normal Business Hours, (i) Tenant shall pay Landlord for all costs of: (x) the excess utility service (based on actual amounts chargeable to Landlord); (y) Landlord’s estimated cost of the increased wear and tear on existing equipment caused by Tenant’s excess consumption; and (z) Landlord’s cost of engineering, maintenance, security, and janitorial services that are required by Landlord as a result of Tenant’s use of the Premises outside of Normal Business Hours, and (ii) Landlord shall have the right to require Tenant to install supplementary air conditioning units and other supplemental facilities in the Premises, the cost, installation, operation and maintenance of which shall be paid by Tenant to Landlord. Subject to Tenant’s obligation to reimburse Landlord for all costs as described in this Section 7(e), if Tenant requires dedicated HVAC services, Landlord shall cooperate in allocating condensed water and other utilities to Tenant’s dedicated HVAC services. Notwithstanding the foregoing, for so long as Tenant (or any Permitted Transferee) is the sole occupant of the office space in the Building, Tenant may establish regular times outside of Normal Business Hours during which Excess HVAC services, the use of Supplemental Equipment, and engineering, maintenance, security, and janitorial services shall be provided by Landlord (at Tenant’s expense), without requiring the confirmation of such times on a rolling daily basis.