Contract

Exhibit (k)(7)

ESCROW AGREEMENT A THIS ESCROW AGREEMENT (this “Agreement”) is made and entered into as of this 17th day of May, 2012 by and among EMS Income Fund, Inc. a Maryland corporation (the “Company”), Xxxxx Securities, Inc., a Delaware corporation (the “Dealer Manager”) and UMB Bank, N.A., as escrow agent, a national banking association organized and existing under the laws of the United States of America (the “Escrow_Agent”). RECITALS WHEREAS, the Company proposes to offer and sell up to 150,000,000 shares of its common stock, par value $0001 per share (the “Shares”) on a best-efforts basis (including the shares of its common stock to be offered and sold pursuant to the Company’s distribution reinvestment plan), at an initial subscription price of $ 10.00 per share (the “Offering”) to investors pursuant to the Company’s Registration statement on Form N-2 (File No. 333-178548), us amended from time to time (the “Offering Document”). WHEREAS, the Dealer Manager has been engaged by the Company to offer and sell the Shares on a best efforts basis through a network of soliciting dealers (the “Soliciting Dealers”). WHEREAS, the Company and the Dealer Manager desire to establish an escrow account (the “Escrow Account”), as further described herein, in which finds received from subscribers (“Investor Funds”) will be deposited into an interest-bearing account entitled “HMS Income Fund, Inc. Escrow Account” and the Company desires that UMB Bank, NA. act as escrow agent to the Escrow Account and Escrow Agent is willing to act in such capacity. WHEREAS, the Escrow Agent has engaged DST Systems, Inc. (the ‘Transfer Agent”) to receive, examine for “good order” and facilitate subscriptions into the Escrow Account as further described herein and to act as record keeper, maintaining on behalf of the Escrow Agent the ownership records for the Escrow Account. In so acting, the Transfer Agent shall be acting solely in the capacity of agent for the Escrow Agent and not in any capacity on behalf of the Company or the Dealer Manager, nor shall they have any interest other than that provided in this Agreement in assets in Transfer Agent’s possession as the agent of the Escrow Agent. WHEREAS, in order to subscribe for Shares during the Escrow Period (as defined below), a subscriber must deliver the fill amount of its subscription price by cheek or wire transfer, payable to HMS lncome Fund, Inc. to the Transfer Agent at the address set forth in the subscription agreement. AGREEMENT NOW, THEREFORE, the Company, Dealer Manager and Escrow Agent agree to the terms of this Agreement as follows: 1. Establishment of Escrow Account: Escrow Period, Upon commencement of the Offering, the Company shall establish the Escrow Account with the Escrow Agent, which shall

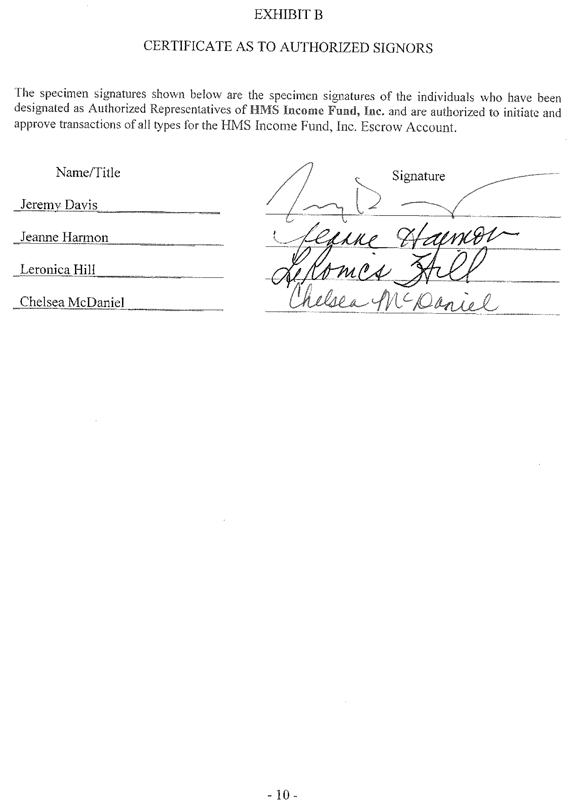

be entitled “HMS Income Fund, Inc. Escrow Account.” The Company shall notify the Escrow Agent when the Offering becomes effective. 2. Operation of the Escrow. (a) Deposits in the Escrow Account. During the Escrow Period, persons subscribing to purchase Shares will be instructed by the Company, the Dealer Manager and the Soliciting Dealers to make checks for subscriptions payable to the order of ”HMS Income Fund, Inc.” Completed subscription agreements and checks, or wire transfers, in payment for the subscription amount shall be remitted to the Transfer Agent at the address set forth in the subscription agreement. The Transfer Agent will promptly deliver all monies received in good order from subscribers for the payment of Shares to the Escrow Agent for deposit in the Escrow Account. Deposits shall be held in the Escrow Account until such Investor Funds are disbursed in accordance with this Agreement. Prior to disbursement of the Investor Funds deposited in the Escrow Account, such Investor Funds shall not be subject to claims by creditors of the Company or any of its affiliates. If any checks are returned to the Escrow Agent for nonpayment, the Escrow Agent shall promptly notify the Transfer Agent and the Company in writing via mail, email or facsimile of such nonpayment, and the Escrow Agent is authorized to debit the Escrow Account in the amount of such returned payment and the Transfer Agent shall delete the appropriate account from the records maintained by the Transfer Agent. The Transfer Agent will maintain a written account of each sale, which account shall set forth, among other things, the following information: (i) the subscriber’s name and address; (ii) the subscriber’s social security number; (iii) the number of Shares purchased by such subscriber, and (iv) the amount paid by such subscriber for such Shares. (b) Disbursement of Investor Funds. During the Escrow Period, the Escrow Agent shall release the Investor Funds, including all earnings thereon, to the Company, when and as directed in writing (or via electronic mail) by the Company. The Escrow Agent agrees that Investor Funds in the Escrow Account shall not be released to the Company until and unless the Escrow Agent receives written instructions (or via electronic mail) to release the Investor Funds from an Authorized Representative of the Company as listed on Exhibit B. It is initially determined that Funds will be released to the Company on a semi-monthly basis. However, the Company reserves the right to initiate releases on different interval as it deems necessary. (c) Duration of the Escrow Period. The Escrow Period shall be determined to be active for the duration of the Company’s first offering, and continue through any extensions of such offering, and any follow on offering. 3. Investor Funds in the Escrow Account. Upon receipt of Investor Funds, the Escrow Agent shall hold such Investor Funds in escrow pursuant to the terms of this Agreement. All Investor Funds held in the Escrow Account shall be invested at the direction of the Company. Unless otherwise directed by the Company, the Escrow Agent is hereby directed to invest all funds received under this Agreement in UMB Bank Money Market Special, a UMB Bank interest-bearing money market deposit account. Notwithstanding the foregoing, Investor Funds shall not be invested in anything other than “Short Term Investments” in compliance with Rule I 5c2-4 of the Securities Exchange Act of 1934, as amended. Income, if any, resulting from the -2-

investment of the funds in the Escrow Account shall be distributed to the Company. The Escrow Agent shall provide to the Company monthly statements (or more frequently as reasonably requested by the Company) on the account balance in the Escrow Account and the activity in such accounts since the last report. 4. Duties of the Escrow Agent. The Escrow Agent shall have no duties or responsibilities other than those expressly set forth in this Agreement, and no implied duties or obligations shall be read into this Agreement against the Escrow Agent. The Escrow Agent is not a party to, or bound by, any other agreement among the other parties hereto with respect to the subject matter hereof, and the Escrow Agent’s duties shall be determined solely by reference to this Agreement. The Escrow Agent shall have no duty to enforce any obligation of any person, other than as provided herein. The Escrow Agent shall be under no liability to anyone by reason of any failure on the part of any party hereto or any maker, endorser or other signatory of any document or any other person to perform such person’s obligations under any such document. 5. Liability of the Escrow Agent and Transfer Agent; Indemnification. The Escrow Agent acts hereunder as a depository only. Each of the Escrow Agent and Transfer Agent shall not be liable for any action taken or omitted by it, or any action suffered by it to be taken or omitted, in good faith, and in the exercise of its own best judgment, and may rely conclusively and shall be protected in acting upon any order, notice, demand, certificate, opinion or advice of counsel (including counsel chosen by the Escrow Agent or Transfer Agent), statement, instrument, report or other paper or document (not only as to its due execution and the validity and effectiveness of its provisions, but also as to the truth and acceptability of any information therein contained) which is believed by the Escrow Agent or Transfer Agent to be genuine and to be signed or presented by the proper person(s). Each of the Escrow Agent and Transfer Agent shall not be held liable for any error in judgment made in good faith by an officer or employee of either unless it shall be proved that such officer or employee was grossly negligent or reckless in ascertaining the pertinent facts or acted intentionally in bad faith. The Escrow Agent shall not be bound by any notice of demand, or any waiver, modification, termination or rescission of this Agreement or any of the terms hereof, unless evidenced by a writing delivered to the Escrow Agent signed by the proper party or parties and, if the duties or rights of the Escrow Agent are affected, unless it shall give its prior written consent thereto. Either of the Escrow Agent or Transfer Agent may consult legal counsel and shall exercise reasonable care in the selection of such counsel, in the event of any dispute or question as to the construction of any provisions hereof or its duties hereunder, and it shall incur no liability and shall be fully protected in acting in accordance with the reasonable opinion or instructions of such counsel. Each of the Escrow Agent and Transfer Agent shall not be responsible, may conclusively rely upon amid shall be protected, indemnified and held harmless by the Company, for the sufficiency or accuracy of the form of, or the execution, validity, value or genuineness of any document or property received, held or delivered by it hereunder, or of the signature or endorsement thereon, or for any description therein; nor shall the Escrow Agent or the Transfer Agent be responsible or liable in any respect on account of the identity, authority or rights of the -3-

persons executing or delivering or purporting to execute or deliver any document, property or this Agreement. In the event that either the Escrow Agent or Transfer Agent shall become involved in any arbitration or litigation relating to the Investor Funds in the Escrow Account, each is authorized to comply with any decision reached through such arbitration or litigation. The Company, hereby agrees to indemnify both the Escrow Agent and the Transfer Agent for, and to hold it harmless against any loss, liability or expense incurred in connection herewith without gross negligence, recklessness or willful misconduct on the part of either of the Escrow Agent or Transfer Agent, including without limitation, legal or other fees arising out of or in connection with its entering into this Agreement and carrying out its duties hereunder, including without limitation the costs and expenses of defending itself against any claim of liability in the premises or any action for interpleader. Neither the Escrow Agent nor the Transfer Agent shall be under any obligation to institute or defend any action, suit, or legal proceeding in connection herewith, unless first indemnified and held harmless to its satisfaction in accordance with the foregoing, except that neither shall be indemnified against any loss, liability or expense arising out of its own gross negligence, recklessness or wilful misconduct. Such indemnity shall survive the termination or discharge of this Agreement or resignation of the Escrow Agent. The terms of this Section shall survive the termination of the Escrow Agreement and the resignation or removal of the Escrow Agent. 6. The Escrow Agent’s Fee. Escrow Agent shall be entitled to fees and expenses for its regular services as Escrow Agent as set forth in Exhibit A. Additionally, Escrow Agent is entitled to reasonable fees for extraordinary services and reimbursement of any reasonable out of pocket and extraordinary costs and expenses related to its obligations as Escrow Agent under this Agreement, including, but not limited to, reasonable attorneys’ fees. All of the Escrow Agent’s compensation, costs and expenses shall be paid by the Company. 7. Security Interests. No party to this Escrow Agreement shall grant a security interest in any monies or other property deposited with the Escrow Agent under this Escrow Agreement, or otherwise create a lien, encumbrance or other claim against such monies or borrow against the same. 8. Dispute. In the event of any disagreement between the undersigned or the person or persons named in the instructions contained in this Agreement, or any other person, resulting in adverse claims and demands being made in connection with or for any papers, money or property involved herein, or affected hereby, the Escrow Agent shall be entitled to refuse to comply with any demand or claim, as long as such disagreement shall continue, and in so refusing to make any delivery or other disposition of any money, papers or property involved or affected hereby. the Escrow Agent shall not he or become liable to the undersigned or to any person named in such instructions for its refusal to comply with such conflicting or adverse demands, and the Escrow Agent shall be entitled to refuse and refrain to act until: (a) the rights of the adverse claimants shall have been fully and finally adjudicated in a Court assuming and -4-

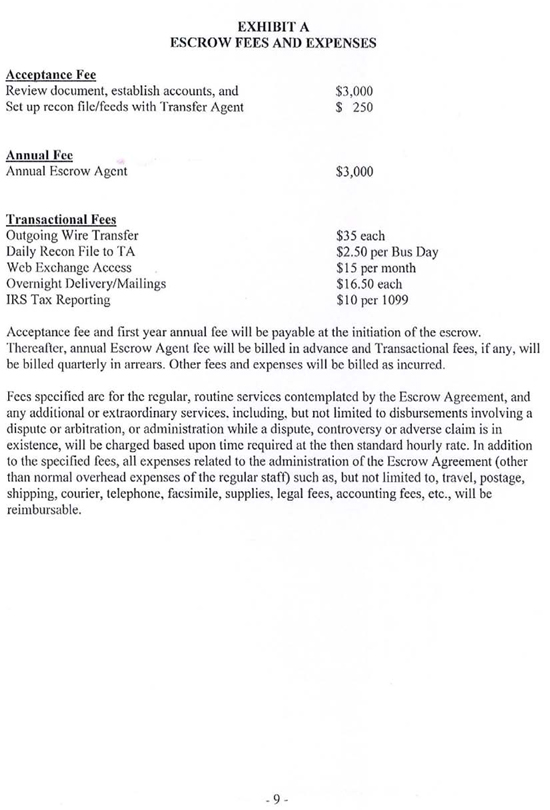

having jurisdiction of the parties and money, papers and property involved herein or affected hereby, or (b) all differences shall have been adjusted by agreement and the Escrow Agent shall have been notified thereof in writing, signed by all the interested parties. 9. Resignation of Escrow Agent. Escrow Agent may resign or be removed, at any time, for any reason, by written notice of its resignation or removal to the proper parties at their respective addresses as set forth herein, at least 60 days before the date specified for such resignation or removal to take effect; upon the effective date of such resignation or removal: (a) All cash and other payments and all other property then held by the Escrow Agent hereunder shall be delivered by it to such successor escrow agent as may be designated in writing by the Company, whereupon the Escrow Agent’s obligations hereunder shall cease and terminate: (b) If no such successor escrow agent has been designated by such date, all obligations of the Escrow Agent hereunder shall, nevertheless, cease and terminate, and the Escrow Agent’s sole responsibility thereafter shall be to keep all property then held by it and to deliver the same to a person designated in writing by the Company or in accordance with the directions of a final order or judgment of a court of competent jurisdiction. (c) Further, if no such successor escrow agent has been designated by such date, the Escrow Agent may petition any court of competent jurisdiction for the appointment of a successor agent; further the Escrow Agent may pay into court all monies and property deposited with Escrow Agent under this Agreement. The terms of this Section shall survive the termination of the Escrow Agreement and the resignation or removal of the Escrow Agent. 10. Notices. All notices, demands and requests required or permitted to be given tinder the provisions hereof must be in writing and shall be deemed to have been sufficiently given, upon receipt, if(i) personally delivered, (ii) sent by telecopy and confirmed by phone or (iii) mailed by registered or certified mail, with return receipt requested, or by overnight courier with signature required, delivered to the addresses set forth below, or to such other address as a party shall have designated by notice in writing to the other parties in the manner provided by this paragraph: (1) If to Company: IIMS Income Fund, Inc. 0000 Xxxx Xxx Xxxxxxxxx Xxxxx 0000 Xxxxxxx, Xxxxx 00000-0 I 18 Attention: Xxxxxx Xxxxx (2) If to the Escrow Agent: UMB Bank, N.A. 0000 Xxxxx Xxxx., 0xx Xxxxx Mail Stop: 1020409 -5-

Xxxxxx Xxxx, Xxxxxxxx 00000 Attention: Xxxx Xxxxxxx Corporate Trust & Escrow Services Telephone: (000) 000-0000 Facsimile: (000) 000-0000 (3) If to Dealer Manager: I-lines Securities, Inc. 0000 Xxxx Xxx Xxxxxxxxx, Xxxxx 0000 Xxxxxxx, Xxxxx 00000-0000 Attention: Xxxx Xxxx 11. Governing Law. This Agreement shall be construed and enforced in accordance with the laws of the State of Missouri without regard to the principles of conflicts of law. 12. Binding Effect; Benefit. This Agreement shall be binding upon and inure to the benefit of the permitted successors and assigns of the parties hereto. 13. Modification. This Agreement may be amended, modified or terminated at any time by a writing executed by the Dealer Manager, the Company and the Escrow Agent. 14. Assignability. This Agreement shall not be assigned by the Escrow Agent without the Company’s prior written consent. 1 5. Counterparts. This Agreement may be executed in one or more counterparts, each of which will be deemed an original, but all of which together will constitute one and the same instrument. Copies, telecopies, facsimiles, electronic files and other reproductions of original executed documents shall be deemed to be authentic and valid counterparts of such original documents for all purposes, including the filing of any claim, action or suit in the appropriate court of law. 16. I leadings. The section headings contained in this Agreement are inserted for convenience only, and shall not affect in any way, the meaning or interpretation of this Agreement. 17. Severability. This Agreement constitutes the entire agreement among the parties and supersedes all prior and contemporaneous agreements and undertakings of the parties in connection herewith. No failure or delay of the Escrow Agent in exercising any right, power or remedy may be, or may be deemed to be, a waiver thereof; nor may any single or partial exercise of any right, power or remedy preclude any other or further exercise of any right, power or remedy. In the event that any one or more of the provisions contained in this Agreement, shall, for any reason, be held to be invalid, illegal or unenforceable in any respect, then to the maximum extent permitted by law, such invalidity, illegality or unenforceability shall not affect any other provision of this Agreement. 18. Earnings Allocation: Tax Matters Patriot Act Compliance: Office of Foreign Control Search Duties. The Company or its agent shall be responsible for all tax reporting under -6-

this Escrow Agreement. The Company shall provide to Escrow Agent up the execution of this Agreement any documentation requested and any information reasonably requested by the Escrow Agent to comply with the USA PATRIOT ACT of 2001, as amended from time to time. The Escrow Agent, or its agent, shall complete an Office of Foreign Assets Control (“OFAC”) search, in compliance with its policy and procedures, of each subscription check and shall inform the Company if a subscription check fails the OFAC search. The Dealer Manager shall provide a copy of each subscription check in order that the Escrow Agent, or its agent, may perform such OFAC search. 19. Miscellaneous. This Agreement shall not be construed against the party preparing it. and shall be construed without regard to the identity of the person who drafted it or the party who caused it to be drafted and shall be construed as if all parties had jointly prepared this Agreement and it shall be deemed their joint work product, and each and every provision of this Agreement shall be construed as though all of the parties hereto participated equally in the drafting hereto and any uncertainty or ambiguity shall not be interpreted against any one party. As a result of the foregoing, any rule of construction that a document is to be construed against the drafting party shall not be applicable. 20. Third Party Beneficiaries. The Transfer Agent shall be a third party beneficiary under this Agreement, entitled to enforce any rights, duties or obligations owed to it under this Agreement notwithstanding the terms of any other agreements between the Transfer Agent and any party hereto. 21. Relationship of Parties. The Dealer Manager, the Company and the Escrow Agent are unaffiliated parties, and this Agreement does not create any partnership or joint venture among them. [SIGNATURE PAGES FOLLOW]

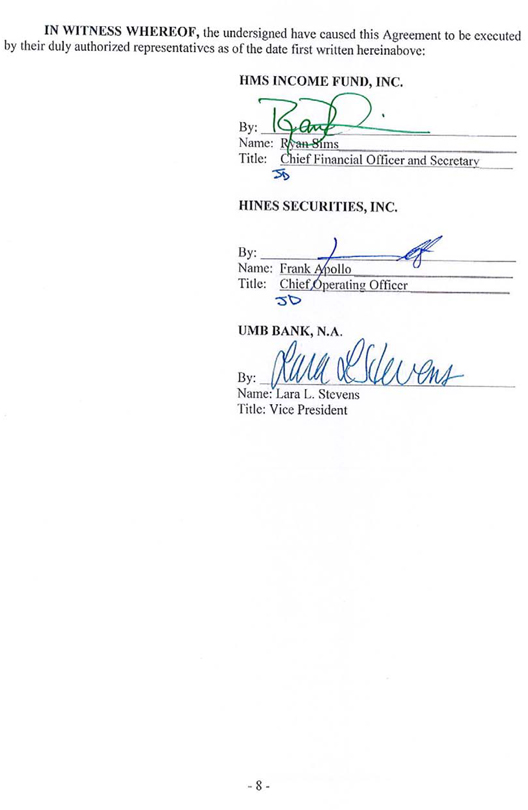

IN WITNESS WHEREOF, the undersigned have caused this Agreement to be executed by their duly authorized representatives as of the date first written hereinabove: HMS INCOME FUND, INC. By: Name: Xxxx Xxxx Title: Chief Financial Officer and Secretary XXXXX SECURITIES, INC. By: Name: Xxxxx Apollo Title: Chief Operating Officer UMB BANK, N.A. By: Name: Xxxx X. Xxxxxxx Title: Vice President

EXHIBIT A ESCROW FEES AND EXPENSES Acceptance Fee Review document, establish accounts, and $3,000 Set up recon file/feeds with Transfer Agent $ 250 Annual Fee Annual Escrow Agent $3,000 Transactional Fees Outgoing Wire Transfer $35 each Daily Recon File to TA $2.50 per Bus Day Web Exchange Access $15 per month Overnight Delivery/Mailings $16.50 each IRS Tax Reporting $10 per 1099 Acceptance fee and first year annual fee will be payable at the initiation of the escrow. Thereafter, annual Escrow Agent fee will be billed in advance and Transactional fees, if any, will be billed quarterly in arrears. Other fees and expenses will be billed as incurred. Fees specified arc for the regular, routine services contemplated by the Escrow Agreement, and any additional or extraordinary services, including, but not limited to disbursements involving a dispute or arbitration, or administration while a dispute, controversy or adverse claim is in existence, will be charged based upon time required at the then standard hourly rate. In addition to the specified fees, all expenses related to the administration of the Escrow Agreement (other than normal overhead expenses of the regular stall) such as, but not limited to, travel, postage, shipping, courier, telephone, facsimile, supplies, legal fees, accounting fees, etc., will be reimbursable. -9-

EXHIBIT B CERTIFICATE AS TO AUTHORIZED SIGNORS The specimen signatures shown below are the specimen signatures of the individuals who have been designated as Authorized Representatives of HMS income Fund, Inc. and are authorized to initiate and approve transactions of all types for the HMS Income Fund, Inc. Escrow Account. Name/Title Xxxxxx Xxxxx Xxxxxx Xxxxxx Xxxxxxxx Xxxx Xxxxxxx XxXxxxxx - 10-