MASTER LAND AND BUILDING LEASE (Pool A) between DBMFI LLC, a Delaware limited liability company, as LANDLORD and MORGAN’S FOODS, INC., an Ohio corporation as TENANT December 9, 2011

Exhibit 10.7

MASTER

LAND AND BUILDING LEASE

(Pool A)

between

DBMFI LLC,

a Delaware limited liability company,

as LANDLORD

and

XXXXXX’X FOODS, INC.,

an Ohio corporation

as TENANT

December 9, 2011

INDEX TO MASTER LAND AND BUILDING LEASE

| ARTICLE 1 | DEMISE OF PREMISES | 2 | |

| ARTICLE 2 | TERM | 2 | |

| ARTICLE 3 | RENT | 4 | |

| ARTICLE 4 | USE | 8 | |

| ARTICLE 5 | PERFORMANCE OF OBLIGATIONS; ACCEPTANCE OF DEMISED PROPERTIES | 8 | |

| ARTICLE 6 | ALTERATIONS | 9 | |

| ARTICLE 7 | REPAIRS AND MAINTENANCE | 10 | |

| ARTICLE 8 | COMPLIANCE WITH LAW | 11 | |

| ARTICLE 9 |

DISCLAIMER AND INDEMNITIES

|

11 | |

| ARTICLE 10 |

INSURANCE

|

13 | |

| ARTICLE 11 |

DAMAGE OR DESTRUCTION

|

16 | |

| ARTICLE 12 |

EMINENT DOMAIN

|

16 | |

| ARTICLE 13 |

FINANCIAL COVENANTS OF TENANT

|

17 | |

| ARTICLE 14 | [Intentionally Omitted] | 19 | |

| ARTICLE 15 | EVENTS OF DEFAULT | 19 | |

| ARTICLE 16 | FORCE MAJEURE | 23 | |

| ARTICLE 17 |

NOTICES

|

24 | |

| ARTICLE 18 | ACCESS | 25 | |

| ARTICLE 19 | SIGNS | 25 | |

| ARTICLE 20 | IMPROVEMENTS, BUILDING EQUIPMENT AND RESTAURANT EQUIPMENT | 26 | |

| ARTICLE 21 | END OF TERM; HOLDING OVER | 27 | |

| ARTICLE 22 |

TENANT ASSIGNMENT AND SUBLETTING

|

27 | |

| ARTICLE 23 | FINANCINGS | 30 | |

| ARTICLE 24 | ESTOPPEL CERTIFICATE |

32

|

|

| ARTICLE 25 | RECORDING |

32

|

|

| ARTICLE 26 | APPLICABLE LAW; WAIVER OF JURY TRIAL |

32

|

|

| ARTICLE 27 | LIABILITY OF PARTIES |

33

|

|

| ARTICLE 28 | ATTORNEYS’ FEES; EXPENSES |

33

|

|

| ARTICLE 29 | ENVIRONMENTAL 34 | 34 | |

| ARTICLE 30 | LANDLORD ASSIGNMENT 36 | 36 | |

| ARTICLE 31 | REPLACEMENTS 37 | 37 | |

| ARTICLE 32 | [Intentionally Omitted] 41 | 41 | |

| ARTICLE 33 | LANDLORD’S RIGHTS UNDER LEASE | 41 | |

| ARTICLE 34 | [Intentionally Omitted] | 42 | |

| ARTICLE 35 | [Intentionally Omitted] | 42 | |

| ARTICLE 36 | INTERPRETATION; MISCELLANEOUS | 42 |

| ARTICLE 37 | QUIET ENJOYMENT SUBJECT TO DILIGENCE MATTERS | 42 | |

| ARTICLE 38 |

NO MERGER OF TITLE

|

43 | |

| ARTICLE 39 | ADDITIONAL CERTIFICATIONS, REPRESENTATIONS AND WARRANTIES | 43 | |

| ARTICLE 40 | BROKERS | 44 | |

| ARTICLE 41 | STATE SPECIFIC PROVISIONS | 44 |

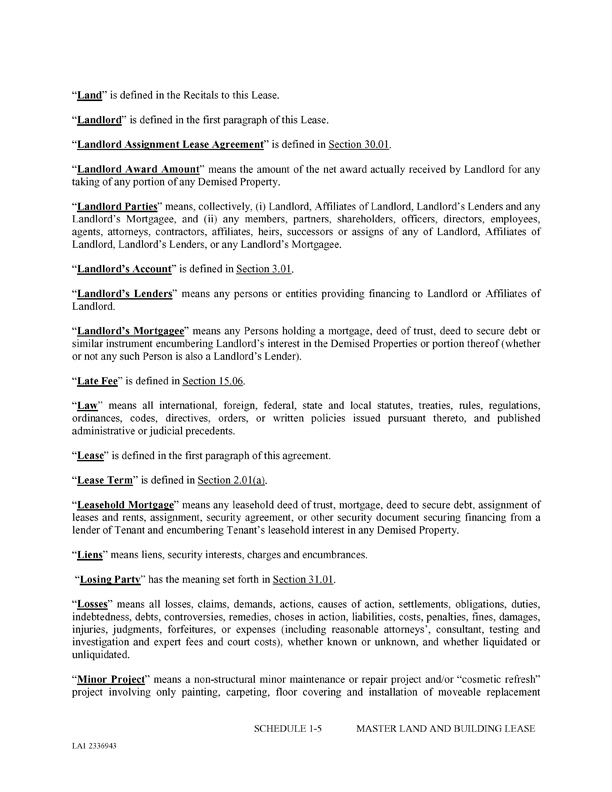

| Schedule 1 | Defined Terms | |

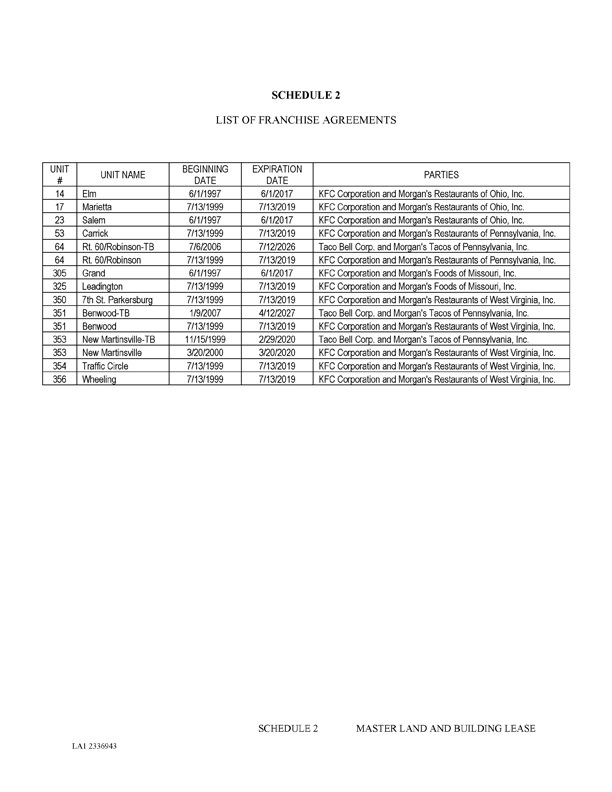

| Schedule 2 | List of Franchise Agreements | |

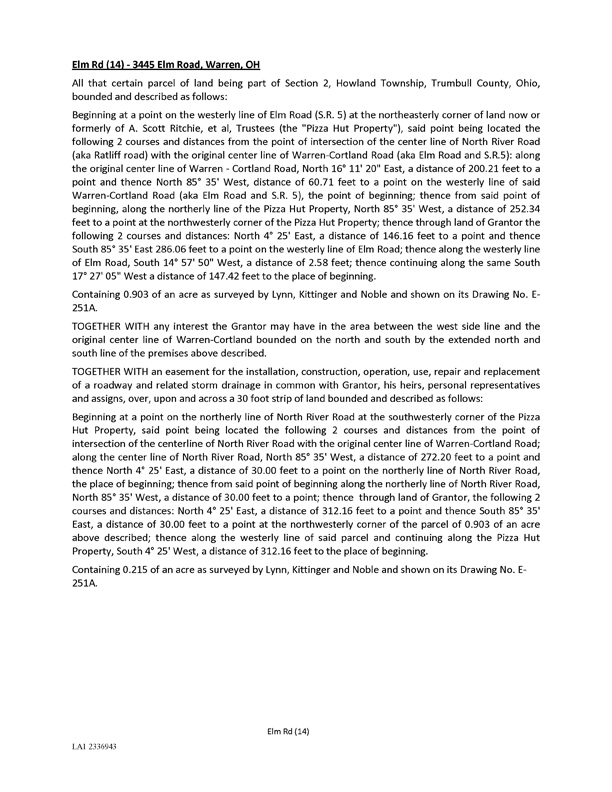

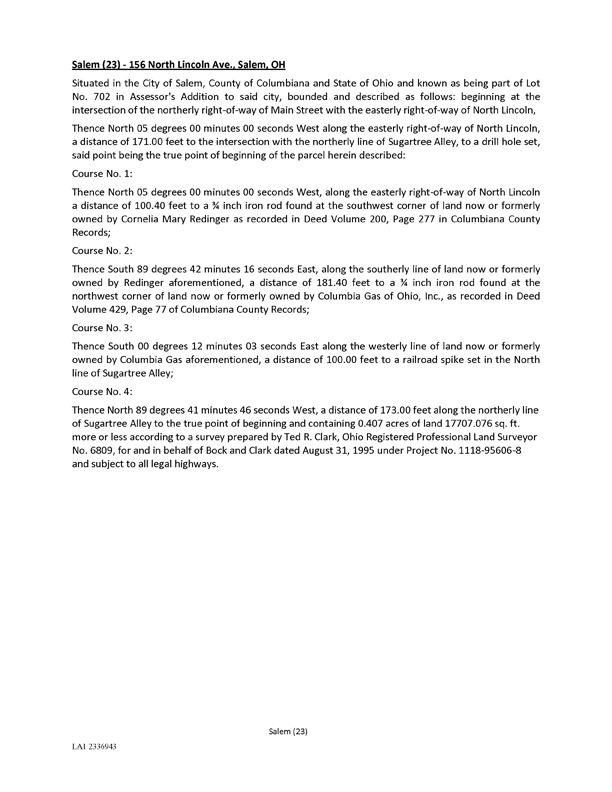

| Exhibit A | Location/Address/Legal Description of Demised Properties | |

| Exhibit B | Form of SNDA | |

| Exhibit C | Form of Tenant’s Estoppel Certificate | |

| Exhibit D-1 | Form of Memorandum of Lease (Missouri) | |

| Exhibit D-2 | Form of Memorandum of Lease (New York) | |

| Exhibit D-3 | Form of Memorandum of Lease (Ohio) | |

| Exhibit D-4 | Form of Memorandum of Lease (Pennsylvania) | |

| Exhibit D-5 | Form of Memorandum of Lease (West Virginia) | |

| Exhibit E | Form of Landlord Assignment Lease Agreement | |

| Exhibit F | Intentionally Omitted | |

| Exhibit G | St. Louis Properties |

MASTER

(Pool A)

THIS MASTER LAND AND BUILDING LEASE (this “Lease”) is made and entered into as of December 9, 2011 (the “Commencement Date”), by and between DBMFI LLC, a Delaware limited liability company (“Landlord”) and XXXXXX’X FOODS, INC., an Ohio corporation (“Tenant ”).

A. Landlord owns (i) good and indefeasible title in fee simple to the land described on Exhibit A attached hereto (collectively, the “Land”); and (ii) all Improvements and other structures located on any of the Land; any rights of way, easements, parking covenants, entitlements, privileges and other rights appurtenant to the Land, including regarding any street adjoining any portion of the Land and any air and development rights related to the Land and any and all fixtures at or on the Land, including all of the machinery, equipment and systems at or on any of the Land (collectively, “Building Equipment”), including the following (but specifically excluding any of the following that are not “fixtures” pursuant to applicable Law): built-in equipment; compressors; appliances; engines; electrical, plumbing, heating, ventilating, and air conditioning machinery; fire sprinklers and fire suppression equipment; lighting (including emergency lighting); security cameras and systems; paging and sound systems; walk-in coolers and grill hoods; built-in sinks; built-in shelving; awnings, and supports for signs (all of the foregoing in this clause (ii), collectively, “Improvements”). The Land and all Improvements thereon are collectively referred to herein as “Demised Properties” and each individually as a “Demised Property .”

B. The personal property, trade fixtures and equipment owned or leased by Tenant located at any Demised Properties and used in connection with the operation of the business at the Demised Properties (other than the Building Equipment) are referred to herein collectively as the “Restaurant Equipment .”

C. Tenant desires to lease from Landlord, and Landlord desires to lease to Tenant, the Demised Properties so that Tenant may, in accordance with and subject to the terms, conditions and restrictions of this Lease, operate (or cause the operation of) a Kentucky Fried Chicken (or KFC) restaurant at each Demised Property.

D. Notwithstanding any other provision of this Lease, this Lease constitutes a single and indivisible lease of all the Demised Properties collectively, and is not an aggregation of leases for the separate Demised Properties. Neither Landlord nor Tenant would have entered into this Lease except as a single and indivisible lease, and the rental herein has been established on the basis of the specific structure of the subject transaction and the economic benefits and risk profile of the transaction as a whole, and not based on the valuation or price of any individual Demised Property. Tenant’s rights to any one Demised Property are dependent on Tenant’s full performance of its obligations as to every other Demised Property, and consideration supporting any agreements under this Lease regarding any Demised Property also supports the agreements under this Lease regarding all other Demised Properties.

ARTICLE 1 DEMISE OF PREMISES

Subject to the terms and conditions contained herein, Landlord does hereby lease unto Tenant, and Tenant does hereby hire from Landlord, for the term hereinafter provided in Article 2 , the Demised Properties for the use thereof by Tenant, Tenant’s employees, customers and invitees.

ARTICLE 2 TERM

Section 2.01

(a) This Lease shall commence on the Commencement Date and terminate on December 8, 2031 (the “Original Lease Term”) unless sooner terminated as hereinafter set forth. The “Lease Term,” as such term is used herein, means the Original Lease Term as extended (or as may be extended) pursuant to Section 2.02 below, unless sooner terminated as hereinafter set forth.

(b) This Lease shall be deemed to be in full force and effect upon the Commencement Date. Tenant shall be deemed in possession of the Demised Properties upon the Commencement Date.

Section 2.02

(a) Tenant shall have the option to extend the term of this Lease for up to four (4) separate option periods upon and subject to the terms set forth below in this Section 2.02. The first option period (the “First Option Period”) shall commence at the expiration of the Original Lease Term. The second option period (the “Second Option Period”) shall commence at the expiration of the First Option Period. The third option period (the “Third Option Period”) shall commence at the expiration of the Second Option Period. The fourth option period (the “Fourth Option Period”) shall commence at the expiration of the Third Option Period. The First Option Period, the Second Option Period, the Third Option Period and the Fourth Option Period are sometimes referred to herein collectively as the “Option Periods” and individually as an “Option Period.” Each Option Period shall continue for a period of five (5) years from and after the commencement date of such Option Period. Except as otherwise expressly provided herein, all of the terms and conditions of this Lease applicable to the Original Lease Term shall continue to apply during each Option Period. In no event shall Tenant have any options to extend the term of this Lease except as expressly provided herein. A notice delivered by Tenant to Landlord in order to extend the term of this Lease for any Option Period pursuant to the terms hereof is referred to herein as an “Extension Notice”.

(b) To validly extend the Lease Term for the First Option Period for all the Demised Properties subject to this Lease at the date of Tenant’s delivery to Landlord of an Extension Notice for the First Option Period (i) Tenant must and shall deliver to Landlord such Extension Notice not earlier than fifteen (15) months prior to the expiration of the Original Lease Term and not later than twelve (12) months prior to the expiration of the Original Lease Term, and (ii) as of the date such Extension Notice is delivered to Landlord, and as of the date the First Option Period is scheduled to commence, there shall be no existing Default or Event of Default under this Lease.

(c) To validly extend the Lease Term for the First Option Period for some, but not all, Demised Properties subject to this Lease at the date of Tenant’s delivery to Landlord of an Extension Notice for the First Option Period (a “PE First Option Period” and such option, a “PE First Option”) (i) Tenant must and shall deliver to Landlord such Extension Notice not earlier than fifteen (15) months prior to the expiration of the Original Lease Term and not later than twelve (12) months prior to the expiration of the Original Lease Term; (ii) Tenant’s Extension Notice shall list the Demised Properties that Tenant desires be subject to such extension (the “First Option Extension Properties ”) provided, however, that the First Option Extension Properties must comprise at least seventy-five percent (75%) of all the Demised Properties covered by this Lease (other than the St. Louis Properties) as of the date of Tenant’s delivery to Landlord of such Extension Notice; and (iii) as of the date such Extension Notice is delivered to Landlord, and as of the date the First Option Period is scheduled to commence, there shall be no existing Default or Event of Default under this Lease.

(d) To validly extend the Lease Term for the Second Option Period for all the Demised Properties subject to this Lease at the date of Tenant’s delivery to Landlord of an Extension Notice for the Second Option Period (i) Tenant must have validly extended this Lease for the First Option Period (whether such First Option Period is for all Demised Properties under this Lease or a PE First Option Period) (ii) Tenant must and shall deliver to Landlord such Extension Notice not earlier than fifteen (15) months prior to the expiration of the First Option Period and not later than twelve (12) months prior to the expiration of the First Option Period, and (iii) as of the date such Extension Notice is delivered to Landlord, and as of the date the Second Option Period is scheduled to commence, there shall be no existing Default or Event of Default under this Lease.

(e) To validly extend the Lease Term for the Second Option Period for some, but not all, Demised Properties subject to this Lease at the date of Tenant’s delivery to Landlord of an Extension Notice for the Second Option Period (a “PE Second Option Period” and such option, a “PE Second Option”) (i) Tenant must have validly extended this Lease for the First Option Period (whether such First Option Period is for all Demised Properties under this Lease or a PE First Option Period), (ii) Tenant must and shall deliver to Landlord such Extension Notice not earlier than fifteen (15) months prior to the expiration of the First Option Period and not later than twelve (12) months prior to the expiration of the First Option Period; (iii) Tenant’s Extension Notice for the Second Option Period shall list the Demised Properties that Tenant desires be subject to such extension (the “Second Option Extension Properties”); provided, however, that the Second Option Extension Properties must comprise at least seventy-five percent (75%) of all the Demised Properties covered by this Lease (other than the St. Louis Properties) as of the date of Tenant’s delivery to Landlord of such Extension Notice; and (iv) as of the date such Extension Notice is delivered to Landlord, and as of the date the Second Option Period is scheduled to commence, there shall be no existing Default or Event of Default under this Lease.

(f) To validly extend the Lease Term for the Third Option Period for all the Demised Properties subject to this Lease at the date of Tenant’s delivery to Landlord of an Extension Notice for the Third Option Period (i) Tenant must have validly extended this Lease for the Second Option Period (whether such Second Option Period is for all Demised Properties under this Lease or a PE Second Option Period) (ii) Tenant must and shall deliver to Landlord such Extension Notice not earlier than fifteen (15) months prior to the expiration of the Second Option Period and not later than twelve (12) months prior to the expiration of the Second Option Period, and (iii) as of the date such Extension Notice is delivered to Landlord, and as of the date the Third Option Period is scheduled to commence, there shall be no existing Default or Event of Default under this Lease.

(g) To validly extend the Lease Term for the Third Option Period for some, but not all, Demised Properties subject to this Lease at the date of Tenant’s delivery to Landlord of an Extension Notice for the Third Option Period (a “PE Third Option Period” and such option, a “PE Third Option”) (i) Tenant must have validly extended this Lease for the Second Option Period (whether such Second Option Period is for all Demised Properties under this Lease or a PE Second Option Period), (ii) Tenant must and shall deliver to Landlord such Extension Notice not earlier than (15) months prior to the expiration of the Second Option Period and not later than twelve (12) months prior to the expiration of the Second Option Period; (iii) Tenant’s Extension Notice for the Third Option Period shall list the Demised Properties that Tenant desires be subject to such extension (the “Third Option Extension Properties”); provided, however, that the Third Option Extension Properties must comprise at least seventy-five percent (75%) of all the Demised Properties covered by this Lease (other than the St. Louis Properties) as of the date of Tenant’s delivery to Landlord of such Extension Notice; and (iv) as of the date such Extension Notice is delivered to Landlord, and as of the date the Third Option Period is scheduled to commence, there shall be no existing Default or Event of Default under this Lease.

(h) To validly extend the Lease Term for the Fourth Option Period for all the Demised Properties subject to this Lease at the date of Tenant’s delivery to Landlord of an Extension Notice for the Fourth Option Period (i) Tenant must have validly extended this Lease for the Third Option Period (whether such Third Option Period is for all Demised Properties under this Lease or a PE Third Option Period) (ii) Tenant must and shall deliver to Landlord such Extension Notice not earlier than (15) months prior to the expiration of the Third Option Period and not later than twelve (12) months prior to the expiration of the Third Option Period, and (iii) as of the date such Extension Notice is delivered to Landlord, and as of the date the Fourth Option Period is scheduled to commence, there shall be no existing Default or Event of Default under this Lease.

(i) To validly extend the Lease Term for the Fourth Option Period for some, but not all, Demised Properties subject to this Lease at the date of Tenant’s delivery to Landlord of an Extension Notice for the Fourth Option Period (a “PE Fourth Option Period” and such option, a “PE Fourth Option”) (i) Tenant must have validly extended this Lease for the Third Option Period (whether such Third Option Period is for all Demised Properties under this Lease or a PE Third Option Period), (ii) Tenant must and shall deliver to Landlord such Extension Notice not earlier than (15) months prior to the expiration of the Third Option Period and not later than twelve (12) months prior to the expiration of the Third Option Period; (iii) Tenant’s Extension Notice for the Fourth Option Period shall list the Demised Properties that Tenant desires be subject to such extension (the “Fourth Option Extension Properties”); provided, however, that the Fourth Option Extension Properties must comprise at least seventy-five percent (75%) of all the Demised Properties covered by this Lease (other than the St. Louis Properties) as of the date of Tenant’s delivery to Landlord of such Extension Notice; and (iv) as of the date such written Extension Notice is delivered to Landlord, and as of the date the Fourth Option Period is scheduled to commence, there shall be no existing Default or Event of Default under this Lease.

(j) Without limiting anything contained in Section 36.02 hereof, time is of the strictest essence in the performance of each provision of this Section 2.02 . Either party, upon request of the other, shall execute and acknowledge, in form suitable for recording, an instrument confirming any Option Period, with Tenant paying all applicable recording costs.

ARTICLE 3 RENT

Section 3.01 Rent. Tenant shall pay all Base Rent and Additional Rent, from and after the Commencement Date and thereafter throughout the Lease Term, without offset, deduction, or abatement, except as may be otherwise expressly provided herein. Notwithstanding the foregoing, any amounts due by Tenant to Landlord hereunder for which no due date is expressly specified herein shall be due within fifteen (15) days following the delivery to Tenant by Landlord of written notice of such amounts due. Except as otherwise expressly provided herein, in the event of nonpayment by Tenant of any Rent, Landlord shall have the same rights and remedies in respect thereof regardless of whether such Rent is Base Rent or Additional Rent. All payments of Rent due to Landlord shall be paid to Landlord (at its election from time to time) in one of the following manners: (a) by electronic deposit into an account designated by Landlord (a “Landlord’s Account”), (b) by mail at Landlord’s address set forth in Article 17 , or (c) by mail to any other place in the United States designated by Landlord upon at least thirty (30) days’ prior written notice to Tenant.

Section 3.02 Base Rent .

(a) The following terms shall have the following meanings:

(i) “Base Date” means (A) if the Commencement Date is the first day of a calendar month, the Commencement Date, and (B) if the Commencement Date is other than the first day of a calendar month, the first day of the first calendar month occurring after the Commencement Date.

(ii) “Initial Adjustment Dates” means, collectively, each anniversary of the Base Date, through and including the fourth (4th) anniversary of the Base Date.

(iii) “Initial Base Rent Escalation” means one and one-half percent (1.5%).

(iv) “PE Option” means any of the First PE Option, the Second PE Option, the Third PE Option or the Fourth PE Option.

(v) “PE Option Base Rent” means, for any PE Option (A) the product of (i) the total dollar amount of all sales at all PE Option Extension Properties for the latest consecutive twelve (12) calendar month period for which sales information has been delivered to Landlord under Section 13.02 as of the calculation date, divided by (ii) the total dollar amount of all sales at all Demised Properties for the latest consecutive twelve (12) calendar month period for which sales information has been delivered to Landlord under Section 13.02 as of the calculation date, multiplied by (B) the Base Rent applicable immediately prior to the PE Option Period caused by the exercise of such PE Option, multiplied by (C) 110%.

(vi) “PE Option Extension Properties” means any of the First PE Option Extension Properties, the Second PE Option Extension Properties, the Third PE Option Extension Properties or the Fourth PE Option Extension Properties.

(vii) “ PE Option Period” means any of the First PE Option Period, the Second PE Option Period, the Third PE Option Period or the Fourth PE Option Period.

(viii) “Subsequent Adjustment Dates” means, collectively, (A) the fifth (5th) anniversary of the Base Date, (B) the tenth (10th) anniversary of the Base Date, (C) the fifteenth (15th) anniversary of the Base Date, (D) in the event the option for a First Option Period (other than a PE First Option Period) is timely exercised as provided in Article 2, the twentieth (20th) anniversary of the Base Date, (E) in the event the option for a Second Option Period (other than a PE Second Option Period) is timely exercised as provided in Article 2, the twenty-fifth (25th) anniversary of the Base Date, (F) in the event the option for a Third Option Period (other than a PE Third Option Period) is timely exercised as provided in Article 2, the thirtieth (30th) anniversary of the Base Date, and (G) in the event the option for a Fourth Option Period (other than a PE Fourth Option Period) is timely exercised as provided in Article 2, the thirty-fifth (35th) anniversary of the Base Date.

(ix) “ Subsequent Base Rent Escalation” means ten percent (10%).

(b) The base rent amount for the Demised Properties for each month of the Lease Term shall be US$95,122, as increased as hereinafter provided (“Base Rent”). Tenant shall pay to Landlord Base Rent, in advance, without demand therefor, on or before the first day of each and every calendar month during the Lease Term and if the Commencement Date is not the first day of a calendar month, Tenant shall pay to Landlord pro-rated Base Rent on the Commencement Date for the partial calendar month in which the Commencement Date occurs.

(c) Subject to the terms of this Section, (i) on each of the Initial Adjustment Dates, the Base Rent shall increase by the Initial Base Rent Escalation, and such increased Base Rent shall apply for the ensuing one-year period; and (ii) on each of the Subsequent Adjustment Dates, the Base Rent shall increase by the Subsequent Base Rent Escalation, and such increased Base Rent shall apply for the ensuing five-year period. For the avoidance of doubt, the parties acknowledge that Base Rent for any PE Option Period shall be determined as provided in clause (d) of this Section 3.02 (and not this clause (c) of this Section 3.02).

(d) Base Rent for any PE Option Period shall be the PE Option Base Rent. After delivery to Landlord by Tenant of a timely and valid exercise of a PE Option, and not later than thirty (30) days prior to the commencement of the applicable PE Option Period, Landlord shall calculate the PE Option Base Rent and notify Tenant of such calculation, which shall be binding on the parties absent manifest error.

Section 3.03 Additional Rent .

(a) If by applicable Law, any general or special assessment or like charge may be paid in installments without any penalty whatsoever, then such assessment may be paid in such installments and Tenant shall only be liable for the portion thereof that is allocable or attributable to the Lease Term or any portion thereof. If such assessment or charge may be payable in installments with interest, Tenant may pay such assessment or charge in installments, together with all interest thereon, provided that if such installments extend beyond the Lease Term, Landlord shall have the option to pay all remaining installments coming due following the Lease Term without interest.

(b) Tenant shall pay all Real Estate Taxes directly to the collecting authority no less than thirty (30) days prior to the delinquency date thereof and shall provide Landlord not less than ten (10) Business Days prior to such delinquency date a copy of the paid receipt for each installment of Real Estate Taxes so paid. Nothing in this Lease shall obligate Tenant to pay any estate, inheritance, franchise, net income or similar taxes of Landlord (other than any rental taxes imposed upon the Landlord that are measured by or based in whole or in part directly upon the Rent payable under this Lease, whether existing at the date hereof or hereinafter imposed by any Governmental Authority) nor shall any of same be deemed Real Estate Taxes, unless the same shall be specifically imposed in substitution for, or in lieu of, Real Estate Taxes. Notwithstanding the first sentence of this clause (b), upon the occurrence of both of the following events, Tenant shall pay Real Estate Taxes to Landlord no less than thirty (30) days prior to the delinquency date thereof (the “RE Taxes Additional Rent”) in lieu of payment directly to the applicable collecting authority: (i) delivery to Tenant of a written request therefor from Landlord, and (ii) the occurrence and continuance of any Default under this Section 3.03(b) by Tenant, or the occurrence and the continuance of any Event of Default under any provision in this Lease (either event described in the foregoing clause (ii) is referred to herein as a “RE Taxes Additional Rent Trigger”). Funds paid by Tenant as RE Taxes Additional Rent shall be used only for the payment of the Real Estate Taxes. If Tenant fails to pay the appropriate party (Landlord or the collecting authority, as provided herein) all Real Estate Taxes when due hereunder, then Tenant shall, without limiting any other remedies available to Landlord, reimburse Landlord for any and all penalties or interest, or portion thereof, paid or incurred by Landlord as a result of such nonpayment or late payment by Tenant.

MASTER LAND AND BUILDING LEASE

(c) Tenant shall have the right to undertake an action or proceeding against the applicable collecting authority seeking an abatement of Real Estate Taxes or a reduction in the valuation of the Demised Properties and/or contest the applicability of any Real Estate Taxes; provided, however, that Tenant delivers to Landlord prior written notice of any such action or proceeding by Tenant, and that Tenant has paid timely (and continues to pay timely) all Real Estate Taxes as provided in this Lease to the extent required by applicable Law. In any instance where any such permitted action or proceeding is being undertaken by Tenant, (i) Landlord shall cooperate reasonably with Tenant, at no cost or expense to Landlord, and execute any and all documents approved by Landlord and reasonably required in connection therewith and (ii) Tenant shall provide Landlord with all information reasonably requested by Landlord with respect to such action or proceeding within five (5) days after receipt of Landlord’s written request. Tenant shall be entitled to any refund (after the deduction therefrom of all expenses incurred by Landlord in connection therewith) of any Real Estate Taxes (including penalties or interest thereon) received by Tenant or Landlord, whether or not such refund was a result of actions or proceedings instituted by Tenant.

(d) Tenant shall be solely responsible for, and shall pay directly to the applicable service providers, the cost of all utility services provided to the Demised Properties throughout the Lease Term. Notwithstanding the foregoing, upon the occurrence of both of the following events, Tenant shall pay to Landlord the cost of any and all utility services provided to the Demised Properties in lieu of payment directly to the applicable service providers: (i) delivery to Tenant of a written request therefor from Landlord, and (ii) any Default under this Section 3.03(d) by Tenant, or any Event of Default. Funds paid by Tenant to Landlord pursuant to the immediately preceding sentence shall be used only for the payment of the cost of utility services to the Demised Properties. If Tenant fails to pay the appropriate party (Landlord or the service providers, as provided herein) all such costs when due hereunder, then Tenant shall, without limiting any other remedies available to Landlord, reimburse Landlord for any and all penalties or interest, or portion thereof, paid or incurred by Landlord as a result of such nonpayment or late payment by Tenant.

(e) Without limiting any of Tenant’s other obligations set forth in this Article, Tenant shall pay to Landlord, with each payment due to Landlord hereunder (and as a part of Rent due hereunder), all sales and excise tax on rental income and all other similar taxes imposed upon Landlord with respect to rental or other payments (including, but not limited to RE Taxes Additional Rent and Real Estate Taxes paid directly to the taxing authority to the extent deemed includible in Landlord’s gross income or gross receipts) in the nature of a gross receipts tax, gross income tax, margins tax, sales tax, occupancy tax, business improvement district tax, occupation tax, business and occupation tax, business privilege tax or the like, whether imposed by a federal, state or local taxing authority, which, when added to such payment, shall yield to Landlord after deduction of all such tax payable by Landlord (including any such taxes that may be payable on the additional amounts payable pursuant to this paragraph, on a “grossed-up” basis) with respect to all such payments a net amount which Landlord would have realized from such payment had no such tax been imposed.

(f) Any indemnity payments due to Landlord from Tenant hereunder that are attributable to liabilities, fixed or contingent, known or unknown (i) that existed as of the date hereof, or relate to periods prior to and including the date hereof, or (ii) to which the Demised Properties were subject as of the date hereof, or that existed on the date hereof and ran with the Demised Properties and became a liability of the Landlord as the transferee or assignee of the previous owner of the Demised Properties, shall not be treated as additional rent or other gross income of the Landlord for federal income

tax purposes, but as an adjustment to the Landlord’s adjusted basis in the Demised Properties, which adjusted basis shall prior to the receipt by Landlord of such indemnity payments be deemed to include the amount of such liabilities. Tenant agrees that it will take no position inconsistent herewith for federal income tax purposes.

MASTER LAND AND BUILDING LEASE

ARTICLE 4 USE

Section 4.01 Tenant may use the Demised Properties to operate “Kentucky Fried Chicken”, “KFC”, “Pizza Hut”, “Taco Xxxx” or any other Yum! National Brand restaurants (each a “Permitted Restaurant Brand” and collectively, the “Permitted Restaurant Brands”), and for no other purpose without the prior written consent of Landlord, which approval may be granted or withheld in the reasonable discretion of Landlord. Subject to (a) applicable Law, and (b) Tenant’s right to make Required Alterations that (i) are completed in fewer than sixty (60) days, and (ii) do not involve more than three (3) Demised Properties at any given time, Tenant shall open and operate a Permitted Restaurant Brand at each of the Demised Properties during all hours that are customary for similarly situated sites of the applicable Permitted Restaurant Brand. This covenant of continuous operation is an additional consideration and a material inducement for Landlord to enter into this Lease.

Section 4.02 Notwithstanding any other provision of this Article, Tenant shall not use, or suffer or permit any Person to use, the Demised Properties or any portion thereof for any purpose in violation of any applicable Law, or in violation of any covenants or restrictions of record. From the Commencement Date and thereafter throughout the Lease Term, Tenant shall conduct its business in a commercially reasonable and reputable manner with respect to each of the Demised Properties and in compliance with the terms and provisions of this Lease. The character of the occupancy of the Demised Properties is an additional consideration and a material inducement for the granting of this Lease by Landlord to Tenant.

Section 4.03 Without limiting any other provision of this Lease, all obligations of Tenant under this Article 4 shall apply also to any subtenant of any of the Demised Properties.

Tenant hereby represents, warrants and covenants to Landlord that Tenant has the right and lawful authority to enter into this Lease and perform Tenant’s obligations hereunder. Tenant acknowledges that it has had access to the Demised Properties prior to execution of this Lease and has had the opportunity to perform all tests, studies, inspections and investigations (including any investigations regarding zoning and use issues regarding all Demised Properties) and has in fact evaluated the Demised Properties to the extent required for its operations, that it desires, and that Tenant is accepting each Demised Property in its AS IS condition existing on the date Tenant executes this Lease. Tenant hereby accepts each Demised Property in its condition as of the date of possession hereunder, subject to all applicable Law, as well as private easements and restrictions, governing and regulating the use, operation or maintenance of the Demised Properties, whether or not of record (collectively, the “Diligence Matters”), and accepts this Lease subject thereto and to all matters disclosed hereby, and by any exhibits attached hereto. Tenant waives to the fullest extent allowed by Law any rights to notice by Landlord regarding the condition of the Demised Properties, whether at law or in equity, and hereby waives any rights and remedies thereunder based in any alleged or actual future of Landlord to provide any such notices. Tenant acknowledges that (a) neither Landlord nor any of its Affiliates has made any representation or warranty as to the suitability of any Demised Property for the conduct of the Tenant’s business and (b) Tenant is entering into this Lease solely on the basis of its own investigations and familiarity with the Demised Properties and not on the basis of any representation, warranty, covenant, agreement, undertaking, promise, statement, arrangement or understanding by, on behalf of, or with, Landlord or any of its Affiliates, except as expressly set forth in this Lease.

MASTER LAND AND BUILDING LEASE

ARTICLE 6 ALTERATIONS

Subject to the provisions of this Article 6, Tenant shall have no right to make changes, alterations or additions (collectively, “Alterations”) to the Improvements at any single Demised Property that involve structural changes or that cost in the aggregate in excess of US$50,000.00 per Demised Property, which amount shall be adjusted annually in proportion to increases in the CPI, in each case without prior written consent of Landlord, which Landlord agrees it will not withhold unreasonably; provided, however, in no event shall any Alterations be made that, after completion, would: (i) reduce the value of the Improvements as they existed prior to the time that said Alterations are made; or (ii) adversely affect the structural integrity of the Improvements; provided further, that Landlord shall not withhold its consent (1) to any Alterations (“Required Alterations”) that (x) have been approved by all applicable Governmental Authorities, (y) are required by the franchisor of the applicable Permitted Restaurant Brand, and (z) otherwise comply with subsections (i) and (ii) above, and (2) provided that no Default has occurred and is continuing. Tenant shall not install any underground storage tanks and any above ground storage tanks shall include secondary containment sufficient to prevent spills, overfills or tank ruptures from causing a release to the environment. Any and all Alterations made by Tenant shall be at Tenant’s sole cost and expense. Prior to the commencement of construction, including Alterations that cost less than US$50,000.00 per Demised Property, which amount shall be adjusted annually in proportion to increases in the CPI (but excluding Minor Projects), Tenant shall deliver promptly to Landlord detailed cost estimates for any such proposed Alterations, as well as all drawings, plans and other information regarding such Alterations (such estimates, drawings, plans and other information are collectively referred to herein as the “Alteration Information”). Notwithstanding the foregoing, in no event shall Tenant have an obligation to provide any Alteration Information to Landlord for its review and approval as to Required Alterations. Landlord’s review and/or approval (if required) of any Alteration Information shall in no event constitute any representation or warranty of Landlord regarding (x) the compliance of any Alteration Information with any applicable Law, (y) the presence or absence of any defects in any Alteration Information, or (z) the safety or quality of any of the Alterations constructed in accordance with any plans or other Alteration Information. Landlord’s review and/or approval of any of the Alteration Information shall not preclude recovery by Landlord against Tenant based upon the Alterations, the Alteration Information, or any defects therein. In making any and all Alterations, Tenant also shall comply with all of the following conditions:

(a) No Alterations shall be undertaken until Tenant shall have (i) procured and paid for, so far as the same may be required, all necessary permits and authorizations of all Governmental Authorities having jurisdiction over such Alterations, and (ii) delivered to Landlord at least fifteen (15) days prior to commencing any such Alterations written evidence acceptable to Landlord, in its reasonable discretion, of all such permits and authorizations. Landlord shall, to the extent necessary (but at no cost, expense, or risk of loss to Landlord), join in the application for such permits or authorizations whenever necessary, promptly upon written request of Tenant.

(b) Any and all structural Alterations of the Improvements shall be performed pursuant to a consulting agreement with an architect and/or structural engineer reasonably acceptable to Landlord.

MASTER LAND AND BUILDING LEASE

(c) Except for Minor Projects, Tenant shall notify Landlord at least fifteen (15) days prior to commencing any Alterations, and Tenant shall permit Landlord access to the relevant Demised Properties in order to post and keep posted thereon such notices as may be provided or required by applicable Law to disclaim responsibility for any construction on the relevant Demised Properties.

(d) Any and all Alterations shall be conducted and completed in a commercially reasonable time period, in a good and workmanlike manner, and in compliance with all applicable Law, municipal ordinances, building codes and permits, and requirements of all Governmental Authorities having jurisdiction over the relevant Demised Properties, and of the local Board of Fire Underwriters, if any; and, upon completion of any and all Alterations, Tenant shall obtain and deliver to Landlord a copy of the amended certificate of occupancy for the relevant Demised Properties, if required under applicable Law or by any Governmental Authority. If any Alterations involve the generation, handling, treatment, storage, disposal, permitting, abatement or reporting of Hazardous Materials, Tenant shall prepare and retain any and all records, permits, reports and other documentation necessary or advisable to document and evidence all such Hazardous Materials were handled in compliance with applicable Law. To the extent reasonably practicable, any and all Alterations shall be made and conducted so as not to disrupt Tenant’s business.

(e) The cost of any and all Alterations shall be promptly paid by Tenant so that the Demised Properties at all times shall be free of any and all liens for labor and/or materials supplied for any Alterations subject to the next succeeding sentence. In the event any such lien shall be filed, Tenant shall, within five (5) days after receipt of notice of such lien, deliver written notice to Landlord thereof, and Tenant shall, within thirty (30) days after receipt of notice of such lien, discharge the same by bond or payment of the amount due the lien claimant. Tenant may in good faith contest any such lien provided that within such thirty (30) day period Tenant provides Landlord with a surety bond or other form of security reasonably acceptable to Landlord, protecting against said lien. Tenant shall provide Landlord promptly with evidence satisfactory to Landlord that all contractors, subcontractors or materialmen have been paid in full with respect to such Alterations and that their lien rights have been waived or released. In the event Tenant fails to either discharge such lien or protect against such lien in accordance with the foregoing, then Landlord shall have the option (but not the obligation) to pay such lien or post a bond to protect against such lien and pass through such costs to Tenant as Additional Rent.

ARTICLE 7 REPAIRS AND MAINTENANCE

Except as otherwise provided in this Article, Tenant, at its sole cost and expense, shall maintain each of the Demised Properties and each part thereof, structural and non-structural, in good order and condition, including all areas outside of any buildings (including all sidewalks, driveways, landscaping, trash enclosures, and trash compacting and loading areas on the Demised Properties), in a neat and clean condition, and ensuring that debris from the operation of each restaurant on the Demised Properties is cleaned and removed on a regular basis) and, subject to the terms and conditions of Article 6, shall make any necessary Repairs thereto, interior and exterior, whether extraordinary, foreseen or unforeseen, but subject to Article 11 and Article 12. Without limitation, (a) no Repairs shall result in any structural damage to any Demised Properties or any injury to any persons, (b) Tenant shall ensure that the quality of materials and workmanship of any Repairs meets or exceeds the quality of materials and workmanship of the Improvements prior to the need for such Repairs; (c) all Repairs shall fully comply with applicable Law, the requirements of any covenants, conditions, restrictions or other permitted encumbrances that are of record regarding the applicable Demised Property, and any applicable repair standards and requirements promulgated by Tenant for its (or its subsidiaries’ or Affiliates’ or franchisees’) properties. Landlord shall have no duty whatsoever to maintain, replace, upgrade, or repair any portion of the Demised Properties, including any structural items, roof or roofing materials, or any aboveground or underground storage tanks, and Tenant hereby expressly waives the right to make Repairs at the expense of Landlord, which right may be provided for in any applicable Law now or hereinafter in effect. In addition to Landlord’s rights under Section 15.05 , if Tenant fails or neglects to commence and diligently proceed with all Repairs or fulfill its other obligations as set forth above within fifteen (15) days after receipt of written notice of the need therefor describing the applicable Repair or other obligation, then Landlord or its agents may enter the Demised Properties for the purpose of making such Repairs or fulfilling those obligations. All costs and expenses incurred by Landlord as a consequence of such Landlord’s actions, plus an administrative charge of fifteen percent (15%) of such costs and expenses, shall be due to Landlord from Tenant within ten (10) days after written demand from Landlord.

MASTER LAND AND BUILDING LEASE

ARTICLE 8 COMPLIANCE WITH LAW

Tenant shall, throughout the Lease Term, at its sole cost and expense, comply with applicable Law.

ARTICLE 9 DISCLAIMER AND INDEMNITIES

Section 9.01 To the extent not prohibited by applicable Law, none of the Landlord Parties shall be liable for, under any circumstances, and Tenant hereby releases all Landlord Parties from, any loss, injury, death or damage to person or property (including any business or any loss of income or profit therefrom) of Tenant, Tenant’s members, officers, directors, shareholders, agents, employees, contractors, customers, invitees, or any other Person in or about the Demised Properties, whether the same are caused by (a) fire, explosion, falling plaster, steam, dampness, electricity, gas, water, rain; (b) breakage, leakage or other defects of Restaurant Equipment, Building Equipment, sprinklers, wires, appliances, plumbing fixtures, water or gas pipes, roof, air conditioning, lighting fixtures, street improvements, or subsurface improvements; (c) theft, acts of God, acts of the public enemy, riot, strike, insurrection, civil unrest, war, court order, requisition or order of governmental body or authority; (d) any act or omission of any other occupant of the Demised Properties; (e) operations in construction of any private, public or quasi-public work; (f) Landlord’s reentering and taking possession of the Demised Properties in accordance with the provisions of this Lease or removing and storing the property of Tenant as herein provided; or (g) any other cause, including damage or injury that arises from the condition of the Demised Properties, from occupants of adjacent property, from the public, or from any other sources or places, and regardless of whether the cause of such damage or injury or the means of repairing the same are inaccessible to Tenant, or that may arise through repair, alteration or maintenance of any part of the Demised Properties or failure to make any such repair, from any condition or defect in, on or about the Demised Properties including any Environmental Conditions or the presence of any mold or any other Hazardous Materials, or from any other condition or cause whatsoever; provided, however, that the foregoing release set forth in this Section 9.01 shall not be applicable to any claim against a Landlord Party to the extent, and only to the extent, that such claim is directly attributable to the gross negligence or willful misconduct of such Landlord Party, as determined by a final nonappealable judgment (or by a judgment that such Landlord Party elects not to appeal) by a court of competent jurisdiction (provided, however, that the term “gross negligence” shall not include gross negligence imputed as a matter of law to Landlord solely by reason of its interest in the Demised Properties or the failure to act by Landlord or anyone acting under its direction or control or on its behalf, in respect of matters that are or were the obligation of Tenant under this Lease). Without limiting the foregoing, Tenant hereby waives any right to any consequential, indirect or punitive damages against any Landlord Parties arising out of any claim in connection with or related to this Lease or the Demised Properties.

MASTER LAND AND BUILDING LEASE

Section 9.02 In addition to any and all other obligations of Tenant under this Lease (including under any indemnity or similar provision set forth herein), to the extent permitted by applicable Law, Tenant hereby agrees to fully and forever indemnify, protect, defend (with counsel selected by Landlord) and hold all Landlord Parties free and harmless of, from and against any and Losses (including, subject to the terms of this Section, diminution in the value of the Demised Properties, normal wear and tear excepted): (a) arising out of or in any way related to or resulting directly or indirectly from: (i) the use, occupancy, or activities of Tenant, its subtenants, agents, employees, contractors or invitees in or about any of the Demised Properties; (ii) any failure on the part of Tenant to comply with any applicable Law, including any Environmental Laws; (iii) any Default or Event of Default under this Lease or any breach or default by Tenant or any other party (other than Landlord) under any other Transaction Document (including as a result of any termination by Landlord, following an Event of Default, of any sublease, license, concession, or other consensual arrangement for possession entered into by Tenant and affecting any of the Demised Properties pursuant to Section 15.08), and including any additional fees and costs, or any increased interest rate or other charges imposed by any Landlord’s Lender by reason of such Default or Event of Default (whether or not such Default or Event of Default is a default under any agreements with any Landlord’s Lender); (iv) any other loss, injury or damage described in Section 9.01 above; (v) in connection with mold at any Demised Property; (vi) work or labor performed, materials or supplies furnished to or at the request of Tenant or in connection with obligations incurred by or performance of any work done for the account of Tenant in, on or about the Demised Properties; and (b) whether heretofore now existing or hereafter arising out of or in any way related to or resulting directly or indirectly from the presence or Release at, on, under, to or from the Demised Properties of Hazardous Materials. Without limiting the foregoing, (x) the indemnity set forth in this Section 9.02 includes direct or indirect compensatory, consequential, and punitive damages, (y) Tenant shall pay on demand all fees and costs of Landlord (including attorneys’ fees and costs) in connection with any enforcement by Landlord of the terms of this Lease and any amendment to this Lease requested by Tenant, and (z) all of the personal or any other property of Tenant kept or stored at, on or about the Demised Properties shall be kept or stored at the sole risk of Tenant. Notwithstanding the foregoing, the indemnity set forth in this Section 9.02 shall not be applicable to any claim against any Landlord Party to the extent, and only to the extent, such claim is directly attributable to the gross negligence or willful misconduct of such Landlord Party, as determined by a final nonappealable judgment (or by a judgment that such Landlord Party elects not to appeal) by a court of competent jurisdiction (provided, however, that the term “gross negligence” shall not include gross negligence imputed as a matter of law to Landlord solely by reason of its interest in the Demised Properties or the failure to act by Landlord or anyone acting under its direction or control or on its behalf, in respect of matters that are or were the obligation of Tenant under this Lease).

Section 9.03 The provisions of this Article 9 shall survive the expiration or sooner termination of this Lease. Tenant hereby waives the provisions of any applicable Law restricting the release of claims, or extent of release of claims, that Tenant does not know or suspect to exist at the time of release, that, if known, would have materially affected Tenant’s decision to agree to the release contained in this Article 9. In this regard, Tenant hereby agrees, represents, and warrants to Landlord that Tenant realizes and acknowledges that factual matters now unknown to Tenant may hereafter give rise to Losses that are presently unknown, unanticipated and unsuspected, and Tenant further agrees, represents and warrants that the release provided hereunder has been negotiated and agreed upon in light of that realization and that Tenant nevertheless hereby intends to release, discharge and acquit the parties set forth herein above from any such unknown Losses that are in any manner set forth in or related to this Lease, the Demised Properties and all dealings in connection therewith.

MASTER LAND AND BUILDING LEASE

ARTICLE 10 INSURANCE

Section 10.01 As of the Commencement Date and throughout the Lease Term, Tenant shall, at its sole expense, obtain, pay for and maintain (or cause to be obtained, paid for and maintained), with financially sound and reputable insurers (as further described in Section 10.03), (a) special risk coverage covering loss or damage to each Demised Property (including Improvements now existing or hereafter erected thereon) caused by fire, lightning, hail, windstorm, explosion, vandalism, malicious mischief, leakage of sprinkler systems, and such other losses, hazards, casualties, liabilities and contingencies as are normally and usually covered by special risk policies in effect where such Demised Property is located, endorsed to include extended coverage perils and other broad form perils, including the standard special risk clauses, including building ordinance or law coverage sufficient to provide coverage for costs to comply with building and zoning codes and ordinances including demolition costs and increased cost of construction and (b) business income/interruption insurance to include loss of business at limits sufficient to cover 100% of the annual revenues at the Demised Properties minus any non-fixed expenses payable by Tenant to Landlord with a period of indemnity not less than twelve (12) months from time of loss (such amount being adjusted annually) and an extended period of indemnity of one hundred eighty (180) days. The policy(ies) referred to in clause (a) above shall be in an amount equal to one hundred percent (100%) of the full replacement cost of the Improvements and the Building Equipment at each Demised Property (without any deduction for depreciation), and shall contain a replacement cost endorsement and an agreed amount or waiver of co-insurance provisions endorsement. The deductible under the policies referred to in clause (a) above shall not exceed US$100,000 or such greater amount as is approved by Landlord from time to time. If any Demised Property is located in area prone to geological phenomena, including sinkholes, mine subsidence, earthquakes, or floods, the insurance policies referred to in clause (a) above shall cover such risks and in such amounts, form and substance, as Landlord shall reasonably determine.

Section 10.02 As of the Commencement Date and throughout the Lease Term, Tenant shall maintain, with financially sound and reputable insurers (as further described in Section 10.03), general liability insurance with respect to its business and each Demised Property (including all Improvements now existing or hereafter erected thereon) against losses, hazards, casualties, liabilities and contingencies as customarily carried or maintained by persons of established reputation engaged in similar businesses. Without limiting of the foregoing, Tenant shall maintain or cause to be maintained policies of insurance with respect to each Demised Property in the following amounts and covering the following risks:

(a) Broad form boiler and machinery or breakdown insurance in an amount equal to the full replacement cost of the Improvements at the Demised Property (without any deduction for depreciation) in which the boiler or similar vessel is located, and including coverage against loss or damage from damage, breakdown or explosion of steam boilers, electrical machinery and equipment, air conditioning, refrigeration, pressure vessels or similar apparatus and mechanical objects now or hereafter installed at the applicable Demised Property.

(b) During any period of construction, reconstruction, renovation or alteration at any Demised Property, a completed value, “All Risks” Builders Risk form or “Course of Construction” insurance policy in non-reporting form and in an amount of the completed value of the construction.

(c) Commercial General Liability insurance covering claims for personal injury, bodily injury, death or property damage occurring upon, in or about each Demised Property on an occurrence form and in an amount not less than US$1,000,000 per occurrence and US$2,000,000 in the aggregate and shall provide coverage for premises and operations, products and completed operations and

contractual liability with a deductible in an amount not to exceed US$0, and an umbrella liability policy in the amount of US$25,000,000.

MASTER LAND AND BUILDING LEASE

(d) Worker’s compensation with statutory limits and employer’s liability insurance in an amount of US$1,000,000 per accident, per employee and in the aggregate.

(e) Except as otherwise provided in Section 10.01 , such other insurance (including increased amounts of insurance) and endorsements, if any, with respect to the Demised Properties and the operation thereof as Landlord may reasonably require from time to time.

Section 10.03 Each carrier providing any insurance, or portion thereof, required by this Article shall have the legal right to conduct its business in the jurisdiction in which the applicable Demised Property is located, and shall have a claims paying ability rating by S&P of not less than “A-” and an A.M. Best Company, Inc. rating of not less than A- and financial size category of not less than VII. Tenant shall cause all insurance that it is required to maintain hereunder to contain a mortgagee clause and loss payee clause in favor of Landlord’s Lender in accordance with this Section to be payable to Landlord’s Lender as a mortgagee and not as a co-insured, as its interest may appear. In the absence of a Landlord’s Lender or if below the casualty threshold set by such Landlord’s Lender, the loss payee clause will be in favor of Landlord. Notwithstanding anything to the contrary contained in this Section 10.03, in any event, casualty insurance proceeds shall be applied in accordance with Section 11.02 .

Section 10.04 All insurance policies required to be maintained by Tenant hereunder and renewals thereof (a) shall be in a form reasonably acceptable to Landlord, (b) shall provide for a term of not less than one year unless approved by Landlord, (c) if the same are insurance policies covering any property (i) shall include a standard mortgagee endorsement or its equivalent in favor of Landlord’s Lender, if any, (ii) shall contain an agreed value clause updated annually (if the amount of coverage under such policy is based upon the replacement cost of the applicable Demised Property), (iii) shall designate Landlord’s Lender, if any, as “mortgagee and loss payee,” and (iv) shall provide terrorism coverage. In addition, all property insurance policies (except for flood and earthquake limits) must automatically reinstate after each loss, and the commercial general liability and umbrella policies shall contain an additional insured endorsement in favor of Landlord and Landlord’s Lender, if any, as their interests may appear.

Section 10.05 Any insurance provided for in this Article may be effected by a blanket policy or policies of insurance, or under so-called “special-risk” or “multi-peril” insurance policies, provided that the amount of the total insurance available with respect to the Demised Properties shall provide coverage and indemnity at least equivalent to separate policies in the amounts herein required, and provided further that in other respects, any such policy or policies shall comply with the provisions of this Article. Any increased coverage provided by individual or blanket policies shall be satisfactory, provided the aggregate liability limits covering the Demised Properties under such policies shall otherwise comply with the provisions of this Article.

Section 10.06 Every insurance policy carried by either party with respect to the Demised Properties shall (if it can be so written) include provisions waiving the insurer’s subrogation rights against the other party to the extent such rights can be waived by the insured prior to the occurrence of damage or loss. Subject to the above, each party hereby waives any rights of recovery against the other party for any direct damage or consequential loss covered by said policies (or by policies required to be carried hereunder by such party) whether or not such damage or loss shall have been caused by any acts or omissions of the other party, but such waiver shall operate only to the extent such waiving party is so protected by such insurance coverage (or would have been protected by maintaining all policies required to be carried hereunder by such party).

MASTER LAND AND BUILDING LEASE

Section 10.07 The general liability and umbrella policies of insurance required to be maintained by Tenant under this Article 10 shall name Tenant as the insured and Landlord, Landlord’s Lenders, and Drawbridge Special Opportunities Fund LP as additional insureds as their interests may appear, with primary coverage in favor of all additional insureds (and with provisions that any other insurance carried by any additional insured or Landlord shall be non-contributing and that naming Landlord and the additional parties listed above in this Section as additional insureds shall not negate any right Landlord or such parties would have had as claimants under the policy if not so designated). Notwithstanding the foregoing, there is no requirement hereunder that the business interruption insurance required pursuant to Section 10.01 name Landlord or Drawbridge Special Opportunities Fund LP as additional insureds. All insurance policies required under this Article 10 also shall provide that the beneficial interest of Landlord in such policies shall be fully transferable. In the event Tenant fails to procure or maintain any policy of insurance required under Article 10, or if the insurance company or coverages provided fail meet the requirements contained in this Article 10 , Landlord may, at its option, purchase such insurance and charge Tenant all costs and expenses incurred in procuring and maintaining such insurance.

Section 10.08 Tenant shall provide to Landlord, beginning on the Commencement Date and continuing annually thereafter with certificates (or other evidence reasonably requested by Landlord) from all applicable insurance carriers evidencing the payment of premiums or accompanied by other evidence of such payment (e.g., receipts, canceled checks) reasonably satisfactory to Landlord. Each insurance policy required to be carried by Tenant hereunder shall include a provision requiring the insurer to provide Landlord with not less than thirty (30) days’ prior written notice of cancellation. Upon the occurrence of both of the following events, Tenant shall pay the Insurance Premium Additional Rent (defined below), on the first day of each month, to Landlord in lieu of payment directly to the applicable insurance carriers: (i) delivery to Tenant of a written request therefor from Landlord, and (ii) the occurrence and continuance of any Default under this Section 10.08 by Tenant, or any occurrence of any Event of Default under any provision in this Lease (the foregoing clause (ii) may be hereinafter referred to as an “Insurance Premium Additional Rent Trigger”). Funds paid by Tenant as Insurance Premium Additional Rent shall be promptly applied towards payment of the insurance premium next coming due when such premiums are due and payable. “Insurance Premium Additional Rent” shall mean a monthly payment equal to the amount of the premium that will next become due and payable under each policy of insurance that Tenant is required to maintain pursuant to their Lease (exclusive of those premiums that will become due within the subsequent month) divided by the number of months remaining until thirty (30) days before the premium for each insurance policy is due. In the event an Insurance Premium Additional Rent Trigger occurs within thirty (30) days prior to the date an insurance policy premium is due, the Insurance Premium Additional Rent shall be calculated for the subsequent policy period and the premium due within the subsequent month shall be due and payable immediately. The Insurance Premium Additional Rent shall be adjusted by Tenant from time to time to reflect any increases in premiums Tenant either obtains knowledge or notice thereof. In the event that Tenant has obtained financing from a third party (the “Premium Lender”) of Tenant’s insurance premium obligations, the term “Insurance Premium Additional Rent” shall be deemed to include the installment payments due to such Premium Lender.

MASTER LAND AND BUILDING LEASE

ARTICLE 11 DAMAGE OR DESTRUCTION

Section 11.01 If at any time during the Lease Term, any of the Demised Properties or any part thereof shall be damaged or destroyed by fire or other casualty of any kind or nature, Tenant shall promptly apply for all necessary permits, but in any event not later than thirty (30) days after the first date of such damage or destruction, and upon issuance of such permits thereafter diligently proceed to repair, replace or rebuild such Demised Property as nearly as possible to its condition and character immediately prior to such damage with such variations and Alterations requested by Landlord as may be permitted under (and subject to the provisions of) Article 6 (the “Restoration Work”).

Section 11.02 All property and casualty insurance proceeds payable to Landlord or Tenant (except (a) insurance proceeds payable to Tenant on account of the Restaurant Equipment or Tenant’s inventory; and (b) insurance proceeds payable from comprehensive general public liability insurance, or any other liability insurance) at any time as a result of casualty to the Demised Properties shall be paid jointly to Landlord and Tenant for purposes of payment for the cost of the Restoration Work, except as may be otherwise expressly set forth herein. Landlord and Tenant shall cooperate in order to obtain the largest possible insurance award lawfully obtainable and shall execute any and all consents and other instruments and take all other actions necessary or desirable in order to effectuate same and to cause such proceeds to be paid as hereinbefore provided. The proceeds of any such insurance in the case of loss shall, to the extent necessary, be used first for the Restoration Work with the balance, if any, payable to Tenant. If insurance proceeds as a result of a casualty to the relevant Demised Property are insufficient to complete the Restoration Work necessary by reason of such casualty, then Tenant shall be responsible for the payment of such amounts necessary to complete such work.

Section 11.03 Subject to the terms hereof, this Lease shall not be affected in any manner by reason of the total or partial destruction to any Demised Property or any part thereof and Tenant, notwithstanding any applicable Law, present or future, waives all rights to quit or surrender any Demised Property or any portion thereof because of the total or partial destruction of any Demised Property (prior to the expiration of this Lease). Without limiting the foregoing, no Rent shall xxxxx as a result of any casualty.

ARTICLE 12 EMINENT DOMAIN

Section 12.01 Landlord and Tenant hereby agree that in no event shall any taking of any Demised Property for any public or quasi-public use under any statute or by right of eminent domain, or by purchase in lieu thereof, in any way relieve Tenant of any obligations under this Lease (as to the applicable Demised Property or otherwise) except as explicitly provided in this Article.

Section 12.02 If any portion of any Demised Property, or existing access to or from any Demised Property, is taken for any public or quasi-public use under any statute or by right of eminent domain, or by purchase in lieu thereof, and such taking, in Landlord’s reasonable determination (a) reduces the value of the Demised Property by fifty percent (50%) or more, or (b) prevents, and would prevent after reasonable repair and reconstruction efforts by Tenant, use of the Demised Property for its current permitted use under applicable zoning or other use regulations (including with respect to required parking and access), then this Lease shall terminate as to such Demised Property (but not any other Demised Property) as of the date that title to the applicable Demised Property, or portion thereof, actually transfers to the applicable authority.

MASTER LAND AND BUILDING LEASE

Section 12.03 Tenant agrees that Landlord has the right in its sole discretion, and at Tenant’s sole cost and expense, to oppose any proposed taking regarding any Demised Property. The parties hereto agree to cooperate in applying for and in prosecuting any claim for any taking regarding any Demised Property and further agree that the aggregate net award shall be distributed as follows:

(a) Landlord shall be entitled to the entire award for the condemned Demised Property.

(b) Tenant shall be entitled to any award that may be made for the taking of Tenant’s inventory and personal property, or costs related to the removal and relocation of Tenant’s inventory and personal property, so long as none of the foregoing reduces Landlord’s award.

Section 12.04 Except in the case of a termination of this Lease with respect to a Demised Property as described in Section 12.02, in case of a taking of any portion of any Demised Property, Tenant at its own expense shall proceed with diligence (subject to reasonable time periods for purposes of adjustment of any award and unavoidable delays) to repair or reconstruct (or cause to be repaired and reconstructed) the affected Improvements to a complete architectural unit, and all such repair or reconstruction work shall be performed in accordance with the standards and requirements for Alterations set forth in Article 6.

Section 12.05 In case of a taking of all or any portion of any Demised Property, the Base Rent payable monthly hereunder shall be reduced by the lesser of the following: (a) the product of the Landlord Award Amount regarding such taking, multiplied by 0.5833%, or (b) the product of (i) the Base Rent immediately preceding such taking, divided by the total number of Demised Properties immediately preceding such taking, multiplied by (ii) the percentage reduction in value of the applicable Demised Property caused by such taking, if any, (as reasonably determined by Landlord based upon, inter alia, the impact on Tenant’s long-term use of such Demised Property). The percentage reduction in value in clause (b)(ii) of the immediately preceding sentence shall be deemed to be 100% if this Lease terminates as to the applicable Demised Property pursuant to Section 12.02 , above.

Section 12.06 Notwithstanding any other provision of this Article, any compensation for a temporary taking shall be payable to Tenant without participation by Landlord, except to the proportionate extent such temporary taking extends beyond the end of the Lease Term, and there shall be no abatement of Rent as a result of any temporary taking affecting any of the Demised Properties.

ARTICLE 13 FINANCIAL COVENANTS OF TENANT

Section 13.01 Definitions . The following terms shall have the following meanings:

(a) Tenant’s Fiscal Year is divided into thirteen four-week periods (each, a “Period”) except in the occurrence of a 53-week year, in which case the thirteenth Period consists of five weeks. “Fiscal Quarter” means, as applicable, the period of time comprised of Periods one through three, the period of time comprised of Periods four through six, the period of time comprised of Periods seven through nine, and the period of time comprised of Periods ten through thirteen.

(b) “Fiscal Year” means any period commencing on the day after the Sunday nearest the last day of February and ending on (and including) the Sunday nearest the last day of February of the following calendar year.

MASTER LAND AND BUILDING LEASE

Section 13.02 Books and Records . Tenant shall keep accurate books and records of account of all of the Demised Properties sufficient to permit the preparation of financial statements in accordance with GAAP. Landlord and its duly authorized representatives shall have the right to examine, copy and audit Tenant’s records and books of account at all reasonable times during regular business hours. Tenant shall provide, or cause to be provided, to Landlord, in addition to any other financial statements required under this Lease, the following financial statements and information, all of which must be prepared in a form acceptable to Landlord:

(a) promptly and in any event within ninety (90) days after the end of each Fiscal Year, audited statements of financial position of Tenant as of the end of each such Fiscal Year, including a balance sheet and statement of profits and losses, expenses and retained earnings, changes in financial position and cash flows for such Fiscal Year, which statements shall be duly certified by an officer of Tenant to fairly represent the financial condition of Tenant, as of the date thereof, prepared by Tenant in accordance with GAAP, and accompanied by a statement of a nationally recognized accounting firm acceptable to Landlord in its sole discretion that such financial statements present fairly, in all material respects, the financial condition of Tenant as of the end of the Fiscal Year being reported on and that the results of the operations and cash flows for such year were prepared, and are being reported on, in conformity with GAAP;

(b) promptly and in any event within forty-five (45) days after the end of each Fiscal Year, (i) profit and loss statements in respect of each Demised Property for each such Fiscal Year, certified by an officer of Tenant to be true, correct, and complete in all material respects; and (ii) total sales figures in respect of each Demised Property for each month within each such Fiscal Year, certified by an officer of Tenant to be true, correct and complete in all material respects;

(c) promptly and in any event within forty-five (45) days after the end of each Fiscal Quarter, (i) quarterly statements of the financial position of Tenant, including a balance sheet and statement of profits and losses, together with a statement showing the net operating cash flow for the previous twelve (12) month period (and containing supporting documentation necessary to confirm the amount of net operating cash flow), such quarterly statements of financial position to be certified by an officer of Tenant to fairly represent the financial condition of Tenant as of the date thereof and to have been prepared and reported in conformity with GAAP; (ii) a compliance certificate from Tenant, in form and substance reasonably acceptable to Landlord, certifying to such financial information of Tenant as reasonably requested by Landlord, and supporting the statements contained in any such compliance certificate; (iii) a compliance certificate from Tenant, in form and substance reasonably acceptable to Landlord, certifying to such financial information of the Demised Properties as reasonably requested by Landlord, and supporting the statements contained in any such compliance certificate, (iv) quarterly profit and loss statements in respect of each Demised Property and trailing twelve (12) month results, certified by an officer of Tenant to be true, correct, and complete in all material respects; and (v) total sales figures in respect of each Demised Property for each month within the applicable Fiscal Quarter, certified by an officer of Tenant to be true, correct and complete in all material respects;

(d) promptly and in any event within fifteen (15) days after the end of each calendar month total sales figures in respect of each Demised Property for the applicable calendar month and trailing twelve (12) month results, certified by an officer of Tenant to be true, correct and complete in all material respects;

(e) any financial statements distributed to any creditors of Tenant within five (5) Business Days after such distribution; and

(f) such other information with respect to the Demised Properties or Tenant that may be reasonably requested from time to time by Landlord, within a reasonable time after the applicable request.

MASTER LAND AND BUILDING LEASE

ARTICLE 14 [Intentionally Omitted]

ARTICLE 15 EVENTS OF DEFAULT

Section 15.01 Events Of Default. Subject to the terms of this Article, the occurrence of any of the following shall constitute an event of default by Tenant under this Lease (“Event of Default ”):

(a) Nonpayment of Base Rent . Failure to pay any installment of Base Rent hereunder within five (5) days of when payment is due.

(b) Nonpayment of Additional Rent . Failure to pay any amount of Additional Rent within five (5) days of when such payment is due.

(c) Bankruptcy and Insolvency . If at any time during the Lease Term, (i) Tenant files a Petition, (ii) any creditor or other Person that is an Affiliate of Tenant files against Tenant any Petition, or any creditor or other Person (whether or not an Affiliate of Tenant) files against Tenant any Petition where Tenant, or an Affiliate of Tenant, cooperates or colludes with such creditor or other Person in connection with such Petition or the filing thereof, (iii) any creditor or other Person that is not an Affiliate of Tenant files a Petition against Tenant, where none of Tenant, or an Affiliate of Tenant, cooperates or colludes with such creditor or other Person in connection with such Petition or the filing thereof, and such Petition is not vacated or withdrawn within sixty (60) days after the filing thereof, (iv) a trustee or receiver is appointed to take possession of any of the Demised Properties, or of all or substantially all of the business or assets of Tenant, and such appointment is not vacated or withdrawn and possession restored to Tenant within sixty (60) days thereafter, (v) a general assignment or arrangement is made by Tenant for the benefit of creditors, (vi) any sheriff, marshal, constable or other duly-constituted public official takes possession of any Demised Property, or of all or substantially all of the business or assets of Tenant by authority of any attachment, execution, or other judicial seizure proceedings, and if such attachment or other seizure remains undismissed or undischarged for a period of sixty (60) days after the levy thereof, (vii) Tenant admits in writing its inability to pay its debts as they become due; or (viii) Tenant files an answer admitting or failing timely to contest a material allegation of any Petition filed against Tenant.

(d) Misrepresentation . The discovery by Landlord, and written notice to Tenant, that any representation, warranty or financial statement given to Landlord by Tenant, or any Affiliate of Tenant, was materially false or misleading when given, including as set forth in any Transaction Document.

(e) Insurance; Environmental; Patriot Act;. Any default by Tenant under Article 10, Article 29, or Article 39(c) .