Certain identified information in this exhibit has been excluded because they are both not material and are the type of information that we treat as private or confidential. VEON HOLDINGS B.V. acting as Seller 1 VEON LTD. acting as Seller 2...

Exhibit 4.6

Certain identified information in this exhibit has been excluded because they are both not material and are the type of information that we treat as private or confidential.

24 NOVEMBER 2022

▇▇▇▇ HOLDINGS B.V.

acting as Seller 1

▇▇▇▇ LTD.

acting as Seller 2

JOINT-STOCK COMPANY KOPERNIK-INVEST 3

acting as Buyer

VIMPEL-COMMUNICATIONS PUBLIC JOINT STOCK COMPANY

acting as Company

IN RELATION TO THE SHARES IN PJSC VIMPEL-COMMUNICATIONS

| DOCPROPERTY cpHeaderText | ||

TABLE OF CONTENTS

1 Definitions | |||||

2 Subject Matter Of The Agreement | |||||

3 Purchase Price | |||||

4 Parties Obligations Prior To Closing | |||||

5 Conduct Of Business | |||||

6 Conditions | |||||

7 Closing | |||||

8 Termination | |||||

9 Sellers’ Warranties | |||||

10 Buyer’s Warranties | |||||

11 Company’s Warranties | |||||

12 Limitation Of Liability | |||||

13 Post-Closing Obligations | |||||

14 Miscellaneous | |||||

Schedule 1 - Form of the Consideration Set-Off Agreement 50

Schedule 2 - Form of the Deed of Release 51

Schedule 3 - Form of the Independent Guarantee 52

THIS SALE AND PURCHASE AGREEMENT (the "Agreement") is entered into on 24 November 2022

BETWEEN

(1)▇▇▇▇ HOLDINGS B.V., a private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) incorporated and existing in accordance with Dutch law, registration number 34345993, legal address: Claude ▇▇▇▇▇▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇ (the “Seller 1”);

(2)▇▇▇▇ LTD., a legal entity incorporated and existing in accordance with the laws of Bermuda Islands, having its office address at Claude ▇▇▇▇▇▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇, and registered in the Dutch Commercial Register under number 34374835 (the “Seller 2”);

hereinafter the Seller 1 and the Seller 2 are jointly referred to as the “Sellers” and individually referred to as a “Seller”;

(3)JOINT-STOCK COMPANY KOPERNIK-INVEST 3, a legal entity incorporated and existing in accordance with the laws of the Russian Federation, main state registration number (OGRN) ▇▇▇▇▇▇▇▇▇▇▇▇▇, with its registered address at: ▇-▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇, ▇▇▇▇. 4/1, office 79, ▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ (the “Buyer”);

2 | 2 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

(4)VIMPEL-COMMUNICATIONS PUBLIC JOINT STOCK COMPANY, a legal entity incorporated and existing in accordance with the laws of the Russian Federation, main state registration number (OGRN) 1027700166636, with its registered address at: ▇▇. ▇ ▇▇▇▇▇ ▇▇, ▇▇▇. ▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ (the “Company”);

hereinafter the Sellers, the Buyer and the Company are jointly referred to as the “Parties” and individually referred to as a “Party”;

WHEREAS:

(A)The Seller 1 owns 51,281,021.00 (fifty-one million two hundred eighty-one thousand twenty-one) ordinary shares with nominal value RUB 0.005 (five thousandths) each registered under state registration number 1-02-00027-A and 6,426,600.00 (six million four hundred twenty-six thousand six hundred) preferred shares with nominal value RUB 0.005 (five thousandths) each registered under state registration number 2-01-00027-A (the “Sale Shares 1”).

(B)The Seller 2 owns 1.00 (one) ordinary share with nominal value 0.005 (five thousandths) registered under state registration number 1-02-00027-A (the “Sale Shares 2”, together with the Sale Shares 1 – the “Sale Shares”).

(C)The Sale Shares represent 100% (one hundred per cent) of the total share capital of the Company.

(D)The Sellers are willing to sell the Sale Shares to the Buyer and the Buyer is willing to buy the Sale Shares on the terms and subject to the conditions set out in this Agreement.

(E)On July 5, 2022, the President of the Russian Federation issued Decree 430 “On Repatriation by Residents – Participants in Foreign Economic Activity of Foreign Currency and Currency of the Russian Federation” (the “Presidential Decree 430”), which, among other legal requirements, may impose an obligation on the Company to fulfil the Seller 1’s obligations under the ▇▇▇▇ ▇▇▇▇▇ held through Russian depositaries, including through the NSD.

(F)On September 20, 2022, the Company received a letter from the Ministry of Finance of the Russian Federation (“MinFin”, and the “MinFin Letter”), stating that MinFin “consider[s] it appropriate that [the Company] ensures the fulfillment of obligations under Eurobonds of ▇▇▇▇ Holding B.V. (formerly known as VimpelCom Holding B.V.) to holders of Eurobonds whose rights are recorded by Russian depositaries.”

(G)The Company has received a number of letters from holders holding the ▇▇▇▇ ▇▇▇▇▇ through the Russian depositaries demanding that the Company satisfy the Seller 1’s obligations under the existing notes, and one such holder has also brought suit in a Russian court claiming payments.

(H)The Parties acknowledge that the Transaction will require approval by the Sub-Commission of the Government Commission for Control over Foreign Investments in the Russian

3 | 3 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

Federation which includes representatives from the MinFin and that no such approval is likely to be granted unless the Company has fulfilled its obligations under the Presidential Decree 430.

(I)Nothing in this Agreement is intended to contravene any applicable laws and/or the lawful requirements of any authority (including any Relevant Authority).

1DEFINITIONS

1.1The following definitions, used in this Agreement, have the meanings set out below, and the singular form (where appropriate) shall include the plural form and vice versa:

1.1.1“Acquired ▇▇▇▇ ▇▇▇▇▇” means the ▇▇▇▇ ▇▇▇▇▇ actually acquired and held by the Company from the Signing Date until the Closing Date (both dates inclusive) excluding any ▇▇▇▇ ▇▇▇▇▇ transferred to any party other than the Seller 1 or its nominee.

1.1.2“Accrued Acquired ▇▇▇▇ ▇▇▇▇▇ Amount” means the aggregate of (a) the principal amount under each Acquired ▇▇▇▇ ▇▇▇▇; and (b) all interest and the ▇▇▇▇ ▇▇▇▇▇ Related Fees under each Acquired ▇▇▇▇ ▇▇▇▇ accrued but remaining unpaid by the Seller 1 as of, as well as all interest and the ▇▇▇▇ ▇▇▇▇▇ Related Fees accrued (whether paid or not) on or after, the moment of transfer of respective Acquired ▇▇▇▇ ▇▇▇▇ to the Company until its cancellation or transfer to the Seller 1, which, in each case, is recognized by the Clearing Systems and the Bonds Registrars, save for the amounts actually received by the Company prior to Closing.

1.1.3“Accrued Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇ Amount” means the aggregate of (a) the principal amount under each Post-Closing Acquired ▇▇▇▇ ▇▇▇▇; and (b) all interest and the ▇▇▇▇ ▇▇▇▇▇ Related Fees under each Post-Closing Acquired ▇▇▇▇ ▇▇▇▇ ▇▇▇▇ ▇▇▇▇ accrued but remaining unpaid by the Seller 1 as of, as well as all interest and the ▇▇▇▇ ▇▇▇▇▇ Related Fees accrued (whether paid or not) on or after, the moment of transfer of respective Post-Closing ▇▇▇▇ ▇▇▇▇ to the Company until its transfer to the Seller 1, which, in each case, is recognized by the Clearing Systems and the Bonds Registrars.

1.1.4“Affiliate” means:

(A)with respect to any entity (or body or Person, as applicable), any other entity, body or Person directly or indirectly Controlling, Controlled by, or under direct or indirect common Control of such entity, provided, however, that the Company shall not be considered Affiliates of any Seller; and

(B)with respect to an individual – a spouse of such person, direct descendant or direct ancestor of such person or of the spouse of such person or civil partner of such person.

1.1.5“Agreed Form” means in the form agreed by the Parties or by the parties to the relevant agreements to be in the Agreed Form in accordance with this Agreement (as applicable) (without prejudice to the right to agree technical amendments thereto) and initialed (or

4 | 4 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

confirmed by written exchange, including e-mail) by them or on their behalf for the purpose of identification with such changes as such parties may agree in writing before Closing.

1.1.6“Agreement” means this share purchase agreement and all schedules attached hereto.

1.1.7“Amended TLA” means the Trademark License Agreements as amended in the Agreed Form with effect from Closing and providing for a term of not less than [*] years with effect from Closing and on substantially the same commercial terms as those in the Trademark License Agreements as of the Signing Date.

1.1.8“Anti-Corruption Laws” means in each case (to the extent applicable to the relevant Party): (i) any anti-corruption or anti-bribery laws, rules or regulations that prohibit, inter alia, the provision or promise to provide cash or any other valuables to a public servant or to any person for the purpose of influencing the actions or decisions of such public servant or person or influencing such public servant or person, including all anti-corruption Applicable Law; (ii) U.S. Foreign Corrupt Practices Act 1977 (as amended); (iii) UK Bribery Act 2010; (iv) Federal Law of the Russian Federation No. 273-FZ “On counteraction to corruption” dated 25 December 2008 (as amended); and (v) Federal Law of the Russian Federation No-115 FZ “On Counteraction against Legalization (Laundering) of the Proceeds of Crime and Financing of Terrorism” dated 7 August 2001 (as amended).

1.1.9 “Anti-Money Laundering Laws” means any anti-money laundering laws and regulations applicable to the Parties, which introduce a ban on participation in financial transactions or on facilitating financial transactions that promote or hide illegal activities or the financing of terrorism in a particular jurisdiction.

“Anti-Money Laundering Laws” means any anti-money laundering laws and regulations applicable to the Parties, which introduce a ban on participation in financial transactions or on facilitating financial transactions that promote or hide illegal activities or the financing of terrorism in a particular jurisdiction.

“Anti-Money Laundering Laws” means any anti-money laundering laws and regulations applicable to the Parties, which introduce a ban on participation in financial transactions or on facilitating financial transactions that promote or hide illegal activities or the financing of terrorism in a particular jurisdiction.

“Anti-Money Laundering Laws” means any anti-money laundering laws and regulations applicable to the Parties, which introduce a ban on participation in financial transactions or on facilitating financial transactions that promote or hide illegal activities or the financing of terrorism in a particular jurisdiction.1.1.10“Applicable Law” means, with respect to any Person, all provisions of laws, rules, regulations or Sanctions applicable to such Person or any of its assets or property, and all judgments, injunctions, orders and decrees of any competent authority exercising statutory or delegated powers over such Person in proceedings or actions in which such Person is a party or by which any of its assets or properties are bound.

1.1.11“Applications” has the meaning given to in clause 6.2.1(A).

1.1.12“Appraiser” means a reputable independent appraiser.

1.1.13“Assignment Agreement for the Accrued Acquired ▇▇▇▇ ▇▇▇▇▇” means an agreement under English law in the Agreed Form to be entered into between the Seller 1 and the Company on Closing for the assignment by the Company to the Seller 1 (or its nominee) of the right to receive the Accrued Acquired ▇▇▇▇ ▇▇▇▇▇ Amount.

1.1.14“Assignment Agreement for the Accrued Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇” means an agreement under English law in the Agreed Form to be entered into between the Seller 1 and the Company for the assignment by the Company to the Seller 1 (or its nominee) of the right to receive the Accrued Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇ Amount.

5 | 5 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.1.15“Assignment Consideration” has the meaning given to it in clause 4.4.1.

1.1.16“BIG 4 Appraiser” means one of the following independent appraisers:

(A)AO “Business Solutions and Technologies” (OGRN: 1027700425444); or

(B)Joint-Stock Company “Technologies of Trust – Audit” (OGRN: 1027700148431); or

(C)Joint-Stock Company “B1 Group” (OGRN: 1227700325610); or

(D)Limited Liability Company “DRT Audit” (OGRN: 5147746420652); or

(E)“KEPT” Limited Liability Company (OGRN: 1147746973637); or

(F)any member of the group of any of the forgoing conducting its business activity under the relevant brand; or

(G)a member of the following group or its equivalent or is conducting its business activity under the brand of:

(i)Ernst & Young Global Limited; or

(ii)Deloitte Touche Tohmatsu Limited; or

(iii)PricewaterhouseCoopers International Limited; or

(iv)KPMG International Cooperative.

1.1.17“Bond Paying Agent” means (i) The Bank of New York Mellon, London Branch; (ii) The Bank of New York Mellon (Luxembourg) S.A.; (iii) The Bank of New York Mellon, New York Branch; (iv) Citibank, N.A., London Branch (whichever is applicable).

1.1.18“Bonds Registrars” means (i) The Bank of New York Mellon (Luxembourg) S.A.; (ii) Citigroup Global Markets Deutschland AG; (iii) Citigroup Global Markets Europe AG; (iv) Citibank, N.A., London Branch (whichever is applicable).

1.1.19“Bond Trustee” means (i) BNY Mellon Corporate Trustee Services Limited; and (ii) Citibank, N.A., London Branch (whichever is applicable).

1.1.20“Business” means the business carried out by the Company as at the Signing Date.

1.1.21“Business Day” means a day on which banks are generally open for business in the city of Amsterdam (the Netherlands) and in the city of Moscow (the Russian Federation).

1.1.22“Buy-Back Request” has the meaning set out in clause 13.2.1.

1.1.23“Buyer” has the meaning set out in the introductory paragraph.

6 | 6 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.1.24“Buyer’s Share Account” means personal account of the Buyer opened (to be opened) with the Registrar.

1.1.25“Buzton Transfer” means the sale (or transfer otherwise) by the Company of Joint Uzbek-American venture “BUZTON” in the form of a limited liability company (registered at the address: the Republic of Uzbekistan, Tashkent, Mirabadskiy district, st. Bukhara, 1).

1.1.26“Breaching Party” has the meaning set out in clause 8.3.

1.1.27“CBR” means Central Bank of Russia.

1.1.28“CBR Exchange Rate” means the official exchange rate set out by the CBR for the relevant currency as of the respective date of payment.

1.1.29“CC RF” means the Civil Code of the Russian Federation (as amended).

1.1.30“Clearing Systems” means Euroclear and Clearstream.

1.1.31“Clearstream” means Clearstream Banking, S.A.

1.1.32“Closing” means the completion of the Transaction as set out in clause 7.2.1.

1.1.33“Closing Actions” has the meaning set out in clause 7.2.1.

1.1.34“Closing Date” has the meaning set out in clause 7.1.1.

1.1.35“Company” has the meaning set out in the introductory paragraph.

1.1.36“Company’s Subsidiaries” means any legal entity where the Company directly or indirectly owns any shares / participation interests.

1.1.37“Competent Arbitration Institution” means the arbitration institution, which at the date of the submission of the notice of arbitration:

(A)has the status of a permanent arbitral institution authorized by the competent government authority of the Russian Federation to administer arbitral proceedings as required by applicable Russian legislation, or any other status required by the applicable Russian legislation to administer arbitral proceedings; and

(B)has the arbitration rules of specific categories of Disputes, adopted, published and deposited in accordance with the applicable law of Russian Federation, if, pursuant to Russian legislation, arbitration of such category of Disputes is possible only under the arbitration rules of specific categories of Disputes;

(C)meets other requirements established by the applicable Russian legislation to administer arbitral proceedings of specific categories of Disputes, including corporate disputes.

1.1.38“Completion Consideration” has the meaning set out in clause 3.1.

7 | 7 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.1.39“Completion Consideration 1” has the meaning set out in clause 3.3.1(A).

1.1.40“Completion Consideration 2” has the meaning set out in clause 3.3.1(B).

1.1.41“Completion Consideration in Cash” has the meaning set out in clause 3.4.1(C).

1.1.42“Completion Consideration Set-Off” has the meaning set out in clause 3.4.1(B).

1.1.43“Consideration Received” has the meaning set out in clause 3.2.2.

1.1.44“Conditions” has the meaning set out in clause 6.1.1.

1.1.45“Confidential Information” means all information of any kind or nature (whether written, oral, electronic or in any other form), including, without limitation, the contents of this Agreement, any financial information, trade secrets or other information, which a Party from time to time may receive as a result of entering into or performing its obligations pursuant to this Agreement, relating to another Party or the Company, which is not in the public domain.

1.1.46“Consideration Set-Off Agreement” means the set-off agreement to be concluded by the Sellers and the Company on the Closing Date on the terms and in the form as attached as Schedule 1 to this Agreement in all material aspects.

1.1.47“Control” means the possession, directly or indirectly, of the power to direct the management or policies of a Person, whether through ownership or otherwise (the terms “Controlling”, “Controlled by” shall be interpreted respectively).

1.1.48“Deed of Release” means an agreement under English law to be entered into between the Parties on the Closing Date on the terms and in the form as attached as Schedule 2 to this Agreement in all material aspects.

1.1.49“Disclosed Information” has the meaning given to in clause 6.2.2(B)(i).

1.1.50“Dispute” has the meaning set out in clause 14.11.2.

1.1.51“Distributions” has the meaning set out in clause 3.2.

1.1.52“Encumbrance” means any rights and claims, including pledge, mortgage, lease, sublease, uncompensated use, easement, lien, assignment, dispute or seizure, interim measures ordered by a court or tribunal, and any other limitations of rights to own, use and dispose of, as contemplated by the Applicable Law and by contract, including, for the avoidance of doubt, any right to acquire, an option, pre-emptive right, and any contract, including preliminary agreement, fiduciary management agreement, option to contract, pre-emptive right or right of conversion, or agreement to establish the same.

1.1.53“EUR” means the single currency of the participating member states in accordance with the relevant legislation of the European Union relating to the Economic and Monetary Union.

1.1.54“Euroclear” means Euroclear Bank, S.A./N.V., as operator of the Euroclear system.

8 | 8 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.1.55“Enforcement Action” means:

(A)the acceleration of any sum payable under the ▇▇▇▇ ▇▇▇▇▇ or the making of any declaration that any sum payable under the ▇▇▇▇ ▇▇▇▇▇ is due and payable or payable on demand;

(B)the making of any demand against Seller 1 under the ▇▇▇▇ ▇▇▇▇▇;

(C)the suing for, commencing or joining of any legal or arbitration proceedings against the Seller 1 to recover any sums in connection with the ▇▇▇▇ ▇▇▇▇▇;

(D)exercising (or causing any Bond Trustee to exercise) any other enforcement remedies in respect of the ▇▇▇▇ ▇▇▇▇▇, whether under contract, at law or in equity; and

(E)the petitioning, applying or voting for any Insolvency Proceedings in relation to the Seller 1.

1.1.56“Extended Long Stop Date” has the meaning set out in clause 6.4.1.

1.1.57“Excess Amount” has the meaning set out in clause 4.5.1.

1.1.58“Federal Law on Joint Stock Companies” means Federal Law of the Russian Federation No. 208-ФЗ “On Joint-Stock Companies” dated 26 December 1995 (as amended).

1.1.59“HKIAC” has the meaning set out in clause 14.11.2.

1.1.60“ICAC at the CCI RF” has the meaning set out in clause 14.11.4.

1.1.61“Independent Guarantees” means independent guarantees granted by the Buyer and the Russian SPVs (acting as guarantors) in favour of the Seller 1 (acting as beneficiary) as a security of the Buyer’s obligation to pay the Total Upside Consideration and the Completion Consideration in Cash in accordance with this Agreement to be entered into on the Closing Date on the terms and in the form as attached as Schedule 3 to this Agreement in all material aspects.

1.1.62“Individuals” means the natural persons, holding directly or indirectly all the shares / participatory interests in the share / charter capital of the Russian SPVs and/or the Buyer in accordance with the Ownership Structure.

1.1.63“Insolvency Proceedings” means any corporate action or legal proceedings taken in relation to:

(A)the suspension of payments, a moratorium of any indebtedness, winding-up, bankruptcy, liquidation, dissolution, administration, receivership, administrative receivership, judicial composition or reorganization (by way of voluntary arrangement, scheme or otherwise) with respect to the Seller 1;

9 | 9 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

(B)a composition, conciliation, compromise or arrangement with the creditors generally of the Seller 1 or an assignment by the Seller 1 of its assets for the benefit of its creditors generally or the Seller 1 becoming subject to a distribution of its assets;

(C)the appointment of a liquidator, receiver, administrator, administrative receiver, compulsory manager, restructuring expert or other similar officer in respect of the Seller 1 or any of its assets; or

(D)any procedure or step in any jurisdiction analogous to those set out in subclauses (A) to (C) above.

1.1.64“Kazakhstan Transfer” means the transfer of 75% (seventy-five per cent) of the share capital and voting rights in VIP Kazakhstan Holding AG from ▇▇▇▇ Eurasia S.à ▇.▇. to the Seller 1.

1.1.65“Kazakhstan Transfer Receivable” means the deferred consideration payable by the Seller 1 to ▇▇▇▇ Eurasia S.à ▇.▇. following completion of the Kazakhstan Transfer and assignment of such deferred consideration by ▇▇▇▇ Eurasia S.à ▇.▇. to the Company.

1.1.66“Kazakhstan Transfer Receivable Set-Off” means the set-off of the Seller 1’s rights to receive RUB [*] ([*] rubles) from the Company under the Shareholders’ Loans against the Company’s rights to receive the Kazakhstan Transfer Receivable from the Seller 1 pursuant to the relevant set off agreement to be concluded between the Seller 1 and the Company (the “Kazakhstan Transfer Receivable Set-Off Agreement”) in the Agreed Form.

1.1.67“Lenders’ Consents” has the meaning set out in clause 6.1.1(G).

1.1.68“Long Stop Date” means 01 June 2023 (or such other date as may be jointly agreed by the Parties in writing).

1.1.69“MinFin” has the meaning set out in clause (F) of Preamble.

1.1.70“MinFin Letter” has the meaning set out in clause (F) of Preamble.

1.1.71“MOEX” means Public Joint-Stock Company Moscow Exchange Micex-Rts, a legal entity incorporated under the laws of the Russian Federation with registration number (OGRN) 1027739387411, LEI 253400M5M1222KPNWE87, SWIFT ▇▇▇▇▇▇▇▇, whose registered office at 125009, the city of Moscow, Bolshoy Kislovksy pereulok, 13.

1.1.72“Non-Breaching Party” has the meaning set out in clause 8.3.

1.1.73“NSD” means Non-Banking Credit Organization JSC “National Settlement Depository” (ORGN 1027739132563).

10 | 10 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.1.74“Ownership Structure” means the ownership structure (including all Individuals holding directly or indirectly shares / participatory interests) of the Russian SPVs and the Buyer, as well as including information on any options, shareholders agreements (except for any shareholders or other similar agreements or arrangements to be entered solely by and between the Individuals and/or the Russian SPVs, if applicable), encumbrances and other economic rights in respect of the Buyer and the Russian SPVs, as provided by the Buyer in writing to the Seller 1 on the Signing Date and in other cases as prescribed by this Agreement.

1.1.75“Party” has the meaning set out in the introductory paragraph.

1.1.76“Permits” has the meaning set out in clause 6.1.1(F).

1.1.77“Person” means any natural person, corporate or unincorporated body (whether or not having separate legal personality), as the case may be.

1.1.78“Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇” means the ▇▇▇▇ ▇▇▇▇▇ actually acquired and held by the Company after the Closing Date excluding any ▇▇▇▇ ▇▇▇▇▇ transferred to any party other than the Seller 1 or its nominee.

1.1.79“Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇ Claim” has the meaning given to this term in clause 13.3.1.

1.1.80“Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇ Settlement Agreement” means an agreement under English law in the Agreed Form to be entered into by the Seller 1 and the Company on the key terms provided for in clause 13.2.

1.1.81“Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇ Purchase Price” has the meaning given to this term in clause 13.2.1.

1.1.82“Postponed Closing Date” has the meaning set out in clause 7.2.4.

1.1.83“Purchase Price” has the meaning set out in clause 3.1.

1.1.84“Presidential Decree 430” has the meaning set out in the clause (E) of Preamble.

1.1.85“Registrar” means Joint Stock Company «Registry society «STATUS» (OGRN 1027700003924).

1.1.86“Regulatory Approvals” has the meaning set out in the clause 6.1.1(A).

1.1.87“Relevant Authorities” means any central bank, ministry, governmental, quasi-governmental, national, supranational (including the European Union), statutory, environmental, administrative, supervisory, fiscal or investigative body or authority (including any antitrust, competition or merger control authority, any sectoral ministry or regulator and any foreign investment or national security review body), any national, state, municipal or local government (including any subdivision, court, administrative agency or commission or

11 | 11 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

other authority thereof), any tribunal, court, trade agency, association, institution or any other body or Person whatsoever in any jurisdiction.

1.1.88“Reorganization” means a reorganization of Company in the form of a merger (“присоединение”) (as provided by Article 17 of the Federal Law on Joint Stock Companies) of the Buyer to the Company occurring after Closing.

1.1.89“Resale Equity Value” has the meaning set out in clause 3.2.

1.1.90“Resale Event” means any transaction or action (or a series of directly or indirectly related transactions or actions) resulting in any of the following within the Resale Event Period:

(A)Individuals acting in concert ceasing to have the Control over the Company, the Buyer, any Russian SPV or their Successor;

(B)admission of any shares in the share capital of the Company, the Buyer or any Russian SPV (or their Successors) to trading on, or the granting of permission for any such shares to be dealt on, any internationally recognized stock exchange (including, without limitations, MOEX and/or SPB Exchange).

1.1.91“Resale Event Period” has the meaning set out in clause 3.2.

1.1.92“Resale Share” has the meaning set out in clause 3.2.

1.1.93“RUB” means ▇▇▇▇▇, the lawful currency of the Russian Federation.

1.1.94“Russian FAS” means the Federal Antimonopoly Service of the Russian Federation.

1.1.95“Russian SPV 1” means JOINT-STOCK COMPANY KOPERNIK-INVEST, a legal entity incorporated and existing in accordance with the laws of the Russian Federation, main state registration number (OGRN) 1227700750760, with its registered address at: ▇-▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇, ▇▇▇▇. 4/1, office 77, ▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇.

1.1.96“Russian SPV 2” means JOINT-STOCK COMPANY KOPERNIK-INVEST 2, a legal entity incorporated and existing in accordance with the laws of the Russian Federation, main state registration number (OGRN) 1227700750881, with its registered address at: ▇-▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇, ▇▇▇▇. 4/1, office 78, ▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇.

1.1.97“Russian SPVs” means the Russian SPV 1 and the Russian SPV 2 collectively.

1.1.98“Sale Share 1” has the meaning set out in clause (A) of Preamble.

1.1.99“Sale Share 2” has the meaning set out in clause (B) of Preamble.

1.1.100“Sale Shares” has the meaning set out in clause (B) of Preamble.

1.1.101“Sanctioned Person” means any Person or organization which (from time to time): (i) is designated on the OFAC list of Specially Designated Nationals and Blocked Persons, the Consolidated List of Financial Sanctions Targets maintained by the OFSI, and/or the

12 | 12 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

Consolidated List of persons, groups and entities subject to EU Financial Sanctions; (ii) is, or is part of, a government of a Sanctioned Territory; (iii) is owned or controlled by, or acting on behalf of, any of the foregoing; (iv) is located within or operating from a Sanctioned Territory; or (v) is otherwise targeted under any Sanctions.

1.1.102“Sanctioned Territory” means any country or other territory targeted by a comprehensive export, import, financial or investment embargo under Sanctions (from time to time) where such restrictions or embargos (as applicable) applied on a country-wide or territory-wide basis (as applicable) so as to prohibit or otherwise restrict trade or other transactions with that country or territory (as applicable) or Persons located in that country or territory.

1.1.103“Sanctions” means any economic sanctions Laws, regulations, embargoes or restrictive measures, as amended from time to time, administered, enacted or enforced by:

(A)the United States;

(B)the European Union or any member state thereof;

(C)the United Kingdom;

(D)Bermuda; or

(E)the respective governmental institutions and agencies of any of the foregoing responsible for administering, enacting or enforcing Sanctions (each a “Sanctions Authority”), including the Office of Foreign Assets Control of the US Department of Treasury (the “OFAC”), the United State Department of State, the Dutch Ministry of Finance, and Her Majesty’s Treasury (the “HM Treasury”), and the Financial Sanctions Implementation Unit of Bermuda (the “FSIU”), UK Office of Financial Sanctions Implementation (the “OFSI”).

1.1.104“Seller 1” has the meaning set out in the introductory paragraph.

1.1.105“Seller 2” has the meaning set out in the introductory paragraph.

1.1.106“Sellers” has the meaning set out in the introductory paragraph.

1.1.107“Sellers’ Group” means the Seller 1, the Seller 2 and their Affiliates (excluding the Company and the Company’s Subsidiaries).

1.1.108“Seller 1’s Account” means the bank account with the following details:

Company name: ▇▇▇▇ HOLDINGS BV

Bank: [*]

13 | 13 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

Bank address:  [*]

[*]

[*]

[*]SWIFT: [*]

IBAN: [*]

Currency: EUR,

Correspondent bank: [*]

Correspondent bank: [*]SWIFT: [*],

or any other bank account to be specified by the Seller 1 by way of notice to the Buyer no later than 5 (five) Business Days prior to the Closing Date.

1.1.109“Seller 1’s Bank” means [*] or any other bank to be specified by the Seller 1 by way of notice to the Buyer no later than 5 (five) Business Days prior to the Closing Date.

1.1.110“Seller 1’s Share Account” means personal account No. [*] opened with the Registrar.

1.1.111“Seller 2’s Share Account” means personal account No. [*] opened with the Registrar.

1.1.112“Service Telecom” means Service Telecom Group of Companies, a limited liability company incorporated under the laws of the Russian Federation having its registered office address at ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇, ▇▇▇▇. ▇, ▇▇▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇, registered in the Unified State Register of Legal Entities under the primary state registration number (ORGN) 1177746836695.

1.1.113“Service Telecom Assignment Agreement” has the meaning set out in clause 4.4.1.

1.1.114“Service Telecom SPA” means a share purchase agreement in respect of the entire share capital of JSC “National Tower Company” entered into by Service Telecom and the Sellers on 05 September 2021.

1.1.115“Service Telecom Receivable” means the outstanding amounts payable by Service Telecom to the Sellers under the Service Telecom SPA in the amount comprising of:

(A)Input VAT (as defined in the Service Telecom SPA) amounts under 8.6-8.9 of the Service Telecom SPA; and

(B)the deferred payments of RUB [*] ([*] rubles), RUB [*] ([*] rubles), and RUB [*] ([*] rubles) under clause 9.3 of the Service Telecom SPA.

14 | 14 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.1.116“Shareholders’ Loans” means loans which are owed by the Company to the Seller 1 pursuant to the following agreements:

(A)the Facility Agreement No. 81/2020 concluded between the Company as a borrower and the Seller 1 as a lender on 17 December 2020, as amended, novated, supplemented, extended or restated from time to time prior to the date hereof, including pursuant to the Deed of Set-Off concluded between the Company and the Seller 1 on 22 July 2022;

(B)the Facility Agreement concluded between the Company as a borrower and the Seller 1 as a lender on 12 May 2021, as amended and restated on 22 July 2022;

(C)the Facility Agreement No. 86/2022 concluded between the Company as a borrower and ▇▇▇▇ Finance Ireland Designated Activity Company as a lender on 15 February 2022 and the Loan Agreement concluded between ▇▇▇▇ Finance Ireland Designated Activity Company as a borrower and the Seller 1 as a lender on 04 April 2022, as amended, novated, supplemented, extended or restated from time to time prior to the date hereof, including pursuant to the Novation and Amendment and Restatement Agreement concluded between the Company, the Seller 1 and ▇▇▇▇ Finance Ireland Designated Activity Company on 22 July 2022.

1.1.117“SIAC” has the meaning set out in clause 14.11.3.

1.1.118“Signing Date” means the date of this Agreement.

1.1.119“SPB Exchange” means Public Joint-Stock Company «SPB Exchange», a legal entity incorporated under the laws of the Russian Federation with registration number (OGRN) 1097800000440, whose registered office at ▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇, ▇▇▇.▇, floor 2, prem. 1, rooms 19, 20.

1.1.120“Sub-Commission” means the Sub-Commission of the Government Commission for Control over Foreign Investments in the Russian Federation.

1.1.121“Successors” means any legal entity created as a result of reorganization (in Russian: “реорганизация”) of the Company, the Buyer or the Russian SPVs.

1.1.122“Surviving Provisions” means the provisions of clauses 1 (Definitions) and 14 (Miscellaneous).

1.1.123“Termination Date” has the meaning set out in clause 8.1.

1.1.124“Total Upside Consideration” has the meaning set out in clause 3.1.

15 | 15 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.1.125“Trademark License Agreements” means the following trademark license agreements concluded between the Company and members of the Sellers’ Group:

(A)the license agreement N 521/07 dated February 20, 2007 between the Company and Limited Liability Partnership “KaR-Tel” (registered at the address: Republic of Kazakhstan, Almaty, microdistrict Koktem-2, 22) with all additional agreements;

(B)the trademark license agreement dated July 15, 2017 between the Company and Limited Liability Company “Sky Mobile” (registered at the address: Kyrgyz Republic, Bishkek, st. Toktogula, 125/1) with all additional agreements;

(C)the license agreement N TM-2006 URS dated June 07, 2006 between the Company and Limited Liability Company “Unitel” (registered at the address: the Republic of Uzbekistan, Tashkent, st. Bukhoro, 1) with all additional agreements.

1.1.126“Transaction” means the transactions contemplated by or in accordance with this Agreement.

1.1.127“Transaction Documents” means:

(A)the Agreement;

(B)the Consideration Set-Off Agreement;

(C)Kazakhstan Transfer Receivable Set-Off Agreement;

(D)the Transitional Services Agreement;

(E)the Amended TLA;

(F)the Independent Guarantee;

(G)if applicable, the Service Telecom Assignment Agreement;

(H)the Deed of Release;

(I)the Assignment Agreement for the Accrued Acquired ▇▇▇▇ ▇▇▇▇▇;

(J)if applicable in accordance with clause 6.2.3(A)(ii), the ▇▇▇▇ ▇▇▇▇▇ Sale Agreement;

(K)if applicable in accordance with clause 6.2.3(C), the ▇▇▇▇ ▇▇▇▇▇ Settlement Agreement;

(L)the Assignment Agreement for the Accrued Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇; and

(M)the Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇ Settlement Agreement.

16 | 16 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.1.128“Transfer Clearance Authorities” means (i) the Russian FAS; and (ii) the Sub-Commission;

1.1.129“Transitional Services Agreement” means the agreement of that name between the Company and the Seller 1 (or its Affiliates) to be entered into in the Agreed Form on the Closing Date in relation to transitional services to be provided by the Company and the Sellers’ Group to each other on substantially the same terms as provided in the period of 12 (twelve) months prior to the Signing Date.

1.1.130“Upside Consideration Payment” has the meaning set out in clause 3.2.

1.1.131“USD” means the official currency of the United States of America.

1.1.132“USRLE” means the Unified State Register of Legal Entities in the Russian Federation.

1.1.133“▇▇▇▇ ▇▇▇▇▇” means eurobonds issued by the Seller 1, held directly or indirectly through NSD and existing as of the Signing Date.

1.1.134“▇▇▇▇ ▇▇▇▇▇ Related Fees” means the fees paid or to be paid by the Seller 1 to the bondholders in connection with or under the ▇▇▇▇ ▇▇▇▇▇.

1.1.135“▇▇▇▇ ▇▇▇▇▇ Sale Agreement” means an agreement under English law in the Agreed Form to be entered into by the Seller 1 and the Company pursuant to clause 6.2.3(A)(ii).

1.1.136“▇▇▇▇ ▇▇▇▇▇ Disposal” means:

(A)cancellation of the Acquired ▇▇▇▇ ▇▇▇▇▇ (whether in accordance with their terms or via a court or other statutory process) which is recognized by the Clearing Systems and the Bonds Registrars in accordance with clause 6.2.3(A)(i); and/or

(B)transfer of title to the Acquired ▇▇▇▇ ▇▇▇▇▇ from the Company to the Seller 1 (or its nominees) which is recognized by the Clearing Systems and the Bonds Registrars in accordance with clause 6.2.3(A)(ii).

1.1.137“▇▇▇▇ ▇▇▇▇▇ Settlement Agreement” means an agreement under English law in the Agreed Form to be entered into by the Seller 1 and the Company pursuant to clause 6.2.3(C).

1.1.138“▇▇▇▇ ▇▇▇▇▇ Settlement” has the meaning set out in clause 6.2.3(C).

1.1.139“▇▇▇▇ Debt” means the total principal amount (excluding interest and the ▇▇▇▇ ▇▇▇▇▇ Related Fees accrued thereon) of the Acquired ▇▇▇▇ ▇▇▇▇▇, provided that the principal amount of any Acquired ▇▇▇▇ ▇▇▇▇▇ denominated in USD (the “USD ▇▇▇▇ Debt”) shall be converted for these purposes into RUB based on the following exchange rates:

(A) [*];

(B)[*];

17 | 17 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

(C)[*];

(D)[*];

(E)[*];

(F)[*].

1.1.140“▇▇▇▇ Debt Consideration” means (i) the ▇▇▇▇ Debt Closing Receivable; and/or (ii) the ▇▇▇▇ Debt Settlement Receivable, as applicable and taking into account clause 6.2.3(D).

1.1.141“▇▇▇▇ Debt Closing Receivable” has the meaning set out in clause 6.2.3(B)(i).

1.1.142“▇▇▇▇ Debt Settlement Receivable” has the meaning set out in clause 6.2.3(E).

1.1.143“▇▇▇▇ Georgia LLC” means a company organized and existing under the laws of Georgia, registered with the Registry of Entrepreneurs and Non-Entrepreneurial (non-Commercial) Legal Entities at LEPL National Agency of Public Registry of the Ministry of Justice of Georgia under the number 204450584, whose registered address is at Bambis Rigi N8, Old Tbilisi District, Tbilisi, Georgia;

1.1.144“▇▇▇▇ Group Authority Matrix” means the Group Authority Matrix/Delegation of the Sellers’ Group as adopted by the Company on 08 October 2020, as amended on 25 November 2021.

1.1.145“Warranty” means the warranties given by the Sellers and by the Buyer in accordance with Article 431.2 of the CC RF and as set out in clauses 9, 10 and 11 respectively.

2SUBJECT MATTER OF THE AGREEMENT

2.1Subject to the Conditions being satisfied (or waived, as applicable) and subject to the other terms set out in this Agreement, the Sellers are obliged to sell the Sale Shares and the Buyer is obliged to purchase the Sale Shares, in each case pursuant to and in accordance with the terms of this Agreement.

2.2The Sale Shares shall be sold by the Sellers to the Buyer on Closing, free and clear of any Encumbrances and together with all rights attaching to them. No Party shall be obliged to

18 | 18 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

complete the sale and purchase of the Sale Shares unless the sale and purchase of all of the Sale Shares is completed simultaneously.

2.3This Agreement is a mixed agreement and may have elements of different agreements.

3PURCHASE PRICE

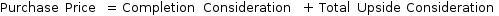

3.1 The aggregate consideration for the Sale Shares (the “Purchase Price”) shall be calculated as follows:

where:

the “Completion Consideration” means the amount of RUB 130,000,000,000.00 (one hundred thirty billion rubles);

the “Total Upside Consideration” means the aggregate amount of all Upside Consideration Payments calculated in accordance with clause 3.2 and paid in accordance with clause 3.4.3;

“+” means plus.

3.2 If within [*] months from the Closing Date (the “Resale Event Period”) any Resale Event occurs, then the Buyer shall pay to the Seller 1 the amount of monetary funds which shall be calculated as follows (provided that such calculation shall be made each time the Resale Event occurs) (the “Upside Consideration Payment”):

[ * ]

where:

“Resale Share” means [*]: [*]

where:

(A)“[*]” means:

(i)[*]; and

(ii)[*];

(B)“[*]” means [*].

19 | 19 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

“Resale Equity Value” shall be calculated in accordance with clause 3.2.2;

“Distributions” means any dividends, profits, actual value (in Russian: “действительная стоимость”), share buyback or other distributions made under 100% (one hundred per cent) of the shares / participatory interests in the share / charter capital of the Company, the Buyer or the Russian SPVs or their successors (as applicable) after the Closing Date, but before the respective Resale Event;

“×” means multiplication;

“+” means plus;

“-” means minus,

provided that if the amount calculated according to the above formula is negative or zero, then the amount of the respective Upside Consideration Payment for the purposes of this Agreement shall be zero and the Upside Consideration Payment for the respective Resale Event shall not be paid.

3.1

3.2.1

3.2.2In case of the Resale Event the Resale Equity Value shall be calculated as follows:

[ * ]

where:

[*]:

(A)[*]

(B)[*]

(C)[*]

(D)[*]

3.2Allocation of the Purchase Price

1.1.1The Completion Consideration shall be allocated between the Sellers as follows:

(A)RUB 129,999,990,000.00 (one hundred twenty-nine billion nine hundred ninety-nine million nine hundred ninety thousand) – to the Seller 1 (the “Completion Consideration 1”); and

(B)RUB 10,000.00 (ten thousand rubles) – to the Seller 2 (the “Completion Consideration 2”).

1.1.2The Completion Consideration and the Upside Consideration Payment shall be paid to the Sellers pursuant to clause 3.4.

20 | 20 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.1Payment of the Purchase Price

1.4.1The Completion Consideration shall be satisfied as follows:

(A)the Sellers and the Buyer acknowledge and agree that the Completion Consideration 2 shall be paid by the Buyer to the Seller 1;

(B)the Completion Consideration (or respective portion thereof) shall be satisfied by way of a set-off against the respective amount of the ▇▇▇▇ Debt Consideration on the ▇▇▇▇▇-to-▇▇▇▇▇ basis (the “Completion Consideration Set-Off”) in accordance with the Consideration Set-Off Agreement. For the avoidance of doubt, for the purposes of the Consideration Set-Off the respective amount of the USD ▇▇▇▇ Debt shall be converted into RUB as indicated in the definition of “▇▇▇▇ Debt”; and

(C)in case the amount of (i) the Completion Consideration minus (ii) the ▇▇▇▇ Debt Consideration (the “Completion Consideration in Cash”) is a positive amount, the entire amount of the Completion Consideration in Cash shall be paid by the Buyer at the Closing Date in EUR at the CBR Exchange Rate as of the Closing Date (with any portion of such consideration that forms a part of the Completion Consideration 2 being received by the Seller 1 for and on behalf of the Seller 2) in immediately available funds to the Seller 1’s Account with the same date value without any set-off, deduction or counterclaim irrespective of any limitations or discounts imposed by the Regulatory Approvals.

1.4.2The obligation of the Buyer to pay the Completion Consideration in Cash in accordance with clause 3.4.1(C) shall be deemed discharged from the date entire amount of Completion Consideration in Cash is credited to the Seller 1’s Bank Account.

1.4.3The Upside Consideration Payment (if any and subject to clause 3.2) shall be paid  in EUR at the CBR Exchange Rate as of the date of payment by the Buyer or its assignee to the Seller 1 in immediately available funds to the Seller 1’s Account without any deduction or counterclaim:

in EUR at the CBR Exchange Rate as of the date of payment by the Buyer or its assignee to the Seller 1 in immediately available funds to the Seller 1’s Account without any deduction or counterclaim:

in EUR at the CBR Exchange Rate as of the date of payment by the Buyer or its assignee to the Seller 1 in immediately available funds to the Seller 1’s Account without any deduction or counterclaim:

in EUR at the CBR Exchange Rate as of the date of payment by the Buyer or its assignee to the Seller 1 in immediately available funds to the Seller 1’s Account without any deduction or counterclaim:(A)within 5 (five) Business Days from the date of occurrence of each respective Resale Event; or

(B)if the Appraiser or the BIG 4 Appraiser (as applicable) is engaged in accordance with clause 3.2, within 5 (five) Business Days from the date when the fair market value is determined in accordance with clause 3.2; or

(C)if the consideration under respective Resale Event is deferred, the relevant deferred part of the Upside Consideration Payment shall be paid within 5 (five) Business Days from the date of receipt of respective deferred consideration (or the part thereof).

21 | 21 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

1.4.4The Buyer’s obligations to pay the Total Upside Consideration and Completion Consideration in Cash in accordance with this Agreement are secured by the Independent Guarantees.

1.4.5The Buyer hereby instructs the Company in accordance with article 313 of the CC RF to pay the Completion Consideration on its behalf, the Company agrees to pay the Completion Consideration on behalf of the Buyer and the Sellers agree to accept the payment of the Completion Consideration performed by the Company. For the purposes of this clause 3.4, any references to the Buyer in respect of payment of the Completion Consideration shall be also deemed to be the references to the Company.

1.2Statutory Pledge

The Parties agree that for the purposes of Article 488.5 of the CC RF, the Sale Shares shall not be deemed pledged to the Sellers.

1.3Resale Event Notification

The Buyer shall, as soon as reasonably practicably (and in any event within 5 (five) Business Days after any Resale Event) give to the Sellers the written notice of the occurrence of the Resale Event.

4PARTIES OBLIGATIONS PRIOR TO CLOSING

4.1▇▇▇▇ ▇▇▇▇▇

4.1.1Each Party hereby acknowledges and agrees that the performance by the Parties of their respective obligations contained in the Transaction Documents do not and are not intended to contravene any Sanctions and in particular, but without limiting the foregoing:

(A)the Company undertakes and covenants not to, directly or, to the knowledge of the Company, indirectly, acquire the ▇▇▇▇ ▇▇▇▇▇ from any Sanctioned Person (including custodians who are Sanctioned Persons) until the Permits and any other licenses or approval issued by competent Sanctions authorities have been obtained by the Sellers;

(B)each Seller undertakes and covenants not to acquire the ▇▇▇▇ ▇▇▇▇▇ from any Sanctioned Person until the Permits and any other licenses or approval issued by competent Sanctions authorities have been obtained by the Sellers. For the avoidance of doubt, such undertaking is given by the Sellers on their own behalf and not on behalf of the Company and no action or omission by the Company shall be attributed directly or indirectly to the Sellers.

4.2Intra-group payables

4.2.1Without prejudice to the ▇▇▇▇ Debt Settlement, as soon as practicable following the Signing Date and by no later than the Closing Date, the Company and the Sellers shall procure the settlement of all intra-group payables between the Company (and its

22 | 22 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

subsidiaries) and the Sellers (its Affiliates) (excluding any payables falling due in the ordinary course of business between the Company (its subsidiaries) and the Sellers (its Affiliates)) resulting in there being no outstanding debt, claims or demands between the Company and the Sellers on or immediately after Closing, other than as may be agreed by the Sellers and the Buyer in writing.

4.3Agreed Form documents

4.3.1As soon as practicable following the Signing Date and by no later than 31 December 2022 (unless otherwise agreed by the Parties in writing) the Parties shall use best endeavors to agree the following Transaction Documents:

(A)Kazakhstan Transfer Receivable Set-Off Agreement;

(B)the Transitional Services Agreement;

(C)the Amended TLA;

(D)if applicable, the Service Telecom Assignment Agreement;

(E)the Assignment Agreement for the Accrued Acquired ▇▇▇▇ ▇▇▇▇▇;

(F)if applicable in accordance with clause 6.2.3(A)(ii), the ▇▇▇▇ ▇▇▇▇▇ Sale Agreement;

(G)if applicable in accordance with clause 6.2.3(C), the ▇▇▇▇ ▇▇▇▇▇ Settlement Agreement;

(H)the Assignment Agreement for the Accrued Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇; and

(I)the Post-Closing Acquired ▇▇▇▇ ▇▇▇▇▇ Settlement Agreement.

4.4Service Telecom Assignment

4.4.1The Parties have agreed that on or prior to 31 December 2022 the Sellers may enter into the assignment agreement with the Company in the Agreed Form (the “Service Telecom Assignment Agreement”) pursuant to which the Sellers shall assign their rights to receive the total amount of the Service Telecom Receivable

to the Company at a consideration equal to RUB [*] ([*] rubles, which shall be reduced to RUB [*] ([*] rubles) on Closing (the “Assignment Consideration”) and which shall be paid or satisfied by the Company in accordance with clause 4.4.2.

4.4.2The Sellers and the Buyer acknowledge and agree that the Assignment Consideration shall be paid by the Company to the Seller 1. The Assignment Consideration shall be paid in cash (the “Assignment Consideration in Cash”) by the Company to the Seller 1 at the Closing Date in immediately available funds to the Seller 1’s Account or satisfied by way of a set-off

23 | 23 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

against the respective amount of the outstanding ▇▇▇▇ Debt Consideration and/or the Excess Amount (or the respective part thereof) in accordance with the Consideration Set-Off Agreement (the “Assignment Consideration Set-Off”).

4.4.3The obligation of the Company to pay the Assignment Consideration in Cash in accordance with clause 4.4.2 shall be deemed discharged from the date the entire amount of the Assignment Consideration in Cash is credited to the Seller 1’s Bank Account.

4.5Excess Amount Compensation

4.5.1In case the amount of the ▇▇▇▇ Debt Consideration exceeds the Completion Consideration (the “Excess Amount”) and such Excess Amount is not fully set off in accordance with clause 4.4.2, the Buyer and the Seller 1 shall agree in good faith within [*] ([*]) months following the Closing on how such Excess Amount may be paid or otherwise compensated by the Seller 1 or its Affiliates to the Buyer. The Buyer in accordance with Article 430 of the CC RF instructs the Seller 1 to pay the Excess Amount to the Company and confirms that the payment  (compensation) of the Excess Amount to the Company by the Seller 1 will be considered to be the proper performance of the Seller 1's obligations to pay the Excess Amount.

(compensation) of the Excess Amount to the Company by the Seller 1 will be considered to be the proper performance of the Seller 1's obligations to pay the Excess Amount.

(compensation) of the Excess Amount to the Company by the Seller 1 will be considered to be the proper performance of the Seller 1's obligations to pay the Excess Amount.

(compensation) of the Excess Amount to the Company by the Seller 1 will be considered to be the proper performance of the Seller 1's obligations to pay the Excess Amount.4.5.2If the Seller 1 and the Buyer do not reach an agreement on how the Excess Amount should be settled within the time period indicated in clause 4.5.1, the Buyer shall be entitled to request the payment of the Excess Amount in cash at any time following the expiration of such time period.

4.6Changes in the Ownership Structure

4.6.1The Buyer shall procure that no change of Control over the Buyer shall occur on or before the Closing Date.

4.6.2Unless otherwise provided in clause 4.6.3, the Buyer shall procure that no changes in the Ownership Structure shall occur on or before the Closing Date without the prior written consent of the Seller 1 (such consent not to be unreasonably withheld).

4.6.3The Parties have agreed that the following changes in the Ownership Structure may occur without the prior written consent of the Seller 1:

(A)issuance of the additional shares by the Russian SPVs or the Buyer to the Individuals and / or Russian SPVs; and

(B)transfers of shares in the Russian SPVs between the Individuals or transfer of shares in the Buyer between the Russian SPVs;

24 | 24 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

in each case provided that (i) such changes do not lead to change of Control (directly or indirectly) over the Russian SPVs or the Buyer, and (ii) the Seller 1 is notified in writing of the respective changes as soon as practicable but no later than 10 (ten) Business Days prior to the Closing Date.

5CONDUCT OF BUSINESS

3.1Between the Signing Date and the Closing the Company and the Sellers shall:

(A)operate Business in the ordinary course and in all material respects in compliance with Applicable Law, Company’s constitutional documents and internal policies, including, but not limited to, the ▇▇▇▇ Group Authority Matrix, and all the material agreements concluded by the Company;

(B)take all reasonable steps to preserve and protect Business and assets (including goodwill);

(C)[*];

(D)[*].

5.2. Clause 5.1 shall not operate so as to restrict or prevent:

(A)any matter mutually agreed by the Seller 1 and the Buyer;

(B)any matter contemplated in the Transaction Documents.

6CONDITIONS

6.1Conditions precedent

6.1.1The obligations of the Sellers and the Buyer to complete the Transaction in accordance with clause 7 shall be subject to the following conditions (the “Conditions”) to be satisfied or waived (subject to clause 6.5) by no later than the Long Stop Date (subject to clause 6.4):

(A)the Buyer and the Company (as applicable) having obtained the following approvals required for the consummation of the Transaction (the “Regulatory Approvals”):

(i)approval by the Russian FAS under the Federal Law No. 135-FZ “On Protection of Competition” dated 26 July 2006; and

(ii)approval by the Sub-Commission under the Presidential Decree No. 81 dated 01 March 2022, the Presidential Decree No. 618 dated 08 September 2022, the Presidential Decree No. 95 dated 05 March 2022 and the Presidential Decree No. 737 dated 15 October 2022, including approval of the transfer of all the Sale Shares, ▇▇▇▇ ▇▇▇▇▇ Disposal (if applicable), Kazakhstan Transfer Receivable Set-Off (if applicable), payment or satisfaction of the Purchase Price in the amount, currency and manner

25 | 25 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

specified in this Agreement;

(B)the ▇▇▇▇ ▇▇▇▇▇ Disposal having occurred;

(C)the ▇▇▇▇ Debt being not less than RUB [*] ([*] Russian rubles) provided that the amount of USD ▇▇▇▇ Debt is not less than USD [*] ([*] United States dollars);

(D)the Kazakhstan Transfer having been completed within 14 (fourteen) calendar days of the Signing Date;

(E)the Kazakhstan Transfer Receivable Set-Off having been completed;

(F)the Sellers having obtained licenses, permits and consents from OFAC, OFSI, the Minister of Legal Affairs and Constitutional Reform of Bermuda and the Dutch Ministry of Finance as may be required (but not limited to) for the ▇▇▇▇ ▇▇▇▇▇ Disposal, the ▇▇▇▇ ▇▇▇▇▇ Settlement, acquisition (including payment for) by the Seller 1 (or its nominee) of the ▇▇▇▇ ▇▇▇▇▇ (and the entitlement to principle and interest and the ▇▇▇▇ ▇▇▇▇▇ Related Fees accrued and/or received prior to, on or after Closing under the ▇▇▇▇ ▇▇▇▇▇) held by the Company on or after Closing, and payment of the Purchase Price by the Company on behalf of the Buyer and/or by the Buyer (what is applicable) (including the set-off of the ▇▇▇▇ Debt Consideration against the Completion Consideration) (the “Permits”); and

(G)the Seller 1 having obtained all consents of the lenders to, and the bondholders of, the Seller 1 to permit the Transaction, applicable as of the Closing Date (the “Lenders’ Consents”).

6.2Responsibility of the Parties for the satisfaction of the Conditions

6.2.1Regulatory Approvals

(A)The Buyer shall have the primary responsibility for the preparation of any notifications and applications to the Transfer Clearance Authorities (the “Applications”) in connection with obtaining of the Regulatory Approvals.

(B)The Buyer shall, submit the Applications as soon as practically possible after the Signing Date but, in any event, no later than [*] Business Days from the Signing Date (except for the Applications for the ▇▇▇▇ Debt Disposal and Kazakhstan Transfer Receivable Set-Off, which may be filed no later than [*] Business Days from the Signing Date), provided that the Sellers have timely provided to the Buyer all information reasonably required in respect of them and their Affiliates as necessary for the completion of such submission by such date (and, if the Sellers do

26 | 26 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

not timely provide such information, the above periods for submission of the Applications shall be extended by such number of days as is equal to the number of days required by the Sellers to provide such information to the Buyer).

(C)At the Seller’s request, the Buyer shall:

(i)provide the Sellers and its internal or external legal counsel as soon as possible with drafts of any written filings and other communications intended to be submitted to the Transfer Clearance Authorities in respect of any Applications;

(ii)provide the Sellers or its internal and external legal counsel with a reasonable opportunity to comment on such filings and communications;

(iii)promptly provide the Sellers or its internal and external legal counsel with final copies of all such filings and communications; or

(iv)promptly forward to the Sellers and its internal and external legal counsel any communications received from the Transfer Clearance Authorities.

provided that in each case the Buyer shall be entitled to reasonably refuse to disclose respective information and/or documents, if such disclosure is likely to result in breach of the Applicable Law.

(D)In case any Regulatory Approvals are issued subject to any terms and/or conditions (including any instructions and obligations), the Parties shall consult with each other whether the conditions of the respective Regulatory Approval are reasonably satisfactory to the Parties.

6.2.2Obligations in relation to the Permits

(A)The Sellers shall submit the filings for the Permits as soon as practically possible after the Signing Date but, in any event, no later than 20 (twenty) Business Days from the Signing Date.

(B)At the Buyer’s request, the Seller 1 shall, for the purposes of fulfillment of the Condition set out in clause 6.1.1(F):

(i)provide the Buyer with drafts (extracts from such drafts) of written filings intended to be submitted and extracts from the fillings already submitted by the Sellers to the Relevant Authority for the fulfillment of such Condition so far as, and to the extent that, information in such fillings relates directly to the Transaction structure and indication of the Buyer as the purchaser of the Sale Shares (the “Disclosed Information”);

(ii)allow the Buyer 3 (three) Business Days to provide comments on drafts of such filings with respect to the Disclosed Information, and the Seller 1 shall

27 | 27 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

reasonably consider such comments (with no obligation to incorporate them) before submitting the filings;

(iii)provide the Buyer with extracts from final copies of such filings in relation to the Disclosed Information; or

(iv)keep the Buyer informed of any material communication received from the Relevant Authority in connection with the Permits so far as it relates to the Disclosed Information,

provided that in each case the Seller 1 shall be entitled to reasonably refuse to disclose respective information and/or documents, if such disclosure is likely to result in breach of the Applicable Law.

(C)In case the Sellers receive a rejection from any of OFAC, or OFSI, or the Minister of Legal Affairs and Constitutional Reform of Bermuda, or the Dutch Ministry of Finance for consummation of the Transaction while obtaining the Permits, the Parties shall consult with each other about the reasons for such rejections and negotiate in good faith how they may achieve completion of the Transaction (including, on the amended terms, provided that such amended terms should not affect the Parties' economic interests as they are provided for in this Agreement).

6.2.3Obligations in respect to the ▇▇▇▇ ▇▇▇▇▇

(A)Subject to clauses 4.1 and 6.1.1(F) and upon the Seller 1's written notice on which below procedure(s) should be taken, the Company and the Buyer shall take all reasonable steps and actions as may be necessary and/or requested by the Seller 1:

(i)to effect the cancellation of the Acquired ▇▇▇▇ ▇▇▇▇▇, including (a) giving any such instructions and/or confirmations as may be required by the Clearing Systems, the Bonds Registrars, the Bond Trustee, the Bond Paying Agent, the NSD, or the custodian through which the Company acquires the Acquired ▇▇▇▇ ▇▇▇▇▇; (b) voting in favour of any amendments or other proposals which may be made by the Seller 1 in respect of the Acquired ▇▇▇▇ ▇▇▇▇▇ (whether pursuant to the terms of the Acquired ▇▇▇▇ ▇▇▇▇▇ or under any court or statutory process)), (c) entering into the Assignment Agreement for the Accrued Acquired ▇▇▇▇ ▇▇▇▇▇; and (d) issuing a power of attorney in favour of the Seller 1 (or its nominee) to take any actions that the Seller 1 may determine to be necessary or desirable to effect the cancellation of the ▇▇▇▇ ▇▇▇▇▇; or

(ii)to sell the Acquired ▇▇▇▇ ▇▇▇▇▇ to the Seller 1 pursuant to the ▇▇▇▇ ▇▇▇▇▇ Sale Agreement including (a) giving any such instructions and/or confirmations as may be required by the Clearing Systems, the Bonds Registrars, the Bond Trustee, the Bond Paying Agent, the NSD, or the custodian through which the Company acquires the Acquired ▇▇▇▇ ▇▇▇▇▇;

28 | 28 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

(b) voting in favour of any amendments or other proposals which may be made by the Seller 1 in respect of the Acquired ▇▇▇▇ ▇▇▇▇▇ (whether pursuant to the terms of the Acquired ▇▇▇▇ ▇▇▇▇▇ or under any court or statutory process)); (c) entering into the Assignment Agreement for the Accrued Acquired ▇▇▇▇ ▇▇▇▇▇; (d) issuing a power of attorney in favour of the Seller 1 (or its nominee) to take any actions that the Seller 1 may determine to be necessary or desirable to effect the transfer of title to the Acquired ▇▇▇▇ ▇▇▇▇▇; and (e) seeking applicable Regulatory Approvals;

(B)Subject to the ▇▇▇▇ ▇▇▇▇▇ Disposal occurring (and being recognized by the Clearing Systems and the Bonds Registrars to the satisfaction of the Seller 1) on or before Closing and without prejudice to clause 4.5:

(i)the Seller 1 agrees that, in consideration of the ▇▇▇▇ ▇▇▇▇▇ Disposal, it shall owe to the Company on the Closing Date an amount equal to the ▇▇▇▇ Debt (the “▇▇▇▇ Debt Closing Receivable”), which may be set-off against the Completion Consideration on the Closing Date in accordance with clause 3.4.1(B);

(ii)the Company shall direct or instruct the Clearing Systems, the Bond Paying Agent, the NSD, or any custodian to pay any amounts payable to it in respect of the Acquired ▇▇▇▇ ▇▇▇▇▇ to the Seller 1 (or its nominee); and

(iii)the Company shall pay to the Seller 1 an amount equal to any principal, interest and the ▇▇▇▇ ▇▇▇▇▇ Related Fees received by the Company in respect the Acquired ▇▇▇▇ ▇▇▇▇▇ after Closing within 5 Business Days of their receipt.

(C)If the Condition set out in clause 6.1.1(B) is waived in accordance with the terms of this Agreement or if, following the ▇▇▇▇ ▇▇▇▇▇ Disposal, there are any Acquired ▇▇▇▇ ▇▇▇▇▇ which were acquired by the Seller 1 after the ▇▇▇▇ ▇▇▇▇▇ Disposal occurred or not included in the ▇▇▇▇ ▇▇▇▇▇ Disposal for any reason and thus such Acquired ▇▇▇▇ ▇▇▇▇▇ become subject to the ▇▇▇▇ Debt Settlement, on Closing the Seller 1 and the Company shall enter into the Assignment Agreement for the Accrued Acquired ▇▇▇▇ ▇▇▇▇▇ and the ▇▇▇▇ ▇▇▇▇▇ Settlement Agreement whereby the Company shall:

(i)undertake to cancel (including to assist in the reduction of the principal amount under the corresponding global note certificate by the amount of Acquired ▇▇▇▇ ▇▇▇▇▇ so cancelled and, in the event that all of the bonds issued under the same series as the Acquired ▇▇▇▇ ▇▇▇▇▇ are cancelled and if so required by the Seller 1, in the cancellation of the corresponding global note certificate) or transfer the Acquired ▇▇▇▇ ▇▇▇▇▇ to the Seller 1 (or its nominee) when it becomes legally possible in a manner recognized by the Clearing Systems and the Bonds Registrars and shall take all reasonable steps and actions as may be necessary and/or requested by the Seller 1 to effect such transfer or cancellation, including to assist in the

29 | 29 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

reduction of the principal amount under the corresponding global note certificate by the amount of Acquired ▇▇▇▇ ▇▇▇▇▇ so cancelled and, in the event that all of the ▇▇▇▇ ▇▇▇▇▇ issued under the same series as the Acquired ▇▇▇▇ ▇▇▇▇▇ are cancelled and if so required by the Seller 1, in the cancellation of the corresponding global note certificate (including, if applicable, seeking regulatory approvals in Russia, giving any such instructions, confirmations or authorizations as may be required to the Clearing Systems, the Bonds Registrars, the Bond Trustee, the Bond Paying Agent, the NSD, or the custodian through which the Company acquires the ▇▇▇▇ ▇▇▇▇▇; opening an account with another custodian);

(ii)undertake not to dispose of, or grant or agree to grant any option in respect of, or create or agree to create any Encumbrance over the Acquired ▇▇▇▇ ▇▇▇▇▇, or to enter into any agreement to do any of the foregoing other than the ▇▇▇▇ ▇▇▇▇▇ Disposal;

(iii)pledge the Acquired ▇▇▇▇ ▇▇▇▇▇ in favor of the Seller 1 and register respective pledge within respective depository and not to remove such pledge without the preliminary consent of the Seller 1;

(iv)waive all entitlements to receive any coupon and principal payments under the Acquired ▇▇▇▇ ▇▇▇▇▇ and release the Seller 1 from any such payment obligations;

(v)to direct or instruct the Clearing Systems, the Bond Paying Agent, the NSD, or any custodian to pay any amounts payable to it in respect of the Acquired ▇▇▇▇ ▇▇▇▇▇ to the Seller 1 (or its nominee);

(vi)undertake to pay to the Seller 1 an amount equal to any payments in respect of principal, interest and/or the ▇▇▇▇ ▇▇▇▇▇ Related Fees received by the Company in respect of the Acquired ▇▇▇▇ ▇▇▇▇▇ after Closing within 5 (five) Business Days of their receipt;

(vii)undertake to vote, instruct its proxy or other relevant person to vote (and deliver within the applicable time periods any proxies, instructions, directions, or consents voting), exercise any powers or rights available to it irrevocably and unconditionally in favour of any amendments to the ▇▇▇▇ ▇▇▇▇ terms proposed by Seller 1 including, without limitation, any amendments to allow direct payments to the holders of the ▇▇▇▇ ▇▇▇▇▇ outside of the Clearing Systems (whether under the terms of the ▇▇▇▇ ▇▇▇▇▇ or pursuant to a statutory or court process);

(viii)undertake to vote, instruct its proxy or other relevant person to vote (and deliver within the applicable time periods any proxies, instructions, directions, or consents voting), exercise any powers or rights available to it irrevocably and unconditionally in favour of cancellation or, transfer to the Seller 1 (or its nominee), of existing ▇▇▇▇ ▇▇▇▇▇ or any other proposal

30 | 30 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

which the Seller 1 may make in respect of the ▇▇▇▇ ▇▇▇▇▇ (whether under the terms of the ▇▇▇▇ ▇▇▇▇▇ or pursuant to a statutory or court process) and, in each case, at the direction of Seller 1, to waive its right to receive or turnover, or to instruct or direct payment to be made, to Seller 1 (or its nominee), any consideration to which the Company may be entitled in respect of such amendments, cancellation, transfers or other proposals;

(ix)grant a power of attorney in favour of the Seller 1 (or its nominee) authorizing the Seller 1 (or its nominee) to take any actions that the Seller may determine to be necessary or desirable to give effect to clauses 6.2.3(C)(i) – 6.2.3(C)(viii) above; and

(x)undertake to take any such actions as may be required to give effect to the matters set out in clauses 6.2.3(C)(i) – 6.2.3(C)(viii) above,

(together, the “▇▇▇▇ ▇▇▇▇▇ Settlement”).

(D)If, following the ▇▇▇▇ ▇▇▇▇▇ Disposal, any Acquired ▇▇▇▇ ▇▇▇▇▇ become subject to the ▇▇▇▇ Debt Settlement (in cases provided for in clause 6.2.3(C)) then the amount of the ▇▇▇▇ Debt Closing Receivable shall be reduced pro-rata so that both amounts, ▇▇▇▇ Debt Closing Receivable and ▇▇▇▇ Debt Settlement Receivable, together representing the total ▇▇▇▇ Debt Consideration, shall be set off against the Completion Consideration.

(E)The Seller 1 hereby agrees that in consideration of the Company’s undertakings set out in the ▇▇▇▇ ▇▇▇▇▇ Settlement Agreement pursuant to Clause 6.2.3(C), the Seller 1 shall owe to the Company on the Closing Date an amount equal to the ▇▇▇▇ Debt (the “▇▇▇▇ Debt Settlement Receivable”), which may be set-off against the Completion Consideration on the Closing Date in accordance with clause 3.4.1(B).

(F)The Company hereby undertakes:

(i)not to take any action or any Enforcement Action in respect of, or direct, instruct, assist or encourage any other person to take Enforcement Action in respect of, the Acquired ▇▇▇▇ ▇▇▇▇▇; and

(ii)to vote against any instruction to any Bond Trustee to take any Enforcement Action, to vote to and to take any steps reasonably required by Seller 1 to waive any defaults under the ▇▇▇▇ ▇▇▇▇▇’ governing documents or rescind any acceleration of, the ▇▇▇▇ ▇▇▇▇▇; and

(iii)to vote, instruct its proxy or other relevant person to vote (and deliver within the applicable time periods any proxies, instructions, directions, or consents voting), exercise any powers or rights available to it irrevocably and unconditionally in favour of any amendments to the ▇▇▇▇ ▇▇▇▇ terms proposed by Seller 1.

31 | 31 of #NUM_PAGES# | |||||||

| DOCPROPERTY cpHeaderText | ||

6.3Obligations in relation to other Conditions

6.3.1The Parties shall notify the other Party of the satisfaction of any Condition as soon as reasonably practicable but in any case not later than within 5 (five) Business Days from the date of satisfaction of such Condition by sending a written notice to the other Party.

6.3.2The Parties shall immediately notify the other Party if they have any reason to believe that any Сondition may not be satisfied, or that satisfaction may be delayed, in that case the Parties shall negotiate and consult with each other in good faith with respect to such issue.

6.3.3If the Buyer has any reason to believe that the Сondition specified in clause 6.1.1(C) may not be satisfied, or that satisfaction may be delayed, the Buyer shall immediately notify the Seller 1 and the Parties shall negotiate and consult with each other in good faith with respect to such issue.

6.3.4The Seller 1 undertakes to take all actions reasonably required or necessary to fulfill or procure the fulfilment of the Conditions set out in clauses 6.1.1(B), 6.1.1(D), 6.1.1(F) and 6.1.1(G).

6.3.5The Seller 1 and the Company undertake to take all actions reasonably required or necessary to fulfill or procure the fulfilment of the Conditions set out in clauses 6.1.1(E).

6.3.6The Buyer undertakes to take all actions reasonably required or necessary to fulfill or procure the fulfillment of the Conditions set out in clauses 6.1.1(A) of this Agreement.

6.3.7The Company shall inform the Seller 1 no later than [*] 2023 (inclusively) if the amount of the ▇▇▇▇ Debt reaches RUB [*] ([*] rubles).

6.3.8 If any circumstances beyond the control of the Parties arise and as a result of which any additional regulatory approvals for the consummation of the Transaction in accordance with the Applicable Law become necessary, the Parties shall be required to obtain such additional regulatory approvals before Closing.

If any circumstances beyond the control of the Parties arise and as a result of which any additional regulatory approvals for the consummation of the Transaction in accordance with the Applicable Law become necessary, the Parties shall be required to obtain such additional regulatory approvals before Closing.

If any circumstances beyond the control of the Parties arise and as a result of which any additional regulatory approvals for the consummation of the Transaction in accordance with the Applicable Law become necessary, the Parties shall be required to obtain such additional regulatory approvals before Closing.

If any circumstances beyond the control of the Parties arise and as a result of which any additional regulatory approvals for the consummation of the Transaction in accordance with the Applicable Law become necessary, the Parties shall be required to obtain such additional regulatory approvals before Closing.6.4Long Stop Date Extension

6.4.1 Notwithstanding any other provisions of this Agreement, in case the Long Stop Date is extended in relation to any Condition in accordance with this clause (the “Extended Long Stop Date”), all provisions of this Agreement in respect of the Long Stop Date shall be also applicable to the Extended Long Stop Date and all references to the Long Stop Date shall be deemed to be references to the Extended Long Stop Date. The Parties agree that the

Notwithstanding any other provisions of this Agreement, in case the Long Stop Date is extended in relation to any Condition in accordance with this clause (the “Extended Long Stop Date”), all provisions of this Agreement in respect of the Long Stop Date shall be also applicable to the Extended Long Stop Date and all references to the Long Stop Date shall be deemed to be references to the Extended Long Stop Date. The Parties agree that the

Notwithstanding any other provisions of this Agreement, in case the Long Stop Date is extended in relation to any Condition in accordance with this clause (the “Extended Long Stop Date”), all provisions of this Agreement in respect of the Long Stop Date shall be also applicable to the Extended Long Stop Date and all references to the Long Stop Date shall be deemed to be references to the Extended Long Stop Date. The Parties agree that the