CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY BRACKETS, HAS BEEN EXCLUDED BECAUSE IT IS NOT MATERIAL AND WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED.

Exhibit 10.6

Execution Version

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT,

MARKED BY BRACKETS, HAS BEEN EXCLUDED BECAUSE IT IS NOT MATERIAL

AND WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED.

AMENDED

AND RESTATED

INSURED DEPOSIT ACCOUNT AGREEMENT

by and among

TD BANK USA, NATIONAL ASSOCIATION,

TD BANK, NATIONAL ASSOCIATION,

AND

THE XXXXXXX XXXXXX CORPORATION

November 24, 2019

Execution Version

Table of Contents

| Page | ||

| 1. | Roles | 2 |

| 2. | Terms and Conditions of the Master and Customer Accounts | 2 |

| 3. | Procedures for Establishment of, and Deposits to, the Master Accounts | 3 |

| 4. | Interest Rate on Deposits | 4 |

| 5. | Fees; Deposit Balances | 4 |

| 6. | Withdrawals from and Closure of a Master Account | 9 |

| 7. | Registration at the Depository Institutions | 9 |

| 8. | Books and Records Concerning the Customer and Master Accounts | 10 |

| 9. | Representations and Warranties relating to Broker-Dealers | 12 |

| 10. | Representations and Warranties of the Depository Institutions | 13 |

| 11. | General Covenants | 14 |

| 12. | Master Account Description, Statements and Disclosures | 16 |

| 13. | Indemnification | 16 |

| 14. | Term; Termination; Related Procedures | 18 |

| 15. | Survival | 20 |

| 16. | Confidentiality | 20 |

| 17. | Notices | 22 |

| 18. | Expenses | 24 |

| 19. | Governing Law | 24 |

| 20. | Assignment | 24 |

| 21. | Court Fees and Damages | 24 |

| 22. | Entire Agreement | 24 |

| 23. | Invalidity | 24 |

| 24. | Counterparts | 24 |

| 25. | Headings | 24 |

| 26. | References to Statutes, Rules or Regulations | 25 |

| 27. | Xxxxx-Xxxxx-Xxxxxx Compliance and Related Matters | 25 |

| 28. | Litigation | 26 |

| 29. | No Recourse to the Broker-Dealers | 26 |

| 30. | Business Continuity Plan | 26 |

| 31. | Amendments | 27 |

| 32. | Benefit of the Parties | 27 |

| 33. | No Agency | 27 |

| 34. | No Waiver | 27 |

| 35. | Amendment and Restatement of the 0000 XXX | 00 |

| 00. | Authorized Representative of the Broker-Dealers | 27 |

| Exhibits | ||

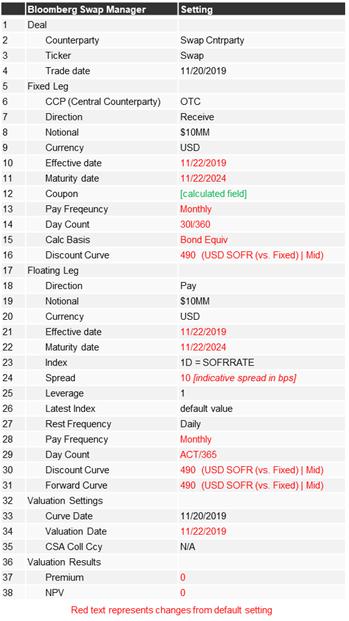

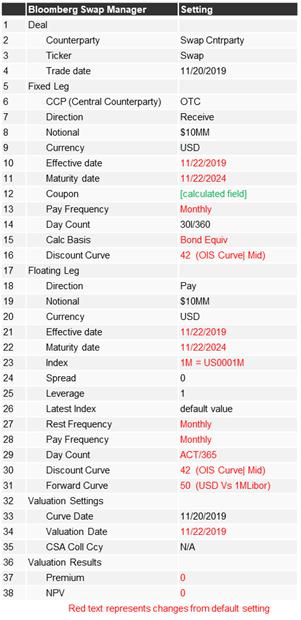

| Exhibit A | Fixed and Float Rate Yield Calculations | |

| Exhibit B | Methodology for Calculating Applicable FDIC Deposit Insurance Premium Assessments | |

| Exhibit C | Economic Replacement Value Calculation |

ii

Index of Defined Terms

| 2013 XXX | Recitals |

| Affiliate | Recitals |

| Agreement | Preamble |

| Anti-Money Laundering Programs | 11(e) |

| BCP | 30 |

| Broker-Dealers | 1(a) |

| Business Day | 3(b) |

| Closing | Recitals |

| Confidential Information | 16(a) |

| Customer Account | Recitals |

| Customer Data | 27(b) |

| Customer Disclosures | 10(h) |

| Customers | Recitals |

| Depository Institutions | Preamble |

| Exempt Fixed Rate Obligation Amounts | 14(i) |

| Exempt Period | 14(i) |

| Exemption Notice | 14(i) |

| FDIC | Recitals |

| Indemnitee | 13(c) |

| Indemnitor | 13(c) |

| Initial Expiration Date | 14(a) |

| Internal Revenue Code | 11(b) |

| Master Accounts | Recitals |

| Merger Agreement | Recitals |

| Merger Sub | 14(i) |

| Non-Renewal Notice | 14(i) |

| Regulation D | 8(b) |

| Schwab | Preamble |

| Service Fee | 5(a) |

| Sweep Arrangement Fee | 5(e) |

| TD Ameritrade Trust Company | Recitals |

| TD Bank | Preamble |

| TD Bank USA | Preamble |

| TD Parent | Recitals |

| TDA | Recitals |

| TDA Broker-Dealers | Recitals |

| TDA Clearing | Recitals |

| U.S. Money Laundering and Investor Identification Requirements | 11(e) |

| Withdrawal Schedule | 14(i) |

iii

AMENDED

AND RESTATED

INSURED DEPOSIT ACCOUNT AGREEMENT

This Amended and Restated Insured Deposit Account Agreement, dated as of November 24, 2019 (as amended, supplemented, restated or otherwise modified from time to time, this “Agreement”), is by and among TD Bank USA, National Association, a national bank with its main office in the State of Delaware (“TD Bank USA”), TD Bank, National Association, a national bank with its main office in the State of Delaware (“TD Bank,” and together with TD Bank USA, the “Depository Institutions”) and The Xxxxxxx Xxxxxx Corporation (“Schwab”). The Depository Institutions, Schwab and the Broker-Dealers (as defined below) are each a “party” and collectively, the “parties”. This Agreement shall become effective upon the Closing (as defined below) without any further action of any party hereto.

Recitals

WHEREAS, Schwab is party to the Agreement and Plan of Merger, dated as of the date hereof (the “Merger Agreement”), by and among Schwab, Americano Acquisition Corp. (“Merger Sub”) and TD Ameritrade Holding Corporation, pursuant to which, at the closing and subject to the terms and conditions set forth therein, Merger Sub will merge with and into TD Ameritrade Holding Corporation and TD Ameritrade Holding Corporation will become a wholly-owned subsidiary of Schwab (the “Closing”);

WHEREAS, TD Bank USA, TD Bank, The TD Bank (“TD Parent”), TD Ameritrade, Inc. (“TDA”), TD Ameritrade Clearing, Inc. (“TDA Clearing”) and TD Ameritrade Trust Company (“TD Ameritrade Trust Company” and together with TD Ameritrade Clearing, the “TDA Broker-Dealers”) are party to an Insured Deposit Account Agreement, effective as of January 1, 2013 (the “2013 XXX”) and the parties hereto desire to enter into this Agreement in order to, effective as of the Closing, amend and restate the 2013 XXX in its entirety;

WHEREAS, the Depository Institutions have established or will establish one or more money market deposit accounts (as that term is defined in 12 C.F.R. Section 204.2(d)(2)) (the “Master Accounts”) in the names of the Broker-Dealers (as defined below) as agent and custodian for customers of the Broker-Dealers (“Customers”), including those Customers that are trust agents, nominees, custodians or other representatives of others;

WHEREAS, each Broker-Dealer will act as agent and recordkeeper with respect to certain books and records relating to each of its Customers’ individual beneficial interest in the Master Accounts (each, a “Customer Account”) and will maintain its deposit account records to reflect at all times the existence of a relationship that serves as the basis for federal deposit insurance of such Customer Accounts by the Federal Deposit Insurance Corporation (the “FDIC”), subject to the terms and conditions of this Agreement;

WHEREAS, the parties intend that the Customer Accounts will be eligible for federal deposit insurance by the FDIC for the maximum aggregate amount of principal and interest available with respect to each Customer’s aggregate deposits maintained in a single recognized legal capacity, as evidenced by the records of the Depository Institutions and the Broker-Dealers pursuant to applicable laws and regulations;

WHEREAS, for purposes of this Agreement, “Affiliate” shall mean, for any specified person, any other person who controls, is controlled by or is under common control with, such specified person. For purposes of this definition, (a) “control” (including, with its correlative meanings, the terms “controlling,” “controlled by” and “under common control with”) as used with respect to any person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such person, whether through the ownership of securities or other similar interest, by contract or otherwise; (b) with respect to the Broker-Dealers, the term Affiliate shall not be deemed to include TD Parent or any of its subsidiaries; and (c) with respect to the Depository Institutions and TD Parent, the term Affiliate shall not be deemed to include Schwab or any of its subsidiaries, including the Broker-Dealers.

NOW, THEREFORE, in consideration of the mutual covenants, representations, warranties, terms and conditions set forth herein, and intending to be legally bound hereby, the parties agree as follows:

1. Roles.

(a) Schwab will cause (i) its subsidiaries that are broker-dealers as of the Closing, including Xxxxxxx Xxxxxx & Co., Inc. and the TDA Broker-Dealers and (ii) any other entity that becomes a broker-dealer subsidiary of Schwab following the Closing (clauses (i) and (ii), collectively, the “Broker-Dealers ”) to make available to their Customers the sweep program contemplated by this Agreement to the extent necessary for Schwab to satisfy its obligations hereunder and will cause the Broker-Dealers to take all other actions required of them pursuant to this Agreement.

(b) The Broker-Dealers will act as the authorized agent, nominee, custodian and messenger of their respective Customers, and not of the Depository Institutions, in establishing, maintaining, making deposits to and withdrawals from, and effecting other transactions in the Master Accounts established and maintained by the Broker-Dealers at the Depository Institutions. Except as set forth in Section 7, all deposits, withdrawals and other transactions in the Master Accounts shall only be effected by the Broker-Dealers, as agent for the Customers, and not directly by the Customers.

(c) The Broker-Dealers will act as recordkeepers in maintaining the information set forth in Section 8 with respect to the Customer Accounts.

2. Terms and Conditions of the Master and Customer Accounts. Unless otherwise required by law or regulation, the parties agree that the Master Accounts and Customer Accounts shall be governed by the following terms and conditions:

(a) no commitment shall be made to pay an interest rate or to employ a method of calculation of an interest rate on the funds deposited in the Master Accounts other than as permitted by applicable law, regulation or rule;

(b) there shall be no maturity on the Master Accounts;

2

(c) the Depository Institutions reserve the right to require seven (7) days’ prior notice of any withdrawal of funds from the Master Accounts; provided, however, that if a Depository Institution elects to exercise its right to require seven (7) days’ prior notice of any withdrawal of funds from a Master Account, it shall, subject to applicable regulatory limitations, exercise such right as to all accounts established at such Depository Institution under 12 C.F.R. Section 204.2(d);

(d) there is no restriction on the number of additional deposits to the Customer Accounts;

(e) the Master Accounts shall not be transferable;

(f) withdrawals from the Master Accounts shall be permitted only in accordance with Section 6 hereof;

(g) the Master Accounts shall be subject to any and all terms and conditions as may from time to time be imposed on any money market deposit account described in 12 C.F.R. Section 204.2(d)(2) by any applicable law, regulation or rule or by any other determination of any governmental or regulatory authority;

(h) no checks shall be furnished by the Depository Institutions to the Customers for check writing purposes directly against the Master Accounts or Customer Accounts; and

(i) no debit cards shall be furnished by the Depository Institutions to the Customers for debit of funds directly against the Master Accounts or Customer Accounts.

3. Procedures for Establishment of, and Deposits to, the Master Accounts.

(a) The Master Accounts shall be established on behalf and for the benefit of the Customers in the name of the Broker-Dealers in each case “for the Exclusive Benefit of Its Customers” at an office of each of the Depository Institutions (as may be determined by the Depository Institutions in their sole discretion). The Master Accounts will be maintained on the books and records of the Depository Institutions, evidenced by book entry on the account records of the Depository Institutions in the name of the Broker-Dealers as agent for the Customers. As set forth in Section 8, and for the purposes set forth therein, the Broker-Dealers shall maintain account information and deposit records with respect to the Customer Accounts.

(b) The Broker-Dealers, as agents for their respective Customers, may on any Business Day deposit federal or other immediately available funds from the Customer Accounts into the applicable Master Account by wire transfer to the designated office, accompanied by appropriate instructions. If that wire transfer together with such instructions is received by the applicable Depository Institution prior to 6:00 p.m., Eastern Time, on any Business Day, the funds deposited by such wire transfer shall be credited to the applicable Master Account on that Business Day. For purposes of this Agreement, “Business Day” shall mean a day on which the Broker-Dealers and the Depository Institutions are open for business, but shall not include any Federal Reserve Bank holiday or any day on which the Fedwire Funds Service is not open for business.

3

(c) If withdrawals from a Master Account cause the deposit balance therein to be reduced to zero, the Depository Institution shall nevertheless continue to maintain such Master Account until the applicable Broker-Dealer notifies the Depository Institution to close such Master Account.

4. Interest Rate on Deposits.

(a) The interest rate payable by the Depository Institutions on the Master Accounts for credit to the Customer Accounts during any day shall be such rate(s) (calculated on the basis of the actual days elapsed of a year of 365 days) as determined by the Broker-Dealers from time to time in their sole discretion. The interest rate to be paid on funds in the Customer Accounts may vary depending on the value of the Customer’s assets, including funds on deposit in such Customer’s Customer Account. The Depository Institutions shall have no responsibility for setting or for disclosing or monitoring the interest rates accrued or paid in respect of Customer Accounts. The Broker-Dealers shall notify the Depository Institutions of the interest rate(s) by e-mail not later than 11:00 a.m., Eastern Time, on each Business Day, or at such other time or in such other manner as the parties may otherwise mutually agree in writing. If a Broker-Dealer does not provide such notification to a Depository Institution, or if a day is not a Business Day, the applicable Master Account shall bear interest at the interest rate last established for such Master Account pursuant to this Section 4.

(b) Interest shall be calculated daily and credited monthly to the principal for the Master Accounts on the last Business Day of the calendar month, or on such other date as may be agreed to by the parties in writing. Interest will begin to accrue on funds deposited to the Master Accounts on the day on which such funds are credited to the Master Accounts in accordance with the provisions of Section 3(b) hereof, and will accrue to, but not including, the day on which funds are withdrawn from the Master Accounts.

5. Fees; Deposit Balances .

(a) From and after the Closing until the earliest of (i) the first date any TDA Broker-Dealer is merged into another Broker-Dealer that is not a TDA Broker-Dealer, (ii) June 30, 2021 and (iii) the date the Broker-Dealers (other than the TDA Broker-Dealers) are operationally able to sweep funds to the Depository Institutions (such earliest date, the “Initial Period End Date”), the TDA Broker-Dealers shall be obligated to make available to their Customers (including any Customer Accounts opened following the Closing) the sweep program contemplated by this Agreement as the exclusive sweep option for such Customers and neither the TDA Broker-Dealers nor Schwab will withdraw deposits from the Master Accounts except to the extent of withdrawals by Customers from their Customer Accounts. Schwab will use its reasonable best efforts to enact such operational changes as necessary to enable the Broker-Dealers to sweep funds to the Depository Institutions as promptly as practicable after Closing. In addition, Schwab will not, directly or indirectly, encourage or solicit Customers of the TDA Broker-Dealers to withdraw their funds from their Customer Accounts or otherwise have their funds not swept to the Depository Institutions. Notwithstanding the foregoing, the TDA Broker-Dealers shall not sweep to the Depository Institutions any Customer funds if such Customer requests in writing that such funds not be swept to the Depository Institutions.

4

(b) If the Initial Period End Date is prior to June 30, 2021, from and after the Initial Period End Date through June 30, 2021, Schwab will cause the Master Accounts for all Broker-Dealers to have an amount of aggregate deposits equal to the amount of aggregate deposits in the Master Accounts as of the Initial Period End Date (such amount, the “Initial Period Balance”).

(c) From and after July 1, 2021, in any 12 month period, the Broker-Dealers may reduce the aggregate deposits in the Master Accounts by up to the Reduction Limit (as defined below) by written notice provided to the Depository Institutions not less than ninety days prior to the commencement of the 12 month period during which such reduction will occur; provided that, except during the Run-Off Period following the expiration or termination of this Agreement, in no event shall the amount of aggregate deposits in the Master Accounts ever be less than $50 billion; provided further that, except as set forth in Section 14(i), the Broker-Dealers shall have no right to terminate any Fixed Rate Obligation Amounts prior to the applicable maturity date, and accordingly such reduction in aggregate deposits may only be accomplished by withdrawing deposits that represent a Fixed Rate Obligation Amount following the maturity date for such Fixed Rate Obligation Amount or by withdrawing deposits that are not Fixed Rate Obligation Amounts. From and after July 1, 2021, the amount of aggregate deposits in the Master Accounts shall not be allowed by Schwab to increase above the amount that is in such Master Accounts as of the Initial Period End Date, as reduced from time to time pursuant to this Section 5(c). For the avoidance of doubt, if there is any reduction of such amount pursuant to this clause (c), then the amount of aggregate deposits may only decrease further in accordance with this Section 5(c) but in no event will ever increase.

(d) The “Reduction Limit” means, in any 12 month period, $10 billion, subject to the adjustments provided below:

(i) if the Initial Period Balance is less than the amount of aggregate deposits under the 2013 XXX as of immediately prior to the Closing (the “Closing Balance”), the Reduction Limit will be reduced by the difference between the Closing Balance and the Initial Period Balance, beginning with the Reduction Limit in the first 12 month period from and after July 1, 2021, with the remainder of any such reduction carrying over into any subsequent 12 month periods from and after July 1, 2022 (for example, if such difference is $20 billion, the Reduction Limit will be reduced to $0 until July 1, 2023);

(ii) if the Initial Period Balance is greater than the Closing Balance, the Reduction Limit for the 12 month period from and after July 1, 2021 (and subject to carryover only to the extent permitted by clause (iii) below) will be increased by the difference between the Initial Period Balance and the Closing Balance; and

(iii) if, in any 12 month period, the amount of the Fixed Rate Obligation Amounts maturing in such 12 month period (the “Available Maturity Amount”) is less than $10 billion (as adjusted in the same manner as the Reduction Limit is adjusted in Section 5(d)(i) and Section 5(d)(ii)) for such 12 month period, then the Reduction Limit in the subsequent 12 month period will be increased by the difference between $10 billion (as adjusted in the same manner as the Reduction Limit is adjusted in Section 5(d)(i) and Section 5(d)(ii)) for such initial 12 month period and the greater of (x) the Available Maturity Amount and (y) the

5

actual amount of the Reduction Limit utilized by Schwab in such 12 month period (for example, assuming no adjustments from 5(d)(i) and 5(d)(ii), (i) if the Available Maturity Amount for the applicable 12 month period is $6 billion, and $7 billion of the Reduction Limit is utilized for such 12 month period (as a result of Schwab using $1 billion from funds not deployed into Fixed Rate Obligation Amounts), $3 billion would be carried forward and added to the Reduction Limit for the next 12 month period, and (ii) if the Available Maturity Amount for the applicable 12 month period is $6 billion, and $6 billion or less of the Reduction Limit is utilized, $4 billion would be carried forward and added to the Reduction Limit for the next 12 month rolling period). Notwithstanding anything herein to the contrary, during the Exempt Period, the Reduction Limit will be fixed at $10 billion and, for the avoidance of doubt, in no event during the Exempt Period shall the amount of aggregate deposits in the Master Accounts ever be less than $50 billion.

(e) In consideration of the services to be provided by Schwab and the Broker-Dealers hereunder, the Depository Institutions agree to pay to (or as directed by) Schwab an aggregate fee (the “Sweep Arrangement Fee”), on a monthly basis in arrears, not later than 15 calendar days after the end of each calendar month, in an amount equal to:

(i) the amount computed in accordance with Exhibit A with respect to the aggregate balances in the Master Accounts during such preceding calendar month; less

(ii) the actual interest paid by the Depository Institutions during such preceding calendar month on the Master Accounts pursuant to Section 4(a); less

(iii) an annual servicing fee (“Service Fee”) of 15 basis points on the aggregate average daily balance in the Master Accounts; less

(iv) an amount equal to the product of (x) [***] multiplied by (y) the sum of (I) the total amount of FDIC deposit insurance premium assessments payable (including, if applicable, any special FDIC deposit insurance premium assessments paid; provided, however, that if and to the extent such special assessment represents a prepayment of assessments for future periods, the Depository Institutions and Schwab shall enter into good faith negotiations regarding a payment schedule for the Broker-Dealers to pay their requisite share of such assessment) by the Depository Institutions each year in respect of or resulting from the deposits in the Master Accounts plus (II) [***]% of the incremental cost incurred by the Depository Institutions due to any [***] to the total base assessment rate applicable to the Depository Institutions in respect of all other liabilities held at the Depository Institutions, pursuant to the methodology set forth in Exhibit B.

(f) For purposes of this Section 5, the amounts determined pursuant to the foregoing clauses (e)(iii) and (iv) shall be based on the actual number of days elapsed in such prior calendar month divided by 365.

6

[***]. With respect to the amounts determined pursuant to clause (e)(iv) above, if at the time of any such payments the actual FDIC assessment for a relevant period has not been determined, such payments shall be based on good faith estimates provided by the Depository Institutions, subject to retroactive adjustment based on final FDIC determination and FDIC assessment payments paid by the Depository Institutions for the relevant period. In connection with the foregoing, the Depository Institutions shall provide the Broker-Dealers, within a reasonable period of time following the end of each calendar quarter, with statements showing the calculation of FDIC assessments used by the Depository Institutions to determine the amounts under clause (e)(iv) above during the immediately preceding calendar quarter. The parties agree that promptly following the end of each calendar quarter, they will jointly review the amounts paid to the FDIC and determine the amounts under clause (e)(iv) for the preceding periods for which final assessment information is available and, if necessary, adjust between the parties any identified over or under payments.

(g) The mechanics of the payment of the Sweep Arrangement Fee may vary from time to time as agreed to in writing by the parties. The parties hereto agree that no portion of the Sweep Arrangement Fee shall compensate the Broker-Dealers, or reimburse the Broker-Dealers for expenses incurred, in connection with acting as messenger for their respective Customers. The Sweep Arrangement Fee shall be allocated between the Depository Institutions as may be determined by the Depository Institutions in their sole discretion. In the event that the computation of the Sweep Arrangement Fee in any given month results in a negative amount, the Broker-Dealers collectively will pay to the Depository Institutions such amount. For avoidance of any doubt, the Sweep Arrangement Fee reflects the elements of the various services and interests paid and does not constitute a derivative contract.

(h) In any calendar week, the Broker-Dealers shall be permitted to designate in the aggregate up to $1 billion of the amounts on deposit in the Master Accounts as “Fixed Rate Obligation Amounts”, on the following terms and conditions:

(i) If a Broker-Dealer elects to designate an amount as a “Fixed Rate Obligation Amount”, an Authorized Person (as defined below) of such Broker-Dealer shall inform an Authorized Person of the Depository Institutions prior to 11 a.m., Eastern time, on a Business Day to provide the Depository Institutions notice of the amount and maturity date of such new Fixed Rate Obligation Amount. When the Authorized Person of the Depository Institutions is determining the Yield in accordance with Exhibit A, an Authorized Person of such Broker-Dealer shall be entitled to participate electronically with such Authorized Person of the Depository Institution in connection with such determination (including by allowing the Authorized Person of such Broker-Dealer to view or share the computer screen of the Authorized Person of the Depository Institution).

(ii) By 4 p.m., Eastern time on such Business Day, the Depository Institutions shall provide such Broker-Dealer with an electronic written confirmation setting forth the amount, maturity date and Yield (determined in accordance with Note 1 to Exhibit A) of such Fixed Rate Obligation Amount.

(iii) No Fixed Rate Obligation Amount may have a maturity date of [***] from the investment date (and the Broker-

7

Dealers shall have no right to withdraw or reinvest such Fixed Rate Obligation Amount prior to such maturity date); provided that Exempt Fixed Rate Obligation Amounts may have a maturity of [***].

(iv) No more than [***]% of the aggregate Fixed Rate Obligation Amounts in the Master Accounts at any time shall mature in any 12 month period, except to the extent resulting from the establishment of Exempt Fixed Rate Obligation Amounts.

(v) The Broker-Dealers shall take all necessary steps to ensure that at all times at least 80% of the aggregate amount of the deposits in the Master Accounts are designated as Fixed Rate Obligation Amounts, except, at the Broker-Dealers’ option, during the Exempt Period.

(vi) For clarity, any reference to a “Fixed Rate Obligation Amount” means the actual dollar amount of such Fixed Rate Obligation Amount and the amount deposited as such Fixed Rate Obligation Amount.

(i) For purposes of this Section 5, an “Authorized Person” of each of the Broker-Dealers and the Depository Institutions consists of those persons that may be specified in writing by each such party to the other from time to time. “Fixed Rate Obligation Amounts” are deposits that have the terms and conditions specified by Section 5(h) and Exhibit A.

(j) From and after the Initial Period End Date, the Broker-Dealers will not sweep (and may not be required by any Depository Institution to sweep) to the Depository Institutions any Customer funds to the extent such funds would exceed the Depository Institutions’ aggregate FDIC deposit insurance limits with respect to any given Customer. From and after the Closing until the Initial Period End Date, the amount of uninsured Customer funds swept by the Broker-Dealers to the Depository Institutions will remain consistent with the amount of uninsured Customer funds swept to the Depository Institutions under the 2013 XXX as of the Closing, except to the extent caused by withdrawals of such Customer funds by Customers from their Customer Accounts. Except as provided by the immediately preceding sentence, the Depository Institutions will allocate Customer funds among themselves to ensure that, with respect to any Customer, each Depository Institution has an amount of funds from such Customer that is less than or equal to the applicable FDIC insurance limit with respect to such Customer.

(k) In the event any change in applicable laws, rules or regulations or any guidance, substantive recommendations, requirements, directives, options and interpretations, policies and guidelines by applicable regulatory authorities results in an increase to the cost to the Depository Institutions or the Broker Dealers of implementing, managing and/or overseeing the sweep program contemplated by this Agreement (including the cost of complying with provisions of this Agreement), then, to the extent such increase in such costs is greater than (x) 1 basis point of the aggregate deposits in the Master Accounts (the “Cost Sharing Threshold”) as of the most recently completed calendar month, but less than (y)10 basis points of the aggregate deposits in the Master Accounts as of the most recently completed calendar month (the “Cost Sharing Cap”), then the Depository Institutions, on the one hand, and the Broker Dealers, on the other hand, will equally share such increase in costs above the Cost Sharing Threshold, with the

8

party not otherwise responsible for such costs reimbursing the party bearing such costs for 50% of the increase in such costs above the Cost Sharing Threshold. If the increase in costs is greater than the Cost Sharing Cap, the party that is not otherwise responsible for such costs has 30 days to elect to pay for 100% of the costs above the Cost Sharing Cap. If such party does not elect to pay for all of such costs, then the other party (i.e., the party that is bearing such costs) can terminate the Agreement any time, with the Run-Off Period to begin immediately upon such termination, and with the parties to continue to share the increase in costs above the Cost Sharing Threshold and below the Cost Sharing Cap until the end of the Run-Off Period. If such other party does not elect to terminate the Agreement, the parties will continue to share equally in the increase in costs above the Cost Sharing Threshold and below the Cost Sharing Cap. The parties agree to discuss in good faith any ways to minimize or mitigate such increase (or potential increase) in costs. Such discussions may occur before the change (or proposed change) that is expected to result in such increase cost is implemented or effective. For the avoidance of doubt, no party shall be required to disclose to the other party confidential supervisory information which by law may not be disclosed.

(l) Notwithstanding anything to the contrary contained in this Section 5, each “Permitted Notional Investment” (as defined in the 2013 XXX) outstanding as of the Closing shall remain in effect in accordance with its terms, including with respect to the yield, maturity date and principal amount, and such “Permitted Notional Investments” shall otherwise be deemed to be Fixed Rate Obligation Amounts hereunder.

6. Withdrawals from and Closure of a Master Account. Subject to Section 5, withdrawals from a Master Account may be made prior to 2:00 p.m., Eastern Time, on any Business Day only by the applicable Broker-Dealer, as agent for its Customers. All withdrawals shall be made no more than once a day on any Business Day pursuant to instructions delivered by such Broker-Dealer, or its respective messenger and are in all cases subject to the requirements of Section 5. Such Broker-Dealer or messenger, as applicable, shall receive evidence of the Depository Institution’s receipt of the withdrawal and transfer instructions for same day funds representing the total of such withdrawals to be made to such Broker-Dealer as agent for its Customers. If directed by such Broker-Dealer or its respective messenger, as applicable, the Depository Institution will transfer funds to accounts at another depository institution. Each Broker-Dealer agrees that upon its receipt of such payment for withdrawals, the Depository Institution shall have no further obligation and shall be discharged as to the Broker-Dealer, and any Customers on whose behalf such payment was made, and that the Depository Institution shall have no further obligation with respect to the funds represented by such withdrawal other than the obligation to pay any accrued and unpaid interest relating to those funds. Any Master Account may only be closed by the Broker-Dealers, as agent for the Customers, in each case subject to the requirements of Section 5.

7. Registration at the Depository Institutions.

(a) Pursuant to instructions received from a Customer, if a Broker-Dealer so advises a Depository Institution, such Depository Institution shall record a money market deposit account on behalf of such Customer on the books and records of the Depository Institution in the name of such Customer if such Customer terminates its agency relationship with respect to the applicable Master Account at the Depository Institution. Upon request, such Broker-Dealer will provide the Depository Institution with confirmation of such Customer’s instructions. To facilitate such recordation in the name of

9

such Customer, and upon direction by such Customer, the Broker-Dealer shall reasonably cooperate with the Depository Institution in establishing the identity of such Customer, including, without limitation, the name, address and taxpayer identification number of such Customer and such other information as the Depository Institution may request in order to comply with applicable law. Upon recordation of a money market deposit account in the name of a Customer, the provisions of this Agreement shall no longer govern the terms of such account and such Broker-Dealer shall have no further obligation with respect to servicing such Customer’s Customer Account.

8. Books and Records Concerning the Customer and Master Accounts.

(a) As agent and custodian for the Customers, each Broker-Dealer will maintain, in good faith and in the regular course of business, and in accordance with applicable published requirements of the FDIC (including, without limitation, FDIC requirements for pass-through deposit insurance coverage), books and records setting forth the daily balance and accrued interest in the Customer Accounts and identifying with respect to such Customer Accounts the names, addresses and social security or tax identification numbers of the Customers and any representative capacity in which the Customers may be acting. It is understood that the names, addresses and social security or tax identification numbers of the Customers, and any representative capacity in which they may be acting, will be maintained on each Broker-Dealers’ books and records in its capacity as agent and custodian for the Customers and will not be disclosed to the Depository Institutions except as otherwise required by law or this Agreement.

(b) In connection with the Depository Institutions’ compliance with 12 C.F.R. Part 204 (“Regulation D”), each Broker-Dealer, as recordkeeper for the Depository Institutions, shall allow independent auditors, examiners and other authorized representatives of the federal bank regulatory agencies that have appropriate jurisdiction over the Depository Institutions reasonable access from time to time upon request to the books and records of such Broker-Dealer, and each Broker-Dealer shall cooperate with such independent auditors and agencies to the extent necessary to enable the Depository Institutions to comply with their obligations under Regulation D and other regulatory guidelines with regard to such requests for access.

(c) Each Broker-Dealer shall at all times maintain, or cause to be maintained, an emergency system to ensure that the books and records concerning the Customer Accounts and Master Accounts will be retrievable within a reasonable period of time in the event of a computer failure or malfunction.

(d) Each Broker-Dealer may delegate to a third party service provider its respective duties under this Section 8; provided, that (i) the third party service provider will at all times maintain, or cause to be maintained, an emergency system to ensure that the books and records concerning the Customer Accounts and Master Accounts will be retrievable within a reasonable period of time in the event of a computer failure or malfunction and (ii) each such Broker-Dealer will remain liable to the Depository Institutions for such delegated services to the same extent as if such Broker-Dealer had performed it itself.

(e) Upon request of a Depository Institution, the Broker-Dealers will prepare and deliver to the Depository Institution, as promptly as is commercially reasonable, the

10

following information with respect to any date(s) designated by the Depository Institution in electronic form:

(i) a list of all beneficial owners of the applicable Master Account(s) at the Depository Institution, designated by account number, in which deposits are being made on that day, setting forth the amount of the deposit to each Customer Account;

(ii) a list of all beneficial owners of the applicable Master Account(s) at the Depository Institution, designated by account number, from which withdrawals are being made on that day, setting forth the amount of the withdrawals from each Customer Account;

(iii) a statement of the aggregate balance in each applicable Customer Account after the deposits and withdrawals set forth in the lists described in (i) and (ii) above, respectively, have been effected;

(iv) a list of all beneficial owners of the applicable Master Account(s) at the Depository Institution, designated by account number, indicating whether each beneficial owner is an individual; an organization that is operated primarily for religious, philanthropic, charitable, educational, political or other similar purpose and that is not operated for profit; the United States; a state, county, municipality or political subdivision thereof; or the District of Columbia, the Commonwealth of Puerto Rico, American Samoa, Guam, any territory or possession of the United States or any political subdivision thereof; and

(v) such other information as the Depository Institution may reasonably request to facilitate or demonstrate its compliance with Regulation D (or any successor regulation).

(f) Not later than 15 days following the end of each calendar quarter, the Broker-Dealers shall furnish to the Depository Institutions such information, and in such format, as the Depository Institutions may from time to time specify in connection with the preparation of their quarterly Consolidated Reports of Condition and Income (Call Reports) or comparable report to be filed with the OCC, the FDIC or any other member of the Federal Financial Institutions Examination Council.

(g) Each Broker-Dealer shall at all times comply, and ensure that any third party service provider to which it delegates any of its respective duties under this Section 8 will at all times comply, with the applicable requirements of OCC Bulletin 2005-13 (12 C.F.R. Part 30, Appendix B) and OCC Bulletin 2013-29, and each Broker-Dealer will allow the Depository Institutions access to their books and records and personnel in order to permit the Depository Institutions to maintain and assess compliance with the foregoing requirements by such Broker-Dealer and any such third party service providers.

(h) The Broker-Dealers will provide the Depository Institutions with such reports as the Depository Institutions may reasonably request from time to time in connection with their asset/liability management and forecasting programs.

(i) Schwab and the Broker-Dealers will provide on a timely basis to the Depository Institutions all necessary information and assistance to comply with applicable laws,

11

rules or regulations or interpretations thereof by applicable regulatory authorities relating to this Agreement, including but not limited to 12 CFR Part 370, FR 2052a and Regulation D, as each may be amended from time to time.

(j) Schwab and the Broker-Dealers will cooperate with the Depository Institutions in conducting such testing of internal controls and systems relating to this Agreement as the Depository Institutions may reasonably request.

9. Representations and Warranties relating to Broker-Dealers. Schwab on behalf of itself and each Broker-Dealer, represents and warrants to the Depository Institutions as follows:

(a) Schwab and each of the Broker-Dealers is duly formed, validly existing and in good standing under the laws of its jurisdiction of organization.

(b) This Agreement constitutes a legal, valid and binding obligation of Schwab and each of the Broker-Dealers, enforceable against each of them in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, liquidation or other similar laws affecting generally the enforcement of creditors’ rights.

(c) Schwab and each Broker-Dealer has full power and authority to do and perform all acts contemplated by this Agreement.

(d) Neither the execution and delivery of this Agreement, the consummation of the transactions herein contemplated, the fulfillment of, or compliance with, the terms and provisions hereof, nor the performance of its obligations hereunder will conflict with, or result in a breach of any of the terms, conditions or provisions of (i) any material federal law, regulation, order, regulatory agreement, or rule applicable to Schwab or any Broker-Dealer, (ii) any material applicable law, rule or regulation of the state in which Schwab or any Broker-Dealer has its principal place of business or of any regulatory agency or self-regulatory organization, (iii) the articles of incorporation or bylaws of Schwab or any Broker-Dealer or (iv) any material agreement to which Schwab or any Broker-Dealer is a party or by which it may be bound.

(e) Each Broker-Dealer is the authorized representative, agent (or sub-agent) and nominee (or sub-nominee) for its Customer in establishing, maintaining, making deposits to and withdrawals from and effecting other transactions in the Master Accounts and is authorized to give the Depository Institutions instructions on behalf of the Customers with respect to the Master Accounts; and the Depository Institutions may conclusively rely without further inquiry on such instructions given by such Broker-Dealer on behalf of its Customers or otherwise in connection with this Agreement.

(f) Each Broker-Dealer either has full power and authority to receive on behalf of, and as agent for, each of the Customers any information, including disclosure information, that the Depository Institutions may provide in connection with a Money Market Deposit Account, including any disclosure information required by law or, if a Broker-Dealer lacks such power and authority, such Broker-Dealer shall deliver such information directly to the Customers within any applicable time periods required by law.

12

(g) There is no action, suit, proceeding, inquiry or investigation by or before any court, governmental agency, public board or body pending or, to the knowledge of Schwab or the Broker-Dealers, threatened against or contemplated by any governmental agency which could reasonably be expected to materially impair the ability of Schwab or the Broker-Dealers to perform their obligations under this Agreement.

(h) The Anti-Money Laundering Programs (as defined below) have been approved by properly authorized officers of Schwab, are overseen, implemented, monitored and enforced by a duly appointed compliance officer and include internal controls and procedures reasonably designed to prevent and detect suspected money laundering and terrorism financing activities. The Anti-Money Laundering Programs provide for ongoing employee training with respect to U.S. Money Laundering and Investor Identification Requirements and the requirements of such programs.

10. Representations and Warranties of the Depository Institutions. Each Depository Institution, severally and not jointly, represents and warrants to Schwab as follows:

(a) Such Depository Institution is a national banking association organized and existing under the laws of the United States and regulated by the OCC.

(b) This Agreement constitutes a legal, valid and binding obligation of such Depository Institution, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, liquidation or other similar laws affecting the enforcement of creditors’ rights generally or of creditors of depository institutions the accounts of which are insured by the FDIC.

(c) Neither the execution and delivery of this Agreement, the consummation of the transactions herein contemplated, the fulfillment of, or compliance with, the terms and provisions hereof, nor the performance of its obligations with respect to the Master Accounts will conflict with, or result in a breach of any of the terms, conditions or provisions of (i) any material federal banking or other law, regulation, order, regulatory agreement, or rule applicable to such Depository Institution or governing the acceptance of deposits, (ii) any material applicable law, rule or regulation of the state in which such Depository Institution has its principal place of business or of any regulatory agency or self-regulatory organization, (iii) the articles of association or bylaws of such Depository Institution or (iv) any material agreement to which such Depository Institution is a party or by which it may be bound.

(d) Such Depository Institution has obtained and/or made any consent, approval, waiver or other authorization of or by, or filing or registration with, any court, administrative or regulatory agency or other governmental authority of the federal government or the state in which such Depository Institution has its principal place of business that is required to be obtained by the Depository Institution in connection with the execution, delivery or performance by the Depository Institution of this Agreement or the consummation by the Depository Institution of the transactions contemplated by this Agreement including, without limitation, the offering of Money Market Deposit Accounts to the Customers.

13

(e) The deposits made at such Depository Institution are insured by the FDIC to the fullest extent permitted by law and the Customer Accounts will be eligible for FDIC insurance for each Customer identified on the records maintained pursuant to Section 8 for each recognized legal capacity for which the Customer is eligible, subject to (i) FDIC aggregation rules for other accounts held by a Customer with such Depository Institution and (ii) such Depository Institution recording the Master Accounts as set forth in Section 3.

(f) As of the date hereof, such Depository Institution is “well capitalized,” as defined in 12 C.F.R. Section 337.6, and may accept, renew or roll over “brokered deposits,” as defined in 12 C.F.R. Section 337.6, without obtaining a waiver from the FDIC. Such Depository Institution will notify the Broker-Dealers promptly (and in any event within two (2) Business Days of learning of the relevant occurrence) upon the occurrence of any event that causes, or could reasonably be expected to cause, any changes in such Depository Institution’s capital category.

(g) There is no action, suit, proceeding, inquiry or investigation by or before any court, governmental agency, public board or body pending or, to the knowledge of such Depository Institution, threatened by any governmental agency which could reasonably be expected to materially impair the ability of such Depository Institution to perform its obligations under this Agreement.

(h) The information provided by such Depository Institution expressly for inclusion in the Broker-Dealers’ disclosures to Customers (collectively, the “Customer Disclosures”) is true and accurate in all material respects.

(i) As of the date hereof, such Depository Institution is not the subject of or party to a memorandum of understanding or any supervisory agreements, mandated board resolutions, cease-and-desist orders, consent agreements, or regulatory restrictions that would, directly or indirectly, materially impair its ability to perform its obligations under this Agreement.

(j) Deposits of Customers in the Master Accounts at such Depository Institution are entitled to the priority provided to “deposit liabilities” by Section 11(d)(11) of the Federal Deposit Insurance Act, as amended, and applicable regulations thereunder.

(k) No applicable law or regulation of the state of such Depository Institution’s principal place of business or any political subdivision thereof imposes any state or local income or franchise tax with respect to any Customer’s interest in a Master Account established by a nonresident of such state.

11. General Covenants.

(a) Each Broker-Dealer, as recordkeeper for the Depository Institutions, will maintain the applicable Master Accounts in accordance with the definition of “savings deposit” in 12 C.F.R. Section 204.2(d)(2), and interpretations of the Federal Reserve thereunder, including the transfer and withdrawal restrictions contained therein.

14

(b) Each Broker-Dealer will prepare and file, on a timely basis and in the manner prescribed by the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), and applicable regulations thereunder, all information returns that may be required by such Broker-Dealer in whatever capacity with respect to its respective Master Accounts (with the customary copies thereof for state and local taxing authorities) and will furnish a copy of all information returns and notifications prescribed by the Internal Revenue Code and applicable regulations thereunder with respect to any Customer holding a Money Market Deposit Account at the Depository Institution(s) to the Customer; provided, however, that in the event such Broker-Dealer does not have available to it the information required to complete such information return and such information is available to the Depository Institution(s), such Broker-Dealer shall request such information from the Depository Institution(s) and upon receipt of such information in a timely manner, such Broker-Dealer shall prepare and file such return in an timely manner. Each Broker-Dealer will cause to be obtained and retained in its files any necessary exemption certificates from its respective Customers with respect to the filing of any information return and the withholding of taxes.

(c) Each Broker-Dealer will withhold in a timely and proper manner any and all taxes required to be withheld under applicable law in connection with the payment or crediting of any interest on any beneficial interest in the applicable Master Accounts and will pay in a timely and proper manner such amount to the appropriate governmental agency or its designated agent.

(d) Each Broker-Dealer shall, with respect to their Customer Accounts, comply with applicable U.S. Money Laundering and Investor Identification Requirements and implement, verify and maintain appropriate procedures to verify suspicious transactions and the source of funds for the Customer Accounts.

(e) Each Broker-Dealer has implemented and will maintain appropriate programs (“Anti-Money Laundering Programs”) reasonably designed to ensure compliance with all regulations, orders and policies concerning matters such as the identity of the Customers and the sources of funds that are handled pursuant to this Agreement, including the Bank Secrecy Act and the USA PATRIOT Act, and all regulations issued thereunder, Executive Order No. 13224 and the regulations administered by the Office of Foreign Assets Control of the U.S. Department of the Treasury (together, “U.S. Money Laundering and Investor Identification Requirements”).

(f) Each Broker-Dealer will provide prompt notice to the Depository Institutions of any material changes to the Anti-Money Laundering Programs and will also provide, within 30 days after the end of each fiscal year for Schwab, an annual Wolfsburg certification that confirms, among other things, that for the relevant period the Broker-Dealers have maintained an Anti-Money Laundering Program that is reasonably designed to comply with applicable U.S. Money Laundering and Investor Identification Requirements and such other information as the Depository Institutions may reasonably require from time to time to verify such Broker-Dealer’s compliance with applicable U.S. Money Laundering and Investor Identification Requirements.

(g) Each Depository Institution shall provide all services specified herein to be provided by the Depository Institution in accordance with industry practices; provided,

15

however, that in the event any applicable regulation, statute or rule changes or any new applicable regulation, statute or rule is enacted, the parties shall negotiate in good faith to determine appropriate service levels.

(h) Each Depository Institution agrees to provide written notice to Schwab as promptly as reasonably practicable if TD no longer owns or controls, directly or indirectly, a majority of the issued and outstanding voting securities of either or both Depository Institutions.

(i) Each Depository Institution will provide notification as promptly as reasonably possible (and in any event within 2 days of learning of the relevant action or information) to Schwab of any action by the FDIC or by such Depository Institution to terminate such Depository Institution’s FDIC insured status.

(j) The Master Accounts will not at any time be subject to any right, charge, security interest, lien or claim of any kind against the Broker-Dealers in favor of the Depository Institutions or any person claiming through the Depository Institutions, and the Depository Institutions will not exercise any right of set-off or recoupment against the Master Accounts.

12. Master Account Description, Statements and Disclosures.

(a) Schwab and the Broker-Dealers shall provide each Customer with Customer Disclosures setting forth a description of the terms and conditions of the Customer Accounts, including applicable interest rates, and Master Accounts prior to the Customer’s funds being swept to a Master Account. The Broker-Dealers agree to provide any amendments to the Customer Disclosures to the Depository Institutions for their review and approval prior to providing the amended Customer Disclosures to Customers.

(b) The Broker-Dealers agree to periodically provide each Customer with a statement on a monthly, quarterly or other basis permitted by law, which shall reflect each deposit to or withdrawal from the Customer Account during the previous period, the closing balance of such Customer Account at the end of the previous period, and the amount of interest earned on funds in such Customer’s Customer Account during the previous period. The parties acknowledge that the Depository Institutions will have no responsibility for providing such periodic statements or for the completeness or accuracy thereof.

(c) Upon establishment of a Customer Account by a Customer, the Broker-Dealers shall provide the Customer with information regarding the date of the initial deposit to the applicable Master Account, the name of the Depository Institution, and the fact that the Broker-Dealers will receive from the Depository Institution the fee described in Section 5 hereof. The information may be furnished by the Broker-Dealers in the form of a trade confirmation or a customer transaction statement.

13. Indemnification.

(a) Each Depository Institution agrees, severally and not jointly, to indemnify and hold harmless Schwab and the Broker-Dealers and their Affiliates, and their respective officers, directors, employees, agents and contractors, from and against any liability, claim, cost or expense (including court costs and attorneys’ fees) arising out of such Depository Institution’s

16

material breach of any of its representations, warranties, covenants or other agreements set forth in this Agreement.

(b) Schwab agrees to indemnify and hold harmless the Depository Institutions and their Affiliates, and their respective officers, directors, employees, agents and contractors, from and against any liability, claim, cost or expense (including court costs and attorneys’ fees) arising out of a material breach of any of representations, warranties, covenants or other agreements of Schwab or a Broker-Dealer set forth in this Agreement.

(c) For purposes of this Section 13, the party obligated to provide the indemnity described in Sections 13(a) and 13(b) will be referred to as the “Indemnitor” and the party receiving the benefit of such indemnity will be referred to as the “Indemnitee.” The Indemnitee shall give the Indemnitor prompt notice of any claim for indemnification; provided, that the Indemnitee’s failure to give such prompt notice shall not relieve the Indemnitor of its indemnification obligation except to the extent that the Indemnitor was materially prejudiced by such failure. The Indemnitor shall have no obligation pursuant to Section 13(a) or 13(b), as applicable, unless the Indemnitee permits the Indemnitor to assume and control the defense of the related claim, suit, action or proceeding, with counsel chosen by the Indemnitor (who must be reasonably acceptable to the Indemnitee). The Indemnitor shall not enter into any settlement or compromise of any such claim, suit, action or proceeding without the Indemnitee’s prior written approval, which approval shall not be unreasonably withheld.

(d) Notwithstanding the foregoing, the Indemnitee may, at its own option and expense, employ counsel to monitor any claim for which it is entitled to indemnification under this Section 13, and counsel for the Indemnitor shall provide cooperation and assistance to such counsel for the purpose of apprising the Indemnitee of the status of such proceeding, including the status of settlement negotiations, if any. Nothing in this Agreement shall be deemed to limit or eliminate the right of a party at any time to waive indemnification to which it is otherwise entitled pursuant to this Section 13 by independently defending or settling any claim on its own behalf; provided, that the party exercising this right will provide the other party with prompt written notice of its intent to do so, and such party agrees that it will not be entitled to seek any other remedy against the other with respect to the subject matter of the claim for which it has waived indemnification.

(e) Notwithstanding any other provision herein, neither party will be liable to the other for:

(i) special, indirect, consequential, punitive, exemplary or incidental damages of the other party of any kind, including but not limited to lost profits, lost savings, and loss of use of facility or equipment, regardless of whether arising from breach of contract, warranty, tort, strict liability or otherwise, even if advised of the possibility of such losses or damages or if such losses or damages could have been reasonably foreseen, except in any such case for amounts awarded by a final judicial determination or settlement to third parties; or

(ii) any delay or failure to perform its obligations under this Agreement to the extent that such delays or failures result from causes or circumstances beyond its reasonable control, including, but not limited to, failure of electronic or mechanical

17

equipment, strikes, failure of common carrier or utility systems, severe weather, market disruptions, or other causes commonly known as “acts of God”; in any such event, in order to be so excused from such delay or failure to perform, the party so affected must give notice of the cause of such delay or failure to the other party as promptly as practicable and use reasonable efforts to remedy the cause of such delay or failure if practicable and take all reasonable actions as may be appropriate to continue performance under this Agreement.

14. Term; Termination; Related Procedures.

(a) The initial term of this Agreement shall expire on July 1, 2031 (the “Initial Expiration Date”) and will automatically renew for a term that is five (5) years from such Initial Expiration Date (for purpose of clarity, such initial renewal term would expire on July 1, 2036) and from each subsequent fifth anniversary of the prior expiration date unless, in the case of any such renewal term, Schwab, on the one hand, or the Depository Institutions, on the other hand, have given the other written notice of non-renewal at least two (2) years prior to (x) the Initial Expiration Date (for purposes of clarity, such date of notice being July 1, 2029), or (y) prior to the expiration date of any subsequent renewal term of this Agreement. If none of the parties gives written notice of non-renewal at least two (2) years prior to the end of a five-year renewal term, this Agreement shall automatically renew for a successive five-year term at the end of such renewal term.

(b) The Depository Institutions shall have the right to terminate this Agreement by written notice to Schwab (i) in order to comply with any order or directive received by the Depository Institutions or TD Parent from any applicable regulatory agency, including, without limitation, OSFI, the Federal Reserve, the OCC and the FDIC, to terminate this Agreement or (ii) pursuant to Section 5(k) above.

(c) Schwab shall have the right to terminate this Agreement by written notice to the Depository Institutions (i) in order to comply with any order or directive received by Schwab or the Broker-Dealers from any applicable regulatory agency, including, without limitation, the Securities and Exchange Commission, the Financial Industry Regulatory Authority or the Federal Reserve, to terminate this Agreement or (ii) pursuant to Section 5(k) above.

(d) Schwab and the Depository Institutions shall each have the right to terminate this Agreement by written notice to the other if TD Parent no longer owns, directly or indirectly, a majority of the issued and outstanding shares of common stock of either or both of the Depository Institutions; provided, that Schwab shall not have a right of termination pursuant to this Section 14(d) as long as TD Parent, directly or indirectly, is able to provide the Broker-Dealers through an Affiliate of TD Parent, without material interruption to their Customers, with sweep deposit accounts on terms, including product terms, economics (including, but not limited to, pricing) and FDIC deposit insurance coverage, at least as favorable in all material respects as offered to the Broker-Dealers hereunder immediately prior to the date on which the termination event provided for in this Section 14(d) first occurred.

(e) Schwab and the Depository Institutions shall each have the right to terminate this Agreement by written notice to the other if both Depository Institutions are

18

deemed (x) “adequately capitalized,” as defined in 12 C.F.R. Section 337.6, and has failed to obtain the waiver referenced in 12 C.F.R. Section 337.6(c) within 180 days of such Depository Institutions being deemed adequately capitalized, or (y) “undercapitalized,” as defined in 12 C.F.R. Section 337.6 or any lower category set forth therein; provided, that Schwab shall not have a right of termination pursuant to this Section 14(e) as long as TD Parent, directly or indirectly, is able to provide the Broker-Dealers, through an Affiliate of TD Parent without material interruption to their Customers, with sweep deposit accounts on terms, including product terms, economics (including, but not limited to, pricing) and FDIC deposit insurance coverage, at least as favorable in all material respects as offered to the Broker-Dealers hereunder immediately prior to the date on which the termination event provided for in this Section 14(e) first occurred, provided further that if at any time the Depository Institutions are either (a) deemed to be “adequately capitalized” as defined in 12 C.F.R. Section 337.6 and have not received and continue to benefit from an effective waiver referenced in 12 C.F.R. 337.6(c) within the 180 day period referenced in clause (x) above, or (b) deemed to be “undercapitalized” as defined in 12 C.F.R. Section 337.6 or any other lower category set forth therein, then Schwab and the Broker Dealers shall have the right to sweep new or rollover funds (but, for the avoidance of doubt, not the right to terminate any Fixed Rate Obligation Amounts prior to the applicable maturity date) to one or more other depository institution of their choice (which may, for the avoidance of doubt, include one or more depository institution controlled by Schwab), but only for such period of time until the Depository Institutions no longer are viewed as falling within conditions (a) or (b) above.

(f) In the event that Schwab or any Broker-Dealer, on the one hand, or the Depository Institutions, on the other hand, materially breaches any of their respective covenants set forth in this Agreement, as applicable, and fails to cure such breach within 90 days of receipt of written notice of such breach from the non-breaching parties if any regulatory action is required to cure such breach (or, if no regulatory action is required to cure such breach, within 45 days of receipt of written notice of such breach), the non-breaching parties shall have the right to terminate this Agreement upon written notice to the breaching parties.

(g) Each of the parties agree that it will not exercise its right to terminate this Agreement (unless in the case of a termination pursuant to Section 14(b) or Section 14(c) an immediate termination of this Agreement is required to comply with any applicable law, regulation, order or directive) until the CEO of Schwab and the CEO of TD Parent have had a reasonable opportunity to discuss the circumstances that give rise to the right of termination and are unable to resolve the matter within ninety (90) days after the referral of the matter to them.

(h) Any termination of this Agreement pursuant to Sections 14(b)-14(f) shall become effective in accordance with the term thereof, in which case the Agreement shall immediately enter the Run-Off Period (as defined below) (unless and to the extent, in the case of a termination pursuant to Section 14(b) or Section 14(c), such Run-off Period is not permitted by applicable laws, regulations, orders or directives, in which case such run-off shall be conducted in compliance with such applicable laws, regulations, orders or directives). In the case of an expiration of this Agreement pursuant to Section 14(a), upon such expiration, this Agreement then shall enter the Run-Off Period. The “Run-Off Period” is the period in which (a) the amount of aggregate deposits in the Master Accounts shall not be allowed by Schwab to increase above

19

the amount that is then in such Master Accounts; and (b) the Broker-Dealers shall reduce the aggregate deposits in the Master Accounts without regard to the Reduction Limit or the $50 billion floor set forth in Section 5; provided that, except as set forth in Section 14(i), the Broker-Dealers shall have no right to terminate any Fixed Rate Obligation Amounts prior to the applicable maturity date and upon the applicable maturity date shall withdraw all deposits subject to such Fixed Rate Obligation Amounts.

(i) Upon expiration of the Agreement pursuant to Section 14(a) (and, for the avoidance of doubt, not in connection with a termination of this Agreement pursuant to Sections 14(b)-14(f)), the Broker-Dealers may, upon at least two years’ prior written notice prior to the expiration date (the “Non-Renewal Notice”), in the Run-Off Period (but, for the avoidance of doubt, not until the Run-Off Period has commenced), withdraw deposits from Fixed Rate Obligation Amounts prior to the maturity date of such Fixed Rate Obligation Amounts, subject to paying the Depository Institutions the Economic Replacement Value (as defined below) with respect to such Fixed Rate Obligation Amounts. Such Non-Renewal Notice must set forth the schedule for deposits (including the Fixed Rate Obligations) to be withdrawn (the “Withdrawal Schedule”) during the Run-Off Period (for clarity, such withdrawal will not begin earlier than the commencement of the Run-Off Period) and the Depository Institutions can select the actual date of termination of such Fixed Rate Obligation Amounts, provided such date shall be no earlier than 60 days before the scheduled withdrawal date in the Withdrawal Schedule and no later than the scheduled withdrawal date in the Withdrawal Schedule. Upon delivery of written notice (“Exemption Notice”) to the Depository Institutions at least two years prior to the beginning of the Exempt Period (as defined below), the Broker-Dealers may during the five year period prior to the expiration of the term of this Agreement as determined pursuant to Section 14(a) (such five year period, the “Exempt Period”) establish new Fixed Rate Obligation Amounts (the “Exempt Fixed Rate Obligation Amounts”) that comply with the requirements set forth in Section 5. In a Non-Renewal Notice, the Broker-Dealers may also establish Exempt Fixed Rate Obligation Amounts that have maturity dates consistent with the Withdrawal Schedule and comply with the requirements set forth in Section 5.

(j) For purposes of this Agreement, “Economic Replacement Value” has the meaning given to it in Exhibit C.

(k) Any right to terminate this Agreement pursuant to Sections 14(b)-14(f) shall not be deemed to be the exclusive remedy for breach of this Agreement but shall be in addition to all other remedies under this Agreement or available at law or in equity.

15. Survival. Following expiration or termination of this Agreement pursuant to Section 14 hereof, Sections 13, 14, 15, 16, 19, 20, 21, 24, 25 and 27 shall survive any such expiration or termination. All other sections of this Agreement shall survive until the Master Accounts established at the Depository Institutions are closed.

16. Confidentiality.

(a) Schwab and the Depository Institutions mutually acknowledge that, in the course of their dealings with each other in connection with this Agreement, each may learn Confidential Information of or concerning the other party or third persons to whom the other

20

party has an obligation of confidentiality. For the purposes of this Agreement, “Confidential Information” shall mean, with respect to any person, any confidential, business, trade secret, proprietary or other like information that is provided, produced or disclosed by such person in connection with performance of this Agreement, whether in written, electronic or oral form, whether tangible or intangible, and whether or not labeled or designated as “confidential.” Confidential Information also includes any information regarding the contents of this Agreement.

(b) Each party shall treat all Confidential Information received from the other party as proprietary, and shall not disclose such Confidential Information orally or in writing to any third party without the prior written consent of the other applicable party, and shall not appropriate any of such Confidential Information for its own use or for the use of any other person. Without limiting the foregoing, each party agrees to take at least such precautions to protect the other party’s Confidential Information as it takes to protect its own Confidential Information, but in no event shall such precautions be less than reasonable or as required by applicable law.

(c) Upon the request of another party following the termination of the Agreement and the closing of the Master Accounts, each party shall (a) return to such other party all tangible items containing any of such other party’s Confidential Information, including all copies, abstractions and compilations thereof, and (b) remove from its computer systems any record in electronic form that contains any of such other party’s Confidential Information, including all copies, abstractions and compilations thereof, without retaining any copies of the items required to be returned. Any party may further require that the other parties certify in writing that they have fulfilled their obligations under this Section 16(c).

(d) Notwithstanding anything herein to the contrary, each party may keep records of the other parties’ Confidential Information for recordkeeping as required by applicable law; provided, that the confidentiality of all such Confidential Information is maintained in a manner consistent with the requirements of this Agreement. The obligations of this Section 16 extend to the employees, agents, service providers and subcontractors of each party and their respective Affiliates, and each party shall inform such persons of their obligations under this Section 16.

(e) Nothing in this Agreement shall be construed to restrict disclosure or use of any information otherwise constituting Confidential Information that: (a) was in the possession of or rightfully known by the recipient, without an obligation to maintain its confidentiality, prior to receipt from the other party; (b) is or becomes generally known to the public without violation of this Agreement; (c) is obtained by the recipient in good faith from a third person having the right to disclose it without an obligation of confidentiality; or (d) is independently developed by the receiving party without the participation of any persons who have had access to the other party’s Confidential Information.

(f) Each party shall, upon learning of any unauthorized disclosure or use of another party’s Confidential Information, notify such other party promptly and cooperate fully with such party in protecting its Confidential Information.

21

(g) If any party believes it is required, by applicable law or by a subpoena or order of a court, regulatory agency or self-regulatory organization having appropriate jurisdiction, to disclose any of another party’s Confidential Information, subject to applicable law that may prohibit the rendering of such notification, it shall promptly notify the applicable party prior to any disclosure and shall make all reasonable efforts to allow such other party an opportunity to seek a protective order or other judicial relief. Despite any contrary provision in this Agreement, if the party seeking to prevent disclosure of such Confidential Information does not obtain a protective order or other judicial relief within a reasonable period of time, the party required to disclose the Confidential Information may disclose such information only to the extent required and will continue to treat the Confidential Information in accordance with this Agreement for all other purposes. Notwithstanding the foregoing and in connection with the Depository Institutions’ compliance with Regulation D, if a Depository Institution receives a request for information regarding a Customer Account at such Depository Institution from a federal bank regulatory agency with jurisdiction over such Depository Institution, the Depository Institution will inform Schwab, of the request and Schwab, will provide (or cause the Broker-Dealers to provide) the information sought as soon as possible, but in any event within ten (10) days. Notwithstanding anything in this Agreement to the contrary, nothing in this Agreement will prevent a party from disclosing any Confidential Information to any regulatory authority having jurisdiction over it or its subsidiaries in connection with ordinary course reporting/discussions between it or its subsidiaries and such authorities, or as may otherwise be required by law or regulation and, accordingly, the prohibitions of disclosure, obligations of notice and related provisions in this Agreement do not apply to any such disclosure to any such regulatory authority.

(h) Each party, with reasonable notice to the other parties and during normal business hours, shall have the right to inspect the other parties’ books and records relating to this Agreement in order to monitor the other parties’ compliance with applicable privacy policies, laws and regulations. The party requesting the inspection shall bear all costs in connection with such inspection. Each party agrees that it shall not interfere with the ordinary and normal course of the other parties’ business in conducting the inspection.

(i) The parties acknowledge that disclosure of any Confidential Information by the party receiving it will cause irreparable injury to the disclosing party, its customers and other persons, and is inadequately compensable in monetary damages. Accordingly, a party may seek injunctive relief in any court of competent jurisdiction for the breach or threatened breach of this Section 16, in addition to any other remedies in law or equity, and no party will raise the defense of an adequate remedy at law in opposition to any such petition for injunctive relief. This Section 16(i) shall not apply to disclosures required by applicable law, as provided in, and under the conditions of Section 16(g) hereof.

17. Notices.

(a) All notices under the Agreement will be in writing and will be sent:

if to TD Bank USA, to:

TD Bank USA, National Association

22

0000 Xxxxx 00 Xxxx

Xxxxxx Xxxx, XX 00000

Attention: Xxxxx Xxxxxxxxx, Group Head and General Counsel

Email: [***]

if to TD Bank, to:

TD Bank, National Association

0000 Xxxxx 00 Xxxx

Xxxxxx Xxxx, XX 00000

Attention: Xxxxx Xxxxxxxxx, Group Head and General Counsel

Email: [***]

In each case, with a copy (which shall not constitute notice) to:

Xxxxxxx Xxxxxxx & Xxxxxxxx LLP