CONTRACT FOR THE EXPLORATION AND EXTRACTION OF HYDROCARBONS UNDER PRODUCTION SHARING MODALITY ENTERED INTO BY THE NATIONAL HYDROCARBONS COMMISSION AND SIERRA O&G EXPLORACIÓN Y PRODUCCIÓN, S. DE R.L. DE C.V., TALOS ENERGY OFFSHORE MÉXICO 2, S. DE R.L....

Exhibit 10.9

CONTRACT FOR THE EXPLORATION AND

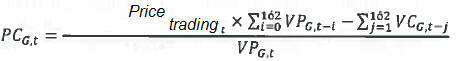

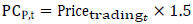

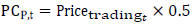

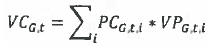

EXTRACTION OF HYDROCARBONS UNDER

PRODUCTION SHARING MODALITY

ENTERED INTO BY

THE NATIONAL HYDROCARBONS COMMISSION

AND

SIERRA O&G EXPLORACIÓN Y PRODUCCIÓN, S.

DE X.X. DE C.V.,

TALOS ENERGY OFFSHORE MÉXICO 2, S. DE

X.X. DE C.V.

AND

PREMIER OIL EXPLORATION AND

PRODUCTION MEXICO, S.A. DE C.V.

SEPTEMBER 4, 2015

XXXXXXXX XXXX 0

Xxxxxxxx Xx. XXX-X00-X00-X0/0000

TABLE OF CONTENTS

| Page # | ||||||

| ARTICLE 1. DEFINITIONS AND INTERPRETATION |

6 | |||||

| 1.1 |

Definitions | 6 | ||||

| 1.2 |

Use of Singular and Plural | 18 | ||||

| 1.3 |

Headings and References | 18 | ||||

| ARTICLE 2. PURPOSE OF CONTRACT |

18 | |||||

| 2.1 |

Production Sharing Modality | 18 | ||||

| 2.2 |

No Grant of Property Rights | 18 | ||||

| 2.3 |

Participating Interests | 19 | ||||

| 2.4 |

Joint and Several Liability | 19 | ||||

| 2.5 |

Operator | 19 | ||||

| 2.6 |

Change of Operators | 20 | ||||

| 2.7 |

Reporting of Benefits for Accounting Purposes | 20 | ||||

| ARTICLE 3. TERM OF CONTRACT |

20 | |||||

| 3.1 |

Effective Date | 20 | ||||

| 3.2 |

Term | 20 | ||||

| 3.3 |

Extension | 20 | ||||

| 3.4 |

Transition Stage for Startup | 21 | ||||

| 3.5 |

Relinquishment by Contractor | 22 | ||||

| ARTICLE 4. EXPLORATION PERIOD |

22 | |||||

| 4.1 |

Exploration Plan | 22 | ||||

| 4.2 |

Initial Exploration Period | 23 | ||||

| 4.3 |

Additional Exploration Period | 23 | ||||

| 4.4 |

Failure to Comply with the Minimum Work Program or Additional Commitment | 23 | ||||

| 4.5 |

Formation Testing | 24 | ||||

| 4.6 |

Notice of a Discovery | 24 | ||||

| ARTICLE 5. APPRAISAL |

24 | |||||

| 5.1 |

Appraisal | 24 | ||||

| 5.2 |

Appraisal Program | 25 | ||||

| 5.3 |

Non Associated Natural Gas Discovery | 25 | ||||

| 5.4 |

Hydrocarbons Extracted During Tests | 25 | ||||

| 5.5 |

Appraisal Report | 25 | ||||

| ARTICLE 6. DECLARATION OF COMMERCIALITY AND DEVELOPMENT PLAN |

26 | |||||

| 6.1 |

Commercial Discovery | 00 | ||||

-x-

Xxxxxxxx Xx. XXX-X00-X00-X0/0000

| 6.2 |

Development Plan | 26 | ||||

| 6.3 |

Observations to the Development Plan by CNH | 26 | ||||

| 6.4 |

Compliance with Development Plan and Modifications | 27 | ||||

| 6.5 |

Additional Exploration Activities | 27 | ||||

| ARTICLE 7. REDUCTION AND RETURN OF THE CONTRACT AREA |

27 | |||||

| 7.1 |

Rules of Reduction and Return | 27 | ||||

| 7.2 |

No Reduction of Other Obligations | 28 | ||||

| 7.3 |

Shape of Portion Subject to Reduction and Return | 28 | ||||

| 7.4 |

Decrease of Percentage of Reduction and Return | 28 | ||||

| ARTICLE 8. PRODUCTION ACTIVITIES |

29 | |||||

| 8.1 |

Production Profile | 29 | ||||

| 8.2 |

Facilities | 29 | ||||

| ARTICLE 9. UNITIZATION |

29 | |||||

| 9.1 |

Unitization Procedure | 29 | ||||

| 9.2 |

Nonexistence of Contractor or Assignee | 30 | ||||

| ARTICLE 10. WORK PROGRAMS |

30 | |||||

| 10.1 |

Work Programs | 30 | ||||

| 10.2 |

Work Program in Exploration Period | 31 | ||||

| 10.3 |

Work Program in Development Period | 31 | ||||

| 10.4 |

Observations by CNH | 31 | ||||

| 10.5 |

Drilling of Xxxxx | 32 | ||||

| 10.6 |

Drilling and Geophysical Reports | 32 | ||||

| 10.7 |

Progress Reports | 32 | ||||

| 10.8 |

Activities Not Requiring Approval | 33 | ||||

| ARTICLE 11. BUDGETS AND RECOVERABLE COSTS |

33 | |||||

| 11.1 |

Budgets | 33 | ||||

| 11.2 |

Exploration Budgets | 33 | ||||

| 11.3 |

Development Budgets | 33 | ||||

| 11.4 |

Modifications | 34 | ||||

| 11.5 |

Accounting of Contractor’s Costs | 34 | ||||

| 11.6 |

Recoverable Costs | 34 | ||||

| 11.7 |

Procurement of Goods and Services | 34 | ||||

| 11.8 |

Recordkeeping Requirement | 34 | ||||

| 11.9 |

Contractor’s Transactions with Third Parties | 34 | ||||

| ARTICLE 12. MEASUREMENT AND RECEPTION OF NET HYDROCARBONS |

35 | |||||

| 12.1 |

Volume and Quality | 35 | ||||

-ii-

Contract No. CNH-R01-L01-A7/2015

| 12.2 |

Procedures for Reception | 35 | ||||

| 12.3 |

Installation, Operation, Maintenance and Calibration of Measurement Systems | 35 | ||||

| 12.4 |

Records | 36 | ||||

| 12.5 |

Measurement System Malfunction | 36 | ||||

| 12.6 |

Replacement of Measurement System | 36 | ||||

| 12.7 |

Access to Measurement systems | 36 | ||||

| 12.8 |

Measurement Point Outside the Contract Area | 37 | ||||

| ARTICLE 13. MATERIALS |

37 | |||||

| 13.1 |

Ownership and Use of Materials | 37 | ||||

| 13.2 |

Leases | 37 | ||||

| 13.3 |

Purchase Option | 37 | ||||

| 13.4 |

Disposition of Assets | 38 | ||||

| ARTICLE 14. ADDITIONAL OBLIGATIONS OF THE PARTIES |

38 | |||||

| 14.1 |

Additional Obligations of the Contractor | 38 | ||||

| 14.2 |

Approvals by CNH | 40 | ||||

| 14.3 |

Environmental Liability and Industrial Safety | 40 | ||||

| 14.4 |

Preexisting Damages | 41 | ||||

| 14.5 |

Right of Access by Third Parties to the Contract Area | 42 | ||||

| ARTICLE 15. DISPOSITION OF PRODUCTION |

42 | |||||

| 15.1 |

Self-Consumed Hydrocarbons | 42 | ||||

| 15.2 |

Measurement Points | 42 | ||||

| 15.3 |

Commercialization of Production of the Contractor | 42 | ||||

| 15.4 |

Commercialization of Production of the State | 42 | ||||

| 15.5 |

Disposal of Sub-Products | 42 | ||||

| 15.6 |

Commercialization Facilities | 43 | ||||

| ARTICLE 16. CONSIDERATION |

43 | |||||

| 16.1 |

Monthly Payments | 43 | ||||

| 16.2 |

State Consideration | 43 | ||||

| 16.3 |

Contractor Consideration | 43 | ||||

| 16.4 |

Recoverable Costs Limit | 43 | ||||

| 16.5 |

Contractual Value of Hydrocarbons | 44 | ||||

| 16.6 |

Calculation of Considerations | 44 | ||||

| ARTICLE 17. GUARANTEES |

44 | |||||

| 17.1 |

Exploration Performance Guarantee | 44 | ||||

| 17.2 |

Corporate Guarantee | 45 | ||||

| ARTICLE 18. ABANDONMENT AND DELIVERY OF THE CONTRACT AREA |

46 | |||||

| 18.1 |

Program Requirements | 46 | ||||

-iii-

Contract No. CNH-R01-L01-A7/2015

| 18.2 |

Notice of Abandonment | 46 | ||||

| 18.3 |

Abandonment Trust | 46 | ||||

| 18.4 |

Funding of Abandonment Trust | 46 | ||||

| 18.5 |

Insufficient Funds | 48 | ||||

| 18.6 |

Substitution Requested by CNH | 48 | ||||

| 18.7 |

Final Transition Stage | 48 | ||||

| ARTICLE 19. LABOR RESPONSIBILITY; SUBCONTRACTORS AND NATIONAL CONTENT |

49 | |||||

| 19.1 |

Labor Responsibility | 49 | ||||

| 19.2 |

Subcontractors | 49 | ||||

| 19.3 |

National Content | 49 | ||||

| 19.4 |

Preference of Goods and Services of National Origin | 51 | ||||

| 19.5 |

Training and Transfer of Technology | 52 | ||||

| ARTICLE 20. INSURANCE |

52 | |||||

| 20.1 |

General Provision | 52 | ||||

| 20.2 |

Insurance Coverage | 52 | ||||

| 20.3 |

Insurers and Conditions | 52 | ||||

| 20.4 |

Modification or Cancellation of Policies | 53 | ||||

| 20.5 |

Waiver of Subrogation | 53 | ||||

| 20.6 |

Use of Insurance Proceeds | 53 | ||||

| 20.7 |

Currency | 53 | ||||

| 20.8 |

Compliance with Applicable Laws | 53 | ||||

| ARTICLE 21. TAX OBLIGATIONS |

53 | |||||

| 21.1 |

Tax Obligations | 53 | ||||

| 21.2 |

Governmental Fees and Charges | 53 | ||||

| ARTICLE 22. ACT OF GOD OR FORCE MAJEURE |

54 | |||||

| 22.1 |

Act of God or Force Majeure | 54 | ||||

| 22.2 |

Burden of Proof | 54 | ||||

| 22.3 |

Extension of Work Program; Extension of Term of Contract | 54 | ||||

| 22.4 |

Right of Termination | 54 | ||||

| 22.5 |

Emergency or Disaster Situations | 55 | ||||

| ARTICLE 23. ADMINISTRATIVE RESCISSION AND RESCISSION |

55 | |||||

| 23.1 |

Administrative Rescission | 55 | ||||

| 23.2 |

Prior Investigation | 56 | ||||

| 23.3 |

Procedure for Administrative Rescission | 56 | ||||

| 23.4 |

Contractual Rescission | 57 | ||||

| 23.5 |

Effects of the Administrative or Contractual Rescission | 58 | ||||

| 23.6 |

Settlement | 58 | ||||

-iv-

Contract No. CNH-R01-L01-A7/2015

| ARTICLE 24. ASSIGNMENT AND CHANGE OF CONTROL |

59 | |||||

| 24.1 |

Assignment | 59 | ||||

| 24.2 |

Indirect Transfers; Change of Control | 59 | ||||

| 24.3 |

Application to CNH | 59 | ||||

| 24.4 |

Effect of Assignment or Change of Control | 59 | ||||

| 24.5 |

Prohibition on Liens | 60 | ||||

| 24.6 |

Invalidity | 60 | ||||

| ARTICLE 25. INDEMNIFICATION |

60 | |||||

| ARTICLE 26. APPLICABLE LAW AND DISPUTE RESOLUTION |

61 | |||||

| 26.1 |

Applicable Laws | 61 | ||||

| 26.2 |

Conciliation | 61 | ||||

| 26.3 |

Conciliator Requirements | 62 | ||||

| 26.4 |

Federal Courts | 62 | ||||

| 26.5 |

Arbitration | 62 | ||||

| 26.6 |

Consolidation | 62 | ||||

| 26.7 |

No Suspension of Petroleum Activities | 63 | ||||

| 26.8 |

Waiver of Diplomatic Channels | 63 | ||||

| ARTICLE 27. AMENDMENTS AND WAIVERS |

63 | |||||

| ARTICLE 28. CAPACITY AND REPRESENTATIONS OF THE PARTIES |

63 | |||||

| 28.1 |

Representations and Warranties | 63 | ||||

| 28.2 |

Relationship of the Parties | 63 | ||||

| ARTICLE 29. DATA AND CONFIDENTIALITY |

64 | |||||

| 29.1 |

Ownership of Information | 64 | ||||

| 29.2 |

Public Information | 64 | ||||

| 29.3 |

Confidentiality | 64 | ||||

| 29.4 |

Exception to Confidentiality | 65 | ||||

| ARTICLE 30. NOTICES |

65 | |||||

| ARTICLE 31. ENTIRE CONTRACT |

66 | |||||

| ARTICLE 32. TRANSPARENCY PROVISIONS |

67 | |||||

| 32.1 |

Information Access | 67 | ||||

| 32.2 |

Conduct of the Contractor and its Affiliates | 67 | ||||

| 32.3 |

Notice of Investigation | 67 | ||||

| 32.4 |

Conflict of Interest | 68 | ||||

| ARTICLE 33. COOPERATION ON NATIONAL SECURITY MATTERS |

68 | |||||

| ARTICLE 34. LANGUAGE |

68 | |||||

| ARTICLE 35. COUNTERPARTS |

68 | |||||

-v-

Contract No. CNH-R01-L01-A7/2015

CONTRACT CNH-R01-L01-A7/2015

CONTRACT FOR THE EXPLORATION AND EXTRACTION

OF HYDROCARBONS UNDER PRODUCTION SHARING MODALITY

This Contract for the Exploration and Extraction of Hydrocarbons under Production Sharing Modality (the “Contract”) is entered into on September 4, 2015, between, on the one hand, the UNITED MEXICAN STATES (“Mexico”, the “State” or the “Nation”), through the NATIONAL HYDROCARBONS COMMISSION (“CNH”), represented by C. Xxxx Xxxxxx Xxxxxx Xxxxxx, in his capacity as Chairperson, Xxxxx Xxxxxxxx Xxxxxxxx Xxxxxxxxx, Executive Secretary; Xxxxxx Xxxxxx Xxxxxx General Director of Petroleum Potential Assessment, and Xxxxxx Xxxxxx Xxxxxxxxx, General Director of Extraction Reports, and on the other hand, Sierra O&G Exploración y Producción, S. de X.X. de C.V., a commercial company incorporated under the laws of Mexico (hereinafter “Sierra O&G Exploración y Producción”) represented by Xxxx Xxxxxx Xxxxxxx Xxxxx and Read Xxxxx Xxxxxx, in their capacity as legal representatives; Talos Energy Offshore Mexico 0, X. de X.X. de C.V., a commercial company incorporated under the laws of the United Mexican States (hereinafter “Talos Energy Offshore Mexico 7”), represented by Xxxx Ashland Shepherd, in his capacity as legal representative, and Premier Oil Exploration and Production Mexico, S.A. de C.V., a commercial company incorporated under the laws of the United Mexican States (hereinafter “Premier Oil Exploration And Production Mexico”), represented by Xxxxxxx Xxxxx Xxxxxx, in his capacity as legal representative, in accordance with the following Declarations and Articles:

DECLARATIONS

The National Hydrocarbons Commission declares that:

I. It is a Coordinated Regulatory Entity of the Energy Sector of the Centralized Public Federal Administration of the State, having legal personality and technical and operational autonomy, in accordance with Article 28, paragraph eight, of the Political Constitution of the United Mexican States (the “Constitution”), and Articles 2, Section I, and 3 of the Law of the Coordinated Regulatory Entities of the Energy Sector;

II. In accordance with Article 27, paragraph seven, of the Constitution, Article 15 of the Hydrocarbons Law and Article 38, Section II, of the Law of the Coordinated Regulatory Entities of the Energy Sector, it has the legal capacity to sign contracts, in the name and on behalf of the State, with private parties or with State Productive Enterprises, through which the Nation conducts strategic activities consisting of the Exploration and Extraction of Petroleum and other solid, liquid or gaseous hydrocarbons within Mexican territory;

III. In accordance with the applicable provisions of the Constitution, the Hydrocarbons Law, the Law of the Coordinated Regulatory Entities of the Energy

1

Contract No. CNH-R01-L01-A7/2015

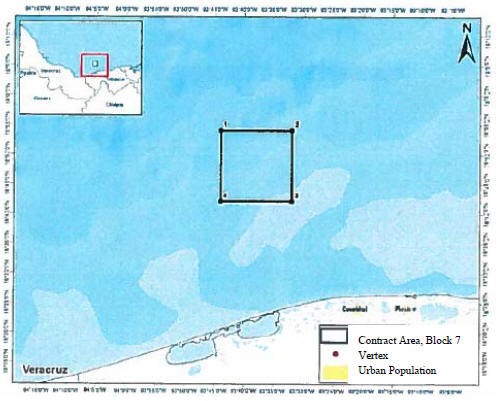

Sector, and the guidelines established by the Ministry of Energy and the Ministry of Finance and Public Credit within the scope of their respective jurisdictions, on December 11, 2014, it published in the Official Gazette of the Federation the Tender No. CNH-R01-C01/2014 for the international public bidding process for a Contract for the Exploration and Extraction under Shared Production Modality relating to the Contract Area described in Annex 1 hereto, and in accordance with the procedure established in the Bidding Guidelines issued for such bidding process, it issued the award on July 17, 2015 pursuant to which Sierra Oil & Gas, S. de X. X. de C.V., in Consortium with Talos Energy, LLC and Premier Oil, PLC were awarded this Agreement

IV. Its representative is authorized to enter into this Contract pursuant to Article 23, Section III, of the Law of the Coordinated Regulatory Entities of the Energy Sector, as well as Articles 14, Section XVI, 20, fourth and fifth transitory articles of the Internal Regulation of the National Hydrocarbons Law.

Sierra O& G Exploración y Producción declares that:

I. It is a corporation organized and existing under the laws of Mexico, and in compliance with the provisions of article 22.3 of Section III of the Bidding Guidelines for the Award of Sharing Production Contracts for the Exploration and Extraction of Hydrocarbons in Shallow Waters – First Call to Bid, Bid CNH-R01-L01/2014, whose sole corporate purpose is the Exploration and Extraction of Hydrocarbons, and it has the legal capacity to enter into and perform this Contract;

II. It is a resident of Mexico for tax purposes, has a Federal Taxpayer Registry number, and does not pay taxes under the optional tax regime for groups of companies referenced in Chapter VI of Title Second of the Income Tax Law;

III. It has knowledge of the laws of Mexico, as well as all related regulations and other applicable provisions;

IV. It has the organization, experience and technical, financial and implementation capacity to comply with its obligations under this Contract;

V. It has taken the corporate actions, obtained the authorizations, corporate or otherwise, and satisfied the applicable legal requirements to enter into and perform this Contract, and neither it nor any third party associated with it falls within any of the provisions of Article 26 of the Hydrocarbons Law, and

VI. The legal capacity of Xxxx Xxxxxx Xxxxxxx Xxxxx and Read Xxxxx Xxxxxx, as legal representatives to enter into this Contract is evidenced by the certified copy of Public Deed No. 69,197 of Book 1,365 granted before Notary Public No. 94 from the Federal District, Mr. Xxxx Namur Campesino, dated August 12, 2015.

2

Contract No. CNH-R01-L01-A7/2015

Talos Energy Offshore Mexico 7 declares that:

I. It is a corporation organized and existing under the laws of Mexico, and in compliance with the provisions of article 22.3 of Section III of the Bidding Guidelines for the Award of Sharing Production Contracts for the Exploration and Extraction of Hydrocarbons in Shallow Waters – First Call to Bid, Bid CNH-R01-L01/2014, whose sole corporate purpose is the Exploration and Extraction of Hydrocarbons, and it has the legal capacity to enter into and perform this Contract;

II. It is a resident of Mexico for tax purposes, has a Federal Taxpayer Registry number, and does not pay taxes under the optional tax regime for groups of companies referenced in Chapter VI of Title Second of the Income Tax Law;

III. It has knowledge of the laws of Mexico, as well as all related regulations and other applicable provisions;

IV. It has the organization, experience and technical, financial and implementation capacity to comply with its obligations under this Contract;

V. It has taken the corporate actions, obtained the authorizations, corporate or otherwise, and satisfied the applicable legal requirements to enter into and perform this Contract, and neither it nor any third party associated with it falls within any of the provisions of Article 26 of the Hydrocarbons Law, and

VI. The legal capacity of Xxxx Ashland Shepherd, as legal representative to enter into this Contract, is evidenced by certified copy of Public Deed No. 74,326, of volume 1,798 granted before Notary Public No. 1 of the Federal District, Xx. Xxxxxxx Xxxxx y Bandera, dated August 3, 2015.

Premier Oil Exploration and Production Mexico declares that:

| I. | It is a corporation organized and existing under the laws of Mexico, and in compliance with the provisions of article 22.3 of Section III of the Bidding Guidelines for the Award of Sharing Production Contracts for the Exploration and Extraction of Hydrocarbons in Shallow Waters – First Call to Bid, Bid CNH-R01-L01/2014, whose sole corporate purpose is the Exploration and Extraction of Hydrocarbons, and it has the legal capacity to enter into and perform this Contract; |

| II. | It is a resident of Mexico for tax purposes, has a Federal Taxpayer Registry number, and does not pay taxes under the optional tax regime for groups of companies referenced in Chapter VI of Title Secondof the Income Tax Law; |

| III. | It has knowledge of the laws of Mexico, as well as all related regulations and other applicable provisions; |

| IV. | It has the organization, experience and technical, financial and implementation capacity to comply with its obligations under this Contract; |

| V. | It has taken the corporate actions, obtained the authorizations, corporate or otherwise, and satisfied the applicable legal requirements to enter into and perform this Contract, and neither it nor any third party associated with it falls within any of the provisions of Article 26 of the Hydrocarbons Law, and |

3

Contract No. CNH-R01-L01-A7/2015

| VI. | The legal capacity of Xxxxxxx Xxxxx Xxxxxx, as legal representative to enter into this Contract, is evidenced through the Second Transcript of Public Deed No. 94,859, of Book 2,865 granted by Notary Public No. 104 of the Federal District, Mr. Xxxx Xxxxxxx Xxxxxxx Xxxxxxx, dated August 12, 2015. |

The JOINT AND SEVERAL OBLIGORS declare that:

Sierra Oil & Gas, S. de X.X. de C.V.

| I. | It is a corporation organized and existing under the laws of Mexico, and has the legal capacity to enter into and comply with the obligations arising from this Agreement in its capacity of joint and several obligor, in compliance with the provisions of article 22.3 of Section III of the Bidding Guidelines for the Award of Sharing Production Contracts for the Exploration and Extraction of Hydrocarbons in Shallow Waters – First Call to Bid, which is evidenced with: |

| • | The transcript of public deed number 71,114, volume 1,714 dated July 10, 2014, granted by Notary Public number 1 of the Federal District, Xx. Xxxxxxx Xxxxx y Bandera, registered in the Public Registry of Commerce of Mexico City, Federal District, under commercial folio 518615-1, and |

| • | The transcript of public instrument number 71,753 of volume 1,730, dated September 25, 2014, granted by Notary Public number 1 of the Federal District, Xx. Xxxxxxx Xxxxx y Bandera, which contains the Comprehensive Amendment to the Bylaws. |

| II. | The legal capacity of Xxxx Xxxxxx Xxxxxxx Xxxxx and of Xxxxxxxx Xxxxxxx del Río Madrid, as legal representatives to enter into this Contract, is evidenced through the power of attorney granted through Public Deed No. 71,753, from volume 1,730, granted by Notary Public number 1 of the Federal District, Xx. Xxxxxxx Xxxxx y Bandera, dated September 25, 2014. |

Talos Energy, LLC

| I. | It is a corporation organized and existing under the laws of Delaware, United States of America, and has the legal capacity to enter into and comply with the obligations arising from this Agreement in its capacity of joint and several obligor, in compliance with the provisions of article 22.3 of Section III of the Bidding Guidelines for the Award of Sharing Production Contracts for the Exploration and Extraction of Hydrocarbons in Shallow Waters – First Call to Bid, which is evidenced with its Certificate of Incorporation issued by the State of Delaware number 111302914-50817148100 dated December 15, 2011, granted by Xx. Xxxx Xxxxxx, officer of the Companies Division of the Secretary of State of the State of Delaware, and authenticated by the Secretary of State Xxxxxxx X. Xxxxxxx, which has the apostille number 10195477 dated February 26, 2015. |

4

Contract No. CNH-R01-L01-A7/2015

| II. | The legal capacity of Xxxxxxx Xxxxxxx Xxxx III as legal representative to enter into this Agreement is evidenced through the First Transcript of public deed number 74,487, from volume 1,804, dated August 13, 2015, granted by Xx. Xxxxxx Xxxxxxx Xxxxxx Xxxxx Xxxxxxxxx, Notary Public No. 165 of the Federal District, acting as alternate and in the notary’s protocol of Xx. Xxxxxxx Xxxxx y Bandera, Public Notary No. 1 of the Federal District. |

Premier Oil, PLC

| I. | It is a company duly organized and existing under the laws of Scotland, and has the legal capacity to enter into and comply with the obligations arising from this Agreement in its capacity of joint and several obligor, in compliance with the provisions of article 22.3 of Section III of the Bidding Guidelines for the Award of Sharing Production Contracts for the Exploration and Extraction of Hydrocarbons in Shallow Waters – First Call to Bid, which is evidenced with: |

| • | Certificate of incorporation number 234781 of the Companies Registry of Scotland, corresponding to the limited private company Dalglen (No. 836) Limited, granted by the Companies Department, Edinburgh, Scotland, on July 31, 2002. |

| • | Certificate of change of name of the company 234781, through which the company Dalglen (No. 836) Limited, changed its name to Premier Oil Group Limited, granted by the Companies Department, Edinburgh, Scotland, on September 13, 2002. |

| • | Certificate through which the company Premier Oil Group Limited changes from private company to a limited public company, granted by the Companies Department, Edinburgh, Scotland, on March 10, 2003. |

| • | Certificate through which the company Premier Oil Group PLC, through special resolution changes its name to Premier Oil Plc, granted by the Companies Department, Edinburgh, Scotland, on July 15, 2003. |

| II. | The legal capacity of Xxxxxxx Xxxxx Xxxxxx, as legal representative to enter into this Contract is evidenced through the First Transcript of Public Deed No. 51,526, of Book 1,178, granted by Notary Public No, 97 of the Federal District, Xx. Xxxxx Xxxxxxx Xxxxxxxx Rommyngth, dated August 17, 2015. |

Based on the foregoing representations, the Parties agree on the following:

5

Contract No. CNH-R01-L01-A7/2015

ARTICLES

ARTICLE 1.

DEFINITIONS AND

INTERPRETATION

1.1 Definitions. For the purposes of this Contract, the following terms shall have the meaning set forth:

“Abandonment” shall mean all activities of removal and dismantling of Materials, including, without limitation, the permanent plugging and abandonment of Xxxxx, the dismantling and removal of all plants, platforms, facilities, machinery and equipment supplied or used by the Contractor in conducting the Petroleum Activities, as well as the environmental restoration of the affected Contract Area by the Contractor in the performance of the Petroleum Activities, in accordance with the terms of this Contract, Industry Best Practices, the Applicable Laws and the Management System.

“Abandonment Trust” shall have the meaning set forth in Article 18.3.

“Accounting Procedures” shall mean the Procedures for Accounting,

Reporting and Recovery of Costs attached hereto as Annex 4.

“Act of God or Force Majeure” shall mean any fact or circumstance which prevents the affected Party from performing its obligations under this Contract if such fact or circumstance is beyond the reasonable control of such Party and does not result from its intentional conduct or fault, provided that such Party has not been able to avoid or overcome such fact or circumstance by the exercise of due diligence. Subject to satisfaction of the foregoing conditions, Act of God or Force Majeure shall include, without limitation, the following acts or events preventing the affected Party from performing its obligations under this Contract: natural phenomena such as storms, hurricanes, floods, mudslides, lightning and earthquakes; fires; acts of war (whether or not declared); civil disturbances, riots, insurrections, sabotage and terrorism; disasters in the transportation of Materials; restrictions due to quarantines, epidemics, strikes or other labor disputes not resulting from a breach of any labor agreement by the affected Party. It is expressly understood that Act of God or Force Majeure (i) shall not include economic hardship or change in market conditions (including difficulties in obtaining funds or financing) and (ii) shall not exempt the Contractor from environmental liability under the Applicable Laws.

“Additional Exploration Period” shall mean the period of two (2) Contractual Years as of the termination date of the Initial Exploration Period, which CNH may grant to the Contractor in order to keep carrying surface Reconnaissance and Exploration, Exploration and Appraisal activities in the Contract Area in accordance with Article 4.3.

6

Contract No. CNH-R01-L01-A7/2015

“Additional Period Guarantee” shall have the meaning set forth in Article 17.1(c).

“Adjustment Mechanism” shall mean the mechanism established in Annex 3, which, based on the measurement of the Contractor’s operating result in each Period, modifies the parameters that determine the State Consideration and the Contractor Consideration, in order for the State’s participation in the results of the Contract Area to be progressive.

“Affiliate” shall mean, with respect to any Person, any other Person that directly or indirectly Controls, is Controlled by, or is under common Control with such Person.

“Agency” shall mean the National Agency for the Industrial Safety and Environmental Protection of the Hydrocarbons Sector.

“Annual Contribution” shall have the meaning set forth in Article 18.4.

“Applicable Laws” shall mean all laws, regulations, general administrative provisions, decrees, administrative orders, court rulings and other rules or decisions of any kind issued by any Governmental Authority which are in effect at the relevant time.

“Appraisal” shall mean all activities and operations carried out by the Contractor after a Discovery to determine the limits, characteristics and production capacity of a Discovery and whether such Discovery is a Commercial Discovery, including, without limitation: (i) additional Surface Reconnaissance and Exploration and Exploration activities; (ii) geological and geophysical surveys; (iii) drilling of test Xxxxx; (iv) studies of Reserves and other studies, and (v) all ancillary operations and activities required or advisable to optimize the performance or results of the foregoing activities.

“Appraisal Area” shall have the meaning set forth in Article 5.2.

“Appraisal Period” shall have the meaning set forth in Article 5.2.

“Asset Inventory” shall mean the inventory of Xxxxx and Materials described in Annex 12.

“Associated Natural Gas” shall mean Natural Gas dissolved in the Crude Oil contained in a reservoir under original pressure and temperature conditions.

7

Contract No. CNH-R01-L01-A7/2015

“Barrel” shall mean a measurement unit equivalent to a volume equal to 158.99 liters at a temperature of 15.56 degrees Celsius at atmosphere pressure conditions.

“Bidding Guidelines” shall mean the bidding guidelines issued pursuant to the Tender, including all the modifications or clarifications thereof issued by CNH.

“BTU” shall mean a British thermal unit, which represents the amount of energy needed to heat one pound (0.4535 kilograms) of water by one degree Fahrenheit at atmosphere pressure conditions.

“Budget” shall mean an estimate of the Costs of all items included in a Work Program, which includes at a minimum a breakdown of the budgetary items corresponding with each category of Petroleum Activities.

“Business Day” shall mean any Day other than a Saturday, Sunday or any other holiday required under Applicable Laws.

“Commercial Discovery” shall mean a Discovery that is declared by the Contractor to be commercial in accordance with Article 6.1.

“Commercialization Facilities” shall mean the infrastructure and equipment necessary to transport, compress, store or distribute Hydrocarbons beyond the Measurement Points, including all pipelines for Crude Oil, Condensates and Natural Gas, pumps, compressors, measuring equipment and additional Storage facilities necessary to transport the Hydrocarbons from the Measurement Point to the point of sale or to the entry to a delivery system.

“Condensates” shall mean Natural Gas liquids consisting primarily of pentanes and heavier Hydrocarbon components.

“Consideration” shall mean, individually or together, the State Consideration or the Contractor Consideration, as the case may be.

“Contract” shall mean this Contract for the Exploration and Extraction of Hydrocarbons under Production Sharing Modality, including the annexes attached hereto (which shall form an integral part hereof), as well as all the modifications made thereto in accordance with its terms and conditions.

“Contract Area” shall mean the surface area described in Annex 1, including the geological formations contained in the vertical projection of such surface to the depth indicated in Annex 1, in which the Contractor is authorized and obligated to conduct Petroleum Activities pursuant to this Contract, in the understanding that: (i) this Contract does not grant the Contractor any real property rights to the Contract Area or to the natural resources in its subsurface and (ii) the Contract Area shall be reduced in accordance with the terms of this Contract.

8

Contract No. CNH-R01-L01-A7/2015

“Contract Fee for the Exploratory Phase” shall have the meaning set forth in Annex 3.

“Contract Year” shall mean a period of twelve (12) consecutive Months from the Effective Date or from any anniversary thereof.

“Contractor” shall mean the Participating Companies, collectively.

“Contractor Consideration” shall mean, with respect to any Month beginning with the Month in which Regular Commercial Production commences, the share of Hydrocarbon production from the Contract Area that the Contractor is entitled to receive in such Month in accordance with Article 16.3 and Annex 3.

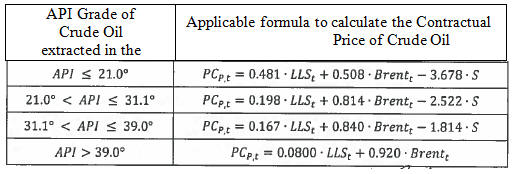

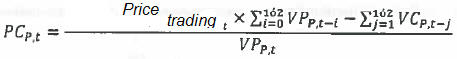

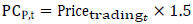

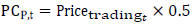

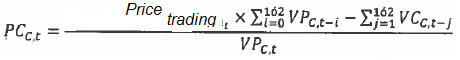

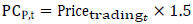

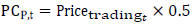

“Contractual Price” shall mean the monetary value in Dollars assigned per each measurement unit for Hydrocarbon in accordance with Annex 3.

“Contractual Value of the Condensates” shall mean the result of multiplying in the relevant Period: (i) the Contractual Price of the Condensates, by (ii) the volume of the Condensates in Barrels at the Measurement Points, determined as provided in Annex 3.

“Contractual Value of the Crude Oil” shall mean the result of multiplying in the relevant Period: (i) the Contractual Price of the Crude Oil, by (ii) the volume of the Crude Oil in Barrels at the Measurement Points, determined as provided in Annex 3.

“Contractual Value of the Hydrocarbons” shall mean the sum of the Contractual Value of the Crude Oil, the Contractual Value of the Natural Gas and the Contractual Value of the Condensates, determined as provided in Annex 3.

“Contractual Value of the Natural Gas” shall mean the result of multiplying in the relevant Period: (i) the Contractual Price of the Natural Gas, by (ii) the volume in millions of BTU of Natural Gas at the Measurement Points, determined as provided in Annex 3.

“Control” shall mean the ability of a Person or group of Persons to carry out any of the following acts: (i) to impose decisions, directly or indirectly, on general meetings of shareholders, partners or equivalent governing bodies or to appoint or remove a majority of the directors, managers or their equivalent, in each case of the Contractor; (ii) to hold ownership rights that grant, directly or indirectly, the exercise of voting rights with respect to more than fifty percent of the Contractor’s capital stock, or (iii) to lead, directly or indirectly, the Contractor’s management, strategy or principal policies, whether through the ownership of securities, by contract or otherwise.

9

Contract No. CNH-R01-L01-A7/2015

“Corporate Guarantee” shall mean the guarantee of the obligations of the Contractor under this Contract in the form set forth in Annex 2, which will be executed by the Guarantor of each of the Participating Companies, simultaneously with the execution of this Contract.

“Cost Recovery Percentage” shall mean the percentage indicated in Annex 3.

“Costs” shall mean all expenditures, expenses, investments, or liabilities related to the Petroleum Activities.

“Crude Oil” shall mean a mixture of hydrogen carbides which exists in liquid form in reservoirs and remains as such under original pressure and temperature conditions, and which may include small quantities of substances other than hydrogen carbides.

“Day” shall mean a calendar day.

“Development Area” shall mean, with regard to any Commercial Discovery, the area within the Contract Area covering the whole extension of the underlying structures or stratigraphic closures defining the reservoir or intervals of interest of the Field where the Discovery has been made.

“Development Period” shall mean, with regard to any Commercial Discovery, the period beginning upon approval of the Development Plan for such Commercial Discovery and ending upon the termination of this Contract for any reason or by any contractual or administrative rescission.

“Development Plan” shall mean the optimal development plan for Extraction which contains a schedule of the specific Petroleum Activities in a particular Development Area in order to reach Regular Commercial Production or increase Hydrocarbon production, including any Enhanced Recovery program.

“Discovery” shall mean any structure or accumulation or group of structures or accumulations which during drilling activities may have been shown to contain Hydrocarbons that may be extracted at a measurable flow rate using Industry Best Practices, regardless of whether the extraction of such detected Hydrocarbons may or may not be considered commercially viable, including an extension of any prior Discovery.

“Dollars” or “US$” shall mean dollars of the United States of America.

“Effective Date” shall mean the date of execution of this Contract.

10

Contract No. CNH-R01-L01-A7/2015

“Eligible Costs” shall mean Costs, which are strictly required for the conduction of the Petroleum Activities, incurred from the Effective Date until the termination of this Contract, provided that they comply with the Annexes 4, 10 and 11, and the guidelines issued by the Ministry of Finance in force as of the award date of the Contract.

“Enhanced Recovery” shall mean secondary or tertiary recovery processes consistent with Industry Best Practices in order to enhance recovery of Hydrocarbons in the Development Area, including, without limitation, increasing the pressure in a reservoir and/or decreasing the viscosity of the Hydrocarbons.

“Exploration” shall mean an activity or group of activities using direct methods, including the drilling of Xxxxx, aimed at the identification, discovery and appraisal of Hydrocarbons in the Subsoil in the Contract Area.

“Exploration Performance Guarantee” shall mean, individually or collectively, the Initial Performance Guarantee, and the Additional Period Guarantee, as the context may require.

“Exploration Period” shall mean the period granted to the Contractor to conduct Surface Reconnaissance and Exploration, Exploration and Appraisal activities, which consists of the Initial Exploration Period, the Additional Exploration Period (if any) and the Appraisal Period (if any).

“Exploration Plan” shall mean a schedule specifying the Surface Reconnaissance and Exploration, Exploration and Appraisal activities to be conducted within the Contract Area, which shall comply at least with the Minimum Work Program and the Minimum Program Increase

“Extraction” shall mean an activity or group of activities carried out for the purpose of Hydrocarbon production, including the drilling of production Xxxxx, injection and stimulation of reservoirs, Enhanced Recovery, Gathering, conditioning and separation of Hydrocarbons and elimination of water and sediments within the Contract Area, as well as the construction, location, operation, use, Abandonment and dismantling of production facilities.

“Field” shall mean the area located within the Contract Area beneath which one or more Hydrocarbon reservoirs are located in one or more formations within the same structure, geological body or stratigraphic condition.

“Final Transition Stage” shall mean the stage carried out in accordance with the Article 18.7 and the Applicable Laws.

“First Additional Term” shall have the meaning set forth in Article 3.3.

“Fund” shall mean the Mexican Petroleum Fund for Stabilization and Development.

11

Contract No. CNH-R01-L01-A7/2015

“Gathering” shall mean the gathering of Hydrocarbons, once they have been extracted from the subsoil, from each Well of the reservoir using a system of discharge lines running from the wellhead to the first separation batteries or, as applicable, to the transportation systems.

“Gathering Facilities” shall mean all facilities and equipment necessary for production testing and separation, Storage tanks, compressors, pipelines, pumps and any other equipment necessary for the Gathering of Hydrocarbons.

“Governmental Authority” shall mean any governmental entity of the federal, state or municipal government or the executive, legislative or judicial branch, including autonomous constitutional entities of the State.

“Guarantor” shall mean the ultimate parent entity of each of the Participating Companies or the company that exercises Control over each of the Participating Companies or that is under common Control of the Person that exercises the Control over each of the Participating Companies, who shall execute the Corporate Guarantee prior approval of CNH.

“Hydrocarbons” shall mean Crude Oil, Natural Gas, Condensates, Natural Gas liquids and methane hydrates.

“Hydrocarbons in the Subsoil” shall mean the total resources or quantity of Hydrocarbons with the potential of being extracted which are estimated to exist originally, prior to their production, in naturally occurring accumulations, as well as estimated quantities of accumulations yet to be discovered.

“Hydrocarbons Law” shall mean the Hydrocarbons Law published in the Official Gazette of the Federation on August 11, 2014, including amendments and supplements thereto.

“Hydrocarbon Revenues Law” shall mean the Hydrocarbon Revenues Law published in the Official Gazette of the Federation on August 11, 2014, including amendments and supplements thereto.

“Industry Best Practices” shall mean the best practices, methods, standards and procedures generally accepted and followed by diligent, expert and prudent operators with experience in the areas of Exploration, Appraisal, development and Extraction of Hydrocarbons and in Abandonment which, in the exercise of reasonable judgment and in light of the facts known at the time a decision is made, would be expected to achieve the anticipated results and increase the economic benefits derived from the Extraction of Hydrocarbons contained within the Contract Area, maximizing the recovery factor of Hydrocarbons throughout the life of the reservoirs, without causing an excessive reduction of pressure or energy.

12

Contract No. CNH-R01-L01-A7/2015

“Initial Exploration Period” shall mean the period specified in Article 4.2, during which the Contractor shall conduct Surface Reconnaissance and Exploration, Exploration and Appraisal activities.

“Initial Performance Guarantee” shall have the meaning set forth in Article 17.1(a).

“Management System” shall mean an integrated set of interrelated and documented elements to prevent, control and improve the performance of a facility or group of facilities related to industrial safety, operational safety and environmental protection in the sector which the Contractor shall implement throughout the performance of the Petroleum Activities in compliance with the requirements set forth in Articles 13, 14 and 16 of the Law of the National Agency for Industrial Safety and Environmental Protection of the Hydrocarbons Sector and the other Applicable Laws.

“Marketer” shall mean the marketer engaged by CNH, in accordance with the Hydrocarbons Law, to provide services to the Nation for the marketing of the Hydrocarbons that correspond to the State as a result of this Contract.

“Market Rules” shall mean the principle of competition pursuant to which parties involved in a transaction are independent and participate on an equal basis in their own interests.

“Materials” shall mean all the machinery, tools, equipment, goods, supplies, pipes, drilling or production platforms, marine devices, plants, infrastructure and other facilities acquired, provided, leased or otherwise held to be used in the Petroleum Activities, including the Gathering Facilities.

“Measurement Points” shall mean the locations proposed by the Contractor and approved by CNH, or in such case, determined by CNH inside or outside the Contract Area, at which the Net Hydrocarbons will be measured, verified and delivered, as provided in this Contract and the Applicable Laws.

“Methodology” shall mean the methodology established by the Ministry of Energy to measure national content in the Assignments and Contracts for Exploration and Extraction pursuant to Article 46 of the Hydrocarbons Law.

“Minimum Program Increase” shall mean the additional Work Units referenced in Annex 5, which the Contractor agreed to carry out through the percentage increase in the Minimum Work Program as part of the economic bid based on which this Contract was awarded.

“Minimum Work Program” shall mean the Work Units indicated in Annex 5, which the Contractor shall carry out during the Initial Exploration Period, it being understood that the Minimum Work Program is only a minimum work program and that the Contractor may carry out additional Surface Reconnaissance and Exploration, Exploration and Appraisal activities during the Exploration Period.

13

Contract No. CNH-R01-L01-A7/2015

“Ministry of Finance” shall mean the Ministry of Finance and Public Credit.

“Month” shall mean a calendar month.

“Natural Gas” shall mean a mixture of gases obtained by Extraction or industrial processing which is composed primarily of methane and usually contains ethanol, propane, and butane, as well as carbon dioxide, nitrogen and sulfuric acid, among other components. It may be Associated Natural Gas and Non-associated Natural Gas.

“Net Hydrocarbons” shall mean the Produced Hydrocarbons minus the Self- Consumed Hydrocarbons, measured at the Measurement Points in acceptable commercial conditions regarding the content of sulfur, water and other elements in accordance with the Applicable Law and the Industry Best Practices which shall be supervised and audited by CNH.

“Non-Associated Natural Gas” shall mean Natural Gas found in reservoirs that do not contain Crude Oil at original pressure and temperature conditions.

“Non-Associated Natural Gas Discovery” shall mean a Discovery made by direct methods of an accumulation or accumulations of Subsoil Hydrocarbons that by any sampling, testing, analysis or flow measurements on site procedures, with over 3,300 cubic feet of Natural Gas per each Barrel of Condensates to be produced, measured at surface conditions.

“Obstacles to the Continuation of Drilling” refers to situations when, before reaching the targeted depth for any Well as required by the relevant Work Program: (i) a geological formation, older than the deepest formation that was established as a goal, is encountered; (ii) it is determined that to continue drilling is dangerous, including dangers associated with abnormally high pressure or resulting from excessive loss of drilling fluids; (iii) an impenetrable formation is encountered which prevents reaching the anticipated depth, or (iv) a geological formation containing Hydrocarbons is encountered and must be protected pursuant to Industry Best Practices.

“Operating Account” shall mean the account books and other accounting records maintained separately by the Contractor for the Petroleum Activities.

“Operating Profit” shall have the meaning set forth in Annex 3.

14

Contract No. CNH-R01-L01-A7/2015

“Operator” shall have the meaning set forth in Article 2.5.

“Participating Companies” means Sierra O&G Exploración y Producción, Talos Energy Offshore Mexico 7, and Premier Oil Exploration and Production Mexico, and their respective successors and assignees permitted in accordance with this Contract. If at any time there is only one entity constituting the Contractor, any reference made in this Contract to “each Participating Company,” “the Participating Companies” or similar references, shall be deemed to mean “the Contractor”.

“Participating Interest” shall mean each Participating Company’s undivided share (expressed as a percentage of the total shares of all Participating Companies) in the rights of the Contractor under this Contract, provided that each Participating Company shall be jointly and severally liable for all of the obligations of the Contractor under this Contract regardless of its Participating Interest.

“Parties” shall mean the State (through CNH) and each of the Participating Companies.

“Period” shall mean a Month, provided that when Petroleum Activities are conducted in a period that is less than a full Month, the Period shall be the number of Days the Contract was effectively in operation.

“Person” shall mean any natural person or legal entity of any kind, including any company, association, trust, joint investment, government or other relevant organ or agency thereof.

“Petroleum Activities” shall mean Surface Reconnaissance and Exploration, as well as Exploration, Appraisal, Extraction and Abandonment activities carried out in the Contract Area by the Contractor in accordance with this Contract.

“Preexisting Damages” shall mean the environmental liabilities within the Contract Area in the environmental base line identified in accordance to Articles 3.4 and 14.4.

“Produced Hydrocarbons” shall mean the total volume of Hydrocarbons extracted by the Contractor from the Contract Area.

“Quarter” shall mean any period of three (3) consecutive Months commencing on January 1, April 1, July 1 or October 1 of any Year.

“Recoverable Costs” shall mean Eligible Costs included in the Budgets and Work Programs approved by CNH, provided that they must be effectively paid and its determination and registration must comply with the requirements established in Annexes 4, 10 and 11 attached herein, and the guidelines issued for such effect by the Ministry of Finance in effect as of the date of the award of the Contract.

15

Contract No. CNH-R01-L01-A7/2015

Recoverable Costs Limit” shall mean the result of multiplying the Cost Recovery Percentage by the Contract Value of the Hydrocarbons in any Period, and that determines the maximum portion of the Contract Value of the Hydrocarbons, which may be used for the recovery of Costs during such Period, as provided in Annex 3 herein.

“Recoverable Costs Reimbursement” shall mean the reimbursement of the aggregated amount of the Recoverable Costs, which is subject to the Recoverable Costs Limit, as provided in Article 16 and Annex 4.

“Regular Commercial Production” shall mean the regular sustained production of any Field for the purpose of making commercial use of such production.

“Reserves” shall mean the volume of Hydrocarbons in the Subsoil calculated at a given date at atmospheric conditions which is estimated to be technically and economically feasible to produce under the applicable tax regime, by any of the Extraction methods and systems applicable at the date of Appraisal.

“Risk Management Program” shall mean the actions and measures undertaken for the prevention, monitoring and mitigation of the identified, analyzed and assessed risks, as well as of improvement in the performance of a facility or group of facilities, pursuant to the Management System. This program is derived from the Management System and shall be submitted to CNH who will then forward it to the Agency for approval.

“Royalty” shall mean a determined portion of the State Consideration based on the Contractual Value of the Hydrocarbons, as provided in Annex 3.

“Second Additional Term” shall have the meaning set forth in Article 3.3 (b).

“Self-Consumed Hydrocarbons” shall mean the Hydrocarbons used as fuel to carry out the Petroleum Activities, or flared, vented or reinjected into the reservoir, but only in the manner and amounts approved in accordance with the Applicable Laws.

“Social Impact Evaluation” shall mean the document that contains the identification of the communities and villages located in the influence area of a project regarding Hydrocarbons, as well as, the identification, characterization, prediction and valuation of the consequences towards the population that may be derived from itself and the mitigation measures and the correspondent social management plans.

“State Consideration” shall mean, for any Month beginning with the Month in which Regular Commercial Production commences, the share of Hydrocarbon production from the Contract Area and the other consideration that the Nation is entitled to in accordance with Article 16.2 and Annex 3.

16

Contract No. CNH-R01-L01-A7/2015

“Storage” shall mean the deposit and safeguard of Hydrocarbons in enclosed deposits and facilities that may be located on the surface, at sea or in the subsoil.

“Subcontractors” shall mean those Persons that carry out Petroleum Activities at the request of the Contractor pursuant to Article 19.2.

“Sub-Products” shall mean those elements or components different from Hydrocarbons, such as, Sulfur or any other mineral or substance contained in Crude Oil or Natural Gas that may be separated from Hydrocarbons.

“Sub-Salt Discovery” shall mean a Discovery by direct methods of an accumulation or accumulations of Subsoil Hydrocarbons, where prospective areas exist in sedimentary formations under salt domes.

“Surface Reconnaissance and Exploration” shall mean all Appraisal studies based solely on activities undertaken on the surface of the land or the ocean to assess the possible existence of Hydrocarbons in the Contract Area, including works for the acquisition, as well as the processing, reprocessing or interpretation of information.

“Tax Obligations” shall mean any and all federal, state r municipal taxes, contributions, government fees, government charges, tariffs or withholding taxes of any kind, together with any and all incidental taxes, surcharges, updates and fines, charged or determined at any time by any Governmental Authority.

“Technical Documents” shall mean all studies, reports, spreadsheets and databases, in any form, relating to the Contract Area or the Petroleum Activities.

“Technical Information” shall mean all of the data and information obtained as a result of the Petroleum Activities, including, without limitation: geological, geophysical, geochemical and engineering information; well logs, progress reports, Technical Documents and any other information related to the completion, production, maintenance or performance of Petroleum Activities.

“Tender” shall mean the international public tender number CNH-R01-C01/2014, published in the Official Gazette of the Federation by CNH on December 11, 2014.

“Transition Stage for Startup” shall mean the stage carried in accordance with Article 3.4 and the Applicable Laws.

“Well” shall mean any opening in the ground made by means of drilling or otherwise with the purpose of discovering, appraising or extracting Hydrocarbons or to inject any substance into, or obtain data related to the reservoir.

17

Contract No. CNH-R01-L01-A7/2015

“Work Program” shall mean a detailed program specifying the Petroleum Activities to be carried out by the Contractor during the applicable period, including the time required to carry out each activity described in such program.

“Work Unit” shall mean the unitary magnitude used as reference to establish and evaluate compliance with the activities listed in the Minimum Work Program as provided in Annex 5.

“Year” shall mean a calendar year.

1.2 Use of Singular and Plural. The terms defined in Article 1.1 may be used in this Contract in both their singular and plural forms.

1.3 Headings and References. The Article headings used in this Contract are included herein for convenience only and shall not in any way affect the interpretation of this Contract. Unless otherwise indicated, all references herein to “Articles” and “Annexes” are to the Articles and Annexes of this Contract.

ARTICLE 2.

PURPOSE OF CONTRACT

2.1 Production Sharing Modality. The purpose of this Contract is to provide for the conduction of Petroleum Activities by the Contractor within the Contract Area, under a production sharing modality, at its sole cost and risk, in accordance with the Applicable Laws, Industry Best Practices and the terms and conditions of this Contract, in exchange for receipt of the Considerations payable to the Contractor as provided by the Hydrocarbon Revenues Law.

The Contractor will be solely responsible for and shall pay all Costs and provide all the personnel, technology, Materials and financing necessary to carry out the Petroleum Activities. The Contractor shall have the exclusive right to conduct the Petroleum Activities in the Contract Area, subject to the terms of this Contract and the Applicable Laws. CNH makes no representation or warranty of any kind regarding the Contract Area, and each of the Participating Companies acknowledges that it has received no guarantee from any Governmental Authority that: (i) there will be any Discoveries in the Contract Area; (ii) in the event of a Discovery, it will be considered a Commercial Discovery, or (iii) that it will receive sufficient Hydrocarbons to cover the Costs it may incur by carrying out Petroleum Activities.

2.2 No Grant of Property Rights. This Contract does not confer upon the any Participating Companies any property rights for the Hydrocarbons in the Subsoil, which are and at all times shall remain the property of the Nation. Furthermore, in no event shall any mineral resources other than Hydrocarbons existing in the Contract Area (whether or not discovered by the Contractor) be the property of the Contractor, and the Contractor shall have no right under this Contract to exploit or use such resources. In the event that while conducting Petroleum Activities the Contractor shall discover any

18

Contract No. CNH-R01-L01-A7/2015

mineral resources other than Hydrocarbons in the Contract Area, the Contractor shall notify CNH during the fifteen (15) Days following such discovery. Nothing in this Contract shall limit the Nation’s right to grant to a third party any type of concession, license, agreement or other legal instrument for the exploitation of mineral resources other than Hydrocarbons in accordance with the Applicable Laws. The Contractor shall provide access to the Contract Area to any Person that receives any concession, license or agreement to exploit or use mineral resources other than Hydrocarbons in the Contract Area, on the terms provided by the Applicable Laws.

2.3 Participating Interests. The initial Participating Interests of the

Participating Companies are as follows:

| Participating Company |

Participating Interest |

|||

| Sierra O&G Exploración y Producción |

45 | % | ||

| Talos Energy Offshore Mexico 7 |

45 | % | ||

| Premier Oil Exploration And Production México |

10 | % | ||

No attempted pledge, assignment or transfer of all or part of a Participating Interest shall be valid or become effective except as provided in Article 24.

2.4 Joint and Several Liability. Each of the Participating Companies shall be jointly and severally liable for the performance of any and all of the Contractor’s obligations under this Contract.

2.5 Operator. Talos Energy Offshore Mexico 7 has been designated by the Participating Companies, with the approval of CNH, as the Operator under this Contract, and as such shall perform the Contractor’s obligations under this Contract in the name and on behalf of each of the Participating Companies. Without prejudice to the foregoing, it is understood that all operational aspects of Petroleum Activities shall be carried out exclusively by the Operator on behalf of all the Participating Companies. The failure by the Operator to meet its obligations to the Participating Companies shall not relieve or release any of the Participating Companies from its joint and several liabilities as provided in this Contract. Each of the Participating Companies hereby appoints the Operator as its representative with an authority as broad as necessary to represent such Participating Company before CNH for any matter related to this Contract. It is hereby understood that any matter agreed between CNH and the Operator shall also bind each of the Participating Companies.

19

Contract No. CNH-R01-L01-A7/2015

2.6 Change of Operators. The Participating Companies may change the Operator, and the Operator may resign from its role as Operator, subject to the prior written consent of the CNH, in the understanding that the new operator shall at least comply with the prequalification criteria established for the Operator in the bidding process for this Contract, provided that the Change of Operator occurs during the first five (5) years following the Effective Date, or if applicable, that there is evidence that the new operator has been prequalified by CNH in a bidding process for areas with characteristics similar to the Contract Area of this Contract in the five (5) years prior to the Change of Operator. The change of Operator shall be approved in accordance with Article 24 of this Agreement and in terms with the Applicable Laws. In the event CNH does not issue a decision during the period set forth in this Contract, it will be deemed to have made in favorable decision.

2.7 Reporting of Benefits for Accounting Purposes. Without prejudice to the provisions of Article 2.2, the Participating Companies may report this Contract and the expected benefits hereunder for accounting and financial purposes as provided by the Applicable Laws.

ARTICLE 3.

TERM OF CONTRACT

3.1 Effective Date. This Contract shall become effective on the Effective Date.

3.2 Term. Subject to the other terms and conditions hereof, the duration of this Contract shall be thirty (30) Contract Years as of the Effective Date, in the understanding that the provisions which by their nature must be performed after the termination of this Contract, including those related to Abandonment, indemnification and industrial safety and environmental protection, shall survive its termination.

3.3 Extension. If the Contractor has met all of its obligations under this Contract, it may request from CNH:

(a) Beginning on the twenty-fifth anniversary of the Effective Date, an extension of this Contract for an additional five (5) Years (the “First Additional Term”) provided it compromises to maintain the Regular Commercial Production in the Development Area, with the understanding that the Contractor shall submit such request at least eighteen (18) Months prior to the termination date of the original term of this Contract;

(b) During the First Additional Term (if any), a second extension of this Contract for an additional five (5) Years (the “Second Additional Term”), provided it compromises to maintain the Regular Commercial Production in the Development Area, with the understanding that the Contractor shall submit such request at least eighteen (18) Months prior to the termination date of the First Additional Term.

20

Contract No. CNH-R01-L01-A7/2015

The Contractor shall provide the following items to CNH, along with the requests for a First Additional Term and Second Additional Term: (i) a proposal for modification of the applicable Development Plans that will include a proposal for the Risk Management Program that will include the reservoirs maturity degree; (ii) a Work Program for implementation of the proposed project; (iii) a Budget for the proposed Work Program, and (iv) the production profile anticipated as a result of the proposed Work Program. CNH will review the requests for extension and will determine whether or not to accept the Contractor’s proposals for extension and, if so, under what technical and economic conditions. If CNH authorize the extensions and the Contractor accepts the technical and economic conditions of the extensions, the Parties will amend the terms of this Contract in writing to reflect such conditions.

3.4 Transition Stage for Startup. As of the Effective Date, a stage of ninety (90) Days will take place in which the CNH or a third party designated for such purpose will deliver to the Contractor the Contract Area and shall be conducted as follows:

(a) CNH will provide the Contractor with the information available at the Effective Date regarding Xxxxx and Materials, including the Asset Inventory, the environmental authorizations and the information regarding social impacts in the Contract Area;

(b) The Contractor must document the existence and integrity status of Xxxxx and Materials. The State will supervise that the contractor or assignee in charge of the Contract Area before the Effective Date performs the activities regarding Abandonment of Xxxxx and Materials without use for the Petroleum Activities;

(c) The Contractor must initiate the Social Impact Evaluation that shall be conducted in accordance with the Hydrocarbons Law and the Applicable Laws, which shall allow the identification, characterization and prediction of social impacts, with the purpose of establishing a social base line prior to the beginning of the Petroleum Activities. The State will supervise that the contractor or assignee in charge of the Contract Area before the Effective Date assumes the identified social liabilities derived from the conduction of the Petroleum Activities conducted prior to the Effective Date;

(d) The Contractor must perform the assessments that allow the identification, characterization and prediction of environmental liabilities through a third party authorized by the Mexican Entity of Accreditation, prior authorization from CNH, with the purpose of establishing an environmental base line prior to the beginning of the Petroleum Activities. The State shall supervise that the contractor or assignee in charge of the Contract Area prior to the Effective Date assumes the expenses related with the settlement, cleaning and remediation of the preexisting environmental liabilities;

CNH will be able to join the Contractor during the Transition Stage for Startup directly or through an appointed third party in order to review and validate that the performance of the activities are in accordance with the Industry Best Practices and the Applicable Law;

21

Contract No. CNH-R01-L01-A7/2015

At the end of the Transition Stage for Startup the Contractor shall assume full responsibility over the Contract Area and over their Xxxxx and Materials, except for such liabilities identified in accordance with subparagraphs (b), (c) and (d) above, and

Once the responsibility over the Contract Area is assumed, only Preexisting Damages may proceed if they were determined in the environmental base line in accordance with Article 14.4.

The Transition Stage for Startup shall be conducted in accordance with the Applicable Laws.

3.5 Relinquishment by Contractor. Without prejudice to the provisions in Article 18, the Contractor may at any time relinquish all or any portion(s) of the Contract Area, thereby terminating this Contract with respect to the relevant portion(s) of the Contract Area, by delivering an irrevocable written notice to CNH at least three (3) Months prior to the effective date of such relinquishment. Such relinquishment shall not affect the Contractor’s obligations regarding (i) completion of the Minimum Work Program and the Minimum Program Increase, and if applicable, payment of the corresponding liquidated damages; (ii) Abandonment and delivery of the area pursuant to Article 18, and (iii) relinquishment and return of the Contractual Area in accordance with Article 7. In the case of early termination of this Contract by the Contractor pursuant to this Article 3.5, the Contractor shall not be entitled to receive any indemnification of any kind.

ARTICLE 4.

EXPLORATION PERIOD

4.1 Exploration Plan. Within one hundred and twenty (120) Days following the Effective Date, the Contractor shall submit the Exploration Plan to CNH for its approval. The Exploration Plan shall contemplate at least, the performance of all of the activities provided for in the Minimum Work Program, the Minimum Program Increase and shall include the Risk Management Program.

CNH will grant or deny its approval of the proposed Exploration Plan in a period that will not exceed one hundred and twenty (120) Days following the receipt of the necessary information pursuant to the terms of the Applicable Laws. In the event CNH does not issue a decision during the period provided, it will be deemed to have made a favorable decision.

Without prejudice of its ability to approve the Exploration Plan within the period indicated in this Article 4.1, CNH may issue observations regarding such Exploration Plan, when it: (i) was not drafted as provided by the Industry Best Practices regarding the evaluation of the Hydrocarbons potential, including environmental, industrial security and health in work standards, or (ii) does not foresee the addition of Reserves nor the delimitation of the corresponding Exploration area within the Contract Area. The Contractor must provide the operative solutions and the

22

Contract No. CNH-R01-L01-A7/2015

correspondent adjustments to the Exploration Plan in response to the observations made by CNH. Hearings or attendances may be held in order to resolve in good faith any technical difference that may exist regarding to the observations of the Exploration Plan, in accordance with the Industry Best Practices and the Applicable Laws.

4.2 Initial Exploration Period. The Initial Exploration Period shall have duration of up to four (4) Contract Years from the Effective Date. The Contractor shall be required to complete at least the Minimum Work Program during the Initial Exploration Period. The Contractor may, carry out during the Initial Exploration Period, a fraction or all of the Petroleum Activities provided in the Minimum Program Increase, or as applicable, perform them during the Additional Exploration Period. Likewise, it may carry out additional Work Units pursuant to the terms of the Work Programs and Budgets approved by CNH. Such additional Work Units would be credited in the event that CNH grants the Additional Exploration Period as provided in Article 4.3.

4.3 Additional Exploration Period. Subject to this Article 4.3, by written notice to CNH at least sixty (60) Days prior to the termination of the Initial Exploration Period, the Contractor may request an extension of the Exploration Period for two (2) additional Contract Years following the termination of the Initial Exploration Period. The Contractor may request such extension only if it: (i) has fully complied with the Minimum Work Program during the Initial Exploration Period; (ii) agrees to comply with the Minimum Program Increase not performed during the Initial Exploration Period, and (iii) agrees in addition to perform at least the Work Units equivalents to one (1) Well during the Additional Exploration Period. CNH will approve such extension, if the three (3) foregoing conditions are satisfied; it receives the Additional Period Guarantee within ten (10) Business Days after CNH approves the extension and if the Contractor has complied with all of its other obligations under this Contract.

In the event that during the Initial Exploration Period, the Contractor carried out additional Work Units to those provided in the Minimum Work Program, the Contractor may request the recognition of such additional Work Units as part of the Additional Exploration Period commitment. Such request must be included in the request for the extension of the Exploration Period as provided in this Article 4.3.

4.4 Failure to Comply with the Minimum Work Program or Additional Commitments. In the event of failure to comply with the Minimum Work Program, in the Minimum Program Increase or the additional commitments acquired for the Additional Exploration Period, the Contractor shall pay to the Fund, as representative of the Nation, as liquidated damages:

(a) The amount necessary to carry out Work Units of the Minimum Work Program not completed at the end of the Initial Exploration Period as well as Work Units not completed of the Minimum Program Increase if the Contractor has not been granted with an Additional Exploration Period at the end of the Initial Exploration Period in accordance with this Article 4, calculated as provided in Article 17.1 (c) and in Annex 5, up to the amount of the Initial Performance Guarantee.

23

Contract No. CNH-R01-L01-A7/2015

(b) The amount necessary to carry out the Work Units the Contractor agreed to perform during the Additional Exploration Period pursuant to Article 4.3 that have not been carried out at the end of the Additional Exploration Period calculated as provided by Article 17.1 (b) and in Annex 5, up to the amount of the Additional Period Guarantee.

(c) In the event that the Contractor relinquishes the entire Contract Area pursuant to Article 3.5, the date of relinquishment will be deemed to be the end of the Initial Exploration Period or Additional Exploration Period, as the case may be, and the related liquidated damages pursuant to subparagraphs (a) and (b) of this Article 4.4 will be applicable.

(d) CNH may make effective the Performance Guarantee in the amount of the corresponding liquidated damages in case the Contractor fails to pay such amounts to the Fund within fifteen (15) Days following the end of the Initial Exploration Period or the Additional Exploration Period, as the case may be.

Without prejudice of the provisions of this Contract, once the Contractor pays the amounts described in subparagraphs (a) and (b), or in the event the Performance Guarantee is made effective pursuant to subparagraph (d) of this Article 4.4, it will be considered that the Contractor has corrected the breach of the Minimum Work Program, the Minimum Program Increase or the additional commitments acquired for the Additional Exploration Period.

4.5 Formation Testing. If the Contractor conducts a formation test in any exploration Well, it shall notify CNH at least ten (10) Days prior to the commencement of the formation test. The Contractor shall submit the data derived directly from the test to the National Hydrocarbons Information Center within fifteen (15) Days following completion of the test. Within ninety (90) Days from completion of the formation test, the Contractor shall submit the relevant information to CNH, along with technical studies and reports conducted after the formation test.

4.6 Notice of a Discovery. The Contractor shall provide notice to CNH within five (5) Business Days after any Discovery is confirmed. In addition, within fifteen (15) Days from giving notice of the Discovery, the Contractor shall submit to CNH: (i) all available Technical Information related to the Discovery, including details as to quality, flow and geological formations; (ii) a report analyzing such information and establishing details related to a possible Well testing program, and (iii) its preliminary criteria as to the advisability of conducting an Appraisal of such Discovery, pursuant to the Applicable Laws.

ARTICLE 5.

APPRAISAL

5.1 Appraisal. In the event of a Discovery during the Initial Exploration Period, or Additional Exploration Period, as the case may be, the Contractor may submit to CNH for approval a Work Program and the corresponding Budget for Appraisal activities related to such Discovery, in such case, the provisions of Article 5.2 shall apply.

24

Contract No. CNH-R01-L01-A7/2015

5.2 Appraisal Program. The Work Program for Appraisal activities submitted pursuant to Article 5.1 shall establish the Work Program for Appraisal of the relevant Discovery for a period of twelve (12) Months as of the date of approval of such program, which may be extended for up to an additional twelve (12) Months with the approval of CNH when the technical or commercial complexity of the development of the relevant Discovery merits such an exception (the “Appraisal Period”), except in case of a Non-Associated Natural Gas Discovery, in which the duration shall be subject to the provisions of Article 5.3. The Work Program for Appraisal of the Discovery shall cover the entire area of the structure in which the Discovery was made (the “Appraisal Area”), and shall contain at a minimum the items indicated in Annex 6, with a sufficient scope to allow for an appraisal to determine whether the Discovery can be considered as a Commercial Discovery. In the event CNH denies the approval of the proposed Work Program, CNH shall establish the legal causes and the motivation of such resolution. The Contractor shall commence the Appraisal activities in accordance with the terms of the approved Work Program.

CNH will decide on the proposed Work Program for Appraisal activities within a period not exceeding sixty (60) Days following the receipt of the necessary information pursuant to the terms of the Applicable Laws. CNH may not deny its approval without cause

5.3 Non Associated Natural Gas Discovery. The Appraisal Period for a Non-Associated Natural Gas Discovery shall last twenty four (24) Months, extendable prior approval from CNH for twelve (12) additional Months considering the requirements related to the technical and commercial complexity of such Non-Associated Natural Gas Discovery.

5.4 Hydrocarbons Extracted During Tests. Hydrocarbons obtained from performance of any test made to determine the characteristics of a reservoir and its production flows shall be delivered to the Marketer at the location established in the Work Program approved by CNH for the Appraisal activities. The Fund will receive from the Marketer the revenues resulting from marketing and will transfer to the Contractor the corresponding amounts that correspond in accordance with the mechanisms indicated in Annex 3. With respect to the calculation and payments executed by the Fund in accordance with this Article 5.4., the Hydrocarbons obtained during the performance of any test made to determine the characteristics of the reservoir and the production flows will be considered as Regular Commercial Production.

5.5 Appraisal Report. No later than thirty (30) Days following the end of the Appraisal Period for any type of Discovery, the Contractor shall deliver to CNH a report of all Appraisal activities carried out during such Appraisal Period, containing the minimum information indicated in Annex 7.

25

Contract No. CNH-R01-L01-A7/2015

ARTICLE 6.

DECLARATION OF COMMERCIALITY AND DEVELOPMENT PLAN