CREDIT AGREEMENT by and among DEERFIELD ELGX REVOLVER, LLC, as Agent, THE LENDERS THAT ARE PARTIES HERETO, as the Lenders, ENDOLOGIX, INC., each of its direct and indirect subsidiaries listed on the signature pages hereto and any additional borrower...

Exhibit 10.1

Execution Version

by and among

DEERFIELD ELGX REVOLVER, LLC,

as Agent,

THE LENDERS THAT ARE PARTIES HERETO,

as the Lenders,

ENDOLOGIX, INC.,

each of its direct and indirect subsidiaries listed on the signature pages hereto and any additional borrower that hereafter becomes party hereto, each as Borrower, and collectively as Borrowers

Closing Date: August 9, 2018

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I. DEFINITIONS AND CONSTRUCTION |

1 | |||||

| 1.01 |

Definitions | 1 | ||||

| 1.02 |

Accounting Terms | 48 | ||||

| 1.03 |

Code | 48 | ||||

| 1.04 |

Construction | 48 | ||||

| 1.05 |

Time References | 49 | ||||

| 1.06 |

Schedules and Exhibits | 49 | ||||

| ARTICLE II. LOANS AND TERMS OF PAYMENT |

49 | |||||

| 2.01 |

Revolving Loans | 49 | ||||

| 2.02 |

Borrowing Procedures and Settlements | 50 | ||||

| 2.03 |

Payments; Reductions of Commitments; Prepayments | 53 | ||||

| 2.04 |

Promise to Pay; Promissory Notes | 56 | ||||

| 2.05 |

Interest Rates: Rates, Payments, and Calculations | 56 | ||||

| 2.06 |

[Reserved] | 58 | ||||

| 2.07 |

Designated Account | 58 | ||||

| 2.08 |

Maintenance of Loan Account; Statements of Obligations | 59 | ||||

| 2.09 |

Fees, Changes, Damages and Revolver Exit Payment | 59 | ||||

| 2.10 |

[Reserved] | 62 | ||||

| 2.11 |

Capital Requirements | 62 | ||||

| 2.12 |

Collections; Crediting Payments | 63 | ||||

| 2.13 |

Appointment of Borrower Representative | 64 | ||||

| 2.14 |

Joint and Several Liability of Borrowers | 65 | ||||

| ARTICLE III. CONDITIONS; TERM OF AGREEMENT |

68 | |||||

| 3.01 |

Conditions Precedent to the Initial Extension of Credit | 68 | ||||

| 3.02 |

Conditions Precedent to all Extensions of Credit | 70 | ||||

| 3.03 |

Effect of Maturity | 71 | ||||

| 3.04 |

Conditions Subsequent | 71 | ||||

| ARTICLE IV. REPRESENTATIONS AND WARRANTIES |

71 | |||||

| 4.01 |

Due Organization and Qualification; No Event of Default; Solvency | 72 | ||||

| 4.02 |

Existence; Power and Authority | 72 | ||||

| 4.03 |

Litigation | 72 | ||||

| 4.04 |

Due Authorization; No Conflict | 73 | ||||

| 4.05 |

Permits and Authorizations | 74 | ||||

| 4.06 |

Title to Assets; No Encumbrances | 74 | ||||

| 4.07 |

Intellectual Property | 74 | ||||

| 4.08 |

No Default | 75 | ||||

| 4.09 |

Taxes | 75 | ||||

| 4.10 |

Compliance with Laws | 75 | ||||

| 4.11 |

SEC Filings | 76 | ||||

| 4.12 |

Financial Statements | 76 | ||||

-i-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 4.13 |

Internal Controls | 77 | ||||

| 4.14 |

ERISA | 77 | ||||

| 4.15 |

Subsidiaries | 78 | ||||

| 4.16 |

No Dividends | 78 | ||||

| 4.17 |

Stock | 78 | ||||

| 4.18 |

Material Contracts | 79 | ||||

| 4.19 |

Use of Proceeds | 79 | ||||

| 4.20 |

Environmental Condition | 79 | ||||

| 4.21 |

Governmental Regulation | 80 | ||||

| 4.22 |

Employee and Labor Matters | 80 | ||||

| 4.23 |

Name and Address; Properties | 81 | ||||

| 4.24 |

Sanctions | 81 | ||||

| 4.25 |

Anti-Money Laundering | 81 | ||||

| 4.26 |

Anti-Corruption | 81 | ||||

| 4.27 |

Anti-Terrorism | 81 | ||||

| 4.28 |

Xxxxxxxx-Xxxxx | 82 | ||||

| 4.29 |

Accounting Practices | 82 | ||||

| 4.30 |

Common Stock | 82 | ||||

| 4.31 |

DTC | 82 | ||||

| 4.32 |

Fees | 82 | ||||

| 4.33 |

Products; Regulatory Required Permits | 83 | ||||

| 4.34 |

No Violation of Healthcare Laws | 83 | ||||

| 4.35 |

No Third Party Payor Program | 84 | ||||

| 4.36 |

Conduct of Business at Facilities | 84 | ||||

| 4.37 |

No Adulteration; Product Manufacturing | 84 | ||||

| 4.38 |

FDA | 84 | ||||

| 4.39 |

Margin Stock | 85 | ||||

| 4.40 |

Complete Disclosure | 85 | ||||

| 4.41 |

Investments | 85 | ||||

| 4.42 |

Schedules | 85 | ||||

| 4.43 |

Eligible Accounts | 86 | ||||

| 4.44 |

Eligible Inventory | 86 | ||||

| 4.45 |

Location of Inventory | 86 | ||||

| 4.46 |

Inventory and Equipment Records | 86 | ||||

| 4.47 |

No Violation of Usury Laws | 86 | ||||

| 4.48 |

Eligible Equipment | 86 | ||||

| ARTICLE V. AFFIRMATIVE COVENANTS |

87 | |||||

| 5.01 |

Existence; Permits | 87 | ||||

| 5.02 |

Compliance with Laws | 87 | ||||

| 5.03 |

Insurance | 87 | ||||

| 5.04 |

Taxes | 88 | ||||

| 5.05 |

Reports, Notices | 88 | ||||

| 5.06 |

Inspection | 90 | ||||

| 5.07 |

Disclosure Updates | 90 | ||||

-ii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 5.08 |

Cash Management | 91 | ||||

| 5.09 |

Further Assurances | 91 | ||||

| 5.10 |

Environmental | 92 | ||||

| 5.11 |

ERISA | 92 | ||||

| 5.12 |

FDA; Healthcare Laws | 93 | ||||

| 5.13 |

Regulatory Required Permits | 93 | ||||

| 5.14 |

Material Contracts | 93 | ||||

| 5.15 |

Notices Regarding Indebtedness | 93 | ||||

| 5.16 |

Reporting | 93 | ||||

| 5.17 |

Lender Meetings | 95 | ||||

| 5.18 |

Location of Collateral | 95 | ||||

| 5.19 |

Updated Borrowing Base Certificate | 95 | ||||

| 5.20 |

Announcing Form 8-K | 95 | ||||

| 5.21 |

Eligible Equipment | 97 | ||||

| 5.22 |

Maximum Revolver Related Notices | 97 | ||||

| ARTICLE VI. NEGATIVE COVENANTS |

98 | |||||

| 6.01 |

Restrictions on Fundamental Changes | 98 | ||||

| 6.02 |

Joint Ventures; Restricted Payments | 98 | ||||

| 6.03 |

Liens | 99 | ||||

| 6.04 |

Disposal of Assets | 99 | ||||

| 6.05 |

Indebtedness | 99 | ||||

| 6.06 |

Investments | 99 | ||||

| 6.07 |

Transactions with Affiliates | 99 | ||||

| 6.08 |

ERISA | 100 | ||||

| 6.09 |

Nature of Business | 100 | ||||

| 6.10 |

Amendments to Organizational Documents and Material Contracts | 100 | ||||

| 6.11 |

Changes to Fiscal Year; GAAP | 101 | ||||

| 6.12 |

Prepayments and Amendments | 101 | ||||

| 6.13 |

Restrictions on Distributions | 101 | ||||

| 6.14 |

Sanctions; Anti-Corruption | 101 | ||||

| 6.15 |

Sale Leaseback Transactions | 102 | ||||

| 6.16 |

Environmental | 102 | ||||

| 6.17 |

Investment Company | 102 | ||||

| 6.18 |

Intercreditor Agreement; Term Debt | 102 | ||||

| 6.19 |

Payment of Convertible Notes | 102 | ||||

| 6.20 |

Commingling of Assets | 103 | ||||

| 6.21 |

Limitation on Issuance of Stock | 103 | ||||

| 6.22 |

Use of Proceeds | 103 | ||||

| 6.23 |

Anti-Layering | 103 | ||||

| 6.24 |

Convertible Notes Restrictions | 103 | ||||

| ARTICLE VII. FINANCIAL COVENANTS |

104 | |||||

| 7.01 |

Financial Covenants | 104 | ||||

-iii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| ARTICLE VIII. EVENTS OF DEFAULT |

105 | |||||

| 8.01 |

Payments | 105 | ||||

| 8.02 |

Covenants | 106 | ||||

| 8.03 |

Representations, etc. | 106 | ||||

| 8.04 |

Insolvency; Bankruptcy | 106 | ||||

| 8.05 |

Judgments | 107 | ||||

| 8.06 |

No Governmental Authorization | 107 | ||||

| 8.07 |

Agreement Invalid Under Applicable Law | 107 | ||||

| 8.08 |

Cross-Default | 107 | ||||

| 8.09 |

Loan Documents; Security Interests | 107 | ||||

| 8.10 |

ERISA | 108 | ||||

| 8.11 |

Product Withdrawal | 108 | ||||

| 8.12 |

Change in Law | 108 | ||||

| 8.13 |

Material Contract Default | 108 | ||||

| 8.14 |

Other Default or Breach | 108 | ||||

| 8.15 |

Criminal Proceedings | 109 | ||||

| 8.16 |

Payment of Subordinated Debt | 109 | ||||

| 8.17 |

Any Intercreditor Agreement Provisions Invalid | 109 | ||||

| 8.18 |

Guaranty | 109 | ||||

| 8.19 |

Subordination Provisions | 109 | ||||

| 8.20 |

Change in Control | 109 | ||||

| 8.21 |

Not Publicly Traded | 109 | ||||

| 8.22 |

Term Debt Defaults | 109 | ||||

| ARTICLE IX. RIGHTS AND REMEDIES |

110 | |||||

| 9.01 |

Rights and Remedies | 110 | ||||

| 9.02 |

Remedies Cumulative | 110 | ||||

| ARTICLE X. WAIVERS; INDEMNIFICATION |

111 | |||||

| 10.01 |

Demand; Protest; etc. | 111 | ||||

| 10.02 |

The Lender Group’s Liability for Collateral | 111 | ||||

| 10.03 |

Indemnification | 111 | ||||

| 112 | ||||||

| ARTICLE XII. CHOICE OF LAW AND VENUE; JURY TRIAL WAIVER; JUDICIAL REFERENCE PROVISION |

113 | |||||

| ARTICLE XIII. ASSIGNMENTS AND PARTICIPATIONS; SUCCESSORS |

115 | |||||

| 13.01 |

Assignments and Participations | 115 | ||||

| 13.02 |

Successors | 118 | ||||

-iv-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| ARTICLE XIV. AMENDMENTS; WAIVERS |

119 | |||||

| 14.01 |

Amendments and Waivers | 119 | ||||

| 14.02 |

[Reserved] | 120 | ||||

| 14.03 |

No Waivers; Cumulative Remedies | 120 | ||||

| ARTICLE XV. AGENT; THE LENDER GROUP |

120 | |||||

| 15.01 |

Appointment and Authorization of Agent | 120 | ||||

| 15.02 |

Delegation of Duties | 121 | ||||

| 15.03 |

Liability of Agent | 121 | ||||

| 15.04 |

Reliance by Agent | 122 | ||||

| 15.05 |

Notice of Default or Event of Default | 122 | ||||

| 15.06 |

Credit Decision | 122 | ||||

| 15.07 |

Costs and Expenses; Indemnification | 123 | ||||

| 15.08 |

Agent in Individual Capacity | 123 | ||||

| 15.09 |

Assignment by Agent; Resignation of Agent; Successor Agent | 123 | ||||

| 15.10 |

Lender in Individual Capacity | 124 | ||||

| 15.11 |

Collateral Matters | 124 | ||||

| 15.12 |

Restrictions on Actions by Lenders; Sharing of Payments | 126 | ||||

| 15.13 |

Agency for Perfection | 126 | ||||

| 15.14 |

Payments by Agent to the Lenders | 127 | ||||

| 15.15 |

Concerning the Collateral and Related Loan Documents | 127 | ||||

| 15.16 |

Several Obligations; No Liability | 127 | ||||

| 15.17 |

Right to Request and Act on Instructions | 127 | ||||

| ARTICLE XVI. WITHHOLDING TAXES |

128 | |||||

| 16.01 |

Payments | 128 | ||||

| 16.02 |

Exemptions | 128 | ||||

| 16.03 |

Refunds | 130 | ||||

| ARTICLE XVII. GENERAL PROVISIONS |

130 | |||||

| 17.01 |

Effectiveness | 130 | ||||

| 17.02 |

Article and Section Headings | 130 | ||||

| 17.03 |

Interpretation | 130 | ||||

| 17.04 |

Severability of Provisions | 131 | ||||

| 17.05 |

Debtor-Creditor Relationship | 131 | ||||

| 17.06 |

Counterparts; Electronic Execution | 131 | ||||

| 17.07 |

Revival and Reinstatement of Obligations; Certain Waivers | 131 | ||||

| 17.08 |

Confidentiality | 131 | ||||

| 17.09 |

Survival | 132 | ||||

| 17.10 |

Patriot Act | 133 | ||||

| 17.11 |

Integration | 133 | ||||

| 17.12 |

No Setoff | 133 | ||||

-v-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 17.13 |

Intercreditor Agreement |

133 | ||||

-vi-

EXHIBITS AND SCHEDULES

| Exhibit A-1 |

Form of Assignment and Acceptance | |

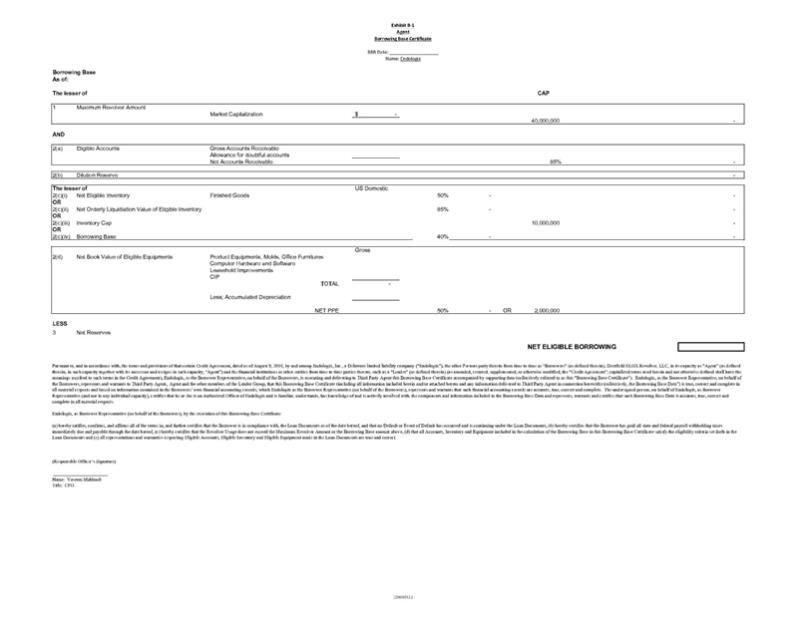

| Exhibit B-1 |

Form of Borrowing Base Certificate (Agent) | |

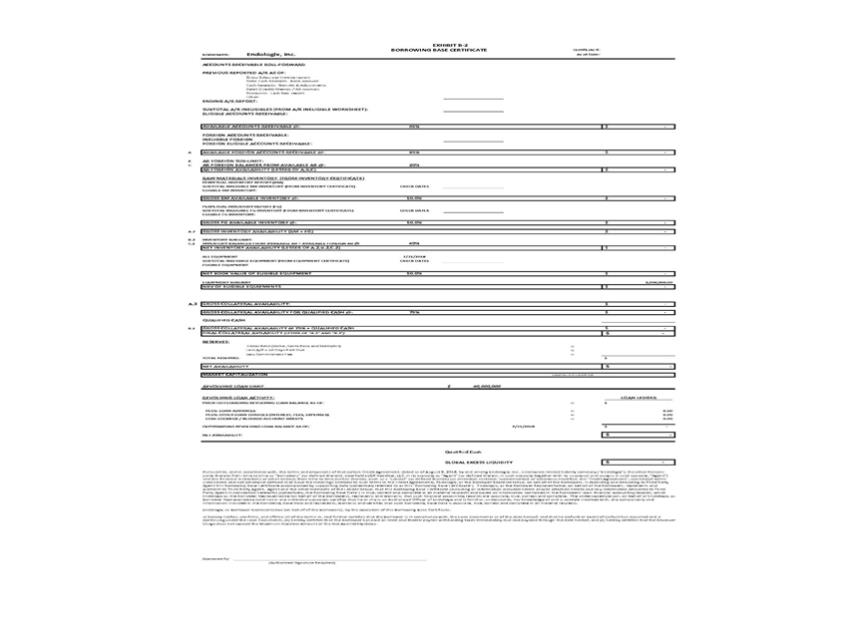

| Exhibit B-2 |

Form of Borrowing Base Certificate (Third Party Agent) | |

| Exhibit C-1 |

Form of Compliance Certificate | |

| Exhibit P-1 |

Form of Perfection Certificate | |

| Schedule A-1 |

Agent’s Account | |

| Schedule A-2 |

Authorized Person | |

| Schedule C-1 |

Commitments | |

| Schedule D-1 |

Designated Account | |

| Schedule E-1 |

Approved Account Debtor | |

| Schedule P-1 |

Existing Investments | |

| Schedule 4.01(d) |

Existing Liens | |

| Schedule 4.01(f) |

Existing Indebtedness | |

| Schedule 4.03 |

Litigation | |

| Schedule 4.06 |

Real Estate | |

| Schedule 4.07 |

Intellectual Property | |

| Schedule 4.15 |

Borrower’s Subsidiaries | |

| Schedule 4.17 |

Borrower’s Outstanding Shares of Stock, Options and Warrants | |

| Schedule 4.18 |

Material Contracts | |

| Schedule 4.20 |

Environmental | |

| Schedule 4.22 |

Labor Relations | |

| Schedule 4.23 |

Jurisdiction of Organization, Legal Name, Organizational Identification Number and Chief Executive Office | |

| Schedule 4.33(a) |

FDA/Governmental Notices | |

| Schedule 4.41 |

Stock of the Subsidiaries of the Loan Parties | |

| Schedule 4.45 |

Inventory Location | |

| Schedule 5.20 |

Other Loan Documents to be Form 8-K Exhibits | |

| Schedule 6.05 |

Contingent Obligations | |

| Schedule 6.07 |

Transactions with Affiliates | |

-vii-

THIS CREDIT AGREEMENT (this “Agreement”), is entered into as of August 9, 2018, by and among the lenders identified on the signature pages hereof (each of such lenders, together with its successors and permitted assigns, is referred to hereinafter as a “Lender”, as that term is hereinafter further defined), DEERFIELD ELGX REVOLVER, LLC, a Delaware limited liability company, as Agent for each member of the Lender Group, Endologix, Inc., a Delaware corporation (“Endologix”), each of its direct and indirect Subsidiaries set forth on the signature pages hereto and any additional borrower that may hereafter be added to this Agreement (individually as a “Borrower”, and collectively with any entities that become party hereto as Borrower and each of their successors and permitted assigns, the “Borrowers”).

Borrowers have requested that Lenders make available to Borrowers the financing facility described herein. Lenders are willing to extend such credit to Borrowers under the terms and conditions set forth.

NOW, THEREFORE, in consideration of the mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

ARTICLE I.

DEFINITIONS AND CONSTRUCTION.

1.01 Definitions. As used in this Agreement, the following terms shall have the meanings set forth below:

“2.25% Convertible Note Documents” means the 2.25% Convertible Notes, the 2.25% Senior Note Indenture and each other document or agreement from time to time entered into in connection with the foregoing.

“2.25% Convertible Notes” means those certain 2.25% senior unsecured notes, governed by the terms of a base indenture, as supplemented by the first supplemental indenture relating to the 2.25% senior notes (together, the “2.25% Senior Notes Indenture”), between Endologix and Xxxxx Fargo Bank, National Association, as trustee, each of which were entered into on December 10, 2013.

“2.25% Senior Notes Indenture” has the meaning provided therefor in the definition of “2.25% Convertible Notes.”

“3.25% Convertible Notes” means those certain 3.25% senior unsecured notes, governed by the terms of a base indenture, as supplemented by the second supplemental indenture relating to the 3.25% senior notes (together, the “3.25% Senior Notes Indenture”), between Endologix and Xxxxx Fargo Bank, National Association, as trustee, each of which were entered into on November 2, 2015, as the same may be amended, restated, refinanced, supplemented or otherwise modified in connection with a Permitted 3.25% Convertible Note Refinancing.

“3.25% Convertible Note Documents” means the 3.25% Convertible Notes, the 3.25% Senior Note Indenture and each other document or agreement from time to entered into in connection with the

foregoing, as the same may be amended, restated, refinanced, supplemented or otherwise modified in on with a Permitted 3.25% Convertible Note Refinancing.

“3.25% Senior Notes Indenture” has the meaning provided therefor in the definition of “3.25% Convertible Notes.”

“10-K” means an annual report on Form 10-K (or successor form thereto), as required to be filed pursuant to the Exchange Act.

“10-Q” means a quarterly report on Form 10-Q (or successor form thereto), as required to be filed pursuant to the Exchange Act.

“Account” means an account (as that term is defined in the Code).

“Account Debtor” means any Person who is obligated on an Account, chattel paper, or a general intangible.

“Acquisition” means any transaction or series of related transactions for the purpose of or resulting, directly or indirectly, in (a) the acquisition of all or substantially all of the assets of a Person, or of any business or division of a Person, (b) the acquisition of in excess of fifty percent (50%) of the Stock of any Person or otherwise causing any Person to become a Subsidiary of the Borrower, (c) a merger or consolidation or any other combination with another Person or (d) the acquisition (including through licensing) of any Product or Intellectual Property of or from another Person if the Acquisition Consideration paid in connection with such acquisition is in excess of $5,000,000 individually or in the aggregate with respect to all such acquisitions in any twelve (12) month period.

“Acquisition Consideration” has the meaning specified therefor in the definition of “Permitted Acquisitions.”

“Administrative Questionnaire” has the meaning specified therefor in Section 13.01(a).

“Affected Lender” has the meaning specified therefor in Section 2.11(b).

“Affiliate” means, with respect to any Person, (a) any Person that directly or indirectly controls such Person, (b) any Person which is controlled by or is under common control with such controlling Person, and (c) each of such Person’s (other than, with respect to any Lender, any Lender’s) officers or directors (or Persons functioning in substantially similar roles) and the spouses, parents, descendants and siblings of such officers, directors or other Persons. As used in this definition, the term “control” of a Person means the possession, directly or indirectly, of the power to vote five percent (5%) or more of any class of voting securities of such Person or to direct or cause the direction of the management or policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Agent” means Deerfield Revolver, in its capacity as administrative agent for itself and for the other members of the Lender Group hereunder, as such capacity is established in, and subject to the provisions of, Article XV, and the successors and assigns of Deerfield Revolver in such capacity, and including, when the context may require, during any Third Party Agent Retention Period, any Third Party Agent.

“Agent-Related Persons” means Agent (including, for the avoidance of doubt, any Third Party Agent), together with its Affiliates, controlling persons and their respective directors, officers, employees,

2

partners, advisors, agents and other representatives of each of the foregoing and their respective successors.

“Agent’s Account” means the Deposit Account of Agent (or, during a Third Party Agent Retention Period, any Third Party Agent) identified on Schedule A-1 (or such other Deposit Account of Agent (or, during a Third Party Agent Retention Period, such Third Party Agent) that has been designated as such, in writing, by Agent (or, during a Third Party Agent Retention Period, such Third Party Agent) to Borrowers and the Lenders).

“Agent’s Liens” means the Liens granted by Borrowers or their Subsidiaries to Agent (or any Third Party Agent) under the Loan Documents and securing the Obligations.

“Agreement” means this Credit Agreement.

“All-in Yield” means the interest rate (including margins and floors), original issue discount and fees paid to all lenders (or consenting lenders) of such debt or their Affiliates (based on the remaining life to maturity), but not including any fees not paid to all lenders (such as fees to initial purchasers (i.e., investment banks in Rule 144A offerings), underwriters or lead agents).

“Announcing Form 8-K” has the meaning specified therefor in Section 5.20.

“Anti-Corruption Laws” means any and all laws, rules, and regulations of any jurisdiction applicable to any Loan Party or any Subsidiary of any Loan Party from time to time concerning or relating to bribery or corruption, including, without limitation, the FCPA, as amended, the UK Xxxxxxx Xxx 0000 and other similar legislation in any other jurisdictions.

“Anti-Money Laundering Laws” means any and all laws, rules, and regulations in effect from time to time related to terrorism or money laundering, including, without limitation, (i) all applicable requirements of the Currency and Foreign Transactions Reporting Act of 1970 (31 U.S.C. 5311 et. seq., (the Bank Secrecy Act)), as amended by Title III of the USA Patriot Act, (ii) the Trading with the Enemy Act, (iii) Executive Order No. 13224 on Terrorist Financing, effective September 24, 2001 (66 Fed. Reg. 49079), and any other enabling legislation, executive order or regulations issued pursuant or relating thereto and (iv) other applicable federal or state laws relating to “know your customer” or anti-money laundering rules and regulations.

“Anti-Terrorism Laws” means any and all laws, regulations, rules, orders, etc. in effect from time to time relating to anti-money laundering and terrorism, including, without limitation, Executive Order No. 13224 (effective September 24, 2001), Trading with the Enemy Act, as amended, and each of the foreign assets control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended), and the USA Patriot Act (Pub. L. No. 107-56 (Oct. 12, 2001)).

“Applicable Laws” means, with respect to any Person, the common law and any federal, state, local, foreign, multinational or international laws, statutes, codes, treaties, standards, rules and regulations, guidelines, ordinances, orders, judgments, writs, injunctions, decrees (including administrative or judicial precedents or authorities) and the interpretation or administration thereof by, and other determinations, directives, requirements or requests of, any Governmental Authority, in each case whether or not having the force of law and that are applicable to or binding upon such Person or any of its property or to which such Person or any of its property is subject. “Applicable Laws” includes Healthcare Laws and Environmental Laws.

“Applicable Revolver Reduction Premium” has the meaning specified in Section 2.09(d)(iii).

3

“Application Event” means the occurrence of (a) a failure by Borrowers to repay all of the Obligations in full in cash on the Maturity Date, or (b) an Event of Default and the election by Agent or the Required Lenders to require that payments and proceeds of Collateral be applied pursuant to Section 2.03(b)(ii).

“Approved Fund” means any (a) investment company, fund, trust, securitization vehicle or conduit that is (or will be) engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit, or (b) any Person (other than a natural person) which temporarily warehouses loans for any Lender or any entity described in the preceding clause (a) and that, with respect to each of the preceding clauses (a) and (b), is administered or managed by (i) a Lender, (ii) an Affiliate of a Lender, or (iii) a Person (other than a natural person) or an Affiliate of a Person (other than a natural person) that administers or manages a Lender.

“Assignee” has the meaning specified therefor in Section 13.01(a).

“Assignment and Acceptance” means an Assignment and Acceptance Agreement substantially in the form of Exhibit A-1 or any other form agreed by the Agent.

“Authorizations” means, with respect to any Person, any permits (including Regulatory Required Permits), approvals, authorizations, licenses, registrations, certificates, clearances, concessions, grants, franchises, variances or permissions from, and any other contractual obligations with, any Governmental Authority, in each case whether or not having the force of law and applicable to or binding upon such Person or any of its property or to which such Person or any of its property is subject, and any supplements or amendments with respect to the foregoing.

“Authorized Person” means any one of the individuals identified on Schedule A-2, as such schedule is updated from time to time by written notice from Borrowers to Agent (and, during any Third Party Agent Retention Period, also to the Third Party Agent).

“Authorized Officer” means the chief executive officer, the president or the chief financial officer of the Borrower Representative or any other officer of the Borrower Representative having substantially the same authority and responsibility.

“Availability” means, as of any date of determination, the amount that Borrowers are entitled to borrow as Revolving Loans under Section 2.01 (after giving effect to the then outstanding Revolver Usage).

“Average Availability” means, with respect to any period, the sum of the aggregate amount of Availability for each Business Day in such period (calculated as of the end of each respective Business Day) divided by the number of Business Days in such period.

“Average Revolver Usage” means, with respect to any period, the sum of the aggregate amount of Revolver Usage for each Business Day in such period (calculated as of the end of each respective Business Day) divided by the number of Business Days in such period.

“Bank of America Cash Collateral Account” means that certain deposit account #1453234066 of Borrower at Bank of America, N.A. (or such replacement deposit account provided by Bank of America, N.A. or by another commercial bank) established and maintained for the sole purpose of providing cash collateral in favor of Bank of America, N.A. (or such replacement commercial bank) for obligations of the Borrower in respect of certain commercial credit cards (or with respect to a replacement commercial bank, similar commercial credit cards to those provided by Bank of America, N.A. as of the Closing

4

Date) provided to the Borrower by Bank of America, N.A. (or such replacement commercial bank); provided that the aggregate amount on deposit in such deposit account (or such replacement deposit account) shall not at any time exceed $2,500,000.

“Bankruptcy Code” means title 11 of the United States Code, as in effect from time to time.

“Blocked Account” has the meaning specified therefor in Section 2.12(a).

“Board of Governors” means the Board of Governors of the Federal Reserve System of the United States (or any successor).

“Borrowers” has the meaning specified therefor in the preamble.

“Borrower Representative” means Endologix, in its capacity as Borrower Representative pursuant to the provisions of Section 2.13, or any successor Borrower Representative selected by Borrowers and approved by Agent.

“Borrowing” means a borrowing consisting of Loans made on the same day by the Lenders (or Agent on behalf thereof), or by Agent in the case of an Extraordinary Advance.

“Borrowing Base” means, as of any date of determination, an amount equal to:

(a) the lesser of:

(i) the Maximum Revolver Amount, and

(ii) an amount equal to:

(A) an amount not to exceed 85% of the aggregate amount of Eligible Accounts; less

(B) the amount, if any, of the Dilution Reserve; plus

(C) the least of (1) the product of 50% multiplied by the value (calculated at the lower of cost or market based on the Borrowers’ historical accounting practices) of Eligible Inventory at such time, (2) the product of 85% multiplied by the Net Orderly Liquidation Value of Eligible Inventory (such determination may be made as to different categories of Eligible Inventory based upon the Net Orderly Liquidation Value applicable to such categories) at such time, (3) the Inventory Cap and (4) an amount equal to 40% of the Borrowing Base; plus

(D) an amount not to exceed 50% of the Net Book Value of Eligible Equipment;

less

(b) the aggregate amount of all Reserves in effect at such time;

provided, that, the Borrowing Base will be automatically adjusted down, if necessary, such that (1) availability from Eligible Foreign Accounts shall never exceed the lesser of (x) $5,000,000 and (y) 20% of the Borrowing Base and (2) availability from Eligible Equipment shall never exceed $2,000,000; and

5

provided, further, that, as of any date of determination prior to the Trigger Date, the Borrowing Base shall never exceed an amount equal to (i) 75% of the Borrowing Base plus (ii) Qualified Cash as of such date.

“Borrowing Base Certificate” means each of the Borrowing Base Certificate (Agent) and Borrowing Base Certificate (Third Party Agent), as the context may require.

“Borrowing Base Certificate (Agent)” means a certificate in the form of Exhibit B-1, which Borrowing Base Certificate (Agent) shall be delivered to Agent in accordance with the terms of this Agreement.

“Borrowing Base Certificate (Third Party Agent)” means a certificate in the form of Exhibit B-2, which Borrowing Base Certificate (Third Party Agent) shall be delivered to a Third Party Agent during a Third Party Agent Retention Period in accordance with the terms of this Agreement.

“Business Day” means any day excluding Saturday, Sunday, and any day which is a legal holiday under the laws of the State of New York or which is a day on which Agent (or, during any Third Party Agent Retention Period, the Third Party Agent) is otherwise closed for transacting business with the public, except that, if a determination of a Business Day shall relate to amounts accruing interest at the LIBOR Rate, the term “Business Day” also shall exclude any day on which banks are closed for dealings in Dollar deposits in the London interbank market.

“Capital Expenditures” means, with respect to any Person for any period, the amount of all expenditures by such Person and its Subsidiaries during such period that are capital expenditures as determined in accordance with GAAP, whether such expenditures are paid in cash or financed, but excluding, without duplication (a) expenditures made during such period in connection with the replacement, substitution, or restoration of assets or properties, (b) with respect to the purchase price of assets that are purchased substantially contemporaneously with the trade-in of existing assets during such period, the amount that the gross amount of such purchase price is reduced by the credit granted by the seller of such assets for the assets being traded in at such time, (c) expenditures made during such period to consummate one or more Permitted Acquisitions, (d) expenditures made during such period to the extent made with the identifiable proceeds of an equity investment in Borrowers which equity investment is made substantially contemporaneously with the making of the expenditure, and (e) expenditures during such period that, pursuant to a written agreement, are reimbursed by a third Person (excluding the Loan Parties and their Affiliates).

“Capital Lease” means, with respect to any Person, any lease of or other arrangement conveying the right to use, any property by such Person as lessee that has been or should be accounted for as a capital lease on a balance sheet of such Person prepared in accordance with GAAP.

“Capital Lease Obligations” means, at any time, with respect to any Capital Lease, any lease entered into as part of any sale leaseback transaction of any Person or any synthetic lease, the amount of all obligations of such Person that is (or that would be, if such synthetic lease or other lease were accounted for as a Capital Lease) capitalized on a balance sheet of such Person prepared in accordance with GAAP.

“Capped Call” means the capped call transactions referenced in Schedule 6.05 in respect of the 2.25% Convertible Notes and any like transactions that are economically similar to such transactions entered into in connection with any Indebtedness contemplated under clause (j) of the definition of Permitted Indebtedness.

6

“Cash Equivalents” means (a) any readily-marketable securities (i) issued by, or directly, unconditionally and fully guaranteed or insured by the United States federal government or (ii) issued by any agency of the United States federal government the obligations of which are fully backed by the full faith and credit of the United States federal government, (b) any readily-marketable direct obligations issued by any other agency of the United States federal government, any state of the United States or any political subdivision of any such state or any public instrumentality thereof, in each case having a rating of at least “A-1” from S&P or at least “P-1” from Xxxxx’x, (c) any commercial paper rated at least “A-1” by S&P or “P-1” by Xxxxx’x and issued by any Person organized under the laws of any state of the United States, (d) any United States dollar-denominated time deposit, insured certificate of deposit, overnight bank deposit or bankers’ acceptance issued or accepted by any commercial bank that is (A) organized under the laws of the United States, any state thereof or the District of Columbia, (B) “adequately capitalized” (as defined in the regulations of its primary federal banking regulators) and (C) has Tier 1 capital (as defined in such regulations) in excess of $250,000,000, (e) shares of any United States money market fund that (i) has substantially all of its assets invested continuously in the types of investments referred to in clause (a), (b), (c) or (d) above with maturities as set forth in the proviso below, (ii) has net assets in excess of $500,000,000 and (iii) has obtained from either S&P or Moody’s the highest rating obtainable for money market funds in the United States; provided, however, that the maturities of all obligations specified in any of clauses (a), (b), (c) or (d) above shall not exceed one year and (f) investments made in accordance with Endologix’ investment policy in effect as of the Closing Date that was provided to the Agent’s counsel on March 14, 2017 at 12:15 p.m. New York time, and any amendments thereto that do not, when taken as a whole, materially increase the risk of the investments made by Endologix from time to time from Endologix’ investment policy in effect as of the Closing Date.

“Cash Management Services” means any cash management or related services including treasury, depository, return items, overdraft, controlled disbursement, merchant store value cards, e-payables services, electronic funds transfer, interstate depository network, automatic clearing house transfer (including the Automated Clearing House processing of electronic funds transfers through the direct Federal Reserve Fedline system) and other customary cash management arrangements.

“Change in Law” means the occurrence after the Closing Date of: (a) the adoption or effectiveness of any law, rule, regulation, judicial ruling, judgment or treaty, (b) any change in any law, rule, regulation, judicial ruling, judgment or treaty or in the administration, interpretation, implementation or application by any Governmental Authority of any law, rule, regulation, guideline or treaty, or (c) the making or issuance by any Governmental Authority of any request, rule, guideline or directive, whether or not having the force of law; provided that notwithstanding anything in the Agreement to the contrary, (i) the Xxxx-Xxxxx Xxxx Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith and (ii) all requests, rules, guidelines or directives concerning capital adequacy promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities shall, in each case, be deemed to be a “Change in Law,” regardless of the date enacted, adopted or issued.

“Change in Control” or “Change of Control” means any of the following events: (a) any Person or two or more Persons acting in concert shall have acquired beneficial ownership, directly or indirectly, of, or shall have acquired by contract or otherwise, or shall have entered into a contract or arrangement that, upon consummation, will result in its or their acquisition of or control over, voting Stock of Endologix (or other securities convertible into such voting Stock) representing more than 50% of the combined voting power of all voting Stock of Endologix; (b) Endologix shall have ceased to own, directly or indirectly, 100% of the Stock of any of its Subsidiaries (with the exception of any Subsidiaries permitted to be dissolved or merged to the extent otherwise permitted by this Agreement and other than,

7

solely with respect to Foreign Subsidiaries, directors qualifying shares as necessary to comply with foreign law); (c) the occurrence of a “Change of Control”, “Change in Control”, “Fundamental Change” or terms of similar import under the 2.25% Convertible Note Documents, the 3.25% Convertible Note Documents, the Term Debt Documents or any Permitted Japan Lifeline Unsecured Debt Documents; or (d) the occurrence of any “Major Transaction” (as defined in any Warrant). As used herein, “beneficial ownership” shall have the meaning provided in Rule 13d-3 of the SEC under the Exchange Act; provided that no Change in Control shall be deemed to have occurred with respect to a “Permitted Successor Transaction” (as defined in the Term Loan Credit Agreement as in effect on the Closing Date) which prohibits the Term Lenders from delivering a “Put Notice” (as defined in the Term Loan Credit Agreement as in effect on the Closing Date) under the Term Loan Credit Agreement as in effect on the Closing Date.

“Closing Date” means the date of this Agreement.

“CMS” means the federal Centers for Medicare and Medicaid Services (formerly the federal Health Care Financing Administration), and any successor Governmental Authority.

“Code” means the New York Uniform Commercial Code, as in effect from time to time.

“Collateral” means all assets and interests in assets and proceeds thereof now owned or hereafter acquired by Borrowers or any of their Subsidiaries in or upon which a Lien is granted by such Person in favor of Agent (or, during any Third Party Agent Retention Period, the Third Party Agent) or the Lenders under any of the Loan Documents, including the “Collateral” (as defined in the Guaranty and Security Agreement).

“Collateral Access Agreement” means a landlord waiver, bailee letter, or acknowledgement agreement of any lessor, warehouseman, processor, consignee, or other Person in possession of, having a Lien upon, or having rights or interests in the Loan Parties’ or their Subsidiaries’ Collateral or books and records, in each case, in form and substance reasonably satisfactory to Agent and the Lenders.

“Commitment” means, with respect to each Lender, its Revolver Commitment and, with respect to all Lenders, their Revolver Commitments, in each case as such Dollar amounts are set forth beside such Lender’s name under the applicable heading on Schedule C-1 or in the Assignment and Acceptance pursuant to which such Lender became a Lender hereunder, as such amounts may be reduced or increased from time to time pursuant to assignments made in accordance with the provisions of Section 13.01.

“Commitment Fee” has the meaning specified therefor in Section 2.09(e).

“Common Stock” means the “Common Stock” of Endologix, with a $0.001 par value per share.

“Compliance Certificate” means a certificate, duly executed by an Authorized Officer of the Borrower Representative, appropriately completed and substantially in the form of Exhibit C-1 hereto.

“Contingent Obligation” means, with respect to any Person, any direct or indirect liability of such Person: (a) with respect to any Indebtedness of another Person (a “Third Party Obligation”) if the purpose or intent of such Person incurring such liability, or the effect thereof, is to provide assurance to the obligee of such Third Party Obligation that such Third Party Obligation will be paid or discharged, or that any agreement relating thereto will be complied with, or that any holder of such Third Party Obligation will be protected, in whole or in part, against loss with respect thereto; (b) with respect to any undrawn portion of any letter of credit issued for the account of such Person or as to which such Person is otherwise liable for the reimbursement of any drawing; (c) under any Swap Contract, to the extent not yet

8

due and payable; (d) to make take-or-pay or similar payments if required regardless of nonperformance by any other party or parties to an agreement; or (e) for any obligations of another Person pursuant to any Guarantee or pursuant to any agreement to purchase, repurchase or otherwise acquire any obligation or any property constituting security therefor, to provide funds for the payment or discharge of such obligation or to preserve the solvency, financial condition or level of income of another Person. The amount of any Contingent Obligation shall be equal to the amount of the obligation so Guaranteed or otherwise supported or, if not a fixed and determinable amount, the maximum amount so Guaranteed or otherwise supported.

“Control Agreement” means a control agreement, in form and substance reasonably satisfactory to Agent and the Lenders, executed and delivered by Borrowers or one of their Subsidiaries, Agent, Term Agent and the applicable securities intermediary (with respect to a Securities Account) or bank (with respect to a Deposit Account).

“Convertible Note Documents” means, collectively the 2.25% Convertible Note Documents and the 3.25% Convertible Note Documents (which, for the avoidance of doubt, shall include the indenture and each other document or agreement from time to time entered into in connection with any Permitted 3.25% Convertible Note Refinancing, in each case, to the extent such indenture, documents or agreements are permitted pursuant to the terms of the definition of “Permitted 3.25% Convertible Note Refinancing”).

“Copyrights” has the meaning specified therefor in the Guaranty and Secured Agreement.

“Copyright Security Agreement” has the meaning specified therefor in the Guaranty and Security Agreement.

“Correction” means the repair, modification, adjustment, relabeling, destruction, or inspection (including patient monitoring) of a product or device without its physical removal from its point of use to some other location.

“Cortland” means Cortland Capital Market Services LLC, a Delaware limited liability company, and its Affiliates and its and their successors and assigns.

“DEA” means the Drug Enforcement Administration of the United States of America, any comparable state or local Governmental Authority, any comparable Governmental Authority in any non-United States jurisdiction, and any successor agency of any of the foregoing.

“Deerfield Revolver” means Deerfield ELGX Revolver, LLC and its successors and assigns.

“Default” means an event, condition, or default that, with the giving of notice, the passage of time, or both, would be an Event of Default.

“Deposit Account” means any deposit account (as that term is defined in the Code).

“Depositary Bank” has the meaning specified therefor in Section 2.12(a).

“Designated Account” means the Deposit Account of Borrower Representative identified on Schedule D-1 (or such other Deposit Account of Borrower Representative located at Designated Account Bank that has been designated as such, in writing, by Borrowers to Agent (and, during any Third Party Agent Retention Period, also to the Third Party Agent)).

9

“Designated Account Bank” has the meaning specified therefor in Schedule D-1 (or such other bank that is located within the United States that has been designated as such, in writing, by Borrowers to Agent (and, during any Third Party Agent Retention Period, also to the Third Party Agent)).

“Dilution” means, as of any date of determination, a percentage, based upon the experience of the immediately prior three (3) months, that is the result of dividing the Dollar amount of (a) bad debt write-downs, discounts, advertising allowances, credits, or other dilutive items with respect to Borrowers’ Accounts during such period, by (b) Borrowers’ xxxxxxxx with respect to Accounts during such period.

“Dilution Reserve” means, as of any date of determination, an amount sufficient to reduce the advance rate against Eligible Accounts by one (1) percentage point for each percentage point by which Dilution is in excess of 5%.

“Dispose” and “Disposition” mean (a) the sale, lease, license, transfer, assignment, conveyance or other disposition of any assets or property (including any transfer or conveyance of any assets or property pursuant to a division or split of a limited liability company or other entity or Person into two or more limited liability companies or other entities or Persons), and (b) the sale or transfer by the Borrower or any Subsidiary of the Borrower of any Stock issued by any Subsidiary of the Borrower.

“Disqualified Stock” means any Stock which, by its terms (or by the terms of any security or other Stock into which it is convertible or for which it is exchangeable), or upon the happening of any event or condition, (a) matures or is mandatorily redeemable (other than solely for Stock that does not constitute Disqualified Stock), pursuant to a sinking fund obligation or otherwise, or is redeemable (in each case, other than solely for Stock that does not constitute Disqualified Stock) at the option of the holder thereof, in whole or in part, on or prior to the date that is one year and one day following the Maturity Date (excluding any provisions requiring redemption upon a “change in control” or similar event, provided that such “change in control” or similar event results in the occurrence of the payment in full in cash of all of the Obligations (other than unasserted contingent indemnification obligations) and the termination of all of the Commitments, (b) is convertible into or exchangeable for (i) debt securities or (ii) any Stock referred to in (a) above, in each case, at any time on or prior to the date that is one year and one day following the Maturity Date at the time such Stock was issued, or (c) is entitled to receive scheduled dividends or distributions in cash prior to the date that is one year and one day following the Maturity Date.

“Dollars” or “$” means United States dollars.

“Domestic Subsidiary” means, with respect to any Person, a Subsidiary of such Person, which is organized, incorporated or otherwise formed under the laws of the United States or any state thereof or the District of Columbia.

10

“Drug Application” means a new drug application, an abbreviated drug application, or a product license application for any Product, as appropriate, as those terms are defined in the FDCA.

“DTC” has the meaning specified therefor in Section 4.31.

“EBITDA” means, for any period, Borrowers and their Subsidiaries’ net income, plus (to the extent deducted from net income in the determination thereof) interest expense, taxes, depreciation and amortization for such period, all calculated on a consolidated basis in accordance with GAAP, consistently applied and determined as of and at the end of such period. For purposes of this Agreement, EBITDA for any period shall be determined by disregarding any extraordinary, unusual or non-recurring items of income during such period.

“Eligible Accounts” means Eligible Domestic Accounts and Eligible Foreign Accounts.

“Eligible Domestic Accounts” means those Accounts created by a Borrower in the ordinary course of its business, that arise out of its sale of goods or rendition of services in the United States that have been acknowledged as accepted by the applicable Account Debtor, that comply with each of the representations and warranties respecting Eligible Domestic Accounts made in the Loan Documents, and that are not excluded as ineligible by virtue of one or more of the excluding criteria set forth below; provided, that such criteria may be revised from time to time by Agent in Agent’s (including, during any Third Party Agent Retention Period, the Third Party Agent’s) Permitted Discretion to address the results of any field examination performed by (or on behalf of) Agent (or, during any Third Party Agent Retention Period, the Third Party Agent) from time to time after the Closing Date. In determining the amount to be included, Eligible Domestic Accounts shall be calculated net of customer deposits, unapplied cash, taxes, discounts, credits, allowances, and rebates. Subject to the proviso to the first sentence of this definition, Eligible Domestic Accounts shall not include the following:

(a) Accounts that the Account Debtor has failed to pay within 90 days of original invoice date, Accounts that are more than 60 days past due or have a credit balance that is more than 60 days past due, or Accounts with selling terms of more than 60 days (or, with respect to Twins & Xxxxxx, 120 days),

(b) Accounts owed by an Account Debtor (or its Affiliates) where 50% or more of all Accounts owed by that Account Debtor (or its Affiliates) are deemed ineligible under clause (a) above,

(c) Accounts with respect to which the Account Debtor is an Affiliate of a Loan Party or an employee or agent of a Loan Party or any Affiliate of a Loan Party,

(d) Accounts arising in a transaction wherein goods are placed on consignment or are sold pursuant to a guaranteed sale, a sale or return, a sale on approval, a xxxx and hold, or any other terms by reason of which the payment by the Account Debtor may be conditional,

(e) Accounts that are not payable in Dollars,

(f) Accounts with respect to which the Account Debtor either (i) does not maintain its chief executive office in the United States or (ii) is not organized under the laws of the United States or any state thereof,

(g) Accounts of a Loan Party with respect to which the Account Debtor is either (i) the United States or any department, agency, or instrumentality of the United States (exclusive, however, of (x) Accounts with respect to which such Loan Party has complied, to the reasonable satisfaction of Agent

11

(or, at the sole option of Agent during any Third Party Agent Retention Period, the Third Party Agent), with the Assignment of Claims Act, 31 USC §3727 and (y) up to $1,000,000, in the aggregate, of Accounts where the Account Debtor is satisfactory to Agent (including, during any Third Party Agent Retention Period, the Third Party Agent) in its Permitted Discretion), or (ii) any state of the United States,

(h) Accounts with respect to which the Account Debtor is a creditor of a Loan Party, has or has asserted a right of recoupment or setoff, or has disputed its obligation to pay all or any portion of the Account, but only to the extent of such claim, right of recoupment or setoff, or dispute,

(i) Accounts with respect to an Account Debtor whose total obligations owing to the Loan Parties exceed 20% of all Eligible Accounts, to the extent of the obligations owing by such Account Debtor in excess of such percentage; provided, that, in each case, the amount of Eligible Accounts that are excluded because they exceed the foregoing percentage shall be determined by Agent (or, at the sole option of Agent during any Third Party Agent Retention Period, the Third Party Agent) based on all of the otherwise Eligible Accounts prior to giving effect to any eliminations based upon the foregoing concentration limit,

(j) Accounts with respect to which the Account Debtor is subject to an Insolvency Proceeding, is not Solvent, has gone out of business, or as to which a Loan Party has received notice of an imminent Insolvency Proceeding or a material impairment of the financial condition of such Account Debtor,

(k) Accounts, the collection of which, Agent (including, during any Third Party Agent Retention Period, the Third Party Agent), in its Permitted Discretion, believes to be doubtful, including by reason of the Account Debtor’s financial condition,

(l) Accounts that are not subject to a valid and perfected first priority Agent’s Lien,

(m) Accounts with respect to which (i) the goods giving rise to such Account have not been shipped and billed to the Account Debtor, or (ii) the services giving rise to such Account have not been performed and billed to the Account Debtor,

(n) Accounts with respect to which the Account Debtor is a Sanctioned Person or Sanctioned Entity,

(o) Accounts with respect to which the Account Debtor is an individual,

(p) Accounts that represent the right to receive progress payments or other advance xxxxxxxx that are due prior to the completion of performance by a Loan Party of the subject contract for goods or services, or

(q) Accounts where the Account or the applicable Account Debtor fails to meet such other specifications and requirements which may be from time to time established by Agent (including, during any Third Party Agent Retention Period, the Third Party Agent) in its Permitted Discretion.

“Eligible Assignee” means (a) a Lender, (b) an Affiliate of a Lender, (c) a Related Fund, and (d) any other Person (other than a natural person) approved by Agent; provided, however, that solely with respect to clause (d) above, no such Person shall include (i) Borrowers or any of Borrowers’ Affiliates or (ii) unless an Event of Default has occurred and is continuing, (A) any direct competitor of the Loan Parties, in each case, as determined by Agent in its reasonable discretion, (B) any investor or fund that has

12

publicly announced in writing its intention to obtain control of Endologix publicly or otherwise to the knowledge of the assigning Lender, or (D) any Person listed in the email delivered by prior counsel to Endologix to counsel to the Agent on March 16, 2017 at 5:00 p.m. (Pacific time) and any Affiliates or Approved Funds of any such Person actually known to the assigning Lender and to the Agent to be Affiliates or Approved Funds of any such Person.

“Eligible Foreign Accounts” means those Accounts created by a Borrower in the Ordinary Course of Business, have been acknowledged as accepted by the applicable Account Debtor, that comply with each of the representations and warranties respecting Eligible Foreign Accounts made in the Loan Documents, and with respect to which the applicable Account Debtor does not have its principal place of business in the United States (but is not located in an OFAC sanctioned country), and in each case that are: (i) supported by an irrevocable letter of credit reasonably satisfactory to Agent and the Lenders (as to form, substance, and issuer or domestic confirming bank) that has been delivered to Agent and is directly drawable by Agent, (ii) covered by credit insurance in form, substance, and amount, and by an insurer, reasonably satisfactory to Agent and the Lenders or (iii) generated by an Account Debtor with its principal place of business in a jurisdiction approved by Agent (including, during any Third Party Agent Retention Period, the Third Party Agent) on a case-by-case basis in its Permitted Discretion; provided, that it is understood that the Account Debtors set forth on Schedule E-1 are in approved jurisdictions as of the date hereof. In addition, Eligible Foreign Accounts shall only include Accounts that are not excluded as ineligible by virtue of one or more of the excluding criteria set forth below; provided, that such criteria may be revised from time to time by Agent in Agent’s (including, during any Third Party Agent Retention Period, the Third Party Agent’s) Permitted Discretion to address the results of any field examination performed by (or on behalf of) Agent (or, during any Third Party Agent Retention Period, the Third Party Agent) from time to time after the Closing Date. In determining the amount to be included, Eligible Foreign Accounts shall be calculated net of customer deposits, unapplied cash, taxes, discounts, credits, allowances, and rebates. Subject to the proviso to the second sentence of this definition, Eligible Foreign Accounts shall not include the following:

(a) Accounts that the Account Debtor has failed to pay within 90 days of original invoice date, Accounts that are more than 60 days past due or have a credit balance that is more than 60 days past due, or Accounts with selling terms of more than 60 days,

(b) Accounts owed by an Account Debtor (or its Affiliates) where 50% or more of all Accounts owed by that Account Debtor (or its Affiliates) are deemed ineligible under clause (a) above,

(c) Accounts with respect to which the Account Debtor is an Affiliate of a Loan Party or an employee or agent of a Loan Party or any Affiliate of a Loan Party,

(d) Accounts arising in a transaction wherein goods are placed on consignment or are sold pursuant to a guaranteed sale, a sale or return, a sale on approval, a xxxx and hold, or any other terms by reason of which the payment by the Account Debtor may be conditional,

(e) Accounts that are not payable in US Dollars,

(f) Accounts with respect to which the Account Debtor is the government of any foreign country or sovereign state, or of any state, province, municipality, or other political subdivision thereof, or of any department, agency, public corporation, or other instrumentality thereof,

(g) Accounts of a Loan Party with respect to which the Account Debtor is either (i) the United States or any department, agency, or instrumentality of the United States (exclusive, however, of

13

Accounts with respect to which such Loan Party has complied, to the reasonable satisfaction of Agent (or, at the sole option of Agent during any Third Party Agent Retention Period, the Third Party Agent), with the Assignment of Claims Act, 31 USC §3727), or (ii) any state of the United States,

(h) Accounts with respect to which the Account Debtor is a creditor of a Loan Party, has or has asserted a right of recoupment or setoff, or has disputed its obligation to pay all or any portion of the Account, but only to the extent of such claim, right of recoupment or setoff, or dispute,

(i) Accounts with respect to an Account Debtor whose total obligations owing to the Loan Parties exceed 20% of all Eligible Accounts, to the extent of the obligations owing by such Account Debtor in excess of such percentage; provided, that, in each case, the amount of Eligible Accounts that are excluded because they exceed the foregoing percentage shall be determined by Agent (or, at the sole option of Agent during any Third Party Agent Retention Period, the Third Party Agent) based on all of the otherwise Eligible Accounts prior to giving effect to any eliminations based upon the foregoing concentration limit,

(j) Accounts with respect to which the Account Debtor is subject to an Insolvency Proceeding, is not Solvent, has gone out of business, or as to which a Loan Party has received notice of an imminent Insolvency Proceeding or a material impairment of the financial condition of such Account Debtor,

(k) Accounts, the collection of which, Agent (including, during any Third Party Agent Retention Period, the Third Party Agent), in its Permitted Discretion, believes to be doubtful, including by reason of the Account Debtor’s financial condition,

(l) Accounts that are not subject to a valid and perfected first priority Agent’s Lien,

(m) Accounts with respect to which (i) the goods giving rise to such Account have not been shipped and billed to the Account Debtor, or (ii) the services giving rise to such Account have not been performed and billed to the Account Debtor,

(n) Accounts with respect to which the Account Debtor is a Sanctioned Person or Sanctioned Entity,

(o) Accounts with respect to which the Account Debtor is an individual,

(p) Accounts that represent the right to receive progress payments or other advance xxxxxxxx that are due prior to the completion of performance by a Loan Party of the subject contract for goods or services, or

(q) Accounts where the Account or the applicable Account Debtor fails to meet such other specifications and requirements which may be from time to time established by Agent (including, during any Third Party Agent Retention Period, the Third Party Agent) in its Permitted Discretion.

“Eligible Equipment” means, subject to the criteria below, all Equipment that is: (a) owned by a Borrower (and for which a Borrower has good and lawful title thereto) free and clear of all Liens other than Liens in favor of Agent securing the Obligations, (b) installed in a facility in the United States (i) owned by a Borrower or (ii) leased by a Loan Party and subject to a landlord’s agreement in favor of Agent that is in form and substance reasonably satisfactory to Agent and the Lenders, (c) in good working order and operating condition (ordinary wear and tear excepted), (d) not obsolete, outdated or surplus

14

Equipment, (e) subject to a first priority Lien in favor of Agent (for the benefit of itself and the Lenders), (f) not “fixtures” under the Applicable Laws of the jurisdiction in which such Equipment is located, (g) subject to liability and property and casualty insurance with insurers reasonable acceptable to Agent and the Lenders and in an amount reasonably acceptable to Agent and the Lenders naming Agent as an additional insured and lender’s loss payee on such insurance policies with evidence reflecting such that is reasonably satisfactory to Agent and the Lenders, and (h) not determined by Agent (or, during any Third Party Agent Retention Period, the Third Party Agent) in its Permitted Discretion to be unacceptable due to age, type, category, quality or quantity and/or for any other reason whatsoever. In addition, Agent (and, during any Third Party Agent Retention Period, the Third Party Agent) reserves the right, at any time and from time to time after the Closing Date (including on the basis of any appraisal conducted after the Closing Date), to adjust any of the applicable criteria, to establish new criteria and to adjust advance rates with respect to Eligible Equipment in its reasonable and good faith credit judgment and discretion, subject to the approval of Required Lenders in the case of adjustments or new criteria or changes in advance rates which have the effect of making more credit available.

“Eligible Inventory” means Inventory of a Loan Party, that complies with each of the representations and warranties respecting Eligible Inventory made in the Loan Documents, and that is not excluded as ineligible by virtue of one or more of the excluding criteria set forth below; provided, that such criteria may be revised from time to time by Agent in Agent’s (including, during any Third Party Agent Retention Period, the Third Party Agent’s) Permitted Discretion to address the results of any field examination or appraisal performed by (or on behalf of) Agent (or, during any Third Party Agent Retention Period, the Third Party Agent) from time to time after the Closing Date. In determining the amount to be so included, Inventory shall be valued at the lower of cost or market on a basis consistent with Borrowers’ historical accounting practices. Subject to the proviso to the first sentence of this definition, an item of Inventory shall not be included in Eligible Inventory if:

(a) such Loan Party does not have good, valid, and marketable title thereto,

(b) such Loan Party does not have actual and exclusive possession thereof (either directly or through a bailee or agent of such Loan Party),

(c) it is not located at one of the locations in the continental United States set forth on Schedule 4.45 or is Trunk Inventory,

(d) it is in-transit,

(e) it is located on Real Property leased by such Loan Party or in a contract warehouse, in each case, unless it is subject to a Collateral Access Agreement executed by the lessor or warehouseman, as the case may be, and unless it is segregated or otherwise separately identifiable from goods of others, if any, stored on the premises, or Agent (or, during any Third Party Agent Retention Period, the Third Party Agent) has established a Landlord Reserve with respect to such location,

(f) it is not held for sale in the Borrowers’ Ordinary Course of Business (unless it consists of first quality raw materials) or is not of good and merchantable quality, or it has not been approved for sale by the Borrowers, or it is quarantined from Borrowers’ general Inventory population or is rejected by Borrowers’ Material Review Board,

(g) it is not subject to a valid and perfected first priority Agent’s Xxxx,

00

(h) it consists of goods returned or rejected by such Loan Party’s customers or is subject to a Recall,

(i) it consists of goods that are obsolete or slow moving, restrictive or custom items, display or demo items, discontinued items, work-in-process, items used in research and development, or goods that constitute spare parts, packaging and shipping materials, supplies used or consumed in such Loan Party’s business, xxxx and hold goods, defective goods, “seconds,” or Inventory acquired on consignment, or Inventory on consignment with third parties,

(j) such Inventory is not covered by casualty insurance reasonably acceptable to Agent and the Lenders,

(k) it consists of goods that can be transported or sold only with licenses that are not readily available or of any substances defined or designated as hazardous or toxic waste, hazardous or toxic material, hazardous or toxic substance, or similar term, by any environmental law or any Governmental Authority applicable to Borrowers or their business, operations or assets,

(l) it does not meet all standards imposed by any Governmental Authority in all material respects, including with respect to its production, acquisition, sale or importation (as the case may be,

(m) it has expired or is obsolete,

(n) such Inventory is located at the Santa Xxxx location and a reserve has been established on the books of the Borrowers against such Inventory in accordance with Endologix’s standards in place regarding aged Inventory,

(o) it is held for rental or lease by or on behalf of Borrowers,

(p) it is subject to third party trademark, licensing or other proprietary rights, unless Agent is satisfied that such Inventory can be freely sold by Agent on and after the occurrence of an Event of a Default despite such third party rights, or

(q) it fails to meet such other specifications and requirements which may from time to time be established by Agent (including, during any Third Party Agent Retention Period, the Third Party Agent) in its Permitted Discretion. Notwithstanding the foregoing, the valuation of Inventory shall be subject to any legal limitations on sale and transfer of such Inventory.

“Employee” means any employee of any Loan Party or any Subsidiary of any Loan Party.

“Employee Benefit Plan” means any “employee benefit plan” within the meaning of Section 3(3) of ERISA, under which (A) any current or former employee, director or independent contractor of the Borrower or any of its Subsidiaries has any present or future right to benefits or compensation and which is contributed to, sponsored by or maintained by the Borrower or any of its Subsidiaries or (B) the Borrower or any of its Subsidiaries has had or has or could reasonably be expected, individually or in the aggregate, to have any present or future obligation or liability.

“Environmental Action” means any written complaint, summons, citation, notice, directive, order, claim, litigation, investigation, judicial or administrative proceeding, judgment, letter, or other written communication from any Governmental Authority, or any third party involving violations of or liability under Environmental Laws or releases of Hazardous Materials, including, without limitation, (a) from any

16

assets, properties, or businesses of any Borrower, any Subsidiary of a Borrower, or any of their predecessors in interest, (b) from adjoining properties or businesses, or (c) from or onto any facilities which received Hazardous Materials generated by any Borrower, any Subsidiary of any Borrower, or any of their predecessors in interest.

“Environmental Laws” means all Applicable Laws, Authorizations and permits imposing liability or standards of conduct for or relating to the regulation and protection of human health, safety, the workplace, the environment and natural resources, and including public notification requirements and environmental transfer of ownership, notification or approval statutes.

“Environmental Liabilities” means all Liabilities (including costs of removal and remedial actions, natural resource damages and costs and expenses of investigation and feasibility studies, including the cost of environmental consultants and attorneys’ costs) that may be imposed on, incurred by or asserted against any Loan Party or any Subsidiary of any Loan Party as a result of, or related to, any claim, suit, action, investigation, proceeding or demand by any Person, whether based in contract, tort, implied or express warranty, strict liability, criminal or civil statute or common law or otherwise, arising under any Environmental Law resulting from the ownership, lease, sublease or other operation or occupation of property by any Loan Party or any Subsidiary of any Loan Party, whether on, prior or after the date hereof.

“Environmental Permits” has the meaning specified therefor in Section 4.20(a).

“Equipment” means all “equipment,” as such term is defined in the UCC, now owned or hereafter acquired by any Loan Party, wherever located.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended and applicable published guidance thereunder.

“ERISA Affiliate” means collectively the Borrower, any Subsidiary of Borrower and any Person under common control or treated as a single employer with, Borrower or any Subsidiary of Borrower within the meaning of IRC Section 414 (b), (c), (m) or (o) or under ERISA.

“ERISA Event” means any of the following: (a) a reportable event described in Section 4043(b) or (c) of ERISA (other than an event for which the 30-day notice period is waived) with respect to a Title IV Plan; (b) the withdrawal of any ERISA Affiliate from a Title IV Plan subject to Section 4063 of ERISA during a plan year in which it was a substantial employer, as defined in Section 4001(a)(2) of ERISA; (c) the complete or partial withdrawal of any ERISA Affiliate from any Multiemployer Plan; (d) with respect to any Multiemployer Plan, the filing of a notice of insolvency or termination, or treatment of a plan amendment as termination, under Section 4041A of ERISA; (e) the filing of a notice of intent to terminate a Title IV Plan, or treatment of a plan amendment as termination, under Section 4041 of ERISA; (f) the institution of proceedings to terminate a Title IV Plan or Multiemployer Plan by the PBGC; (g) the failure to make any required contribution to any Title IV Plan or Multiemployer Plan when due; (h) the imposition of a Lien under Section 412 or 430(k) of the IRC or Section 303 or 4068 of ERISA on any property (or rights to property, whether real or personal) of any ERISA Affiliate; (i) the failure of an Employee Benefit Plan or any trust thereunder intended to qualify for tax exempt status under Section 401 or 501 of the IRC or other Applicable Law to qualify thereunder; (j) a Title IV plan is in “at risk” status within the meaning of IRC Section 430(i); (k) a Multiemployer Plan is in “endangered status” or “critical status” within the meaning of Section 432(b) of the IRC; and (l) any other event or condition that constitutes grounds under Section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any Title IV Plan or Multiemployer Plan or for the imposition of

17

any Liability upon any ERISA Affiliate under Title IV of ERISA other than for contributions to Title IV Plans and Multiemployer Plans in the ordinary course and PBGC premiums due but not delinquent

“Event of Default” has the meaning specified therefor in Article VIII.

“Excess Availability” means, as of any date of determination, the amount equal to Availability minus the aggregate amount, if any, of all trade payables of Borrowers and their Subsidiaries aged in excess of thirty (30) days with respect thereto and all book overdrafts of Borrowers and their Subsidiaries in excess of historical practices with respect thereto, in each case as determined by Agent (including, during any Third Party Agent Retention Period, the Third Party Agent) in its Permitted Discretion.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, including the rules and regulations promulgated thereunder.

“Excluded Accounts” has the meaning specified therefor in Section 5.08.

“Excluded Domestic Holdco” means a wholly-owned Domestic Subsidiary of a Borrower substantially all of the assets of which consist of Stock of Excluded Foreign Subsidiaries held directly or indirectly by such Subsidiary and which does not engage in any business, operations or activity other than that of a holding company, excluding for purposes of such determination, Indebtedness of such Excluded Foreign Subsidiaries.

“Excluded Foreign Subsidiary” means any Foreign Subsidiary which is a controlled foreign corporation (as defined in the IRC) that has not guaranteed or pledged any of its assets to secure, or with respect to which there shall not have been pledged two-thirds or more of the voting Stock to secure, any Indebtedness (other than the Obligations) of a Loan Party.

“Excluded Property” means, collectively:

(a) voting shares of any (A) Excluded Foreign Subsidiary of Borrower or (B) Excluded Domestic Holdco, in each case, in excess of 65% of all of the issued and outstanding voting shares of capital stock of such subsidiary;

(b) any lease, license, contract, property right or agreement as to which, if and to the extent that, and only for so long as, the grant of a security interest therein shall (1) constitute or result in a breach, termination or default under any such lease, license, contract, property right or agreement or render it unenforceable, (2) be prohibited by any applicable law or (3) require the consent of any third party (in each case of clauses (1), (2) and (3), other than to the extent that any such breach, termination, default, prohibition or requirement for consent would be rendered ineffective pursuant to Sections 9-406, 9-407, 9-408 or 9-409 of the UCC of any relevant jurisdiction or any other applicable Law), provided that such security interest shall attach immediately to each portion of such lease, license, contract, property rights or agreement that does not result in any of the consequences specified above;

(c) any “intent to use” trademark applications for which a statement of use has not been filed (but only until such statement is filed);

(d) motor vehicles and other assets, in each instance, in which perfection of a security requires notation on certificates of title with a value, individually, of less than $250,000;

(e) without in any way limiting clause (a) above, equity interests in any Person (other than wholly owned Subsidiaries) to the extent not permitted by the terms of such Person’s organizational or

18

joint venture documents (so long as such joint venture was not entered into (or such Subsidiary was not formed) in contravention of the terms of the Loan Documents and such prohibition did not arise in anticipation of the restrictions under the Loan Documents);

(f) any assets financed by purchase money Indebtedness or Capital Leases, to the extent such purchase money Indebtedness or Capital Lease is permitted hereunder, if the documentation governing such purchase money Indebtedness or Capital Leases securing such purchase money Indebtedness or Capital Leases prohibits the creation of a security interest or lien thereon or requires the consent of any Person as a condition to the creation of any other security interest or lien on such property or if such contract or other agreement would be breached or give any party the right to terminate it as a result of creation of such security interest or lien;

(g) those assets as to which Agent determines (in its sole discretion) that the cost of obtaining such a security interest or perfection thereof are excessive in relation to the benefit to the Lender Group of the security to be afforded thereby; and

(h) the Bank of America Cash Collateral Account;