CREDIT AGREEMENT Dated as of August 9, 2006 among NIELSEN FINANCE LLC, as a U.S. Borrower, VNU, INC., as a U.S. Borrower, VNU HOLDING AND FINANCE B.V., as Dutch Borrower, THE GUARANTORS PARTY HERETO FROM TIME TO TIME CITIBANK, N.A., as Administrative...

Exhibit 4.1(a)

Dated as of August 9, 2006

among

XXXXXXX FINANCE LLC,

as a U.S. Borrower,

VNU, INC.,

as a U.S. Borrower,

VNU HOLDING AND FINANCE B.V.,

as Dutch Borrower,

THE GUARANTORS PARTY HERETO FROM TIME TO TIME

CITIBANK, N.A.,

as Administrative Agent, Swing Line Lender and L/C Issuer,

ABN AMRO BANK N.V.,

as Swing Line Lender

THE OTHER LENDERS PARTY HERETO FROM TIME TO TIME,

DEUTSCHE BANK SECURITIES INC.,

as Syndication Agent,

and

JPMORGAN CHASE BANK, N.A.,

ABN AMRO BANK N.V. and

ING BANK N.V.,

as Co-Documentation Agents

CITIGROUP GLOBAL MARKETS INC.,

DEUTSCHE BANK SECURITIES INC. and

X.X. XXXXXX SECURITIES INC.,

as Co-Lead Arrangers and Joint Bookrunners

TABLE OF CONTENTS

| Page | ||||

| ARTICLE I. |

||||

| DEFINITIONS AND ACCOUNTING TERMS | ||||

| Section 1.01 |

Defined Terms. | 1 | ||

| Section 1.02 |

Other Interpretive Provisions. | 59 | ||

| Section 1.03 |

Accounting Terms. | 59 | ||

| Section 1.04 |

Rounding. | 60 | ||

| Section 1.05 |

References to Agreements, Laws, Etc. | 60 | ||

| Section 1.06 |

Times of Day. | 60 | ||

| Section 1.07 |

Timing of Payment of Performance. | 60 | ||

| Section 1.08 |

Currency Equivalents Generally. | 60 | ||

| Section 1.09 |

Change of Currency. | 61 | ||

| Section 1.10 |

Cumulative Credit Transactions. | 61 | ||

| ARTICLE II. |

||||

| THE COMMITMENTS AND CREDIT EXTENSIONS | ||||

| Section 2.01 |

The Loans. | 62 | ||

| Section 2.02 |

Borrowings, Conversions and Continuations of Loans. | 63 | ||

| Section 2.03 |

Letters of Credit. | 66 | ||

| Section 2.04 |

Swing Line Loans. | 75 | ||

| Section 2.05 |

Prepayments. | 78 | ||

| Section 2.06 |

Termination or Reduction of Commitments. | 81 | ||

| Section 2.07 |

Repayment of Loans. | 82 | ||

| Section 2.08 |

Interest. | 83 | ||

| Section 2.09 |

Fees. | 84 | ||

| Section 2.10 |

Computation of Interest and Fees. | 84 | ||

| Section 2.11 |

Evidence of Indebtedness. | 85 | ||

| Section 2.12 |

Payments Generally. | 85 | ||

| Section 2.13 |

Sharing of Payments. | 88 | ||

| Section 2.14 |

Incremental Credit Extensions. | 89 | ||

| Section 2.15 |

Currency Equivalents. | 91 | ||

| ARTICLE III. |

||||

| TAXES, INCREASED COSTS PROTECTION AND ILLEGALITY | ||||

| Section 3.01 |

Taxes. | 92 | ||

-i-

| Page | ||||

| Section 3.02 |

Illegality. | 94 | ||

| Section 3.03 |

Inability to Determine Rates. | 94 | ||

| Section 3.04 |

Increased Cost and Reduced Return; Capital Adequacy; Reserves on Eurocurrency Rate Loans. | 95 | ||

| Section 3.05 |

Funding Losses. | 96 | ||

| Section 3.06 |

Matters Applicable to All Requests for Compensation. | 97 | ||

| Section 3.07 |

Replacement of Lenders under Certain Circumstances. | 98 | ||

| Section 3.08 |

Survival. | 99 | ||

| ARTICLE IV. |

||||

| CONDITIONS PRECEDENT TO CREDIT EXTENSIONS | ||||

| Section 4.01 |

Conditions Precedent to Term Loan Borrowings. | 100 | ||

| Section 4.02 |

Conditions to Credit Extensions under Revolving Credit Facilities. | 100 | ||

| ARTICLE V. |

||||

| REPRESENTATIONS AND WARRANTIES | ||||

| Section 5.01 |

Existence, Qualification and Power; Compliance with Laws. | 101 | ||

| Section 5.02 |

Authorization; No Contravention. | 101 | ||

| Section 5.03 |

Governmental Authorization; Other Consents. | 102 | ||

| Section 5.04 |

Binding Effect. | 102 | ||

| Section 5.05 |

Financial Statements; No Material Adverse Effect. | 103 | ||

| Section 5.06 |

Litigation. | 104 | ||

| Section 5.07 |

No Default. | 104 | ||

| Section 5.08 |

Ownership of Property; Liens. | 104 | ||

| Section 5.09 |

Environmental Compliance. | 104 | ||

| Section 5.10 |

Taxes. | 106 | ||

| Section 5.11 |

ERISA Compliance. | 106 | ||

| Section 5.12 |

Subsidiaries; Equity Interests. | 106 | ||

| Section 5.13 |

Margin Regulations; Investment Company Act. | 107 | ||

| Section 5.14 |

Disclosure. | 107 | ||

| Section 5.15 |

Labor Matters. | 107 | ||

| Section 5.16 |

Patriot Act. | 108 | ||

| Section 5.17 |

Intellectual Property; Licenses, Etc. | 109 | ||

| Section 5.18 |

Solvency. | 109 | ||

-ii-

| Page | ||||

| Section 5.19 |

Subordination of Junior Financing. | 109 | ||

| Section 5.20 |

Dutch Banking Act. | 109 | ||

| Section 5.21 |

Security Documents. | 110 | ||

| ARTICLE VI. |

||||

| AFFIRMATIVE COVENANTS | ||||

| Section 6.01 |

Financial Statements. | 111 | ||

| Section 6.02 |

Certificates; Other Information. | 113 | ||

| Section 6.03 |

Notices. | 114 | ||

| Section 6.04 |

Payment of Obligations. | 114 | ||

| Section 6.05 |

Preservation of Existence, Etc. | 115 | ||

| Section 6.06 |

Maintenance of Properties. | 115 | ||

| Section 6.07 |

Maintenance of Insurance. | 115 | ||

| Section 6.08 |

Compliance with Laws. | 115 | ||

| Section 6.09 |

Books and Records. | 116 | ||

| Section 6.10 |

Inspection Rights. | 116 | ||

| Section 6.11 |

Additional Collateral; Additional Guarantors. | 116 | ||

| Section 6.12 |

Compliance with Environmental Laws. | 119 | ||

| Section 6.13 |

Further Assurances and Post-Closing Conditions. | 119 | ||

| Section 6.14 |

Designation of Subsidiaries. | 120 | ||

| ARTICLE VII. |

||||

| NEGATIVE COVENANTS | ||||

| Section 7.01 |

Liens. | 121 | ||

| Section 7.02 |

Investments. | 124 | ||

| Section 7.03 |

Indebtedness. | 127 | ||

| Section 7.04 |

Fundamental Changes. | 131 | ||

| Section 7.05 |

Dispositions. | 132 | ||

| Section 7.06 |

Restricted Payments. | 135 | ||

| Section 7.07 |

Change in Nature of Business. | 138 | ||

| Section 7.08 |

Transactions with Affiliates. | 138 | ||

| Section 7.09 |

Burdensome Agreements. | 139 | ||

| Section 7.10 |

Use of Proceeds. | 140 | ||

| Section 7.11 |

Financial Covenants. | 140 | ||

-iii-

| Page | ||||

| Section 7.12 |

Accounting Changes. | 141 | ||

| Section 7.13 |

Prepayments, Etc. of Indebtedness. | 141 | ||

| Section 7.14 |

Permitted Activities. | 142 | ||

| ARTICLE VIII. |

||||

| EVENTS OF DEFAULT AND REMEDIES | ||||

| Section 8.01 |

Events of Default. | 142 | ||

| Section 8.02 |

Remedies Upon Event of Default. | 145 | ||

| Section 8.03 |

Exclusion of Immaterial Subsidiaries; Certain Dutch Matters. | 146 | ||

| Section 8.04 |

Application of Funds. | 147 | ||

| Section 8.05 |

Company’s Right to Cure. | 148 | ||

| ARTICLE IX. |

||||

| ADMINISTRATIVE AGENT AND OTHER AGENTS | ||||

| Section 9.01 |

Appointment and Authorization of Agents. | 149 | ||

| Section 9.02 |

Delegation of Duties. | 150 | ||

| Section 9.03 |

Liability of Agents. | 150 | ||

| Section 9.04 |

Reliance by Agents. | 150 | ||

| Section 9.05 |

Notice of Default. | 151 | ||

| Section 9.06 |

Credit Decision; Disclosure of Information by Agents. | 151 | ||

| Section 9.07 |

Indemnification of Agents. | 152 | ||

| Section 9.08 |

Agents in their Individual Capacities. | 153 | ||

| Section 9.09 |

Successor Agents. | 153 | ||

| Section 9.10 |

Administrative Agent May File Proofs of Claim. | 154 | ||

| Section 9.11 |

Collateral and Guaranty Matters. | 155 | ||

| Section 9.12 |

Other Agents; Arrangers and Managers. | 156 | ||

| Section 9.13 |

Appointment of Supplemental Agents. | 156 | ||

| ARTICLE X. |

||||

| MISCELLANEOUS | ||||

| Section 10.01 |

Amendments, Etc. | 157 | ||

| Section 10.02 |

Notices and Other Communications; Facsimile Copies. | 160 | ||

| Section 10.03 |

No Waiver; Cumulative Remedies. | 161 | ||

| Section 10.04 |

Attorney Costs and Expenses. | 161 | ||

| Section 10.05 |

Indemnification by the Borrowers. | 162 | ||

| Section 10.06 |

Payments Set Aside. | 163 | ||

-iv-

| Page | ||||

| Section 10.07 |

Successors and Assigns. | 164 | ||

| Section 10.08 |

Confidentiality. | 169 | ||

| Section 10.09 |

Setoff. | 170 | ||

| Section 10.10 |

Interest Rate Limitation. | 170 | ||

| Section 10.11 |

Counterparts. | 170 | ||

| Section 10.12 |

Integration. | 171 | ||

| Section 10.13 |

Survival of Representations and Warranties. | 171 | ||

| Section 10.14 |

Severability. | 171 | ||

| Section 10.15 |

GOVERNING LAW. | 171 | ||

| Section 10.16 |

WAIVER OF RIGHT TO TRIAL BY JURY. | 172 | ||

| Section 10.17 |

Binding Effect. | 172 | ||

| Section 10.18 |

Judgment Currency. | 173 | ||

| Section 10.19 |

Lender Action. | 173 | ||

| Section 10.20 |

USA Patriot Act. | 174 | ||

| Section 10.21 |

Agent for Service of Process. | 174 | ||

| Section 10.22 |

PMP Representations. | 174 | ||

| ARTICLE XI. |

||||

| GUARANTEE | ||||

| Section 11.01 |

The Guarantee. | 174 | ||

| Section 11.02 |

Obligations Unconditional. | 175 | ||

| Section 11.03 |

Reinstatement. | 176 | ||

| Section 11.04 |

Subrogation; Subordination. | 177 | ||

| Section 11.05 |

Remedies. | 177 | ||

| Section 11.06 |

Instrument for the Payment of Money. | 177 | ||

| Section 11.07 |

Continuing Guarantee. | 177 | ||

| Section 11.08 |

General Limitation on Guarantee Obligations. | 177 | ||

| Section 11.09 |

Release of Guarantors. | 178 | ||

| Section 11.10 |

Right of Contribution. | 178 | ||

| Section 11.11 |

Certain Dutch Matters. | 178 | ||

-v-

| SCHEDULES |

||

| 1.01A |

Commitments | |

| 1.01B |

Unrestricted Subsidiaries | |

| 1.01C |

Mandatory Cost Formulae | |

| 1.01D |

Transaction | |

| 1.01E |

Outstanding Indebtedness | |

| 1.01F |

Existing Letters of Credit | |

| 5.05 |

Certain Liabilities | |

| 5.08 |

Ownership of Property | |

| 5.09(b) |

Environmental Matters | |

| 5.09(d) |

Environmental Actions | |

| 5.10 |

Taxes | |

| 5.11(a) |

ERISA Compliance | |

| 5.12 |

Subsidiaries and Other Equity Investments | |

| 6.13(a) |

Certain Collateral Documents | |

| 7.01(b) |

Existing Liens | |

| 7.02(f) |

Existing Investments | |

| 7.03(b) |

Existing Indebtedness | |

| 7.05(k) |

Dispositions | |

| 7.08 |

Transactions with Affiliates | |

| 7.09 |

Certain Contractual Obligations | |

| 10.02 |

Administrative Agent’s Office, Certain Addresses for Notices | |

| EXHIBITS |

||

| Form of |

||

| A |

Committed Loan Notice | |

| B |

Swing Line Loan Notice | |

| C-1 |

Dollar Term Note | |

| C-2 |

Euro Term Note | |

| C-3 |

Revolving Credit Note | |

| C-4 |

Swing Line Note | |

| D |

Compliance Certificate | |

| E |

Assignment and Assumption | |

| F |

Security Agreement | |

| G-1 |

Perfection Certificate | |

| G-2 |

Perfection Certificate Supplement | |

| H |

Intercompany Note | |

This CREDIT AGREEMENT (this “Agreement”) is entered into as of August 9, 2006, among Xxxxxxx Finance LLC, a Delaware limited liability company (together with its successors and assigns, “Nielsen”), VNU, INC., a New York corporation (together with its successors and assigns, “VNU, Inc.” and, together with Nielsen, the “U.S. Borrowers”), VNU Holding and Finance B.V., a private company organized under the laws of The Netherlands, having its corporate seat in Haarlem, The Netherlands (together with its successors and assigns, the “Dutch Borrower” and, together with the U.S. Borrowers, the “Borrowers”), the Guarantors party hereto from time to time, CITIBANK, N.A., as Administrative Agent, a Swing Line Lender and an L/C Issuer, ABN AMRO Bank N.V., as a Swing Line Lender, each lender from time to time party hereto (collectively, the “Lenders” and individually, a “Lender”), DEUTSCHE BANK SECURITIES INC., as Syndication Agent, and JPMORGAN CHASE BANK, N.A., ABN AMRO BANK N.V. and ING BANK N.V., as Co-Documentation Agents.

The Borrowers have requested that the Lenders extend credit to the Borrowers in the form of (i) Term Loans in an initial aggregate amount of up to $4,175,000,000 and €800,000,000 and (ii) Revolving Credit Loans in an initial aggregate amount of up to $687,500,000. The Tranche A Revolving Credit Facility may include one or more Swing Line Loans and one or more Letters of Credit from time to time.

The applicable Lenders have indicated their willingness to lend, and the L/C Issuers have indicated their willingness to issue Letters of Credit, in each case, on the terms and subject to the conditions set forth herein.

In consideration of the mutual covenants and agreements herein contained, the parties hereto covenant and agree as follows:

ARTICLE I.

Definitions and Accounting Terms

Section 1.01 Defined Terms.

As used in this Agreement, the following terms shall have the meanings set forth below:

“ACN” means ACN Holdings, Inc., a Delaware corporation.

“Acquired EBITDA” means, with respect to any Acquired Entity or Business for any period, the amount for such period of Consolidated EBITDA of such Acquired Entity or Business (determined as if references to the Covenant Parties and their Restricted Subsidiaries in the definition of Consolidated EBITDA were references to such Acquired Entity or Business and its Subsidiaries), all as determined on a consolidated basis for such Acquired Entity or Business.

“Acquired Entity or Business” has the meaning set forth in the definition of the term “Consolidated EBITDA”.

“Additional Lender” has the meaning set forth in Section 2.14(a).

“Administrative Agent” means Citibank, N.A., in its capacity as administrative agent under any of the Loan Documents, or any successor administrative agent; it being understood that Citibank, N.A. may designate any of its Affiliates, including without limitation Citicorp International Limited, as administrative agent for a particular Alternative Currency and that such Affiliate shall be considered an Administrative Agent for all purposes hereunder.

“Administrative Agent’s Office” means, with respect to any currency, the Administrative Agent’s address and, as appropriate, account as set forth on Schedule 10.02 with respect to such currency, or such other address or account with respect to such currency as the Administrative Agent may from time to time notify the Borrowers and the Lenders.

“Administrative Questionnaire” means an Administrative Questionnaire in a form supplied by the Administrative Agent.

“Affiliate” means, with respect to any Person, (i) another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified, or (ii) if such Person is an investment fund, any other investment fund the primary investment advisor to which is the primary investment advisor to such Person or an Affiliate thereof. “Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto.

“Agent-Related Persons” means the Agents, together with their respective Affiliates, and the officers, directors, employees, agents and attorneys-in-fact of such Persons and Affiliates.

“Agents” means, collectively, the Administrative Agent, the Collateral Agent, the Syndication Agent, the Co-Documentation Agents and the Supplemental Agents (if any).

“Aggregate Commitments” means the Commitments of all the Lenders.

“Agreement” means this Credit Agreement, as the same may be amended, supplemented or otherwise modified from time to time.

“Agreement Currency” has the meaning set forth in Section 10.18.

“Alternative Currency” means Euros, Canadian Dollars, Mexican Pesos, Sterling, Australian Dollars, Japanese Yen and Hong Kong Dollars.

-2-

“Alternative Currency Loan” means a Loan that is a Eurocurrency Rate Loan and that is made in an Alternative Currency pursuant to the applicable Committed Loan Notice or a Swing Line Loan denominated in Euro.

“Anti-Terrorism Laws” has the meaning set forth in Section 5.16.

“Applicable ECF Percentage” means, for any fiscal year, (a) 50% if the Total Leverage Ratio as of the last day of such fiscal year is greater than or equal to 6.00 to 1.00, (b) 25% if the Total Leverage Ratio as of the last day of such fiscal year is less than 6.00 to 1.00 but greater than or equal to 5.00 to 1.00 and (c) 0% if the Total Leverage Ratio as of the last day of such fiscal year is less than 5.00 to 1.00.

“Applicable Rate” means a percentage per annum equal to:

(a) with respect to Euro Term Loans, 2.50%;

(b) with respect to Dollar Term Loans (i) until delivery of financial statements for the first full fiscal quarter commencing on or after the Tender Funding Date pursuant to Section 6.01, (A) 2.75% for Eurocurrency Rate Loans and (B) 1.75% for Base Rate Loans, and (ii) thereafter, the following percentages per annum based upon the Secured Leverage Ratio as set forth in the most recent Compliance Certificate received by the Administrative Agent pursuant to Section 6.02(a):

| Applicable Rate |

||||||||

| Pricing Level |

Secured Leverage Ratio |

Eurocurrency Rate | Base Rate | |||||

| 1 |

<4.25:1 | 2.50 | % | 1.50 | % | |||

| 2 |

³4.25:1 | 2.75 | % | 1.75 | % | |||

(c) with respect to Revolving Credit Loans, unused Revolving Credit Commitments and Letter of Credit fees, (i) until delivery of financial statements for the first full fiscal quarter commencing on or after the Tender Funding Date pursuant to Section 6.01, (A) for Eurocurrency Rate Loans, 2.25%, (B) for Base Rate Loans, 1.25%, (C) for Letter of Credit fees, 2.25% less the fronting fee payable in respect of the applicable Letter of Credit and (D) for unused commitment fees, 0.50% and (ii) thereafter, the following percentages per annum (less, in the case of Letter of Credit fees, the fronting fee payable in respect of the applicable Letter of Credit), based upon the Total Leverage Ratio as set forth in the most recent Compliance Certificate received by the Administrative Agent pursuant to Section 6.02(a):

-3-

| Applicable Rate |

|||||||||||

| Pricing Level |

Total Leverage Ratio |

Eurocurrency Rate and Letter of Credit Fees |

Base Rate | Unused Commitment Fee Rate |

|||||||

| 1 |

<5.0:1 | 1.50 | % | 0.50 | % | 0.375 | % | ||||

| 2 |

³5.0:1 but <5.5:1 | 1.75 | % | 0.75 | % | 0.375 | % | ||||

| 3 |

³5.5:1 but <6.0:1 | 2.00 | % | 1.00 | % | 0.50 | % | ||||

| 4 |

³6.0:1 | 2.25 | % | 1.25 | % | 0.50 | % | ||||

Any increase or decrease in the Applicable Rate resulting from a change in the Total Leverage Ratio or the Secured Leverage Ratio shall become effective as of the first Business Day immediately following the date a Compliance Certificate is delivered pursuant to Section 6.02(a); provided that, at the option of the Administrative Agent or the Required Lenders, the highest Pricing Level shall apply (x) as of the first Business Day after the date on which a Compliance Certificate was required to have been delivered but was not delivered, and shall continue to so apply to and including the date on which such Compliance Certificate is so delivered (and thereafter the Pricing Level otherwise determined in accordance with this definition shall apply) and (y) as of the first Business Day after an Event of Default under Section 8.01(a) shall have occurred and be continuing, and shall continue to so apply to but excluding the date on which such Event of Default is cured or waived (and thereafter the Pricing Level otherwise determined in accordance with this definition shall apply).

“Appropriate Lender” means, at any time, (a) with respect to Loans of any Class, the Lenders of such Class, (b) with respect to Letters of Credit, (i) the relevant L/C Issuers and (ii) the Tranche A Revolving Credit Lenders and (c) with respect to the Swing Line Facility, (i) the relevant Swing Line Lender and (ii) if any Swing Line Loans are outstanding pursuant to Section 2.04(a), the Tranche A Revolving Credit Lenders.

“Approved Bank” has the meaning set forth in clause (c) of the definition of “Cash Equivalents”.

“Approved Fund” means any Fund that is administered, advised or managed by (a) a Lender, (b) an Affiliate of a Lender or (c) an entity or an Affiliate of an entity that administers, advises or manages a Lender.

“Arrangers” means Citigroup Global Markets Inc., X.X. Xxxxxx Securities Inc. and Deutsche Bank Securities Inc.

“Assignees” has the meaning set forth in Section 10.07(b).

“Assignment and Assumption” means an Assignment and Assumption substantially in the form of Exhibit E.

-4-

“Attorney Costs” means and includes all reasonable fees, expenses and disbursements of any law firm or other external legal counsel.

“Attributable Indebtedness” means, on any date, in respect of any Capitalized Lease of any Person, the capitalized amount thereof that would appear on a balance sheet of such Person prepared as of such date in accordance with GAAP.

“Audited Financial Statements” means the audited consolidated balance sheet of the Company and its Subsidiaries as of each of December 31, 2005 and 2004, and the related audited consolidated statements of income, of changes in shareholders’ equity and of cash flows for the Company and its Subsidiaries for the fiscal years ended December 31, 2005, 2004 and 2003, respectively.

“Australian Dollar” or “AUD” means lawful money of the Commonwealth of Australia.

“Auto-Extension Letter of Credit” has the meaning set forth in Section 2.03(b)(iii).

“Base Rate” means for any day a fluctuating rate per annum equal to the higher of (a) the Federal Funds Rate plus 1/2 of 1% and (b) the rate of interest in effect for such day as publicly announced from time to time by Citibank, N.A. as its “prime rate.” The “prime rate” is a rate set by Citibank, N.A. based upon various factors including Citibank, N.A. costs and desired return, general economic conditions and other factors, and is used as a reference point for pricing some loans, which may be priced at, above, or below such announced rate. Any change in such rate announced by Citibank, N.A. shall take effect at the opening of business on the day specified in the public announcement of such change.

“Base Rate Loan” means a Loan that bears interest based on the Base Rate.

“Basel II” has the meaning set forth in Section 3.04(a).

“BME” means VNU Business Media Europe B.V., a private company incorporated under the laws of The Netherlands, having its corporate seat in Haarlem, The Netherlands, and its and the other Subsidiaries of VNUHF that constitute the European portion of the Company’s BI segment (i) as identified to the Administrative Agent prior to the Closing Date and (ii) after the Closing Date.

“Borrowers” has the meaning set forth in the introductory paragraph to this Agreement.

“Borrowing” means a Revolving Credit Borrowing, a Swing Line Borrowing, or a Term Borrowing, as the context may require.

“Business Day” means any day other than a Saturday, Sunday or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in, the state

-5-

where the Administrative Agent’s Office with respect to Obligations denominated in Dollars is located and:

(a) if such day relates to any interest rate settings as to a Eurocurrency Rate Loan denominated in Dollars, any fundings, disbursements, settlements and payments in Dollars in respect of any such Eurocurrency Rate Loan, or any other dealings in Dollars to be carried out pursuant to this Agreement in respect of any such Eurocurrency Rate Loan, means any such day on which dealings in deposits in Dollars are conducted by and between banks in the London interbank eurodollar market; and

(b) if such day relates to any interest rate settings as to a Eurocurrency Rate Loan denominated in Euros, any fundings, disbursements, settlements and payments in Euros in respect of any such Eurocurrency Rate Loan, or any other dealings in Euros to be carried out pursuant to this Agreement in respect of any such Eurocurrency Rate Loan, means a TARGET Day; and

(c) if such day relates to any interest rate settings as to an Alternative Currency Loan denominated in an Alternative Currency other than Euros, any fundings, disbursements, settlements and payments in such Alternative Currency in respect of any such Alternative Currency Loan, or any other dealings in such Alternative Currency to be carried out pursuant to this Agreement in respect of any such Alternative Currency Loan, means any such day on which dealings in deposits in such Alternative Currency are conducted by and between banks in the London or other applicable offshore interbank market and in the home country for such Alternative Currency.

“Canadian Borrower” shall mean a Restricted Subsidiary of VNUHF organized under the laws of Canada and identified by the Company to become a borrower under an additional Revolving Credit Facility hereunder pursuant to Section 2.14 hereof; provided, that such Restricted Subsidiary shall be reasonably acceptable to the Administrative Agent and shall execute and deliver an Incremental Amendment and such Collateral Documents or other Loan Documents as the Administrative Agent shall deem reasonably necessary for such Restricted Subsidiary to become a borrower hereunder.

“Canadian Dollar” and “CAD” means lawful money of Canada.

“Capital Expenditures” shall mean, for any period, the aggregate of (a) all expenditures (whether paid in cash or accrued as liabilities) by the Covenant Parties and their Restricted Subsidiaries during such period that, in conformity with GAAP, are or are required to be included as additions during such period to tangible fixed assets, Capitalized Software Expenditures and other deferred charges included in Capital Expenditures reflected in the consolidated balance sheet of the Covenant Parties and their Restricted Subsidiaries, and (b) the value of all assets under Capitalized Leases incurred by the Covenant Parties and their Restricted Subsidiaries during such period; provided that the term “Capital Expenditures” shall not include (i) expenditures made in connection with the replacement, substitution, restoration or repair of

-6-

assets to the extent financed with (x) insurance proceeds paid on account of the loss of or damage to the assets being replaced, re-stored or repaired or (y) awards of compensation arising from the taking by eminent domain or condemnation of the assets being replaced, (ii) the purchase price of equipment that is purchased simultaneously with the trade-in of existing equipment to the extent that the gross amount of such purchase price is reduced by the credit granted by the seller of such equipment for the equipment being traded in at such time, (iii) the purchase of plant, property or equipment or software to the extent financed with the proceeds of Dispositions that are not required to be applied to prepay Term Loans pursuant to Section 2.05(b), (iv) expenditures that are accounted for as capital expenditures by a Covenant Party or any Restricted Subsidiary and that actually are paid for by a Person other than a Covenant Party or any Restricted Subsidiary and for which neither a Covenant Party nor any Restricted Subsidiary has provided or is required to provide or incur, directly or indirectly, any consideration or obligation to such Person or any other Person (whether before, during or after such period), (v) the book value of any asset owned by a Covenant Party or any Restricted Subsidiary prior to or during such period to the extent that such book value is included as a capital expenditure during such period as a result of such Person reusing or beginning to reuse such asset during such period without a corresponding expenditure actually having been made in such period, provided that (x) any expenditure necessary in order to permit such asset to be reused shall be included as a Capital Expenditure during the period in which such expenditure actually is made and (y) such book value shall have been included in Capital Expenditures when such asset was originally acquired, or (vi) expenditures that constitute Permitted Acquisitions.

“Capitalized Leases” means all leases that have been or should be, in accordance with GAAP, recorded as capitalized leases; provided that for all purposes hereunder the amount of obligations under any Capitalized Lease shall be the amount thereof accounted for as a liability in accordance with GAAP.

“Capitalized Software Expenditures” means, for any period, the aggregate of all expenditures (whether paid in cash or accrued as liabilities) by the Covenant Parties and their Restricted Subsidiaries during such period in respect of purchased software or internally developed software and software enhancements that, in conformity with GAAP, are or are required to be reflected as capitalized costs on the consolidated balance sheet of the Covenant Parties and their Restricted Subsidiaries.

“Cash Collateral” has the meaning specified in Section 2.03(g).

“Cash Collateral Account” means a blocked account at Citibank, N.A. (or another commercial bank selected in compliance with Section 9.09) in the name of the Administrative Agent and under the sole dominion and control of the Administrative Agent, and otherwise established in a manner satisfactory to the Administrative Agent.

“Cash Collateralize” has the meaning specified in Section 2.03(g).

-7-

“Cash Equivalents” means any of the following types of Investments, to the extent owned by the Covenant Parties or any Restricted Subsidiary:

(a) Dollars, Euros or, in the case of any Foreign Subsidiary, such local currencies held by it from time to time in the ordinary course of business;

(b) readily marketable obligations issued or directly and fully guaranteed or insured by the government or any agency or instrumentality of (i) the United States or (ii) any member nation of the European Union, in each case having average maturities of not more than 12 months from the date of acquisition thereof; provided that the full faith and credit of the United States or a member nation of the European Union is pledged in support thereof;

(c) time deposits with, or insured certificates of deposit or bankers’ acceptances of, any commercial bank that (i) is a Lender or (ii) (A) is organized under the Laws of the United States, any state thereof, the District of Columbia or any member nation of the Organization for Economic Cooperation and Development or is the principal banking Subsidiary of a bank holding company organized under the Laws of the United States, any state thereof, the District of Columbia or any member nation of the Organization for Economic Cooperation and Development, and is a member of the Federal Reserve System, and (B) has combined capital and surplus of at least $250,000,000 (any such bank in the foregoing clauses (i) or (ii) being an “Approved Bank”), in each case with average maturities of not more than 12 months from the date of acquisition thereof;

(d) commercial paper and variable or fixed rate notes issued by an Approved Bank (or by the parent company thereof) or any variable or fixed rate note issued by, or guaranteed by, a corporation rated A-2 (or the equivalent thereof) or better by S&P or P-2 (or the equivalent thereof) or better by Xxxxx’x, in each case with average maturities of not more than 12 months from the date of acquisition thereof;

(e) repurchase agreements entered into by any Person with a bank or trust company (including any of the Lenders) or recognized securities dealer, in each case, having capital and surplus in excess of $250,000,000 for direct obligations issued by or fully guaranteed or insured by the government or any agency or instrumentality of (i) the United States or (ii) any member nation of the European Union, in which such Person shall have a perfected first priority security interest (subject to no other Liens) and having, on the date of purchase thereof, a fair market value of at least 100% of the amount of the repurchase obligations;

(f) securities with average maturities of 12 months or less from the date of acquisition issued or fully guaranteed by any state, commonwealth or territory of the United States, by any political subdivision or taxing authority of any such state, commonwealth or territory or by any foreign government having an investment grade rating from either S&P or Xxxxx’x (or the equivalent thereof);

-8-

(g) Investments with average maturities of 12 months or less from the date of acquisition in money market funds rated AAA- (or the equivalent thereof) or better by S&P or Aaa3 (or the equivalent thereof) or better by Xxxxx’x;

(h) instruments equivalent to those referred to in clauses (a) through (g) above denominated in Euros or any other foreign currency comparable in credit quality and tenor to those referred to above and customarily used by corporations for cash management purposes in any jurisdiction outside the United States to the extent reasonably required in connection with any business conducted by any Restricted Subsidiary organized in such jurisdiction; and

(i) Investments, classified in accordance with GAAP as current assets of a Covenant Party or any Restricted Subsidiary, in money market investment programs which are registered under the Investment Company Act of 1940 or which are administered by financial institutions having capital of at least $250,000,000, and, in either case, the portfolios of which are limited such that substantially all of such Investments are of the character, quality and maturity described in clauses (a) through (h) of this definition.

“Cash Management Obligations” means obligations owed by a Covenant Party or any Restricted Subsidiary to any Lender or any Affiliate of a Lender in respect of any overdraft and related liabilities arising from treasury, depository and cash management services or any automated clearing house transfers of funds.

“Casualty Event” means any event that gives rise to the receipt by a Covenant Party or any Restricted Subsidiary of any insurance proceeds or condemnation awards in respect of any equipment, fixed assets or real property (including any improvements thereon) to replace or repair such equipment, fixed assets or real property.

“CERCLA” means the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as subsequently amended.

“CERCLIS” means the Comprehensive Environmental Response, Compensation and Liability Information System maintained by the U.S. Environmental Protection Agency.

“CET” has the meaning specified in Section 2.04(b).

“Change of Control” shall be deemed to occur if:

(a) at any time prior to a Qualified IPO, any combination of Permitted Holders shall fail to own beneficially (within the meaning of Rule 13d-5 of the Exchange Act as in effect on the Closing Date), directly or indirectly, in the aggregate Equity Interests representing at least a majority of the aggregate ordinary voting power represented by the issued and outstanding Equity Interests of the Company; or

-9-

(b) at any time after a Qualified IPO, (i) any person or “group” (within the meaning of Rules 13d-3 and 13d-5 under the Exchange Act as in effect on the Closing Date), other than any combination of the Permitted Holders or any “group” including any Permitted Holders, shall have acquired beneficial ownership of 35% or more on a fully diluted basis of the voting interest in the Company’s capital stock and the Permitted Holders shall own, directly or indirectly, less than such person or “group” on a fully diluted basis of the voting interest in the Company’s capital stock or (ii) during each period of twelve consecutive months, the supervisory board of directors of the Company shall not consist of a majority of the Continuing Directors; or

(c) a “change of control” (or similar event) shall occur under the Senior Subordinated Debt, the Senior Unsecured Debt, any Indebtedness for borrowed money permitted under Section 7.03 with an aggregate principal amount in excess of the Threshold Amount or any Permitted Refinancing Indebtedness in respect of any of the foregoing or any Disqualified Equity Interests.

“Class” (a) when used with respect to Lenders, refers to whether such Lenders are Tranche A Revolving Credit Lenders, Tranche B Revolving Credit Lenders, Tranche C Revolving Credit Lenders, Tranche D Revolving Credit Lenders, Tranche E Revolving Credit Lenders, Tranche F Revolving Credit Lenders, Tranche G Revolving Credit Lenders, Tranche H Revolving Credit Lenders, Dollar Term Lenders, or Euro Term Lenders, (b) when used with respect to Commitments, refers to whether such Commitments are Tranche A Revolving Credit Commitments, Tranche B Revolving Credit Commitments, Tranche C Revolving Credit Commitments, Tranche D Revolving Credit Commitments, Tranche E Revolving Credit Commitments, Tranche F Revolving Credit Commitments, Tranche G Revolving Credit Commitments, Tranche H Revolving Credit Commitments, Dollar Term Commitments, or Euro Term Commitments and (c) when used with respect to Loans or a Borrowing, refers to whether such Loans, or the Loans comprising such Borrowing, are Tranche A Revolving Credit Loans, Tranche B Revolving Credit Loans, Tranche C Revolving Credit Loans, Tranche D Revolving Credit Loans, Tranche E Revolving Credit Loans, Tranche F Revolving Credit Loans, Tranche G Revolving Credit Loans, Tranche H Revolving Credit Loans, Dollar Term Loans or Euro Term Loans.

“Clean-Up Period” has the meaning specified in Section 8.02(b).

“Closing Date” means the first date all the conditions precedent in Sections 4.01 and 4.02(a) are satisfied or waived in accordance with Sections 4.01 and 4.02(a).

“Code” means the U.S. Internal Revenue Code of 1986 and rules and regulations related thereto.

“Co-Documentation Agents” means JPMorgan Chase Bank, N.A., ABN AMRO Bank N.V. and ING Bank N.V., as co-documentation agents under this Agreement.

“Collateral” means the “Collateral” as defined in the Security Agreement and all the “Collateral” or “Pledged Assets” as defined in any other Collateral Document.

-10-

“Collateral Agent” means Citibank, N.A., in its capacity as collateral agent or pledgee in its own name under any of the Loan Documents, or any successor collateral agent.

“Collateral Documents” means, collectively, the Security Agreement, each of the Mortgages, collateral assignments, security agreements, pledge agreements, intellectual property security agreements or other similar agreements delivered to the Administrative Agent and the Lenders pursuant to Section 6.11 or Section 6.13, and each of the other agreements, instruments or documents that creates or purports to create a Lien in favor of the Administrative Agent for the benefit of the Secured Parties.

“Commitment” means a Term Commitment or a Revolving Credit Commitment of any Class or of multiple Classes, as the context may require.

“Committed Loan Notice” means a notice of (a) a Borrowing, (b) a conversion of Loans from one Type to the other, or (c) a continuation of Eurocurrency Rate Loans, pursuant to Section 2.02(a), which, if in writing, shall be substantially in the form of Exhibit A.

“Company” means VNU Group B.V. (formerly known as VNU N.V.), a private company incorporated under the laws of The Netherlands, having its corporate seat in Haarlem, The Netherlands, together with its successors and assigns.

“Company Restricted Payments Election” has the meaning set forth in Section 7.06(d).

“Compensation Period” has the meaning set forth in Section 2.12(c)(ii).

“Compliance Certificate” means a certificate substantially in the form of Exhibit D.

“Consolidated EBITDA” means, for any period, the Consolidated Net Income for such period, plus

(a) without duplication and to the extent already deducted (and not added back) in arriving at such Consolidated Net Income, the sum of the following amounts for such period:

(i) total interest expense (including interest expense attributable to Holdings Debt) and, to the extent not reflected in such total interest expense, any losses on hedging obligations or other derivative instruments entered into for the purpose of hedging interest rate risk, net of interest income and gains on such hedging obligations, and costs of surety bonds in connection with financing activities, and commissions, discounts, yield and other fees and charges (including any interest expense) related to any Permitted Receivables Financing,

(ii) provision for taxes based on income, profits or capital of a Covenant Party or its Restricted Subsidiaries, including, without limitation, state, franchise and similar taxes and foreign withholding taxes paid or accrued during such period,

-11-

(iii) depreciation and amortization (including amortization of Capitalized Software Expenditures) and amortization of unrecognized prior service costs and actuarial gains and losses related to pensions and other post-employment benefits,

(iv) Non-Cash Charges,

(v) extraordinary losses and unusual or non-recurring charges, duplicative running costs, severance, relocation costs and curtailments or modifications to pension and post-retirement employee benefit plans,

(vi) business optimization expenses and restructuring charges or reserves (including restructuring costs related to acquisitions after the date hereof and to closure/consolidation of facilities, retention charges, systems establishment costs and excess pension charges); provided that with respect to each business optimization expense or other restructuring charge or reserve, the Borrowers shall have delivered to the Administrative Agent an officer’s certificate specifying and quantifying such expense, charge or reserve and stating that such expense, charge or reserve is a business optimization expense or restructuring charge or reserve, as the case may be,

(vii) any deductions attributable to minority interests,

(viii) the amount of management, monitoring, consulting, transaction and advisory fees and related expenses paid to the Sponsors or their Affiliates,

(ix) the amount of net cost savings projected by Borrowers in good faith to be realized as a result of specified actions taken during such period (calculated on a pro forma basis as though such cost savings had been realized on the first day of such period), net of the amount of actual benefits realized during such period from such actions, provided that (A) such cost savings are reasonably identifiable and factually supportable, (B) such actions are taken or committed to be taken within 36 months after the Closing Date, (C) no cost savings shall be added pursuant to this clause (ix) to the extent duplicative of any expenses or charges relating to such cost savings that are included in clause (vi) above with respect to such period and (D) the aggregate amount of cost savings added pursuant to this clause (ix) shall not exceed $125,000,000 for any period consisting of four consecutive quarters (while subject to upward or downward adjustment in accordance with this clause, it is agreed that as of the Closing Date the projected cost savings for the first full four fiscal quarter period ended after the Closing Date is €75.0 million), and

(x) cash distributions received from unconsolidated joint ventures and Unrestricted Subsidiaries, less

(b) without duplication and to the extent included in arriving at such Consolidated Net Income, the sum of the following amounts for such period:

(i) extraordinary gains and unusual or non-recurring gains,

-12-

(ii) non-cash gains (excluding any non-cash gains to the extent it represents the reversal of an accrual or reserve for a potential cash item that reduced Consolidated EBITDA in any prior period),

(iii) gains on asset sales (other than asset sales in the ordinary course of business),

(iv) any net after-tax income from the early extinguishment of Indebtedness or hedging obligations or other derivative instruments, and

(v) all gains from investments recorded using the equity method (other than cash dividends actually received),

in each case, as determined on a consolidated basis for the Covenant Parties and their Restricted Subsidiaries (other than in respect of interest expense attributable to Holdings Debt) in accordance with GAAP; provided that, to the extent included in Consolidated Net Income,

(A) there shall be excluded in determining Consolidated EBITDA currency translation gains and losses related to currency remeasurements of indebtedness (including the net loss or gain (i) resulting from Swap Contracts for currency exchange risk and (ii) resulting from intercompany indebtedness),

(B) there shall be excluded in determining Consolidated EBITDA for any period any adjustments resulting from the application of Statement of Financial Accounting Standards No. 133 and International Accounting Standard No. 39 and their respective related pronouncements and interpretations,

(C) there shall be included in determining Consolidated EBITDA for any period, without duplication, (1) the Acquired EBITDA of any Person, property, business or asset acquired by a Covenant Party or any Restricted Subsidiary during such period (but not the Acquired EBITDA of any related Person, property, business or assets to the extent not so acquired), to the extent not subsequently sold, transferred or otherwise disposed of by such Covenant Party or such Restricted Subsidiary (each such Person, property, business or asset acquired and not subsequently so disposed of, an “Acquired Entity or Business”), based on the actual Acquired EBITDA of such Acquired Entity or Business for such period (including the portion thereof occurring prior to such acquisition) and (2) for the purposes of the definition of the term “Permitted Acquisition” and Section 7.11, an adjustment equal to the amount of the Pro Forma Adjustment with respect to the Covenant Parties and their Restricted Subsidiaries or any Acquired Entity or Business for such period (including the portion thereof occurring prior to such acquisition) as specified in a certificate executed by a Responsible Officer delivered to the Administrative Agent (for delivery to the Lenders), and

(D) for purposes of determining the Total Leverage Ratio or Interest Coverage Ratio only, there shall be excluded in determining Consolidated EBITDA for any period the Disposed EBITDA of any Person, property, business or asset sold, transferred or otherwise disposed of,

-13-

closed or classified as discontinued operations by a Covenant Party or any Restricted Subsidiary of a Covenant Party during such period (each such Person, property, business or asset so sold or disposed of, a “Sold Entity or Business”), based on the actual Disposed EBITDA of such Sold Entity or Business for such period (including the portion thereof occurring prior to such sale, transfer or disposition).

For the purpose of the definition of Consolidated EBITDA, “Non-Cash Charges” means (a) losses on asset sales, disposals or abandonments, (b) any impairment charge or asset write-off related to intangible assets, long-lived assets, and investments in debt and equity securities pursuant to GAAP, (c) all losses from investments recorded using the equity method, (d) stock-based awards compensation expense, and (e) other non-cash charges (provided that if any non-cash charges referred to in this clause (e) represent an accrual or reserve for potential cash items in any future period, the cash payment in respect thereof in such future period shall be subtracted from Consolidated EBITDA in such future period to such extent paid, but excluding from this proviso, for the avoidance of doubt, non-cash charges consisting of the amortization of a prepaid cash item that was paid in a prior period).

“Consolidated Interest Expense” means, for any period, the sum, without duplication, of (i) the cash interest expense (including that attributable to Capitalized Leases), net of cash interest income, of the Covenant Parties and their Restricted Subsidiaries, determined on a consolidated basis in accordance with GAAP, with respect to all outstanding Indebtedness of the Covenant Parties and their Restricted Subsidiaries, including all commissions, discounts and other fees and charges owed with respect to letters of credit and bankers’ acceptance financing and net costs under Swap Contracts and the cash interest expense attributable to Holdings Debt, and (ii) any cash payments made during such period in respect of obligations referred to in clause (b) below relating to Funded Debt that were amortized or accrued in a previous period, but excluding, however, (a) amortization of deferred financing costs and any other amounts of non-cash interest, (b) the accretion or accrual of discounted liabilities during such period, (c) commissions, discounts, yield and other fees and charges (including any interest expense) incurred in connection with a Permitted Receivables Financing and (d) all non-recurring cash interest expense consisting of liquidated damages for failure to timely comply with registration rights obligations and financing fees, all as calculated on a consolidated basis in accordance with GAAP; provided that for purposes of the definition of the term “Permitted Acquisition” and Section 7.11, there shall be included in determining Consolidated Interest Expense for any period the cash interest expense (or income) of any Acquired Entity or Business acquired during such period, based on the cash interest expense (or income) of such Acquired Entity or Business for such period (including the portion thereof occurring prior to such acquisition) assuming any Indebtedness incurred or repaid in connection with any such acquisition had been incurred or prepaid on the first day of such period. Notwithstanding anything to the contrary contained herein, for purposes of determining Consolidated Interest Expense (i) for any period ending prior to the first anniversary of the Closing Date, Consolidated Interest Expense shall be an amount equal to actual Consolidated Interest Expense from the Closing Date through the date of determination multiplied by a fraction the numerator of which is 365 and the denominator of which is the number of days from the Closing Date through the date of determination and (ii) shall exclude the purchase accounting effects described in the last sentence of the definition of Consolidated Net Income.

-14-

“Consolidated Net Income” means, for any period, the net income (loss) of the Covenant Parties and their Restricted Subsidiaries for such period determined on a consolidated basis in accordance with GAAP, excluding, without duplication, (a) extraordinary items for such period, (b) the cumulative effect of a change in accounting principles during such period to the extent included in Consolidated Net Income (including changes from international financial reporting standards to United States financial reporting standards), (c) Transaction Expenses incurred during such period, (d) any fees and expenses incurred during such period, or any amortization thereof for such period, in connection with any acquisition, investment, asset disposition, issuance or repayment of debt, issuance of equity securities, refinancing transaction or amendment or other modification of any debt instrument (in each case, including any such transaction consummated prior to the Tender Funding Date and any such transaction undertaken but not completed) and any charges or non-recurring merger costs incurred during such period as a result of any such transaction, (e) any income (loss) for such period attributable to the early extinguishment of indebtedness and (f) accruals and reserves that are established within twelve months after the Closing Date that are so required to be established as a result of the Transaction in accordance with GAAP. There shall be excluded from Consolidated Net Income for any period the purchase accounting effects of adjustments in component amounts required or permitted by GAAP and related authoritative pronouncements (including the effects of such adjustments pushed down to the Covenant Parties and their Restricted Subsidiaries), as a result of the Transaction, any acquisition consummated prior to the Tender Funding Date, any Permitted Acquisitions, or the amortization or write-off of any amounts thereof.

“Consolidated Total Net Debt” shall mean, as of any date of determination, (a) the aggregate principal amount of Indebtedness of the Covenant Parties and their Restricted Subsidiaries outstanding on such date, determined on a consolidated basis in accordance with GAAP, consisting of Indebtedness for borrowed money, Attributable Indebtedness, and debt obligations evidenced by promissory notes or similar instruments, plus (b) the aggregate principal amount of Holdings Debt as reflected on the Company’s balance sheet, minus (c) the aggregate amount of cash and Cash Equivalents, in each case, free and clear of all Liens, other than nonconsensual Liens permitted by Section 7.01 and Liens permitted by Section 7.01(p) and Section 7.01(q) and clauses (i) and (ii) of Section 7.01(r), in excess of the sum of (x) $10,000,000 million and (y) any Restricted Cash included in the consolidated balance sheet of the Covenant Parties and their Restricted Subsidiaries as of such date.

“Consolidated Working Capital” means, with respect to the Covenant Parties and their Restricted Subsidiaries on a consolidated basis at any date of determination, Current Assets at such date of determination minus Current Liabilities at such date of determination; provided, that, increases or decreases in Consolidated Working Capital shall be calculated without regard to any changes in Current Assets or Current Liabilities as a result of (a) any reclassification in accordance with GAAP of assets or liabilities, as applicable, between current and noncurrent or (b) the effects of purchase accounting.

-15-

“Continuing Directors” means the supervisory directors of the Company on the Closing Date, as elected or appointed after giving effect to the Transaction, and each other supervisory director, if, in each case, such other supervisory director’s nomination for election to the supervisory board of directors of the Company is recommended by a majority of the then Continuing Directors or such other supervisory director receives the vote of the Permitted Holders in his or her election by the stockholders of the Company.

“Contract Consideration” has the meaning set forth in the definition of “Excess Cash Flow.”

“Contractual Obligation” means, as to any Person, any provision of any security issued by such Person or of any agreement, instrument or other undertaking to which such Person is a party or by which it or any of its property is bound.

“Control” has the meaning specified in the definition of “Affiliate.”

“Covenant Parties” means (i) each of VNUHF, VNU International, ACN, VNU, Inc., and the Borrowers and (ii) at the Company’s sole discretion, upon written notice to the Administrative Agent, the Company and any Subsidiary of the Company as designated by the Company; provided that (i) immediately before and after such designation, no Default shall have occurred and be continuing, (ii) immediately after giving effect to such designation, the Covenant Parties shall be in compliance, on a Pro Forma Basis, with the covenants set forth in Section 7.11 (it being understood that if no Test Period cited in Section 7.11 has passed, the covenants in Section 7.11 for the first Test Period cited in such Section shall be satisfied as of the last four quarters ended and, as a condition precedent to the effectiveness of any such designation, Xxxxxxx shall deliver to the Administrative Agent a certificate setting forth in reasonable detail the calculations demonstrating such compliance) and (iii) once an entity is designated a Covenant Party it remains a Covenant Party for the term of this Agreement. The designation of any entity as a Covenant Party shall constitute the incurrence at the time of designation of any Investment, Indebtedness or Liens of such entity existing at such time (but, for the avoidance of doubt, without duplication of any Holdings Debt existing at such time to the extent it already constitutes Indebtedness for any given purpose). Consolidated EBITDA applicable to an entity designated a Covenant Party shall only be included within such definition to the extent related to a fiscal quarter beginning after such designation.

“Credit Extension” means each of the following: (a) a Borrowing and (b) an L/C Credit Extension.

“Cumulative Credit” means, at any date, an amount, not less than zero in the aggregate, determined on a cumulative basis equal to, without duplication:

(a) the Cumulative Retained Excess Cash Flow Amount at such time, plus

-16-

(b) the cumulative amount of proceeds (including cash and the fair market value of property other than cash) from the sale of (i) Equity Interests of the Company or any direct or indirect parent of the Company after the Tender Funding Date and on or prior to such time (including upon exercise of warrants or options) which proceeds have been contributed as common equity to the capital of the Company, or (ii) the common Equity Interests of a Covenant Party issued upon conversion of Indebtedness (other than Indebtedness that is contractually subordinated to the Obligations) of a Covenant Party or any Restricted Subsidiary of a Covenant Party or Holdings Debt owed to a Person other than a Loan Party or a Restricted Subsidiary of a Loan Party not previously applied for a purpose other than use in the Cumulative Credit; plus

(c) 100% of the aggregate amount of contributions to the common capital of the Company received in cash (and the fair market value of property other than cash) after the Tender Funding Date; plus

(d) the principal amount of any Indebtedness (including the liquidation preference or maximum fixed repurchase price, as the case may be, of any Disqualified Equity Interests) of a Covenant Party or Holdings Debt issued after the Tender Funding Date (other than Indebtedness issued to a Restricted Subsidiary), which has been converted into or exchanged for Equity Interests (other than Disqualified Equity Interests) in the Company or any direct or indirect parent of the Company, plus

(e) 100% of the aggregate amount received by a Covenant Party or any Restricted Subsidiary of a Covenant Party in cash (and the fair market value of property other than cash received by a Covenant Party or any such Restricted Subsidiary) from:

(A) the sale (other than to a Covenant Party or any such Restricted Subsidiary) of the Equity Interests of an Unrestricted Subsidiary, or

(B) any dividend or other distribution by an Unrestricted Subsidiary, plus

(f) in the event any Unrestricted Subsidiary has been re-designated as a Restricted Subsidiary or has been merged, consolidated or amalgamated with or into, or transfers or conveys its assets to, or is liquidated into, a Covenant Party or a Restricted Subsidiary, the fair market value of the Investments of the Covenant Parties and the Restricted Subsidiaries in such Unrestricted Subsidiary at the time of such redesignation, combination or transfer (or of the assets transferred or conveyed, as applicable), plus

(g) an amount equal to any returns (including dividends, interest, distributions, returns of principal, profits on sale, repayments, income and similar amounts) actually received by the Covenant Parties or any Restricted Subsidiary in respect of any Investments made pursuant to Section 7.02(n), minus

-17-

(h) any amount of the Cumulative Credit used to make Investments pursuant to Section 7.02(s) after the Tender Funding Date and prior to such time, minus

(i) any amount of the Cumulative Credit used to make Investments pursuant to Section 7.02(n) after the Tender Funding Date and prior to such time, minus

(j) any amount of the Cumulative Credit used to pay dividends or make distributions pursuant to Section 7.06(h) after the Tender Funding Date and prior to such time, minus

(k) any amount of the Cumulative Credit used to make payments or distributions in respect of Junior Financings pursuant to Section 7.13 after the Tender Funding Date and prior to such time.

“Cumulative Retained Excess Cash Flow Amount” means, at any date, an amount, not less than zero in the aggregate, determined on a cumulative basis equal to the aggregate cumulative sum of the Retained Percentage of Excess Cash Flow for all Excess Cash Flow Periods ending after the Tender Funding Date and prior to such date.

“Current Assets” means, with respect to the Covenant Parties and their Restricted Subsidiaries on a consolidated basis at any date of determination, the sum of (a) all assets (other than cash and Cash Equivalents) that would, in accordance with GAAP, be classified on a consolidated balance sheet of the Covenant Parties and their Restricted Subsidiaries as current assets at such date of determination, other than amounts related to current or deferred Taxes based on income or profits (but excluding assets held for sale, loans (permitted) to third parties, pension assets, deferred bank fees and derivative financial instruments) and (b) in the event that a Permitted Receivables Financing is accounted for off balance sheet, (x) gross accounts receivable comprising part of the Receivables Assets subject to such Permitted Receivables Financing less (y) collections against the amounts sold pursuant to clause (x).

“Current Liabilities” means, with respect to the Covenant Parties and their Restricted Subsidiaries on a consolidated basis at any date of determination, all liabilities that would, in accordance with GAAP, be classified on a consolidated balance sheet of the Covenant Parties and their Restricted Subsidiaries as current liabilities at such date of determination, other than (a) the current portion of any Indebtedness, (b) accruals of Consolidated Interest Expense (excluding Consolidated Interest Expense that is due and unpaid), (c) accruals for current or deferred Taxes based on income or profits, (d) accruals of any costs or expenses related to restructuring reserves and (e) any Revolving Credit Exposure or Revolving Credit Loans.

“Debtor Relief Laws” means the Bankruptcy Code of the United States, the Dutch Bankruptcy Act (Faillissementswet) and all other liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, receivership, insolvency, reorganization, faillissement, surseance van betaling, onderbewindstelling, ontbinding, or similar debtor relief Laws of the United States, The Netherlands or other applicable jurisdictions from time to time in effect and affecting the rights of creditors generally.

-18-

“Default” means any event or condition that constitutes an Event of Default or that, with the giving of any notice, the passage of time, or both, would be an Event of Default.

“Default Rate” means an interest rate equal to (a) the Base Rate plus (b) the Applicable Rate, if any, applicable to Base Rate Loans plus (c) 2.0% per annum; provided that with respect to an Alternative Currency Loan, the Default Rate shall be an interest rate equal to the interest rate (including any Applicable Rate and any applicable Mandatory Cost) otherwise applicable to such Loan plus 2.0% per annum, in each case, to the fullest extent permitted by applicable Laws.

“Defaulting Lender” means any Lender that (a) has failed to fund any portion of the Term Loans, Revolving Credit Loans, participations in L/C Obligations or participations in Swing Line Loans required to be funded by it hereunder within one (1) Business Day of the date required to be funded by it hereunder, unless the subject of a good faith dispute or subsequently cured, (b) has otherwise failed to pay over to the Administrative Agent or any other Lender any other amount required to be paid by it hereunder within one (1) Business Day of the date when due, unless the subject of a good faith dispute or subsequently cured, or (c) has been deemed insolvent or become the subject of a bankruptcy or insolvency proceeding.

“Designated Non-Cash Consideration” means the fair market value of non-cash consideration received by a Covenant Party or a Restricted Subsidiary in connection with a Disposition pursuant to Section 7.05(j) that is designated as Designated Non-Cash Consideration pursuant to a certificate of a Responsible Officer, setting forth the basis of such valuation (which amount will be reduced by the fair market value of the portion of the non-cash consideration converted to cash within 180 days following the consummation of the applicable Disposition).

“Designation Date” shall have the meaning set forth in Section 6.14

“Disposed EBITDA” means, with respect to any Sold Entity or Business for any period, the amount for such period of Consolidated EBITDA of such Sold Entity or Business (determined as if references to the Covenant Parties and their Restricted Subsidiaries in the definition of Consolidated EBITDA were references to such Sold Entity or Business and its Subsidiaries), all as determined on a consolidated basis for such Sold Entity or Business.

“Disposition” or “Dispose” means the sale, transfer, license, lease or other disposition (including any sale and leaseback transaction and any sale or issuance of Equity Interests) of any property by any Person, including any sale, assignment, transfer or other disposal, with or without recourse, of any notes or accounts receivable or any rights and claims associated therewith; provided that “Disposition” and “Dispose” shall not be deemed to include (a) any issuance by VNUHF of any of its Equity Interests to another Person or (b) any non-cash sale, conveyance, transfer or other disposition of the Transactions Intercompany Obligations.

“Disqualified Equity Interests” means any Equity Interest which, by its terms (or by the terms of any security or other Equity Interests into which it is convertible or for which it is exchangeable), or upon the happening of any event or condition (a) matures or is mandatorily

-19-

redeemable, pursuant to a sinking fund obligation or otherwise (except as a result of a change of control or asset sale so long as any rights of the holders thereof upon the occurrence of a change of control or asset sale event shall be subject to the prior repayment in full of the Loans and all other Obligations that are accrued and payable and the termination of the Commitments), (b) is redeemable at the option of the holder thereof, in whole or in part, (c) provides for the scheduled payments of dividends in cash, or (d) is or becomes convertible into or exchangeable for Indebtedness or any other Equity Interests that would constitute Disqualified Equity Interests, in each case, prior to the date that is ninety-one (91) days after the Maturity Date of the Term Loans.

“Dollar” and “$” mean lawful money of the United States.

“Dollar Amount” means, at any time:

(a) with respect to any Loan denominated in Dollars (including, with respect to any Swing Line Loan, any funded participation therein), the principal amount thereof then outstanding (or in which such participation is held);

(b) with respect to any Alternative Currency Loan (including, with respect to any Swing Line Loan, any funded participation therein), the principal amount thereof then outstanding in the relevant Alternative Currency, converted to Dollars in accordance with Section 1.08 and Section 2.15(a); and

(c) with respect to any L/C Obligation (or any risk participation therein), (A) if denominated in Dollars, the amount thereof and (B) if denominated in an Alternative Currency, the amount thereof converted to Dollars in accordance with Section 1.08 and Section 2.15(a).

“Dollar Refinanced Term Loans” has the meaning specified in Section 10.01.

“Dollar Replacement Term Loans” has the meaning specified in Section 10.01

“Dollar Term Commitment” means, as to each Dollar Term Lender, its obligation to make a Dollar Term Loan to Nielsen pursuant to Section 2.01(a) in an aggregate Dollar Amount not to exceed the amount set forth opposite such Lender’s name on Schedule 1.01A under the caption “Dollar Term Commitment” or in the Assignment and Assumption pursuant to which such Dollar Term Lender becomes a party hereto, as applicable, as such amount may be adjusted from time to time in accordance with this Agreement (including Section 2.14). The initial aggregate amount of the Dollar Term Commitments is $4,175,000,000.

“Dollar Term Lender” means, at any time, any Lender that has a Dollar Term Commitment or a Dollar Term Loan at such time.

“Dollar Term Loan” means a Loan made pursuant to Section 2.01(a).

-20-

“Dollar Term Note” means a promissory note of Nielsen payable to any Dollar Term Lender or its registered assigns, in substantially the form of Exhibit C-1 hereto, evidencing the aggregate Indebtedness of Nielsen to such Dollar Term Lender resulting from the Dollar Term Loans made by such Dollar Term Lender.

“Domestic Subsidiary” means any Subsidiary that is organized under the Laws of the United States, any state thereof or the District of Columbia.

“DNB” means the Dutch Central Bank (De Nederlandsche Bank N.V.).

“Dutch Banking Act” means the Dutch Act on the Supervision of Credit Institutions 1992 (Wet toezicht kredietwezen 1992) as amended from time to time.

“Dutch Borrower” has the meaning set forth in the introductory paragraph to this Agreement.

“Eligible Assignee” has the meaning set forth in Section 10.07(a).

“EMU Legislation” means the legislative measures of the European Council for the introduction of, changeover to or operation of a single or unified European currency.

“Environment” means indoor air, ambient air, surface water, groundwater, drinking water, land surface, subsurface strata, and natural resources such as wetlands, flora and fauna.

“Environmental Laws” means the common law and any and all Federal, state, local, and foreign statutes, Laws, regulations, ordinances, rules, judgments, orders, decrees, permits, concessions, grants, franchises, licenses, agreements or governmental restrictions relating to pollution, the protection of the Environment or, to the extent relating to exposure to Hazardous Materials, human health or to the Release or threat of Release of Hazardous Materials into the Environment.

“Environmental Liability” means any liability, contingent or otherwise (including any liability for damages, costs of investigation and remediation, fines, penalties or indemnities), of the Loan Parties or any Restricted Subsidiary directly or indirectly resulting from or based upon (a) violation of any Environmental Law, (b) the generation, use, handling, transportation, storage, treatment or disposal of any Hazardous Materials, (c) exposure to any Hazardous Materials, (d) the Release or threatened Release of any Hazardous Materials into the Environment or (e) any contract, agreement or other consensual arrangement pursuant to which liability is assumed or imposed with respect to any of the foregoing.

“Environmental Permit” means any permit, approval, identification number, license or other authorization required under any Environmental Law.

-21-

“Equity Interests” means, with respect to any Person, all of the shares, interests, rights, participations or other equivalents (however designated) of capital stock of (or other ownership or profit interests or units in) such Person and all of the warrants, options or other rights for the purchase, acquisition or exchange from such Person of any of the foregoing (including through convertible securities).

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time.

“ERISA Affiliate” means any trade or business (whether or not incorporated) that is under common control with a Loan Party or any Restricted Subsidiary within the meaning of Section 414 of the Code or Section 4001 of ERISA.

“ERISA Event” means (a) a Reportable Event with respect to a Pension Plan; (b) a withdrawal by a Loan Party, any Restricted Subsidiary or any ERISA Affiliate from a Pension Plan subject to Section 4063 of ERISA during a plan year in which it was a substantial employer (as defined in Section 4001(a)(2) of ERISA) or a cessation of operations that is treated as such a withdrawal under Section 4062(e) of ERISA; (c) a complete or partial withdrawal by a Loan Party, any Restricted Subsidiary or any ERISA Affiliate from a Multiemployer Plan or notification that a Multiemployer Plan is in reorganization; (d) the filing of a notice of intent to terminate, the treatment of a Plan amendment as a termination under Sections 4041 or 4041A of ERISA, or the commencement of proceedings by the PBGC to terminate a Pension Plan or Multiemployer Plan; (e) an event or condition which constitutes grounds under Section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any Pension Plan or Multiemployer Plan; or (f) the imposition of any liability under Title IV of ERISA, other than for PBGC premiums due but not delinquent under Section 4007 of ERISA, upon a Loan Party, any Restricted Subsidiary or any ERISA Affiliate.

“Euro” and “EUR” means the lawful currency of the Participating Member States introduced in accordance with EMU Legislation.

“Euro Refinanced Term Loans” has the meaning specified in Section 10.01.

“Euro Replacement Term Loans” has the meaning specified in Section 10.01.

“Euro Term Commitment” means, as to each Euro Term Lender, its obligation to make a Euro Term Loan to Nielsen pursuant to Section 2.01(b) in an aggregate Dollar Amount not to exceed the amount set forth opposite such Lender’s name on Schedule 1.01A under the caption “Euro Term Commitment” or in the Assignment and Assumption pursuant to which such Euro Term Lender becomes a party hereto, as applicable, as such amount may be adjusted from time to time in accordance with this Agreement (including Section 2.14). The initial aggregate amount of the Euro Term Commitments is €800,000,000.

-22-

“Euro Term Lender” means, at any time, any Lender that has a Euro Term Commitment or a Euro Term Loan at such time.

“Euro Term Loan” means a Loan made pursuant to Section 2.01(b).

“Euro Term Note” means a promissory note of Nielsen payable to any Euro Term Lender or its registered assigns, in substantially the form of Exhibit C-2 hereto, evidencing the aggregate Indebtedness of Nielsen to such Euro Term Lender resulting from the Euro Term Loans made by such Euro Term Lender.

“Eurocurrency Rate” means, for any Interest Period with respect to any Eurocurrency Rate Loan:

(i) denominated in a currency other than Australian Dollars, Hong Kong Dollars or Japanese Yen:

(a) the rate per annum equal to the rate determined by the Administrative Agent to be the offered rate that appears on the page of the Dow Xxxxx Market screen (or any successor thereto) that displays an average British Bankers Association Interest Settlement Rate for deposits in Dollars or the relevant Alternative Currency (for delivery on the first day of such Interest Period), as applicable, with a term equivalent to such Interest Period, determined as of approximately 11:00 a.m. (London time) two (2) Business Days prior to the first day of such Interest Period, or, if different, the date on which quotations would customarily be provided by leading banks in the London Interbank Market for deposits of amounts in the relevant currency for delivery on the first day of such Interest Period, or

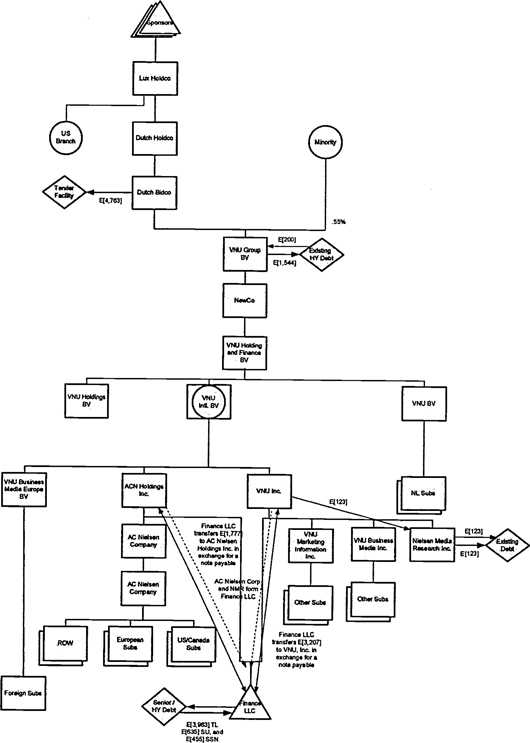

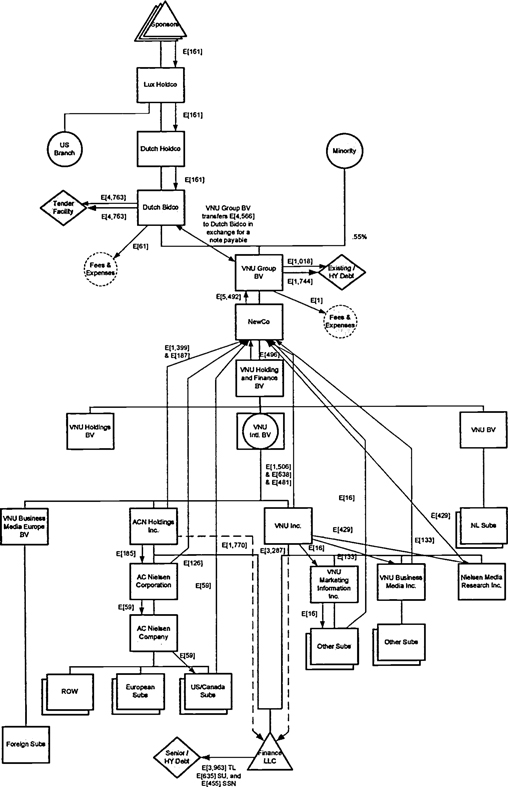

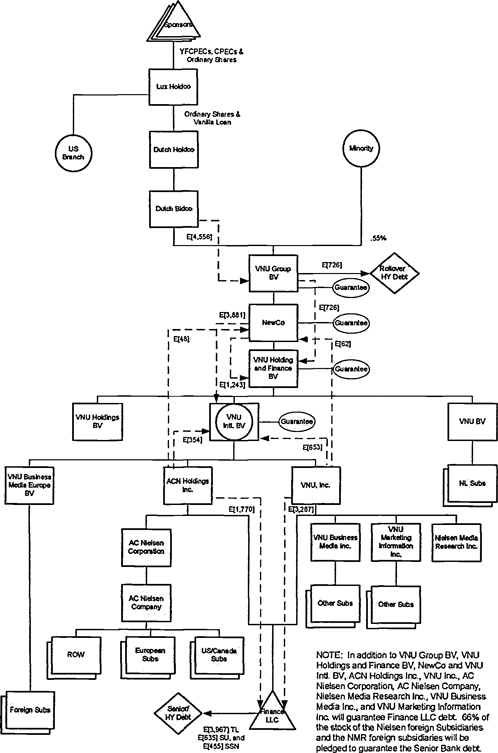

(b) if the rate referenced in the preceding clause (a) does not appear on such page or service or such page or service shall not be available, the rate per annum equal to the rate determined by the Administrative Agent to be the offered rate on such other page or other service that displays an average British Bankers Association Interest Settlement Rate for deposits in Dollars or the relevant Alternative Currency (for delivery on the first day of such Interest Period), as applicable, with a term equivalent to such Interest Period, determined as of approximately 11:00 a.m. (London time) two (2) Business Days prior to the first day of such Interest Period, or, if different, the date on which quotations would customarily be provided by leading banks in the London Interbank Market for deposits of amounts in the relevant currency for delivery on the first day of such Interest Period, or