EXECUTION COPY PRIVATE LABEL CREDIT CARD PLAN AGREEMENT BETWEEN WORLD FINANCIAL NETWORK BANK AND PIER 1 IMPORTS (U.S.), INC. DATED AS OF OCTOBER 5, 2011

Exhibit 10.1

Confidential Treatment Requested

Certain material (indicated by asterisks) has been omitted from this document and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment.

EXECUTION COPY

BETWEEN

WORLD FINANCIAL NETWORK BANK

AND

PIER 1 IMPORTS (U.S.), INC.

DATED AS OF OCTOBER 5, 2011

CONFIDENTIAL

|

1.1

|

Certain Definitions

|

|

1.2

|

Other Definitions

|

|

1.3

|

Additional Points of Interpretation

|

|

SECTION 2. THE PLAN

|

|

|

2.1

|

Establishment and Operation of the Plan

|

|

2.1.1

|

Portfolio Purchase and Sale Agreement

|

|

2.2

|

Applications for Credit Under the Plan; Internet Features

|

|

2.3

|

Operating Procedures

|

|

2.4

|

Plan Documents (Forms and Collateral)

|

|

2.5

|

Marketing and Promotion of Plan

|

|

2.6

|

Administration of Accounts and Plan

|

|

2.7

|

Credit Decision

|

|

2.8

|

Ownership of Accounts and Information

|

|

2.9

|

Protection Programs and Enhancement Marketing Services

|

|

2.10

|

Ownership and Licensing of the Parties’ Marks

|

|

2.11

|

|

|

SECTION 3. OPERATION OF THE PLAN

|

|

|

3.1

|

Honoring Credit Cards

|

|

3.2

|

Intentionally Left Blank

|

|

3.3

|

Cardholder Disputes Regarding Accounts and Goods and/or Services

|

|

3.4

|

No Special Agreements

|

|

3.5

|

Cardholder Disputes Regarding Violations of Applicable Law

|

|

3.6

|

Payment to Pier 1; Ownership of Accounts; Fees; Accounting

|

|

3.7

|

Bank Mailings; Insertion of Pier 1’s Promotional Materials

|

|

3.8

|

Cardholder Payments on Accounts

|

|

3.9

|

Chargebacks

|

|

3.10

|

Exercise of Chargebacks

|

|

3.11

|

Non-Competition

|

|

3.12

|

Intentionally Left Blank

|

|

3.13

|

Reports

|

|

3.14

|

New Businesses and Existing Credit Program Conversions

|

|

SECTION 4. REPRESENTATIONS AND WARRANTIES OF PIER 1

|

|

|

4.1

|

Organization, Power and Qualification

|

|

4.2

|

Authorization, Validity and Non-Contravention

|

|

4.3

|

Accuracy of Information

|

|

4.4

|

Validity of Transaction Records

|

|

4.5

|

Compliance with Law

|

|

4.6

|

Pier 1 Marks

|

|

4.7

|

Intellectual Property Rights

|

|

4.8

|

Promotional Plans Under the Pier 1 Program

|

i

|

SECTION 5. COVENANTS OF PIER 1

|

|

|

5.1

|

Notices of Changes

|

|

5.2

|

Financial Statements

|

|

5.3

|

Access Rights

|

|

5.4

|

Intentionally Left Blank

|

|

5.5

|

Insurance

|

|

5.6

|

Intentionally Left Blank

|

|

5.7

|

Business Continuation/Disaster Recovery Plan

|

|

5.8

|

SSAE 16

|

|

SECTION 6. REPRESENTATIONS AND WARRANTIES OF BANK

|

|

|

6.1

|

Organization, Power and Qualification

|

|

6.2

|

Authorization, Validity and Non-Contravention

|

|

6.3

|

Accuracy of Information

|

|

6.4

|

Compliance with Law

|

|

6.5

|

Intellectual Property Rights

|

|

SECTION 7. COVENANTS OF BANK

|

|

|

7.1

|

Notices of Changes

|

|

7.2

|

Financial Statements

|

|

7.3

|

Access Rights

|

|

7.4

|

Bank’s Business

|

|

7.5

|

Insurance

|

|

7.6

|

Business Continuation/Disaster Recovery Plan

|

|

7.7

|

SSAE 16

|

|

SECTION 8. INDEMNIFICATION

|

|

|

8.1

|

Indemnification Obligations

|

|

8.2

|

LIMITATION ON LIABILITY

|

|

8.3

|

NO WARRANTIES

|

|

8.4

|

Notification of Indemnification, Conduct of Defense

|

|

SECTION 9. TERM, EXPIRATION AND TERMINATION

|

|

|

9.1

|

Term and Expiration

|

|

9.2

|

Termination with Cause by Bank; Bank Termination Events

|

|

9.2.1

|

Special Circumstances Bank Termination Event

|

|

9.3

|

Termination with Cause by Pier 1; Pier 1 Termination Events

|

|

9.3.1

|

Special Circumstances Pier 1 Termination Event

|

|

9.4

|

Intentionally Left Blank

|

|

9.5

|

Purchase of Accounts

|

ii

|

10.1

|

Entire Agreement

|

|

10.2

|

Coordination of Public Statements

|

|

10.3

|

Amendment

|

|

10.4

|

Successors and Assigns

|

|

10.5

|

Waiver

|

|

10.6

|

Severability

|

|

10.7

|

Notices

|

|

10.8

|

Captions and Cross-References

|

|

10.9

|

GOVERNING LAW / WAIVER OF JURY TRIAL

|

|

10.10

|

Counterparts

|

|

10.11

|

Force Majeure

|

|

10.12

|

Relationship of Parties

|

|

10.13

|

Survival

|

|

10.14

|

Mutual Drafting

|

|

10.15

|

Independent Contractor

|

|

10.16

|

No Third Party Beneficiaries

|

|

10.17

|

Confidentiality and Security Control

|

|

10.18

|

Taxes

|

|

1.1

|

Other Definitions and Payments Between the Parties

|

|

2.1 (a)

|

Plan Commencement Date

|

|

2.1 (b)

|

Service Standards

|

|

2.1.1

|

Portfolio Purchase and Sale Agreement

|

|

2.2 (b)

|

Quick Credit

|

|

2.4 (e) (x)

|

Converted Cardholders/Accounts

|

|

2.5 (a)

|

Marketing Promotions

|

|

2.5 (b)

|

Marketing Funds

|

|

2.5 (c)

|

New Account Prospect Funds

|

|

2.5 (d)

|

Launch Incentive Funds

|

|

2.7

|

Special Credit Program: Employee Program

|

|

2.8

|

Monthly Master File Information

|

|

2.9 (b)

|

Enhancement Marketing Services

|

|

3.6 (d)

|

Summary of Rates and Fees

|

|

3.13

|

Bank Reports

|

|

5.5

|

Pier 1 Insurance

|

|

7.5

|

Bank Insurance

|

|

9.5

|

Purchase of Accounts

|

|

10.4

|

Successors and Assigns

|

|

11

|

Plan Committee

|

|

EXHIBITS

|

|

|

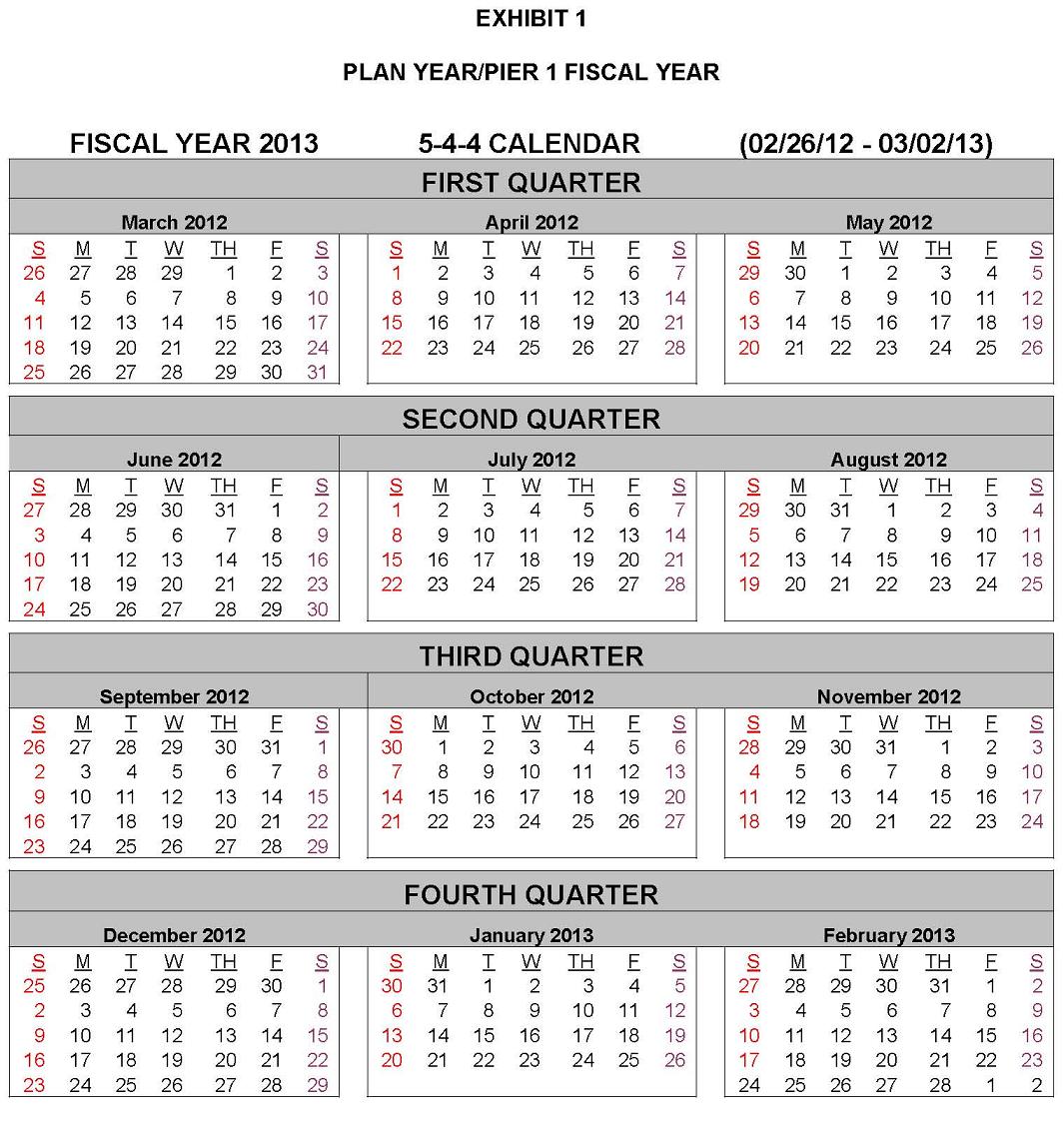

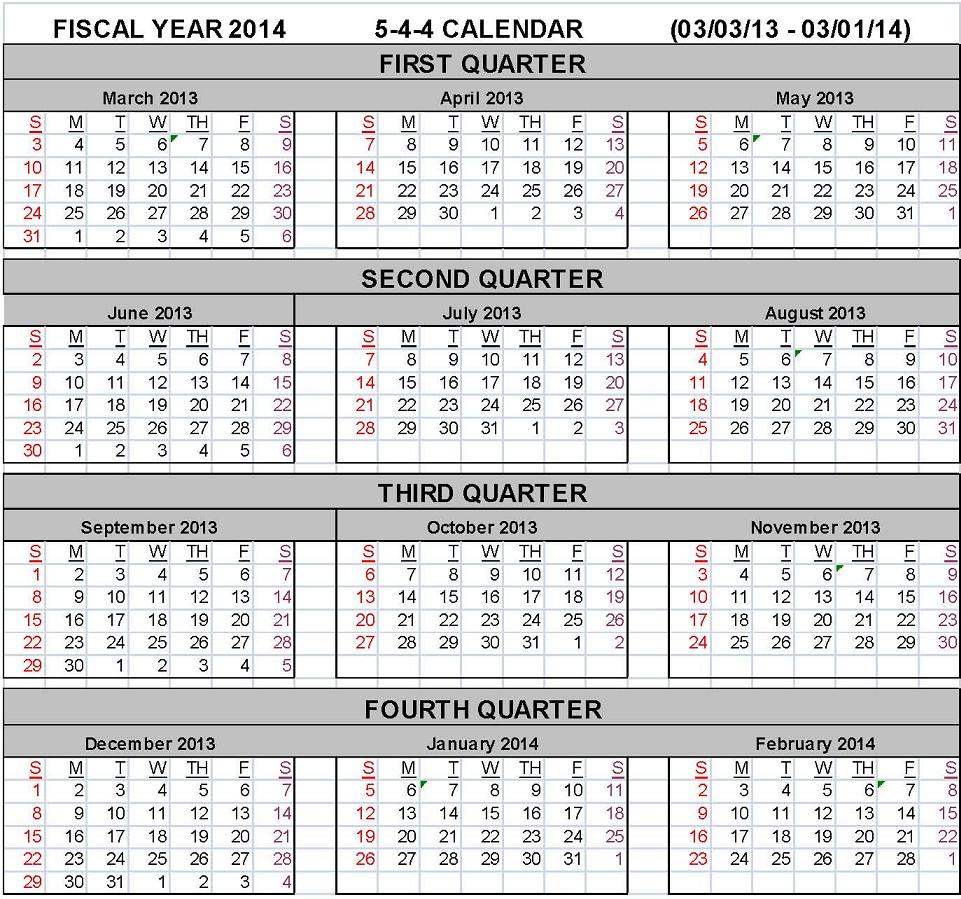

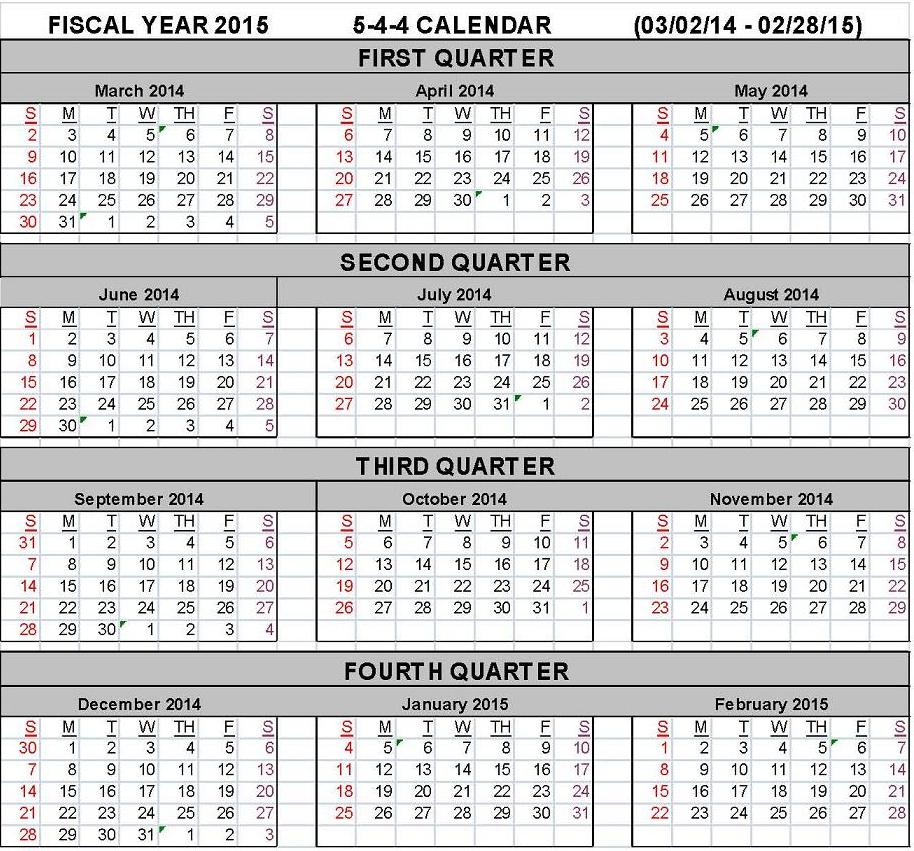

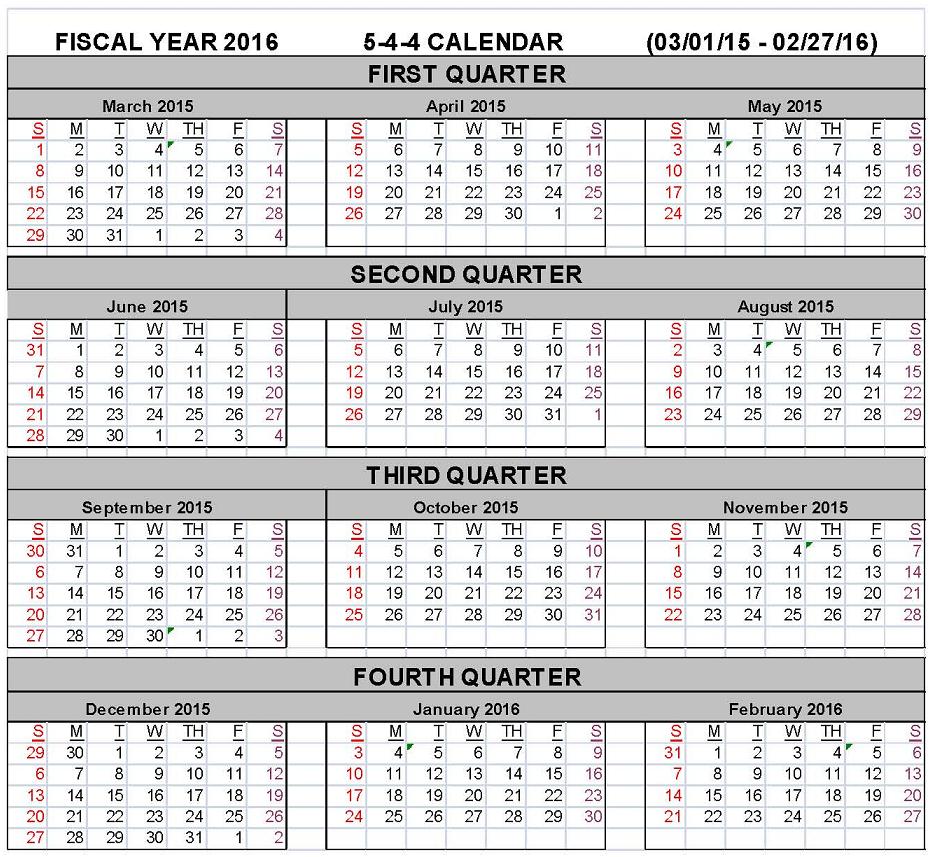

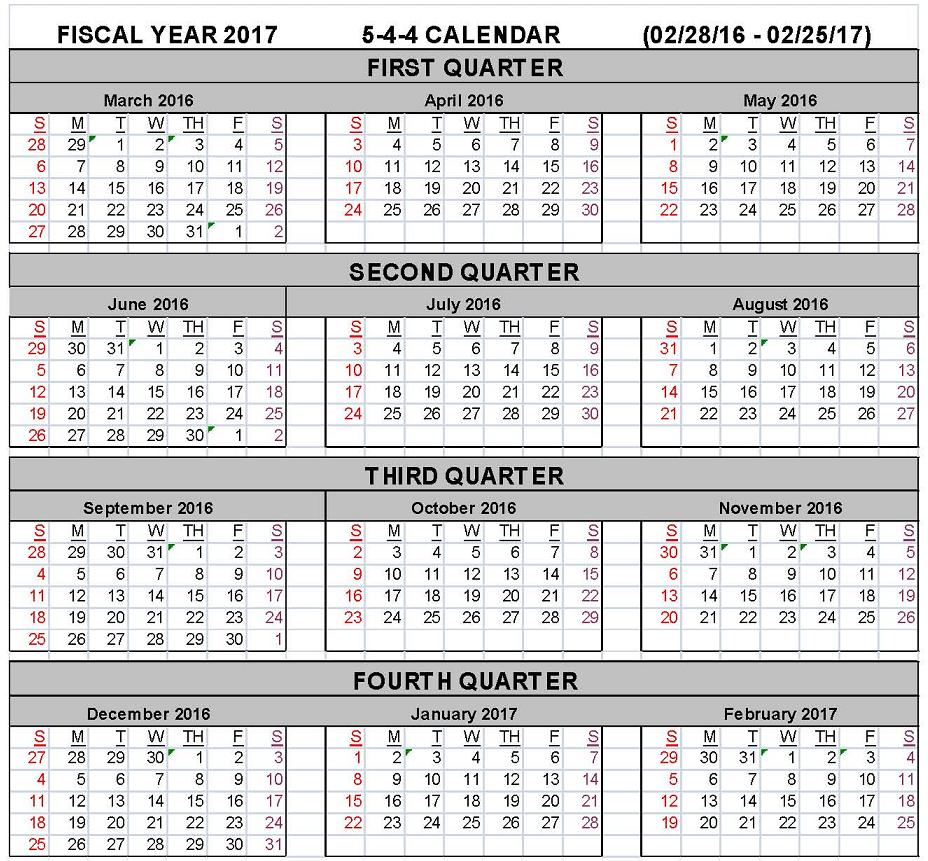

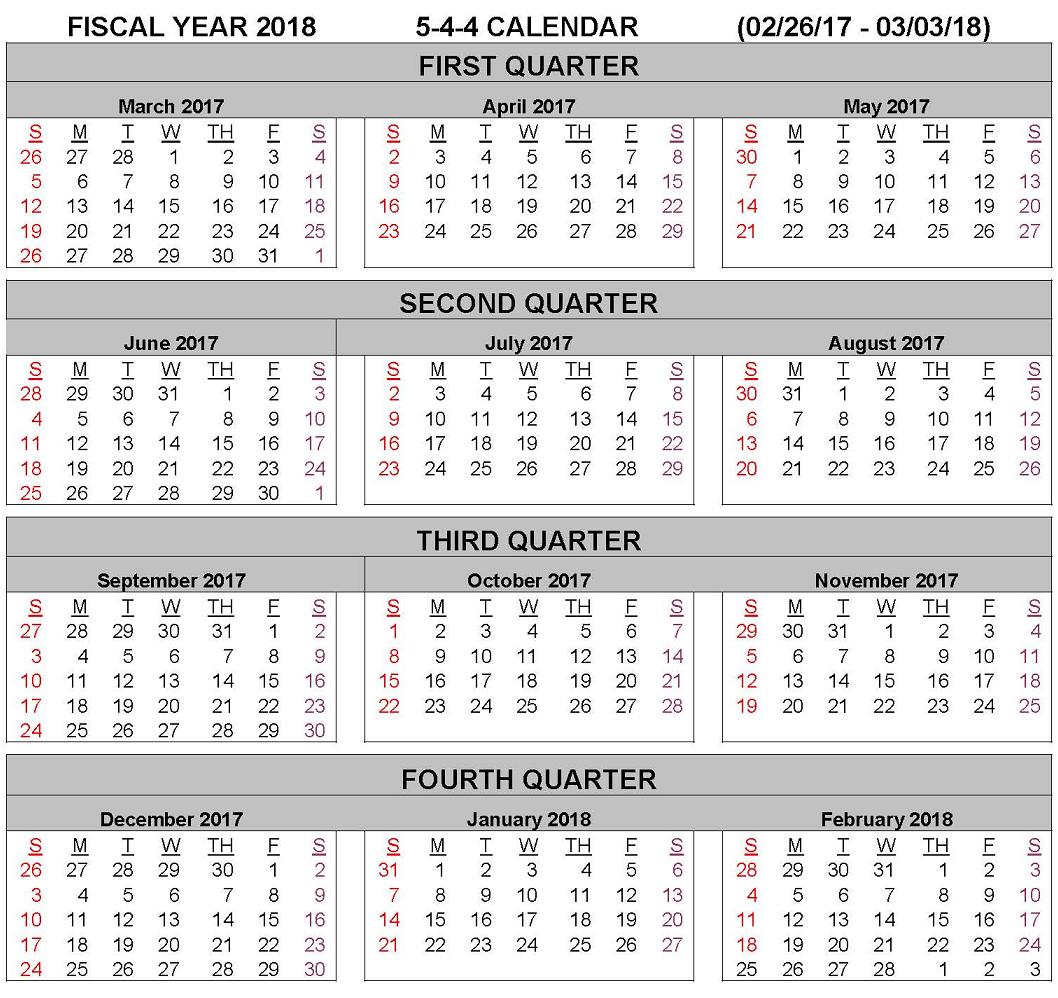

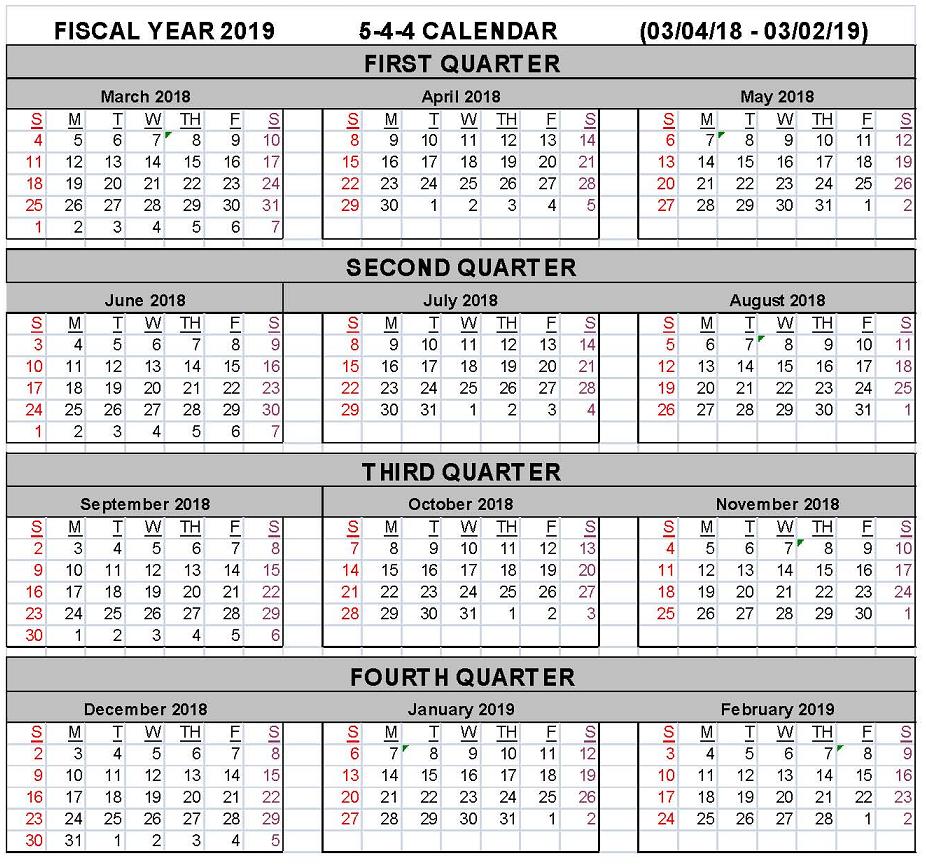

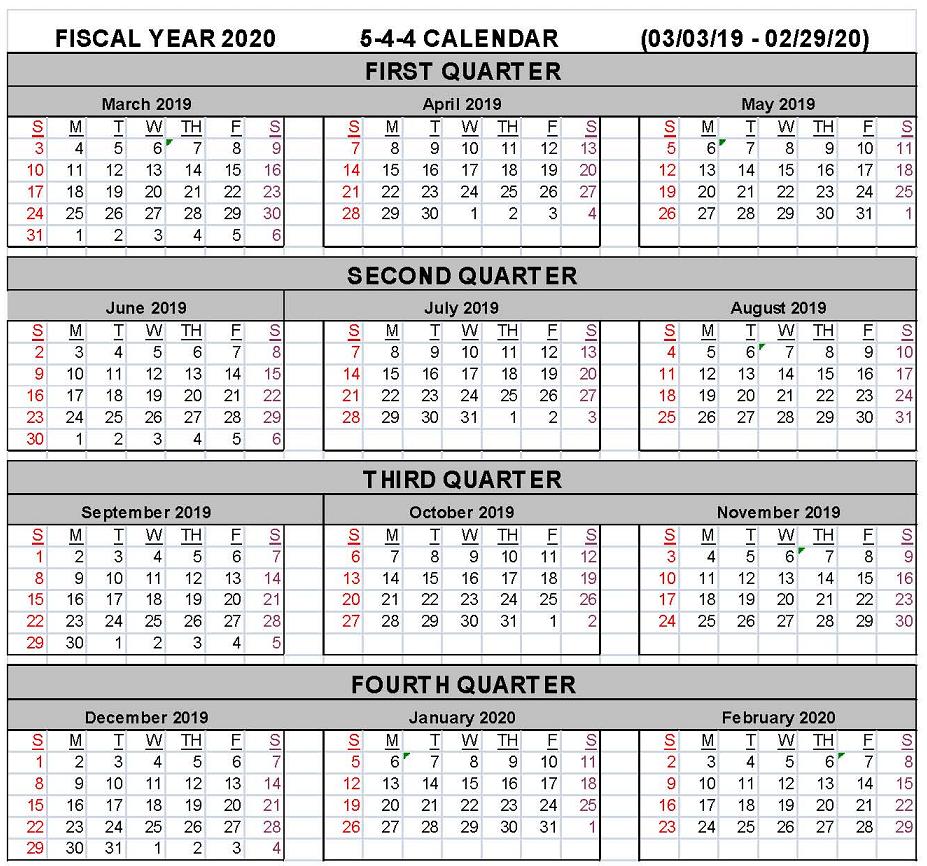

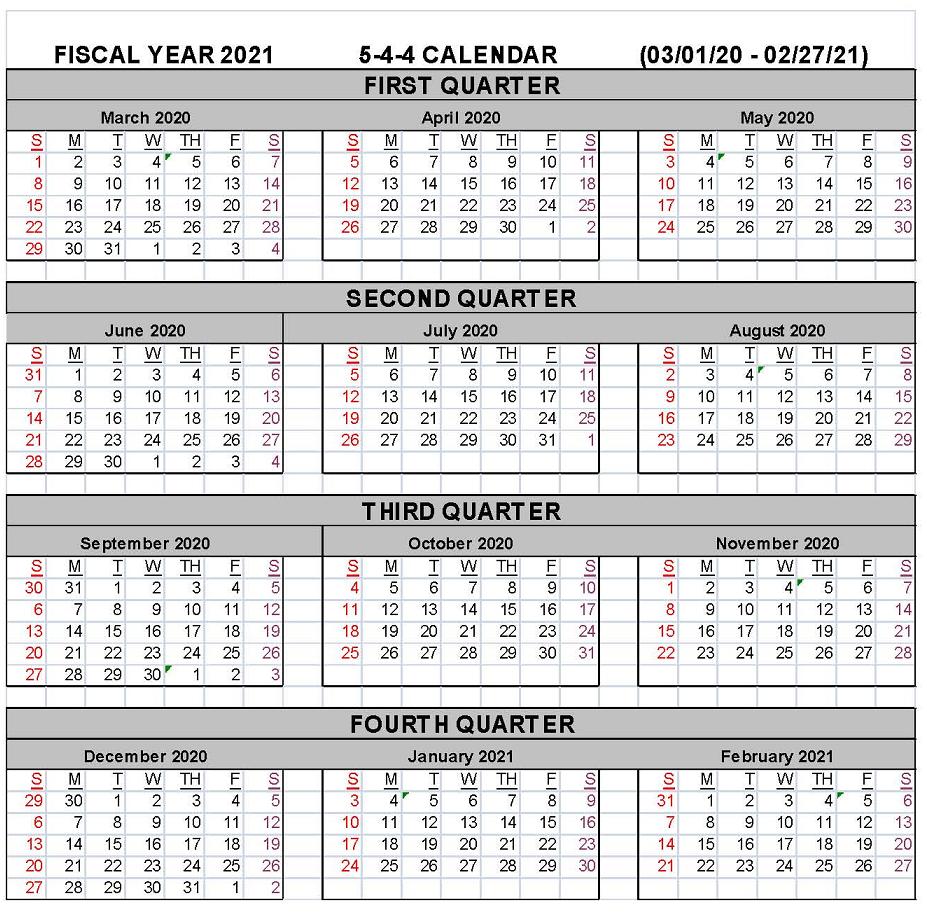

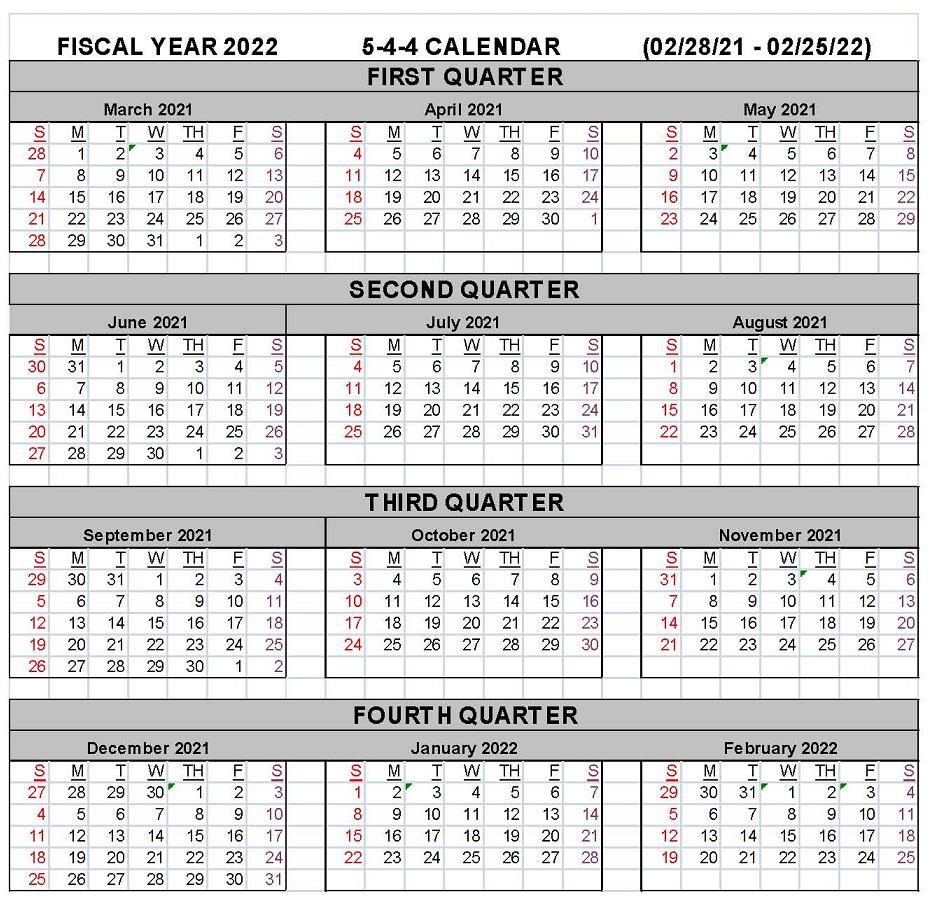

Exhibit 1:

|

Plan Year/Pier 1 Fiscal Year

|

|

Exhibit 9.5:

|

Accounts Not Included in Sale of Portfolio

|

iii

THIS PRIVATE LABEL CREDIT CARD PLAN AGREEMENT is made as of the 5th day of October, 2011 (the “Effective Date”) by and between Pier 1 Imports (U.S.), Inc., with its principal office at 000 Xxxx 0 Xxxxx, Xxxx Xxxxx, Xxxxx 00000 (hereinafter referred to as “Pier 1”), and WORLD FINANCIAL NETWORK BANK, with offices at Xxx Xxxxxxx Xxxxxxx, Xxxxx 000, Xxxxxxxxxx, XX 00000 (hereinafter referred to as “Bank”).

SECTION 1. DEFINITIONS

1.1 Certain Definitions. As used herein and unless otherwise required by the context, the following terms shall have the following respective meanings.

“Account” shall mean an individual open-ended revolving line of credit which is (i) established by Bank for a Customer pursuant to the terms of a Credit Card Agreement, and (ii) marketed with a Pier 1 Xxxx. As a point of clarification, once the Conversion has occurred, “Account” shall include, without limitation, the Converted Accounts.

“Accounts Receivable” shall mean, as to any Account at the time of reference, any and all amounts owing on such Account, including, without limitation, principal balances from Purchases, fees related to Protection Programs and Enhancement Marketing Services (as defined in Section 2.9), accrued finance charges (whether or not posted or billed to an Account), late fees, and all other fees and charges assessed on the Accounts, less any payments received by Bank and credits issued by Bank with respect to the Accounts. This definition specifically excludes any amounts which have been written-off by Bank with respect to such Accounts.

1

“Affiliate” shall mean with respect to a party any entity that is owned by, owns, or is under common control with such party.

“Agreement” shall mean this Private Label Credit Card Plan Agreement, including any schedules, exhibits, addenda, and future amendments and supplements hereto.

“Annual Average Accounts Receivable” shall mean, as to the particular Plan Year for which the calculation is made, the amount calculated as follows: [the sum of the months-end Accounts Receivable for each Plan Month in that Plan Year] divided by [the number of Plan Months in the subject Plan Year].

“Applicable Law” shall mean any applicable federal, state or local law, rule, or regulation.

“Applicant” shall mean an individual who is a Customer and applies for an Account under the Plan.

“Bank Xxxx” shall mean a trademark, service xxxx, or name owned by or licensed (and capable of being sublicensed) to Bank and designated by Bank to Pier 1 for use in connection with the Plan.

“Batch Prescreen” shall mean a process where Bank’s offer of credit is made to certain Customers prequalified by Bank (per its criteria), in a batch mode (often but not exclusively within a direct-to-consumer environment).

“Billing Statement” shall mean Bank’s periodic statement listing the amounts of Purchases made, credits received, and other information, as required by Applicable Law and/or deemed desirable by Bank.

“Business Day” shall mean any day, except Saturday, Sunday or a day on which banks in Delaware are required to be closed under Applicable Law.

“Cardholder” shall mean any natural person to whom an Account has been issued by Bank and/or any authorized user of the Account.

“Cardholder Loyalty Program” shall have the meaning set forth in Section 2.11.

2

“Charge Slip” shall mean a sales receipt, register receipt tape, invoice or other documentation, whether in hard copy or electronic form (such as, but not limited to, that which is part of a Transaction Record), and in each case evidencing a Purchase that is to be charged to a Cardholder’s Account.

“Consumer Personal Information” shall mean that non-public personal information regarding Applicants, Customers, and Cardholders, including but not limited to Account information, consumer reports, and information derived from consumer reports, that is subject to protection under Applicable Law (which includes but is not limited to publication).

“Conversion” shall mean the transfer of ownership and custody to Bank of all those Pier 1 Program Accounts that are sold to Bank under the terms of the Portfolio Purchase and Sale Agreement.

“Conversion Date” shall mean the date on which the Conversion takes place, if it does.

“Converted Accounts” shall mean those Pier 1 Program Accounts sold to Bank under the terms of the Portfolio Purchase and Sale Agreement.

“Converted Cardholders” shall mean Pier 1 Program Cardholders whose accounts were converted to Bank’s ownership upon the Conversion.

“Credit Card” shall mean the private label credit card issued by Bank to Cardholders under the terms of this Agreement, which card corresponds to a related Account for the purpose of purchasing Goods and/or Services pursuant to this Agreement.

“Credit Card Agreement” shall mean the open-ended revolving credit agreement between a Cardholder and Bank governing the Account and Cardholder’s use of the Credit Card, together with any modifications or amendments which may be made to such agreement.

“Credit Sales Day” shall mean any day, whether or not a Business Day, on which Goods and/or Services are sold by Pier 1 through its Sales Channels.

“Credit Slip” shall mean a sales credit receipt or other documentation, whether in hard copy or electronic form (such as, but not limited to, that which is part of a Transaction Record), in each case evidencing (i) a return or exchange of Goods, or (ii) a credit on an Account as an adjustment by Pier 1 for goodwill or for Services rendered or not rendered by Pier 1 to a Cardholder.

“Customer” shall mean any individual consumer who was (prior to the Effective Date), is (as of the Effective Date), or becomes or potentially could become (after the Effective Date), a customer of Pier 1.

“Customer Loyalty Program” shall have the meaning set forth Section 2.11.

3

“Discount Fee” shall have the meaning set forth in Schedule 1.1.

“Discount Rate” shall have the meaning set forth in Schedule 1.1.

“Effective Date” shall mean the date set forth in the first paragraph on Page 1 of this Agreement.

“Electronic Xxxx Presentment and Payment” (or “EBPP”) shall mean a procedure offered by Bank whereby Cardholders can elect to receive their Billing Statements electronically and that also allows them an opportunity to remit their Account payments to Bank electronically. See also Schedule 2.5 (a).

“Electronic Customer Service” (or “eCS”) shall mean a web-based customer service system Bank makes available on a Bank website.

“Financial Products” shall mean credit card, credit issuance or payment processing arrangements, or other programs (including but not limited to ones involving a credit card) similar in purpose to those components of the Plan dealing with the extension of credit and repayment of debt extended to Customers as contemplated under this Agreement, including cardless, Internet-based or Internet-only payment vehicles and contactless payment vehicles to be used as devices and/or methods by Customers to purchase Goods and/or Services. By way of clarification the following are not “Financial Products”: gift cards, coupons, or mail-in rebate offers that can be used to purchase Goods and/or Services. See also Section 3.11 (b) regarding certain Financial Products that are exempt from the prohibitions provided elsewhere in Section 3.11.

“Force Majeure” shall have the meaning set forth in Section 10.11.

“Forms” shall have the meaning set forth in Section 2.4.

“Goods and/or Services” shall mean those goods and/or services sold at retail by Pier 1 through its Sales Channels to the general public for individual, personal, family or household use.

“Initial Term” shall have the meaning set forth in Section 9.1.

“Instant Credit” shall mean Pier 1’s POS new Account acquisition. See also Schedule 2.2 (b) regarding Quick Credit.

“IVR” shall mean an interactive voice response system and/or procedure.

“Launch Incentive Fund” shall have the meaning set forth in Schedule 2.5 (d).

“Marketing Fund” shall have the meaning set forth in Section 2.5 (b).

4

“Net Proceeds” shall mean Purchases: (i) less credits to Accounts for the return or exchange of Goods and/or Services, or a credit on an Account as an adjustment by Pier 1 for goodwill or for Goods and/or Services rendered or not rendered by Pier 1 to a Cardholder, all as shown in the Transaction Records and as corrected by Bank in the event of any computational error, calculated each Business Day; (ii) less payments from Cardholders received by Pier 1 from Cardholders on Bank’s behalf; (iii) less any amounts owed to Bank by Pier 1 under Section 3.9 and Schedule 1.1 (B); and (iv) plus any amounts owed by Bank to Pier 1 under Schedule 1.1 (A).

“Net Sales” shall mean Purchases, less credits or refunds for Goods and/or Services, all as shown in the Transaction Records (as corrected by Bank in the event of any computational error), calculated each Business Day.

“Net Sales on Regular Revolving Purchases” shall mean Regular Revolving Purchases, less credits or refunds for Goods and/or Services related to such Purchases, all as shown in the Transaction Records (as corrected by Bank in the event of any computational error), calculated each Business Day.

“Net Sales on Promotional Program Purchases” shall mean Promotional Program Purchases, less credits or refunds for Goods and/or Services related to such Purchases, all as shown in the Transaction Records (as corrected by Bank in the event of any computational error), calculated each Business Day.

“New Account Prospect Funds” shall have the meaning set forth in Schedule 2.5 (c).

“On-Line Prescreen” shall mean a process where Bank’s offer of credit is made to certain Customers pre-qualified by Bank (per its criteria), in a real-time pre-approved manner, at the POS at the time of a transaction.

“Operating Procedures” shall mean Bank’s instructions and procedures regarding operation of the Plan as written by Bank and provided to Pier 1 to be followed by Pier 1. As of the Effective Date, the Operating Procedures are those provided to Pier 1 on September 20, 2011. See also Section 2.3.

“Pier 1” shall mean the party identified by such name in the first paragraph on Page 1 of this Agreement.

“Pier 1 Deposit Account” shall mean the one (1) deposit account maintained by Pier 1 and designated by it in writing to Bank as to which Bank should direct its payments. See also Section 3.6 (a).

“Pier 1 Fiscal Time Periods” shall mean those time periods reflected on Exhibit 1.

“Pier 1 Xxxx” shall mean a trademark, service xxxx, or trade name owned by or licensed (and capable of being sublicensed) to Pier 1 and designated by Pier 1 to Bank for use in connection with the Plan. As of the Effective Date, the Pier 1 Marks are: “Pier 1” and “Pier 1 Imports”.

5

“Pier 1 Plan” shall mean the private label credit card plan established and administered by Bank for Customers pursuant to this Agreement.

“Pier 1 Program” shall mean the private label credit account program in which Pier 1 participates as of the Effective Date. The Converted Accounts are a part thereof, and will be until the Conversion Date, when they will have been sold to Bank under the Portfolio Purchase and Sale Agreement.

“Pier 1 Program Accounts” shall mean the private label credit accounts issued under the Pier 1 Program. By way of clarification, not all Pier 1 Program Accounts shall be Converted Accounts.

“Pier 1 Program Agreement” shall mean the agreement between Pier 1 and the issuer of the Pier 1 Program Accounts that are part of the Pier 1 Program.

“Pier 1 Program Cardholders” shall mean those to whom Pier 1 Program Accounts and Pier 1 Program Credit Cards were issued.

“Pier 1 Program Credit Cards” shall mean the credit cards issued to Pier 1 Program Cardholders (each corresponding to a related Pier 1 Program Account).

“Pier 1 Total Net Sales” shall mean, as to the subject time period being measured, the amount of total net sales for Pier 1 (all forms of tender) through its Sales Channels, calculated in a manner consistent with Pier 1’s practices in place as of the Effective Date. Provided, however, that Pier 1 may modify such manner of calculation to the extent necessitated by Applicable Law as well as necessitated in response to a change in Applicable Law.

“Plan Commencement Date” shall have the meaning set forth in Section 2.1 (a) (ii).

“Plan Committee” shall have the meaning set forth in Schedule 11.

“Plan Documents” shall mean those items comprised of Forms and Collateral as such terms are defined in Section 2.4.

“Plan Month” shall mean each four (4) or five (5) week period corresponding to the fiscal month designated as such by Pier 1 in Exhibit 1.

“Plan Quarter” shall mean each three (3) Plan Month period corresponding to the fiscal quarter designated by Pier 1 as such in Exhibit 1.

“Plan Year” shall mean: (i) as to Plan Year One, the time period beginning on the Plan Commencement Date and continuing through the end of the period designated by Pier 1 as its fiscal year 2013 (which per Exhibit 1 is March 2, 2013

6

(ii) as to Plan Year Two and thereafter, the period of time corresponding to the fiscal year designated as such by Pier 1 on Exhibit 1.

“Point of Sale” (or “POS”) shall mean the physical or electronic location at which transactions (sales, credits, and returns) take place. This includes but is not limited to a cash register, point of order entry, or website (as applicable).

“Portfolio Purchase and Sale Agreement” shall mean the agreement between Bank (as buyer) and the current owner of the Pier 1 Program Accounts (as seller) for the purchase by Bank of all the Converted Accounts as of the Conversion Date. See also Section 2.1.and Section 2.1.1.

“Prescreen Acceptance” shall mean a POS process designed to recognize and activate Bank’s pre-approved batch offers for Accounts for Customers.

“Prime Rate” (or “Prime”) shall mean the “Prime Rate” as published in the “Money Rates” section of the Wall Street Journal on the date of reference.

“Promotional Program” shall mean any special Cardholder payment terms approved by Bank for certain Purchases, including without limitation deferred or equal payment programs. The initial Promotional Programs are set forth in Schedule 1.1.

“Purchase” shall mean, in each case, a purchase of Goods and/or Services, including without limitation all applicable taxes and shipping costs, with a specific extension of credit by Bank to a Cardholder using an Account as provided for under this Agreement. The term shall be interpreted to include Regular Revolving Purchases as well as Promotional Program Purchases unless the context of the reference clearly indicates otherwise.

“Quick Credit” shall mean Bank’s application procedure designed to open Accounts as expeditiously as possible at the Point of Sale, whereby an application for an Account might be processed without a paper application being completed by an Applicant.

“Rates and Fees” shall mean those Cardholder terms and conditions regarding rates and fees as are initially set forth in Schedule 3.6 (d), as amended from time to time pursuant to Section 3.6 (d).

“Rebate Fees” shall have the meaning set forth in Schedule 1.1.

“Rebate Rate” shall have the meaning set forth in Schedule 1.1.

“Regular Revolving Purchases” shall mean Purchases which are not subject to any Promotional Program.

“Renewal Term” shall have the meaning set forth in Section 9.1.

7

“Sales Channels” shall mean those certain sales channels through which Pier 1 sells its Goods and/or Services under the terms and conditions of this Agreement during the Term, such as: (i) retail locations (but all retail stores must be located in the U.S.) which are owned and operated by Pier 1 or Pier 1’s Affiliates or Pier 1’s licensees or franchisees, (ii) Pier 1’s websites (which as of the Effective Date is “xxxx0.xxx”); and (iii) catalogs. As a point of clarification, this definition includes different or additional sales channels that are part of Pier 1’s expansion of its business as then constituted, if such expansion does not include a sales channel operated by an entity other than Pier 1. For example: the opening of a new store or development of a website through either (i) “organic growth” or (ii) acquisition of the assets (but not the ownership interest) of a competitor. (See also Section 3.14 regarding the internal development or acquisition of a business that would be new to Pier 1’s business as then constituted or that involves an entity other than Pier 1). However, the ownership or operation by a Pier 1 Affiliate of a business that is substantially similar to that of Pier 1 (at the then current point in time) shall be considered an expansion of Pier 1 for the purposes of this Agreement and such business (and its owner entity) shall be included in this Agreement by amendment.

“Service Standards” shall have the meaning set forth in Schedule 2.1 (b).

“Term” shall mean the Initial Term plus any Renewal Terms, as defined in Section 9.1.

“Transaction Record” shall mean the following, with respect to each Purchase or with respect to a credit or return related to a Purchase (as applicable), and each payment received by Pier 1 from a Cardholder on Bank’s behalf: (a) the Charge Slip or Credit Slip corresponding to the Purchase, credit or return; or (b) a computer readable tape/cartridge or electronic transmission containing the following information: the Account number of the Cardholder, identification of the Pier 1’s Sales Channel (location) where the Purchase, credit or return was made (if applicable), the total of (i) the Purchase price of Goods or Services purchased or amount of the credit, as applicable, plus (ii) the date of the transaction, a description of the Goods or Services purchased, credited or returned and the authorization code, if any, obtained by Pier 1 prior to completing the transaction; or (c) electronic record whereby Pier 1 or one of its Sales Channels electronically transmits the information described in subsection (b) hereof to a network provider (selected by Pier 1 at its expense), which in turn transmits such information to Bank by a computer tape/cartridge or electronic tape or transmission.

“United States” (or “U.S.”) shall mean the geographic area consisting of the fifty states of the United States, District of Columbia, Puerto Rico and any other U.S. commonwealth or territory.

“Web” (or “web” or “Internet”) shall mean the world-wide web internet network as generally understood in the greater business community.

“Web Application” shall mean a web based new Account application procedure made available by Bank. See also Section 2.2 (d).

8

1.2 Other Definitions. As used herein, terms defined in the introductory paragraph hereof and in other sections of this Agreement shall have such respective defined meanings. Defined terms stated in the singular shall include reference to the plural and vice versa. The terms “shall” and “will” have the identical meaning (i.e., that something is compulsory and certain), and the use of one versus the other is not to be interpreted as implying less certainty or a sense of possibility or choice.

1.3 Additional Points of Interpretation. (a) One method (but not the only) for one party to fulfill its obligation to provide notice or information to the other (in writing or orally) can be satisfied by communicating same at a Plan Committee Meeting. Provided, however, that such method shall not (i) serve as a substitute for any written notice required under Sections 9.1 through 9.5 (including the corresponding Schedules thereto); and (ii) obviate any obligation in terms of the timing of such notice/information.

(b) Many provisions in this Agreement relate to others. However, such relationships are not cross-referenced in every case and the lack of a specific and/or express cross-reference does not negate the relationship. By way of example and not limitation, the matters addressed in Schedule 11 relate to many other provisions (both sections and schedules) in this Agreement, but are not reflected by cross-references in or to Schedule 11.

SECTION 2. THE PLAN

2.1 Establishment and Operation of the Plan.

(a) The Plan is established for the primary purposes of providing Customer financing for purchasing Goods and/or Services and providing a means to promote increased Pier 1 sales of Goods and/or Services through Sales Channels, in a manner that is mutually beneficial to the parties. See Schedule 2.1 (a)

(b) Bank shall perform in accordance with the Service Standards. Bank will provide Pier 1 with a monthly summary of Bank’s performance regarding the Service Standards, as set forth in Schedule 2.1 (b). Bank shall provide eCS, and Pier 1 shall provide a weblink to the eCS. Regardless of whether any Bank website related to eCS is the same as any referenced in Section 2.2 (d) below, Pier 1’s obligations with respect to the eCS website (and the terms and conditions related to the eCS website) shall be the same as those applicable to the Website described in Section 2.2 (d) below.

2.1.1 Portfolio Purchase and Sale Agreement

See Schedule 2.1.1

9

2.2 Applications for Credit Under the Plan; Internet Features.

(a) Pier 1 shall not promote or participate in any application by a Customer for financing the purchase of Goods and/or Services other than for participation in the Plan as provided in Section 3.11. Applicants who wish to apply for an Account under the Plan must submit a completed application on a form or in an electronic format approved by Bank, and Bank shall grant or deny the request for credit based solely upon Bank’s credit criteria. In the case of in-store applications, Pier 1 shall (i) provide a copy of the Credit Card Agreement to the Applicant to be retained for the Applicant’s records, and (ii) follow any applicable Operating Procedures. When facilitating any other method of application, Pier 1 shall follow all applicable Operating Procedures. The application shall be submitted to Bank by the Applicant or submitted by Pier 1 on behalf of the Applicant, as required in the Operating Procedures. If Bank grants the request for an Account, Bank will issue a Credit Card to the Applicant to access an individual line of credit in an amount determined by Bank.

(b) As of the Plan Commencement Date, Bank shall make available, and Pier 1 shall utilize, Web Application. Pursuant to the provisions of Schedule 2.2 (b), Bank shall make available and Pier 1 shall utilize Quick Credit. In addition, if and as agreed to by the parties as to each method, at some point during the Term, Bank will make available (and in which case Pier 1 shall utilize) On-Line Prescreen, Batch Prescreen, and/or a mobile technology method for new Account acquisition. See also subsection (d) below regarding Web Application.

(c) Regarding applications submitted in whole or in part by Pier 1 on an Applicant’s behalf, Pier 1 agrees that it will, pursuant to and subject to the provisions of this Agreement (including but not limited to Section 10.17): (i) protect and keep confidential any and all Applicant information (which information shall be Bank Consumer Personal Information) acquired as a result of participating in the submission of any such applications, (ii) not disclose the information to anyone other than authorized representatives of Bank, and (iii) follow all Operating Procedures applicable to such Bank Consumer Personal Information.

(d) Bank shall, on or before the Plan Commencement Date, make available the Web Application procedure by establishing a website for such purpose, which shall be accessible from Pier 1’s website. Bank shall bear the entire cost of those components involving its systems that are required to make Web Application available. Accordingly, Pier 1 shall be responsible for integrating and maintaining on its website, at its sole expense, access to Bank’s Web Application. Pier 1 agrees that, to integrate and maintain the Web Application, to ensure access to the Bank’s designated website, and to reduce technical errors, Pier 1’s software providing the access will function, and continue to function, in a sound technical manner. Pier 1 shall monitor its website to ensure proper functioning. In the event Bank changes or otherwise modifies the website address for its designated website, Pier 1 will either update or modify its website accordingly, as directed by Bank upon prior written notice. In providing Web Application on the Pier 1 website, if appropriate, Pier 1 shall make it clear and conspicuous that the Customer is leaving Pier 1’s website and is being directed to Bank’s website for the exclusive purpose of accessing Bank’s website and submitting an application for credit. Pier 1 agrees that, in connection with the Web Application, it will use Bank’s name, or any logo, statements, or any other information that is related to Bank, only as directed by Bank, or as previously approved by Bank in writing. Without limiting the generality of the scope of required approvals, but by way of example, Pier 1 shall seek Bank’s approval not only with respect to content, but also with respect to any typestyle, color, or abbreviations used in connection with the Web Application.

10

2.3 Operating Procedures. Pier 1 shall observe and comply with the Operating Procedures as Bank may prescribe on not less than thirty (30) days’ prior notice to Pier 1 or otherwise required by Applicable Law. The Operating Procedures may be amended or modified by Bank from time to time in its reasonable discretion; provided, however, unless such changes are required by Applicable Law, a copy of any such amendment or modification shall be provided to Pier 1 at least thirty (30) days before its effective date, and for those changes required by Applicable Law, notice shall be given as soon as practicable.

2.4 Plan Documents (Forms and Collateral).

(a) Forms - General. Subject to (b) below, Bank shall design, determine the terms and conditions of, and generate the form of the Credit Card Agreement, applications, Credit Card, card mailers, privacy notices, Billing Statements (including backers), Cardholder letters, templates, and other documents and forms to be used under the Plan which (i) relate to the Plan, (ii) relate to Bank’s and/or the Cardholder’s obligations, (iii) are used by Bank in maintaining and servicing the Accounts; or (iv) are required by Applicable Law (collectively, “Forms”). By way of clarification, Bank’s responsibilities do not include any obligations Pier 1 may have as a retailer, such as creating the form of Charge Slips and Credit Slips. All Forms shall be in the English language only unless otherwise agreed by the parties in writing, and there shall be only one design for each Form.

(b) Forms - Conditions. The provisions of (a) above are subject to the following conditions. First, Bank’s actions are subject to Section 3.6 (d), Applicable Law, and Section 2.10. Second, Bank and Pier 1 shall jointly design any Customer marketing aspects of Billing Statements, Credit Cards, and card mailers.

(c) Collateral. Pier 1 may design and produce promotional material, direct mail pieces, catalog, newspaper, radio, TV and Internet advertisements, and other collateral documents (collectively, “Collateral”) which reference the Plan. Pier 1 shall submit all Collateral to Bank for its review and approval of the Plan disclosures, as well as references to the Plan and use of Bank Marks. Pursuant to this review and approval process, Pier 1 will make (or have made) all changes that Bank requests to satisfy Applicable Law and/or in exercising its rights under this Agreement.

(d) Bank’s Costs. Subject to subsection (e) below, Bank will determine which and how many of the following to provide, which shall be at its expense. First, Bank will provide to Pier 1 at one central location in the Continental U.S., for distribution to Customers and Cardholders, marketing purposes, and mass mailings, as applicable: (i) adequate copies of Credit Card Agreements and applications; and (ii) the template of any appropriate Forms. Second, Bank shall provide an appropriate number of (or copies of, as applicable) Credit Card Agreements, applications, Credit Cards, Billing Statements, and card mailers.

11

(e) Costs Related to Mailings to Certain Converted Cardholders. Costs for mailings to certain Converted Cardholders as described in the immediately following paragraph shall be borne by Bank as set forth herein, including but not limited to (i) Credit Card: design, production, plastics, holder, and Credit Card Agreement; (ii) postage, envelopes, and welcome kit enclosures for those who accept an offer for a new Account; (iii) new marketing materials (POS, catalogue, and Web) and training materials; and (iv) applications. All Bank Forms, costs, and procedures related thereto shall be consistent with the terms of this Agreement, and in particular subsections (a), (b), and (f) (ii) of this Section 2.4. By way of clarification and emphasis, the provisions of this subsection (e) relate to the initial, post-Conversion mailing to certain Converted Cardholders, and does not apply to subsequent re-issuances requested by Pier 1, as described in subsection (f) below.

Once Conversion occurs, Bank shall identify each Converted Cardholder that made a purchase using her or his Pier 1 Program Account: (i) twelve (12) months or less prior to the Conversion Date, and (ii) more than twelve (12) months, but less than or equal to eighteen (18) months, prior to the Conversion Date. As to Converted Accounts in each such category, Bank shall determine which Converted Cardholders are eligible to be issued a new Account and corresponding Credit Card. For Converted Cardholders categorized in (i) or (ii), such Converted Cardholders shall not be eligible if Bank has determined (per its standard practices, policies and procedures) that the corresponding Converted Account: (x) is one that falls into a category listed in Schedule 2.4 (e) (x); (y) is not considered in good standing with Bank for reasons consistent with its practices, policies, and procedures, and/or (z) represents an unsatisfactory level of risk. In addition, as to a Converted Cardholder in category (ii), Bank shall not include the Converted Account in the mailing if the parties agree in writing that its inclusion is not likely to provide a net enhancement to the Plan.

Each eligible Converted Cardholder shall be assigned a credit limit by Bank in an amount at least equal to the credit limit in effect under the Pier 1 Program prior to the Conversion. In addition, Bank shall issue to (and bear the cost of issuing to) each such Converted Cardholder an appropriate version of a Credit Card to replace the Pier 1 Program Credit Card. Furthermore, with respect to each eligible Converted Cardholder that falls into the “12-18 months prior” category described in (ii) above, Pier 1 must fund a value proposition, the form and value of which shall be agreed to by the parties.

(f) Pier 1’s Costs.

(i) Pier 1 Re-issuances. By way of clarification and emphasis, the provisions of this subsection (f) do not obviate or otherwise modify Bank’s responsibilities under subsection (e) above. Any re-issuances requested by Pier 1 after the Plan launch described in subsection (e) above shall be referred to, collectively, as “Pier 1 Re-issuances”. Regarding any Pier 1 Re-issuance, Pier 1 shall pay all costs (i) for the card itself (including all embossing and encoding), card mailers, envelopes, Credit Card Agreements, and other Forms, Collateral, and postage, and (ii) any Bank out-of-pocket expense necessitated by Pier 1’s decision to launch a Pier 1 Re-issuance. As a point of clarification, none of the following constitutes a Pier 1 Re-issuance: Bank’s replacement (on an Account-by-Account basis) of lost or stolen Credit Cards, expired Credit Cards, or in response to some other Cardholder request. By way of further clarification, the Plan launch described in (e) above is not a Pier 1 Re-issuance.

12

(ii) Variations from Bank’s Standards. If a request or requirement (as applicable) of Pier 1 with regard to any Plan Documents requires a variation from Bank’s standard specifications, and such variation causes an increase in any cost of Bank, the following shall apply. First, Bank will advise Pier 1 in writing of the variance and provide a written estimate of the related cost increase. Second, Pier 1 shall notify Bank in writing of its decision to forego the request, to modify the request such that no cost increase is generated, or agree to bear the additional expense. In the event any Forms become obsolete as a result of changes requested by Pier 1 or necessitated by its decisions and/or actions, then upon written notice by Bank of such event, Pier 1 shall reimburse Bank for the costs associated with any unused obsolete Forms.

(iii) Mass Mailings. As to any mass mailings requested by Pier 1 (including but not limited to catalog mailings, pre-approved mailings, and zero balance mailings), Pier 1 shall pay all reasonable costs related thereto incurred by Bank.

2.5 Marketing and Promotion of Plan.

(a) Throughout the Term of this Agreement, Pier 1 shall actively market, promote, participate in and support the Plan, including without limitation those marketing promotions set forth in Schedule 2.5 (a) and such other methods mutually agreed upon by Pier 1 and Bank. As one example, Pier 1 agrees to prominently advertise and actively promote the Plan through all Sales Channels (e.g., as applicable, signage and spiffs at retail locations, catalog inserts, and promotions on Pier 1’s website). Pier 1 and Bank will jointly agree upon programs to market the Plan, both initially and on a continuing basis.

(b) Bank shall contribute the amounts set forth in Schedule 2.5 (b) to apply to marketing and promotion expenses associated with the Plan. All of such funds shall be referred to herein as the “Marketing Fund”. If the Marketing Funds are not used in the Plan Year or other time period contributed, they will not roll over to the next Plan Year and they shall not have any cash value. Pier 1 shall pay all marketing and promotion expenses directly as they are incurred, and shall send Bank an invoice for the aggregate amount of the expenditures mutually agreed upon by the parties, together with copies of paid invoices or other supporting documentation reasonably satisfactory to Bank for such expenses, which invoice shall be paid by Bank within thirty (30) days of receipt. Bank shall continue such reimbursements as just described until Bank’s maximum contribution amount for the applicable Plan Year has been met. Bank shall have the right to cease the availability of the Marketing Funds contributed by Bank for any future marketing or promotions if either party: (i) terminates this Agreement, (ii) notifies the other party of an intent to terminate or the fact that the notifying party has already terminated this Agreement, or (iii) notifies the other of an intent to allow this Agreement to expire. However, Bank shall renew the availability of the Marketing Funds for the then current Plan Year on a retroactive basis under the following circumstances: if despite the occurrence of (i), (ii), or (iii) but prior to this Agreement’s expiration or termination, the parties renew this Agreement and/or extend the expiration date by at least two (2) years.

13

(c) See also Schedule 2.5 (c) attached.

(d) See also Schedule 2.5 (d) attached.

2.6 Administration of Accounts and Plan. Bank shall perform, in compliance with Applicable Law, all functions necessary to administer and service the Accounts, including but not limited to: making all necessary credit investigations; notifying Applicants in writing of acceptance or rejection of credit under the Plan; preparing and mailing Billing Statements; making collections; handling Cardholder inquiries; and processing payments. See also Schedule 11.

2.7 Credit Decision. The decision to extend credit to any Applicant under the Plan shall be Bank’s decision. Bank shall establish and administer the underwriting and credit decisions for the Plan. If and when Bank determines that making changes in such criteria is appropriate, the following provisions shall apply. Bank shall provide Pier 1 with as much advance written notice as is reasonable under the circumstances. Such notice shall include (or be followed by a timely subsequent writing that includes) identification of what the changes will be and the date of implementation (or at least a best estimate as of the time of the notice/subsequent writing). Bank shall also provide its then current assessment of the impact of such changes on the Plan. By way of clarification, Bank’s notice and explanation of credit criteria changes as described above does not include disclosure of other Bank Confidential Information that Bank does not choose to disclose.

Pier 1 may from time to time request Bank to consider offering certain types of special credit programs. However, Bank shall, in its sole discretion, subject to Applicable Laws and its safety and soundness considerations, determine whether or not to offer any of such special credit programs. In the event Bank agrees to any special credit program, Pier 1 and Bank shall mutually agree in writing upon any special terms and fees associated with the special credit program. As of the Effective Date, the special credit program agreed to by the parties is described in greater detail in Schedule 2.7.

2.8 Ownership of Accounts and Information.

(a) The parties recognize that Cardholders are Customers, and that each of Bank and Pier 1 has certain ownership rights in information relating to such individuals in their respective roles as Cardholders and Customers. The parties acknowledge that the same or similar information may be contained in the Bank Cardholder Information (defined below) and the Pier 1 Customer Information (defined below); such common information being referred to herein as “Common Information”. Each such pool of data shall therefore be considered separate information subject to the specific provisions applicable to that data hereunder. For example, in subsection (b) below Bank is authorized to use Pier 1 Customer Information only for certain limited purposes. Presume such information included names of both Customers who were Cardholders and non-Cardholder Customers. The names of those who were both Customers and Cardholders would be Common Information. So, Bank would not be limited by the terms of subsection (b) as to such names. However, the names of non-Cardholder Customers would not be Common Information, and thus would be subject to the limitations set forth in subsection (b). Likewise, though subsection (c) below limits what Pier 1 can do with Bank Cardholder Information, such limitations do not apply to that portion of Bank Cardholder Information that is comprised of Common Information.

14

(b) The Customer’s names and addresses and other Customer information collected by Pier 1 independent of Bank and set forth in Pier 1’s records shall be the exclusive property of Pier 1; such information and Pier 1’s Common Information shall be referred to collectively as “Pier 1 Customer Information”. Pier 1 Customer Information might or might not be comprised exclusively of Pier 1’s Consumer Personal Information. As requested by Bank, but subject to Applicable Law and Pier 1’s privacy policy, Pier 1 shall provide the names and addresses of Customers to Bank, to be used only for purposes of (i) evaluating such Customer’s creditworthiness, (ii) soliciting such Customers for Credit Cards, and (iii) administering the Plan in accordance with the terms of this Agreement and Applicable Law. Bank shall protect the confidentiality of such information as set forth in Section 10.17.

|

(c)

|

(i)

|

The Accounts and all information related thereto set forth in Bank’s records, including without limitation the information listed in Schedule 2.8, the information obtained through applications, the receivables, names, addresses, credit, and transaction information of Cardholders shall be the exclusive property of Bank during the Term, and thereafter (unless the Accounts are purchased by Pier 1 or its designee pursuant to Section 9.5). Such information and Bank’s Common Information shall be referred to collectively as “Bank Cardholder Information”. Bank Cardholder Information might or might not be comprised exclusively of Bank’s Consumer Personal Information.

|

|

(ii)

|

Bank shall provide to Pier 1 monthly one (1) master file extract, initially containing the information set forth on Schedule 2.8 to the extent such information is available to and may be shared by Bank, and subject to change by Bank at any time. Bank shall also provide to Pier 1 any other Bank Cardholder Information requested by Pier 1, to the extent permitted by Applicable Law and Bank’s privacy and security policies. Pier 1 may use such information in connection with maintaining and servicing the Accounts; furthermore, Pier 1 may use it to market its Goods and/or Services or its business in general to the Cardholders, but in any event only as permitted by Applicable Law. The parties recognize that Pier 1’s efforts related to such approved purposes might necessitate disclosure of Bank Cardholder Information to Pier 1’s vendors and contractors. Such disclosure shall be permitted, provided the third-parties agree in writing to use the information only for the aforementioned approved purposes and to protect the confidentiality of such information as set forth in Section 10.17. Except as so provided, unless Bank consents otherwise in advance and in writing, Pier 1 shall keep such Bank Cardholder Information confidential as set forth in Section 10.17, and shall not disclose such information to any third-party nor sell, lease, or otherwise transfer such information to any third-party.

|

15

2.9 Protection Programs and Enhancement Marketing Services.

(a) Pier 1 and Bank agree that Bank will have the exclusive right but not the obligation to make available to Cardholders various types of debt cancellation and credit related protection programs (collectively referred to herein as “Protection Programs”) offered by Bank. Bank may but is not obligated to offer such Protection Programs through direct marketing channels including but not limited to telemarketing, call transfer, inbound customer service call offers, call to confirm programs, IVR, eCS, and EBPP. Bank also has the right but not the obligation to make written offers through Billing Statement bangtails and inserts, Billing Statement messaging, and direct mail. The fees for Protection Programs will be charged to the applicable Cardholder’s Account. Bank shall have the right but not the obligation to immediately terminate any Protection Programs if and when either party: (i) terminates this Agreement, (ii) notifies the other party of an intent to terminate or that the notifying party has already terminated this Agreement, or (iii) notifies the other of an intent not to renew this Agreement.

(b) Pier 1 and Bank agree that Bank will have the exclusive right but not the obligation, and in any event subject to Pier 1’s prior written consent, not to be unreasonably withheld or delayed, to make available to Cardholders, through solicitations made in connection with their Accounts, various types of products and services other than Protection Programs. Such other products and services shall be referred to collectively herein as “Enhancement Marketing Services”. Such Enhancement Marketing Services include, but are not limited to, travel clubs, legal services, and merchandise products. Bank may but is not obligated to offer Enhancement Marketing Services through direct marketing channels including but not limited to telemarketing, call transfer, inbound customer service call offers, call to confirm programs, IVR, ECS, and EBPP. Bank also has the right but not the obligation to make written Enhancement Marketing Services offers through Billing Statement bangtails and inserts, Billing Statement messaging, and direct mail. Bank will notify Pier 1 in writing (and/or in a Plan Committee meeting) of proposed offers through direct mail, telemarketing, statement inserts, and statement messaging prior to execution. The charges for Enhancement Marketing Services will be billed to the applicable Cardholder’s Account when appropriate. Bank shall have the right but not the obligation to immediately terminate any Enhancement Marketing Services if and when either party: (i) terminates this Agreement, (ii) notifies the other party of an intent to terminate or that the notifying party has already terminated this Agreement, or (iii) notifies the other of an intent not to renew this Agreement. See also Schedule 2.9 (b).

16

2.10 Ownership and Licensing of the Parties’ Marks.

(a) Subject to the other provisions of this Agreement, Pier 1 hereby grants to Bank a non-exclusive (except as to branded credit account and card plans per Section 3.11), non-transferable license to use the Pier 1 Marks solely in satisfaction of its duties, rights and obligations described in this Agreement, including without limitation, using same in any and all promotional materials, Account documentation, advertising, websites, marketing, and solicitations related to the Plan, during the Term. Bank shall use the trademark designations “®” or “TM” or such other designation as Pier 1 may specify or approve in connection with the Pier 1 Marks on the Credit Cards, Account documentation and promotional materials. Bank agrees it will not use the Pier 1 Marks on or in connection with any products or services or for any other purpose other than as explicitly described in this Agreement except as required by Applicable Law.

(b) Anything in this Agreement to the contrary notwithstanding, Pier 1 shall retain all rights in and to Pier 1 Marks pertaining to such Accounts, and all goodwill associated with the use of Pier 1 Marks (whether under this Agreement or otherwise) shall inure to the benefit of Pier 1. Pier 1 shall have the right, in its sole and absolute discretion, to prohibit the use of any Pier 1 Marks in any Forms, advertisements or other materials or references proposed to be used by Bank which Pier 1 in its reasonable business judgment deems objectionable or improper. Bank shall cease all use of Pier 1 Marks upon the termination of this Agreement unless Bank retains the Accounts after termination of the Agreement. In that case, Bank may use Pier 1 Marks solely in connection with the administration and collection of the balance due on the Accounts. Provided, however, that Pier 1 grants Bank and its Affiliates the non-exclusive, non-transferable right to use Pier 1 Marks in connection with their respective product marketing and promotional materials and literature in written and electronic form and their business client lists.

(c) Pier 1 recognizes that Bank is the sole owner of the Bank Marks, that Pier 1 has no rights of ownership or license therein, and that Pier 1 is not entitled to (and shall not) use the Bank Marks other than as explicitly and specifically provided in this Agreement. As a point of clarification, Bank has and retains all rights in and to Bank Marks and the use thereof, and all goodwill associated with the use of Bank Marks (whether under this Agreement or otherwise) shall inure to the benefit of Bank. Bank shall have the right, in its sole and absolute discretion, to prohibit the use of any Bank Marks in any Plan Documents, advertisements, or other materials or references proposed to be used by Pier 1 which Bank in its reasonable business judgment deems objectionable or improper. Pier 1 shall cease all use of Bank Marks upon the termination of this Agreement.

17

2.11. Loyalty Programs.

(a) General. Pier 1 shall own and operate a loyalty program, either (i) just for Cardholders (a “Cardholder Loyalty Program”), or (ii) for all Customers (a “Customer Loyalty Program”). In either case, Pier 1 will be responsible for determining the program’s rules, funding the rewards related to it, and ensuring compliance with all Applicable Laws.

(b) Bank Support of Cardholder Loyalty Program. Upon request by Pier 1, and to the extent available, Bank will provide Pier 1 with certain system functionality tied to the Accounts to support a Cardholder Loyalty Program, for matters such as recording the accumulation of loyalty points, tracking, lookup/reporting, and redemption where a coupon is part of the Billing Statement. Any such system functionality provided by Bank shall be at no additional charge to Pier 1, to the extent the Cardholder Loyalty Program: (i) is compatible with Bank’s existing or future functionality offered to other Bank clients; (ii) is facilitated using monthly Billing Statements to active Accounts; (iii) does not require Bank to incur additional internal or external expense; and (iv) does not include stand-alone mailings. Otherwise, such functionality if available shall be provided pursuant to terms (including fees to Bank) mutually agreed to by the parties. For example, Bank will, at an agreed cost to Pier 1, support stand-alone Cardholder mailings and zero-balance Billing Statements associated with the Cardholder Loyalty Program.

(c) Loyalty Program Value Propositions. For a Cardholder Loyalty Program, Pier 1 shall offer a value proposition that is substantially the same as that featured in the Pier 1 Program as of the Effective Date.

The value proposition offered under a Customer Loyalty Program must be one that satisfies the provisions of this subsection (c). Pier 1 acknowledges and agrees that the intent of the parties is that the Credit Card shall be the preferred form of tender to purchase Goods and/or Services, no matter what other forms of tender might be permissible under this Agreement. One (but not the only) objective in reaching this goal is to ensure that Customers readily identify the Credit Card with Pier 1 and (accurately) perceive that the benefits of the Credit Card exceed any comparable benefits of other forms of tender (individually and/or collectively). That principle applies, but is not limited to, the value proposition offered as part of a Customer Loyalty Program.

For example, presume that Consumer “A” (using a Credit Card) and Consumer “B” (using any one or more non-Credit Card form(s) of tender) are both enrolled in a Customer Loyalty Program. Further, presume that they spend the exact same amount of money on the exact same Goods and/or Services over the exact same period of time. The total benefit to Customer A, from Pier 1, in terms of the Customer Loyalty Program benefit, must always be greater than the total benefit to Customer B, from Pier 1, and in an amount that a reasonable Customer would consider to be meaningful. By way of clarification, the value proposition offered to Cardholders under a Customer Loyalty Program shall never be less than that required under a Cardholder Loyalty Program as described in the first paragraph of this subsection (c).

18

3.1 Honoring Credit Cards. Pier 1 agrees that Pier 1 will honor any Credit Card properly issued and currently authorized by Bank pursuant to the Plan. In addition, Pier 1 shall, in accordance with the provisions of this Agreement and the Operating Procedures, deliver to Bank all Transaction Records evidencing transactions made under the Plan.

3.2 Intentionally Left Blank.

3.3 Cardholder Disputes Regarding Accounts and Goods and/or Services.

(a) Pier 1 shall promptly notify Bank regarding any Cardholder dispute regarding an Account. This includes but is not limited to claims related to outstanding balances, Bank reports to credit bureaus, finance charges, fees, and collection efforts (e.g., notification that the Cardholder has filed bankruptcy or wants collection communications directed to legal counsel, etc.).

(b) Pier 1 shall act promptly to investigate and work to resolve disputes with Cardholders regarding Goods and/or Services obtained through Pier 1 pursuant to the Plan. Pier 1 shall timely process credits or refunds for Cardholders utilizing the Plan.

3.4 No Special Agreements. Pier 1 will not extract any special agreement, condition, fee, or security from Cardholders in connection with their use of a Credit Card, unless approved in advance by Bank in writing.

3.5 Cardholder Disputes Regarding Violations of Applicable Law. Pier 1 shall cooperate with Bank in further investigating and using its reasonable efforts to help resolve any Applicant or Cardholder claim, dispute, or defense which may be asserted under Applicable Law.

3.6 Payment to Pier 1; Ownership of Accounts; Fees; Accounting.

(a) Each day (not just Business Days), Pier 1 shall electronically transmit all Transaction Records (from its main offices and/or its Sales Channels) to Bank within a reasonable period of time and in a format acceptable to Bank. Upon receipt, Bank shall use commercially reasonable efforts to promptly verify and process such Transaction Records and, in the time frames specified herein, Bank will remit to Pier 1 an amount equal to the Net Proceeds indicated by such Transaction Records for the Credit Sales Day(s) for which such remittance is made. Bank will transfer funds via Automated Clearing House (“ACH”) to an account designated in writing by Pier 1 to Bank (the “Pier 1 Deposit Account”). For Transaction Records received by Bank’s processing center before 12 noon Eastern time on a Business Day, Bank will initiate such ACH transfer on the next Business Day thereafter. For Transaction Records received by Bank’s processing center either (i) after 12 noon Eastern time on a Business Day, or (ii) on a non-Business Day, Bank will initiate such transfer no later than the second Business Day thereafter. The term “initiate” shall mean that Bank shall transmit an ACH file to Bank’s financial institution for payment to the Pier 1 Deposit Account on the next Business Day.

19

Bank reserves the right to deny (or reverse) an extension of credit for particular transactions in order to comply with Applicable Law, which might include but not be limited to prohibitions against transactions related to gambling.

(b) Bank shall own all the Accounts under the Plan from the time of establishment, and except as otherwise provided herein, Pier 1 shall not have any right to any indebtedness on an Account or to any Account payment from a Cardholder arising out of or in connection with any Purchases under the Plan. Effective upon the delivery of each Transaction Record by Pier 1 to Bank and each corresponding payment to Pier 1 by Bank pursuant to Section 3.6(a), Pier 1 shall be deemed to have transferred, conveyed, assigned and surrendered to Bank all right, title or interest in all (and in all other rights and writings evidencing such Purchases, if any) that comprise part of such corresponding Transaction Record. By way of clarification, Bank’s above referenced ownership shall be without recourse to Pier 1, except to the extent otherwise provided for in this Agreement, including but not limited to Section 3.9 and Schedule 2.7.

(c) All Transaction Records are subject to review by Bank. In the event of a computational or similar error of an accounting or record keeping nature with respect to such Transaction Records, Bank may credit to the Pier 1 Deposit Account or net against the Net Proceeds (as the case may be) the proper amount as corrected. If the Net Proceeds are insufficient, Pier 1 shall remit the proper amount to Bank promptly upon written demand. Upon any such correction, Bank shall give Pier 1 prompt notice of same, including details of the discrepancy and correction.

(d) The Credit Card Agreement shall include the Rates and Fees as are set forth in Schedule 3.6 (d). In connection with its servicing of the Accounts, Bank may make changes to the Credit Card Agreement on an individual Account by Account basis and without notice to Pier 1.

With regard to Plan-wide changes to the Credit Card Agreement, the following provisions shall apply. First, Bank may make changes to non-Rates and Fees terms at any time, including but not limited to changes required by Applicable Law. Bank shall notify Pier 1 in writing of any such changes, and such notice shall be provided as far in advance of its implementation as is reasonable under the circumstances. Second, with respect to any changes in the Rates and Fees, Bank will notify Pier 1 in writing of same as far in advance of its implementation as is reasonable under the circumstances. In addition, Bank will discuss such changes with Pier 1 in Plan Committee Meetings as set forth in Schedule 11.

(e) (i) General. Pier 1 shall obtain and maintain at its own expense such Point of Sale terminals, cash registers, network (electronic communication interchange system), telephone or other communication lines, software, hardware and other items of equipment as are necessary for it to request and receive authorizations, transmit Charge Slip and Credit Slip information, process applications and perform its obligations under this Agreement. The computer programs and telecommunications protocols necessary to facilitate communications between Bank and Pier 1 (and/or Bank and specific Sales Channels, if applicable) shall be determined by Bank from time to time. By way of example (only) and by no means limitation, as of the Plan Commencement Date Pier 1’s POS systems shall be able to perform what is known as “Account Look-up” and what is known as “in-store payments”

20

By way of clarification, the Bank systems changes described in this (e) are not the same as those discussed in (f) below.

(ii) Notice of Bank Systems Changes. Bank shall provide to Pier 1 prior written notice (to the extent reasonable under the circumstances) of any changes to then current Bank systems, equipment, and/or protocols as described in (i) above. With regard to major Bank changes to its systems, Bank shall, to the extent practical under the circumstances, make a good faith effort to provide such notice at least six (6) months prior to the subject change. Bank shall be responsible to pay for all Bank’s changes to its systems.

“Bank Non-Plan Impact Systems Change” shall mean a Bank change to its systems which does not impact the Plan.

“Bank Plan Impact Systems Change” shall mean a Bank change to its systems which does impact the Plan.

“Pier 1 System Change” shall mean changes by Pier 1 to its systems which are necessitated by Bank Plan Impact Systems Change and Pier 1’s obligations related thereto under (i) above.

(iv) Effects on Pier 1. First, Pier 1 shall work in good faith and a cooperative manner to effectuate any Pier 1 Systems Changes on or before the date targeted by Bank as Pier 1’s date of completion, which date shall have been communicated by Bank to Pier 1 as set forth above in (ii). Second, the parties agree that Bank Non-Plan Impact Systems Changes shall not give rise to any Pier 1 costs. Third, costs incurred by Pier 1 arising from its transition from Instant Credit to Quick Credit are outside the scope of this subsection (e). Fourth, with regard to costs incurred by Pier 1 to make Pier 1 Systems Changes, the following provisions shall apply:

|

(x)

|

Category 1: The Bank Plan Impact Systems Changes are necessitated by a change in Applicable Law. In such case, Pier 1 shall bear the entire expense.

|

|

(y)

|

Category 2. The Bank Plan Impact Systems Changes are not necessitated by a change in Applicable Law.

|

|

In such case, Pier 1 shall bear the cost, up to a cap of One Hundred Thousand Dollars ($100,000) in any subject Plan Year. By way of clarification, if there is more than one such change in a subject Plan Year, Pier 1’s obligation would not exceed $100,000. In other words, the cap is not $100,000 per incident in each Plan Year. By way of further clarification, if Pier 1 spends less than $100,000 in any one Plan Year, any unspent amount does not roll-over into any subsequent Plan Year such that the cap in any subsequent Plan Year would be greater than $100,000.

|

21

(f) Bank systems changes describe in this (f) are not the same as those described in (e) above. With regard to Bank’s changes to its then current systems, equipment, and/or protocols (i) that do not apply to the Plan but (ii) which such changes Bank believes Pier 1 might want to incorporate into the Plan, Bank shall offer to Pier 1 the opportunity to have such Bank systems changes incorporated into the Plan. If Pier 1 so chooses, then Pier 1 shall be responsible to pay (x) to Bank a fee agreed upon by the parties in consideration for Bank making its systems changes available for the Plan, and (y) Pier 1’s costs for changes to its own systems required to incorporate the subject Bank systems changes into the Plan.

(g) Pier 1 shall be responsible for ensuring that all Promotional Program Purchases are properly designated as such on the Transaction Record in accordance with Bank’s instructions.

(h) Bank may, if Pier 1 fails to pay Bank any amounts due to Bank pursuant to this Agreement for more than thirty (30) days after the due date, offset such amounts against the Net Proceeds or any other amounts owed by Bank to Pier 1 under this Agreement. Pier 1 may, if Bank fails to pay Pier 1 any amounts due to Pier 1 pursuant to this Agreement for more than thirty (30) days after the due date, offset such amounts against any other amounts owed by Pier 1 to Bank under this Agreement.

3.7 Bank Mailings; Insertion of Pier 1’s Promotional Materials. Envelope space (including bangtail) for Billing Statements and Credit Card mailers shall be allocated as follows:

(a) “Priority Materials,” defined as: legally required material, privacy notices, disclosures, Cardholder notices, Billing Statements, new Credit Card mailers, Credit Card Agreement, and notices sent by Bank;

(b) Bank’s other inserts (including bangtail); and

(c) Pier 1’s promotional materials, subject to the following terms:

At Pier 1’s request, Bank will include with the Billing Statements and new Credit Card mailers Pier 1 promotional materials provided by Pier 1 (and at Pier 1’s expense), so long as the materials: (i) are provided to Bank at least thirty (30) days prior to the scheduled mailing date of such statements or notices and pursuant to an insert schedule that Pier 1 provided to Bank at least sixty (60) days in advance; (ii) have been approved as to content by Bank (in its reasonable discretion) with respect to any manner of reference to Bank or the Plan; (iii) meet all size, weight, or other specifications for such inserts as shall be reasonably set by Bank from time to time; (iv) would not require the removal (in Bank’s standard envelope) of Priority Materials and/or Bank’s other inserts; and (v) along with all incremental postage costs caused by Bank’s insertion of such materials are paid by Pier 1. Notwithstanding the immediately preceding sentence, Bank must provide Pier 1 reasonable advance notice of any such additional postage charge. Furthermore, Bank shall only insert Pier 1 materials (and charge such additional expense to Pier 1) if Pier 1 approves such insertion regardless of the additional postage costs.

22

Bank reserves the right to disallow any inserts which are in violation of Applicable Law, conflict with any other provision of this Agreement, or whose subject matter is reasonably deemed by Bank to be salacious in nature.

3.8 Cardholder Payments on Accounts.

(a) Subject to the provisions of this Section 3.8, Bank hereby authorizes Pier 1 to accept, on Bank’s behalf, Cardholder payments on Accounts at Pier 1 stores in the U.S. Any Cardholder payments on Accounts not made at such Pier 1 stores shall be made directly to Bank in accordance with the instructions of Bank and at the location or address (physical or electronic, as applicable) specified by Bank. By way of clarification, Bank has the sole right to receive and retain all payments made with respect to all Accounts and to pursue collection of all amounts outstanding, unless a Purchase is charged back to Pier 1 pursuant to the provisions of Sections 3.9 and 3.10 hereof.

(b) Upon receipt of such payments, Pier 1 (on Bank’s behalf) will hold the payment in trust (in the sense that Pier 1 is obligated to pay such amount to Bank, not that such amount be held in a separate Pier 1 account) for Bank and will transmit record of such payment to the Bank at the time of payment using Bank’s transaction specifications. Payments made by Cardholders at Pier 1 stores shall be deemed received by Bank when Bank receives the Transaction Record that corresponds to the payment. Bank will deduct the amount of such payment from the Net Proceeds (to the extent not previously deducted); or if the Net Proceeds are insufficient, Pier 1 shall remit the amount of such payment or any unpaid portion thereof, to Bank, immediately upon written demand from Bank.

(c) Notwithstanding any provision to the contrary elsewhere in this Section 3.8 or elsewhere in this Agreement, Pier 1 shall comply with any written instruction by Bank that Pier 1 cease accepting Cardholder payments on Accounts when such instruction is related to (i) Applicable Law, and/or (ii) securitization of the Accounts by Bank. Provided, however, that Bank shall notify Pier 1 in writing of the desired date for cessation of such acceptance of Cardholder payments, which written notice shall be provided to Pier 1 as far in advance of the subject cessation date as is commercially reasonable under the circumstances. In addition, Pier 1 shall not accept Cardholder payments at any Pier 1 store once Goods and/or Services are no longer being sold from such store.

(d) Pier 1 hereby authorizes Bank, or any of its employees or agents, to endorse “World Financial Network Bank” upon all or any checks, drafts, money orders or other evidence of payment, made payable to Pier 1 and intended as payment on an Account, that may come into Bank’s possession from Cardholders and to credit said payment against the appropriate Cardholder’s Account.

23

3.9 Chargebacks. Bank shall have the right to charge back the amount (or portion of the amount, as applicable) of the subject Purchase under the terms and conditions of this Section 3.9. In addition, if the basis for the chargeback is non-authorization by Bank and/or the failure to supply necessary copies of relevant documentation, the chargeback amount shall also include: the unpaid principal balance, applicable sales tax, accrued and billed finance charges, fees, and any Rebate Fees paid by Bank to Pier 1, relating to any such Purchase. As to chargebacks for any other reasons, the amount of the chargeback shall not include accrued and billed finance charges or Cardholder fees, unless discussed with Pier 1.

(a) If any Applicant or Cardholder claim, defense, dispute, or basis for non-payment is based on an alleged action or inaction by Pier 1 and/or otherwise involves the Goods and/or Services, including but not limited to an alleged: (i) breach of warranty or representation; (ii) unauthorized use of the Credit Card; (iii) charge for something other than an actual Purchase; (iv) the Charge Slip related to the Purchase is a duplicate of one already paid and/or the price on it differs from the price on the Cardholder’s copy of same; and/or (v) where Pier 1 has failed to follow any other provisions in this Agreement and/or or the Operating Procedures, and Bank determines, upon receipt of a fraud affidavit from the Cardholder, that the signature on any Charge Slip has been forged or is counterfeit; or

(b) If Bank determines that, with respect to such Purchase or the Account that: (i) there is a breach of any warranty or representation made by or with respect to Pier 1 under this Agreement; (ii) there is a failure by Pier 1 to comply with any term or condition of this Agreement, which failure shall not have been cured within fifteen (15) days after receipt of written notice thereof from Bank; or

(c) For any chargeback reason as set forth in the Operating Procedures.

3.10 Exercise of Chargebacks. With respect to any amounts to be charged back pursuant to Section 3.9, Bank will offset such amount as part of the Net Proceeds to be paid to Pier 1, to the extent the balance thereof is sufficient or, to the extent not sufficient, Bank may demand payment from Pier 1 in immediately available funds for the full or any partial amount of such chargeback. Upon payment in full of the related amount by Pier 1 to Bank, or off-setting, as the case may be, Bank shall transfer to Pier 1, without any representation, warranty or recourse, all of Bank’s right to payments of such amounts charged back in connection with such Purchase. Bank will exercise commercially reasonable efforts to cooperate with Pier 1 in any efforts by Pier 1 to collect the chargeback amount. Bank may reduce the amount owed by a Cardholder on any Purchase subject to chargeback, but the related chargeback shall then be equal to the reduced (or net) amount owed by the Cardholder. Pier 1 shall not resubmit or re-transmit any charged back Purchase to Bank, without Bank’s prior written consent.

24

3.11 Non-Competition.

(a) Pier 1 shall actively and consistently market, promote, participate in and support the Plan as set forth in this Agreement. Furthermore, except as otherwise provided in subsections (b) and (c) below, Pier 1 agrees that, in consideration of and as an inducement for Bank to make the Plan available to Pier 1 as provided in this Agreement, Pier 1 (including its Affiliates) shall not, during the Term or for the fifteen (15) month period following the end of the Term, either on its own or under contract or in concert with any third-party, establish, provide, own, accept or process any (i) private label revolving credit card, (ii) co-brand credit card or debit card that is branded with a Pier 1 Xxxx or other xxxx or name related to or for the promotion of Pier 1 and/or its Affiliates; or (iii) other Financial Product.