Master Repurchase Agreement

Exhibit 10.1

EXECUTION VERSION

|

Master Repurchase Agreement |

September 1996 Version

| Dated as of: | June 13, 2011 | |

| Between: | Integrated Device Technology, Inc., as “Seller” | |

| and: | Bank of America, N.A., as “Buyer” | |

| 1. | Applicability |

From time to time the parties hereto may enter into transactions in which one party (“Seller”) agrees to transfer to the other (“Buyer”) securities or other assets (“Securities”) against the transfer of funds by Buyer, with a simultaneous agreement by Buyer to transfer to Seller such Securities at a date certain or on demand, against the transfer of funds by Seller. Each such transaction shall be referred to herein as a “Transaction” and, unless otherwise agreed in writing, shall be governed by this Agreement, including any supplemental terms or conditions contained in Annex I hereto and in any other annexes identified herein or therein as applicable hereunder.

| 2. | Definitions |

| (a) | “Act of Insolvency”, with respect to any party, (i) the commencement by such party as debtor of any case or proceeding under any bankruptcy, insolvency, reorganization, liquidation, moratorium, dissolution, delinquency or similar law, or such party seeking the appointment or election of a receiver, conservator, trustee, custodian or similar official for such party or any substantial part of its property, or the convening of any meeting of creditors for purposes of commencing any such case or proceeding or seeking such an appointment or election, (ii) the commencement of any such case or proceeding against such party, or another seeking such an appointment or election, or the filing against a party of an application for a protective decree under the provisions of the Securities Investor Protection Act of 1970, which (A) is consented to or not timely contested by such party, (B) results in the entry of an order for relief, such an appointment or election, the issuance of such a protective decree or the entry of an order having a similar effect, or (C) is not dismissed within 15 days, (iii) the making by such party of a general assignment for the benefit of creditors, or (iv) the admission in writing by such party of such party’s inability to pay such party’s debts as they become due; |

| (b) | “Additional Purchased Securities”, Securities provided by Seller to Buyer pursuant to Paragraph 4(a) hereof; |

| (c) | “Buyer’s Margin Amount”, with respect to any Transaction as of any date, the amount obtained by application of the Buyer’s Margin Percentage to the Repurchase Price for such Transaction as of such date; |

| (d) | “Buyer’s Margin Percentage”, with respect to any Transaction as of any date, a percentage (which may be equal to the Seller’s Margin Percentage) agreed to by Buyer and Seller or, in the absence of any such agreement, the percentage obtained by dividing the Market Value of the Purchased Securities on the Purchase Date by the Purchase Price on the Purchase Date for such Transaction; |

| (e) | “Confirmation”, the meaning specified in Paragraph 3(b) hereof; |

| (f) | “Income”, with respect to any Security at any time, any principal thereof and all interest, dividends or other distributions thereon; |

| (g) | “Margin Deficit”, the meaning specified in Paragraph 4(a) hereof; |

| (h) | “Margin Excess”, the meaning specified in Paragraph 4(b) hereof; |

| (i) | “Margin Notice Deadline”, the time agreed to by the parties in the relevant Confirmation, Annex I hereto or otherwise as the deadline for giving notice requiring same-day satisfaction of margin maintenance obligations as provided in Paragraph 4 hereof (or, in the absence of any such agreement, the deadline for such purposes established in accordance with market practice); |

| (j) | “Market Value”, with respect to any Securities as of any date, the price for such Securities on such date obtained from a generally recognized source agreed to by the parties or the most recent closing bid quotation from such a source, plus accrued Income to the extent not included therein (other than any Income credited or transferred to, or applied to the obligations of, Seller pursuant to Paragraph 5 hereof) as of such date (unless contrary to market practice for such Securities); |

| (k) | “Price Differential”, with respect to any Transaction as of any date, the aggregate amount obtained by daily application of the Pricing Rate for such Transaction to the Purchase Price for such Transaction on a 360 day per year basis for the actual number of days during the period commencing on (and including) the Purchase Date for such Transaction and ending on (but excluding) the date of determination (reduced by any amount of such Price Differential previously paid by Seller to Buyer with respect to such Transaction); |

| (l) | “Pricing Rate”, the per annum percentage rate for determination of the Price Differential; |

| (m) | “Prime Rate”, the prime rate of U.S. commercial banks as published in The Wall Street Journal (or, if more than one such rate is published, the average of such rates); |

2

| (n) | “Purchase Date”, the date on which Purchased Securities are to be transferred by Seller to Buyer; |

| (o) | “Purchase Price”, (i) on the Purchase Date, the price at which Purchased Securities are transferred by Seller to Buyer, and (ii) thereafter, except where Buyer and Seller agree otherwise, such price increased by the amount of any cash transferred by Buyer to Seller pursuant to Paragraph 4 (b) hereof and decreased by the amount of any cash transferred by Seller to Buyer pursuant to Paragraph 4(a) hereof or applied to reduce Seller’s obligations under clause (ii) of Paragraph 5 hereof; |

| (p) | “Purchased Securities”, the Securities transferred by Seller to Buyer in a Transaction hereunder, and any Securities substituted therefor in accordance with Paragraph 9 hereof. The term “Purchased Securities” with respect to any Transaction at any time also shall include Additional Purchased Securities delivered pursuant to Paragraph 4(a) hereof and shall exclude Securities returned pursuant to Paragraph 4(b) hereof; |

| (q) | “Repurchase Date”, the date on which Seller is to repurchase the Purchased Securities from Buyer, including any date determined by application of the provisions of Paragraph 3(c) or 11 hereof; |

| (r) | “Repurchase Price”, the price at which Purchased Securities are to be transferred from Buyer to Seller upon termination of a Transaction, which will be determined in each case (including Transactions terminable upon demand) as the sum of the Purchase Price and the Price Differential as of the date of such determination; |

| (s) | “Seller’s Margin Amount”, with respect to any Transaction as of any date, the amount obtained by application of the Seller’s Margin Percentage to the Repurchase Price for such Transaction as of such date; |

| (t) | “Seller’s Margin Percentage”, with respect to any Transaction as of any date, a percentage (which may be equal to the Buyer’s Margin Percentage) agreed to by Buyer and Seller or, in the absence of any such agreement, the percentage obtained by dividing the Market Value of the Purchased Securities on the Purchase Date by the Purchase Price on the Purchase Date for such Transaction. |

| 3. | Initiation; Confirmation; Termination |

| (a) | An agreement to enter into a Transaction may be made orally or in writing at the initiation of either Buyer or Seller. On the Purchase Date for the Transaction, the Purchased Securities shall be transferred to Buyer or its agent against the transfer of the Purchase Price to an account of Seller. |

| (b) | Upon agreeing to enter into a Transaction hereunder, Buyer or Seller (or both), as shall be agreed, shall promptly deliver to the other party a written confirmation of each Transaction (a “Confirmation”). The Confirmation shall describe the Purchased Securities (including CUSIP number, if any), identify |

3

| Buyer and Seller and set forth (i) the Purchase Date, (ii) the Purchase Price, (iii) the Repurchase Date, unless the Transaction is to be terminable on demand, (iv) the Pricing Rate or Repurchase Price applicable to the Transaction, and (v) any additional terms or conditions of the Transaction not inconsistent with this Agreement. The Confirmation, together with this Agreement, shall constitute conclusive evidence of the terms agreed between Buyer and Seller with respect to the Transaction to which the Confirmation relates, unless with respect to the Confirmation specific objection is made promptly after receipt thereof. In the event of any conflict between the terms of such Confirmation and this Agreement, this Agreement shall prevail. |

| (c) | In the case of Transactions terminable upon demand, such demand shall be made by Buyer or Seller, no later than such time as is customary in accordance with market practice, by telephone or otherwise on or prior to the business day on which such termination will be effective. On the date specified in such demand, or on the date fixed for termination in the case of Transactions having a fixed term, termination of the Transaction will be effected by transfer to Seller or its agent of the Purchased Securities and any Income in respect thereof received by Buyer (and not previously credited or transferred to, or applied to the obligations of, Seller pursuant to Paragraph 5 hereof) against the transfer of the Repurchase Price to an account of Buyer. |

| 4. | Margin Maintenance |

| (a) | If at any time the aggregate Market Value of all Purchased Securities subject to all Transactions in which a particular party hereto is acting as Buyer is less than the aggregate Buyer’s Margin Amount for all such Transactions (a “Margin Deficit”), then Buyer may by notice to Seller require Seller in such Transactions, at Seller’s option, to transfer to Buyer cash or additional Securities reasonably acceptable to Buyer (“Additional Purchased Securities”), so that the cash and aggregate Market Value of the Purchased Securities, including any such Additional Purchased Securities, will thereupon equal or exceed such aggregate Buyer’s Margin Amount (decreased by the amount of any Margin Deficit as of such date arising from any Transactions in which such Buyer is acting as Seller). |

| (b) | If at any time the aggregate Market Value of all Purchased Securities subject to all Transactions in which a particular party hereto is acting as Seller exceeds the aggregate Sellers Margin Amount for all such Transactions at such time (a “Margin Excess”), then Seller may by notice to Buyer require Buyer in such Transactions, at Buyer’s option, to transfer cash or Purchased Securities to Seller, so that the aggregate Market Value of the Purchased Securities, after deduction of any such cash or any Purchased Securities so transferred, will thereupon not exceed such aggregate Seller’s Margin Amount (increased by the amount of any Margin Excess as of such date arising from any Transactions in which such Seller is acting as Buyer). |

4

| (c) | If any notice is given by Buyer or Seller under subparagraph (a) or (b) of this Paragraph at or before the Margin Notice Deadline on any business day, the party receiving such notice shall transfer cash or Additional Purchased Securities as provided in such subparagraph no later than the close of business in the relevant market on such day. If any such notice is given after the Margin Notice Deadline, the party receiving such notice shall transfer such cash or Securities no later than the close of business in the relevant market on the next business day following such notice. |

| (d) | Any cash transferred pursuant to this Paragraph shall be attributed to such Transactions as shall be agreed upon by Buyer and Seller. |

| (e) | Seller and Buyer may agree, with respect to any or all Transactions hereunder, that the respective rights of Buyer or Seller (or both) under subparagraphs (a) and (b) of this Paragraph may be exercised only where a Margin Deficit or Margin Excess, as the case may be, exceeds a specified dollar amount or a specified percentage of the Repurchase Prices for such Transactions (which amount or percentage shall be agreed to by Buyer and Seller prior to entering into any such Transactions). |

| (f) | Seller and Buyer may agree, with respect to any or all Transactions hereunder, that the respective rights of Buyer and Seller under subparagraphs (a) and (b) of this Paragraph to require the elimination of a Margin Deficit or a Margin Excess, as the case may be, may be exercised whenever such a Margin Deficit or Margin Excess exists with respect to any single Transaction hereunder (calculated without regard to any other Transaction outstanding under this Agreement). |

| 5. | Income Payments |

Seller shall be entitled to receive an amount equal to all Income paid or distributed on or in respect of the Securities that is not otherwise received by Seller, to the full extent it would be so entitled if the Securities had not been sold to Buyer. Buyer shall, as the parties may agree with respect to any Transaction (or, in the absence of any such agreement, as Buyer shall reasonably determine in its discretion), on the date such Income is paid or distributed either (i) transfer to or credit to the account of Seller such Income with respect to any Purchased Securities subject to such Transaction or (ii) with respect to Income paid in cash, apply the Income payment or payments to reduce the amount, if any, to be transferred to Buyer by Seller upon termination of such Transaction. Buyer shall not be obligated to take any action pursuant to the preceding sentence (A) to the extent that such action would result in the creation of a Margin Deficit, unless prior thereto or simultaneously therewith Seller transfers to Buyer cash or Additional Purchased Securities sufficient to eliminate such Margin Deficit, or (B) if an Event of Default with respect to Seller has occurred and is then continuing at the time such Income is paid or distributed.

| 6. | Security Interest |

Although the parties intend that all Transactions hereunder be sales and purchases and not loans, in the event any such Transactions are deemed to be loans, Seller shall be deemed to have pledged to Buyer as security for the performance by Seller of its obligations under each such Transaction, and shall be deemed to have granted to Buyer a security interest in, all of the Purchased Securities with respect to all Transactions hereunder and all Income thereon and other proceeds thereof.

5

| 7. | Payment and Transfer |

Unless otherwise mutually agreed, all transfers of funds hereunder shall be in immediately available funds. All Securities transferred by one party hereto to the other party (i) shall be in suitable form for transfer or shall be accompanied by duly executed instruments of transfer or assignment in blank and such other documentation as the party receiving possession may reasonably request, (ii) shall be transferred on the book-entry system of a Federal Reserve Bank, or (iii) shall be transferred by any other method mutually acceptable to Seller and Buyer.

| 8. | Segregation of Purchased Securities |

To the extent required by applicable law, all Purchased Securities in the possession of Seller shall be segregated from other securities in its possession and shall be identified as subject to this Agreement. Segregation may be accomplished by appropriate identification on the books and records of the holder, including a financial or securities intermediary or a clearing corporation. All of Seller’s interest in the Purchased Securities shall pass to Buyer on the Purchase Date and, unless otherwise agreed by Buyer and Seller, nothing in this Agreement shall preclude Buyer from engaging in repurchase transactions with the Purchased Securities or otherwise selling, transferring, pledging or hypothecating the Purchased Securities, but no such transaction shall relieve Buyer of its obligations to transfer Purchased Securities to Seller pursuant to Paragraph 3, 4 or 11 hereof, or of Buyer’s obligation to credit or pay Income to, or apply Income to the obligations of, Seller pursuant to Paragraph 5 hereof.

Required Disclosure for Transactions in Which the Seller Retains Custody of the Purchased Securities

Seller is not permitted to substitute other securities for those subject to this Agreement and therefore must keep Buyer’s securities segregated at all times, unless in this Agreement Buyer grants Seller the right to substitute other securities. If Buyer grants the right to substitute, this means that Buyer’s securities will likely be commingled with Seller’s own securities during the trading day. Buyer is advised that, during any trading day that Buyer’s securities are commingled with Seller’s securities, they [will]* [may]** be subject to liens granted by Seller to [its clearing bank]* [third parties]** and may be used by Seller for deliveries on other securities transactions. Whenever the securities are commingled, Seller’s ability to resegregate substitute securities for Buyer will be subject to Seller’s ability to satisfy [the clearing]* [any]** lien or to obtain substitute securities.

| * | Language to be used under 17 C.F.R. B403.4(e) if Seller is a government securities broker or dealer other than a financial institution. |

| ** | Language to be used under 17 C.F.R. B403.5(d) if Seller is a financial institution. |

6

| 9. | Substitution |

| (a) | Seller may, subject to agreement with and acceptance by Buyer, substitute other Securities for any Purchased Securities. Such substitution shall be made by transfer to Buyer of such other Securities and transfer to Seller of such Purchased Securities. After substitution, the substituted Securities shall be deemed to be Purchased Securities. |

| (b) | In Transactions in which Seller retains custody of Purchased Securities, the parties expressly agree that Buyer shall be deemed, for purposes of subparagraph (a) of this Paragraph, to have agreed to and accepted in this Agreement substitution by Seller of other Securities for Purchased Securities; provided, however, that such other Securities shall have a Market Value at least equal to the Market Value of the Purchased Securities for which they are substituted. |

| 10. | Representations |

Each of Buyer and Seller represents and warrants to the other that (i) it is duly authorized to execute and deliver this Agreement, to enter into Transactions contemplated hereunder and to perform its obligations hereunder and has taken all necessary action to authorize such execution, delivery and performance, (ii) it will engage in such Transactions as principal (or, if agreed in writing, in the form of an annex hereto or otherwise, in advance of any Transaction by the other party hereto, as agent for a disclosed principal), (iii) the person signing this Agreement on its behalf is duly authorized to do so on its behalf (or on behalf of any such disclosed principal), (iv) it has obtained all authorizations of any governmental body required in connection with this Agreement and the Transactions hereunder and such authorizations are in full force and effect and (v) the execution, delivery and performance of this Agreement and the Transactions hereunder will not violate any law, ordinance, charter, by-law or rule applicable to it or any agreement by which it is bound or by which any of its assets are affected. On the Purchase Date for any Transaction Buyer and Seller shall each be deemed to repeat all the foregoing representations made by it.

| 11. | Events of Default |

In the event that (i) Seller fails to transfer or Buyer fails to purchase Purchased Securities upon the applicable Purchase Date, (ii) Seller fails to repurchase or Buyer fails to transfer Purchased Securities upon the applicable Repurchase Date, (iii) Seller or Buyer fails to comply with Paragraph 4 hereof, (iv) Buyer fails, after one business day’s notice, to comply with Paragraph 5 hereof, (v) an Act of Insolvency occurs with respect to Seller or Buyer, (vi) any representation made by Seller or Buyer shall have been incorrect or untrue in any material respect when made or repeated or deemed to have been made or repeated, or (vii) Seller or Buyer shall admit to the other its inability to, or its intention not to, perform any of its obligations hereunder (each an “Event of Default”):

7

| (a) | The nondefaulting party may, at its option (which option shall be deemed to have been exercised immediately upon the occurrence of an Act of Insolvency), declare an Event of Default to have occurred hereunder and, upon the exercise or deemed exercise of such option, the Repurchase Date for each Transaction hereunder shall, if it has not already occurred, be deemed immediately to occur (except that, in the event that the Purchase Date for any Transaction has not yet occurred as of the date of such exercise or deemed exercise, such Transaction shall be deemed immediately canceled). The nondefaulting party shall (except upon the occurrence of an Act of Insolvency) give notice to the defaulting party of the exercise of such option as promptly as practicable. |

| (b) | In all Transactions in which the defaulting party is acting as Seller, if the nondefaulting party exercises or is deemed to have exercised the option referred to in subparagraph (a) of this Paragraph, (i) the defaulting party’s obligations in such Transactions to repurchase all Purchased Securities, at the Repurchase Price therefor on the Repurchase Date determined in accordance with subparagraph (a) of this Paragraph, shall thereupon become immediately due and payable, (ii) all Income paid after such exercise or deemed exercise shall be retained by the nondefaulting party and applied to the aggregate unpaid Repurchase Prices and any other amounts owing by the defaulting party hereunder, and (iii) the defaulting party shall immediately deliver to the nondefaulting party any Purchased Securities subject to such Transactions then in the defaulting party’s possession or control. |

| (c) | In all Transactions in which the defaulting party is acting as Buyer, upon tender by the nondefaulting party of payment of the aggregate Repurchase Prices for all such Transactions, all right, title and interest in and entitlement to all Purchased Securities subject to such Transactions shall be deemed transferred to the nondefaulting party, and the defaulting party shall deliver all such Purchased Securities to the nondefaulting party. |

| (d) | If the nondefaulting party exercises or is deemed to have exercised the option referred to in subparagraph (a) of this Paragraph, the nondefaulting party, without prior notice to the defaulting party, may: |

| (i) | as to Transactions in which the defaulting party is acting as Seller, (A) immediately sell, in a recognized market (or otherwise in a commercially reasonable manner) at such price or prices as the nondefaulting party may reasonably deem satisfactory, any or all Purchased Securities subject to such Transactions and apply the proceeds thereof to the aggregate unpaid Repurchase Prices and any other amounts owing by the defaulting party hereunder or (B) in its sole discretion elect, in lieu of selling all or a portion of such Purchased Securities, to give the defaulting party credit for such Purchased Securities in an amount equal to the price therefor on such date, obtained from a generally recognized source or the most recent closing bid quotation from such a source, against the aggregate unpaid Repurchase Prices and any other amounts owing by the defaulting party hereunder; and |

8

| (ii) | as to Transactions in which the defaulting party is acting as Buyer, (A) immediately purchase, in a recognized market (or otherwise in a commercially reasonable manner) at such price or prices as the nondefaulting party may reasonably deem satisfactory, securities (“Replacement Securities”) of the same class and amount as any Purchased Securities that are not delivered by the defaulting party to the nondefaulting party as required hereunder or (B) in its sole discretion elect, in lieu of purchasing Replacement Securities, to be deemed to have purchased Replacement Securities at the price therefor on such date, obtained from a generally recognized source or the most recent closing offer quotation from such a source. |

Unless otherwise provided in Annex I, the parties acknowledge and agree that (1) the Securities subject to any Transaction hereunder are instruments traded in a recognized market, (2) in the absence of a generally recognized source for prices or bid or offer quotations for any Security, the nondefaulting party may establish the source therefor in its sole discretion and (3) all prices, bids and offers shall be determined together with accrued Income (except to the extent contrary to market practice with respect to the relevant Securities).

| (e) | As to Transactions in which the defaulting party is acting as Buyer, the defaulting party shall be liable to the nondefaulting party for any excess of the price paid (or deemed paid) by the nondefaulting party for Replacement Securities over the Repurchase Price for the Purchased Securities replaced thereby and for any amounts payable by the defaulting party under Paragraph 5 hereof or otherwise hereunder. |

| (f) | For purposes of this Paragraph 11, the Repurchase Price for each Transaction hereunder in respect of which the defaulting party is acting as Buyer shall not increase above the amount of such Repurchase Price for such Transaction determined as of the date of the exercise or deemed exercise by the nondefaulting party of the option referred to in subparagraph (a) of this Paragraph. |

| (g) | The defaulting party shall be liable to the nondefaulting party for (i) the amount of all reasonable legal or other expenses incurred by the nondefaulting party in connection with or as a result of an Event of Default, (ii) damages in an amount equal to the cost (including all fees, expenses and commissions) of entering into replacement transactions and entering into or terminating hedge transactions in connection with or as a result of an Event of Default, and (iii) any other loss, damage, cost or expense directly arising or resulting from the occurrence of an Event of Default in respect of a Transaction. |

9

| (h) | To the extent permitted by applicable law, the defaulting party shall be liable to the nondefaulting party for interest on any amounts owing by the defaulting party hereunder, from the date the defaulting party becomes liable for such amounts hereunder until such amounts are (i) paid in full by the defaulting party or (ii) satisfied in full by the exercise of the nondefaulting party’s rights hereunder. Interest on any sum payable by the defaulting party to the nondefaulting party under this Paragraph 11 (h) shall be at a rate equal to the greater of the Pricing Rate for the relevant Transaction or the Prime Rate. |

| (i) | The nondefaulting party shall have, in addition to its rights hereunder, any rights otherwise available to it under any other agreement or applicable law. |

| 12. | Single Agreement |

Buyer and Seller acknowledge that, and have entered hereinto and will enter into each Transaction hereunder in consideration of and in reliance upon the fact that, all Transactions hereunder constitute a single business and contractual relationship and have been made in consideration of each other. Accordingly, each of Buyer and Seller agrees (i) to perform all of its obligations in respect of each Transaction hereunder, and that a default in the performance of any such obligations shall constitute a default by it in respect of all Transactions hereunder, (ii) that each of them shall be entitled to set off claims and apply property held by them in respect of any Transaction against obligations owing to them in respect of any other Transactions hereunder and (iii) that payments, deliveries and other transfers made by either of them in respect of any Transaction shall be deemed to have been made in consideration of payments, deliveries and other transfers in respect of any other Transactions hereunder, and the obligations to make any such payments, deliveries and other transfers may be applied against each other and netted.

| 13. | Notices and Other Communications |

Any and all notices, statements, demands or other communications hereunder may be given by a party to the other by mail, facsimile, telegraph, messenger or otherwise to the address specified in Annex II hereto, or so sent to such party at any other place specified in a notice of change of address hereafter received by the other. All notices, demands and requests hereunder may be made orally, to be confirmed promptly in writing, or by other communication as specified in the preceding sentence.

| 14. | Entire Agreement; Severability |

This Agreement shall supersede any existing agreements between the parties containing general terms and conditions for repurchase transactions. Each provision and agreement herein shall be treated as separate and independent from any other provision or agreement herein and shall be enforceable notwithstanding the unenforceability of any such other provision or agreement.

| 15. | Non-assignability; Termination |

| (a) | The rights and obligations of the parties under this Agreement and under any Transaction shall not be assigned by either party without the prior written consent of the other party, and any such assignment without the prior written consent of the other party shall be null and void. Subject to the foregoing, this Agreement and any Transactions shall be binding upon and shall inure to the benefit of the parties and |

10

| their respective successors and assigns. This Agreement may be terminated by either party upon giving written notice to the other, except that this Agreement shall, notwithstanding such notice, remain applicable to any Transactions then outstanding. |

| (b) | Subparagraph (a) of this Paragraph 15 shall not preclude a party from assigning, charging or otherwise dealing with all or any part of its interest in any sum payable to it under Paragraph 11 hereof. |

| 16. | Governing Law |

This Agreement shall be governed by the laws of the State of New York without giving effect to the conflict of law principles thereof.

| 17. | No Waivers, Etc. |

No express or implied waiver of any Event of Default by either party shall constitute a waiver of any other Event of Default and no exercise of any remedy hereunder by any party shall constitute a waiver of its right to exercise any other remedy hereunder. No modification or waiver of any provision of this Agreement and no consent by any party to a departure herefrom shall be effective unless and until such shall be in writing and duly executed by both of the parties hereto. Without limitation on any of the foregoing, the failure to give a notice pursuant to Paragraph 4 (a) or 4(b) hereof will not constitute a waiver of any right to do so at a later date.

| 18. | Use of Employee Plan Assets |

| (a) | If assets of an employee benefit plan subject to any provision of the Employee Retirement Income Security Act of 1974 (“ERISA”) are intended to be used by either party hereto (the “Plan Party”) in a Transaction, the Plan Party shall so notify the other party prior to the Transaction. The Plan Party shall represent in writing to the other party that the Transaction does not constitute a prohibited transaction under ERISA or is otherwise exempt therefrom, and the other party may proceed in reliance thereon but shall not be required so to proceed. |

| (b) | Subject to the last sentence of subparagraph (a) of this Paragraph, any such Transaction shall proceed only if Seller furnishes or has furnished to Buyer its most recent available audited statement of its financial condition and its most recent subsequent unaudited statement of its financial condition. |

| (c) | By entering into a Transaction pursuant to this Paragraph, Seller shall be deemed (i) to represent to Buyer that since the date of Seller’s latest such financial statements, there has been no material adverse change in Seller’s financial condition which Seller has not disclosed to Buyer, and (ii) to agree to provide Buyer with future audited and unaudited statements of its financial condition as they are issued, so long as it is a Seller in any outstanding Transaction involving a Plan Party. |

11

| 19. | Intent |

| (a) | The parties recognize that each Transaction is a “repurchase agreement” as that term is defined in Section 101 of Title 11 of the United States Code, as amended (except insofar as the type of Securities subject to such Transaction or the term of such Transaction would render such definition inapplicable), and a “securities contract” as that term is defined in Section 741 of Title 11 of the United States Code, as amended (except insofar as the type of assets subject to such Transaction would render such definition inapplicable). |

| (b) | It is understood that either party’s right to liquidate Securities delivered to it in connection with Transactions hereunder or to exercise any other remedies pursuant to Paragraph 11 hereof is a contractual right to liquidate such Transaction as described in Sections 555, 559 and 561 of Title 11 of the United States Code, as amended, and that this Agreement constitutes a “master netting agreement” as defined in Section 101(38A) of Title 11 of the United States Code, as amended. |

| (c) | The parties agree and acknowledge that if a party hereto is an “insured depository institution,” as such term is defined in the Federal Deposit Insurance Act, as amended (“FDIA”), then each Transaction hereunder is a “qualified financial contract,” as that term is defined in FDIA and any rules, orders or policy statements thereunder (except insofar as the type of assets subject to such Transaction would render such definition inapplicable). |

| (d) | It is understood that this Agreement constitutes a “netting contract” as defined in and subject to Title IV of the Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”) and each payment entitlement and payment obligation under any Transaction hereunder shall constitute a “covered contractual payment entitlement” or “covered contractual payment obligation”, respectively, as defined in and subject to FDICIA (except insofar as one or both of the parties is not a “financial institution” as that term is defined in FDICIA). |

| 20. | Disclosure Relating to Certain Federal Protections |

The parties acknowledge that they have been advised that:

| (a) | in the case of Transactions in which one of the parties is a broker or dealer registered with the Securities and Exchange Commission (“SEC”) under Section 15 of the Securities Exchange Act of 1934 (“1934 Act”), the Securities Investor Protection Corporation has taken the position that the provisions of the Securities Investor Protection Act of 1970 (“SIPA”) do not protect the other party with respect to any Transaction hereunder; |

| (b) | in the case of Transactions in which one of the parties is a government securities broker or a government securities dealer registered with the SEC under Section 15C of the 1934 Act, SIPA will not provide protection to the other party with respect to any Transaction hereunder; and |

12

| (c) | in the case of Transactions in which one of the parties is a financial institution, funds held by the financial institution pursuant to a Transaction hereunder are not a deposit and therefore are not insured by the Federal Deposit Insurance Corporation or the National Credit Union Share Insurance Fund, as applicable. |

13

| Integrated Device Technology, Inc. | Bank of America, N.A. | |||||||

| By: | /s/ ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇ |

By: | /s/ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | |||||

| Name: ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇▇ | Name: ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | |||||||

| Title: Vice President, Chief Financial Officer | Title: Managing Director | |||||||

| Date: June 13, 2011 | Date: June 13, 2011 | |||||||

14

ANNEX I

Supplemental Terms and Conditions

This Annex I forms a part of the Master Repurchase Agreement (“Agreement”) dated as of June 13, 2011 between Integrated Device Technology, Inc. (the “Seller”) and Bank of America, N.A. (the “Buyer”). Capitalized terms used but not defined in this Annex I shall have the meanings ascribed to them in the Agreement. References in this Annex I and in the Agreement to provisions of the Agreement shall refer to such provisions as amended by this Annex I.

| 1. | Other Applicable Annexes. In addition to this Annex I and Annex II, the following Annexes and any Schedules thereto shall form a part of the Agreement and shall be applicable thereunder: |

None.

| 2. | Definitions. |

(a) For purposes of the Agreement and this Annex I, the following terms shall have the following meanings:

“Action” means any claim, action, suit, arbitration, inquiry, proceeding or investigation by or before any Governmental Authority.

“Availability Period” means the period from June 13, 2011 to June 13, 2012.

“Business Day” means a day other than (i) a Saturday or Sunday or (ii) a day on which banks in New York, London or the Cayman Islands are authorized or required by law or executive order to, or customarily, remain closed.

“Certificate” means the Certificate of Designations of Preferences, Limitations and Relative Rights of Class A Preferred Shares of IDTI (Cayman) Limited dated June 10, 2011.

“Confirmation” has the meaning specified in Paragraph 3(d) (as amended pursuant to the terms hereof).

“Consolidated Funded Indebtedness” means the sum, determined for the Seller and its subsidiaries on a consolidated basis, without duplication, of (a) the outstanding principal amount of all obligations, whether current or long-term, for borrowed money, and all obligations evidenced by bonds, debentures, notes, loan agreements or other similar instruments, and all obligations to repurchase Purchased Securities under the Agreement, (b) all purchase money indebtedness, (c) all direct obligations arising under letters of credit (including standby and commercial), bankers’ acceptances, bank guaranties, surety bonds and similar instruments, (d) all obligations in respect of the deferred purchase price of property or services (other than trade accounts payable in the ordinary course of business), (e) attributable indebtedness in respect of capital leases and synthetic lease obligations, (f) without duplication, all guarantees with respect to outstanding indebtedness of the types specified in clauses (a) through (e) above of persons other than the Seller or any subsidiary, and (g) all indebtedness of the types referred to in clauses (a) through (f) above of any partnership or joint venture (other than a joint venture that is itself a corporation or limited liability company) in which the Seller or a subsidiary is a general partner or joint venturer, except to the extent such indebtedness is expressly made non-recourse to the Seller or such subsidiary.

15

“Default” means an event or circumstances that, with the giving of notice or lapse of time or both, would constitute an Event of Default.

“Governmental Authority” means any government, governmental, regulatory or administrative authority, agency or commission or any court, tribunal, or judicial body.

“Income Payment Date” means, with respect to any Securities, the date on which Income is paid in respect of such Securities.

“IDTI Agreement” means the IDTI Agreement, dated as of June 13, 2011, by Integrated Device Technology, Inc. and Seller in favor of the Applicable Persons (as defined therein).

“IDTI (Cayman) Limited” means IDTI (Cayman) Limited, a company incorporated with limited liability under the laws of the Cayman Islands.

“Law” means any publicly promulgated applicable statute, law, ordinance, regulation, rule, code, order, other requirement or rule of law.

“Material Adverse Effect” has the same meaning as set forth in the Certificate.

“Material Affiliate” has the same meaning as set forth in the Certificate.

“Material Affiliate Event” has the same meaning as set forth in the Certificate.

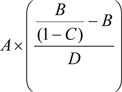

“Net Value” means:

| (a) | if Buyer is the defaulting party, the amount which, in the reasonable opinion of the Seller, represents the fair market value of the Purchased Securities, having regard to such pricing sources and methods (which may include, without limitation, available quotations for the Purchased Securities) as the Seller considers appropriate. |

| (b) | if Seller is the defaulting party: |

| (i) | if any of the Purchased Securities are sold through the Valuation Process on or prior to the Valuation Process Cut-Off Date, then the Net Value in respect of such Purchased Securities shall be the net proceeds received by Buyer in respect of such Purchased Securities at the conclusion of the Valuation Process, net of all reasonable costs, commissions, fees and expenses incurred by Buyer in connection with the Valuation Process; |

| (ii) | if any of the Purchased Securities have not been sold through the Valuation Process on or prior to the Valuation Process Cut-Off Date, then the Net Value in respect of such Purchased Securities shall be the amount which, in the reasonable opinion of Buyer, represents their fair market value, having regard to such pricing sources and methods (which may include, without limitation, available quotations for the Purchased Securities) as Buyer considers appropriate. |

“Person” means any individual, corporation, partnership, joint venture, association, joint-stock company, trust, unincorporated organization, limited liability company or government or other entity.

16

“Price Differential” has the meaning specified in the Confirmation.

“Price Differential Payment Date” means each of the dates specified in the Confirmation as being a Price Differential Payment Date.

“Purchased Securities” means as of any date of determination, the aggregate number of shares of the Purchased Security that have been purchased by Buyer pursuant to Transactions hereunder, less the number, if any, of shares of the Purchased Security for which the Repurchase Price has been tendered to Buyer in satisfaction of Seller’s obligation to repurchase such number of shares of the Purchased Security on or prior thereto.

“Purchased Security” has the meaning specified in the Confirmation.

“Repurchase Price” has the meaning specified in the Confirmation.

“Stated Price Differential Period” has the meaning specified in the Confirmation.

“Taxes” mean any tax, duty, levy, impost, duty, charge, assessment or fee of any nature (including any interest, penalties and additions thereto) that is imposed by any government or other taxing authority in respect of any payment.

“Transaction Documents” means (a) this Agreement, (b) the IDTI Agreement and (c) any Indemnity Documents (as defined in the IDTI Agreement).

“Undrawn Fee Calculation Period” means, with respect to each Undrawn Fee Payment Date, the period from and including the immediately preceding Undrawn Fee Payment Date to but excluding such Undrawn Fee Payment Date, except that (a) the initial Undrawn Fee Calculation Period will commence on and include June 13, 2011 and end on but exclude the first Undrawn Fee Payment Date.

“Undrawn Fee Payment Date” means (i) each of the first four dates following the date hereof that falls on the 14th of March, June, September or December and (ii) only if such date is after the fourth Undrawn Fee Payment Date, the first anniversary of the date hereof (or, if any of the foregoing dates is not a Business Day, the immediately following Business Day).

“Valuation Process” means the following sequence of events:

(i) Buyer shall deliver written notice to Seller that Buyer has elected to determine the Net Value of the Purchased Securities, which notice shall include the Net Value determined by Buyer as if clause (b)(ii) of the definition of Net Value were applicable;

(ii) following such notification, Seller may elect, by notice to Buyer (which notice shall state that Buyer will avail itself of the Valuation Process but need not identify a financial institution or provide the price or other terms of any offer for the Purchased Securities) on or prior to the third (3rd) Business Day following Buyer’s notice pursuant to clause (i), to designate a nationally or internationally recognized financial institution to propose a firm price at which it will offer to purchase the Purchased Securities from Buyer pursuant to customary documentation reasonably satisfactory to Buyer, the terms of which (a) will provide that such financial institution will be liable for and pay any share transfer payments due upon transfer of the Class A Preferred Shares to it, (b) will include customary representations of Buyer regarding the conveyance of good title to the Purchased Securities, free and clear of liens, but not any provisions whereby Buyer indemnifies such financial institution for matters relating to the actions, status or financial condition of Seller or any of Seller’s affiliates, including IDTI (Cayman) Limited;

17

(iii) if in the reasonable and good faith determination of Buyer, the financial institution designated by Seller is capable of consummating the purchase of the Purchased Securities and meets the standards of creditworthiness that Buyer generally applies to counterparties in similar transactions, and applicable legal and regulatory requirements pertaining to the purchase, including Buyer’s internal policies of general application, would be satisfied, then Buyer shall negotiate in good faith with such financial institution and use its commercially reasonable efforts to consummate the sale of the Purchased Securities to such financial institution on or prior to the Valuation Process Cut-Off Date.

“Valuation Process Cut-Off Date” means the earliest to occur of (i) Seller’s failure to notify Buyer of its election to avail itself of the Valuation Process within the time period specified in clause (ii) of the definition thereof; (ii) the date on which the sale of the Purchased Securities pursuant to the Valuation Process is consummated; and (iii) the 30th calendar day following the date of Buyer’s notice to Seller pursuant to clause (i) of the definition of Valuation Process.

(b) Paragraphs 2(b), 2(c), 2(d), 2(e), 2(g), 2(h), 2(i), 2(j), 2(k), 2(p), 2(r), 2(s) and 2(t) of the Agreement are hereby deleted.

| 3. | Commitment to Enter into Transactions |

Subject to and in accordance with the terms and conditions of this Annex and the Agreement, Buyer agrees to enter into Transactions from time to time on any Business Day during the Availability Period; provided, however, that Buyer shall have no obligation to enter into any proposed Transaction to the extent that the proposed number of Purchased Securities thereunder, when aggregated with the number of Purchased Securities under all prior Transactions hereunder (whether or not such other Transactions are then outstanding) would exceed 1,431.

| 4. | Initiation; Conditions; Confirmation; Termination |

Paragraph 3 of the Agreement is hereby deleted and replaced with the following:

| “3. | Initiation, Conditions; Confirmation, Termination |

| (a) | Seller shall initiate each proposed Transaction by submitting a written request duly executed by an authorized officer of Seller in the form attached hereto as Exhibit II for Buyer’s review, which shall set forth (i) the proposed number of Purchased Securities, which shall be an integral number not less than 358 (except that if the number of Purchased Securities under all Transactions entered into prior to such request is greater than 1073, then Seller may specify a proposed number of Purchased Securities such that, after giving effect to the proposed Transaction, the aggregate number of Purchased Securities would equal 1,431) and (ii) a date not earlier than three (3) Business Days following, and not later than fifteen (15) Business Days following, the effective date of such request as the Purchase Date for the proposed Transaction. Any such request shall be effective (x) on the Business Day made, if delivered to Seller at or before 1:00 p.m. (New York City time) on such Business Day, or (y) otherwise, on the Business Day immediately following the date of its delivery to Buyer. |

18

| (b) | Buyer’s agreement to enter into the initial Transaction hereunder is subject to the satisfaction, immediately prior to or concurrently with the making of such Transaction, of each of the following conditions precedent: |

| (i) | Buyer shall have received all of the following documents, each of which shall have been duly completed and executed by each of the parties thereto and satisfactory in form and substance to Buyer and its counsel (each, a “Transaction Document”): |

| (A) | this Agreement; |

| (B) | the IDTI Agreement; |

| (C) | a certificate, dated as of the Purchase Date, of the corporate secretary of IDTI (Cayman) Limited certifying that (A) the Memorandum & Articles and the Certificate, as in effect on such date, are in the form of Exhibit III and Exhibit IV, respectively and (B) ▇▇▇▇▇▇▇ ▇▇▇▇▇▇ and ▇▇▇▇▇▇ ▇▇▇▇▇▇ have been duly appointed as directors of IDTI (Cayman) Limited; and |

| (D) | each of the following opinions addressed to Buyer, in form and substance satisfactory to it: (I) from ▇▇▇▇▇▇ & ▇▇▇▇▇▇▇ LLP, (II) from Walkers, (III) ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇, in-house counsel to Seller, (IV) from ▇▇▇▇▇▇▇ ▇▇▇▇ & ▇▇▇▇▇▇▇ and (V) from ▇▇▇▇▇ & ▇▇▇▇▇▇▇▇. |

| (E) | good standing certificates and certified copies of the charters and by-laws (or equivalent documents) of Seller and IDTI (Cayman) Limited; |

| (ii) | Buyer shall have received from Seller copies of appropriate resolutions of each of Seller and IDTI (Cayman) Limited authorizing the transactions contemplated hereby to be performed by IDTI, Seller and IDTI (Cayman) Limited, as the case may be; and |

| (iii) | Buyer shall have received all such other and further customary closing documentation, including without limitation legal opinions, financial information, evidence of capacity, authority, incumbency and specimen signatures as Buyer in good faith shall reasonably require. |

| (c) | Buyer’s commitment to enter into each Transaction (including the initial Transaction) is subject to the satisfaction of the following further conditions precedent as of the Purchase Date designated in accordance with Paragraph 3(a), both immediately prior to entering into such Transaction and also after giving effect to the consummation thereof and the intended use of the proceeds of the sale of the Purchased Securities: |

| (i) | each representation or warranty of Seller and IDTI (Cayman) Limited contained in Transaction Documents or in any certificate or other document delivered pursuant to any Transaction Document is true and correct in all material respects (or, in the case of a representation or warranty that is already qualified by |

19

| materiality, in all respects), as of the Purchase Date with the same force and effect as though made on and as of such date (except to the extent that such representation or warranty expressly relates solely to an earlier date, in which case as of such earlier date); |

| (ii) | as of the Purchase Date for such proposed Transaction, no Act of Insolvency shall have occurred with respect to any of Seller or IDTI (Cayman) Limited; |

| (iii) | Buyer shall have received documentary evidence reasonably satisfactory to it that the shares of the Purchased Security that are to be purchased by Buyer under the proposed Transaction have been registered in the name of Buyer and conveyed to Buyer free and clear of any lien, charge, claim or other encumbrances; |

| (iv) | Seller shall have taken such other actions as Buyer shall have reasonably requested in order to transfer the Purchased Securities pursuant to this Agreement and to perfect all security interests granted under this Agreement or any other Transaction Document in favor of Buyer with respect to the Purchased Securities; |

| (v) | as of the Purchase Date, there shall not have occurred any Material Adverse Effect; |

| (vi) | as of the Purchase Date, there shall not have occurred and be continuing any Incipient Material Affiliate Event or Material Affiliate Event (including a Default or Event of Default with respect to Seller under this Agreement); |

| (vii) | no Action shall be pending or, to Seller’s knowledge, threatened by or before any Governmental Authority; no Law shall have been enacted after the date of this Agreement; and no judicial or administrative decision shall have been rendered; in each case, which enjoins, prohibits or materially restricts, or seeks to enjoin, prohibit or materially restrict, the consummation of any Transaction contemplated by this Agreement; and |

| (viii) | Buyer shall have received a certificate from an officer of Seller certifying that (A) the conditions precedent specified in clauses (i), (ii), (v), (vi) and, solely with respect to actions of Seller and its affiliates, (vii) of this Section 3(c) are satisfied as of the Purchase Date; and (B) the assumptions set forth in the non-consolidation opinion of ▇▇▇▇▇▇ & ▇▇▇▇▇▇▇ LLP remain true and correct with respect to the applicable Transaction; and |

| (d) | Upon conditions precedent to a proposed Transaction being satisfied (or waived by Buyer), Buyer shall promptly, and, in any event, no later than 1 Business Day after satisfaction or waiver of the conditions precedent, deliver to Seller a written confirmation of the Transaction (a “Confirmation”) in the form of Exhibit I hereto. Each Confirmation, together with this Agreement, shall be conclusive evidence of the terms of the Transaction(s) covered thereby (absent manifest error) unless specific objection is made in writing by Seller no more than the third (3rd) Business Days after such Confirmation is received by Seller. |

20

| 5. | Purchase Price Maintenance. |

Provided that no Event of Default with respect to Seller has occurred and is continuing, the parties agree that in any Transaction hereunder whose term extends over an Income Payment Date for the Securities subject to such Transaction, Buyer shall (including by causing its custodian, if any, to take such actions on its behalf), on the first Business Day following the Income Payment Date, transfer to or credit to the account of Seller an amount equal to such Income payment or payments pursuant to Paragraph 5(i) of the Agreement and Buyer shall not apply the Income payment or payments to reduce the amount to be transferred to Buyer by Seller upon termination of the Transaction pursuant to Paragraph 5(ii) of the Agreement; provided, however, that any Income paid as consideration for a redemption of the Purchased Securities shall be applied first to reduce the Repurchase Price and shall only be transferred to or credited for the account of Seller to the extent that such further application would reduce the Repurchase Price, as of the Income Payment Date, below zero.

| 6. | Margin Maintenance. Paragraph 4 of the Agreement is hereby deleted in its entirety. Clause (A) of the third sentence of Paragraph 5 of this Agreement shall be inapplicable to any Transaction hereunder. |

| 7. | No Recognized Market. Notwithstanding anything to the contrary in the Agreement but subject to the Valuation Process to the extent it is applicable, Seller and Buyer acknowledge and agree that the Purchased Securities subject to the Transaction hereunder are not instruments traded in a recognized market and therefore the nondefaulting party may establish the Net Value acting in a commercially reasonable manner. |

| 8. | Income Payments. Paragraph 5 of the Agreement is hereby amended by replacing the words “on the date such Income is paid or distributed” in the fifth line thereof with the following words: “on the date that is the first Business Day after the applicable Income Payment Date”. |

| 9. | Security Interest. Paragraph 6 of the Agreement is hereby deleted and replaced with the following: |

6. Security Interest. Although the parties intend that all Transactions hereunder be sales and purchases and not loans, in the event any such Transactions are deemed to be loans, Seller shall be deemed to have pledged to Buyer as security for the performance by Seller of its obligations under each such Transaction, and shall be deemed to have granted to Buyer a security interest in, all of Seller’s right, title and interest in and to the Purchased Securities with respect to all Transactions hereunder, all securities accounts to which the Purchased Securities are credited and all security entitlements with respect thereto and all Income on and other proceeds of the foregoing (collectively the “Deemed Collateral”).

| 10. | Events of Default. |

(a) The first paragraph in Paragraph 11 of the Agreement is hereby deleted and replaced with the following:

“In the event that (i) Seller fails to transfer Purchased Securities or Buyer fails to transfer the Purchase Price in accordance with Paragraph 3 of this Agreement, (ii) Seller fails to repurchase or Buyer fails to transfer Purchased Securities upon the applicable Repurchase Date (except that a failure to repurchase Purchased Securities upon the applicable Repurchase Date shall not constitute an Event of Default in the event that Buyer is a defaulting party on such ▇▇▇▇▇▇▇▇▇▇

▇▇

Date), (iii) Buyer fails to comply with Paragraph 5 of the Agreement, as amended, and such failure is not remedied on or before the second Business Day after such failure, (iv) Seller fails to pay Buyer the Price Differential on the related Price Differential Payment Date and such failure is not remedied on or before the third Business Day following the related Price Differential Payment Date, (v) Seller fails to pay to Buyer any amounts, other than Price Differential, owing under the Agreement when due and such failure is not remedied on or before the third Business Day following the date on which such amounts are due, (vi) an Act of Insolvency occurs with respect to Seller or Buyer, (vii) any representation made by Seller or Buyer hereunder shall have been incorrect or untrue in any material respect when made or repeated or deemed to have been made or repeated, (viii) Seller or Buyer shall admit in writing to the other its inability to, or its intention not to, perform any of its obligations hereunder; (ix) Buyer or Seller breaches Paragraph 15(a) of the Agreement; or (x) Seller’s Consolidated Funded Indebtedness at any time exceeds U.S. $550 million (each an “Event of Default”):”

(b) Paragraph 11(b) of the Agreement is hereby amended by inserting after the words “at the Repurchase Price therefor” the following words: “, together with all accrued unpaid Price Differential”. Paragraph 11(c) of the Agreement is hereby amended by inserting after the words “aggregate Repurchase Prices” the following words: “, together with all accrued unpaid Price Differential,”.

(c) Paragraph 11(d)(i) is hereby amended by deleting subparagraph (B) in its entirety and substituting the following words therefor: “(B) in its sole discretion elect, in lieu of selling all or a portion of such Purchased Securities, to commence the Valuation Process and, upon determination of the Net Value following the Valuation Process Cut-Off Date, give the defaulting party credit for such Purchased Securities in an amount equal to the Net Value therefor on such date of determination against the aggregate unpaid Repurchase Price and any other amounts owing by the defaulting party hereunder; and”.

(d) Paragraph 11(d)(ii) is hereby replaced with the following:

“(ii) as to Transactions in which the defaulting party is acting as Buyer, determine in a commercially reasonable manner an amount equal to the Net Value of the Purchased Securities that are not delivered by the defaulting party to the nondefaulting party as required hereunder.”

(f) Paragraph 11(e) is hereby replaced with the following:

“Upon application of the proceeds or determination of the Net Value, in each case as described in Paragraph 11(d), (i) the Seller shall be liable to the Buyer for the excess, if any, of (1) (I) the Repurchase Price plus (II) any unpaid Price Differential over (2) (I), as applicable, (A) if the defaulting party is acting as Buyer, the amount equal to the Net Value of the Purchased Securities as determined by the Seller or (B) if the defaulting party is acting as Seller, the proceeds realized from the liquidation of the Purchased Securities or the Net Value of the Purchased Securities as determined by Buyer plus (II) any amounts actually received by Buyer and payable by Buyer under Paragraph 5 hereof or otherwise hereunder and not paid, and (ii) the Buyer shall be liable to the Seller for the excess, if any, of (1) (I), as applicable, (A) if the defaulting party is acting as Buyer, the amount equal to the Net Value of the Purchased Securities as determined by the Seller or (B) if the defaulting party is acting as Seller, the proceeds realized from the liquidation of the Purchased Securities or the Net Value of the Purchased Securities as determined by Buyer plus (II) any amounts actually received by Buyer and payable by Buyer under Paragraph 5 hereof or otherwise hereunder and not paid over (2) (I) the Repurchase Price plus (II) any unpaid Price Differential.”

22

(g) Paragraph 11(g) is hereby deleted in its entirety.

| 11. | Payments by Seller to Buyer. |

(a) The Seller shall pay to the Buyer on each Price Differential Payment Date an amount equal to the accrued unpaid Price Differential.

(b) Seller agrees to pay to Buyer on each Undrawn Fee Payment Date after the date hereof a nonrefundable fee equal to the sum, over each calendar day during the related Undrawn Fee Calculation Period, of (x) USD 135,000,000 minus the aggregate Purchase Price as of such day, multiplied by (y) 0.625% divided by 360.

(c) All payments by Seller hereunder shall be made free and clear of, and without any deduction or withholding for or on account of, any current or future Taxes levied in any jurisdiction from or through which payment is made, unless such deduction or withholding is required by applicable law, in which event the Seller will pay to Buyer such additional amount or amounts as may be necessary so that the Buyer receives without delay the full amount that would otherwise have been received but for such deduction or withholding.

| 12. | Overdue Payments. If a party does not pay any amount on the date due (without regard to any applicable grace periods), including without limitation any Price Differential or any amount payable by Buyer under Paragraph 5 of the Agreement, such party will, to the extent permitted by applicable law, pay interest on that amount to the other party in the same currency as that amount, for the period from (and including) the date the amount becomes due to (but excluding) the date the amount is actually paid, by daily application of the greater of the Pricing Rate and the Prime Rate to such amount. Notwithstanding the above, upon the declaration of an Event of Default, Paragraph 11(h) shall apply in lieu of this paragraph. |

| 13. | Dividends, Distributions, etc. |

| (a) | In accordance with Paragraph 5 of the Agreement, but subject to paragraph 5 and paragraph 13(d) of this Annex I, Seller shall be entitled to receive an amount equal to all Income paid or distributed on or in respect of Purchased Securities that is not otherwise received by Seller, to the full extent it would be so entitled if Purchased Securities had not been sold to Buyer, except as provided in paragraph 5 of this Annex I with respect to Income paid as consideration for a redemption of the Purchased Securities. The parties expressly acknowledge and agree, for the avoidance of doubt, that Income shall include, but is not limited to: (i) cash and all other property, (ii) stock dividends, (iii) Securities received as a result of split ups of Purchased Securities and distributions in respect thereof, and (iv) all rights to purchase additional Securities (except to the extent that any amounts included in the foregoing clauses (i) through (iv) would be deemed to be Purchased Securities). |

| (b) | Cash Income paid or distributed on or in respect of Purchased Securities, which Seller is entitled to receive pursuant to subparagraph (a) of this paragraph, shall be treated in accordance with Paragraph 5 of the Agreement, as supplemented and modified herein. Notwithstanding Paragraph 5 of the Agreement, non-cash Income received by Buyer shall be added to the Purchased Securities on the date of distribution and shall be considered as additional Purchased Securities for all purposes, subject to Buyer’s obligation to transfer Purchased Securities to Seller upon termination of the relevant Transaction in accordance with the terms of the Agreement. |

23

| (c) | Any and all payments by Buyer to or for the account of Seller hereunder shall be made subject to deduction for any and all applicable future taxes, levies, imposts, deductions, charges or withholdings, and all liabilities with respect thereto, excluding, in the case of the Buyer, (i) income or franchise taxes imposed on (or measured by) its net income or net profits by the United States of America or by the jurisdiction (or any political subdivision of any such jurisdiction) under the laws of which Buyer is organized, in which its principal office (or other fixed place of business) is located or in which it is otherwise engaged in a trade or business as a result of transactions unrelated to the Transactions, (ii) any branch profits tax or any similar tax that is imposed on Buyer with respect to Buyer’s income or profits by any jurisdiction described in clause (i) above (all such non-excluded taxes, levies, imposts, deductions, charges, withholdings and liabilities in respect of payments hereunder being hereinafter referred to as “Non-Excluded Taxes”). Buyer shall pay the full amount deducted to the relevant taxation authority or other authority in accordance with applicable law. In the event that Buyer shall make a payment to or for the account of the Seller that is subsequently determined to be subject to Non-Excluded Taxes, Seller shall promptly reimburse Buyer for the amount of such Non-Excluded Taxes together with all costs and expenses associated therewith. |

| (d) | Notwithstanding anything to the contrary in paragraph 5 of this Annex I or subparagraphs (a) (b) and (c) above, in the event that Seller fails to pay Buyer the Price Differential or the amount specified in paragraph 11(b) of this Annex I on the related Price Differential Payment Date or Undrawn Fee Payment Date and such failure is not remedied on or before the third Business Day following such Price Differential Payment Date or Undrawn Fee Payment Date, then Buyer may, without exercising its option to declare an Event of Default to have occurred under the Agreement and only for as long as such failure is continuing, retain Income paid or distributed after such Price Differential Payment Date or Undrawn Fee Payment Date and apply it to the amount of any accrued but unpaid Price Differential or amount specified in paragraph 11(b) of this Annex I and, in each case, any interest thereon. |

| 14. | Rights in Purchased Securities. |

For the avoidance of doubt, Seller waives any right to vote, or to provide any consent or to take any similar action with respect to, Purchased Securities in the event that the record date or deadline for such vote, consent or other action falls during the term of the Transaction.

| 15. | Assignability. |

| (a) | Paragraph 15(a) of the Agreement is hereby amended (i) by inserting the following words after the first occurrence of the words “other party,” in the first sentence thereof: “such prior written consent not to be unreasonably withheld (it being understood that the Seller may withhold its consent if the proposed transferee would be required to withhold amounts on account of any Taxes from any payments that it is required to make to Seller pursuant to paragraph 13(a) of Annex I hereto in excess of such amounts that Buyer would be required to withhold at the time the assignment or transfer would occur),” and (ii) by inserting the following words at the end of the first sentence thereof: “, provided that the transfer of the rights and obligations of Buyer under the Agreement and the Transactions thereunder to any “affiliate” (as defined in Rule 12b-2 under the Securities Exchange Act of 1934) of Buyer does not require the prior consent of the other party, if (i) such affiliate at the time of the assignment or transfer would not be required to withhold amounts on account of any withholding tax or other Taxes from any payments that it is required to make to Seller pursuant to paragraph 13(a) of Annex I hereto, (ii) any such |

24

| assignment or transfer does not result in Seller being obligated to withhold amounts in respect of any withholding tax or other Taxes from any payment to any transferee of Buyer, (iii) any such assignment or transfer could not reasonably be expected to result in Seller having to comply with any additional legal or regulatory requirement if such compliance would have an adverse effect on Seller, (iv) the credit ratings of such affiliate are equal to or better than the credit ratings of Buyer immediately prior to such assignment or transfer, (v) such assignment or transfer is completed at no cost or expense to Seller (other than Seller’s incidental costs and expenses, not to exceed $5,000, relating to the review and execution of transfer documentation and the registration of the Purchased Securities in the name of the transferee) and does not otherwise increase Seller’s costs and expenses in respect of the Agreement and the Transactions thereunder, (vi) Seller shall have received 30 calendar days’ prior notice of any proposed assignment or transfer, and (vii) such assignee or transferee is organized under the laws of a jurisdiction located in the United States. |

| (b) | Buyer agrees that any transfer of its rights and obligations under the Agreement shall be effected by novation pursuant to and in accordance with the terms of a novation agreement substantially in the form of Schedule A hereto (a “Novation Agreement”), which contemplates the transfer of all (but not less than all) of Buyer’s rights and interest in the Agreement and the Purchased Securities and in accordance with Paragraph 15(a) of the Agreement as amended herein. Any transfer in violation of this subparagraph (b) shall be null and void. |

| 16. | Covered Transaction. |

Each party acknowledges and agrees that the transactions evidenced by Confirmations contemplated under Section 3(d) of this Annex I shall be the only Transactions governed by the Agreement. The Seller and the Buyer shall not enter into any other Confirmations or Transactions hereunder. The parties hereby expressly agree that any TBMA Master Agreement entered into between them after the date hereof shall not supersede the Agreement or the Transaction hereunder.

| 17. | Limited Recourse. Except as expressly set forth herein, the obligations of each party under the Agreement and the Transaction are solely the corporate obligations of such party. Except as expressly set forth herein, no recourse shall be had for the payment of any amount owing by a party under the Agreement or for the payment by such party of any fee or any other obligation or claim of or against such party arising out of or based upon the Agreement, against any trustee, adviser, employee, officer, director, incorporator, manager or affiliate of such party. The provisions of this paragraph shall survive the termination of the Agreement. |

| 18. | No Recourse against IDTI (Cayman) Limited. Notwithstanding any condition relating to IDTI (Cayman) Limited or any other provision of this Agreement, nothing herein shall be construed as creating any obligation of IDTI (Cayman) Limited to Buyer under this Agreement. |

| 19. | Other Documents. |

Each party shall deliver to the other, upon request, such financial information, evidence of capacity, authority, incumbency and specimen signatures and other documentation as are required by law or are reasonably requested in order to enable a party to comply with legal or regulatory requirements.

| 20. | Submission to Jurisdiction and Waivers. |

25

(a) Each party irrevocably and unconditionally (i) submits to the exclusive jurisdiction of any United States Federal or New York State court sitting in the Borough of Manhattan and any appellate court from any such court solely for the purpose of any suit, action or proceeding brought to enforce its obligations under the Agreement or relating in any way to the Agreement or any Transaction under the Agreement, and (ii) waives, to the fullest extent it may effectively do so, any defense of an inconvenient forum to the maintenance of such action or proceeding in any such court and any right of jurisdiction on account of its place of residence or domicile.

(b) Each party hereby irrevocably agrees that the summons and complaint or any other process in any action in any jurisdiction may be served by mailing (using certified or registered mail, postage prepaid) to the notice address for it set forth herein or by hand delivery to a person of suitable age and discretion at such address. Each party may also be served in any other manner permitted by law, in which event its time to respond shall be the time provided by law.

(c) To the extent that either party has or hereafter may acquire any immunity (sovereign or otherwise) from any legal action, suit or proceeding from jurisdiction of any court or from set off or any legal process (whether service or notice, attachment prior to judgment, attachment in aid of execution of judgment, execution of judgment, or otherwise) with respect to itself or any of its property, such party hereby irrevocably waives and agrees not to plead or claim such immunity in respect of any action brought to enforce its obligations under the Agreement or relating in any way to the Agreement or any Transaction hereunder.

| 21. | WAIVER OF RIGHT TO TRIAL BY JURY. EACH PARTY IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY WITH RESPECT TO ANY PROCEEDING ARISING OUT OF OR RELATING TO THE AGREEMENT OR ANY TRANSACTION HEREUNDER. |

| 22. | Consent to Recording. Each party: (a) consents to the recording of the telephone conversations of trading and marketing personnel of the parties in connection with the Agreement, any Transaction, or any potential Transaction; and (b) agrees to obtain any necessary consent of, and give notice of such recording to, such personnel. |

| 23. | Business Day. If any payment shall be required by the terms of the Agreement to be made on a day that is not a Business Day, such payment shall be made on the immediately succeeding Business Day and no further Price Differential (with respect to a payment of Price Differential) or interest (with respect to any other payment due hereunder) shall accumulate or accrue after the day on which payment was required. |

| 24. | Counterparts. The Agreement (and each amendment, modification and waiver in respect of it) may be executed and delivered in any number of counterparts, each of which counterparts shall be deemed to be an original and such counterparts shall constitute but one and the same instrument. |

| 25. | Tax Matters. (a) Seller and Buyer understand and intend that the Transaction provided for in the Agreement will be treated as a loan secured by the Purchased Securities for U.S. federal income tax and state and local income and franchise tax purposes and will file any tax returns, tax reports and other tax filings in each case required to be filed under applicable U.S. federal income tax or state or local income or franchise tax purposes, in a manner consistent with such understanding and intent and will not take any U.S. tax position inconsistent therewith. Nothing in paragraphs 6 or 19(a) of the Agreement shall be read to imply anything to the contrary, and the statements therein shall be understood to be construed as subject to this paragraph 25(a). |

26

(b) As a condition of executing the Agreement, Buyer will deliver or cause to be delivered to Seller on or before the date it becomes a party to the Agreement a correct, complete and duly executed Internal Revenue Service Form W-9. Within 20 days of the earlier of the date on which Buyer has knowledge of, and the date on which Seller requests in writing such form after the occurrence of obsolescence or invalidity of any Internal Revenue Service Form W-9 previously delivered by Buyer, Buyer will deliver to Seller a correct, complete and duly executed Internal Revenue Service Form W-9 or any successor forms. In the event that any assignee of Buyer is not a U.S. person, as defined in Internal Revenue Code section 7701(a)(30), the assignee shall deliver to Seller an Internal Revenue Service Form W-8BEN or other applicable form in lieu of Internal Revenue Service Form W-9.

(c) Buyer warrants and represents that it is a national banking association organized under the laws of the United States.

(d) Upon request, Seller shall deliver to Buyer a correct, complete and duly executed Internal Revenue Form W-9. Within 20 days of the earlier of the date on which Seller has knowledge of, and the date on which Buyer requests in writing such form after the occurrence of obsolescence or invalidity of any Internal Revenue Form W-9 previously delivered by Seller, Seller will deliver to Buyer a correct, complete and duly executed Form W-9 or any successor form.

| 26. | Accounts for Payment. |

Payments shall be made to the following accounts, or to such other account as may hereafter be notified to Seller or Buyer in writing by Buyer or Seller respectively.

| To Buyer: | ||

| Name of Bank: | Bank of America | |

| Swift Code: | ▇▇▇▇▇▇▇▇ | |

| Beneficiary | Credit Services | |

| Beneficiary’s Swift Code: | Same (▇▇▇▇▇▇▇▇) | |

| Account No: | 3750836479 | |

| Chips UID: | ||

| Reference: | Integrated Device Technology Inc | |

| To Seller: | ||

| Name of Bank: | Bank of America | |

| Account No: | 1233328893 | |

| Fed ABA No: | ▇▇▇▇▇▇▇▇▇ | |

| Beneficiary: | Integrated Device Technology, Inc. | |