201 MISSION SAN FRANCISCO, CALIFORNIA OFFICE LEASE AGREEMENT BETWEEN CA-MISSION STREET LIMITED PARTNERSHIP, a Delaware limited partnership (“LANDLORD”) AND JAGUAR HEALTH, INC., a Delaware corporation (“TENANT”) SUITE 2375

000 XXXXXXX

XXX XXXXXXXXX, XXXXXXXXXX

BETWEEN

CA-MISSION STREET LIMITED PARTNERSHIP, a Delaware limited partnership

(“LANDLORD”)

AND

JAGUAR HEALTH, INC., a Delaware corporation

(“TENANT”)

SUITE 2375

TABLE OF CONTENTS

|

1. |

BASIC LEASE INFORMATION |

1 |

|

2. |

LEASE GRANT |

3 |

|

3. |

POSSESSION |

3 |

|

4. |

RENT |

4 |

|

5. |

COMPLIANCE WITH LAWS; USE |

5 |

|

6. |

SECURITY FOR LEASE |

6 |

|

7. |

BUILDING SERVICES |

6 |

|

8. |

LEASEHOLD IMPROVEMENTS |

8 |

|

9. |

REPAIRS AND ALTERATIONS |

8 |

|

10. |

ENTRY BY LANDLORD |

10 |

|

11. |

ASSIGNMENT AND SUBLETTING |

10 |

|

12. |

LIENS |

12 |

|

13. |

INDEMNITY AND WAIVER OF CLAIMS |

12 |

|

14. |

INSURANCE |

15 |

|

15. |

SUBROGATION |

16 |

|

16. |

CASUALTY DAMAGE |

16 |

|

17. |

CONDEMNATION |

18 |

|

18. |

EVENTS OF DEFAULT |

18 |

|

19. |

REMEDIES |

19 |

|

20. |

LANDLORD DEFAULT; LIMITATION OF LIABILITY |

22 |

|

21. |

RELOCATION |

23 |

|

22. |

HOLDING OVER |

23 |

|

23. |

SUBORDINATION TO MORTGAGES; ESTOPPEL CERTIFICATE |

23 |

|

24. |

NOTICE |

24 |

|

25. |

SURRENDER OF PREMISES |

24 |

|

26. |

MISCELLANEOUS |

25 |

The following exhibits and attachments are incorporated into and made a part of this Lease:

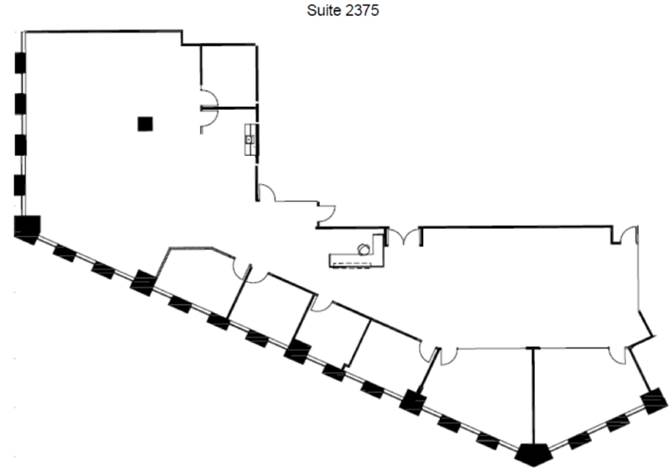

Exhibit A Outline and Location of Premises

Exhibit B Expenses, Taxes and Insurance Expenses

Exhibit C [Intentionally Omitted]

Exhibit D [Intentionally Omitted]

Exhibit E Building Rules and Regulations

Exhibit F Additional Provisions

Exhibit G Parking Agreement

Exhibit H Form of Letter of Credit

Exhibit I Disability Access Notice

THIS OFFICE LEASE AGREEMENT (this “Lease”) is entered into as of August 30, 2018 (the “Effective Date”), by and between CA-MISSION STREET LIMITED PARTNERSHIP, a Delaware limited partnership (“Landlord”) and JAGUAR HEALTH, INC., a Delaware corporation (“Tenant”).

1.01 “Building” means the building located at 000 Xxxxxxx Xxxxxx, Xxx Xxxxxxxxx, Xxxxxxxxxx, commonly known as 201 Mission. “Rentable Area of the Building” is deemed to be 511,449 square feet.

1.02 “Premises” means the area shown on Exhibit A to this Lease. The Premises consists of a portion of the twenty-third (23rd) floor known as Suite 2375. The “Rentable Area of the Premises” is deemed to be 6,311 square feet. All Rentable Area referred to herein is calculated in accordance with the “Office Buildings: Standard Methods of Measuring and Calculating Rentable Area” published by the Building Owners and Managers Association International (BOMA Z65.1-2010) as interpreted and applied by Landlord’s measurement firm to the Building. Landlord and Tenant stipulate and agree that the Rentable Area of the Building and the Premises as set forth herein are correct. If and to the extent that the Premises is exclusively served by an exterior deck, such exterior deck shall not be deemed a portion of the Premises for the purposes of the calculation of the rentable area of the Premises for the payment of Base Rent, but such exterior deck shall be deemed a part of the Premises for the purpose of Tenant’s indemnity and insurance obligations set forth in this Lease.

1.03 “Base Rent”:

|

Months of Term |

|

Annual Rate |

|

Monthly |

| ||

|

Month 1 – Month 12 |

|

$ |

73.00 |

|

$ |

38,391.92 |

** |

|

Month 13 – Month 24 |

|

$ |

75.19 |

|

$ |

39,543.67 |

|

|

Month 25 |

|

$ |

77.45 |

|

$ |

40,729.98 |

|

** Subject to abatement pursuant to Section 4.02

All such Base Rent shall be payable by Tenant in accordance with the terms of this Lease.

1.04 “Tenant’s Share”: 1.24%

1.05 “Base Year” for Taxes (defined in Exhibit B): 2018; “Base Year” for Expenses (defined in Exhibit B): 2018; “Base Year” for Insurance Expenses (defined in Exhibit B): 2018.

1.06 “Term”: The period commencing on September 1, 2018 (the “Commencement Date”) and, unless terminated earlier in accordance with this Lease, ending on

September 30, 2020, which is the last day of the twenty-fifth (25th) full calendar month of the Term (the “Termination Date”).

1.07 “Parking Rights”: One (1) parking space.

1.08 [Intentionally Omitted]

1.09 “Letter of Credit Amount”: $475,000.00 (See Exhibit F, Section 1).

1.10 “Guarantor(s)”: None.

1.11 “Broker(s)”: Xxxxx Xxxx LaSalle, representing Landlord. Tenant is not represented by a broker.

1.12 “Permitted Use”: General office and administrative use.

1.13 “Notice Address(es)”:

|

Landlord: |

|

Tenant: |

|

Xxxxx Lang LaSalle Americas, Inc. and:

CA-Mission Street Limited Partnership

With a copy to:

Shartsis Xxxxxx LLP |

|

Jaguar Health, Inc. Attn: Xxxxx Xxxxxx |

Rent Payments: Rent shall be payable to “CA-Mission Street Limited Partnership” at the following address:

CA-Mission Street Limited Partnership

Xxxxx Lang LaSalle Americas as Agent

00000 Xxxxxxxx Xxxxxx

Xxxxxxx, XX 00000-0000

For payments made by wire/ACH:

Bank:

ABA:

Acct. No.:

1.14 “Business Day(s)” are Monday through Friday of each week, exclusive of New Year’s Day, Presidents Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day (“Holidays”). Landlord may designate additional Holidays that are commonly recognized by other office buildings in the area where the Building is located. “Building Service Hours” are 7:00 A.M. to 6:00 P.M. on Business Days (other than Holidays).

1.15 [Intentionally Omitted]

1.16 “Property” means the Building and the parcel(s) of land on which it is located and, at Landlord’s discretion, the parking facilities and other improvements, if any, serving the Building and the parcel(s) of land on which they are located.

2. Lease Grant.

The Premises are hereby leased to Tenant from Landlord for the Term, together with the right to use the Common Areas, subject to the terms and conditions of this Lease. For purposes of this Lease, “Common Areas” mean those certain areas and facilities of the Building and other improvements on the Property which are from time to time provided by Landlord for the use in common of tenants of the Building and their employees, clients, customers, licensees and invitees or for use by the public, which facilities and improvements include any and all common corridors, elevator foyers, the lobby, vending areas, bathrooms on multi-tenant floors, electrical and telephone rooms, mechanical rooms, janitorial areas and other similar facilities of the Building and any and all grounds, landscaped areas, outside sitting areas, sidewalks, walkways and pedestrianways.

3. Possession.

3.01 As-Is Delivery; Timing. Tenant is in possession of Suite 2375 per the terms of that certain sublease dated as of May 8, 2015 by and between Tenant, as subtenant, and Healthmine Inc., as successor in interest to SeeChange Health Management Company, Inc., a Delaware corporation, as sublandlord (the “Sublease”), which Sublease has been amended to terminate as of September 30, 2018, simultaneously with the termination of the master lease of Suite 2375 between sublandlord and Landlord. Pursuant to the terms of the Sublease, Suite 2375 consists of approximately 6,008 square feet of Rentable Area. Landlord has remeasured Suite 2375, and Landlord and Tenant agree that, as a result of such remeasurement, and effective as of September 1, 2018, Suite 2375 shall consist of 6,311 square feet of Rentable Area. The Rentable Area of Suite 2375 was remeasured in accordance with the standards set forth in Section 1.02 above. Tenant has been in possession of Suite 2375 pursuant to the terms of the Sublease, and therefor accepts Suite 2375 in its “as is” condition, without any agreements, representations, understandings or obligations on the part of Landlord to (i) perform any alterations, additions, repairs or improvements, except that Landlord shall professionally clean the carpets in the Premises within sixty (60) days after the Commencement Date. The carpet

cleaning will be performed after Business Hours at a time mutually acceptable to Landlord and Tenant and Tenant shall be responsible for moving all furniture and materials from areas to be cleaned, (ii) fund or otherwise pay for any alterations, additions, repairs or improvements to the Expansion, or (iii) grant Tenant any free or abated rent, concessions, credits or contributions of money with respect to the Premises. Notwithstanding the provisions of Section 5.02 of this Lease to the contrary, Landlord shall have no obligation to correct any violations of Title III of the Americans with Disabilities Act with respect to Suite 2375.

3.02 One (1) Business Day following the later of delivery by Tenant to Landlord of an executed Lease, Tenant shall deliver (B) the prepaid Base Rent required pursuant to Section 4.01 below, (C) evidence of all insurance coverage required hereunder, and (D) the Letter of Credit.

4. Rent.

4.01 General. From and after the Commencement Date, Tenant shall pay Landlord, without any setoff or deduction, unless expressly set forth in this Lease, all Base Rent and Additional Rent due for the Term (collectively referred to as “Rent”). “Additional Rent” means all sums (exclusive of Base Rent) that Tenant is required to pay Landlord under this Lease. Tenant shall pay and be liable for all rental, sales and use taxes (but excluding income taxes), if any, imposed upon or measured by Rent. Base Rent and recurring monthly charges of Additional Rent shall be due and payable in advance on the first day of each calendar month without notice or demand, provided that the installment of Base Rent attributable to the first (1st) full calendar month of the Term following the Abatement Period shall be due concurrently with the execution of this Lease by Tenant. All other items of Rent shall be due and payable on or before thirty (30) days after billing by Landlord. Rent shall be made payable to the entity, and sent to the address, that Landlord designates and shall be made by good and sufficient check or by other means acceptable to Landlord. Landlord may return to Tenant, at any time within fifteen (15) days after receiving same, any payment of Rent (a) made following any Default (irrespective of whether Landlord has commenced the exercise of any remedy), or (b) that is less than the amount due. Each such returned payment (whether made by returning Tenant’s actual check, or by issuing a refund in the event Tenant’s check was deposited) shall be conclusively presumed not to have been received or approved by Landlord. If Tenant does not pay any Rent when due hereunder, Tenant shall pay Landlord an administration fee in the amount of five percent (5%) of the past due amount. In addition, past due Rent shall accrue interest at a rate equal to the lesser of (i) twelve percent (12%) per annum or (ii) the maximum legal rate, and Tenant shall pay Landlord a fee for any checks returned by Tenant’s bank for any reason. To ascertain whether any interest payable exceeds the legal limits imposed, any non-principal payment (including the administration fee) shall be considered to the extent permitted by Law to be an expense or a fee, premium or penalty, rather than interest. Landlord’s acceptance of less than the correct amount of Rent shall be considered a payment on account of the oldest obligation due from Tenant hereunder, then to any current Rent then due hereunder, notwithstanding any statement to the contrary contained on or accompanying any such payment from Tenant. Rent for any partial month during the Term shall be prorated. No endorsement or statement on a check or letter accompanying payment shall be considered an accord and satisfaction. Accordingly, Tenant hereby waives the provisions of California Uniform Commercial Code §3311 (and any similar Law that would permit an accord and satisfaction contrary to the provisions of this Section 4.01). Any partial payment shall be treated as a payment on account, and Landlord may accept such payment without prejudice to Landlord’s right to recover any balance due or to pursue any other remedy permitted by this Lease. No payment, receipt or acceptance of Rent following (a) any Default; (b) the

commencement of any action against Tenant; (c) termination of this Lease or the entry of judgment against Tenant for possession of the Premises; or (d) the exercise of any other remedy by Landlord, shall cure the Default, reinstate the Lease, grant any relief from forfeiture, continue or extend the Term, or otherwise affect or constitute a waiver of Landlord’s right to or exercise of any remedy, including Landlord’s right to terminate the Lease and recover possession of the Premises; provided, however, the full payment of all amounts required to cure any Monetary Default shall operate to cure said Default if paid within the time period provided in this Lease. The foregoing constitutes actual notice to Tenant of the provisions of California Code of Civil Procedure §1161.1(c).

4.02. Rent Abatement. Notwithstanding Section 4.01 above to the contrary, so long as Tenant is not in Default, Tenant shall be entitled to an abatement of Base Rent for the first full calendar month of the Term (the “Abatement Period”). The total amount of Base Rent abated during the Abatement Period is $38,391.92 and is referred to herein as the “Abated Rent”. If Tenant is in Monetary Default at any time, or in the event of any other Default where Landlord has elected to terminate the Lease, at Landlord’s option, all Abated Rent credited to Tenant prior to the occurrence of the Default shall become due and payable to Landlord. If a Default of any nature occurs prior to the expiration of the Abatement Period, there will be no further abatement of Base Rent pursuant to this Section 4.02. No such recapture by Landlord of the Abated Rent pursuant to clause (a) above shall constitute a waiver of any Default of Tenant or any election of remedies by Landlord.

4.03. Additional Rent. Tenant shall pay Tenant’s Share of Taxes, Insurance Expenses and Expenses in accordance with Exhibit B of this Lease. In addition, Tenant shall pay before delinquency any and all taxes levied or assessed and which become payable by Tenant (or directly or indirectly by Landlord) during the Term (excluding, however, state and federal personal or corporate income taxes measured by the net income of Landlord from all sources, capital stock taxes, and estate and inheritance taxes), whether or not now customary or within the contemplation of the parties hereto, which are based upon, measured by or otherwise calculated with respect to: (i) the gross or net rental income of Landlord under this Lease, including, without limitation, any gross receipts tax levied by any taxing authority (including without limitation the San Xxxxxxxxx Xxxxx Receipts Tax and Business Registration Fees Ordinance (2012 Proposition E)), or any other gross income tax or excise tax levied by any taxing authority with respect to the receipt of the rental payable hereunder, except to the extent Landlord elects to include any of the foregoing in Taxes; (ii) the value of Tenant’s equipment, furniture, fixtures or other personal property located in the Premises; (iii) the possession, lease, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises or any portion thereof; (iv) the value of any leasehold improvements, alterations or additions made in or to the Premises, regardless of whether title to such improvements, alterations or additions shall be in Tenant or Landlord; or (v) this transaction or any document to which Tenant is a party creating or transferring an interest or an estate in the Premises.

5.01 Tenant’s Compliance with Laws. The Premises shall be used for the Permitted Use and for no other use whatsoever. Tenant shall comply with all statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity whether in effect now or later, including the Americans with Disabilities Act (“Law(s)”), regarding the operation of Tenant’s business and the use, condition, configuration and occupancy of the Premises. In addition, Tenant, at its sole cost and expense, will promptly comply with any Laws that relate to the “Base Building” (defined below) and/or any areas of the Building or the Property outside the

Premises, but only to the extent such obligations are triggered by Tenant’s use of the Premises (other than for general office use) or Alterations or improvements in the Premises performed by or on behalf of Tenant, including the Tenant Improvements. “Base Building” shall mean the structural portions of the Building, the public restrooms and the Building mechanical, electrical, fire/life-safety and plumbing systems and equipment. Tenant shall promptly provide Landlord with copies of any notices it receives regarding an alleged violation of Law in connection with the Premises.

5.02 ADA Compliance. Landlord, at its sole cost and expense (except to the extent properly included in Expenses), shall be responsible for correcting any violations of Title III of the Americans with Disabilities Act with respect to the Common Areas. Landlord’s obligation to correct any violations of Title III of the Americans with Disabilities Act with respect to the Premises shall be limited to violations that arise out of the condition of the Premises prior to the construction of the Tenant Improvements and the installation of any furniture, equipment and other personal property of Tenant. Notwithstanding the foregoing, Landlord shall have the right to contest any alleged violation in good faith, including, without limitation, the right to apply for and obtain a waiver or deferment of compliance, the right to assert any and all defenses allowed by Law and the right to appeal any decisions, judgments or rulings to the fullest extent permitted by Law. Notwithstanding the foregoing, Tenant, not Landlord, shall be responsible for the correction of any violations that arise out of or in connection with the specific nature of Tenant’s business in the Premises (other than general office use) and/or the acts or omissions of Tenant, its agents, employees or contractors, Tenant’s arrangement of any furniture, equipment or other property in the Premises, any repairs, or alterations performed by or on behalf of Tenant and any design or configuration of the Premises specifically requested by Tenant.

5.03 Density. Tenant shall not exceed the standard density limit for the Building (i.e., one (1) person per every 150 square feet of Rentable Area of the Premises (the “Standard Density”)).

5.04 Rules and Regulations. Tenant shall comply with the rules and regulations attached hereto as Exhibit E and such other reasonable rules and regulations adopted by Landlord from time to time, including rules and regulations for the performance of Alterations (defined in Section 9.03).

6.01 Letter of Credit. Tenant shall provide a Letter of Credit pursuant to the provisions of Exhibit F attached hereto.

7.01 Building Services. Landlord shall furnish Tenant with the following services: (a) water for use in the Base Building lavatories and in any kitchen/coffee room located within the Premises; (b) heat and air conditioning in season during Building Service Hours, although (i) Tenant shall have the right to receive HVAC service during hours other than Building Service Hours by paying Landlord’s then standard charge for additional HVAC service (current charges are set forth below) and providing such prior notice as is reasonably specified by Landlord (Landlord’s charge for additional HVAC service shall be based on a minimum of four (4) hours of usage), and (ii) if Tenant is permitted to connect any supplemental HVAC units to the Building’s condenser water loop or chilled water line, such permission shall be conditioned upon Landlord having adequate excess capacity from time to time and such connection and use shall

be subject to Landlord’s reasonable approval and reasonable restrictions imposed by Landlord, and Landlord shall have the right to charge Tenant a connection fee and/or a monthly usage fee, as reasonably determined by Landlord; (c) janitorial service on Business Days; (d) elevator service; (e) electricity in accordance with the terms and conditions of Section 7.02; (f) access to the Building for Tenant and its employees twenty-four (24) hours per day/7 days per week, subject to the terms of this Lease and such protective services or monitoring systems, if any, as Landlord may reasonably impose, including, without limitation, sign-in procedures and/or presentation of identification cards; and (g) such other services as Landlord reasonably determines are necessary or appropriate for the Property. If Landlord, at Tenant’s request, provides any services which are not Landlord’s express obligation under this Lease, including, without limitation, any repairs which are Tenant’s responsibility pursuant to Section 9 below, Tenant shall pay Landlord, or such other party designated by Landlord, the cost of providing such service plus a reasonable administrative charge.

HVAC service during hours other than Building Service Hours requires at least twenty-four (24) hours prior notice to Landlord, and can be requested for either “Economizer” service, or for “fan only” service. Full HVAC service during hours other than Building Service Hours requires at least one (1) week prior notice to Landlord. There is a four (4) hour minimum for after-hours HVAC service. Landlord’s charges for such services as of the Effective Date are as follows:

|

$85.00 per hour, plus a $25.00 programming fee | |

|

|

|

|

Full HVAC: |

$180.00 per hour on weeknights, plus engineering and labor costs |

|

|

|

|

Full HVAC: |

$230.00 per hour on weekends/Holidays, plus engineering and labor costs |

7.02 Electricity. Electricity used by Tenant in the Premises shall be paid for by Tenant through inclusion in Expenses (except as provided for excess usage). Without the consent of Landlord, Tenant’s use of electrical service shall not exceed Building standard usage, per square foot, as reasonably determined by Landlord, based upon the Building standard electrical design load. Landlord shall have the right to measure electrical usage by commonly accepted methods, including the installation of measuring devices such as submeters and check meters. If it is determined that Tenant is using electricity in such quantities or during such periods as to cause the total cost of Tenant’s electrical usage, on a monthly, per-rentable-square-foot basis, to materially exceed that which Landlord reasonably deems to be standard for the Building, Tenant shall pay Landlord Additional Rent for the cost of such excess electrical usage and, if applicable, for the cost of purchasing and installing the measuring device(s).

7.03 Service Failure. Landlord’s failure to furnish, or any interruption, diminishment or termination of services due to the application of Laws, the failure of any equipment, the performance of maintenance, repairs, improvements or alterations, utility interruptions or the occurrence of an event of Force Majeure (defined in Section 26.04) (collectively a “Service Failure”) shall not render Landlord liable to Tenant, constitute a constructive eviction of Tenant, give rise to an abatement of Rent, nor relieve Tenant from the obligation to fulfill any covenant or agreement. Tenant hereby waives the provisions of California Civil Code Section 1932(1) or any other applicable existing or future law, ordinance or governmental regulation permitting the termination of this Lease due to an interruption, failure or inability to provide any services. However, if the Premises, or a material portion of the Premises, are made untenantable for a period in excess of five (5) consecutive Business Days (and the Premises are not being used by Tenant) as a result of a Service Failure that is reasonably within the control of Landlord to

correct, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Rent payable hereunder during the period beginning on the sixth (6th) consecutive Business Day of the Service Failure and ending on the day the service has been restored. If the entire Premises have not been rendered untenantable by the Service Failure, the amount of abatement shall be equitably prorated.

All improvements in and to the Premises, including any Alterations (defined in Section 9.03) (collectively, “Leasehold Improvements”) shall remain upon the Premises at the end of the Term without compensation to Tenant, provided that Tenant, at its expense, shall remove all Cable (defined in Section 9.01 below). In addition, Landlord, by written notice delivered to Tenant at least 30 days prior to the Termination Date, may require Tenant, at Tenant’s expense, to remove any Alterations; provided in all cases Tenant shall remove all Cable (defined below) prior to the Termination Date (the Cable and such other items collectively are referred to as “Required Removables”). Required Removables shall include, without limitation, internal stairways, raised floors, personal baths and showers, vaults, supplemental HVAC units (and associated mechanical infrastructure), rolling file systems and structural alterations and modifications and specialized non-standard office improvements (game room, bowling alley, etc.). Notwithstanding the foregoing, Tenant, at the time it requests approval for a proposed Alteration, including any initial Alterations or Tenant Improvements, may request in writing that Landlord advise Tenant whether the improvement is a Required Removable. In such event, if Landlord approves the Alteration(s) in question, Landlord shall advise Tenant concurrently with such approval as to which portions of the proposed Alterations or other improvements are Required Removables. Required Removables shall be removed by Tenant before the Termination Date. Tenant shall repair damage caused by the installation or removal of Required Removables to Landlord’s satisfaction. If Tenant fails to perform its obligations in a timely manner, Landlord may perform such work at Tenant’s expense.

9.01 Tenant’s Obligations. Tenant, at its sole cost and expense, shall perform all maintenance and repairs to the Premises that are not Landlord’s express responsibility under this Lease, and keep the Premises in good condition and repair, reasonable wear and tear excepted. Tenant’s repair and maintenance obligations include, without limitation, repairs to: (a) floor covering; (b) interior partitions; (c) doors; (d) the interior side of demising walls; (e) Alterations; (f) supplemental air conditioning units, kitchens, including hot water heaters, plumbing, and similar facilities exclusively serving the Premises, whether such items are installed by Tenant or are currently existing in the Premises and whether such items are located within or outside of the Premises; and (g) electronic, fiber, phone and data cabling and related equipment installed by or for the exclusive benefit of Tenant (collectively, “Cable”). All repairs and other work performed by Tenant or its contractors, including that involving Cable, shall be subject to the terms of Section 9.03 below. If Tenant fails to make any repairs to the Premises for more than fifteen (15) days after notice from Landlord (although notice shall not be required in an emergency), Landlord may make the repairs and Tenant shall pay the reasonable cost of the repairs, together with an administrative charge equal to ten percent (10%) of the cost of the repairs.

9.02 Landlord’s Obligations. Landlord shall keep and maintain in good repair and working order and perform maintenance upon the: (a) Base Building; (b) mechanical (including HVAC), electrical, plumbing and fire/life safety systems serving the Building in general (the “Building

Systems”); (c) Common Areas; (d) roof of the Building; (e) exterior windows of the Building; and (f) elevators. Tenant hereby waives any and all rights under and benefits of subsection 1 of Section 1932, and Sections 1941 and 1942 of the California Civil Code, or any similar or successor Laws now or hereafter in effect.

9.03 Alterations. Tenant shall not make alterations, repairs, additions or improvements or install any Cable (collectively referred to as “Alterations”) without first obtaining the written consent of Landlord in each instance, which consent shall not be unreasonably withheld or delayed. However, Landlord’s consent shall not be required for any Alteration that satisfies all of the following criteria (a “Cosmetic Alteration”): (a) is of a cosmetic nature such as painting, wallpapering, hanging pictures and installing carpeting; (b) is not visible from the exterior of the Premises or Building; (c) will not affect the Base Building (defined in Section 5); (d) does not require work to be performed inside the walls or above the ceiling of the Premises; (e) will not create excessive noise or result in the dispersal of odors or debris (including dust or airborne particulate matter); (f) costs less than $35,000.00; and (g) does not require the issuance of a construction permit. Cosmetic Alterations shall be subject to all the other provisions of this Section 9.03. Prior to starting any work, Tenant shall furnish Landlord with detailed plans and specifications (which shall be in CAD format if requested by Landlord) prepared by a duly licensed architect or engineer; names of contractors reasonably acceptable to Landlord (provided that Landlord may designate specific contractors with respect to Base Building, Building Systems and vertical Cable, as may be described more fully below); required permits and approvals; evidence of contractor’s and subcontractor’s insurance in form and amounts reasonably required by Landlord; and any security for performance in amounts reasonably required by Landlord. Landlord may designate specific contractors with respect to oversight, installation, repair, connection to, and removal of vertical Cable. All Cable shall be clearly marked with adhesive plastic labels (or plastic tags attached to such Cable with wire) to show Tenant’s name, suite number, and the purpose of such Cable (i) every 6 feet outside the Premises (specifically including, but not limited to, the electrical room risers and any Common Areas), and (ii) at the termination point(s) of such Cable. All changes to plans and specifications must also be submitted to Landlord for its approval. Alterations shall be constructed in a good and workmanlike manner using materials of a quality reasonably approved by Landlord, and Tenant shall ensure that no Alteration impairs any Building system or Landlord’s ability to perform its obligations hereunder. Landlord’s consent shall be deemed to have been reasonably withheld if the proposed Alterations could (a) affect any structural component of the Building; (b) be visible from or otherwise affect any portion of the Building other than the interior of the Premises; (c) affect the Base Building or any Building Systems; (d) result in Landlord being required under any Laws to perform any work that Landlord could otherwise avoid or defer; (e) result in an increase in the demand for utilities or services that Landlord is required to provide (whether to Tenant or to any other tenant in the Building); (f) cause an increase in any Insurance Expenses; (g) result in the disturbance or exposure of, or damage to, any ACM or other Hazardous Material (defined below); or (h) violate or result in a violation of any Law, Rule or requirement under this Lease. Tenant shall reimburse Landlord for any sums paid by Landlord for third party examination of Tenant’s plans for non-Cosmetic Alterations. In addition, Tenant shall pay Landlord a fee for Landlord’s oversight and coordination of any non-Cosmetic Alterations equal to ten percent (10%) of the cost of the Alterations. Landlord may require a deposit of its estimated fees in advance of performing any review. Neither the payment of any such fees or costs, nor the monitoring, administration or control by Landlord of any contractor or any part of the Alterations shall be deemed to constitute any express or implied warranty or representation that any Alteration was properly designed or constructed, nor shall it create any liability on the part of Landlord. Landlord’s approval of an Alteration shall not be deemed a representation by Landlord that the Alteration complies with

Law. Upon completion of any Alteration, Tenant shall (a) furnish Landlord with “as-built” plans (in CAD format, if requested by Landlord) for non-Cosmetic Alterations, (b) cause a timely notice of completion to be recorded in the Office of the Recorder of the county in which the Building is located, in accordance with California Civil Code § 8182 or any successor statute; and (c) deliver to Landlord evidence of full payment and unconditional final lien waivers for all labor, services and materials furnished in connection therewith. By way of clarification, any cubicles that Tenant places in the Premises that are not affixed to the walls, ceiling or floor are Tenant’s personal property and not Alterations.

Landlord may enter the Premises to inspect, show or clean the Premises or to perform or facilitate the performance of repairs, alterations or additions to the Premises or any portion of the Building. Except in emergencies or to provide services, Landlord shall provide Tenant with prior notice of entry at least twenty four (24) hours in advance, which notice may be delivered by telephone or by email, and shall use reasonable efforts to minimize any interference with Tenant’s use of the Premises. If necessary, Landlord may temporarily close all or a portion of the Premises to perform repairs, alterations and additions. However, except in emergencies, Landlord will not close the Premises if the work can reasonably be completed on weekends and after Building Service Hours. Entry by Landlord shall not constitute a constructive eviction or entitle Tenant to an abatement or reduction of Rent.

11. Assignment and Subletting.

11.01 Restrictions on Transfer. Tenant shall not assign, sublease, transfer or encumber any interest in this Lease or allow any third party to use any portion of the Premises (collectively or individually, a “Transfer”) without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed if Landlord does not exercise its recapture rights under Section 11.02. Without limitation, Landlord’s consent shall not be considered unreasonably withheld if the proposed transferee is a governmental entity or an occupant of the Building, or if the proposed transferee, whether or not an occupant of the Building, is in discussions with Landlord regarding the leasing of space within the Building, and Landlord has, or reasonably expects to have within six (6) months after such time, comparable space available in the Building reasonably sufficient to meet the proposed transferee’s requirements. If the entity(ies) which directly or indirectly controls the voting shares/rights of Tenant (other than through the ownership of voting securities listed on a recognized securities exchange) changes at any time, such change of ownership or control shall constitute a Transfer. Tenant hereby waives the provisions of Section 1995.310 of the California Civil Code, or any similar or successor Laws, now or hereafter in effect, and all other remedies, including, without limitation, any right at law or equity to terminate this Lease, on its own behalf and, to the extent permitted under all applicable Laws, on behalf of the proposed transferee. Any Transfer in violation of this Section shall, at Landlord’s option, be deemed a Default by Tenant and shall be voidable by Landlord. In no event shall any Transfer, including a Permitted Transfer, release or relieve Tenant from any obligation under this Lease, and Tenant shall remain primarily liable for the performance of the Tenant’s obligations under this Lease, as amended from time to time.

11.02 Request Procedure; Recapture. Tenant shall provide Landlord with financial statements (prepared in accordance with generally accepted accounting principles), a reasonably determined calculation of excess rent (described in Section 11.03 below) and company information for the proposed transferee (or, in the case of a change of ownership or control, for the proposed new controlling entity(ies)), a fully executed copy of the proposed

assignment, sublease or other Transfer documentation and such other information as Landlord may reasonably request. Within thirty (30) days after receipt of the required information and documentation, Landlord shall either: (a) consent to the Transfer by execution of Landlord’s form of consent agreement; (b) reasonably refuse to consent to the Transfer in writing; or (c) in the event of an assignment of Tenant’s interest in this Lease or subletting of more than thirty-five percent (35%) of the Rentable Area of the Premises, recapture the portion of the Premises that Tenant is proposing to Transfer. If Landlord exercises its right to recapture, this Lease shall automatically be amended (or terminated if the entire Premises is being assigned or sublet) to delete the applicable portion of the Premises effective on the proposed effective date of the Transfer, although Landlord may require Tenant to execute a reasonable amendment or other document reflecting such reduction or termination. Concurrently with Tenant’s request for a proposed Transfer, Tenant shall pay Landlord a review fee of $1,500.00 for Landlord’s review of any requested Transfer, regardless of whether consent is granted, and thereafter Tenant shall be obligated to pay all reasonable costs incurred by Landlord in preparing the documents for any requested Transfer, including but not limited to Landlord’s attorneys’ fees.

11.03 Transfer Premium. Tenant shall pay Landlord fifty percent (50%) of all rent and other consideration which Tenant receives as a result of a Transfer that is in excess of the Rent payable to Landlord for the portion of the Premises and Term covered by the Transfer. Tenant shall pay Landlord for Landlord’s share of the excess within thirty (30) days after Tenant’s receipt of the excess. In determining the excess due Landlord, Tenant may deduct from the excess, on a straight-line basis, the following reasonable and customary expenses directly incurred by Tenant attributable to the Transfer: commercially reasonable attorneys’ fees and brokerage commissions.

11.04 Additional Restrictions. Notwithstanding anything to the contrary contained in this Section 11, neither Tenant nor any other person having a right to possess, use, or occupy (for convenience, collectively referred to in this subsection as “Use”) the Premises shall enter into any lease, sublease, license, concession or other agreement for Use of all or any portion of the Premises which provides for rental or other payment for such Use based, in whole or in part, on the net income or profits derived by any person that leases, possesses, uses, or occupies all or any portion of the Premises (other than an amount based on a fixed percentage or percentages of receipts or sales), and any such purported lease, sublease, license, concession or other agreement shall be absolutely void and ineffective as a transfer of any right or interest in the Use of all or any part of the Premises.

11.05 Collection of Rent. If Tenant’s interest in this Lease is assigned, Landlord may elect to collect Rent directly from the assignee. If the Premises or any part thereof is sublet or used or occupied by anyone other than Tenant, Landlord may, after any Default(s) by Tenant (or if Tenant becomes insolvent or rejects this Lease or any relevant sublease under section 365 of the Bankruptcy Code), collect from the subtenant or occupant all amounts due from such party to Tenant. Tenant hereby authorizes and directs any assignee or subtenant (a “Transferee”) to make payments of rent or other consideration directly to Landlord upon receipt of any notice from Landlord requesting such action. Landlord may apply all such amounts collected to Rent due or coming due hereunder, and no such collection or application shall be deemed a waiver of any of Landlord’s rights or remedies hereunder, or the acceptance by Landlord of such party as a permitted Transferee, or the release of Tenant or any Guarantor from any of its obligations under or in connection with this Lease. The consent by Landlord to any Transfer shall not relieve Tenant from obtaining the express written consent of Landlord to any other Transfer. The listing of any name other than that of Tenant on any door of the Premises or on any directory or in any elevator in the Building, or otherwise, or the acceptance of Rent for the

Premises from any entity other than Tenant shall not operate to vest in the person so named any right or interest in this Lease or in the Premises, or be deemed to constitute, or serve as a substitute for, or any waiver of, any consent of Landlord required under this Section 11.

11.06 Permitted Transfers. So long as Tenant is not entering into the Permitted Transfer for the purpose of avoiding or otherwise circumventing the remaining terms of this Section 11, Tenant may assign its entire interest in this Lease, without the consent of Landlord, to (i) an affiliate, subsidiary, or parent of Tenant, or a corporation, partnership or other legal entity wholly owned by Tenant (collectively, an “Affiliated Party”), or (ii) a successor to Tenant by purchase, merger, consolidation or reorganization, provided that all of the following conditions are satisfied (each such Transfer a “Permitted Transfer”): (1) Tenant is not in Default; (2) Tenant gives Landlord written notice at least thirty (30) days prior to the effective date of the proposed Permitted Transfer; and (3) with respect to a purchase, merger, consolidation or reorganization or any other Permitted Transfer which results in Tenant ceasing to exist as a separate legal entity, (a) Tenant’s successor shall own all or substantially all of the assets of Tenant, and (b) Tenant’s successor shall have a net worth which is at least equal to the greater of Tenant’s net worth at the date of this Lease or Tenant’s net worth as of the day prior to the proposed purchase, merger, consolidation or reorganization. Tenant’s notice to Landlord shall include information and documentation showing that each of the above conditions has been satisfied. If requested by Landlord, Tenant’s successor shall sign a commercially reasonable form of assumption agreement. As used herein, (A) “parent” shall mean a company which owns a majority of Tenant’s voting equity; (B) “subsidiary” shall mean an entity wholly owned by Tenant or at least 51% of whose voting equity is owned by Tenant; and (C) “affiliate” shall mean an entity controlled by, controlling or under common control with Tenant. Notwithstanding the foregoing, if any parent, affiliate or subsidiary to which this Lease has been assigned or transferred subsequently sells or transfers its voting equity or its interest under this Lease other than to another parent, subsidiary or affiliate of the original Tenant named hereunder, such sale or transfer shall be deemed to be a Transfer requiring the consent of Landlord hereunder.

12. Liens.

Tenant shall not permit mechanics’ or other liens to be placed upon or otherwise encumber the Property, Premises or Tenant’s leasehold interest in connection with any work or service done or purportedly done by or for the benefit of Tenant or its transferees, or the Premises. Tenant shall give Landlord notice at least fifteen (15) days prior to the commencement of any work in the Premises to afford Landlord the opportunity, where applicable, to post and record notices of non-responsibility. Tenant, within ten (10) days of notice from Landlord, shall fully discharge any lien by settlement, by payment of the claim, posting a proper bond, or by insuring over the lien in the manner prescribed by the applicable lien Law and, if Tenant fails to do so, Tenant shall be deemed in Default and, in addition to any other remedies available to Landlord as a result of such Default, Landlord, at its option (without any duty to investigate the validity of the lien or other encumbrance), may bond, insure over or otherwise discharge the lien. Tenant shall reimburse Landlord for any amount paid by Landlord in connection therewith, including, without limitation, reasonable attorneys’ fees.

13. Indemnity and Waiver of Claims.

13.01 Indemnity. Except to the extent caused by the gross negligence or willful misconduct of Landlord or any Landlord Related Parties (defined below), Tenant shall indemnify, protect, defend and hold Landlord and all Landlord Related Parties harmless against and from all liabilities, obligations, losses, damages, penalties, claims, actions, costs, charges and

expenses, including, without limitation, reasonable attorneys’ fees and other professional fees (if and to the extent permitted by Law) (collectively referred to as “Losses”), which may be imposed upon, incurred by or asserted against Landlord or any Landlord Related Parties by any third party and arising out of or in connection with any damage or injury occurring in the Premises or any acts or omissions (including violations of Law) of Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, employees and agents (each a “Tenant Related Party”) or any of Tenant’s transferees, contractors, invitees or licensees in or about the Property (inclusive of any Common Areas). Tenant hereby waives all claims against and releases Landlord and its trustees, members, principals, beneficiaries, partners, officers, directors, employees, Mortgagees (defined in Section 23) and agents (the “Landlord Related Parties”) from all claims for any injury to or death of persons, damage to property or business loss in any manner related to (a) Force Majeure, (b) acts of third parties, (c) the bursting or leaking of any tank, water closet, drain or other pipe, (d) the inadequacy or failure of any security or protective services, personnel or equipment, or (e) any matter not within the reasonable control of Landlord. The indemnities provided in this Section 13.01 shall survive the expiration or earlier termination of this Lease.

13.02 Hazardous Materials. “Environmental Laws” means all Laws pertaining to (a) protection of health against environmental hazards; (b) the protection of the environment, including air, soils, wetlands, and surface and underground water, from contamination by any substance that may have any adverse health effect; (c) underground storage tank regulation or removal; (d) protection or regulation of natural resources; (e) protection of wetlands or wildlife; (f) management, regulation and disposal of solid and hazardous wastes; (g) radioactive materials; (h) biologically hazardous materials; (i) indoor air quality; (j) the manufacture, possession, presence, use, generation, storage, transportation, treatment, release, emission, discharge, disposal, abatement, cleanup, removal, remediation or handling of any Hazardous Materials. Environmental Laws include the Comprehensive Environmental Response, Compensation, and Liability Act, as amended by the Superfund Amendments and Reauthorization Act of 1986, 42 U.S.C. §9601 et seq. (“CERCLA”); the Resource Conservation and Xxxxxxxx Xxx, 00 X.X.X. §0000 et seq. (“RCRA”); the Federal Water Pollution Control Act, as amended by the Clean Xxxxx Xxx, 00 X.X.X. §0000 et seq.; the Clean Air Act, 42 U.S.C. §7401 et seq.; and the Toxic Substances Xxxxxxx Xxx, 00 X.X.X. §0000 et seq., as well as all similar state and local Laws. “Hazardous Material” means any substance the release of or the exposure to which is prohibited, limited or regulated by any Environmental Law, or which poses a hazard to human health because of its toxicity or other adverse effect, including (a) any “oil,” as defined by the Federal Water Pollution Control Act and regulations promulgated thereunder (including crude oil or any fraction of crude oil); (b) any radioactive material, including any source, special nuclear, or byproduct material as defined in 42 United States Code §2011 et seq.; (c) Stacchybotris chartarum and other molds; (d) asbestos containing materials (“ACM”) in any form or condition; and (e) polychlorinated biphenyls (“PCBs”) and any substances or compounds containing PCBs.

(a) Tenant shall not use, store or permit Hazardous Materials to be present on or about the Premises. Notwithstanding the foregoing, Tenant may keep and use, solely for maintenance and administrative purposes, small amounts of ordinary cleaning and office supplies customarily used in business offices (such as, for example, glass cleaner, carpet spot remover, and toner for Tenant’s business equipment in use on the Premises), provided that Tenant complies with all Environmental Laws relating to the use, storage or disposal of all such supplies. With respect to the presence of Hazardous Materials in or about the Premises that are stored, used or permitted by Tenant or any Tenant Related Party, Tenant

shall provide to Landlord on January 1st of each calendar year during the Term, or upon request from Landlord, Material Safety Data Sheets (MSDS) in compliance with Hazard Communication Standards of the Occupational Safety & Health Administration.

(b) If the use, storage or possession of Hazardous Materials by Tenant or any Tenant Related Party on or about the Premises results in a release, discharge or disposal of Hazardous Materials on, in, at, under, or emanating from, the Premises or the Building, Tenant agrees to investigate, clean up, remove or remediate such Hazardous Materials in full compliance with (a) the requirements of all Environmental Laws, and any governmental authority responsible for the enforcement of any Environmental Laws; and (b) any additional requirements of Landlord that are necessary, in Landlord’s sole discretion, to protect the value of the Premises and the Building. Landlord shall also have the right, but not the obligation, to take whatever action with respect to any such Hazardous Materials that it deems necessary, in Landlord’s sole discretion, to protect the value of the Premises and the Building. All costs and expenses paid or incurred by Landlord in the exercise of such right shall be payable by Tenant upon demand.

(c) Upon reasonable notice to Tenant, Landlord may inspect the Premises for the purpose of determining whether there exists on the Premises any Hazardous Materials or other condition or activity that is in violation of the requirements of this Lease or of any Environmental Laws. The right granted to Landlord herein to perform inspections shall not create a duty on Landlord’s part to inspect the Premises, or liability on the part of Landlord for Tenant’s use, storage or disposal of Hazardous Materials, it being understood that Tenant shall be solely responsible for all liability in connection therewith. Tenant shall surrender the Premises to Landlord upon the expiration or earlier termination of this Lease free of debris, waste or Hazardous Materials placed on or about the Premises by Tenant or any Tenant Related Party, and in a condition that complies with all Environmental Laws.

(d) Tenant shall indemnify, defend, protect and hold harmless Landlord from and against any and all claims, damages, liabilities, fines, judgments, penalties, costs, losses (including loss in value of the Premises or the Building, the loss of rentable or usable space, any adverse effect on marketability of the Building or any space therein, and all sums paid for settlement of claims), costs incurred in connection with any site investigation or any cleanup, removal or restoration mandated by any governmental authority, and expenses (including attorneys’ fees, consultant and expert fees) to the extent attributable to (i) any Hazardous Materials placed on or about the Building by Tenant or any Tenant Related Party, or on or about the Premises by any party other than Landlord, at any time during the Term, or (ii) Tenant’s failure to comply with any of its obligations under this Section 13.02, all of which shall survive the expiration or earlier termination of this Lease.

14. Insurance.

14.01 Tenant’s Insurance. From and after the date Tenant first has access to the Premises, Tenant shall maintain the following insurance (“Tenant’s Insurance”):

(a) Commercial General Liability Insurance applicable to the Premises and its appurtenances written on an occurrence (rather than “claims made”) basis, covering the Premises and all operations of Tenant in or about the Premises against claims for bodily injury, death, property damage, advertising injury and products liability and to include contractual liability coverage insuring Tenant’s indemnification obligations under this Lease, to be in combined single limits of not less than $1,000,000 each occurrence for bodily injury, death and property damage, $2,000,000 for products/completed operations aggregate, $2,000,000 for personal injury, and to have general aggregate limits of not less than $2,000,000 (per location) and Umbrella Liability Insurance in an amount not less than $5,000,000 per occurrence and $5,000,000 annual aggregate. The general aggregate limits under the Commercial General Liability insurance policy or policies shall apply separately to the Premises and to Tenant’s use thereof (and not to any other location or use of Tenant) and such policy shall contain an endorsement to that effect. The certificate of insurance evidencing the form of policy shall specify all endorsements required herein and shall specify on the face thereof that the limits of such policy apply separately to the Premises.

(b) Insurance covering any of the items included in any equipment maintained by Tenant, as well as trade fixtures, merchandise, movable partitions, furniture and other personal property from time to time in, on or upon the Premises (“Tenant’s Property”), and all Leasehold Improvements, in an amount not less than one hundred percent (100%) of their full replacement value from time to time during the Term, providing protection against perils included within the standard form of “all-risk” (i.e., “Special Cause of Loss”) fire and casualty insurance policy, and including earthquake sprinkler leakage coverage;

(c) Workers’ Compensation Insurance in amounts required by Law;

(d) Employers Liability Coverage of at least $500,000.00 per occurrence (with $500,000.00 disease coverage per employee);

(e) if Tenant owns or leases any vehicles, automobile liability coverage for all vehicles owned or leased by Tenant in an amount not less than $1,000,000.00 per accident; and

(f) business interruption coverage in an amount equal to 100% of Tenant’s estimated gross revenues from the Premises for a twelve (12) month period.

All policies of the insurance provided for in this Section 14.01 above shall be issued in form acceptable to Landlord by insurance companies with a rating and financial size of not less than A:XII in the most current available “Best’s Insurance Reports”, and licensed to do business in the state of California. Each and every such policy:

(i) shall designate Landlord (as well as Landlord’s managing agent, asset manager, and any mortgagee of Landlord and any other party reasonably designated by

Landlord) as an additional insured, except with respect to the insurance described in clauses (c) and (d) above;

(ii) shall be delivered in its entirety (or, in lieu thereof, a certificate in form and substance satisfactory to Landlord) to each of Landlord and any such other parties in interest prior to any entry by Tenant or Tenant’s employees or contractors onto the Premises and thereafter within five (5) days after the inception (or renewal) of each new policy, and as often as any such policy shall expire or terminate. Renewal or additional policies shall be procured and maintained by Tenant in like manner and to like extent;

(iii) shall contain a provision that the insurer will give to Landlord at least thirty (30) days’ notice in writing (and ten (10) days in the case of non-payment) in advance of any material change, cancellation, termination or lapse, or the effective date of any reduction in the amounts of insurance; and

(iv) shall be written as a primary policy which does not contribute to and is not in excess of coverage which Landlord may carry.

In addition, Landlord shall be named as a loss payee with respect to Tenant’s Property insurance on the Leasehold Improvements. Tenant will be responsible for the payment of any deductible amount under any policy of insurance maintained by Tenant. Tenant shall additionally carry and maintain such other types of insurance coverage in such reasonable amounts as may be reasonably requested from time to time by Landlord.

14.02 Landlord’s Insurance. Landlord shall maintain so called All Risk property insurance on the Building in amounts reasonably determined by Landlord to be necessary, together with such other insurance coverage as Landlord, in its reasonable judgment, may elect to maintain; Landlord may elect to self-insure with respect to any such coverage.

15. Subrogation.

Landlord and Tenant hereby waive and release, and shall cause their respective insurance carriers to waive and release, any and all rights of recovery, claims, actions or causes of action against the other for any loss or damage with respect to Tenant’s Property, Leasehold Improvements, the Building, the Premises, or any contents thereof, including rights, claims, actions and causes of action based on negligence, which loss or damage is (or would have been, had the insurance required by this Lease been carried) covered by insurance. The parties agree that the foregoing waiver shall be binding upon their respective property and business income insurance carriers, and (except for any insurance policy that provides that the insured thereunder may effectively waive subrogation without further action on the part of the insured) each party shall obtain endorsements or take such other action as may be required to effect such insurer’s waiver of subrogation under each such policy.

16. Casualty Damage.

16.01 Casualty; Completion Estimate; Termination. If, as a result of fire or other casualty (each, a “Casualty”), all or any portion of the Premises becomes untenantable or inaccessible, Landlord, with reasonable promptness, shall cause a general contractor selected by Landlord to provide Landlord with a written estimate of the amount of time required, using standard working methods, to substantially complete the repair and restoration of the Premises and any Common

Areas necessary to provide access to the Premises (“Completion Estimate”). Landlord shall promptly forward a copy of the Completion Estimate to Tenant. If the Completion Estimate indicates that the Premises or any Common Areas necessary to provide access to the Premises cannot be made tenantable within 210 days from the date of the Casualty (when such repairs are made without the payment of overtime or other premiums), then either party shall have the right to terminate this Lease upon written notice to the other within ten (10) days after Landlord’s delivery of the Completion Estimate. Tenant, however, shall not have the right to terminate this Lease if the Casualty was caused by the gross negligence or intentional misconduct of Tenant or any Tenant Related Parties. In addition, Landlord, by notice delivered to Tenant within ninety (90) days after the date of the Casualty, shall have the right to terminate this Lease if the Building or Property shall be damaged by Casualty, whether or not the Premises are affected, and one or more of the following conditions is present: (1) in Landlord’s reasonable judgment, repairs cannot reasonably be completed within two hundred ten (210) days from the date the repairs are started (when such repairs are made without the payment of overtime or other premiums); (2) any Mortgagee requires that the insurance proceeds or any portion thereof be applied to the payment of the mortgage debt; (3) the damage is not fully covered by Landlord’s insurance policies; (4) Landlord decides to rebuild the Building or Common Areas so that they will be substantially different structurally or architecturally; or (5) the damage occurs during the last twenty-four (24) months of the Term.

16.02 Restoration. If this Lease is not terminated, Landlord shall promptly and diligently, subject to reasonable delays for insurance adjustment or other matters beyond Landlord’s reasonable control, restore the Premises and Common Areas. Such restoration shall be to substantially the same condition that existed prior to the Casualty, except for modifications required by Law or any other modifications to the Common Areas deemed desirable by Landlord. Upon notice from Landlord, Tenant shall assign or endorse over to Landlord (or to any party designated by Landlord) all property insurance proceeds payable to Tenant under Tenant’s Insurance with respect to any Leasehold Improvements performed by or for the benefit of Tenant; provided if the estimated cost to repair such Leasehold Improvements exceeds the amount of insurance proceeds received by Landlord from Tenant’s insurance carrier, the excess cost of such repairs shall be paid by Tenant to Landlord prior to Landlord’s commencement of repairs. Within 15 days of demand, Tenant shall also pay Landlord for any additional excess costs that are determined during the performance of the repairs to such Leasehold Improvements, provided that Tenant shall have the reasonable opportunity to reduce the scope of the Leasehold Improvements to reduce or eliminate the payment of such excess costs. In no event shall Landlord be required to spend more for the restoration of the Premises and Common Areas than the proceeds received by Landlord, whether insurance proceeds under Landlord’s insurance or insurance proceeds or other amounts received from Tenant. Landlord shall not be liable for any inconvenience to Tenant, or injury to Tenant’s business resulting in any way from the Casualty or the repair thereof. Provided that Tenant is not in Default, during any period of time that all or a material portion of the Premises is rendered untenantable as a result of a Casualty, the Rent shall xxxxx for the portion of the Premises that is untenantable and not used by Tenant.

16.03 Waiver. The provisions of this Section 16, constitute an express agreement between Landlord and Tenant with respect to any and all damage to, or destruction of, all or any part of the Premises or the Property, and any Laws, including, without limitation, Sections 1932(2) and 1933(4) of the California Civil Code, with respect to any rights or obligations concerning damage or destruction in the absence of an express agreement between the parties, and any similar or successor Laws now or hereafter in effect, shall have no application to this Lease or any damage or destruction to all or any part of the Premises or the Property.

17. Condemnation.

Either party may terminate this Lease if any material part of the Premises is taken or condemned for any public or quasi-public use under Law, by eminent domain or private purchase in lieu thereof (a “Taking”). Landlord shall also have the right to terminate this Lease if there is a Taking of any portion of the Building or Property which would have a material adverse effect on Landlord’s ability to profitably operate the remainder of the Building. The terminating party shall provide written notice of termination to the other party within 45 days after it first receives notice of the Taking. The termination shall be effective as of the effective date of any order granting possession to, or vesting legal title in, the condemning authority. If this Lease is not terminated, Base Rent and Tenant’s Share shall be appropriately adjusted to account for any reduction in the square footage of the Building or Premises. All compensation awarded for a Taking shall be the property of Landlord. The right to receive compensation or proceeds are expressly waived by Tenant, provided, however, Tenant may file a separate claim for Tenant’s Property and Tenant’s reasonable relocation expenses, provided the filing of the claim does not diminish the amount of Landlord’s award. If only a part of the Premises is subject to a Taking and this Lease is not terminated, Landlord, with reasonable diligence, will restore the remaining portion of the Premises as nearly as practicable to the condition immediately prior to the Taking. Tenant hereby waives any and all rights it might otherwise have pursuant to Section 1265.130 of the California Code of Civil Procedure, or any similar or successor Laws.

In addition to any other default specifically described in this Lease, each of the following occurrences shall be a “Default”: (a) Tenant’s failure to pay any portion of Rent when due, if the failure continues for three (3) Business Days after written notice to Tenant (“Monetary Default”); (b) Tenant’s failure (other than a Monetary Default) to comply with any term, provision, condition or covenant of this Lease, if the failure is not cured within thirty (30) days after written notice to Tenant provided, however, if Tenant’s failure to comply cannot reasonably be cured within thirty (30) days, Tenant shall be allowed additional time (not to exceed 90 days) as is reasonably necessary to cure the failure so long as Tenant begins the cure within fifteen (15) days and diligently pursues the cure to completion; (c) Tenant permits a Transfer without Landlord’s required approval or otherwise in violation of Section 11 of this Lease; (d) Tenant or any Guarantor becomes insolvent, makes a transfer in fraud of creditors, makes an assignment for the benefit of creditors, admits in writing its inability to pay its debts when due or forfeits or loses its right to conduct business; (e) the leasehold estate is taken by process or operation of Law; (f) in the case of any ground floor or retail Tenant, Tenant does not take possession of or abandons or vacates all or any portion of the Premises; or (g) Tenant is in default beyond any notice and cure period under any other lease or agreement at the Building or Property. If Tenant, by repeating substantially the same act or omission, breaches a particular provision of this Lease and Landlord notifies Tenant of such breach, on three (3) or more occasions during any twelve (12) month period, then Tenant’s subsequent breach of such provision by commission of substantially the same act or omission shall be, at Landlord’s option, an incurable Default by Tenant and Tenant shall lose any renewal and/or expansion options. All notices sent under this Section shall be in satisfaction of, and not in addition to, notice required by Law. Tenant acknowledges that its obligation to pay Rent hereunder is a condition as well as a covenant, and that such obligation is independent of any and all covenants of Landlord hereunder. Tenant shall not interpose any counterclaim of whatever nature or description in any summary proceeding commenced by Landlord for non-payment of Rent. Tenant waives any rights of redemption or relief from forfeiture under California Code of Civil Procedure sections 1174 and

1179, or under any other applicable present or future Law, if Tenant is evicted or Landlord takes possession of the Premises by reason of any Default.

19. Remedies.

19.01 General. Upon the occurrence of any Default under this Lease, whether enumerated in Section 18 or not, Landlord shall have the option to pursue any one or more of the following remedies without any notice (except as expressly prescribed herein) or demand whatsoever (and without limiting the generality of the foregoing, Tenant hereby specifically waives notice and demand for payment of Rent or other obligations, except for those notices specifically required pursuant to the terms of Section 18 or this Section 19, and waives any and all other notices or demand requirements imposed by applicable Law):

(a) Terminate this Lease and Tenant’s right to possession of the Premises and recover from Tenant an award of damages equal to the sum of the following:

(i) The Worth at the Time of Award of the unpaid Rent which had been earned at the time of termination;

(ii) The Worth at the Time of Award of the amount by which the unpaid Rent which would have been earned after termination until the time of award exceeds the amount of such Rent loss that Tenant affirmatively proves could have been reasonably avoided;

(iii) The Worth at the Time of Award of the amount by which the unpaid Rent for the balance of the Term after the time of award exceeds the amount of such Rent loss that Tenant affirmatively proves could be reasonably avoided;

(iv) Any other amount necessary to compensate Landlord for all the detriment either proximately caused by Tenant’s failure to perform Tenant’s obligations under this Lease or which in the ordinary course of things would be likely to result therefrom; and

(v) All such other amounts in addition to or in lieu of the foregoing as may be permitted from time to time under applicable law.

The “Worth at the Time of Award” of the amounts referred to in parts (i) and (ii) above, shall be computed by allowing interest at an annual rate equal to the lesser of (A) the maximum rate permitted by Law, or (B) the Prime Rate plus five percent (5%). For purposes hereof, the “Prime Rate” shall be annual interest rate publicly announced as its prime or base rate by a federally insured bank selected by Landlord in the State of California. The “Worth at the Time of Award” of the amount referred to in part (iii), above, shall be computed by discounting such amount at the discount rate of the Federal Reserve Bank of San Francisco at the time of award plus 1%;

(b) Employ the remedy described in California Civil Code § 1951.4 (Landlord may continue this Lease in effect after Tenant’s breach and abandonment and recover Rent as it becomes due, if Tenant has the right to sublet or assign, subject only to reasonable limitations). Accordingly, if Landlord does not elect to

terminate this Lease on account of any Default by Tenant, Landlord may, from time to time, without terminating this Lease, enforce all of its rights and remedies under this Lease, including the right to recover all Rent as it becomes due; or

(c) Notwithstanding Landlord’s exercise of the remedy described in California Civil Code § 1951.4 in respect of an event or events of default, at such time thereafter as Landlord may elect in writing, to terminate this Lease and Tenant’s right to possession of the Premises and recover an award of damages as provided above in Section 19.01(a).

19.02 Requirements for Landlord Waiver. The subsequent acceptance of Rent hereunder by Landlord shall not be deemed to be a waiver of any preceding breach by Tenant of any term, covenant or condition of this Lease, other than the failure of Tenant to pay the particular Rent so accepted, regardless of Landlord’s knowledge of such preceding breach at the time of acceptance of such Rent. No waiver by Landlord of any breach hereof shall be effective unless such waiver is in writing and signed by Landlord.

19.03 Waiver. TENANT HEREBY WAIVES ANY AND ALL RIGHTS CONFERRED BY SECTION 3275 OF THE CIVIL CODE OF CALIFORNIA AND BY SECTIONS 1174 (c) AND 1179 OF THE CODE OF CIVIL PROCEDURE OF CALIFORNIA AND ANY AND ALL OTHER LAWS AND RULES OF LAW FROM TIME TO TIME IN EFFECT DURING THE LEASE TERM OR THEREAFTER PROVIDING THAT TENANT SHALL HAVE ANY RIGHT TO REDEEM, REINSTATE OR RESTORE THIS LEASE FOLLOWING ITS TERMINATION BY REASON OF TENANT’S BREACH.

county in which the Premises are located for the purpose of appointment of a referee under the Referee Sections. If the referee is appointed by the court, the referee shall be a neutral and impartial retired judge with substantial experience in the relevant matters to be determined, from Jams/Endispute, Inc., the American Arbitration Association or similar mediation/arbitration entity. The proposed referee may be challenged by any party for any of the grounds listed in the Referee Sections. The referee shall have the power to decide all issues of fact and law and report his or her decision on such issues, and to issue all recognized remedies available at Law or in equity for any cause of action that is before the referee, including an award of attorneys’ fees and costs in accordance with this Lease. The referee shall not, however, have the power to award punitive damages, nor any other damages which are not permitted by the express provisions of this Lease, and the parties hereby waive any right to recover any such damages. The parties shall be entitled to conduct all discovery as provided in the California Code of Civil Procedure, and the referee shall oversee discovery and may enforce all discovery orders in the same manner as any trial court judge, with rights to regulate discovery and to issue and enforce subpoenas, protective orders and other limitations on discovery available under California law. The reference proceeding shall be conducted in accordance with California law (including the rules of evidence), and in all regards, the referee shall follow California law applicable at the time of the reference proceeding. The parties shall promptly and diligently cooperate with one another and the referee, and shall perform such acts as may be necessary to obtain a prompt and expeditious resolution of the dispute or controversy in accordance with the terms of this Section 19.03. In this regard, the parties agree that the parties and the referee shall use best efforts to ensure that (a) discovery be conducted for a period no longer than 6 months from the date the referee is appointed, excluding motions regarding discovery, and (b) a trial date be set within 9 months of the date the referee is appointed. In accordance with Section 644 of the California Code of Civil Procedure, the decision of the referee upon the whole issue must stand as the decision of the court, and upon the filing of the statement of decision with the clerk of the court, or with the judge if there is no clerk, judgment may be entered thereon in the same manner as if the action had been tried by the court. Any decision of the referee and/or judgment or other order entered thereon shall be appealable to the same extent and in the same manner that such decision, judgment, or order would be appealable if rendered by a judge of the superior court in which venue is proper hereunder. The referee shall in his/her statement of decision set forth his/her findings of fact and conclusions of law. The parties intend this general reference agreement to be specifically enforceable in accordance with the Code of Civil Procedure. Nothing in this Section 19.03 shall prejudice the right of any party to obtain provisional relief or other equitable remedies from a court of competent jurisdiction as shall otherwise be available under the Code of Civil Procedure and/or applicable court rules.

19.04 Remedies Cumulative. No right or remedy herein conferred upon or reserved to Landlord is intended to be exclusive of any other right or remedy, and each and every right and remedy shall be cumulative and in addition to any other right or remedy given hereunder or now or hereafter existing by agreement, applicable Law or in equity. In addition to other remedies provided in this Lease, Landlord shall be entitled, to the extent permitted by applicable Law, to injunctive relief, or to a decree compelling performance of any of the covenants, agreements, conditions or provisions of this Lease, or to any other remedy allowed to Landlord at law or in equity. Forbearance by Landlord to enforce one or more of the remedies herein provided upon any Default shall not be deemed or construed to constitute a waiver of such Default.

19.05 Landlord’s Rights. If Tenant is in Default of any of its non-monetary obligations under the Lease, Landlord shall have the right to perform such obligations. Tenant shall reimburse Landlord for the cost of such performance upon demand together with an administrative charge equal to ten percent (10%) of the cost of the work performed by Landlord.

19.06 Written Agreement. No act of Landlord or of any Landlord Related Party, including Landlord’s acceptance of the keys to the Premises, shall constitute Landlord’s acceptance of a surrender or abandonment of the Premises by Tenant prior to the expiration of the Term unless such acceptance is expressly acknowledged by Landlord in a written agreement executed by both parties.

19.07 Severability. This Section 19 shall be enforceable to the maximum extent such enforcement is not prohibited by applicable Law, and the unenforceability of any portion thereof shall not thereby render unenforceable any other portion.

20. Landlord Default; Limitation of Liability.