Inventory Management Agreement

Exhibit 10.36

Inventory Management Agreement

This Inventory Management Agreement (“Agreement”) is entered into as of the earliest Product Land Date set forth on Schedule A (the “Effective Date”) by and between the vendor identified on Schedule A (“Vendor”), and Forever 8 Fund, LLC, a limited liability company organized and existing under the laws of Delaware (“F8”). Vendor and F8 are sometimes individually referred to herein as a “Party” and collectively as the “Parties.” The owner of Vendor identified on Schedule A (“Owner”) joins this Agreement for the limited purposes described in the Agreement.

(a) Product Schedules. Each Product under this Agreement is identified on a separate Product sub-schedule of Schedule A commencing with Schedule A-1 for the first Product and continuing in sequence for each additional Product (each, a “Product Schedule”). When used in this Agreement, “Schedule A” shall refer to all Product Schedules collectively.

(b) Definitions. Capitalized terms used but not otherwise defined in this Agreement shall have the meaning given on Schedule A or as set forth below:

(i) “Actual Cost Per Unit” means, with respect to a Product, the actual cost, on a per-unit basis, of such Product purchased from the Supplier (not including Shipping Costs required to transport and deliver the Product to the Facility).

(ii) “Actual Inventory Turn Weeks” means, with respect to a Product, the amount of time (measured in weeks) required for Vendor to sell a number of units of the Product to its customers on Platform(s) equal to the Minimum Inventory Amount.

(iii) “Actual Lead Time” means, with respect to a Product, the time elapsed between the date units of such Product are purchased from the Supplier by F8 and the date on which such units are received by a Third Party Facility.

(iv) “Daily Inventory History Report” means the Daily Inventory History report (API) provided through Vendor’s Amazon Seller Central account (or a comparable report in the case of a Platform other than Amazon).

(v) “Inventory Event Detail” means the Inventory Event Detail report (API) provided through Vendor’s Amazon Seller Central account (or such comparable report in the case of a Platform other than Amazon).

| 1 |

(vi) “Planned Inventory Turn Weeks” means, with respect to a Product, the anticipated amount of time (measured in weeks) it will take to Vendor to sell the Minimum Inventory Amount, using the Projected Monthly Sales rate of such Product.

(vii) “Product Land Date” means, with respect to a Product, the first date on which any Inventory of such Product lands at the Facilities as set forth on the applicable Product Schedule.

(viii) “Projected Monthly Sales” means, with respect to a Product, the estimated amount of unit sales of such Product per month, as provided by the Vendor.

(ix) “Receipts in Period” means, with respect to a Product, the “Receipts in Period” of units of such Product set forth on the Inventory Event Detail (or a comparable amount in the case of an Inventory Event Detail from a Platform other than Amazon).

(x) “Shipping Costs” means all costs of shipping, handling, duties, taxes, tariffs, and other similar costs and expenses incurred in connection with transportation of units of Products under this Agreement.

(xi) “Ending Sellable Units” means, with respect to a Product, the number of “Sellable” units of such Product set forth on the Daily Inventory History Report (or such comparable amount of units in the case of a Daily Inventory History Report from a Platform other than Amazon) reflecting the number of units available for sale as of the close of business on the date of the Daily Inventory History Report.

(c) Historical SKU Information. On or prior to the Effective Date, Vendor has provided to F8 the Historical Cost Per Unit, the Historical Lead Time, the Projected Monthly Sales, the Planned Inventory Turn Weeks for the completion of each Product Schedule (collectively, the “SKU Information”). Vendor acknowledges that F8 has relied on the SKU Information provided with respect to each Product for purposes of determining the Fee Schedule and other information set forth on the respective Product Schedule. Vendor hereby represents and warrants to F8 that all SKU Information and any supporting documentation provided to F8 are true, accurate, and complete in all respects.

(a) Starting Inventory Units. The Parties agree that for each Product F8 shall initially purchase the number of inventory units of such Product set forth on the respective Product Schedule (“Starting Inventory Units”) as follows: (i) on the Effective Date, F8 shall purchase from Vendor those units of the Product in Vendor’s existing inventory and those that have been purchased by Vendor and are in transit from the Supplier, in each case that are in saleable condition and for which Vendor shall have provided documentation acceptable to F8 sufficient to identify such inventory and its supplier cost, as determined by F8 in its sole discretion, and are free and clear of all liens, security interests, or other encumbrances of any nature, in such quantity and for the aggregate purchase price as set forth on the respective Product Schedule (the “Agreed Existing Inventory Units”); and (ii) within a reasonable time after the Effective Date, F8 shall purchase a number of additional units of the Product equal to the Starting Inventory Units less the Agreed Existing Inventory Units (the “Additional Starting Inventory Units”) from the supplier(s) identified on the respective Product Schedule (each a, or collectively, as the context requires, the “Supplier”). F8 shall have no obligation to find a replacement supplier of any Product in the event such Product cannot be purchased, for any reason, from the applicable Supplier.

(b) Minimum Inventory Amount; Additional Inventory; Adjustments.

(i) F8 shall purchase additional units of a Product from the Supplier (“Additional Inventory”) as necessary to maintain the minimum number of units of such Product set forth on the respective Product Schedule (“Minimum Inventory Amount”).

| 2 |

(ii) The Minimum Inventory Amount consists of Inventory on hand in the Facilities plus Additional Inventory on order from the Supplier.

(iii) The Minimum Inventory Amount of a Product shall remain in effect during the Product Term; provided, however, that in the event that the Actual Inventory Turn Weeks of such Product falls below the Minimum Inventory Turn Weeks of such Product (each as set forth on the Product Schedule for such Product), the Minimum Inventory Amount of such Product may be revised by mutual written agreement of the Parties.

(iv) F8 shall not be obligated to maintain the Minimum Inventory Amount if a Party provides written notice to terminate this Agreement at least 10 weeks prior to the end of the Term under Section 7(a).

(c) Additional Inventory Orders. Vendor shall initiate all orders of Additional Inventory by submitting a purchase order request to F8 via the Vendor dashboard or delivering a purchase order (or similar document in such form required by the Supplier) (“Inventory Order Request”). The Inventory Order Request must include all necessary information for the Supplier to fulfill the order (including, without limitation, quantity of units of the Product, unit price, requested delivery date, delivery location, and reason for reorder). Subject to the terms and conditions of this Agreement, within 7 days following receipt of the Inventory Order Request from Vendor, F8 shall submit a purchase order and payment for such Additional Inventory to the Supplier.

(d) Inspection; Costs of Delivery. Vendor shall be solely responsible for inspecting each order of Additional Inventory for, and remedying any issue with, non-conformity, including, but not limited to, non-conformity for quantity, quality, and/or defects (“Product Non-Conformity”). Vendor shall provide F8 with written notice of any Product Non-Conformity within 5 days of inspection, identifying all defects and steps taken by Vendor to remedy such Product Non-Conformity with the Suppler. Vendor shall be responsible for all Shipping Costs with respect to transportation and delivery of all Products under this Agreement. If at any time F8 is required to incur any Shipping Costs directly, F8 shall invoice such amounts to Vendor and payment will be due from Vendor immediately upon receipt of the invoice. In the event F8 has not received timely payment from Vendor, the amount of such Shipping Costs (and any applicable late charges) may be treated as COGS and reimbursed to F8 in the next distribution from the DACA Account.

(e) Storage. Unless agreed otherwise in writing, all Starting Inventory Units and Additional Inventory of all Products (collectively, the “Inventory”) shall be stored by Vendor on a consignment basis at one or more Amazon fulfillment centers or other third-party Platform warehouse/storage locations as set forth on the Product Schedule(s) or otherwise agreed by the Parties from time to time (a “Third-Party Facility”). Vendor shall (i) use commercially reasonable efforts to cause each Third Party Facility to (x) clearly and conspicuously label Inventory stored at such Third-Party Facility as property of F8, and (y) segregate all Inventory stored at such Third-Party Facility from other goods; and (ii) take reasonable measures, at its cost and expense, at least equal to those it uses to protect its own goods, to secure and protect the Inventory stored at a Third-Party Facility from loss or damage. At F8’s election, Inventory may be stored by F8 at F8’s facilities (the “F8 Facilities” and, collectively with each Third-Party Facility, the “Facilities”). Vendor shall be solely responsible for all storage costs and expenses in connection with the storage of units of all Products at the Facilities.

(f) Fulfillment. Vendor is solely responsible for overseeing the Third-Party Facilities, which shall xxxx, xxxx, and ship Products to such customer or Platform fulfillment center (as applicable) in the quantities, to the locations, and by the delivery dates specified in purchase orders submitted through the Platform. Vendor will be solely responsible for all Shipping Costs incurred in delivery of the Products to the site designated by the customer.

| 3 |

3. Sale of Products; Account Administration.

(a) Sharing of Information. F8 and Vendor agree to share all data and information required to support the Inventory management services to be provided by F8 under this Agreement. Vendor shall provide F8 access to all of Vendor’s systems (including those set forth on Schedule A) as necessary to provide F8 with current sales information and any other information reasonably required for the purchase of Inventory and fulfillment of F8’s obligations pursuant to this Agreement. Each Party shall be responsible for ensuring that its data and information relating to the Inventory shall be maintained in a current and accurate manner throughout the Term.

(b) Account Administration. On the Effective Date, Vender shall designate F8 as the “Administrator” of, and take all other steps required to transfer to F8 administrative control of, Vendor’s Amazon Seller Central account and/or comparable seller account on each Platform identified on Schedule A (as applicable, a “Vendor Sale Account”). F8 shall enable Vendor to access each Vendor Sale Account and modify certain settings of such Vender Sale Account during the Term; provided, however, that only F8 will have the authority to change the payment, Processor settings, and such other settings as may be determined to be necessary to be controlled by F8 in order to comply with the terms and conditions of this Agreement in the Vendor Sale Account. In the event that Vendor sells other products (SKUs) that are not part of this Agreement, Vendor shall remove such SKUs from each Vendor Sale Account on or prior to the Effective Date and take such other actions as F8 may reasonably request in order for the Parties to fulfill their obligations under this Agreement.

(c) Sales.

(i) During the Term, all sales of a Product shall originate exclusively on a Platform through the corresponding Vendor Sale Account. All sales of a Product to Vendor’s customers on a Platform are made solely by Vendor. Upon receipt of an order by Vendor’s customer for a Product on a Platform, F8 shall sell units of such Product held as Inventory to Vendor (on an “as is” basis) for the purpose of immediate resale of such units of the Product by Vendor to its customer. Vendor shall remain responsible for the design, development, marketing, advertising, pricing, logistics, customs, order fulfillment, customer service, and sale of the Products during the Term.

(ii) The sales of units of a Product sold on a Platform on a given day shall be calculated as follows:

Ending Sellable Units (Day 1*) + Receipts in Period (Day 1*) – Ending Sellable Units (Day 0**) = Units sold (Day 1*)

* Day 1 refers to the date on which sales are being measured.

** Day 0 refers to the day immediately preceding Day 1.

(iii)

(d) Payment.

(i) On or prior to the Effective Date, Vendor shall open a deposit account at the bank identified on Schedule A (the “Bank”) subject to an active Deposit Account Control Agreement executed by and among the Bank, F8, and Vendor (“DACA Account”) substantially in the form set forth on Schedule B (the “Deposit Account Control Agreement”). Funds shall be distributed from the DACA Account in accordance with Section 3(d)(iii) of this Agreement, and the Deposit Account Control Agreement shall direct the Bank shall at all times during its term to accept disposition instructions solely from F8 without consent from Vendor.

(ii) All proceeds from sales of Products on the Platform(s) (less all required deductions for Platform costs in accordance with the terms and conditions of such Platform’s agreements) shall be directed to the DACA Account. Vendor shall not (directly or indirectly) redirect any funds away from the DACA Account.

| 4 |

(iii) At F8’s discretion, F8 may cause the release of some or all of the funds in the DACA Account for distribution at any time; provided, however, that F8 shall distribute such funds no less frequently than on a bi-weekly basis during the Term. Each bi-weekly distribution will be made within 48 hours following the transfer of funds into the DACA Account by the Platform operator. F8 shall distribute all funds then in the DACA Account, net of any amounts refunded to Vendor’s customers for return units of Product(s) for the period through the date of the distribution, as follows (and in the following order): (i) F8 shall receive an amount equal to the costs incurred by F8 in purchasing Products (based on the Actual Cost Per Unit of each Product) plus any Shipping Costs incurred by F8 to the extent not already repaid by Vendor, and, if applicable, storing (including any costs incurred by F8 to restock returned units of Products received prior to the date of the distribution, but excluding Inventory returned in accordance with Section 3(e)) more than 10 days prior to the date of the distribution (“COGS”); (ii) F8 shall receive the F8 Fees for the Products calculated in accordance with Section 4; and (iii) the balance will be remitted to Vendor. On a bi-weekly basis during the Term, F8 will provide Vendor with a report via e-mail for such period setting forth, on a Product-by-Product basis, the number of units of the Product sold, the number of returns received, the funds received in the DACA Account, the COGS of the units of such Product sold, and the F8 Fees with respect to such Product for such period. Vendor shall notify F8 of any dispute regarding any amount remitted by F8 pursuant to this Section 3 within 10 calendar days of Vendor’s receipt of such amount or Vendor shall be deemed to have irrevocably and finally accepted the amount. The Parties shall seek to resolve any disputes expeditiously and in good faith.

(e) Returns of Products.

(i) Units of a Product that are returned by Vendor’s customers in accordance with applicable return policies and that are unused, undamaged, and in the original packaging shall be returned to the applicable Facility and held as Inventory in accordance with this Agreement. The Age of Inventory Sold of such returned units of that Product shall be calculated from the date that such units were delivered to the Facilities for purposes of determining the F8 Fees. Any costs of restocking such returned units of such Product shall be advanced by F8 and then reimbursed to F8 as COGS of such Product in the following distribution from the DACA Account. If not already refunded by the applicable Platform (and deducted from the amount deposited by the Platform in the DACA Account), F8 shall cause the refund of amounts in the DACA Account associated with properly returned units of the Product to the appropriate customer(s).

(ii) Units of a Product that are returned by Vendor’s customers in accordance with applicable return policies but are not, for any reason, in saleable condition shall be charged to Vendor’s account as a separate sale at its COGS plus applicable fees as per the Fee Schedule for such Product.

(f) Security Interest. Without limiting F8’s rights as owner of the Inventory at all times until a Product is sold by Vendor to a customer, as collateral security for the payment of all amounts owed to F8 under this Agreement Vendor hereby grants to F8 (i) a purchase money security interest in all of the Inventory held in a Third-Party Facility on a consignment basis which have not been purchased by Vendor, and (ii) a lien on and security interest in all of Vendor’s (x) Products and the proceeds thereof, (y) any accounts receivable related to sales of Products, and (z) the DACA Account and the funds deposited therein (“Collateral”). The Deposit Account Control Agreement is intended to constitute an “authenticated record” under the Uniform Commercial Code with respect to such Collateral and Vendor hereby authorizes F8 to file a financing statement (or amendment thereto) as the secured party covering the remaining Collateral in any relevant jurisdiction and to take such other steps as necessary to secure F8’s rights in and to the Collateral.

4. F8 Fees. As consideration for the inventory management services provided under this Agreement, Vendor agrees to pay F8 a fee for each unit of each Product sold on a Platform determined in accordance with the fee schedule set forth in the applicable Product Schedule (the “Fee Schedule”) based on the Age of Inventory Sold set forth on the Fee Schedule (the “F8 Fees”). The first-in, first-out (FIFO) accounting method shall be used for purposes of determining the Age of Inventory Sold of units of a Product.

| 5 |

(a) Exclusivity. During the Term, Vendor shall not, directly or indirectly: (i) sell any Products other than through the Vendor Sale Account on a Platform in accordance with this Agreement, (ii) purchase any Products from a Supplier or any person or entity other than F8 in accordance with this Agreement or (iii) develop, manufacture, distribute, purchase, or sell any products that are materially similar to or competitive with the Products.

(b) Vendor Obligations. During the Term, Vendor agrees: (i) to conduct its business consistent with past practice; (ii) for each Platform, to exclusively use the processor required by the Platform to process all credit card payments involving the DACA Account pursuant or otherwise acceptable to F8 pursuant to a processing agreement that is acceptable to F8 (“Processor”), (iii) to not change Vendor’s arrangements with Processor without the prior written consent of F8, (iv) to not take any action that has the effect of causing the processor through which cards are settled to be changed from Processor to another processor; (v) to not take any action to discourage the use of credit cards and to not permit any event to occur that could have an adverse effect on the use, acceptance, or authorization of cards for the purchase of Products; (vi) to not take any action to cause future receivables for Products to be settled or delivered to any account other than the DACA Account; (vii) not to sell, dispose, convey, or otherwise transfer its business or assets without the express prior written consent of F8; (viii) to comply in all material respects with the agreements with each Platform in which it sells Products and (ix) to maintain all Inventory held on a consignment basis free of and clear from and against all liens and encumbrances of any nature.

(c) Remedies. Vendor hereby agrees and acknowledges that any breach or threatened breach of the obligations set forth in this Section 5 will result in irreparable harm to F8 for which there will be no adequate remedy at law. In addition to other remedies provided by law or at equity, in such event F8 shall be entitled to seek an injunction, without the necessity of posting a bond, to prevent any further breach of this Section 5 by Vendor.

(d) Owner Guaranty. In consideration of the substantial direct and indirect benefits derived by Owner from the transactions contemplated by this Agreement, Owner hereby absolutely, unconditionally, and irrevocably guarantees, as primary obligor, the punctual payment of amounts due to F8 under this Agreement and the performance of all of the covenants made by Vendor in this Section 5.

6. Title and Risk of Loss. F8 shall hold title to all Products purchased by F8 and held as Inventory unless and until they are purchased by Vendor’s customers, at which time title to Products shipped under any order shall transfer to Vendor immediately before Vendor’s sale to its customers. All risk of loss, theft, or damage to the Inventory shall transfer to Vendor upon delivery to a Third-Party Facility.

(a) Term. This Agreement shall commence on the Effective Date and shall continue in full force and effect until January 31, 2022 (the “Initial Term”), unless terminated earlier as provided in this Agreement. The Initial Term shall automatically be extended for additional 1-year periods (each, a “Renewal Term” and, collectively with the Product Initial Term, the “Term”) unless either Party provides written notice to terminate at least 10 weeks prior to the end of the Initial Term or the Renewal Term (as applicable).

| 6 |

(b) Termination.

(i) Either Party may terminate this Agreement in its entirety at any time in the event of a material breach by the other Party that remains uncured after 10 days following written notice thereof; provided, however, that a breach by Vendor of its obligations under Section 5 shall be considered a non-curable breach and F8 may terminate this Agreement immediately upon such breach without notice. Any such termination shall be effective immediately and automatically upon the expiration of the applicable notice period, if any, without further notice or action by either Party. Termination shall be in addition to any other remedies that may be available to the non-breaching Party.

(ii) F8 may terminate a Product Schedule or the Agreement in its entirety, at its sole election (provided that this Agreement will remain in effect with respect to all other Products if F8 does not elect to terminate this Agreement in its entirety), at any time, without providing prior notice and an opportunity to cure, in the event that:

| (1) | at any time during the Term the Actual Inventory Turn Weeks of a Product exceeds the Maximum Inventory Turn Weeks as set forth on the applicable Product Schedule; | |

| (2) | at any time during the Term the Actual Cost Per Unit of a Product exceeds the Maximum Allowable Cost Per Unit set forth on the applicable Product Schedule; or | |

| (3) | at any time during the Term the Actual Lead Time of a Product exceeds the Maximum Allowable Lead Time set forth on the applicable Product Schedule. |

(iii) F8 may terminate this Agreement in its entirety pursuant to Section 14(i).

(iv) F8 may terminate this Agreement in its entirety at any time in the event Vendor (1) becomes insolvent or is generally unable to pay its debts when due, (2) files, or as filed against it, a petition for voluntary or involuntary bankruptcy or otherwise becomes subject, voluntarily or involuntarily, to any proceeding under any domestic or foreign bankruptcy or insolvency law, (3) makes or seeks to make a general assignment for the benefit of its creditors, or (4) applies for or has appointed a receiver, trustee, custodian, or similar agent appointed by order of any court of competent jurisdiction to take charge of or sell any material portion of its property or business.

(v) F8 may terminate this Agreement in its entirety at any time in the event Vendor sells, leases, or exchanges a material portion of Vendor’s assets, Vendor merges with or consolidates into another entity, or a change of control of Vendor occurs.

(c) Effect of Termination; Certain Remedies on or prior to Termination.

(i) Termination of this Agreement for any reason shall not discharge either Party’s liability for obligations incurred and amounts unpaid at the time of such termination (and shall not alter the obligations of the parties with respect all Product Terms that thereafter remain in effect). Following any termination of a Product Schedule or of this Agreement in its entirety, F8 may continue to use any sign, display, or other advertising or marketing materials containing Vendor Marks as reasonably required for the resale of the Product or Products (as applicable) that remain in Inventory after termination. Upon termination of this Agreement in its entirety, each Party shall destroy or return to the other all Confidential Information that is in its possession at the time of termination.

(ii) Subject to Section 7(c)(iv), upon the expiration of the Term or a termination of this Agreement in its entirety (other than resulting from a termination of the final Product Schedule(s) by F8 pursuant to Section 7(b)(ii)), F8 shall promptly transfer all administrative control over the Vendor Sale Account to Vendor and deliver notice to the Bank to terminate Deposit Account Control Agreement in accordance with its terms.

| 7 |

(iii) Upon the expiration or termination of either a Product Schedule or the Agreement in its entirety, F8 shall offer Vendor the opportunity to purchase the remaining unsold Inventory (of the applicable Product in the case of termination of a Product Schedule, or of all Products in the case of termination of the Agreement in its entirety, as the case may be) at a price based on the Age of Inventory Sold as set forth on the respective Fee Schedule(s) (the “Unsold Inventory Offer”). The Vendor shall have 7 calendar days of receiving the Unpaid Inventory Offer from F8 to accept the Unsold Inventory Offer and make payment in accordance with the Unsold Inventory Offer.

(iv) Upon a termination (1) of a Product Schedule by F8 pursuant to Section 7(b)(ii), or (2) a termination of the Agreement by F8 pursuant to Section 7(b)(iv), Section 7(b)(v), or Section 7(b)(i) due to a breach by Vendor of its obligations under Section 5 (whether before or after termination of a Product Schedule or the Term), until the Unsold Inventory Offer is accepted by Vendor and payment received by F8, F8 shall have the right to continue to sell all remaining Inventory as of the date of termination (whether on the Platform or otherwise). In the event that the Unsold Inventory Offer is not accepted by Vendor and payment is not received by F8, F8 shall retain all administrative control over and exclusive use of the Vendor Sale Account and the DACA Account until F8 liquidates the Inventory at prices to be determined by F8 in its sole discretion. In this event, F8 shall retain all proceeds from the sale of the remaining Inventory. Upon the liquidation of all remaining Inventory of all Products, F8 shall transfer administrative control over the Vender Sale Account to Vendor and deliver notice to the Bank to terminate Deposit Account Control Agreement in accordance with its terms.

8. Insurance. Vendor shall obtain and keep in force during the Term of this Agreement (a) Commercial General Liability insurance, including contractual liability and product liability, with a combined single limit for bodily injury and property damage of not less than [$___________], and (b) Commercial Property insurance including Fire Legal Liability Coverage with minimum per occurrence limit of [$_________]. The policies required in this Section 8 shall name the F8 as an additional insured and shall cover all claims arising out of incidents or events occurring during the term of the policies.

9. Intellectual Property Rights. Vendor hereby grants to F8 a non-transferable, non-exclusive, limited license to use Vendor’s logos, trademarks, and trade names (collectively the “Vendor Marks”), in connection with the sale of the Products upon termination or expiration of this Agreement in accordance with Section 7(c). The license shall continue to be in effect until F8 liquidates all of the Inventory purchased during the Term of this Agreement.

10. Disclaimer of Warranties. F8 makes no representations or warranties of any kind, express or implied, as to the Products purchased from the Supplier. To the fullest extent permitted by law, F8 disclaims all warranties, express or implied, with respect to the Products including, but not limited to, warranties of fitness for a particular purpose or use.

11. Indemnification.

(a) Indemnification by Vendor. Vendor agrees to defend, indemnify, and hold harmless F8, its affiliates, and their respective officers, members, managers, employees, and agents from and against any and all third party losses, damages, suits, expenses (including reasonable attorneys’ fees), and costs (collectively “Claims”): (i) alleging that the Vendor Marks or any Products sold pursuant to this Agreement infringe any U.S. patent, trademark, or copyright; (ii) arising out of any defects in any Products sold by Vendor (including, without limitation, Product Non-Conformity), (iii) arising out of the acts or omissions of Vendor, its employees, agents, or representatives with respect to Vendor’s performance of this Agreement; or (iv) arising out of any breach by Vendor of any of the terms, conditions, representations, or warranties provided pursuant to this Agreement; provided, however, that Vendor shall have no liability to F8 for any Claims to the extent that such Claims are attributable to F8 under Section 11(b). F8 shall promptly notify the Vendor in writing of any Claim and give control of the defense and settlement of the Claim to the Vendor. F8 shall reasonably cooperate with Vendor, and its legal counsel and insurance carriers, at the Vendor’s expense, in its defense of such Claims. F8 shall also have the right to participate in the defense of any such action and have the right to hire its own legal counsel at F8’s expense.

| 8 |

(b) Indemnification by F8. F8 hereby agrees to defend, indemnify and hold harmless Vendor, its affiliates, and their respective officers, directors, employees, and agents from and against any and all Claims arising out of the gross negligence or willful misconduct of F8, its employees, agents, or representatives with respect to its performance of this Agreement. Vendor shall promptly notify F8 in writing of any Claim, give control of the defense and settlement of the Claim to F8, and shall reasonably cooperate with F8, its legal counsel, and insurance carriers, at F8’s expense, in its defense of such Claim. Vendor shall also have the right to participate in the defense of any such action and have the right to hire its own legal counsel at Vendor’s expense.

12. Confidentiality.

(a) The Parties acknowledge that each Party may be provided with or have access to certain information (whether in oral, tangible, electronic, or other form) related to the other Party’s business and operations that is confidential, proprietary, or otherwise non-public (whether or not identified as confidential) (“Confidential Information”). All Confidential Information shall remain the property of the disclosing Party.

(b) For a period of 1 year from the date of disclosure, the receiving Party shall maintain the Confidential Information in strict confidence and disclose the Confidential Information only to its employees or agents who have a need to know such Confidential Information in order to perform the receiving Party’s obligations contemplated by this Agreement and who are under confidentiality obligations no less restrictive than this Agreement. The receiving Party shall at all times remain responsible for breaches of this Agreement arising from the acts of its employees and agents. The receiving Party agrees to use the disclosing Party’s Confidential Information solely for the purpose of performing its obligations under this Agreement and not for any other purpose or for its own benefit or for the benefit of any third party, without the prior written approval of the disclosing Party. No Confidential Information furnished to the receiving Party shall be duplicated or copied except as may be necessary to effectuate the purpose of this Agreement. The receiving Party shall promptly return or, at the disclosing Party’s option, certify destruction of, all copies of Confidential Information at any time upon the request of the disclosing Party or within 10 days following the expiration or earlier termination of this Agreement.

(c) The receiving Party shall not have any obligations to preserve the confidential nature of any Confidential Information that: (i) receiving Party can demonstrate by competent evidence was rightfully in its possession before receipt from the disclosing Party; (ii) is or becomes a matter of public knowledge through no fault of the receiving Party; (iii) is rightfully provided to the receiving Party from a third party without, to the best of receiving Party’s knowledge, a duty of confidentiality; (iv) is independently developed by receiving Party without use of the Confidential Information, as demonstrated by competent evidence; or (v) is disclosed by receiving Party with disclosing Party’s prior written approval. If the receiving Party is confronted with legal action to disclose Confidential Information received under this Agreement, the receiving Party shall, unless prohibited by applicable law, provide prompt written notice to the disclosing Party to allow the disclosing Party an opportunity to seek a protective order or other relief it deems appropriate.

(d) The receiving Party hereby agrees and acknowledges that any breach or threatened breach of this Agreement regarding the treatment of the Confidential Information will result in irreparable harm to the disclosing Party for which there will be no adequate remedy at law. In addition to other remedies provided by law or at equity, in such event the disclosing Party shall be entitled to seek an injunction, without the necessity of posting a bond, to prevent any further breach of this Agreement by the receiving Party.

| 9 |

13. Limitation of Liability. IN NO EVENT WILL F8’S MAXIMUM OBLIGATION FOR INDEMNIFICATION CLAIMS UNDER THIS AGREEMENT EXCEED AN AMOUNT EQUAL TO THE F8 FEES PAID TO F8 IN THE 6-MONTH PERIOD PRECEDING THE EVENT GIVING RISE TO THE INDEMNIFICATION CLAIM. IN NO EVENT WILL F8 BE LIABLE UNDER THIS AGREEMENT TO VENDOR FOR ANY INCIDENTAL, CONSEQUENTIAL, INDIRECT, STATUTORY, SPECIAL, EXEMPLARY, OR PUNITIVE DAMAGES ARISING OUT OF THIS AGREEMENT OR AS A RESULT OF THE SALE, DELIVERY, SERVICING, USE, OR LOSS OF THE PRODUCTS SOLD HEREUNDER, REGARDLESS OF WHETHER SUCH LIABILITY IS BASED ON BREACH OF CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE, AND EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGES OR SUCH DAMAGES COULD HAVE BEEN REASONABLY FORESEEN.

14. General.

(a) Representations and Warranties. Each Party hereby represents and warrants to the other Party that: (i) such Party has the full right, power, and authority to enter into this Agreement and to perform its obligations hereunder; (ii) such Party has obtained all material licenses, authorizations, approvals, consents, or permits required by applicable laws to conduct its business and perform its obligations under this Agreement; (iii) this Agreement constitutes the legal, valid, and binding obligation of such Party, enforceable against such Party in accordance with its terms, except as may be limited by any applicable bankruptcy, insolvency, reorganization, moratorium, or similar laws and equitable principles related to or affecting creditors’ rights generally; and (iv) such Party is duly organized, validly existing, and in good standing under the laws of the state of such Party’s formation. Vendor hereby represents and warrants to F8 that: (1) Vendor is not insolvent and is paying all of its debts as they become due; (2) all financial information that Vendor has provided to F8 (including, but not limited to, the SKU Information) is true and accurate and fairly represents Vendor’s financial condition; and (3) there are no creditors of Vendor holding a security interest in Vendor’s assets except as completely and accurately listed on Schedule A.

(b) Waiver. No waiver of any term or right in this Agreement shall be effective unless in writing, signed by an authorized representative of the waiving Party. The failure of either Party to enforce any provision of this Agreement shall not be construed as a waiver or modification of such provision, or impairment of its right to enforce such provision or any other provision of this Agreement thereafter.

(c) Relationship of the Parties. Nothing in this Agreement shall be construed to create or imply an employment or agency relationship or a partnership or joint venture relationship between the Parties. Each Party is an independent contractor and, except as expressly provided for in this Agreement, neither Vendor nor F8 has the authority to bind or contract any obligation in the name of or on account of the other Party or to incur any liability or make any statements, representations, warranties, or commitments on behalf of the other Party.

(d) Force Majeure. Neither Party shall be liable hereunder for any failure or delay in the performance of its obligations under this Agreement, except for the payment of money, if such failure or delay is on account of causes beyond its reasonable control, including civil commotion, war, fires, floods, accident, earthquakes, inclement weather, electrical outages, network failures, governmental regulations or controls, epidemic or pandemic, casualty, strikes or labor disputes, supply chain disruption, terrorism, acts of God, or other similar or different occurrences beyond the reasonable control of the Party so defaulting or delaying in the performance of this Agreement, for so long as such force majeure is in effect. If performance is delayed over 90 days, the Party not experiencing the force majeure event may terminate this Agreement in its entirety.

(e) Governing Law and Venue. This Agreement will be governed by and interpreted in accordance with the laws of the State of Delaware, without giving effect to the principles of conflicts of law of such state. The United Nations Convention on Contracts for the International Sale of Goods shall not apply to this Agreement.

(f) Dispute Resolution. The Parties hereby agree that any dispute or claim arising out of or relating to this Agreement (other than claims for preliminary injunctive relief or other pre-judgment remedies which shall be commenced in any court having jurisdiction thereof) shall be settled by arbitration administered by the American Arbitration Association in accordance with the provisions of its Commercial Arbitration Rules in Bethlehem, Pennsylvania by a one-person arbitrator, unless the parties mutually agree otherwise. The Parties agree that such arbitration shall be the exclusive means of finally resolving such disputes or claims. The decision of the arbitrator shall be final and binding on the Parties, and judgment on the award rendered may be entered in any court having jurisdiction thereof. The prevailing Party in any dispute under this Agreement shall be entitled to receive, in addition to all other damages to which it may be entitled, the costs and expenses incurred by such Party in conducting such dispute, including, without limitation, reasonable attorneys’ fees, court costs, arbitrators’ fees, and administrative fees.

| 10 |

(g) Cooperation. Each Party shall fully cooperate with the other Party with respect to the performance of this Agreement. Each Party will provide or make available to the other Party any information and will execute and deliver such further documents that may reasonably be required in order to effectively perform this Agreement.

(h) Assignment; No Third-Party Beneficiaries. Vendor may not assign this Agreement nor delegate performance hereunder, either in whole or part, without the express written consent of F8. Any assignment without such consent of F8 shall be null and void. This Agreement shall be binding upon and inure to the benefit of the successors and permitted assigns of the Parties. Except as provided in Section 11, there are no third-party beneficiaries to this Agreement.

(i) Severability. If any provision or portion of this Agreement shall be held by a court of competent jurisdiction to be illegal, invalid, or unenforceable, the remaining provisions or portions shall remain in full force and effect. Upon a determination that any material provision of this Agreement is illegal, invalid, or unenforceable, F8 may, in its discretion, (i) negotiate in good faith with Vendor to modify such provision to affect the original intent of the Parties as closely as possible in order that the transactions contemplated by this Agreement be consummated as originally intended, or (ii) terminate this Agreement upon notice to Vendor.

(j) Interpretation. The headings/captions appearing in this Agreement have been inserted for the purposes of convenience and ready reference, and do not purport to and shall not be deemed to define, limit or extend the scope or intent of the provisions to which they appertain. This Agreement shall not be construed more strongly against either Party regardless of which Party is more responsible for its preparation.

(k) Counterparts. This Agreement may be executed in one or more counterparts, each of which will be deemed to be an original, but all of which together will constitute one and the same instrument, without necessity of production of the others. An executed signature page delivered via facsimile or electronic transmission shall be deemed as effective as an original executed signature page.

(l) Notice. All notices or other communications required under this Agreement shall be deemed effective when received and made in writing by either (i) hand delivery, (ii) registered mail, (iii) certified mail, return receipt requested, (iv) facsimile or email, or (v) overnight mail, addressed to the Party to be notified at the address specified on the signature page to this Agreement.

(m) Entire Agreement; Amendment. This Agreement, and any schedules and exhibits attached hereto, is the entire agreement between the Parties with respect to the subject matter hereof and supersedes any prior agreement or communications between the Parties, whether written, oral, electronic or otherwise. No change, modification, amendment, or addition of or to this Agreement shall be valid unless in writing and signed by both of the Parties. Each Party hereto has received independent legal advice regarding this Agreement and their respective rights and obligations set forth herein.

(n) Survival. Subject to the limitations and other provisions of this Agreement: (i) the representations and warranties of the Parties contained herein shall survive the expiration or earlier termination of the Term for a period of 12 months after such expiration or termination; and (ii) any other provision of this Agreement that, in order to give proper effect to its intent, should survive such expiration or termination, shall survive the expiration or earlier termination of the Term for the period specified therein, or if nothing is specified for a period of 12 months after such expiration or termination.

[Signature Page Follows]

| 11 |

In witness whereof, the Parties hereto have executed this Agreement on the date first written above.

| EDISON NATION, LLC | ||

| By: | ||

| Name: | Xxxxx Xxxxxx | |

| Title: | Authorized Agent | |

| Address: | ||

| Phone: | ||

| Email: | xxxxxxx@xxxxxxxxxxxx.xxx | |

| Forever 8 Fund, LLC | ||

| By: | ||

| Name: | Xxxx Xxxxxxxxxx | |

| Title: | Member | |

| Address: 0 Xxxx Xxxxx Xxxxxx, Xxxxx 0000, Xxxxxxxxx, XX 00000 | ||

| Phone: | (000) 000-0000 | |

| Email: | xxxxxxxxxxx@xxxxxxx0xxxx.xxx | |

[Signature Page to Inventory Management Agreement]

Schedule A

Product Schedule A-1

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7323-ZZ | |

| Description of SKU: | Twilight Turtle Classic Night Light Star Projector | |

| SKU Information: | ||

| Historical Cost per Unit | $7.11 | |

| Projected Monthly Sales | 1,682 | |

| Historical Lead Time | 115 | |

| Planned Inventory Turn Weeks | 17 | |

| Starting Inventory Units: | 3,000 | |

| Agreed Existing Inventory Units | 0 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 6,448 | |

| Minimum Inventory Turn Weeks | 8 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| California 3PL [BV to insert legal name& location] | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| xxx.xxxxxx.xxx - Magento | ||

| Other Vendor Sale Accounts: | BBB/Macy’s - CommerceHub | |

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 33 | |

| Maximum Allowable Cost Per Unit | $8.18 | |

| Maximum Allowable Lead Time (days) | 145 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

A-1 Fee Schedule. The F8 Fees for this Product Schedule A-1 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.60), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.81).

Product Schedule A-2

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7423-AQ | |

| Description of SKU: | Cloud B Tranquil Turtle, Aqua | |

| SKU Information: | ||

| Historical Cost per Unit | $6.50 | |

| Projected Monthly Sales | 901 | |

| Historical Lead Time | 115 | |

| Planned Inventory Turn Weeks | 17 | |

| Starting Inventory Units: | 3,000 | |

| Agreed Existing Inventory Units | 0 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,453 | |

| Minimum Inventory Turn Weeks | 8 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx - Magento | |

| BBB/Macy’s - CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 33 | |

| Maximum Allowable Cost Per Unit | $7.48 | |

| Maximum Allowable Lead Time (days) | 145 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

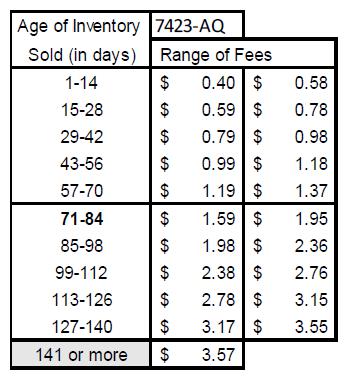

A-2 Fee Schedule. The F8 Fees for this Product Schedule A-2 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.40), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.58).

Product Schedule A-3

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, Inc. | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7423-PR | |

| Description of SKU: | Cloud b Tranquil Turtle Ocean Nightlight and Sound Soother | |

| SKU Information: | ||

| Historical Cost per Unit | $8.64 | |

| Projected Monthly Sales | 683 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 19 | |

| Starting Inventory Units: | 3,004 | |

| Agreed Existing Inventory Units | 4 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,000 | |

| Minimum Inventory Turn Weeks | 10 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, Inc. Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx - Magento | |

| BBB/Macy’s - CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 38 | |

| Maximum Allowable Cost Per Unit | $9.94 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

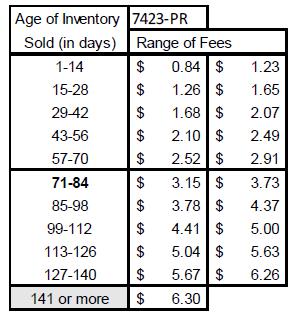

A-3 Fee Schedule. The F8 Fees for this Product Schedule A-3 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.84), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($1.23).

Product Schedule A-4

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7303-Z8 | |

| Description of SKU: | Cloud b Sleep Sheep Sound Soother | |

| SKU Information: | ||

| Historical Cost per Unit | $6.67 | |

| Projected Monthly Sales | 2,056 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 17 | |

| Starting Inventory Units: | 9,316 | |

| Agreed Existing Inventory Units | 4,312 | |

| Additional Starting Inventory Units | 5,004 | |

| Minimum Inventory Amount | 8,225 | |

| Minimum Inventory Turn Weeks | 9 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx - Magento | |

| BBB/Macy’s - CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 35 | |

| Maximum Allowable Cost Per Unit | $0.00 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

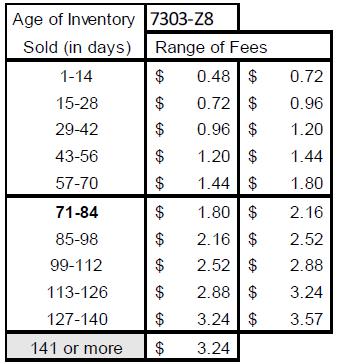

A-4 Fee Schedule. The F8 Fees for this Product Schedule A-4 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.48), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.72).

Product Schedule A-5

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7302-ZZ | |

| Description of SKU: | Cloud b Sleep Sheep On The Go Travel Sound Soother | |

| SKU Information: | ||

| Historical Cost per Unit | $5.87 | |

| Projected Monthly Sales | 1,578 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 17 | |

| Starting Inventory Units: | 11,147 | |

| Agreed Existing Inventory Units | 8,147 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 6,312 | |

| Minimum Inventory Turn Weeks | 9 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx – Magento | |

| BBB/Macy’s – CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 35 | |

| Maximum Allowable Cost Per Unit | $6.75 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

A-5 Fee Schedule. The F8 Fees for this Product Schedule A-5 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.44), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.64).

Product Schedule A-6

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7323-BL | |

| Description of SKU: | Cloud b Twilight Turtle Blue Night Light Soother | |

| SKU Information: | ||

| Historical Cost per Unit | $6.22 | |

| Projected Monthly Sales | 551 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 24 | |

| Starting Inventory Units: | 3,224 | |

| Agreed Existing Inventory Units | 224 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,000 | |

| Minimum Inventory Turn Weeks | 12 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx – Magento | |

| BBB/Macy’s – CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 47 | |

| Maximum Allowable Cost Per Unit | $7.15 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

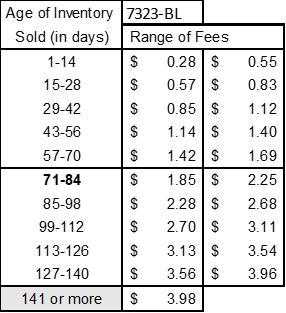

A-6 Fee Schedule. The F8 Fees for this Product Schedule A-6 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.28), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.55).

Product Schedule A-7

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7323-PR | |

| Description of SKU: | Cloud b Twilight Turtle Purple Night Light Soother | |

| SKU Information: | ||

| Historical Cost per Unit | $6.41 | |

| Projected Monthly Sales | 451 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 29 | |

| Starting Inventory Units: | 3,001 | |

| Agreed Existing Inventory Units | 1 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,000 | |

| Minimum Inventory Turn Weeks | 14 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx - Magento | |

| BBB/Macy’s - CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 58 | |

| Maximum Allowable Cost Per Unit | $7.37 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

A-7 Fee Schedule. The F8 Fees for this Product Schedule A-7 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.50), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.73).

Product Schedule A-8

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7473-WUN | |

| Description of SKU: | Cloud b Twilight Buddies Winged Unicorn Night Light Soother | |

| SKU Information: | ||

| Historical Cost per Unit | $6.64 | |

| Projected Monthly Sales | 249 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 52 | |

| Starting Inventory Units: | 3,317 | |

| Agreed Existing Inventory Units | 317 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,000 | |

| Minimum Inventory Turn Weeks | 26 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx – Magento | |

| BBB/Macy’s – CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 104 | |

| Maximum Allowable Cost Per Unit | $7.64 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

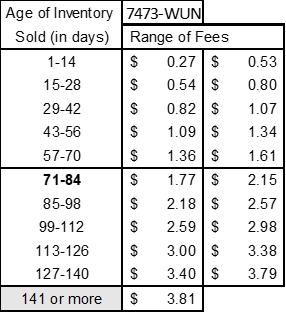

A-8 Fee Schedule. The F8 Fees for this Product Schedule A-8 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.27), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.53).

Product Schedule A-9

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7470-FX8 | |

| Description of SKU: | Cloud b Xxxxxxx The Xxx Sound Soother | |

| SKU Information: | ||

| Historical Cost per Unit | $6.85 | |

| Projected Monthly Sales | 273 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 48 | |

| Starting Inventory Units: | 3,000 | |

| Agreed Existing Inventory Units | 0 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,000 | |

| Minimum Inventory Turn Weeks | 24 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx - Magento | |

| BBB/Macy’s - CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 95 | |

| Maximum Allowable Cost Per Unit | $7.88 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

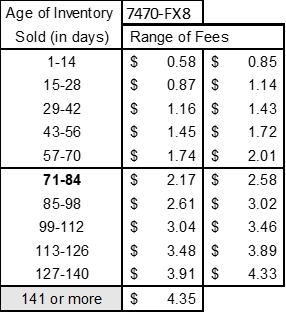

A-9 Fee Schedule. The F8 Fees for this Product Schedule A-9 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.58), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.85).

Product Schedule A-10

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7106-UC | |

| Description of SKU: | Soothing Sounds Xxxx The Unicorn (White Noise Machine) | |

| SKU Information: | ||

| Historical Cost per Unit | $6.95 | |

| Projected Monthly Sales | 227 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 57 | |

| Starting Inventory Units: | 3,206 | |

| Agreed Existing Inventory Units | 206 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,000 | |

| Minimum Inventory Turn Weeks | 29 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx – Magento | |

| BBB/Macy’s – CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 114 | |

| Maximum Allowable Cost Per Unit | $7.99 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

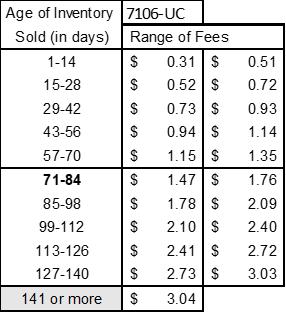

A-10 Fee Schedule. The F8 Fees for this Product Schedule A-10 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.31), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.51).

Product Schedule A-11

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7323-T2P | |

| Description of SKU: | Cloud b Pink Twinkling Twilight Turtle, 1 EA | |

| SKU Information: | ||

| Historical Cost per Unit | $7.10 | |

| Projected Monthly Sales | 341 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 38 | |

| Starting Inventory Units: | 4,734 | |

| Agreed Existing Inventory Units | 1,734 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,000 | |

| Minimum Inventory Turn Weeks | 19 | |

| Third Party Facility: | AMZN FBA | |

| Other Third-Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx – Magento | |

| BBB/Macy’s – CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 76 | |

| Maximum Allowable Cost Per Unit | $8.17 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

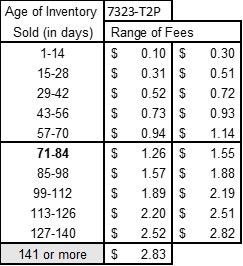

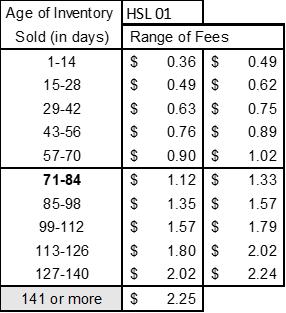

A-11 Fee Schedule. The F8 Fees for this Product Schedule A-11 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.10), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.30).

Product Schedule A-12

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | King Honor Enterprises Ltd. | |

| Product: | 7323-T2 | |

| Description of SKU: | Night Light Star Projector with Soothing Melodies, Twinkling Twilight Turtle - Aqua | |

| SKU Information: | ||

| Historical Cost per Unit | $6.95 | |

| Projected Monthly Sales | 449 | |

| Historical Lead Time | 120 | |

| Planned Inventory Turn Weeks | 29 | |

| Starting Inventory Units: | 4,312 | |

| Agreed Existing Inventory Units | 1,312 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,000 | |

| Minimum Inventory Turn Weeks | 14 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| 3PL -0000-X Xxxxxxxx Xx, XXXX X, Xxxxxxxxxx, XX 00000 | ||

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | xxx.xxxxxx.xxx - Magento | |

| BBB/Macy’s - CommerceHub | ||

| BBB-Nordstrom, VonMaur, Xxxxxx.xxx DVS - SPS Commerce | ||

| Nordstrom Rack, other Brick & Mortar - Retailers for Cloud B, Pirasta | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 58 | |

| Maximum Allowable Cost Per Unit | $7.99 | |

| Maximum Allowable Lead Time (days) | 150 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

A-12 Fee Schedule. The F8 Fees for this Product Schedule A-12 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.60), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.88).

Product Schedule A-13

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | SupplyOne Tampa | |

| Product: | D8-9H8V-HIPD | |

| Description of SKU: | Cardboard Shipping Boxes, 9x6x4 Inch, Pack of 25 | |

| SKU Information: | ||

| Historical Cost per Unit | $4.84 | |

| Projected Monthly Sales | 1,012 | |

| Historical Lead Time | 75 | |

| Planned Inventory Turn Weeks | 8 | |

| Starting Inventory Units: | 2,101 | |

| Agreed Existing Inventory Units | 1 | |

| Additional Starting Inventory Units | 2,100 | |

| Minimum Inventory Amount | 2,530 | |

| Minimum Inventory Turn Weeks | 4 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 15 | |

| Maximum Allowable Cost Per Unit | $5.56 | |

| Maximum Allowable Lead Time (days) | 105 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

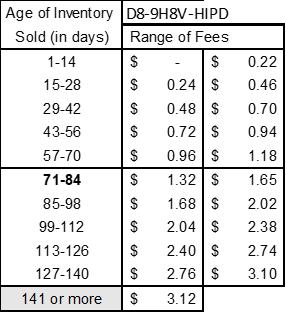

A-13 Fee Schedule. The F8 Fees for this Product Schedule A-13 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.

For purposes of the F8 Free Ranges (per Unit), the fees are prorated for the daily age of the inventory. For example, if the proceeds of the sale of units of Inventory are received in the DACA Account on day one (1), the applicable fee is low point of the range ($0.00), whereas if the proceeds of the sale of units of Inventory are received in the DACA Account on day fourteen (14), the applicable fee is high point of the range ($0.22).

Product Schedule A-14

| Product Land Date: | 10/1/2020 | |

| Parties: | ||

| Vendor | Edison Nation, LLC | |

| Owner | Forever 8 Fund, LLC | |

| Supplier: | Ningbo OK Homeware lmp&Exp Co. Ltd | |

| Product: | 11001 | |

| Description of SKU: | Universal Acrylic Serveware Stand and Tray (Reversible Cake Stand, Punch Bowl, Serving Platter Tray and Dip Bowl) | |

| SKU Information: | ||

| Historical Cost per Unit | $4.25 | |

| Projected Monthly Sales | 1,701 | |

| Historical Lead Time | 70 | |

| Planned Inventory Turn Weeks | 10 | |

| Starting Inventory Units: | 3,000 | |

| Agreed Existing Inventory Units | 0 | |

| Additional Starting Inventory Units | 3,000 | |

| Minimum Inventory Amount | 3,970 | |

| Minimum Inventory Turn Weeks | 5 | |

| Third Party Facility: | AMZN FBA | |

| Other Third Party Facility | Edison Nation, LLC Clearwater, Florida Warehouse | |

| Vendor Sale Accounts: | AMZN Seller Central | |

| Other Vendor Sale Accounts: | ||

| Termination Thresholds: | ||

| Maximum Inventory Turn Weeks | 20 | |

| Maximum Allowable Cost Per Unit | $4.89 | |

| Maximum Allowable Lead Time (days) | 100 | |

| Bank: | Enterprise Bank | |

| Vendor holding a security interest in Vendor’s assets: | [To be inserted post UCC search] |

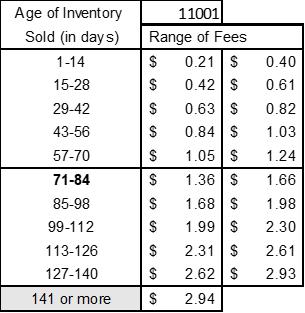

A-14 Fee Schedule. The F8 Fees for this Product Schedule A-14 will be determined as follows:

For purposes of this Fee Schedule, Age of Inventory Sold with respect to particular unit(s) of Inventory is measured beginning on the date such unit(s) of Inventory arrived at the Facilities until the date that the proceeds of the sale of such units of Inventory by Vendor to Vendor’s customer are received in the DACA Account.