Dated 29 September 2021 Deed of Adherence, Amendment and Restatement Between Aleph Internet Media Services LLC A15 Holding Netherlands B.V. IMS Internet Media Services, Inc. Httpool Holdings UK Limited Connect Ads DMCC and Aleph Group Inc.

Exhibit 10.1

EXECUTION VERSION

| CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY , HAS BEEN OMITTED BECAUSE IT IS NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE AND CONFIDENTIAL |  |

Dated 29 September 2021

Deed of

Adherence, Amendment and Restatement

Between

Aleph Internet Media Services LLC

A15 Holding Netherlands B.V.

IMS Internet Media Services, Inc.

Httpool Holdings UK Limited

Connect Ads DMCC

and

Aleph Group Inc.

| Table of Contents | ||

| Page | ||

| 1. | Interpretation | 2 |

| 2. | Adherence to the SPA | 2 |

| 3. | Amendment and Restatement of the SPA | 2 |

| 4. | Miscellaneous | 3 |

| Schedule 1 The Amended and Restated SPA | 7 | |

(i)

This Deed of Adherence, Amendment and Restatement is made on 29 September 2021

Between:

| (1) | Aleph Internet Media Services LLC, a limited liability company incorporated in the United States, with registered number L21000042376 and whose registered office is at (“Aleph”); |

| (2) | X00 Xxxxxxx Xxxxxxxxxxx B.V., a company incorporated in the Netherlands, with registered number 63036673 and whose registered office is at (“A15”); |

| (3) | IMS Internet Media Services, Inc., a company incorporated in the United States, with registered number P05000006068 and whose registered office is at (“IMS”); |

| (4) | Httpool Holdings UK Limited, a company incorporated in the United Kingdom, with registered number 10375627 and whose registered office is at (“Httpool”); |

| (5) | Connect Ads DMCC, a company incorporated in the Dubai Multi Commodities Centre, Dubai, UAE, with registered number DMCC91896 and whose registered office is at (“Connect Ads”); and |

| (6) | Aleph Group Inc., an exempted company incorporated in the Cayman Islands, with registered number 378353 and whose registered office is at the offices of (“Aleph Cayman”). |

| (A) | On 5 July 2021, Aleph, A15, IMS, Httpool and Connect Ads entered into a share sale and purchase agreement (the “SPA”), pursuant to which (inter alia): |

| (i) | A15 agreed to sell, and Httpool agreed to purchase, certain shares in the share capital of Connect Ads, for cash consideration; and |

| (ii) | A15 agreed to sell, and IMS agreed to purchase, certain shares in the share capital of Connect Ads, in consideration for the allotment and issuance of certain shares in the share capital IMS. |

| (B) | As at the date of the SPA: |

| (i) | Aleph was the legal and beneficial owner of 90% of the entire issued share capital of IMS and Sony Pictures Advertising Sales Company (“Sony”) was the legal and beneficial owner of 10% of the entire issued share capital of IMS; and |

| (ii) | IMS was, in turn, the legal and beneficial owner of 75.5% of the entire issued share capital of Httpool and Akuma Ventures Limited (“Akuma”) was the legal and beneficial owner of 24.5% of the entire issued share capital of Httpool. |

| (C) | On 8 July 2021, Aleph, Akuma Ventures Limited (“Akuma”), Aleph Cayman, IMS and Aleph Maradona LP (“CVC”) entered into a stock purchase agreement (as amended and restated on 28 July 2021) (the “CVC SPA”), pursuant to which (inter alia): |

| (i) | Akuma agreed to exchange its existing shares in the share capital of Httpool for certain shares in the share capital of IMS; |

| (ii) | CVC agreed to acquire certain shares in the share capital of IMS; and |

| (iii) | the shareholders in IMS (including Akuma and CVC) then agreed to exchange all of their shares in the share capital of IMS for shares in the share capital of Aleph Cayman. |

Completion of the transactions contemplated by the CVC SPA occurred on 30 July 2021.

(D) As at the date of this Deed:

| (i) | Aleph is legal and beneficial owner of 48.91% of the entire issued share capital of Aleph Cayman, Akuma is the legal and beneficial owner of 22.16% of the entire issued share capital of Aleph Cayman, CVC is the legal and beneficial owner of 23.50% of the entire issued share capital of Aleph Cayman and Sony is the legal and beneficial owner of 5.43% of the entire issued share capital of Aleph Cayman; |

| (ii) | Aleph Cayman is the legal and beneficial owner of the entire issued share capital of IMS; and |

| (iii) | IMS is, in turn, the legal and beneficial owner of the entire issued share capital of Httpool. |

| (E) | In order to reflect the completion of transactions contemplated by the CVC SPA and to facilitate completion of the SPA, the Parties wish for Aleph Cayman to adhere to the SPA and for the SPA to be amended and restated in the form set out in Schedule 1 (The Amended and Restated SPA) to this Deed. |

It is agreed:

1. Interpretation

1.1 In this Deed (including the Recitals):

“Effective Date” means the date of this Deed;

“Party” means a party to this Deed, and “Parties” shall mean the parties to this Deed;

“Transaction Document” has the meaning given to it in the SPA.

1.2 Clauses 1.2 to 1.14 (Interpretation) of the SPA shall apply mutatis mutandis to this Deed.

2. Adherence to the SPA

With effect from the Effective Date, Aleph Cayman undertakes to adhere to and be bound by the provisions of the SPA, and to perform the obligations imposed on it by the SPA and to assume the rights and benefits conferred on it by the SPA.

3. Amendment and Restatement of the SPA

| 3.1 | With effect from the Effective Date, the Parties agree that the SPA shall be amended and restated in the form set out in the Schedule (The Amended and Restated SPA) so that the Parties’ rights and obligations under it shall be read and construed for all purposes in accordance with the amended and restated terms and conditions as set out in such Schedule. |

2

| 3.2 | The amendment and restatement of the SPA pursuant to this Deed shall constitute a variation of the SPA in accordance with Clause 28 (Variations) of the SPA. |

| 3.3 | Save as amended and restated in accordance with Clause 3.1 above, the SPA shall continue in full force and effect. |

| 3.4 | With effect from the Effective Date, any reference in a Transaction Document to “the SPA” shall be read and construed as references to the SPA as amended and restated by this Deed. For the avoidance of doubt, references in the SPA to the “Signature Date” or the “date of this Agreement” shall be deemed to be references to 5 July 2021. |

4. Miscellaneous

Clause 18 (Confidentiality), Clause 19 (Announcements), Clause 20 (Further Assurance), Clause 21 (Effect of Completion), Clause 22 (Assignment), Clause 24 (Costs and Expenses), Clause 25 (Notices), Clause 26 (Entire Agreement), Clause 27 (Severance and Validity), Clause 28 (Variations), Clause 29 (Remedies and Waiver), Clause 30 (Third Party Rights), Clause 31 (Counterparts) and Clause 33 (Governing Law and Submission to Jurisdiction) of the SPA shall apply mutatis mutandis to this Deed.

Executed and delivered as a deed on the date which first appears above.

3

| Executed as a Deed by Aleph Group Inc. |  |

|

| acting by , a director, in | ||

| the presence of: | Director | |

| Signature: | ||

| Name: | ||

| Address: | ||

| Occupation: Executive Assistant |

[Signature Page to the Deed of Adherence, Amendment and Restatement]

| Executed as a Deed by Aleph Internet Media |  |

|

| Service LLC acting by , | ||

| a director, in the presence of: | Director | |

| Signature: | ||

| Name: | ||

| Address: | ||

| Occupation: Executive Assistant |

[Signature Page to the Deed of Adherence, Amendment and Restatement]

| Executed as a Deed by X00 Xxxxxxx |  |

|

| Xxxxxxxxxxx B.V. acting by , | ||

| a director, in the presence of: | Director | |

| Signature: | ||

| Name: | ||

| Address: | ||

| Occupation: Lawyer |

[Signature Page to the Deed of Adherence, Amendment and Restatement]

| Executed as a Deed by IMS Internet Media |  |

|

| Services, Inc. acting by , | ||

| a director, in the presence of: | Director | |

| Signature: | ||

| Name: | ||

| Address: | ||

| Occupation: Executive Assistant |

[Signature Page to the Deed of Adherence, Amendment and Restatement]

| Executed as a Deed by Httpool Holdings UK |  |

|

| Limited acting by , a | ||

| director, in the presence of: | Director | |

| Signature: | ||

| Name: | ||

| Address: | ||

| Occupation: Executive Assistant |

[Signature Page to the Deed of Adherence, Amendment and Restatement]

| Executed as a Deed by Connect Ads DMCC |  |

|

| acting by an authorised signatory by way attorney | ||

| the presence of: | Authorised Signatory by way attorney | |

| Signature: | ||

| Name: | ||

| Address: | ||

| Occupation: Lawyer |

[Signature Page to the Deed of Adherence, Amendment and Restatement]

Schedule 1

The Amended and Restated SPA

7

Dated 5 July 2021

and as amended and restated pursuant to a deed of adherence, amendment and

restatement dated 29 September 2021

Sale and Purchase Agreement

relating to the shares in Connect Ads DMCC

between

Aleph Internet Media Services LLC

A15 Holding Netherlands B.V.

IMS Internet Media Services, Inc.

Httpool Holdings UK Limited

Connect Ads DMCC

and

| Table of Contents | ||

| Page | ||

| 1. | Interpretation | 0 |

| 2. | Sale and Purchase of the Sale Shares and the Swap Shares | 20 |

| 3. | Consideration for the Sale Shares and the Swap Shares | 21 |

| 4. | Pre-Completion Conditions | 23 |

| 5. | Pre-Completion Conduct of Business | 26 |

| 6. | Pre-Completion Arrangements | 29 |

| 7. | Completion | 32 |

| 8. | Post Completion Obligations | 33 |

| 9. | A15 Warranties and Connect Ads Xxxxxxxxxx | 00 |

| 00. | Httpool, IMS and Aleph Cayman Warranties | 34 |

| 11. | Indemnities | 35 |

| 12. | Leakage | 36 |

| 13. | Qualifying IPO | 39 |

| 14. | A15 Put Option and A15 Anti-Embarrassment Protection | 39 |

| 15. | Aleph Undertakings | 41 |

| 16. | Termination | 41 |

| 17. | Failure to Complete | 42 |

| 18. | Confidentiality | 42 |

| 19. | Announcements | 43 |

| 20. | Further Assurance | 44 |

| 21. | Effect of Completion | 44 |

| 22. | Assignment | 44 |

| 23. | Payment | 44 |

| 24. | Costs and Expenses | 45 |

| 25. | Notices | 45 |

| 26. | Entire Agreement | 47 |

| 27. | Severance and Validity | 47 |

| 28. | Variations | 47 |

| 29. | Remedies and Waiver | 47 |

| 30. | Third Party Rights | 48 |

| 31. | Counterparts | 48 |

| 32. | Standstill | 48 |

| 33. | Governing Law and Submission to Jurisdiction | 49 |

| Schedule 1 The Connect Ads Group | 51 | |

| Part 1 | Details of Connect Ads | 51 |

| Part 2 | Details of the Connect Ads Subsidiaries | 52 |

i

| Page | ||||

| Schedule 2 | The IMS Group | 55 | ||

| Part 1 | Details of IMS | 55 | ||

| Part 2 | Details of the IMS Subsidiaries | 56 | ||

| Schedule 3 | The Httpool Group | 64 | ||

| Part 1 | Details of Httpool | 64 | ||

| Part 2 | Details of Httpool Subsidiaries | 65 | ||

| Schedule 4 | Pre-Completion Conditions | 79 | ||

| Part 1 | Non-Regulatory Pre-Completion Conditions | 79 | ||

| Part 2 | Regulatory Pre-Completion Conditions | 80 | ||

| Part 3 | DMCCA Pre-Completion Condition | 80 | ||

| Part 4 | No Injunction Pre-Completion Condition | 80 | ||

| Schedule 5 | Completion Arrangements | 81 | ||

| Part 1 | A15’s Obligations | 81 | ||

| Part 2 | Aleph Cayman’s Obligations | 83 | ||

| Part 3 | Httpool’s Obligations | 84 | ||

| Part 4 | IMS’s Obligations | 85 | ||

| Schedule 6 | Earn Outs | 86 | ||

| Annex 1 | Earn Out Amount 2 – Worked Examples | 89 | ||

| Schedule 7 | A15 Put Option | 90 | ||

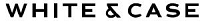

| Annex 1 | Put Option – Second Anniversary – Worked Examples | 99 | ||

| Annex 2 | Form of Put Option Exercise Notice | 100 | ||

| Schedule 8 | A15 Anti-Embarrassment Protection | 101 | ||

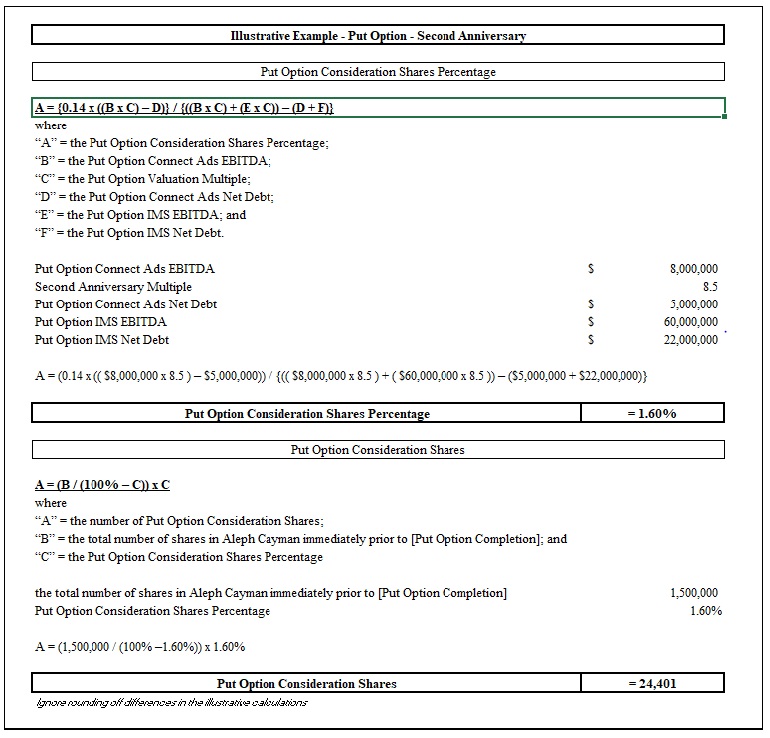

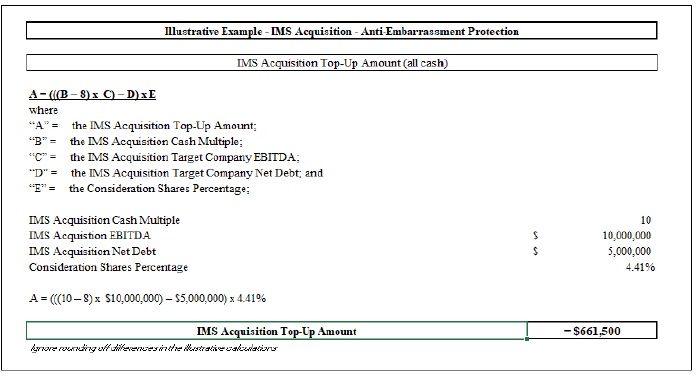

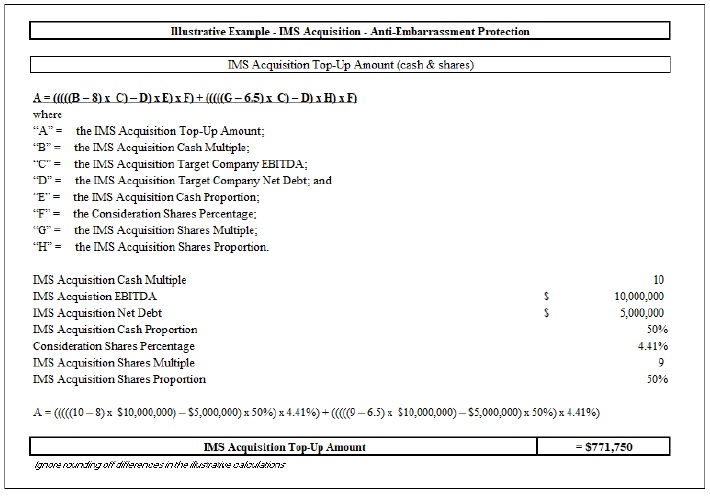

| Part 1 | IMS Acquisition - Anti-Embarrassment Protection | 101 | ||

| Annex 1 | IMS Acquisition - Anti-Embarrassment Protection – Worked | |||

| Examples | 106 | |||

| Part 2 | IMS Disposal - Anti-Embarrassment Protection | 108 | ||

| Annex 1 | IMS Disposal - Anti-Embarrassment Protection – Worked | |||

| Examples | 112 | |||

| Schedule 9 | A15 Warranties | 113 | ||

| Schedule 10 | Connect Ads Warranties | 127 | ||

| Schedule 11 | A15 Limitations of Liability | 128 | ||

| Schedule 12 | IMS Warranties | 132 | ||

| Schedule 13 | Aleph Cayman Warranties | 146 | ||

| Schedule 14 | Httpool Warranties | 160 | ||

| Schedule 15 | IMS and Aleph Cayman Limitations of Liability | 161 | ||

| Schedule 16 | IMS Tax Covenant | 164 | ||

| Schedule 17 | Connect Ads Tax Covenant | 172 | ||

| Schedule 18 | Connect Ads Outstanding Receivables | 184 | ||

| Schedule 19 | Specified Customers and Agencies | 191 | ||

| Schedule 20 | Joinder and Amendment Agreement to the Aleph Cayman Shareholders’ Agreement | 192 | ||

(ii)

This Agreement (this “Agreement”) is made on 5 July 2021 and amended and restated pursuant to a deed of adherence, amendment and restatement dated 29 September 2021

Between:

| (1) | Aleph Internet Media Services LLC, a limited liability company incorporated in the United States, with registered number L21000042376 and whose registered office is at (“Aleph”), solely as a Party for the purposes of the Aleph Provisions and the Continuing Provisions; |

| (2) | X00 Xxxxxxx Xxxxxxxxxxx B.V., a company incorporated in the Netherlands, with registered number 63036673 and whose registered office is at (“A15”), as seller of the Sale Shares and the Swap Shares; |

| (3) | IMS Internet Media Services, Inc., a company incorporated in the United States, with registered number P05000006068 and whose registered office is at (“IMS”); |

| (4) | Httpool Holdings UK Limited, a company incorporated in the United Kingdom, with registered number 10375627 and whose registered office is at (“Httpool”), as purchaser of the Sale Shares; |

| (5) | Connect Ads DMCC, a company incorporated in the Dubai Multi Commodities Centre, Dubai, UAE, with registered number DMCC91896 and whose registered office is at (“Connect Ads”); and |

| (6) | Aleph Group, Inc, an exempted company incorporated in the Cayman Islands, with registered number 378353 and whose registered office is at the offices of , as purchaser of the Swap Shares (“Aleph Cayman”). |

| (A) | A15 has agreed to sell, and Httpool has agreed to purchase, the Sale Shares, on the terms and subject to the conditions of this Agreement. |

| (B) | A15 has further agreed to sell, and Aleph Cayman has agreed to purchase, the Swap Shares, on the terms and subject to the conditions of this Agreement. |

| (C) | In consideration of receipt of the Swap Shares, Aleph Cayman has agreed to allot and issue to A15, the Consideration Shares. |

It is agreed:

| 1. | Interpretation |

| 1.1 | In this Agreement (including the Recitals): |

“A15’s Designated Account” means the US$ denominated bank account of A15, details of which shall be notified in writing by A15 to Httpool prior to Completion;

“A15 Disclosure Letter” means the letter dated the Signature Date from A15 to IMS and Httpool containing A15’s disclosures against the A15 Warranties given at the Signature Date;

“A15 Fundamental Warranties” means any of the A15 Warranties set out in paragraphs 1, 2, 3, 4 and 20 of Schedule 9 (A15 Warranties);

“A15 Group” means A15, each of its Subsidiary Undertakings, any Parent Undertaking of A15 and all other Subsidiary Undertakings of any such Parent Undertaking from time to time (excluding each member of the Connect Ads Group);

“A15 Permitted Actions” means the incorporation of a wholly-owned subsidiary in Morocco beneath Connect Ads;

“A15 Supplemental Disclosure Letter” means the letter from A15 to Aleph Cayman and Httpool containing A15’s disclosures against the A15 Warranties given at Completion in respect of matters arising between the Signature Date and the date of such letter;

“A15 Tax Warranties” means the warranties set out in paragraph 21 of Schedule 9 (A15 Warranties);

“A15 Warranties” means the warranties set out in Schedule 9 (A15 Warranties) and “X00 Xxxxxxxx” shall mean any one of them;

“X00 Xxxxxxxx Claim” means a Claim under the A15 Warranties (other than the A15 Fundamental Warranties);

“A15’s Lawyers” means White & Case LLP of Xxxxx 0, Xxxx Xxxxx, Xx Xxxxxxxxx Xxxxxx, Xxxxx International Financial Centre, Dubai;

“AED” means the lawful currency of the UAE, being the UAE dirham;

“Agents” means, in relation to a person, that person’s directors, officers, employees, advisers, agents and representatives;

“Agreed Connect Ads/Httpool Leakage Amount” has the meaning given in Clause 12.4 (Leakage);

“Agreed Connect Ads/IMS Leakage Amount” has the meaning given in Clause 12.5 (Leakage);

“Agreed Form Connect Ads Shareholders’ Agreement” has the meaning given in paragraph 4 of Part 1 (Non-Regulatory Pre-Completion Conditions) of Schedule 4 (Pre-Completion Conditions);

“Agreed IMS Leakage Amount” has the meaning given in Clause 12.6 (Leakage);

“Akuma” means Akuma Ventures Ltd;

“Akuma Deed of Novation” means the Deed of Novation for First Amendment to Amended and Restated Shareholders Agreement dated April 4, 0000, xxxxxxx XXX, Xxxxxxx Xxxxxxxx Xxxxxxx, Xxxxx, Xxxxxx Xxxxx, Timotej Gala, Xxxxxxx Xxxxxxx, Digital Ventures Partners Inc., New Media Ventures Ltd., Toyi Ventures Ltd, Toboads Ltd. and Httpool dated December 15, 2020;

“Akuma Flip-Up” means the issue of new ordinary shares in the share capital of IMS (and subsequent exchange for new ordinary shares in the share capital of Aleph Cayman) to Akuma in consideration for shares held by Akuma in Httpool;

“Akuma Outstanding Amount” means the EUR6,250,000 payable by IMS to Akuma pursuant to a share purchase agreement dated April 4, 2020, between IMS and Httpool Holdings Limited;

“Aleph Cayman Shareholders’ Agreement” means the shareholders’ agreement dated July 30, 2021 between Aleph, Akuma, Sony, CVC and Aleph Cayman;

1

“Aleph Cayman Warranties” means the warranties set out in Schedule 13 (Aleph Cayman Warranties), and “Aleph Cayman Warranty” shall mean any one of them;

“Aleph Group” means Aleph, each of its Subsidiary Undertakings, any Parent Undertaking of Aleph and all other Subsidiary Undertakings of any such Parent Undertaking from time to time (excluding each member of the Connect Ads Group and the IMS Group);

“Aleph Provisions” means Clause 3.2(c) (Swap Shares Consideration), Clause 13 (Qualifying IPO), Clause 15 (Aleph Undertakings), Clause 17 (Failure to Complete), Schedule 7 (A15 Put Option) and Schedule 8 (Anti-Embarrassment Protection);

“Anti-Bribery Laws” means, in each case, to the extent that they have been applicable to a Connect Ads Group Company, a member of the A15 Group, an IMS Group Company or a member of the Aleph Group (as the case may be) at any time prior to the Signature Date: (a) the UK Xxxxxxx Xxx 0000; (b) the U.S. Foreign Corrupt Practices Act of 1977 (as amended); (c) any applicable law, rule, or regulation promulgated to implement the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, signed on December 17, 1997; and (d) any other applicable law, rule or regulation of similar purpose and scope in any jurisdiction, including books and records offences relating directly or indirectly to a bribe;

“Applicable Connect Ads Territories” means Egypt, Morocco, Tunisia, Algeria, Lebanon, Jordan, Saudi Arabia, Kuwait, Qatar, Bahrain, Oman, Pakistan, and Turkey;

“Applicable IMS Territories” means Argentina, Colombia, Chile, Brazil, Mexico, Panama, Peru, Ecuador, Spain, England, Portugal, Uruguay, Costa Rica, Rep. Dominican, Greece, Croatia, Slovenia, Slovakia, Romania, Bulgaria, Austria, Switzerland, Hungary, Czech Republic, Poland, Kosovo, Ukraine, Russia, Serbia, Lithuania, Latvia, Estonia, Denmark, Norway, Sweden, Finland, India, Belarus, Kazakhstan, Macedonia, Singapore, Myanmar, Bangladesh, Sri Lanka, Indonesia, Malaysia, Cambodia, Laos and Hong Kong;

“Benefit Plan” means any pension, profit-sharing, savings, retirement, executive compensation, incentive compensation, bonus, share option, phantom share or other equity-based compensation, vacation, sick leave, disability, death benefit, group insurance, hospitalization, medical, dental, life (including all individual life insurance policies as to which any Connect Ads Group Company or IMS Group Company (as applicable) is the owner, the beneficiary or both), employee loan, educational assistance program, policy, practice, agreement or arrangement, whether written or oral, formal or informal;

“Business Day” means a day (other than a Friday, Saturday, Sunday or a public holiday) when commercial banks are open for ordinary banking business in Dubai (UAE), Xxxxxx Town (the Cayman Islands), Amsterdam (the Netherlands), Miami (United States) and London (United Kingdom);

“Capital Expenditure” means any expenditure or obligation in respect of cash expenditure which, in accordance with IFRS, is treated as capital expenditure (including the capital element of any expenditure or obligation incurred in connection with a capitalized finance lease obligation), and only taking into account the actual cash payment made where assets are replaced and part of the purchase price is paid by way of part exchange;

“Cash Consideration” means US$52,722,883;

“Cash Consideration Escrow Account” means the US$ denominated account in the name of A15 and/or Httpool with the Escrow Agent pursuant to the Escrow Agreement for the purposes of the deposit of the Cash Consideration;

“Citi Consent and Waiver” means the written waiver and consent from Citibank, N.A. pursuant to which Citibank, N.A. irrevocably: (a) consents to the acquisition of: (i) the Sale Shares by Httpool and (ii) the Swap Shares by Aleph Cayman, as required by clause 11(j) of the Citi ULCA; and (b) waives any right that it has to object to the Latam Reorganization pursuant to clause 7(a) of the Citi Security Agreement;

2

“Citi Grantors” means IMS, IMM Internet Media Mexico, S. de X.X. de C.V., Personal Corp. IMM Mexico, S. de X.X. de C.V., IMS Chile SpA, IMS Media, LLC, IMS Internet Media Services Panama, S. De X.X., IMS-Internet Media Services Ecuador S.A., Radobel S.A., Internet Media Services Colombia S.A.S., 10 Midia Publicidade e Propaganda Ltda., Blue Sky Servicos de Publicidade Ltda, IMS-Brasil Marketing e Publicidade Ltda, IMS Argentina S.R.L., and “Citi Grantor” shall be construed accordingly;

“Citi Notification” means the written notification from IMS to Citibank, N.A. pursuant to which IMS on behalf of itself and each other Citi Grantor gives written notice to Citibank, N.A. of the Transaction at least thirty (30) days’ prior to Completion as required by clause 7(a) of the Citi Security Agreement;

“Citi Security Agreement” means the security agreement between Latam, the Citi Grantors and Citibank, N.A., dated November 26, 2019;

“Citi ULCA” means the first amended and restated uncommitted line of credit between IMS and Citibank, N.A., dated November 19, 2020;

“Claim” means any claim against a Party arising out of or in connection with this Agreement, and “Claims” shall mean all such claims;

“Commercial Registration” means the issuance by the DMCCA of each of the documents referred to in Clause 8 (Post Completion Obligations);

“Completion” means the completion of the sale and purchase of the Sale Shares and the Swap Shares, and the allotment and issuance of the Consideration Shares under this Agreement;

“Completion Date” means:

| (a) | the date falling eight (8) Business Days after the day on which the last of the Pre-Completion Conditions has been satisfied or waived in accordance with this Agreement; or |

| (b) | such other date as may be agreed in writing by the Parties; |

“Connect Ads Auditors” means Xxxxx Xxxxxxxx in respect of each member of the Connect Ads Group, save for:

| (a) | Techno Dev LLC, in respect of which the auditor is Xxxxxx Xxxxx Xxxxx Accountants & Tax Consultants – ATC; |

| (b) | 4G for Advanced Technology LLC, in respect of which the auditor is Xxxxxx Xxxxx Xxxxx Accountants & Tax Consultants – ATC; and |

| (c) | Connect Ads Italy S.r.l, in respect of which the auditor for FY2020 is a third party whose work is reviewed by Xxxxx Xxxxxxxx, with Xxxxx Xxxxxxxx serving as the auditor from FY2021 onwards; |

“Connect Ads Benefit Plan” means any Benefit Plan: (a) under which any current or former Connect Ads Worker has any present or future right to benefits and that is maintained, sponsored or contributed to by a Connect Ads Group Company; or (b) with respect to which a Connect Ads Group Company has any liability, including any Connect Ads Disclosed Plans;

“Connect Ads Business” means the business of the Connect Ads Group comprising digital media representation business, programmatic media advertising business and digital advertising sales business in, based on or through social media platforms and websites, application programming interface (or API) or other platforms and/or websites, including but not limited to, digital, audio and visual platforms and or websites in MENA, Turkey, Pakistan and Italy as conducted by it at the Signature Date;

3

“Connect Ads Business Intellectual Property” means the Intellectual Property owned by the Connect Ads Group Companies and used or held for use for the purposes of the Connect Ads Business and required in all material respects to conduct the Connect Ads Business;

“Connect Ads Contract” has the meaning given in paragraph 1.1 of Schedule 6 (Earn Outs);

“Connect Ads Data Room” means the virtual data room comprising copies of documents and other information relating to the Connect Ads Business and the Connect Ads Group Companies made available to IMS and Httpool at xxxxx://xxxxxxxx.xxxxxxxx.xxx/xxxxx/xxxxxxx/0x0000000xxxxx000xx0000x/xxxxxxx/0x0000xx0xx0x000x00x00xx?xxxxxxxxxxxx&xxxxxxXxxxxxxXxx0x0000000xxxxx000xx0000x a copy of which is contained on the Connect Ads Data Room USB Drive;

“Connect Ads Data Room USB Drive” means the USB drive containing a copy of the Connect Ads Data Room to be delivered by A15 to IMS and Httpool as soon as reasonably practicable after the Signature Date;

“Connect Ads Disclosed Plans” has the meaning given in paragraph 26 of Schedule 9 (A15 Warranties);

“Connect Ads Egypt” means Connect Ads for Advertising and Programming S.A.E.;

“Connect Ads Final 2018 Outstanding Receivables” means the amount, in US$, equal to the aggregate amount of the Connect Ads Preliminary 2018 Outstanding Receivables which remain outstanding and uncollected as at the commencement of business on the first (1st) anniversary of the Completion Date;

“Connect Ads Final 2019 Outstanding Receivables” means the amount, in US$, equal to the aggregate amount of the Connect Ads Preliminary 2019 Outstanding Receivables which remain outstanding and uncollected as at the commencement of business on the first (1st) anniversary of the Completion Date;

“Connect Ads Group” means Connect Ads and the Connect Ads Subsidiary Undertakings, and “Connect Ads Group Company” shall be construed accordingly;

“Connect Ads Incoming Licenses” has the meaning given in paragraph 22.9 of Schedule 9 (A15 Warranties);

“Connect Ads IT Contracts” means any material written agreements, arrangements or licenses relating to the Connect Ads IT Systems, including all hire purchase contracts or leases of hardware owned or used by a Connect Ads Group Company and licenses of software owned or used by a Connect Ads Group Company for the purposes of the Connect Ads Business (but excluding any shrink-wrapped, click-wrapped or other software commercially available off the shelf) and which are required, in all material respects, to conduct the Connect Ads Business;

“Connect Ads IT Systems” means computer hardware and software (excluding shrink-wrapped, click-wrapped or other software commercially available off the shelf) which, in each case, is owned by a Connect Ads Group Company and used or held for use for the purposes of the Connect Ads Business and required, in all material respects, to conduct the Connect Ads Business;

“Connect Ads Italy” means Connect Ads Italy S.r.l;

4

“Connect Ads Key Manager” means the CEO; VP Commercial; VP Technical Operations; VP Finance; VP Human Capital; Twitter Product Director; Non-Twitter Sales Director GCC, Kuwait & Pakistan; General Counsel; CEO Turkey; and VP Organization Development;

“Connect Ads Leakage” means, in each case, (a) by any member of the Connect Ads Group to, on behalf of or for the benefit of A15 or its Connected Persons (excluding, for the avoidance of doubt, any member of the Connect Ads Group); and (b) during the period from (but excluding) the Connect Ads Locked-Box Date to (and including) the Completion Date:

| (a) | any: |

| (i) | dividend or distribution (whether in cash or in kind) or any payments in lieu of any dividend or distribution, declared, paid or made; |

| (ii) | redemption, repurchase, repayment or return of shares or other securities, or return of capital (whether by reduction of capital or otherwise and whether in cash or in kind); |

| (iii) | payment of any consultant, advisory, management, monitoring, service, shareholder, director or other fees, costs, charges, expenses, royalty payments, interest payments, loan payments, bonuses or compensation of a similar nature in connection with the Transactions; |

| (iv) | payment of any external third-party or transaction fees of any kind; |

| (v) | payment or incurrence of liability for any fees, costs or expenses in connection with the Transactions (including professional advisers’ fees, consultancy fees, transaction bonuses, finders’ fees and brokers’ fees or similar commissions); |

| (vi) | waiver, discount, deferral, release or forgiveness of any amount owed to a Connect Ads Group Company or release of any obligation; |

| (vii) | assumption or incurrence of any liability or obligation (including the provision of any guarantee or indemnity or the creation of any Encumbrance); and |

| (viii) | transfer or surrender of assets, rights or other benefits, including waiver, discount, deferral, release or discharge of any amount, obligation or liability; or any claim (howsoever arising); |

| (b) | the entry into of any agreement to enter into or carry out any of the actions or transactions referred to in paragraph (a) above; and |

| (c) | any Tax becoming payable at any time by any Connect Ads Group Company as a consequence of any of the matters referred to above, or which would have become payable in the absence of any applicable relief, |

but, in each case, not including any Connect Ads Permitted Leakage;

“Connect Ads Licenses” has the meaning given in paragraph 10.1 of Schedule 9 (A15 Warranties);

“Connect Ads Locked-Box Accounts” means the audited financial statements of Connect Ads and each member of the Connect Ads Group and the audited consolidated financial statements of the Connect Ads Group for the accounting reference period ended on the Connect Ads Locked-Box Date, such financial statements comprising, in each case, a balance sheet, profit and loss account and cash flow statement;

“Connect Ads Locked-Box Date” means December 31, 2019;

5

“Connect Ads Management Accounts” means the unaudited balance sheet of each Connect Ads Group Company as at the Connect Ads Management Accounts Date and the unaudited profit and loss account of each Connect Ads Group Company for the period ended on such date;

“Connect Ads Management Accounts Date” means April 30, 2021;

“Connect Ads Material Contract” has the meaning given in paragraph 5.1 of Schedule 9 (A15 Warranties);

“Connect Ads Outgoing Licenses” has the meaning given in paragraph 22.10 of Schedule 9 (A15 Warranties);

“Connect Ads Outstanding Receivables” means the Connect Ads Preliminary 2018 Outstanding Receivables and the Connect Ads Preliminary 2019 Outstanding Receivables;

“Connect Ads Permitted Dividends” means:

| (a) | the dividend of US$2,000,000 which was declared and paid by Connect Ads on January 19, 2020 |

| (b) | the dividend of US$110,339 which was declared and paid by Connect Ads on October 21, 2020; |

| (c) | the dividend in the aggregate amount of US$13,082,691 declared by Connect Ads on 16 July 2021, US$5,000,000 of which was paid by Connect Ads to A15 immediately following such declaration; and US$8,082,691 was left outstanding; and |

| (d) | the dividend in the aggregate amount of US$963,801 to be declared by Connect Ads prior to Completion; |

“Connect Ads Permitted Leakage” means:

| (a) | the Connect Ads Permitted Dividends; |

| (b) | the amount of US$288,948 in aggregate owed by A15 to Connect Ads Egypt; and |

| (c) | any Tax becoming payable at any time by any Connect Ads Group Company as a consequence of any of the matters referred to above; |

“Connect Ads Preliminary 2018 Outstanding Receivables” means US$2,415,739, representing the aggregate amount of the receivables of Connect Ads listed in Part 1 of Schedule 18 (Connect Ads Outstanding Receivables);

“Connect Ads Preliminary 2019 Outstanding Receivables” means US$261,678, representing the aggregate amount of the receivables of Connect Ads listed in Part 2 of Schedule 18 (Connect Ads Outstanding Receivables);

“Connect Ads Properties” means the land and premises currently used or occupied by the Connect Ads Group for the purposes of the Connect Ads Business, certain details of which are set out in a table provided in Section 3.5.1 of the Connect Ads Data Room;

“Connect Ads Registered Intellectual Property” means patents, registered trademarks and service marks, registered designs, domain name registrations (and applications for any of the same), owned, used or held for use by a Connect Ads Group Company;

“Connect Ads Shareholders’ Agreement” means the shareholders’ agreement in respect of Connect Ads to be entered into at Completion between A15, Aleph Cayman, Httpool and Connect Ads, in the agreed terms;

6

“Connect Ads Subsidiary Undertakings” means all Subsidiary Undertakings of Connect Ads, and “Connect Ads Subsidiary Undertaking” shall be construed accordingly;

“Connect Ads Tax Claim” means a claim under the Connect Ads Tax Covenant or the A15 Tax Warranties;

“Connect Ads Tax Covenant” means the tax covenant set out in Schedule 17 (Connect Ads Tax Covenant);

“Connect Ads Territory” means any country or territory or possession thereof in which any Connect Ads Group Company does business at the Signature Date;

“Connect Ads Warranties” means the warranties set out in Schedule 10 (Connect Ads Warranties), and “Connect Ads Warranty” shall mean any one of them;

“Connect Ads Workers” means any employees, directors, officers, workers and self-employed contractors of the Connect Ads Group;

“Connected Person” means, in relation to an Undertaking:

| (a) | any other person who has Control of that Undertaking (a “Controlling Person”); |

| (b) | any Controlling Person’s own spouse or civil partner, parents and siblings (including step-siblings and half-siblings), linear ancestors and direct descendants, including adopted children, of that Controlling Person and of other such persons and their respective spouses or civil partners, parents and siblings (including step-siblings and half-siblings), linear ancestors and direct descendants, including adopted children (together, the “Controlling Person’s Family”); |

| (c) | any trust established by or for the benefit of a Controlling Person or a member of a Controlling Person’s Family; |

| (d) | any Undertaking in whose equity shares or partnership interests a Controlling Person and/or one or more members of a Controlling Person’s Family are, taken together, able to exercise or control the exercise of at least twenty per cent. (20%) of the votes able to be cast at general meetings, or to appoint or remove directors or equivalent officers holding a majority of voting rights at meetings of the board or equivalent management body, in each case on all, or substantially all, matters; |

| (e) | any Undertaking whose directors or equivalent officers are accustomed to act in accordance with the directions or instructions of a Controlling Person and/or any one or more members of a Controlling Person’s Family; |

| (f) | any Undertaking (other than any Connect Ads Group Company or IMS Group Company, as applicable) of which a Controlling Person or a member of a Controlling Person’s Family is a director or equivalent officer; and |

| (g) | any nominee, trustee or agent or any other person acting on behalf of any person referred to in this definition; |

“Consideration” means an amount equal to the sum of the Sale Share Consideration and the Consideration Shares Value;

“Consideration Shares” means newly issued ordinary shares in the share capital of Aleph Cayman in aggregate representing the Consideration Shares Percentage of the entire issued share capital of Aleph Cayman on a Fully-Diluted Basis immediately following Completion and the issuance of shares in Aleph Cayman to CVC in accordance with Clause 3.2(d);

7

“Consideration Shares Percentage” means 4.41% as may be reduced in accordance with Clause 3.2(e);

“Consideration Shares Value” means US$14,067,556.51;

“Continuing Provisions” means Clause 1 (Interpretation), Clause 17 (Failure to Complete) Clause 18 (Confidentiality), Clause 19 (Announcements), Clause 22 (Assignment), Clause 24 (Costs and Expenses), Clause 25 (Notices), Clause 26 (Entire Agreement), Clause 27 (Severance and Validity), Clause 28 (Variations), Clause 29 (Remedies and Waiver), Clause 30 (Third Party Rights), Clause 31 (Counterparts), Clause 32 (Standstill) and Clause 33 (Governing Law and Submission to Jurisdiction), all of which shall continue to apply after the termination of this Agreement without limit in time;

“Contract” means any written or oral contract, agreement, lease, license, instrument, note, evidence of indebtedness or other legally binding commitment or undertaking;

“CVC” means Aleph Maradona LP, a limited partnership organized and existing under the Laws of Delaware;

“CVC Completion Date” means 30 July 2021;

“CVC Escrow Amount” has the meaning given in Clause 3.4 (Deferred Consideration);

“CVC SPA” means the stock purchase agreement, dated 8 July 2021, between Aleph, Akuma, Aleph Cayman, IMS and CVC, as amended and restated on 28 July 2021;

“CVC Transaction” means the transactions expressly provided for in the CVC SPA;

“Defaulting Party” has the meaning given in Clause 7.3 (Completion);

“Deferred Consideration” has the meaning given in Clause 3.4 (Deferred Consideration);

“Disclosed” means fairly disclosed in the Connect Ads Data Room or in the IMS Data Room, or in the A15 Disclosure Letter, the A15 Supplemental Disclosure Letter, the IMS Disclosure Letter, or the IMS Supplemental Disclosure Letter in sufficient detail to enable A15, Aleph Cayman, IMS or Httpool (as appropriate) to understand the nature and scope of the relevant matter;

“Dispute” has the meaning given in Clause 33.2 (Governing Law and Submission to Jurisdiction);

“Dispute Notice” has the meaning given in Clause 33.2 (Governing Law and Submission to Jurisdiction);

“DMCC” means Dubai Multi Commodities Centre;

“DMCCA” means Dubai Multi Commodities Centre Authority;

“DMCCA Pre-Completion Condition” means the Pre-Completion Condition set out in paragraph 1 of Part 3 of Schedule 4 (Pre-Completion Conditions);

“Earn Out 1 Period” has the meaning given in paragraph 1.1 of Schedule 6 (Earn Outs);

“Earn Out 1 Statement” has the meaning given in paragraph 1.2 of Schedule 6 (Earn Outs);

“Earn Out 2 Period” has the meaning given in paragraph 2.1 of Schedule 6 (Earn Outs);

“Earn Out 2 Statement” has the meaning given in paragraph 2.2 of Schedule 6 (Earn Outs);

“Earn Out Amount 1” has the meaning given in paragraph 1.1 of Schedule 6 (Earn Outs);

8

“Earn Out Amount 2” has the meaning given in paragraph 2.1 of Schedule 6 (Earn Outs);

“Egyptian Competition Filing” means the regulatory filing referred to in Clause 8.1 (Post Completion Obligations);

“Egyptian Competition Law” means the Egyptian Law for the Protection of Competition and Combatting Monopolistic Practices, Law No. 3 of 2005, as amended;

“Encumbrance” means any pledge, charge, lien (other than a lien arising by operation of Law), mortgage, debenture, hypothecation, security interest, pre-emption right or option;

“Environment” means all or any of the following media (alone or in combination): air (including the air within buildings and the air within other natural or manmade structures whether above or below ground); water (including water under or within land or in drains or sewers); soil and land and any ecological systems and living organisms supported by these media;

“Environmental Law” means any Law whose purpose is to protect, or prevent pollution of, the Environment or to regulate emissions, discharges or releases of Hazardous Substances into the Environment, or to regulate the use, treatment, storage, burial, disposal, transport or handling of Hazardous Substances, and all by-laws, codes, regulations with any of therein, decrees or orders issued or promulgated or approved under or in connection with any of them;

“Environmental Proceedings” means proceedings arising out of or based upon violations or breaches of Environmental Laws;

“Escrow Account 1” means the US$ denominated account in the name of A15 and/or Httpool with the Escrow Agent pursuant to the Escrow Agreement for the purposes of the deposit of Escrow Amount 1;

“Escrow Account 2” means the US$ denominated account in the name of A15 and/or Httpool with the Escrow Agent pursuant to the Escrow Agreement for the purposes of the deposit of Escrow Amount 2;

“Escrow Accounts” means Escrow Account 1, Escrow Account 2 and the Cash Consideration Escrow Account;

“Escrow Agent” means Citibank, New York branch;

“Escrow Agreement” means the escrow agreement to be entered into by A15, Httpool and the Escrow Agent prior to Completion, in the agreed terms;

“Escrow Amount 1” means US$1,110, 410;

“Escrow Amount 2” means US$3,740,500;

“Escrow Amount 3” means US$5,000,000;

“Excess Cash” means the cash held by Connect Ads at the end of each month minus the average of the last twelve months of working capital, excluding funds otherwise committed (including, any cash held in respect of securing rent deposits, in respect of employee withholding taxes or any other cash held as collateral in respect of obligations of any party);

“Exclusivity Period” means the period commencing on the Signature Date and ending on the earlier of Completion or the termination of this Agreement in accordance with Clause 16.1;

“Expert” has the meaning given in paragraph 3.1 of Schedule 7 (A15 Put Option);

“First Long Stop Date” means the date falling sixty (60) days after the Restatement Date, or such other date as Parties agree in writing;

9

“Fully-Diluted Basis” means the total of all classes and series of shares outstanding on a particular date, combined with all options (whether granted, vested or exercised or not), warrants (whether exercised or not), LTIPs (long term incentive plans) and convertible securities of all kinds, all on an “as if converted” basis. For the purpose of this Agreement, “as if converted” basis shall mean as if such option, warrant or security had been converted into equity shares of the relevant person in accordance with their terms;

“Fundamental Warranties” means the A15 Fundamental Warranties, the Connect Ads Fundamental Warranties, the Httpool Warranties and the IMS Fundamental Warranties;

“GDPR” has the meaning given in Clause 11.1 (Indemnities);

“Google Non-Recurring Non-Cash Event” means the non-payment by Google LLC to IMS of certain commission due in respect of Waze amounting to US$530,000 that was recorded by IMS as a loss in 2020 pursuant to the terms of a settlement and release agreement between Google LLC and IMS dated 1 September 2020;

“Government Official” means: (a) any officer, director, employee, appointee or official representative of a Governmental Authority or of a public international organization; (b) any political party or party official; and (c) any candidate for political or judicial office;

“Governmental Authority” means: (a) any international, national, state, city or local governmental authority; (b) any commission, organization, agency, department, board, bureau or instrumentality of any of the foregoing governmental authorities (and “instrumentality of government of any of the foregoing governmental authorities” includes any entity owned or controlled by such governmental authorities); (c) any stock exchange or similar self-regulatory or quasi-governmental agency; and (d) any court, arbitrator, arbitral body or other tribunal having jurisdiction;

“Hazardous Substances” means any wastes, pollutants, contaminants and any other natural or artificial substance (whether in the form of a solid, liquid, gas or vapor) which is capable of causing harm or damage to the Environment or a nuisance to any person;

“Httpool’s Designated Account” means the US$ denominated bank account of Httpool, details of which shall be notified in writing by Httpool to A15 prior to Completion;

“Httpool Group” means Httpool and each of its Subsidiary Undertakings;

“Httpool Warranties” means the warranties set out in Schedule 14 (Httpool Warranties), and “Httpool Warranty” shall mean any one (1) of them;

“Httpool’s Lawyers” means Brabners, Xxxxx Xxxxx, 00 Xxxx Xxxxxx, Xxxxxxxxxx X0 0XX, Xxxxxx Xxxxxxx, who for purposes of this definition shall also be considered counsel for IMS;

“IFRS” means International Financial Reporting Standards, as adopted by the European Union, in effect on the relevant dates thereof;

“IMS Acquisition” has the meaning given in paragraph 1.1, Part 1 of Schedule 8 (A15 Anti-Embarrassment Protection);

“IMS Audited Accounts” means the audited financial statements of IMS and each member of the IMS Group and the audited consolidated financial statements of the IMS Group for the accounting reference period ended on the IMS Locked-Box Date, together with, in each case, the auditors’ and directors’ reports and the notes to the audited financial statements, such financial statements comprising, in each case, a balance sheet, profit and loss account and cash flow statement;

“IMS Business” means the business of the IMS Group comprising digital media representation business, programmatic media advertising business and advertising sales business in, based on or through social media platforms, application programming interface (or API) or other platforms that compete with social media platforms in Latin America, Europe and Asia as conducted by it at the Signature Date;

10

“IMS Business Intellectual Property” means the Intellectual Property owned by the IMS Group Companies and used or held for use for the purposes of the IMS Business and required in all material respects to conduct the IMS Business;

“IMS Data Room” means the virtual data room comprising copies of documents and other information relating to the IMS Business and the IMS Group Companies made available to A15 at xxxxx://xxxxxxxx.xxxxxxxx.xxx/xxxxx/xxxxxxx/0x0000000xxxxx000xx0000x/xxxxxxx/xxxxx?xxx e=index a copy of which is contained on the IMS Data Room USB Drive;

“IMS Data Room USB Drive” means the USB drive containing a copy of the IMS Data Room to be delivered by IMS to A15 as soon as reasonably practicable after the Signature Date;

“IMS Disclosed Plans” has the meaning given in paragraph 25 of Schedule 12 (IMS Warranties);

“IMS Disclosure Letter” means the letter dated the Signature Date from IMS to A15 containing IMS’s disclosures in connection with this Agreement given at the Signature Date;

“IMS Disposal” has the meaning given in paragraph 1.1, Part 2 of Schedule 8 (A15 Anti-Embarrassment Protection);

“IMS Fundamental Warranties” means the warranties set out in paragraphs 1 to 3 of Schedule 12 (IMS Warranties) and the warranties set out in paragraphs 1 to 4 of Schedule 13 (Aleph Cayman Warranties);

“IMS Group” means:

| (a) | in respect of any time prior to the CVC Completion Date, IMS and the IMS Subsidiary Undertakings; and |

| (b) | in respect of any time on or after the CVC Completion Date, Aleph Cayman and the IMS Subsidiary Undertakings, |

and “IMS Group Company” shall be construed accordingly;

“IMS Incoming Licenses” has the meaning given in paragraph 21.9 of Schedule 12 (IMS Warranties);

“IMS IT Contracts” means any material written agreements, arrangements or licenses relating to the IMS IT Systems, including all hire purchase contracts or leases of hardware owned or used by an IMS Group Company and licenses of software owned or used by an IMS Group Company for the purposes of the IMS Business (but excluding any shrink-wrapped, click-wrapped or other software commercially available off the shelf) and which are required, in all material respects, to conduct the IMS Business;

“IMS IT Systems” means computer hardware and software (excluding shrink-wrapped, click-wrapped or other software commercially available off the shelf) which, in each case, is owned by an IMS Group Company and used or held for use for the purposes of the IMS Business and required, in all material respects, to conduct the IMS Business;

“IMS Key Manager” means any employee of the IMS Group (a) whose annual salary is in excess of US$100,000 (or equivalent in the relevant local currency); or (b) who holds a C-suite position within the IMS Group;

11

“IMS Leakage” means in each case (a) by any member of the IMS Group to, on behalf of or for the benefit of Aleph, Akuma, CVC or any of their respective Connected Persons (excluding, for the avoidance of doubt, any member of the IMS Group); and (b) during the period from (but excluding) the IMS Locked-Box Date to (and including) the Completion Date:

| (a) | any: |

| (i) | dividend or distribution (whether in cash or in kind) or any payments in lieu of any dividend or distribution, declared, paid or made; |

| (ii) | redemption, repurchase, repayment or return of shares or other securities, or return of capital (whether by reduction of capital or otherwise and whether in cash or in kind); |

| (iii) | payment of any consultant, advisory, management, monitoring, service, shareholder, director or other fees, costs, charges, expenses, royalty payments, interest payments, loan payments, bonuses or compensation of a similar nature in connection with the Transactions; |

| (iv) | payment of any external third-party or transaction fees of any kind; |

| (v) | payment or incurrence of liability for any fees, costs or expenses in connection with the Transactions (including professional advisers’ fees, consultancy fees, consultancy fees, transaction bonuses, finders’ fees and brokers’ fees or similar commissions); |

| (vi) | waiver, discount, deferral, release or forgiveness of any amount owed to an IMS Group Company or release of any obligation; |

| (vii) | assumption or incurrence of any liability or obligation (including the provision of any guarantee or indemnity or the creation of any Encumbrance); and |

| (viii) | transfer or surrender of assets, rights or other benefits, including waiver, discount, deferral, release or discharge of any amount, obligation or liability; or any claim (howsoever arising); |

| (b) | the entry into of any agreement to enter into or carry out any of the actions or transactions referred to in paragraph (a) above; and |

| (c) | any Tax becoming payable at any time by any IMS Group Company as a consequence of any of the matters referred to above, or which would have become payable in the absence of any applicable relief, |

but, in each case, not including any IMS Permitted Leakage;

“IMS Leased Properties” means the leased land and premises currently used or occupied by the IMS Group for the purposes of the IMS Business, certain details of which are set out in a table provided in Section 4 of the IMS Data Room;

“IMS Locked-Box Accounts” means the audited financial statements of IMS and each member of the IMS Group and the audited consolidated financial statements of the IMS Group for the accounting reference period ended on the IMS Locked-Box Date audited by BDO, such financial statements comprising, in each case, a balance sheet, profit and loss account and cash flow statement;

“IMS Locked-Box Date” means December 31, 2020;

12

“IMS Management Accounts” means the unaudited balance sheet of each IMS Group Company as at the IMS Management Accounts Date and the unaudited profit and loss account of each IMS Group Company for the period ended on such date;

“IMS Management Accounts Date” means 30 April 2021;

“IMS Material Contract” has the meaning given in paragraph 4.1 of Schedule 12 (IMS Warranties);

“IMS Outgoing Licenses” has the meaning given in paragraph 21.10 of Schedule 12 (IMS Warranties);

“IMS Permitted Actions” means:

| (a) | subject to Clause 13 (Qualifying IPO), a Qualifying IPO; |

| (b) | any actions expressly provided for in the CVC SPA; |

| (c) | the allotment and issuance by Aleph Cayman to Xxxxx Xxxx, immediately prior to a Qualifying IPO, of new ordinary shares in the share capital of Aleph Cayman representing, in aggregate, up to 0.75% of the entire issued share capital of Aleph Cayman; |

| (d) | the transfer by Aleph to Xxxxxxx Libre (MELI) of existing ordinary shares in the share capital of Aleph Cayman representing, in aggregate, up to 1.25% of the entire issued share capital of Aleph Cayman; |

| (e) | the allotment and issuance by Aleph Cayman to CVC, at Completion, of new ordinary shares in the share capital of Aleph Cayman in accordance with Clause 3.2(d); |

| (f) | the allotment and issuance by Aleph Cayman to CVC, at any time prior to Completion, of new ordinary shares in the share capital of Aleph Cayman in accordance with Clause 3.2(e); |

| (g) | the consolidation or redemption of the existing ordinary shares in the share capital of Aleph Cayman, in each case, on a pro rata basis amongst the existing shareholder of Aleph Cayman, in order to reduce the total number of issued and outstanding shares in the share capital of Aleph Cayman and any associated amendments to Aleph Cayman’s constitutional documents required to effect such consolidation or redemption; |

| (h) | the allotment and issuance by Aleph Cayman to up to nine (9) commercial partners or prospective commercial partners of IMS Group, which may include, without limitation, Twitter, Inc. (or any of its group companies, Snap, Inc. (or any of its group companies) and/or Warner Music Group Corp (or any of its group companies)) of new ordinary shares in the share capital of Aleph Cayman, provided that (i) the number of shares issued to all such partners shall not exceed three per cent. (3%) of the entire issued share capital of Aleph Cayman in aggregate; and (ii) each such partner shall pay a subscription price for such shares calculated based on an enterprise value for the IMS Group of not less than US$2,000,000,000; |

| (i) | the transfer of all the shares held by Sony in Aleph Cayman to a third party purchaser; and |

| (j) | the creation of any IMS Permitted Encumbrance; |

“IMS Permitted Dividends” means the dividends in an aggregate amount not exceeding:

| (a) | US$7,200,000 declared by IMS April 1, 2021 and paid to Aleph on April 26, 2021; and |

| (b) | US$800,000 declared by IMS on April 1, 2021 and paid to Sony on April 26, 2021; |

13

“IMS Permitted Encumbrance” means:

| (a) | any Encumbrance created in connection with any borrowings of the IMS Group existing at the Signature Date, provided that such Encumbrance has been Disclosed to A15; or |

| (b) | any Encumbrance created in connection with any borrowings of the IMS Group in accordance with Clause 5.2(e) or 5.2(i) (Pre-Completion Conduct of Business), |

but, in each case, excluding any Encumbrance over or in respect of the Consideration Shares;

“IMS Permitted Leakage” means:

| (a) | the IMS Permitted Dividends; |

| (b) | the loan from Httpool Latvia SIA of US$2,000,000 to Latam; |

| (c) | any Tax becoming payable at any time by any IMS Group Company as a consequence of any of the matters referred to above; and |

| (d) | the reasonable and documented third party fees, costs, and expenses payable by Aleph Cayman in connection with the CVC Transaction, a Qualifying IPO or this Transaction (excluding, for the avoidance of doubt, any fees, costs and expenses paid on behalf of the Aleph Group in connection with the same); |

“IMS Proportion” means, in the case of any reference to an IMS Group Company:

| (a) | in the case of Aleph Cayman, one hundred per cent. (100%); and |

| (b) | in the case of any IMS Group Company other than Aleph Cayman, Aleph Cayman’s direct and indirect percentage of equity ownership in such IMS Group Company as at Completion; |

“IMS Registered Intellectual Property” means patents, registered trademarks and service marks, registered designs, domain name registrations (and applications for any of the same), owned, used or held for use by an IMS Group Company;

“IMS Subsidiary Undertakings” means:

| (a) | in respect of any time prior to the CVC Completion Date, all Subsidiary Undertakings of IMS; and |

| (b) | in respect of any time on or after the CVC Completion Date, all Subsidiary Undertakings of Aleph Cayman (including, for the avoidance of doubt, IMS and all of its Subsidiary Undertakings), |

and “IMS Subsidiary Undertaking” shall be construed accordingly;

“IMS Tax Claim” means a claim under the IMS Tax Warranties;

“IMS Tax Covenant” means the tax covenant set out in Schedule 16 (IMS Tax Covenant);

“IMS Supplemental Disclosure Letter” means the letter from Aleph Cayman to A15 containing Aleph Cayman’s disclosures in connection with the Aleph Cayman Warranties given at Completion in respect of matters arising between the Signature Date and the date of such letter;

“IMS Tax Warranties” means the warranties set out in paragraph 20 of Schedule 12 (IMS Warranties) and the warranties set out in paragraph 21 of Schedule 13 (Aleph Cayman Warranties);

14

“IMS Territory” means any country or territory or possession thereof in which any IMS Group Company does business at the Signature Date;

“IMS Warranties” means the warranties set out in Schedule 12 (IMS Warranties), and “IMS Warranty” shall mean any one of them;

“IMS Warranty Claim” means a Claim under the IMS Warranties or the Aleph Cayman Warranties (other than the IMS Fundamental Warranties);

“IMS Workers” means any employees, directors, officers, workers and self-employed contractors of the IMS Group;

“Indemnity Claim” means a claim under any of the indemnities in Clause 11 (Indemnities);

“Intellectual Property” means patents, utility models, trademarks, service marks, trade and business names, registered designs, design rights, copyright and neighboring rights, database rights, domain names, semi-conductor topography rights and rights in inventions, software, trade secrets, confidential information of all kinds and other similar proprietary rights which may subsist in any part of the world and whether registered or not, including, where such rights are obtained or enhanced by registration, any registration of such rights and rights to apply for such registrations;

“Interest” means the aggregate of (a) any amount of accrued and outstanding interest owed to any banking, financial, acceptance credit, lending or other similar institution or organization or general public on all borrowing and indebtedness (including, but not limited to, by way of net debit balances, loan stocks, bonds, debentures, notes, commercial paper, finance leases or similar), excluding any accrued interest on ‘right of use’ assets capitalized as per IFRS 16; and (b)any bank charges or foreign exchange charges;

“Joinder and Amendment Agreement to the Aleph Cayman Shareholders’ Agreement” means the joinder and amendment agreement (in the agreed form which shall be substantially on the terms set out in Schedule 20) to be executed by Aleph, Akuma, Sony, CVC, Aleph Cayman and A15 at Completion, pursuant to which (inter alia) A15 shall adhere to the Aleph Cayman Shareholders’ Agreement;

“Knowledge” means:

| (a) | when used in reference to A15 and/or Connect Ads, the knowledge, information and belief of each of Xxxx Xxxxxx, Xxxxxxx Abou El Xxxxxxx, Xxxxx Xxxxxxx, Xxxxxxx El Mehairy, Xxxxx Xxxxx, Xxxx Xxxxxx and Xxxxxxx Xxxxxxx; and with respect to the A15 Warranties at paragraph 25 (Employment; Labor Matters) of Schedule 9 (A15 Warranties) only, Lamiaa Balbaa and with respect to the A15 Warranties to the extent that they relate to Genart Medya Reklamcilik İletişim Ticaret A.Ş.only, Xxxxx Xxxxx Yilmaz; |

| (b) | when used in reference to Aleph Cayman, IMS and/or Httpool, the knowledge, information and belief of each of Xxxxxxxxx Xxxxxx Xxxxxxxx, Xxxx Manual Xxxx, Xxxxxx Xxxxxxxxx, Xxxxxxx Vidaguren, Carolina Suissis, Xxxx Xxxxx, Xxxxxx Xxxxx, and Xxxx Xxxxx, |

in each case, on the basis that they have made reasonable inquiry of any individuals holding c-suite positions within each IMS Group Company or Connect Ads Group Company (as appropriate);

“KSA” means the Kingdom of Saudi Arabia;

“KYC” means know your customer;

15

“Law” means any applicable law, statute, ordinance, rule, regulation, or other pronouncement having the effect of law or any interpretation or adjudication having the force of law;

“Latam” means Latam Media Holdings, LLC;

“Latam Reorganization” means the reorganization effected in February 19, 2021 pursuant to which Latam transferred its entire shareholding in IMS to Aleph;

“LCIA” has the meaning given in Clause 33.3 (Governing Law and Submission to Jurisdiction);

“Leakage Expert” has the meaning given in Clause 12.12 (Leakage);

“Loss” or “Losses” means any and all losses, liabilities, including charges, costs, damages, fines, penalties, interest and all legal and other reasonable and documented professional fees and expenses, including, in each case, all related Taxes;

“Material Contract” any contract involving revenue or expenditure in excess of fifty thousand US Dollars (US$50,000);

“MENA” means Middle East and North Africa;

“No Injunction Pre-Completion Condition” means the Pre-Completion Condition set out in paragraph 1 of Part 4 of Schedule 4 (Pre-Completion Conditions);

“Non-Regulatory Pre-Completion Conditions” means the Pre-Completion Condition set out in paragraphs 1 to 10 of Part 1 of Schedule 4 (Pre-Completion Conditions);

“Notice” has the meaning given in Clause 25.1 (Notices);

“Order” means any order, injunction, judgement, writ, assessment (other than a Tax assessment in the ordinary course of business), award, determination or decree of any Government Authority or arbitrator or administrative guidance having the effect of the foregoing;

“Organizational Documents” means, with respect to any person that is not a natural person, such person’s memorandum and articles of association, certificate of incorporation, articles or statement of incorporation or formation, bylaws, operating agreement, limited liability company agreement, partnership agreement, limited partnership agreement, limited liability partnership agreement, joint stock company agreement or other constituent or organizational documents of such person;

“Parent Undertaking” means an Undertaking which, in relation to another Undertaking, a “Subsidiary Undertaking”:

| (a) | holds a majority of the voting rights in the Undertaking; or |

| (b) | is a member of the Undertaking and has the right to appoint or remove a majority of its board of directors (or analogous body, including a management board and supervisory council); or |

| (c) | has the right to exercise a dominant influence over the Undertaking, by virtue of provisions contained in its constitutional documents or elsewhere; or |

| (d) | is a member of the Undertaking and controls alone, pursuant to an agreement with the other shareholders or members, a majority of the voting rights in the Undertaking, |

and an Undertaking shall be treated as the Parent Undertaking of any Undertaking in relation to which any of its Subsidiary Undertakings is, or is to be treated as, Parent Undertaking, and “Subsidiary Undertaking” shall be construed accordingly;

16

“Party” means a party to this Agreement, and “Parties” shall mean the parties to this Agreement;

“Pension Benefits” means any pension, lump sum or other benefit payable on, in anticipation of, or following retirement, death, reaching a particular age, illness or disability, or in similar circumstances;

“Portal” has the meaning given in Clause 6.3 (Pre-Completion Arrangements);

“Potential Opportunity” means the amount determined in accordance with paragraph 1.4 (Earn Out 1 – Facebook / Google Contract) of Schedule 6 (Earn Outs);

“Pre-Completion Conditions” has the meaning given in Clause 4.1 (Pre-Completion Conditions);

“Pre-Completion IPO Sale Shares” has the meaning given in Clause 13.2;

“Put Option Trigger Event” has the meaning given in paragraph 1.1 of Schedule 7 (A15 Put Option);

“Qualifying IPO” means an initial public offering of ordinary shares in the share capital of Aleph Cayman on a Recognized Investment Exchange, provided that the Qualifying IPO Multiple is greater than 8.5;

“Qualifying IPO Multiple” has the meaning given in Schedule 7 (A15 Put Option);

“Recognized Investment Exchange” means an investment exchange that is recognized under the Financial Services and Markets Xxx 0000;

“Regulatory Pre-Completion Conditions” means the Pre-Completion Conditions set out in paragraphs 1 to 2 of Part 2 (Regulatory Pre-Completion Conditions) of Schedule 4 (Pre-Completion Conditions);

“Released Amount” has the meaning given in Clause 3.4 (Deferred Consideration);

“Relevant Party’s Group” means:

| (a) | in respect of A15, any other member of the A15 Group; |

| (b) | in respect of Httpool, any other member of the Httpool Group; and |

| (c) | in respect of Aleph Cayman or IMS, any other member of the IMS Group; |

“Relevant Territory” means Egypt, Morocco, Tunisia, Algeria, Lebanon, Jordan, UAE, Saudi Arabia, Kuwait, Qatar, Bahrain, Oman, Pakistan, Turkey and Italy;

“Relief” includes any loss, relief, allowance, credit, exemption or set off for Tax or any deduction in computing income, profits or gains for the purposes of Tax and any right to a repayment of Tax or to a payment in respect of Tax;

“Restatement Date” means 29 September 2021;

“Restricted Transaction” means each and any of the following:

| (a) | any investment in the Connect Ads Group; |

| (b) | the disposal (whether by way of sale, offer, transfer or otherwise) of all or any part of, or any interest in, the issued share capital of Connect Ads or any other member of the Connect Ads Group; |

17

| (c) | the disposal (whether by way of sale, offer, transfer or otherwise) of all, or any part of, the business, assets or undertaking of the Connect Ads Group; or |

| (d) | any other disposal, merger, business combination or similar transaction involving Connect Ads or any member of the Connect Ads Group; |

“Rules” has the meaning given in Clause 33.3 (Governing Law and Submission to Jurisdiction);

“Sale Shares” means shares in the share capital of Connect Ads together representing fifty-one per cent. (51%) of the entire issued share capital of Connect Ads on a Fully-Diluted Basis at Completion;

“Sale Shares Consideration” has the meaning given in Clause 3.1(a) (Sale Shares Consideration);

“Saudi Competition Filing” means the regulatory filing referred to in paragraph 1 of Part 2 (Regulatory Pre-Completion Conditions) of Schedule 4 (Pre-Completion Conditions);

“Saudi Competition Law” means Royal Decree no. M/75 dated 29/06/1440H (corresponding to 06/03/2019G) and the Implementing Regulations which entered into force on 25/01/1441H (corresponding to 24/09/2019G);

“Second Long Stop Date” means the date falling one hundred and thirty (130) days after the Restatement Date, or such other date as Parties agree in writing;

“Service Request” has the meaning given in Clause 6.3 (Pre-Completion Arrangements);

“Signature Date” means the July 5, 2021;

“Sony” means Sony Pictures Television Advertising Sales Company, a corporation organized and existing under the laws of Delaware, whose offices are at 00000 Xxxx Xxxxxxxxxx Xxxx, Xxxxxx Xxxx, Xxxxxxxxxx, 00000;

“Specified Customers and Agencies” means each of the Connect Ads Italy customers and/or umbrella agencies listed in Schedule 19 (Specified Customers and Agencies);

“Swap Shares” means shares in the share capital of Connect Ads, together representing thirty-five per cent. (35%) of the entire issued share capital of Connect Ads on a Fully-Diluted Basis at Completion;

“Swap Shares Consideration” has the meaning given in Clause 3.2 (Swap Shares Consideration);

“Tax” or “Taxation” means and includes all forms of taxation and statutory and governmental, state, provincial, local governmental or municipal charges, duties, contributions and levies, withholdings and deductions, in each case wherever and whenever imposed and all related penalties, charges, costs and interest;

“Taxation Authority” means any Governmental Authority or other authority competent to impose, administer, levy, assess or collect Tax whether in the Cayman Islands, the Netherlands, the UAE, the United Kingdom, the United States, or elsewhere where any Connect Ads Group Company or IMS Group Company transacts business;

“Tax Returns” means any report, return, declaration, certificate, statement, or other document required to be supplied to a Governmental Authority in connection with Taxes;

“Third Long Stop Date” means the date falling fifteen (15) UAE Business Days after the date on which all Non-Regulatory Pre-Completion Conditions and Regulatory Pre-Completion Conditions have been satisfied or waived, or such other date as Parties agree in writing;

18

“Third Party Claim” has the meaning given in paragraph 10 (Conduct of Claims) of Schedule 11 (A15 Limitations of Liability);

“Third Party” means any person other than a member of the Aleph Group or the IMS Group or any of their respective Agents;

“Third Party Negotiations” means any discussions or negotiations relating to or otherwise concerning a Restricted Transaction, between a Third Party and any of A15, Connect Ads or another member of the Connect Ads Group (or any of their respective Agents);

“Transaction Documents” means this Agreement, the A15 Disclosure Letter, the A15 Supplemental Disclosure Letter, the IMS Disclosure Letter, the IMS Supplemental Disclosure Letter, the Escrow Agreement and any other document or instrument entered into or to be entered into pursuant to this Agreement;

“Transactions” means individually and collectively the (a) sale and purchase of the Sale Shares; and (b) the sale and purchase of the Swap Shares;

“Turkish Competition Filing” means the regulatory filing referred to in paragraph 2 of Part 2 (Regulatory Pre-Completion Conditions) of Schedule 4 (Pre-Completion Conditions);

“Turkish Merger Approval Communiqué” means Communiqué No. 2010/4 on Mergers and Acquisitions Subject to the Approval of the Competition Board issued by the Turkish Competition Board;

“Twitter Agreements” means the agreements between the relevant Connect Ads Group Companies and Twitter in Egypt, Saudi Arabia, Turkey and the UAE;

“Twitter Condition” means the Pre-Completion Condition referred to in paragraph 8 of Part 1 (Non-Regulatory Pre-Completion Conditions) of Schedule 4 (Pre-Completion Conditions);

“UAE” mean the United Arab Emirates;

“UAE Business Day” means a day (other than a Friday or Saturday or a public holiday) when commercial banks are open for ordinary banking business in Dubai (UAE);

“Undertaking” means a body corporate or partnership or an unincorporated association carrying on trade or business;

“UniCredit Consent and Waiver” means the written waiver and consent from UniCredit Bank Slovenia pursuant to which UniCredit Bank Slovenia irrevocably: (a) consents to the Transaction; and (b) waives its rights to terminate the UniCredit Framework Loan Agreement;

“UniCredit Framework Loan Agreement” means the framework loan agreement between Httpool Internet Marketing d.o.o. (Slovenia) and UniCredit Bank Slovenia, dated May 29, 2015;

“US Dollars” or “US$” means the lawful currency of the United States of America, being the United States Dollar; and

“US GAAP” means United States Generally Accepted Accounting Standards.

| 1.2 | The expression “in the agreed terms” means in the form agreed by the Parties and initialed for the purposes of identification by or on behalf of the Parties. |

| 1.3 | Any reference to “writing” or “written” means any method of reproducing words in a legible and non-transitory form. |

| 1.4 | References to “include” or “including” are to be construed without limitation. |

19

| 1.5 | References to a “company” include any company, corporation or other body corporate wherever and however incorporated or established. |

| 1.6 | References to a “person” include any individual, company, partnership, joint venture, firm, association, trust, governmental or regulatory authority or other body or entity (whether or not having separate legal personality). |

| 1.7 | The table of contents and headings are inserted for convenience only and do not affect the construction of this Agreement. |

| 1.8 | Unless the context otherwise requires, words in the singular include the plural and vice versa and a reference to any gender includes all other genders. |

| 1.9 | References to Clauses, paragraphs and Schedules are to clauses and paragraphs of, and schedules to, this Agreement. The Schedules form an integral part of this Agreement. |

| 1.10 | References to any statute or statutory provision include a reference to that statute or statutory provision as amended, consolidated or replaced from time to time (whether before or after the Signature Date) and include any subordinate legislation made under the relevant statute or statutory provision except to the extent that any amendment, consolidation or replacement arising after the Signature Date would create or increase a liability of any Party. |

| 1.11 | References to any English legal term for any action, remedy, method of financial proceedings, legal document, legal status, court, official or any legal concept or thing shall, in respect of any jurisdiction other than England, be deemed to include what most nearly approximates in that jurisdiction to the English legal term. |

| 1.12 | References to “substantiated” in the context of a Claim means a Claim for which A15, Aleph Cayman or IMS (as applicable) may be liable and which is admitted or proved before an arbitral tribunal constituted pursuant to Clause 33 (Governing Law and Submission to Jurisdiction). |

| 1.13 | Any reference to currency in this Agreement shall be to US$, and all payments required in accordance with this Agreement shall be made in US$. For the purposes of applying a reference to a monetary sum expressed in US$, an amount in a different currency shall be converted into US$ on a particular date at an exchange rate equal to the mid-point closing rate for that currency into US$ on that date as quoted in the London edition of the Financial Times first next published (or, if no such rate is quoted in the Financial Times, the mid-point closing rate quoted by HSBC Bank PLC in London). In relation to a Claim, the date of such conversion shall be the date of receipt of notice of that Claim in accordance with Schedule 11 (A15 Limitations of Liability) or Schedule 15 (IMS and Aleph Cayman Limitations of Liability) (as applicable). |

| 1.14 | This Agreement shall be binding on and be for the benefit of the successors of the Parties. |

| 2. | Sale and Purchase of the Sale Shares and the Swap Shares |

| 2.1 | A15 shall sell, and Httpool shall purchase, the Sale Shares, with all rights attaching to them at Completion (including, without limitation, and subject to Clause 3.3, the right to receive all dividends and distributions declared, made or paid on or after Completion), and A15 shall transfer legal and beneficial title to the Sale Shares to Httpool free from all Encumbrances, on the terms of this Agreement. |

| 2.2 | A15 shall sell, and Aleph Cayman shall purchase, the Swap Shares, with all rights attaching to them at Completion (including, without limitation, and subject to Clause 3.3, the right to receive all dividends and distributions declared, made or paid on or after Completion), and A15 shall transfer legal and beneficial title to the Swap Shares to Aleph Cayman free from all Encumbrances, on the terms of this Agreement. |

20