AMENDED AND RESTATED FIRST BANK OF GEORGIA SUPPLEMENTAL EXECUTIVE RETIREMENT PLAN PLAN DOCUMENT FOR KEY OFFICERS

Exhibit 10.6

|

AMENDED AND RESTATED FIRST BANK OF GEORGIA SUPPLEMENTAL EXECUTIVE RETIREMENT PLAN

PLAN DOCUMENT FOR KEY OFFICERS

|

(A Non-Qualified Supplemental Income Plan)

As of June 24, 2014

This Agreement is executed this 24th day of June, 2014 by First Bank of Georgia (hereinafter sometimes referred as the “Company” or “Employer”), a bank duly organized under the laws of the state of Georgia, amending, restating and replacing, in its entirety, that certain agreement, dated as of October 22, 2007, by and between the Company and Xxxxx X. Xxxxxxx, III, and evidencing and sometimes referred to as the “First Bank of Georgia Supplemental Executive Retirement Plan” or the “Plan.”

Employer desired to retain the valuable services of its key management team and other highly compensated employees by providing attractive and competitive supplemental retirement income, death and other benefit programs to such employees that retain the services of these key executives; and

Employer recognized that it was in the best interest of both Employer and these select employees to provide attractive employer-sponsored programs to assure that these employees have sufficient retirement income for themselves and survivor income for their families and other dependents; and

Tax qualified retirement plans, with limitations on benefits and employer contributions under the current Internal Revenue Code, may be inadequate or inappropriate, and an employer-sponsored supplemental income plan can help provide these select employees with the appropriate levels of income continuation in the specific desired circumstances; and

The Employer agreed that such a non-qualified benefit plan would serve the Employer’s best business interests to retain the services of those certain key executives and managers, and the Employer was willing to provide such a Plan for such purposes to this select group of key executives in return for their current and future services and wishes to provide the terms and conditions for such Plan; and

The Employer therefore adopted this First Bank of Georgia Supplemental Executive Retirement Plan for the benefit of a certain key executive; and

The Employer now intends to enter into a transaction pursuant to which Employer’s parent, Georgia-Carolina Bancshares, Inc., will merge with and into State Bank Financial Corporation (“Buyer”), with Buyer as the surviving entity, at which time Employer will become a wholly-owned subsidiary of Buyer (collectively the “Transaction”); and

In connection with the Transaction, the Employer and the key executive now desire to amend and restate the Plan to confirm the amount of the key executive’s Normal Retirement Benefit (as defined in the Plan) as the result of the Transaction and to make certain other changes to address Section 409A of the Code (as defined in the Plan); and

The parties intend and agree that the amendment and restatement of the Plan will be contingent upon the closing of the Transaction except that the change to eliminate the alternative payment schedule upon the key executive’s voluntary resignation without good reason shall be effective immediately and not contingent upon the closing of the Transaction.

Now, THEREFORE, the Plan is hereby amended and restated in its entirety as follows:

|

1.1 |

The name of this Plan is the “First Bank of Georgia Supplemental Executive Retirement Plan”.

|

1.2 |

The effective date of the Plan, as amended, restated and replaced by this Agreement, is June __, 2014, contingent upon the closing of the Transaction (other than the change to eliminate the alternative payment schedule upon the Participant’s voluntary resignation without good reason which shall be effective as of the date hereof and not contingent upon the closing of the Transaction).

|

1.3 |

The purpose of the Plan is to offer Eligible Employees of each Employer certain supplemental benefits for retirement income and other income continuation needs for themselves and their families and other dependents, and to provide each Employer, if appropriate, a vehicle to address limitations on total benefits payable under any tax-qualified defined benefit plan, and to do so in such as manner as to retain the services these key executives to Employer for significant periods in order to claim these supplemental benefits.

This Plan is intended to be a non-qualified “Top-Hat” plan under applicable Code sections. That is, the Plan is an unfunded plan of deferred compensation maintained for a select group of management or highly compensated employees pursuant to sections 201(2), 301(a)(3), and 401 (a)(1) of ERISA, and an unfunded plan of deferred compensation under the Internal Revenue Code.

|

1.4 |

Wherever appropriate, pronouns of any gender shall be deemed synonymous, as shall singular and plural pronouns. Headings of Articles and Sections are for convenience of reference only, and are not to be considered in the construction or interpretation of the Plan. The Plan shall be interpreted and administered so as to give effect to its purpose as expressed in Section 1.3 and to qualify as a non-qualified, unfunded plan of deferred compensation in compliance with the requirements of Code section 409A, and the regulations thereto as amended from time to time.

ARTICLE II - DEFINITIONS & TERMS

Certain words and phrases are defined when first used in later paragraphs of this Agreement. Unless the context clearly indicates otherwise, the following words, when used in this Agreement, shall have the following respective meanings:

|

2.1.1 |

“Actuarial Equivalent” means having an equal value on an actuarial basis determined by applying the reasonable actuarial factors and assumptions used consistently with respect to the Plan.

|

2.1.2 |

“Affiliate” shall mean any corporation, partnership, joint venture, association, or similar organization or entity, the employees of which would be treated as employed by the Company under Section 414(b) and 414(c) of the Code. It also means any organization that is a member of an affiliated service group with the Company within the meaning of Section 414(m) of the Code and any other organization required to be aggregated with the Company under Section 414(o) of the Code. No entity shall be treated as an Affiliate for any period that it is not a part of a controlled group, under common control, part of an affiliated service group or is otherwise required to be aggregated under Section 414 of the Code.

|

2.1.3 |

“Agreement” shall mean this agreement, evidencing the Plan, together with any and all amendments or restatements thereof.

|

2.1.4 |

“Board Committee” shall mean the Compensation Committee of the Board of Directors, or such other Committee of the Board as may be delegated with the duty of determining employee eligibility under the Plan. If such Compensation Committee or other Committee has not been delegated such duty, the Board of Directors shall constitute the Board Committee.

|

2.1.5 |

“Board of Directors” shall mean the Board of Directors of the Company.

|

2.1.6 |

“Cause” (as determined by the Board of Directors) shall mean:

|

A. |

the gross negligence or willful misconduct by the Participant which is materially damaging to the business of the Company or any Employer or Affiliate; |

|

B. |

the conviction of the Participant of any crime involving breach of trust or moral turpitude; |

|

C. |

a consistent pattern of failure by the Participant to follow the reasonable written instructions or policies of the Participant's supervisor or the Board of Directors of the Company or any Employer or Affiliate; or |

|

D. |

receipt by the Company or any Employer or Affiliate of any written notice from the Georgia Department of Banking and Finance, the Federal Deposit Insurance Corporation or the Board of Governors of the Federal Reserve System requiring the removal of the Participant as an employee or other service provider. |

|

2.1.7 |

“Code” means the Internal Revenue Code of 1986 and regulations thereto, as amended.

|

2.1.8 |

“Committee” shall mean the person or persons described in Article VII who are charged with the day-to-day administration, interpretation and operation of the Plan.

|

2.1.9 |

“Disability” shall mean the definition in Code section 409A, as detailed in the regulations thereto, as they amended from time to time, and that currently provides that a Participant is disabled if he/she is: 1.) unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, or 2.) receiving income replacement benefits for a period of not less than three months under an accident and health policy covering employees of the Corporation, by reason of a medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months. Such determination shall be made by the opinion of a physician selected by the Employer, and may be further evidenced by the Participant’s receipt of benefits under the Employer’s long-term disability welfare benefit plan, any supplemental individual disability policy bought or purchased through or in connection with the Employer, or by the receipt of Social Security disability benefits if the Employer has no long-term disability plan, or the Participant is not covered by the Employer’s long-term disability plan.

|

2.1.10 |

“Effective Date” shall mean the effective date of the amendment and restatement of this Plan as defined in Section 1.2.

|

2.1.11 |

“Eligible Employee” shall mean only Xxxxx X. Xxxxxxx, III.

|

2.1.12 |

[RESERVED] |

|

2.1.13 |

“Employer” shall mean the Company and its Affiliates and their successors or assigns.

|

2.1.14 |

“ERISA” shall mean the Employee Retirement Income Security Act of 1974, as amended.

|

2.1.15 |

"Good Reason" shall mean any of the following, provided that Participant terminates his employment for Good Reason within ninety (90) days thereof, provides at least thirty (30) days advance written notice to the Company explaining the basis for "Good Reason", and the Company or the applicable Employer or Affiliate has not remedied such Good Reason within thirty (30) days following such notice:

|

A. |

a material reduction in the Participant's rate of regular compensation from the Company, Employers and Affiliates; |

|

B. |

a requirement that the Participant relocate to a county other than Columbia, XxXxxxxx or Richmond County; or |

|

C. |

a material reduction in the Participant's duties, title, and/or responsibilities, other than any change resulting from a change in the publicly-traded status of the Company, any Employer or any Affiliate. |

|

2.1.16 |

“Leave of Absence” shall mean a temporary period of time, not to exceed twelve (12) consecutive calendar months during which time a Participant shall not be an active employee of an Employer, but shall be treated for purposes of this Plan as in continuous employment with the Employer, including for purposes of vesting. A Leave of Absence may be either paid or unpaid, but must be agreed to in writing by both the Employer and the Participant. A Leave Of Absence that continues beyond the twelve (12) consecutive months shall be treated as a voluntary Termination of Employment, subject to Section 4.3, as of the first business day of the thirteenth month for purposes of the Plan.

|

2.1.17 |

“Named Beneficiary” or "Designated Beneficiary" or "Beneficiary" shall mean any person or trust, or combination, as last designated by the Participant during his/her lifetime upon a “Beneficiary Designation Form”, provided by the Employer and filed with the Committee, who is specifically named to be a direct or contingent recipient of all or a portion of a Participant's benefits under the Plan in the event of the Participant's death. Such designation shall be revocable by the Participant at any time during his/her lifetime without the consent of any Beneficiary, whether living or born hereafter. Unless expressly provided by law, the Named Beneficiary may not be designated or revoked and changed by the Participant in any other way. No beneficiary designation or beneficiary change shall be effective until received in writing and acknowledged according to established Employer procedures and practices. Should the Participant fail to designate the Named Beneficiary, the Named Beneficiary shall be the Participant’s estate.

|

2.1.18 |

“Participant” shall mean only the Eligible Employee. Solely and exclusively for purposes of payment of survivor death benefits, if any, the term “Participant” shall also include a surviving Beneficiary.

|

2.1.19 |

“Plan” shall mean the “First Bank of Georgia Supplemental Executive Retirement Plan” as set forth herein and amended and restated.

|

2.1.20 |

“Plan Distribution” shall mean any distributions made from the Plan pursuant to applicable Plan provisions.

|

2.1.21 |

“Plan Year” shall mean the twelve (12) consecutive month period constituting a calendar year, beginning on January 1 and ending on December 31. However, in any partial year of the Plan that does not begin on January 1, “Plan Year” shall also mean the remaining partial year ending on December 31.

|

2.1.22 |

"Retirement Age" shall mean the Participant's attainment of age 65.

|

2.1.23 |

"Termination of Employment" shall mean a Participant's separation from service with the Employer and all Affiliates within the meaning of Code section 409A.

|

2.1.24 |

“Trust” shall mean one or more grantor trusts (so-called “Rabbi Trusts”), if any, established pursuant to Sections 671 et. seq. of the Code, and maintained by the Employer for its own administrative convenience in connection with the operation of the Plan and the management of any of its general assets set aside to help cover its financial obligations under the Plan. Such Trusts, if any, shall be governed by a separate agreement between the Employer and the Trustee. Any such assets held in such a Trust shall remain subject to the claims of the Employer's general creditors. The Employer shall not be required to establish such a Trust, and may continue or discontinue such a Trust, if created, only subject to those limitations of termination and amendment as may be contained in the Trust agreement.

|

2.1.25 |

“Trustee” shall mean the party or parties named under any Trust agreement (and such successor and/or additional trustees) who shall possess such authority and discretion to hold, manage and control such Employer assets in connection with the Plan as provided under the agreement between the Trust and the Employer.

ARTICLE III - ELIGIBILITY & PARTICIPATION

|

3.1 |

|

A. |

General Eligibility - The Eligible Employee is the only Participant. The Plan Participant shall remain eligible in accordance with the terms of the Plan. |

|

B. |

No Employee Contributions Required - No Participant contribution shall be required to become a Participant in the Plan or accrue benefits under the Plan, nor shall any such contribution be permitted. All Plan costs, including administration, and federal, state and local employment taxes, shall be borne exclusively by the Employer. However, a Participant shall bear all federal, state and local (or other) personal income taxes on his/her plan benefits. |

ARTICLE IV - PARTICIPANT BENEFITS

|

4.1 |

|

A. |

Except as set forth below, upon achieving Retirement Age while still employed with the Employer, the Participant shall be paid an annual benefit for life in the amount of One Hundred Twenty-Eight Thousand Dollars ($128,000) per year (with a minimum payout of at least fifteen (15) years) (the “Normal Retirement Benefit”). Such annual benefit shall be paid annually for and during the life of the Participant (subject to section 4.2.A below). |

|

B. |

The Employer shall commence payment of such annual benefits on the first payment date as outlined in Article VI. |

|

C. |

The payment of this benefit shall be in lieu of and replacement of all other benefits promised under the Plan and shall be in full satisfaction of any and all benefits promised under the Plan. |

|

4.2 |

|

A. |

Death Following Retirement Age. In the event of the Participant’s death after Normal Retirement Benefit payments have commenced (as identified in section 4.1), the Participant’s Named Beneficiary shall continue to receive the annual benefit identified in section 4.1.A for a period of fifteen (15) years, inclusive of all payments made prior to the death of the Participant. For example, if Participant received three (3) applicable annual payments under this Plan prior to Participant’s death, then the number of annual death benefit payments after the Participant’s death would be twelve (12). |

|

B. |

Death Prior to Retirement Age. In the event of the Participant’s death, whether or not employed with the Employer and prior to the date Normal Retirement Benefit or Disability payments commence, the Participant’s Named Beneficiary shall receive the Actuarial Equivalent of the Normal Retirement Benefit identified in section 4.1.A (but only to the extent vested as of the Participant’s Termination of Employment including any vesting that may occur in connection with the Termination of Employment) for a period of ten (10) years. Such Normal Retirement Benefit shall be paid to Participant’s Named Beneficiary as set forth in section 6.3.B.2 below. The payment of this benefit shall be in lieu of and replacement of all other benefits promised under the Plan and shall be in full satisfaction of the any and all benefits promised under the Plan. |

|

C. |

No Other Death Benefit. There is no other death benefit payable under the Plan. |

|

4.3 |

In the event the Participant prior to Retirement Age incurs a Termination of Employment (other than on account of the Participant’s death or Disability), the Participant shall be paid the Participant’s Normal Retirement Benefit (but only to the extent vested as of the Participant’s Termination of Employment including any vesting that may occur in connection with the Termination of Employment). This benefit shall commence at the specified Retirement Age and continue for the life of the Participant (subject to section 4.2.A and 4.2.B above). The payment of this benefit shall be in lieu of and in replacement of all other benefits promised under this Plan and shall be in full satisfaction of any and all benefits promised under this Plan.

|

4.4 |

The Plan may not be terminated prior to payment in full of the Participant’s benefit as described herein.

|

4.5 |

In the case of Disability, as established by the definition of Disability contained in the Plan and required by Code section 409A, while employed with the Employer and prior to the Participant's Retirement Age, Employer shall pay the Participant the Actuarial Equivalent of the Participant’s Normal Retirement Benefit. This Disability Benefit shall be paid in five (5) equal annual installments. The payment of this Disability Benefit shall be in lieu of and in replacement of all other benefits promised under this Plan and shall be in full satisfaction of the any and all benefits promised under this Plan.

|

4.6 |

In the event the Participant’s Named Beneficiary or the Participant is to commence receipt of payment of the Participant’s applicable benefits under the Plan prior to the Participant’s Retirement Age upon the Participant’s (i) death prior to Retirement Age under section 4.2.B or (ii) Disability prior to Retirement Age under section 4.5, the Participant’s applicable benefit payable at such time shall be the Actuarial Equivalent of the Participant’s Normal Retirement Benefit.

|

5.1 |

The Participant’s Normal Retirement Benefit under this Plan shall be eighty percent (80%) vested as of the Effective Date (or such higher percentage as of the Effective Date as will not entitle the Participant to the Gross-Up Payment described in section 6.6 below in connection with the Transaction).

|

5.2 |

The remaining unvested portion of the Participant’s Normal Retirement Benefit shall become vested, subject to the Participant’s continued employment with the Employer, in such increments as are required to be accrued on the books of the Company at any applicable specified time, using the accrual methodology consistently applied prior to the date hereof, through the Participant’s Termination of Employment or, if earlier, the date the Participant attains Retirement Age while employed with the Employer. Notwithstanding the foregoing, the Participant’s Normal Retirement Benefit will be fully vested if (i) the Participant, prior to Retirement Age, incurs an involuntary Termination of Employment for reasons other than “Cause” or a voluntary Termination of Employment for Good Reason or (ii) the Participant, while employed with the Employer, attains Retirement Age or dies or incurs a Disability.

|

6.1 |

The Participant’s Plan Distributions shall be distributed only in accordance with the provisions of this Plan. No other distributions of a Participant's Plan Distributions, except those permitted by Code section 409A, shall be allowed from the Plan under any circumstances.

|

6.2 |

All Plan Distributions shall be made in cash, in U.S. currency.

|

6.3 |

|

A. |

Normal Retirement Benefit - Upon the first day of the month following or coincident with the Participant’s Retirement Age, the Employer shall commence payment to Participant of the Normal Retirement Benefit identified in section 4.1. Such benefit shall continue to be paid annually on the same date of each year thereafter (the “Annual Payment Date”) for the life of the Participant (subject to section 4.2.A. above). |

|

B. |

|

1. |

In the event the Participant dies following the commencement of his Normal Retirement Benefits, Employer shall pay the Participant’s Named Beneficiary the Death Benefit identified in section 4.2.A on the Annual Payment Date of the applicable following years. |

|

2. |

In the event the Participant dies prior to the commencement of Normal Retirement Benefits or Disability benefits, whether or not employed with the Employer, Employer shall pay the Participant’s Named Beneficiary the Normal Retirement Benefit identified in section 4.2.B beginning on the first day of the month following the Participant’s date of death, and continuing on the same date of each applicable year thereafter. |

|

C. |

In the event the Participant incurs a Termination of Employment prior to Retirement Age, Employer shall pay the Participant the benefit identified in section 4.3. This benefit shall commence upon the first day of the month following or coincident with the Participant reaching Retirement Age (subject to section 6.3.B.2). Each subsequent annual payment shall be paid on the same date of each applicable year thereafter.

|

D. |

In the event the Participant becomes Disabled prior to the Participant's Retirement Age, while employed with the Employer, Employer shall pay the Participant the benefit identified in section 4.5. Such payment shall begin not later than sixty (60) days from the date of Disability, and as soon as administratively practicable. Subsequent payments shall be made on the same date of the applicable following years.

|

6.4 |

Acceleration or deferral of the time or schedule of any payment under the Plan is not permitted except as may be permitted by Code Section 409A.

|

6.5 |

The Employer shall make all benefit payments to the Participant or the Participant’s Named Beneficiary directly, unless the Employer may determine to create a Trust for its own administrative convenience. In such case, the Employer may direct the Trustee to make such payments directly to the Participant or Named Beneficiary. The payment of any benefits from any Trust by a Trustee shall not be a representation to a Participant of any actual or implied beneficial interest in any assets in such Trust. A Participant or Named Beneficiary, or any other person claiming or receiving such distribution payment remains a general unsecured creditor of the Employer as to such benefit payments.

|

6.6 |

|

A. |

Application of Code Section 4999. - Notwithstanding anything in this Agreement to the contrary, if it shall be determined that any payment or distribution to the Participant or for the Participant’s benefit (whether paid or payable or distributed or distributable) pursuant to the terms of this Agreement or otherwise pursuant to or by reason of any other agreement, policy, plan, program or arrangement, including without limitation any stock option, stock appreciation right or similar right, or the lapse or termination of any restriction on or the vesting or exercisability of any of the foregoing (the “Payments”) would be subject to the excise tax imposed by Code section 4999 by reason of being “contingent on a change in the ownership or control” of the Company, within the meaning of Code section 280G or to any similar tax imposed by state or local law, or any interest or penalties with respect to such excise tax (such tax or taxes, together with any such interest or penalties, are collectively referred to as the “Excise Tax”), then the Participant shall be entitled to receive from the Employer an additional payment (the “Gross-Up Payment”) in an amount such that the net amount of the Payments and the Gross-Up Payment retained by the Participant after the calculation and deduction of all Excise Taxes (including any interest or penalties imposed with respect to such taxes) on the Payment and all federal, state and local income tax, employment tax and Excise Tax (including any interest or penalties imposed with respect to such taxes) on the Gross-Up Payment provided for in this Section 6.6, and taking into account any lost or reduced tax deductions on account of the Gross-Up Payment, shall be equal to the Payments; provided, however, no portion of the Payments, the receipt or enjoyment of which the Participant shall have effectively waived in writing prior to the date of payment of the Payments shall be taken into account for purposes of the limitation set forth in Code section 280G. |

|

B. |

Reliance on Accountants. - All determinations required to be made under this Section 6.6, including whether and when the Gross-Up Payment is required and the amount of such Gross-Up Payment, and the assumptions to be utilized in arriving at such determinations shall be made by the Accountants (as defined below) which shall provide the Participant and the Employer with detailed supporting calculations with respect to such Gross-Up Payment within fifteen (15) business days of the receipt of notice from the Participant or the Employer that the Participant has received or will receive a Payment. For purposes of making the determinations and calculations required herein, the Accountants may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations concerning the application of Code sections 280G and 4999, provided that the Accountant’s determinations must be made on the basis of “substantial authority” (within the meaning of Code section 6662). For the purposes of this Section 6.6, the “Accountants” shall mean the Employer’s independent certified public accountants serving immediately prior to the Change in Control. In the event that the Accountants are also serving as accountant or auditor for the individual, entity, or group effecting the Change in Control, the Participant shall appoint another nationally recognized public accounting firm to make the determinations required hereunder (which accounting form shall then be referred to as the Accountants hereunder). All fees and expenses of the Accountants shall be borne solely by the Employer. |

|

C. |

Payments Treated as Parachute Payments. - For the purposes of determining whether any of the Payments will be subject to the Excise Tax and the amount of such Excise Tax, such Payments will be treated as “parachute payments” within the meaning of Code section 280G, and all “parachute payments” in excess of the “base amount” (as defined under Code section 280G(b)(3)) shall be treated as subject to the Excise Tax, unless and except to the extent that in the opinion of the Accountants such Payments (in whole or in part) either do not constitute “parachute payments” or represent reasonable compensation for services actually rendered (within the meaning of Code section 280G(b)(4)) in excess of the “base amount,” or such “parachute payments” are otherwise not subject to such Excise Tax. For purposes of determining the amount of the Gross-Up Payment, the Participant shall be deemed to pay federal income taxes at the highest applicable marginal rate of federal income taxation for the calendar year in which the Gross-Up Payment is to be made and to pay any applicable state and local income taxes at the highest applicable marginal rate of taxation for the calendar year in which the Gross-Up Payment is to be made, net of the maximum reduction in federal income taxes which could be obtained from the deduction of such state or local taxes if paid in such year (determined without regard to limitations on deductions based upon the amount of the Participant’s adjusted gross income), and to have otherwise allowable deductions for federal, state and local income tax purposes at least equal to those disallowed because of the inclusion of the Gross-Up Payment in the Participant’s adjusted gross income. To the extent practicable, any Gross-Up Payment with respect to any Payment shall be paid by the Employer at the time the Participant is entitled to receive the Payment and in no event will any Gross-Up Payment be paid later than five (5) days after the receipt by the Participant of the Accountant’s determination. Any determination by the Accountants shall be binding upon the Employer and the Participant. |

|

D. |

Underpayment. - As a result of uncertainty in the application of Code section 4999 at the time of the initial determination by the Accountants hereunder, it is possible that the Gross-Up Payment made will have been an amount less than the Employer should have paid pursuant to this Section 6.6 (the “Underpayment”). In the even that the Employer exhausts its remedies pursuant to Section 6.6 and the Participant is required to make a payment of any Excise Tax, the Underpayment shall be promptly paid by the Employer to or for the Participant’s benefit. |

|

E. |

Cooperation and Access. - The Participants and the Employer shall each provide the Accountants access to and copies of any books, records and documents in the possession of the Employer or the Participant, as the case may be, reasonably requested by the Accountants, and otherwise cooperate with the Accountants in connection with the preparation and issuance of the determination contemplated by this Section 6.6. |

|

F. |

Notice and Contest of Any Claim. - The Participant shall notify the Employer in writing of any claim by the Internal Revenue Service that, if successful, would require the payment by the Employer of the Gross-Up Payment. Such notification shall be given as soon as practicable after the Participant is informed in writing of such claim and shall apprise the Employer of the nature of such claim and the date on which such claim is requested to be paid. The Participant shall not pay such claim prior to the expiration of the 30-day period following the date on which the Participant gives such notice to the Employer (or such shorter period ending on the date that any payment of taxes, interest and/or penalties with respect to such claim is due). |

|

1. |

If the Employer notifies the Participant in writing prior to the expiration of such period that it desires to contest such claim, the Participant shall (i) give the Employer any information reasonably requested by the Employer relating to such claim; (ii) take such action in connection with contesting such claim as the Employer shall reasonably request in writing from time to time, including, without limitation, accepting legal representation with respect to such claim by an attorney reasonably selected by the Employer; (iii) cooperate with the Employer in good faith in order to effectively contest such claim; and (iv) permit the Employer to participate in any proceedings relating to such claims; provided, however, that the Employer shall bear and pay directly all costs and expenses (including additional interest and penalties) incurred in connection with such contest and shall indemnify the Participant for and hold the Participant harmless from, on an after-tax basis, any Excise Tax or income tax (including interest and penalties with respect thereto) imposed as a result of such representation and payment of all related costs and expenses. |

|

2. |

Without limiting the foregoing provisions of this Section 6.6, the Employer shall control all proceedings taken in connection with such contest and, at its sole option, may pursue or forgo any and all administrative appeals, proceedings, hearings, and conferences with the taxing authority in respect of such claim and may, at its sole option, either direct the Participant to pay the tax claimed and xxx for a refund or contest the claim in any permissible manner, and the Participant agrees to prosecute such contest to a determination before any administrative tribunal, in a court of initial jurisdiction and in one or more appellate courts, as the Employer shall determine; provided, however, that if the Employer directs the Participant to pay such claim and xxx for a refund, the Employer shall advance the amount of such payment to the Participant, on an interest-free basis, and shall indemnify the Participant for and hold the Participant harmless from, on an after-tax basis, any Excise Tax or income tax (including interest or penalties with respect thereto) imposed with respect to such advance or with respect to any imputed income with respect to such advance (including as a result of any forgiveness by the Employer of such advance); provided, further, that any extension of the statute of limitations relating to the payment of taxes for the Participant’s taxable year with respect to which such contested amount is claimed to be due is limited solely to such contested amount. |

|

3. |

Furthermore, the Employer’s control of the contest shall be limited to issues with respect to which a Gross-Up Payment would be payable hereunder and the Participant shall be entitled to settle or contest, as the case may be, any other issue raised by the Internal Revenue Service or any other taxing authority. |

|

G. |

Timing of Payments. -The payments provided for in this Section 6.6 shall be made not later than the fifth day following the Participant’s Termination of Employment upon a Change in Control; provided, however, that if the amounts of such payments cannot be finally determined on or before such day, the Employer shall pay to the Participant on such day an estimate, as determined in good faith by the Employer, of the minimum amount of such payments and shall pay the remainder of such payments as soon as the amount thereof can be determined but in no event later than the thirteenth day after the Participant’s Termination of Employment upon a Change in Control. In the event that the amount of the estimated payments exceeds the amount subsequently determined to have been due, such excess shall constitute a loan by the Employer to the Participant, payable on the fifth day after demand by the Employer (together with interest at the rate provided in Code section 1274 (b)(2)(B). |

|

H. |

Limitation. - Notwithstanding the foregoing, the Gross-Up Payment described above shall only apply and become payable with respect to Payments that relate to the closing of the Transaction (and no other subsequent transaction) or any subsequent event that would be treated as related to the closing of the Transaction (and no other subsequent transaction) within the meaning of Code Section 280G. |

ARTICLE VII - ADMINISTRATION & CLAIMS PROCEDURE

|

7.1 |

The Company shall have overall responsibility for the establishment, amendment, termination, administration, and operation of the Plan. The Company may discharge this responsibility through members of the Committee.

|

7.2 |

The Committee shall consist of one (1) to five (5) members appointed by the Company and one of whom must be an officer of the Company and shall be designated by the Company as Chairman of the Committee. In the absence of such appointment, the Company shall serve as the Committee. The Committee shall consist of officers or other employees of Employers, or any other persons who shall serve at the request of the Company. Any member of the Committee may resign in writing, such resignation becoming effective upon the date specified therein. The members of the Committee shall serve at the will of the Company, and the Company may from time to time remove any Committee member with or without Cause and appoint their successors. In the event of a vacancy in membership, the remaining members shall constitute the Committee with full authority to act.

|

7.3 |

Committee’s Powers and Duties to Administer, Interpret and Enforce the Plan |

The Committee shall be the “Plan Administrator” and “Named Fiduciary”, but only to the extent required by ERISA for “top-hat” plans, and shall have the authority to administer and enforce the Plan on behalf of any and all persons having or claiming any interest in the Plan in accordance with its terms and purposes. The Committee, or any single individual Committee member it may designate, shall have the authority to interpret the Plan and its provisions, and shall determine any and all questions or claims arising in the administration and application of the Plan, in accordance with applicable laws. Any such interpretation by the Committee, or its authorized individual member, shall be conclusive and binding on all persons. Written interpretations or responses by the Committee, or its authorized individual member, shall only be required to the extent required by the Claims Procedure of Section 7.8 herein.

|

7.4 |

The Committee shall act by a majority of its members at the time in office. Committee action may be taken either by a vote at a meeting or by written consent without a meeting. The Committee may authorize any one or more of its members to execute any document or documents on behalf of the Committee, or to act in its behalf without additional consent as to any issue of Plan administration. The Committee shall notify the Company, in writing, of such authorization and the name or names of its member or members so designated in such cases. The Company thereafter shall accept and rely on any documents executed by or actions taken by said member of the Committee or members as representing action by the Committee until the Committee shall file with the Company a written revocation of such designation. The Committee may adopt such by-laws and regulations, as it deems desirable for the proper conduct of the Plan and to change or amend these by-laws and regulations from time to time. With the permission of the Company, the Committee may employ and appropriately compensate accountants, legal counsel, benefit specialists, actuaries and record keepers and any other persons as it deems necessary or desirable in connection with the administration and maintenance of the Plan. Such professionals and advisors shall not be considered members of the Committee for any purpose.

|

7.5 |

|

A. |

No member of the Board of Directors, the Company and no officer or employee of the Company shall be liable to any employee, Participant, Named Beneficiary or any other person for any action taken or act of omission in connection with the administration or operation of this Plan unless attributable to his or her own fraud or willful misconduct. Nor shall an Employer be liable to any employee, Participant, Named Beneficiary any other person for any such action taken or act of omission unless attributable to fraud, gross negligence or willful misconduct on the part of a director, officer or employee of the Employer. Moreover, each Participant, Named Beneficiary, and any other person claiming a right to payment under the Plan shall only be entitled to look to the applicable Employer for payment, and shall not have the right, claim or demand against any other Employer, the Committee (or any member thereof), or any director, officer or employee of an Employer. |

|

B. |

To the fullest extent permitted by the law, each Employer shall indemnify the Committee, each of its members, and the Employer’s officers and directors for expenses, costs, or liabilities arising out of the performance of duties required by the Plan or any Trust agreement, except for those expenses, costs, or liabilities arising out of a member’s fraud, willful misconduct or gross negligence. |

|

7.6 |

The Committee shall be entitled to rely upon certificates, reports, and opinions provided by an accountant, tax or pension advisors, actuary or legal counsel employed by the Employer or Committee. The Committee shall keep a record of all its proceedings and acts, and shall keep all such books of account, records, and other data as may be necessary for the proper administration of the Plan. The regularly kept records of the Committee and the Employer shall be conclusive evidence of the service of a Participant, compensation, age, marital status, status as an employee, and all other matters contained therein and relevant to this Plan. However, a Participant may request a correction in the record of his age at any time prior to his Retirement Age. Such correction shall be made if Participant furnishes a birth certificate, or other satisfactory documentary proof of age within 90 days after such correction request. The Committee, in any of its dealings with Participant(s) may conclusively rely on any written statement, representation, or documents made or provided by such Participants.

|

7.7 |

All the costs and expenses for administering and operating the Plan shall be borne by the Employers (in such proportions as reasonably determined by the Company). The Employers shall also bear the expense of any federal or state employment taxes in connection with the Plan.

|

7.8 |

|

A. |

Claim. - Benefits shall be paid in accordance with the terms of this Plan. A Participant, Named Beneficiary or any person who believes that he is being denied a benefit to which he is entitled under the Plan (“Claimant”) may file a written request for such benefit with the Company, setting forth his claim. The request must be addressed to the Committee at the Company's principal place of business. |

|

B. |

Claim Decision. - Upon the receipt of a claim, the Committee shall advise the Claimant that a reply will be forthcoming within ninety (90) days and shall, in fact, deliver such reply within such period. However, the Committee may extend the reply period for an additional ninety (90) days for reasonable Cause. Any claim not granted or denied within such time period shall be deemed to have been denied. If the claim is denied in whole or in part, the Committee shall adopt a written opinion, using language calculated to be understood by the Claimant, setting forth: |

|

1. |

The specific reason or reasons for such denial; |

|

2. |

The specific reference to pertinent provisions of this Plan on which such denial is based; |

|

3. |

A description of any additional material or information necessary for the Claimant to perfect his claim and an explanation why such material or such information is necessary; |

|

4. |

Steps to be taken if the Claimant wishes to submit the claim for review; and |

|

5. |

The time limits for requesting a review under Subsection C. and under Subsection D hereof. |

|

C. |

Request for Review - Within sixty (60) days after the receipt by the Claimant of the Committee's written opinion described above, the Claimant may request in writing that the Secretary of the Company review the determination of the Committee. Such request must be addressed to the Secretary of the Company, at its then principal place of business. The Claimant or his duly authorized representative may, but need not, review the pertinent documents and submit issues and comments in writing for consideration by the Company. If the Claimant does not request a review of the Committee’s determination by the Secretary of the Company within such sixty (60) day period, he shall be barred and estopped from challenging the Committee’s determination. |

|

D. |

Review of Decision - Within sixty (60) days after the Secretary’s receipt of a request for review, he or she will review the Committee’s determination. After considering all materials presented by the Claimant, the Secretary will render a written opinion, written in a manner calculated to be understood by the Claimant, setting forth the specific reasons for the decision and containing specific references to the pertinent provisions of this Plan on which the decision is based. If special circumstances require that the sixty (60) day time period be extended, the Secretary will so notify the Claimant and shall render the decision as soon as possible, but no later than one hundred twenty (120) days after receipt of the request for review. Any claim not granted or denied within such time period will be deemed to have been denied. |

|

7.9 |

It shall only be necessary to join the Employer as a party in any action or judicial proceeding affecting the Plan. No Participant or Named Beneficiary or any other person claiming under the Plan shall be entitled to service of process or notice of such action or proceeding except as may be expressly required by law. Any final judgment in such action or proceeding shall be binding on all Participants, Named Beneficiaries or persons claiming under the Plan.

ARTICLE VIII - AMENDMENT, TERMINATION & MERGER

|

8.1 |

The Company by action of its Board of Directors, or duly authorized Board Committee thereof, in accordance with its by-laws, reserves the right to amend the Plan, by resolution of the Company, to the extent permitted under the Code and ERISA. However, no amendment to the Plan shall be effective to the extent that it has the effect of decreasing a Participant’s or Named Beneficiary’s Normal Retirement Benefit as defined above or changing the time(s) at which such Normal Retirement Benefit will be paid.

|

8.2 |

Notwithstanding Section 8.1, the Plan may be amended at any time, if the opinion of the Employer, such amendment is necessary to ensure the Plan is treated as a non-qualified plan under the Code and ERISA, or other law applicable to a non-qualified plan. This includes the right to amend this Plan, so that any Trust, if applicable, created in conjunction with this Plan, will be treated as a grantor trust under Sections 671 through 679 of the Code, and to otherwise conform the Plan provisions and such Trust, if applicable, to the requirements of any applicable law.

|

8.3 |

An Employer shall not enter into any consolidation, merger or reorganization without the Employer obtaining from the successor-in-interest organization an agreement to an assignment and assumption of the obligations under this Plan by its successor-in-interest or surviving company or companies. Should such consolidation, merger or reorganization occur with such an assignment and assumption of the Plan’s obligation, the term “Employer” as defined and used in this Agreement shall refer to the successor-in-interest or surviving company or companies.

ARTICLE IX - GENERAL PROVISIONS

|

9.1 |

Except insofar as the law has been superseded by applicable federal law, Georgia law shall govern the construction, validity and administration of this Plan as created by this Agreement. This Plan is intended be a non-qualified unfunded plan of deferred compensation and any ambiguities in its construction shall be resolved in favor of an interpretation which will affect this intention.

|

9.2 |

|

A. |

Benefits under the Plan shall not be subject to anticipation, alienation, sale, transfer, assignment, pledge, encumbrance or charge and any attempt to anticipate, alienate, sell, transfer, assign, pledge, encumber or charge such benefits shall be void, nor shall any such benefits be in any way liable for or subject to the debts, contracts, liabilities, engagements or torts of any person entitled to them. This section shall also apply to the creation, assignment or recognition of a right to any benefit payable with respect to a Participant pursuant to a domestic relations order, including a qualified domestic relations order under Section 414(p) of the Code. |

|

B. |

An Employer may bring an action for a declaratory judgment if a Participant’s Named Beneficiary or any beneficiary’s benefits hereunder are threatened to be attached by an order from any court. The Employer may seek such declaratory judgment in a court of competent jurisdiction to: |

|

1. |

Determine the proper recipient or recipients of the benefits to be paid under the plan; |

|

2. |

Protect the operation and consequences of the Plan for the Employer and all Participants; and |

|

3. |

Request any other equitable relief the Employer in its sole judgment may feel appropriate. |

Benefits which may become payable during the pendency of such an action shall, at the sole discretion of the Employer, either be:

|

1. |

Paid into the court as they become payable, or |

|

2. |

Held in a separate account subject to the court’s final distribution order. Any such delay shall comply in all respects with Code Section 409A. |

|

9.3 |

The Plan is not and shall not be deemed to constitute a contract between the Employer or any Affiliate and any Participant, or to be a consideration for, or an inducement to, or a condition of, the employment of any employee. Nothing contained in the Plan shall give or be deemed to give an employee the right to remain in the employment of an Employer or any Affiliate or to interfere with the right to be retained in the employ of the Employer, any legal or equitable right against the Employer or an Affiliate, or to interfere with the right of the Employer or any Affiliate to discharge or retire any employee at any time. It is expressly understood by the parties that the Plan relates to the payment of deferred compensation for the Participant’s services, and is not intended to be an employment contract.

|

9.4 |

|

A. |

Any notices required or permitted hereunder shall be in writing and shall be deemed to be sufficiently given at the time when delivered personally or when mailed by certified or registered first class mail, postage prepaid, addressed to either party hereto as follows: |

If to the Company:

First Bank of Georgia

0000 Xxxxxxx Xxxx

Xxxxxxx, Xxxxxxx 00000

Or another address communicated by the Company to the Participant in future Plan communications.

If to the Participant:

At his last known address, as indicated by the records of the Employer, or to such changed address as such parties may have fixed by notice. However, any notice of change of address shall be effective only upon receipt.

|

B. |

Any communication, benefit payment, statement of notice addressed to a Participant or Named Beneficiary at the last post office address as shown on the Employer’s records shall be binding on the Participant or Named Beneficiary for all purposes of the Plan. The Employer, and a Trustee, if applicable, shall not be obligated to search for any Participant or Named Beneficiary beyond sending a registered letter to such last known address. |

|

9.5 |

The Plan as contained in this document constitutes the entire agreement with each Participant. If any provision of the Plan shall for any reason be invalid or unenforceable, the remaining provisions of the Plan shall be carried into effect, unless the effect thereof would be to materially alter or defeat the purposes of the Plan.

|

9.6 |

|

A. |

The payments to the Participant or his Named Beneficiary or any other beneficiary hereunder shall be made from assets that shall continue, for all purposes, to be a part of the general, unrestricted assets of the Employer; no person shall have any interest in any such assets by virtue of the provisions of this Plan. The Employer’s obligation under this Plan shall be an unfunded and unsecured promise to pay money in the future. To the extent that any person acquires a right to receive a benefit from the Employer under the provisions hereof, such right shall be no greater than the right of any unsecured general creditor of the Employer; no such person shall have nor acquire any legal or equitable right, or claim in or to any property or assets of the Employer. The Employer shall not be obligated under any circumstances to fund obligations under this Agreement. |

|

B. |

An Employer, at its sole discretion, may acquire and/or set aside assets or funds to support its financial obligations under this Plan. No such acquisition or set-aside shall impair or derogate from the Employer’s direct obligation to a Participant or Named Beneficiary under this Plan. However, no Participant or Named Beneficiary shall be entitled to receive duplicate payments of any benefits provided under the Plan because of the existence of such assets or funds. |

|

C. |

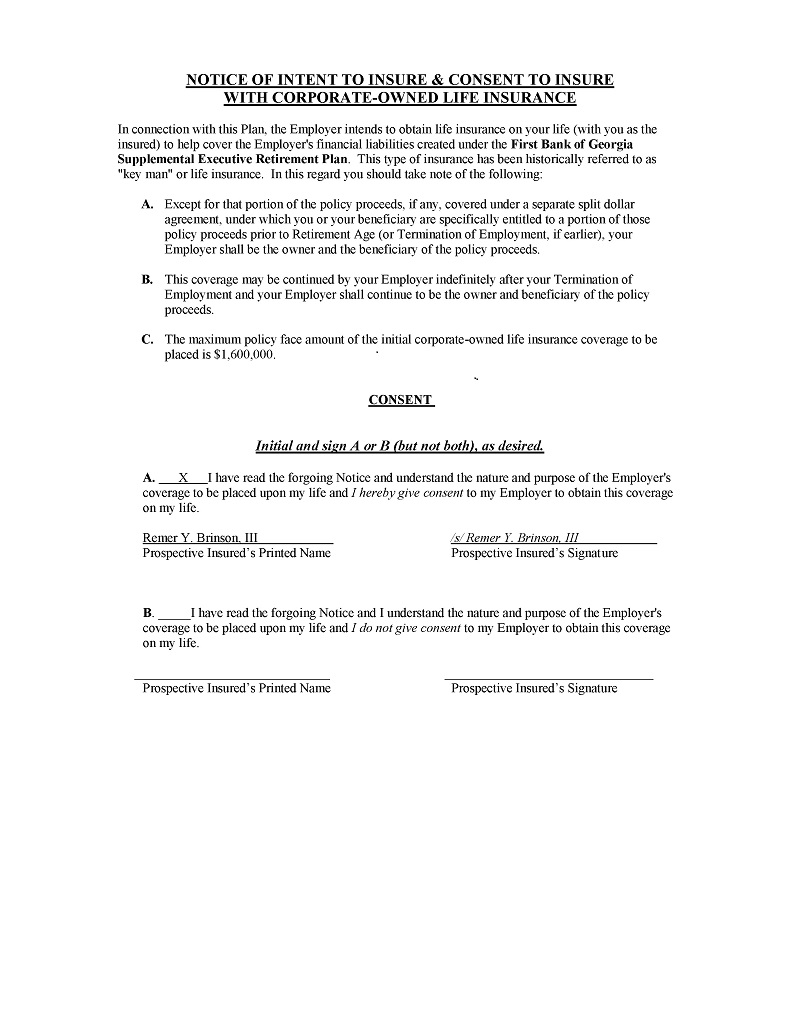

In the event that, in its discretion, the Employer purchases an asset(s) or insurance policy or policies insuring the life of the Participant to allow the Employer to recover the cost of providing benefits, in whole or in part hereunder, neither the Participant, Named Beneficiary nor any other beneficiary shall have any rights whatsoever therein in such assets or in the proceeds therefrom. The Employer shall be the sole owner and beneficiary of any such assets or insurance policies and shall possess and may exercise all incidents of ownership therein. No such asset or policy, policies or other property shall be held in any Trust either for the Participant or any other person nor as collateral security for any obligation of the Employer hereunder. A Participant's participation in the acquisition of such assets or policy or policies shall not be a representation to the Participant, Named Beneficiary or any other beneficiary of any beneficial interest or ownership in such assets, policy or policies. A Participant may be required to submit to medical examinations, supply such information and to execute such documents as may be required by any insurance carriers as a pre-condition to participate in the Plan. |

|

9.7 |

Nothing contained in this Plan shall be deemed to create a trust of any kind or create any fiduciary relationship between the Employer and the Participant, Named Beneficiary, other beneficiaries of the Participant, or any other person claiming through the Participant. Funds allocated hereunder shall continue for all purposes to be part of the general assets and funds of the Employer and no person other than the Employer shall, by virtue of the provisions of this Plan, have any beneficial interest in such assets and funds. The creation of a grantor trust under the Code to hold such assets or funds for the administrative convenience of the Employer shall in no way represent to the Participant or Named Beneficiary a property or beneficial ownership interest in such assets.

|

9.8 |

Neither the establishment of the Plan nor any modification hereof nor the creation of any account under the Plan nor the payment of any benefits under the Plan shall be construed as giving to any Participant or any other person any legal or equitable right against the Employer or any officer or employee thereof except as provided by law.

|

9.9 |

Agreement between Employer and Participant Only; Certain Construction Matters |

This Plan is solely between the Employers and the Participants. The Participant, Named Beneficiary, estate or any other person claiming through the Participant, shall only have recourse against the applicable Employer for enforcement of the terms of this Plan. This Plan shall be binding upon and inure to the benefit of each Employer and its successors and assigns, and the Participant, and his or her heirs, executors, administrators and Beneficiaries.

|

9.10 |

The benefits payable under this Plan are for services already rendered or to be rendered and shall be independent of, and in addition to, any other benefits or compensation, whether by salary, bonus or otherwise, payable to the Participant under any compensation and/or benefit arrangements or plans, incentive cash compensations and stock plans and other retirement or welfare benefit plans, that now exist or may hereafter exist from time to time.

|

9.11 |

Except as may be required by law, the Company may take of any the following actions if it gives notice to a Participant or Named Beneficiary of an entitlement to a benefit under the Plan, and the Participant or Named Beneficiary fails to claim such benefit or fails to provide their location to the Company within three (3) calendar years of such notice:

|

A. |

Direct distribution of such benefits, in such proportions as the Company may determine, to one or more or all, of a Participant’s next of kin, if the Company knows their location; or |

|

X. |

Xxxx this benefit to be forfeited and paid to the Employer if the location of a Participant’s next of kin is not known. However, the Employer shall pay the benefit, unadjusted for gains or losses from the date of such forfeiture, to a Participant or Named Beneficiary who subsequently makes proper claim to the benefit. |

The Employers and any Trustee, if applicable, shall not be liable to any person for payment made in accordance pursuant to applicable state unclaimed property laws.

|

9.12 |

As long as this Plan is in force, a Participant shall be entitled to specify or revoke and change the beneficiary or beneficiaries of a survivor benefit, if any, to be paid at the time of his/her death according to procedures set out by the Employer. No Named Beneficiary shall obtain any vested right to have this Plan continued in force, and it may be amended, modified, terminated in whole or in part by the Company in writing without the consent of any Named Beneficiary.

|

9.13 |

The Employer shall withhold and report federal, state and local income and other tax amounts in connection with this Plan as may be required by law from time to time.

|

9.14 |

Discrepancies between the Plan Document and Any Other Understanding |

In the event of any discrepancies or ambiguities between the terms of the Plan and any other understanding of the Plan, the terms of the Plan as set forth in this Agreement (and any amendment or restatement of this Agreement) shall control.

|

9.15 |

|

A. |

This Plan shall be interpreted by the Committee to comply with Code Section 409A. Notwithstanding anything herein to the contrary, (i) if at the time of Participant’s Termination of Employment Participant is a “specified employee” as defined in Code Section 409A and the deferral of the commencement of any payments or benefits otherwise payable hereunder as a result of such Termination of Employment is necessary in order to prevent any accelerated or additional tax under Code Section 409A, then the Employer will defer the commencement of the payment of any such payments or benefits hereunder (without any reduction in such payments or benefits ultimately paid or provided to Participant) until the date that is six months following Participant’s Termination of Employment (or the earliest date as is permitted under Code Section 409A) and (ii) if any other payments of money or other benefits due to Participant hereunder could cause the application of an accelerated or additional tax under Code Section 409A, such payments or other benefits shall be deferred if deferral will make such payment or other benefits compliant under Code Section 409A, or otherwise such payment or other benefits shall be restructured, to the extent possible, in a manner, determined by the Board of Directors, that does not cause such an accelerated or additional tax. |

|

B. |

The intent of the parties is that payments and benefits under this Agreement comply with Code Section 409A and the regulations and guidance promulgated such that taxation under Code Section 409A shall not arise in connection with this Agreement, and, accordingly, to the maximum extent permitted, this Agreement shall be interpreted so as to be in compliance with Code Section 409A. |

|

C. |

For purposes of Section 409A, each installment payment provided under this Agreement or Plan shall be treated as a separate payment. |

|

|

COMPANY: |

| |

| First Bank of Georgia | |||

|

|

|

|

|

|

|

By: |

/s/ Xxxxx X. Xxxxxxx, III |

|

|

|

|

|

|

|

|

Print Name: |

Xxxxx X. Xxxxxxx, III |

|

| Title: | President & CEO | ||

|

|

PARTICIPANT: |

| |

| /s/ Xxxxx X. Xxxxxxx, III | |||

|

|

|

|

|

|

|

Print Name: |

Xxxxx X. Xxxxxxx, III |

|

20