23 December 2003 SENIOR FACILITIES AGREEMENT Between BUHRMANN N.V. as Parent BUHRMANN US INC. as Borrower THE ORIGINAL GUARANTORS NAMED HEREIN as Original Guarantors DEUTSCHE BANK AG LONDON ABN AMRO BANK N.V. as Arrangers DEUTSCHE BANK AG LONDON as...

Exhibit 4.19

|

|

|

CONFORMED COPY |

|

|

|

(Incorporating amendments made pursuant to an amendment agreement dated 10 March 2004 and a second amendment deed dated 28 June 2004) |

23 December 2003

€730,000,000

Between

XXXXXXXX N.V.

as Parent

XXXXXXXX

US INC.

as Borrower

THE

ORIGINAL GUARANTORS NAMED HEREIN

as Original Guarantors

DEUTSCHE

BANK AG LONDON

ABN AMRO BANK N.V.

as Arrangers

DEUTSCHE

BANK AG LONDON

as Agent

DEUTSCHE

BANK AG LONDON

as Security Trustee

and

THE LENDERS

![]()

London

TABLE OF CONTENTS

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

i

ii

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

iii

THIS AGREEMENT is dated 23 December 2003 and made between:

(1) XXXXXXXX N.V. (the “Parent”);

(2) XXXXXXXX US INC. (the “Borrower”);

(3) THE ORIGINAL GUARANTORS NAMED IN PART II OF SCHEDULE 1 (together with the Parent, the “Original Guarantors” and each an “Original Guarantor”);

(4) DEUTSCHE BANK AG LONDON and ABN AMRO BANK N.V. (each an “Arranger” and together, the “Arrangers”);

(5) DEUTSCHE BANK AG LONDON (as agent for and on behalf of the Finance Parties, the “Agent”);

(6) DEUTSCHE BANK AG LONDON (as security trustee for and on behalf of the Finance Parties, the “Security Trustee”); and

(7) THE LENDERS (as defined below).

1. DEFINITIONS AND INTERPRETATION

1.1 Definitions

In this Agreement the following terms have the meanings set out below.

“Acceding Guarantor” means any member of the Group which has complied with the requirements of Clause 27 (Accession of New Guarantors).

“Accession Notice” means a duly completed notice of accession in the form of Part I of Schedule 7 (Form of Accession Notice).

“Act” means the Companies Xxx 0000.

“Additional C Facility Commitments” means, at any time, the aggregate of the Additional C1 Facility Commitments and the Additional C2 Facility Commitments.

“Additional C1 Facility” means the term loan facility agreement granted to the Borrower pursuant to Clause 2.1(f)(i) (The Facilities).

“Additional C1 Facility Advance” means an advance (as from time to time reduced by repayment) made or to be made by the C1 Facility Lenders under the Additional C1 Facility.

“Additional C1 Facility Commitment” means, in relation to a C1 Facility Lender at any time, and save as otherwise provided in this Agreement, the amount set opposite its name in the relevant column of Section A of Part I of Schedule 1 (Lenders and Commitments) or as specified in the Transfer Certificate pursuant to which such Lender becomes a party to this Agreement.

“Additional C2 Facility” means the term loan facility granted to the Borrower pursuant to Clause 2.1(g)(i) (The Facilities).

1

“Additional C2 Facility Advance” means an advance (as from time to time reduced by repayment) made or to be made by the C2 Facility Lenders under the Additional C2 Facility.

“Additional C2 Facility Commitment” means, in relation to a C2 Facility Lender at any time, and save as otherwise provided in this Agreement, the amount set opposite its name in the relevant column of Section A of Part I of Schedule 1 (Lenders and Commitments) or as specified in the Transfer Certificate pursuant to which such Lender becomes a party to this Agreement.

“Additional Security Documents” means all mortgages, pledge agreements, security agreements and other security documents entered into from time to time pursuant to Clauses 25.7 (Additional Security and Further Assurances), 25.8 (Stock Pledges in Non-U.S. Subsidiaries of the Borrower Which Are Not Guarantors) and/or 26.12 (Limitation on Creation of Subsidiaries), as each such document may be amended, modified or supplemented from time to time in accordance with the terms hereof and thereof.

“Adjusted Consolidated EBITDA” means, for any period, Consolidated EBITDA for such period, adjusted by excluding therefrom (to the extent otherwise included therein) any amounts attributable to CEAL and any of its Subsidiaries, so long as CEAL is a Non-Wholly Owned Subsidiary.

“Adjusted Consolidated Net Income” means, for any period, Consolidated Net Income for such period plus, without duplication, the sum of the amount of all net non-cash charges (including, without limitation, depreciation, amortisation, deferred tax expense and non-cash interest expense) and net non-cash losses which were included in arriving at Consolidated Net Income for such period, less the amount of all net non-cash gains and non-cash credits which were included in arriving at Consolidated Net Income for such period.

“Adjusted Consolidated Tangible Assets” means, at any time, the Consolidated Tangible Assets at such time, adjusted by excluding therefrom (to the extent otherwise reflected therein) any amounts attributable to (a) CEAL and any of its Subsidiaries, so long as CEAL is a Non-Wholly Owned Subsidiary and (b) any Receivables Subsidiary.

“Adjusted Consolidated Working Capital” means, at any time, Consolidated Current Assets (but excluding therefrom all cash and Cash Equivalents) less Consolidated Current Liabilities at such time.

“Advance” means, save as otherwise provided in this Agreement, a Revolving Facility Advance, an A Facility Advance, a B1 Facility Advance, a B2 Facility Advance, a C1 Facility Advance, a C2 Facility Advance, a Swingline Facility Advance or an Incremental Term Facility Advance as the context may require.

“A Facility” means the term loan facility granted to the Borrower pursuant to Clause 2.1(c) (The Facilities).

“A Facility Advance” means an advance (as from time to time reduced by repayment) made or to be made by the A Facility Lenders under the A Facility or arising in respect of the A Facility under Clause 15.3 (Division of Term Facility Advances).

“A Facility Commitment” means, in relation to an A Facility Lender at any time, and save as otherwise provided in this Agreement, the amount set opposite its name in the relevant

2

column of Section A of Part I of Schedule 1 (Lenders and Commitments) or as specified in the Transfer Certificate pursuant to which such Lender becomes a party to this Agreement.

“A Facility Lender” means a person which:

(a) is named opposite the column relating to the A Facility (with a positive amount) in Section A of Part I of Schedule 1 (Lenders and Commitments); or

(b) has become a party to this Agreement in accordance with the provisions of Clause 39 (Assignments and Transfers),

which in each case has not ceased to be a party to this Agreement in accordance with the terms of this Agreement.

“A Facility Margin” means, in relation to A Facility Advances, 2.50 per cent. per annum.

“A Facility Outstandings” means, at any time, the aggregate principal amount of the A Facility Advances outstanding under this Agreement.

“A Facility Repayment Date” has the meaning ascribed to that term in Clause 10.1 (Repayment of A Facility Outstandings).

“Affiliate” means, with respect to any person, any other person directly or indirectly controlling (including, but not limited to, all directors and officers of such person), controlled by, or under direct or indirect common control with, such person. A person shall be deemed to control another person if such person possesses, directly or indirectly, the power (a) to vote 10 per cent. or more of the securities having ordinary voting power for the election of directors of such corporation or (b) to direct or cause the direction of the management and policies of such other person, whether through the ownership of voting securities, by contract or otherwise, provided that neither the Agent nor any Lender (nor, in each case, any affiliate thereof) shall be considered an Affiliate of the Parent or any subsidiary thereof.

“Affiliate Debt” means any Indebtedness (including, without limitation, any Intercompany Existing Indebtedness), whether now existing or hereafter incurred, owed by (a) the Parent to any of its Subsidiaries or Affiliates (b) any Subsidiaries of the Parent to the Parent or any of its Subsidiaries or Affiliates or (c) any Affiliate of the Parent to the Parent or any of its Subsidiaries.

“Agent’s Spot Rate of Exchange” means, in relation to two currencies, the Agent’s spot rate of exchange for the purchase of the first-mentioned currency with the second-mentioned currency in the London foreign exchange market at or about 11a.m. on a particular day.

“Agreed Business Plan” means the business plan for the Group prepared by or on behalf of the Parent in the agreed form.

“Alternate Currency Incremental Term Facility Advance” means each Incremental Term Facility Advance denominated in an Optional Currency.

“Applicable Currency” means, for any Tranche of Incremental Term Facility Advances, the currency (in euros or in an Optional Currency) for such Tranche designated in the Incremental Term Facility Commitment Agreement for such Tranche.

3

“Applicable Excess Cash Flow Percentage” means, (a) so long as a Default or an Event of Default exists on the respective Excess Cash Flow Payment Date, 100 per cent. and (b) so long as no Default or Event of Default exists on the respective Excess Cash Flow Payment Date, 50 per cent. where the Consolidated Leverage Ratio on the last day of the respective Excess Cash Flow Payment Period is equal to or greater than 2.50:1.00 and zero where the Consolidated Leverage Ratio on the last day of the respective Excess Cash Flow Payment Period is less than 2.50:1.00.

“Applicable Margin” means:

(a) with respect to the A Facility, the C Facilities and the Revolving Facility, the A Facility Margin, the C Facilities Margin and the Revolving Facility Margin, respectively. From and after each day of delivery of any certificate delivered in accordance with the following sentence indicating an entitlement to a different margin than the A Facility Margin, the C Facilities Margin or the Revolving Facility Margin, as the context may require, (each, a “Start Date”) to and including the applicable End Date described below, the Applicable Margin shall (subject to any adjustment pursuant to the immediately succeeding paragraph) be that set forth below opposite the Consolidated Leverage Ratio indicated to have been achieved in any certificate delivered in accordance with the following sentence:

|

Consolidated |

|

Applicable Margin for |

|

Applicable Margin for |

|

Applicable Margin for |

|

Greater than 3.50:1.00 |

|

2.500 per cent. |

|

1.500 per cent. |

|

2.50 per cent |

|

Greater than 3.00:1.00 but less than or equal to 3.50:1.00 |

|

2.250 per cent. |

|

1.250 per cent. |

|

2.50 per cent |

|

Greater than 2.50:1:00 but less than or equal to 3.00:1.00 |

|

2.000 per cent. |

|

1.000 per cent. |

|

2.25 per cent |

|

Greater than 2.00:1.00 but less than or equal to 2.50:1.00 |

|

1.750 per cent. |

|

0.750 per cent |

|

2.25 per cent |

|

Less than or equal to 2.00:1.00 |

|

1.500 per cent. |

|

0.500 per cent. |

|

2.25 per cent |

The Consolidated Leverage Ratio shall be determined based on the delivery of a certificate of the Parent by an Authorised Representative of the Parent to the Agent (with a copy to be sent by the Agent to each Lender), within 50 days of the last day of any fiscal quarter of the Parent, which certificate shall set forth the calculation of the Consolidated Leverage Ratio as at the last day of the Test Period ended immediately prior to the relevant Start Date (but determined on a Pro Forma Basis to give effect to any €5 Million Permitted Acquisition and any €5 Million Asset Sale effected on or prior to the date of delivery of such certificate) and the Applicable Margins which shall be thereafter applicable (until same are changed or cease to apply in accordance

4

with the following sentences). The Applicable Margins so determined shall apply, except as set forth in the succeeding sentence, from the Start Date to the earlier of (i) the date on which the next certificate is delivered to the Agent, (ii) the date which is 50 days following the last day of the Test Period in which the previous Start Date occurred (the “End Date”), at which time, if no certificate has been delivered to the Agent indicating an entitlement to an Applicable Margin other than those described in the first sentence of this paragraph (a) (and thus commencing a new Start Date), the Applicable Margins shall be the A Facility Margin, the C Facilities Margin and the Revolving Facility Margin (as applicable); and

(b) with respect to each Tranche of the Incremental Term Facility Outstandings, that percentage set forth in, or calculated in accordance with, Clause 7 (Uncommitted Incremental Facilities) and the relevant Incremental Term Facility Commitment Agreement provided that, if at any time, the Applicable Margin relating to any Incremental Term Facility Outstandings exceeds by more than 0.50 per cent. the Applicable Margin relating to the C Facilities at such time, the Applicable Margin relating to the C Facilities shall be automatically increased to a percentage which is 0.50 per cent. below the Applicable Margin relating to the Incremental Term Facility Outstandings.

“Asset Sale” means any sale (including pursuant to sale-leaseback transactions (other than a sale-leaseback transaction where the Parent or any of its Subsidiaries played a primary financial role in the development of the relevant asset)), transfer or other disposition by the Parent or any of its Subsidiaries to any person other than the Parent or any Wholly-Owned Subsidiary of the Parent of any asset or Property (including, without limitation, any Equity Interests or other securities of another person, but excluding the sale by the Parent of its own share capital) of the Parent or such Subsidiary other than (a) sales, transfers or other dispositions of inventory made in the ordinary course of business, (b) sales, transfers or other dispositions of assets pursuant to paragraphs (c)(i) (obsolete equipment), (f) (inventory), (g) (overdue receivables) and (h) (condemned property) of Clause 26.2 (Consolidation, Merger, Purchase or Sale of Assets, etc.), (c) sales or liquidations of Cash Equivalents, (d) sales of Receivables Facility Assets pursuant to any Permitted Receivables Transaction, (e) operating leases or subleases of any property by the Parent and its Subsidiaries in the ordinary course of business, (f) the licensing of intellectual property in the ordinary course of business, (g) any Sale In Lieu of Liquidation and (h) any single sale of assets (or series of related sales of assets) which generates Net Sale Proceeds of less than €250,000 (or its equivalent in other currencies).

“Associated Costs Rate” means, in relation to any Advance or Unpaid Sum, the rate determined in accordance with Schedule 6 (Associated Costs Rate).

“Authorisation” means an authorisation, consent, approval, resolution, licence, exemption, filing, notarisation or registration.

“Authorised Representative” means, with respect to (i) delivering Utilisation Requests and similar notices, any person or persons that has or have been authorised by the board of directors of the Borrower to deliver such notices pursuant to this Agreement and that has or have appropriate signature cards on file with the Agent, (ii) delivering financial information and officer’s certificates pursuant to this Agreement, the chief financial officer, any treasurer or other financial officer of the Borrower or the Parent and (iii) any other matter in

5

connection with any Finance Document, any officer (or a person or persons so designated by any two officers) of the Parent or the Borrower.

“Available Additional C1 Facility Commitment” means, in relation to a C1 Facility Lender, at any time and save as otherwise provided in this Agreement, its Additional C1 Facility Commitment at such time adjusted to take account of:

(a) any cancellation or reduction of it or any transfer by such C1 Facility Lender or any transfer to it, in each case, pursuant to the terms of this Agreement; and

(b) in the case of any proposed Advance, the Euro Amount of any Additional C1 Facility Advance which, pursuant to any other Utilisation Request is to be made on or before the proposed Utilisation Date,

less the Euro Amount of its share of the Additional C1 Facility Advances made under this Agreement, provided always that such amount shall not be less than zero.

“Available Additional C2 Facility Commitment” means, in relation to a C2 Facility Lender, at any time and save as otherwise provided in this Agreement, its Additional C2 Facility Commitment at such time adjusted to take account of:

(a) any cancellation or reduction of it or any transfer by such C2 Facility Lender or any transfer to it, in each case, pursuant to the terms of this Agreement; and

(b) in the case of any proposed Advance, the Euro Amount of any Additional C2 Facility Advance which, pursuant to any other Utilisation Request is to be made on or before the proposed Utilisation Date,

less the Euro Amount of its share of the Additional C2 Facility Advances made under this Agreement, provided always that such amount shall not be less than zero.

“Available A Facility Commitment” means, in relation to an A Facility Lender, at any time and save as otherwise provided in this Agreement, its A Facility Commitment at such time adjusted to take account of:

(a) any cancellation or reduction of it or any transfer by such an A Facility Lender or any transfer to it, in each case, pursuant to the terms of this Agreement; and

(b) in the case of any proposed Advance, the Euro Amount of any A Facility Advance which, pursuant to any other Utilisation Request is to be made on or before the proposed Utilisation Date,

less the Euro Amount of its share of the A Facility Advances made under this Agreement, provided always that such amount shall not be less than zero.

“Available B1 Facility Commitment” means, in relation to a B1 Facility Lender, at any time and save as otherwise provided in this Agreement, its B1 Facility Commitment at such time adjusted to take account of:

(a) any cancellation or reduction of it or any transfer by such B1 Facility Lender or any transfer to it, in each case, pursuant to the terms of this Agreement; and

6

(b) in the case of any proposed Advance, the Euro Amount of any B1 Facility Advance which, pursuant to any other Utilisation Request is to be made on or before the proposed Utilisation Date,

less the Euro Amount of its share of the B1 Facility Advances made under this Agreement, provided always that such amount shall not be less than zero.

“Available B2 Facility Commitment” means, in relation to a B2 Facility Lender, at any time and save as otherwise provided in this Agreement, its B2 Facility Commitment at such time adjusted to take account of:

(a) any cancellation or reduction of it or any transfer by such B2 Facility Lender or any transfer to it, in each case, pursuant to the terms of this Agreement; and

(b) in the case of any proposed Advance, the Euro Amount of any B2 Facility Advance which, pursuant to any other Utilisation Request is to be made on or before the proposed Utilisation Date,

less the Euro Amount of its share of the B2 Facility Advances made under this Agreement, provided always that such amount shall not be less than zero.

“Available Commitment” means, in relation to a Lender, the aggregate amount of its Available Revolving Facility Commitment, its Available Term Facility Commitments and, subject to Clause 7 (Uncommitted Incremental Facilities) and the relevant Incremental Facility Commitment Agreement, its Available Incremental Term Facility Commitment or, in the context of a particular Facility, its Available A Facility Commitment, its Available B1 Facility Commitment, its Available B2 Facility Commitment, its Available Additional C1 Facility Commitment, its Available Additional C2 Facility Commitment, its Available Revolving Facility Commitment, its Available Swingline Facility Commitment or its Available Incremental Term Facility Commitment, as the context may require.

“Available Facility” means, in relation to a Facility, at any time, the aggregate amount of the Available Commitments in respect of that Facility at that time.

“Available Incremental Term Facility Commitment” means, in relation to a Lender, at any time and save as otherwise provided in this Agreement, its Incremental Term Facility Commitment at such time adjusted to take account of:

(a) any cancellation or reduction of it or any transfer by such Lender or any transfer to it, in each case, pursuant to the terms of this Agreement; and

(b) in the case of any proposed Advance, the Euro Amount of any Incremental Term Facility Advance which, pursuant to any other Incremental Term Facility Commitment Agreement is to be made on or before the proposed Utilisation Date,

less the Euro Amount of its share of the Incremental Term Facility Advances made under this Agreement and the relevant Incremental Term Facility Commitment Agreement, provided always that such amount shall not be less than zero.

“Available Liquidity” means, at any time, an amount equal to the Available Revolving Facility.

7

“Available Revolving Facility” means, at any time, the aggregate amount of the Available Revolving Facility Commitments.

“Available Revolving Facility Commitment” means, in relation to a Revolving Facility Lender, at any time and save as otherwise provided in this Agreement, its Revolving Facility Commitment, adjusted to take account of:

(a) any cancellation or reduction of it or any transfer by such Revolving Facility Lender or any transfer to it, in each case, pursuant to the terms of this Agreement; and

(b) in the case of any proposed Utilisation, the Euro Amount of (i) any Revolving Facility Advance and/or Documentary Credit and/or any Swingline Facility Advance which pursuant to any other Utilisation Request is to be made, or as the case may be, issued and (ii) any Revolving Facility Advance and/or Documentary Credit and/or any Swingline Facility Advance which is due to be repaid or expire (as the case may be), in each case, on or before the proposed Utilisation Date,

less the Euro Amount of its participation in the Swingline Facility Outstandings and the Revolving Facility Outstandings at such time provided always that such amount shall not be less than zero.

“Available Swingline Facility” means, at any time, the aggregate amount of the Available Swingline Facility Commitments.

“Available Swingline Facility Commitment” means, in relation to a Swingline Facility Lender, at any time and save as otherwise provided in this Agreement its Swingline Facility Commitment, adjusted to take account of:

(a) any cancellation or reduction of it or any transfer by such Swingline Facility Lender or any transfer to it, in each case, pursuant to the terms of this Agreement; and

(b) in the case of any proposed Utilisation, the Euro Amount of (A) any Swingline Facility Advance which pursuant to any other Utilisation Request is to be made and (B) any Swingline Facility Advance which is due to be repaid, in each case, on or before the proposed Utilisation Date,

less the Euro Amount of its participation in the Swingline Facility Outstandings at such time,

provided always that such amount shall not be less than zero.

“Available Term Facility Commitment” means, in relation to a Lender, the aggregate amount of its Available A Facility Commitment, its Available B1 Facility Commitment, its Available B2 Facility Commitment, its Available Additional C1 Facility Commitment and its Available Additional C2 Facility Commitment.

“BBA LIBOR” means in relation to an Optional Currency, the British Bankers’ Association Interest Settlement Rate for the relevant currency and specified period.

“B Facilities” means the B1 Facility and the B2 Facility and “B Facility” means any of them as the context may require from time to time.

8

“B Facility Advances” means the B1 Facility Advances and the B2 Facility Advances.

“B Facility Commitments” means, at any time, the aggregate of the B1 Facility Commitments and the B2 Facility Commitments.

“B Facility Lenders” means the B1 Facility Lenders and the B2 Facility Lenders and “B Facility Lender” means any of them as the context may require from time to time.

“B Facility Outstandings” means the B1 Facility Outstandings and the B2 Facility Outstandings.

“B1 Facility” means the term loan facility granted to the Borrower pursuant to Clause 2.1(d) (The Facilities).

“B1 Facility Advance” means an advance (as from time to time reduced by repayment) made or to be made by the B1 Facility Lenders under the B1 Facility or arising in respect of the B1 Facility under Clause 15.3 (Division of Term Facility Advances).

“B1 Facility Commitment” means, in relation to a B1 Facility Lender at any time, and save as otherwise provided in this Agreement, the amount set opposite its name in the relevant column of Section A of Part I of Schedule 1 (Lenders and Commitments) or as specified in the Transfer Certificate pursuant to which such Lender becomes a party to this Agreement.

“B1 Facility Conversion” has the meaning ascribed to that term in Clause 2.1(f)(i) (The Facilities).

“B1 Facility Lender” means a person which:

(a) is named opposite the column relating to the B1 Facility (with a positive amount) in Section A of Part I of Schedule 1 (Lenders and Commitments); or

(b) has become a party to this Agreement in accordance with the provisions of Clause 39 (Assignments and Transfers),

which in each case has not ceased to be a party to this Agreement in accordance with the terms of this Agreement.

“B1 Facility Outstandings” means, at any time, the aggregate principal amount of the B1 Facility Advances outstanding under this Agreement.

“B2 Facility” means the term loan facility granted to the Borrower pursuant to Clause 2.1(e) (The Facilities).

“B2 Facility Advance” means an advance (as from time to time reduced by repayment) made or to be made by the B2 Facility Lenders under the B2 Facility or arising in respect of the B2 Facility under Clause 15.3 (Division of Term Facility Advances).

“B2 Facility Commitment” means, in relation to a B2 Facility Lender at any time, and save as otherwise provided in this Agreement, the amount set opposite its name in the relevant column of Section A of Part I of Schedule 1 (Lenders and Commitments) or as specified in the Transfer Certificate pursuant to which such Lender becomes a party to this Agreement.

9

“B2 Facility Conversion” has the meaning ascribed to that term in Clause 2.1(g)(i) (The Facilities).

“B2 Facility Lender” means a person which:

(a) is named opposite the column relating to the B2 Facility (with a positive amount) in Section A of Part I of Schedule 1 (Lenders and Commitments); or

(b) has become a party to this Agreement in accordance with the provisions of Clause 39 (Assignments and Transfers),

which in each case has not ceased to be a party to this Agreement in accordance with the terms of this Agreement.

“B2 Facility Outstandings” means, at any time, the aggregate principal amount of the B2 Facility Advances outstanding under this Agreement.

“Bankruptcy Code” means Title 11 of the United States Code entitled “Bankruptcy” as now or hereafter in effect, or any successor to it.

“Belgian Guarantor” means each of the parties as set out in Part II of Schedule 1 (Original Guarantors) named as Belgian Guarantors and any Acceding Guarantor incorporated in the Kingdom of Belgium.

“Beneficiary” means, in relation to a Documentary Credit, the beneficiary of it.

“Break Costs” means the amount (if any) by which:

(a) the interest which a Lender should have received for the period from the date of receipt of all or any part of its participation in an Advance or Unpaid Sum to the last day of the current Interest Period or Term in respect of that Advance or Unpaid Sum, had the principal amount of such Advance or Unpaid Sum received been paid on the last day of that Interest Period or Term,

exceeds:

(b) the amount which that Lender would be able to obtain by placing an amount equal to the principal amount of such Advance or Unpaid Sum received or recovered by it on deposit with a leading bank in the Relevant Interbank Market for a period starting on the Business Day following such receipt or recovery and ending on the last day of the current Interest Period or Term.

“Business Day” means a day (other than a Saturday or Sunday) on which (a) banks generally are open for business in London and (b) if such reference relates to a date for the payment or purchase of any sum denominated in:

(i) euro (A) is a TARGET Day and (B) is a day on which banks generally are open for business in the financial centre selected by the Agent for receipt of payments in euro; or

(ii) an Optional Currency, banks generally are open for business in the principal financial centre of the country of such Optional Currency.

10

“C Facilities” means the C1 Facility and the C2 Facility and “C Facility” means any of them as the context may require from time to time.

“C Facilities Margin” means, in relation to the C Facility Advances, [2.50] per cent. per annum.

“C Facilities Repayment Date” has the meaning ascribed to it in Clause 10.3 (Repayment of C Facility Outstandings).

“C Facility Advances” means the C1 Facility Advances and the C2 Facility Advances.

“C Facility Lenders” means the C1 Facility Lenders and the C2 Facility Lenders and “C Facility Lender” means any of them as the context may require from time to time.

“C Facility Outstandings” means the C1 Facility Outstandings and the C2 Facility Outstandings.

“C1 Facility” has the meaning ascribed to that term in Clause 2.1(f) (i)(The Facilities).

“C1 Facility Advance” means any Converted C1 Facility Advance or Additional C1 Facility Advance (and, for the avoidance of doubt, shall include the consolidated C1 Facility Advance pursuant to the simultaneous conversion of B1 Facility Advances and incurrence of Additional C1 Facility Advances on the Second Amendment Effective Date) or any advance arising in respect of the C1 Facility under Clause 15.3 (Division of Term Facility Advances), in each case as from time to time reduced by repayment.

“C1 Facility Lender” means a person which:

(a) is a Consenting B1 Facility Lender; or

(b) is named opposite the column relating to the Additional C1 Facility (with a positive amount) in Section A of Part I of Schedule 1 (Lenders and Commitments); or

(c) has become a party to this Agreement in accordance with the provisions of Clause 39 (Assignments and Transfers),

which in each case has not ceased to be a party to this Agreement in accordance with the terms of this Agreement.

“C1 Facility Outstandings” means, at any time, the aggregate principal amount of the C1 Facility Advances outstanding under this Agreement.

“C2 Facility” has the meaning ascribed to that term in Clause 2.1(g)(i) (The Facilities).

“C2 Facility Advance” means any Converted C2 Facility Advance or Additional C2 Facility Advance (and, for the avoidance of doubt, shall include the consolidated C2 Facility Advance pursuant to the simultaneous conversion of B2 Facility Advances and incurrence of Additional C2 Facility Advances on the Second Amendment Effective Date) or any advance arising in respect of the C2 Facility under Clause 15.3 (Division of Term Facility Advances), in each case as from time to time reduced by repayment.

“C2 Facility Lender” means a person which:

11

(a) is a Consenting B2 Facility Lender; or

(b) is named opposite the column relating to the Additional C2 Facility (with a positive amount) in Section A of Part I of Schedule 1 (Lenders and Commitments); or

(c) has become a party to this Agreement in accordance with the provisions of Clause 39 (Assignments and Transfers),

which in each case has not ceased to be a party to this Agreement in accordance with the terms of this Agreement.

“C2 Facility Outstandings” means, at any time, the aggregate principal amount of the C2 Facility Advances outstanding under this Agreement.

“Capital Expenditures” means, with respect to any person, all expenditures by such person which is required to be treated as capital expenditure in accordance with GAAP.

“Capitalised Lease” of a person means any lease of Property by such person as lessee which would be capitalised on a balance sheet of such person prepared in accordance with GAAP.

“Capitalised Lease Obligations” of any person means all rental obligations which, under GAAP, are required to be capitalised on the books of such person, in each case taken at the amount thereof accounted for as indebtedness in accordance with GAAP.

“Cash” means any credit balances on any deposit, savings or current account with a bank and cash in hand held in the ordinary course of business.

“Cash Equivalents” means:

(a) Cash;

(b) securities issued or directly fully guaranteed or insured by the governments of the United States, The Netherlands, the United Kingdom, France, Switzerland, Germany or Australia or any agency or instrumentality thereof (provided that the full faith and credit of the respective such government is pledged in support thereof) having maturities of not more than six months from the date of acquisition;

(c) certificates of deposit and time deposits with maturities of six months or less from the date of acquisition, bankers’ acceptances with maturities not exceeding six months and overnight bank deposits, in each case with any commercial bank incorporated in the United States or commercial bank of a foreign country recognised by the United States, in each case having capital and surplus in excess of €500,000,000 (or the foreign currency equivalent thereof) and has outstanding debt which is rated “A” (or similar equivalent thereof) or higher by at least one nationally recognised statistical rating organisation (as defined under Rule 436 under the Securities Act) or any money-market fund sponsored by a registered broker dealer or mutual fund distributor;

(d) repurchase obligations with a term of not more than seven days for underlying securities of the types described in (b) and (c) above entered into with any financial institution meeting the qualifications specified in (c) above; and

12

(e) commercial paper having one of the two highest ratings obtainable from S&P or Xxxxx’x and in each case maturing within six months after the date of acquisition.

Furthermore, with respect to Subsidiaries of the Parent which are not organised in one or more Qualified Jurisdictions, Cash Equivalents shall include bank deposits (and investments pursuant to operating account agreements) maintained with various local banks in the ordinary course of business consistent with past practice of the Parent’s Subsidiaries.

“CEAL” means Corporate Express Australia Limited, a corporation incorporated in Australia.

“CEAL Exception Conditions” means, in relation to the CEAL Group at any time:

(a) each member of the CEAL Group is a Non-Wholly Owned Subsidiary of the Parent; and

(b) no member of the CEAL Group has incurred any Indebtedness which directly or indirectly guarantees or supports any obligation of the Group (other than members of the CEAL Group).

“CEAL Group” means CEAL and its Subsidiaries.

“CEXP” means Corporate Express, Inc., a Colorado Corporation.

“Change of Control” means:

(a) any person or “group” (within the meaning of Sections 13(d) and 14(d) under the Securities Exchange Act, as in effect on the Effective Date), other than as a result of the ownership of Parent Preference Shares A and Parent Preference Shares B by the respective Permitted Holders thereof, shall (i) have acquired beneficial ownership of 35 per cent. or more on a fully diluted basis of the voting and/or economic interest in the Parent’s share capital or (ii) obtained the power (whether or not exercised) to elect a majority of the Parent’s directors;

(b) the board of directors of the Parent shall cease to consist of a majority of Continuing Directors;

(c) any “change of control” or similar event under, and as defined in, the Senior Subordinated Note Indenture, the Senior Subordinated Convertible Bond Agency Agreement, the documentation relating to any Permitted Subordinated Indebtedness or any Permitted Refinancing Indebtedness or any issue of Parent Preferred Stock (including, without limitation, each of the Parent Preference Shares A, the Parent Preference Shares B and the Parent Preference Shares C), in each case to the extent then outstanding, shall occur; or

(d) the Parent shall at any time cease to own beneficially and of record, directly or indirectly through one or more Wholly-Owned Subsidiaries of the Parent, free and clear of all Liens (other than those created pursuant to the Finance Documents), other encumbrances, or voting agreements, restrictions or trusts of any kind, 100 per cent. of the outstanding Equity Interests of the Borrower on a fully diluted basis and shares representing the right to elect a majority of the directors of the Borrower.

13

“Code” means the U.S. Internal Revenue Code of 1986, as amended from time to time, and the cases and applicable regulations and rulings promulgated or issued thereunder. Section references to the Code are to the Code, as in effect as at the Effective Date and any subsequent provisions of the Code, amendatory thereof, supplemental thereto or substituted therefor.

“Collateral” means all property (whether real or personal, movable or immovable) with respect to which any security interests have been granted (or purported to be granted) pursuant to any Security Document (including any Additional Security Document).

“Commitment” means, in relation to a Lender, its A Facility Commitment, its B1 Facility Commitment, B2 Facility Commitment, its Additional C1 Facility Commitment, its Additional C2 Facility Commitment, its Revolving Facility Commitment, its Swingline Facility Commitment and/or, subject to Clause 7 (Uncommitted Incremental Facilities) its Incremental Revolving Facility Commitment and/or its Incremental Term Facility Commitment, as the context may require.

“Commitment Letter” means the letter dated 13 November 2003 from the Arrangers to the Parent and the Borrower with respect to arranging the Facilities.

“Compliance Certificate” means a certificate substantially in the form set out in Part I of Schedule 8 (Form of Auditors’ Confirmation) (or such other similar form as the Agent shall agree with the Parent and the relevant auditors) or Part II of Schedule 8 (Form of Directors’ Compliance Certificate) as appropriate.

“Consenting B Facility Lender” means a Consenting B1 Facility Lender or a Consenting B2 Facility Lender, as the context may require, and “Consenting B Facility Lenders” means all of them.

“Consenting B1 Facility Lender” means a B1 Facility Lender that has executed and delivered the Second Amendment Deed (or that has authorised the Agent to execute and deliver the Second Amendment Deed on its behalf) on or before the Second Amendment Effective Date.

“Consenting B2 Facility Lender” means a B2 Facility Lender that has executed and delivered the Second Amendment Deed (or that has authorised the Agent to execute and deliver the Second Amendment Deed on its behalf) on or before the Second Amendment Effective Date.

“Consolidated Current Assets” means, at any time, the current assets of the Parent and its Consolidated Subsidiaries at such time determined on a consolidated basis.

“Consolidated Current Liabilities” means, at any time, the consolidated current liabilities of the Parent and its Consolidated Subsidiaries at such time, but excluding (i) the current portion of any Indebtedness under this Agreement, of any Permitted Receivables Transaction Indebtedness and of any other long-term Indebtedness which would otherwise be included therein, (ii) accrued but unpaid interest with respect to the Indebtedness and (iii) the current portion of Indebtedness constituting Capitalised Lease Obligations.

“Consolidated EBITDA” means, for any applicable computation period, Consolidated Net Income for such period from continuing operations, notwithstanding that same may not

14

constitute continuing operations plus, in each case to the extent deducted in determining Consolidated Net Income for such period, (a) taxes accrued during such period, plus (b) interest expense accrued during such period, plus (c) amortisation and depreciation expenses for such period. Such calculation shall exclude the effect on such Consolidated Net Income of:

(i) non-cash extraordinary, non-cash unusual and non-cash non-recurring gains, losses and charges occurring during such period;

(ii) non-recurring charges related to assimilation of persons acquired, and the expenses of, Permitted Acquisitions, including expenses incurred in connection with the retirement of Indebtedness of persons so acquired;

(iii) the write-off of debt financing fees associated with terminated credit facilities;

(iv) any non-cash pre-acquisition write-offs or similar charges incurred by a person acquired pursuant to a Permitted Acquisition that as the result of a pooling of interest are included in the Parent’s consolidated financial statements for the period;

(v) any non-cash write-offs or similar non-cash charges which are recorded following a Permitted Acquisition in the Parent’s consolidated financial statements with respect to an acquired person’s assets to the extent such amounts were accounted for in the first twelve months following the date such acquisition was consummated;

(vi) any restoration to income of any contingency reserve, except to the extent that provision for such reserve was made out of Consolidated Net Income accrued at any time after the Initial Borrowing Date;

(vii) any profits (or adding back losses) attributable to minority interests in the Group;

(viii) until the fiscal year ending 31 December 2004, any contribution attributable (on a basis satisfactory to the Agent) to the Paper Merchant Division;

(ix) one-time charges (including, without limitation, restructuring charges and any upfront fees related to these Facilities, the refinancing of the Senior Subordinated Notes and the issue of the Senior Subordinated Convertible Bonds) occurring during such period to the extent not already included above; and

(x) for the fiscal year ended 31 December 2003 only any cash extraordinary and/or exceptional gains or losses,

provided that Consolidated EBITDA for any period shall be reduced by the aggregate amount of all cash payments made during such period in respect of any amounts previously excluded pursuant to sub-paragraphs (i), (iv), (v), (vii), (viii) and (ix) of this sentence, whether in such period or a prior period.

“Consolidated EBITDAR” means, for any period, Consolidated EBITDA for such period, adjusted by adding thereto the amount of all rent and lease expense included as a component of Consolidated Fixed Charges for such period pursuant to sub-paragraph (ii) of the definition thereof and which was deducted in arriving at Consolidated Net Income (and not already added back in determining Consolidated EBITDA) for such period.

15

“Consolidated Fixed Charge Coverage Ratio” for any period, means the ratio of Consolidated EBITDAR to Consolidated Fixed Charges for such period.

“Consolidated Fixed Charges” means, for any period, the sum, without duplication, of (i) Consolidated Interest Expense for such period, (ii) the amount of all rent expense of, and lease payments expensed by, the Parent and its Subsidiaries with respect to Real Property (including land, buildings, improvements and fixtures, including Leaseholds) and vehicles, determined on a consolidated basis for such period, (iii) the amount of all Capital Expenditures made by the Parent and its Subsidiaries determined on a consolidated basis for such period (other than Capital Expenditures to the extent made pursuant to Clause 24.1(b) (Capital Expenditures)), (iv) all Dividends (excluding dividends paid-in-kind through the issuance of additional shares of share capital of the Parent) actually paid by the Parent in relation to the Parent Preference Shares A and the Parent Common Stock during such period and (v) the scheduled principal amount of all amortisation payments with respect to the Term Facilities for such period (as determined on the first day of the respective period).

“Consolidated Indebtedness” means, as at any date of determination, the aggregate stated balance sheet amount of all Indebtedness of the Parent and its Subsidiaries (excluding (i) all Contingent Obligations other than Contingent Obligations which are required, in accordance with GAAP, to be reflected on the consolidated balance sheet of the Parent and its Subsidiaries and (ii) obligations under any Hedging Agreements and Other Hedging Agreements or other similar types of agreements) on a consolidated basis as determined in accordance with GAAP, provided that notwithstanding any contrary treatment pursuant to GAAP, (a) the aggregate amount of guarantees or letters of credit issued in support of Indebtedness of persons which are not Subsidiaries of the Parent shall at all times be included as a component of Consolidated Indebtedness and (b) the amount of Permitted Receivables Transaction Outstandings at any time shall be included as a component of Consolidated Indebtedness.

“Consolidated Interest Coverage Ratio” means, for any period, the ratio of Consolidated EBITDA to Consolidated Interest Expense for such period.

“Consolidated Interest Expense” means, for any period, the total consolidated interest expense of the Parent and its Consolidated Subsidiaries for such period plus, without duplication, that portion of Capitalised Lease Obligations of the Parent and its Consolidated Subsidiaries representing the interest factor for such period excluding (to the extent included in total consolidated interest expense) upfront fees relating to these Facilities or the refinancing of the Senior Subordinated Notes. Notwithstanding anything to the contrary contained above, to the extent Consolidated Interest Expense for any period does not already include all Receivables Facility Financing Costs for such period, the amount of such Receivables Facility Financing Costs shall be added to (and form part of) Consolidated Interest Expense. Notwithstanding anything to the contrary contained above, to the extent any Test Period begins before the Initial Borrowing Date, Consolidated Interest Expense as calculated above for each such period shall instead be deemed to be for a period as set out in column 1 below and for an amount equal to the product of such number of times as set out in column 2 below and the Consolidated Interest Expense as calculated above.

16

|

Column 1 - Deemed Test Period |

|

|

|

For the period beginning on 1 January 2004 and ending on 31 March 2004. |

|

4 |

|

For the period beginning on 1 January 2004 and ending on 30 June 2004. |

|

2 |

|

For the period beginning on 1 January 2004 and ending on 30 September 2004. |

|

1.33 |

“Consolidated Leverage Ratio” means, on any date, the ratio of (i) Consolidated Indebtedness on such date to (ii) Consolidated EBITDA for the period of four consecutive fiscal quarters most recently ended on or prior to such date, in each case taken as one accounting period, provided that (x) to the extent any €5 Million Permitted Acquisition or any €5 Million Asset Sale (for purposes of the Consolidated Leverage Ratio) has occurred during the relevant Test Period, Consolidated EBITDA shall be determined for the respective Test Period on a Pro Forma Basis for such occurrences and (y) for the purpose of calculating the Consolidated Leverage Ratio, freely available cash balances of the Group held with a Lender in an aggregate amount not to exceed €50,000,000 shall be deducted from the amount of Consolidated Indebtedness.

“Consolidated Net Income” means, for any period, the net income (or loss) of the Parent and its Consolidated Subsidiaries for such period, determined on a consolidated basis (after any deduction for minority interests), provided that (a) in determining Consolidated Net Income, the net income of any person which is not a Subsidiary of the Parent or is accounted for by the Parent by the equity method of accounting shall be included only to the extent of the payment of cash dividends or cash distributions by such other person to the Parent or a Subsidiary thereof during such period, (b) the net income of any Subsidiary of the Parent shall be excluded to the extent that the declaration or payment of cash dividends or similar distributions by that Subsidiary of that net income is not at the date of determination permitted by operation of its charter or any agreement, instrument or law applicable to such Subsidiary, (c) the net income (or loss) of any other person acquired by such specified person or a Subsidiary of such person in a pooling of interests transaction for any period prior to the date of such acquisition shall be excluded and (d) after tax gains and losses from Asset Sales (without regard to the exceptions in (d) or (e) in the proviso of the definition thereof) or abandonments or reserves relating thereto shall be excluded.

“Consolidated Net Income Available to Common” means, for any period, Consolidated Net Income for such period less (to the extent same have not already been deducted in determining such Consolidated Net Income) the amount of all Dividends (excluding Dividend paid pursuant to Clause 26.3(f) (Restricted Payments) to the extent representing a return of the issue price rather than the payment of accrued dividends thereon) paid or accrued (whether or not paid, and including amounts attributable to dividends paid-in-kind) during the respective period with respect to Preferred Stock (including, without limitation, all such amounts attributable to the Parent Preference Shares A, the Parent Preference Shares B (after any issuance thereof), the Parent Preference Shares C and any other Preferred Stock of Parent (from time to time issued).

17

“Consolidated Subsidiaries” means, as to any person, all Subsidiaries of such person which are consolidated with such person for financial reporting purposes in accordance with GAAP.

“Consolidated Tangible Assets” means, at any time, the total consolidated assets of the Parent and its Consolidated Subsidiaries as same would be shown on a consolidated balance sheet of the Parent prepared in accordance with GAAP, provided that all intangible assets (in any event including good will) shall be excluded in making such determinations.

“Contingent Obligation” means, as to any person, any obligation of such person guaranteeing or intended to guarantee any Indebtedness, leases or dividends (“primary obligations”) of any other person (the “primary obligor”) in any manner, whether directly or indirectly or to otherwise assure or hold harmless the holder of such primary obligation against loss in respect thereof, provided, however, that the term Contingent Obligation shall not include endorsements of instruments for deposit or collection in the ordinary course of business. The amount of any Contingent Obligation shall be deemed to be an amount equal to the stated or determinable amount of the primary obligation in respect of which such Contingent Obligation is made or, if not stated or determinable, the maximum reasonably anticipated liability in respect thereof (assuming such person is required to perform thereunder) as determined by such person in good faith.

“Continuing Director” means a director who is either a member of the Supervisory Board of the Parent on the Initial Borrowing Date or who became a member of the Supervisory Board of the Parent subsequent to the Initial Borrowing Date and whose election, or nomination for election by the Parent’s shareholders, was duly approved by a majority of the Continuing Directors then on the Supervisory Board of the Parent.

“Converted C1 Facility” has the meaning ascribed to that term in Clause 2.1(f)(i) (The Facilities).

“Converted C1 Facility Advance” has the meaning ascribed to that term in Clause 2.1(f) (i)(The Facilities).

“Converted C2 Facility” has the meaning ascribed to that term in Clause 2.1(g)(i) (The Facilities).

“Converted C2 Facility Advance” has the meaning ascribed to that term in Clause 2.1(g) (i) (The Facilities).

“Default” means an Event of Default or any event or circumstance which (with the passage of time, the expiry of a grace period, the giving of notice, the making of any determination under any of the Finance Documents or any combination of any of the foregoing) would be an Event of Default.

“Defaulting Lender” means any Lender with respect to which a Lender Default is in effect.

“Dividend” means, with respect to any person, that such person has declared or paid a dividend (excluding dividends paid by the Parent in the Parent Common Stock and Parent Preferred Stock) or returned any equity capital to its stockholders, partners or members or authorised or made any other distribution, payment or delivery of property (other than ordinary share capital of such person) or cash to its stockholders, partners or members as such, or redeemed, retired, purchased or otherwise acquired, directly or indirectly, for a

18

consideration any shares of any class of its share capital or any partnership or membership interests outstanding (or any options or warrants issued by such person with respect to its share capital or other Equity Interests), or set aside any funds for any of the foregoing purposes, or shall have permitted any of its Subsidiaries to purchase or otherwise acquire for a consideration any shares of any class of the share capital or any partnership or membership interests of such person outstanding (or any options or warrants issued by such person with respect to its share capital or other Equity Interests).

“Documentary Credit” means a letter of credit, bank guarantee or other documentary credit issued or to be issued by an L/C Bank pursuant to Clause 4.1 (Conditions to Utilisation) or assumed in accordance with Clause 5.12 (Assumption of Existing Documentary Credits) and, where relevant, issued in conformity with Uniform Customs and Practice for Documentary Credits (1993 Revision) ICC Publication No. 500.

“Dollar Swingline Facility Advance” means an advance denominated in dollars as from time to time reduced by repayment made or to be made by the Swingline Facility Lenders under the Swingline Facility.

“Dollar Swingline Facility Outstandings” means, at any time, the aggregate principal amount of the Dollar Swingline Facility Advances outstanding under this Agreement.

“Double Taxation Treaty” means in relation to a payment of interest on an Advance made to a particular Borrower, any convention or agreement between the government of the Relevant Tax Jurisdiction of the Borrower and any other government for the avoidance of double taxation with respect to taxes on income and capital gains which makes provision in relation to interest.

“Dutch GAAP” means generally accepted accounting principles in The Netherlands.

“Dutch Guarantor” means each of the parties as set out in Part II of Schedule 1 (Original Guarantors) named as Dutch Guarantors and any Acceding Guarantor incorporated in The Netherlands.

“Effective Date” means the date of this Agreement.

“Eligible Institution” means and includes a commercial bank, a finance company, an insurance company, a financial institution, fund or other person which regularly lends, or purchases interests, in loans or extensions of credit of the types made pursuant to this Agreement, but in any event excluding the Parent and its Subsidiaries and Affiliates.

“EMU Legislation” means the legislative measures of the European Union for the introduction of changeover to or operation of the euro in one or more member states being in part legislative measures to implement the third stage of the European Monetary Union.

“End Date” has the meaning ascribed to that term in the definition of “Applicable Margin”.

“Environment” means living organisms including the ecological systems of which they form part and the following media:

(a) air (including air within natural or man-made structures, whether above or below ground);

19

(b) water (including territorial, coastal and inland waters, water under or within land and water in drains and sewers); and

(c) land (including land under water).

“Environmental Claims” means any and all administrative, regulatory or judicial actions, suits, demands, demand letters, directives, claims, liens, notices of non-compliance or violation, investigations or proceedings pursuant to or under any Environmental Law or any permit issued, or any approval given, under any such Environmental Law or Environmental Licence.

“Environmental Law” means all laws and regulations of any relevant jurisdiction which:

(a) have as a purpose or effect the protection of, and/or prevention of harm or damage to, the Environment;

(b) provide remedies or compensation for harm or damage to the Environment; and

(c) relate to Hazardous Materials or health or safety matters.

“Environmental Licence” means any Authorisations required at any time under Environmental Law.

“Equity Interests” means, in relation to any person, any and all shares, interests, rights to purchase, warrants, options, participation or other equivalents of or interest in (however designated) equity of such person, including any preferred stock, any limited or general partnership interest and any limited liability company membership interest.

“ERISA” means the U.S. Employee Retirement Income Security Act of 1974, as amended from time to time, and the regulations promulgated and rulings issued thereunder. Section references to ERISA are to ERISA, as in effect as at the Effective Date and any subsequent provisions of ERISA, amendatory thereof, supplemental thereto or substituted therefor.

“ERISA Affiliate” means each person (as defined in Section 3(9) of ERISA) which together with the Parent or a Subsidiary of the Parent would be deemed to be a “single employer” (i) within the meaning of Section 414(b), (c), (m) or (o) of the Code or (ii) as a result of the Parent or a Subsidiary of the Parent being or having been a general partner of such person.

“EURIBOR” means, in relation to any amount owed by an Obligor under this Agreement in euro on which interest for a given period is to accrue:

(a) the rate per annum for deposits in euro which appears on the Relevant Page for such period at or about 11.00 am (Brussels time) on the Quotation Date for such period; or

(b) if no such rate is displayed and the Agent shall not have selected an alternative service on which such rate is displayed, the arithmetic mean (rounded upwards, if not already such a multiple, to 4 decimal places) of the rates (as notified to the Agent) at which each of the Reference Banks was offering to prime banks in the European interbank market deposits in euro for such period at or about 11.00 am (Brussels time) on the Quotation Date for such period.

20

“Euro Amount” means:

(a) in relation to an Advance, (i) if such Advance is denominated in euro, the amount of such Advance or (ii) if such Advance is denominated in a currency other than euro, the equivalent in euro of such Advance, as the amount specified in the Utilisation Request for that Advance as adjusted, if necessary, in accordance with the terms of this Agreement and to reflect any repayment, consolidation or division of that Advance;

(b) in relation to a Documentary Credit, (i) if such Documentary Credit is denominated in euro, the Outstanding L/C Amount in relation to it at such time or (ii) if such Documentary Credit is not denominated in euro, the equivalent in euro of the Outstanding L/C Amount at such time, calculated as at the later of (A) the date which falls 2 Business Days before its issue date or any renewal date or (B) the date of any revaluation pursuant to Clause 5.3 (Revaluation of Documentary Credits); and

(c) in relation to any Outstandings, the aggregate of the Euro Amounts (calculated in accordance with paragraphs (a) and (b) above) of each outstanding Advance and/or Outstanding L/C Amount, made under the relevant Facility or Facilities (as the case may be), (i) if such Outstandings are denominated in euro, the aggregate amount in euro of it at such time or (ii) if such Outstandings are not denominated in euro, the equivalent in euro of the aggregate amount of it at such time.

“Euro Swingline Facility Advance” means an advance denominated in euro as from time to time reduced by repayment made or to be made by the Swingline Facility Lenders under the Swingline Facility.

“Euro Swingline Facility Outstanding” means, at any time, the aggregate principal amount of the Euro Swingline Facility Advances outstanding under this Agreement.

“Europcenter” means Xxxxxxxx Europcenter N.V., a corporation organised under the laws of the Kingdom of Belgium.

“Event of Default” means any of the events or circumstances described as such in Clause 28 (Events of Default).

“Excess Cash Flow” means, for any period, the amount (if any) by which:

(a) the sum of:

(i) Adjusted Consolidated Net Income (excluding any amounts of Consolidated Net Income attributable to CEAL and its Subsidiaries but including any cash Dividends actually received from CEAL only) for such period; and

(ii) the decrease, if any, in Adjusted Consolidated Working Capital (excluding any decrease in Adjusted Consolidated Working Capital attributable to CEAL and its Subsidiaries) from the first day to the last day of such period,

exceeds:

(b) the sum of:

21

(i) the aggregate amount of all Capital Expenditures made by the Parent and its Subsidiaries during such period (other than Capital Expenditures to the extent financed with existing moneys);

(ii) the aggregate amount of all Permitted Acquisitions made by the Parent and its Subsidiaries during such period (other than Permitted Acquisitions to the extent financed with existing moneys);

(iii) the aggregate amount of permanent principal payments of Indebtedness for borrowed money of the Parent and its Subsidiaries during such period (other than, without double counting, (A) repayments to the extent made with existing moneys, (B) repayments of the Borrower’s 12¼ per cent. Senior Subordinated Notes due 2009 to the extent made with cash on the consolidated balance sheet of the Parent and its Subsidiaries and (C) repayments of Outstandings, unless such repayments of Outstandings were (1) required as a result of a Scheduled Repayment and paid with internally generated funds or (2) made as a voluntary prepayment with internally generated funds (but in the case of a voluntary prepayment of the Revolving Facility, only to the extent accompanied by a voluntary reduction to the Revolving Facility Commitments));

(iv) the increase, if any, in Adjusted Consolidated Working Capital (excluding any increase in Adjusted Consolidated Working Capital attributable to CEAL and its Subsidiaries) from the first day to the last day of such period;

(v) the aggregate amount of cash Dividends paid by the Parent during such period pursuant to paragraph (g) of Clause 26.3 (Restricted Payments), as the case may be;

(vi) the net amount of Investments (i.e., the amount invested during the respective period, net of any returns on investments previously made pursuant to said sections during said period) pursuant to Clause 26.5(g)(ii) and/or (n) (Advances, Investments and Loans); and

(vii) one-time charges (including, without limitation, restructuring charges and any upfront fees related to these Facilities, the refinancing of the Senior Subordinated Notes and the issue of the Senior Subordinated Convertible Bonds) occurring during such period to the extent not already included above.

For the purposes of this definition only:

(A) “existing moneys” means equity proceeds, share capital, Asset Sales proceeds, insurance proceeds and/or Indebtedness; and

(B) in calculating Adjusted Consolidated Working Capital, any amounts expressed in currencies other than euros shall be converted into euros (as shown on Reuters ECB page 37 or, if same does not provide such exchange rate, on such other basis as may be satisfactory to the Agent) for the exchange of such currency into euros for the last day of the fiscal year of the Parent.

22

“Excess Cash Flow Payment Date” means the date occurring 105 days after the last day of each fiscal year of the Parent, with the first Excess Cash Flow Payment Date to occur on the 105th day after the last day of the fiscal year of the Parent ending closest to 31 December, 2004.

“Excess Cash Flow Payment Period” means, with respect to the repayment required on each Excess Cash Flow Payment Date, the immediately preceding fiscal year of the Parent.

“Existing Credit Agreement” means the Credit Agreement dated 26 October 1999 between, inter alios, the Parent, the Borrower, the banks and financial institutions named therein and the Bankers Trust Company as administrative agent as amended, modified or supplemented from time to time.

“Existing Documentary Credit” means each letter of credit, bank guarantee or other documentary credit as set out in Section C of Part II of Schedule 10 (Existing Indebtedness) each as issued pursuant to or existing under the Existing Credit Agreement and outstanding on the Initial Borrowing Date.

“Existing Indebtedness” means all Third Party Existing Indebtedness and all Intercompany Existing Indebtedness existing as at the Effective Date each as set out in Part II of Schedule 10 (Existing Indebtedness).

“Existing Lien” means the list of Liens existing as at the Effective Date set out in Part I of Schedule 10 (Existing Liens).

“Expiry Date” means, in relation to any Documentary Credit granted under this Agreement, the date stated in it to be its expiry date or the latest date on which demand may be made under it.

“Facilities” means the Term Facilities, the Revolving Facility, the Swingline Facility and (subject to Clause 7 (Uncommitted Incremental Facilities)) the Incremental Revolving Facility and the Incremental Term Facility granted to the Borrower in this Agreement, and “Facility” means any of them as the context may require.

“Facilities Obligations” means all amounts owing to the Finance Parties pursuant to the terms of this Agreement or any other Finance Document.

“Facility Office” means:

(a) in relation to the Agent, the office identified with its signature below or such other office as it may, from time to time select for performance of its agency function under this Agreement; and

(b) in relation to a Lender, the office from time to time designated by it to the Agent for the purposes of this Agreement (or, in the case of a Transferee, at the end of the Transfer Certificate to which it is a party as Transferee) or such other office as such Lender may from time to time select.

“Fair Market Value” means, with respect to any asset, the price at which a willing buyer, not an Affiliate of the seller, and a willing seller who does not have to sell, would agree to purchase and sell such asset, as determined in good faith by the board of directors or other governing body or, pursuant to a specific delegation of authority by such board of directors or

23

governing body, a designated senior executive officer, of the Parent or the Subsidiary of the Parent selling such asset.

“Federal Funds Rate” means in relation to any day, the rate per annum equal to:

(a) the weighted average of the rates on overnight Federal Funds transactions with members of the US Federal Reserve System arranged by Federal Funds brokers, as published for that day (or, if that day is not a New York Business Day, for the immediately preceding New York Business Day) by the Federal Reserve Bank of New York; or

(b) if a rate is not published for that day or immediately preceding New York Business Day, the average of the quotations for that day on those transactions received by the Agent from three Federal Funds brokers of recognised standing selected by the Agent.

“Fee Letters” means the fee letters referred to in Clauses 17.2 (Underwriting Fee) and 17.3 (Agency Fee).

“€5 Million Asset Sale” means any Asset Sale where the aggregate consideration (taking the Fair Market Value of any non-cash consideration) received by the Parent and its Subsidiaries in connection therewith is equal to or in excess of €5,000,000 (or its equivalent in other currencies).

“€5 Million Permitted Acquisition” means each Permitted Acquisition where the aggregate consideration paid (or which may be paid) in connection therewith (including any deferred compensation arrangements, the principal amount of Seller Debt and/or Permitted Acquired Debt and the Fair Market Value of all Equity Interests in the Parent issued as consideration in connection therewith) exceeds €5,000,000 (or its equivalent in other currencies).

“Final Maturity Date” means:

(a) in respect of the Revolving Facility and the Incremental Revolving Facility, the date falling 60 months after the date of this Agreement;

(b) in respect of the A Facility, subject to Clause 10.1 (Repayment of A Facility Outstandings), the date falling 72 months after the date of this Agreement;

(c) in respect of the B Facilities, subject to Clause 10.2 (Repayment of B Facility Outstandings), the date falling 84 months after the date of this Agreement;

(d) in respect of the C Facilities, subject to Clause 10.3 (Repayment of C Facility Outstandings), the date falling 84 months after the date of this Agreement; and

(e) in respect of the Incremental Term Facility, the Incremental Term Facility Maturity Date.

“Finance Documents” means:

(a) this Agreement, any Documentary Credit, any Accession Notices, Transfer Certificates and the Fee Letters;

(b) any Incremental Facility Commitment Agreement;

24

(c) the Security Documents;

(d) the Intercreditor Deed;

(e) the Hedging Agreements;

(f) any Additional Security Document; and

(g) any other agreement or document designated a “Finance Document” in writing by the Parent and the Agent.

“Finance Parties” means the Agent, the Arrangers, the Security Trustee, the Lenders and each Hedge Counterparty to a Hedging Agreement and “Finance Party” means any of them.

“GAAP” means in relation to any financial statement to be delivered in accordance with this Agreement generally accepted accounting principles in The Netherlands

“Group” means the Parent, the Borrower, and all other Subsidiaries of the Parent from time to time.

“Group Business” means the business as conducted by the Parent and its Subsidiaries on the date of this Agreement and any logical extensions or related ancillary businesses thereto (including business functions incidental to such business).

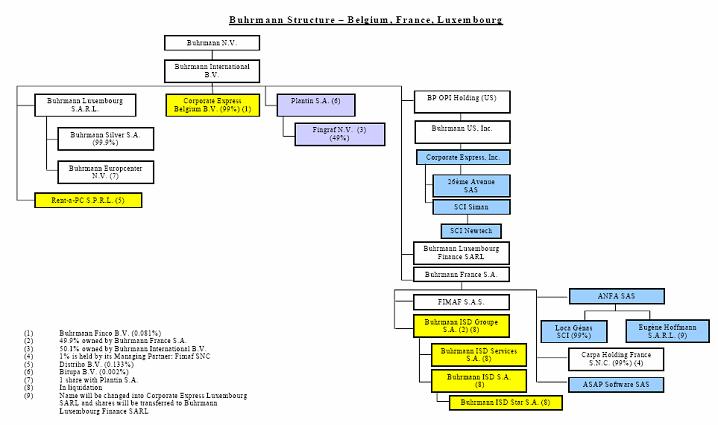

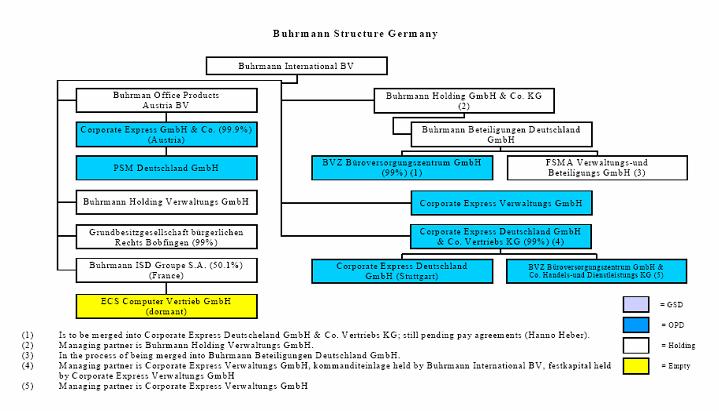

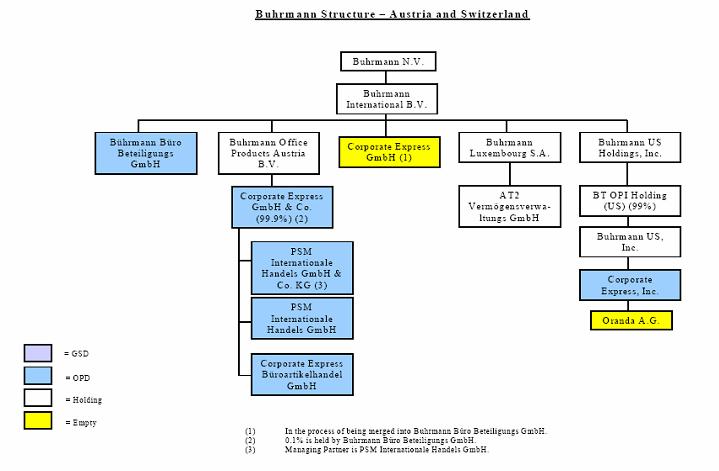

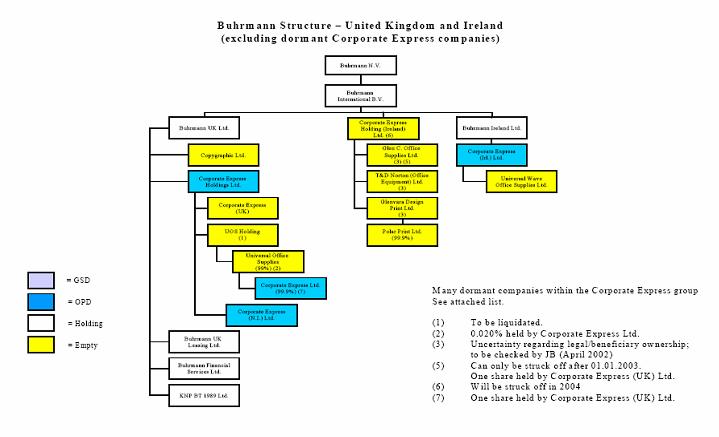

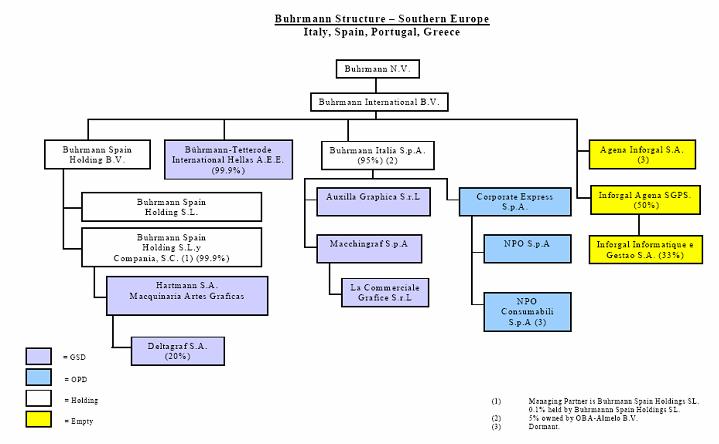

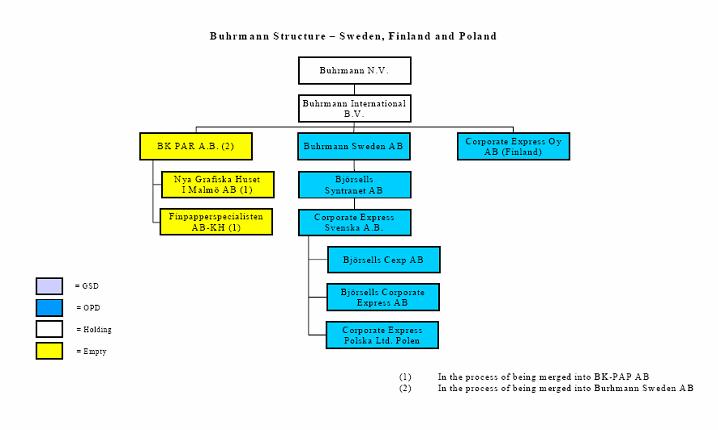

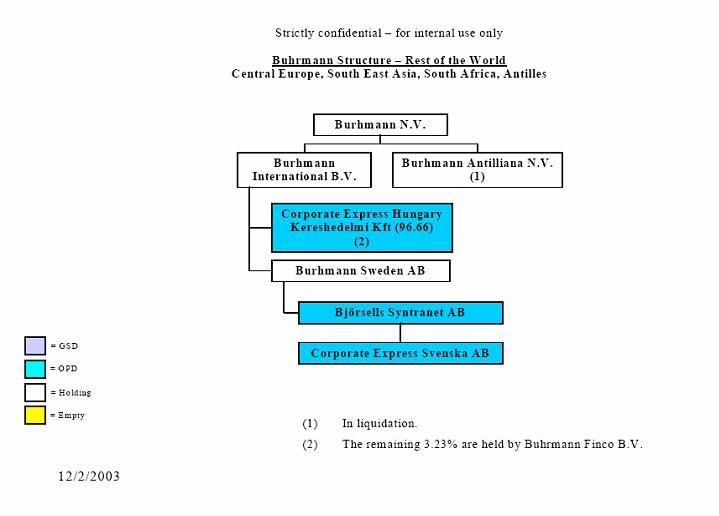

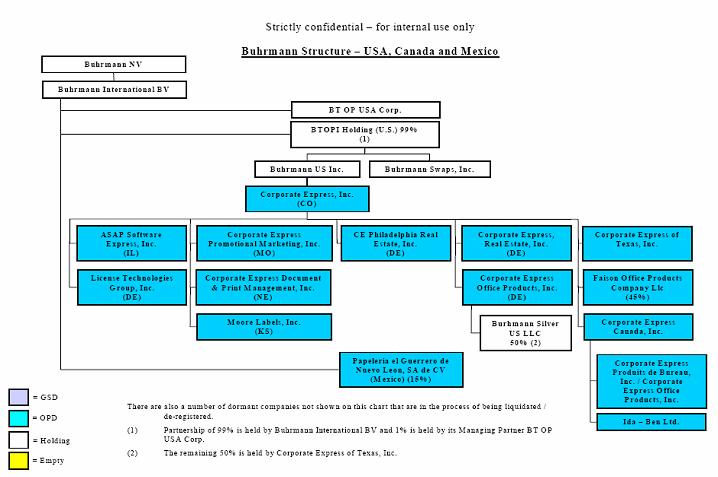

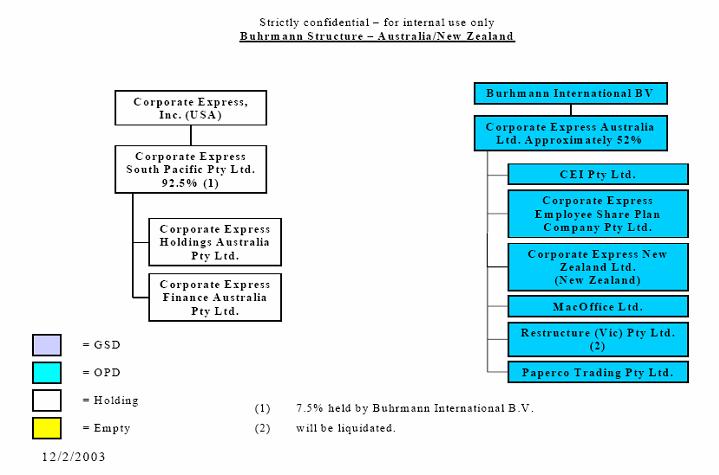

“Group Structure Chart” means the group structure chart set out in Schedule 9 (Group Structure).

“Guarantee” means the guarantee contained in Clause 30 (Guarantee and Indemnity).

“Guarantors” means the Original Guarantors and any Acceding Guarantors and “Guarantor” means any one of them, as the context requires.

“Hazardous Materials” means (a) any petroleum or petroleum products, radioactive materials, asbestos in any form that is friable, urea formaldehyde foam insulation, transformers or other equipment that contains dielectric fluid containing levels of polychlorinated biphenyls, and radon gas, (b) any chemicals, materials or substances defined as or included in the definition of “hazardous substances”, “hazardous waste”, “hazardous materials”, “extremely hazardous substances”, “restricted hazardous waste”, “toxic substances”, “toxic pollutants”, “contaminants”, or “pollutants”, or words of similar import, under any applicable Environmental Law and (c) any other chemical, material or substance, the Release of which is prohibited, limited or regulated by any governmental authority.

“Hedge Counterparty” means each party other than a member of the Group to a Hedging Agreement or, as the case may be, an Other Hedging Agreement and “Hedge Counterparties” means all such parties.

“Hedging Agreement” means any agreement entered into in connection with Clause 25.12 (Interest Rate Protection) between a member of the Group and a Lender in respect of an interest rate swap, currency swap, forward foreign exchange transaction, cap, floor, collar or option transaction or any other treasury transaction or any combination of it or any other transaction entered into in connection with protection against or benefit from fluctuation in any currency, rate or price.

25

“Hedging Letter” means the letter dated on or about the date of this Agreement from the Agent to the Parent setting out the agreed hedging policy in respect of the Term Facilities (other than the Incremental Term Facility).

“Holding Company” means a company or corporation of which another company or corporation is a Subsidiary.

“Increased Cost” means:

(a) any reduction in the rate of return from a Facility or on a Finance Party’s (or an Affiliate’s) overall capital;

(b) any additional or increased cost; or

(c) any reduction of any amount due and payable under any Finance Document,

which is incurred or suffered by a Finance Party or any of its Affiliates to the extent that it is attributable to that Finance Party having agreed to make available its Commitment or having funded or performed its obligations under any Finance Document.

“Incremental Facility Commitment Agreement” means an Incremental Revolving Facility Commitment Agreement or an Incremental Term Facility Commitment Agreement, as the context may require.

“Incremental Revolving Facility” means, subject to Clause 7 (Uncommitted Incremental Facilities), the uncommitted revolving credit facility as may be granted to the Borrower pursuant to Clause 2.1(h) (The Facilities).

“Incremental Revolving Facility Commitment” means, in relation to an Incremental Revolving Facility Lender at any time, and save as otherwise provided in this Agreement, any commitment to make Utilisations provided by such Incremental Revolving Facility Lender pursuant to Clause 7 (Uncommitted Incremental Facilities), in such amount as agreed to by such Incremental Revolving Facility Lender in the respective Incremental Revolving Facility Commitment Agreement.

“Incremental Revolving Facility Commitment Agreement” means each incremental revolving facility commitment agreement in the form set out in Part IV of Schedule 4 (Form of Incremental Revolving Facility Commitment Agreement).

“Incremental Revolving Facility Lender” has the meaning ascribed to that term in Clause 7.2(b) (Incremental Revolving Facility Commitment Agreement).

“Incremental Term Facility” means, subject to Clause 7 (Uncommitted Incremental Facilities), the uncommitted term loan facility as may be granted to the Borrower pursuant to Clause 2.1(i) (The Facilities).

“Incremental Term Facility Advance” means an advance (as from time to time reduced by repayment) made or to be made by one or more of the Lenders under the Incremental Term Facility or arising in respect of the Incremental Term Facility.

“Incremental Term Facility Commitment” means, in relation to a Lender at any time, and save as otherwise provided in this Agreement, any commitment to make Incremental Term

26