Independent Contractor Services Agreement

Exhibit 10.1

Independent Contractor Services Agreement

THIS INDEPENDENT CONTRACTOR SERVICES AGREEMENT (the “Agreement”) is entered into as of February 23, 2021 (the “Effective Date”) between AppTech, Corp., A Wyoming Corporation having an address at 0000 Xxxxx Xxx. Xxxxx 000 Xxxxxxxx, Xx 00000 (hereinafter “Company”) and Innovations Realized, LLC, a California Limited Liability Company having an address at 0000 Xxxxxx Xxxxxx Xx. #000-000 Xxx Xxxxx, XX 00000-0000 (hereinafter “Contractor”) (each, a “Party”) (collectively the “Parties”). This Agreement supersedes any and all Independent Contractor Agreements between the Parties.

Company is of the opinion that the Contractor has the necessary qualifications, experience and abilities to assist and benefit the Company in its business. Company desires to retain the Contractor as an Independent Contractor and the Contractor has agreed to accept the terms and conditions set out in this Agreement.

IN CONSIDERATION of the matters described above and the mutual benefits and obligations set forth in this Agreement, the receipt and sufficiency of such consideration is hereby acknowledged, the parties to this Agreement agree as follows:

1. Definitions. As used in this Agreement:

1.1 “Competitors” means companies in the payment space that may currently or in the future offer services that compete with the Company’s current or anticipated product offering.

1.2 “Confidential Information” means any and all information related to the Parties’ business (including trade secrets, technical information, business forecasts and strategies, marketing plans, customer and supplier lists, personnel information, financial data, and proprietary information of third Parties provided to Company in confidence) that is labeled or identified as “confidential” or “proprietary” or that Contractor otherwise knows, or would reasonably be expected to know, Company considers to be confidential or proprietary or Company has a duty to treat as confidential.

1.3 “Deliverables” means the items to be provided or actually provided by Contractor to Company under this Agreement, including items specifically designated or characterized as deliverables in a Statement of Work.

1.4 “Intellectual Property” means all algorithms, application programming interfaces (APIs), apparatus, assay components, circuit designs and assemblies, concepts, Confidential Information, data (including clinical data), databases and data collections, designs, diagrams, documentation, drawings, flow charts, formulae, ideas and inventions (whether or not patentable or reduced to practice), know-how, materials, marketing and development plans, marks (including brand names, product names, logos, and slogans), methods, models, net lists, network configurations and architectures, photomasks, procedures, processes, protocols, schematics, semiconductor devices, software code (in any form including source code and executable or object code), specifications, subroutines, techniques, test vectors, tools, uniform resource identifiers including uniform resource locators (URLs), user interfaces, web sites, works of authorship, and other forms of technology.

1.5 “Intellectual Property Rights” means all past, present, and future rights of the following types, which may exist or be created under the laws of any jurisdiction in the world: (a) rights associated with works of authorship, including exclusive exploitation rights, copyrights, moral rights, and mask work rights; (b) trademark and trade name rights and similar rights; (c) trade secret rights; (d) patent and industrial property rights; (e) other proprietary rights in Intellectual Property of every kind and nature; and (f) rights in or relating to registrations, renewals, extensions, combinations, divisions, and reissues of, and applications for, any of the rights referred to in clauses (a) through (e) of this sentence.

1.6 “Services” means the services to be performed or actually performed by Contractor under this Agreement.

1.7 “Work Product” means (a) all Deliverables, (b) all Intellectual Property, in any stage of development, that Contractor conceives, creates, develops, or reduces to practice in connection with performing the Services, and (c) all tangible embodiments (including models, presentations, prototypes, reports, samples, and summaries) of each item of such Intellectual Property.

1

Independent Contractor Services Agreement

2. Engagement.

2.1 Statements of Work. From time to time, Company may submit to Contractor written work orders substantially in the form of Appendix A that contain the terms (including specifications, delivery and performance schedules, and fees) for Services and Deliverables that Company desires Contractor to provide. If Contractor begins to perform services under a work order, Contractor will be deemed to have accepted such work order. Upon acceptance of a work order by Contractor (in writing, by performance, or otherwise), such work order will be a “Statement of Work.” A Statement of Work may include a limited license to Contractor to use certain Intellectual Property of Company or its licensors, such as software, tools, or know-how, solely as necessary to complete that Statement of Work. Any such license automatically terminates upon the completion of the applicable Statement of Work and is limited by the terms of this Agreement.

2.2 Consulting Services. During the Term of the Agreement, Contractor shall provide consulting services to the Company related delivery of its fintech initiatives.

2.3 Performance of Services. Contractor will perform the Services in accordance with the terms of this Agreement and the applicable Statement of Work. Except as otherwise provided in the applicable Statement of Work, Contractor will mutually agree with Company on the manner and means of performing the Services, including the choice of place and time, and will use Contractor’s expertise and creative talents in performing the Services. Contractor will provide, at Contractor’s own expense, a place of work and all equipment, tools, and other materials necessary to complete the Statement of Work; however, to the extent necessary to facilitate performance of the Services and for no other purpose, Company may, in its discretion, make its equipment or facilities available to Contractor at Contractor’s request.

2.4 Disclosure of Work Product. In accordance with the applicable Statement of Work, including any schedule therein, Contractor will deliver all Deliverables and disclose all other Work Product to Company (or any person designated by Company in writing) in the form specified in the Statement of Work or otherwise designated by Company.

2.5 Competitive Engagements. Company acknowledges that Contractor provides services to other businesses that may be Competitors of Company. During the term of the Agreement, Contractor must provide the name of the company to which the Contractor is providing services and nature of the services provided subject to any relevant non-disclosure or privacy agreements. The Company agrees that Contractor shall have the right to continue to provide services to such businesses and engage other businesses, regardless of their status as Competitors, subject to Contractor’s compliance with the terms of this Agreement, including the conflict of interest requirements described in Section 7 of this Agreement. For avoidance of doubt, Contractor provides, but is not limited to consulting services including strategy and operations, process improvements, digital transformation, partner and contract negotiations, system and process implementation, go to market planning and lifecycle management in support of company initiatives across several verticals including fintech and payments.

3. Intellectual Property Rights.

3.1 Except for rights expressly granted under this agreement, nothing in this agreement will function to transfer any of either Party’s Intellectual Property rights to the other Party, and each Party will retain exclusive interest in and ownership of its Intellectual Property developed before this agreement or developed outside the scope of this agreement (“Background IP”).

3.2 All Work Product and/or Intellectual Property originally conceived or reduced to practice with the performance of services under this Agreement to the extent the same does not constitute an improvement or modification to Background IP of the Contractor shall be deemed the Intellectual Property of the Company. Contractor does not now or in the future possess any Intellectual Property Rights to said Intellectual Property.

4.1 Relationship. Contractor’s relationship to Company under this Agreement is that of an independent contractor. Nothing in this Agreement is intended or should be construed to create a partnership, joint venture, or employer-employee relationship between Company and Contractor (including any individuals providing services on Contractor’s behalf). Contractor will take no position with respect to or on any tax return or application for benefits, or in any proceeding directly or indirectly involving Company, that is inconsistent with Contractor being an independent contractor (and not an employee) of Company. Contractor is not the agent of Company and is not authorized, and must not represent to any third party that Contractor is authorized, to make any commitment or otherwise act on behalf of Company. Without limiting the generality remainder of Section 4.

2

Independent Contractor Services Agreement

4.2 Benefits and Contributions. Neither Contractor nor its representatives is entitled to or eligible for any benefits that Company may make available to its employees, such as group insurance or retirement benefits. Because Contractor is an independent contractor, Company will not withhold or make payments for social security, make unemployment insurance or disability insurance contributions, or obtain workers’ compensation insurance on behalf of Contractor or its representatives. If, notwithstanding the foregoing, Contractor is reclassified as an employee of Company, or any affiliate of Company, by the U.S. Internal Revenue Service, the U.S. Department of Labor, or any other federal or state or foreign agency as the result of any administrative or judicial proceeding, Contractor agrees that Contractor will not, as the result of such reclassification, be entitled to or eligible for, on either a prospective or a retrospective basis, any employee benefits under any plans or programs established or maintained by Company.

4.3 Taxes. Contractor is solely responsible for filing all tax returns and submitting all payments as required by any federal, state, local, or foreign tax authority arising from the payment of fees to Contractor under this Agreement, and agrees to do so in a timely manner. If applicable, Company will report the fees paid to Contractor under this Agreement by filing Form 1099-MISC with the Internal Revenue Service as required by law.

4.4 Compliance with Law. Contractor will comply with all applicable federal, state, local, and foreign laws governing self-employed individuals, including laws requiring the payment of taxes, such as income and employment taxes, and social security, disability, and other contributions.

5.1 Fees. Subject to the terms and conditions of this Agreement, Company will pay Contractor in accordance with the fees specified in each Statement of Work provided to the Company. All Statements of Work must be mutually agreed upon in writing.

5.2 Expenses. Company will reimburse Contractor for all reasonable, approved “out-of-pocket” and travel expenses (conferences, transportation, lodging, meals) as agreed upon prior to travel. Prior to incurring expenses, Contractor must be given express written approval by the Company’s Chief Financial Officer.

5.3 Invoicing. Unless otherwise expressly provided in the applicable Statement of Work, (a) payment to Contractor of Fees and Expenses will be paid on each Friday, provided such invoice is submitted 3 business days prior and (b) Contractor will submit invoices to Company as specified in each Statement of Work. Contractor will maintain, in accordance with generally-accepted accounting principles, complete and accurate records of the work performed and expenses incurred sufficient to document the Fees and Expenses invoiced to Company.

5.4 Purchase Option Agreement. In association with this Agreement and the attached Appendix B – Purchase Option Agreement, Company shall grant the option to Contractor to purchase up to two million nine hundred thousand (2,900,000) shares of Company Common stock as described in the Purchase Option Agreement.

6.1 Use and Disclosure. During the term of this Agreement and at all times thereafter, Contractor will (a) hold all Confidential Information in strict trust and confidence, (b) refrain from using or permitting others to use Confidential Information in any manner or for any purpose not expressly permitted or required by this Agreement, and (c) refrain from disclosing or permitting others to disclose any Confidential Information to any third party without obtaining Company’s express prior written consent on a case-by-case basis.

6.2 Standard of Care. Contractor will protect the Confidential Information from unauthorized use, access, or disclosure in the same manner as Contractor protects Contractor’s own confidential or proprietary information of a similar nature, and with no less than the greater of reasonable care and industry-standard care.

6.3 Exceptions. Contractor’s obligations under Sections 6.1 and 6.2 will terminate with respect to any particular information that Contractor can prove, by clear and convincing evidence, (a) Contractor lawfully knew prior to Company’s first disclosure to Contractor, (b) a third party rightfully disclosed to Contractor free of any confidentiality duties or obligations, or (c) is, or through no fault of Contractor has become, generally available to the public. Additionally, Contractor will be permitted to disclose Confidential Information to the extent that such disclosure is expressly approved in writing by Company, or is required by law or court order, provided that Contractor immediately notifies Company in writing of such required disclosure and cooperates with Company, at Company’s reasonable request and expense, in any lawful action to contest or limit the scope of such required disclosure, including filing motions and otherwise making appearances before a court.

3

Independent Contractor Services Agreement

6.4 Removal; Return. Contractor will not remove any tangible embodiment of any Confidential Information from Company’s facilities or premises without Company’s express prior written consent. Upon Company’s request and upon any termination or expiration of this Agreement, Contractor will promptly (a) return to Company or, if so directed by Company, destroy all tangible embodiments of the Confidential Information (in every form and medium), (b) permanently erase all electronic files containing or summarizing any Confidential Information, and (c) certify to Company in writing that Contractor has fully complied with the foregoing obligations.

7.1 No Conflicts. Contractor will refrain from any activity that prevents or materially impairs Contractor’s ability to perform under this Agreement, including forgoing any agreement or making any commitment that will limit the Contractor’s ability to perform the Services. Contractor represents and warrants that Contractor is not now subject to any contract or duty that would be breached by Contractor’s entering into or performing Contractor’s obligations under this Agreement. At no time during the term of this Agreement shall Contractor permit an actual or potential conflict to result in Contractor acting in a way contrary to the best interests of the Company. Any potential or actual conflict of interest must be disclosed to the Company, which has the ability to waive such conflict in writing.

8.1 General. This Agreement shall commence on the Funding Date and continue for two (2) years thereafter and shall be automatically renewed for additional periods of three (3) months, until terminated by either Party as provided below..

8.2 Company Termination Rights. If at any time the Company, in good faith, determines that it is dissatisfied with the Deliverables or other material aspects of the Contractor’s performance the Company shall provide written notice of this position. Should the Contractor fail to satisfactorily cure this dissatisfaction within thirty (30) days, Company may terminate the Agreement effective upon written notice.

8.3 Contractor Termination Rights. If at any time the Contractor no longer wishes to continue providing services to the Company, Contractor may terminate this agreement with thirty (30) days written notice.

8.4 Contractor Termination for Missed Payment. Contractor shall have the right, upon written notice, to immediately terminate this Agreement if any payment obligation is more than 15 days past due.

8.5 Automatic Termination. This Agreement will automatically terminate, regardless of the term:

8.5.1 Upon mutual written agreement by the Parties;

8.5.2 In the event of a breach of any representation, warranty, covenant or agreement of this Agreement by a Party following written notice of such a breach to the breaching Party by the non-breaching party.

8.5.3 if it becomes apparent that any Party has become insolvent or has a receiver appointed or applied for, has called a meeting of creditors, or has resolved to go into bankruptcy or liquidation (except a bona fide amalgamation or reconstruction while solvent).

8.6 Effects of Termination. In the event of any termination of this Agreement as provided in Section 8, this Agreement (other than Section 6) and all applicable defined terms, which shall remain in full force and effect, shall forthwith become wholly void and of no further force and effect; provided that nothing herein shall relieve any party from liability for willful breach of this Agreement.

4

Independent Contractor Services Agreement

10.1 Governing Law. This Agreement and any disputes hereunder will be governed by the laws of the State of California, without regard to its conflict of law principles. The state and federal courts located in San Diego County, California shall have exclusive jurisdiction to adjudicate any dispute arising out of or relating to this Agreement. Each party hereby consents to the exclusive jurisdiction of such courts. Each party also hereby waives any right to jury trial in connection with any action or litigation in any way arising out of or related to this Agreement.

10.2 Severability. If any provision of this Agreement is, for any reason, held to be invalid or unenforceable, the other provisions of this Agreement will be unimpaired and the invalid or unenforceable provision will be deemed modified so that it is valid and enforceable to the maximum extent permitted by law.

10.3 No Assignment. This Agreement and Contractor’s rights and obligations under this Agreement may not be assigned, delegated, or otherwise transferred, in whole or in part, by operation of law or otherwise, by Contractor without Company’s express prior written consent. Any attempted assignment, delegation, or transfer in violation of the foregoing will be null and void. Company may assign this Agreement, or any of its rights under this Agreement to any third party with or without Contractor’s consent.

10.4 Force Majeure. Neither party will be liable for non-performance or delay in performance of its obligations caused by events beyond its control, including but not limited to: act of war, terrorism, riot, civil commotion, revolution, blockade, embargo, fire, explosion, flood, adverse weather, other act of God, disease, pandemic, shortage of necessary materials, interruption of transport, electricity or other supply, any form of government, (or other public authority) intervention, industrial dispute, strike, lock-out, sit-in, industrial or trade dispute, or labor shortage. The date of the performance of the obligation(s) affected shall be postponed for so long as is made necessary by the event of force majeure. If the event of force majeure, continues for more than three (3) months, either party may terminate this agreement.

10.5 Notices. Business-related notices may be delivered by email. All legal notices under this Agreement will be in writing addressed to the parties at the address set forth in the preamble hereto and will be deemed to have been duly given (a) when received, if personally delivered; (b) the first business day after sending by email; (c) the day after it is sent, if sent for next day delivery by recognized overnight delivery service; and (d) upon receipt, if sent by certified or registered mail, return receipt requested.

10.6 Attorneys’ Fees. If any litigation, including arbitration, occurs between: Contractor and Company arising out of or as a result of this Agreement or the acts of the parties under this Agreement, or which seeks an interpretation of this agreement, each party in such litigation must bear its own expenses, including attorneys’ fees.

10.7 Construction. In the event of any conflict between this Agreement and a Statement of Work, this Agreement will control unless the Statement of Work expressly refers to the Parties’ intent to alter the terms of this Agreement with respect to that Statement of Work.

5

Independent Contractor Services Agreement

10.8 Use of Name and Logo. Neither Party is authorized to use the name(s) and/or logo(s) of the other Party for publicity and marketing without the written consent of such party.

10.9 Waiver. All waivers must be in writing and signed by the Party to be charged. Any waiver or failure to enforce any provision of this Agreement on one occasion will not be deemed a waiver of any other provision or of such provision on any other occasion.

10.10 Entire Agreement; Amendments. Agreement is the final, complete, and exclusive agreement of the Parties with respect to the subject matter hereof and supersedes and merges all prior or contemporaneous communications and understandings between the Parties. No modification of or amendment to this Agreement will be effective unless in writing and signed by the Party to be charged.

In Witness Whereof, the undersigned Parties, intending to be legally bound, have duly executed this Agreement as of the Effective Date.

| Apptech Corp. (“Company”) | Inovations Realized, LLC (“Contractor”) | |||

| Signed: | /s/ Xxxx X’Xxxxxx | Signed: | /s/ Xxx Xxxxxxx | |

| Name: | Xxxx X’Xxxxxx | Name: | Xxx Xxxxxxx | |

| Title: | CEO | Title: | CEO | |

| Address: | 0000 Xxxxx Xxx. Xxxxx 000,Xxxxxxxx, XX00000 | Address: | 0000 Xxxxxx Xxxxxx Xxxxx, #000-000 Xxx Xxxxx, XX 00000-0000 | |

6

Independent Contractor Services Agreement

Appendix A

Statement of Work

This Statement of Work is incorporated into the Independent Contractor Services Agreement dated February 23, 2021 (for the purposes of this Statement of Work, the “Agreement”) by and between AppTech Corp. (hereinafter the “Company”) and Innovations Realized, LLC (hereinafter the “Contractor”). This Statement of Work describes Services and Deliverables to be performed and provided by Contractor pursuant to the Agreement. If any item in this Statement of Work is inconsistent with the Agreement prior to such incorporation, the terms of the Agreement will control. All capitalized terms used and not expressly defined in the Statement of Work will have the meanings given to them in the Agreement.

Fees & Payments. In exchange for the services provided below, Company agrees to pay Contractor a total fee of [****] dollars [****] for professional services (the “Professional Services Fee”) which shall be invoiced by Contractor and paid by Company as follows:

| 1. | Within two (2) business the Effective Date of this Agreement (“First Installment Date”): $ [****] |

| 2. | March 05, 2021: $ [****] |

| 3. | April 05, 2021: $ [****] |

| 4. | May 05, 2021: $ [****] |

| 5. | June 05, 2021: $ [****] |

| 6. | July 05, 2021: $ [****] |

| 7. | August 05, 2021: $ [****] |

As soon as economically feasible, a sum of [****] dollars ($ [****]), or the remainder of the fees as outlined in this Fees & Payments Section shall be set aside in a separate Company account only to be drawn upon to fund this Statement of Work and fulfill invoices.

Invoices shall be sent to the following email address: xxxxxx@xxxxxxxxxxx.xxx

In accordance with Section 5.2 of the Agreement, Company will reimburse Contractor for all reasonable “out-of-pocket” and travel expenses with prior written approval.

Invoices for Contractor shall be paid via wire transfer to the following bank credentials:

Innovations Realized LLC

0000 Xxxxxx Xxxxxx Xxxxx,

#000-000

Xxx Xxxxx, Xx 00000-0000

Acct #: 925758901

Chase Wire #: 021000021

Company Oversight & Management:

Contractor shall provide, on a bi-weekly basis after the first thirty (30) days, a status and progress report using a structure agreed upon by Company and Contractor. The status and progress report will provide insight into any material variance to the overall planning, execution, or strategy and will be considered the point of communication, discussion and feedback on the direction of the project between both parties.

It is understood that, based on the nature of this Project, any substantive material variances that may arise may require additional financial resources to execute the strategy. In such cases, both parties shall agree in writing to such changes in the form of an Addendum to this Statement of Work.

7

Independent Contractor Services Agreement

Given the cross-departmental nature of this Project, Contractor’s ability to perform certain aspects of the above listed Project Plan is dependent on Company and Company’s current and future Partners and corresponding resources. It is expected that reasonable efforts and access to needed resources will be provided by all parties. In addition, certain aspects of this Project are dependent on first signing an agreement(s) with Partner(s). For avoidance of doubt, this is inclusive Payment gateway, processing and acquiring relationships.

Working with Company and NECP, it is expected that all parties will be involved in defining the plan to properly go to market in the U.S. with the next phase (not included in this Appendix A Statement of Work) being Company’s commitment to deploying funds necessary to execute on the plan.

Services:

Objective and Key Deliverables:

Company is licensing NECP’s platform along with a commitment to develop the payment processing infrastructure, text payment and other services as identified by Company and NECP contract(s). Contractor is being hired to Develop a Strategic Operating Plan focused on the design, execution and go to market aspects of the platform (NECP) to enter the U.S. market (product market fit).

Overall Strategy and Leadership: ensure all aspects of the strategy, NECP build and go to market planning are being managed properly.

General Management and Leadership: Given the multi-faceted aspects of strategy development and operational planning, leadership is required to manage the overall success of this project. Leadership will consist of bringing together a team of experts that can perform specific tasks based on assigned areas of focus. This will require the recruiting and management of these relationships, the integration of these resources into the overall project (kickoff) and ongoing management of the performance and deliverables expected. As the project unfolds, resources may need to be added or replaced to ensure the project continues to move forward with the right outcomes.

8

Independent Contractor Services Agreement

NECP Liaison: In addition, working alongside the NECP team to properly manage expected output, product market fit and overall alignment of objectives is critical in ensuring the product(s) align with the market segments and vice versa. This will include solutioning with the NECP team to determine product differentiation and market strategies based on the existing technology stack, as well as the payment integration execution.

Bi-directional Communication: Additionally, it is imperative that Contractor maintain clear communication with Company surrounding all aspects of the project. This will require insight and feedback between parties on an ongoing basis to ensure proper direction and alignment as set forth in this statement of work. This will include communication channels (i.e. Slack, email), facilitating proper checkpoints (tracking project progression – completion, learnings, risks, pivots, etc.) and strategic discussions related to the product, market and overall opportunities being identified through the Strategic Planning Process.

Vendors, Integrations, Product & Project Management: Perform industry and vendor research, negotiations and contractual constructs, platform integrations, product management, project management

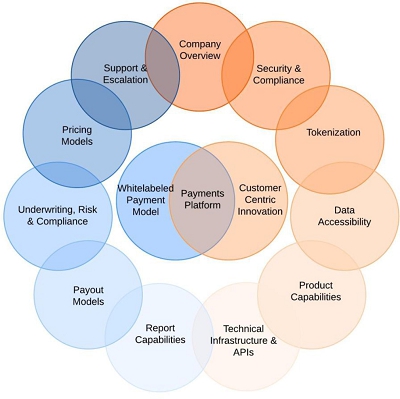

As a part of the NECP build, it is required that the proper payment vendor(s) be identified to meet the objectives of delivering the payment integration on the NECP platform. This will require researching and identifying payment vendors, vetting against a multitude of factors to determine the proper integration partner as set out to meet the strategic objectives. Formulate a “plan of attack” across all aspects of the payment landscape (building blocks) based on discovery analysis and output. This will help to dictate future actions, analysis and outreach (vendors) to align with expected outcomes. Evaluation criteria of vendors are inclusive of the following key areas.

In addition, properly defining current and anticipated processing & acquiring economics (buy rate, residual split etc.) and how this impacts go to market strategy will be highly important. Defining scope and timelines and documenting business requirements alongside NECP will drive both current and future development projects.

9

Independent Contractor Services Agreement

Vendor decisioning will be a decision involving all parties inclusive of Company, Contractor and NECP. It is imperative that the proper decisions be made given the nature of this relationship as the initial payment rails within the NECP platform and alignment with target market objectives. It is expected that Contractor will drive these conversations and decision criteria.

Vendors and Platform Technical Expertise & Strategy: Oversee vendor selection, capabilities and technical aspects, technical architecture definition, technical requirement analysis.

When looking at payment vendors and other additive technology partners, reviewing technical frameworks, capabilities and overall architectural decisions will greatly impact the future flexibility and build of the platform to properly provide both a solid, extensible platform while also considering future impact and growth. Develop architectural strategies, documenting proper database structures and aligning with NECP’s existing platform and planned build to strengthen opportunities in market.

Assessing vendors is inclusive of reviewing APIs, security protocols, change management, software lifecycle, technical implementation and support, data and reporting to determine the right “fit” from a technical perspective. This foundational analysis will have impact on decisions and implementation protocols and is as important as the business requirements in defining the proper partner modeling.

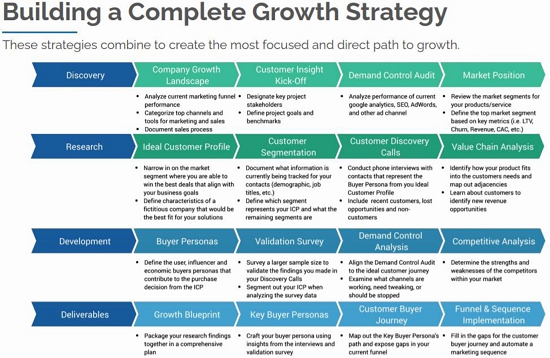

Growth Playbook - Go To Market Strategy: Deliver market insights, discovery & research, growth blueprint, 2-3 ideal customer profiles, customer segmentation, value chain analysis, competitive analysis, key buyer personas, funnel and sequence mapping.

As the core technology is being developed and vendor selection is taking place, defining a go to market growth strategy creates an intentional growth plan based on strategic insights and data – ultimately building a system that finds and guides the ideal audience to a sales decision is vital.

A proper growth plan is built using two strategic foundations - competitive advantage and demand control. Competitive Advantage - know the audience that allows you to win in the market. Understand why they choose you and if there is a correlation to the market segments where you win. Learn how you can win once you reach your ideal audience. Demand Control - understand how people currently find you. Learn what channels you can use to reach the right people. Know where your marketing dollars should go.

Focusing on the key buyers, not only the market segments provides a valuable tool to understand the purchase drivers for the user and economic buyer personas that will make the decisions. Focusing on how to target the key buyer—how they buy and why they buy delivers the strategy necessary to impact and drive sales.

10

Independent Contractor Services Agreement

Operational Planning - Go To Market Execution Plan: Building operational strategy, team structures, process, budgets, timing, costs, targets, pricing constructs

Given the technology and growth strategy work in preparation for entering the market, creating the proper operational strategy for launch provides the construct that will feed the next phase(s). Defining the operations required to drive revenue and market share across the identified ICP’s will feed budget projections.

Modeling the organizational structure and phased timing of bringing these resources on board is required as well to deliver a strategic operating plan and budget which will ultimately be used to hire resources for launch and growth. Forecasting and budgeting for specific roles will also provide guidelines as to what the costs are applied against revenue (e.g. ARR).

Additionally, modeling pricing options in light of identified ICPs will prove beneficial in defining the proper approach to the market buyers. Understanding pricing models will also help to identify proper sales compensation models and metrics as well.

Statement of Work is NOT inclusive of separate NECP/AppTech Contract Terms.

11

Independent Contractor Services Agreement

In Witness Whereof, the undersigned Parties, intending to be legally bound, have duly executed this Statement of Work as of the Effective Date.

| Apptech Corp. (“Company”) | Inovations Realized, LLC (“Contractor”) | |||

| Signed: | /s/ Xxxx X’Xxxxxx | Signed: | /s/ Xxx Xxxxxxx | |

| Name: | Xxxx X’Xxxxxx | Name: | Xxx Xxxxxxx | |

| Title: | CEO | Title: | CEO | |

| Address: | 0000 Xxxxx Xxx. Xxxxx 000,Xxxxxxxx, XX00000 | Address: | 0000 Xxxxxx Xxxxxx Xxxxx, #000-000 Xxx Xxxxx, XX 00000-0000 | |

12

Independent Contractor Services Agreement

APPENDIX B

PURCHASE OPTION AGREEMENT

This Purchase Option Agreement (this “Agreement”) is entered into as of February 23, 2021 (hereinafter, the Effective Date”) by and between APPTECH CORP. (hereinafter “Company”), A Wyoming corporation with offices at 0000 Xxxxx Xxx. and INNOVATIONS REALIZED (hereinafter “Contractor”) (collectively the “Parties”). All capitalized terms used and not expressly defined in the Statement of Work will have the meanings given to them in the Agreement.

1. CERTAIN DEFINITIONS.

“Change of Control” means the sale of all or substantially all the assets of a Party; any merger, consolidation or acquisition of a Party with, by or into another corporation, entity or person; or any change in the ownership of more than fifty percent (50%) of the voting capital stock of a Party in one or more related transactions.

“Common Shares” means the shares of common stock of APCX, par value $0.001 per share.

“Grantors” means AppTech Corp.

“Incidental Registration” means as defined in Section 6.

“Option Exercise Period” means the period beginning on no later than two (2) business days from the Effective Date, as defined in the Agreement above, and/or any applicable vesting date and ending 2 years from such date.

“Registration” means a registration of securities (including Registrable Securities) under the Securities Act.

“Registration Statement” means any registration statement of the Company that covers any Registrable Securities filed or to be filed pursuant to this Agreement in connection with a Registration of Registrable Securities pursuant to Section 6, including the Prospectus, amendments and supplements to such Registration Statement, including post-effective amendments, all exhibits, and all material incorporated by reference or deemed to be incorporated by reference in such registration statement.

2. PURCHASE OPTION.

(a) Grant of the Option. Company hereby grants Contractor the exclusive right and option (the “Option”) to purchase up to 2,900,000 (two million nine hundred thousand) shares of Company Common Shares, exercisable at any time during the Option Exercise Period, pursuant to the terms and subject to the conditions of this Purchase Option Agreement. Four hundred thousand (400,000) shares are exercisable at a per share purchase price of $0.01 (one cent). The remaining two million five hundred thousand (2,500,0000) shares are exercisable at a per share purchase price of $0.25 (twenty-five cents).

(b) Early Vest of Options. Upon the occurrence of either: (i) Change of Control of Company or (ii) Company and IR’s CEO, Xxx Xxxxxxx, jointly agree to a direct employment engagement (W-2) all outstanding unvested options shall vest. Further, if the Agreement Appendix A: Statement of Work is completed within six (6) months from Effective Date, the shares which originally vested at 21 (twenty-one) months and 24 (twenty-four) months shall vest at six (6) months after the Effective Date. If the Agreement Appendix A: Statement of Work is completed within nine (9) months from the Effective Date, the shares which originally vested at 24 (twenty-four) months shall vest at nine (9) months.

13

Independent Contractor Services Agreement

(c) If Company or Contractor Terminate the Agreement based on section 8.2 Company Termination Rights or 8.3 Contractor Termination Right in no event will future Options be Granted beyond the date of the Termination.

(d) The Options are exercisable during its term in accordance with the Vesting Schedule set forth in below and the applicable provisions of Section 2 of this Option Agreement and the Plan.

VESTING SCHEDULE:

| Percentage of Shares Subject to Grant Option | Number of Shares Subject to Grant Option | Vesting Date |

| 13.8% | Four Hundred Thousand (400,000) | The Effective Date of this Agreement |

| 10.8% | Three Hundred Twelve Thousand Five Hundred (312,500) | 3 months after the Effective Date of this Agreement |

| 10.8% | Three Hundred Twelve Thousand Five Hundred (312,500) | 6 months after the Effective Date of this Agreement |

| 10.8% | Three Hundred Twelve Thousand Five Hundred (312,500) | 9 months after the Effective Date of this Agreement |

| 10.8% | Three Hundred Twelve Thousand Five Hundred (312,500) | 12 months after the Effective Date of this Agreement |

| 10.8% | Three Hundred Twelve Thousand Five Hundred (312,500) | 15 months after the Effective Date of this Agreement |

| 10.8% | Three Hundred Twelve Thousand Five Hundred (312,500) | 18 months after the Effective Date of this Agreement |

| 10.8% | Three Hundred Twelve Thousand Five Hundred (312,500) | 21 months after the Effective Date of this Agreement |

| 10.8% | Three Hundred Twelve Thousand Five Hundred (312,500) | 24 months after the Effective Date of this Agreement |

3. EXERCISE OF THE OPTION.

(a) Notice of Intent to Exercise Purchase Option. Provided that Contractor has fulfilled or is in process of fulfilling its obligations pursuant to the Agreement and is not in material default under any of its obligation thereunder, Contractor may exercise the Option, in whole or in multiple parts, at any time during the Option Exercise Period by delivering written notice to the Grantor (the “Exercise Notice”).

(b) Purchase of Option Shares. Following receipt of the Exercise Notice, the closing (the “Closing”) of the purchase of the Option Shares shall take place as soon as reasonably practicable, as determined by the mutual agreement of the parties. At the Closing, (i) Company shall transfer all of its respective rights, title and interest in the Option Shares to Contractor pursuant to the instructions provided in the Exercise Notice and (ii) Contractor shall deliver to Company its respective Purchase Price. Each party hereto hereby agrees to execute and deliver all documents or instruments reasonably necessary to effectuate the Closing.

4. RULE 144 RESTRICTED SHARES.

(a) This transaction has not been registered under the Securities Act of 1933, as amended (the “Securities Act”). The shares of Common Stock subject to this Option Purchase Agreement were acquired by Contractor in a transaction exempt from registration under the Securities Act and constitute Restricted Securities under the Rule 144 promulgated under the Securities Act. The Contractor acknowledges and agrees that the shares of Common Stock must be held indefinitely unless they are subsequently registered under the Securities Act or an exemption from such registration is available. The Assignee has been advised or is aware of the provisions of Rule 144 promulgated under the Securities Act as in effect from time to time, which permit limited resale of shares purchased in a private placement subject to the satisfaction of certain conditions, including, among other things, the availability of certain current public information about the Company, the resale occurring following the required holding period under Rule 144 and the number of shares being sold during any three (3) month period not exceeding specified limitations.

(b) Contractor is aware of the Contractor’s business affairs and financial condition and has acquired sufficient information about the Company to reach an informed and knowledgeable decision to acquire the rights under the Option Purchase Agreement and the Common Stock. Contractor agrees that the Company afforded Contractor and Contractor’s advisors full and complete access to all information with respect to the Company and the Company’s operations that Contractor and Contractor’s advisors deemed necessary to evaluate the merits and risks of an investment in the Company. Contractor further acknowledges that Contractor and Contractor’s advisors have had the opportunity to ask questions of and receive answers from the Company’s management concerning this investment. Contractor has not used any broker or finder in respect of the purchase of the Securities.

14

Independent Contractor Services Agreement

(c) Contractor is aware that investment in the Common Stock is speculative and involves a high degree of risk. Contractor has carefully considered the risks of this investment and understands that the financial risks involved in this investment could result in a substantial or complete loss of Contractor’s investment. Contractor has such knowledge and experience in financial and business matters that Assignee is capable of evaluating the merits and risks of investing in the Common Stock. Contractor, in evaluating the merits of an investment in the Common Stock, is not relying on the Company, its counsel, or the Company’s financial advisor for an evaluation of the tax, legal or other consequences of an investment in the Common Stock.

(d) The shares of Common Stock will be acquired by the Contractor for investment purposes, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and that Contractor has no present intention of selling, granting any participation in or otherwise distributing the same. Contractor further represents that Contractor does not have any contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participations to such person or to any third person, with respect to any of the shares of Common Stock.

(e) The Contractor acknowledges that each share of Common Stock acquired by the Contractor pursuant to Option Purchase Agreement shall bear a legend substantially to the following effect until the same is no longer required under the Securities Act:

SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (“THE ACT”), AND MAY NOT BE OFFERED, SOLD, OR OTHERWISE TRANSFERRED, ASSIGNED, PLEDGED OR HYPOTHECATED UNLESS AND UNTIL REGISTERED UNDER THE ACT OR UNLESS THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY AND ITS COUNSEL THAT SUCH REGISTRATION IS NOT REQUIRED.

The certificates evidencing the shares of Common Stock shall also bear any legend required by applicable state securities or corporate laws.

5. LOCK-UP PERIOD

The parties agree that the Common Shares associated with the Option Purchase Agreement shall be subject to a lock-up period of twelve (12) months commencing on the date of Funding (the “Lock-Up Period”). During the Lock-Up Period, the transfer of the common shares of the Contractor shall be restricted.

6. INCIDENTAL REGISTRATION RIGHTS

(a) Requests for Incidental Registration. If Company proposes to register any of its Common Stock (other than pursuant to a Registration on Form S-4 or S-8 or any successor form), it will give prompt written notice to Contractor of its intention to effect such Registration (the “Incidental Registration”). Within fifteen (15) days of receiving such written notice of an Incidental Registration, Contractor may make a written request (the “Piggy-Back Request”) that the Company include in the proposed Incidental Registration all, or a portion, of the Registrable Securities owned by Contractor (which Piggy-Back Request shall set forth, if applicable, the Registrable Securities intended to be disposed of by Contractor and the intended method of disposition thereof).

(b) Obligation to Effect Incidental Registration. Company shall use all commercially reasonable efforts to include in any Incidental Registration all Registrable Securities which Company has been requested to register pursuant to any timely Piggy-Back Request to the extent required to permit the disposition (in accordance with the intended methods thereof as aforesaid) of the Registrable Securities so to be registered. Notwithstanding the preceding 6(a) and 6(b):

(i) Company shall not be obligated pursuant to this Section 6 to effect a Registration of Registrable Securities requested pursuant to a timely Piggy-Back Request if Company discontinues the related Incidental Registration at any time prior to the effective date of any Registration Statement filed in connection therewith;

(ii) if a Registration pursuant to this Section 6 involves an underwritten offering, and the managing underwriter (or, in the case of an offering that is not underwritten, an investment banker) shall advise Company that, in its opinion, the number of securities requested and otherwise proposed to be included in such Registration exceeds the number which can be sold in such offering without adversely affecting the marketability of the offering, Company will include in such Registration to the extent of the number which Company is so advised can be sold in such offering, first, the securities Company proposes to sell for its own account in such Registration and second, the Registrable Securities of Contractor requesting to be included in such Registration and all other securities requested to be included in such Registration on a pro rata basis; and

(iii) if Company is engaged in, or has definitive plans to engage in, any activity or negotiations that, in the good faith determination of the Board of Directors of Company, would be adversely affected by disclosure that would be required in connection with a Registration to the material detriment of Company, then Company may delay such registration for a period of eighty (80) days from the date of termination or disclosure of such activity or negotiations.

15

Independent Contractor Services Agreement

7. MANDATORY REGISTRATION

In the event Company does not initiate an Incidental Registration, discontinues an Incidental Registration at any time prior to the effective date of any Registration Statement, or any of the Registrable Securities remain unregistered as of the eighteen (18) month anniversary of the exercise date, then Contractor shall have the right to demand (the “Demand Notice”), and Company agrees to file, a Registration Statement with the SEC to register the Registrable Securities and to achieve effectiveness of said Registration Statement within one hundred twenty (120) days of the Demand Notice.

(a) Construction. This Purchase Option Agreement and the performance of the transactions and the obligations of the parties hereunder will be governed by and construed and enforced in accordance with the laws of the State of California, without giving effect to any choice of law principles.

16

Independent Contractor Services Agreement

In Witness Whereof, the undersigned Parties, intending to be legally bound, have duly executed this Statement of Work as of the Effective Date.

| Apptech Corp. (“Company”) | Inovations Realized, LLC (“Contractor”) | |||

| Signed: | /s/ Xxxx X’Xxxxxx | Signed: | /s/ Xxx Xxxxxxx | |

| Name: | Xxxx X’Xxxxxx | Name: | Xxx Xxxxxxx | |

| Title: | CEO | Title: | CEO | |

| Address: | 0000 Xxxxx Xxx. Xxxxx 000,Xxxxxxxx, XX00000 | Address: | 0000 Xxxxxx Xxxxxx Xxxxx, #000-000 Xxx Xxxxx, XX 00000-0000 | |

17