THE CHARLES SCHWAB CORPORATION, as Issuer and THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., as Trustee Floating Rate Senior Notes due 2027 2.450% Senior Notes due 2027 2.900% Senior Notes due 2032 Twentieth Supplemental Indenture Dated as of March...

Exhibit 4.74

THE XXXXXXX XXXXXX CORPORATION, as Issuer

and

THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., as Trustee

Floating Rate Senior Notes due 2027

2.450% Senior Notes due 2027

2.900% Senior Notes due 2032

Twentieth Supplemental Indenture

Dated as of March 3, 2022

to

Senior Indenture dated as of June 5, 2009

Table of Contents

| Page | ||||||

| ARTICLE I DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION |

1 | |||||

| Section 1.01 |

Definitions | 1 | ||||

| Section 1.02 |

Conflicts with Base Indenture | 9 | ||||

| ARTICLE II FORM OF NOTES |

9 | |||||

| Section 2.01 |

Form of Notes | 9 | ||||

| ARTICLE III THE NOTES |

9 | |||||

| Section 3.01 |

Amount; Series; Terms. | 9 | ||||

| Section 3.02 |

Execution, Authentication, Delivery and Dating | 11 | ||||

| Section 3.03 |

Calculation Agent | 12 | ||||

| Section 3.04 |

SOFR Unavailable | 13 | ||||

| Section 3.05 |

Effect of a Benchmark Transition Event | 13 | ||||

| Section 3.06 |

Additional Notes | 14 | ||||

| ARTICLE IV OPTIONAL REDEMPTION OF SECURITIES |

15 | |||||

| Section 4.01 |

Optional Redemption | 15 | ||||

| ARTICLE V COVENANTS AND REMEDIES |

17 | |||||

| Section 5.01 |

Limitations on Liens | 17 | ||||

| ARTICLE VI SUPPLEMENTAL INDENTURES |

17 | |||||

| Section 6.01 |

Supplemental Indentures with Consent of Holders | 17 | ||||

| ARTICLE VII MISCELLANEOUS |

18 | |||||

| Section 7.01 |

Sinking Funds | 18 | ||||

| Section 7.02 |

Conversion of Notes | 18 | ||||

| Section 7.03 |

Reports by the Company | 18 | ||||

| Section 7.04 |

Confirmation of Indenture | 18 | ||||

| Section 7.05 |

Counterparts | 18 | ||||

| Section 7.06 |

Governing Law | 18 | ||||

| Section 7.07 |

Trustee | 18 | ||||

| Exhibit A |

Form of Floating Rate Senior Note | E-1 | ||||

| Exhibit B |

Form of 2027 Fixed Rate Senior Note | E-10 | ||||

| Exhibit C |

Form of 2032 Fixed Rate Senior Note | E-19 | ||||

i

TWENTIETH SUPPLEMENTAL INDENTURE, dated as of March 3, 2022 (“Supplemental Indenture”), to the Indenture dated as of June 5, 2009 (as amended, modified or supplemented from time to time in accordance therewith, other than with respect to a particular series of debt securities, the “Base Indenture” and, as amended, modified and supplemented by this Supplemental Indenture, the “Indenture”), by and among THE XXXXXXX XXXXXX CORPORATION (the “Company”), and THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., as trustee (the “Trustee”).

Each party agrees as follows for the benefit of the other party and for the equal and ratable benefit of the Holders of the Notes:

WHEREAS, the Company has duly authorized the execution and delivery of the Base Indenture to provide for the issuance from time to time of senior debt securities to be issued in one or more series as provided in the Base Indenture;

WHEREAS, the Company has duly authorized the execution and delivery, and desires and has requested the Trustee to join it in the execution and delivery, of this Supplemental Indenture in order to establish and provide for the issuance by the Company of three new series of Securities designated as its Floating Rate Senior Notes due 2027 (the “Floating Rate Notes”), 2.450% Senior Notes due 2027 (the “2027 Fixed Rate Notes”) and its 2.900% Senior Notes due 2032 (the “2032 Fixed Rate Notes” and, together with the 2027 Fixed Rate Notes, the “Fixed Rate Notes”; the Fixed Rate Notes together with the Floating Rate Notes, the “Notes”), on the terms set forth herein;

WHEREAS, Article IX of the Base Indenture provides that a supplemental indenture may be entered into by the parties for such purpose provided certain conditions are met;

WHEREAS, the conditions set forth in the Base Indenture for the execution and delivery of this Supplemental Indenture have been met; and

WHEREAS, all things necessary to make this Supplemental Indenture a valid and legally binding agreement of the parties, in accordance with its terms, and a valid and legally binding amendment of, and supplement to, the Base Indenture with respect to the Notes have been done;

NOW, THEREFORE:

ARTICLE I

DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION

Section 1.01 Definitions. Capitalized terms used herein and not otherwise defined herein have the meanings assigned to them in the Base Indenture. The words “herein”, “hereof” and “hereby” and other words of similar import used in this Supplemental Indenture refer to this Supplemental Indenture as a whole and not to any particular section hereof.

As used herein, the following terms have the specified meanings:

1

“2027 Fixed Rate Notes” has the meaning specified in the recitals of this Supplemental Indenture.

“2027 Interest Payment Date” has the meaning set forth in Section 3.01(d) of this Supplemental Indenture.

“2027 Regular Record Date” has the meaning set forth in Section 3.01(d) of this Supplemental Indenture.

“2027 Par Call Date” means February 3, 2027.

“2032 Fixed Rate Notes” has the meaning specified in the recitals of this Supplemental Indenture.

“2032 Interest Payment Date” has the meaning set forth in Section 3.01(d) of this Supplemental Indenture.

“2032 Regular Record Date” has the meaning set forth in Section 3.01(d) of this Supplemental Indenture.

“2032 Par Call Date” means December 3, 2031.

“Additional Notes” has the meaning specified in Section 3.06 of this Supplemental Indenture.

“Base Indenture” has the meaning specified in the recitals of this Supplemental Indenture.

“Benchmark” means, initially, Compounded SOFR; provided that if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Compounded SOFR (or the published SOFR Index used in the calculation thereof) or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by the Company or its designee as of the Benchmark Replacement Date:

a) the sum of: (a) an alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark and (b) the Benchmark Replacement Adjustment;

b) the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; or

c) the sum of: (a) the alternate rate of interest that has been selected by the Company or its designee as the replacement for the then-current Benchmark giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for the Floating Rate Notes at such time and (b) the Benchmark Replacement Adjustment.

2

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by the Company or its designee as of the Benchmark Replacement Date:

a) the spread adjustment (which may be a positive or negative value or zero), or method for calculating or determining such spread adjustment, that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement;

b) if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, the ISDA Fallback Adjustment; or

c) the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company or its designee giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for the Floating Rate Notes at such time.

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definitions or interpretations of interest period, the timing and frequency of determining rates and making payments of interest, the rounding of amounts or tenors, and other administrative matters) that the Company or its designee decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if the Company or its designee decides that adoption of any portion of such market practice is not administratively feasible or if the Company or its designee determines that no market practice for use of the Benchmark Replacement exists, in such other manner as the Company or its designee determines is reasonably practicable).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark (including any daily published component used in the calculation thereof):

a) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark (or such component); or

b) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein.

3

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark (including the daily published component used in the calculation thereof):

a) a public statement or publication of information by or on behalf of the administrator of the Benchmark (or such component) announcing that such administrator has ceased or will cease to provide the Benchmark (or such component), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component);

b) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark (or such component), the central bank for the currency of the Benchmark (or such component), an insolvency official with jurisdiction over the administrator for the Benchmark (or such component), a resolution authority with jurisdiction over the administrator for the Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark (or such component), which states that the administrator of the Benchmark (or such component) has ceased or will cease to provide the Benchmark (or such component) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); or

c) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative.

“Business Day” means any day other than (i) a Saturday or Sunday or (ii) a day on which banking institutions in Los Angeles, California or New York, New York are authorized or obligated by law or executive order to close.

“Calculation Agency Agreement” has the meaning specified in Section 3.03 of this Supplemental Indenture.

“Calculation Agent” means The Bank of New York Mellon Trust Company, N.A. and its successors or assigns, or any other calculation agent appointed by the Company at its discretion.

“Company” has the meaning specified in the recitals of this Supplemental Indenture.

“Comparable Treasury Issue” means the U.S. Treasury security or securities selected by the Quotation Agent as being the U.S. Treasury security that has a remaining maturity closest to the remaining maturity of the Fixed Rate Notes to be redeemed, assuming for this purpose that the Fixed Rate Notes would mature on the applicable Par Call Date, provided that if two or more U.S. Treasury securities have the same maturity, the Quotation Agent shall select the U.S. Treasury security that is trading closest to par and that is otherwise consistent with customary financial practice.

4

“Comparable Treasury Price” means, with respect to any Redemption Date pursuant to Section 4.01 of this Supplemental Indenture, (A) the arithmetic average of the Reference Treasury Dealer Quotations for such Redemption Date, after excluding the highest and lowest such Reference Treasury Dealer Quotations, or (B) if the Quotation Agent obtains fewer than five such Reference Treasury Dealer Quotations, the arithmetic average of all such quotations for such Redemption Date.

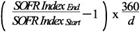

“Compounded SOFR” means, with respect to any Floating Rate Interest Period and the Interest Payment Determination Date in relation to such Floating Rate Interest Period, the rate calculated by the Calculation Agent on such Interest Payment Determination Date as follows:

where:

“SOFR IndexStart” means, for Floating Rate Interest Periods other than the initial Floating Rate Interest Period, the SOFR Index value on the preceding Interest Payment Determination Date, and, for the initial Floating Rate Interest Period, the SOFR Index value on March 1, 2022;

“SOFR IndexEnd” means the SOFR Index value on the Interest Payment Determination Date relating to the applicable Floating Rate Interest Period (or in the final Floating Rate Interest Period, relating to the applicable maturity date); and

“d” means the number of calendar days in the relevant Observation Period.

“Depositary” means The Depository Trust Company or such other Depositary designated by the Company from time to time.

“XXXXX” means the Electronic Data Gathering, Analysis and Retrieval system or such successor system so designated by the Commission.

“Fixed Rate Notes” has the meaning specified in the recitals of this Supplemental Indenture.

“Floating Rate Interest Payment Date” has the meaning set forth in Section 3.01(d) of this Supplemental Indenture.

“Floating Rate Interest Period” means the period from and including, a Floating Rate Interest Payment Date to, but excluding, the next Floating Rate Interest Payment Date, except that the initial Floating Rate Interest Period shall commence on, and include March 3, 2022, the original issue date of the Floating Rate Notes.

5

“Floating Rate Notes” has the meaning specified in the recitals of this Supplemental Indenture.

“Floating Rate Regular Record Date” has the meaning set forth in Section 3.01(d) of this Supplemental Indenture.

“Indenture” has the meaning specified in the recitals of this Supplemental Indenture.

“Interest Payment Determination Date” means, the date two U.S. Government Securities Business Days before each Floating Rate Interest Payment Date.

“Interest Payment Date” has the meaning set forth in Section 3.01(d) of this Supplemental Indenture.

“ISDA Definitions” means the 2006 ISDA Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor.

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“ISIN” means International Securities Identifying Number.

“Notes” has the meaning specified in the recitals of this Supplemental Indenture.

“Observation Period” means, in respect of any Floating Rate Interest Period, the period from, and including, the date two U.S. Government Securities Business Days preceding the first day of such Floating Rate Interest Period to, but excluding, the date two U.S. Government Securities Business Days preceding the Floating Rate Interest Payment Date for such Floating Rate Interest Period (or in the final Floating Rate Interest Period, preceding the applicable maturity date).

“Par Call Dates” means the 2027 Par Call Date and the 2032 Par Call Date.

“Permitted Liens” has the meaning set forth in Section 5.01 of this Supplemental Indenture.

“Primary Treasury Dealer” means a primary U.S. Government securities dealer in the United States.

6

“Quotation Agent” means the Reference Treasury Dealer that is selected by the Company in connection with an optional redemption pursuant to Article IV hereof to act as Quotation Agent in addition to acting as a Reference Treasury Dealer; provided, however, that if such Reference Treasury Dealer ceases to be a Primary Treasury Dealer, the Company will substitute another Primary Treasury Dealer.

“Redemption Date,” when used with respect to any Note to be redeemed, means the date specified for redemption by the Company.

“Redemption Price” means, when used with respect to any Note to be redeemed, the price at which it is to be redeemed pursuant to this Supplemental Indenture.

“Reference Time” with respect to any determination of the Benchmark means (1) if the Benchmark is Compounded SOFR, the SOFR Index Determination Time, as such time is defined above, and (2) if the Benchmark is not Compounded SOFR, the time determined by the Company or its designee in accordance with the Benchmark Replacement Conforming Changes.

“Reference Treasury Dealer” means each of (i) BofA Securities, Inc. (or its successor) or any affiliate that is a Primary Treasury Dealer; (ii) Citigroup Global Markets Inc. (or its successor) or any affiliate that is a Primary Treasury Dealer; (iii) Credit Suisse Securities (USA) LLC (or its successor) or any affiliate that is a Primary Treasury Dealer; (iv) X.X. Xxxxxx Securities LLC (or its successor) or any affiliate that is a Primary Treasury Dealer; (v) Xxxxxx Xxxxxxx & Co. LLC (or its successor) or any affiliate that is a Primary Treasury Dealer; (vi) Xxxxx Fargo Securities, LLC (or its successor) or any affiliate that is a Primary Treasury Dealer and (vii) one other Primary Treasury Dealer that is selected by the Company; provided, however, that if any of the foregoing or their affiliates cease to be a Primary Treasury Dealer, the Company will substitute therefor another Primary Treasury Dealer.

“Reference Treasury Dealer Quotations” means, with respect to each Reference Treasury Dealer and any Redemption Date, the arithmetic average, as determined by the Quotation Agent, of the bid and asked prices for the Comparable Treasury Issue (expressed in each case as a percentage of its principal amount) quoted in writing to the Quotation Agent by such Reference Treasury Dealer at 3:30 p.m., New York City time, on the third Business Day preceding such Redemption Date.

“Regular Record Date” means collectively, the Floating Rate Regular Record Date, 2027 Regular Record Date and the 2032 Regular Record Date.

“Relevant Governmental Body” means the Federal Reserve Board and/or the FRBNY, or a committee officially endorsed or convened by the Federal Reserve Board and/or the FRBNY or any successor thereto.

“SOFR” means the daily secured overnight financing rate as provided by the SOFR Administrator on the SOFR Administrator’s Website.

“SOFR Administrator” means the FRBNY (or a successor administrator of SOFR).

7

“SOFR Administrator’s Website” means the website of the FRBNY, currently at xxxx://xxx.xxxxxxxxxx.xxx, or any successor source.

“SOFR Index” means, with respect to any U.S. Government Securities Business Day,

(1) the SOFR Index value as published by the SOFR Administrator as such index appears on the SOFR Administrator’s Website at the SOFR Index Determination Time; or:

(2) if a SOFR Index value does not so appear as specified in clause (1) above at the SOFR Index Determination Time, then: (i) if a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred with respect to SOFR, then Compounded SOFR shall be the rate determined pursuant to Section 3.04; or (ii) if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR, then Compounded SOFR shall be the rate determined pursuant to Section 3.05.

“SOFR Index Determination Time” means 3:00 p.m. (New York time) on any U.S. Government Securities Business Day.

“Supplemental Indenture” has the meaning specified in the recitals of this Supplemental Indenture.

“Treasury Rate” means, with respect to any redemption date for the applicable series of notes being redeemed, the yield calculated by the Quotation Agent after 4:15 p.m., New York time, on the third business day preceding the redemption date, as follows: for the latest business day that appears in the statistical release published by the Board of Governors of the Federal Reserve System designated as “Selected Interest Rates (Daily)—H.15” (or any successor designation or publication) (“H.15”) under the caption “Treasury Constant Maturities – Nominal,” the Quotation Agent shall select two maturities – one for the maturity immediately before and one for the maturity immediately after the remaining maturity of the applicable Fixed Rate Notes (assuming for this purpose that the applicable Fixed Rate Notes would mature on the applicable Par Call Date) – and, using the arithmetic means of such yields for the immediately preceding week for each maturity, interpolate on a straight-line basis to the applicable Par Call Date; or

(i) if there is no maturity immediately before or immediately after, or if a maturity on H.15 matches exactly the remaining maturity of the applicable Fixed Rate Notes (rounding to the nearest month and assuming the notes matured on the applicable Par Call Date) (e.g., a remaining maturity of less than one month or exactly three years), the Quotation Agent shall select the single maturity immediately following or preceding, or which matches exactly, as the case may be, the remaining maturity of the applicable Fixed Rate Notes (assuming for this purpose that the notes would mature on the applicable Par Call Date) and use the arithmetic mean of such yield for the immediately preceding week; or

(ii) if H.15 is no longer published or regularly available, the rate per annum equal to the semi-annual equivalent yield to maturity of the Comparable Treasury Issue, selected by the Quotation Agent assuming a price equal to the Comparable Treasury Price for such redemption date (expressed in each case as a percentage of its principal amount).

8

“U.S. Government Securities Business Day” means any day, except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association or any successor organization recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

“Voting Securities” has the meaning specified in Section 5.01 of this Supplemental Indenture.

Section 1.02 Conflicts with Base Indenture

In the event that any provision of this Supplemental Indenture limits, qualifies or conflicts with a provision of the Base Indenture, such provision of this Supplemental Indenture shall control.

ARTICLE II

FORM OF NOTES

Section 2.01 Form of Notes The Notes shall be substantially in the forms of Exhibit A, Exhibit B and Exhibit C for the Floating Rate Notes, the 2027 Fixed Rate Notes and the 2032 Fixed Rate Notes, respectively, hereto which are hereby incorporated in and expressly made a part of this Indenture.

ARTICLE III

THE NOTES

Section 3.01 Amount; Series; Terms.

(a) There are hereby created and designated three series of Securities under the Base Indenture: the title of the Floating Rate Notes shall be “Floating Rate Senior Notes due 2027”, the title of the 2027 Fixed Rate Notes shall be “2.450% Senior Notes Due 2027” and the title of the 2032 Fixed Rate Notes shall be “2.900% Senior Notes Due 2032”. The changes, modifications and supplements to the Base Indenture effected by this Supplemental Indenture shall be applicable only with respect to, and govern the terms of, the Notes of the applicable series and shall not apply to any other series of Securities that may be issued under the Base Indenture unless a supplemental indenture with respect to such other series of Securities specifically incorporates such changes, modifications and supplements.

(b) The aggregate principal amount of Floating Rate Notes that initially may be authenticated and delivered under this Supplemental Indenture shall be limited to $500,000,000, the aggregate principal amount of 2027 Fixed Rate Notes that initially may be authenticated and delivered under this Supplemental Indenture shall be limited to $1,500,000,000, and the aggregate principal amount of 2032 Fixed Rate Notes that initially may be authenticated and delivered under this Supplemental Indenture shall be limited to $1,000,000,000, each subject to increase as set forth in Section 3.06 of this Supplemental Indenture.

9

(c) The Stated Maturity of the Floating Rate Notes shall be March 3, 2027, the Stated Maturity of the 2027 Fixed Rate Notes shall be March 3, 2027 and the Stated Maturity of the 2032 Fixed Rate Notes shall be March 3, 2032. The Notes shall be payable and may be presented for payment, redemption, registration of transfer and exchange, without service charge, at the Corporate Trust Office.

(d) The Floating Rate Notes shall bear interest for each Floating Rate Interest Period at a rate per annum equal to Compounded SOFR on the Interest Payment Determination Date for that Floating Rate Interest Period plus 1.05%, all as determined by the Calculation Agent, as further provided in this Supplemental Indenture. Interest on the Floating Rate Notes will be computed on the basis of the actual number of days in each Floating Rate Interest Period and a 360-day year. The 2027 Fixed Rate Notes shall bear interest at the rate of 2.450% per annum from and including March 3, 2022, or from and including the most recent date to which interest has been paid or duly provided for, as further provided in the form of 2027 Fixed Rate Notes annexed hereto as Exhibit B. The 2032 Fixed Rate Notes shall bear interest at the rate of 2.900% per annum from and including March 3, 2022, or from and including the most recent date to which interest has been paid or duly provided for, as further provided in the form of 2032 Fixed Rate Notes annexed hereto as Exhibit C. Interest on the Fixed Rate Notes shall be computed on the basis of a 360-day year composed of twelve 30-day months. For the Floating Rate Notes, the dates on which such interest shall be payable (each, a “Floating Rate Interest Payment Date”) shall be March 3, June 3, September 3 and December 3 of each year, commencing on June 3, 2022, and the “Floating Rate Regular Record Date” for any interest payable on each such Floating Rate Interest Payment date shall be the close of business on the immediately preceding February 16, May 19, August 19 and November 18, respectively, whether or not a Business Day. For the 2027 Fixed Rate Notes, the dates on which such interest shall be payable (each, a “2027 Interest Payment Date”) shall be March 3 and September 3 of each year, commencing on September 3, 2022, and the “2027 Regular Record Date” for any interest payable on each such Interest Payment Date shall be the close of business on the immediately preceding February 16 and August 19, respectively, whether or not a Business Day. For the 2032 Fixed Rate Notes, the dates on which such interest shall be payable (each, a “2032 Interest Payment Date” and together with the Floating Rate Interest Payment Date and the 2027 Interest Payment Date, an “Interest Payment Date”) shall be March 3 and September 3 of each year, commencing on September 3, 2022, and the “2032 Regular Record Date” for any interest payable on each such Interest Payment Date shall be the close of business on the immediately preceding February 16 and August 19, respectively, whether or not a Business Day. Interest will be payable to the Holder of record on the applicable Regular Record Date, provided, however, interest payable on the Stated Maturity of any series of the Notes will be paid to the person to whom the principal will be payable.

(e) If any Interest Payment Date, Redemption Date or the Stated Maturity of the applicable series of Notes is not a Business Day, then the related payment of interest and/or principal payable, as applicable, on such date will be paid on the next succeeding Business Day with the same force and effect as if made on such Interest Payment Date, Redemption Date or Stated Maturity and no further interest will accrue as a result of such delay.

10

(f) Each series of Notes will be issued in the form of one or more Global Securities, duly executed by the Company and authenticated by the Trustee as provided in Section 3.02 of this Supplemental Indenture and the Base Indenture and deposited with the Trustee as custodian for the Depositary or its nominee.

(g) Initially, the Trustee will act as Paying Agent. The Company may change any Paying Agent without notice to the Holders.

(i) With respect to the Floating Rate Notes and notwithstanding anything to the contrary in this Supplemental Indenture or the Floating Rate Notes, if the Company or its designee determines on or prior to the relevant Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to determining Compounded SOFR, then Section 3.05 of this Supplemental Indenture will thereafter apply to all determinations of the rate of interest payable on the Floating Rate Notes. For the avoidance of doubt, after a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, the interest rate for each Floating Rate Interest Period will be an annual rate equal to the sum of the Benchmark Replacement and the applicable margin.

(h) DenominationsThe Notes shall be issuable only in registered form without coupons and only in denominations of $2,000 and any multiple of $1,000 in excess thereof.

Section 3.02 Execution, Authentication, Delivery and Dating. The Notes shall be executed on behalf of the Company by its Chairman of the Board, its Chief Executive Officer, its Chief Financial Officer or its Treasurer, and attested by its Secretary or one of its Assistant Corporate Secretaries or Deputy Corporate Secretaries. The signature of any of these officers on the Notes may be manual, facsimile or electronic signature (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law, e.g., xxx.xxxxxxxx.xxx) and shall not be required to be under the Company’s corporate seal.

Notes bearing the manual, facsimile or electronic signatures of individuals who were at any time the proper officers of the Company shall bind the Company, notwithstanding that such individuals or any of them have ceased to hold such offices prior to the authentication and delivery of such Notes or did not hold such offices at the date of such Notes.

Pursuant to a Company Order, the Trustee shall authenticate for original issue Notes in an aggregate principal amount specified in the Company Order. The Trustee shall be provided with an Officer’s Certificate and an Opinion of Counsel of the Company that it may reasonably request in connection with such authentication of Notes. Such Company Order shall specify the amount of Notes to be authenticated and the date on which the original issue of Notes is to be authenticated.

Each Note shall be dated the date of its authentication.

11

No Note shall be entitled to any benefit under this Indenture or be valid or obligatory for any purpose unless there appears on such Note a certificate of authentication substantially in the form provided for in the Base Indenture executed by the Trustee by manual, facsimile or electronic signature (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law, e.g., xxx.xxxxxxxx.xxx), and such certificate upon any Note shall be conclusive evidence, and the only evidence, that such Note has been duly authenticated and delivered hereunder.

Section 3.03 Calculation Agent.

(a) Initially, the Trustee will act as Calculation Agent, in accordance with the provisions of that certain Calculation Agency Agreement, dated the date hereof (the “Calculation Agency Agreement”). For the avoidance of doubt, in acting under the Calculation Agency Agreement, the Calculation Agent shall have the benefit of the rights, protections and immunities granted to it hereunder. The Company may appoint a successor calculation agent at its discretion. So long as Compounded SOFR is required to be determined with respect to the Floating Rate Notes, there shall at all times be a Calculation Agent. In the event that any then acting Calculation Agent shall be unable or unwilling to act, or that such Calculation Agent shall fail duly to establish Compounded SOFR for any Floating Rate Interest Period, or the Company proposes to remove such Calculation Agent, the Company shall appoint another Calculation Agent.

(b) None of the Trustee, the Paying Agent or the Calculation Agent shall be under any obligation (i) to monitor, determine or verify the unavailability or cessation of SOFR or the SOFR Index, or whether or when there has occurred, or to give notice to any other transaction party of the occurrence of, any Benchmark Transition Event or related Benchmark Replacement Date, (ii) to select, determine or designate any Benchmark Replacement, or other successor or replacement benchmark index, or whether any conditions to the designation of such a rate or index have been satisfied, (iii) to select, determine or designate any Benchmark Replacement Adjustment, or other modifier to any replacement or successor index, or (iv) to determine whether or what Benchmark Replacement Conforming Changes are necessary or advisable, if any, in connection with any of the foregoing, including, but not limited to, adjustments as to any alternative spread thereon, the Business Day convention, Interest Payment Determination Dates or any other relevant methodology applicable to such substitute or successor Benchmark. In connection with the foregoing, each of the Trustee, the Paying Agent and the Calculation Agent shall be entitled to conclusively rely on any determinations made by the Company or its designee without independent investigation, and none will have any liability for actions taken at the Company’s direction in connection therewith. None of the Trustee, the Paying Agent or the Calculation Agent shall be liable for any inability, failure or delay on its part to perform any of its duties set forth in this Supplemental Indenture as a result of the unavailability of SOFR, the SOFR Index or other applicable Benchmark Replacement, including as a result of any failure, inability, delay, error or inaccuracy on the part of any other transaction party in providing any direction, instruction, notice or information required or contemplated by the terms of this Supplemental Indenture and reasonably required for the performance of such duties. None of the Trustee, Paying Agent or Calculation Agent shall be responsible or liable for the Company’s actions or omissions or for those of any designee, nor shall any of the Trustee, Paying Agent or Calculation Agent be under any obligation to oversee or monitor the Company’s performance or that of the designee.

12

(c) The Company will give the Trustee and the Calculation Agent written notice of the person appointed as its designee.

(d) All determinations made by the Calculation Agent shall, in the absence of manifest error, be conclusive for all purposes and binding on the Company and Holders of the Floating Rate Notes.

Section 3.04 SOFR Unavailable.

If a SOFR IndexStart or SOFR IndexEnd is not published on the associated Interest Payment Determination Date and a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred with respect to SOFR, “Compounded SOFR” means, for the applicable interest period for which such index is not available, the rate of return on a daily compounded interest investment calculated in accordance with the formula for SOFR Averages, and definitions required for such formula, published on the SOFR Administrator’s Website at xxxxx://xxx.xxxxxxxxxx.xxx/xxxxxxx/xxxxxxxx-xxxx-xxxxxxxxx-xxxxx-xxxxxxxxxxx. For the purposes of this provision, references in the SOFR Averages compounding formula and related definitions to “calculation period” shall be replaced with “Observation Period” and the words “that is, 30-, 90-, or 180- calendar days” shall be removed. If SOFR does not so appear for any day, “i” in the Observation Period, SOFRi for such day “i” shall be SOFR published in respect of the first preceding U.S. Government Securities Business Day for which SOFR was published on the SOFR Administrator’s Website.

Section 3.05 Effect of a Benchmark Transition Event.

(a) If the Company or its designee determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred prior to the Reference Time in respect of any determination of the Benchmark on any date, the Benchmark Replacement will replace the then-current Benchmark for all purposes relating to the Floating Rate Notes in respect of such determination on such date and all determinations on all subsequent dates.

(b) In connection with the implementation of a Benchmark Replacement, the Company or its designee will have the right to make Benchmark Replacement Conforming Changes from time to time.

(c) Any determination, decision or election that may be made by the Company or its designee pursuant to the benchmark replacement provisions set forth in this Section 3.05, including any determination with respect to tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection:

(i) will be conclusive and binding absent manifest error;

(ii) if made by the Company, will be made in its sole discretion;

13

(iii) if made by the Company’s designee, will be made after consultation with the Company, and such designee will not make any such determination, decision or election to which the Company objects; and

(iv) notwithstanding anything to the contrary in the Supplemental Indenture or the Floating Rate Notes shall become effective without consent from the Holders of the Floating Rate Notes or any other party.

(d) Any determination, decision or election pursuant to this Section 3.05 shall be made by the Company or its designee (which may be the Company’s Affiliate) on the basis as provided above, and in no event shall the Calculation Agent be responsible for making any such determination, decision or election.

Section 3.06 Additional Notes.

The Company may, from time to time, subject to compliance with any other applicable provisions of this Indenture, without notice to or consent of the Holders of the Notes, create and issue pursuant to this Indenture additional Notes of any series (“Additional Notes”) having terms and conditions set forth in this Supplemental Indenture, identical to the Notes of one of the three series issued on the date hereof, except that Additional Notes may:

(i) have a different issue date than other Outstanding Notes of such series;

(ii) have a different issue price than other Outstanding Notes of such series;

(iii) have a different initial Interest Payment Date than other Outstanding Notes of such series; and

(iv) have a different amount of interest that has accrued prior to the issue date of such Additional Notes than has accrued on other Outstanding Notes of such series;

provided, no Additional Notes shall be issued unless such Additional Notes will be fungible for U.S. federal income tax and securities law purposes with Notes of one of the three series issued on the date hereof; and provided further, the Additional Notes have the same CUSIP number as the Notes of one of the three series issued on the date hereof. No Additional Notes may be issued if on the issue date therefor, any Event of Default has occurred and is continuing.

The Notes of any series issued on the date hereof and any Additional Notes of the same series shall be treated as a single class for all purposes under this Indenture, including waivers, amendments and United States federal tax purposes.

With respect to any issuance of Additional Notes, the Company shall deliver to the Trustee a resolution of the Board of Directors or, if applicable, a certificate signed by the Chairman of the Board of Directors of the Company, the Chief Executive Officer, the Chief Financial Officer or the Treasurer of the Company and an Officers’ Certificate in respect of such Additional Notes, which shall together provide the following information:

14

(i) the aggregate principal amount of such Additional Notes to be authenticated and delivered pursuant to this Indenture; and

(ii) the issue date, issue price, the first Interest Payment Date, the amount of interest accrued and payable on the first Interest Payment Date, the applicable series, the CUSIP number and corresponding ISIN of such Additional Notes.

ARTICLE IV

OPTIONAL REDEMPTION OF SECURITIES

Section 4.01 Optional Redemption. (a) The provisions of Article XI of the Base Indenture, as supplemented by the provisions of this Supplemental Indenture, shall apply to the Notes.

(b) On or after February 3, 2027, the Floating Rate Notes shall be redeemable, as a whole or in part, at the Company’s option, on at least 10 days, but not more than 60 days, prior notice electronically delivered or mailed to each registered Holder of the Floating Rate Notes to be redeemed, at a Redemption Price equal to 100% of the principal amount of the Floating Rate Notes to be redeemed, plus accrued and unpaid interest to, but not including, the Redemption Date for such Floating Rate Notes.

(c) On or after September 3, 2022, and prior to the 2027 Par Call Date, the 2027 Fixed Rate Notes shall be redeemable, as a whole or in part, at the Company’s option, on at least 10 days, but not more than 60 days, prior notice electronically delivered or mailed to each registered Holder of the 2027 Fixed Rate Notes to be redeemed, at a Redemption Price equal to the greater of (i) 100% of the principal amount of the 2027 Fixed Rate Notes to be redeemed, or (ii) as determined by the Quotation Agent, the sum of the present values of the remaining scheduled payments of interest and principal thereon (exclusive of interest accrued and unpaid to, but not including, the Redemption Date), assuming for this purpose that the 2027 Fixed Rate Notes would mature on the 2027 Par Call Date, discounted to the Redemption Date on a semiannual basis, assuming a 360-day year consisting of twelve 30-day months, at the Treasury Rate plus 15 basis points, plus, in either case, accrued and unpaid interest to, but not including, the Redemption Date for such 2027 Fixed Rate Notes; provided, however, if the Redemption Date is after a 2027 Regular Record Date and on or prior to a corresponding Interest Payment Date, such accrued and unpaid interest will be paid on the Redemption Date to the holder of record on the 2027 Regular Record Date.

(d) On or after the 2027 Par Call Date, the 2027 Fixed Rate Notes shall be redeemable, as a whole or in part, at the Company’s option, on at least 10 days, but not more than 60 days, prior notice electronically delivered or mailed to each registered Holder of the 2027 Fixed Rate Notes to be redeemed, at a Redemption Price (calculated by the Company) equal to 100% of the principal amount of the 2027 Fixed Rate Notes to be redeemed plus accrued and unpaid interest to, but not including, the Redemption Date for such 2027 Fixed Rate Notes.

15

(e) On or after September 3, 2022 and prior to the 2032 Par Call Date, the 2032 Fixed Rate Notes shall be redeemable, as a whole or in part, at the Company’s option, on at least 10 days, but not more than 60 days, prior notice electronically delivered or mailed to each registered Holder of the 2032 Fixed Rate Notes to be redeemed, at a Redemption Price equal to the greater of (i) 100% of the principal amount of the 2032 Fixed Rate Notes to be redeemed, or (ii) as determined by the Quotation Agent, the sum of the present values of the remaining scheduled payments of interest and principal thereon (exclusive of interest accrued and unpaid to, but not including, the Redemption Date), assuming for this purpose that the 2032 Fixed Rate Notes would mature on 2032 Par Call Date, discounted to the Redemption Date on a semiannual basis, assuming a 360-day year consisting of twelve 30-day months, at the Treasury Rate plus 20 basis points, plus, in either case, accrued and unpaid interest to, but not including, the Redemption Date for such 2032 Fixed Rate Notes; provided, however, if the Redemption Date is after a 2032 Regular Record Date and on or prior to a corresponding Interest Payment Date, such accrued and unpaid interest will be paid on the Redemption Date to the holder of record on the 2032 Regular Record Date.

(f) On or after the 2032 Par Call Date, the 2032 Fixed Rate Notes shall be redeemable, as a whole or in part, at the Company’s option, on at least 10 days, but not more than 60 days, prior notice electronically delivered or mailed to each registered Holder of the 2032 Fixed Rate Notes to be redeemed, at a Redemption Price (calculated by the Company) equal to 100% of the principal amount of the 2032 Fixed Rate Notes to be redeemed plus accrued and unpaid interest to, but not including, the Redemption Date for such 2032 Fixed Rate Notes.

(g) On and after the Redemption Date for the applicable series of Notes to be redeemed, interest will cease to accrue on such Notes or any portion thereof called for redemption, unless the Company defaults in the payment of the Redemption Price and accrued interest, if any. On or before the Redemption Date for such Notes, the Company shall deposit with the Trustee or a Paying Agent, funds sufficient to pay the Redemption Price of the applicable series of Notes to be redeemed on the Redemption Date, and accrued and unpaid interest, if any, on such Notes. If less than all of the applicable series of Notes are to be redeemed, such Notes to be redeemed shall be selected in accordance with the procedures of the Depositary; provided, however, that in no event, shall Notes of a principal amount of $2,000 or less be redeemed in part.

(h) Notice of any redemption shall be electronically delivered or mailed at least 10 days but not more than 60 days before the Redemption Date to each Holder of the applicable series of Notes to be redeemed; provided, however, that if the Trustee is asked to give such notice it shall be notified in writing of such request at least 5 days prior to the date of the giving of such notice (unless a shorter notice shall be satisfactory to the Trustee). Such notice shall state the Redemption Price (if known) or the formula pursuant to which the Redemption Price is to be determined if the Redemption Price cannot be determined at the time the notice is given. If the Redemption Price cannot be determined at the time such notice is to be given, the actual Redemption Price, calculated as described above in clause (b) in the case of the

16

Floating Rate Notes, in clause (c) or (d) in the case of the 2027 Fixed Rate Notes, or in clause (e) or (f) in the case of the 2032 Fixed Rate Notes shall be set forth in an Officer’s Certificate of the Company delivered to the Trustee no later than two Business Days prior to the Redemption Date. Notice of redemption having been given as provided in the Indenture, the applicable series of Notes called for redemption shall become due and payable on the Redemption Date and at the applicable Redemption Price, plus accrued and unpaid interest, if any, to, but not including, the Redemption Date.

ARTICLE V

COVENANTS AND REMEDIES

Section 5.01 Limitations on Liens. The Company (or any successor corporation) will not, and will not permit any Subsidiary to, create, assume, incur or guarantee any indebtedness for borrowed money secured by a pledge, lien or other encumbrance, except for Permitted Liens (defined below), on the Voting Securities (defined below) of Xxxxxxx Xxxxxx & Co., Inc., Xxxxxxx Xxxxxx Bank, SSB, Xxxxxxx Xxxxxx Investment Management, Inc., or Schwab Holdings, Inc. unless the Company shall cause the Notes to be secured equally and ratably with (or, at the Company’s option, prior to) any indebtedness secured thereby. “Permitted Liens” means (i) liens for taxes or assessments or governmental charges or levies (a) that are not then due and delinquent, (b) the validity of which is being contested in good faith or (c) which are less than $1,000,000 in amount; (ii) liens created by or resulting from any litigation or legal proceedings which are currently being contested in good faith by appropriate proceedings or which involve claims of less than $1,000,000; (iii) deposits to secure (or in lieu of) surety, stay, appeal or customs bonds; and (iv) such other liens as the Board of Directors of the Company determines do not materially detract from or interfere with the present value or control of the Voting Securities subject thereto or affected thereby. “Voting Securities” means stock of any class or classes having general voting power under ordinary circumstances to elect a majority of the board of directors, managers or trustees of the corporation in question, provided that, for the purposes hereof, stock which carries only the right to vote conditionally on the happening of an event shall not be considered voting stock whether or not such event shall have happened.

ARTICLE VI

SUPPLEMENTAL INDENTURES

Section 6.01 Supplemental Indentures with Consent of Holders. The terms of this Supplemental Indenture may be modified as set forth in Article IX of the Base Indenture. For the avoidance of doubt, no supplemental indenture shall, without the consent of the Holder of each Outstanding Note of a series affected thereby, reduce the Redemption Price of any Note of the same series.

17

ARTICLE VII

MISCELLANEOUS

Section 7.01 Sinking Funds. Article XII of the Base Indenture shall have no application. The Notes shall not have the benefit of a sinking fund.

Section 7.02 Conversion of Notes. Article XIV of the Base Indenture shall have no application. The Notes shall not be convertible into shares of Common Stock of the Company.

Section 7.03 Reports by the Company. The Company shall be deemed to have complied with the first sentence of Section 7.4 of the Base Indenture to the extent that such information, documents and reports are filed with the Commission via XXXXX (or any successor electronic delivery procedure); provided, however, that the Trustee shall have no obligation whatsoever to determine whether or not such information, documents or reports have been filed pursuant to the XXXXX system (or its successor).

Section 7.04 Confirmation of Indenture. The Base Indenture, as supplemented and amended by this Supplemental Indenture and all other indentures supplemental thereto, is in all respects ratified and confirmed, and the Base Indenture, this Supplemental Indenture and all indentures supplemental thereto shall be read, taken and construed as one and the same instrument.

Section 7.05 Counterparts. The parties hereto may sign one or more copies of this Supplemental Indenture in counterparts, all of which together shall constitute one and the same agreement.

Section 7.06 Governing Law. THIS SUPPLEMENTAL INDENTURE AND THE NOTES SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF CALIFORNIA.

Section 7.07 Trustee. The Trustee makes no representations as to the validity or sufficiency of this Supplemental Indenture. The recitals herein are deemed to be those of the Company and not of the Trustee.

[Remainder of Page Intentionally Left Blank]

18

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed as of the day and year first written above.

| THE XXXXXXX XXXXXX CORPORATION, as Issuer | ||

| By: | /s/ Xxxxx Xxxxxxxx | |

| Name: Xxxxx Xxxxxxxx | ||

| Title: Managing Director, Executive Vice President and Chief Financial Officer | ||

| THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., as Trustee | ||

| By: | /s/ Xxx Xxxxxxx | |

| Name: Xxx Xxxxxxx | ||

| Title: Vice President | ||

[Signature Page to Twentieth Supplemental Indenture]

EXHIBIT A

FORM OF FLOATING RATE NOTE

THIS SECURITY IS A GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE THEREOF. THIS SECURITY MAY NOT BE EXCHANGED IN WHOLE OR IN PART FOR A SECURITY REGISTERED, AND NO TRANSFER OF THIS SECURITY IN WHOLE OR IN PART MAY BE REGISTERED, IN THE NAME OF ANY PERSON OTHER THAN SUCH DEPOSITARY OR A NOMINEE THEREOF, EXCEPT IN THE LIMITED CIRCUMSTANCES DESCRIBED IN THE INDENTURE.

UNLESS THIS NOTE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), TO THE ISSUER OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY NOTE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS A BENEFICIAL INTEREST HEREIN.

TRANSFERS OF THIS NOTE ARE LIMITED TO TRANSFERS IN WHOLE, BUT NOT IN PART, TO NOMINEES OF DTC OR TO A SUCCESSOR THEREOF OR SUCH SUCCESSOR’S NOMINEE AND TRANSFERS OF PORTIONS OF THIS GLOBAL SECURITY ARE LIMITED TO TRANSFERS MADE IN ACCORDANCE WITH THE RESTRICTIONS SET FORTH IN THE INDENTURE REFERRED TO ON THE REVERSE HEREOF.

E-1

THE XXXXXXX XXXXXX CORPORATION

Floating Rate Senior Notes due 2027

| No. [ ] |

CUSIP No.: 808513 BZ7 ISIN No.: US808513BZ79 |

THE XXXXXXX XXXXXX CORPORATION, a Delaware corporation (the “Issuer”), for value received promises to pay to CEDE & CO., or its registered assigns, the principal sum of [ ] DOLLARS, or such lesser amount as is indicated in the records of the Trustee and Depositary, on March 3, 2027.

Interest Payment Dates: March 3, June 3, September 3 and December 3 of each year (each, an “Interest Payment Date”), commencing on June 3, 2022.

Interest Record Dates: February 16, May 19, August 19 and November 18 (each, a “Regular Record Date”).

Reference is made to the further provisions of this Note contained herein, which will for all purposes have the same effect as if set forth at this place.

Dated: March 3, 2022

2

IN WITNESS WHEREOF, the Issuer has caused this Note to be signed manually, by facsimile or electronically by its duly authorized officers.

| THE XXXXXXX XXXXXX CORPORATION | ||

| By: |

| |

| Name: Xxxxx Xxxxxxxx | ||

| Title: Managing Director, Executive Vice President and Chief Financial Officer | ||

| Attest: |

|

|

| Name: Xxxxx X. Xxxxxxxxx |

| Title: Vice President, Associate General |

| Counsel and Assistant Corporate Secretary |

3

This is one of the Notes of the series designated herein and referred to in the within-mentioned Indenture.

Dated: March 3, 2022

| THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., as Trustee | ||

| By: |

| |

| Authorized Signatory | ||

4

(REVERSE OF NOTE)

THE XXXXXXX XXXXXX CORPORATION

Floating Rate Senior Notes due 2027

1. Interest.

The Xxxxxxx Xxxxxx Corporation (the “Issuer”) promises to pay interest on the principal amount of this Note at a rate per annum, reset quarterly, equal to Compounded SOFR plus 1.05%, all as determined by the Calculation Agent as provided for in the Indenture (as defined below). Interest on the Notes will be payable quarterly in arrears on March 3, June 3, September 3 and December 3 of each year (each, an “Interest Payment Date”), commencing June 3, 2022, until the principal thereof is paid or made available for payment. The interest rate for each Interest Period will be calculated by the Calculation Agent on the applicable Interest Payment Determination Date using Compounded SOFR with respect to the applicable Observation Period relating to the Interest Period. The Calculation Agent will then add the spread of 1.05% per annum to Compounded SOFR as determined on the Interest Payment Determination Date. Absent manifest error, the Calculation Agent’s determination of the interest rate for an Interest Period for the Notes will be binding and conclusive on the Holders, the Trustee and Paying Agent, and the Issuer.

The initial Interest Period is March 3, 2022 through June 3, 2022. Cash interest on the Notes will accrue from the most recent date to which interest has been paid; or, if no interest has been paid, from and including March 3, 2022. Interest on this Note will be paid to but excluding the relevant Interest Payment Date or on such earlier date as the principal amount shall become due in accordance with the provisions hereof. Interest will be payable to the holder of record on the Regular Record Date, provided, however, interest payable on the Stated Maturity will be paid to the person to whom the principal will be payable. Interest on the Notes will be computed on the basis of the actual number of days in each Interest Period and a 360-day year. If any Interest Payment Date, Redemption Date or the Stated Maturity of the Notes is not a Business Day, then the related payment of interest and/or principal payable, as applicable, on such date will be paid on the next succeeding Business Day with the same force and effect as if made on such Interest Payment Date, Redemption Date or Stated Maturity and no further interest will accrue as a result of such delay.

The Issuer shall pay interest on overdue principal from time to time on demand by the Trustee pursuant to Section 5.3 of the Base Indenture (defined below) at the rate borne by the Notes and on overdue installments of interest (without regard to any applicable grace periods) to the extent lawful.

2. Paying Agent; Calculation Agent.

Initially, The Bank of New York Mellon Trust Company, N.A. (the “Trustee”) will act as paying agent (the “Paying Agent”). The Issuer may change any paying agent without notice to the Holders. Initially, the Trustee will act as calculation agent (the “Calculation Agent”). The Issuer may appoint a successor calculation agent at its discretion.

5

3. Indenture; Defined Terms.

This Note is one of the Floating Rate Senior Notes due 2027 (the “Notes”) issued under the Senior Indenture dated as of June 5, 2009 (as amended, modified or supplemented from time to time in accordance therewith, the “Base Indenture” and, as amended, modified and supplemented by the Twentieth Supplemental Indenture dated as of March 3, 2022, the “Indenture”) by and between the Issuer and the Trustee, as trustee. This Note is a “Global Security” and the Notes are “Global Securities” under the Indenture.

For purposes of this Note, unless otherwise defined herein, capitalized terms herein are used as defined in the Indenture. The terms of the Notes include those stated in the Indenture and those made part of the Indenture by reference to the Trust Indenture Act of 1939 (15 U.S.C. Sections 77aaa-77bbbb) (the “TIA”) as in effect on the date on which the Indenture was qualified under the TIA. Notwithstanding anything to the contrary herein, the Notes are subject to all such terms, and Holders of Notes are referred to the Indenture and the TIA for a statement of them. To the extent the terms of the Indenture and this Note are inconsistent, the terms of the Indenture shall govern.

4. Denominations; Transfer; Exchange.

The Notes are in registered form, without coupons, in denominations of $2,000 and multiples of $1,000 thereafter. A Holder shall register the transfer or exchange of Notes in accordance with the Indenture. The Issuer may require a Holder, among other things, to furnish appropriate endorsements and transfer documents and to pay certain transfer taxes or similar governmental charges payable in connection therewith as permitted by the Indenture. The Issuer need not issue, authenticate, register the transfer of or exchange any Notes or portions thereof for a period of fifteen (15) days before the electronic delivery or mailing of a notice of redemption, nor need the Issuer register the transfer or exchange of any Note selected for redemption in whole or in part, except the unredeemed portion of any Security being redeemed in part.

5. Amendment; Modification; Waiver.

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Issuer and the rights of the Holders of the Securities of all series affected under the Indenture at any time by the Issuer and the Trustee with the consent of the Holders of not less than a majority in aggregate principal amount of the Securities of all series at the time Outstanding affected thereby (voting together as a single class). The Indenture contains provisions permitting the Holders of not less than a majority in aggregate principal amount of the Securities of all series at the time Outstanding with respect to which an Event of Default under the Indenture shall have occurred and be continuing (voting together as a single class), on behalf of the Holders of all Securities of such affected series, to waive, with certain exceptions, such past default with respect to all such series and its consequences. The Indenture also permits the Holders of not less than a majority in aggregate principal amount of the Securities of each series at the time Outstanding affected thereby (voting together as a single class), on behalf of the Holders of all Securities of such affected series, to waive compliance by the Issuer with certain provisions of the Indenture. Any such consent or waiver by the Holder of this Note shall be conclusive and binding upon such Holder and upon all future Holders of this Note and of any Security issued upon the registration of transfer hereof or in exchange therefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Note.

6

6. Optional Redemption.

Beginning on or after February 3, 2027, the Issuer may redeem the Notes in whole or in part, at its option, at any time or from time to time prior to maturity on at least 10 days, but not more than 60 days, prior notice electronically delivered or mailed to each registered Holder of the Notes (the “Redemption Date”).

If any or all of the Notes are redeemed on or after February 3, 2027, the Redemption Price (calculated by the Company) will be equal to 100% of the principal amount of the Notes to be redeemed plus accrued and unpaid interest to, but not including, the Redemption Date for such Notes.

On and after the Redemption Date for the Notes, interest will cease to accrue on the Notes or any portion thereof called for redemption, unless the Issuer defaults in the payment of the Redemption Price and accrued interest, if any. On or before the Redemption Date for the Notes, the Issuer shall deposit with the Trustee or a Paying Agent, funds sufficient to pay the Redemption Price of the Notes to be redeemed on the Redemption Date, and accrued and unpaid interest, if any, on such Notes. If less than all of the Notes are to be redeemed, the Notes to be redeemed shall be selected in accordance with the procedures of the Depositary; provided, however, that in no event, shall Notes of a principal amount of $2,000 or less be redeemed in part.

Notice of any redemption shall be electronically delivered or mailed at least 10 days but not more than 60 days before the Redemption Date to each Holder of the Notes to be redeemed; provided, however, that if the Trustee is asked to give such notice it shall be notified in writing of such request at least 5 days prior to the date of the giving of such notice (unless a shorter notice shall be satisfactory to the Trustee). Such notice shall state the Redemption Price (if known) or the formula pursuant to which the Redemption Price is to be determined if the Redemption Price cannot be determined at the time the notice is given. If the Redemption Price cannot be determined at the time such notice is to be given, the actual Redemption Price, calculated as described above, shall be set forth in an Officer’s Certificate of the Issuer delivered to the Trustee no later than two Business Days prior to the Redemption Date. Notice of redemption having been given as provided in the Indenture, the Notes called for redemption shall become due and payable on the Redemption Date and at the applicable Redemption Price, plus accrued and unpaid interest, if any, to, but not including, the Redemption Date.

7. Defaults and Remedies.

If an Event of Default with respect to Notes at the time Outstanding occurs and is continuing, then in every such case the Trustee or the Holders of not less than 25% in aggregate principal amount of the Securities of all affected series then Outstanding (voting together as a single class) may declare the principal amount of all the Securities of the affected series to be due and payable immediately, by a notice in writing to the Issuer (and to the Trustee if given by Holders), and upon any such declaration such principal amount (or specified amount) of and the accrued interest on all the Securities of such affected series shall become immediately due and payable.

7

The Indenture permits, subject to certain limitations therein provided, Holders of not less than a majority in aggregate principal amount of the Securities of all affected series (voting together as a single class) at the time Outstanding, to direct the time, method and place of conducting any proceeding for any remedy available to the Trustee or exercising any trust or power conferred on the Trustee, with respect to the Securities of such series.

8. Authentication.

This Note shall not be valid until the Trustee manually, electronically or by facsimile signs the certificate of authentication on this Note.

9. Abbreviations and Defined Terms.

Customary abbreviations may be used in the name of a Holder of a Note or an assignee, such as: TEN COM (= tenants in common), TEN ENT (= tenants by the entireties), JT TEN (= joint tenants with right of survivorship and not as tenants in common), CUST (= Custodian), and U/G/M/A (= Uniform Gifts to Minors Act).

10. CUSIP Numbers.

Pursuant to a recommendation promulgated by the Committee on Uniform Security Identification Procedures, the Issuer has caused CUSIP numbers to be printed on the Notes as a convenience to the Holders of the Notes. No representation is made as to the accuracy of such numbers as printed on the Notes and reliance may be placed only on the other identification numbers printed hereon.

11. Governing Law.

This Note and the Indenture shall be governed by, and construed in accordance with, the laws of the State of California.

8

ASSIGNMENT FORM

To assign this Note, fill in the form below:

I or we assign and transfer this Note to

(Print or type assignee’s name, address and zip code)

(Insert assignee’s soc. sec. or tax I.D. No.)

and irrevocably appoint as agent to transfer this Note on the books of the Issuer. The agent may substitute another to act for him.

Date: Your Signature:

Sign exactly as your name appears on the other side of this Note.

| Signature Guarantee: |

Signature | |||

|

Signature must be guaranteed |

Signature |

Signatures must be guaranteed by an “eligible guarantor institution” meeting the requirements of the Registrar, which requirements include membership or participation in the Security Transfer Agent Medallion Program (“STAMP”) or such other “signature guarantee program” as may be determined by the Registrar in addition to, or in substitution for, STAMP, all in accordance with the United States Securities Exchange Act of 1934, as amended.

9

EXHIBIT B

FORM OF 2027 FIXED RATE NOTE

THIS SECURITY IS A GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE THEREOF. THIS SECURITY MAY NOT BE EXCHANGED IN WHOLE OR IN PART FOR A SECURITY REGISTERED, AND NO TRANSFER OF THIS SECURITY IN WHOLE OR IN PART MAY BE REGISTERED, IN THE NAME OF ANY PERSON OTHER THAN SUCH DEPOSITARY OR A NOMINEE THEREOF, EXCEPT IN THE LIMITED CIRCUMSTANCES DESCRIBED IN THE INDENTURE.

UNLESS THIS NOTE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), TO THE ISSUER OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY NOTE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS A BENEFICIAL INTEREST HEREIN.

TRANSFERS OF THIS NOTE ARE LIMITED TO TRANSFERS IN WHOLE, BUT NOT IN PART, TO NOMINEES OF DTC OR TO A SUCCESSOR THEREOF OR SUCH SUCCESSOR’S NOMINEE AND TRANSFERS OF PORTIONS OF THIS GLOBAL SECURITY ARE LIMITED TO TRANSFERS MADE IN ACCORDANCE WITH THE RESTRICTIONS SET FORTH IN THE INDENTURE REFERRED TO ON THE REVERSE HEREOF.

10

THE XXXXXXX XXXXXX CORPORATION

2.450% Senior Notes due 2027

| No. [ ] |

CUSIP No.: 808513 BY0 ISIN No.: US808513BY05 |

THE XXXXXXX XXXXXX CORPORATION, a Delaware corporation (the “Issuer”), for value received promises to pay to CEDE & CO., or its registered assigns, the principal sum of [ ] DOLLARS, or such lesser amount as is indicated in the records of the Trustee and Depositary, on March 3, 2027.

Interest Payment Dates: March 3 and September 3 of each year (each, an “Interest Payment Date”), commencing on September 3, 2022.

Interest Record Dates: February 16 and August 19 (each, a “Regular Record Date”).

Reference is made to the further provisions of this Note contained herein, which will for all purposes have the same effect as if set forth at this place.

Dated: March 3, 2022

11

IN WITNESS WHEREOF, the Issuer has caused this Note to be signed manually, by facsimile or electronically by its duly authorized officers.

| THE XXXXXXX XXXXXX CORPORATION | ||

| By: |

| |

| Name: Xxxxx Xxxxxxxx | ||

| Title: Managing Director, Executive Vice President and Chief Financial Officer | ||

| Attest: |

|

|

| Name: Xxxxx X. Xxxxxxxxx |

| Title: Vice President, Associate General |

| Counsel and Assistant Corporate Secretary |

12

This is one of the Notes of the series designated herein and referred to in the within-mentioned Indenture.

Dated: March 3, 2022

| THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A., as Trustee | ||

| By: |

| |

| Authorized Signatory | ||

13

(REVERSE OF NOTE)

THE XXXXXXX XXXXXX CORPORATION

2.450% Senior Notes due 2027

1. Interest.

The Xxxxxxx Xxxxxx Corporation (the “Issuer”) promises to pay interest on the principal amount of this Note at the rate per annum described above. Cash interest on the Notes will accrue from the most recent date to which interest has been paid; or, if no interest has been paid, from and including March 3, 2022. Interest on this Note will be paid to but excluding the relevant Interest Payment Date or on such earlier date as the principal amount shall become due in accordance with the provisions hereof. Interest will be payable to the Holder of record on the Regular Record Date, provided, however, interest payable on the Stated Maturity will be paid to the person to whom the principal will be payable. The Issuer will pay interest semi-annually in arrears on each Interest Payment Date, commencing September 3, 2022. If any Interest Payment Date, Redemption Date or the Stated Maturity of the Notes is not a Business Day, then the related payment of interest and/or principal payable, as applicable, on such date will be paid on the next succeeding Business Day with the same force and effect as if made on such Interest Payment Date, Redemption Date or Stated Maturity and no further interest will accrue as a result of such delay. Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months.

The Issuer shall pay interest on overdue principal from time to time on demand by the Trustee pursuant to Section 5.3 of the Base Indenture (defined below) at the rate borne by the Notes and on overdue installments of interest (without regard to any applicable grace periods) to the extent lawful.

2. Paying Agent.

Initially, The Bank of New York Mellon Trust Company, N.A. (the “Trustee”) will act as paying agent (the “Paying Agent”). The Issuer may change any paying agent without notice to the Holders.

3. Indenture; Defined Terms.

This Note is one of the 2.450% Senior Notes due 2027 (the “Notes”) issued under the Senior Indenture dated as of June 5, 2009 (as amended, modified or supplemented from time to time in accordance therewith, the “Base Indenture” and, as amended, modified and supplemented by the Twentieth Supplemental Indenture dated as of March 3, 2022, the “Indenture”) by and between the Issuer and the Trustee, as trustee. This Note is a “Global Security” and the Notes are “Global Securities” under the Indenture.

For purposes of this Note, unless otherwise defined herein, capitalized terms herein are used as defined in the Indenture. The terms of the Notes include those stated in the Indenture and those made part of the Indenture by reference to the Trust Indenture Act of 1939 (15 U.S.C. Sections 77aaa-77bbbb) (the “TIA”) as in effect on the date on which the Indenture was qualified under the TIA. Notwithstanding anything to the contrary herein, the Notes are subject to all such terms, and Holders of Notes are referred to the Indenture and the TIA for a statement of them. To the extent the terms of the Indenture and this Note are inconsistent, the terms of the Indenture shall govern.

14

4. Denominations; Transfer; Exchange.

The Notes are in registered form, without coupons, in denominations of $2,000 and multiples of $1,000 thereafter. A Holder shall register the transfer or exchange of Notes in accordance with the Indenture. The Issuer may require a Holder, among other things, to furnish appropriate endorsements and transfer documents and to pay certain transfer taxes or similar governmental charges payable in connection therewith as permitted by the Indenture. The Issuer need not issue, authenticate, register the transfer of or exchange any Notes or portions thereof for a period of fifteen (15) days before the electronic delivery or mailing of a notice of redemption, nor need the Issuer register the transfer or exchange of any Note selected for redemption in whole or in part, except the unredeemed portion of any Security being redeemed in part.

5. Amendment; Modification; Waiver.