STOCK PURCHASE AGREEMENT

Exhibit 10.27

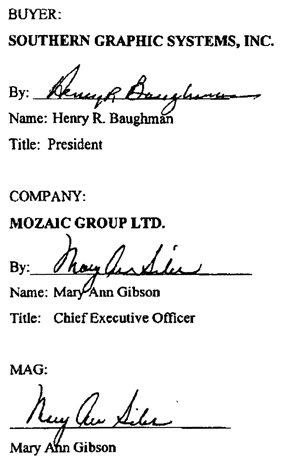

THIS STOCK PURCHASE AGREEMENT (this “Agreement”) is made effective as of the 30th day of June, 2004 by and among SOUTHERN GRAPHIC SYSTEMS, INC., a corporation duly organized and existing under the laws of the State of Kentucky (“Buyer”), MOZAIC GROUP LTD., a corporation duly organized and existing under the laws of the State of Missouri (the “Company”), and Xxxx Xxx Xxxxxx, an individual residing in the State of Florida (“MAG”).

This Agreement sets forth the terms and conditions upon which Buyer is purchasing and Company is selling newly-issued capital stock of the Company consisting of 8,565 shares of Voting Common Stock and 118,400 shares of Non-Voting Common Stock which equal 50.997% of each class of Voting Common Stock and Non-Voting Common Stock, respectively, of the Company (collectively, the “Shares”).

In consideration of, and in reliance on, the mutual agreements, covenants, representations and warranties contained in this Agreement, Buyer, the Company and MAG agree as follows:

ARTICLE I

As used in this Agreement, the terms below shall have the following meanings:

“Arbitrating Accountant” has the meaning given in Section 9.5(b)(i).

“Affiliate” means any Person, directly or indirectly, controlling, controlled by, or under common control with, the Company, Buyer or MAG. Without limiting the generality of the foregoing, a Person is considered to be in control of or to be controlled by another Person if such Person holds 50% or more of the outstanding voting equity interest in such other Person or such other Person holds 50% or more of its outstanding voting equity interest.

“Agreement” has the meaning given in the introductory paragraph.

“Alcoa” means Alcoa Inc., a Pennsylvania corporation.

“ASC” means Alcoa Securities Corporation, a Delaware corporation.

“ASC Loan” has the meaning given in Section 7.6.

“ASC Loan Agreement” has the meaning given in Section 7.6.

“Amended and Restated Shareholders’ Agreement” has the meaning given in Section 2.4.

“Ancillary Agreements” has the meaning given in Section 3.4.

“Balance Sheet” has the meaning given in Section 4.6.

“Business” means the business conducted by the Company which includes providing a full-suite of integrated services including brand architecture, comprehensive design solutions, interactive development, digital photography, imaging, dynamic publishing and workflow tools, large format digital printing, print management and complete outsourced capabilities to execute and produce direct response TV campaigns.

“Business Day” means any day other than Saturday, Sunday and any day which is a legal holiday or a day on which banking institutions in the United States are authorized by Law or other government action to close.

“Buyer” has the meaning given in the introductory paragraph.

“Buyer Indemnitees” has the meaning given in Section 10.1.

“Closing” means the taking of the actions described in Article III of this Agreement.

“Closing Date” means 11:59 PM EST on June 30, 2004, or such other date as may be mutually agreed by the parties in writing.

“Closing Date Debt Amount” has the meaning given in Section 9.5(a).

“Closing Date Net Working Capital” has the meaning given in Section 9.5(a).

“Closing Date Statement” has the meaning given in Section 9.5(b).

“Code” means the Internal Revenue Code of 1986, as amended. All references to the Code, or to the Treasury Regulations promulgated thereunder, shall include any amendments or any substitute or successor provisions thereto.

“Company” has the meaning given in the introductory paragraph.

“Company Earn-Out Payment” has the meaning given in Section 3.5.1(b).

“Company IP” has the meaning given in Section 4.13.

“Company Shares” has the meaning given in Section 4.1(a).

“Confidential Information” has the meaning given in Section 9.2.

2.

“Current Maturities of Lone Term Debt” means, with respect lo long term debt shown on the Financial Statements, principal payments due within 12 months following the date of the Financial Statements, excluding principal payments on subordinated debt.

“Current Maturities of LT Debt” means the same as the foregoing.

“DCS Family Investments” has the meaning given in Section 3.2(b).

“DCS Real Estate” has the meaning given in Section 8.12.

“Dispute Period” has the meaning given in Section 9.5(b).

“Dispute” has the meaning given in Section 9.5(b).

“EBITDA” shall mean the total revenue of the Company minus (i) the cost of goods sold and services provided, (ii) general administrative and selling expenses and (iii) research and development expenses. EBITDA will not include the effects of (i) depreciation and amortization, (ii) income taxes, and (iii) interest income or interest expense. EBITDA will not include income statement impact of Earnouts. The calculation and the amounts of EBITDA’s components will be determined in accordance with Alcoa’s accounting practices for its operating locations, with such modifications as are reasonably necessary to be consistent with Company’s Projections. Such modifications shall include, but not be limited to, percentage completion accounting for unbilled revenues pertaining to work-in-process.

“Employee Arrangements” has the meaning given in Section 4.19(a).

“Employment Agreements” has the meaning given in Section 8.10.

“Encumbrances” means any mortgage, covenant, condition, restriction, option, lien (statutory or other), pledge, charge, easement, right-of-way, security interest, or other right or interest of third parties, but excluding any such Encumbrance as expressly provided in the Amended and Restated Shareholders’ Agreement.

“Environmental Condition” means: (i) the past or present release, spill, discharge, dispersal, leaching, emission, disposal or migration (as defined in any Environmental Law) into the indoor or outdoor environment (including, without limitation, ambient air, surface water, groundwater and surface or subsurface strata) or into or out of any property, and/or contamination with hazardous wastes, materials or substances, as defined by any applicable Environmental Law, including oil and petroleum products, radioactive, nuclear or source materials; or (ii) injury to health, public safety or the environment relating to activities of the Company.

“Environmental Law” means any and all laws concerning the protection of human health and the environment which include, but are not limited to, applicable common law, the Comprehensive Environmental Response, Compensation and Liability Act

3.

(“CERCLA”), 42 U.S.C. §§ 9601 et seq.; the Emergency Planning and Community Right-to-Know Act of 1960, 42 U.S.C. §§ 13101 et seq.; the Resource Conservation and Recovery Act (“RCRA”), 42 U.S.C. §§ 6901, et seq.; the Federal Water Pollution Control Act, 33 U.S.C. §§ 1251 et seq,; the Clean Air Act, 42 U.S.C. §§ 7401 et seq.; the Hazardous Materials Transportation Act, 49 U.S.C. §§ 1471 et seq.; the Toxic Substances Control Act, 15 U.S.C. §§ 2601 et seq.; Federal Insecticide, Fungicide, and Rodenticide Act (“FIFRA”), 7 U.S.C. §§ 136 et seq.; the Occupational Safety and Health Act of 1970 (“OSHA”), 29 U.S.C. §§ 651-678; and the Safe Drinking Water Act, 42 U.S. §§ 300f through 300j, each, as they have been or will be amended from time to time, and the rules and regulations implementing such statutes or promulgated thereunder together with any and all federal, state, and local environmental laws, rules, ordinances, regulations or guidance similar or analogous to the above-listed laws.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“Financial Statements” has the meaning given in Section 4.6.

“GAAP” means generally accepted United States accounting principles.

“Hazardous Substances” means any material, substance, chemical or waste that is listed, defined or regulated as hazardous or toxic under applicable Environmental Law.

“Indemnification Agreement” has the meaning given in Section 10.4(d).

“Indemnified Party” has the meaning given in Section 10.5.

“Indemnifying Party” has the meaning given in Section 10.5.

“Intellectual Property” means (a) all inventions (whether patentable or unpatentable and whether or not reduced to practice), all improvements thereon, and all patents, patent applications and patent disclosures, together with all reinsurances, continuation, continuations-in-part, divisions, revisions, extensions and re-examinations thereof, (b) all trademarks, service marks, trade dress, logos, tradenames, domain names, and corporate names, together with all translations, adaptations, derivations and combinations thereof and including all goodwill associated therewith, and all applications, registrations and renewals in connection therewith, (c) all copyrights and copyrightable works and all applications, registrations and renewals in connection therewith, (d) all trade secrets and confidential business information (including ideas, research and development, know-how, formulas, compositions, manufacturing and production processes and techniques, methods, schematics, technology, technical data, designs, drawings, flowcharts, block diagrams, specifications, customer and supplier lists, pricing and cost information and business and marketing plans and proposals), (e) all computer software (including data and related documentation), (f) all other proprietary rights, (g) all copies and tangible embodiments of any of the foregoing (in whatever form or medium), and (h) all licenses, sublicenses, agreements or permissions related to any of the foregoing.

4.

“Inventors” has the meaning given in Section 4.13.

“Law” means any applicable federal, state, provincial, local or foreign order, writ, injunction, decree, regulation, rule, ordinance, law, statute or code.

“Liability for Tax” has the meaning given in Section 10.1.

“Letter of Intent” means that certain Letter of Intent executed by Buyer and Company dated April 14, 2004.

“Losses” has the meaning given in Section 10.1.

“MAG” has the meaning given in the introductory paragraph.

“MAG Loan” has the meaning given in Section 8.12.

“Net Working Capital” means (i) the amount of “current assets” reflected in the Projections (defined below) as of a given date minus (ii) the amount of “current maturities of LT debt”, “accounts payable”, and “accrued expenses” reflected in the Projections as of the same date.

“Non-Management Shareholders” has the meaning given in Section 3.2(b).

“Non-Voting Common Stock” means Class B Common Stock.

“NPL” has the meaning given in Section 4.25(d).

“Permits” has the meaning given in Section 4.14.

“Permitted Exceptions” means (i) those exceptions to title to the assets of the Company listed on Schedule 4.10(b) and (ii) Encumbrances related to the line of credit and long term debt referred in the 12-31-03 Financial Statements and Projections.

“Person” means a natural person, a corporation, a partnership, a limited liability company, or any other legal entity.

“Pre-existing Liabilities” has the meaning given in Section 10.1.

“Projections” has the meaning given in Section 4.8.

“Projected Debt Amount” has the meaning given in Section 9.5(a).

“Projected Net Working Capital” has the meaning given in Section 9.5(a).

5.

“Purchase Price” has the meaning given in Section 2.2.

“Related Parties” has the meaning given in Section 4.21.

“Returns” means all returns, declarations, reports, statements and other documents required to be filed in respect of Taxes, and any claims for refunds of Taxes, including any amendments or supplements to any of the foregoing. The term “Return” means any one of the foregoing Returns.

“Sales” means the total sales of the Company calculated in accordance with Alcoa’s accounting policies, with such modifications as are reasonably necessary to be consistent with Company’s Projections.

“Securities Act” shall mean the Securities Act of 1933, as amended.

“Seller Indemnitees” has the meaning given in Section 10.2.

“Shares” has the meaning given in the second introductory paragraph.

“Shareholder Earn-Out Payment” has the meaning given in Section 3.5.1 (a).

“Subsidiaries” mean Mozaic Management, Inc. and 617 Front, Inc.

“Tax” or “Taxes” means any federal, state, local, foreign or other taxes including but not limited to income, corporation, gross receipts, profits, gains, capital stock, franchise, sales, use, transfer, payroll, personal property, real property, occupancy, alternative minimum, estimated or other tax, levy, impost, fee, imposition, assessment or similar charge, together with any additions to Tax or additional amounts, interest and penalty thereon.

“Third Party Claim” has the meaning given in Section 10.5.

“Voting Common Stock” means Class A Common Stock.

“Year 1” has the meaning given in Section 3.5.1 (a)(i).

“Year 2” has the meaning given in Section 3.5.1 (a)(ii).

“4-30-04 Financial Statements” has the meaning given in Section 4.6.

“12-31-03 Financial Statements” has the meaning given in Section 4.6.

6.

ARTICLE II

2.1 Purchase and Sale of Shares. On the Closing Date, subject to the terms and conditions of this Agreement, Company will issue and sell to Buyer and Buyer will purchase and acquire from Company, the Shares, free and clear of any and all Encumbrances. This sale and purchase transaction is subject to the conditions set forth in Article VII and VIII.

2.2 Purchase Price. The total purchase price for the Shares will be Two Million Dollars ($2,000,000) (the “Purchase Price”). At Closing, the Company will apply the Purchase Price amount it receives from Buyer to pay off subordinated debt totaling $2,000,000 in the aggregate (excluding the MAG Loan amount which will not be repaid at Closing).

2.3 Payment of Purchase Price. On the Closing Date, Buyer shall pay the Purchase Price to Company by wire transfer of immediately available funds to the following Summers, Compton, Xxxxx & Hamburg, P.C. Trust Account for distribution to the subordinated debt holders:

| Name of Bank: |

Enterprise Bank, St. Louis, MO | |

| Name of Account: |

Summers, Compton, Xxxxx & Hamburg, P.C. | |

| Trust Account | ||

| Routing Number: |

ABA # 000000000 | |

| Account Number: |

0000000 |

2.4 Shareholder Agreement. Simultaneously with the purchase of the Shares hereunder, Buyer, Company, and all of the shareholders of the Company will amend and execute an amendment and restatement of the Shareholders’ Agreement dated August 14, 2003, substantially in the form attached hereto as Exhibit A (the “Amended and Restated Shareholders’ Agreement”).

ARTICLE III

3.1 Time; Location. Subject to the conditions contained herein, the Closing shall be held on the Closing Date at 9:00 a.m., local time, at the offices of Company’s attorney, Summers, Compton, Hamburg & Xxxxx, 0000 Xxxxx Xxxx, Xx. Xxxxx, Xxxxxxxx 00000, or at such other time and place as the parties shall agree.

3.2 Deliveries by the Company. At the Closing, the Company shall execute and deliver or cause to be executed and delivered the following:

| (a) | Certificates evidencing the Shares, free and clear of any Encumbrances; |

| (b) | Releases signed by each of the non-management shareholders identified on Schedule 3.2 (b) (the “Non-Management Shareholders”) who sold their shares to DCS Family Investments, LLC, a Missouri limited liability company (“DCS |

7.

| Family Investments”), controlled by MAG, substantially in the form attached hereto as Exhibit B. |

| (c) | Resignations of the individuals identified on Schedule 3.2(c) as members of the board of directors and as officers of the Company, effective as of the Closing Date; |

| (d) | A resolution of the Company’s board of directors, authorizing the consummation of the transaction contemplated in this Agreement; |

| (e) | All documents required to be delivered to Buyer pursuant to Article VIII; |

| (f) | Such additional instruments as Buyer may reasonably require in order to effectively vest title in the Shares. |

| (g) | A certificate executed by an officer of the Company representing that the representations and warranties of the Company in this Agreement were accurate when made and are accurate in all respects as of the Closing Date as if made on the Closing Date and that all covenants to be complied with by the Company has been complied with in all material respects; |

| (h) | Consents authorizing the election of the new board of directors and officers of the Company set forth in the Amended and Restated Shareholders’ Agreement; |

| (i) | An acknowledgment and representation by each shareholder of the Company, substantially in the form attached hereto as Exhibit C. which Buyer is relying upon in purchasing the Shares pursuant to this Agreement; |

| (j) | The Indemnification Agreements executed by MAG and her Affiliates; and |

| (k) | Correct and complete copies of (a) the governing documents (other than the bylaws) of the Company as of a date not more than 10 days prior to the Closing Date, certified by the Secretary of State of Missouri and the governing documents of the Subsidiaries, certified by the Secretary of the jurisdiction in which the Subsidiaries are incorporated, and (b) the bylaws of the Company and its Subsidiaries as of the Closing Date, certified by the Company’s Secretary; and |

| (l) | Certificates of the appropriate public officials dated not more than 10 days prior to the Closing Date to the effect that the (i) Company is a validly existing corporation in good standing in the State of Missouri and in each jurisdiction listed in Schedule 4.2 and (ii) Each Subsidiary is a validly existing corporation in good standing in the jurisdiction it is incorporated and each jurisdiction listed on Schedule 4.2. |

3.3 Deliveries by the Buyer. At the Closing, Buyer shall execute and deliver or cause to be executed and delivered the following:

| (a) | All documents required to be delivered to the Company pursuant to Article VII; |

| (b) | A certificate representing that each of Buyer’s representations and warranties in this Agreement were accurate when made and are accurate in all respects as of the Closing Date as if made on the Closing Date and that all covenants to be complied with by Buyer have been complied with in all material respects; |

| (c) | The Purchase Price; |

8.

| (d) | The ASC Loan proceeds in an amount of no more than $3.1 million which amount shall be used to pay off the Company’s line of credit at Enterprise Bank, St. Louis, Missouri; |

| (e) | Consents authorizing the election of the new board of directors and officers of the Company set forth in the Amended and Restated Shareholders’ Agreement; and |

| (f) | The certificate of Directors & Officers Liability Insurance for Company for wrongful acts or loss which occur as of or after the Closing Date. |

3.4 Other Agreements to be Executed at Closing. At the Closing, the following additional agreements (the “Ancillary Agreements”) shall also be executed and delivered by the applicable parties:

| (a) | The Employment Agreements; |

| (b) | The Amended and Restated Shareholders’ Agreement; |

| (c) | The ASC Loan Agreement; and |

| (d) | MAG Loan documentation. |

3.5 Earn-Out.

3.5.1 Earn-Out Payment.

(a) Shareholder Earn-Out Payment. Buyer agrees to pay to the shareholders of the Company the following earn-out payments (each, a “Shareholder Earn-Out Payment”), if the applicable conditions are satisfied:

(i) $600,000 if the Sales equal or exceed $15,000,000 and EBITDA equals or exceeds $3,088,800 for the twelve-calendar month period beginning on the first day of the month first succeeding the month in which the Closing occurs (“Year 1”); and

(ii) $800,000 if the Sales equal or exceed $25,000,000 and EBITDA equals or exceeds $6,682,000 for the twelve-calendar month period beginning on the first anniversary of the first day of Year 1 (“Year 2”).

(b) Company Earn-Out Payment. Buyer agrees to pay to the Company an earn-out payment (the “Company Earn-Out Payment”) of $500,000 if the Sales equal or exceed $25,000,000 and EBITDA equals or exceeds $6,682,000 in Year 2.

9.

(c) Pro-rata. If the Company fails to satisfy the thresholds set forth in 3.5.1 (a)(i), 3.5.1(a)(ii) and/or 3.5.1(b) but Sales are at least 80% or more of the applicable Sales threshold and EBITDA is at least 90% or more of the applicable EBITDA threshold, a portion of the applicable Shareholder Earn-Out Payment or Company Earn-Out Payment will be paid in an amount equal to the applicable Shareholder Earn-Out Payment or Company Earn-Out Payment multiplied by the percentage that the actual EBITDA is of the threshold EBITDA for such time period. The following are examples of various calculations:

Example 1:

If Sales are at least 80% of the applicable Sales threshold and the actual EBITDA equals 95% of the EBITDA threshold in Year 1, then the Shareholder Earn-Out Payment for Year 1 will be $570,000 ($600,000 x 95% = $570,000).

Example 2:

If Sales equal 95% of the applicable Sales threshold and the actual EBITDA equals 90% of the EBITDA threshold in Year 1, then the Shareholder Earn-Out Payment for Year 1 will be $540,000 ($600,000 x 90% =$540,000).

Example 3:

If Sales are at least 80% of the applicable Sales threshold and the actual EBITDA equals 85% of the EBITDA threshold in Year 1, then there is no Shareholder Earn-Out Payment for Year 1.

Example 4:

If Sales equal 75% of the applicable Sales threshold and the actual EBITDA equals 90% of the EBITDA threshold in Year 1, then there is no Shareholder Earn-Out Payment for Year 1.

(d) Within 30 days following the last day of the twelve-calendar month period of the year to which the Shareholder Earn-Out Payment or Company Earn-out Payment relates, the Company will prepare and submit to Buyer a statement of calculation of Sales and EBITDA, certified by the Chief Financial Officer of the Company as true and correct in all material respects and calculated in accordance with this Agreement. Within 60 days following delivery of the Company’s statement of calculation of the Sales and EBITDA, Buyer will notify the Company of any objections to the Sales and EBITDA calculations, and the parties will reach agreement with regard to Buyer’s objections to the Sales and EBITDA calculations. During such 60 day period, during regular business hours and with prior notice, the Company will provide to Buyer, its Affiliates and its independent public accountants access to the financial books and records of the Company (including work papers and all relevant personnel) as may reasonably be required for preparation of any objections and to confirm compliance with this Section 3.5.1, including without limitation proper calculation of Sales and EBITDA in accordance with this Agreement. For purposes of determining whether the threshold for the Shareholder Earn-Out Payment and the Company Earn-Out Payment have been met Buyer and MAG will make such adjustments to the calculation of EBITDA as are reasonably appropriate to reflect what the EBITDA would have been had the Company remained an independent corporation.

(e) Each Shareholder Earn-Out Payment and Company Earn-out Payment required to be made pursuant to Section 3.5.1(a) and (b) will be due and payable within 90 days following the last day of the twelve-calendar month period to which the Shareholder Earn-Out Payment and Company Earn-out Payment relates. Each Shareholder Earn-Out Payment shall be paid pro rata to the shareholders of the Company (but not including the Buyer) of record as of the last day of the twelve-calendar month period for which the Shareholder Earn-Out Payment is being paid.

10.

All payments will be made by wire transfer to an account designated in writing by each shareholder of the Company (but not including the Buyer).

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

The Company and MAG, jointly and severally, represents and warrants to Buyer as follows:

4.1 Capitalization: Title to Shares: Business.

(a) The authorized capital stock of the Company consists solely of (i) 100,000 shares of Voting Company Stock, $.10 par value per share, of which, prior to the issuance of the Shares, 8230 shares are currently issued and outstanding, (ii) 900,000 shares of Non-Voting Common Stock, $.10 par value per share, of which 113,770 shares are currently issued and outstanding (the “Company Shares”). There are no other shares of capital stock authorized, issued or outstanding. The Company Shares are owned of record by the shareholders in the amount identified on Schedule 4.1(a). All issued and outstanding capital stock of the Subsidiaries is owned of record by the Company. The Company Shares and all issued and outstanding capital stock of the Subsidiaries have been duly authorized and validly issued, are fully paid and non assessable. The Company Shares and all issued and outstanding capital stock of the Subsidiaries are, and the Shares, when issued at Closing will be, free and clear of all Encumbrances.

(b) The Shares, when issued at Closing, will represent 50.997% of the total issued and outstanding shares of each class of Voting Common Stock and Non-Voting Common Stock, respectively. When issued on the Closing Date, the Shares will be duly authorized, validly issued, fully paid and non-assessable.

(c) Except for those plans and agreements identified on Schedule 4.1(c) and except as expressly provided in the Amended and Restated Shareholders’ Agreement, there are no outstanding subscriptions, options, warrants, calls or rights of any kind to purchase or otherwise acquire, and no securities convertible into, capital stock of the Company or its Subsidiaries. The Company Shares have been issued to the shareholders of the Company, and the Shares will at Closing be issued to Buyer, in compliance with all applicable federal and state securities laws.

(e) The Company and the Subsidiaries do not conduct any business other than the Business.

4.2 Organization, Good Standing and Power. The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Missouri, and has all requisite corporate power and authority to conduct its Business as it is now being conducted, to own or use the properties and assets that it purports to own or use, and to perform its obligations. Each Subsidiary is a corporation duly organized, validly existing and in good standing under the laws of the jurisdiction in which it is incorporated. Each of the Company and its Subsidiaries is duly qualified to do business as a foreign corporation and is in good standing

11.

under the laws of each state or other jurisdiction in which either the ownership or use of the properties owned or used by it, or the nature of the activities conducted by it, requires such qualification, all of such states and jurisdictions being listed on Schedule 4.2.

4.3 Authorization of Agreement and Enforceability. The Company and MAG has the power, authority and legal capacity to enter into this Agreement and the Ancillary Agreements to which each is a party and to perform all of their respective obligations hereunder and thereunder. The Company and MAG have taken all necessary action to authorize the execution and delivery of this Agreement and the Ancillary Agreements, the performance by them of all terms and conditions to be performed by them, and the consummation of the transactions contemplated hereby and thereby. This Agreement constitutes, and the Ancillary Agreements to which the Company and MAG are to become a party at the Closing, when executed and delivered by the Company and MAG, shall constitute at the Closing, legal, valid and binding obligations of the Company and MAG, enforceable against them in accordance with their terms, subject to the effect of applicable bankruptcy, insolvency, reorganization, fraudulent transfer, moratorium or other similar laws affecting rights and remedies of creditors generally and to the exercise of judicial discretion in accordance with general principles of equity (whether applied by a court of law or equity).

4.4 No Violation. Except as disclosed on Schedule 4.4, the execution, delivery and performance by the Company and MAG of this Agreement and the Ancillary Agreements, and the consummation of the transactions contemplated hereby and thereby will not (with or without the giving of notice or the lapse of time, or both) (i) result in a violation of any provision of the bylaws or articles of incorporation of the Company; (ii) result in a violation of any applicable law, statute, rule, regulation, judicial or administrative order, award, judgment or decree; (iii) contravene, conflict with, result in a breach of, or a default (or give rise to any right of termination, amendment, cancellation or acceleration) under, any term or provision of any contract, agreement, or instrument to which Company or MAG is a party; (iv) require any filing with, or permit, authorization, consent or approval of any Person; or (v) result in the creation of any Encumbrance upon the Shares or the assets of the Company, except for the ASC Loan.

4.5 Governmental Consents. No consent, approval or authorization of, or declaration, notification, filing or registration with, any United States governmental or regulatory authority is required to be made or obtained by Company or MAG in connection with the execution, delivery and performance of this Agreement and the Ancillary Agreements and the consummation of the transactions contemplated hereby and thereby.

4.6 Financial Statements. The Company has delivered to Buyer true and correct copies of (i) the internal unaudited consolidated balance sheet of the Company and the Subsidiaries at December 31, 2003, and the related statements of operations and statements of cash flows for the period beginning May 1, 2003 and ending (the “12-31-03 Financial Statements”), and (ii) the internal unaudited consolidated balance sheet of the Company and the Subsidiaries at April 30, 2004, and the reviewed internal unaudited related income statement and cash flow statement for the fiscal year then ended (the “4-30-04 Financial Statements”, and, together with the 12-31-03 Financial Statements, the “Financial Statements” ). True and correct copies of such Financial

12.

Statements are collectively attached hereto as Schedule 4.6. The Financial Statements have been prepared in accordance with GAAP, except for the 12-31-03 Financial Statements, and the information contained in such Financial Statements is complete and accurate in all material respects, subject to normal fiscal year-end adjustments in the case of the 12-31-03 Financial Statements. The Financial Statements, including the related notes, present fairly in all material respects the financial position of the Company and the Subsidiaries at the dates indicated and the results of operations and cash flows of the Company and the Subsidiaries for the periods then ended. Unless the context indicates otherwise, references in this Agreement to “Balance Sheet” shall mean the balance sheet of the Company as of April 30, 2004.

4.7 Notes and Accounts Receivable. All notes and accounts receivable were reflected properly on the Balance Sheet and those outstanding as of the Closing Date are valid receivables for sales actually made or services actually performed by the Company, as the case may be, in the ordinary course of business consistent with past practice for goods sold and delivered or services performed. No portion of any account receivable is subject to any counterclaim, defense or set-off, or is otherwise in dispute. All notes and accounts receivable outstanding as of the Closing Date are collectible to the best of the knowledge of the Company and MAG in the ordinary course of business in amounts not less than the aggregate amount thereof.

4.8 Financial Projections. Company has delivered to Buyer financial projections for the year ending December 31, 2004 and December 31, 2005 (the “Projections”), which were made in good faith with a reasonable basis. Such Projections are attached in Schedule 4.8. As of the Closing Date, the Projections shall be deemed to apply to the 24-month period following Closing rather than to calendar years 2004 and 2005 and the Company represents that, as of the Closing Date, there is a good faith reasonable basis for the Projections as applied to such 24-month period. Company, MAG and SGS acknowledge that the Projections will be deemed to be modified post-closing as appropriate to reflect the fact that the $2,000,000 of subordinated debt has been paid off at Closing and that the ASC Loan has replaced the Enterprise Bank Credit Line.

4.9 Absence of Certain Changes or Events.

4.9.1 Actions Not Taken. Since December 31, 2003, the Company and its Subsidiaries have not:

(a) Waived any rights under, amended in any material respect or terminated any contract other than in the ordinary course of the business consistent with past practice;

(b) Suffered the occurrence of any events that have had or could have a material adverse effect on the Company’s operations, assets, liabilities, financial condition or the Business;

(c) Incurred any damage, destruction or casualty having a material adverse effect on the Company’s assets or the Business, whether or not covered by insurance;

(d) Sold, transferred, replaced or leased any assets or sold any inventory at a discount, except for transactions in the ordinary course of the business consistent with past

13.

practice and except that the Company will enter into additional equipment leases for $100,000 on or before July 30, 2004;

(e) Waived or released any material rights with respect to the Company’s assets or the Business;

(f) Transferred or granted any proprietary rights;

(g) Entered into any transaction or made any commitments other than in the ordinary course of the business consistent with past practice;

(h) Changed its methods of accounting;

(i) Changed the rate of compensation paid to anyone connected with the Business, except for those increases planned in the ordinary course of business consistent with past practices, or established any new pension or profit-sharing plan, deferred compensation agreement or employee benefit arrangement of any kind;

(j) Materially altered its conduct in its relations with suppliers or customers;

(k) Declared or paid any dividend or distributions to shareholders or awarded or paid any bonuses to management or employees (other than salaries payable in the ordinary course of business to Company’s shareholders);

(l) Increased the salary, wage or bonus of any employee of the Company except for a partial reinstatement of wages effective April 1, 2004, that were rolled back with management approval and employee consent in October 2003. The amount of the April wage increase averaged 13%, and the amount of the October 2003 roll back was approximately 25%;

(m) Changed the Projections, the basis for such Projections, the Business, operations, assets, liabilities or financial condition of the Company, that such change constitutes a material adverse change; and

(n) Agreed or committed to do any of the foregoing.

4.9.2 Actions Taken. Since December 31, 2005, the Company and its Subsidiaries have:

(a) Operated the Business in the usual, regular and ordinary manner as such Business was operated prior to December 31, 2003 and, to the extent consistent with such operation, used its best efforts to preserve the goodwill of the Business, kept the Business intact, and preserved its relationships with customers, suppliers and others having business dealings with the Company; and

14.

(b) Billed its customers and paid its suppliers in the usual, regular and ordinary manner, on a basis consistent with past practice.

4.10 Title to Assets; Absence of Encumbrances. Schedule 4.10 ( a) is a complete and accurate list of the assets of the Company and its Subsidiaries. Except as otherwise disclosed on Schedule 4.10(b) and subject to the Permitted Exceptions, the Company and its Subsidiaries has good and marketable title to, or, in the case of leased assets, has a valid leasehold interest in, all of the real and personal assets of the Business. All tangible assets and properties are in good operating condition and repair and are usable in the ordinary course of the business, consistent with past practice and conform to applicable laws relating to their construction, use and operation. The assets listed are sufficient for the continued conduct of the Business after the Closing in substantially the same manner as conducted prior to the Closing. Except as disclosed on Schedule 4.10(b). all assets are free and clear of all Encumbrances other than Permitted Exceptions.

4.11 Contracts and Commitments. A complete and accurate list of all written or oral contracts, agreements and commitments of the Company and its Subsidiaries is identified on Schedule 4.11. Company has provided Buyer with complete and accurate copies of all written contracts, agreements and commitments and descriptions of all oral contracts, agreements and commitments. The Company and its Subsidiaries are not in breach of any of the foregoing, and the Company and its Subsidiaries have not waived the future enforceability of any significant rights under any such contract, agreement or commitment. The Company does not have any knowledge that any other party has terminated, canceled, or substantially modified any such contracts nor threatened to take such actions, and the Company does not have any knowledge that any other party is in default under any such contracts. Other than as disclosed in the Financial Statements, the Company and its Subsidiaries have paid in full all amounts due under leases and all other written or oral contracts, agreements and commitments.

4.12 No Other Agreements. Except as disclosed on Schedule 4.12, there is no outstanding option, right, agreement or other obligation pursuant to which any person or entity could claim a right to acquire in any way all or any part of, or interest in, the assets or stock of the Company or its Subsidiaries. No person possesses any rights which do or could commit or obligate the Company to issue additional shares of stock or other equity interests in the Company or its Subsidiaries.

4.13 Intellectual Property. Except as disclosed on Schedule 4.13, the Company is the sole owner of, or a licensee under a valid license for, all items of Intellectual Property which are used in the Business as currently conducted (the “Company IP”). Such items of Company IP that are registrations or applications are listed on Schedule 4.13, and Schedule 4.13 also indicates those items of Company IP that are owned by, and those items licensed to, the Company. Except as disclosed on Schedule 4.13, (a) the Company, and the Business are not in default (nor with the giving of notice or lapse of time or both would be in default) under any license or other grant to or from third parties to use any Company IP; (b) to the best of Company’s knowledge, such Company IP is not being infringed by any third party; (c) there arc no claims pending or, to the best of Company’s knowledge, threatened, that (i) the Business is in violation of, infringing

15.

upon, or in conflict with any such Intellectual Property rights of any third party, (including any claim that the Company, or the Business must license or refrain from using any intellectual property rights of third parties) or (ii) challenging the validity, enforceability, or ownership of any Company IP, and (d) the Company and the Business have taken all reasonable action to maintain and preserve the Company IP, including without limitation making all filings and all payments or all maintenance and similar fees for any Company IP listed on Schedule 4.13, and obtaining valid and effective assignments from employees, former employees (or persons they currently intend to hire), independent contractors and former independent contractors (collectively, the “Inventors”) of all such Inventors’ rights in any Company IP developed by such Inventors. The Company owns or possesses adequate licenses or other valid rights to use all items of Intellectual Property utilized in the conduct of the Business in accordance with past practice, free and clear of all liens except Permitted Exceptions.

4.14 Permits. The Company and its Subsidiaries have and are in compliance with all necessary permits, licenses, registrations, orders, authorizations and approvals of applicable government authorities to operate the Business, including those required under any Environmental Law (collectively, the “Permits”) and there is no proceeding pending or, to Company’s knowledge, threatened to revoke or limit any Permit and with respect to renewal of any Permit. The Company and its Subsidiaries have made, in a timely manner, all filings, reports, notices and other communications with the appropriate governmental body, and have otherwise taken, in a timely manner, all other actions, known or anticipated to be required to be taken by the Company, reasonably necessary to secure the renewal of the Permits prior to the date of their respective expirations. A complete and accurate list of all Permits is set forth on Schedule 4.14.

4.15 Compliance with Laws. Except as disclosed on Schedule 4.15 the Business and operations are being and have been conducted in compliance with all applicable laws, rules, regulations, or ordinances, including workers’ compensation statutes, and all applicable orders, rules, writs, judgments, injunctions, and decrees. The Company and its Subsidiaries have not received any notice of investigation or request for information or any notice alleging any violation of any applicable laws, rules, regulations, orders, ordinances, writs, judgments, injunctions, decrees, awards of any court or any governmental instrumentality. The Company has made available to the Buyer copies of all reports, if any, of the Company with respect to the Company required under the Federal Occupational Safety and Health Act of 1970, as amended, and under all other applicable health and safety regulations. The deficiencies, if any, noted on such reports have been corrected by the Company.

4.16 Litigation and Claims. Except as disclosed on Schedule 4.16, there are no civil, criminal or administrative legal actions, suits, hearings, proceedings, written notices of violation, demands, claims, investigations, arbitrations or other legal administrative or governmental proceedings pending or threatened against the Company, its Subsidiaries, or the Business, and the Company does not know or has any reasonable grounds to know of any basis for the same. No judgment, decree, injunction, rule or order of any governmental entity or arbitrator is outstanding against the Company, its Subsidiaries, or the Business.

16.

4.17 Books and Records. All books of account and other financial records of the Company and its Subsidiaries are complete and correct in all material respects and have been made available to Buyer. All of the books of account and other financial records have been prepared and maintained in accordance with good business practice and, where applicable, in conformity with GAAP and in compliance with applicable laws. The books of account, minute books, stock certificate books and stock transfer ledgers of the Company and its Subsidiaries are complete and correct, and there have been no transactions involving the Company and/or its Subsidiaries which are required to have been set forth therein and which have not been so set forth.

4.18 Labor Matters. Schedule 4.18 sets forth a true and correct list of the name, present position and compensation of the employees employed by the Company and its Subsidiaries. Neither the Company nor any of its Subsidiaries is a party to or bound by any collective bargaining agreement, and there has been no attempt to organize the Company’s or its Subsidiaries’ employees since inception of the Company. There are no strikes or other labor disturbances pending or threatened involving employees of the Company or its Subsidiaries. No question concerning representation (as such term is used in the context of proceedings before the National Labor Relations Board) exists respecting the employees of the Company or its Subsidiaries. No grievance nor any arbitration proceeding arising out of or under any collective bargaining agreement of the Company or its Subsidiaries is pending or threatened. Neither the Company nor its Subsidiaries has since its inception experienced a work stoppage by its employees which work stoppage caused a significant interruption of normal operations. The Company and its Subsidiaries are in compliance with all applicable federal, state and local laws with respect to discrimination, hours worked by, working conditions of, and payments made to or on behalf of, their respective employees.

4.19 Employee Benefit Plans.

(a) Schedule 4.19(a) is a true and complete list of each employee benefit plan, program or practice, whether or not subject to ERISA, and including all fringe benefits, programs and practices, and any commitment with respect to which the Company or its Subsidiaries has any liability or obligation (an “Employee Arrangement”) relating to employees or their beneficiaries. The Company has provided to Buyer copies of: (i) each employee benefit plan (ii) Employee Arrangement; (iii) summary plan descriptions; (iv) summary of material modifications; (v) other employee communications applicable to any such plan or arrangement; and (vi) Form 5500’s since its inception. Except as specifically provided in this Agreement, neither the Company nor any of its Subsidiaries has taken any action that may result in Buyer being a party to, or bound by, any ERISA plan or Employee Arrangement, and Buyer shall have no liability arising out of or relating to any ERISA plan or Employee Arrangement following the consummation of the transactions contemplated hereby. No ERISA plan or Employee Arrangement has provided for the payment of retiree benefits, other than benefits payable pursuant to employees’ 401(k) plans.

(b) The Company and its Subsidiaries have not incurred (i) any obligation to make any contribution to any “multi-employer plan” as defined in Section 4001 (a) (3) of ERISA or (ii) any withdrawal liability from any multi-employer plan under Section 4201 of ERISA. The

17.

Employee Arrangements intended to qualify under Section 401(a) of the Code so qualify and the trusts maintained pursuant thereto are exempt from federal income taxation under Section 501(a) of the Code, and nothing has occurred with respect to the operation of the Employee Arrangements which could cause the loss of such qualification or exemption or the imposition of any material liability, penalty, or tax under ERISA or the Code. The Company and its Subsidiaries, and each of the Employee Arrangements are in compliance in all material respects with the applicable provisions of ERISA and other applicable laws. There is no material violation of ERISA with respect to the filing of any applicable reports, documents, and notices regarding the Employee Arrangements with the Secretary of Labor, the Secretary of the Treasury or any other governmental agency, or the furnishing of such documents to the participants or beneficiaries of the Employee Arrangements. All contributions required by law to any Employee Arrangement have been made by the Company without regard to any waivers granted under Section 412 of the Code, and there are no accumulated funding deficiencies with respect to any of the plans subject to Section 412 of the Code. All unpaid contributions to all payments due under the Employee Arrangements (except those to be made from a trust qualified under Section 401(a) of the Code) have been properly accrued and reflected on the Balance Sheet or are disclosed on Schedule 4.19(b). There are no pending actions, claims or lawsuits which have been asserted or instituted against any of the Employee Arrangements, the assets of any of the trusts or funds under any of such plans or the plan sponsor or the plan administrator of such plans, or against any fiduciary (as defined in Section 3(21) of ERISA) of the Employee Arrangements with respect to the operation or administration of such Employee Arrangements (other than routine benefit claims), nor does the Company have knowledge of facts which could form the basis for any such action, claim or lawsuit which could lead to a material claim against Buyer. There are no pending investigations by any governmental agency involving the Employee Arrangements.

4.20 Finder. The Company and its Subsidiaries has not taken any action that would give any person or entity a right to a finder’s fee or any type of brokerage commission relating to the transactions contemplated by this Agreement.

4.21 Related Party Transactions. Except as set forth on Schedule 4.21, neither the Company, its Subsidiaries, nor any of its officers, directors, employees, current or former owners, family members of any current or former owners, Affiliates, or other related party (“Related Parties”), has been involved in any business transactions, agreements, contracts, or other arrangements for the sale of products or services with Company since its inception. Except as set forth on Schedule 4.21, none of the Related Parties has any claim of any nature against the Company or its Subsidiaries, and the Company and its Subsidiaries have no claim of any nature against any of the Related Parties. Except as set forth on Schedule 4.21, none of the Related Parties directly or indirectly owns or is engaged in any business that competes directly or indirectly with the Company or its Subsidiaries. Except pursuant to the employment agreements or employment relationships disclosed on Schedule 4.19(a)(a) none of the Related Parties will at any time after the Closing for any reason, directly or indirectly be or become entitled to receive any payment or transfer of money or other property of any kind from the Company or its Subsidiaries with respect to facts, circumstances or events existing or occurring on or before the Closing, and (b) the Company and its Subsidiaries will not at any time after the Closing for any

18.

reason, directly or indirectly, be or become subject to any obligation to any of the Related Parties with respect to facts, circumstances or events existing or occurring on or before the Closing.

4.22 Debt: Letter of Credit; Powers of Attorney; Guarantees. Except as disclosed on Schedule 4.22, the Company and its Subsidiaries have no outstanding debt, lines of credit, letters of credit, powers of attorney or guarantees and no Person holds a power of attorney to act on behalf of the Company.

4.23 Tax Returns. Except as disclosed on Schedule 4.23, all Tax Returns of the Company and its Subsidiaries required by law to have been filed have been duly and properly filed for all periods ending on or before the Closing Date, and all Taxes, assessments, fees and other governmental charges which have become due and payable for all periods ending on or before the Closing Date have been paid in full. All such Tax Returns were correct and complete. The Company and its Subsidiaries have withheld and remitted all amounts required to be withheld and have paid such amounts due to the appropriate authority on a timely basis. No extension of time within which to file any Return has been requested. There is no investigation or other proceeding pending, threatened or expected to be commenced by any taxing authority for any jurisdiction in which the Company does not file Tax Returns that may lead to an assertion that the Company or its Subsidiaries is or may be subject to a Tax liability in such jurisdiction.

4.24 Tax Liens. Except as disclosed on Schedule 4.24, there are no liens for Taxes (other than for current Taxes not yet due and payable) upon the assets of the Company or its Subsidiaries.

4.25 Environmental Matters.

(a) The Company and its Subsidiaries have not received any notice relating to the Business or the leased real property alleging any violation of any Environmental Law, any Environmental Condition or any request for information pursuant to any Environmental Law.

(b) Except as disclosed on Schedule 4.15, to the best knowledge of the Company , the Company and its Subsidiaries are and have been in compliance with all applicable Environmental Laws, there are no Environmental Conditions relating to the leased real property, and the Company and its Subsidiaries have no liability with respect to Environmental Conditions at any other site.

(c) Schedule 4.25(c) identifies all environmental studies which the Company has with respect to the leased real property, and true and complete copies of such studies have been delivered to Buyer.

(d) The Company and its Subsidiaries have not been notified that they have been named as a Potentially Responsible Party at a site listed on the National Priorities List (“NPL”), and/or that they transported or disposed of Hazardous Substances at a site listed on the NPL.

19.

4.26 List of Locations; Real Property. Schedule 4.26 sets forth a complete and accurate list of each location where the Company and its Subsidiaries leases real property or equipment or where inventory or other assets are located and such Schedule identifies the lease and the parties to the lease. Neither the Company nor any of its Subsidiaries owns, nor have they ever Owned, real property. Any lease of real property by the Company and its Subsidiaries is in full force and effect, and Company and its Subsidiaries hold a valid and existing leasehold interest under any such lease. Buyer either has been supplied with, or has been given access to, complete and accurate copies of each of the leases and none of the leases have been modified in any respect. Company is not in default under any such lease, and to the best of Company’s knowledge, none of the landlords or lessors are in default in any material respect thereunder. To the best of Company’s knowledge, except to the extent set forth on Schedule 4.26, none of the leased real property or any current use thereof violates any applicable building, zoning or other land-use Law. Except as set forth on Schedule 4.26, all leased real property can in effect be transferred to Buyer by virtue of this Agreement and used in substantially the same manner after the Closing as before the Closing. Except as set forth on Schedule 4.26, the transactions contemplated by this Agreement do not require the consent of any other party to any lease and will not result in a breach of or default under any such lease.

4.27 No Significant Items Excluded. There are no assets or properties of the Company, its Subsidiaries, or its Related Parties, or agreements, contracts or commitments to which the Company, its Subsidiaries, or a Related Party is a party that are of significant importance to the ongoing operation of the Business which have not been included in this transaction or otherwise expressly disclosed to Buyer in this Agreement or in a Schedule hereto.

4.28 Absence of Undisclosed Liabilities. The Company and its Subsidiaries have no liabilities or obligations, secured or unsecured, whether absolute, contingent or otherwise, except; (a) those liabilities and obligations set forth on the 4-30-04 Financial Statements and not heretofore paid or discharged; (b) those liabilities and obligations arising in the ordinary course of business consistent with past practice since April 30, 2004; and (c) the new $100,000 equipment leases.

4.29 Insurance. Schedule 4.29 contains a complete and correct description of all current surety bonds and policies of property and casualty insurance, including fire, general and product liability and workers’ compensation, owned, held by or issued on behalf of the Company and its Subsidiaries covering the Business or the assets of the Company and its Subsidiaries. All such policies and bonds are in full force and effect, all premiums have been paid in full, and no written notice of cancellation has been received with respect to any such insurance or surety bond. The Company and its Subsidiaries are not in default with respect to any provision contained in the policies and bonds nor have they failed to give any notice or present any material claim under the insurance policies in due and timely fashion.

4.30 Certain Payments. Since the Company’s inception, neither the Company nor any of its Subsidiaries, director, officer, agent, or employee of the Company or any of its Subsidiaries, or any other Person associated with or acting for or on behalf of the Company or its Subsidiaries, has directly or indirectly (a) made any contribution, gift, bribe, rebate, payoff, influence payment,

20.

kickback, or other payment to any Person, private or public, regardless of form, whether in money, property, or services (i) to obtain favorable treatment in securing business, (ii) to pay for favorable treatment for business secured, (iii) to obtain special concessions or for special concessions already obtained, for or in respect of the Company or its Subsidiaries, or (iv) in violation of any applicable legal requirements, or (b) established or maintained any fund or asset that has not been recorded in the books and records of the Company.

4.31 Completeness and Accuracy. All information set forth on any Schedule hereto is true, correct and complete. No representation or warranty of the Company contained in this Agreement contains any untrue statement of material fact, or omits to state any material fact necessary to make the statement made therein not misleading; there is no known fact, development or threatened development that the Company has not disclosed to Buyer that materially adversely affects or may so affect the Business or the assets of the Company and its Subsidiaries.

4.32 Disclosure. None of the representations or warranties of the Company contained in this Article IV and none of the information contained in the Schedules referred to in Article IV is false or misleading in any material respect or omits to state a fact necessary to make the statements in this Article IV or in the Schedules to Article IV not misleading in any material respect. It is the explicit intent of the parties that the Company is not making any representation or warranty whatsoever, express or implied, other than those contained in this Article IV.

4.33 Subsidiaries. Except as set forth on Schedule 4.33, the Company has no subsidiaries.

4.34 Inventory. The Company’s inventories are saleable and usable in the ordinary course of business.

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer hereby represents and warrants to the Company as follows:

5.1 Organization, Good Standing and Power. Buyer is a corporation duly organized, validly existing and in good standing under the laws of the State of Kentucky, and has all requisite corporate power and authority to execute and deliver this Agreement and the Ancillary Agreements to which it is a party, to consummate the transactions contemplated hereby and thereby and to perform all the terms and conditions hereof and thereof to be performed by it.

5.2 Authorization of Agreement and Enforceability. Buyer has taken all necessary corporate action to authorize the execution and delivery of this Agreement and the Ancillary Agreements, the performance by it of all terms and conditions to be performed by it, and the consummation of the transactions contemplated hereby and thereby. This Agreement and the

21.

Ancillary Agreements to which Buyer is a party are the legal, valid and binding obligations of the Buyer enforceable against Bayer in accordance with their terms.

5.3 No Violation. The execution, delivery and performance by Buyer of this Agreement and the Ancillary Agreements, and the consummation of the transactions contemplated hereby and thereby do not, in the case of this Agreement, and will not, in the case of this Agreement and the Ancillary Agreements, (with or without the giving of notice or the lapse of time, or both) result in (a) a violation of any provision of the bylaws or articles of incorporation of the Buyer; (b) a violation of any applicable law, statute, rule, regulation, judicial or administrative order, award, judgment or decree; or (c) a breach of, or a default under, any term or provision of any contract, agreement, or instrument to which Buyer is a party.

5.4 Governmental Consents. No consent, approval or authorization of, or declaration, filing or registration with, any United States governmental or regulatory authority is required to be made or obtained by Buyer in connection with the execution, delivery and performance of this Agreement and the Ancillary Agreements and the consummation of the transactions contemplated hereby and thereby.

ARTICLE VI

6.1 Covenants of the Company. The Company, as indicated, hereby agree to do or refrain from doing the following, as applicable, from and after the date hereof to and including the Closing Date:

(a) Ordinary Course. The Company shall conduct its Business and the business of its Subsidiaries in the ordinary course and shall make all reasonable efforts to maintain intact its business and its relationships with employees, suppliers, customers and others.

(b) No Amendments. No change or amendment shall be made in the articles of incorporation or bylaws of the Company or its Subsidiaries.

(c) No Capital Changes. The Company and its Subsidiaries shall not issue or sell, or grant options, warrants or rights to purchase or to subscribe to, or enter into any arrangement or contract with respect to the issuance or sale of, any of its capital stock or any securities or obligations convertible into or exchangeable for any shares of its capital stock, or make any changes in its capital stock.

(d) Dividends and Distributions. The Company and its Subsidiaries shall not declare, pay or set aside for payment any dividend or other distribution in respect of its capital stock, or redeem, purchase or otherwise acquire any shares of its capital stock.

(e) Forbearance by the Company. Except for performance of its obligations under contracts or other instruments or documents listed in any Schedule hereto in the ordinary course of business (or any similar contracts or other instruments or documents not

22.

required to be disclosed therein), without the prior written consent of Buyer, neither the Company or its Subsidiaries shall:

(i) incur any obligation or liability, direct or indirect, absolute or contingent, other than liabilities incurred in the ordinary course of business and not otherwise prohibited by this Agreement, or pay any obligation or liability of any kind other than current liabilities and long-term debt as it becomes due in accordance with its terms;

(ii) incur any indebtedness for borrowed money, assume, guarantee, endorse or otherwise become responsible for the obligations of any other individual, firm or corporation, or make any loans or advances to any individual, firm or corporation;

(iii) mortgage, pledge or otherwise encumber or in any way subject to encumbrance any of its properties or assets, except for purchase money security interests incurred in the ordinary course of business;

(iv) sell or transfer any of its properties or assets (except for sales of inventory in the ordinary course of business) or cancel, release or assign any indebtedness owed to it or any claims held by it;

(v) make any investment of a capital nature either by: (i) purchase of stock or securities, contributions to capital, property transfers or otherwise or (ii) purchase of any property or assets of any other individual, firm or corporation;

(vi) enter into or terminate any material contract (other than in the ordinary course of business and then only for commitments not in excess of $20,000 in the aggregate, or make any material amendment or change thereto;

(vii) (A) increase, or agree to increase, the compensation payable or to become payable by it, (B) pay or agree to pay any bonuses, (C) make or agree to make any severance or termination arrangement, or (D) pay or agree to pay any pension, retirement allowance or benefit not required by any existing plan or agreement or commit itself to any pension, retirement or profit-sharing plan or agreement or any employment agreement; to or with any of its officers, directors or employees, over the rate being paid to them or accrued for at December 31, 2003;

(viii) enter into or amend any employment agreement or savings, retirement, pension or other benefit plan, except as required by law;

23.

(ix) disclose any proprietary information other than as covered by confidentiality agreements;

(x) make, or agree to make, any changes in its accounting methods or practices; or

(xi) enter into any agreement to do any of the things described in clauses (i) through (x) above.

(f) Access. The Company and its Subsidiaries shall afford Buyer and its employees, attorneys, accountants, consultants and other authorized representatives a full opportunity (at Buyer’s expense during regular business hours and subject to reasonable constraints to protect health and safety and minimize business disruption) to examine the books, records and assets of the Company and its Subsidiaries; to conduct (or have conducted) environmental audits of the properties of the Company and its Subsidiaries; and to meet with the employees of the Company and its Subsidiaries, all so that Buyer may complete its due diligence investigation.

(g) Satisfaction of Conditions. The Company will in good faith take all such action as may be reasonably necessary or appropriate to cause all of the conditions set forth in Article VII hereof, as applicable, to be satisfied on or before the Closing Date to the extent that the satisfaction of such conditions is reasonably within the control of the Company.

(h) Consents. The Company shall use its best efforts and make every good faith attempt (and Buyer shall cooperate with the Company) to obtain all consents by third parties that are required for the transactions contemplated hereby or that are required for the consummation of the transactions contemplated hereby, or that are required in order to prevent a breach of or default under or termination of any material contract.

(i) Exclusivity. Neither the Company, nor any of the Company’s officers, directors, Affiliates or other authorized agents will, directly or indirectly, encourage, solicit, initiate, conduct, engage in or continue discussions or negotiations with, or provide any information to, any other entity or person interested in acquiring, or arranging for the purchase or sale of, the outstanding shares of the Company or any of its assets (other than sales of inventory in the ordinary course of business). The Company agrees to disclose to Buyer the existence of any unsolicited proposals received after the date hereof relating to the foregoing transactions and the content thereof as soon as practicable after they take place.

24.

ARTICLE VII

CONDITIONS PRECEDENT TO COMPANY’S OBLIGATIONS

The obligations of the Company hereunder are subject, in the discretion of the Company, to the satisfaction, on or prior to the Closing Date, of each of the following conditions:

7.1 Representations and Warranties. All representations and warranties of Buyer contained in this Agreement shall have been true when made and shall be true in all material respects at and as of the Closing Date as if such representations and warranties were made at and as of the Closing Date.

7.2 Performance. Buyer shall have performed in all material respects all obligations and agreements and complied in all material respects with all covenants and conditions required hereby to be performed or complied with by it at or prior to the Closing Date.

7.3 Actions and Proceedings. All corporate actions, proceedings, instruments and documents required to carry out the transaction contemplated by this Agreement or incidental thereto and all other related legal matters shall be reasonably satisfactory to counsel for the Company, and such counsel shall have been furnished with copies of such corporate actions and proceedings and such other instruments and documents as it shall have reasonably requested.

7.4 Consents. Any third party consents, approvals or authorizations necessary and required by Buyer for the transactions contemplated hereby shall have been obtained by Buyer.

7.5 Litigation. No suit, action, investigation, inquiry or other proceeding by any person or other entity (other than the Company or shareholders of the Company) shall have been instituted or threatened which questions the validity or legality of the transactions contemplated hereby.

7.6 ASC Loan. At Closing, Buyer shall cause ASC to issue to the Company an intercompany line of credit (the “ASC Loan”) pursuant to the terms and conditions set forth in the revolving loan agreement, which shall be in the form attached hereto as Exhibit D (the “ASC Loan Agreement”) and which shall be used at Closing to pay off the Company’s Enterprise Bank line of credit.

7.7 Opinion of Counsel. Company shall have received the favorable opinion of Xxxxxxx X. Xxxxxx, counsel for Buyer, reasonably satisfactory to the Company and its counsel as to the matters set forth in Sections 5.1, 5.2, 5.3 and 5.4 hereof.

ARTICLE VIII

CONDITIONS PRECEDENT TO BUYER’S OBLIGATIONS

The obligations of Buyer hereunder are subject, in the discretion of Buyer, to the satisfaction, on or prior to the Closing Date, of each of the following conditions:

8.1 Representations and Warranties. All representations and warranties of the Company contained in this Agreement shall have been true when made and shall be true in all material respects at and as of the Closing Date as if such representations and warranties were made at and as of the Closing Date.

25.

8.2 Performance. The Company shall have performed in all material respects all obligations and agreements and complied in all material respects with all covenants and conditions required hereby to be performed or complied with by them at or prior to the Closing Date.

8.3 Actions and Proceedings. All corporate actions, proceedings, instruments and documents required to carry out the transactions contemplated by this Agreement or incidental thereto and all other related legal matters shall be reasonably satisfactory to counsel for Buyer, and such counsel shall have been furnished with copies of such corporate actions and proceedings and such other instruments and documents as it shall have reasonably requested.

8.4 Consents. Any third party consents, approvals or authorizations necessary required by Company for the transactions contemplated hereby shall have been obtained by the Company without cost to Buyer.

8.5 Litigation. No suit, action, investigation, inquiry or other proceeding by any person or other entity (other than Buyer) shall have been instituted or threatened which questions the validity or legality of the transactions contemplated hereby or if successfully asserted may otherwise have a material adverse effect on the conduct of the business or impose any additional material financial obligation on, or require the surrender of any material right by, Buyer.

8.6 No Material Adverse Change. From December 31, 2003 through the Closing Date, there shall have been no material adverse change, regardless of insurance coverage, in the Business or any of the assets, results of operations, liabilities, prospects or condition, financial or otherwise, of the Company and its Subsidiaries.

8.7 Protections. There shall have been no material adverse change in the Projections or the basis for such Projections. For purposes of this Section 8.7, the Projections shall be deemed to apply to the twelve-calendar month period for Year 1 and Year 2, respectively, rather than to calendar year 2004 and 2005.

8.8 Operation in Ordinary Course. From April 14, 2004 through the Closing Date, the Company shall have operated the Business in the ordinary course of business. From December 31, 2003 through the Closing Date, no dividends or other distributions of the assets of the Company shall have been made to the shareholders of the Company or declared except for (i) salaries, payable in the ordinary course of business or (ii) as disclosed on Schedule 8.8.

8.9 Debt; Encumbrances.

(a) All debt owed to the Company or its Subsidiaries by the Company’s or its Subsidiaries’ officers, directors and /or shareholders of the Company prior to Closing, if any,

26.

shall have been paid, and Company shall have presented to Buyer such documentation reasonably required by Buyer as evidence of such payment.

(b) Evidence of the removal or release of any Encumbrances affecting the Company or its Subsidiaries or any of their respective assets shall have been delivered to Buyer.

8.10 Employment Agreement. The Company shall have entered into (i) a two-year employment agreement with MAG and Xxxxxxx X. Xxxxxxx, III and (ii) retain the Xxxxxxx X. Xxxxxxx and Xxxxx Xxxxx’x pre-existing employment agreement with the Company (each, an “Employment Agreement”, and collectively, the “Employment Agreements”). The terms of the Employment Agreements must be satisfactory to Buyer, Company and each employee who is subject to the Employment Agreement.

8.11 Non-Management Shares. DCS Family Investments, controlled by MAG shall have acquired all outstanding and issued capital stock of the Company owned of record by the Company’s Non-Management Shareholders.

8.12 The MAG Loan. MAG shall have caused DCS Real Estate, L.L.C., a Missouri limited liability company and a wholly-owned entity by MAG (“DCS Real Estate”) to execute and deliver an amendment to DCS Real Estate’s pre-existing $500,000 loan to the Company (the “MAG Loan”), providing that the MAG Loan will be subordinate to the ASC Loan and will bear interest at the same rate as the ASC Loan, and will contain such terms and conditions as are customary in transactions of this type and are reasonably acceptable to the parties.

8.13 Budget and Capital Expenditures. The Company and Buyer shall have agreed to the operating and capital expenditures and related budgets for Year 1 and Year 2, as attached on Schedule 8.13 (see Schedule 4.8).

8.14 Opinion of Counsel. Buyer shall have received the favorable opinion of Summers, Compton, Xxxxx & Hamburg, P.C., counsel for the Company, reasonably satisfactory to Buyer and its counsel as to the matters set forth in Sections 4.1, 4.2, 4.3, 4.4 and 4.5.

ARTICLE IX

9.1 Assurances. On and after the Closing Date, the parties will take all appropriate action and execute all documents, instruments or conveyances of any kind, which may reasonably be necessary or advisable to carry out any of the provisions hereof.

9.2 Confidentiality. Buyer shall continue to be bound by the terms of the Confidentiality Agreement dated August 7, 2003 among the Company, Buyer, MAG, Xxxxxxx X. Xxxxxxx and Xxxx Xxxxxxx, in accordance with the terms of such agreement. Each other party to this Agreement agrees that such party will keep confidential and will not, directly or indirectly, disclose, divulge or use for any purpose, any trade secrets, any confidential information, whether written or oral, of the Company and Buyer that is not generally known to the public, any

27.

information, whether written or oral, relating to the business or activities of, or belonging to, controlled or possessed by the Company and Buyer, and any information, whether written or oral, that the Company, MAG, and Buyer have received from each other in the preparation, negotiation, execution and implementation of this Agreement and all Ancillary Agreements (“Confidential Information”), unless such Confidential Information (a) is known or becomes known to the public in general (other than as a result of a breach of this Section 9.2), (b) was or is lawfully obtained by the receiving party from other sources without a breach of any obligation of confidentiality such other source may have to the Company or Buyer; and (c) is required by law, governmental or court orders or stock exchange regulations; provided, however, that a party may disclose Confidential Information to (i) its attorneys, consultants and other professionals to the extent necessary to obtain such third party’s services in connection with consummating the transactions contemplated in this Agreement and the Ancillary Agreements as long as such third party agrees to be bound by the provisions of this Section 9.2; (ii) to any prospective investor of any of the shares of the Company pursuant to the Amended and Restated Shareholders’ Agreement as long as such prospective investor agrees to be bound by the provisions of this Section 9.2, or (iii) to any Affiliate or wholly owned subsidiary of such party in the ordinary course of business.

9.3 Debt. At Closing, the Company agrees to use the ASC Loan to pay off and discharge Company’s existing line of credit with Enterprise Bank.

9.4 Repayment of MAG Loan. If Company receives the Company Earn-Out Payment then Company shall repay the MAG Loan with the proceeds of such earn-out payment; provided, however, that the ASC Loan shall have been repaid in full first and the Company can legally pay the MAG Loan without obtaining additional financing. If the MAG Loan cannot be repaid by such means then the Company shall repay the MAG Loan, after repayment in full of the ASC Loan, with any excess cash flow of the Company that becomes available or as otherwise provided in the Amended and Restated Shareholders’ Agreement or the MAG Loan.

9.5 Net Working Capital and Debt.