Shares Purchase Agreement of Entire Outstanding Shares of Gainfirst Asia Limited

EXHIBIT 4.104

of

Entire Outstanding Shares

of

Gainfirst Asia Limited

Table of Content

| Chapter 1 |

Definitions | 2 | ||

| Chapter 2 |

Reorganization and Transfer Framework | 5 | ||

| Chapter 3 |

Reorganization | 5 | ||

| Chapter 4 |

Shares Transfer | 9 | ||

| Chapter 5 |

Consolidation of financial statements | 13 | ||

| Chapter 6 |

Conditions Precedent of the Shares Transfer | 14 | ||

| Chapter 7 |

Closing | 17 | ||

| Chapter 8 |

The Management of the New Company and BXRT after the Closing | 20 | ||

| Chapter 9 |

Commitment of Non-competition | 21 | ||

| Chapter 10 |

Representations and Warranties | 22 | ||

| Chapter 11 |

Due Diligence Research | 25 | ||

| Chapter 12 |

Tax and Compensation Obligation | 26 | ||

| Chapter 13 |

Confidentiality Obligation | 26 | ||

| Chapter 14 |

Exclusivity | 27 | ||

| Chapter 15 |

Force Majeure | 27 | ||

| Chapter 16 |

Obligation for Breach of Contracts | 27 | ||

| Chapter 17 |

Applicable Law | 27 | ||

| Chapter 18 |

Disputes Settlement | 28 | ||

| Chapter 19 |

Complete Agreement and Revision | 28 | ||

| Chapter 20 |

Notice and Delivery | 28 | ||

| Chapter 21 |

Language | 29 | ||

| Chapter 22 |

Effect of the Agreement | 29 | ||

| Schedule I |

Information of Party B and Party C | 31 | ||

| Schedule II |

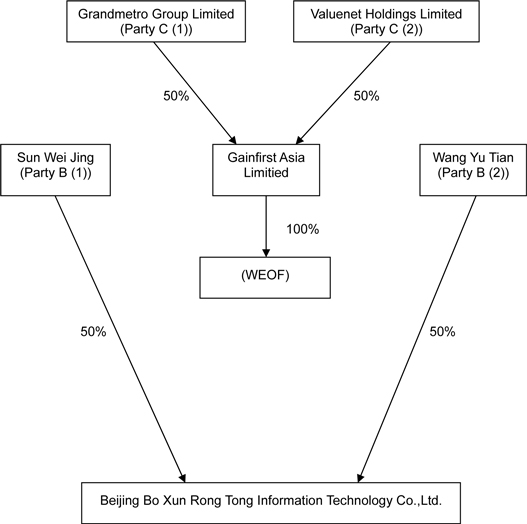

Reorganization Structure | 32 | ||

| Schedule III |

Management Staff List | 33 | ||

| Schedule IV |

Relevant Contracts List | 34 | ||

| Schedule V |

The Exclusive Technical and Consulting Services Agreement | 36 | ||

| Schedule XIII |

The Contract List of BXRT and Telecommunication Operators | 37 | ||

This Shares Purchase Agreement (the “Agreement’) is entered into by and among the following parties as of 12 June 2006:

Party A: XXX ONLINE MEDIA GROUP LIMITED

Registered Address: X.X.XXX 957, Offshore Incorporations Center, Road Town, Tortola, British Virgin Islands

Party B (1) and Party B (2) with the information listed as Attachment I (1)

(Party B (1) and Party B (2) are collectively referred to as “Party B”)

Party C (1) and Party C (2) with the information listed as Attachment I (2)

(Party C (1) and Party C (2) are collectively referred to as “Party C”)

Parties A, Party B (1), Party B (2), Party C (1) and Party C (2) are individually referred to as a “Party” and collectively as the “Parties”.

| 1. | Party A is a limited company incorporated and duly existent under laws of BVI. |

| 2. | Party B (1) and Party B (2) are respectively a Chinese citizen with full capacity for civil conduct. Party B (1) legally owns 50% BXRT shares and Party B (2) legally owns 50% BXRT shares (please find the details in Schedule II Reorganization Structure) |

| 3. | Party C (1) and Party C (2) are respectively a limited company incorporated and duly existent under laws of BVI. Party B (1) legally owns 50% the BVI Company shares and Party B (2) legally owns 50% the BVI Company shares (please find the details in Schedule II Reorganization Structure) |

| 4. | Party A, Party B and Party C unanimously agree that, in accordance with this Agreement, Party A will purchase 100% BVI company shares held by Party C, and Party C agrees to sell such shares. Party B agrees to guarantee that Party C will perform all the obligations hereunder, and make all the representations, warranties and commitments hereunder jointly with Party C. |

The Parties hereby agree to enter into this Agreement in relation to the cooperation matters.

1

Chapter 1 Definitions

| 1.1 | The terms used in this Agreement has the meaning as respectively set forth below unless otherwise defined in the context: |

| Party A | Shall mean XXX ONLINE MEDIA GROUP LIMITED, a limited company incorporated and duly existent under laws of BVI; | |

| Natural Person Designated by Party A |

Shall mean Xx. Xxxxx Yinnan and Mr. Changcheng; | |

| Party A WFOE | Shall mean Beijing Lahiji Technology Development Co., Ltd; | |

| Party B | Shall mean Ms. Sun Wei Jing, Mr. Xxxx Xx Tian. Mr. Sun is referred to as Party B (1) and Mr. Xxxx Xx Tian is referred to as Party B (2); | |

| Party C | Shall mean Grandmetro Group Limited and Valuenet Holdings Limited. Grandmetro Group Limited is referred to as Party C (1) and Valuenet Holdings Limited is referred to as Party C (2); | |

| BXRT | Shall mean Beijing Bo Xun Xxxx Xxxx Information Technology Co., Ltd., a a limited company incorporated and duly existent under laws of the PRC, of which 50 % shares are held by Party B (1) and 50% are held by Party B (2). BXRT mainly engages in information services of the value-added telecommunication business; | |

| BVI Company | Shall mean Gainfirst Asia Limited, a limited company incorporated and duly existent under laws of BVI, 100% owned by Party C; | |

| BVI Group | Shall mean the BVI Company, the New Company and BXRT; | |

| Reorganization and Transfer Framework |

Shall mean a series of reorganizations and Transfers for which Party B shall be responsible to procure the completion, which shall include:

1. a wholly foreign-owned enterprise established by the BVI Company in the PRC (the “New Company”, of which the definition is set forth hereafter), engages in developing, researching, manufacturing computer software products; selling self-made products; and providing computer technology consulting and technology services. | |

2

| 2. Party B will procure in its best effort the Parties to execute the documents in accordance to the checklist attached as Schedule IV Part 2 and relevant schedules;

3. Party A will purchase from Party C all the outstanding shares of the BVI Company in accordance with this Agreement, provided that the New Company has been duly established, the Natural Person Designated by Party A, the New Company, the BVI Company, BXRT and its shareholders Party B (1) and Party B (2) have executed all the contracts listed in the checklist attached as Schedule IV Part 2, such documents have legally come to effect, and the Conditions Precedent for the Shares Transfer hereunder have all been met. | ||

| New Company | Shall mean A wholly foreign-owned enterprise invested and established by Party B in Beijing PRC after executing the Agreement; | |

| Shares Transfer | Shall mean Party A purchase from Party C all the outstanding shares of the BVI Company at the closing day after the New Company have completed the reorganization in accordance with Chapter 3 hereof and the Conditions Precedent (of which the definition is listed hereafter) have been met; | |

| Closing | Shall mean the Share Transfer has been effected in accordance with all the applicable laws and regulations, featuring all the outstanding shares being registered under Party A; or if all the Conditions Precedent have not been met, or exempt in accordance with Chapter 6.2 hereof by 7 July 2007, and Party A decides to apply other legal arrangement, then Party A have actually obtained 100% interests of the New Company through such other legal arrangements or Party A indirectly obtaining the interests of BXRT through the Relevant Contracts executed by the Parties will be deemed as Closing; | |

| Closing Date | Shall mean the date when the last Condition Precedent are met (or exempt in accordance with Chapter 6.2 hereof), or any other date agreed by the Parties in writing; | |

3

| PRC |

Shall mean, for the purpose of this Agreement, the People’s Republic of China, which shall exclude Hong Kong (of which the definition is listed hereafter), Macau Special Administrative Region or Taiwan district; | |

| Hong Kong | Shall mean Hong Kong Special Administrative Region; | |

| HKEx | Shall mean Hong Kong Exchanges and Clearing Limited; | |

| Business Day | Shall mean any day that PRC banks are open for business (excluding Saturdays and Sundays); | |

| GEM Listing Rules | Shall mean the GEM Listing Rules of the HKEx; | |

| Main Board Listing Rules | Shall mean the Main Board Listing Rules of the HKEx; | |

| Condition(s) Precedent | Shall mean the conditions precedent set forth in Chapter 6.1 hereof; | |

| Management Team | Shall mean the main managing staff and other key staff of BXRT, of which the list is attached in Schedule III; | |

| Relevant Contracts | Shall mean all the documents set forth in Schedule IV; | |

| Transaction Consideration | Shall mean the total consideration of the transaction hereunder, of which the amount is calculated and decided in accordance with Chapter 4.3 hereof; | |

| BVI | Shall mean the British Virgin Island; | |

| NASDAQ | Shall mean the National Association of Securities Dealers Automated Quotation of the United States; | |

| Audit or Financial Audit | Shall mean the financial audit conducted by the auditor recognized by Party A and Party B in accordance with the US GAAP | |

| Date of the Completion of the Shares Altering Registration |

Shall mean the issuance date recorded in the new business license of BXRT issued by relevant industry and commercial registration authority in relation to the Natural Person Designated by Party A transferring all the shares of BXRT. | |

4

| 1.2 | The Agreement shall be interpreted in accordance with the principles set forth below unless the context requires otherwise: |

| (1) | All the responsibilities born by Party B (including but not limited to Covenants and Warranties) are several and joint liabilities unless provided otherwise herein, and Party B(1) and Party B(2) are respectively liable to perform the related obligations severally or jointly until the related obligations are fully fulfilled-. |

| (2) | The headings hereof are for reference only and shall not constitute an integral part of the Agreement nor be used for assisting interpretation. |

| (3) | All the attachments hereto shall be the integral parts of the Agreement, and shall have the same effect as the Agreement. |

| (4) | if the payment date provided herein is not a Business Day, such payment date shall be postponed to the next Business Day. |

Chapter 2 Reorganization and Transfer Framework

| 2.1 | Party B shall be responsible to procure the establishment of the New Company by the BVI Company in Beijing in the PRC, and to procure BXRT and /or its shareholders Party B(1) and Party B(2), Party A WFOE, the New Company, the BVI Company and the Natural Person Designated by Party A to execute the Relevant Contracts as listed in the checklist attached as Schedule IV Part 2 in accordance with the provisions hereunder. Party C will sell to Party A 100% outstanding shares of the BVI Company, provided that the New Company has been duly established, the Relevant Contracts have been executed and have come into effect, and all the Conditions Precedent have been met or exempt subject to Chapter 6.2 hereunder. Party B shall submit to Party A the documents evidencing the Completion of the Shares Altering Registration of BXRT in time after the Closing Date, and provide effective support to Party A and its Group by its marketing channel of TV media presently in use and its expertise, management and technical skills concerning the value-added telecommunication business, in order to strengthen the leading role of Xxx Group in the value-added telecommunication business. |

| 3.1 | The BVI Company shall establish the New Company in Beijing immediately after the execution of the Agreement, and the parties agree as follow: |

| (1) | The nature of the New Company is a wholly foreign-owned enterprise. |

5

| (2) | The registered capital of the New Company is US$100,000. |

| (3) | The business scope of the New Company: developing, researching and manufacturing calculater software products; selling self-manufactured products; and providing calculater technology consulting and technology services. |

| (4) | Party B shall procure in its best effort the New Company to be eligible for developing , researching, and manufacturing calculater software products, selling self-manufactured products, providing calculater technology consulting and technology services and so on, and acquiring all the business license(if necessary) required for legitimate operation. |

| 3.2 | Staff Arrangement |

Party B shall be responsible to procure the main managing staff and other key staff (the “Management Team”, of which the name list is attached in Schedule III) to abide by the Employment Agreement specified in Schedule XII (1) executed with Party A WFOE on 1st June, 2006, and to procure the Management Team to execute the Employment Agreement with the New Company on the date of the establishment of the New Company in accordance with the form and content specified in Schedule XII (2) hereof; the Employment Agreement specified in Schedule XII (1) will automatically terminate from the date of the Completion of the Shares Altering Registration, and the Employment Agreement executed in accordance with the form and content specified in Schedule XII (2) will take effect from the date of the termination of the Employment Agreement specified in Schedule XII (1). The terms and conditions of the termination of the Employment Agreement, and the rights and obligations of Management Team in the daily operation of the New Company and BXRT will be stipulated in The Employment Agreement specified in Schedule XII (2).

| 3.3 | Entry into contracts |

Party B herby warrants and covenants that, the Relevant Contracts shall be entered into by and among the New Company (or Party A WFOE, before the establishment of the New Company), BXRT (and/or its shareholders Party B or Natural Person Designated by Party A, as the case may be), the BVI Company and Natural Person Designated by Party A (Party B makes no warranty or covenant with respect to the subsection (2) (B), (C), (D), (F), (G) under this chapter as set forth below), and the content and the form of the Relevant Contracts shall be subject to the requirements herein and the agreement by Party A and Party B. a series of legal relationships will be establish therefrom between the New Company and BXRT, which shall include:

| (1) |

The contractual relationship established and entered into on Jan 1st, 2006 |

6

| (A) | Party A WFOE and BXRT shall execute an Exclusive Technical and Consulting Services Agreement, in accordance with which Party A WFOE shall provide BXRT with technical and consulting cooperation and related services, and BXRT shall accept the technical and consulting cooperation and pays the percentage as specified hereunder to Party A WFOE; this agreement shall automatically terminate on the date of the Completion of the Shares Altering Registration when the Exclusive Technical and Consulting Services Agreement specified in the subsection (2) (A) under this chapter comes into effect. |

| (B) | Party A WFOE and BXRT with its shareholders Party B (1) and Party B (2) will execute a Business Operation Agreement, in accordance with which Party A WFOE, as a performance guarantor of BXRT in the contracts, agreements or transaction entered into by and between BXRT and any other third party, shall provide full guarantee of the BXRT’s performance of obligations under these contracts, agreement and transaction to guarantee the sound business operation of BXRT. BXRT agrees to pledge to Party A WFOE the whole assets of the company and the accounts receivable in its operation as counter-guarantee; this agreement will automatically terminate on the date of the Completion of the Shares Altering Registration when the Business Operation Agreement specified in the subsection (2) (B) under this chapter comes into effect. |

| (C) | The shareholders of BXRT, namely Party B (1) , Party B (2) and Party A WFOE will execute an Exclusive Option Agreement, in accordance with which Party B (1) and Party B(2) shall grant to Party A WFOE the exclusive option to purchase the whole or partial shares of BXRT owned by the shareholders of BXRT to the extent permitted by the laws of PRC; this agreement will automatically terminate on the date of the Completion of the Shares Altering Registration when the Exclusive Option Agreement specified in the subsection (2) (C) under this chapter comes into effect. |

| (D) | The shareholders of BXRT, namely Party B (1) , Party B (2) and Party A WFOE will execute an Equity Pledge Contract, in accordance with which Party B (1) and Party B(2) pledge to Party A WFOE all the equity of BXRT owned by Party B (1) and Party B(2) as the guarantee of BXRT’s performance of the obligations to pay the percentage under the Exclusive Technical and Consulting Services Agreement set forth above; this agreement will automatically terminate on the date of the Completion of the Shares Altering Registration when the Equity Pledge Contract specified in the subsection (2) (D) under this chapter comes into effect. |

| (E) | Letter of Attorney the shareholders of BXRT, namely Party B (1) and Party B(2) will issue a Letter of Attorney, to authorize the persons designated by Party A WFOE to exercise all the shareholder’s rights of BXRT’s shareholders; the persons designated by Party A WFOE shall receive the full authorization to exercise all the shareholder’s rights |

7

| of BXRT’s shareholders; this Letter of Attorney will automatically terminate on the date of the Completion of the Shares Altering Registration when the Letter of Attorney specified in the subsection (2) (F) under this chapter comes into effect. |

| (F) | The Management Team of BXRT and Party A WFOE shall execute the Employment Agreement as specified in Schedule XII (1), which will automatically terminate on the date of the Completion of the Shares Altering Registration when the Employment Agreement specified in the subsection (2) (H) under this chapter comes into effect |

| (2) | The contractual relationship established and entered into on the date of the establishment of the New Company. |

| (A) | The New Company and BXRT will execute an Exclusive Technical and Consulting Services Agreement, in accordance with which the New Company shall provide BXRT with technical and consulting cooperation and related services, and BXRT shall accept the technical and consulting cooperation and pay the percentage as specified thereunder to the New Company; this agreement will take effect on the date of the Completion of the Shares Altering Registration. |

| (B) | The The New Company, BXRT and the Natural Person Designated by Party A shall execute a Business Operation Agreement, in accordance with which the New Company, as a performance guarantor of BXRT in the contracts, agreements or transaction entered into by and between BXRT and any other third party, shall provide full guarantee of the BXRT’s performance of obligations under the contracts, agreement and transaction as to guarantee the sound business operation of BXRT. As a counter-guarantee, BXRT agrees to pledge to the New Company the whole assets of the company and the accounts receivable in its operation; this agreement will take effect on the date of the Completion of the Shares Altering Registration. |

| (C) | The Natural Person Designated by Party A and the BVI Company shall execute an Exclusive Option Agreement, in accordance with which the Natural Person Designated by Party A shall grant to the BVI Company the exclusive option to purchase the whole or partial shares of BXRT owned by the Natural Person Designated by Party A to the extent permitted by the laws of PRC; this agreement will take effect on the date of the Completion of the Shares Altering Registration. |

| (D) | The Natural Person Designated by Party A and the New Company will execute an Equity Pledge Contract, in accordance with which the Natural Person Designated by Party A shall pledge to the New Company all the equity of BXRT owned by the Natural Person Designated by Party A as the guarantee of BXRT’s performance of the obligations to pay the percentage under the Exclusive Technical and Consulting Services Agreement set forth above; this agreement will take effect on the date of the Completion of the Shares Altering Registration. |

8

| (E) | Party B (1), Party B(2) and the Natural Person Designated by Party A shall execute a Share Transfer Agreement; in accordance with which Party B (1) and Party B (2) shall respectively transfer50% shares of BXRT to the Natural Person Designated by Party A; this agreement will take effect on the date of execution hereof. |

| (F) | The Natural Person Designated by Party A and the persons designated by the New Company shall issue a Letter of Attorney, to authorize the natural person designated by the New Company to exercise all the shareholder’s rights of BXRT’s shareholders; the persons designated by the New Company will receive the full authorization to exercise all the shareholder’s rights of BXRT’s shareholders; this Letter of Attorney will take effect on the date of the Completion of the Shares Altering Registration. |

| (G) | The BVI Company and the Natural Person Designated by Party A shall execute a Loan Agreement, in accordance with which the BVI Company shall provide loan to the Natural Person Designated by Party A and such loan can only be used as operating fund of BXRT to develop its business after Party B (1) and Party B (2) transfer their shares of BXRT to the Natural Person Designated by Party A. |

| (H) | The Management Team of BXRT and the New Company shall execute the Employment Agreement specified in Schedule XII (2)on the date of establishment of the New Company, which will take effect on the date of the Completion of the Shares Altering Registration. |

| 4.1 | Shares Transfer |

| 4.2 | The calculation and payment of the Transaction Consideration |

The parties agree that, the Transaction Consideration shall be calculated in the way set forth below and paid by Party A to Party C in three installments provided that all the Conditions Precedent have been met before or on July 7th, 2006 or exempt in accordance with Chapter 6.2 hereunder, and the completion of the closing on the Closing Day is legal and valid subject to the terms and conditions hereof; However, in any case, the estimated corporate value of the BVI Company shall subject to the cap of RMB600,000,000.

9

| (1) | The first installment shall be HKD with an amount equivalent toRMB150,000,000(“First Installment”), of which RMB10,000,000 shall be paid in cash as the consideration of the Natural Person designated by Party A purchasing the shares of BXRT held by Party B (1) and Party B (2) within 15 Business Days after the date of the Completion of the Shares Altering Registration (subject to the requirements set forth in Article 7.4); Liquidated damages of 0.1‰ of the outstanding payment per day shall be payable if such payment is overdue. |

| (2) | The second installment shall be HKD with an amount equivalent to RMB set forth hereinafter: |

A= (B – C + D) ×E1 – F

among which,

“A” represents the total amount of second installment;

“B” represents the Audited consolidated after-tax net profit of BVI Group in 2006;

“C” represents the outstanding accounts receivable at the end of 2006( excluding provision for bad debts) (“Accounts Receivable of 2006) deduct any provisions for bad debts after the Audit of 2006(if any);

“D” represents the amount of accounts receivable collected from 1 January 2007 to 30 June 2007

“E1” represents the coefficient 2.5(when “B – C + D” < RMB35,000,000) or the coefficient 3.5(when “B – C + D” > RMB35,000,000);

“F” represents the First Installment (RMB150,000,000).

Party A shall pay for the amount of A prior to July 21st, 2007 provided that the amount of A calculateis calculated to be more than zero, and liquidated damages of 0.1‰ of the outstanding payment per day shall be payable if such payment is overdue.

Party A bears no obligation for payment of the second installment provided that the amount of A calculateis calculated to be less than or equal to zero.

The consolidated after tax net profit of BVI Group hereunder shall be subject to the adjustments specified in Article 4.4 and Article 4.5 set forth below.

10

| (3) | The third installment is HKD with an amount equivalent to RMB set forth hereinafter: |

W = ( H – I + Y ) × J + ( B – C + X ) × E2 – Z

Among which,

“A”, “B “, “C shall have the same meanings as provided in Article 4.2(2);

“W” represents the total amount of the third installment;

“H” represents the Audited after-tax consolidated net profit of BVI Group in 2007.

“I”represents the accounts receivable at the end of 2007 (excluding the provision for bad debts) (“Accounts Receivable of 2007) deduct any provisions for bad debts after the Audit of 2007 (if any);

“Y” represents the amount of accounts receivable collected from 1 January 2008 to 30 June, 2008;

“J” represents the coefficient 3(when “H – I + Y” < RMB65,000,000) or the coefficient 4(when “H – I + Y” ? RMB65,000,000);

“X” represents the amount of accounts receivable collected from 1 January 2008 to 30 June, 2008;

“E2” represents the coefficient 2.5(when “B – C + X” < RMB35,000,000) or the coefficient 3.5(when “B – C+ X” ? RMB35,000,000);

“Z” represents the total amount of the payment paid by Party A to Party C prior to the third installment payment, which shall be:

(i) if A > 0, Z = F + A;

(ii) if A < 0, Z = F;

Party A shall pay for the amount of W prior to July 21st, 2008 provided that the amount of W is calculated to be more than zero, and liquidated damages of 0.1‰ of the outstanding payment per day shall be payable if such payment is overdue.

Party A bears no obligation for payment in the second installment provided that the he amount of W calculated is below or equal to zero.

11

| 4.3 | The First Installment, the second installment and the third installment aforesaid shall be paid in HKD or USD, among which: |

| (1) | The amount of the First Installment paid in HKD shall be calculated pursuant to the average central parity rate of RMB against HKD published by the China Foreign Exchange Trading Center 30 Business Days prior to the execution of the Agreement in accordance with Article 4.2 (1) hereunder; |

| (2) |

The amount of the second installment paid in HKD shall be calculated pursuant to the average central parity rate of RMB against HKD published by the China Foreign Exchange Trading Center 30 Business Days prior to June 30th, 2007 in accordance with Article 4.2 (2) hereunder; |

| (3) | The amount of the third installment paid in HKD shall be calculated pursuant to the average central parity rate of RMB against HKD published by the China Foreign Exchange Trading Center 30 Business Days prior to 30 June 2008 in accordance with Article 4.2 (3) hereunder; |

| 4.4 | With respect to “the consolidated after tax net profit of BVI Group of 2006”, all the technical and consulting services fee paid by BXRT to Party A WFOE in accordance with the Exclusive Technical and Consulting Services Agreement executed by Party A WFOE and BXRT shall not be included in the operating expenses of the BVI Group in 2006, therefore the amount of the “consolidated after tax net profit of BVI Group in 2006” shall not have deducted such fee. |

| 4.5 | For the purpose of clarification, the value of the goodwill paid by Party A for the purchase of all the outstanding shares of the BVI Company shall not be included in the consolidated after tax net profit of BVI Group of the current year as the intangible asset amortization or value Impairment; “the consolidated after tax net profit of BVI Group of the current year” shall be the consolidated after tax net profit without the intangible asset amortization or value Impairment if the consolidated after tax net profit of BVI Group of the current year is not subject to the intangible asset amortization or value Impairment. |

| 4.6 | In relation to Article 4.2 aforesaid: |

| (1) |

Party A and Party B shall procure in their commercially reasonable effort the auditor employed by Party A to issue the audit report of 2006 and 2007 prior to 30 April 2007 and 30 April 2008 respectively; Party A agrees to submit the audit reports to Party B and Party C within 5 Business Days from the date of issuance of the audit reports. |

| (2) | Party C agrees that the way the First Installment (namely HKD equivalent to RMB150,000,000) of the Transaction Consideration to be paid shall be the way specified in the written notice jointly issued by Party C and Party B. Party C covenants Party C and Party B will jointly issue such written notice to Party A at least 3 days prior to the date of the First Installment. |

12

| (3) | With respect to the payment of the second installment and the third installment in accordance with Article 4.2(2) and Article 4.2(3), Party C agrees to the way of the payment shall be the way specified in the written notice jointly issued by Party C and Party B. Party C covenants that Party C and Party B will jointly issue the written notices hereof to Party A at least 3 days prior to the corresponding dates of the payment of the second installment and the third installment respectively. |

| (4) | The Party A shall pay the Transaction Consideration as specified in Article 4.6(2) and Article 4.6(3) provided that the relevant payment ways determined by Party C must be in compliance with the applicable laws and regulations, otherwise Party A has the right to require Party C to use other legal ways to pay the Transaction Consideration legally. |

| 4.7 | The Parties confirm and agree, the Transaction Consideration specified in Article 4 shall be deemed as the payment for all outstanding shares, equities, licenses, property and any other kinds of assets owned by BXRT by the date of the execution of the Agreement to be used as operating expenses for BXRT in the future, including cash of no less than RMB7,000,000 and the outstanding amount of the accounts receivable ( “Former Accounts Receivable”:) deducting the accounts payable (“Former Accounts Payable “) of BXRT by the date of the execution of the Agreement of no less than RMB3,000,000. Notwithstanding the above, Party B if the amount collected within the scope of the Former Accounts Receivable deducting the Former Accounts Payable exceeds RMB3,000,000 within 180 days after the date of execution of the Agreement, BXRT shall refund the exceeding amount to Party B in a lawful and feasible way; if the amount collected within the scope of the Former Accounts Receivable deducting the Former Accounts Payable is less than RMB3,000,000 within 180 days after the date of execution of the Agreement, Party C and/or Party B shall make up such margin to BXRT. |

| 4.8 | Party A agrees that, if the New Company and/or BXRT undergo any reorganization (e.g. split-up, merger) within 2 years after the execution of the Agreement, such reorganization shall not cause any impairment of the consolidated after tax net profit of BVI Group in accordance with the reasonable expectations. |

Chapter 5 Consolidation of financial statements

| 5.1 | Whereas Party A has executed the Relevant Contracts set forth in Article 3.3 (1) and established contractual relationships with Party B, BXRT, the Management Team of BXRT respectively on 1 June 2006, the Parties hereby confirm that the reorganization transaction hereunder shall be deemed to be complete on 1 June 2006 in finance and Party A shall be entitled to share and consolidate the income and profits of BXRT from 1 June, 2006. |

13

Chapter 6 Conditions Precedent of the Shares Transfer

| 6.1 | The Shares Transfer hereunder shall not be effected until the Conditions Precedent as specified hereinafter are met or exempt in accordance with Article 6.2 : |

| (1) | Party B or Party C Shall submits the PRC legal opinion to Party A (the PRC law firms who are to issue such legal opinion, the content and form hereof shall be to the satisfaction of Party A), confirming and validating that: |

| (a) | The New Company has been duly established under the laws of the PRC with all permits, approval certificates and business licenses as well as other operating licenses (if legally necessary) issued by the PRC authorities responsible for examination and approval, and have the right to engage in developing, researching and manufacturing computer software products; selling self-made products; and providing computer technology consulting and technology services businesses; |

| (b) | The contracts governed by the laws of China among the Relevant Contracts shall be valid, lawful and have the binding force against the signing parties thereto, and shall be legally enforceable towards the parties thereto, and the proposed content of transaction to be carried out, the structure and the ways to pay the Transaction Consideration as specified in the contracts aforesaid shall be lawful and valid and in compliance with all applicable PRC laws, rules and regulations; |

| (c) | Party B (1) and Party B (2) is respectively a Chinese citizen with full capacity for civil conduct; |

| (d) | Party B (1) legally and beneficially owns 50% BXRT shares; |

| (e) | Party B (2) legally and beneficially owns 50% BXRT shares; |

| (f) | The shares of BXRT shall be free from any mortgage, pledge, preemptive right and encumbrance of any kind unless otherwise set out in the Relevant Contracts; |

| (g) | The BVI Company’s holding of all the shares of the New Company owned by shall be legal which will not cause any legal barrier in the execution of the Relevant Contracts by the New Company; and |

| (h) | The certification documents provided by Party B (1) and Party B (2), and BXRT procured by Party B (1) and Party B (2) to Party A (except the relevant certificates of the BVI Company) as set out in Article 6.1(16) are authentic and lawful. |

| (2) | The New Company is duly and validly incorporated with all the registered capital paid up. |

14

| (3) | Party B and each member in the Management team have executed the Employment Agreement specified in Schedule XII (1) with Party A WFOE subject to Article 3.2, of which the content includes the covenant of no engagement in any business and assets operation relating the transaction herein nor any operation in any business in competition with the New Company or BXRT, nor any impairment of the interests of the New Company and BXRT; and Party B and each member in the Management Team shall execute the Employment Agreement with the New Company in accordance with the content and form specified in Schedule XII (2) on the date of the establishment of the New Company. |

| (4) | BXRT has executed the Exclusive Technical and Consulting Services Agreement specified in Schedule V (1) with Party A WFOE on 1 June 2006. |

| (5) | BXRT, Party B (1) and Party B (2) have executed the Business Operation Agreement specified in Schedule VI (1) hereunder with Party A on 1 June 2006. |

| (6) | Party B (1) and Party B (2) have executed the Exclusive Option Agreement specified in Schedule VII (1) hereunder with Party A WFOE on the date of the execution of this Agreement. |

| (7) | Party B (1) and Party B (2) have executed the Equity Pledge Contract specified in Schedule VIII (1) hereunder with Party A WFOE on 1 June 2006. |

| (8) | Party B (1) and Party B (2) have executed the Letter of Attorney specified in Schedule IX (1) hereunder with Party A WFOE on 1 June 2006. |

| (9) | Party B (1) and Party B (2) have executed the Share Transfer Agreement specified in Schedule X hereunder with the Natural Person Designated by Party A on the date of the establishment of the New Company. |

| (10) | The Natural Person Designated by Party A, BXRT, the New Company and the BVI Company have respectively executed the Exclusive Technical and Consulting Services Agreement, the Business Operation Agreement, the Exclusive Option Agreement, the Equity Pledge Contract and the Letter of Attorney in accordance with the content and form specified in Schedule V (2), Schedule VI (2), Schedule VII (2), Schedule VIII (2), Schedule IX (2), and these agreements shall come into effect on the date of the Completion of the Shares Altering Registration. |

| (11) | The Natural Person Designated by Party A have executed the Loan Agreement in accordance with the content and form specified in Schedule XI with the BVI Company on the date of the establishment of the New Company. |

| (12) | The License for Telecom Business Operation and Information Service of the PRC (Jing ICP Zheng 030110 Hao) concerning the internet information service business and the License for Value-added Telecom Business Operation of the PRC (B2-20040136) hold by BXRT have passed the annual review. |

15

| (13) | Party A, Party B and Party C or their authorized representatives have formally executed the Agreement. |

| (14) | The board of directors of Party A has passed the resolution of approving the terms and conditions hereof and the transaction contemplated in the Agreement; the board meeting and/or the shareholders’ meeting of Party A (if necessary) have passed the resolution of approving the terms and conditions hereof and the transaction contemplated in the Agreement (including but not limited to (if necessary) agreeing to make any change to the nature and character of the business of the shareholders of Party A in accordance with the GEM Listing Rules); and Party A shall make commercially reasonable efforts to procure these resolutions and approvals to be made prior to the application of the shares altering registration in relation to the Shares Transfer by Party B to The Natural Person Designated by Party A. |

| (15) | The board of directors and/or shareholders’ meeting (if necessary) of XXX Group Limited have passed the resolution of approving the terms and conditions hereof and the transaction contemplated in the Agreement (including but not limited to (if necessary) the approval of XXX Group Limited carrying out the transaction in accordance with the Main Board Listing Rules); and Party A shall make commercially reasonable efforts to procure these resolutions and approvals to be made prior to the application of the shares altering registration in relation to the Shares Transfer by Party B to The Natural Person Designated by Party A. |

| (16) | The Party B has truly, accurately and completely provided Party A and/or the persons assigned by Party A with the certification documents in relation to the operation, assets, financial and legal condition, profit-making performance and business prospects of the BVI Company, the New Company, BXRT and other organizations related to the transaction herein; Party A and/or the persons assigned by Party A have finished the due diligence research in relation to the legal, financial and technical conditions (except for Party B) of the companies related to the transaction herein and Party B, and Party A is satisfied with the outcome of the due diligence research with the confirmation that all the transaction barriers stated in the financial and legal due diligence report of the transaction herein have been settled completely and satisfactorily. |

| (17) | The HKEx and NASDAQ have approved the transaction herein if necessary. |

| (18) | The Party B and BXRT shall register the two Natural Persons Designated by Party A as the directors of BXRT (there shall be 3 members in the board of directors of BXRT) within one Business Day after the date of the execution of the Agreement, and submit the signature sample of the Natural Persons Designated by Party A to all the banks where BXRT opens accounts, so such persons may become the authorized signatorys of BXRT, Also, they shall finish all the legal and/or relevant formalities required by the industrial and commercial registration authorities and banks in relation to |

16

| the altering herein, including but nor limited to the relevant resolution by board of directors and shareholders’ meeting, the revision of articles of association( including the revision of Articles relating the board of directors and the revisions of the stipulation of the business scope set out in articles of association pursuant to the existing valid business license), the completion of the formalities of filing or registration in industrial and commercial authorities, the acquirement of the confirmation from the banks of the altering of the signatory and so on. |

| 6.2 | Party A can issue a written notice to exempt Party B from any Conditions Precedent at any time, except for the Conditions Precedent set out in Article 6.1 (15) ( if necessary) hereunder. |

| 6.3 | The Parties shall make commercially reasonable efforts to meet the Conditions Precedent set out in Article 6.1 (10), (13) and (17) herein or procure the satisfaction of the Conditions Precedent aforesaid on or prior to the date specified in Article 6.4 hereunder, and Party B and Party C shall provide necessary and reasonable assistance. Party B and/or Party C shall make commercially reasonable efforts to meet the Conditions Precedent set out in Article 6.1 (1)~(9), (12) and (16),(18) herein or procure the satisfaction of the Conditions Precedent aforesaid on or prior to the date specified in Article 6.4 herein, and Party A shall provide necessary and reasonable assistance. Party A shall make commercially reasonable efforts to meet the Conditions Precedent set out in Article 6.1 (11), (14) and (15) herein or procure the satisfaction of the Conditions Precedent aforesaid. |

| 6.4 | The Agreement (except Article 6, 12, 13, 14, 16~20 (collectively referred to as Reserved Clauses) hereunder) and all the obligations and rights under the Agreement (except the Reserved Clauses and the obligations to be born by any Party for the breach of the Agreement) shall be deemed void provided that any of the Conditions Precedent fails to be satisfied on or prior to 7 July 2006 (or other date agreed by the Parties in writing) or any of the Conditions Precedent is exempt pursuant to Article 6.2 herein. If this is the case, all the agreements executed by Party B and BXRT in accordance with Article 3.3 hereunder shall be terminated on 7 July, 2006 (or other date agreed by the Parties in writing, and the later date shall prevail) regardless of any provisions otherwise; Party A WFOE shall refund the fees of technical consulting services paid by BXRT, but Party A WFOE has the right to deduct the relevant fees for the technical services provided (if any). The Party A shall procure the Natural Person Designated by Party A to adopt relevant resolutions and execute all the documents necessary. |

| 7.1 | The Closing shall be carried out at 6 o’clock in the afternoon of the Closing date at the office of Party A (or other date and/or place agreed by Parties); |

17

| 7.2 | Party C shall (and Party B shall procure Party C to) at the Closing: |

| (1) | submit to Party A the documents and archival materials as follows: |

| (a) | Certificate of Good Standing of the BVI Company and Certificate of Incumbency of the BVI Company; |

| (b) | The original certificate of all the outstanding shares of the BVI Company and the instrument of Shares Transfer executed by the transferor with Party A ( or its gent) as the transferee. |

| (c) | The resolution of the BVI Company, which shall (aa) approve Party C to transfer all the outstanding shares of the BVI Company to Party A and Party A (or its agent) shall be registered in the shareholder register of the BVI Company to confirm Party A (or its agent) as the shareholder of the BVI Company; (bb) appoint the Natural Person Designated by Party A to be the director and the secretary of the BVI Company;(cc) approve the resignation of the former director, secretary and auditor of the BVI Company; (dd) approve to alter the address of the registered office (if necessary); (ee) approve to alter the signatory of banks (if necessary); |

| (d) | The relevant instruments of Shares Transfer in accordance with the resolution adopted by the board of the directors and shareholders of Party C; |

| (e) | All the letter of attorney, waiver, letter of consent, resolutions of the board of directors, resolutions of the shareholders and other instruments necessary for the completion of the Shares Transfer and registration of Party A ( or its agent) as the shareholder of all the outstanding shares of BVI Company. |

| (f) | All the documents of the incorporation the legal documentation books, accounts books, name lists and records, cooperate registration certificate, seals, steel seals, stock certificate book, bank accounts, cheque book, monthly statements and all the relevant documents of the BVI Company,; and |

| (2) | procure the Natural Person Designated by Party A to be appointed as the director and the secretary of the BVI Company and procure the resignation of the former director, and secretary of the BVI Company without compensation after the appointment aforesaid and with the written confirmation that no claim of any nature towards the BVI Company is applicable. |

| (3) | submit to Party A the documents and archival materials in relation to the New Company set forth below: |

| (a) | the original official reply and approval certificate of the New Company; |

18

| (b) | the original and duplicate of the business license of the company; |

| (c) | the original operation license for special business (if any); |

| (d) | the official seal and any other seals; and |

| (e) | the letters of resignation of the former director of the New Company (including the content that the former director shall not claim any compensation and obligations towards the New Company and the BVI Company), letter issued by the BVI Company to revoke the position of the former director of the New Company, and documents of valid appointment of the Natural Person Designated by Party A as the director hereof. |

| (4) | submit to Party A the License for Telecom Business Operation and Information Service of PRC concerning internet information service business and the License for Value-added Telecom Business Operation issued by the Ministry of Information Industry hold by BXRT which shall have passed the annual review of 2005. |

| (5) | submit any documents in the required documents checklist provided by Party A and the companies directly or indirectly controlled by Party A (if applicable) in accordance with the requirements of HKEx, Hong Kong Securities and Futures Commission, Hong Kong Companies Registry, NASDAQ and relevant laws and regulations, provided that Party A notify Party B and Party C the specific document checklist 5 Business Days prior to the Closing Date; if HKEx, Hong Kong Securities and Futures Commission, Companies Registry and NASDAQ, etc make any requirements temporarily, Party A shall immediately notify Party B and Party C, and Party B and Party C shall provide the documents in accordance with the requirements of the organizations aforesaid free from the restriction of the 5 days aforesaid. |

| (6) | submit to Party A the Relevant Contracts executed by the New Company, BXRT, Party B and Party C. |

| (7) | alter all the authorized signatories and signing instructions of the bank accounts of the BVI Company, the New Company and BXRT in accordance with the requirement of Party A and bring forth the alteration certification. |

| (8) | submit to Party A the relevant notice of the acceptance of the Shares Altering Registration application issued by the relevant industry and commerce registration authority (or other certificates of applying the shares altering registration to the satisfaction of Party A shall be submitted if the aforesaid notice is not applicable.) |

| (9) | submit to Party A the certification documents i in relation to the filing the Natural Person Designated by Party A as the director of the BXRT with the of relevant industry and commerce registration authority, and the certification documents of the related banks’ recognition of the Natural Person Designated by Party A as the necessary signatory of BXRT. |

19

| 7.3 | The Party A shall have the right to choose to if provided that Party B and Party C fail to finish in accordance with the provisions set out in Article 7.2 herein at the Closing: |

| (1) | delay in closing (Article 7.3 remains effective then); |

| (2) | endeavor to carry out the closing under a feasible condition (without any prejudice to any rights of Party A hereunder); or |

| (3) | terminate the Agreement. |

The article 7.3 shall be without any prejudice to any rights of Party A hereunder.

| 7.4 | Party B shall submit the new business license issued by the relevant industry and commerce registration authority after the Completion of the Shares Altering Registration (or other certification documents proving the Completion of the Shares Altering Registration to the satisfaction of Party A) as soon as possible after the Closing (no later than 5 days after the Closing Date); meanwhile all the documents as specified in the Schedule IV Part 2 shall be executed and come into effect, otherwise Party A has the right to decline to pay any consideration hereof. |

Chapter 8 The Management of the New Company and BXRT after the Closing

| 8.1 | Lawful Operation |

| (1) | Party B and Party C shall respectively and jointly guarantee the lawful business operation of the New Company after the Closing and obtain the necessary business license in their best efforts. |

| (2) | Party B shall procure BXRT to continue the lawful operation of its present value-added telecommunication business after the Closing and maintain the legitimacy and validity of all the business licenses in relation to the business BXRT engages in in its best effort. |

| 8.2 | Daily Management |

Ms. Sun Wei Jing shall continue to assume the position as the General Manager of BXRT and be responsible for the daily management of BXRT in accordance with the Employment Agreement executed with Party A WFOE and the Employment

20

Agreement executed with the New Company. Ms Sun Wei Jing shall conduct the daily management in the maximum long-term business interests of BXRT with the professional level that the management staff at the equal positions in the companies of the similar kind commonly have, and in compliance with the instructions of the board of directors, the Employment Agreement and the relevant laws and regulations of the PRC. The assistant manager and the Chief Financial Officer (CFO) of BXRT shall be nominated by Party A and employed by the board of directors of BXRT; the financial management system of Party A shall be adopted.

| 8.3 | There shall be 4 directors in the New Company within 2 years after the Closing Date, including 3 directors designated by Party A (or by the BVI Company or the Natural Person Designated by Party A) and 1 director designated by Party B. There shall be 3 directors in BXRT, including 2 directors designated by Party A (or by the BVI Company or the Natural Person Designated by Party A) and 1 director designated by Party B. Party A and Party B shall procure the directors designated by both sides to exercise the functions and powers of the directors in accordance with the articles of associations of BXRT and the PRC Company Law to maintain the duly existence and operation of BXRT. |

Chapter 9 Commitment of Non-competition

| 9.1 | Unless agreed by Party A in writing in advance, Party B and Party C shall respectively and jointly guarantee that within the effective period of the Employment Agreement and 2 years after the termination of the aforesaid agreement, both sides shall not in any way directly or indirectly engage in any business that is in competition against the present business of the BVI Company, the New Company or BXRT, the guarantee including but not limited to; |

| (1) | Party B and Party C and the companies directly or indirectly controlled by Party B and Party C shall not in any way invest to establish, indirectly control or hold equity in any enterprises or other organizations that are in competition against the present business of the BVI Company, the New Company or BXRT. The conducts of investing (except for holding less than 5% of the shares of a listed company) or controlling the enterprises and organizations that are in competition against the present business of the BVI Company, the New Company or BXRT by Party C, the subsidiaries of Party C, and the companies of which Party C holds shares, and the spouses, parents and children of Party B, shall be deemed as the conducts of Party B. |

| (2) | Party B shall not assume any position in any other enterprises or organizations that are in competition or potentially in competition against the present business of the BVI Company, the New Company or BXRT, nor assume positions as consultant in or provide consulting services to the enterprises and the organizations aforesaid. The conducts of assuming positions as consultant in or providing consulting services to the enterprises and organizations that are in competition against the present business of the BVI Company, the New Company or BXRT by Party C, the subsidiaries, the companies of which Party C holds shares, other affiliates and the spouses, parents and children of Party B, shall be deemed as the conducts of Party B. |

21

Chapter 10 Representations and Warranties

| 10.1 | Representations and Warranties of Party A: |

| (1) | Party A represents and warrants that, Party A is a limited company incorporated and duly existent under laws of BVI, which has acquired the approval in relation to the cooperation matters hereunder from relevant authorities and authorized its representative to sign on the Agreement and bound by this Agreement. |

| (2) | Party A warrants that it will pay the Transaction Consideration pursuant to the ways, terms and conditions set forth herein |

| 10.2 | Party B (including Party B (1) and Party B (2)) and Party C (including Party C(1) and Party C(2)) shall respectively and jointly, continuously and irrevocably make the representations, warranties and covenants to Party A as follows: |

| (1) | Party B (including Party B (1) and Party B (2)) are respectively a Chinese citizen with full capacity for civil conduct. Party C (including Party C (1) and Party C (2)) are respectively a BVI Company with full capacity for civil conduct. Both Party B and Party C have full capacity for the performance of the obligations in relation to the cooperation matters under the Agreement. Besides, Party B have the capacity to to acquire all the approvals of BXRT, Party C, the BVI Company and the New Company from the corresponding authorities, to authorize its representative to sign on the other agreements and documents relating the Agreement and bound by this Agreement. |

| (2) | shall incorporate the New Company in time and complete the reorganizations and establishment of the contractual relationships strictly in accordance with Article 3 herein, including but not limited to the execution of the relevant documents in accordance with the form and content specified in Schedule V (2), Schedule VI (2), Schedule VII (2), Schedule VIII (2), Schedule IX (2), Schedule X, Schedule XI, Schedule XII(2) on the date of the establishment of the New Company; |

| (3) | Any documents or information provided relating the Agreement provided for the execution and performance hereof are true, complete and accurate in all aspects without any faults, omissions or misleading. |

| (4) | BXRT is a limited liability company duly incorporated and validly existing with the right to engage in the value-added telecommunication business; all of its current media and telecommunication service provider agreements (as listed in Schedule XIII) are true, lawful and under full performance in accordance with such agreements. The Party B shall ensure in its best effort the agreements aforesaid can be performed in due course after the Closing. |

22

| (5) | BXRT and its branches have all acquired all the approvals, licenses, registration certificates and registrations necessary for their current business. The approvals, licenses, registration certificates and registrations aforesaid shall have full legal effect and not be terminated or revoked by the Agreement. |

| (6) | There shall be no potential, on-going or outstanding lawsuits, arbitrations, administration procedure or any claims of any other person relating Party B, the BVI Company, BXRT and the New Company except for those otherwise disclosed in written form to Party A prior to the date of the execution of the Agreement (the disclosure documents shall be confirmed by executions of Party A and Party B) |

| (7) | The BVI Company, BXRT and the New Company duly own all their assets, which (except for the contracts executed in accordance with Article 2 and article 3 herein, and those disclosed in written form to Party A prior to the date of execution of the Agreement (such disclosure documents shall be confirmed by execution of Party A and Party B)) shall be free and clear of any warrants, mortgage, pledge and security of other kinds, and the BVI Company, BXRT and the New Company have not provided any security of any kind to any third party; |

| (8) | The BVI Company and the New Company have never carried out any business or activities, entered into any contracts, agreements or legal relationships, nor generate or bear any liabilities (including contingent liabilities) or obligations except for the contracts executed and transactions contemplated in accordance with Article 2 and Article 3 herein, those disclosed to Party A in written form prior to the date of the execution of the Agreement and fully fulfillment of the rights and obligations hereunder in accordance with the Relevant Contracts (the disclosure documents shall be confirmed by executions of Party A and Party B); |

| (9) | BXRT has never generated or borne any liabilities (including contingent liabilities) or obligations except for the contracts executed and transactions contemplated in accordance with Article 2 and Article 3 herein, those disclosed to Party A in written form prior to the date of the execution of the Agreement and fully fulfillment of the rights and obligations hereunder in accordance with the Relevant Contracts (the disclosure documents shall be confirmed by executions of Party A and Party B); |

| (10) | All the shares of the BVI Company shall be free and clear of any pledge, mortgage, warrants or other rights and interests of any third party except for those disclosed in written form to Party A prior to the date of execution of the Agreement (the disclosure documents shall be confirmed by executions of Party A and Party B); |

23

| (11) | All the business of the BVI Company, BXRT and the New Company shall be carried on under a sound, consistent and continuing condition without any material adverse change from the date of the execution of the Agreement to the date of Closing of the Shares Transfer; |

| (12) | The Party B and Party C shall in the best effort to satisfy the requirements of Party A and the companies controlled directly or indirectly by Party A (if applicable) to provide and/or issue any documents required by HKEx, Hong Kong Securities and Futures Commission, Hong Kong Companies Registry, NASDAQ and applicable laws and/or rules; |

| (13) | The business of the BVI Company and/or the New Company and/or BXRT have never infringed upon any lawful rights and interests of any third party up to the Date of the Completion of the Shares Altering Registration except for those disclosed explicitly in the Agreement, including but not limited to the patent right, trade xxxx right, copy right and other similar rights; Party B and Party C shall bear all the relevant liabilities provided that the business scopes of the BVI Company and/or BXRT infringe upon any lawful rights and interests of any third party; |

| (14) | The BVI Company, the New Company, BXRT, Party B and Party C have not involved or engaged in any activities in violation of the laws and regulations of the PRC or other areas that currently or contingently causes suspension of business license of BXRT or any other legal or administrative penalties that materially affect the operation of BXRT up to Date of the Completion of the Shares Altering Registration; |

| (15) | The relationship between Party B and BXRT as well as the relationship between Party C and BXRT have been clear of any liabilities (except the liabilities rising from the Employment Agreement) up to the Date of the Completion of the Shares Altering Registration; Party A and the Natural Person Designated by Party A will not inherit any debt of Party B to BXRT due to the Share Transfer hereunder. |

| (16) | The BVI Company, the New Company and BXRT have paid in full (and/or withhold) all taxes, fine, the interests of the fine and fees due or payable (and/or those shall be withheld) in compliance with the taxation laws and regulations of PRC up to the Date of the Completion of the Shares Altering Registration. There shall no debt, liabilities and tax debt apart from the regular operation. |

| (17) | BXRT have paid up the retirement pension, the unemployment pension, welfare benefit or any other fees and fund related to employees up to the Date of the Completion of the Shares Altering Registration. |

| (18) | BXRT have not violated any material agreement as a party thereto nor borne any liabilities for any representations, warranties, compensation or other matters up to the Date of the Completion of the Shares Altering Registration. |

24

| (19) | BXRT have not executed any contracts as a party thereto that currently or contingently have adverse effect on the business, profits or assets composition except the contracts disclosed to Party A; |

| (20) | Party B(1) and Party B (2) are all the shareholders of BXRT who respectively legally owns 50% BXRT shares at the execution of the Agreement; Party C is the sole shareholder of the BVI Company at the execution of the Agreement who legally owns 100% shares of the BVI Company; |

| (21) | BXRT has RMB7,000,000 in cash and the amount of its accounts receivable deducting the accounts payable is no less than RMB3,000,000 up to the execution of the Agreement; since the Date of the Completion of the Shares Altering Registration Party B have not had the right in relation to the undistributed profits prior to the Date of the Completion of the Shares Altering Registration; and |

| (22) | The BVI Company shall have completed the formalities of the shares altering of the BVI Company by the same day when BXRT submits the application for the Shares Altering Registration to relevant company registration authorities. |

| 10.3 | The representations, warranties and covenants in relation to Article 10.1 and Article 10.2 hereunder are respectively made by Party A, Party B and Party C repeatedly subject to the current facts and conditions from the date of the execution of the Agreement and the Date of the Completion of the Shares Altering Registration. Party B(1), Party B(2) and Party C(1), Party C(2) hereby agree and confirm that they respectively and jointly make the representations, warranties and covenants aforesaid and bear joint liabilities in relation to the representations, warranties and covenants hereof. |

Chapter 11 Due Diligence Research

| 11.1 | The Party B and Party C agree to truly, completely and accurately provide Party A and/or the people designated by Party A with the certification documents in relation to the operation, assets, financial and legal conditions, profit-making performance and business prospects of Party B , Party C, the BVI Company, the New Company, BXRT, and other organizations relating the transaction herein upon the reasonable requirements of Party A and/or the people designated by Party A, to assist Party A and/or the people designated by Party A to conduct due diligence research. |

25

Chapter 12 Tax and Compensation Obligation

| 12.1 | Any existing, potential or/and undisclosed tax legal obligation relating the BVI Company, BXRT and the New Company prior to the Closing Date shall be born by Party B and Party C. Any tax caused by the cooperation matters hereunder and the establishment of the New Company based on the cooperation shall be paid by Party B and Party C. Any act or omission by Party B, Party C, the BVI Company, BXRT and the New Company prior to the Closing Date (including but not limited to the individual income tax of Party B for acquiring the profits distributed by BXRT) causes any loss of Party A, Party A shall have the right of directly deducting the amount equivalent to such loss from the unpaid Consideration Transaction subject to reasonable written evidence in advance. In the event aforesaid, Party A does not need to fulfil the corresponding obligation of payment set out in Article 4, which shall not constitute any breach of the Agreement. If the parties fail to reach consensus on the amount of loss Party A incurred, Party A and Party B agree to jointly appoint an independent accountant to assess the loss incurred by Party A, and the relevant amount assessed shall be final with binding force against both sides. |

Chapter 13 Confidentiality Obligation

| 13.1 | The Parties acknowledge and confirm that any oral or written information exchanged in relation to the main clauses among each other shall be deemed as confidential information (including but not limited to the clauses of the Agreement and the transaction contemplated herein). All the parties shall keep strictly confidential the information hereof. Any relevant information shall not be disclosed to any third party without the written consent by the other Party, only excluding the following conditions: |

| (1) | the information disclosed in accordance with the applicable laws, the GEM Listing Rules or the Main Board Listing Rules; and |

| (2) | the information in relation to the transactions set out in the main clauses disclosed to its legal or financial consultants who are also subject to the confidentiality obligation herein. |

| 13.2 | The Parties confirm and guarantee that they will not disclose the content of the transaction set out in the Agreement in any way without the consent by the other Parties in advance. Party B or Party C shall disclose the relevant information in the way defined by Party A with the consent of Party A. |

| 13.3 | The Parties agree, the confidentiality obligations aforesaid shall likewise be applied to the professional organizations and persons authorized by the Parties for the performance of the Agreement. |

26

| 14.1 |

Party B and Party C agree, they shall not approach, discuss, negotiate or execute, directly or indirectly, any agreement or letter of intent (regardless whether the agreement or letter of intent has binding force or not) with any third party in relation to any content set out herein (including but not limited to the Shares Transfer, equity transfer of BXRT) on or prior to June 15th, 2006. |

| 15.1 | If unavoidable, unforeseen and insurmountable force majeure occurs, the affected Party shall notify the other Party within 14 Business Days after the ocurrance of such force majeure and within 30 Business Days, provide relevant details and a certificate issued by the relevant local authority and certified by the local notarization authority, and the Parties shall conduct consultation to settle the consequences of the force majeure. Any Party has the right to require the termination of the obligations of relevant Parties set out herein provided that the force majeure or the influence of force majeure has been continued for more than 3 months and interfered with any Party to perform the obligations hereof. |

Force majeure hereunder shall mean, any uncontrollable, unforeseen, unavoidable event interfering any party’s partial or full performance of the obligations herein, including earthquake, landslide, slump, flood, typhoon and other natural disasters, fire, explosion, accident, war, rebellion, social turmoil or upheaval, riot or any other similar or different accidental event.

Chapter 16 Obligation for Breach of Contracts

| 16.1 | Any Party hereto who violates, or refuses to perform any presentations, warranties and obligations shall constitute breach of contract. Any Party shall make corresponding compensation to protect the other Party from any direct loss caused by the breach of contract. |

| 16.2 | Party B and Party C shall respectively and jointly warrant to Party A particularly that, Party B shall make compensation to protect Party A from any loss provided that the events leading to any loss of Party A (except those caused by the fault of Party A) occur during the time set forth below: (i) before the lawful registration of Party A as the shareholder of the BVI Company; (ii) before Party B (1) and Party B (2) transfer the shares of BXRT to the Natural Person Designated by Party A; and (iii) the duly establishment of the New Company. |

| 17.1 | The conclusion, effectiveness, termination, interpretation and implementation of this Agreement are governed by the laws of Hong Kong. |

27

Chapter 18 Disputes Settlement

| 18.1 | All the disputes arising from the change of the Agreement or relating the Agreement shall be settled through friendly consultation. If consultation fails to result in a settlement within 60 days after one Party notify in writing the other Party of the existing dispute, the dispute shall be tried by courts of Hong Kong. |

Chapter 19 Complete Agreement and Revision

| 19.1 | Complete Agreement |

| (1) | The Agreement is the only complete and sole agreement in relation to the main subject set out hereof reached by the Parties, which shall supersede all the relevant content in oral or written agreements, contracts, memorandums and correspondence in relation to the main subject hereof. |

| (2) | Any agreements, documents, letters of attorney, reports, lists, permits, covenants and waivers formed, made, executed and attached in accordance with the Agreement shall constitute the annex to the Agreement which constitute an integral part hereof and have the same legal effect with the Agreement. |

| 19.2 | Revision |

| (1) | Any revision, supplement, modification hereof shall be agreed by the Parties and made in written form, which will take effect after the authorized representatives sign the Agreement in accordance with the Agreement. |

| (2) | Any written revision and modification hereof shall constitute an integral part of the Agreement. |

Chapter 20 Notice and Delivery

| 20.1 | Any notice or other correspondence in relation to the Agreement sent by the parties shall be in written form, and delivered to the addresses set out below or other addresses notified in writing: |

The Party A: XXX ONLINE MEDIA GROUP LIMITED

Address: P.O. BOX 957, Offshore Incorporations Center, Road Town, Tortola, British Virgin Islands

Fax: x00-00-00000000

Contact Person: Xxxxx Xxxxxxx

28

Any notice or other correspondence to Party A shall be copied to the addresses below or other addresses notified in writing:

Address: 48th Xxxxx, Xxx Xxxxxx, 00 Xxxxx’x Xxxx Xxxxxxx, Xxxx Xxxx

Fax: x000 0000 0000

Contact Person: company secretary

The Party B (1): Sun Wei Jing

Address: Room 1021, CTS (HongKong) Xxxxxxxx, Xx.000 Xxxxxxxxxxxxx Xxxxxx, Xxxxxx Xxxxxxxx, Xxxxxxx

Fax: 00-00-00000000

The Party B (2): Xxxx Xx Tian

Address: Room 1021, CTS (HongKong) Xxxxxxxx, Xx.000 Xxxxxxxxxxxxx Xxxxxx, Xxxxxx Xxxxxxxx, Xxxxxxx

Fax: 00-00-00000000

The Party C (1): Grandmetro Group Limited

Address: Xxxx 0000, XXX (XxxxXxxx) Xxxxxxxx, Xx.000 Xxxxxxxxxxxxx Xxxxxx, Xxxxxx Xxxxxxxx, Xxxxxxx

Fax: 00-00-00000000

Contact Person: Sun Wei Jing

The Party C (2): Valuenet Holdings Limited

Address: Room 1021, CTS (HongKong) Xxxxxxxx, Xx.000 Xxxxxxxxxxxxx Xxxxxx, Xxxxxx Xxxxxxxx, Xxxxxxx

Fax: 00-00-00000000

Contact Person: Sun Wei Jing

Chapter 21 Language

| 21.1 | This Agreement is executed in Chinese in 6 copies. The Party A hold 2 copies and each of the Other Parties holds 1 copy respectively. All the executed copies shall have the same effect. |

Chapter 22 Effect of the Agreement

| 22.1 | The Agreement shall come into effect upon the signing of the authorized representatives of the Parties hereto. |

(The Remainder of the Page Left Intentionally Blank)

(This is the Signature Page with No Text)

29

IN WITNESS WHEREOF, this Agreement has been duly executed by:

The Party A: XXX ONLINE MEDIA GROUP LIMITED

Representative:

Signature:

Seal:

The Party B (1): Sun Wei Jing

Signature:

The Party B (2): Xxxx Xx Tian

Signature:

The Party C (1): Grandmetro Group Limited

Representative:

Signature:

Seal:

The Party C (2): Valuenet Holdings Limited

Representative:

Signature:

Seal:

30

Schedule I Information of Party B and Party C

Schedule I (1)

Party B (1)

Name: Sun Wei Jing

Nationality: Chinese

ID: 000000000000000000

Address: 702, Xxxx 0, Xxxxxxxx 0, Xxxxxxxxxxxxxxxx Xxxxxx, Kuiwen District, Weifang City, Shandong

Party B (2)

Name: Xxxx Xx Tian

Nationality: Chinese

ID:000000000000000000

Address: Mid. 000, Xxxx Xxxxxxxx 00, Xxxx 0 Xxxxxxx Xxxxxx, Xxxxxxx Xxxxxxxx, Xxxxxxx

Schedule I (2)

The Party C (1)

Name: Grandmetro Group Limited

Address: ROOM 3310 XX XX HOUSE PO NGA COURT TAI PONT

Telephone: +00852 0000 0000

Contact Person: You Susheng

The Party C (2)

Name: Valuenet Holdings Limited

Address: ROOM 3310 XX XX HOUSE PO NGA COURT TAI PONT

Telephone: +00852 0000 0000

Contact Person: Lie Suling

31

Schedule II Reorganization Structure

32

Schedule III Management Staff List

| Management staff | Position | |

| Sun Wei Jing | General manger | |

| Li Yiman | Deputy General Manager for Technology | |

| Xxxx Xxx | Deputy General Manager for Business Operation | |

| Xxxx Xxxx | Finance manager | |

33

Schedule IV Relevant Contracts List

| 1. | Contracts executed on 1 June 2006 |

| (1) | The Exclusive Technical and Consulting Services Agreement executed by Party A WFOE and BXRT, which will automatically terminate on the date of the Completion of the Shares Altering Registration when the Exclusive Technical and Consulting Services Agreement specified in the subsection 2 (1) under this schedule comes into effect. |

| (2) | The Business Operation Agreement executed by Party A WFOE and BXRT with its shareholders Party B (1) and Party B (2), which will automatically terminate on the date of the Completion of the Shares Altering Registration when the Business Operation Agreement specified in the subsection 2 (2) under this schedule comes into effect. |

| (3) | The Exclusive Option Agreement executed by the shareholders of BXRT Party B (1) , Party B (2) and Party A WFOE, which will automatically terminate on the date of the Completion of the Shares Altering Registration when the Exclusive Option Agreement specified in the subsection 2 (3) under this schedule comes into effect. |

| (4) | The Equity Pledge Contract executed by the shareholders of BXRT Party B (1) , Party B (2) and Party A WFOE, which will automatically terminate on the date of the Completion of the Shares Altering Registration when the Equity Pledge Contract specified in the subsection 2 (4) under this schedule comes into effect. |

| (5) | The Letter of Attorney issued by the shareholders of BXRT, Party B (1) and Party B(2) , which will automatically terminate on the date of the Completion of the Shares Altering Registration when the Letter of Attorney specified in the subsection 2 (6) under this schedule comes into effect. |

| (6) | The Employment Agreement executed by the Management Team of BXRT and Party A WFOE, which will automatically terminate on the date of the Completion of the Shares Altering Registration when the Employment Agreement specified in the subsection 2 (8) under this schedule comes into effect. |

| 2. | The contracts to be executed immediately after the establishment of the New Company |

| (1) | The Exclusive Technical and Consulting Services Agreement to be executed by the New Company and BXRT, which will take effect on the date of the Completion of the Shares Altering Registration. |

| (2) | The Business Operation Agreement to be executed by the New Company, BXRT and Natural Person Designated by Party A, which will take effect on the date of the Completion of the Shares Altering Registration. |

34

| (3) | The Exclusive Option Agreement to be executed by the Natural Person Designated by Party A (shareholder of BXRT) and the BVI Company, which will take effect on the date of the Completion of the Shares Altering Registration. |

| (4) | The Equity Pledge Contract to be executed by the Natural Person Designated by Party A and the New Company which will take effect on the date of the Completion of the Shares Altering Registration. |

| (5) | The Share Transfer Agreement to be executed by Party B (1), Party B(2) and the Natural Person Designated by Party A, which will take effect on the date of execution hereof. |

| (6) | The Letter of Attorney to be issued by the Natural Person Designated by Party A and the persons designated by the New Company, which will take effect on the date of the Completion of the Shares Altering Registration. |

| (7) | The Loan Agreement to be executed by the BVI Company and the Natural Person Designated by Party A and; |

| (8) | The Employment Agreement to be executed by the Management Team of BXRT and the New Company which will take effect on the date of the Completion of the Shares Altering Registration. |

35

Schedule V The Exclusive Technical and Consulting Services Agreement

Schedule V(1)

Schedule V(2)

36

Schedule XIII The Contract List of BXRT and Telecommunication Operators

| 1. | Cooperation Agreement executed by BXRT and MyCCTV Ltd, Co on 28 August 2003 |