FIRST AMENDMENT TO LEASE

Exhibit 10.28

FIRST AMENDMENT TO LEASE

This FIRST AMENDMENT TO LEASE (“Amendment”) is dated as of this 30th day of January, 2012, by and between NW AUSTIN OFFICE PARTNERS LLC, a Delaware limited liability company (“Landlord”), and MOLECULAR TEMPLATES, INC., a Delaware corporation (“Tenant”).

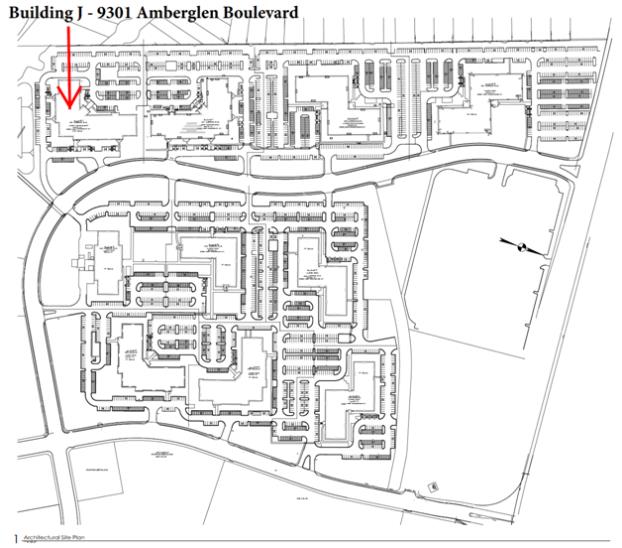

A. Landlord and Tenant entered into that certain Lease (“Original Lease” as amended by this Amendment, the “Lease”) dated as of October 1, 2016, whereby Landlord agreed to lease to Tenant pursuant to the terms of the Original Lease certain space located in the building with a street address of 0000 Xxxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx, also known as Building J (the “Building”).

B. By this Amendment, Landlord and Tenant desire to expand the space to be leased by Tenant and to otherwise modify the Original Lease as provided herein.

C. Unless otherwise defined herein, capitalized terms as used herein shall have the same meanings as given thereto in the Original Lease.

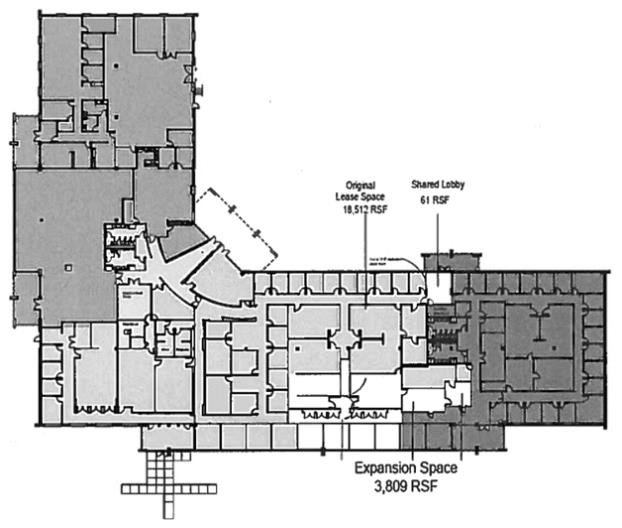

1. The Existing Premises. Pursuant to the Original Lease, Landlord has agreed to lease to Tenant that certain office space containing approximately 18,512 rentable square feet located on the first (151) floor of the Building (collectively, the “Existing Premises”).

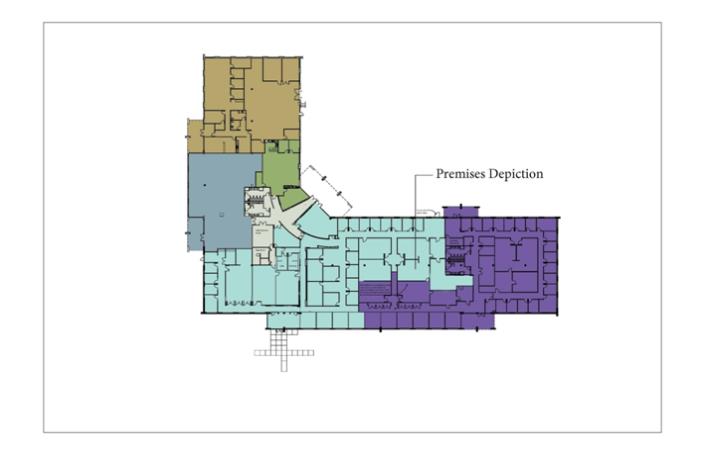

2. Expansion of the Leased Premises. That certain space located on the first (1st) floor of the Building, consisting of approximately 3,870 rentable square feet, as shown on the floor plan attached hereto as Exhibit A and made a part hereof, is referred to herein as the “Expansion Space.” Tenant shall lease the Expansion Space on all the same terms and conditions set forth in the Lease, as amended by this Amendment, effective as of the Lease Commencement Date and terminating on the Lease Expiration Date. Effective as of the date of this Amendment, all references to the “Leased Premises” in the Lease shall mean and refer to the Existing Premises as expanded by the Expansion Space, consisting of approximately 22,382 rentable square feet in the aggregate. Notwithstanding anything to the contrary contained in the Original Lease or this Amendment, however, Tenant hereby acknowledges and agrees that the Expansion Space is currently subject to that certain Lease between Landlord and Xxxxxx Holdings, Inc., as tenant, dated as of October 19, 2006, as amended, supplemented and otherwise modified, and Tenant’s rights in or access to the Expansion Space pursuant to this Amendment shall commence on June 1, 2017.

3. Tenant Improvement Allowance. Notwithstanding anything to the contrary contained in the Lease, Tenant shall renovate the Leased Premises to build a wall, remove doors and add one additional door through the shared lobby (the “Improvement Work”) subject to Landlord’s approval of plans thereof in accordance with the “Work Letter,” attached to the Original Lease as Exhibit B. The term “Tenant Improvement Allowance,” as defined in the Work Letter, is hereby revised to mean “$111,910.00,” (based upon $5.00 per rentable square foot of the Leased Premises) solely for the costs relating to the Improvement Work and Tenant Improvements. Furthermore, (i) the “$4,628.00” amount in the last full sentence of Paragraph 2(a) in the Work Letter is hereby amended and replaced with “$5,595.50,” and (ii) the “1,851.20” amount in the last paragraph of Paragraph 2 is hereby amended and replaced with “$2,238.20”. All Improvement Work performed pursuant to this Section 3 shall be performed in accordance with and subject to the terms and conditions of the Work Letter and Landlord shall disburse the Tenant Improvement Allowance to Tenant pursuant to and in accordance with the Work Letter. In no event will Tenant be entitled to any rent credit based on any unused Tenant Improvement Allowance. Other than the Tenant Improvement Allowance provided herein, and except to the extent expressly provided in the Original Lease, Landlord shall not be responsible for the payment or performance of any improvements or alterations to the Leased Premises and, except to the extent expressly provided in the Original Lease, Tenant agrees to accept the same in their “as is” condition as of the Lease Commencement Date.

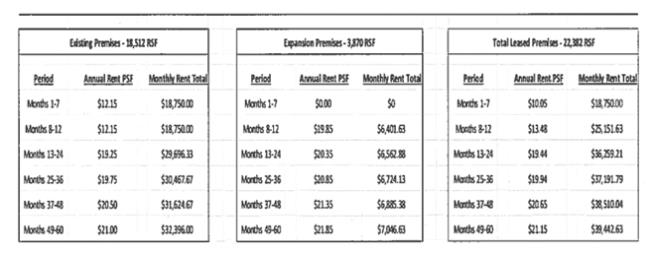

5. Rental Abatement. Notwithstanding anything to the contrary contained in Section 4 above, and provided that Tenant faithfully performs all of the terms and conditions of the Lease, Landlord agrees to xxxxx Tenant’s obligation to pay Base Monthly Rent for the Expansion Space for the initial seven full months of the Lease Term (the “Expansion Space Rent Abatement Period”). During such abatement period, Tenant shall still be responsible for the payment of all of its other monetary obligations under the Lease. In the event of a default by Tenant under the terms of the Lease that results in early termination of the Lease, then as a part of the recovery set forth in the Lease, Landlord shall be entitled to the recovery of the Base Monthly Rent that was abated during the initial four (4) full months of the Lease Term.

The second paragraph of Paragraph 3.1(a) is hereby deleted and replaced in its entirety with the below:

“Base Monthly Rent for the Existing Premises is payable at a reduced rate during the first twelve (12) full calendar months of the Lease Term (the “Base Rent Abatement Period”), as if the Existing Premises contained only 12,000 rentable square feet, and Base Monthly Rent for the Expansion Space is not payable during Expansion Space Rent Abatement

2

The schedule contained in Section 5 of Exhibit E to the Original Lease is hereby deleted in its entirety and replaced with the following:

| Period |

Base Monthly Rent | |||

| Months **-12 |

$ | 35,326.63 | ||

| Months 13-24 |

$ | 36,259.21 | ||

| Months 25-36 |

$ | 37,191.79 | ||

| Months 37-48 |

$ | 38,510.04 | ||

| Months 49-60 |

$ | 39,442.63 | ||

3

6. Tenant’s Pro Rata Share. “Tenant’s Building Share” is hereby amended to be 44.26%, and “Tenant’s Project Share” is hereby amended to be 4.12%.

7. Security Deposit. On or before the Lease Commencement Date, Tenant shall deliver to Landlord: (i) a substitute or replacement Letter of Credit in the amount of One Hundred Seventy Six Thousand Nine Hundred Sixty Eight and 72/100 ($176,968.72), in the form and as required under the Lease, (ii) an amendment to the Letter of Credit (the “Original Letter of Credit”) delivered with respect to Existing Premises at the time of execution of the Original Lease pursuant to which the maximum amount secured by said letter of credit, as so amended, is increased to One Hundred Seventy Six Thousand Nine Hundred Sixty Eight and 72/100 ($176,968.72), or (iii) Thirty One Thousand Two Hundred Seventy Nine and 28/100 ($31,279.28), in cash or immediately available funds, to be held by Landlord as the Security Deposit. From and after the delivery of the foregoing, the term “Security Deposit” as used in the Lease shall mean One Hundred Seventy Six Thousand Nine Hundred Sixty Eight and 72/100 ($176,968.72). Furthermore, the “$48,563.15” amount in the last paragraph of Paragraph 3.7 is hereby amended and replaced with $58,989.57. In the event that Tenant elects to deliver a substitute or replacement Letter of Credit pursuant to clause (i) above, Landlord shall cooperate and coordinate the concurrent return of the Original Letter of Credit to Tenant or the issuing bank, as the case may be, in accordance with the instructions of the issuing bank.

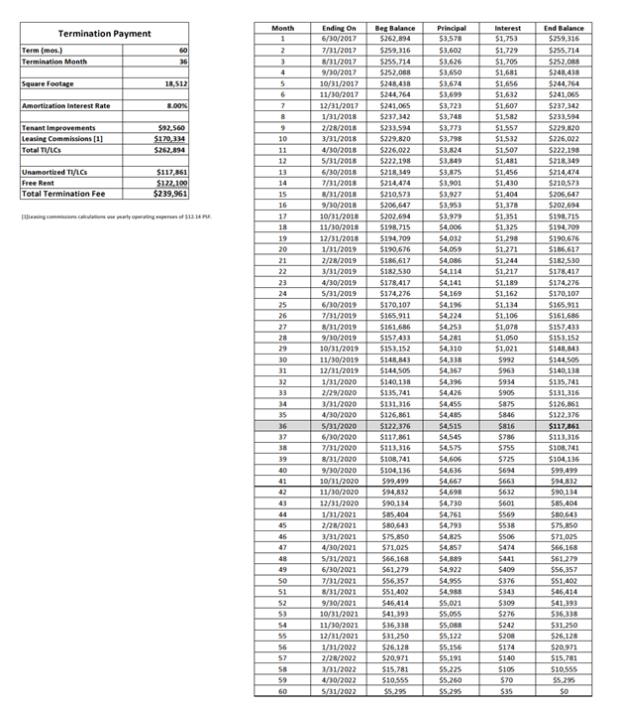

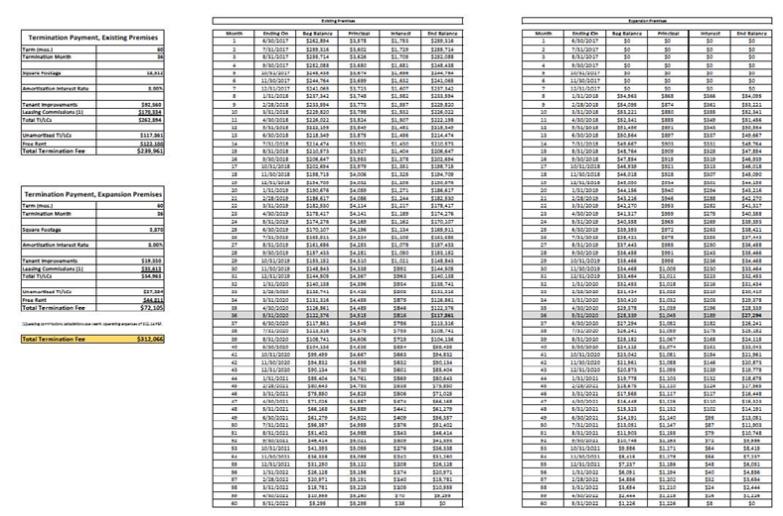

8. Termination Payment. Schedule 1 of the Original Lease is hereby deleted and replaced in its entirety with the Schedule I attached hereto and made a part hereof.

9. Broker. Landlord and Tenant each represents, warrants and agrees to the other that it has not had any dealings with any real estate broker(s), leasing agent(s), finder(s) or salesmen, other than Landlord’s Broker and Tenant’s Broker, respectively, in negotiating or consummating this Amendment. Landlord and Tenant each agrees to indemnify, defend with competent counsel, and hold the other harmless from and against any claim for commission or finder’s fee by any person or entity who claims or alleges that they were retained or engaged by it or at its request in connection with this Amendment, other than Landlord’s Broker and Tenant’s Broker. Landlord shall pay any commission or fee due to Tenant’s Broker in connection with this Amendment.

10. Tenant Representations. Each person executing this Amendment on behalf of Tenant represents and warrants to Landlord that: (a) Tenant is properly formed and validly existing under the laws of the state in which Tenant is formed and Tenant is authorized to transact business in the state in which the Building is located; (b) Tenant has full right and authority to enter into this Amendment and to perform all of Tenant’s obligations hereunder; and (c) each person (and both persons if more than one signs) signing this Amendment on behalf of Tenant is duly and validly authorized to do so.

11. Defaults. Tenant hereby represents and warrants to Landlord that, to the knowledge of’ Tenant, as of the date of this Amendment, Landlord and Tenant are in full compliance with all terms, covenants and conditions of the Lease and that there are no breaches or defaults under the Lease by Landlord or Tenant, and that Tenant does not know of any event or circumstance which, given the passage of time, would constitute a default under the Lease by either Landlord or Tenant.

4

Landlord hereby represents and warrants to Tenant that, to the knowledge of Landlord, as of the date of this Amendment, Landlord and Tenant are in full compliance with all terms, covenants and conditions of the Lease and that there are no breaches or defaults under the Lease by Landlord or Tenant, and that Landlord does not know of any event or circumstance which, given the passage of time, would constitute a default under the Lease by either Landlord or Tenant.

12. No Further Modification. Except as set forth in this Amendment, all of the terms and provisions of the Lease shall apply with respect to the Leased Premises (including the Expansion Space) and shall remain unmodified and in full force and effect.

13. Counterparts and Electronic Signatures. This Amendment may be executed in counterparts, each of which shall be deemed an original, but such counterparts, when taken together, shall constitute one agreement. This Amendment may be executed by a party’s signature transmitted by electronic means, and copies of this Amendment executed and delivered by means of electronic signatures shall have the same force and effect as copies hereof executed and delivered with original signatures. All parties hereto may rely upon electronic signatures as if such signatures were originals. Any party executing and delivering this Amendment electronically shall promptly thereafter deliver a counterpart signature page of this Amendment containing said party’s original signature. All parties hereto agree that an electronic signature page may be introduced into evidence in any proceeding arising out of or related to this Amendment as if it were an original signature page.

14. Condition Precedent To Lease Amendment. Landlord’s obligations hereunder are subject to the receipt by Landlord, no later than fifteen (15) business days after the date hereof, of the Lender’s Consent, as hereinafter defined. Landlord hereby agrees to use diligent efforts to obtain the Lender’s Consent by such date; however, if Landlord does not receive the Lender’s Consent by such date, this Amendment shall, at Landlord’s option, thereupon be deemed terminated and of no further force or effect, and neither party shall have any further rights, obligations, or liabilities hereunder. As used herein, the term “Lender’s Consent” means a written consent to this Amendment in form reasonably satisfactory to Landlord, executed by the holder of the promissory note secured by any deed of trust encumbering the fee interest in the real property of which the Leased Premises are a part.

15. Shared Lobby Space. As part of the Improvement Work, Tenant shall install a demising wall separating the Expansion Space from the area identified as “Shared Lobby” on Exhibit A hereto. Tenant shall have the right to install an entrance door into the Shared Lobby and shall have the right to use the Shared Lobby in common with other tenants of the Building. The Shared Lobby shall be a Common Area under the Lease.

[Signature Page Follows]

5

IN WITNESS WHEREOF, this Amendment has been executed as of the day and year first above written.

LANDLORD:

| NW AUSTIN OFFICE PARTNERS LLC, | ||||||||||

| a Delaware limited liability company | ||||||||||

| By: | NW Austin Holdco LLC, a Delaware limited liability company, its Manager | |||||||||

| By: | Menlo Equities V LLC, a California limited liability company, its Manager | |||||||||

| By: | Diamant Investments LLC a Delaware limited liability company, Member | |||||||||

| By: | /s/ Xxxxxxx Xxxxxxxxx |

Dated: 1/30, 2017 | ||||||||

| Xxxxxxx Xxxxxxxxx, Manager | ||||||||||

TENANT:

| MOLECULAR TEMPLATES, INC.

a Delaware corporation |

||||||

| By: | /s/ Xxxxx Xxx |

|||||

| Printed Name: Xxxxx Xxx Title: President & CFO |

||||||

| Dated: Jan 30th, 2017 | ||||||

EXHIBIT A

OUTLINE OF EXPANSION SPACE

Exhibit A

EXHIBIT B

CONSOLIDATED RENT SCHEDULE

Exhibit B

SCHEDULE 1

LEASE

BY AND BETWEEN

NW Austin Office Partners LLC,

a Delaware limited liability company,

as Landlord

and

Molecular Templates, Inc.

a Delaware corporation,

as Tenant

October 1, 2016

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE 1 |

REFERENCE | 5 | ||||

| 1.1 |

References |

5 | ||||

| ARTICLE 2 |

LEASED PREMISES, TERM AND POSSESSION | 9 | ||||

| 2.1 |

Demise Of Leased Premises |

9 | ||||

| 2.2 |

Right To Use Common Areas |

9 | ||||

| 2.3 |

Lease Commencement Date And Lease Term |

9 | ||||

| 2.4 |

Delivery Of Possession |

9 | ||||

| 2.5 |

Performance Of Tenant Improvement Work; Acceptance Of Possession |

10 | ||||

| 2.6 |

Surrender Of Possession |

10 | ||||

| ARTICLE 3 |

RENT, LATE CHARGES AND SECURITY DEPOSITS | 10 | ||||

| 3.1 |

Base Monthly Rent |

10 | ||||

| 3.2 |

Additional Rent |

11 | ||||

| 3.3 |

Year-End Adjustments |

12 | ||||

| 3.4 |

Late Charge, And Interest On Rent In Default |

12 | ||||

| 3.5 |

Payment Of Rent |

13 | ||||

| 3.6 |

Prepaid Rent |

13 | ||||

| 3.7 |

Security Deposit |

13 | ||||

| ARTICLE 4 |

USE OF LEASED PREMISES AND COMMON AREA | 14 | ||||

| 4.1 |

Permitted Use |

14 | ||||

| 4.2 |

General Limitations On Use |

14 | ||||

| 4.3 |

Noise And Emissions |

14 | ||||

| 4.4 |

Trash Disposal |

15 | ||||

| 4.5 |

Parking |

15 | ||||

| 4.6 |

Signs |

15 | ||||

| 4.7 |

Compliance With Laws And Restrictions |

16 | ||||

| 4.8 |

Compliance With Insurance Requirements |

16 | ||||

| 4.9 |

Landlord’s Right To Enter |

17 | ||||

| 4.10 |

Use Of Common Areas |

17 | ||||

| 4.11 |

Environmental Protection |

17 | ||||

| 4.12 |

Rules And Regulations |

19 | ||||

| 4.13 |

Reservations |

19 | ||||

| ARTICLE 5 |

REPAIRS, MAINTENANCE, SERVICES AND UTILITIES | 19 | ||||

| 5.1 |

Repair And Maintenance |

19 | ||||

| (a) Tenant’s Obligations |

19 | |||||

| (b) Landlord’s Obligation |

19 | |||||

| 5.2 |

Utilities |

20 | ||||

| 5.3 |

Security |

22 | ||||

| 5.4 |

Energy And Resource Consumption |

22 | ||||

| 5.5 |

Limitation Of Landlord’s Liability |

22 | ||||

| ARTICLE 6 |

ALTERATIONS AND IMPROVEMENTS | 23 | ||||

| 6.1 |

By Tenant |

23 | ||||

| 6.2 |

Ownership Of Improvements |

23 | ||||

| 6.3 |

Alterations Required By Law |

24 | ||||

| 6.4 |

Liens |

24 | ||||

| ARTICLE 7 |

ASSIGNMENT AND SUBLETTING BY TENANT | 24 | ||||

| 7.1 |

By Tenant |

24 | ||||

| 7.2 |

Merger, Reorganization, or Sale of Assets |

25 | ||||

| 7.3 |

Landlord’s Election |

25 | ||||

| 7.4 |

Conditions To Landlord’s Consent |

26 | ||||

| 7.5 |

Assignment Consideration And Excess Rentals Defined |

27 | ||||

i

| 7.6 |

Payments |

27 | ||||

| 7.7 |

Good Faith |

27 | ||||

| 7.8 |

Effect Of Landlord’s Consent |

27 | ||||

| ARTICLE 8 |

LIMITATION ON LANDLORD’S LIABILITY AND INDEMNITY | 28 | ||||

| 8.1 |

Limitation On Landlord’s Liability And Release |

28 | ||||

| 8.2 |

Tenant’s Indemnification Of Landlord |

28 | ||||

| ARTICLE 9 |

INSURANCE | 29 | ||||

| 9.1 |

Tenant’s Insurance |

29 | ||||

| 9.2 |

Landlord’s Insurance |

30 | ||||

| 9.3 |

Mutual Waiver Of Subrogation |

30 | ||||

| ARTICLE 10 |

DAMAGE TO LEASED PREMISES | 31 | ||||

| 10.1 |

Landlord’s Duty To Restore |

31 | ||||

| 10.2 |

Insurance Proceeds |

31 | ||||

| 10.3 |

Landlord’s Right To Terminate |

31 | ||||

| 10.4 |

Tenant’s Right To Terminate |

31 | ||||

| 10.5 |

Tenant’s Waiver |

32 | ||||

| 10.6 |

Abatement Of Rent |

32 | ||||

| ARTICLE 11 |

CONDEMNATION | 32 | ||||

| 11.1 |

Tenant’s Right To Terminate |

32 | ||||

| 11.2 |

Landlord’s Right To Terminate |

32 | ||||

| 11.3 |

Restoration |

32 | ||||

| 11.4 |

Temporary Taking |

32 | ||||

| 11.5 |

Division Of Condemnation Award |

33 | ||||

| 11.6 |

Abatement Of Rent |

33 | ||||

| 11.7 |

Taking Defined |

33 | ||||

| ARTICLE 12 |

DEFAULT AND REMEDIES | 33 | ||||

| 12.1 |

Events Of Tenant’s Default |

33 | ||||

| 12.2 |

Landlord’s Remedies |

34 | ||||

| 12.3 |

Landlord’s Default And Tenant’s Remedies |

36 | ||||

| 12.4 |

Limitation Of Tenant’s Recourse |

36 | ||||

| 12.5 |

Tenant’s Waiver |

36 | ||||

| ARTICLE 13 |

GENERAL PROVISIONS | 37 | ||||

| 13.1 |

Taxes On Tenant’s Property |

37 | ||||

| 13.2 |

Holding Over |

37 | ||||

| 13.3 |

Subordination To Mortgages |

37 | ||||

| 13.4 |

Tenant’s Attornment Upon Foreclosure |

38 | ||||

| 13.5 |

Mortgagee Protection |

38 | ||||

| 13.6 |

Estoppel Certificate |

38 | ||||

| 13.7 |

Tenant’s Financial Information |

38 | ||||

| 13.8 |

Transfer By Landlord |

39 | ||||

| 13.9 |

Force Majeure |

39 | ||||

| 13.10 |

Notices |

39 | ||||

| 13.11 |

Attorneys’ Fees and Costs |

40 | ||||

| 13.12 |

Definitions |

40 | ||||

| (a) Real Property Taxes |

40 | |||||

| (b) Landlord’s Insurance Costs |

41 | |||||

| (c) Property Maintenance Costs |

41 | |||||

| (d) Property Operating Expenses |

42 | |||||

| (e) Law |

42 | |||||

| (f) Lender |

42 | |||||

| (g) Rent |

42 | |||||

| (h) Restrictions |

42 | |||||

ii

| 13.13 |

General Waivers |

43 | ||||

| 13.14 |

Miscellaneous |

43 | ||||

| 13.15 |

Patriot Act Compliance |

43 | ||||

| 13.16 |

Calculation of Charges |

44 | ||||

| 13.17 |

DTPA Waiver |

44 | ||||

| 13.18 |

Waiver of Right to Protest |

44 | ||||

| 13.19 |

Waiver of Lien |

44 | ||||

| 13.20 |

Express Negligence/Fair Notice |

44 | ||||

| ARTICLE 14 |

LEGAL AUTHORITY BROKERS AND ENTIRE AGREEMENT | 45 | ||||

| 14.1 |

Legal Authority |

45 | ||||

| 14.2 |

Brokerage Commissions |

45 | ||||

| 14.3 |

Entire Agreement |

45 | ||||

| 14.4 |

Landlord’s Representations |

45 | ||||

| ARTICLE 15 |

OPTION TO EXTEND | 45 | ||||

| 15.1 |

Option to Extend |

45 | ||||

| 15.2 |

Fair Market Rent |

46 | ||||

| 15.3 |

Tenant’s Election |

46 | ||||

| 15.4 |

Rent Arbitration |

46 | ||||

| ARTICLE 16 |

TELECOMMUNICATIONS SERVICE | 47 | ||||

| ARTICLE 17 |

RIGHT TO TERMINATE | 48 | ||||

| 17.1 |

Right to Terminate |

48 | ||||

iii

LEASE

THIS LEASE, dated October 1, 2016 for reference purposes only, is made by and between NW AUSTIN OFFICE PARTNERS LLC, a Delaware limited liability company (“Landlord”), and MOLECULAR TEMPLATES, INC., a Delaware corporation (“Tenant”), to be effective and binding upon the parties as of the date the last of the designated signatories to this Lease shall have executed this Lease (the “Effective Date of this Lease”).

ARTICLE 1

REFERENCE

1.1 References. All references in this Lease (subject to any further clarifications contained in this Lease) to the following terms shall have the following meaning or refer to the respective address, person, date, time period, amount, percentage, calendar year or fiscal year as below set forth:

| Tenant’s Representative: | Xxxxx Xxx | |

| Phone Number: | (000) 000-0000 | |

| Landlord’s Representative: | Xxxxx Xxxxxxx/Xxxxxxx Xxxxxxxxx | |

| Phone Number: | (000) 000-0000 | |

| Lease Commencement Date:

Intended Term: |

June 1, 2017

Sixty (60) months | |

| Lease Expiration Date: | Sixty (60) months from the Lease Commencement Date (defined in Paragraph 2.3 below), plus any days required for the Lease Expiration Date to occur on the last day of a calendar month, unless earlier terminated by Landlord in accordance with the terms of this Lease, or extended by Tenant pursuant to Article 15. | |

| Option to Extend: | One (1) option to extend for a term of five (5) years. | |

| Prepaid Rent: | $35,881.61, consisting of one (1) month of Base Monthly Rent at the rate of $18.75 per rentable square foot and 12,000 rentable square feet (i.e., $18,750), plus one month’s estimated Additional Rent in the amount of $17,131.76. | |

| Tenant’s Security Deposit: | $145,689.44, subject to adjustment in accordance with Paragraph 3.7 hereof. | |

| Late Charge Amount: | Five Percent (5%) of the Delinquent Amount | |

| Tenant’s Required Liability Coverage: | $5,000,000 Combined Single Limit | |

| Tenant’s Broker: | Core Group | |

| Landlord’s Broker: | CBRE, Inc. | |

| Project: | That certain real property situated in the City of Austin, County of Xxxxxxxxxx, State of Texas, which real property is shown on the Site Plan attached hereto as Exhibit A (the “Site Plan”) and is commonly known as or otherwise described as follows: Xxxxx Xxxx Corporate Center located at 9301, 9400, 9401, 9500, and 0000 Xxxxxxxxx Xxxxxxxxx, and 13620, 13630 and 00000 Xxxxxxxxx Xxxxx, Xxxxxx, Xxxxx. Landlord may from time to time sell the Building and/or other parcels and one or more Other Buildings (as defined below) in the Project, and upon such sales, the “Project” shall exclude those parcels that are not under common ownership with the Building and Property, and the defined term “Other Buildings” shall exclude any such buildings which are not under common ownership with the Building and Property. | |

5

| Property: | That certain separate legal parcel of real property on which is situated the Building as delineated on the Site Plan, with a street address of 0000 Xxxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx. Landlord reserves the right to adjust the boundaries of the Property at any time, provided that any such adjustment shall not reduce the number of parking spaces within the Common Areas to which Tenant has the right to park as provided in this Lease, nor impair ingress or egress to or from the Property or the Leased Premises. | |

| Building: | That certain building on the Property in which the Leased Premises are located commonly known as Building J, with a street address of 0000 Xxxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx, containing approximately 50,572 rentable square feet, as such rentable square footage was determined by Landlord’s method of measurement (which has been explained to Tenant) and, for purposes of this Lease, agreed to contain said number of rentable square feet (the “Building”), which Building is shown outlined on Exhibit A hereto. | |

| Other Buildings: | Subject to adjustment upon sale as provided above, those certain buildings in the Project (but outside the Property) commonly known as Building A with a street address of 00000 Xxxxxxxxx Xxxxx, Xxxxxx, Xxxxx, Xxxxxxxx X with a street address of 00000 Xxxxxxxxx Xxxxx, Xxxxxx, Xxxxx, Building C with a street address of 00000 Xxxxxxxxx Xxxxx, Xxxxxx, Xxxxx, Building D with a street address of 0000 Xxxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx, Building E with a street address of 0000 Xxxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx, Building F with a street address of 0000 Xxxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx, Building H with a street address of 0000 Xxxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx, and Building I with a street address of 0000 Xxxxxxxxx Xxxxxxxxx, Xxxxxx, Xxxxx. | |

| Common Areas: | The “Common Areas” shall mean the areas within the Project which are located outside the Leased Premises, such as common lobbies, electrical closets, pedestrian walkways, parking areas, circulation roads and ways, parking structures and surface parking areas, landscaped areas, open areas, amenity areas and enclosed trash disposal areas which, at the time in question, are not for the exclusive use of a tenant of the Building or of the Other Buildings. Landlord reserves the right to make changes to the Common Areas as it deems reasonably necessary provided the same do not adversely affect ingress or egress to the Leased Premises or decrease the number of parking spaces serving or allocated to Building J. | |

6

| Parking: | With respect to the Leased Premises, Tenant shall be entitled to utilize four (4) unreserved and unassigned parking spaces for each 1,000 net rentable square feet of the Leased Premises, eight (8) spaces of which shall be near the Building and designated for Tenant’s exclusive use (as may change from time to time in accordance with the terms of this Lease or an amendment hereto), such spaces to be located in the parking area of the Common Areas. Parking is provided to Tenant by Landlord without additional charge for the entire Lease Term including any expansion and/or extension periods. | |

| Building Standard Hours: | The term “Building Standard Hours” means from 7:00 a.m. and 7:00 p.m. Monday through Friday and on Saturdays from 8:00 a.m. to noon, excluding Sundays and New Year’s Day, Presidents Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, Christmas and such other holidays as are generally recognized in the vicinity of the Project. | |

| HVAC: | Heating, ventilating, and/or air conditioning. | |

| Leased Premises: | The space located on the first (1st) floor of the Building and shown on the floor plan attached hereto as Exhibit B, plus the load factor associated therewith, consisting of approximately 18,512 rentable square feet, which rentable square footage has been determined utilizing Landlord’s method of measurement, which has been explained to Tenant, and, for purposes of this Lease, the Leased Premises is agreed to contain said number of rentable square feet. The Building, the Other Buildings, and the Leased Premises are not subject to re-measurement unless, pursuant to a written amendment to this Lease, space is subtracted therefrom or additional space is added thereto. Recognizing that both Landlord and Tenant have agreed to the foregoing rentable square footage number and have agreed that there will be no re-measurement except as expressly provided above, Landlord has given Tenant the opportunity to measure the Building, the Other Buildings, and the Leased Premises and has encouraged Tenant to do so, and Tenant hereby confirms that it has elected, in its sole discretion and without reliance on any representation by Landlord or its agents or any brokers, not to measure the Building, the Other Buildings, or the Leased Premises. | |

| ________________ Initials | ||

| Tenant’s Building Share: | The term “Tenant’s Building Share” shall mean the percentage obtained by dividing the rentable square footage of the Leased Premises at the time of calculation by the rentable square footage of the Building at the time of calculation. Such percentage is currently 36.61%. In the event that the rentable square footage of the Leased Premises or the Building is changed (by the physical addition or subtraction of space), Tenant’s Building Share shall be recalculated to equal the percentage described in the first sentence of this paragraph, so that the aggregate Tenant’s Building Share of all tenants of the Building shall equal 100%. Tenant’s Building Share is subject to adjustment as set forth in Paragraphs 13.12(b) and 13.12(c). | |

7

| Tenant’s Project Share: | The term “Tenant’s Project Share” shall mean the percentage obtained by dividing the rentable square footage of the Leased Premises at the time of calculation by the rentable square footage of the Building and the Other Buildings at the time of calculation; provided, however, with respect to any components of Additional Rent (as defined herein) that are determined based upon Tenant’s Project Share (as distinguished from Tenant’s Building Share) and that are applicable to the Building and only a portion of the Other Buildings, Tenant’s Project Share for such components of Additional Rent shall mean the percentage obtained by dividing the rentable square footage of the Leased Premises at the time of calculation by the rentable square footage of the Building and the applicable Other Building(s) at the time of calculation. In the event that any portion of the Project is sold by Landlord, or if new improvements are constructed on the Project, or the rentable square footage of the Leased Premises, the Building, or the Other Buildings is otherwise changed, Tenant’s Project Share shall be recalculated to equal the applicable percentage described in the first sentence of this paragraph, so that, in each case, the aggregate Tenant’s Project Share of all tenants and occupants (including Landlord or any management office) of the Project shall equal 100%. Tenant’s Project Share is subject to adjustment as set forth in Paragraphs 13.12(b) and 13.12(c). | |||||

| Standard Interest Rate: | The term “Standard Interest Rate” shall mean the greater of (a) 12%, or (b) the sum of that rate quoted by Xxxxx Fargo Bank, N.A., from time to time as its prime rate, plus two percent (2%), but in no event more than the maximum rate of interest not prohibited or made usurious. | |||||

| Default Interest Rate: | The term “Default Interest Rate” shall mean the Standard Interest Rate, plus five percent (5%), but in no event more than the maximum rate of interest not prohibited or made usurious. | |||||

| Base Monthly Rent: | The term “Base Monthly Rent” shall mean the following: | |||||

| Period |

Base Monthly Rent | |||||

| Months 1-12 | $18,750.00* | |||||

| Months 13-24 | $29,696.33 | |||||

| Months 25-36 | $30,467.67 | |||||

| Months 37-48 | $31,624.67 | |||||

| Months 49-60 | $32,396.00 | |||||

|

* Base Monthly Rent for months 1-12 is calculated as if the Leased Premises contained 12,000 rentable square feet. | ||||||

| Permitted Use: | General office, research and development, sales and distribution, and uses ancillary thereto, to the extent each such use is in compliance with all Laws and Restrictions. | |||||

| Exhibits: | The term “Exhibits” shall mean the Exhibits of this Lease which are described as follows: | |||||

| Exhibit A - Site Plan showing the Project and delineating the Property and the Building in which the Leased Premises are located. | ||||||

| Exhibit B – Floor Plan | ||||||

| Exhibit C – Work Letter | ||||||

8

| Exhibit D – Form of Letter of Credit | ||

| Exhibit E – Lump Sum Payment Amendment | ||

| Exhibit F – Form of Subordination, Nondisturbance and Attornment Agreement | ||

| Exhibit G – Form of Tenant Estoppel Certificate

Exhibit H – Approved Tenant Logo and Typeface

Exhibit I – Janitorial Specifications

Schedule 1 – Termination Payment Calculation | ||

ARTICLE 2

LEASED PREMISES, TERM AND POSSESSION

2.1 Demise Of Leased Premises. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord for Tenant’s own use in the conduct of Tenant’s business and not for purposes of speculating in real estate, for the Lease Term and upon the terms and subject to the conditions of this Lease, that certain interior space described in Article 1 as the Leased Premises, reserving and excepting to Landlord the right to fifty percent (50%) of all assignment consideration and excess rentals as provided in Article 7 below. Tenant’s lease of the Leased Premises, together with the appurtenant right to use the Common Areas as described in Paragraph 2.2 below, shall be conditioned upon and be subject to the continuing compliance by Tenant with (i) all the terms and conditions of this Lease, (ii) all Laws and Restrictions governing the use or occupancy of the Leased Premises, the Property, and the Project, (iii) all easements and other matters now of public record respecting the use of the Leased Premises, the Property, and the Project or entered into after the date hereof in accordance with this Lease, and (iv) all reasonable rules and regulations from time to time established by Landlord provided Tenant is given notice of the same and the same do not conflict with this Lease, increase the monetary obligations of Tenant hereunder, or decrease Tenant’s rights hereunder. Notwithstanding any provision of this Lease to the contrary, Landlord hereby reserves to itself and its designees all rights of access, use and occupancy of the Building roof, and Tenant shall have no right of access, use or occupancy of the Building roof except (if at all) to the extent required in order to enable Tenant to perform Tenant’s maintenance and repair obligations pursuant to this Lease.

2.2 Right To Use Common Areas. As an appurtenant right to Tenant’s right to the use and occupancy of the Leased Premises, Tenant shall have the right to use the Common Areas in conjunction with its use of the Leased Premises solely for the purposes for which they were designed and intended and for no other purposes whatsoever. Tenant’s right to so use the Common Areas shall be subject to the limitations on such use as set forth in Article 1 and shall terminate concurrently with any termination of this Lease.

2.3 Lease Commencement Date And Lease Term. The term of this Lease shall begin on the Lease Commencement Date . The Lease Term shall be that period of time commencing on the Lease Commencement Date and ending on the Lease Expiration Date (the “Lease Term”).

2.4 Delivery Of Possession. Landlord shall deliver to Tenant, and Tenant shall accept, possession of the Leased Premises in its AS IS condition, WITH ALL FAULTS on the Lease Commencement Date, other than as provided hereinafter.

Notwithstanding the foregoing to the contrary, to the extent any required repairs are the responsibility of Landlord hereunder, Landlord shall insure that the roof of the Building shall be in good order and condition and free of leaks on the Lease Commencement Date, and that the mechanical, plumbing and electrical systems which serve the Leased Premises and other portions of the Building, shall be in good working order and condition on the Lease Commencement Date; provided, however, Landlord will not be obligated, under any circumstances, to repair any damage caused by Tenant in its prior sublease of the Leased Premises.

9

2.5 Performance Of Tenant Improvement Work; Acceptance Of Possession

Tenant shall, pursuant to the Work Letter, perform the work and make the installations in the Leased Premises substantially as set forth in the Work Letter (such work and installations hereinafter referred to as the “Tenant Improvements”). Tenant may perform Tenant Improvements prior to the Lease Commencement Date so long as Tenant’s sublease from the current tenant in the Leased Premises is in effect. It is agreed that by accepting possession of the Leased Premises, Tenant formally accepts same and acknowledges that the Leased Premises are in the condition called for hereunder.

2.6 Surrender Of Possession. Immediately prior to the expiration or upon the sooner termination of this Lease, Tenant shall remove all of Tenant’s signs from the exterior of the Building and shall remove all of Tenant’s equipment (including telecommunications wiring and cabling, unless Landlord otherwise elects), trade fixtures, furniture, supplies, wall decorations and other personal property from within the Leased Premises, the Building and the Common Areas, and shall vacate and surrender the Leased Premises, the Building, the Common Areas, the Property, and the Project to Landlord in broom clean condition and as existed on the Lease Commencement Date (or as the Leased Premises may have been thereafter improved, subject to Tenant’s removal obligations set forth below), reasonable wear and tear excepted; provided however, that Tenant shall remove, prior to Lease expiration, any non-standard office improvements then-existing in the Leased Premises. Tenant shall repair all damage to the Leased Premises, the exterior of the Building and the Common Areas caused by Tenant’s removal of Tenant’s property and non-standard office improvements as required hereunder. If Landlord elects by written notice to Tenant not later than ten (10) days prior to the termination or expiration of the Term to require Tenant to surrender Tenant’s telecommunications wiring and cabling, then Tenant shall leave the same in good condition and repair and labeled and/or coded sufficiently so that Landlord can readily determine the origin, destination and function of the wires and cables. Tenant shall patch and refinish, to Landlord’s reasonable satisfaction, all penetrations made by Tenant or its employees to the floor, walls or ceiling of the Leased Premises, whether such penetrations were made with Landlord’s approval or not. Tenant shall repair all damage caused by Tenant (as opposed to wear and tear and natural deterioration) to the exterior surface of the Building and the paved surfaces of the Common Areas and, where necessary, replace or resurface same. Additionally, to the extent that Landlord notifies Tenant in writing that it desires to have certain improvements made by Tenant or at the request of Tenant removed at the expiration or sooner termination of the Lease (including, without limitation, the Tenant Improvements), Tenant shall, upon the expiration or sooner termination of the Lease, remove any such improvements constructed or installed by Landlord or Tenant and repair all damage caused by such removal. However, Tenant shall not be required to remove any improvements or alterations that are for first class general office use. If the Leased Premises, the Building, the Common Areas, the Property, and the Project are not surrendered to Landlord in the condition required by this paragraph at the expiration or sooner termination of this Lease, Landlord may, at Tenant’s expense, so remove Tenant’s signs, property and/or improvements not so removed and make such repairs and replacements not so made or hire, at Tenant’s expense, independent contractors to perform such work. Tenant shall be liable to Landlord for all costs incurred by Landlord in returning the Leased Premises, the Building and the Common Areas to the required condition, together with interest on all costs so incurred from the date paid by Landlord at the Default Interest Rate until paid. Tenant shall pay to Landlord the amount of all costs so incurred plus such interest thereon, within ten (10) days of Landlord’s billing Tenant for same. Notwithstanding the foregoing, Landlord may consent (in its sole and absolute discretion, which consent may be withheld for any reason or no reason) to accept a cash payment from Tenant in lieu of Tenant completing all or any portion of the work required pursuant to this paragraph, such consent to be in a written notice specifying the work from which Tenant shall be excused. Tenant shall indemnify Landlord against loss or liability resulting from delay by Tenant in surrendering the Leased Premises, including, without limitation, any claims made by any succeeding Tenant or any losses to Landlord with respect to lost opportunities to lease to succeeding tenants.

ARTICLE 3

RENT, LATE CHARGES AND SECURITY DEPOSITS

3.1 Base Monthly Rent

(a) Commencing on the Lease Commencement Date (as determined pursuant to Paragraph 2.3 above) and continuing throughout the Lease Term, Tenant shall pay to Landlord, without prior demand therefor, in advance on the first day of each calendar month, cash or other immediately available good funds in the amount set forth as Base Monthly Rent in Article 1. If for any reason the Lease Commencement Date occurs pursuant to the terms of this Lease on a day other than the first day of a calendar month, the period commencing on the Lease Commencement Date and ending on the last day of the calendar month in which the Lease Commencement Date occurs shall be an initial “Stub Period” which shall be added to the Lease Term, and Tenant shall pay all rent and other charges with respect to such Stub Period (on a prorated basis) on the Lease Commencement Date at the same rate applicable to the first full calendar month of this Lease.

10

Base Monthly Rent is payable at a reduced rate during the first twelve (12) full calendar months of the Lease Term, as if the Leased Premises contained only 12,000 rentable square feet (the “Base Rent Abatement Period”). Notwithstanding anything to the contrary contained in this Lease, Landlord shall have the option (the “Lump Sum Payment Option”) to require Tenant to pay Base Monthly Rent for so much of the Base Rent Abatement Period as remains following Landlord’s notice as hereinafter provided at the rate of $28,925.00 per month, beginning on the date (the “Base Monthly Rent Start Date”) set forth in the Lump Sum Payment Option Notice (defined below), which shall in no event be a date prior to payment to Tenant of the Abated Rent Lump Sum Payment. To exercise the Lump Sum Payment Option, Landlord must (i) provide written notice to Tenant of such exercise (the “Lump Sum Payment Option Notice”) and (ii) pay to Tenant the Base Monthly Rent that would be payable for the remaining Base Rent Abatement Period at the rate of $28,925.00 per month (the “Abated Rent Lump Sum Payment”). If Landlord elects its Lump Sum Payment Option, the Abated Rent Lump Sum Payment shall be made, at Landlord’s election (a) within thirty (30) days of Tenant’s receipt of the Lump Sum Payment Option Notice, or (b) on the closing date of any financing or sale of the Building by Landlord (the date of such payment is hereinafter referred to as the “Lump Sum Payment Date”), but, in either event, not later than the Base Monthly Rent Start Date. If Landlord fails to pay the Abated Rent Lump Sum Payment by the Lump Sum Payment Date or the financing or sale transaction for the Building, if applicable, expires or is terminated or deemed null and void for any reason, Landlord’s exercise of the Lump Sum Payment Option shall be deemed null and void and of no further force or effect and the Abated Rent Lump Sum Payment, if theretofore paid by Landlord to Tenant, shall promptly be returned by Tenant to Landlord. If Landlord’s Lump Sum Payment Notice is effective on a day other than the first day of a calendar month and Landlord has then paid the Abated Rent Lump Sum Payment, then Tenant shall pay any Base Monthly Rent payable hereunder for the period from the Base Monthly Rent Start Date through the last day of such calendar month (less any amounts paid previously paid by Tenant on account of such period), with the next installment of Base Monthly Rent due for the calendar month following the month in which such Lump Sum Payment Notice is effective.

(b) If Landlord exercises its Lump Sum Payment Option in accordance with the above paragraph, Landlord shall prepare an amendment in the form of Exhibit E attached hereto and made a part hereof (the “Lump Sum Payment Amendment”) that documents the effect of Landlord’s exercise of the Lump Sum Payment Option and sets forth a revised rent schedule reflecting Tenant’s payment of the Base Monthly Rent for the remaining Base Rent Abatement Period following the Lump Sum Payment Option Notice. A copy of the Lump Sum Payment Amendment shall be sent to Tenant and Tenant shall execute and return the Lump Sum Payment Amendment to Landlord within ten (10) business days thereafter, but Landlord’s otherwise valid exercise of the Lump Sum Payment Option shall be fully effective whether or not the Lump Sum Payment Amendment is executed.

3.2 Additional Rent

Commencing on the Lease Commencement Date (as determined pursuant to Paragraph 2.3 above) and continuing throughout the Lease Term, in addition to the Base Monthly Rent and to the extent not required by Landlord to be contracted for and paid directly by Tenant, Tenant shall pay to Landlord as additional rent (the “Additional Rent”), cash or other immediately available good funds in the following amounts:

(a) An amount equal to all Property Operating Expenses (as defined in Article 13) incurred or to be incurred by Landlord during the Term. Payment shall be made by whichever of the following methods (or combination of methods) is (are) from time to time designated by Landlord:

(i) Landlord may xxxx to Tenant, on a periodic basis not more frequently than monthly, the amount of such expenses (or group of expenses) as paid or incurred by Landlord during the Term, together with the underlying xxxx or invoice for which Landlord seeks reimbursement or payment and evidence of payment thereof, and Tenant shall pay to Landlord the amount of such expenses within fifteen (15) days after receipt of a written xxxx (and evidence of the cost incurred) therefor from Landlord, and/or

(ii) Landlord may deliver to Tenant Landlord’s reasonable estimate of any given expense (such as Landlord’s Insurance Costs or Real Property Taxes), or group of expenses, which it anticipates will be paid or incurred for the ensuing calendar or fiscal year, as Landlord may reasonably determine in accordance with Article 13, and Tenant shall pay to Landlord an amount equal to the estimated amount of such expenses for such year in equal monthly installments during such year with the installments of Base Monthly Rent. Landlord reserves the right to revise such estimate from time to time.Landlord reserves the right to change from time to time the methods of billing Tenant for any given expense or group of expenses or the periodic basis on which such expenses are billed.

11

(b) Landlord’s share of the consideration received by Tenant upon certain assignments and sublettings as required by Article 7.

(c) Any legal fees and costs that Tenant is obligated to pay or reimburse to Landlord pursuant to Article 13; and

(d) Any other charges or reimbursements due Landlord from Tenant pursuant to the terms of this Lease.

Notwithstanding the foregoing, Landlord may elect by written notice to Tenant to have Tenant pay Real Property Taxes or any portion thereof directly to the applicable taxing authority, in which case Tenant shall make such payments and deliver satisfactory evidence of payment to Landlord no later than ten (10) days before such Real Property Taxes become delinquent. In the event Tenant is responsible to pay taxes directly, Landlord shall have no obligation to make such payments, whether or not Landlord receives evidence of payment from Tenant, and Tenant shall in all cases be responsible for any fines, penalties, interest and damages for late payment.

3.3 Year-End Adjustments. If Landlord shall have elected to xxxx Tenant for the Property Operating Expenses (or any group of such expenses) on an estimated basis in accordance with the provisions of Paragraph 3.2(a)(ii) above, Landlord shall furnish to Tenant within four months following the end of the applicable calendar or fiscal year, as the case may be, a statement setting forth (i) the amount of such expenses paid or incurred during the just ended calendar or fiscal year, as appropriate, and (ii) the amount that Tenant has paid to Landlord for credit against such expenses for such period. If Tenant shall have paid more than its obligation for such expenses for the stated period, Landlord shall, at its election, either (i) credit the amount of such overpayment toward the next ensuing payment or payments of Base Rent and/or Additional Rent that would otherwise be due or (ii) refund in cash to Tenant the amount of such overpayment within fifteen (15) days of delivery of such statement. If such year-end statement shall show that Tenant did not pay its obligation for such expenses in full, then Tenant shall pay to Landlord the amount of such underpayment within sixty (60) days from Landlord’s billing of same to Tenant. Tenant may, at Tenant’s sole cost and expense, cause an audit of Landlord’s books and records to determine the accuracy of Landlord’s xxxxxxxx for Property Operating Expenses under this Lease, provided Tenant completes (and delivers to Landlord the written results of) such audit within thirty (30) days after Tenant’s receipt of the year-end statement described above setting forth the annual reconciliation of the Property Operating Expenses, and provided further that the person or entity performing such audit is not compensated on any type of contingent basis. If such audit reveals that the actual Property Operating Expenses for any given year were less than the amount that Tenant paid for Property Operating Expenses for any such year, then unless Landlord contests such audit results as provided below, Landlord shall credit the excess to Tenant’s next payment of Additional Rent. If such audit reveals that the actual Property Operating Expenses for any given year were more than the amount that Tenant paid for Property Operating Expenses for any such year, Tenant shall pay such amount to Landlord within thirty (30) days after completion of the audit. Landlord shall have the right to contest the results of Tenant’s audit and thereafter promptly have an audit performed (“Landlord’s Audit”) by a certified public accounting firm selected by Landlord and acceptable to Tenant in Tenant’s reasonable discretion. In such case, the results of Landlord’s audit shall be binding and conclusive on Landlord and Tenant, and any resulting overpayment or underpayment shall be handled as provided above. Tenant shall pay the cost of Landlord’s Audit unless Landlord’s Audit confirms an overpayment by Tenant, in which case Landlord shall pay the cost of Landlord’s Audit. The provisions of this Paragraph shall survive the expiration or sooner termination of this Lease.

3.4 Late Charge, And Interest On Rent In Default. Tenant acknowledges that the late payment by Tenant of any monthly installment of Base Monthly Rent or any Additional Rent will cause Landlord to incur certain costs and expenses not contemplated under this Lease, the exact amounts of which are extremely difficult or impractical to fix. Such costs and expenses will include without limitation, administration and collection costs and processing and accounting expenses. Therefore, if any installment of Base Monthly Rent is not received by Landlord from Tenant within five (5) business days after the same becomes due, Tenant shall immediately pay to Landlord a late charge in an amount equal to the amount set forth in Article 1 as the “Late Charge Amount,” and if any Additional Rent is not received by Landlord when the same becomes due, Tenant shall immediately pay to Landlord a late charge in an amount equal to 4% of the Additional Rent not so paid. Landlord and Tenant agree that this late charge represents a reasonable estimate of such costs and expenses and is fair compensation to Landlord for the anticipated loss Landlord would suffer by reason of Tenant’s failure to make timely payment. In no event shall this provision for a late charge be

12

deemed to grant to Tenant a grace period or extension of time within which to pay any rental installment or prevent Landlord from exercising any right or remedy available to Landlord upon Tenant’s failure to pay each rental installment due under this Lease when due, including the right to terminate this Lease. If any rent remains delinquent for a period in excess of five (5) business days, then, in addition to such late charge, Tenant shall pay to Landlord interest on any rent that is not so paid from said fifth (5th) day at the Default Interest Rate until paid.

3.5 Payment Of Rent. Except as specifically provided otherwise in this Lease, all rent shall be paid in lawful money of the United States, without any abatement, reduction or offset for any reason whatsoever, to Landlord at such address as Landlord may designate from time to time. Tenant’s obligation to pay Base Monthly Rent and all Additional Rent shall be appropriately prorated at the commencement and expiration of the Lease Term. The failure by Tenant to pay any Additional Rent as required pursuant to this Lease when due shall be treated the same as a failure by Tenant to pay Base Monthly Rent when due, and Landlord shall have the same rights and remedies against Tenant as Landlord would have had Tenant failed to pay the Base Monthly Rent when due.

3.6 Prepaid Rent. Tenant shall, upon execution of this Lease, pay to Landlord the amount set forth in Article 1 as Prepaid Rent, as prepayment of rent for credit against the first installment of Base Monthly Rent and Additional Rent due hereunder.

3.7 Security Deposit. Tenant shall deposit concurrently with Tenant’s execution of this Lease, with Landlord the amount set forth in Article 1 as the Security Deposit as security for the performance by Tenant of the terms of this Lease to be performed by Tenant, and not as prepayment of rent. Tenant hereby grants to Landlord a security interest in the Security Deposit, including but not limited to replenishments thereof. Landlord may apply such portion or portions of the Security Deposit as are reasonably necessary for the following purposes: (i) to remedy any default beyond applicable periods of notice and grace by Tenant in the payment of Base Monthly Rent or Additional Rent or a late charge or interest on defaulted rent, or any other monetary payment obligation of Tenant under this Lease; (ii) to repair damage to the Leased Premises, the Building or the Common Areas caused or permitted to occur by Tenant and not repaired or restored by Tenant within the applicable notice and grace period; (iii) to clean and restore and repair the Leased Premises, the Building or the Common Areas following their surrender to Landlord if not surrendered in the condition required pursuant to the provisions of Article 2, (iv) to remedy any other default of Tenant beyond applicable notice and grace periods including, without limitation, paying in full on Tenant’s behalf any sums claimed by materialmen or contractors of Tenant to be owing to them by Tenant for work done or improvements made at Tenant’s request to the Leased Premises, and (v) to cover any other reasonable out of pocket expense, loss or damage which Landlord may at any time suffer due to Tenant’s default of its obligations under this Lease beyond applicable periods of notice and grace. In this regard, Tenant hereby waives any restriction on the uses to which the Security Deposit may be applied as contained in any Laws. In the event the Security Deposit or any portion thereof is so used, Tenant shall pay to Landlord, promptly upon demand, an amount in cash sufficient to restore the Security Deposit to the full original sum. Landlord shall not be deemed a trustee of the Security Deposit. Landlord may use the Security Deposit in Landlord’s ordinary business and shall not be required to segregate it from Landlord’s general accounts. Tenant shall not be entitled to any interest on the Security Deposit. If Landlord transfers the Building, the Property, or the Project during the Lease Term, Landlord shall pay or transfer the Security Deposit to any subsequent owner in conformity with Laws, in which event the transferring landlord shall be released from all liability for the return of the Security Deposit. Tenant specifically grants to Landlord (and Tenant hereby waives the provisions of Texas Property Code Sections 93.005-93.011 to the contrary) a period of sixty (60) days following a surrender of the Leased Premises by Tenant to Landlord within which to inspect the Leased Premises, make required restorations and repairs, receive and verify workmen’s xxxxxxxx therefor, cure any other defaults, deduct any damages, and prepare a final accounting with respect to the Security Deposit. In no event shall the Security Deposit or any portion thereof, be considered prepaid rent.

Notwithstanding the foregoing, Tenant may deliver to Landlord a clean, unconditional, irrevocable, transferable, fully cash-collateralized letter of credit in lieu of cash for the Security Deposit (the “Letter of Credit”) in form and issued by a financial institution (“Issuer”) reasonably satisfactory to Landlord in its sole discretion, substantially in the form attached as Exhibit D. Landlord hereby approves Silicon Valley Bank as Issuer. Tenant hereby waives any right to protest the Issuer’s honoring of the Letter of Credit. The Letter of Credit shall permit partial draws, and provide that draws thereunder will be honored upon presentation by Landlord. The Letter of Credit shall have an expiration period of one (1) year but shall automatically renew by its terms unless affirmatively cancelled by either Issuer or Tenant, in which

13

case Issuer must provide Landlord 30 days’ prior written notice of such expiration or cancellation. The Letter of Credit shall remain in effect until sixty (60) days after the Lease Expiration Date. Any amount drawn under the Letter of Credit and not utilized by Landlord for the purposes permitted by this Lease shall be held in accordance with subparagraph (a) of this Paragraph 3.7. If the Tenant fails to renew or replace the Letter of Credit as required under this Lease at least thirty (30) days before its stated expiration date, Landlord may draw upon the entire amount of the Letter of Credit and hold the same as a cash Security Deposit and/or apply the same in accordance with this Lease. No fees applicable to the Letter of Credit shall be charged to Landlord.

Notwithstanding anything to the contrary contained herein and subject to the terms of this Section, (a) provided this Lease is in full force and effect, and (b) Tenant is not in default beyond applicable periods of notice and grace, (i) Tenant shall have the right to reduce the Letter of Credit or cash Security Deposit to the sum of $48,563.15 upon Tenant’s delivery to Landlord of reasonably satisfactory evidence of Tenant raising $10,000,000 or more in the aggregate in additional funding following the Effective Date from whatever sources (whether via equity or debt, including without limitation convertible or mezzanine debt but excluding any grant funding from Cancer Prevention and Research Initiative of Texas (“CPRIT”)). If Tenant is entitled to the reduction, then Landlord shall either accept an amended Letter of Credit to reflect the reduced amount, or simultaneously return the Letter of Credit to Tenant upon receipt of a replacement Letter of Credit in the reduced amount or promptly return to Tenant the remaining balance of the cash Security Deposit. For avoidance of doubt, Tenant’s receipt of funding satisfying the Security Deposit/Letter of Credit reduction requirements of this Paragraph will result in the expiration of Tenant’s termination right under Article 17 hereof.

ARTICLE 4

USE OF LEASED PREMISES AND COMMON AREA

4.1 Permitted Use. Tenant shall be entitled to use the Leased Premises solely for the Permitted Use as set forth in Article 1 and for no other purpose whatsoever. Tenant shall have the right to use the Common Areas in conjunction with its Permitted Use of the Leased Premises solely for the purposes for which they were designed and intended and for no other purposes whatsoever.

4.2 General Limitations On Use. Tenant shall not do or permit anything to be done in or about the Leased Premises, the Building, the Common Areas, the Property, or the Project which does or could (i) jeopardize the structural integrity of the Building or (ii) cause damage to any part of the Leased Premises, the Building, the Common Areas, the Property, or the Project. Tenant shall not operate any equipment within the Leased Premises which does or could (A) injure, vibrate or shake the Leased Premises or the Building, (B) damage, overload or impair the operation of any electrical, plumbing, and HVAC systems within or servicing the Leased Premises or the Building, or (C) damage or impair the operation of the sprinkler system (if any) within or servicing the Leased Premises or the Building. Tenant shall not install any equipment or antennas on or make any penetrations of the exterior walls or roof of the Building without Landlord’s prior written consent. Tenant shall not affix any equipment to or make any penetrations or cuts in the floor, ceiling, walls or roof of the Leased Premises without Landlord’s prior written consent, except that no consent shall be required with respect to equipment installations or penetrations of the floor or walls within the Leased Premises for purposes of installing typical office equipment and furniture. Tenant shall not place any loads upon the floors, walls, ceiling or roof systems which could endanger the structural integrity of the Building or damage its floors, foundations or supporting structural components. Tenant shall not place any explosive, flammable or harmful fluids or other waste materials in the drainage systems of the Leased Premises, the Building, the Common Areas, the Property, or the Project. Tenant shall not drain or discharge any fluids in the landscaped areas or across the paved areas of the Property or the Project. Tenant shall not use any of the Common Areas for the storage of its materials, supplies, inventory or equipment and all such materials, supplies, inventory or equipment shall at all times be stored within the Leased Premises but Tenant may use the Common Areas, including the parking area, as temporary (but not overnight) storage during unloading of materials in connection with Tenant Improvements. Tenant shall not commit nor permit to be committed by any of its employees, agents, invitees, guests, permittees, assignees, sublessees, or contractors (the “Tenant Parties”), any waste in or about the Leased Premises, the Building, the Common Areas, the Property, or the Project.

4.3 Noise And Emissions. All noise generated by Tenant in its use of the Leased Premises shall be confined or muffled so that it does not unreasonably interfere with the businesses of or unreasonably annoy the occupants and/or users of space in the Building or Other Buildings. All dust, fumes, odors and other emissions generated by Tenant’s use of the Leased Premises shall be sufficiently dissipated in accordance with sound

14

environmental practice and exhausted from the Leased Premises in such a manner so as not to unreasonably interfere with the businesses of or unreasonably annoy the occupants and/or users of adjacent properties, or cause any damage to the Leased Premises, the Building, the Common Areas, the Property, or the Project or any component part thereof or the property of adjacent property owners.

4.4 Trash Disposal. Landlord shall provide trash bins or other adequate garbage disposal facilities within the trash enclosure areas provided or permitted by Landlord outside the Leased Premises sufficient for the interim disposal of all of its trash, garbage and waste. All such trash, garbage and waste temporarily stored in such areas by Tenant or any of the Tenant Parties shall be stored in such a manner so that it is not visible from outside of such areas. Landlord shall cause such trash, garbage and waste to be regularly removed from the trash bins/garbage disposal facilities and the Property. Subject to the foregoing removal obligation of Landlord, Tenant shall keep the interior of the Leased Premises in a clean, safe and neat condition and shall keep the Common Areas free and clear of all of Tenant’s trash, garbage, waste and/or boxes, pallets and containers containing same at all times.

4.5 Parking

Tenant shall not, at any time, park or permit to be parked any recreational vehicles, inoperative vehicles or equipment in the Common Areas or on any portion of the Project. Tenant agrees to assume responsibility for compliance by its employees and invitees with the parking provisions contained herein. If Tenant or its employees park any vehicle within the Property or the Project in violation of these provisions, then Landlord may, upon prior written notice to Tenant giving Tenant one (1) day (or any applicable statutory notice period, if longer than one (1) day) to remove such vehicle(s), in addition to any other remedies Landlord may have under this Lease, charge Tenant, as Additional Rent, and Tenant agrees to pay, as Additional Rent, One Hundred Dollars ($100) per day for each day or partial day that each such vehicle is so parked within the Property. Tenant agrees to assume responsibility for compliance by the Tenant Parties with the parking provisions contained herein. Landlord reserves the right to grant easements and access rights to others for use of the parking areas on the Property, provided that such grants do not reduce the number of parking spaces allocated to Tenant in Article 1.

4.6 Signs. Except as provided in the following paragraph, Tenant shall not place or install on or within any portion of the Leased Premises, the exterior of the Building, the Common Areas, the Property or the Project any sign, advertisement, banner, placard, or picture which is visible from the exterior of the Leased Premises, the Building, the Property or the Project. Except as provided in the following paragraph, Tenant shall not place or install on or within any portion of the Leased Premises, the exterior of the Building, the Common Areas, the Property or the Project any business identification sign which is visible from the exterior of the Leased Premises, the Building, the Property or the Project until Landlord shall have approved in writing and in its sole and reasonable discretion the location, size, content, design, method of attachment and material to be used in the making of such sign. Any sign, once approved by Landlord, shall be installed at Tenant’s sole cost and expense and only in strict compliance with Landlord’s approval and any applicable Laws and Restrictions, using a person approved by Landlord to install same. Landlord may remove any signs (which have not been approved in writing by Landlord), advertisements, banners, placards or pictures so placed by Tenant on or within the Leased Premises, the exterior of the Building, the Common Areas, the Property or the Project and charge to Tenant the cost of such removal, together with any costs incurred by Landlord to repair any damage caused thereby, including any cost incurred to restore the surface (upon which such sign was so affixed) to its original condition.

Subject to the terms of this Paragraph 4.6 and applicable Laws and Restrictions, (i) Landlord shall at Tenant’s expense provide non-exclusive Building-standard suite identification signage for Tenant at the entrance to the Leased Premises, (ii) Landlord shall at Tenant’s expense place Tenant’s name (Molecular Templates) on one (1) line of the existing Building monument sign, and (iii) Tenant will be permitted to install a single Building exterior sign above the entrance to the Leased Premises identifying Tenant at Tenant’s sole cost (subject to reimbursement from the Tenant Improvement Allowance, as defined in the Work Letter) in a location at the exterior entrance to the Leased Premises reasonably approved by Landlord (collectively, “Tenant’s Pre-Approved Signage”).1 Tenant’s logo and type face presently used in Tenant’s promotional materials and letterhead are hereby deemed approved by Landlord as shown on Exhibit H. Tenant’s Pre-Approved Signage (including, without limitation, the size, design, location, colors and material thereof) shall not be installed without Tenant having first obtained the written approval of Landlord (which shall not be unreasonably withheld or delayed) and any approval required by the local government. Tenant’s Pre-Approved Signage shall be subject to each of the following conditions:

| 1 | Tenant, please send proposed dimensions and specs for signs. |

15

(i) Tenant’s Pre-Approved Signage shall be designed, maintained and installed in accordance with all applicable laws, rules and regulations. The design and location of Tenant’s Pre-Approved Signage shall be consistent with applicable Laws and Restrictions.

(ii) Tenant may not change Tenant’s Pre-Approved Signage without the prior written consent of Landlord which consent may not be unreasonably withheld or delayed.

(iii) All approvals and permits required to be obtained for the installation and maintenance of Tenant’s Pre-Approved Signage shall be obtained and maintained at Tenant’s sole cost and expense.

(iv) Tenant’s Pre-Approved Signage will be constructed, installed and maintained at Tenant’s sole cost and expense.

(v) Tenant shall install, operate, insure, maintain, repair and replace Tenant’s Pre-Approved Signage (and the lighting therefor, if any) at Tenant’s sole cost and expense subject to applicable code and such reasonable rules and regulations as Landlord may require, including, without limitation, the Building’s construction rules and regulations.

Tenant must remove Tenant’s Pre-Approved Signage described in clause (iii) above at Tenant’s sole cost and expense upon the earliest to occur of (x) any termination of this Lease or (y) the expiration of the Term. Upon such removal by Tenant, Tenant shall fully repair and restore the area where Tenant’s Pre-Approved Signage was installed and located, including, without limitation, the restoration and replacement of any Building surfaces. If Tenant does not remove such Tenant’s Pre-Approved Signage as and when required under the terms of the Lease, Landlord may remove it and perform such restoration, repair and replacement, and Tenant shall reimburse Landlord for Landlord’s costs and expenses of such removal, restoration and replacement within thirty (30) days of demand. Tenant shall have no obligation to remove Tenant’s Pre-Approved Signage of the nature described in clauses (i) and (ii) above.

The Building exterior and monument signage rights provided in this Paragraph 4.6 hereof are personal to the original Tenant named herein (Molecular Templates) and any assignee pursuant to the second sentence of Paragraph 7.2(b) hereof.

Notwithstanding the signage rights granted to Tenant pursuant to this Paragraph 4.6, Landlord reserves and retains the right to place Landlord’s name and/or ownership affiliation in or on the Building, the Property, or the Project, or on any of the signs located thereon, as determined in Landlord’s reasonable discretion other than signs identifying Tenant.

4.7 Compliance With Laws And Restrictions. Tenant shall abide by and shall promptly observe and comply with, at its sole cost and expense, all Laws and Restrictions respecting the use and occupancy of the Leased Premises, the Building, the Common Areas, the Property, or the Project including, without limitation, building codes, the Americans with Disabilities Act and the rules and regulations promulgated thereunder, and all Laws governing the use and/or disposal of hazardous materials, and shall defend with competent counsel, indemnify and hold Landlord harmless from any claims, damages or liability resulting from Tenant’s failure to so abide, observe, or comply. Tenant’s obligations hereunder shall survive the expiration or sooner termination of this Lease for so long as Tenant remains in possession or occupancy of the Leased Premises. In no event shall Tenant be obligated to comply with any Law if compliance is triggered because of construction of any improvements at the Project after the date hereof by or on behalf of Landlord, unless completed for Tenant’s benefit. In no event shall Tenant be required to make any improvement or installation to the any portion of the Project other than the Leased Premises in order to comply with any Law or Restriction, unless the need for such improvement or installation is triggered by Tenant’s alterations or improvements, or Tenant’s particular use (as distinguished from office use generally).

4.8 Compliance With Insurance Requirements. With respect to any insurance policies required or permitted to be carried by Landlord in accordance with the provisions of this Lease, Tenant shall not conduct nor knowingly permit any other person to conduct any activities nor keep, store or use (or allow any other person to keep, store or use) any item or thing within the Leased Premises, the Building, the Common Areas, the Property, or the Project which (i) is prohibited under the terms of any such policies, (ii) could result in the termination of the coverage afforded under any of such policies, (iii) could give to the insurance carrier the right to cancel any of such policies, or (iv) could cause an increase in the rates (over standard rates) charged for the coverage afforded under any of such policies. Tenant shall comply with all requirements of any insurance company, insurance underwriter, or Board of Fire Underwriters which are necessary to maintain, at standard rates, the insurance coverages carried by either Landlord or Tenant pursuant to this Lease.

16

4.9 Landlord’s Right To Enter. Landlord and its agents shall have the right to enter the Leased Premises during normal business hours after giving Tenant reasonable prior notice and subject to Tenant’s reasonable security measures for the purpose of (i) inspecting the same; (ii) showing the Leased Premises to prospective purchasers, or mortgagees or (and within the last twelve (12) months of the term, prospective tenants); (iii) making necessary alterations, additions or repairs; and (iv) performing any of Tenant’s obligations when Tenant has failed to do so. Landlord shall have the right to enter the Leased Premises during normal business hours (or as otherwise agreed), subject to Tenant’s reasonable security measures, for purposes of supplying any maintenance or services agreed to be supplied by Landlord. Landlord shall also have the right, upon reasonable advance notice to Tenant, to access the Building’s vertical risers and the interstitial space above Tenant’s acoustical ceiling to connect new utility and communications lines from other floors to the base Building utility lines. Landlord shall have the right to enter the Common Areas during normal business hours for purposes of (i) inspecting the exterior of the Building and the Common Areas; (ii) posting notices of nonresponsibility (and for such purposes Tenant shall provide Landlord at least ten (10) days’ prior written notice of any work to be performed on the Leased Premises); and (iii) supplying any services to be provided by Landlord. In no event may the exercise by Landlord of its right of access to the Common Areas unreasonably and materially interfere with Tenant’s ingress and egress from the Leased Premises and use of the parking area in the location identified in Article 1. Any entry into the Leased Premises or the Common Areas obtained by Landlord in accordance with this paragraph shall not under any circumstances be construed or deemed to be a forcible or unlawful entry into, or a detainer of, the Leased Premises, or an eviction, actual or constructive of Tenant from the Leased Premises or any portion thereof provided, in each instance, Landlord takes all commercially reasonable steps to minimize any inconvenience to Tenant and the duration of such access to the Leased Premises.

4.10 Use Of Common Areas

Throughout the term, Tenant may use the Common Areas in common with other tenants and occupants of the Project. Tenant, in its use of the Common Areas, shall at all times keep the Common Areas in a safe condition free and clear of all materials, equipment, debris, trash (except within existing enclosed trash areas), inoperable vehicles, and other items which are not specifically permitted by Landlord to be stored or located thereon by Tenant. If, in the opinion of Landlord, unauthorized persons are using any of the Common Areas by reason of, or under claim of, the express or implied authority or consent of Tenant, then Tenant, upon demand of Landlord, shall restrain, to the fullest extent then allowed by Law, such unauthorized use, and shall initiate such appropriate proceedings as may be required to so restrain such use. Landlord reserves the right to grant easements and access rights to others for use of the Common Areas and shall not be liable to Tenant for any diminution in Tenant’s right to use the Common Areas as a result thereof, so long as Tenant’s parking and access to the Leased Premises are not adversely affected thereby.

4.11 Environmental Protection. Tenant’s obligations under this Paragraph 4.11 shall survive the expiration or termination of this Lease.