Industrial Lease Moffett Park I & II Sunnyvale, California AMB PROPERTY, L.P., a Delaware limited partnership, as Landlord, and InvenSense, Inc., a Delaware corporation, as Tenant

Exhibit 10.13

Xxxxxxx Park I & II

Sunnyvale, California

AMB PROPERTY, L.P., a Delaware limited partnership,

as Landlord,

and

InvenSense, Inc., a Delaware corporation,

as Tenant

Table of Contents

| Section | Page | |||||

| 1. Basic Provisions | 1 | |||||

| 1.1 | Parties | 1 | ||||

| 1.2 | Premises | 1 | ||||

| 1.3 | Term | 1 | ||||

| 1.4 | Base Rent | 1 | ||||

| 1.5 | Tenant’s Share of Operating Expenses | 1 | ||||

| 1.6 | Tenant’s Estimated Monthly Rent Payment | 1 | ||||

| 1.7 | Security Deposit | 1 | ||||

| 1.8 | Permitted Use | 1 | ||||

| 1.9 | Guarantor | 1 | ||||

| 1.10 | Addenda | 1 | ||||

| 1.11 | Exhibits | 1 | ||||

| 1.12 | Address for Rent Payments | 2 | ||||

| 1.13 | Brokers | 2 | ||||

| 2. Premises and Common Areas |

2 | |||||

| 2.1 | Letting | 2 | ||||

| 2.2 | Common Areas - Definition | 2 | ||||

| 2.3 | Common Areas - Tenant’s Rights | 2 | ||||

| 2.4 | Common Areas - Rules and Regulations | 2 | ||||

| 2.5 | Common Area Changes | 2 | ||||

| 2.6 | Parking | 2 | ||||

| 2.7 | Furniture | 3 | ||||

| 3. Term |

3 | |||||

| 3.1 | Term | 3 | ||||

| 3.2 | Delay in Possession | 3 | ||||

| 3.3 | Commencement Date Certificate | 3 | ||||

| 3.4 | Landlord’s Right To Advance Expiration Date | 3 | ||||

| 4. Rent |

3 | |||||

| 4.1 | Base Rent | 3 | ||||

| 4.2 | Operating Expenses | 3 | ||||

| 5. Security Deposit |

5 | |||||

| 6. Use |

5 | |||||

| 6.1 | Permitted Use | 5 | ||||

| 6.2 | Hazardous Substances | 5 | ||||

| 6.3 | Tenant’s Compliance with Requirements | 6 | ||||

| 6.4 | Inspection; Compliance with Law | 6 | ||||

| 6.5 | Tenant Move-in Questionnaire | 6 | ||||

| 7. Maintenance, Repairs, Trade Fixtures and Alterations |

6 | |||||

| 7.1 | Tenant’s Obligations | 6 | ||||

| 7.2 | Landlord’s Obligations | 7 | ||||

| 7.3 | Alterations | 7 | ||||

| 7.4 | Surrender/Restoration | 7 | ||||

| 8. Insurance; Indemnity |

8 | |||||

| 8.1 | Payment of Premiums | 8 | ||||

| 8.2 | Tenant’s Insurance | 8 | ||||

| 8.3 | Landlord’s Insurance | 8 | ||||

| 8.4 | Waiver of Subrogation | 8 | ||||

| 8.5 | Indemnity | 8 | ||||

| 8.6 | Exemption of Landlord from Liability | 9 | ||||

| 9. Damage or Destruction |

9 | |||||

| 9.1 | Termination Right | 9 | ||||

| 9.2 | Damage Caused by Tenant | 9 | ||||

| 10. Real Property Taxes |

9 | |||||

| 10.1 | Payment of Real Property Taxes | 9 | ||||

| 10.2 | Real Property Tax Definition | 9 | ||||

| 10.3 | Additional Improvements | 9 | ||||

| 10.4 | Joint Assessment | 10 | ||||

| 10.5 | Tenant’s Property Taxes | 10 | ||||

| 11. Utilities |

10 | |||||

| 12. Assignment and Subleasing |

10 | |||||

| 12. Assignment and Subleasing |

10 | |||||

| 12.1 | Prohibition | 10 | ||||

| 12.2 | Request for Consent | 10 | ||||

i

| 12.3 | Criteria for Consent | 10 | ||||

| 12.4 | Effectiveness of Transfer and Continuing Obligations | 11 | ||||

| 12.5 | Recapture | 11 | ||||

| 12.6 | Transfer Premium | 11 | ||||

| 12.7 | Waiver | 11 | ||||

| 12. Assignment and Subletting |

11 | |||||

| 12.8 | Special Transfer Prohibitions | 11 | ||||

| 12.9 | Permitted Transfers | 12 | ||||

| 13. Default; Remedies |

12 | |||||

| 13.1 | Default | 12 | ||||

| 13.2 | Remedies | 12 | ||||

| 13.3 | Late Charges | 14 | ||||

| 13.4 | Breach by Landlord | 14 | ||||

| 14. Condemnation |

14 | |||||

| 15. Estoppel Certificate and Financial Statements |

14 | |||||

| 15.1 | Estoppel Certificate | 14 | ||||

| 15.2 | Financial Statement | 14 | ||||

| 16. Additional Covenants and Provisions |

14 | |||||

| 16.1 | Severability | 14 | ||||

| 16.2 | Interest on Past-Due Obligations | 14 | ||||

| 16.3 | Time of Essence | 15 | ||||

| 16.4 | Landlord Liability | 15 | ||||

| 16.5 | No Prior or Other Agreements | 15 | ||||

| 16.6 | Notice Requirements | 15 | ||||

| 16.7 | Date of Notice | 15 | ||||

| 16.8 | Waivers | 15 | ||||

| 16.9 | Holdover | 15 | ||||

| 16.10 | Cumulative Remedies | 15 | ||||

| 16.11 | Binding Effect: Choice of Law | 15 | ||||

| 16.12 | Landlord | 15 | ||||

| 16.13 | Attorneys’ Fees and Other Costs | 16 | ||||

| 16.14 | Landlord’s Access; Showing Premises; Repairs | 16 | ||||

| 16.15 | Signs | 16 | ||||

| 16.16 | Termination; Merger | 16 | ||||

| 16.17 | Quiet Possession | 16 | ||||

| 16.18 | Subordination; Attornment; Non-Disturbance | 16 | ||||

| 16.19 | Rules and Regulations | 17 | ||||

| 16.20 | Security Measures | 17 | ||||

| 16.21 | Reservations | 17 | ||||

| 16.22 | Conflict | 17 | ||||

| 16.23 | Offer | 17 | ||||

| 16.24 | Amendments | 17 | ||||

| 16.25 | Multiple Parties | 17 | ||||

| 16.26 | Authority | 17 | ||||

| 16.27 | Recordation | 17 | ||||

| 16.28 | Confidentiality | 17 | ||||

| 16.29 | Landlord Renovations | 17 | ||||

| 16.30 | Waiver of Jury Trial | 17 | ||||

ii

The following terms in the Lease are defined in the paragraphs opposite the terms.

| Term | Defined in Paragraph | |||||||||

| Additional Rent |

4.1 | |||||||||

| Applicable Requirements |

6.3 | |||||||||

| Assign |

12.1 | |||||||||

| Base Rent |

1.4 | |||||||||

| Basic Provisions |

1 | |||||||||

| Building |

1.2 | |||||||||

| Building Operating Expenses |

4.2(b) | |||||||||

| Code |

12.1(a) | |||||||||

| Commencement Date |

1.3 | |||||||||

| Commencement Date Certificate |

3.3 | |||||||||

| Common Areas |

2.2 | |||||||||

| Common Area Operating Expenses |

4.2(b) | |||||||||

| Condemnation |

14 | |||||||||

| Default |

13.1 | |||||||||

| Expiration Date |

1.3 | |||||||||

| HVAC |

4.2(a)(x) | |||||||||

| Hazardous Substance |

6.2 | |||||||||

| Indemnity |

8.5 | |||||||||

| Industrial Center |

1.2 | |||||||||

| Landlord |

1.1 | |||||||||

| Landlord Entities |

6.2(c) | |||||||||

| Lease |

1.1 | |||||||||

| Lenders |

6.4 | |||||||||

| Mortgage |

16.18 | |||||||||

| Operating Expenses |

4.2 | |||||||||

| Party/Parties |

1.1 | |||||||||

| Permitted Use |

1.8 | |||||||||

| Premises |

1.2 | |||||||||

| Prevailing Party |

16.13 | |||||||||

| Real Property Taxes |

10.2 | |||||||||

| Rent |

4.1 | |||||||||

| Reportable Use |

6.2 | |||||||||

| Requesting Party |

15 | |||||||||

| Responding Party |

15 | |||||||||

| Rules and Regulations |

2.4, 16.19 | |||||||||

| Security Deposit |

1.7, 5 | |||||||||

| Taxes |

10.2 | |||||||||

| Tenant |

1.1 | |||||||||

| Tenant Acts |

9.2 | |||||||||

| Tenant’s Entity |

6.2(c) | |||||||||

| Tenant’s Share |

1.5 | |||||||||

| Term |

1.3 | |||||||||

| Use |

6.1 | |||||||||

iii

| 1. | Basic Provisions (“Basic Provisions”). |

1.1 Parties. This Lease (“Lease”) dated June 13, 2007, is made by and between AMB PROPERTY, L.P., a Delaware limited partnership, (“Landlord”) and InvenSense, Inc., a Delaware corporation (“Tenant”) (collectively, the “Parties” or individually, a “Party”).

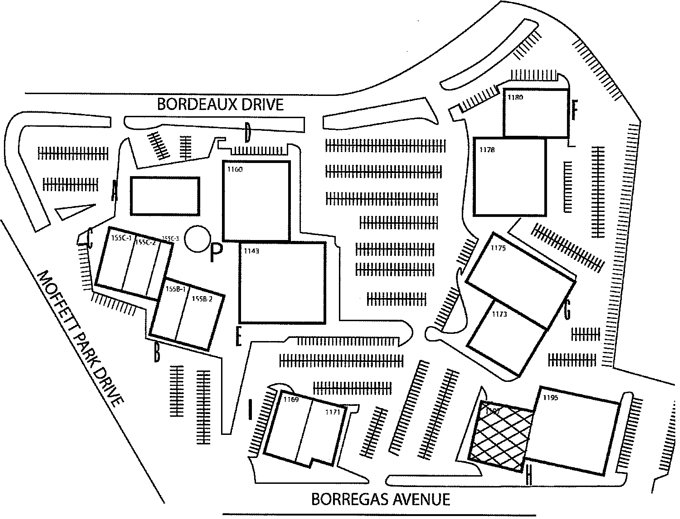

1.2 Premises. The premises (“Premises”), which are the subject of this Lease, are located in the industrial center commonly known as the Xxxxxxx Park I & II (the “Industrial Center”). The Premises are:

[ X ] Approximately 19,638 square feet of space commonly known as 0000 Xxxxxxxx Xxxxxx, Xxxxxxxxx, XX and as depicted on Exhibit A. This space is a part of the building (“Building”) which is also identified on Exhibit A.

If the Premises are all of the Building, there shall, for purposes of this Lease, be no distinction between the words “Premises” or “Building.” Tenant shall have nonexclusive rights to the Common Areas (as defined in Paragraph 2.2 below) but shall not have any rights to the roof, exterior walls, or utility raceways of the Building or to any other buildings in the Industrial Center. The Industrial Center consists of the Premises, the Building, the Common Areas, the land upon which they are located, and all other buildings and improvements within the boundaries of the Industrial Center.

1.3 Term. Thirty Seven (37) months and One (1) day (“Term”) commencing June 30, 2007 (“Commencement Date”) and ending July 31, 2010 (“Expiration Date”).

1.4 Base Rent. Base Monthly Rent (“Base Rent”) shall be payable as follows:

| June 30, 2007-August 31, 2007 |

$0 | |||||

| September 1, 2007-July 31, 2008 |

$25,529.40 NNN [$1.30 psf] | |||||

| August 1, 2008-July 31, 2009 |

$26,511.30 NNN [$1.35 psf] | |||||

| August 1, 2009-July 31, 2010 |

$27,493.20 NNN [$1.40 psf] |

1.5 Tenant’s Share of Operating Expenses (“Tenant’s Share”).

| (a) | Common Area Operating Expenses | 6% | ||||

| (b) | Building Operating Expenses | 38.6% |

Tenant shall commence paying Operating Expenses as of August 1, 2007.

1.6 Tenant’s Estimated Monthly Rent Payment. Following is the estimated monthly Rent payment to Landlord pursuant to the provisions of this Lease. This estimate is made at the inception of the Lease and is subject to adjustment pursuant to the provisions of this Lease. The Estimated Total Monthly Payment, set forth below, shall be paid upon the execution of this Lease for the first month of the Lease Term.

| (a) | Base Rent (Paragraph 4.1) | $ | 25,529.40 | ||||||

| (b) |

Operating Expenses (Paragraph 4.2, excluding Real Property Taxes, Landlord Insurance) |

$ | 2,505.00 | ||||||

| (c) |

Landlord Insurance (Paragraph 8.3) | $ | 507.00 | ||||||

| (d) |

Real Property Taxes (Paragraph 10) | $ | 2,135.00 | ||||||

| Estimated Total Monthly Payment | $ | 30,676.40 | |||||||

1.7 Security Deposit. See Addendum Two (Letter of Credit).

1.8 Permitted Use (“Permitted Use”). General office, sales, marketing, engineering lab, light production testing, and design of semiconductor electronic components, but only to the extent permitted by the City in which the Premises are located and all agencies and governmental authorities having jurisdiction of the Premises.

1.9 Guarantor. N/A

1.10 Addenda. Attached hereto are the following Addenda, all of which constitute a part of this Lease:

(a) Addendum 1: Early Occupancy and Inducement Recapture

(b) Addendum 2: Letter of Credit

(c) Addendum 3: Option to Extend the Lease Term

1.11 Exhibits. Attached hereto are the following Exhibits, all of which constitute a part of this Lease:

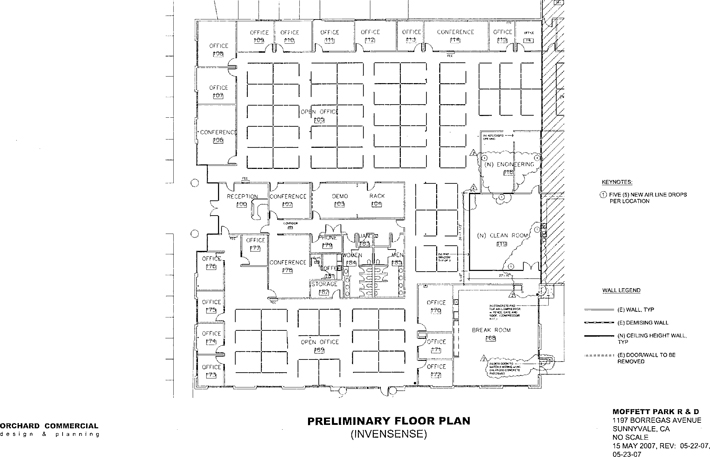

Exhibit A: Description of Premises.

Exhibit B: Commencement Date Certificate.

Exhibit C: Tenant Move-in and Lease Renewal Environmental Questionnaire

Exhibit D: Move Out Standards

1

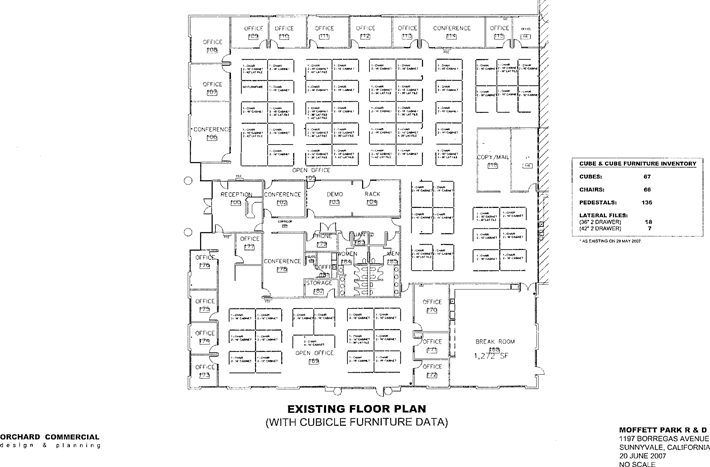

Exhibit G: Schedule of Furniture Systems

1.12 Address for Rent Payments. All amounts payable by Tenant to Landlord shall, until further notice from Landlord, be paid to Landlord at the following address:

AMB PROPERTY, L.P., a Delaware limited partnership

c/o AMB Property Corporation

X.X. Xxx 0000

Xxxxxxxxxx, XX 00000-0000

1.13 Brokers. Tenant represents that it has not dealt with any real estate brokers or agents other than Colliers International representing Landlord and Xxxxx Xxxxxx Associates representing Tenant (collectively the “Brokers”). The Brokers shall receive commissions pursuant to a separate listing agreement with Landlord.

| 2. | Premises and Common Areas. |

2.1 Letting. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the Premises upon all of the terms, covenants, and conditions, set forth in this Lease. Any statement of square footage set forth in this Lease or that may have been used in calculating Base Rent and/or Operating Expenses is an approximation which Landlord and Tenant agree is reasonable, and the Base Rent and Tenant’s Share based thereon is not subject to revision whether or not the actual square footage is more or less. Tenant accepts the Premises in its present “As-Is” condition, state of repair and operating order, subject to Exhibit F (Tenant Improvements); provided, however, Landlord shall repair, at its sole cost and expense, after receipt of Tenant’s written notice thereof, which notice must be delivered to Landlord within the first sixty (60) days after possession of the Premises have been tendered to Tenant for occupancy or early occupancy as the case may be, any defects or deficiencies of the mechanical or electrical systems serving the Premises which are not in good working order to the extent Tenant has not caused such systems to not be in good working order. If Tenant fails to timely deliver to Landlord any such written notice of the aforementioned defects or deficiencies within said 60-day period, Landlord shall have no obligation to perform any such work thereafter, except as otherwise specifically provided in this Lease.

2.2 Common Areas - Definition. “Common Areas” are all areas and facilities outside the Premises and within the exterior boundary line of the Industrial Center and interior utility raceways within the Premises that are provided and designated by the Landlord from time to time for the general nonexclusive use of Landlord, Tenant, and other tenants of the Industrial Center and their respective employees, suppliers, shippers, tenants, contractors, and invitees.

2.3 Common Areas - Tenant’s Rights. Landlord hereby grants to Tenant, for the benefit of Tenant and its employees, suppliers, shippers, contractors, customers, and invitees, during the term of this Lease, the nonexclusive right to use, in common with others entitled to such use, the Common Areas as they exist from time to time, subject to any rights, powers, and privileges reserved by Landlord under the terms hereof or under the terms of any rules and regulations or covenants, conditions, and restrictions governing the use of the Industrial Center.

2.4 Common Areas - Rules and Regulations. Landlord shall have the exclusive control and management of the Common Areas and shall have the right, from time to time, to establish, modify, amend, and enforce reasonable Rules and Regulations with respect thereto in accordance with Paragraph 16.19.

2.5 Common Area Changes. Landlord shall have the right, in Landlord’s sole discretion, from time to time:

(a) To make changes to the Common Areas, including, without limitation, changes in the locations, size, shape, and number of driveways, entrances, parking spaces, parking areas, loading and unloading areas, ingress, egress, direction of traffic, landscaped areas, walkways, and utility raceways;

(b) To close temporarily any of the Common Areas for maintenance purposes so long as reasonable access to the Premises remains available;

(c) To designate other land outside the boundaries of the Industrial Center to be a part of the Common Areas;

(d) To add additional buildings and improvements to the Common Areas;

(e) To use the Common Areas while engaged in making additional improvements, repairs, or alterations to the Industrial Center, or any portion thereof; and

(f) To do and perform such other acts and make such other changes in, to, or with respect to the Common Areas and Industrial Center as Landlord may, in the exercise of sound business judgment, deem to be appropriate.

Notwithstanding anything to the contrary in this Paragraph 2.5, Landlord agrees to use reasonable efforts to perform the foregoing in a manner to attempt to minimize unreasonable and material interference with Tenant’s use and occupancy of the Premises.

2.6 Parking. Tenant may use Tenant’s Share of the undesignated vehicle parking spaces, on an unreserved and unassigned basis, on those portions of the Common Areas designated by Landlord for such parking. Landlord shall

2

exercise reasonable efforts to ensure that such spaces are available to Tenant for its use, but Landlord shall not be required to enforce Tenant’s right to use the same. Tenant shall not use more parking spaces than such number. Such parking spaces shall be used only for parking by vehicles no larger than full sized passenger automobiles or pick-up trucks and in no event shall Tenant or any of Tenant’s Representatives park or permit any parking of vehicles overnight except on an occasional basis when traveling on business and then only to the extend allowed by Applicable Requirements. Tenant shall not permit or allow any vehicles that belong to or are controlled by Tenant or Tenant’s employees, suppliers, shippers, customers or invitees to be loaded, unloaded or parked in areas other than those designated by Landlord for such activities. If Tenant permits or allows any of the prohibited activities described herein, then Landlord shall have the right, without notice, in addition to such other rights and remedies that it may have, to remove or tow away the vehicle involved and charge the cost to Tenant, which cost shall be immediately payable as additional rent upon demand by Landlord. Landlord may change the number of parking spaces and configuration of the parking areas at any time, and may assign reserved parking spaces to any tenant, in Landlord’s sole discretion, provided that in no event shall such changes decrease the minimum number of parking spaces available to Tenant and Landlord agrees to use reasonable efforts to perform the foregoing in a manner to attempt to minimize unreasonable and material interference with Tenant’s use and occupancy of the Premises.

2.7 Furniture. Landlord and Tenant acknowledge and agree that during the Term of this Lease and any extension thereof, Landlord shall lease to Tenant, at no additional cost or expense, all of those certain furniture, cabling, and phone systems listed in Exhibit G attached hereto and made a part hereof (collectively “Furniture”). Such leasing of the Furniture to Tenant is on an “AS-IS, WITH ALL FAULTS” basis and subject to all of the terms of this Lease, without recourse, representation or warranty of any kind or nature, express or implied, including without limitation, habitability, merchantability or fitness for a particular purpose. At the expiration or earlier termination of this Lease, the Furniture shall be returned and surrendered to Landlord in good condition and repair, reasonable wear and tear and damage by Landlord excepted. Landlord shall have no obligation to repair, maintain or insure any of the Furniture. Tenant shall insure the Furniture for its full replacement value. Tenant shall not have the right to (i) remove or materially modify the Furniture or (ii) assign or sublet any of the Furniture except in conjunction with this Lease and the Premises. Tenant shall pay any taxes, assessments and insurance premiums attributable to the Furniture.

| 3. | Term. |

3.1 Term. The Commencement Date, Expiration Date, and Term of this Lease are as specified in Paragraph 1.3.

3.2 Delay in Possession. If for any reason Landlord cannot deliver possession of the Premises to Tenant by the Commencement Date, Landlord shall not be subject to any liability therefor, nor shall such failure affect the validity of this Lease or the obligations of Tenant hereunder. In such case, Tenant shall not, except as otherwise provided herein, be obligated to pay Rent or perform any other obligation of Tenant under the terms of this Lease until Landlord delivers possession of the Premises to Tenant in the condition required under the Lease. The term of the Lease shall commence on the earlier of (a) the date Tenant takes possession of the Premises for purposes other than set forth in Addendum 1 (Early Occupancy) or (b) the date Landlord tenders possession of the Premises to Tenant in the condition required under the Lease (provided, however, that such date shall not be prior to August 1, 2007).

3.3 Commencement Date Certificate. At the request of Landlord, Tenant shall execute and deliver to Landlord a completed certificate (“Commencement Date Certificate”) in the form attached hereto as Exhibit B.

3.4 Landlord’s Right To Advance Expiration Date. At any time during the initial Lease Term or any extension thereof, in the event that the Landlord contemplates a redevelopment of the Building or the Industrial Center, Landlord may elect to deliver to Tenant written notice (“Termination Notice”) advancing the Expiration Date of the Lease to the date specified in the Termination Notice (“Advanced Expiration Date”), which Advanced Expiration Date shall not be earlier than (a) twelve (12) months from and after the date of the Landlord’s Termination Notice or (b) the initial Expiration Date of this Lease (i.e. anticipated to be July 31, 2010), whichever is later. If Landlord delivers a Termination Notice to be effective on the initial Expiration Date of this Lease, Tenant’s right to extend, as set forth in Addendum Three shall be void.

| 4. | Rent. |

4.1 Base Rent. Tenant shall pay to Landlord Base Rent and other monetary obligations of Tenant to Landlord under the terms of this Lease (such other monetary obligations are herein referred to as “Additional Rent”) in lawful money of the United States, without offset or deduction, in advance on or before the first day of each month. Base Rent and Additional Rent for any period during the term hereof which is for less than one full month shall be prorated based upon the actual number of days of the month involved. Payment of Base Rent and Additional Rent shall be made to Landlord at its address stated herein or to such other persons or at such other addresses as Landlord may from time to time designate in writing to Tenant. Base Rent and Additional Rent are collectively referred to as “Rent.” All monetary obligations of Tenant to Landlord under the terms of this Lease are deemed to be Rent.

4.2 Operating Expenses. Tenant shall pay to Landlord on the first day of each month during the term hereof, in addition to the Base Rent, Tenant’s Share of all Operating Expenses in accordance with the following provisions.

(a) “Operating Expenses” are all costs incurred by Landlord relating to the ownership and/or operation of the Industrial Center, Building, and Premises including, but not limited to, the following:

3

(i) Expenses relating to the ownership, management, maintenance, repair, replacement and/or operation of the Common Areas, including, without limitation, parking areas, loading and unloading areas, trash areas, roadways, sidewalks, walkways, parkways, driveways, rail spurs, landscaped areas, striping, bumpers, irrigation systems, drainage systems, lighting facilities, fences and gates, exterior signs, and/or tenant directories.

(ii) Water, gas, electricity, telephone, and other utilities not paid for directly by tenants of the Industrial Center.

(iii) common area trash disposal, snow removal, security and the management and administration of any and all portions of the Industrial Center, including, without limitation, a property management fee, accounting, auditing, billing, postage, salaries and benefits for clerical and supervisory employees to the extent attributable to time devoted to the Industrial Center, whether located at the Industrial Center or off-site, payroll taxes and legal and accounting costs and all fees, licenses and permits related to the ownership, operation and management of the Industrial Center;

(iv) Real Property Taxes;

(v) Premiums and all applicable deductibles for the insurance policies maintained by Landlord under paragraph 8 below.

(vi) Environmental monitoring and insurance programs.

(vii) Monthly amortization of capital improvements to any portion of the Industrial Center which are not expensed by Landlord. The monthly amortization of any such capital improvement shall be the sum of the (a) quotient obtained by dividing the cost of the capital improvement by Landlord’s estimate of the number of months of useful life of such improvement plus (b) an amount equal to the cost of the capital improvement times 1/12 of the lesser of 12% or the maximum annual interest rate permitted by law.

(ix) Maintenance of the Industrial Center, including, but not limited to, painting, caulking, and repair and replacement of Building components, including, but not limited to, roof membrane, elevators, and fire detection and sprinkler systems.

(x) Heating, ventilating, and air conditioning systems (“HVAC”) the costs for which are not the sole responsibility of Tenant or another tenant of the Industrial Center.

(b) Tenant’s Share of Operating Expenses that are not specifically attributed to the Premises or Building (“Common Area Operating Expenses”) shall be that percentage shown in Paragraph 1.5(a). Tenant’s Share of Operating Expenses that are attributable to the Building (“Building Operating Expenses”) shall be that percentage shown in Paragraph 1.5(b). Landlord, in its reasonable discretion, shall determine which Operating Expenses are Common Area Operating Expenses, Building Operating Expenses, or expenses to be entirely borne by Tenant.

(c) The inclusion of the improvements, facilities, and services set forth in Subparagraph 4.2(a) shall not impose any obligation upon Landlord either to have said improvements or facilities or to provide those services, except as set forth herein.

(d) Tenant shall pay monthly in advance, on the same day that the Base Rent is due, Tenant’s Share of the expenses set forth in Paragraph 1.6. Landlord shall deliver to Tenant within 90 days after the expiration of each calendar year a reasonably detailed statement showing Tenant’s Share of the actual expenses incurred during the preceding year. If Tenant’s estimated payments under this Paragraph 4(d) during the preceding year exceed Tenant’s Share as indicated on said statement, Tenant shall be credited the amount of such overpayment against Base Rent and Tenant’s Share of expenses next becoming due. If Tenant’s estimated payments under this Paragraph 4.2(d) during said preceding year were less than Tenant’s Share as indicated on said statement, Tenant shall pay to Landlord the amount of the deficiency within 10 days after delivery by Landlord to Tenant of said statement. At any time during the term of the Lease, provided not more than once in a calendar year, Landlord may adjust the amount of the estimated Tenant’s Share of expenses to reflect Landlord’s estimate of such expenses for the year.

(e) After delivery to Landlord of at least thirty (30) days prior written notice, Tenant, at its sole cost and expense through any accountant designated by it, shall have the right to examine and/or audit the books and records evidencing such costs and expenses for the previous one (1) calendar year, during Landlord’s reasonable business hours but not more frequently than once during any calendar year. Any such accounting firm designated by Tenant may not be compensated on a contingency fee basis. The results of any such audit (and any negotiations between the parties related thereto) shall be maintained strictly confidential by Tenant and its accounting firm and shall not be disclosed, published or otherwise disseminated to any other party other than to Landlord and its authorized agents. Landlord and Tenant each shall use its best efforts to cooperate in such negotiations and to promptly resolve any discrepancies between Landlord and Tenant in the accounting of such costs and expenses.

(f) Notwithstanding anything to the contrary contained herein, for purposes of this Lease, the term “Operating Expenses” shall not include the following: (i) costs (including permit, license, and inspection fees) incurred in renovating, improving, decorating, painting, or redecorating vacant space or space for other tenants within the Industrial Center; (ii) legal and auditing fees (other than those fees reasonably incurred in connection with the ownership and operation of all or any portion the Industrial Center); (iii) leasing commissions, advertising expenses, and other costs incurred in connection with the original leasing of the Industrial Center or future re-leasing of any portion of the Industrial Center; (iv) depreciation of the Building or any other improvements situated within the Industrial Center; (v) any items for which Landlord is actually and directly reimbursed by any other tenant of the Industrial Center; (vi) costs of repairs or other work necessitated by fire, windstorm or other casualty (excluding any deductibles) and/or costs of

4

repair or other work necessitated by the exercise of the right of eminent domain to the extent insurance proceeds or a condemnation award, as applicable, is actually received by Landlord for such purposes; provided, such costs of repairs or other work shall be paid by the parties in accordance with the provisions of Sections 7, 8 and 9 below; (vii) other than any interest charges as expressly provided for in this Lease, any interest or payments on any financing for any portion of the Industrial Center, interest and penalties incurred as a result of Landlord’s late payment of any invoice (provided that Tenant pays Tenant’s Share of Operating Expenses and Tax Expenses to Landlord when due as set forth herein), and any bad debt loss, rent loss or reserves for same; (viii) costs associated with the investigation and/or remediation of Hazardous Substance present in, on or about any portion of the Industrial Center, unless such costs and expenses are the responsibility of Tenant as provided in Section 6.2 hereof; (ix) any amounts, including, without limitation, overhead and profit increment, that is paid to Landlord or to subsidiaries or affiliates of Landlord for goods and/or services in the Industrial Center to the extent the same exceeds the costs of such charged by unaffiliated third parties on a competitive basis; or any costs included in Operating Expenses representing an amount paid to a person, firm, corporation or other entity related to Landlord which is in excess of the amount which would have been paid in the absence of such relationship; (xi) any payments under a ground lease or master lease; and/or (xii) any profit made by Landlord in connection with Landlord’s collections of reimbursable costs (excluding management or administrative fees which may be charged on such reimbursable costs).

| 5. | Security Deposit. See Addendum Two (Letter of Credit). |

| 6. | Use. |

6.1 Permitted Use. Tenant shall use and occupy the Premises only for the Permitted Use set forth in Paragraph 1.8. Tenant shall not commit any nuisance, permit the emission of any objectionable noise or odor, suffer any waste, make any use of the Premises which is contrary to any law or ordinance, or which will invalidate or increase the premiums for any of Landlord’s insurance. Tenant shall not service, maintain, or repair vehicles on the Premises, Building, or Common Areas. Tenant shall not store foods, pallets, drums, or any other materials outside the Premises. Tenant’s use is subject to, and at all times Tenant shall comply with any and all Applicable Requirements, defined below. Landlord reserves to itself the right, from time to time, to grant, without the consent of Tenant, such easements, rights and dedications that Landlord deems reasonably necessary, and to cause the recordation of parcel or subdivision maps and/or restrictions, so long as such easements, rights, dedications, maps and restrictions, as applicable, do not materially and adversely interfere with Tenant’s operations in the Premises. Tenant agrees to sign any documents reasonably requested by Landlord to effectuate any such easements, rights, dedications, maps or restrictions. Tenant shall not initiate, submit an application for, or otherwise request, any land use approvals or entitlements with respect to the Premises or any other portion of the Industrial Center, including without limitation, any variance, conditional use permit or rezoning, without first obtaining Landlord’s prior written consent thereto, which consent may be given or withheld in Landlord’s sole discretion.

6.2 Hazardous Substances.

(a) Reportable Uses Require Consent. The term, “Hazardous Substance,” as used in this Lease, shall mean any product, substance, chemical, material, or waste whose presence, nature, quantity, and/or intensity of existence, use, manufacture, disposal, transportation, spill, release, or effect, either by itself or in combination with other materials expected to be on the Premises, is either: (i) potentially injurious to the public health, safety or welfare, the environment, or the Premises; (ii) regulated or monitored by any governmental authority; or (iii) a basis for potential liability of Landlord to any governmental agency or third party under any applicable statute or common law theory. Hazardous Substance shall include, but not be limited to, hydrocarbons, petroleum, gasoline, crude oil, or any products or by-products thereof. Tenant shall not engage in any activity in or about the Premises which constitutes a Reportable Use (as hereinafter defined) of Hazardous Substances without the express prior written consent of Landlord and compliance in a timely manner (at Tenant’s sole cost and expense) with all Applicable Requirements (as defined in Paragraph 6.3). “Reportable Use” shall mean (i) the installation or use of any above or below ground storage tank, (ii) the generation, possession, storage, use, transportation, or disposal of a Hazardous Substance that requires a permit from, or with respect to which a report, notice, registration, or business plan is required to be filed with, any governmental authority, and (iii) the presence in, on, or about the Premises of a Hazardous Substance with respect to which any Applicable Requirements require that a notice be given to persons entering or occupying the Premises or neighboring properties. Notwithstanding the foregoing, Tenant may, without Landlord’s prior consent, but upon notice to Landlord and in compliance with all Applicable Requirements, use any ordinary and customary materials reasonably required to be used by Tenant in the normal course of the Permitted Use, so long as such use is not a Reportable Use and does not expose the Premises or neighboring properties to any meaningful risk of contamination or damage, or expose Landlord to any liability therefor. In addition, Landlord may (but without any obligation to do so) condition its consent to any Reportable Use of any Hazardous Substance by Tenant upon Tenant’s giving Landlord such additional assurances as Landlord, in its reasonable discretion, deems necessary to protect itself, the public, the Premises, and the environment against damage, contamination, injury, and/or liability therefor, including but not limited to the installation (and, at Landlord’s option, removal on or before Lease expiration or earlier termination) of reasonably necessary protective modifications to the Premises (such as concrete encasements) and/or the deposit of an additional Security Deposit.

(b) Duty to Inform Landlord. If Tenant knows, or has reasonable cause to believe, that a Hazardous Substance is located in, under, or about the Premises or the Building, Tenant shall immediately give Landlord written notice thereof, together with a copy of any statement, report, notice, registration, application, permit, business plan, license, claim, action, or proceeding given to, or received from, any governmental authority or private party concerning the presence, spill, release, discharge of, or exposure to such Hazardous Substance. Tenant shall not cause or permit any Hazardous Substance to be spilled or released in, on, under, or about the Premises (including, without limitation, through the plumbing or sanitary sewer system).

5

(c) Indemnification. Tenant shall indemnify, protect, defend, and hold Landlord, Landlord’s affiliates, Lenders, and the officers, directors, shareholders, partners, employees, managers, independent contractors, attorneys, and agents of the foregoing (“Landlord Entities” or “Landlord Entity”) and the Premises harmless from and against any and all damages, liabilities, judgments, costs, claims, liens, expenses, penalties, loss of permits, and attorneys’ and consultants’ fees arising out of or involving any Hazardous Substance on or brought onto the Premises by or for Tenant or by any of Tenant’s employees, agents, contractors, servants, visitors, suppliers, or invitees (such employees, agents, contractors, servants, visitors, suppliers, and invitees as herein collectively referred to as “Tenant Entities” or “Tenant Entity”). Tenant’s obligations under this Paragraph 6.2(c) shall include, but not be limited to, the effects of any contamination or injury to person, property, or the environment created or suffered by Tenant, and the cost of investigation (including consultants’ and attorneys’ fees and testing), removal, remediation, restoration and/or abatement thereof, or of any contamination therein involved. Tenant’s obligations under this Paragraph 6.2(c) shall survive the Expiration Date or earlier termination of this Lease.

(d) Tenant’s Exculpation. Tenant shall not be liable for nor otherwise obligated to Landlord under any provision of this Lease with respect to any claim, cost, expense or damage resulting from any Hazardous Substance now or hereafter present upon the Industrial Center to the extent not caused nor otherwise permitted, directly or indirectly, by Tenant or by a Tenant Entity; provided, however, Tenant shall be fully liable for and otherwise obligated to Landlord under the provisions of this Lease for all liabilities, costs, damages, penalties, claims, judgments, expenses (including, without limitation, attorneys’ and experts’ fees and costs) and losses to the extent (a) Tenant or any Tenant Entity contributes to the presence of such Hazardous Substances or Tenant and/or any Tenant Entity exacerbates the conditions caused by such Hazardous Substances, or (b) Tenant and/or any Tenant Entity allows or permits persons over which Tenant or any Tenant Entity has control and/or for which Tenant or any Tenant Entity are legally responsible for, to cause such Hazardous Substances to be present in, on, under, through or about any portion of the Premises, the Building or the Industrial Center, or does not take all reasonably appropriate actions to prevent such persons over which Tenant or any Tenant Entity has control and/or for which Tenant or any Tenant Entity are legally responsible for causing the presence of Hazardous Substances in, on, under, through or about any portion of the Premises, the Building or the Industrial Center.

6.3 Tenant’s Compliance with Requirements. Tenant shall, at Tenant’s sole cost and expense, fully, diligently, and in a timely manner comply with all “Applicable Requirements,” which term is used in this Lease to mean all laws, rules, regulations, ordinances, directives, covenants, easements, and restrictions of record, permits, the requirements of any applicable fire insurance underwriter or rating bureau, and the recommendations of Landlord’s engineers and/or consultants, relating in any manner to the Premises (including but not limited to matters pertaining to (a) industrial hygiene, (b) environmental conditions on, in, under, or about the Premises, including soil and groundwater conditions, and (c) the use, generation, manufacture, production, installation, maintenance, removal, transportation, storage, spill, or release of any Hazardous Substance), now in effect or which may hereafter come into effect. Tenant shall, within 5 days after receipt of Landlord’s written request, provide Landlord with copies of all documents and information evidencing Tenant’s compliance with any Applicable Requirements, and shall immediately upon receipt notify Landlord in writing (with copies of any documents involved) of any threatened or actual claim, notice, citation, warning, complaint, or report pertaining to or involving failure by Tenant or the Premises to comply with any Applicable Requirements.

6.4 Inspection; Compliance with Law. In addition to Landlord’s environmental monitoring and insurance program, the cost of which is included in Operating Expenses, Landlord and the holders of any mortgages, deeds of trust, or ground leases on the Premises (“Lenders”) shall have the right to enter the Premises at any time in the case of an emergency, and otherwise at reasonable times, for the purpose of inspecting the condition of the Premises and for verifying compliance by Tenant with this Lease and all Applicable Requirements. Landlord shall be entitled to employ experts and/or consultants in connection therewith to advise Landlord with respect to Tenant’s installation, operation, use, monitoring, maintenance, or removal of any Hazardous Substance on or from the Premises. The cost and expenses of any such inspections shall be paid by the party requesting same unless a violation of Applicable Requirements exists or is imminent, or the inspection is requested or ordered by a governmental authority. Tenant shall upon request reimburse Landlord or Landlord’s Lender, as the case may be, for the costs and expenses of such inspections.

6.5 Tenant Move-in Questionnaire. Prior to executing this Lease, Tenant has completed, executed and delivered to Landlord Tenant’s Move-in and Lease Renewal Environmental Questionnaire (the “Tenant Move-in Questionnaire”), a copy of which is attached hereto as Exhibit C and incorporated herein by this reference. Tenant covenants, represents and warrants to Landlord that the information on the Tenant Move-in Questionnaire is true and correct and accurately describes the use(s) of Hazardous Substances which will be made and/or used on the Premises by Tenant.

| 7. | Maintenance, Repairs, Trade Fixtures and Alterations. |

7.1 Tenant’s Obligations. Subject to the provisions of Paragraph 7.2 (Landlord’s Obligations), Paragraph 9 (Damage or Destruction), and Paragraph 14 (Condemnation), Tenant shall, at Tenant’s sole cost and expense and at all times, keep the Premises and every part thereof in good order, condition, and repair (whether or not such portion of the Premises requiring repair, or the means of repairing the same, are reasonably or readily accessible to Tenant and whether or not the need for such repairs occurs as a result of Tenant’s use, any prior use, the elements, or the age of such portion of the Premises) including, without limiting the generality of the foregoing, all equipment or facilities specifically serving the Premises, such as plumbing, heating, ventilating, air conditioning, electrical, lighting facilities, boilers, fired or unfired pressure vessels, fire hose connectors if within the Premises, fixtures, interior walls, interior surfaces of exterior walls, ceilings, floors, windows, doors, plate glass, and skylights, but excluding any items which are the responsibility of Landlord pursuant to Paragraph 7.2 below. Tenant’s obligations shall include restorations, replacements, or renewals when necessary to keep the Premises and all improvements thereon or a part thereof in good order, condition, and state of repair. Tenant shall also be solely responsible for the cost of all repairs and replacements

6

caused by the negligent acts or omissions or intentional misconduct by Tenant or Tenant’s employees, contractors, agents, guests or invitees to the extent not actually paid for by insurance carried or required to be carried by Landlord. If Tenant refuses or neglects to perform its obligations under this paragraph to the reasonable satisfaction of Landlord, Landlord may, but without obligation to do so, at any time perform the same without Landlord having any liability to Tenant for any loss or damage that may accrue to Tenant’s Property or to Tenant’s business by reason thereof. If Landlord performs any such obligations, Tenant shall pay to Landlord, as Additional Rent, Landlord’s reasonable costs and expenses actually incurred therefor.

7.2 Landlord’s Obligations. Subject to the provisions of Paragraph 6 (Use), Paragraph 7.1 (Tenant’s Obligations), Paragraph 9 (Damage or Destruction), and Paragraph 14 (Condemnation), Landlord, at its expense and not subject to the reimbursement requirements of Paragraph 4.2, shall maintain and repair the roof structure, foundations and the structure of the exterior walls of the Building. Landlord, subject to reimbursement pursuant to Paragraph 4.2, shall maintain and repair the Building roof membrane, Common Areas, and utility systems within the Industrial Center which are outside of the Premises. In addition, Landlord may, in Landlord’s sole discretion, and at Tenant’s sole cost, elect to contract for all or any portion of the maintenance, repair and/or replacement of the HVAC systems serving the Premises.

7.3 Alterations. Tenant shall not install any signs, fixtures, improvements, nor make or permit any other alterations or additions (individually, an “Alteration”, and collectively, the “Alterations”) to the Premises without the prior written consent of Landlord, except for Alterations that cumulatively cost less than Twenty Thousand Dollars ($20,000.00) and which do not affect the Building systems or the structural integrity or structural components of the Premises or the Building. In addition, Landlord’s consent shall not be unreasonably withheld, conditioned or delayed for other Alterations which do not affect the Building systems or the structural integrity or structural components of the Premises or the Building. In all events, Tenant shall deliver at least ten (10) days prior notice to Landlord, from the date Tenant intends to commence construction, sufficient to enable Landlord to post a Notice of Non-Responsibility and Tenant shall obtain all permits or other governmental approvals prior to commencing any of such work and deliver a copy of same to Landlord. All Alterations shall be at Tenant’s sole cost and expense in accordance with plans and specifications which have been previously submitted to and approved in writing by Landlord, and shall be installed by a licensed, insured, and bonded contractor (reasonably approved by Landlord) in compliance with all applicable Laws (including, but not limited to, the ADA), and all recorded matters and rules and regulations of the Industrial Center. In addition, all work with respect to any Alterations must be done in a good and workmanlike manner. Landlord’s approval of any plans, specifications or working drawings for Tenant’s Alterations shall not create nor impose any responsibility or liability on the part of Landlord for their completeness, design sufficiency, or compliance with any laws, ordinances, rules and regulations of governmental agencies or authorities. In performing the work of any such Alterations, Tenant shall have the work performed in such a manner as not to obstruct access to the Industrial Center, or the Common Areas for any other tenant of the Industrial Center, and as not to obstruct the business of Landlord or other tenants in the Industrial Center, or interfere with the labor force working in the Industrial Center. As Additional Rent hereunder, Tenant shall reimburse Landlord, within ten (10) days after demand, for actual legal, engineering, architectural, planning and other expenses incurred by Landlord in connection with Tenant’s Alterations, plus Tenant shall pay to Landlord a fee equal to fifteen percent (15%) of the total cost of the Alterations. If Tenant makes any Alterations, Tenant agrees to carry “Builder’s All Risk” insurance, in an amount approved by Landlord and such other insurance as Landlord may require, it being understood and agreed that all of such Alterations shall be insured by Tenant in accordance with Section 8.2 of this Lease immediately upon completion thereof. Tenant shall keep the Premises and the property on which the Premises are situated free from any liens arising out of any work performed, materials furnished or obligations incurred by or on behalf of Tenant. Tenant shall, prior to construction of any and all Alterations, cause its contractor(s) and/or major subcontractor(s) to provide insurance as reasonably required by Landlord, and Tenant shall provide such assurances to Landlord, including without limitation, waivers of lien, surety company performance bonds (if the cost of the work exceeds $20,000) as Landlord shall require to assure payment of the costs thereof to protect Landlord and the Industrial Center from and against any loss from any mechanic’s, materialmen’s or other liens. Notwithstanding the foregoing, or any other provisions to the contrary herein, Landlord hereby consents to the reconfiguration of the cubes, that are being provided by Landlord, within the Premises during the term, and Tenant shall not be required to reconfigure such cubes upon the expiration or earlier termination of this Lease.

Notwithstanding anything to the contrary contained herein, so long as Tenant’s written request for consent for a proposed Alteration contains the following statement in large, bold and capped font “PURSUANT TO THE LEASE, IF LANDLORD CONSENTS TO THE SUBJECT ALTERATION, LANDLORD SHALL NOTIFY TENANT IN WRITING WHETHER OR NOT LANDLORD WILL REQUIRE SUCH ALTERATION TO BE REMOVED AT THE EXPIRATION OR EARLIER TERMINATION OF THE LEASE.”, at the time Landlord gives its consent for any Alteration, if it so does, Tenant shall also be notified whether or not Landlord will require that such Alteration be removed upon the expiration or earlier termination of this Lease. If Tenant’s written notice strictly complies with the foregoing and if Landlord fails to notify Tenant whether Tenant shall be required to remove the subject Alteration at the expiration or earlier termination of this Lease, it shall be assumed that Landlord shall require the removal of the subject Alteration.

A. Compressor Installation. So long as Tenant complies with all applicable provisions of this Lease with respect to such alterations, including, without limitation, the provisions of this Section 7, Landlord shall consent to Tenant’s installation of a compressor outside and adjacent to the Building in the area designated on the Space Plan with such compressor to be fenced and screened from view.

7.4 Surrender/Restoration. Tenant shall surrender the Premises by the end of the last day of the Lease term or any earlier termination date, clean and free of debris and in good operating order and substantially the same condition as received, ordinary wear and tear, damage by casualty and condemnation excepted and in accordance with the Move Out Standards set forth in Exhibit D to this Lease. Without limiting the generality of the above and except as set forth herein, Tenant shall remove all Alterations designated by Landlord in Landlord’s sole discretion, personal property, trade fixtures, and floor bolts, patch all floors, and cause all lights to be in good operating condition. Tenant

7

shall have no responsibility to remove any of the Tenant Improvements as set forth on Exhibit F (except for the compressor and related components).

| 8. | Insurance; Indemnity. |

8.1 Payment of Premiums and Deductibles. The cost of the premiums and all applicable deductibles for the insurance policies maintained by Landlord under this Paragraph 8 shall be a Common Area Operating Expense reimbursable pursuant to Paragraph 4.2 hereof. Premiums for policy periods commencing prior to, or extending beyond, the term of this Lease shall be prorated to coincide with the corresponding Commencement Date and Expiration Date.

8.2 Tenant’s Insurance.

(a) At its sole cost and expense, Tenant shall maintain in full force and effect during the Term of the Lease the following insurance coverages insuring against claims which may arise from or in connection with the Tenant’s operation and use of the Premises.

(i) Commercial General Liability insurance with minimum limits of $1,000,000 per occurrence and $3,000,000 general aggregate for bodily injury, personal injury, and property damage. If required by Landlord, liquor liability coverage will be included. Such insurance shall be endorsed to include Landlord and Landlord Entities as additional insureds, shall be primary and noncontributory with any Landlord insurance, and shall provide severability of interests between or among insureds.

(ii) Workers’ Compensation insurance with statutory limits and Employers Liability with a $1,000,000 per accident limit for bodily injury or disease.

(iii) Automobile Liability insurance covering all owned, nonowned, and hired vehicles with a $1,000,000 per accident limit for bodily injury and property damage.

(iv) Property insurance against “all risks” at least as broad as the current ISO Special Form policy, excluding earthquake and flood, for loss to any tenant improvements or betterments, floor and wall coverings, and business personal property on a full insurable replacement cost basis with no coinsurance clause, and Business Income insurance covering at least six months of loss of income and continuing expense.

(b) Tenant shall deliver to Landlord certificates of all insurance reflecting evidence of required coverages prior to initial occupancy, and annually thereafter.

(c) If, in the opinion of Landlord’s insurance advisor, the amount or scope of such coverage is deemed inadequate at any time during the Term, Tenant shall increase such coverage to such reasonable amounts or scope as Landlord’s advisor deems adequate.

(d) All insurance required under Paragraph 8.2 (a) shall be issued by insurers licensed to do business in the state in which the Premises are located and which are rated A-:VII or better by Best’s Key Rating Guide and (ii) shall be endorsed to provide at least 30-days prior notification of cancellation or material change in coverage to said additional insureds.

8.3 Landlord’s Insurance. Landlord may, but shall not be obligated to, maintain risk of direct physical loss property damage insurance coverage, including earthquake and flood, covering the buildings within the Industrial Center, Commercial General Liability insurance, and such other insurance in such amounts and covering such other liability or hazards as deemed appropriate by Landlord. The amount and scope of coverage of Landlord’s insurance shall be determined by Landlord from time to time in its sole discretion and shall be subject to such deductible amounts as Landlord may elect. Landlord shall have the right to reduce or terminate any insurance or coverage.

8.4 Waiver of Subrogation. To the extent permitted by law and with permission of their insurance carriers, Landlord and Tenant each waive any right to recover against the other on account of any and all claims Landlord or Tenant may have against the other with respect to property insurance actually carried, or required to be carried hereunder, to the extent of the proceeds realized from such insurance coverage or which could be realized from such insurance coverage.

8.5 Indemnity. Except to the extent of damage resulting from the gross active or gross passive negligence or willful misconduct of Landlord and/or any Landlord Entities, Tenant shall protect, defend, indemnify, and hold Landlord and Landlord Entities harmless from and against any and all loss, claims, liability, or costs (including court costs and attorneys’ fees) incurred by reason of:

(a) any damage to any property (including but not limited to property of any Landlord Entity) or death, bodily, or personal injury to any person occurring in or about the Premises, the Building, or the Industrial Center to the extent that such injury or damage shall be caused by or arise from any actual or alleged act, neglect, fault, or omission by or of Tenant, its agents, servants, employees, invitees, contractors, suppliers, subtenants, or visitors;

(b) the conduct or management of any work or anything whatsoever done by the Tenant on or about the Premises or from transactions of the Tenant concerning the Premises;

(c) Tenant’s failure to comply with any and all governmental laws, ordinances, and regulations applicable to the condition or use of the Premises or its occupancy; or

8

(d) any breach or default on the part of Tenant in the performance of any covenant or agreement to be performed pursuant to this Lease.

The provisions of this Paragraph 8.5 shall, with respect to any claims or liability accruing prior to such termination, survive the Expiration Date or earlier termination of this Lease,

8.6 Exemption of Landlord from Liability. Except to the extent caused by the gross active or gross passive negligence or willful misconduct of Landlord, neither Landlord nor Landlord Entities shall be liable for and Tenant waives any claims against Landlord and Landlord Entities for injury or damage to the person or the property of Tenant, Tenant’s employees, contractors, invitees, customers or any other person in or about the Premises, Building or Industrial Center from any cause whatsoever, including, but not limited to, damage or injury which is caused by or results from (i) fire, steam, electricity, gas, water or rain, or from the breakage, leakage, obstruction or other defects of pipes, fire sprinklers, wires, appliances, plumbing, heating, ventilating, air conditioning or lighting fixtures or (ii) from the condition of the Premises, other portions of the Building or Industrial Center. Landlord shall not be liable for any damages arising from any act or neglect (passive or active) of any other tenants of Landlord or any subtenant or assignee of such other tenants nor from the failure by Landlord to enforce the provisions of any other lease in the Industrial Center. Except to the extent actually reimbursed by policies of insurance actually carried by Landlord or which would have been reimbursed by policies required to be carried by Landlord pursuant to this Lease, notwithstanding Landlord’s negligence (active or passive), gross negligence (active or passive), or breach of this Lease, Landlord shall under no circumstances be liable for (a) injury to Tenant’s business, for any loss of income or profit therefrom or any indirect, consequential or punitive damages or (b) any damage to property or injury to persons arising from any act of God or war, violence or insurrection, including, but not limited to, those caused by earthquakes, hurricanes, storms, drought, floods, acts of terrorism, and/or riots.

| 9. | Damage or Destruction. |

9.1 Termination Right. Tenant shall give Landlord prompt written notice of any damage to the Premises that it becomes aware of. Subject to the provisions of Paragraph 9.2, if the Premises or the Building shall be damaged to such an extent that there is substantial interference for a period exceeding one hundred twenty (120) consecutive days with the conduct by Tenant of its business at the Premises, then either party, at any time prior to commencement of repair of the Premises and following ten (10) days written notice to the other party, may terminate this Lease effective thirty (30) days after delivery of such notice to the other party. Further, if any portion of the Premises is damaged and is not fully covered by the aggregate of insurance proceeds received by Landlord and any applicable deductible or if the holder of any indebtedness secured by the Premises requires that the insurance proceeds be applied to such indebtedness, and Tenant does not voluntarily contribute any shortfall thereof to Landlord, then Landlord shall have the right to terminate this Lease by delivering written notice of termination to Tenant within thirty (30) days after the date of notice to Tenant of any such event. Such termination shall not excuse the performance by Tenant of those covenants which under the terms hereof survive termination. Rent shall be abated in proportion to the degree of interference during the period that there is such material interference with the conduct of Tenant’s business at the Premises. Abatement of rent and Tenant’s right of termination pursuant to this provision shall be Tenant’s sole remedy with respect to any such damage regardless of the cause thereof.

9.2 Damage Caused by Tenant. Tenant’s termination rights under Paragraph 9.1 shall not apply if the damage to the Premises or Building is the result of the negligence or intentional misconduct of Tenant or of any of Tenant’s agents, employees, customers, invitees, or contractors (“Tenant Acts”). Any damage resulting from a Tenant Act shall be promptly repaired by Tenant (and any insurance proceeds that are paid for such damage shall be made available for such repairs). Landlord at its option may at Tenant’s expense repair any damage caused by Tenant Acts. Tenant shall continue to pay all rent and other sums due hereunder and shall be liable to Landlord for all damages that Landlord may sustain resulting from a Tenant Act.

| 10. | Real Property Taxes. |

10.1 Payment of Real Property Taxes. Landlord shall pay the Real Property Taxes due and payable during the term of this Lease and, except as otherwise provided in Paragraph 10.3, such payments shall be a Common Area Operating Expense reimbursable pursuant to Paragraph 4.2.

10.2 Real Property Tax Definition. As used herein, the term “Real Property Taxes” is any form of tax or assessment, general, special, ordinary, or extraordinary, imposed or levied upon (a) the Industrial Center or Building, (b) any interest of Landlord in the Industrial Center or Building, (c) Landlord’s right to rent or other income from the Industrial Center or Building, and/or (d) Landlord’s business of leasing the Premises. Real Property Taxes include (a) any license fee, commercial rental tax, excise tax, improvement bond or bonds, levy, or tax; (b) any tax or charge which replaces or is in addition to any of such above-described “Real Property Taxes,” and (c) any fees, expenses, or costs (including attorneys’ fees, expert fees, and the like) incurred by Landlord in protesting or contesting any assessments levied or any tax rate. Real Property Taxes shall not include Landlord’s State and Federal income taxes, estate, insurance, franchise and transfer taxes. Real Property Taxes for tax years commencing prior to, or extending beyond, the term of this Lease shall be prorated to coincide with the corresponding Commencement Date and Expiration Date.

10.3 Additional Improvements. Operating Expenses shall not include Real Property Taxes attributable to improvements placed upon the Industrial Center by other tenants or by Landlord for the exclusive enjoyment of such other tenants. Tenant shall, however, pay to Landlord at the time Operating Expenses are payable under Paragraph 4.2, the entirety of any increase in Real Property Taxes if assessed by reason of improvements placed upon the Premises by Tenant or at Tenant’s request.

9

10.4 Joint Assessment. If the Building is not separately assessed, Real Property Taxes allocated to the Building shall be an equitable proportion of the Real Property Taxes for all of the land and improvements included within the tax parcel assessed.

10.5 Tenant’s Property Taxes. Tenant shall pay prior to delinquency all taxes assessed against and levied upon Tenant’s improvements, fixtures, furnishings, equipment, and all personal property of Tenant contained in the Premises or stored within the Industrial Center.

11. Utilities/Janitorial. Tenant shall arrange and pay directly for all utilities and services supplied to the Premises, including but not limited to electricity, telephone, security, gas, garbage and waste disposal, and cleaning of the Premises, together with any taxes thereon. For any such utility fees or services that may not be billed or metered separately to Tenant, including without limitation, water and sewer charges, and garbage and waste disposal (collectively, “Utility Expenses”), Tenant shall pay to Landlord Tenant’s Share of Utility Expenses. If Landlord reasonably determines that Tenant’s Share of Utility Expenses is not commensurate with Tenant’s use of such services, Tenant shall pay to Landlord the amount which is attributable to Tenant’s use of the utilities or similar services, as reasonably estimated and determined by Landlord, based upon factors such as size of the Premises and intensity of use of such utilities by Tenant such that Tenant shall pay the portion of such charges reasonably consistent with Tenant’s use of such utilities and similar services. If Tenant disputes any such estimate or determination, then Tenant shall at Tenant’s option either pay the estimated amount or cause the Premises to be separately metered at Tenant’s sole expense. Tenant shall also pay Tenant’s Share of any assessments, charges, and fees included within any tax xxxx for the lot on which the Premises are situated, including without limitation, entitlement fees, allocation unit fees, sewer use fees, and any other similar fees or charges.

| 12. | Assignment and Subleasing. |

12.1 Prohibition. Tenant shall not, without the prior written consent of Landlord, assign, mortgage, hypothecate, encumber, grant any license or concession, pledge or otherwise transfer this Lease or any interest herein, permit any assignment or other such transfer of this Lease or any interest hereunder by operation of law, sublet the Premises or any part thereof, or permit the use of the Premises by any persons other than Tenant and Tenant’s Representatives (all of the foregoing are sometimes referred to collectively as “Transfers” and any person to whom any Transfer is made or sought to be made is sometimes referred to as a “Transferee”). No consent to any Transfer shall constitute a waiver of the provisions of this Section, and all subsequent Transfers may be made only with the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned, or delayed but which consent shall be subject to the provisions of this Section.

12.2 Request for Consent. If Tenant seeks to make a Transfer, Tenant shall notify Landlord, in writing, and deliver to Landlord at least thirty (30) days (but not more than one hundred eighty (180) days) prior to the proposed commencement date of the Transfer (the “Proposed Effective Date”) the following information and documents (the “Tenant’s Notice”): (i) a description of the portion of the Premises to be transferred (the “Subject Space”); (ii) all of the terms of the proposed Transfer including without limitation, the Proposed Effective Date, the name and address of the proposed Transferee, and a copy of the existing or proposed assignment, sublease or other agreement governing the proposed Transfer; (iii) current financial statements of the proposed Transferee certified by an officer, member, partner or owner thereof, and any such other information as Landlord may then reasonably require, including without limitation, audited financial statements for the previous three (3) most recent consecutive fiscal years (if available and un-audited if audited financials are not available); (iv) the Plans and Specifications (defined below), if any; and (v) such other information as Landlord may then reasonably require. Tenant shall give Landlord the Tenant’s Notice by registered or certified mail addressed to Landlord at Landlord’s Address specified in the Basic Lease Information. Within thirty (30) days after Landlord’s receipt of the Tenant’s Notice (the “Landlord Response Period”) Landlord shall notify Tenant, in writing, of its determination with respect to such requested proposed Transfer and the election to recapture as set forth below. If Landlord does not elect to recapture pursuant to the provisions hereof and Landlord does consent to the requested proposed Transfer, Tenant may thereafter assign its interests in and to this Lease or sublease all or a portion of the Premises to the same party and on substantially the same terms as set forth in the Tenant’s Notice. If Landlord fails to respond to Tenant’s Notice within Landlord’s Response Period, then, after Tenant delivers to Landlord twenty (20) days written notice (the “Second Response Period”) and Landlord fails to respond thereto prior to the end of the Second Response Period, the proposed Transfer shall then be deemed approved by Landlord.

12.3 Criteria for Consent. Tenant acknowledges and agrees that, among other circumstances for which Landlord could reasonably withhold consent to a proposed Transfer, it shall be reasonable for Landlord to withhold its consent where (a) Tenant is or has been in default of its obligations under this Lease beyond applicable notice and cure periods, (b) the use to be made of the Premises by the proposed Transferee is prohibited under this Lease or differs from the uses permitted under this Lease, (c) the proposed Transferee or its business is subject to compliance with additional requirements of the ADA beyond those requirements which are applicable to Tenant, unless the proposed Transferee shall (1) first deliver plans and specifications for complying with such additional requirements (the “Plans and Specifications”) and obtain Landlord’s written consent thereto, and (2) comply with all Landlord’s conditions contained in such consent, (d) the proposed Transferee does not intend to occupy a substantial portion of the Premises assigned or sublet to it, (e) Landlord reasonably disapproves of the proposed Transferee’s business operating ability or history, reputation or creditworthiness or the character of the business to be conducted by the proposed Transferee at the Premises, (f) the proposed Transferee is a governmental agency or unit or an existing tenant in the Industrial Center, (g) the proposed Transfer would violate any “exclusive” rights of any occupants in the Industrial Center or cause Landlord to violate another agreement or obligation to which Landlord is a party or otherwise subject, (h) Landlord or Landlord’s agent has shown space in the Industrial Center to the proposed Transferee or responded to any inquiries from the proposed Transferee or the proposed Transferee’s agent concerning availability of space in the Industrial Center, at any time within the preceding six (6) months, (i) Landlord otherwise determines that the proposed Transfer would have the effect of decreasing the value of the Building or the Industrial Center, or materially increasing the expenses associated with operating, maintaining and repairing the Industrial Center, (j) either the proposed Transferee, or any person or entity

10

which directly or indirectly, controls, is controlled by, or is under common control with, the proposed Transferee: (i) occupies space in the Building at the time of the request for consent, (ii) is negotiating with Landlord to lease space in the Building at such time, or (iii) has negotiated with Landlord during the 6 month period immediately preceding the Tenant’s Notice, or (k) the proposed Transferee will use, store or handle Hazardous Materials (defined below) in or about the Premises of a type, nature or quantity not reasonably then acceptable to Landlord.

12.4 Effectiveness of Transfer and Continuing Obligations. Prior to the date on which any permitted Transfer becomes effective, Tenant shall deliver to Landlord (i) a counterpart of the fully executed Transfer document, (ii) an executed Hazardous Materials Disclosure Certificate substantially in the form of Exhibit C hereto (the “Transferee HazMat Certificate”), and (iii) Landlord’s form of Consent to Assignment or Consent to Sublease, as applicable, executed by Tenant and the Transferee in which each of Tenant and the Transferee confirms its obligations pursuant to this Lease. Failure or refusal of a Transferee to execute any such consent instrument shall not release or discharge the Transferee from its obligation to do so or from any liability as provided herein. The voluntary, involuntary or other surrender of this Lease by Tenant, or a mutual cancellation by Landlord and Tenant, shall not work a merger, and any such surrender or cancellation shall, at the option of Landlord, either terminate all or any existing subleases or operate as an assignment to Landlord of any or all of such subleases. Each permitted Transferee shall assume and be deemed to assume this Lease as it relates to the portion of the Premises sublet and shall be and remain liable jointly and severally with Tenant for payment of Rent and for the due performance of, and compliance with all the terms, covenants, conditions and agreements herein contained on Tenant’s part to be performed or complied with, for the Term of this Lease or Sublease, as applicable. No Transfer shall affect the continuing primary liability of Tenant (which, following assignment, shall be joint and several with the assignee), and Tenant shall not be released from performing any of the terms, covenants and conditions of this Lease. An assignee of Tenant shall become directly liable to Landlord for all obligations of Tenant hereunder applicable to the Premises so assigned or sublet, but no Transfer by Tenant shall relieve Tenant of any obligations or liability under this Lease whether occurring before or after such consent, assignment, subletting or other Transfer. The acceptance of any or all of the Rent by Landlord from any other person (whether or not such person is an occupant of the Premises) shall not be deemed to be a waiver by Landlord of any provision of this Lease or to be a consent to any Transfer. If Tenant is a business entity, the direct or indirect transfer of more than fifty percent (50%) of the ownership interest of the entity (whether in a single transaction or in the aggregate through more than one transaction) shall be deemed a Transfer and shall be subject to all the provisions hereof and in such event, it shall be a condition to Landlord’s consent to such ownership change that such entities or persons acquiring such ownership interest assume, as a primary obligor, all rights and obligations of Tenant under this Lease (and such entities and persons shall execute all documents reasonably required to effectuate such assumption). Any and all options, first rights of refusal, tenant improvement allowances and other similar rights granted to Tenant in this Lease, if any, shall not be assignable by Tenant unless: (i) expressly authorized in writing by Landlord (which shall be in Landlord’s sole discretion); or, (ii) to a Permitted Transferee. Except to a Permitted Transferee, any transfer made without Landlord’s prior written consent, shall, at Landlord’s option, be null, void and of no effect, and shall, at Landlord’s option, constitute a material default by Tenant of this Lease. As Additional Rent hereunder, Tenant shall pay to Landlord each time it requests a Transfer, an administrative fee in the amount of one thousand dollars ($1,000) and shall promptly reimburse Landlord for all reasonable and actual legal and other reasonable expenses incurred by Landlord in connection with any actual or proposed Transfer.

12.5 Recapture. Except for the approximate 5,000 square foot portion of the Premises that is separately demised as of the execution of this Lease (which is not subject to recapture), Landlord may recapture the Subject Space described in the Tenant’s Notice. If such recapture notice is given, it shall serve to terminate this Lease with respect to the proposed Subject Space, or, if the proposed Subject Space covers all the Premises, it shall serve to terminate the entire Term of this Lease, in either case, as of the Proposed Effective Date. However, no termination of this Lease with respect to part or all of the Premises shall become effective without the prior written consent, where necessary, of the holder of each deed of trust encumbering the Premises or any other portion of the Industrial Center. If this Lease is terminated pursuant to the foregoing provisions with respect to less than the entire Premises, the Rent shall be adjusted on the basis of the proportion of rentable square feet retained by Tenant to the rentable square feet originally demised and this Lease as so amended shall continue thereafter in full force and effect.

12.6 Transfer Premium. If Landlord consents to a Transfer, as a condition thereto, Tenant shall pay to Landlord monthly, as Additional Rent, at the same time as the monthly installments of Rent are payable hereunder, seventy-five percent (75%) of any Transfer Premium after the payment of reasonable and customary real estate commissions and costs of altering the Premises for such assignee or subtenant with such expenses to be amortized (on a straight line basis) and deducted from the profits over the term of the sublease in the event of a sublease. The term “Transfer Premium” shall mean all rent, additional rent and other consideration payable by such Transferee which either initially or over the term of the Transfer exceeds the Rent or pro rata portion of the Rent, as the case may be, for such space reserved in the Lease.

12.7 Waiver. Notwithstanding any Transfer, or any indulgences, waivers or extensions of time granted by Landlord to any Transferee, or failure by Landlord to take action against any Transferee, Tenant agrees that Landlord may, at its option, proceed against Tenant without having taken action against or joined such Transferee, except that Tenant shall have the benefit of any indulgences, waivers and extensions of time granted to any such Transferee.

12.8 Special Transfer Prohibitions. Notwithstanding anything set forth above to the contrary, Tenant may not (a) sublet the Premises or assign this Lease to any person or entity in which Landlord owns an interest, directly or indirectly (by applying constructive ownership rules set forth in Section 856(d)(5) of the Internal Revenue Code (the “Code”); or (b) sublet the Premises or assign this Lease in any other manner which could cause any portion of the amounts received by Landlord pursuant to this Lease or any sublease to fail to qualify as “rents from real property” within the meaning of Section 856(d) of the Code, or which could cause any other income received by Landlord to fail to qualify as income described in Section 856(c)(2) of the Code.

11