STANDARD COMMERCIAL LEASE

Exhibit 10.33

STANDARD COMMERCIAL LEASE

ARTICLE 1.00 BASIC LEASE TERMS

1.01. Parties. This lease agreement (“Lease”) is entered into by and between the following Landlord and Tenant, effective on the date last executed below (“Effective Date”):

OMC Investment Venture, a Tennessee general partnership (“Landlord”).

Oxford Immunotec, Inc., a Delaware corporation (“Tenant”).

1.02. Leased Premises. In consideration of the rents, terms, provisions and covenants of this Lease, Landlord hereby leases, lets and demises to the Tenant the following described premises (“Leased Premises”):

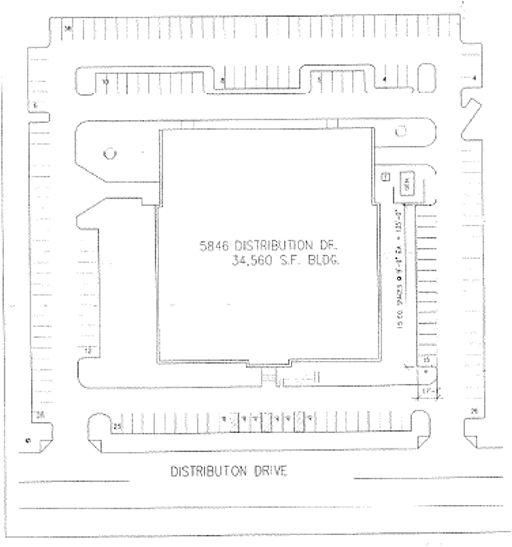

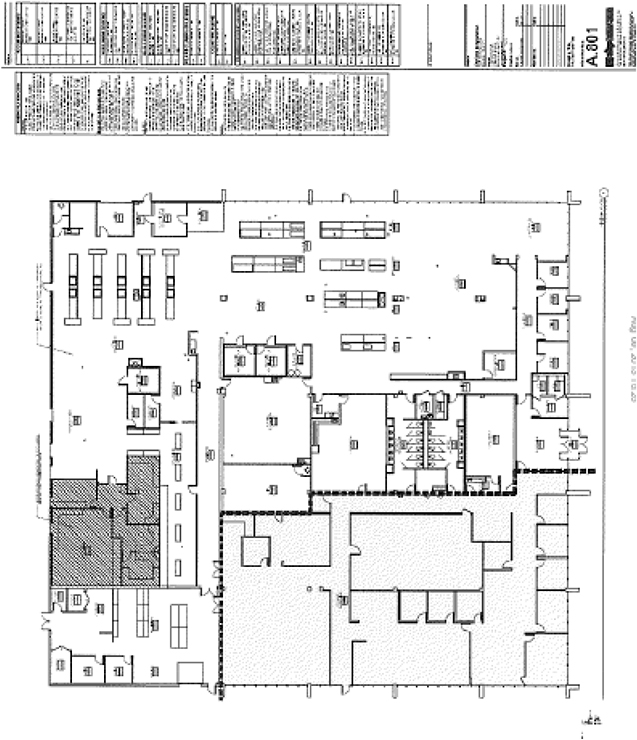

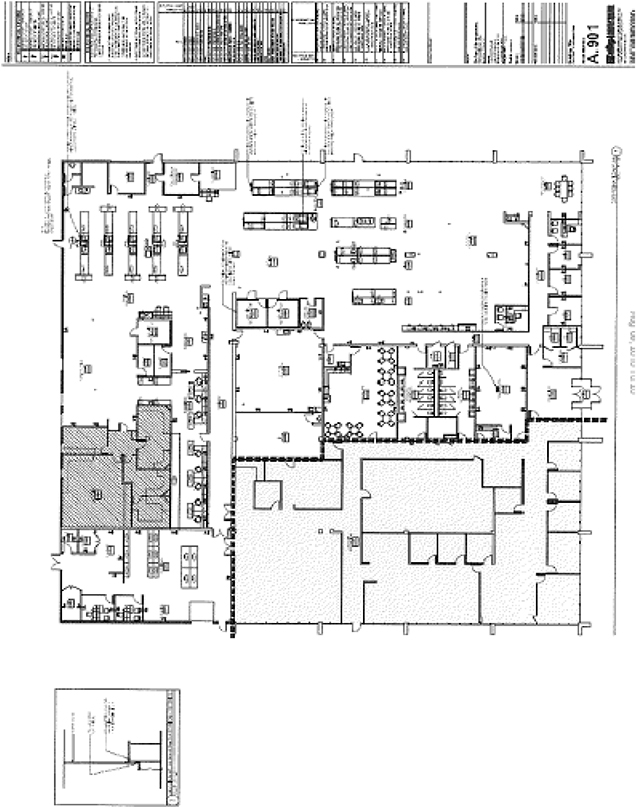

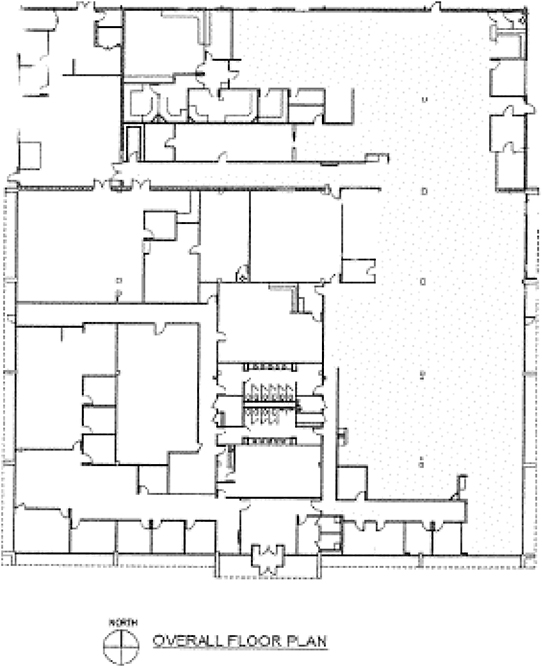

Land comprising approximately 3.182 acres and all improvements thereon, including a building containing approximately 34,560 square feet, located at 0000 Xxxxxxxxxxxx Xxxxx, Xxxxxxx, Xxxxxxxxx 00000, as generally depicted on the site plan attached hereto as Exhibit A,

for the Term specified herein, all upon and subject to the terms and conditions set forth herein.

Tenant acknowledges that the square footage of the Leased Premises is as set forth above.

1.03. Term. The term (the “Term”) of this Lease shall commence on October 24, 2011 (the “Commencement Date”) and terminate on December 31, 2016 (the “Termination Date”). Any occupancy of the Leased Premises by Tenant prior to the Commencement Date shall be subject to all obligations of Tenant under this Lease.

1.04. Base Rent and Security Deposit.

a) Base Rent per month for the Leased Premises shall be as follows but subject to adjustment in accordance with Section 6.01:

| Commencement Date through December 31, 2011 |

$ | 0.00 | ||

| January 1, 2012 through December 31, 2012 |

$ | 6,000.00 | ||

| January 1, 2013 through December 31, 2013 |

$ | 7,250.00 | ||

| January 1, 2014 through December 31, 2016 |

$ | 12,140.00 |

b) The Security Deposit to be deposited by Tenant shall be: $ 12,140.00

| Landlord: |

Tenant: | |

| Mailing Address: X.X. Xxx 00000 Xxxxxxx, XX 00000-0000 Physical Address: 0000 Xxxxx Xxxxxxx Xxxxx 000 Xxxxxxx, XX 00000 |

Mailing and Physical Address: 0 Xxxxx Xxxxx Xxxxx 000 Xxxxxxxxxxx, XX 00000 | |

1.06. Permitted Use. Tenant shall use the Leased Premises for clinical testing laboratory, general office, storage and other related purposes.

2.01. Base Rent. Tenant agrees to pay monthly as Base Rent during the Term without notice, demand, deduction, counter-claim, set-off, or abatement (except as other expressly provided in Sections 7.01, 7.02, 8.01 and 8.02 of this Lease), the sum of money set forth in Section 1.04 of this Lease. Tenant shall pay one monthly installment of Base Rent on the date of execution of this Lease by Tenant for the Base Rent for January 2012 and a like monthly installment shall be due and must be paid on or before the first day of each calendar month thereafter, commencing February 1, 2012. No payment by Tenant or receipt by Landlord of a lesser amount than the amount of Base Rent due will be deemed to be other than on account of the earliest past due installment of Base Rent required to be paid hereunder. Tenant agrees that no endorsement or statement on any check or in any letter accompanying any check or payment of Base Rent constitutes an accord and satisfaction and Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance of Base Rent then due or to pursue any remedy available under this Lease, at law or in equity.

i. Security Deposit. Tenant shall deliver the Security Deposit to Landlord on the date of execution of the Lease by Tenant. The Security Deposit will be held by Landlord without liability for interest and as security for the performance of Tenant’s covenants and obligations under this Lease, it being expressly understood that it is not an advance payment of Base Rent, Taxes and Insurance (as defined in Section 2.04), or a measure of Landlord’s damage upon an Event of Default (as defined in Section 11.01). Landlord may commingle the Security Deposit with its other funds. Upon the occurrence of any Event of Default (as defined in Section 11.01), Landlord may, from time to time, without prejudice to any other remedy, use the Security Deposit, to the extent necessary, to make good any arrears of Base Rent, Taxes and Insurance, or pay any expense or liability incurred by Landlord as a result of the Event of Default. Provided Tenant delivers the Leased Premises to Landlord as required herein upon expiration or earlier termination of this Lease, Landlord shall return any remaining balance of the Security Deposit to Tenant within forty-five (45) days following such expiration or termination of this Lease. If any

2

portion of the Security Deposit is so used or applied, Tenant shall upon twenty (20) days written notice from Landlord, deposit with Landlord by cash or cashier’s check an amount sufficient to restore the Security Deposit to its original amount. If Landlord transfers its interest in the Leased Premises during the Term, Landlord shall assign the Security Deposit to the transferee and, upon assumption of Landlord’s obligations hereunder, have no further liability for the return of, or any matter relating to, such Security Deposit.

ii. Letter of Credit. As additional security for the performance of its obligations under the Lease, within ten (10) days after the Effective Date, Tenant shall deliver to Landlord an irrevocable, unconditional, transferable, standby letter of credit issued in favor of Landlord, as beneficiary, and issued for Tenant, as account party in the amount of Three Hundred Fifty-eight Thousand, Six Hundred & xx/100 Dollars ($358,600.00), in substantially the form attached hereto as Schedule I (the “Letter of Credit”).

(i) Requirements of the Letter of Credit. The Letter of Credit shall be, among other things:

(1) In form and content satisfactory to Landlord in its reasonable discretion,

(2) Issued by a United States commercial bank satisfactory to Landlord and that is a member of the New York Clearing House Association,

(3) Subject to the International Standby Practices 1998, International Chamber of Commerce Publication No. 590,

(4) Conditioned for payment solely upon presentation of the Letter of Credit and a sight draft, and

(5) Transferable one or more times by Landlord without the consent of Tenant if Landlord’s interest in the Premises is sold or otherwise transferred and the obligations of Landlord under this Lease assumed in writing by such transferee.

(ii) Permitted Reductions in Letter of Credit. Provided no uncured Event of Default exists on each the following dates (“Default Compliance Date”), the Letter of Credit shall be reduced to the following amounts effective the following January 1 (“LOC Reduction Date”):

| Default Compliance Date |

Reduced Letter of Credit Amount |

LOC Reduction Date | ||||||

| November 30, 2012 |

$ | 286,600.00 | January 1, 2013 | |||||

| November 30, 2013 |

$ | 199,600.00 | January 1, 2014 | |||||

| November 30, 2014 |

$ | 53,900.00 | January 1, 2015 | |||||

Notwithstanding the foregoing, in the event Landlord has delivered written notice to Tenant of an event that will constitute an Event of Default if not timely cured in accordance with Section 11.01 of this Lease, and Tenant has not cured such event on or before fifteen (15) days prior to any LOC Reduction Date, Landlord may draw the LOC without any further notice to Tenant.

3

(iii) Expiration/Replacement of Letter of Credit. The original Letter of Credit shall not expire earlier than December 31, 2012. If Tenant does not deliver an amendment to or substitute for the Letter of Credit extending the expiration of the letter of credit for an additional twelve (12) months on or before December 1, 2012, December 1, 2013 and December 1, 2014, respectively, such failure shall be deemed an Event of Default, and Landlord shall provide written notice to Tenant of such Event of Default. If Tenant fails to deliver an amendment to or substitution of the Letter of Credit within ten (10) days of the date of such notice, Landlord shall have the right to draw the full amount of the existing Letter of Credit and hold such amount as additional Security Deposit as set forth in Section 2.02, until receipt of a replacement Letter of Credit consistent with the requirements of this Section 2.02. So long as no Event of Default exists at November 30, 2015, the Letter of Credit may expire on December 31, 2015.

(iv) Draws against Letter of Credit.

(1) Landlord may only draw the Letter of Credit and use, apply, or retain the proceeds thereof to the same extent that Landlord may use, apply or retain the Security Deposit, as set forth in Section 2.02.

2.03. Additional Rent. For purposes of this Lease, Additional Rent shall include Taxes and Insurance and all other amounts due Landlord from Tenant pursuant to the terms of this Lease.

2.04. Taxes and Insurance. Tenant agrees to pay without notice, demand, counter-claim, deduction, set-off or abatement of any kind all real property taxes and installments of special assessments (including dues and assessments by means of deed restrictions and/or owners associations) lawfully levied or assessed against the Leased Premises, and any and all insurance required herein or as Landlord deems reasonably necessary (specifically including fire and casualty, commercial general liability and rent loss [a/k/a business income] insurance) (collectively “Taxes and Insurance”). Landlord shall invoice Tenant monthly (in advance) for Taxes and Insurance commencing on the Commencement Date and such xxxxxxxx will be based upon Landlord’s estimate of Taxes and Insurance for the current calendar year, provided, that in the event Landlord is required under a mortgage, deed of trust, underlying lease or loan agreement covering the Leased Premises to escrow Taxes and Insurance, Landlord may but will not be obligated, to use the amount required to be escrowed as a basis for its estimate. To the extent the Commencement Date or Termination Date of the Lease is not on the first day of the calendar year or last day of the calendar year respectively, Tenant’s liability for Taxes and Insurance is subject to a pro rata adjustment based on the number of days of any such year during which the Term is in effect. Landlord shall contest or appeal any value assessment rendered by applicable taxing authorities that is deemed to be in excess of fair market value or the value of comparable properties and if such efforts result in a reduction of the real property taxes for any period during the Term, Landlord shall refund Tenant the amount of such reduction less the fees of the Landlord’s third party property tax consultants for obtaining such reduction. In no event shall Tenant be liable for any income or franchise taxes imposed upon Landlord unless such taxes are in substitution of the taxes set forth above.

4

2.07. Reconciliation. Within one hundred twenty (120) days of the close of each calendar year, Landlord shall provide Tenant an accounting showing in reasonable detail all computations of Taxes and Insurance due under Section 2.04. If the accounting shows that the total of the monthly payments made by Tenant exceeds the amount of Taxes and Insurance due by Tenant, such amount will be credited against the next required payment of Taxes and Insurance. If the accounting shows that the total of the monthly payments made by Tenant is less than the amount due by Tenant, such accounting will be accompanied by an invoice for the additional amount. If this Lease terminates on a day other than the last day of a calendar year, the amount of any Taxes and Insurance payable by Tenant applicable to the year in which such termination occurs will be prorated on the ratio that the number of days from the commencement of the calendar year to and including the Termination Date bears to 365.

2.08. Late Payment Charge. Other remedies for nonpayment of Base Rent and Additional Rent notwithstanding, if the monthly Base Rent, Taxes and Insurance, and other payments are not in Landlord’s possession on or before the tenth (10th) day of the month for which such amounts are due, or if payment of any other Additional Rent payments due Landlord by Tenant is not received by Landlord on or before the tenth (10th) day of the month next following the month in which Tenant was invoiced, such amount shall bear interest at the lesser of (i) the highest lawful rate per annum or (ii) the rate of one and one-half percent (11/2%) per month until paid. In lieu of interest on past due amounts, Landlord may charge a late fee equal to 5% of the amount past due to cover the extra expense involved in collecting past due amounts. In addition, (i) Landlord is entitled to charge one-hundred dollars ($100.00) for each check or payment which is not honored by Tenant’s bank, said charge to be in addition to any other amounts owed under this Lease, and (ii) if any Base Rent or Additional Rent payments are late two or more times in any calendar year, Landlord may require all future payments be made by certified bank check.

2.09. Holding Over. If Tenant does not vacate the Leased Premises upon the expiration or termination of this Lease, such holding over shall constitute, and be construed as, a tenancy at will at a daily rental equal to one-thirtieth (1/30th of an amount equal to, in addition to Additional Rent, one and one-half (11/2) times the Base Rent being paid by Tenant immediately prior to the expiration or termination of the Lease, and all other terms and provisions of this Lease shall apply during such holdover period (with the exclusion of any expansion or renewal options). During such holdover period, Tenant agrees to vacate and deliver the Leased Premises to Landlord within thirty (30) days of Tenant’s receipt of notice from Landlord to vacate. Landlord may give such notice pursuant to the notice provisions of Section 14.07 herein or by e-mail or facsimile transmission. Tenant agrees to pay the rental payable during the holdover period to Landlord on demand. No holding over by Tenant, whether with or without the consent of Landlord and notwithstanding receipt by Tenant of an invoice from Landlord for holdover rent, will operate to extend the Term. Additionally, Tenant shall pay to Landlord all damages

5

sustained by Landlord as a result of such holding over by Tenant without Landlord’s consent. For purposes hereof, Tenant shall considered to have vacated the Leased Premises only at such time as it has delivered the Leased Premises to Landlord in the condition required by Section 5.05.

ARTICLE 3.00 OCCUPANCY AND USE

3.01. Use. The Leased Premises shall be used and occupied only for the purpose set forth in Section 1.06. Tenant shall occupy the Leased Premises, conduct its business and control its agents, employees, invitees and visitors in such a manner as is lawful, reputable, will not create a nuisance or affect the structural integrity, or design capabilities of the Leased Premises. Tenant shall not conduct any auction, liquidation or going out of business sale. Outside storage is prohibited unless approved by Landlord. Tenant shall neither permit any waste on the Leased Premises nor allow the Leased Premises to be used in any way which would, in the opinion of the Landlord, be extra hazardous on account of fire or which would in any way increase or render void the fire insurance on the Leased Premises. If at any time during the Term the State Board of Insurance or other insurance authority disallows any of Landlord’s sprinkler credits or imposes an additional penalty or surcharge in Landlord’s insurance premiums solely because of Tenant’s original or subsequent placement or use of storage racks or bins, method of storage or nature of Tenant’s inventory or any other act of Tenant, Tenant agrees to pay as Additional Rent the directly associated increase in Landlord’s insurance premiums. Notwithstanding anything set forth in this Section 3.01, in no way does Landlord warrant or represent, either expressly or impliedly, that Tenant’s use of the Leased Premises is in accordance with applicable codes or ordinances of the municipality within which the Leased Premises is located.

3.02. Signs. No sign (which shall include balloons, flags, pennants, banners, etc.) of any type or description visible from outside the Leased Premises may he erected, placed or painted on or about the Leased Premises by Tenant, except those signs submitted to Landlord in writing and approved by Landlord in writing, and which signs are in conformance with all Legal Requirements (the “Permitted Signs”). Such permitted signs shall be installed at Tenant’s sole cost and expense and must be removed by Tenant upon expiration or termination of the Lease. Any damage from such removal shall be repaired at Tenant’s sole cost and expense.

3.03. Compliance with Laws, Rules and Regulations. Tenant, at Tenant’s sole cost and expense, shall comply with all laws, ordinances, orders, rules and regulations now in effect or enacted subsequent to the date hereof (“Legal Requirements”) of state, federal, municipal or other agencies or bodies having jurisdiction over Tenant or the Tenant’s occupancy of the Leased Premises. Tenant shall comply with the rules and regulations of the Leased Premises adopted by Landlord which are set forth on Schedule H attached to this Lease (“Rules and Regulations”). Landlord is entitled, at all times, to change and amend the Rules and Regulations in any reasonable manner as Landlord deems advisable for the safety, care, cleanliness, preservation of good order and operation or use of the Leased Premises. All such changes and amendments to the Rules and Regulations must be in writing and sent to Tenant at the Leased Premises and must thereafter be carried out and observed by Tenant.

6

3.04. Warranty of Possession and Covenant of Quiet Enjoyment. Landlord warrants that it has the right and authority to execute this Lease, and Tenant, upon compliance with the terms, conditions, covenants and agreements contained in this Lease, will be entitled to possession of the Leased Premises during the Term as well as any extension or renewal thereof. Landlord shall warrant and defend Tenant in the quiet enjoyment and possession of the Leased Premises during the Term, provided, Landlord is not responsible for the acts of any third-party not under Landlord’s control.

3.05. Inspection. Landlord or its authorized agents may, at any and all reasonable times with reasonable advance notice (except in the event of an emergency, when notice is not required), enter the Leased Premises to inspect the same, conduct tests, environmental audits or other procedures to determine Tenant’s compliance with the terms hereof; to supply any other service to be provided by Landlord; to show the Leased Premises to prospective purchasers, mortgagees or within the last six (6) months of the Term, prospective tenants; to alter, improve or repair the Leased Premises or for any other purpose Landlord deems necessary. Landlord shall use its commercially reasonable efforts to minimize any interruption or disturbance to Tenant’s use or occupancy of the Leased Premises. Tenant shall not change Landlord’s lock system or in any other manner prohibit Landlord from entering the Leased Premises. Landlord is entitled to use any and all means which Landlord may deem proper to open any door in an emergency. During the final one hundred eighty (180) days of the Term, Landlord or its authorized agents have the right to erect or maintain on or about the Leased Premises customary signs advertising the Leased Premises for lease, provided such does not materially interfere with Tenant’s use or occupancy of the Leased Premises.

Landlord acknowledges that Tenant may from time to time possess and keep in the Leased Premises individually identifiable health information relating to the Tenant’s clients or their patients (“Protected Health Information” or “PHI”) which is a necessary part of Tenant’s use of the Leased Premises. If Landlord should enter onto the Leased Premises, it may come in contact with such PHI, and if so, then Landlord shall not use or disclose any PHI. Further, Landlord agrees that it shall (i) hold the PHI confidentially and not use or disclose the PHI, and (ii) to notify Tenant immediately of any instances of which it becomes aware in which the confidentiality of the PHI is breached.

3.06. Hazardous, Biological & Medical Waste

(a) Hazardous Waste. The term “Hazardous Substances,” as used in this Lease means pollutants, contaminants, toxic or hazardous wastes, or any other substances, the presence or use of which is regulated, restricted or prohibited by any “Environmental Law,” which term means any federal, state or local law, ordinance or other statute of a governmental or quasi-governmental authority relating to pollution or protection of the environment. Tenant hereby agrees that (i) no activity will be conducted on the Leased Premises that will produce any Hazardous Substance, except for such activities that are part of the ordinary course of Tenant’s business activities and of which Landlord has been notified in writing (the “Permitted Activities”), provided said Permitted Activities are conducted in accordance with all Environmental Laws; Tenant shall obtain all required permits and pay all fees and provide any testing required by any governmental agency; (ii) the Leased Premises will not be used by Tenant, its agents, employees, contractors, invitees or licensees (each and collectively a “Tenant Party”) in any manner for the storage of any Hazardous Substances except for the temporary storage of such materials that are used in the ordinary course of Tenant’s business and of which

7

Landlord has been notified in writing (the “Permitted Materials”), provided such Permitted Materials are properly stored in a manner and location meeting all Environmental Laws; Tenant shall obtain any required permits and pay any fees and provide any testing required by any governmental agency; (iii) no portion of the Leased Premises will be used by Tenant (or any Tenant Party) as a landfill or a dump; (iv) Tenant will not install any underground or above ground tanks of any type; (v) Tenant will not allow any surface or subsurface conditions to exist or come into existence that constitute, or with the passage of time may constitute a public or private nuisance; (vi) Tenant will not permit any Hazardous Substances to be brought onto the Leased Premises, except for the Permitted Materials, and if so brought or found located thereon, the same must be immediately removed, with proper disposal, and all required cleanup procedures must be diligently undertaken pursuant to all Environmental Laws.

Landlord or Landlord’s representative have the right but not the obligation to enter the Leased Premises for the Purpose of inspection to ensure compliance with all Environmental Laws. Should Landlord determine, in Landlord’s opinion, that any Hazardous Substances, including Permitted Materials, are being improperly stored, used, or disposed of, or any Permitted Activities are being improperly conducted, then Tenant shall immediately take such corrective action as required by Landlord. Should Tenant fail to take such corrective action within twenty-four (24) hours, Landlord is entitled to perform such work and Tenant shall promptly reimburse Landlord for any and all costs associated with said work. If at any time during or after the Term, the Leased Premises are found to be so contaminated or subject to said conditions, and said conditions did not exist on the Commencement Date, Tenant shall diligently institute proper and thorough cleanup procedures at Tenant’s sole cost. Before taking any action to comply with Environmental Laws or to clean up Hazardous Substances contaminating the Leased Premises, Tenant shall submit to Landlord a plan of action, including all plans and documents required by any Environmental Law to be submitted to a governmental authority (collectively a “plan of action”). Such plan of action must be implemented by a licensed environmental contractor. Before Tenant begins the actions necessary to comply with Environmental Laws or to clean up contamination from Hazardous Substances, Landlord must (1) approve the nature, scope and timing of the plan of action, and (2) approve any and all covenants and agreements to affect the plan of action.

(b) Landlord’s Obligations.

(i) Landlord represents and warrants that to its knowledge, without independent investigation, on the Commencement Date the Leased Premises will be in compliance with all Environmental Laws. Landlord shall be solely responsible, at Landlord’s cost, for removing or otherwise remediating all Hazardous Substances existing on the Commencement Date within the Leased Premises in violation of Environmental Laws, and in full compliance with all Environmental Laws.

(ii) If Tenant incurs any costs, fees, and/or expenses, in connection with removal of Hazardous Substances existing within the Leased Premises on the Commencement Date in violation of Environmental Laws, Landlord shall pay such costs, fees and/or expenses within thirty (30) days of a written request from Tenant, along with documentation of all costs, fees and/or expenses incurred by Tenant. Furthermore, Landlord shall indemnify, protect, defend and hold Tenant harmless from and against any and all costs,

8

fees, and/or expenses in any way related to the removal of Hazardous Substances existing within the Leased Premises on the Commencement Date in violation of Environmental Laws. If any action or proceeding is brought against Tenant by reason of the existence of Hazardous Substances within the Leased Premises on the Commencement Date in violation of Environmental Laws, Landlord, upon written notice from Tenant, shall defend the same at Landlord’s expense by counsel reasonably satisfactory to Tenant.

(c) Biological and Medical Waste Contaminants and Materials.

(iii) Tenant represents and warrants that it shall handle and dispose of all blood, urine, fecal, tissues and other biological and medical waste, contaminants and materials (collectively, the “Biohazardous Substances”) in a manner that is in accordance with all federal, state and local laws and ordinances 41:1 regulations (collectively, the “Biohazardous Regulations”). Tenant hereby agrees to save, indemnify, defend and hold Landlord harmless from any and all claims, actions, causes of actions and losses, including attorneys’ and consultants’ fees and expenses, resulting from the release or threatened release of any Biohazardous Substances on or about the Leased Premises, which occurs while Tenant is occupying the Leased Premises, or from Tenant’s failure to strictly abide by the Biohazardous Regulations. This warranty, representation and indemnification shall survive the expiration or other termination of this Lease.

(iv) Prior to the expiration of this Lease or within thirty (30) days after a termination of this Lease or within thirty (30) days after Tenant ceases to occupy the Lease Premises, Tenant shall cause the entire Leased Premises to be decontaminated in accordance with all Biohazardous Regulations and shall bear all costs and expenses related to such decontamination. Within thirty (30) days after the decontamination is completed, Tenant shall furnish Landlord written evidence from a nationally recognized third party biohazardous testing firm that the Leased Premises have been completely decontaminated of all Biohazardous Substances in accordance with all Biohazardous Regulations. Failure to timely furnish such third party written evidence to Landlord as specified herein or if the furnished evidence is not reasonably satisfactory to Landlord shall constitute an Event of Default and Landlord, in addition to any other remedies provided for in this Lease, may take such other action as is lawful, including, but not limited to, having the entire Leased Premises decontaminated in accordance with all Biohazardous Regulations, and Tenant shall reimburse Landlord for the total cost thereof plus any additional costs of Landlord as a result of enforcing this provision, including, but not limited to attorneys’ fees and expenses. Tenant’s obligation in this regard shall constitute an independent obligation to indemnify Landlord and such indemnity obligations shall survive the expiration or other termination of this Lease.

(v) Tenant represents and warrants that it has not been previously cited for any environmental or biohazardous violations by any applicable governmental agency.

3.07. Parking, Road Use and Improvements by Landlord. Tenant is granted the license and right to use, for the benefit of Tenant, its employees, customers, invitees and licensees, 1) the parking areas on an unassigned, unreserved and exclusive basis, and 2) the roadways, in each case subject to reasonable regulation by Landlord. No parking is permitted on any common drive areas by Tenant or any of Tenant’s employees, customers, invitees or

9

licensees. No driving or parking of any vehicles on non-paved areas is permitted. With respect to the parking and parking lots serving the Leased Premises, Landlord (i) shall not) block or restrict the parking available to the Tenant, (ii) shall make such parking and parking lot available for Tenant’s use at all times during this Lease, and (iii) shall not change or reconfigure the parking or parking lots. LANDLORD WILL HAVE NO LIABILITY TO TENANT, ITS EMPLOYEES, AGENTS OR INVITEES FOR ANY CLAIMS OR LIABILITIES ARISING FROM SUCH PARTIES’ USE OF THE PARKING AREAS AND TENANT WILL INDEMNIFY AND HOLD LANDLORD HARMLESS AGAINST ALL SUCH CLAIMS AND LIABILITIES UNLESS CAUSED BY THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF LANDLORD.

3.08. Permits. Tenant shall, at its sole cost, be responsible for all permits with respect to the operation of its business and use and occupancy of the Leased Premises by Tenant and will provide copies of such permits from time to time upon the written request of Landlord.

ARTICLE 4.00 UTILITIES AND SERVICE

4.01. Services. Landlord shall provide at its sole cost and expense on the Commencement Date (a) water and sewer service connections to the Leased Premises, (b) electricity service connections to the electrical box mounted on the outside of the Leased Premises, and (c) telephone service connections to the telephone box adjacent to the Leased Premises (the “Essential Building Services”). The Essential Building Services shall be provided by the applicable utility providers in manner, quantity and quality equal to utility services provided to buildings of comparable size, use and location. Tenant shall arrange for connection to such services and pay directly to the appropriate supplier all cost of utility services to the Leased Premises, including, but not limited to, security deposits, initial connection charges, taxes, penalties, surcharges or the like, all charges for gas, electricity, telephone, water, sprinkler monitoring devices, sanitary and storm sewer service, and security systems. Tenant shall pay all costs caused by Tenant introducing excessive pollutants or solids other than ordinary human waste into the sanitary sewer system, including permits, fees and charges levied by any governmental subdivision for any such pollutants or solids. Tenant shall be responsible for the installation and maintenance of any dilution tanks, holding tanks, settling tanks, sewer sampling devices, sand traps, grease traps or similar devices as may be required by any governmental subdivision for Tenant’s use of the sanitary sewer system. Except as set forth herein, Landlord shall not be required to pay for any utility services, supplies’ or upkeep in connection with the Leased Premises.

Tenant agrees that Landlord shall not be liable to Tenant in any respect for damages to either person, property or business on account of any interruption or failure of utility services. No such interruption or failure may be construed as an eviction of Tenant or entitle Tenant to (i) any abatement of rent unless the interruption or failure of utilities is the result of the gross negligence or willful misconduct of Landlord or any Landlord Party, (ii) terminate the Lease, or (iii) be relieved from fulfilling any covenant or agreement contained herein. Should any malfunction of the improvements or facilities to the Leased Premises (which by definition do not include any improvements or facilities of Tenant above standard improvements for the Leased Premises) occur for any reason, Landlord shall use reasonable diligence to see that such malfunction is corrected promptly.

10

4.02. Telecommunications. Tenant, at its sole cost, may order and use telephone and other wired telecommunications services in accordance with rules and regulations adopted by Landlord from time to time, but Tenant must obtain Landlord’s prior written consent to Tenant’s use of services of a telephone or telecommunications service provider who is not then providing service to the Leased Premises. Unless Landlord otherwise requests or consents in writing, Tenant’s telecommunications equipment must be located in the Leased Premises. Landlord has no obligation to maintain Tenant’s telecommunications equipment, wiring, or other infrastructure, and if any such service is interrupted, curtailed, or discontinued, Landlord will have no obligation or liability to Tenant. Landlord shall not build or erect any structure on or about the Leased Premises which may or interfere with such telecommunications equipment.

(a) Landlord, upon reasonable prior notice to Tenant, will be entitled to interrupt or turn off telecommunications facilities for any emergency, to repair the Leased Premises. Landlord shall use commercially reasonable efforts to make any such repairs during non-business hours, minimizing the interruption to Tenant.

(b) Upon expiration or termination of this Lease, Tenant, at its sole cost, will remove all telecommunications equipment and other facilities for telecommunications transmittal (including wiring) installed in the Leased Premises for Tenant’s use.

4.03. Security Service. Tenant acknowledges and agrees that Landlord is not providing any security services with respect to the Leased Premises and that Landlord shall not be liable to Tenant for, and Tenant waives any claim against Landlord with respect to, any loss by theft or any other damage suffered or incurred by Tenant in connection with any unauthorized entry into the Leased Premises or any other breach of security with respect to the Leased Premises, unless caused by the gross negligence or willful misconduct of Landlord, or its agents, employees, contractors, invitees or licenses (each and collectively, a “Landlord Party”). Tenant shall, at all times, secure the Leased Premises to prevent unlawful or uninvited entry thereon.

ARTICLE 5.00 REPAIRS AND MAINTENANCE

5.01. Existing Conditions. Tenant accepts the Leased Premises as of the date hereof, subject to all recorded matters, laws, ordinances, and governmental rules, regulations and orders. Tenant acknowledges that except as set forth in Section 14.20, neither Landlord nor any agent of Landlord has made any warranty or representation of any kind, either express or implied as to the condition of the Leased Premises or the suitability of the Leased Premises for Tenant’s intended use. Tenant’s execution of Landlord’s Standard Tenant Acceptance of Premises form will be conclusive evidence that Tenant accepts the Leased Premises, that the Leased Premises have been completed in accordance with Section 6.01 and were in good and satisfactory condition at the time such possession was so taken. Prior to taking occupancy of the Leased Premises, Tenant shall sign a copy of the space plan of the Leased Premises acknowledging its condition on the date thereof (unless Landlord waives such requirement) and execute Landlord’s Standard Tenant Acceptance of Premises form accepting such condition.

5.02. Landlord Repairs and Maintenance. Landlord is not required to maintain or make any repairs or replacements of any kind or character to the Leased Premises during the Term except as are set forth in this Section 5.02. Landlord shall maintain in good repair and

11

condition, except for reasonable wear and tear, only the structural components of the roof, foundation, surfaces and structural soundness of exterior walls (excluding windows, window glass, plate glass, doors, store fronts, uninsured losses and damages caused by Tenant or any third party). Landlord’s costs of maintaining the items set forth in this section are not subject to the Additional Rent provisions in Section 2.03. Tenant is not entitled to any abatement or reduction of rent by reason of any maintenance, repairs, replacement or alterations made by Landlord under this Lease, unless Tenant is unable to conduct its business within the Leased Premises as a result of the gross negligence or willful misconduct of Landlord, or any Landlord Party, while performing its obligations under this Section 5.02.

5.03. Tenant Repairs and Maintenance. Tenant shall, at its sole cost and expense, maintain, repair and replace all other parts of the Leased Premises in good repair and condition (reasonable wear and tear excepted), including, but not limited to windows, window glass, plate glass, doors, store fronts, floor covering, interior walls, partitions and finish work, interior side of structural walls, water closets, kitchens, interior plumbing, electrical systems, heating, ventilating and air-conditioning systems, down spouts, fire sprinkler system, dock bumpers, levelers, lights, truck and rail doors, pest control and extermination and trash pick-up and removal, lawn and landscaping, the landscaping irrigation system and the common areas (i.e. parking lot and sidewalks). Tenant shall repair and pay for any damage caused by any act or omission of Tenant or Tenant Party. Repairs and replacements shall be done in a good and workmanlike manner and in accordance with all Legal Requirements. If Tenant fails to maintain, repair or replace as required herein, Landlord may, at its option, perform on Tenant’s behalf and charge the cost of such performance to Tenant as Additional Rent which is due and payable by Tenant within thirty (30) days from receipt of Landlord’s invoice with accompanying description of services. Costs under this section are the total responsibility of Tenant.

Notwithstanding the foregoing, provided Tenant complies with Section 5.06 below, Landlord shall reimburse Tenant for (i) 100% of the cost of any repairs to or replacement of the HVAC, plumbing or electrical systems through March 31, 2012. Tenant shall notify Landlord in writing of the need for such repairs or replacement no less than ten (10) days prior to such repairs or replacements being made to allow Landlord to confirm that such repairs or replacements are necessary. Reimbursement required hereunder shall be made within fifteen (15) days of receipt of the vendor invoice detailing the costs of repair or replacement incurred by Tenant.

Landlord agrees that Tenant may receive the benefit of all guaranties and warranties owned by Landlord on items for which Tenant is responsible for repair and maintenance, provided Tenant complies with all conditions established in any such guaranty or warranty.

5.04. Request for Repairs. All requests for repairs or maintenance that are the responsibility of Landlord pursuant to any provision of this Lease must be made in writing to Landlord at the address in Section 1.05 and delivered pursuant to Section 14.07. Notices sent by facsimile are not considered proper notice for purposes hereof. If Tenant shall promptly give Landlord written notice of any need for repairs or maintenance for which Landlord is responsible under this Lease, and if Landlord shall fail to conduct such repairs or maintenance in accordance with this Lease within sixty (60) days of Tenant’s notification, or such shorter time as is reasonable if expedited repair or maintenance is needed to avoid personal injury or property damage, or such longer time as is reasonable if necessary to conduct such repair or maintenance,

12

Tenant shall have the option to conduct such repair or maintenance, and Landlord shall pay to Tenant all reasonable costs and expenses incurred with respect thereto within thirty (30) days after receipt of Tenant’s invoice therefore, which invoice shall be accompanied by reasonably sufficient documentation evidencing the amount required to be paid. Notwithstanding the foregoing, any repair or maintenance work performed by Tenant pursuant to this Section 5.04 shall be done in accordance with all warranties and in a manner that will not invalidate any warranties.

5.05. Tenant Damages. Tenant shall not cause any damage (or allow any damage by a Tenant Party) to any portion of the Leased Premises, and at the termination of this Lease Tenant shall deliver the Leased Premises to Landlord in good condition and repair, ordinary wear and tear and damage from insured casualty excepted. For purposes of this Section 5.05, “good condition and repair” shall mean, at a minimum, broom-clean, carpet vacuumed, light fixtures working properly, electrical outlets working properly, HVAC systems working properly, plumbing fixtures working properly, hot water heaters working properly, doors opening and closing properly, damage to sheet rock repaired, dock doors working properly, and all damaged plate-glass repaired. Tenant shall remove all personal property from the Leased Premises, including laboratory benches and vents for hooded equipment, and shall repair any damages to the Leased Premises due to such removal.

Tenant shall notify Landlord in writing prior to vacating the Leased Premises and arrange to meet with Landlord for a joint inspection immediately prior to evacuation. The cost and expense of any repairs necessary to restore the condition of the Leased Premises to the condition required herein shall be borne by Tenant. Should Landlord be required to expend any sums to ensure compliance with this Section 5.05, Tenant shall reimburse Landlord within thirty (30) days of receipt of notice from Landlord.

5.06. Maintenance Contract. Tenant shall, at its sole cost and expense, during the Term maintain a regularly scheduled preventative maintenance/service contract on an annual basis with a maintenance contract for the servicing of all heating, ventilation and air conditioning systems and equipment within or servicing to Leased Premises, including the UPS system and diesel generator. The maintenance contractors and contracts must be reasonably approved by Landlord and must include all services suggested by the equipment manufacturer. A copy of the service contract shall be provided to Landlord within thirty (30) days following the Commencement Date. In the event the service contracts are not provided, then Landlord shall have the right, but not the obligation to have the work done and the cost therefor shall be charged to Tenant as Additional Rent and shall become payable by Tenant with the payment of the rent next due hereunder.

ARTICLE 6.00 ALTERATIONS AND IMPROVEMENTS

(a) On the Commencement Date, Landlord will deliver the Leased Premises to Tenant in a broom clean condition, and, along with the lighting, electrical (excluding the UPS system and the diesel generator), mechanical and plumbing fixtures, plumbing systems, dock doors and HVAC servicing the Leased Premises, hot water, doors and plate-glass, will be delivered to Tenant in good condition and repair, as defined in Section 5.05 above.

13

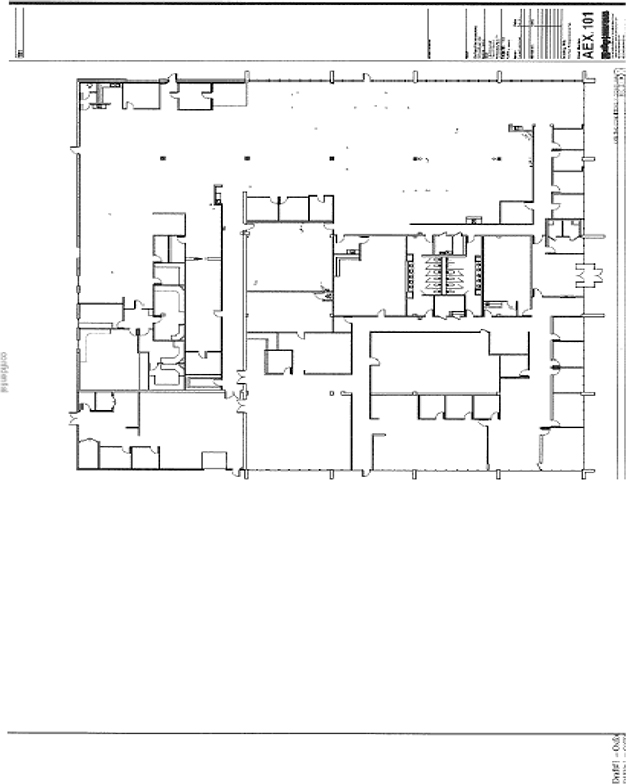

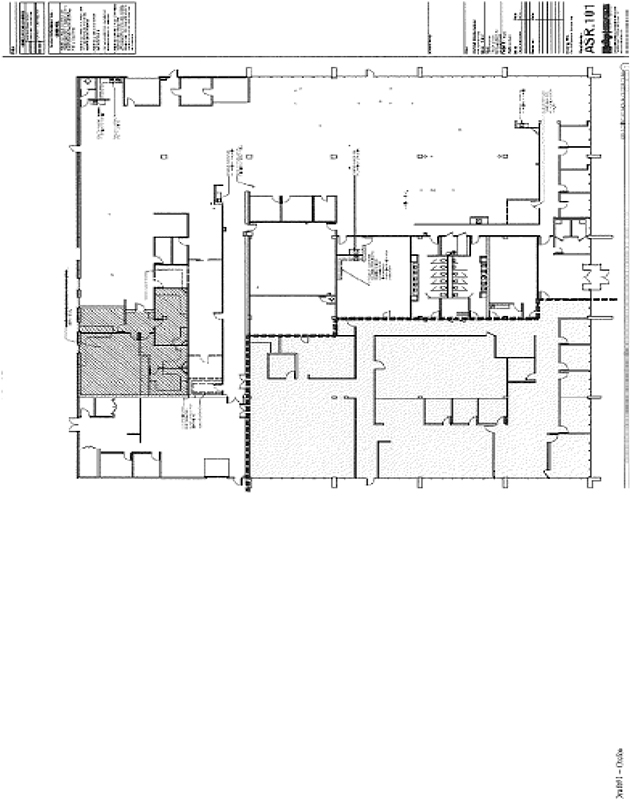

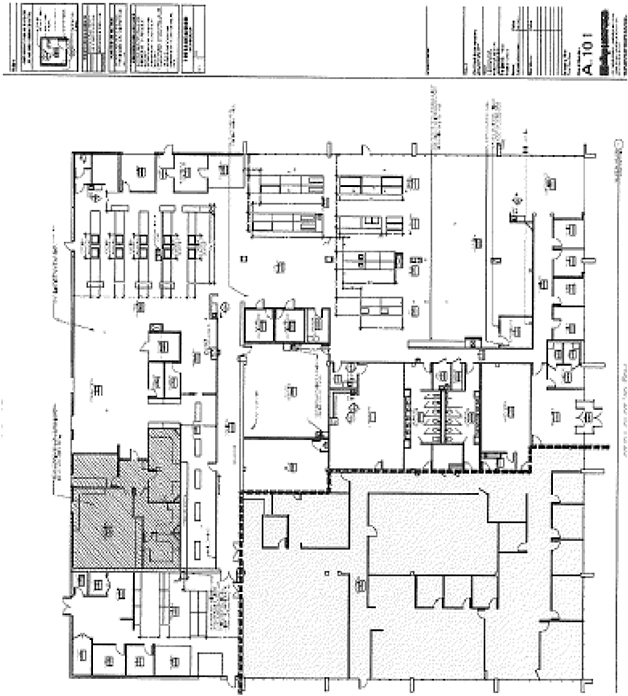

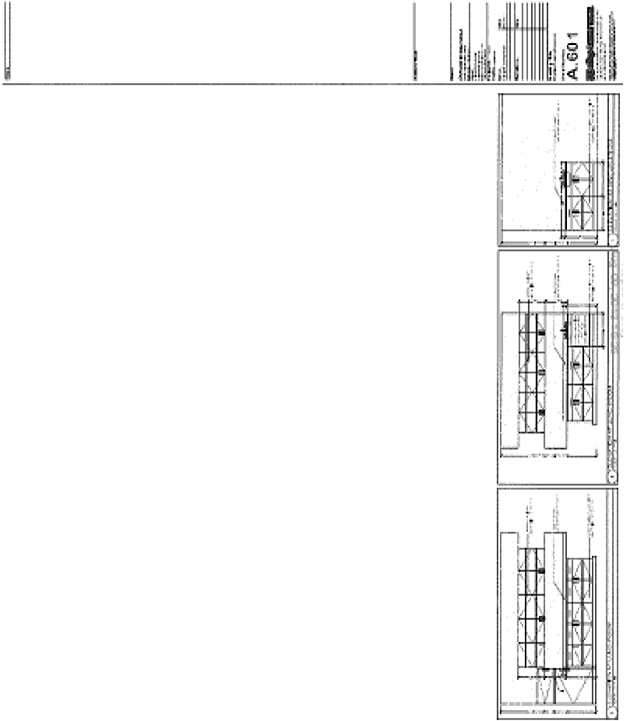

(b) After receipt of the Letter of Credit and any required building permit, Landlord will commence and diligently pursue to completion, the construction of the improvements to the Leased Premises (the “Landlord Improvements”), in accordance with plans and specifications as shown in Exhibit B, subject to approval by local regulatory authorities (the “Plans”), which Plans are made a part of this Lease by reference. Any changes or modifications to the Plans must be made and accepted by written change order or agreement signed by Landlord and Tenant and will constitute an amendment to this Lease. Any Landlord Improvements made by Landlord are the property of Landlord and must be surrendered to Landlord upon the termination of this Lease without credit to Tenant. Upon completion of any Landlord Improvements and issuance of a final certificate of occupancy (to be applied for by Landlord’s general contractor) and certification from Landlord’s general contractor certifying to Tenant that all Landlord Improvements have been completed in accordance with the Plans (the “General Contractor’s Certificate”), thereafter Landlord shall provide and Tenant shall acknowledge receipt and acceptance of “as-built plans” of all work done in accordance with this Section 6.01.

(c) Landlord shall furnish an allowance of up to $172,800.00 (One hundred seventy-two thousand, eight hundred dollars) (“Landlord Improvement Allowance”) to be credited against the cost of the construction of the Landlord Improvements. If the actual cost of construction of the Landlord Improvements is less than the Landlord Improvement Allowance (“Allowance Overage”), Tenant shall have no right or claim to such difference; provided however, that if there is an Allowance Overage, Landlord, upon submission of supporting documentation by Tenant, will reimburse Tenant for any third party costs of low voltage wiring and laboratory benches for the Leased Premises, but such reimbursement shall not exceed the lesser of the Allowance Overage or 69,120.00 (Sixty-nine thousand, one hundred twenty & xx/100 dollars). If the actual cost of construction of the Landlord Improvements exceeds the Landlord Improvement Allowance, Tenant shall pay such excess cost to Landlord within ten (10) business days after receipt of supporting documentation and the General Contractor’s Certificate,.

(d) Notwithstanding anything contained in Section 6.01 (c) above, within 30 days after the issuance of the General Contractor’s Certificate, Landlord will determine the sum of (i) the actual cost of the Landlord Improvements, plus (ii) if any, the actual costs submitted by Tenant towards the Contingent Allowance, and the product of the calculation shall be rounded to the next $1,000.00 (One Thousand Dollars). If the resultant amount is less than the Landlord Improvement Allowance, Landlord shall reduce the monthly Base Rent by $20.25 (“Base Rent Reduction Factor”) for each whole $1,000.00 (One Thousand Dollars) of such amount effective January 1, 2012. If it is determined that the monthly Base Rent is to be reduced and if Tenant has already paid Base Rent in a pre-reduction amount, Landlord shall give Tenant credit for any such excess payment, and reduction in monthly Base Rent shall be memorialized in an amendment to this Lease. In the event that the monthly Base Rent is reduced in accordance with this Section 6.01(d), there shall be no reduction in the Security Deposit Amount or in the requirements set forth for the Letter of Credit.

14

The following example illustrates the intentions of the parties hereto as to computation of any reduction of the monthly Base Rent:

Assumptions:

| 1. | Actual cost of the Landlord Improvements: $100,000.00 |

| 2. | Actual cost of qualifying costs for Contingent Allowance: $50,500.00 |

Total cost of Landlord Improvements and Contingent Allowance Costs: ($100,000.00 + $50,500.00) = $150,500.00

Determination of reduction in monthly Base Rent:

| Total Landlord Improvement Allowance |

$ | 172,800.00 | ||

| Less total cost of Landlord Improvements and contingent costs |

150,500.00 | |||

|

|

|

|||

| $ | 22300.00 | |||

|

|

|

|||

| Rounded to next $1,000.00 (One Thousand Dollars) |

$ | 23,000.00 | ||

| Divided by $1,000.00 (One Thousand Dollars) |

1,000.00 | |||

|

|

|

|||

| 23.00 | ||||

| Base Rent Reduction Factor |

20.25 | |||

|

|

|

|||

| Reduction in monthly Base Rent |

$ | 465.75 | ||

|

|

|

(e) In addition to the Landlord Improvements, Landlord, at Landlord’s sole cost and expense, shall have the following additional work performed on the Leased Premises prior to delivery of possession to Tenant, such work to be coordinated with the construction of the Landlord Improvements:

| (i) | Replace all stained, damaged or missing ceiling tiles, |

| (ii) | Paint all walls in the Leased Premises, the color to be designated by Tenant, |

| (iii) | Replace all vinyl floor tiles in the open laboratory area as shown in Exhibit C, |

| (iv) | Shampoo all carpets in the office areas and hallways and |

| (v) | Any existing water supply or drainage pipes in the open lab area that are not initially utilized by Tenant shall be capped and made reasonably flush with the floor, but such capping shall allow for those pipes to be tapped by Tenant for future use. |

| (vi) | Re-caulk all perimeter flashing; install new pads under all gas line blocking; repair any loose or open curb or wall flashing; repack all pitch pans; repair any open joints on gravel guard; repair any loose scupper flashing; clean, prime and install EPDM peel and stick tape to all roof side tilt wall joints; clean all debris from around drains and entire roof; install Xxxxxx 97 asbestos free aluminum coating to entire roof surface |

| (vii) | Repair any existing alligator or pothole areas. |

15

6.02. Tenant Improvements. Tenant shall not make or allow to be made any structural alterations or physical additions in or to the Leased Premises (“Tenant Alterations”) without complying with all Legal Requirements and without first obtaining the written consent of Landlord. Consent may be conditioned upon review and approval of plans and specifications and monitoring of construction by Landlord, Landlord’s consultants or any manufacturer providing any original components of the Leased Premises. Landlord’s review of Tenant’s plans and specifications and monitoring of construction shall be solely for Landlord’s benefit and shall impose no duty or obligation on Landlord to confirm that the plans and specifications and/or construction comply with any Legal Requirements. Any Tenant Alterations shall be made or performed at Tenant’s sole cost and expense by a contractor or contractors acceptable to Landlord and in a good, workmanlike and lien free manner. All Tenant Alterations are the property of Landlord and must be surrendered to Landlord upon the termination of this Lease without credit to Tenant; provided, however, Landlord, at its option, at the time Landlord’s consent is granted, may designate in writing to Tenant that Tenant remove certain Tenant Alterations in order to restore the Leased Premises to the condition existing at the time Tenant took possession, all costs of removal to be borne by Tenant. This clause does not apply to moveable equipment, fixtures or furniture owned by Tenant, which may be removed by Tenant at the end of the Term, provided such removal can he accomplished without material damage to the Leased Premises. Upon completion of any Tenant Alterations, Tenant shall provide Landlord with “as built plans” (on CAD form), copies of all construction contracts and proof of payment for all labor and materials (including lien waivers). To defer the cost to Landlord associated with Tenant Alterations and confirming that such improvements are in accordance with the terms of this Lease and comply with all Legal Requirements, Tenant shall reimburse Landlord within thirty (30) days after notice and supporting documentation, as Additional Rent, any sums expended by Landlord for third party examination of the architectural, mechanical, electrical and plumbing plans for any Tenant Alterations.

Tenant, at its own cost and expense and without Landlord’s prior approval, may erect such shelves, machinery and trade fixtures (collectively “Trade Fixtures”) in the ordinary course of its business provided that such items do not alter the basic character of the Leased Premises, do not overload or damage the Leased Premises, may be removed without injury to the Leased Premises, and the construction, erection, and installation thereof complies with all Legal Requirements and with Landlord’s requirements set forth above. Upon expiration or earlier termination or this Lease, Tenant shall remove its Trade Fixtures and shall repair any damage caused by such removal.

6.03. Alterations By Landlord. With respect to Landlord’s ability to alter the Leased Premises after completion of the Landlord Improvements, Landlord covenants not to make any changes, additions, or alterations which materially and adversely affect the Leased Premises, Tenant’s business operations thereat, access to the Leased Premises, visibility of the Leased Premises or Tenant’s signs, or the proximity of and convenient access between the parking areas and the Leased Premises; without first obtaining Tenant’s written consent, which consent may be withheld if any such changes, alterations or additions materially and adversely affect Tenant’s business operations; otherwise Tenant’s consent shall not be unreasonably withheld or delayed.

16

ARTICLE 7.00 CASUALTY AND INSURANCE

7.01. Substantial Destruction. If the Leased Premises or any part thereof are damaged by fire or other casualty, Tenant shall give prompt written notice thereof to Landlord: 1) If the Leased Premises are totally destroyed by fire or other casualty, 2) if the Leased Premises are damaged so that rebuilding cannot reasonably be completed within one hundred eighty (180) days after the date of written notification by Tenant to Landlord of the destruction, 3) if the Leased Premises are substantially destroyed (even though the Leased Premises are not totally or substantially destroyed), 4) if the Leased Premises are damaged by fire or other casualty and applicable law would prevent rebuilding to substantially the condition prior to such fire or casualty, 5) if any mortgagee requires the insurance proceeds payable as a result of such casualty to be applied to the payment of the mortgage debt, or 6) the Leased Premises are materially damaged and less than one (1) year remain on the Term on the date of such casualty, Landlord may at its option terminate this Lease by providing Tenant written notice thereof within sixty (60) days of such casualty and xxxxx Base Rent and Additional Rent for the unexpired portion of the Term effective as of the date of the casualty.

7.02. Partial Destruction. If this Lease is not terminated under Section 7.01, Landlord shall proceed with reasonable diligence to rebuild or repair the Leased Premises and Landlord Improvements, if applicable, to substantially the same condition in which they existed prior to the damage, provided, Tenant agrees that Landlord has no obligation to repair or rebuild any Tenant Alterations or Tenant’s furniture, fixtures or personal property. If the Leased Premises are to be rebuilt or repaired and are untenantable in whole or in part following the damage, Landlord and Tenant agree to adjust the Base Rent and Additional Rent payable under this Lease during the period for which the Leased Premises are untenantable to such an extent as may be fair and reasonable under the circumstances. If Landlord elects to repair or rebuild the Leased Premises and fails to complete such repair or rebuilding to substantially the same condition in which they existed prior to the damage (excluding the Tenant items set forth above) within one hundred eighty (180) days from the date of written notice by Tenant to Landlord of such damage by fire or other casualty, and the damage is not the result of any act or omission by Tenant or any Tenant Party, then Tenant may terminate this Lease by providing written notice to Landlord.

7.03. Property Insurance. Landlord shall at all times during the Term of this Lease maintain All Risk of Physical Loss Insurance with the premiums paid in advance, issued by and binding upon an insurance company with an A.M. Best rating of A- or better, insuring the Leased Premises, and Landlord Improvements, if applicable, in an amount equal to the full replacement cost of the Leased Premises and Landlord Improvements, if applicable, as of the date of the loss (exclusive of excavation and foundation costs, costs of underground items and costs of parking lot paving and landscaping); provided, Landlord shall not be obligated in any way or manner to insure any Tenant Alterations or any personal property (including, but not limited to, any furniture, machinery, goods or supplies) of Tenant upon or within the Leased Premises, or any fixtures installed or paid for by Tenant upon or within the Leased Premises. Tenant shall have no right in or claim to the proceeds of any policy of insurance maintained by Landlord even if the cost of such insurance is borne by Tenant as set forth in Article 2.00.

17

7.04. Waiver of Subrogation. ANYTHING IN THIS LEASE TO THE CONTRARY NOTWITHSTANDING, LANDLORD AND TENANT HEREBY WAIVE AND RELEASE EACH OTHER OF AND FROM ANY AND ALL RIGHT OF RECOVERY, CLAIM, ACTION OR CAUSE OF ACTION, AGAINST EACH OTHER, THEIR AGENTS, OFFICERS, EMPLOYEES OR ANY PARTY CLAIMING BY, THROUGH OR UNDER LANDLORD OR TENANT, FOR ANY LOSS OR DAMAGE THAT MAY OCCUR TO THE LEASED PREMISES, IMPROVEMENTS TO THE LEASED PREMISES, OR PERSONAL PROPERTY WITHIN THE LEASED PREMISES, BY REASON OF FIRE, EXPLOSION, OR ANY OTHER OCCURRENCE, REGARDLESS OF CAUSE OR ORIGIN, INCLUDING NEGLIGENCE OF LANDLORD OR TENANT AND THEIR AGENTS, OFFICERS AND EMPLOYEES WHICH LOSS OR DAMAGE IS (OR WOULD HAVE BEEN, HAD THE INSURANCE REQUIRED BY THIS LEASE BEEN MAINTAINED) COVERED BY INSURANCE. LANDLORD AND TENANT AGREE IMMEDIATELY TO GIVE THEIR RESPECTIVE INSURANCE COMPANIES WHICH HAVE ISSUED POLICIES OF INSURANCE COVERING ALL RISK OF DIRECT PHYSICAL LOSS, WRITTEN NOTICE OF THE TERMS OF THE MUTUAL WAIVERS CONTAINED IN THIS SECTION AND TO HAVE THE INSURANCE POLICIES PROPERLY ENDORSED, IF NECESSARY, TO PREVENT THE INVALIDATION OF THE INSURANCE COVERAGES BY REASON OF THE MUTUAL WAIVERS.

A. At all times commencing on and after the earlier of the Commencement Date and the date Tenant or its agents, employees or contractors enters the Leased Premises for any purpose, Tenant shall carry and maintain, at its sole cost and expense:

1. Commercial General Liability Insurance covering the Leased Premises, its appurtenances and Tenant’s actions therein, providing, on an occurrence basis, with a combined single limit, including umbrella coverage, of not less than Two Million and No/100 Dollars. Coverage shall include premises and operations, products and completed operations, independent contractors and blanket contractual liability;

18

2. All Risks of Physical Loss Insurance written at full replacement cost value and with a replacement cost endorsement covering (i) damage to Tenant’s personal property and the Tenant Alterations in the Leased Premises, resulting from fire or other casualty, and (ii) all damage to the Landlord Improvements resulting from theft, burglary or vandalism;

3. Workers’ Compensation Insurance as required by the state in which the Leased Premises is located and in amounts as may be required by applicable statute, and Employers’ Liability Coverage of One Million Dollars ($1,000,000.00) per occurrence;

4. Business interruption or loss of income insurance for at least six (6) months of Tenant’s income and expenses; and

5. Should Landlord’s Mortgagee require additional insurance coverage or different types of insurance in connection with the Leased Premises or Tenant’s use and occupancy thereof, Tenant shall, upon request, obtain such insurance at Tenant’s expense and provide Landlord with evidence thereof.

B. Before any repairs, alterations, additions, improvements, or construction are undertaken by or on behalf of Tenant, Tenant shall carry and maintain, at its expense, or Tenant shall require any contractor performing work on the Leased Premises to carry and maintain, at no expense to Landlord, in addition to Workers’ Compensation Insurance, All Risk Builder’s Risk Insurance in the amount of the full replacement cost of any alterations, additions or improvements and Commercial General Liability Insurance (including, without limitation, Contractor’s Liability coverage, Contractual Liability coverage, Completed Operations coverage, Automobile Liability coverage ) written on an occurrence basis with a minimum combined single limit of Two Million Dollars ($2,000,000.00) and adding “the named Landlord hereunder (or any successor thereto), and its respective members, principals, beneficiaries, partners, officers, directors, employees, agents and any Mortgagee(s)”, and other designees of Landlord as the interest of such designees appear, as additional insureds (collectively referred to as the “Additional Insureds”).

C. Any company writing any insurance which Tenant is required to maintain or cause to be maintained pursuant to the terms of this Lease (all such insurance as well as any other insurance pertaining to the Leased Premises or the operation of Tenant’s business therein being referred to as “Tenant’s Insurance”), as well as the form of such insurance, are at all times subject to Landlord’s reasonable approval, and each such insurance company must have an A.M. Best rating of “A-” or better and be licensed and qualified to do business in the state in which the Leased Premises are located. All policies evidencing Tenant’s Insurance (except for Workers’ Compensation Insurance) must specify Tenant as named insured and the Additional Insureds as additional insureds. Provided that the coverage afforded Landlord and any designees of Landlord is not reduced or otherwise adversely affected, all of Tenant’s Insurance may be carried under a blanket policy covering the Leased Premises and any other of Tenant’s locations. All policies of Tenant’s Insurance must contain endorsements requiring that the insurer(s) give

19

Landlord and its designees at least thirty (30) days’ advance written notice of any change, cancellation, termination or lapse of said insurance. Tenant shall be solely responsible for payment of premiums for all of Tenant’s Insurance. Tenant shall deliver to Landlord at least three (3) business days prior to the time Tenant’s Insurance is first required to be carried by Tenant, and upon renewals as soon as reasonably possible prior to the expiration of any such insurance coverage (but in no event after termination or expiration of the Policy), certificates evidencing all policies procured by Tenant in compliance with its obligations under this Lease. The limits of Tenant’s Insurance do not in any manner limit Tenant’s liability under this Lease.

D. Tenant shall not do or fail to do anything in, upon or about the Leased Premises which will (1) violate the terms of any of Landlord’s insurance policies which have been provided to Tenant; (2) prevent Landlord from obtaining policies of insurance acceptable to Landlord or any Mortgagees; or (3) result in an increase in the rate of any insurance on the Leased Premises, any other property of Landlord or of others within the Leased Premises. In the event of the occurrence of any of the events set forth in this Section, Tenant shall pay Landlord within thirty (30) days of receipt of notice and supporting documentation, as Additional Rent, the cost of the amount of any increase in any such insurance premium, provided that the acceptance by Landlord of such payment may not be construed to be a waiver of any rights by Landlord in connection with a default by Tenant under the Lease. If Tenant fails to obtain the insurance coverage required by this Lease, Landlord may, at its option, obtain such insurance for Tenant, and Tenant shall pay, as Additional Rent, the cost of all premiums thereon and all of Landlord’s costs associated therewith.

8.01. Substantial Taking. If all or a substantial portion of the Leased Premises are taken for any public or quasi-public use under any governmental law, ordinance or regulation, or by right of eminent domain or by purchase in lieu thereof, and the taking would prevent or materially interfere with the use of the Leased Premises for the purpose for which it is then being used, then either Landlord or Tenant may, but is not required to, terminate this Lease and xxxxx Base Rent and Additional Rent during the unexpired portion of this Lease effective on the date title or physical possession is taken by the condemning authority, whichever occurs first.

8.02. Partial Taking. If a portion of the Leased Premises are taken as set forth in Section 8.01 above and this Lease is not terminated as provided above, Landlord shall, at Landlord’s sole risk and expense, restore and reconstruct the Leased Premises and Landlord Improvements, if applicable, to the extent necessary to make it tenantable and suitable for use and occupancy by Tenant for the Permitted Use, provided, if the damages received by Landlord are insufficient to cover the costs of restoration, Landlord may terminate this Lease. Landlord shall have no obligation to restore any Tenant Alterations, however should any portion of the award paid to Landlord be applicable to the Tenant Alterations, Landlord shall pay such amount to Tenant for use by Tenant in the restoration of such Tenant Alterations. The Base Rent and Additional Rent payable under this Lease during the unexpired portion of the Term will be adjusted to such an extent as is fair and reasonable under the circumstances.

20

8.03. In the event of any taking as set forth above, Tenant may seek a separate award for any loss of improvements made or paid for by Tenant, including the Tenant Alterations, its personal property, and its moving expenses (so long as no such claim diminishes Landlord’s claim or award), but all other claims of any nature shall belong to Landlord. In the event Tenant does not receive such a separate award, Landlord shall be entitled to receive any and all sums awarded for the taking.

8.04. Notwithstanding anything herein to the contrary, if the holder of any indebtedness secured by a mortgage or deed of trust covering the Leased Premises requires that the condemnation proceeds be applied to such indebtedness, then Landlord shall have the right to terminate this Lease by delivering written notice of termination to Tenant within fifteen (15) days after such requirement is imposed.

ARTICLE 9.00 ASSIGNMENT OR SUBLEASE

9.01. Landlord Assignment. Landlord is entitled to sell, transfer or assign, in whole or in part, its rights and obligations under this Lease and in the Leased Premises provided such transferee assumes all obligations of Landlord under this Lease. Any such sale, transfer or assignment shall, upon assumption by the transferee of Landlord’s obligations hereunder, release Landlord from all liabilities under this Lease arising after the date of such sale, assignment or transfer, and Tenant agrees to look solely to the successor in interest of Landlord for the performance of such obligation.

9.02. Tenant Assignment. Tenant shall not assign, in whole or in part, this Lease, or allow it to be assigned, in whole or in part, by operation of law or otherwise (including without limitation, if Tenant’s voting securities are not traded on any national securities exchange, by transfer of more than a fifty percent (50%) interest in Tenant in a single transaction or in a series of transactions, which transfer will be deemed an assignment) or mortgage or pledge the same or sublet the Leased Premises, in whole or in part, without the prior written consent of Landlord which consent may, in Landlord’s sole discretion, be withheld. This prohibition shall not apply to an initial public offering of Tenant’s stock on a nationally recognized stock exchange. Notwithstanding the foregoing, provided no Event of Default exists, Tenant may, without Landlord’s prior written consent, assign this Lease, sublet the Leased Premises and grant concessions and licenses for the occupancy of the Leased Premises, to (i) any successor or assignee of Tenant resulting from any merger, consolidation or reorganization, (ii) any corporation which is the parent, affiliate or wholly owned subsidiary of Tenant, (iii) any assignee which acquires all, or substantially all, of the business assets of Tenant located at the Leased Premises and used in connection with Tenant’s use of the Leased Premises, and assumes all obligations of Tenant set forth in this Lease, or (iv) any assignee which acquires all, or substantially all, of the business assets of Tenant and assumes all, or substantially all, obligations of Tenant, including those set forth in the Lease (in each case a “Permitted Assignment”). Evidence reasonably satisfactory to Landlord of any Permitted Assignment shall be provided within ten (10) days of the completion of such transaction. In no event will any assignment or sublease ever release Tenant from any obligation or liability hereunder, provided, however, in the event of a Permitted Assignment, Landlord agrees to consider, in good faith, a release of Tenant from its obligations under this Lease. Such consideration shall be based upon an evaluation by Landlord of the financial status of Tenant and the Permitted Assignee on the date of the Permitted Assignment, and the three (3) full calendar years prior thereto, including, but not limited to, an evaluation of the net worth, cash position, liquidity, short and long term debt, and

21

profitability of each party during such time period. Tenant shall provide Landlord with all financial information requested by Landlord to perform such evaluation. Tenant acknowledges that notwithstanding Landlord’s agreement to consider a release, the decision will be made by Landlord in its sole and absolute discretion.

9.03. Conditions of Assignment. With the exception of a Permitted Assignment, if Tenant desires to assign or sublet all or any part of the Leased Premises it must so notify Landlord at least thirty (30) days in advance of the date on which Tenant desires to make such assignment or sublease. Tenant shall provide Landlord with a copy of the proposed assignment or sublease and such information as Landlord might request concerning the proposed subtenant or assignee to allow Landlord to make informed judgments as to the financial condition, reputation, operations and general desirability of the proposed subtenant or assignee. Within fifteen (15) days after Landlord’s receipt of Tenant’s proposed assignment or sublease and all required information concerning the proposed subtenant or assignee, Landlord is entitled to exercise any of the following options: (1) consent to the proposed assignment or sublease, pursuant to a Consent Agreement on a form approved by Landlord in its reasonable discretion, and, if the rent due and payable by any assignee or subtenant under any such permitted assignment or sublease (or a combination of the rent payable under such assignment or sublease plus any bonus or any other consideration or any payment incident thereto) exceeds the rent payable under this Lease for such space, Tenant shall pay to Landlord one-half (1/2) of such excess rent and other excess consideration immediately upon receipt thereof by Tenant, or (2) refuse, in its sole and absolute discretion and judgment, to consent to the proposed assignment or sublease, which refusal will be deemed to have been exercised unless Landlord gives Tenant written notice providing otherwise. If Landlord exercises option (1) above, and thereafter an Event of Default occurs, Landlord, in addition to any other remedies provided by this Lease or provided by law, may, at its option, collect directly from the assignee or subtenant all rents becoming due to Tenant by reason of the assignment or sublease. Tenant agrees that any collect collection directly by Landlord from the assignee or subtenant may not be construed as, or constitute, a novation or a release of Tenant or any guarantor from the further performance of its obligations under this Lease. As a condition to a request for Landlord’s review of any assignment or sublease, Tenant must pay Landlord all legal fees and expenses incurred by Landlord in connection with the review by Landlord of Tenant’s requested assignment or sublease together with any legal fees and disbursements incurred in the preparation and/or review of any documentation required by the requested assignment or sublease within thirty (30) days of demand with supporting documentation for payment thereof.

9.04. Subordination. Tenant accepts this Lease subject and subordinate to any recorded mortgage or deed of trust lien or assignment of leases and rents presently existing or hereafter created upon the Leased Premises (provided, however, that any such mortgagee may, at any time, subordinate such mortgage, deed of trust or other lien or assignment of leases and rents to this Lease) and to any renewals thereof. Tenant agrees that this clause is self-operative and no further instrument of subordination is required to effect such subordination. Tenant also agrees within fifteen (15) business days of demand to execute additional instruments subordinating this Lease as Landlord may require, provided such instruments include the non-disturbance of Tenant’s rights and tenancy under this Lease as long as no Event of Default exists. If the interests of Landlord under this Lease are transferred by reason of foreclosure or other proceedings for enforcement of any first mortgage or deed of trust lien or assignment of leases

22

and rents on the Leased Premises, and provided such Purchaser assumes the obligations of Landlord under this Lease after the date of such transfer, Tenant agrees to be bound to the transferee (sometimes called the “Purchaser”), under the terms, covenants and conditions of this Lease for the balance of the term remaining, including any extensions or renewals, with the same force and effect as if the Purchaser were Landlord under this Lease, and, if requested by the Purchaser, Tenant agrees to attorn to the Purchaser, including the first mortgagee under any such mortgage if it be the Purchaser, as its landlord. Upon transfer of Landlord’s interest to Purchaser, Purchaser shall not be 1) subject to any credit, demand, claim, counterclaim, offset or defense which theretofore accrued to Tenant against Landlord nor 2) liable for any previous act or omission of Landlord.

9.05. Estoppel Certificates. Tenant agrees to furnish, from time to time (but not more often than two times during any calendar year), within twenty (20) days after receipt of a request from Landlord, Landlord’s mortgagee or any potential purchaser of the Leased Premises, a statement certifying, if applicable, the following: Tenant is in possession of the Leased Premises; the Landlord Improvements were completed in accordance with the Plans; the Lease is in full force and effect; the Lease is unmodified; Tenant claims no present charge, lien, or claim of offset against Base Rent; the Base Rent is paid for the current month, but is not prepaid for more than one month and will not be prepaid for more than one month in advance; Tenant has no knowledge of any default by reason of some act or omission by Landlord; and such other matters as may be reasonably required by Landlord, Landlord’s mortgagee or any potential purchaser. Tenant’s failure to deliver such statement, will be deemed to establish conclusively that this Lease is in full force and effect except as declared by Landlord, that Landlord is not in default of any of its obligations under this Lease and that Landlord has not received more than one month’s Base Rent in advance. Any notice and cure provisions set forth in any other part of this Lease does not apply to a default of this Section 9.05.

ARTICLE 10.00 INTENTIONALLY OMITTED

ARTICLE 11.00 DEFAULT AND REMEDIES

11.01. Default by Tenant. In addition to other events stipulated to be Events of Defaults elsewhere in the Lease, the following events also constitute an Event of Default by Tenant under this Lease:

(a) Tenant fails to pay when due any installment of Base Rent, Taxes and Insurance or Additional Rent within ten (10) days of receipt of written notice thereof from Landlord provided that if Landlord has delivered two (2) such notices in the preceding 12-month period, then Landlord shall not be obligated to deliver notice of late payment and the failure to pay within ten (10) days after the due date any installment of Base Rent, Taxes and Insurance, Operating Expenses or Additional Rent shall automatically be deemed an Event of Default;

(b) Tenant fails to comply with any term, provision or covenant of this Lease, other than the payment of Base Rent or Additional Rent within thirty (30) days after receipt of written notice from Landlord specifying such failure or such shorter time as reasonable if expedited action is needed to avoid personal injury or property damage, or such additional time as may be reasonably necessary provided Tenant commences and diligently prosecutes cure of such failure, but in no event in excess of sixty (60) days;

23

(c) Tenant or any guarantor of Tenant’s obligations hereunder files, causes to be filed or has filed against it a petition in bankruptcy or is adjudged bankrupt or insolvent under any applicable federal or state bankruptcy or insolvency law, or admits that it cannot meet its financial obligations as they become due; or a receiver or trustee is appointed for all or substantially all of the assets of Tenant or such guarantor; or Tenant or any guarantor of Tenant’s obligations hereunder makes a transfer in fraud of creditors or makes an assignment for the benefit of creditors; or

(d) Tenant does or permits to be done any act which results in a lien (of any nature) being filed against the Leased Premises which is not otherwise bonded around or released within ten (10) business days of notice thereof.

11.02. Remedies for Tenant’s Default. Upon the occurrence of any Event of Default, Landlord is entitled to pursue any one or more of the remedies set forth herein (provided such remedies are permitted pursuant to applicable Legal Requirements) without any notice or demand.