UNDERWRITING AGREEMENT

Exhibit 99.22

Execution Copy

December 15, 2020

00 Xxxxxx Xxxxxx, Xxxxx 000

Xxxxxxx, Xxxxxxx

X0X 0X0

|

Attention: |

Xxxxxx Del Moral, Founder and Chief Executive Officer and Xxxxx Xxxx, Founder and Executive Chairman |

Dear Sirs:

Xxxxxx Xxxxxxxx Canada Inc. (“Stifel GMP” or the “Lead Underwriter”), as lead underwriter and sole bookrunner, along with Canaccord Genuity Corp., Xxxxx Xxxxxx Securities Inc. and Eight Capital (collectively, the “Underwriters” and each individually, an “Underwriter”), hereby severally, and not jointly, nor jointly and severally, in their respective percentages set out in Section 18 below, offer to purchase from Field Trip Health Ltd. (the “Corporation”), and the Corporation hereby agrees to issue and sell to the Underwriters, 3,868,000 units (the “Initial Units”) at a price of $4.50 per Initial Unit (the “Offering Price”) for aggregate gross proceeds of $17,406,000. Each Initial Unit will consist of one common share (a “Common Share”) in the capital of the Corporation (each such Common Share issued as part of an Initial Unit, a “Unit Share”) and one-half of one common share purchase warrant (each whole common share purchase warrant, a “Warrant”, and each Warrant underlying the Initial Units, a “Unit Warrant”). Each Warrant will entitle the holder thereof to purchase one Common Share (each, a “Warrant Share”) at an exercise price of $5.60. The Warrants shall have a term of 18 months from the Closing Date (as defined below). In the event that the volume weighted average trading price of the Common Shares on the Exchange (as defined below), or such other recognized stock exchange as the Underwriters may approve on which the Common Shares are then principally traded, for ten consecutive trading days exceeds $9.00, the Corporation shall have the right to accelerate the expiry date of the Warrants upon not less than fifteen trading days’ notice.

The Warrants shall be duly and validly created and issued pursuant to, and governed by, a warrant indenture (the “Warrant Indenture”) in a form acceptable to the Lead Underwriter (acting reasonably) to be dated as of the Closing Date between the Corporation and the Transfer Agent (as defined below), in its capacity as warrant agent. The description of the Warrants herein is a summary only and is subject to the specific attributes and detailed provisions of the Warrants to be set forth in the Warrant Indenture. In case of any inconsistency between the description of the Warrants in this Agreement and the terms of the Warrants set forth in the Warrant Indenture, the provisions of the Warrant Indenture will govern.

The Corporation has granted to the Underwriters an option (the “Over-Allotment Option”), exercisable in whole or in part at any time, and from time to time, until that date which is 30 days following the Closing Date, to offer for sale such number of additional units (the “Over–Allotment Units”), Common Shares (the “Over-Allotment Shares”), and/or Warrants (the “Over-Allotment Warrants” and together with the Over-Allotment Units and Over-Allotment Shares, the “Over-Allotment Securities”) as is equal to 15% of the number of Initial Units issued under the Offering, to cover over-allotments, if any, and for market stabilization purposes. The Over-Allotment Option may be exercised by the Underwriters in respect of: (i) Over-Allotment Units at the Offering Price; (ii) Over-Allotment Shares at a price of $4.29 per Over-Allotment Share; (iii) Over-Allotment Warrants at a price of $0.42 per Over-Allotment Warrant; or (iv) any combination of Over-Allotment Units, Over-Allotment Shares and/or Over-Allotment Warrants, provided that, (A) the number of Over–Allotment Units does not exceed 580,200, (B) the number of Over-Allotment Shares does not exceed 580,200, and (C) the number of Over-Allotment Warrants does not exceed 290,100. The Underwriters shall be under no obligation whatsoever to exercise the Over-Allotment Option in whole or in part.

The Common Shares issuable upon exercise of the Over-Allotment Warrants (including Warrants issuable as part of the Over-Allotment Units) are referred to herein as the “Over-Allotment Warrant Shares”. The Initial Units and the Over-Allotment Securities are collectively referred to in this Agreement as the “Offered Securities” and the offering of the Offered Securities by the Corporation is referred to in this Agreement as the “Offering”.

The Offered Securities shall have the attributes described in and contemplated by the Prospectus (as defined below).

The Underwriters agree that up to 2,000,000 Initial Units may be allocated to certain (i) insiders, shareholders and affiliates of the Corporation, and (ii) persons who are not institutions or otherwise clients of the Underwriters (collectively, the “President’s List Subscribers”), provided that the President’s List Subscribers shall be identified by the Corporation to the Underwriters at least three Business Days (defined below) prior to the Closing Date and that the issuances of Initial Units to such President’s List Subscribers comply with Applicable Securities Laws (as defined below).

In consideration of the services rendered by the Underwriters in connection with the Offering, the Corporation shall pay to the Underwriters at the Closing Time, as set forth in Section 14, a cash commission equal to: (i) 5.5% of the aggregate gross proceeds raised from the sale of Offered Securities, other than in respect of gross proceeds from the sale of Offered Securities to President’s List Subscribers; plus (ii) 1.0% of the aggregate gross proceeds raised from the sale of Offered Securities to President’s List Subscribers (collectively, the “Underwriting Fee”). As additional compensation for the services provided, the Corporation shall issue to the Underwriters at the Closing Time, in aggregate, that number of compensation warrants (the “Broker Warrants”) which is equal to (i) 5.5% of the aggregate number of Offered Securities sold, other than to President’s List Subscribers; plus (ii) 1.0% of the aggregate number of Offered Securities sold to President’s List Subscribers. Each Broker Warrant shall be exercisable to acquire one Common Share (each, a “Broker Warrant Share”) at an exercise price equal to the Offering Price for a period of 24 months following the Closing Date, pursuant to the terms of the certificates representing the Broker Warrants (the “Broker Warrant Certificates”). The Underwriting Fee shall be inclusive of a 5% work fee payable to Stifel GMP and shall be payable as provided for in Section 18.

2

The Underwriters may arrange for substituted purchasers (the “Substituted Purchasers”) for the Offered Securities, where such Substituted Purchasers are resident in the Selling Jurisdictions (as defined below). Each Substituted Purchaser shall purchase the Offered Securities at the Offering Price, and to the extent that Substituted Purchasers purchase Offered Securities, the obligations of the Underwriters to do so will be reduced by the number of Offered Securities purchased by the Substituted Purchasers from the Corporation.

The Underwriters propose to distribute the Offered Securities in each of the provinces of Canada, other than Quebec, pursuant to the Final Prospectus (as defined below) and may also distribute the Offered Securities in the United States (as defined below) or to, or for the account or benefit of, U.S. Persons (as defined below) in transactions that are exempt from the registration requirements of the U.S. Securities Act (as defined below) pursuant to the U.S. Private Placement Memorandum (as defined below), all in the manner contemplated by this Agreement.

Subject to applicable law, including Applicable Securities Laws (as defined below) and the terms of this Agreement, the Offered Securities may also be distributed outside of Canada and the United States, in each jurisdiction as mutually agreed to in writing by the Corporation and the Underwriters where they may be lawfully sold by the Underwriters without: (i) giving rise to any requirement under the laws of such jurisdiction to prepare and/or file a prospectus or document having similar effect; or (ii) creating any ongoing compliance or continuous disclosure obligations for the Corporation pursuant to the laws of such jurisdiction.

The Underwriters shall be entitled to appoint a selling group consisting of other registered dealers in accordance with Applicable Securities Laws for the purposes of arranging for purchasers of the Offered Securities. Any member of any selling group formed by the Underwriters pursuant to the provisions of this Agreement or with whom any Underwriter has a contractual relationship with respect to the Offering, if any, shall agree with such Underwriter to comply with the covenants and obligations given by the Underwriters herein. The fee payable to any such member of any selling group shall be for the account of the Underwriters.

The Underwriters may offer the Offered Securities at a price less than the Offering Price as described in further detail in Section 18 below, in compliance with Canadian Securities Laws and, specifically, the requirements of NI 44-101 (as defined below) and the disclosure concerning the same contained in the Prospectus, provided that the net proceeds received by the Corporation for the Offered Securities shall not be reduced as a result thereof.

The following are additional terms and conditions of this Agreement between the Corporation and the Underwriters:

Section 1 Definitions and Interpretation

|

(1) |

Where used in this Agreement or in any amendment hereto, the following terms have the following meanings, respectively: |

“Accredited Investor” means “accredited investor” as such term is defined in Rule 506 under the U.S. Securities Act;

3

“Agreement” means this underwriting agreement, as it may be amended from time to time;

“Applicable Laws” means, in relation to any person, the Business or the Offering, all applicable laws, statutes, Authorizations, ordinances, decrees, rules, regulations, by-laws, legally enforceable policies, codes or guidelines, judicial, arbitral, administrative, ministerial, departmental or regulatory judgements, orders, decisions, directives, rulings, subpoenas, or awards, and conditions of any grant or maintenance of any approval, permission, certification, consent, registration, authority or licence, any applicable federal or provincial pricing policies, and any other requirements of any Governmental Authority, by which such person is bound or having application to the Business or the Offering and any amendments or supplements to, or replacements and substitutions of, any of the foregoing;

“Applicable Securities Laws” means collectively, Canadian Securities Laws and all applicable securities laws, rules, regulations, policies and other instruments promulgated by the Securities Regulators in any of the other Selling Jurisdictions;

“associate”, “affiliate” and “insider” have the respective meanings given to them in the Securities Act;

“Authorizations” means any approval, consent, exemption, ruling, authorization, notice, permit, including an import permit or export permit, or acknowledgement that may be required from any Governmental Authority pursuant to Applicable Law, or which is otherwise required under Applicable Law for the parties to perform their obligations under this Agreement or in relation to the Business, including any, ethical review board approval or other authorization for a study, including authorizations related to medical clinics, authorizations necessary to administer ketamine to patients, or other authorizations related to the Business;

“Broker Warrant Certificate” has the meaning ascribed thereto in the seventh paragraph of this Agreement;

“Broker Warrant Shares” has the meaning ascribed thereto in the seventh paragraph of this Agreement;

“Broker Warrants” has the meaning ascribed thereto in the seventh paragraph of this Agreement;

“Business” means the business carried on by the Corporation and the Subsidiaries as described in the Offering Documents, including, for the avoidance of doubt, of delivery of Drug Products, or other drug substances for therapeutic purposes, including the development, formulation and compounding of Drug Products or other drug substances, in the jurisdictions in which the Corporation and the Subsidiaries operate, including in the context of clinical trials, research, development, service delivery or other contexts, and the business of developing, cultivating fungal inputs for, and manufacturing natural health products, and the operation of clinics for physicians engaged in any of the foregoing activities;

4

“Business Assets” means all tangible and intangible property and assets owned (either directly or indirectly), leased, licensed, loaned, operated or used, including all real property, fixed assets, facilities, equipment, inventories and accounts receivable, by the Corporation and the Subsidiaries in connection with the Business;

“Business Day” means a day, other than a Saturday, a Sunday or statutory or civic holiday in the City of Toronto, Ontario;

“Canadian Securities Laws” means, collectively, all applicable securities laws of each of the Qualifying Jurisdictions and the respective rules and regulations under such laws together with applicable published instruments, notices and orders of the securities regulatory authorities in the Qualifying Jurisdictions, including the rules and policies of the Exchange;

“CBCA” means the Canada Business Corporations Act;

“CDS” means CDS Clearing and Depository Services Inc.;

“CDSA” means the Controlled Drugs and Substances Act (Canada);

“Claims” has the meaning ascribed thereto in Section 13 of this Agreement;

“Closing” means the completion of the sale of the Offered Securities and the purchase by the Underwriters of the Offered Securities pursuant to this Agreement;

“Closing Date” means January 5, 2021 or such earlier or later date as may be agreed to in writing by the Corporation and the Lead Underwriter, each acting reasonably, provided that it is not later than 42 days after the date of the receipt for the Final Prospectus;

“Closing Time” means 8:00 a.m. (Toronto time) on the Closing Date, or such other time on the Closing Date as may be agreed to by the Corporation and the Lead Underwriter;

“Common Shares” has the meaning ascribed thereto in the first paragraph of this Agreement;

“controlled substance” has the meaning ascribed thereto in section 2(1) of the CDSA;

“Corporation” has the meaning ascribed thereto in the first paragraph of this Agreement;

“Corporation’s Auditors” means MNP LLP;

“CPSO” means the College of Physicians and Surgeons of Ontario;

“Criminal Code” means the Criminal Code (Canada);

5

“Debt Instrument” means any and all loans, bonds, notes, debentures, indentures, promissory notes, mortgages, guarantees or other instruments evidencing indebtedness (demand or otherwise) for borrowed money or other liability to which the Corporation or a Subsidiary are a party or to which their property or assets are otherwise bound;

“distribution” means distribution or distribution to the public, as the case may be, for the purposes of Canadian Securities Laws or any of them;

“Documents Incorporated by Reference” means, without limitation, all financial statements, related management’s discussion and analysis, management information circulars, joint information circulars, annual information forms, material change reports or other documents filed by the Corporation, whether before or after the date of this Agreement, that are required to be incorporated by reference into the Prospectus under Applicable Securities Laws;

“Drug Product” means any drug product regulated for sale or use under supervision of a health care practitioner and that includes an active pharmaceutical ingredient that is ketamine, psilocin, psilocybin, and other restricted drugs or controlled substances in the jurisdictions in which the Corporation operates;

“Employee Plans” has the meaning ascribed thereto in Section 7(jj) of this Agreement;

“Environmental Laws” means all Applicable Laws relating to the environment or environmental issues (including air, surface, water and stratospheric matters), pollution or protection of human health and safety, including without limitation relating to the release, threatened release, manufacture, processing, blending, distribution, use, treatment, storage, disposal, transport or handling of Hazardous Materials;

“Exchange” means the Canadian Securities Exchange;

“FDA” mean the Food and Drugs Act (Canada);

“FDR-J” means part J of the Food and Drugs Regulations (Canada) of the CDSA;

“Field Trip Psychedelics” means Field Trip Psychedelics Inc.;

“Final Prospectus” means the (final) short form prospectus of the Corporation relating to the Offering, including all of the Documents Incorporated by Reference prepared and to be filed by the Corporation with the Securities Commissions in accordance with the Passport System and NI 44-101 in the Qualifying Jurisdictions in respect of the Offering and for which a Final Receipt has been issued;

“Final Receipt” means the receipt issued by the Principal Regulator, evidencing that a receipt has been, or has been deemed to be, issued for the Final Prospectus in each of the Qualifying Jurisdictions;

“Financial Statements” means (a) audited financial statements of the Corporation for the fiscal year ended December 31, 2019 and 2018, together with the independent auditors’ report thereon and the notes thereto; (b) audited consolidated financial statements of Field Trip Psychedelics for the fiscal period from April 2, 2019 to March 31, 2020, together with the independent auditors’ report thereon and the notes thereto; (c) the unaudited interim financial statements of the Corporation for the nine months ended September 30, 2020 and 2019, together with the notes thereto and (d) the unaudited condensed interim consolidated financial statements of Field Trip Psychedelics for the three and six months ended September 30, 2020 and 2019;

6

“Former Auditors” means XxXxxxxx Xxxx LLP;

“Government Official” means (a) any official, officer, employee, or representative of, or any person acting in an official capacity for or on behalf of, any Governmental Authority, (b) any salaried political party official, elected member of political office or candidate for political office, or (c) any company, business, enterprise or other entity owned or controlled by any person described in the foregoing clauses;

“Governmental Authority” means any provincial, territorial or federal, and as applicable in the circumstances, any foreign: (a) government; (b) court, arbitral or other tribunal or governmental or quasi-governmental authority of any nature (including any governmental agency, political subdivision, instrumentality, branch, department, official, or entity); (c) body or other instrumentality exercising, or entitled to exercise, any administrative, executive, judicial, legislative, police, regulatory, or taxing authority or power of any nature pertaining to government, including Health Canada, the New York State Medical Board and/or the California Medical Board; (d) any formulary body with responsibility for determining listability of a Drug Product on any applicable formulary or for determining the pricing of Drug Products for reimbursement, with jurisdiction to review the pricing of and payment for Drug Products under Applicable Law; (e) any provincial, state, territorial or federal government or review board with jurisdiction over pricing of patented products or with jurisdiction over competition aspects of pricing of products; or (f) any other body or entity created under the authority of or otherwise subject to the jurisdiction of any of the foregoing and any stock exchange or self-regulatory authority and, for greater certainty, includes the Securities Commissions, the Exchange and the Investment Industry Regulatory Organization of Canada;

“Hazardous Material” means, collectively, (a) any chemicals or other materials or substances which are defined as or included in the definition of “hazardous recyclables,” “extremely hazardous wastes,” “restricted hazardous wastes,” “toxic substances,” “toxic pollutants,” “contaminants,” “pollutants” or words of similar import under any Environmental Law, and (b) any other chemical, contaminant, pollutant, deleterious substance, dangerous good or other material or substance, which is limited or regulated under any Environmental Law;

“IFRS” means International Financial Reporting Standards as issued by the International Accounting Standards Board;

“including” means including but not limited to;

7

“Indemnified Party” or “Indemnified Parties” have the meanings ascribed thereto in Section 13 of this Agreement;

“Initial Units” has the meaning ascribed thereto in the first paragraph of this Agreement;

“Intellectual Property Rights” means all industrial and other intellectual property rights comprising or relating to (a) trademarks, trade dress, trade and business names, branding, brand names, logos, design rights, corporate names and domain names and other similar designations of source, sponsorship, association or origin, together with the goodwill symbolized by any of the foregoing; (b) internet domain names registered by any authorized private registrar or Governmental Authority, web addresses, web pages, website and URLs; (c) works of authorship, expressions, designs and industrial design registrations, whether or not copyrightable, including copyrights and copyrightable works, software and firmware, data, data files, and databases and other specifications and documentation; (d) inventions, discoveries, trade secrets, business and technical information, know-how, databases, data collections, patent disclosures and other confidential or proprietary information; (e) plant or fungal varieties, strains or cultivars; and (f) all industrial and other intellectual property rights, and all rights, interests and protections that are associated with, equivalent or similar to, or required for the exercise of, any of the foregoing, however arising, in each case whether registered or unregistered, such registered rights including patent, registered plant breeders’ rights, trademark, industrial design and copyright, and including all registrations and applications for, and renewals or extensions of, such rights or forms of protection under the Applicable Law of any jurisdiction which the Corporation operates;

“ketamine” means 2-(2-chlorophenyl)-2-(methylamino)cyclohexanone;

“knowledge of the Corporation” (or similar phrases or knowledge qualifiers) means, with respect to the Corporation, the actual knowledge of its directors and officers after reasonable inquiry;

“Liens” means any encumbrance or title defect of whatever kind or nature, regardless of form, whether or not registered or registrable and whether or not consensual or arising by law (statutory or otherwise), including any mortgage, lien, charge, pledge or security interest, whether fixed or floating, or any assignment, lease, option, right of pre-emption, privilege, easement, servitude, right of way, restrictive covenant, right of use or any other right or claim of any kind or nature whatever which affects ownership or possession of, or title to, any interest in, or right to use or occupy such property or assets;

“Losses” has the meaning ascribed thereto in Section 13 of this Agreement;

“marketing materials” has the meaning ascribed thereto in NI 41-101;

“Marketing Materials” means the term sheet in respect of the Offering dated December 10, 2020, as agreed to between the Corporation and Stifel GMP;

“Material Adverse Effect” means (a) any event, occurrence, state of facts, effect or change on the Corporation and the Subsidiaries or the Business, taken as a whole and as a going concern, that has had or would reasonably be expected to have a material adverse effect on the results of operations, financial condition, assets, properties, capital, liabilities (contingent or otherwise), cash flow, income, prospects or business operations of the Corporation and its Subsidiaries or the Business, taken as a whole and as a going concern, or (b) any event, occurrence, state of facts, effect or change that would result in any Offering Document containing a misrepresentation;

8

“Material Agreement” means any and all contracts, commitments, agreements (written or oral), instruments, leases or other documents, including licences, sub-licences, supply agreements, manufacturing agreements, distribution agreements, sales agreements, or any other similar type agreements, to which the Corporation or any Subsidiary is a party or to which their Business Assets are otherwise bound, and which is material to the Corporation and the Subsidiaries on a consolidated basis;

“material change”, “material fact” and “misrepresentation” have the respective meanings ascribed thereto in the Securities Act;

“MI 11-102” means Multilateral Instrument 11-102 – Passport System;

“NI 41-101” means National Instrument 41-101 – General Prospectus Requirements;

“NI 44-101” means National Instrument 44-101 - Short Form Prospectus Distributions;

“NI 51-102” means National Instrument 51-102 – Continuous Disclosure Obligations;

“NP 11-202” means National Policy 11-202 – Process for Prospectus Reviews in Multiple Jurisdictions;

“Offered Securities” has the meaning ascribed thereto in the fourth paragraph of this Agreement;

“Offering” has the meaning ascribed thereto in the fourth paragraph of this Agreement;

“Offering Documents” means the Preliminary Prospectus, the Final Prospectus, any Supplementary Material and, if applicable, the U.S. Private Placement Memorandum;

“Offering Price” has the meaning ascribed thereto in the first paragraph of this Agreement;

“Option Closing Date” means the date, not earlier than the Closing Date or later than 30 days following the Closing Date, for the closing of the Over-Allotment Option set out in the written notice of exercise of the Over-Allotment Option;

“Option Closing Time” means 8:00 a.m. (Toronto time) on the Option Closing Date or such other time on the Closing Date as may be agreed to by the Corporation and the Lead Underwriter;

“Ordinary Course” means, with respect to an action taken by a Person, that such action is consistent in all material respects with past practices of the Person and is taken in the ordinary course of the normal day-to-day operations of the Person, in each case, as is determined as of the relevant date;

9

“OSC” means the Ontario Securities Commission;

“Over-Allotment Option” has the meaning ascribed thereto in the third paragraph of this Agreement;

“Over-Allotment Securities” has the meaning ascribed thereto in the third paragraph of this Agreement;

“Over-Allotment Shares” has the meaning ascribed thereto in the third paragraph of this Agreement;

“Over-Allotment Units” has the meaning ascribed thereto in the third paragraph of this Agreement;

“Over-Allotment Warrant Shares” has the meaning ascribed thereto in the fourth paragraph of this Agreement;

“Over-Allotment Warrants” has the meaning ascribed thereto in the third paragraph of this Agreement;

“Passport System” means the system for review of prospectus filings set out in MI 11-102 and NP 11-202;

“person” shall be broadly interpreted and shall include any individual, corporation, partnership, joint venture, association, trust or other legal entity;

“Preliminary Prospectus” means the preliminary short form prospectus of the Corporation dated December 15, 2020, including all of the Documents Incorporated by Reference, prepared and filed by the Corporation in accordance with the Passport System and NI 44-101 in the Qualifying Jurisdictions in respect of the Offering;

“Preliminary Receipt” means the receipt issued by the Principal Regulator, evidencing that a receipt has been, or has been deemed to be, issued for the Preliminary Prospectus in each of the Qualifying Jurisdictions;

“President’s List Subscribers” has the meaning ascribed thereto in the sixth paragraph of this Agreement;

“Principal Regulator” means the Ontario Securities Commission;

“Prospectus” means, collectively, the Preliminary Prospectus and the Final Prospectus;

“provide” in the context of sending or making available marketing materials to a potential investor of Offered Securities has the meaning ascribed thereto under Canadian Securities Laws;

10

“psilocin” means 3–[2–(dimethylamino)ethyl]–4–hydroxyindole and any salt thereof;

“psilocybin” means 3–[2–(dimethylamino)ethyl]–4–phosphoryloxyindole and any salt thereof;

“Purchasers” means, collectively, each of the purchasers of Offered Securities arranged by the Underwriters, including the Substituted Purchasers, in connection with the Offering, including, if applicable, the Underwriters;

“Qualified Institutional Buyers” means “qualified institutional buyers” as such term is defined in Rule 144A;

“Qualifying Jurisdictions” means each of the provinces of Canada, other than Quebec;

“Regulation S” means Regulation S adopted by the SEC under the U.S. Securities Act;

“Repayment Event” means any event or condition which gives the holder of any Debt Instrument (or any person acting on such holder’s behalf) the right to require the repurchase, redemption or repayment of all or a material portion of such indebtedness by the Corporation or the Subsidiaries;

“Rule 144A” means Rule 144A under the U.S. Securities Act;

“SEC” means the United States Securities and Exchange Commission;

“Securities Act” means the Securities Act (Ontario);

“Securities Commissions” means the securities regulatory authority in each of the Qualifying Jurisdictions;

“Securities Laws” means collectively, Canadian Securities Laws, U.S. Securities Laws and all applicable securities laws, rules, regulations, policies and other instruments promulgated by the Securities Regulators in any of the other Selling Jurisdictions;

“Securities Regulators” means collectively, the securities regulators or other securities regulatory authorities in the Selling Jurisdictions;

“Selling Jurisdictions” means, collectively, each of the Qualifying Jurisdictions and may also include, the United States and any other jurisdictions outside of Canada and the United States as mutually agreed to by the Corporation and the Underwriters;

“subsidiary” or “subsidiaries” has the meaning ascribed thereto in the Securities Act;

“Subsidiaries” has the meaning ascribed thereto in Section 7(b) of this Agreement;

“Substituted Purchasers” has the meaning ascribed thereto in the eighth paragraph of this Agreement;

11

“Supplementary Material” means, collectively, any amendment to the Preliminary Prospectus or the Final Prospectus, and any amendment or supplemental prospectus that may be filed by or on behalf of the Corporation under Canadian Securities Laws relating to the distribution of the Offered Securities;

“template version” has the meaning ascribed thereto under NI 41-101 and includes any revised template version of marketing materials as contemplated by NI 41-101;

“Transfer Agent” means Computershare Trust Company of Canada;

“Underwriters” has the meaning ascribed thereto in the first paragraph of this Agreement;

“Underwriting Fee” has the meaning ascribed thereto in the seventh paragraph of this Agreement;

“Unit” means any Initial Unit or Over–Allotment Unit;

“Unit Share” has the meaning ascribed thereto in the first paragraph of this Agreement;

“Unit Warrant” has the meaning ascribed thereto in the first paragraph of this Agreement;

“United States” means the United States of America, its territories and possessions, any state of the United States and the District of Columbia;

“U.S. Affiliates” means the Underwriters’ respective United States registered broker-dealer affiliates;

“U.S. Exchange Act” means the United States Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder;

“U.S. Person” means a “U.S. person” as that term is defined in Rule 902(k) of Regulation S;

“U.S. Private Placement Memorandum” means the private placement offering memorandum in the event of an offering of the Offered Securities in the United States, which will include and supplement the Prospectus;

“U.S. Securities Act” means the United States Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder;

“U.S. Securities Laws” means all applicable securities legislation in the United States, including, without limitation, the U.S. Exchange Act and U.S. Securities Act;

“Warrant” has the meaning ascribed thereto in the first paragraph of this Agreement;

“Warrant Indenture” has the meaning ascribed thereto in the second paragraph of this Agreement; and

12

“Warrant Share” has the meaning ascribed thereto in the first paragraph of this Agreement.

|

(2) |

Any reference in this Agreement to a section or subsection shall refer to a section or subsection of this Agreement. |

|

(3) |

All words and personal pronouns relating thereto shall be read and construed as the number and gender of the party or parties referred to in each case required and the verb shall be construed as agreeing with the required word and/or pronoun. |

|

(4) |

Any reference in this Agreement to $ or to “dollars” shall refer to the lawful currency of Canada, unless otherwise specified. |

|

(5) |

The following are the schedules to this Agreement, which schedules are deemed to be a part hereof and are hereby incorporated by reference herein: |

Schedule “A” Subsidiaries

Schedule “B” Compliance with United States Securities Laws (if applicable)

Section 2 Attributes of the Offered Securities.

|

(1) |

The Offered Securities to be sold by the Corporation hereunder shall have the rights, privileges, restrictions and conditions that conform in all material respects to the rights, privileges, restrictions and conditions set forth in the Offering Documents. |

|

(2) |

The Underwriters severally agree not to offer or sell the Offered Securities in such a manner as to require registration of any of them or the filing of a prospectus or any similar document under the laws of any jurisdiction outside the Qualifying Jurisdictions and to distribute or offer the Offered Securities only in the Qualifying Jurisdictions and in accordance with all Applicable Securities Laws. However, the Corporation and each Underwriter acknowledge that, in the event of any offer, sale or resale of the Offered Securities in the United States or to, or for the account or benefit of, U.S. Persons, the Underwriters acting through their U.S. Affiliates will offer, sell and resell the Offered Securities in the United States or to, or for the account or benefit of, U.S. Persons only to Qualified Institutional Buyers or Accredited Investors, all in accordance with Schedule “B”, which terms and conditions are hereby incorporated by reference in and shall form a part of this Agreement, provided that no such action on the part of the Underwriters or their U.S. Affiliates shall in any way oblige the Corporation to register any Offered Securities under the U.S. Securities Act or the securities laws of any state of the United States. Any agreements between the Underwriters and the members of any selling group will contain restrictions which are substantially the same as those contained in this Section 2. |

|

(3) |

Notwithstanding the foregoing, an Underwriter will not be liable to the Corporation under this section or Schedule “B” with respect to a violation by another Underwriter or its U.S. Affiliate(s) of the provisions of this section or Schedule “B” if the former Underwriter or its U.S. Affiliate, as applicable, is not itself also in violation. |

13

Section 3 Filing of Prospectus.

|

(1) |

The Corporation shall: |

|

|

(a) |

not later than 5:00 p.m. (Toronto time) on the date hereof, have filed the Preliminary Prospectus pursuant to the Passport System with the Securities Commissions and obtain a Preliminary Receipt not later than 5:00 p.m. (Toronto time) on December 16, 2020; |

|

|

(b) |

(i) use commercially reasonable efforts to promptly resolve all comments made and deficiencies raised in respect of the Preliminary Prospectus by the Principal Regulator, and (ii) file the Final Prospectus and obtain a Final Receipt not later than 5:00 p.m. (Toronto time) on December 24, 2020, and otherwise fulfill all legal requirements to qualify the Offered Securities for distribution to the public in the Qualifying Jurisdictions through the Underwriters or any other investment dealer or broker properly registered to transact such business in the applicable Qualifying Jurisdictions contracting with the Underwriters, and to qualify the grant of the Over-Allotment Option; and |

|

|

(c) |

until the date on which the distribution of the Offered Securities is completed, promptly take, or cause to be taken, all additional steps and proceedings that may from time to time be required under Canadian Securities Laws to continue to qualify the distribution of the Offered Securities for sale to the public and the grant of the Over-Allotment Option to the Underwriters or, in the event that the Offered Securities or the Over-Allotment Option have, for any reason, ceased to so qualify, to again so qualify the Offered Securities and the Over-Allotment Option. |

|

(2) |

Prior to the filing of the Offering Documents and thereafter, during the period of distribution of the Offered Securities, the Corporation shall have allowed the Underwriters to participate fully in the preparation of, and to approve the form and content of, such documents and shall have allowed the Underwriters to conduct all due diligence investigations (which shall include the attendance of management of the Corporation, the Corporation’s Auditors and the Former Auditors at one or more due diligence sessions to be held) which they may reasonably require in order to fulfill their obligations as underwriters and in order to enable them to responsibly execute the certificate required to be executed by them at the end of the Prospectus. |

|

(3) |

It shall be a condition precedent to (i) the Underwriters’ execution of any certificate in any Prospectus, that the Underwriters be satisfied as to the form and substance of the document, and (ii) the delivery of each U.S. Private Placement Memorandum (if applicable) to any purchaser or prospective purchaser in the United States or purchasing for the account or benefit of a U.S. Person, that the Underwriters and their U.S. Affiliates be satisfied as to the form and substance of such document. |

14

Section 4 Deliveries on Filing and Related Matters.

|

(1) |

The Corporation shall deliver to each of the Underwriters: |

|

|

(a) |

prior to the time of each filing thereof, a copy of the Preliminary Prospectus and the Final Prospectus each manually signed on behalf of the Corporation, by the persons and in the form signed and certified as required by Canadian Securities Laws; |

|

|

(b) |

a copy of the preliminary U.S. Private Placement Memorandum or the final U.S. Private Placement Memorandum, if and as applicable; |

|

|

(c) |

prior to the time of filing thereof, a copy of any Supplementary Material, or other document required to be filed with or delivered to, the Securities Commissions by the Corporation under Canadian Securities Laws in connection with the Offering, including any document incorporated by reference in the Final Prospectus (other than documents already filed publicly with a Securities Commission); |

|

|

(d) |

concurrently with the filing of the Final Prospectus with the Securities Commissions, a “long-form” comfort letter of the Corporation’s Auditors dated the date of the Final Prospectus (with the requisite procedures to be completed by such auditor within two Business Days of the date of such letter), in form and substance satisfactory to the Underwriters, acting reasonably, addressed to the Underwriters, the Corporation and the board of directors of the Corporation, with respect to the verification of financial and accounting information and other financial information contained in the Final Prospectus (including all Documents Incorporated by Reference) and matters involving changes or developments since the respective dates as of which specific financial information is given therein which letter shall be in addition to the auditor’s consent letter and comfort letter (if any) addressed to the Securities Commissions; and |

|

|

(e) |

concurrently with the filing of the Final Prospectus with the Securities Commissions, a “long form” comfort letter of the Former Auditors, dated to the date of the Final Prospectus (with the requisite procedures to be completed by such auditors no later than two Business Days prior to the date of the Final Prospectus) with respect to the financial and accounting information relating to the Corporation addressed to the Underwriters, in form and substance satisfactory to the Underwriters, acting reasonably, containing statements and information of the type ordinarily included in “comfort letters” to underwriters in connection with the Offering. |

Unless otherwise advised in writing, such deliveries shall also constitute the Corporation’s consent to the Underwriters’ use of the Offering Documents in connection with the distribution of the Offered Securities in compliance with this Agreement and Securities Laws.

|

(2) |

The Corporation represents and warrants to the Underwriters with respect to the Offering Documents that as at their respective dates of delivery to the Underwriters as set out in Section 4(1) above: |

|

|

(a) |

all information and statements in such documents (including information and statements incorporated by reference to the extent they have not been superseded by the information and statements in the Offering Documents) (except information and statements relating solely to the Underwriters and furnished by them specifically for use in a Prospectus) are true and correct, in all material respects, and contain no misrepresentation and constitute full, true and plain disclosure of all material facts relating to the Corporation, the Offering and the Offered Securities, as required by Canadian Securities Laws; |

15

|

|

(b) |

no material fact or information in such documents (including information and statements incorporated by reference) (except information and statements relating solely to the Underwriters and furnished by them specifically for use in a Prospectus) has been omitted therefrom which is required to be stated in such disclosure or is necessary to make the statements or information contained in such disclosure not misleading in light of the circumstances under which they were made; and |

|

|

(c) |

the Prospectus and any Supplementary Material comply in all material respects with the requirements of Canadian Securities Laws. |

|

(3) |

The Corporation shall cause commercial copies of the Preliminary Prospectus, the Final Prospectus and the U.S. Private Placement Memorandum, as the case may be, to be delivered to the Underwriters without charge, in such quantities and in such cities as the Underwriters may reasonably request by written instructions to the printer of such documents as soon as possible after obtaining the Preliminary Receipt or the Final Receipt, as the case may be, but, in any event on or before noon (Toronto time) on the next Business Day (or for delivery locations outside of Toronto, on the second Business Day). Such deliveries shall constitute the consent of the Corporation to the Underwriters’ use of the Preliminary Prospectus, the Final Prospectus and the U.S. Private Placement Memorandum for the distribution of the Offered Securities in the Qualifying Jurisdictions in compliance with the provisions of this Agreement and Canadian Securities Laws; the offer and sale of the Offered Securities in the United States and to, or for the account or benefit of, U.S. Persons in compliance with the provisions of this Agreement (including, without limitation, Schedule “B” hereto) and U.S. Securities Laws; and the offer and sale of the Offered Securities in such other Selling Jurisdictions agreed to between the Corporation and the Lead Underwriter, in compliance with the provisions of this Agreement and Applicable Securities Laws. The Corporation shall similarly cause to be delivered commercial copies of any Supplementary Material and hereby similarly consents to the Underwriters’ use thereof. The Corporation shall cause to be provided to the Underwriters, without cost, such number of copies of any Documents Incorporated by Reference as the Underwriters may reasonably request for use in connection with the distribution of the Offered Securities. |

|

(4) |

Each of the Corporation and the Underwriters have approved the Marketing Materials, including any template version thereof which the Corporation has filed with the Securities Commissions and which is and will be incorporated by reference into the Prospectus, as the case may be. The Corporation and the Underwriters each covenant and agree that during the distribution of the Offered Securities, it will not provide any potential investor of Offered Securities with any marketing materials except for marketing materials that comply with, and have been approved in accordance with, NI 44-101. If requested by the Underwriter, in addition to the Marketing Materials, the Corporation will cooperate, acting reasonably, with the Underwriter in approving any other marketing materials to be used in connection with the Offering. |

16

|

(5) |

Subject to compliance with Securities Laws, during the period commencing on the date hereof and until completion of the distribution of the Offered Securities, the Corporation will promptly provide to the Underwriters drafts of any press releases of the Corporation for review by the Underwriters prior to issuance, and shall obtain the prior approval of the Underwriters as to the content and form of any press release relating to the Offering prior to issuance, such approval not to be unreasonably withheld or delayed. If required by Securities Laws, any press release announcing or otherwise referring to the Offering disseminated in the United States shall comply with the requirements of Rule 135c under the U.S. Securities Act and any press release announcing or otherwise referring to the Offering disseminated outside the United States shall include (i) an appropriate notation on each page as follows: “Not for distribution to the U.S. news wire services, or dissemination in the United States” and (ii) the following (or similar) disclosure: |

“The securities referred to in this news release have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold within the United States or to, or for the account or benefit of, “U.S. persons” (as such term is defined in Regulation S under the U.S. Securities Act) absent such registration or an applicable exemption from the registration requirements of the U.S. Securities Act. This news release does not constitute an offer for sale of securities for sale, nor a solicitation for offers to buy any securities. Any public offering of securities in the United States must be made by means of a prospectus containing detailed information about the company and management, as well as financial statements.”

|

(6) |

Notwithstanding any provision hereof, nothing in this Agreement will create any obligation of the Corporation to file a registration statement or otherwise register or qualify the Offered Securities for sale or distribution outside of Canada. |

Section 5 Material Change.

|

(1) |

During the period from the date of this Agreement to the completion of the distribution of the Offered Securities, the Corporation covenants and agrees with the Underwriters that it shall promptly notify the Underwriters in writing with full particulars of: |

|

|

(a) |

any material change (actual, anticipated, contemplated or threatened) in respect of the Corporation and the Subsidiaries considered on a consolidated basis or any development involving a prospective material change; |

|

|

(b) |

any new or any change in a material fact which has arisen or has been discovered and would have been required to have been stated in any of the Offering Documents had the fact arisen or been discovered on, or prior to, the date of such document; and |

17

|

|

(c) |

any change in any material fact (which for the purposes of this Agreement shall be deemed to include the disclosure of any previously undisclosed material fact) contained in the Offering Documents which fact or change is, or may be, of such a nature as to render any statement in such Offering Document misleading or untrue in any material respect or which would result in a misrepresentation in the Offering Document or which would result in any of the Offering Documents not complying (to the extent that such compliance is required) with Securities Laws. |

The Corporation shall promptly, and in any event within any applicable time limitation, comply, to the satisfaction of the Underwriters, acting reasonably, with all applicable filings and other requirements under Canadian Securities Laws and U.S. Securities Laws as a result of such fact or change; provided that the Corporation shall not file any Supplementary Material or other document without first providing the Underwriters with a copy of such Supplementary Material or other document and consulting with the Underwriters with respect to the form and content thereof. The Corporation shall in good faith discuss with the Underwriters any fact or change in circumstances (actual, anticipated, contemplated or threatened, financial or otherwise) which is of such a nature that there is or could be reasonable doubt whether written notice need be given under this Section 5.

|

(2) |

If during the period of distribution of the Offered Securities there shall be any change in Canadian Securities Laws or other laws which results in any requirement to file Supplementary Material, the Corporation will promptly prepare and file such Supplementary Material with the appropriate Securities Commissions where such filing is required, provided that the Corporation shall have allowed the Underwriters and its counsel to participate in the preparation and review of any Supplementary Material. |

|

(3) |

During the period from the date of this Agreement to the completion of the distribution of the Offered Securities, the Corporation will notify the Underwriters promptly: |

|

|

(a) |

when any supplement to any of the Offering Documents or any Supplementary Material shall have been filed; |

|

|

(b) |

of any request by any Securities Commission to amend or supplement the Prospectus or for additional information; |

|

|

(c) |

of the suspension of the qualification of the Common Shares, Warrants or the Over-Allotment Option for offering, sale, issuance, or grant, as applicable, in any jurisdiction, or of any order suspending or preventing the use of the Offering Documents (or any Supplementary Material) or of the institution or, to the knowledge of the Corporation, threatening of any proceedings for any such purpose; and |

|

|

(d) |

of the issuance by any Securities Commission or any stock exchange of any order having the effect of ceasing or suspending the distribution of the Common Shares or Warrants or the trading in any securities of the Corporation, or, to the knowledge of the Corporation, of the institution or threatening of any proceeding for any such purpose. The Corporation will use its reasonable efforts to prevent the issuance of any such stop order or of any order preventing or suspending such use or such order ceasing or suspending the distribution of the Common Shares or Warrants or the trading in the Common Shares and, if any such order is issued, to obtain the lifting thereof at the earliest possible time. |

18

Section 6 Regulatory Approvals.

The Corporation will make all necessary filings, obtain all necessary consents and approvals (if any) and pay all filing fees required to be paid in connection with the transactions contemplated by this Agreement. The Corporation will cooperate with the Underwriters in connection with the qualification of the distribution of the Offered Securities for offer and sale in the Qualifying Jurisdictions and the grant of the Over-Allotment Option under Canadian Securities Laws and in maintaining such qualifications in effect for so long as required for the distribution of the Offered Securities.

Section 7 Representations and Warranties of the Corporation.

The Corporation represents and warrants to each of the Underwriters, and acknowledges that each of them is relying upon such representations and warranties in connection with the purchase of the Offered Securities, that:

|

|

(a) |

Good Standing of the Corporation. The Corporation (i) is a corporation existing under the laws of Canada and is and will at the Closing Time be current and up-to-date with all material filings required to be made and in good standing under the CBCA, (ii) has all requisite corporate power and capacity to own, lease and operate its properties and assets, including its Business Assets, and to conduct the Business as now carried on by it, and (iii) has, and at the Closing Time will have, all requisite corporate power and authority to issue and sell the Offered Securities, to create and issue the Broker Warrants and to execute, deliver and perform its obligations under this Agreement and the Broker Warrant Certificates. |

|

|

(b) |

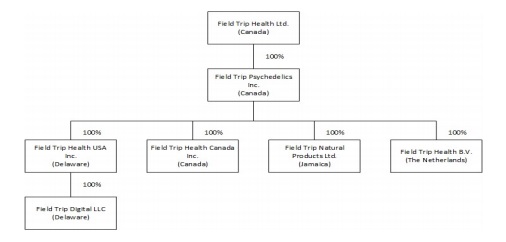

Good Standing of Subsidiaries. The Corporation’s only subsidiaries are listed in Schedule “A” (collectively, the “Subsidiaries”), which schedule is true, complete and accurate in all respects. Each Subsidiary is formed, organized and existing under the laws of the jurisdiction set out in Schedule “A”, is current and up-to-date with all material filings required to be made and has all requisite corporate power and capacity to own, lease and operate its properties and assets, including its Business Assets, and to conduct its Business as is now carried on by it, and is duly qualified to transact business and is in good standing in each jurisdiction in which such qualification is required in all material respects. All of the issued and outstanding shares in the capital of the Subsidiaries have been duly authorized and validly issued, are fully paid and, except as set out in Schedule “A”, are directly or indirectly beneficially owned by the Corporation. All of the issued and outstanding shares in the capital of the Subsidiaries owned by the Corporation are owned free and clear of any Liens, and none of the outstanding securities of the Subsidiaries were issued in violation of the pre-emptive or similar rights of any security holder of the Subsidiaries. There exist no options, warrants, purchase rights, or other contracts or commitments that could require the Corporation to sell, transfer or otherwise dispose of any securities of the Subsidiaries. |

19

|

|

(c) |

No Proceedings for Dissolution. No act or proceeding has been taken by or against the Corporation or the Subsidiaries in connection with their liquidation, winding-up or bankruptcy, or, to the knowledge of the Corporation, is pending. |

|

|

(d) |

Share Capital of the Corporation. The Corporation has an authorized capital consisting of an unlimited number of Common Shares, and an unlimited number of preferred shares of which (i) 37,954,943 Common Shares, and (ii) no preferred shares are issued and outstanding as of the date hereof. Except as disclosed in the Offering Documents, no securities exchangeable or convertible into Common Shares or preferred shares are issued and outstanding as of the date hereof, other than (A) the Over-Allotment Option, (B) an aggregate of 3,871,729 options to purchase 3,871,729 Common Shares under the Corporation’s stock option plan, and (C) an aggregate of 299,753 warrants to purchase 299,753 Common Shares. The rights, privileges, restrictions, conditions and other terms attaching to the Common Shares and preferred shares, respectively, conform in all material respects to the description thereof contained in the Offering Documents. |

|

|

(e) |

Form of Broker Warrant Certificate. At the Closing time, the form of Broker Warrant Certificate respecting the Broker Warrants will have been approved and adopted by the board of directors of the Corporation and will not conflict with any Applicable Law. |

|

|

(f) |

Common Shares Validly Issued. The Unit Shares and the Over-Allotment Shares, at or prior to the Closing Time, and the Broker Warrant Shares and the Over-Allotment Warrant Shares, upon the exercise of the Broker Warrants and Over-Allotment Warrants, respectively, shall be duly and validly authorized for issuance and sale pursuant to this Agreement, and when issued and delivered by the Corporation pursuant to this Agreement, against payment of the consideration therefor, will be validly issued as fully paid and non-assessable Common Shares and will not be issued in violation of any pre-emptive rights or contractual rights to purchase securities issued by the Corporation. |

|

|

(g) |

Warrants Validly Issued. At the Closing Time, the Unit Warrants and the Over-Allotment Warrants will have been duly authorized for issuance and sale, and the maximum number of Common Shares issuable upon due exercise of the Unit Warrants and the Over-Allotment Warrants will have been duly authorized for issuance upon due exercise of such Warrants in accordance with the terms of the Warrant Indenture and, when so issued, will be validly issued, fully paid and non-assessable. Such Common Shares, upon issuance upon due exercise of any such Warrants, will not be issued in violation of or subject to any pre-emptive rights or contractual rights to purchase securities issued by the Corporation. |

|

|

(h) |

Forms of Certificates. At the Closing Time, the forms of the certificates representing the Common Shares and Warrants will have been duly approved and adopted by the Corporation and comply in all respects with the applicable requirements of the CBCA and the Exchange. |

20

|

|

(i) |

Broker Warrants Validly Issued. At the Closing Time, the Broker Warrants will have been duly authorized for issuance pursuant to this Agreement and the maximum number of Broker Warrant Shares issuable upon due exercise of the Broker Warrants will have been duly authorized for issuance upon due exercise of such Broker Warrants and, when so issued, will be validly issued, fully paid and non-assessable. Such Broker Warrant Shares, upon due exercise of any Broker Warrants, will not be issued in violation of any pre-emptive rights or contractual rights to purchase securities issued by the Corporation. |

|

|

(j) |

Registrar and Transfer Agent. The Transfer Agent at its principal office in Calgary, Alberta has been duly appointed as transfer agent and registrar for the Common Shares. |

|

|

(k) |

Absence of Rights. Except as disclosed in the Offering Documents, no person has any existing right, agreement or option, present or future, contingent or absolute, or any right capable of becoming a right, agreement or option, for the issue or allotment of any unissued shares of the Corporation or any other agreement or option, for the issue or allotment of any unissued shares of the Corporation or any other security convertible into or exchangeable for any such shares, or to require the Corporation to purchase, redeem or otherwise acquire any of the issued and outstanding shares of the Corporation, other than pursuant to outstanding stock options. The Offered Shares, Over-Allotment Shares and Broker Warrant Shares, upon issuance, will not be issued in violation of any pre-emptive rights or contractual rights to purchase securities issued by the Corporation. |

|

|

(l) |

Corporate Actions. The Corporation has taken, or will have taken prior to the Closing Time, all necessary corporate action, (i) to authorize the execution, delivery and performance of this Agreement, the Warrant Indenture and the Broker Warrant Certificates, (ii) to authorize the execution and filing, as applicable, of the Offering Documents, (iii) to validly issue and sell the Offered Securities, (iv) to validly reserve for issuance the Warrant Shares, Over-Allotment Warrant Shares and the Broker Warrant Shares, (vi) to validly issue the Broker Warrants and (vii) to validly issue the Warrant Shares, Over-Allotment Warrant Shares and Broker Warrant Shares upon due exercise of the Unit Warrants, Over-Allotment Warrants and Broker Warrants, respectively, as fully paid and non-assessable Common Shares. |

|

|

(m) |

Valid and Binding Documents. The Corporation has the power and capacity to enter into and perform its obligations under this Agreement and to carry out the transactions contemplated in the Offering Documents. This Agreement, and at the time of execution of the Warrant Indenture, such documents will have been duly authorized, executed and delivered by the Corporation and will be legal, valid and binding obligations of the Corporation, enforceable against the Corporation in accordance with its terms, subject to exceptions as to applicable bankruptcy, insolvency and similar laws and the availability of equitable remedies and the provisions of the Limitations Act (Ontario). |

21

|

|

(n) |

No Consents, Approvals etc. The execution and delivery of this Agreement, the Warrant Indenture and the Broker Warrant Certificates, as applicable, and the fulfilment of the terms of such documents by the Corporation, including the issuance, sale and delivery of the Offered Securities and the issuance and delivery of the Broker Warrants, do not and will not require any Authorization of, or registration or qualification of or with, any Governmental Authority, stock exchange or other third party (including under the terms of any Material Agreement or Debt Instrument), except: (i) those which may be required and shall be obtained prior to the Closing Time under Applicable Securities Laws, and (ii) such customary post-closing notices or filings required to be submitted within the applicable time frame pursuant to Applicable Securities Laws, as may be required in connection with the Offering. |

|

|

(o) |

Financial Statements. The Financial Statements: |

|

|

(i) |

present fairly, in all material respects, the financial position of the Corporation on a consolidated basis and the statements of operations, retained earnings, cash flow from operations and changes in financial information of the Corporation on a consolidated basis for the periods specified in such Financial Statements; |

|

|

(ii) |

have been prepared in accordance with IFRS, applied on a consistent basis throughout the periods involved; and |

|

|

(iii) |

do not contain any misrepresentations with respect to the period covered by the Financial Statements. |

|

|

(p) |

Off-Balance Sheet Transactions. There are no off-balance sheet transactions, arrangements, obligations or liabilities of the Corporation or its Subsidiaries, whether direct, indirect, absolute, contingent or otherwise. |

|

|

(q) |

Accounting Policies. There has been no change in accounting policies or practices of the Corporation or its Subsidiaries other than as disclosed in the Financial Statements. |

|

|

(r) |

Liabilities. Neither the Corporation nor the Subsidiaries have any liabilities, obligations, indebtedness or commitments, whether accrued, absolute, contingent or otherwise, which are not disclosed in the disclosed in the Offering Documents, including the Financial Statements, other than liabilities, obligations, or indebtedness or commitments: (i) incurred in the normal course of business; or (ii) which would not, individually or in the aggregate, have a Material Adverse Effect. |

|

|

(s) |

Independent Auditors. The Corporation’s Auditors are, and the Former Auditors were, at the time they were auditors of the Corporation, independent with respect to the Corporation and Field Trip Psychedelics within the meaning of the rules of professional conduct applicable to auditors in Canada and there has never been a “reportable event” (within the meaning of NI 51-102) with such auditors. |

22

|

|

(t) |

Accounting Controls. The Corporation maintains a system of internal accounting controls sufficient to provide reasonable assurance that (i) transactions are executed in accordance with management’s general or specific authorizations, (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with IFRS and to maintain asset accountability, (iii) access to monies and investments is permitted only in accordance with management’s general or specific authorization, and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. |

|

|

(u) |

Purchases and Sales. Neither the Corporation nor any of the Subsidiaries has approved, has entered into any agreement in respect of, or has any knowledge, as the case may be, of: |

|

|

(i) |

the sale, transfer or other disposition of any Business Assets or any interest therein currently owned, directly or indirectly, by the Corporation or any Subsidiary, whether by asset sale, transfer of shares, or otherwise; |

|

|

(ii) |

a transaction which would result in the change of control (by sale or transfer of Common Shares or sale of all or substantially all of the Business Assets) of the Corporation or any Subsidiary; or |

|

|

(iii) |

a proposed or planned disposition of Common Shares by any shareholder who owns, directly or indirectly, 10% or more of the outstanding Common Shares. |

|

|

(v) |

Title to Business Assets. The Corporation and the Subsidiaries have good, valid and marketable title to, and have all necessary rights in respect of, all of their Business Assets as owned, leased, licensed, loaned, operated or used by them or over which they have rights, free and clear of Liens and, except as set out in the Offering Documents, no other material rights or Business Assets are necessary for the conduct of the Business as currently conducted. The Corporation knows of no claim or basis for any claim that would reasonably be likely to result in a Material Adverse Effect on the rights of the Corporation or the Subsidiaries to use, transfer, lease, licence, operate, sell or otherwise exploit such Business Assets and neither the Corporation nor any Subsidiary has any obligation to pay any commission, licence fee or similar payment to any person in respect thereof and there are no outstanding rights of first refusal or other pre-emptive rights of purchase which entitle any person to acquire any of the rights, title or interests in such Business Assets. |

|

|

(w) |

Standard Operating Procedures. All research and development activities, including quality assurance, quality control, testing, and research and analysis activities, conducted or contemplated by the Corporation and the Subsidiaries in connection with the Business are being or will be conducted in compliance, in all material respects, with all industry, laboratory safety, management and training standards in the jurisdiction where such activities take place which are applicable to the Business, and all such processes, procedures and practices required in connection with such activities are or will be in place as necessary at the applicable time, and are or will be being complied with in all material respects. |

23

|

|

(x) |

Business Relationships. All agreements with third parties in connection with the Business have been entered into and are being performed by the Corporation and the Subsidiaries and, to the knowledge of the Corporation, by all other third parties thereto, in compliance with their terms in all material respects. There exists no actual or, to the knowledge of the Corporation, threatened termination, cancellation or limitation of, or any material adverse modification or material change in, the business relationship of the Corporation or the Subsidiaries, with any supplier or customer, or any group of suppliers or customers, whose business with or whose purchases or inventories/components provided to the Business are, individually or in the aggregate, material to the assets, Business, properties, operations or financial condition of the Corporation or the Subsidiaries. |

| (y) | Privacy Protection. Each of the Corporation and the Subsidiaries have complied, in all material respects, with all applicable privacy and consumer protection legislation and neither the Corporation nor the Subsidiaries has collected, received, stored, disclosed, transferred, used, misused or permitted unauthorized access to any information protected by privacy laws, whether collected directly or from third parties, in an unlawful manner. |

|

|

(z) |

Intellectual Property. The Corporation and the Subsidiaries, as applicable, own or possess the right to use all material Intellectual Property Rights necessary for the conduct of the Business, and the Corporation is not aware of any bona fide claim to the contrary or any challenge by any other person to the rights of the Corporation and the Subsidiaries with respect to the foregoing. To the knowledge of the Corporation, the Business of the Corporation, including that of the Subsidiaries, as now conducted does not infringe any Intellectual Property Rights of any person. The Corporation has not received notice of any bona fide claim made against the Corporation or the Subsidiaries alleging the infringement by the Corporation or the Subsidiaries of any Intellectual Property Rights of any person, other than as disclosed to the Underwriters in writing. |

|

|

(aa) |

Environmental and Workplace Laws. To the Corporation’s knowledge, each of the Corporation and the Subsidiaries is currently in compliance, in all material respects, with all Environmental Laws, and there are no pending or, to the knowledge of the Corporation, any threatened, administrative, regulatory or judicial actions, suits, demands, claims, liens, notices of non-compliance or violation, investigation or proceedings relating to any Environmental Laws. Neither the Corporation nor the Subsidiaries have ever received any notice of any non-compliance in respect of Environmental Laws, there are no events or circumstances that might reasonably be expected to form the basis of an order for clean up or remediation under Environmental Laws or relating to any Hazardous Materials, and there are no permits required under Environmental Laws for the conduct of the Business. The facilities and operations of the Corporation and the Subsidiaries are currently being conducted, and to the knowledge of the Corporation have been conducted, in all material respects in accordance with all applicable workers’ compensation and health and safety and workplace laws, regulations and policies. |

24

|

|

(bb) |

Insurance. The Corporation and the Subsidiaries maintain in good standing insurance, or where insurance has not yet been obtained, shall use commercially reasonable efforts to obtain and maintain insurance, by insurers of recognized financial responsibility, against such losses, risks and damages to their Business Assets in such amounts that are customary for the business in which they are engaged and on a basis consistent with reasonably prudent persons in comparable businesses. Each of the Corporation and the Subsidiaries has complied with the terms of such policies and instruments in all material respects and there are no material claims by the Corporation or the Subsidiaries under any such policy or instrument as to which any insurance company is denying liability or defending under a reservation of rights clause. The Corporation has no reason to believe that it will not be able to renew such existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue the Business at a cost that would not have a Material Adverse Effect, and neither the Corporation nor the Subsidiaries have failed to promptly give any notice of any material claim thereunder. |

|

|

(cc) |

Material Agreements and Debt Instruments. Each Material Agreement and Debt Instrument has been provided to the Underwriters and is valid, subsisting, in good standing in all material respects and in full force and effect, enforceable in accordance with the terms thereof, subject to bankruptcy, insolvency and other laws affecting the rights of creditors generally, and subject to other standard assumptions and qualifications, including the qualifications that equitable remedies may be granted in the discretion of a court of competent jurisdiction and that enforcement of rights to indemnity, contribution and waiver of contribution set out in such agreements may be limited by Applicable Law. The Corporation and the Subsidiaries have, in all material respects, performed all obligations in a timely manner under, and are in compliance, in all material respects, with all terms and conditions (including any financial covenants) contained in, each Material Agreement and Debt Instrument. |

|

|

(dd) |

No Material Changes. Except as disclosed in the Prospectus, since March 31, 2020 (i) there has been no material change in the assets, liabilities, obligations (absolute, accrued, contingent or otherwise) business, condition (financial or otherwise), properties, capital or results of operations of the Corporation and the Subsidiaries considered as one enterprise, and (ii) there have been no transactions entered into by the Corporation or the Subsidiaries, other than those in the ordinary course of business, which are material with respect to the Corporation and the Subsidiaries considered as one enterprise. |

25

|

|

(ee) |

Absence of Proceedings. There is no action, suit, proceeding, inquiry or investigation before or brought by any Governmental Authority, domestic or foreign, now pending or, to the knowledge of the Corporation, threatened against or affecting the Corporation, any Subsidiary or the Business Assets (including in respect of any product liability claims) which would have a Material Adverse Effect, or would materially and adversely affect the consummation of the transactions contemplated in this Agreement or the performance by the Corporation of its obligations hereunder. The aggregate of all pending legal or governmental proceedings to which the Corporation or the Subsidiaries is a party or of which any of their respective property or assets is subject would not reasonably be expected to result in a Material Adverse Effect. |

|

|

(ff) |

Absence of Defaults and Conflicts. Neither the Corporation nor any of the Subsidiaries is in material violation, default or breach of, and the execution, delivery and performance of this Agreement, the Offering Documents and the consummation of the transactions and compliance by the Corporation with its obligations hereunder and thereunder, the sale of the Offered Securities and the issuance of the Broker Warrants, do not and will not, whether with or without the giving of notice or passage of time or both, result in a material violation, default or breach of, or conflict with, or result in a Repayment Event or the creation or imposition of any Lien upon any property or assets of the Corporation, including the Business Assets, or the Subsidiaries, under the terms or provisions of (i) any Material Agreements or Debt Instruments, (ii) the articles or by-laws or other constating documents or resolutions of the directors or shareholders of the Corporation or the Subsidiaries, (iii) to the knowledge of the Corporation, any existing Applicable Law, including Applicable Securities Laws, or (iv) to the knowledge of the Corporation, any judgment, order, writ or decree of any Governmental Authority. |

|

|

(gg) |

Labour Matters. No material work stoppage, strike, lock-out, labour disruption, dispute, grievance, arbitration, proceeding or other conflict with the employees of the Corporation or the Subsidiaries currently exists or, to the knowledge of the Corporation, is imminent or pending and the Corporation and the Subsidiaries are in material compliance with all Applicable Law respecting employment and employment practices, terms and conditions of employment and wages and hours. |

|

|

(hh) |