LEASE BETWEEN THE IRVINE COMPANY LLC AND AVIAT U.S., INC.

LEASE

BETWEEN

THE IRVINE COMPANY LLC

AND

AVIAT U.S., INC.

LEASE

THIS LEASE is made as of June 8th, 2016, by and between THE IRVINE COMPANY LLC, a Delaware limited liability company, hereafter called “Landlord,” and AVIAT U.S., INC., a Delaware corporation, hereafter called “Tenant.”

Each reference in this Lease to the “Basic Lease Provisions” shall mean and refer to the following collective terms, the application of which shall be governed by the provisions in the remaining Articles of this Lease.

1. | Tenant’s Trade Name: N/A |

2. | Premises: Suite No. 200 (The Premises are more particularly described in Section 2.1) |

Address of Building: 000 X XxXxxxxx Xxxx, Xxxxxxxx, XX 00000

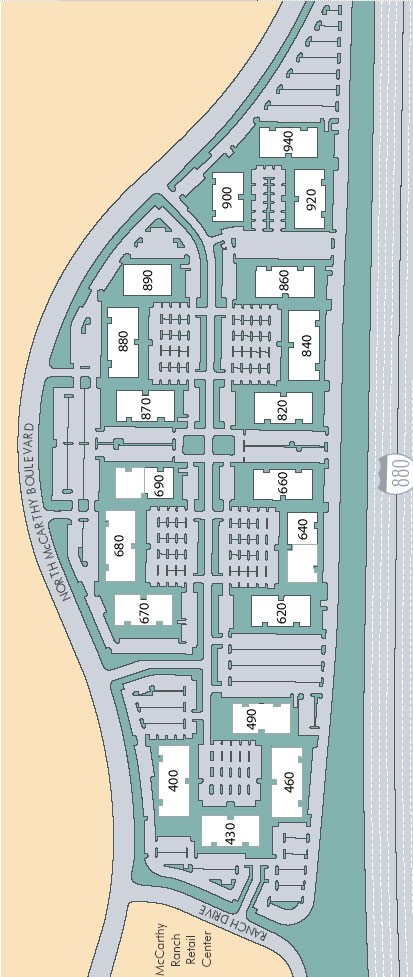

Project Description XxXxxxxx Center (as shown on Exhibit Y to this Lease)

3. | Use of Premises: General office, research and development and computer lab. |

4. | Estimated Commencement Date: 8 weeks from and after the date of this Lease |

5. | Lease Term: 60 months, plus such additional days as may be required to cause this Lease to expire on the final day of the calendar month. |

6. | Basic Rent: |

Months of Term or Period | Monthly Rate Per Rentable Square Foot | Monthly Basic Rent (rounded to the nearest dollar) |

1 to 12 | $1.35 | $25,650.00 |

13 to 24 | $1.39 | $26,410.00 |

25 to 36 | $1.43 | $27,170.00 |

37 to 48 | $1.48 | $28,120.00 |

49 to 60 | $1.52 | $28,880.00 |

Notwithstanding the above schedule of Basic Rent to the contrary, as long as Tenant is not in Default (as defined in Section 14.1) under this Lease, Tenant shall be entitled to an abatement of 3 full calendar months of Basic Rent in the aggregate amount of $76,950.00 (i.e. $25,650.00 per month) (the “Abated Basic Rent”) for the initial 2nd, 3rd, and 4th full calendar months of the Term (the “Abatement Period”). In the event Tenant Defaults at any time during the Term beyond any applicable “cure” period with the result that Tenant’s right to possession of the Premises is terminated, then unamortized Abated Basic Rent to the date of such termination (amortized over the initial 60 months of the Term) shall immediately become due and payable. The payment by Tenant of the unamortized Abated Basic Rent in the event of a Default shall not limit or affect any of Landlord's other rights, pursuant to this Lease or at law or in equity. Only Basic Rent shall be abated during the Abatement Period and all other additional rent and other costs and charges specified in this Lease shall remain as due and payable pursuant to the provisions of this Lease.

7. | Expense Recovery Period: Every twelve month period during the Term (or portion thereof during the first and last Lease years) ending June 30. |

8. | Floor Area of Premises: approximately 19,000 rentable square feet |

Floor Area of Building: approximately 53,284 rentable square feet

9. | Security Deposit: $31,768.00 |

10. | Broker(s): Irvine Realty Company and CBRE, Inc. (collectively, "Landlord's Broker") is the agent of Landlord exclusively and CBRE, Inc./Palo Alto ("Tenant's Broker") is the agent of Tenant exclusively. |

11. | Parking: 72 parking spaces in accordance with the provisions set forth in Exhibit F to this Lease. |

12. |

LANDLORD | TENANT |

Payment Address: THE IRVINE COMPANY XXX X.X. Xxx #000000 Xxx Xxxxxxxxx, XX 00000-0000 Notice Address: THE IRVINE COMPANY XXX 000 Xxxxxxx Xxxxxx Xxxxx Xxxxxxx Xxxxx, XX 00000 Xxxx: Senior Vice President, Property Operations Irvine Office Properties | AVIAT U.S., INC. 860 X XxXxxxxx Xxxx, Xxxxx 000 Xxxxxxxx, XX 00000 |

LIST OF LEASE EXHIBITS (All exhibits, riders and addenda attached to this Lease are hereby incorporated into and made a part of this Lease):

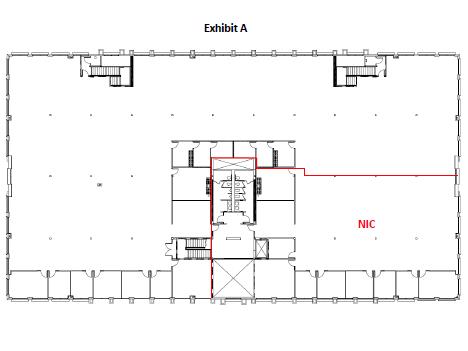

Exhibit A Description of Premises

Exhibit B Operating Expenses

Exhibit C Utilities and Services

Exhibit D Tenant’s Insurance

Exhibit E Rules and Regulations

Exhibit F Parking

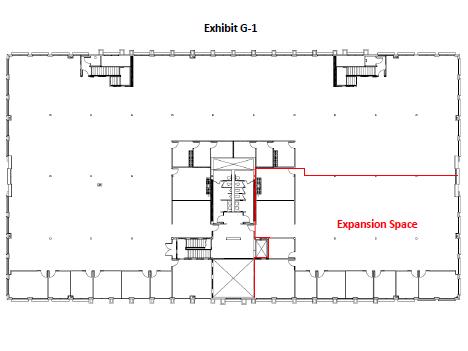

Exhibit G Additional Provisions

Exhibit H Hazardous Materials Disclosure Statement

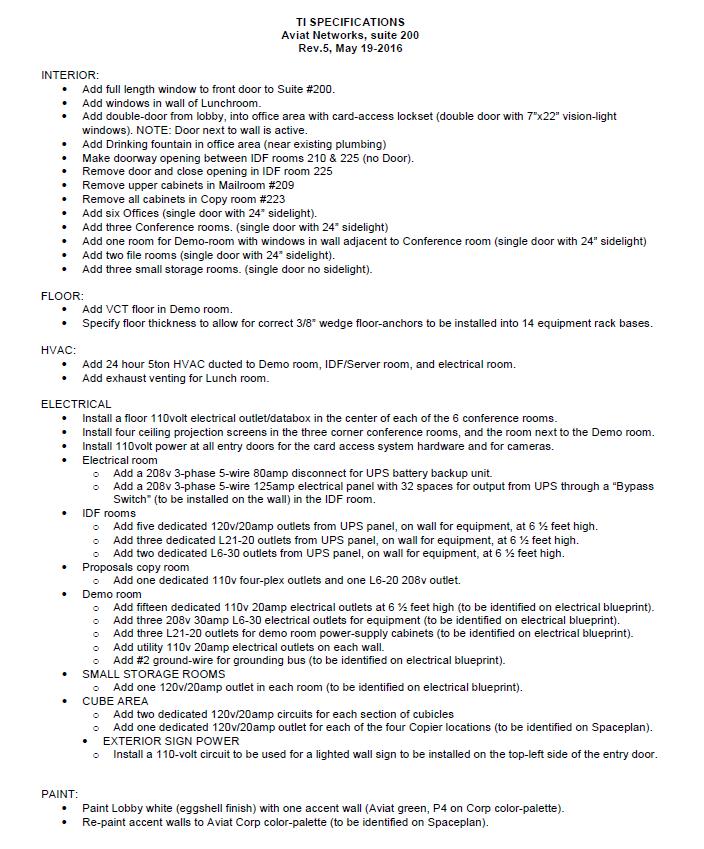

Exhibit X Work Letter

Exhibit Y Project Description

2.1. LEASED PREMISES. Landlord leases to Tenant and Tenant leases from Landlord the Premises shown in Exhibit A (the “Premises”), containing approximately the floor area set forth in Item 8 of the Basic Lease Provisions (the “Floor Area”). Landlord and Tenant stipulate and agree that the Floor Area of Premises set forth in Item 8 of the Basic Lease Provisions is correct. The Premises are a portion of certain real property which is leased by Landlord pursuant to that certain Master Lease dated December 31, 2003 (the “Master Lease”) by and between XxXxxxxx Center Partners LLC, a Delaware limited liability company, subsequently assigned to The Irvine Company LLC, a Delaware limited liability company (“Master Lessor”), as “Landlord”, and Landlord as “Tenant”. That certain Master Lease (Short Form – Memorandum) was recorded on December 31, 2003 as Document No. 17553727 in the Official Records of Santa Xxxxx County, California.

2.2. ACCEPTANCE OF PREMISES. Tenant acknowledges that neither Landlord nor any representative of Landlord has made any representation or warranty with respect to the Premises, the Building or the Project or the suitability or fitness of either for any purpose, except as set forth in this Lease. Tenant acknowledges that the flooring materials which may be installed within portions of the Premises located on the ground floor of the Building may be limited by the moisture content of the Building slab and underlying soils. The taking of possession or use of the Premises by Tenant for any purpose other than construction shall conclusively establish that the Premises and the Building were in satisfactory condition and in conformity with the provisions of this Lease in all respects, except for those matters which Tenant shall have brought to Landlord’s attention on a written punch list. The punch list shall be limited to any items required to be accomplished by Landlord under the Work Letter (if any) attached as Exhibit X, and shall be delivered to Landlord within 30 days after the Commencement Date (as defined herein). If there is no Work Letter, or if no items are required of Landlord under the Work Letter, by taking possession of the Premises Tenant accepts the improvements in their existing condition, and waives any right or claim against Landlord arising out of the condition of the Premises. Nothing contained in this Section 2.2 shall affect the commencement of the Term or the obligation of Tenant to pay rent. Landlord shall diligently complete all punch list items of which it is notified as provided above.

3.1. GENERAL. The term of this Lease (“Term”) shall be for the period shown in Item 5 of the Basic Lease Provisions. The Term shall commence (“Commencement Date”) on the earlier of (a) the date the Premises are deemed “ready for occupancy” (as hereinafter defined) and possession thereof is delivered to Tenant, but not sooner than July 1, 2016, or (b) the date Tenant commences its regular business activities within the Premises. Promptly following request by Landlord, the parties shall memorialize on a form provided by Landlord (the "Commencement Memorandum") the actual Commencement Date and the expiration date (“Expiration Date") of this Lease; should Tenant fail to execute and return the Commencement Memorandum to Landlord within 5 business days (or provide specific written objections thereto within that period), then Landlord's determination of the Commencement and Expiration Dates as set forth in the Commencement Memorandum shall be conclusive. The Premises shall be deemed “ready for occupancy” when Landlord, to the extent applicable, has substantially completed all the work required to be completed by Landlord pursuant to the Work Letter (if any) attached to this Lease but for minor punch list matters, and has obtained the requisite governmental approvals for Tenant’s occupancy in connection with such work.

3.2. DELAY IN POSSESSION. If Landlord, for any reason whatsoever, cannot deliver possession of the Premises to Tenant on or before the Estimated Commencement Date set forth in Item 4 of the Basic Lease Provisions, this Lease shall not be void or voidable nor shall Landlord be liable to Tenant for any resulting loss or damage. However, Tenant shall not be liable for any rent until the Commencement Date occurs as provided in Section 3.1 above, except that if Landlord’s failure to substantially complete all work required of Landlord pursuant to Section 3.1(i) above is attributable to any action or inaction by Tenant (including without limitation any Tenant Delay described in the Work Letter, if any, attached to this Lease), then the Premises shall be deemed ready for occupancy, and Landlord shall be entitled to full performance by Tenant (including the payment of rent), as of the date Landlord would have been able to substantially complete such work and deliver the Premises to Tenant but for Tenant’s delay(s).

4.1. BASIC RENT. Concurrently with the execution and delivery of this Lease, Tenant shall pay to Landlord the sum of $52,820.00, constituting the Basic Rent due and payable under this Lease (at the monthly rate shown in Item 6 of the Basic Lease Provisions) for the initial 1st, 13th and 25th months of the Term. From and after the Commencement Date, Tenant shall pay to Landlord without deduction or offset a Basic Rent for the Premises in the total amount shown (including subsequent adjustments, if any) in Item 6 of the Basic Lease Provisions (the “Basic Rent”). If the Commencement Date is other than the first day of a calendar month, any rental adjustment shown in Item 6 shall be deemed to occur on the first day of the next calendar month following the specified monthly anniversary of the Commencement Date. Notwithstanding anything contrary contained in this Section 4.1, the Basic Rent shall be due and payable in advance commencing on the Commencement Date and continuing thereafter on the first day of each successive calendar month of the Term, as prorated for any partial month. No demand, notice or invoice shall be required. The next installment of Basic Rent shall be due on the first day of the fifth calendar month

of the Term, which installment shall, if applicable, be appropriately prorated to reflect the amount prepaid for that calendar month.

4.2. OPERATING EXPENSES. Tenant shall pay Tenant’s Share of Operating Expenses in accordance with Exhibit B of this Lease.

4.3. SECURITY DEPOSIT. Concurrently with Tenant’s delivery of this Lease, Tenant shall deposit with Landlord the sum, if any, stated in Item 9 of the Basic Lease Provisions (the “Security Deposit”), to be held by Landlord as security for the full and faithful performance of Tenant’s obligations under this Lease, to pay any rental sums, including without limitation such additional rent as may be owing under any provision hereof, and to maintain the Premises as required by Sections 7.1 and 15.2 or any other provision of this Lease. Upon any breach of the foregoing obligations by Tenant, Landlord may apply all or part of the Security Deposit as full or partial compensation. If any portion of the Security Deposit is so applied, Tenant shall within 5 days after written demand by Landlord deposit cash with Landlord in an amount sufficient to restore the Security Deposit to its original amount. Landlord shall not be required to keep the Security Deposit separate from its general funds, and Tenant shall not be entitled to interest on the Security Deposit. In no event may Tenant utilize all or any portion of the Security Deposit as a payment toward any rental sum due under this Lease. Any unapplied balance of the Security Deposit shall be returned to Tenant or, at Landlord’s option, to the last assignee of Tenant’s interest in this Lease within 30 days following the termination of this Lease and Tenant's vacation of the Premises. Tenant hereby waives the provisions of Section 1950.7 of the California Civil Code, or any similar or successor laws now or hereafter in effect, in connection with Landlord’s application of the Security Deposit to prospective rent that would have been payable by Tenant but for the early termination due to Tenant’s Default (as defined herein).

5.1. USE. Tenant shall use the Premises only for the purposes stated in Item 3 of the Basic Lease Provisions and for no other use whatsoever. The uses prohibited under this Lease shall include, without limitation, use of the Premises or a portion thereof for (i) offices of any agency or bureau of the United States or any state or political subdivision thereof; (ii) offices or agencies of any foreign governmental or political subdivision thereof; or (iii) schools, temporary employment agencies or other training facilities which are not ancillary to corporate, executive or professional office use. Tenant shall not do or permit anything to be done in or about the Premises which will in any way interfere with the rights or quiet enjoyment of other occupants of the Building or the Project, or use or allow the Premises to be used for any unlawful purpose, nor shall Tenant permit any nuisance or commit any waste in the Premises or the Project. Tenant shall not perform any work or conduct any business whatsoever in the Project other than inside the Premises. Tenant shall comply at its expense with all present and future laws, ordinances and requirements of all governmental authorities that pertain to Tenant or its use of the Premises. As of the date of this Lease, there has been no inspection of the Building and Project by a Certified Access Specialist as referenced in Section 1938 of the California Civil Code.

5.2. SIGNS. Provided Tenant continues to occupy the entire Premises, Tenant shall have the non-exclusive right to one (1) position on the exterior monument sign at the front entrance to the Building and one (1) exterior “building top” sign on the Building for Tenant’s name and graphics in a location designated by Landlord, subject to Landlord's right of prior approval that such exterior signage is in compliance with the Signage Criteria (defined below). Except as provided in the foregoing, and except for Landlord’s standard lobby directory and suite signage identifying Tenant’s name and/or logo, Tenant shall have no right to maintain signs in any location in, on or about the Premises, the Building or the Project and shall not place or erect any signs that are visible from the exterior of the Building. The size, design, graphics, material, style, color and other physical aspects of any permitted sign shall be subject to Landlord's written determination, as determined solely by Landlord, prior to installation, that signage is in compliance with any covenants, conditions or restrictions encumbering the Premises and Landlord's signage program for the Project, as in effect from time to time and approved by the City in which the Premises are located ("Signage Criteria"). Prior to placing or erecting any such signs, Tenant shall obtain and deliver to Landlord a copy of any applicable municipal or other governmental permits and approvals, except to Landlord’s standard suite signage. Tenant shall be responsible for all costs of any permitted sign, including, without limitation, the fabrication, installation, maintenance and removal thereof and the cost of any permits therefor, except that Landlord shall pay for the initial installation costs only of the standard lobby directory and suite signage. If Tenant fails to maintain its sign in good condition, or if Tenant fails to remove same upon termination of this Lease and repair and restore any damage caused by the sign or its removal, Landlord may do so at Tenant's expense. Landlord shall have the right to temporarily remove any signs in connection with any repairs or maintenance in or upon the Building. The term "sign" as used in this Section shall include all signs, designs, monuments, displays, advertising materials, logos, banners, projected images, pennants, decals, pictures, notices, lettering, numerals or graphics. Tenant’s exterior signage rights under this Section 5.2 belong solely to Aviat U.S., Inc., a Delaware corporation, or any transferee under a Permitted Transfer, and any attempted assignment or transfer of such rights shall be void and of no force and effect.

5.3. HAZARDOUS MATERIALS. Tenant shall not generate, handle, store or dispose of hazardous or toxic materials (as such materials may be identified in any federal, state or local law or regulation) in the Premises or Project without the prior written consent of Landlord; provided that the foregoing shall not be deemed to proscribe the use by Tenant of customary office supplies in normal quantities so long as such

use comports with all applicable laws. Tenant acknowledges that it has read, understands and, if applicable, shall comply with the provisions of Exhibit H to this Lease, if that Exhibit is attached.

6.1. UTILITIES AND SERVICES. Landlord and Tenant shall be responsible to furnish those utilities and services to the Premises to the extent provided in Exhibit C, subject to the conditions and payment obligations and standards set forth in this Lease. Landlord shall not be liable for any failure to furnish any services or utilities when the failure is the result of any accident or other cause beyond Landlord’s reasonable control, nor shall Landlord be liable for damages resulting from power surges or any breakdown in telecommunications facilities or services. Landlord’s temporary inability to furnish any services or utilities shall not entitle Tenant to any damages, relieve Tenant of the obligation to pay rent or constitute a constructive or other eviction of Tenant, except that Landlord shall diligently attempt to restore the service or utility promptly. Tenant shall comply with all rules and regulations which Landlord may reasonably establish for the provision of services and utilities, and shall cooperate with all reasonable conservation practices established by Landlord. Landlord shall at all reasonable times have free access to all electrical and mechanical installations of Landlord.

6.2. OPERATION AND MAINTENANCE OF COMMON AREAS. During the Term, Landlord shall operate and maintain all Common Areas within the Building and the Project. The term “Common Areas” shall mean all areas within the Building and other buildings in the Project which are not held for exclusive use by persons entitled to occupy space, including without limitation parking areas and structures, driveways, sidewalks, landscaped and planted areas, hallways and interior stairwells not located within the premises of any tenant, common electrical rooms, entrances and lobbies, elevators, and restrooms not located within the premises of any tenant.

6.3. USE OF COMMON AREAS. The occupancy by Tenant of the Premises shall include the use of the Common Areas in common with Landlord and with all others for whose convenience and use the Common Areas may be provided by Landlord, subject, however, to compliance with Rules and Regulations described in Article 17 below. Landlord shall at all times during the Term have exclusive control of the Common Areas, and may restrain or permit any use or occupancy, except as otherwise provided in this Lease or in Landlord’s rules and regulations. Tenant shall keep the Common Areas clear of any obstruction or unauthorized use related to Tenant’s operations. Landlord may temporarily close any portion of the Common Areas for repairs, remodeling and/or alterations, to prevent a public dedication or the accrual of prescriptive rights, or for any other reasonable purpose. Landlord’s temporary closure of any portion of the Common Areas for such purposes shall not deprive Tenant of reasonable access to the Premises.

6.4. CHANGES AND ADDITIONS BY LANDLORD. Landlord reserves the right to make alterations or additions to the Building or the Project or to the attendant fixtures, equipment and Common Areas, and such change shall not entitle Tenant to any abatement of rent or other claim against Landlord. No such change shall deprive Tenant of reasonable access to or use of (a) the Premises or any part of the Premises as well as (b) the elevator and stairs in the Building.

7.1. TENANT’S MAINTENANCE AND REPAIR. Subject to Articles 11 and 12, Tenant at its sole expense shall make all repairs necessary to keep the Premises and all improvements and fixtures therein in good condition and repair, ordinary wear and tear excepted. Notwithstanding Section 7.2 below, Tenant’s maintenance obligation shall include without limitation all appliances, interior glass, doors, door closures, hardware, fixtures, electrical, plumbing, fire extinguisher equipment and other equipment installed in the Premises and all Alterations constructed by Tenant pursuant to Section 7.3 below, together with any supplemental HVAC equipment servicing only the Premises. All repairs and other work performed by Tenant or its contractors shall be subject to the terms of Sections 7.3 and 7.4 below. Alternatively, should Landlord or its management agent agree to make a repair on behalf of Tenant and at Tenant’s request, Tenant shall promptly reimburse Landlord as additional rent for all reasonable costs incurred (including the standard supervision fee not to exceed 15% of such costs) upon submission of an invoice.

7.2. LANDLORD’S MAINTENANCE AND REPAIR. Subject to Articles 11 and 12, Landlord shall provide service, maintenance and repair with respect to the heating, ventilating and air conditioning (“HVAC”) equipment of the Building (exclusive of any supplemental HVAC equipment servicing only the Premises) and shall maintain in good repair the Common Areas, roof, foundations, footings, the exterior surfaces of the exterior walls of the Building (including exterior glass), and the structural, electrical, mechanical and plumbing systems of the Building (including elevators, if any, serving the Building), except to the extent provided in Section 7.1 above. Landlord need not make any other improvements or repairs except as specifically required under this Lease, and nothing contained in this Section 7.2 shall limit Landlord’s right to reimbursement from Tenant for maintenance, repair costs and replacement costs as provided elsewhere in this Lease. Notwithstanding any provision of the California Civil Code or any similar or successor laws to the contrary, Tenant understands that it shall not make repairs at Landlord’s expense or by rental offset. Except as provided in Section 11.1 and Article 12 below, there shall be no abatement of rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of any repairs, alterations or improvements to any portion of the Building, including repairs to the Premises, nor

shall any related activity by Landlord constitute an actual or constructive eviction; provided, however, that in making repairs, alterations or improvements, Landlord shall interfere as little as reasonably practicable with the conduct of Tenant’s business in the Premises. Tenant hereby waives any and all rights under and benefits of subsection 1 of Section 1932, and Sections 1941 and 1942 of the California Civil Code, or any similar or successor laws now or hereafter in effect.

7.3. ALTERATIONS. Except for cosmetic alterations and projects that do not exceed $15,000.00 during any calendar year of the Term, that do not require a permit from the City of Milpitas and that satisfy the criteria in the next following sentence (which cosmetic work shall require notice to Landlord but not Landlord’s consent), Tenant shall make no alterations, additions, decorations, or improvements (collectively referred to as “Alterations”) to the Premises without the prior written consent of Landlord. Landlord’s consent shall not be unreasonably withheld as long as the proposed Alterations do not affect the structural, electrical or mechanical components or systems of the Building, are not visible from the exterior of the Premises, do not change the basic floor plan of the Premises, and utilize only Landlord’s building standard materials (“Standard Improvements”). Landlord may impose, as a condition to its consent, any requirements that Landlord in its reasonable discretion may deem reasonable or desirable. Without limiting the generality of the foregoing, Tenant shall use Landlord’s designated mechanical and electrical contractors for all Alterations work affecting the mechanical or electrical systems of the Building. Should Tenant perform any Alterations work that would necessitate any ancillary Building modification or other expenditure by Landlord, then Tenant shall promptly fund the cost thereof to Landlord. Tenant shall obtain all required permits for the Alterations and shall perform the work in compliance with all applicable laws, regulations and ordinances with contractors reasonably acceptable to Landlord, and except for cosmetic Alterations not requiring a permit, Landlord shall be entitled to a supervision fee in the amount of 3% of the cost of the Alterations. Any request for Landlord’s consent shall be made in writing and shall contain architectural plans describing the work in detail reasonably satisfactory to Landlord. Landlord may elect to cause its architect to review Tenant’s architectural plans, and the reasonable and actual out-of-pocket cost of that review shall be reimbursed by Tenant. Should the Alterations proposed by Tenant and consented to by Landlord change the floor plan of the Premises, then Tenant shall, at its expense, furnish Landlord with as-built drawings and CAD disks compatible with Landlord’s systems. Alterations shall be constructed in a good and workmanlike manner using materials of a quality reasonably approved by Landlord Unless Landlord otherwise agrees in writing, all Alterations affixed to the Premises, including without limitation all Tenant Improvements constructed pursuant to the Work Letter (except as otherwise provided in the Work Letter), but excluding moveable trade fixtures and furniture, shall become the property of Landlord and shall be surrendered with the Premises at the end of the Term. Notwithstanding the foregoing, Landlord shall have the right by written notice to Tenant given at the time of Landlord’s consent to any Alterations requested by Tenant to require Tenant to remove by the Expiration Date, or sooner termination date of this Lease, all or any Alterations (including without limitation all telephone and data cabling) installed either by Tenant or by Landlord at Tenant’s request (collectively, the “Required Removables”), and to replace any non-Standard Improvements with the applicable Standard Improvements. Tenant, at the time it requests approval for a proposed Alteration, may request in writing that Landlord advise Tenant whether the Alteration or any portion thereof, is a Required Removable. Within 10 days after receipt of Tenant’s request, Landlord shall advise Tenant in writing as to which portions of the subject Alterations are Required Removables. In connection with its removal of Required Removables, Tenant shall repair any damage to the Premises arising from that removal and shall restore the affected area to its pre-existing condition, reasonable wear and tear excepted.

7.4. MECHANIC’S LIENS. Tenant shall keep the Premises free from any liens arising out of any work performed, materials furnished, or obligations incurred by or for Tenant. Upon request by Landlord, Tenant shall promptly cause any such lien to be released by posting a bond in accordance with California Civil Code Section 8424 or any successor statute. In the event that Tenant shall not, within 15 days following the imposition of any lien, cause the lien to be released of record by payment or posting of a proper bond, Landlord shall have, in addition to all other available remedies, the right to cause the lien to be released by any means it deems proper, including payment of or defense against the claim giving rise to the lien. All expenses so incurred by Landlord, including Landlord’s attorneys’ fees, shall be reimbursed by Tenant promptly following receipt of Landlord’s invoice for the same. Tenant shall give Landlord no less than 20 days’ prior notice in writing before commencing construction of any kind on the Premises.

7.5. ENTRY AND INSPECTION. Landlord shall at all reasonable times have the right to enter the Premises to inspect them, to supply services in accordance with this Lease, to make repairs and renovations as reasonably deemed necessary by Landlord, and to submit the Premises to prospective or actual purchasers or encumbrance holders (or, during the final twelve months of the Term or when an uncured Default exists, to prospective tenants), all without being deemed to have caused an eviction of Tenant and without abatement of rent except as provided elsewhere in this Lease. If reasonably necessary, Landlord may temporarily close all or a portion of the Premises to perform repairs, alterations and additions. Except in emergencies or to provide Building services, Landlord shall provide Tenant with at least 24 hours prior verbal notice of entry and shall use reasonable efforts to minimize any interference with Tenant’s use of the Premises.

Landlord shall have the right, upon providing not less than 120 days prior written notice, to move Tenant to other space of comparable size in the Building or in the Project provided that Landlord may exercise such relocation right only once during the Term and only subsequent to the expiration of the initial 18 months of

the Term. The new space shall be provided with improvements of comparable quality to those within the Premises. Landlord shall pay the reasonable out-of-pocket costs to relocate and reconnect Tenant’s personal property and equipment within the new space; provided that Landlord may elect to cause such work to be done by its contractors. Landlord shall also reimburse Tenant for such other reasonable out-of-pocket costs that Tenant may incur in connection with the relocation, including without limitation necessary stationery revisions. Within 10 days following request by Landlord, Tenant shall execute an amendment to this Lease prepared by Landlord to memorialize the relocation. Should Tenant fail timely to execute and deliver the amendment to Landlord, or should Tenant thereafter fail to comply with the terms thereof, then Landlord may at its option elect to terminate this Lease upon not less than 60 days prior written notice to Tenant. Notwithstanding the foregoing, in the event the relocation space designated by Landlord is not acceptable to Tenant, then Tenant may, by written notice to Landlord within 5 business days following delivery of Landlord’s relocation notice, elect to terminate this Lease by written notice to Landlord (the "Termination Notice"); in such event, unless Landlord revokes in writing its relocation election within three business days thereafter (in which case the Termination Notice shall be null and void), this Lease shall terminate 60 days following delivery of the Termination Notice.

(a) Except as otherwise specifically provided in this Article 9, Tenant may not, either voluntarily or by operation of law, assign, sublet, encumber, or otherwise transfer all or any part of Tenant’s interest in this Lease, or permit the Premises to be occupied by anyone other than Tenant (each, a “Transfer”), without Landlord’s prior written consent, which consent shall not unreasonably be withheld in accordance with the provisions of Section 9.1(b). For purposes of this Lease, references to any subletting, sublease or variation thereof shall be deemed to apply not only to a sublease effected directly by Tenant, but also to a sub-subletting or an assignment of subtenancy by a subtenant at any level. Except as otherwise specifically provided in this Article 9, no Transfer (whether voluntary, involuntary or by operation of law) shall be valid or effective without Landlord’s prior written consent and, at Landlord’s election, a Transfer without such consent shall constitute a material default of this Lease.

(b) Except as otherwise specifically provided in this Article 9, if Tenant or any subtenant hereunder desires to transfer an interest in this Lease, Tenant shall first notify Landlord in writing and shall request Landlord’s consent thereto. Tenant shall also submit to Landlord in writing: (i) the name and address of the proposed transferee; (ii) the nature of any proposed subtenant’s or assignee’s business to be carried on in the Premises; (iii) the terms and provisions of any proposed sublease or assignment (including without limitation the rent and other economic provisions, term, improvement obligations and commencement date); (iv) evidence that the proposed assignee or subtenant will comply with the requirements of Exhibit D to this Lease; and (v) any other information reasonably requested by Landlord and reasonably related to the Transfer. Landlord shall not unreasonably withhold its consent, provided: (1) the use of the Premises will be consistent with the provisions of this Lease and with Landlord’s commitment to other tenants of the Building and Project; (2) any proposed subtenant or assignee demonstrates that it is financially responsible by submission to Landlord of all reasonable information as Landlord may reasonably request concerning the proposed subtenant or assignee, including, but not limited to (if such items are available), a balance sheet of the proposed subtenant or assignee as of a date within 90 days of the request for Landlord’s consent and statements of income or profit and loss of the proposed subtenant or assignee for the two-year period preceding the request for Landlord’s consent; (3) the proposed assignee or subtenant is neither an existing tenant or occupant of the Building or Project nor a prospective tenant with whom Landlord or Landlord's affiliate has been actively negotiating to become a tenant at the Building or Project during the 6 month period prior to the submission of Tenant’s notice of request to assign; and (4) the proposed transferee is not an SDN (as defined below) and will not impose additional burdens or security risks on Landlord. If Landlord consents to the proposed Transfer, then the Transfer may be effected within 90 days after the date of the consent upon the terms described in the information furnished to Landlord; provided that any material change in the terms shall be subject to Landlord’s consent as set forth in this Section 9.1(b). Landlord shall approve or disapprove any requested Transfer within 15 business days following receipt of Tenant’s written notice and the information set forth above. Except in connection with a Permitted Transfer (as defined below), if Landlord approves the Transfer Tenant shall pay a transfer fee of $1,000.00 to Landlord concurrently with Tenant’s execution of a Transfer consent prepared by Landlord.

(c) Notwithstanding the provisions of Subsection (b) above, and except in connection with a “Permitted Transfer” (as defined below), in lieu of consenting to a proposed assignment of this Lease to or to a subletting of 50% or more of the Floor Area of the Premises for all or substantially all of the remainder of the Term, Landlord may elect to terminate this Lease in its entirety in the event of an assignment, or terminate this Lease as to the portion of the Premises proposed to be subleased with a proportionate abatement in the rent payable under this Lease, such termination to be effective on the date that the proposed sublease or assignment would have commenced. Landlord may thereafter, at its option, assign or re-let any space so recaptured to any third party, including without limitation the proposed transferee identified by Tenant.

(d) Should any Transfer occur, Tenant shall, except in connection with a Permitted Transfer, promptly pay or cause to be paid to Landlord, as additional rent, 50% of any amounts paid by the assignee or subtenant, however described and whether funded during or after the Lease Term, to the extent such

amounts are in excess of the sum of (i) the scheduled Basic Rent payable by Tenant hereunder (or, in the event of a subletting of only a portion of the Premises, the Basic Rent allocable to such portion as reasonably determined by Landlord) and (ii) the direct out-of-pocket costs, as evidenced by third party invoices provided to Landlord, incurred by Tenant to effect the Transfer, which costs shall be reimbursed to Tenant before Landlord shall be entitled to any profits as set forth above. Such transfer costs shall include all reasonable and customary expenses directly incurred by Tenant attributable to the Transfer, including without limitation brokerage fees, legal fees, construction costs, and Landlord’s review fee.

(e) The sale of all or substantially all of the assets of Tenant (other than bulk sales in the ordinary course of business), the merger or consolidation of Tenant, the sale of Tenant’s capital stock, or any other direct or indirect change of control of Tenant, including, without limitation, change of control of Tenant’s parent company or a merger by Tenant or its parent company, shall be deemed a Transfer within the meaning and provisions of this Article. Notwithstanding the foregoing, Tenant may assign this Lease to a successor to Tenant by merger, consolidation or the purchase of substantially all of Tenant’s assets, or assign this Lease or sublet all or a portion of the Premises to an Affiliate (defined below), without the consent of Landlord but subject to the provisions of Section 9.2, provided that all of the following conditions are satisfied (a “Permitted Transfer”): (i) Tenant is not then in Default hereunder; (ii) Tenant gives Landlord written notice at least 10 business days before the effective date of such Permitted Transfer if such notice is permitted by law, and if not, as soon thereafter as so permitted by law, and (iii) the successor entity resulting from any merger or consolidation of Tenant or the sale of all or substantially all of the assets of Tenant, has a net worth (computed in accordance with generally accepted accounting principles, except that intangible assets such as goodwill, patents, copyrights, and trademarks shall be excluded in the calculation (“Net Worth”)) at the time of the Permitted Transfer that is at least equal to the Net Worth of Tenant immediately before the Permitted Transfer. Upon Landlord’s written request, Tenant shall provide reasonable information and documentation substantiating subsection (iii) above. If requested by Landlord, Tenant shall use commercially reasonable efforts to cause its successor to sign and deliver to Landlord a commercially reasonable form of assumption agreement. “Affiliate” shall mean an entity controlled by, controlling or under common control with Tenant or its parent company.

9.2. EFFECT OF TRANSFER. No subletting or assignment, even with the consent of Landlord, shall relieve Tenant, or any successor-in-interest to Tenant hereunder, of its obligation to pay rent and to perform all its other obligations under this Lease. Each assignee, other than Landlord, shall be deemed to assume all obligations of Tenant under this Lease and shall be liable jointly and severally with Tenant for the payment of all rent, and for the due performance of all of Tenant’s obligations, under this Lease. Such joint and several liability shall not be discharged or impaired by any subsequent modification or extension of this Lease. Consent by Landlord to one or more transfers shall not operate as a waiver or estoppel to the future enforcement by Landlord of its rights under this Lease.

9.3. SUBLEASE REQUIREMENTS. Any sublease, license, concession or other occupancy agreement entered into by Tenant shall be subordinate and subject to the provisions of this Lease, and if this Lease is terminated during the term of any such agreement, Landlord shall have the right to: (i) treat such agreement as cancelled and repossess the subject space by any lawful means, or (ii) require that such transferee attorn to and recognize Landlord as its landlord (or licensor, as applicable) under such agreement. Landlord shall not, by reason of such attornment or the collection of sublease rentals, be deemed liable to the subtenant for the performance of any of Tenant’s obligations under the sublease. If Tenant is in Default (hereinafter defined), Landlord is irrevocably authorized to direct any transferee under any such agreement to make all payments under such agreement directly to Landlord (which Landlord shall apply towards Tenant’s obligations under this Lease) until such Default is cured. No collection or acceptance of rent by Landlord from any transferee shall be deemed a waiver of any provision of Article 9 of this Lease, an approval of any transferee, or a release of Tenant from any obligation under this Lease, whenever accruing. In no event shall Landlord’s enforcement of any provision of this Lease against any transferee be deemed a waiver of Landlord’s right to enforce any term of this Lease against Tenant or any other person.

10.1. TENANT’S INSURANCE. Tenant, at its sole cost and expense, shall provide and maintain in effect the insurance described in Exhibit D. Evidence of that insurance must be delivered to Landlord prior to the Commencement Date.

10.2. LANDLORD’S INSURANCE. Throughout the Term of this Lease, Landlord shall provide the following types of insurance, with or without deductible and in amounts and coverages as may be determined by Landlord in its discretion: property insurance, subject to standard exclusions (such as, but not limited to, earthquake and flood exclusions), covering the Building or Project. In addition, Landlord may, at its election, obtain insurance coverages for such other risks as Landlord or its Mortgagees may from time to time deem appropriate, including earthquake, terrorism and commercial general liability coverage. Landlord shall not be required to carry insurance of any kind on any tenant improvements or Alterations in the Premises installed by Tenant or its contractors or otherwise removable by Tenant (collectively, "Tenant Installations"), or on any trade fixtures, furnishings, equipment, interior plate glass, signs or items of personal property in the Premises, and Landlord shall not be obligated to repair or replace any of the foregoing items

should damage occur. All proceeds of insurance maintained by Landlord upon the Building and Project shall be the property of Landlord, whether or not Landlord is obligated to or elects to make any repairs.

10.3. INDEMNITY. Except to the extent caused by the negligence or willful misconduct of Landlord and its trustees, members, principals, beneficiaries, partners, officers, directors, employees, mortgagees and agents (the “Landlord Parties”), Tenant shall indemnify, defend and hold Landlord and Landlord Parties harmless against and from all liabilities, obligations, damages, penalties, claims, actions, costs, charges and expenses, including, without limitation, reasonable attorneys’ fees and other professional fees (if and to the extent permitted by law) (collectively referred to as “Losses”), which may be imposed upon, incurred by or asserted against Landlord or any of the Landlord Parties by any third party and arising out of or in connection with any damage or injury occurring in the Premises or any acts or omissions (including violations of law) of Tenant, the Tenant Parties (defined below) or any of Tenant’s transferees, contractors or licensees. Except to the extent caused by the negligence or willful misconduct of Tenant or any Tenant Parties, Landlord shall indemnify, defend and hold Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, employees and agents (“Tenant Parties”) harmless against and from all Losses which may be imposed upon, incurred by or asserted against Tenant or any of the Tenant Parties by any third party and arising out of or in connection with the acts or omissions (including violations of law) of Landlord or the Landlord Parties. The provisions of this Section 10.3 shall survive the expiration or sooner termination of this Lease with respect to any Losses arising in connection with any event occurring prior to such expiration or termination.

10.4. LANDLORD’S NONLIABILITY. Unless caused by the negligence or intentional misconduct of Landlord, its agents, employees or contractors but subject to Section 10.5 below, Landlord shall not be liable to Tenant, its employees, agents and invitees, and Tenant hereby waives all claims against Landlord, its employees and agents for loss of or damage to any property, or any injury to any person, resulting from any condition including, but not limited to, acts or omissions (criminal or otherwise) of third parties and/or other tenants of the Project, or their agents, employees or invitees, fire, explosion, falling plaster, steam, gas, electricity, water or rain which may leak or flow from or into any part of the Premises or from the breakage, leakage, obstruction or other defects of the pipes, sprinklers, wires, appliances, plumbing, air conditioning, electrical works or other fixtures in the Building, whether the damage or injury results from conditions arising in the Premises or in other portions of the Building. It is understood that any such condition may require the temporary evacuation or closure of all or a portion of the Building. Should Tenant elect to receive any service from a concessionaire, licensee or third party tenant of Landlord, Tenant shall not seek recourse against Landlord for any breach or liability of that service provider. Notwithstanding anything to the contrary contained in this Lease, in no event shall Landlord be liable for Tenant’s loss or interruption of business or income (including without limitation, Tenant’s consequential damages, lost profits or opportunity costs), or for interference with light or other similar intangible interests.

10.5. WAIVER OF SUBROGATION. Landlord and Tenant each hereby waives all rights of recovery against the other on account of loss and damage occasioned to the property of such waiving party to the extent that the waiving party is entitled to proceeds for such loss and damage under any property insurance policies carried or otherwise required to be carried by this Lease; provided however, that the foregoing waiver shall not apply to the extent of Tenant’s obligation to pay deductibles under any such policies and this Lease. By this waiver it is the intent of the parties that neither Landlord nor Tenant shall be liable to any insurance company (by way of subrogation or otherwise) insuring the other party for any loss or damage insured against under any property insurance policies, even though such loss or damage might be occasioned by the negligence of such party, its agents, employees, contractors or invitees. The foregoing waiver by Tenant shall also inure to the benefit of Landlord's management agent for the Building.

(a) If the Building of which the Premises are a part is damaged as the result of an event of casualty, then subject to the provisions below, Landlord shall repair that damage as soon as reasonably possible unless Landlord reasonably determines that: (i) the Premises have been materially damaged and there is less than 1 year of the Term remaining on the date of the casualty; (ii) any Mortgagee (defined in Section 13.1) requires that the insurance proceeds be applied to the payment of the mortgage debt; or (iii) proceeds necessary to pay the full cost of the repair are not available from Landlord’s insurance, including without limitation earthquake insurance. Should Landlord elect not to repair the damage for one of the preceding reasons, Landlord shall promptly thereafter so notify Tenant in the “Casualty Notice” (as defined below), and this Lease shall terminate as of the date of delivery of that notice.

(b) As soon as reasonably practicable following the casualty event but not later than 60 days thereafter, Landlord shall notify Tenant in writing (“Casualty Notice”) of Landlord’s election, if applicable, to terminate this Lease. If this Lease is not so terminated, the Casualty Notice shall set forth the anticipated period for repairing the casualty damage. If the anticipated repair period exceeds 180 days and if either (i) the damage is so extensive as to reasonably prevent Tenant’s substantial use and enjoyment of any material portion of the Premises, or (ii) the casualty occurs during the final year of the Term, then either party may elect to terminate this Lease by written notice to the other within 10 days following delivery of the Casualty Notice.

(c) In the event that neither Landlord nor Tenant terminates this Lease pursuant to Section 11.1(b), Landlord shall repair all material damage to the Premises or the Building as soon as reasonably possible and this Lease shall continue in effect for the remainder of the Term. Upon notice from Landlord, Tenant shall assign or endorse over to Landlord (or to any party designated by Landlord) all property insurance proceeds payable to Tenant under Tenant's insurance with respect to any Tenant Installations; provided if the estimated cost to repair such Tenant Installations exceeds the amount of insurance proceeds received by Landlord from Tenant's insurance carrier, the excess cost of such repairs shall be paid by Tenant to Landlord prior to Landlord's commencement of repairs. Within 30 days of demand, Tenant shall also pay Landlord for any additional excess costs that are reasonably determined during the performance of the repairs to such Tenant Installations to be necessary to complete such repairs.

(d) From and after the 3rd business day following the casualty event, the rental (Basic Rent and Tenant’s Share of Operating Expenses) to be paid under this Lease shall be abated in the same proportion that the Floor Area of the Premises that is rendered unusable by the damage from time to time bears to the total Floor Area of the Premises.

(e) Notwithstanding the provisions of subsections (a), (b) and (c) of this Section 11.1, but subject to Section 10.5, Tenant shall not be entitled to rental abatement or termination rights, to the extent the damage is due to the fault or neglect of Tenant or its employees, subtenants, contractors, invitees or representatives. In addition, the provisions of this Section 11.1 shall not be deemed to require Landlord to repair any Tenant Installations, fixtures and other items that Tenant is obligated to insure pursuant to Exhibit D or under any other provision of this Lease.

11.2. LEASE GOVERNS. Tenant agrees that the provisions of this Lease, including without limitation Section 11.1, shall govern any damage or destruction and shall accordingly supersede any contrary statute or rule of law.\ to the extent such law may be superseded by contract.

Either party may terminate this Lease if any material part of the Premises is taken or condemned for any public or quasi-public use under Law, by eminent domain or private purchase in lieu thereof (a “Taking”). Landlord shall also have the right to terminate this Lease if there is a Taking of any portion of the Building or Project which would have a material adverse effect on Landlord’s ability to profitably operate the remainder of the Building. The termination shall be effective as of the effective date of any order granting possession to, or vesting legal title in, the condemning authority. If this Lease is not terminated, Basic Rent and Tenant’s Share of Operating Expenses shall be appropriately adjusted to account for any reduction in the square footage of the Building or Premises. All compensation awarded for a Taking shall be the property of Landlord and the right to receive compensation or proceeds in connection with a Taking are expressly waived by Tenant; provided, however, Tenant may file a separate claim for Tenant's personal property and Tenant's reasonable relocation expenses. If only a part of the Premises is subject to a Taking and this Lease is not terminated, Landlord, with reasonable diligence, will restore the remaining portion of the Premises as nearly as practicable to the condition immediately prior to the Taking. Tenant agrees that the provisions of this Lease shall govern any Taking and shall accordingly supersede any contrary statute or rule of law.

13.1. SUBORDINATION. Tenant accepts this Lease subject and subordinate to any mortgage(s), deed(s) of trust, ground lease(s) or other lien(s) now or subsequently arising upon the Premises, the Building or the Project, and to renewals, modifications, refinancings and extensions thereof (collectively referred to as a “Mortgage”). The party having the benefit of a Mortgage shall be referred to as a “Mortgagee”. This clause shall be self-operative, but upon request from a Mortgagee, Tenant shall execute a commercially reasonable subordination and attornment agreement in favor of the Mortgagee, provided such agreement provides a non-disturbance covenant benefiting Tenant. Alternatively, a Mortgagee shall have the right at any time to subordinate its Mortgage to this Lease. Upon request, Tenant, without charge, shall attorn to any successor to Landlord’s interest in this Lease in the event of a foreclosure of any mortgage. Tenant agrees that any purchaser at a foreclosure sale or lender taking title under a deed in lieu of foreclosure shall not be responsible for any act or omission of a prior landlord, shall not be subject to any offsets or defenses Tenant may have against a prior landlord, and shall not be liable for the return of the Security Deposit not actually recovered by such purchaser nor bound by any rent paid in advance of the calendar month in which the transfer of title occurred; provided that the foregoing shall not release the applicable prior landlord from any liability for those obligations. Tenant acknowledges that Landlord’s Mortgagees and their successors-in-interest are intended third party beneficiaries of this Section 13.1.

13.2. ESTOPPEL CERTIFICATE. Tenant shall, within 10 business days after receipt of a written request from Landlord, execute and deliver a commercially reasonable estoppel certificate in favor of those parties as are reasonably requested by Landlord (including a Mortgagee or a prospective purchaser of the Building or the Project).

14.1. TENANT’S DEFAULTS. In addition to any other event of default set forth in this Lease, the occurrence of any one or more of the following events shall constitute a “Default” by Tenant:

(a) The failure by Tenant to make any payment of Rent required to be made by Tenant, as and when due, where the failure continues for a period of 5 business days after Tenant’s receipt of written notice from Landlord to Tenant. The term “Rent” as used in this Lease shall be deemed to mean the Basic Rent and all other sums required to be paid by Tenant to Landlord pursuant to the terms of this Lease.

(b) The assignment, sublease, encumbrance or other Transfer of the Lease by Tenant, either voluntarily or by operation of law, whether by judgment, execution, transfer by intestacy or testacy, or other means, without the prior written consent of Landlord in violation of Article 9 of this Lease.

(c) The discovery by Landlord that any financial statement provided by Tenant, or by any affiliate, successor or guarantor of Tenant, was materially false.

(d) Except where a specific time period is otherwise set forth for Tenant’s performance in this Lease (in which event the failure to perform by Tenant within such time period shall be a Default), the failure or inability by Tenant to observe or perform any of the covenants or provisions of this Lease to be observed or performed by Tenant, other than as specified in any other subsection of this Section 14.1, where the failure continues for a period of 30 days after written notice from Landlord to Tenant. However, if the nature of the failure is such that more than 30 days are reasonably required for its cure, then Tenant shall not be deemed to be in Default if Tenant commences the cure within 30 days, and thereafter diligently pursues the cure to completion.

The notice periods provided herein are in lieu of, and not in addition to, any notice periods provided by law, and Landlord shall not be required to give any additional notice under California Code of Civil Procedure Section 1161, or any successor statute, in order to be entitled to commence an unlawful detainer proceeding.

(a) Upon the occurrence of any Default by Tenant, then in addition to any other remedies available to Landlord, Landlord may exercise the following remedies:

(i) Landlord may terminate Tenant’s right to possession of the Premises by any lawful means, in which case this Lease shall terminate and Tenant shall immediately surrender possession of the Premises to Landlord. Such termination shall not affect any accrued obligations of Tenant under this Lease. Upon termination, Landlord shall have the right to reenter the Premises and remove all persons and property. Landlord shall also be entitled to recover from Tenant:

(1) The worth at the time of award of the unpaid Rent which had been earned at the time of termination;

(2) The worth at the time of award of the amount by which the unpaid Rent which would have been earned after termination until the time of award exceeds the amount of such loss that Tenant proves could have been reasonably avoided;

(3) The worth at the time of award of the amount by which the unpaid Rent for the balance of the Term after the time of award exceeds the amount of such loss that Tenant proves could be reasonably avoided;

(4) Any other amount necessary to compensate Landlord for all the detriment proximately caused by Tenant’s failure to perform its obligations under this Lease or which in the ordinary course of things would be likely to result from Tenant’s default, including, but not limited to, the cost of recovering possession of the Premises, commissions and other expenses of reletting, including necessary repair, renovation, improvement and alteration of the Premises for a new tenant, reasonable attorneys’ fees, and any other reasonable costs; and

(5) At Landlord’s election, all other amounts in addition to or in lieu of the foregoing as may be permitted by law. Any sum, other than Basic Rent, shall be computed on the basis of the average monthly amount accruing during the 24 month period immediately prior to Default, except that if it becomes necessary to compute such rental before the 24 month period has occurred, then the computation shall be on the basis of the average monthly amount during the shorter period. As used in subparagraphs (1) and (2) above, the “worth at the time of award” shall be computed by allowing interest at the rate of 10% per annum. As used in subparagraph (3) above, the “worth at the time of award” shall be computed by discounting the amount at the discount rate of the Federal Reserve Bank of San Francisco at the time of award plus 1%.

(ii) Landlord may elect not to terminate Tenant’s right to possession of the Premises, in which event Landlord may continue to enforce all of its rights and remedies under this Lease, including the right to collect all rent as it becomes due. Efforts by the Landlord to maintain, preserve or relet the Premises, or the appointment of a receiver to protect the Landlord’s interests under this Lease, shall not constitute a termination of the Tenant’s right to possession of the Premises. In the event that Landlord elects to avail itself of the remedy provided by this subsection (ii), Landlord shall not unreasonably withhold its

consent to an assignment or subletting of the Premises subject to the reasonable standards for Landlord’s consent as are contained in this Lease.

(b) The various rights and remedies reserved to Landlord in this Lease or otherwise shall be cumulative and, except as otherwise provided by California law, Landlord may pursue any or all of its rights and remedies at the same time. No delay or omission of Landlord to exercise any right or remedy shall be construed as a waiver of the right or remedy or of any breach or Default by Tenant. The acceptance by Landlord of rent shall not be a (i) waiver of any preceding breach or Default by Tenant of any provision of this Lease, other than the failure of Tenant to pay the particular rent accepted, regardless of Landlord’s knowledge of the preceding breach or Default at the time of acceptance of rent, or (ii) a waiver of Landlord’s right to exercise any remedy available to Landlord by virtue of the breach or Default. The acceptance of any payment from a debtor in possession, a trustee, a receiver or any other person acting on behalf of Tenant or Tenant’s estate shall not waive or cure a Default under Section 14.1. No payment by Tenant or receipt by Landlord of a lesser amount than the rent required by this Lease shall be deemed to be other than a partial payment on account of the earliest due stipulated rent, nor shall any endorsement or statement on any check or letter be deemed an accord and satisfaction and Landlord shall accept the check or payment without prejudice to Landlord’s right to recover the balance of the rent or pursue any other remedy available to it. Tenant hereby waives any right of redemption or relief from forfeiture under California Code of Civil Procedure Section 1174 or 1179, or under any successor statute, in the event this Lease is terminated by reason of any Default by Tenant. No act or thing done by Landlord or Landlord’s agents during the Term shall be deemed an acceptance of a surrender of the Premises, and no agreement to accept a surrender shall be valid unless in writing and signed by Landlord. No employee of Landlord or of Landlord’s agents shall have any power to accept the keys to the Premises prior to the termination of this Lease, and the delivery of the keys to any employee shall not operate as a termination of the Lease or a surrender of the Premises.

14.3. LATE PAYMENTS. Any Rent due under this Lease that is not paid to Landlord within 5 days of the date when due shall bear interest on the unpaid portion at 10% per annum from the date due until fully paid. The payment of interest shall not cure any Default by Tenant under this Lease. In addition, Tenant acknowledges that the late payment by Tenant to Landlord of rent will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult and impracticable to ascertain. Those costs may include, but are not limited to, administrative, processing and accounting charges, and late charges which may be imposed on Landlord by the terms of any ground lease, mortgage or trust deed covering the Premises. Accordingly, if any rent due from Tenant shall not be received by Landlord or Landlord’s designee within 5 days after the date due, then Tenant shall pay to Landlord, in addition to the interest provided above, a late charge for each delinquent payment equal to the greater of (i) 5% of that delinquent payment or (ii) $100.00. Acceptance of a late charge by Landlord shall not constitute a waiver of Tenant’s Default with respect to the overdue amount, nor shall it prevent Landlord from exercising any of its other rights and remedies. Notwithstanding the foregoing, Landlord shall waive the late fee set forth above the first time that a late payment occurs during any calendar year during the Term.

14.4. RIGHT OF LANDLORD TO PERFORM. If Tenant is in Default of any of its obligations under the Lease, Landlord shall have the right to perform such obligations. Tenant shall reimburse Landlord for the cost of such performance upon receipt of invoice together with an administrative charge equal to 10% of the cost of the work performed by Landlord.

14.5. DEFAULT BY LANDLORD. Landlord shall not be deemed to be in default in the performance of any obligation under this Lease unless and until it has failed to perform the obligation within 30 days after written notice by Tenant to Landlord specifying in reasonable detail the nature and extent of the failure; provided, however, that if the nature of Landlord’s obligation is such that more than 30 days are required for its performance, then Landlord shall not be deemed to be in default if it commences performance within the 30 day period and thereafter diligently pursues the cure to completion. Tenant hereby waives any right to terminate or rescind this Lease as a result of any default by Landlord hereunder or any breach by Landlord of any promise or inducement relating hereto, and Tenant agrees that its remedies shall be limited to a suit for actual damages and/or injunction and shall in no event include any consequential damages, lost profits or opportunity costs.

14.6. EXPENSES AND LEGAL FEES. Should either Landlord or Tenant bring any action in connection with this Lease, the prevailing party shall be entitled to recover as a part of the action its reasonable attorneys’ fees, and all other reasonable costs. The prevailing party for the purpose of this paragraph shall be determined by the trier of the facts.

(a) LANDLORD AND TENANT EACH ACKNOWLEDGES THAT IT IS AWARE OF AND HAS HAD THE ADVICE OF COUNSEL OF ITS CHOICE WITH RESPECT TO ITS RIGHT TO TRIAL BY JURY, AND EACH PARTY DOES HEREBY EXPRESSLY AND KNOWINGLY WAIVE AND RELEASE ALL SUCH RIGHTS TO TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM BROUGHT BY EITHER PARTY HERETO AGAINST THE OTHER (AND/OR AGAINST ITS OFFICERS, DIRECTORS, EMPLOYEES, AGENTS, OR SUBSIDIARY OR AFFILIATED ENTITIES) ON ANY MATTERS WHATSOEVER ARISING OUT OF OR IN ANY WAY CONNECTED WITH THIS LEASE, TENANT’S USE OR OCCUPANCY OF THE PREMISES, AND/OR ANY CLAIM OF INJURY OR DAMAGE.

(b) In the event that the jury waiver provisions of Section 14.7(a) are not enforceable under California law, then, unless otherwise agreed to by the parties, the provisions of this Section 14.7(b) shall apply. Landlord and Tenant agree that any disputes arising in connection with this Lease (including but not limited to a determination of any and all of the issues in such dispute, whether of fact or of law) shall be resolved (and a decision shall be rendered) by way of a general reference as provided for in Part 2, Title 8, Chapter 6 (§§ 638 et. seq.) of the California Code of Civil Procedure, or any successor California statute governing resolution of disputes by a court appointed referee. Nothing within this Section 14.7 shall apply to an unlawful detainer action.

14.8. SATISFACTION OF JUDGMENT. The obligations of Landlord do not constitute the personal obligations of the individual partners, trustees, directors, officers, members or shareholders of Landlord or its constituent partners or members (each an “Individual”). Should Tenant recover a money judgment against Landlord, such judgment shall be satisfied only from the interest of Landlord in the Project and out of the rent or other income from such property receivable by Landlord, and no action for any deficiency may be sought or obtained by Tenant from any Individual.

15.1. HOLDING OVER. If Tenant holds over for any period after the Expiration Date (or earlier termination of the Term) without the prior written consent of Landlord, such tenancy shall constitute a tenancy at sufferance only and a Default by Tenant; such holding over with the prior written consent of Landlord shall constitute a month-to-month tenancy commencing on the 1st day following the termination of this Lease and terminating 30 days following delivery of written notice of termination by either Landlord or Tenant to the other. In either of such events, possession shall be subject to all of the terms of this Lease, except that the monthly rental shall be 150% of the total monthly rental for the month immediately preceding the date of termination, subject to Landlord’s right to modify same upon 30 days notice to Tenant. The acceptance by Landlord of monthly hold-over rental in a lesser amount shall not constitute a waiver of Landlord's right to recover the full amount due unless otherwise agreed in writing by Landlord. If Tenant fails to surrender the Premises upon the expiration of this Lease despite demand to do so by Landlord, Tenant shall indemnify and hold Landlord harmless from all loss or liability, including without limitation, any claims made by any succeeding tenant relating to such failure to surrender. The foregoing provisions of this Section 15.1 are in addition to and do not affect Landlord’s right of re-entry or any other rights of Landlord under this Lease or at law.

15.2. SURRENDER OF PREMISES; REMOVAL OF PROPERTY. Upon the Expiration Date or upon any earlier termination of this Lease, Tenant shall quit and surrender possession of the Premises to Landlord in as good order, condition and repair as when received or as hereafter may be improved by Landlord or Tenant, reasonable wear and tear and repairs which are Landlord’s obligation excepted, and shall remove all wallpapering, voice and/or data transmission cabling installed by or for Tenant and Required Removables, together with all personal property and debris, and shall perform all work required under Section 7.3 of this Lease. If Tenant shall fail to comply with the provisions of this Section 15.2, Landlord may effect the removal and/or make any repairs, and the cost to Landlord shall be additional rent payable by Tenant upon receipt of invoice.

All sums payable by Tenant to Landlord shall be paid, without deduction or offset, in lawful money of the United States to Landlord at its address set forth in Item 12 of the Basic Lease Provisions, or at any other place as Landlord may designate in writing. Unless this Lease expressly provides otherwise, as for example in the payment of rent pursuant to Section 4.1, all payments shall be due and payable within 30 days after receipt of invoice. All payments requiring proration shall be prorated on the basis of the number of days in the pertinent calendar month or year, as applicable. Any notice, election, demand, consent, approval or other communication to be given or other document to be delivered by either party to the other may be delivered to the other party, at the address set forth in Item 12 of the Basic Lease Provisions, by personal service, or by any courier or “overnight” express mailing service. Either party may, by written notice to the other, served in the manner provided in this Article, designate a different address. The refusal to accept delivery of a notice, or the inability to deliver the notice (whether due to a change of address for which notice was not duly given or other good reason), shall be deemed delivery and receipt of the notice as of the date of attempted delivery. If more than one person or entity is named as Tenant under this Lease, service of any notice upon any one of them shall be deemed as service upon all of them.

Tenant agrees to comply with the Rules and Regulations attached as Exhibit E, and any reasonable and nondiscriminatory amendments, modifications and/or additions as may be adopted and published by written notice to tenants by Landlord for the safety, care, security, good order, or cleanliness of the Premises, Building, Project and/or Common Areas; provided that any change to the Rules and Regulations shall not materially interfere with Tenant’s access to or use of the Premises. Landlord shall not be liable to Tenant for any violation of the Rules and Regulations or the breach of any covenant or condition in any lease or any other act or conduct by any other tenant, and the same shall not constitute a constructive eviction hereunder. One or more waivers by Landlord of any breach of the Rules and Regulations by Tenant or by any other

tenant(s) shall not be a waiver of any subsequent breach of that rule or any other. Tenant’s failure to keep and observe the Rules and Regulations shall constitute a default under this Lease. In the case of any conflict between the Rules and Regulations and this Lease, this Lease shall be controlling.

The parties recognize as the broker(s) who negotiated this Lease the firm(s) whose name(s) is (are) stated in Item 10 of the Basic Lease Provisions, and agree that Landlord shall be responsible for the payment of brokerage commissions to those broker(s) unless otherwise provided in this Lease. It is understood that Landlord's Broker represents only Landlord in this transaction and Tenant's Broker (if any) represents only Tenant. Each party warrants that it has had no dealings with any other real estate broker or agent in connection with the negotiation of this Lease, and agrees to indemnify and hold the other party harmless from any cost, expense or liability (including reasonable attorneys’ fees) for any compensation, commissions or charges claimed by any other real estate broker or agent employed or claiming to represent or to have been employed by the indemnifying party in connection with the negotiation of this Lease. The foregoing agreement shall survive the termination of this Lease.

In the event of any transfer of Landlord’s interest in the Premises, the transferor shall be automatically relieved of all obligations on the part of Landlord accruing under this Lease from and after the date of the transfer, provided that Tenant is duly notified of the transfer. Any funds held by the transferor in which Tenant has an interest, including without limitation, the Security Deposit, shall be turned over, subject to that interest, to the transferee. No Mortgagee to which this Lease is or may be subordinate shall be responsible in connection with the Security Deposit unless the Mortgagee actually receives the Security Deposit. It is intended that the covenants and obligations contained in this Lease on the part of Landlord shall, subject to the foregoing, be binding on Landlord, its successors and assigns, only during and in respect to their respective successive periods of ownership.

20.1. NUMBER. Whenever the context of this Lease requires, the words “Landlord” and “Tenant” shall include the plural as well as the singular.

20.2. HEADINGS. The captions and headings of the articles and sections of this Lease are for convenience only, are not a part of this Lease and shall have no effect upon its construction or interpretation.

20.3. JOINT AND SEVERAL LIABILITY. If more than one person or entity is named as Tenant, the obligations imposed upon each shall be joint and several and the act of or notice from, or notice or refund to, or the signature of, any one or more of them shall be binding on all of them with respect to the tenancy of this Lease, including, but not limited to, any renewal, extension, termination or modification of this Lease.

20.4. SUCCESSORS. Subject to Sections 13.1 and 22.3 and to Articles 9 and 19 of this Lease, all rights and liabilities given to or imposed upon Landlord and Tenant shall extend to and bind their respective heirs, executors, administrators, successors and assigns. Nothing contained in this Section 20.4 is intended, or shall be construed, to grant to any person other than Landlord and Tenant and their successors and assigns any rights or remedies under this Lease.

20.5. TIME OF ESSENCE. Time is of the essence with respect to the performance of every provision of this Lease in which time of performance is a factor.

20.6. CONTROLLING LAW/VENUE. This Lease shall be governed by and interpreted in accordance with the laws of the State of California. Should any litigation be commenced between the parties in connection with this Lease, such action shall be prosecuted in the applicable State Court of California in the county in which the Building is located.

20.7. SEVERABILITY. If any term or provision of this Lease, the deletion of which would not adversely affect the receipt of any material benefit by either party or the deletion of which is consented to by the party adversely affected, shall be held invalid or unenforceable to any extent, the remainder of this Lease shall not be affected and each term and provision of this Lease shall be valid and enforceable to the fullest extent permitted by law.

20.8. WAIVER. One or more waivers by Landlord or Tenant of any breach of any term, covenant or condition contained in this Lease shall not be a waiver of any subsequent breach of the same or any other term, covenant or condition. Consent to any act by one of the parties shall not be deemed to render unnecessary the obtaining of that party’s consent to any subsequent act. No breach of this Lease shall be deemed to have been waived unless the waiver is in a writing signed by the waiving party.

20.9. INABILITY TO PERFORM. In the event that either party shall be delayed or hindered in or prevented from the performance of any work or in performing any act required under this Lease by reason of any cause beyond the reasonable control of that party, then the performance of the work or the doing of the act shall be excused for the period of the delay and the time for performance shall be extended for a

period equivalent to the period of the delay. The provisions of this Section 20.9 shall not operate to excuse Tenant from the prompt payment of Rent.

20.10. ENTIRE AGREEMENT. This Lease and its exhibits and other attachments cover in full each and every agreement of every kind between the parties concerning the Premises, the Building, and the Project, and all preliminary negotiations, oral agreements, understandings and/or practices, except those contained in this Lease, are superseded and of no further effect. Tenant waives its rights to rely on any representations or promises made by Landlord or others which are not contained in this Lease. No verbal agreement or implied covenant shall be held to modify the provisions of this Lease, any statute, law, or custom to the contrary notwithstanding.

20.11. QUIET ENJOYMENT. Upon the observance and performance of all the covenants, terms and conditions on Tenant’s part to be observed and performed, and subject to the other provisions of this Lease, Tenant shall have the right of quiet enjoyment and use of the Premises for the Term without hindrance or interruption by Landlord or any other person claiming by or through Landlord.

20.12. SURVIVAL. All covenants of Landlord or Tenant which reasonably would be intended to survive the expiration or sooner termination of this Lease, including without limitation any warranty or indemnity hereunder, shall so survive and continue to be binding upon and inure to the benefit of the respective parties and their successors and assigns.