EXECUTIVE EMPLOYMENT AGREEMENT

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

THIS EXECUTIVE EMPLOYMENT AGREEMENT (“Agreement”) is made and entered into on November 10, 2023 but shall be effective as of the 1st day of June 2023, by and between Sharps Technology, Inc., a Nevada Corporation (the “Company”) and Xxxxxx Xxxxx (the “Executive”) (together the Company and the Executive are the “Parties”) and supersedes and replaces any prior employment agreement or employment letter between the Parties.

WHEREAS, the Board of Directors of the Company (the “Board”) has approved the Company entering into an employment agreement with the Executive;

WHEREAS, the Executive is now the Chief Executive Officer of the Company and thus the key senior executive of the Company;

WHEREAS, the Executive is currently under contractual rights pursuant to an employment letter dated September 6, 2021 between Sharps Technology, Inc., the Company and the Executive;

WHEREAS, the Company would like to enter into a revised formal agreement with the Executive to set forth the terms of Executive’s employment as well as certain termination and post-termination rights and obligations of the Parties, as further described below;

NOW THEREFORE, in consideration of the promises and mutual covenants herein and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

ARTICLE 1

1.1 Employment. The Company hereby employs Executive and Executive accepts employment as Chief Executive Officer of the Company. As its Chief Executive Officer, Executive shall render such services to the Company as are customarily rendered by the Chief Executive Officer of comparable companies and as required by the articles and by-laws of Employer. Executive accepts such employment and, consistent with fiduciary standards which exist between an employer and an employee, shall perform and discharge the duties commensurate with his position that may be assigned to him from time to time by the Company.

1.2 Term and Renewal. The term of this Agreement shall commence on the date first written above (the “Commencement Date”) and shall continue until the last day of the calendar year following the Commencement Date, and shall then automatically renew for successive one year terms, unless the Company or Executive provides the other party at least 90 days’ prior written notice before the end of the First Term or any Additional Term, in which event no automatic renewal will occur (a “Notice of Non-Renewal”). For purposes of this Agreement, the first term of this Agreement (the “First Term”), and each subsequent automatic renewal shall each be considered a separate term (an “Additional Term”).

| 1 |

EXECUTIVE EMPLOYMENT AGREEMENT

1.3 Compensation and Benefits. During the Term of this Agreement, the Executive shall be entitled to the compensation (“Compensation) and benefits (“Benefits”) described in in Exhibit A attached hereto, with the understanding that, from time to time and as the Parties deem appropriate, the Parties will negotiate in good faith any other performance thresholds or other Compensation or Benefits terms that will be incorporated into Exhibit A for any Additional Term.

ARTICLE 2

TERMINATION OF EMPLOYMENT AND SEVERANCE BENEFITS

2.1 General. Executive’s employment may be terminated by the Company or Executive at any time (subject to notice obligations set forth in Section 1.2 of this Agreement) and for any reason or no reason; and upon termination of Executive’s employment, the First Term or any Additional Term, as applicable, shall end.

2.2 Termination By The Company For Cause Or By Non-Renewal of Agreement. If the Executive’s employment is terminated by the Company for Cause or by the Company pursuant to a Notice of Non-Renewal (including for no reason), then the Executive shall only be entitled to his earned but unpaid “Base Salary”, as described in Section 1 of Exhibit A, and Benefits owing to Executive under the terms of any employee benefits under Sections 7 and 8 of Exhibit A (the “Accrued Benefits”). For purposes of this Agreement, Accrued Benefits shall include any unused vacation time which has accrued during the Term in which the Executive’s employment is terminated, but shall not include any accrued vacation from prior Terms.

2.3 Termination By The Company Without Cause. If the Executive’s employment is terminated by the Company without Cause, then the Executive shall only be entitled to the Severance Benefits as described in Section 2.9 of this Agreement as well as his Accrued Benefits.

2.4 Termination By The Executive For Good Reason. If the Executive’s employment is terminated by the Executive for Good Reason, then the Executive shall only be entitled to the Severance Benefits as described in Section 2.9 of this Agreement as well as his Accrued Benefits.

2.5 Termination By The Executive Without Good Reason. If the Executive’s employment is terminated by the Executive without Good Reason, then the Executive shall only be entitled to his earned but unpaid Base Salary as well as his Accrued Benefits.

2.6 Termination By The Executive By Non-Renewal of Agreement. If the Executive’s employment is terminated by the Executive pursuant to a Notice of Non-Renewal (including for no reason), then the Executive shall only be entitled to his earned but unpaid Base Salary (as described in Exhibit A) as well as his Accrued Benefits.

| 2 |

EXECUTIVE EMPLOYMENT AGREEMENT

2.7 Termination By Death. If the Executive’s employment is terminated by the his death, Executive’s estate, survivors or beneficiaries (as the case may be) shall only be entitled to receive Severance Benefits as described in Section 2.9 of this Agreement, Accrued Benefits and a pro-rated portion of each of Executive’s “Revenue Performance Incentive Bonus” and “Long Term Incentive Bonus,” as these terms are defined in Sections 2 and 4 of Exhibit A, respectively, for the fiscal year in which Executive’s death occurs, as determined as follows: (i) for the Revenue Performance Incentive Bonus, by multiplying the Revenue Performance Incentive Bonus Executive would have earned absent Executive’s death based on the achievement of the gross revenues for such fiscal year as set forth in Section 2 of Exhibit A, by a fraction, (x) the numerator of which equals the number of days during such fiscal year that Executive was employed by the Company up to and including the date of death and (y) the denominator of which is the number of days in such fiscal year, paid in accordance with paid in accordance with the Company’s normal payroll practices; and (ii) for the Long Term Incentive Bonus, by multiplying the Long Term Incentive Bonus Executive would have earned absent Executive’s death based on the market capitalization thresholds set forth in Section 4 of Exhibit A, by a fraction, (x) the numerator of which equals the number of days during such fiscal year that Executive was employed by the Company up to and including the date of death and (y) the denominator of which is the number of days in such fiscal year, paid in accordance with paid in accordance with the Company’s normal payroll practices. To the extent any conflict exists between the calculation of Revenue Performance Incentive Bonus and Long Term Incentive Bonus as set forth in this Section ___ of the Agreement and Exhibit A, Exhibit A shall control and govern.

2.8 Termination By Disability. During any period that Executive is unable to perform Executive’s duties hereunder as a result of a disability prior to the termination of Executive’s employment for a “permanent and total disability” (within the meaning Section 22(e)(3) of Internal Revenue Code of 1986, as amended the “Code”), Executive shall continue to receive Executive’s full Base Salary and Benefits until Executive’s employment is terminated pursuant to this Section. Upon termination of Executive’s employment hereunder as a result of Executive’s permanent and total disability, Executive shall only be entitled to the Severance Benefits as described in Section 2.9 of this Agreement as well as his Accrued Benefits.

2.9 Severance Benefits. In the event that the Executive becomes entitled to receive severance benefits pursuant to Sections 2.3, 2.4, 2.7 or 2.8 of this Agreement, the Company shall pay and provide the Executive with the following “Severance Benefits”:

| a) | Within 30 days after the Date of Termination and for a period of twelve (12) months after the Date of Termination, one-twelfth (1/12th) of the Executive’s then current annual Base Salary per month, less any taxes and withholding as may be necessary pursuant to law, to be paid in accordance with the Company’s normal payroll practices, but in no event less frequently than monthly. | |

| b) | To the extent the Executive and his dependents elect coverage under the Company’s health insurance plan pursuant to the Consolidated Omnibus Budget Reconciliation Act (“COBRA”), the Company shall reimburse the COBRA premium payments of the Executive and his dependents for a period of up to twelve months (12) months after the date of Executive’s termination of employment with the Company. |

| 3 |

EXECUTIVE EMPLOYMENT AGREEMENT

As a condition to receiving payments contemplated by this Article 2.9, within 30 days after the effective date of such termination, Executive shall execute and deliver, and not have revoked, a separation agreement and general release in favor of the Company and its affiliates in such form as is mutually agreeable to the Company and Executive. The Severance Benefits shall terminate immediately upon the Executive violating any of the provisions of Article III of this Agreement. Notwithstanding anything herein to the contrary, in the event such 30-day period falls into two (2) calendar years, the payments contemplated in this Article 1.3 shall not commence until the second calendar year and within the above-referenced 30-day period. The Severance Benefits shall terminate immediately upon the Executive violating any of the provisions of Article III of this Agreement.

2.10 Good Reason. For purposes of this Agreement, “Good Reason” shall mean the occurrence of any of the following, without the Executive’s prior written consent: (i) a material diminution of Executive’s title, authority, duties or responsibilities, (ii) a material reduction in Executive’s Base Salary or Benefits, (iii) any requirement that the Executive report to anyone other than the Board, or (iv) any material breach of this Agreement by the Company. However, none of the foregoing events or conditions will constitute Good Reason unless: (x) the Executive provides the Company with written objection to the event or condition within 60 days following the event or condition, (y) the Company does not “cure” the event or condition within 30 days of receiving that written objection, and (z) the Executive terminates his employment within 30 days following the expiration of that cure period.

2.11 Cause. For purposes of this Agreement, “Cause” shall be deemed to exist upon any of the following events: (i) the Executive’s commission or conviction of, or plea of guilty or nolo contendere, to a felony, a crime involving fraud or moral turpitude or any other crime relating to the Company which would reasonably be expected to be materially injurious to the Company; (ii) the Executive abuses alcohol and/or drugs in a manner that materially impacts his ability to successfully perform his duties under this Agreement; (iii) failure to substantially perform Executive’s essential job functions as directed by the Board; (iv) Executive’s material misconduct or gross negligence; (v) Executive’s material violation of any Company policy; or (vi) any material breach of this Agreement; provided that: (a) a termination of Executive’s employment for Cause that is susceptible to cure shall not be effective unless the Company first gives Executive written notice of its intention to terminate and the grounds for such termination, and Executive has not, within thirty (30) business days following receipt of such notice, cured such Cause, it being understood that subparts (ii), (iii), (iv), (v) and (vi) are curable; (b) the failure of the Company to achieve budgeted or projected financial or similar performance objectives shall not, in and of itself, be considered a breach of any obligation under this Agreement or to otherwise constitute “Cause” as defined herein.

| 4 |

EXECUTIVE EMPLOYMENT AGREEMENT

2.12 Termination Related to Change of Control. In the event of the termination of the Executive’s employment by the Company without Cause or the Executive’s termination of his employment for Good Reason (other than for “permanent and total disability” (within the meaning Section 22(e)(3) of Internal Revenue Code of 1986, as amended the “Code”), within twelve months following a “Change of Control,” as defined in Section 2.13 below, the Executive’s Additional Term of employment shall terminate without further obligations to the Executive under this Agreement. In addition, and if the Executive shall have executed and delivered, and not have revoked, a separation agreement and general release in a form mutually agreeable to the Company and Executive, the Company shall: (A) pay Executive, within thirty (30) days of the occurrence of the Change of Control event, a lump sum amount in cash equal to three (3) times (3x) Executive’s then current Base Salary; (B) immediately vest all of the Executive’s outstanding options in full and any such options shall remain exercisable until the later of three (3) years from the Change of Control event or the date on which each such option would have expired had the Executive’s employment not terminated, and, upon vesting, the method of payment for the exercise price of each option will be considered received by the Company as a cashless exercise, pursuant to which the Company will hold back a sufficient number of its shares to cover the exercise price of each option; (C) directly pay all of the COBRA premiums incurred by the Executive for the Executive and his eligible dependents under the Company’s health care plan during for an eighteen (18) month period following the Executive’s termination of employment.; and (D) a bonus equal to 2.5% of the sale price of the Company; provided that the sale price is equal to at least one hundred and fifty million U.S. Dollars ($150,000,000.00) (“Sale Bonus”). In calculating the sale price of the Company, it shall include the value of all cash paid, the value of all stock issued in connection with the sale and the assumption of any of the Company’s debt. The Sale Bonus shall be payable thirty (30) days after the Change in Control, except that if the sale price is payable to the Company in public-traded stock, the Sale Bonus shall also be payable to Executive in publicly-traded stock subject to applicable law.

2.13 Change of Control. For purposes of this Agreement, “Change of Control” shall mean the occurrence of any one of the following events, provided that, to the extent required by Section 409A of the Code for purposes of determining the timing of any payment or distribution hereunder that is subject to Section 409A of the Code, a Change of Control shall only occur to the extent such event also constitutes a “change in control event” for purposes of Section 409A of the Code: (i) a sale, lease, exclusive license or other disposition of all of substantially all of the assets of the Company; (ii) a consolidation or merger of the Company with or into any other corporation or other entity or person, or any other corporate reorganization, in which the shareholders of the Company immediately prior to such consolidation, merger or reorganization, own less than fifty percent (50%) of the Company’s outstanding voting power of the surviving entity following the consolidation, merger or reorganization; or (iii) any transaction (or series of related transactions involving a person or entity, or a group of affiliated persons or entities) in which in excess of fifty percent (50%) of the Company’s then- outstanding voting power is transferred, excluding any consolidation or merger effected exclusively to change the domicile of the Company and excluding any such change of voting power resulting from a bona fide equity financing event or public offering of the stock of the Company.

ARTICLE 3

3.1 Covenant not to Compete. Executive agrees that, during Executive’s employment with the Company and until the first anniversary of Executive’s termination of employment (except in the event of Executive’s “permanent and total disability”) (“Non-Compete Period”), Executive shall not become employed by or associated with as employee, consultant, director, or in any other equivalent capacity, any company considered a competitor by the Company.

| a) | If Executive’s employment is terminated: by the Company for Cause; or by the Company pursuant to a Notice of Non-Renewal (including for no reason); or by the Executive pursuant to a Notice of Non-Renewal (including for no reason); or by the Executive without Good Reason, the Company and Executive agree that the Company will provide no additional consideration to Executive (or his estate, survivors or beneficiaries, as the case may be), to support the enforcement of the covenant not to compete. |

| 5 |

EXECUTIVE EMPLOYMENT AGREEMENT

| b) | If Executive’s employment is terminated: by the Company without Cause; or by the Executive for Good Reason; or because of Executive’s “permanent and total disability,” the Company and Executive agree that the Company’s provision of Severance Benefits as described in Section 2.9 of this Agreement will support the enforcement of the covenant not to compete for the shorter of the Non-Compete Period or an amount proportionate to the period of time the Company, in its sole discretion, elects to enforce the covenant not to compete. |

3.2 Covenant not to Solicit. Executive agrees that, during Executive’s employment, and until the one (1) year anniversary of Executive’s termination of employment (“Non-Solicit Period”), , Executive shall not directly or indirectly solicit for employment or employ any person, who is or was employed by the Company within one (1) year prior to Executive’s termination of employment, in any business in which the Executive has a material interest (meaning where Executive does, directly or indirectly, own 5% or more of any class of securities of such interest), as an officer, manager, partner, shareholder or beneficial owner. Further, during the Non-Solicit Period, Executive will not assist or encourage any employee of the Company to cease working for the Company.

3.3 Confidentiality and Nondisclosure. The Executive will not use or disclose to any individual or entity any Confidential Information (as defined below) except (i) in the performance of Executive’s duties for the Company, (ii) as authorized in writing by the Company, or (iii) as required by subpoena or court order, provided that, prior written notice of such required disclosure is provided to the Company and, provided further that all reasonable efforts to preserve the confidentiality of such information shall be made. As used in this Agreement, “Confidential Information” shall mean information that (i) is used or potentially useful in the business of the Company, (ii) the Company treats as proprietary, private or confidential, and (iii) is not generally known to the public. “Confidential Information” includes, without limitation, information relating to the Company’s products or services, processing, manufacturing, marketing, selling, customer lists, call lists, customer data, memoranda, notes, records, technical data, sketches, plans, drawings, chemical formulae, trade secrets, composition of products, research and development data, sources of supply and material, operating and cost data, financial information, personal information and information contained in manuals or memoranda. “Confidential Information” also includes proprietary and/or confidential information of the Company’s customers, suppliers and trading partners who may share such information with the Company pursuant to a confidentiality agreement or otherwise. The Executive agrees to treat all such customer, supplier or trading partner information as “Confidential Information” hereunder. The foregoing restrictions on the use or disclosure of Confidential Information shall continue after Executive’s employment terminates for any reason for so long as the information is not generally known to the public.

| 6 |

EXECUTIVE EMPLOYMENT AGREEMENT

3.4 Non-Disparagement. The Executive will not at any time during his employment with the Company, or after the termination of his employment with the Company, directly or indirectly (i) disparage, libel, defame, ridicule or make negative comments regarding, or encourage or induce others to disparage, libel, defame, ridicule or make negative comments regarding, the Company, or any of the Company’s officers, directors, employees or agents, or the Company’s products, services, business plans or methods (it being understood that comments made in Executive’s good faith performance of Executive’s duties hereunder shall not be deemed disparaging or defamatory for purposes of this Agreement); or (ii) engage in any conduct or encourage or induce any other person to engage in any conduct that is in any way injurious or potentially injurious to the reputation or interests of the Company or any of the Company’s, officers, directors, employees or agents. The Company will instruct the members of the Board of Directors as well as the Company’s officers and anyone who is authorized to make any public statement on behalf of the Company, not to make, or direct any other person, entity or interest to make, any Disparaging Statement about Executive. For purposes of this Agreement, a “Disparaging Statement” shall mean any communication that is intended to defame or disparage, or has the effect of defaming or disparaging.

3.5 Restrictions Reasonable. Executive acknowledges that the restrictions under this Article III are substantial, and may effectively prohibit him from working for a period of one year in the field of his experience and expertise. Executive further acknowledges that he has been given access and shall continue to be given access to all of the Confidential Matters and trade secrets described above during the course of his employment, and therefore, the restrictions are reasonable and necessary to protect the competitive business interests and goodwill of the Company and do not cause Executive undue hardship.

3.6 Survival of Restrictive Covenants. Executive’s obligations under this Article III of the Agreement shall survive Executive’s termination of employment with the Company and the termination of this Agreement.

3.7 Equitable Relief. Executive hereby acknowledges and agrees that the Company and its goodwill would be irreparably injured by, and that damages at law are an insufficient remedy for, a breach of the provisions of this Agreement, and agrees that the Company, in addition to other remedies available to it for such breach shall be entitled to seek a preliminary injunction, temporary restraining order, or other equivalent relief, restraining Executive from any actual breach of the provisions hereof, and that the Company’s rights to such equitable relief shall be cumulative and in addition to any other rights or remedies to which the Company may be entitled.

3.8 Nothing in this Agreement generally and in Section 3.3 specifically, will (or should be construed to): (i) interfere with Executive’s right and responsibility to give truthful testimony under oath; (ii) restrict Executive’s ability to communicate information regarding wages or terms and conditions of his employment with Sharps; (iii) prohibit Executive from disclosing the information contained in this Agreement to the Equal Employment Opportunity Commission (“EEOC”) or any state agency responsible for enforcing anti-discrimination laws; or (iv) preclude Executive from participating in an investigation, filing a charge, or otherwise communicating with the EEOC or any other fair employment agency, but, in connection with any such charge or proceeding, Executive will have no personal right to any monetary recovery of any kind. Consistent with Rule 21F-17 of the Securities Exchange Act of 1934, any confidentiality and non-disclosure provisions in this Agreement or arising from this Agreement do not prohibit or restrict Executive (or his attorneys) from: initiating communications directly with, or responding to any inquiry from, or providing testimony before, the U.S. Securities and Exchange Commission, NASD/FINRA, any other self-regulatory organization, any other state or federal regulatory authority or pursuant to court or administrative proceedings. In broadest terms, nothing herein is intended to impede any governmental investigation, Executive’s ability to report potential violations of the federal and state securities laws or Executive’s participation in any whistleblower rewards program.

| 7 |

EXECUTIVE EMPLOYMENT AGREEMENT

ARTICLE 4

4.1 Entire Agreement. This Agreement contains the entire understanding of the Company and the Executive with respect to the subject matter hereof.

4.2 Prior Agreement. This Agreement supersedes and replaces any prior oral or written employment or severance agreement between the Executive and the Company.

4.3 Subsidiaries. Where appropriate in this Agreement, including all of Article 2, the term “Company” shall also include any direct or indirect subsidiaries of the Company.

4.4 D&O Insurance; Indemnification. In addition to any indemnification rights that Executive may have under the Company’s bylaws, while employed by the Company and continuing until the later of the sixth anniversary of the termination of Executive’s employment and the date on which all claims against Executive that would otherwise be covered by such policy (or policies) become fully time-barred, the Company shall purchase and maintain, at its own expense, directors’ and officers’ liability insurance providing coverage to Executive on terms that are no less favorable than the coverage provided to directors and senior executives of the Company. The Company agrees that if Executive is made a party, or is threatened to be made a party, to any action, suit or proceeding, whether civil, criminal, administrative or investigative (each, a “Proceeding”), by reason of the fact that he is or was a director, officer or employee of the Company or is or was serving at the request of the Company as a director, officer, member, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans, whether or not the basis of such Proceeding is Executive’s alleged action in an official capacity while serving as a director, officer, member, employee or agent, in each case, whether on, prior to, or following the Effective Date, Executive shall be indemnified and held harmless by the Company to the fullest extent permitted or authorized by applicable law and the Company’s bylaws, against all cost, expense, liability and loss reasonably incurred or suffered by Executive in connection therewith, and such indemnification shall continue as to Executive even if he has ceased to be a director, member, employee or agent of the Company or other entity and shall inure to the benefit of Executive’s heirs, executors and administrators. The Company may promptly advance to Executive all reasonable costs and expenses incurred by Executive in connection with any such action, suit or proceeding provided that Executive furnishes the Company with a written undertaking, executed personally or on Executive’s behalf, to repay any advances if it is ultimately determined that Executive is not entitled to be indemnified by the Company.

| 8 |

EXECUTIVE EMPLOYMENT AGREEMENT

4.5 Compliance with Code Section 409A.

4.6 Severability. It is mutually agreed and understood by the Parties that should any of the restrictions and covenants contained in Article 3 be determined by any court of competent jurisdiction to be invalid by virtue of being vague, overly broad, unreasonable as to time, territory or otherwise, then the Agreement shall be amended retroactive to the date of its execution to include the terms and conditions which such court deems to be reasonable and in conformity with the original intent of the parties and the parties hereto consent that under such circumstances, such court shall have the power and authority to determine what is reasonable and in conformity with the original intent of the parties to the extent that such restrictions and covenants are enforceable. In the event any other provision of this Agreement shall be held illegal or invalid for any reason, the illegality or invalidity shall not affect the remaining parts of the Agreement, and the Agreement shall be construed and enforced as if the illegal or invalid provision had not been included.

| 9 |

EXECUTIVE EMPLOYMENT AGREEMENT

4.7 Modification. No provision of this Agreement may be modified, waived, or discharged unless such modification, waiver, or discharge is agreed to in writing and signed by the Executive and by an authorized officer of the Company on the Company’s behalf, or by the respective parties’ legal representations and successors.

4.8 Dispute Resolution & Applicable Law. All disputes regarding this agreement shall resolved by arbitration to be administered by the American Association of Arbitration (Employment Arbitration Rules and Mediation Procedures) or JAMS ADR (Employment Rules and Procedures), except to the extent that the Company or Executive seeks injunctive relief before a court of competent jurisdiction. The Company and the Executive shall pay all costs peculiar to the arbitration (and/or mediation, if applicable), including arbitrator’s fees, and the administration, forum and filing fees equally.. This Agreement shall be governed by, and construed in accordance with and subject to, the laws of the State of New York applicable to agreements made and to be performed entirely within such state or torts without regard to its conflicts of law rules.

4.9 Legal Fees and Expenses. The prevailing party of any arbitration to enforce the terms of this Agreement shall be entitled to recover reasonable costs and expenses, including reasonable attorneys’ fees.

4.10 Successors and Assigns. This Agreement shall inure to the benefit of and be enforceable by the Company’s and the Executive’s successors, assigns and/or heirs and/or assigns.

4.11 Headings/References. The headings in this Agreement are inserted for convenience only and shall not be deemed to constitute a part hereof nor to affect the meaning thereof.

4.12 Notices. Any notice, request, instruction, or other document to be given hereunder shall be in writing and shall be deemed to have been given: (a) on the day of receipt, if sent by overnight courier (with a courtesy copy also sent by email, which will not alter or extend the date deemed to have been given); (b) upon receipt, if given in person; (c) five days after being deposited in the mail, certified or registered mail, postage prepaid, and in any case addressed as follows:

| If to the Company: | |

| 000 Xxxxxx Xxxx | |

| Melville, New York 11747 | |

| Attn: Chief Financial Officer |

with copy sent to the attention of the Chairman of the Board of Directors at the same address.

| If to the Executive: | |

| 00000 Xxxxxx Xxxxxx Xxxx | |

| Tyler, TX 75703 |

or to such other address or to the attention of such other person as the recipient party has specified by prior written notice to the sending party.

| 10 |

EXECUTIVE EMPLOYMENT AGREEMENT

IN WITNESS WHEREOF, the parties have executed this Agreement on this 10th day of November 2023.

SHARPS TECHNOLOGY, INC.

| By: | ||

| Name: | Xxxxx Xxxxxxxxxxxx | |

| Title: | Chairman of the Board | |

| EXECUTIVE | ||

| By: | ||

| Xxxxxx Xxxxx | ||

| 11 |

EXECUTIVE EMPLOYMENT AGREEMENT

EXHIBIT A

EXECUTIVE’S COMPENSATION AND BENEFITS

| 1. | Base Salary: $600,000 per year. Base Salary shall be increased to $1,000,000 per year commencing the 1st day of the month following the month in which both of the following two events occur: (a) the successful acquisition of the “InjectEZ” syringe manufacturing facility by the Company from Nephron Pharmaceutical Corporation; and (b) the Company’s receipt of an initial purchase order from Nephron Pharmaceutical Corporation in an amount of at least $20.0 million. |

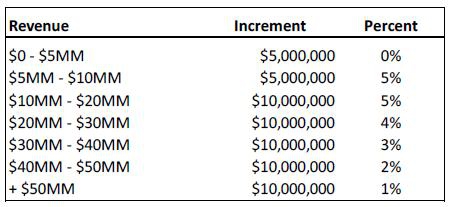

| 2. | Revenue Performance Incentive Bonus: On an annual basis, the Executive shall be paid a sliding cash bonus based on total gross revenues as reported in the Company’s public filings pursuant to the following schedule: |

This cash bonus is intended to qualify as performance-based compensation under Internal Revenue Code section 162(m). The sliding bonus shall reset at $0.00 revenue annually and shall be payable within ten (10) days of the Company’s filing of its Form 10-K which reports such revenues. In the event that Executive terminates his employment other than for Good Reason or the Company terminates his employment without Cause, the Executive shall be entitled to a sliding bonus based on the Company’s revenues as of the termination date. In the event that revenues can’t be determined as of the date of termination, Executive shall be entitled to a pro rata portion of the total revenues for the fiscal year. For example, if Executive is so terminated after working 182 days, he shall be entitled to 50% of such sliding bonus. If Executive terminates without Good Cause or his terminated by the Company for cause, Executive shall not be entitled to the sliding bonus.

| 3. | Asset Acquisition Bonus: A one-time Asset Acquisition Bonus payment of $500,000 shall be paid on the 1st day of the month following the month in which both of the following two events occur: (a) the successful acquisition of the “InjectEZ” syringe manufacturing facility by the Company from Nephron Pharmaceutical Corporation; and (b) the Company’s receipt of an initial purchase order from Nephron Pharmaceutical Corporation in an amount of not less than $20.0 million. |

| 12 |

EXECUTIVE EMPLOYMENT AGREEMENT

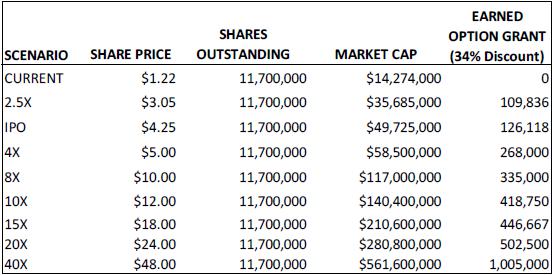

| 4. | Long Term Incentive Bonus: Executive shall be eligible to participate in an equity grant program intended to qualify as performance-based compensation under Internal Revenue Code section 162(m) existing from time to time for its executives. Executive shall receive an annual grant of equity compensation in the form of stock options based on the achievement of the following market cap thresholds: |

| 5. | Specific Milestone Performance Bonuses: Certain one-time performance bonus payments for specific milestone achievements shall be paid as follows: |

| a) | $50,000.00 for the successful conversion of the Hungary manufacturing facility from Provensa products to Securegard production which the parties acknowledge the Executive has already achieved, and shall be paid no later than 15 days from the parties’ execution of this Agreement; | |

| b) | $50,000.00 for the successful execution of a series of business agreements with Nephron Pharmaceutical Corporation including Manufacturing & Supply, a Pharma Services Program, and a Distribution Program which the parties acknowledge Executive has already achieved, and shall be paid no later than 30 days from the parties’ execution of this Agreement; and | |

| c) | $50,000.00 upon Executive’s resolution on terms acceptable to the Board of Directors of the Company of a pending dispute involving the Company and Plasto Design, which will include that the Company makes no further payments to Plasto Design and receives a general release of any and all claims from Plasto Design, which shall be paid within 30 days of the parties’ execution of an agreement and release. |

| 6. | Paid Time Off (PTO): Executive shall be granted up to 25 days of PTO per year, increasing to 30 days of PTO per year after Executive’s second year of service with the Company. Executive may not carry over any unused PTO from prior years. The effective date of initial service for purposes of calculating PTO shall be defined as June 1, 2023. |

| 7. | Health & Welfare Benefits: Executive shall be eligible to participate in all health and welfare benefits as provided by the Company (other than any severance plans). |

| 13 |

EXECUTIVE EMPLOYMENT AGREEMENT

| 8. | Retirement Benefits: Executive shall be eligible to participate in all retirement benefits as provided by the Company. |

ACKNOWLEDGED AND AGREED:

SHARPS TECHNOLOGY, INC.

| By: | ||

| Name: | Xxxxx Xxxxxxxxxxxx | |

| Title: | Chairman of the Board | |

| EXECUTIVE | ||

| By: | ||

| Xxxxxx Xxxxx | ||

| 14 |

EXECUTIVE EMPLOYMENT AGREEMENT

EXHIBIT B

1. Xxxxxx Xxxxx (“Executive”), for himself and his family, heirs, executors, administrators, legal representatives and their respective successors and assigns, in exchange for the Severance Benefits, as defined under the Executive Employment Agreement made and entered effective as of the 10th of November 2023, by and between Sharps Technology, Inc., a Nevada Corporation (the “Company”) and Xxxxxx Xxxxx (the “Executive”), to which this release is attached as Exhibit B (the “Employment Agreement”), does hereby release and forever discharge the Company, its subsidiaries, affiliated companies, successors and assigns, and its current or former directors, officers or shareholders in such capacities (collectively with the Company, the “Released Parties”) from any and all actions, causes of action, suits, controversies, claims and demands whatsoever, for or by reason of any matter, cause or thing whatsoever, whether known or unknown including, but not limited to, all claims under any applicable laws arising under or in connection with Executive’s employment or termination thereof, whether for tort, breach of express or implied employment contract, wrongful discharge, intentional infliction of emotional distress, or defamation or injuries incurred on the job or incurred as a result of loss of employment. Executive acknowledges that the Company encouraged him to consult with an attorney of his choosing, and through this General Release of Claims encourages him to consult with his attorney with respect to possible claims under the Age Discrimination in Employment Act (“ADEA”) and that he understands that the ADEA is a Federal statute that, among other things, prohibits discrimination on the basis of age in employment and employee benefits and benefit plans. Without limiting the generality of the release provided above, Executive expressly waives any and all claims under ADEA that he may have as of the date hereof. Executive further understands that by signing this General Release of Claims he is in fact waiving, releasing and forever giving up any claim under the ADEA as well as all other laws within the scope of this paragraph 1 that may have existed on or prior to the date hereof. Notwithstanding anything in this paragraph 1 to the contrary, this General Release of Claims shall not apply to (i) any rights to receive any payments or benefits to which Executive is entitled under COBRA, the Employment agreement or any other compensation or employee benefit plans in which Executive is eligible to participate at the time of execution of this General Release of Claims, (ii) any rights or claims that may arise as a result of events occurring after the date this General Release of Claims is executed, any indemnification and advancement rights Executive may have as a former employee, officer or director of the Company or its subsidiaries or affiliated companies including, without limitation, any rights arising pursuant to the articles of incorporation, bylaws and any other organizational documents of the Company or any of its subsidiaries, (iii) any claims for benefits under any directors’ and officers’ liability policy maintained by the Company or its subsidiaries or affiliated companies in accordance with the terms of such policy, and (iv) any rights as a holder of equity securities of the Company (clauses (i) through (iv), the “Reserved Claims”).

| 15 |

EXECUTIVE EMPLOYMENT AGREEMENT

2. Executive represents that he has not filed against the Released Parties any complaints, charges, or lawsuits arising out of his employment, or any other matter arising on or prior to the date of this General Release of Claims other than Reserved Claims, and covenants and agrees that he will never individually or with any person file, or commence the filing of any lawsuits, complaints or proceedings with any governmental agency, or against the Released Parties with respect to any of the matters released by Executive pursuant to paragraph 1 hereof (a “Proceeding”); provided, however, Executive shall not have relinquished his right to (i) commence a Proceeding to challenge whether Executive knowingly and voluntarily waived his rights under ADEA; (ii) file a charge with an administrative agency or take part in any agency investigation or (iii) commence a Proceeding pursuant to the Reserved Claims. Executive does agree, however, that he is waiving his right to recover any money in connection with such an investigation or charge filed by him or by any other individual, or a charge filed by the Equal Employment Opportunity Commission or any other federal, state or local agency, except as prohibited by law.

3. Executive hereby acknowledges that the Company has informed him that he has up to twenty-one (21) days to sign this General Release of Claims and he may knowingly and voluntarily waive that twenty-one (21) day period by signing this General Release of Claims earlier. Executive also understands that he shall have seven (7) days following the date on which he signs this General Release of Claims within which to revoke it by providing a written notice of his revocation to the Company.

4. Executive acknowledges that this General Release of Claims will be governed by and construed and enforced in accordance with the internal laws of the laws of Nevada, without giving effect to any choice of law principles.

5. Executive acknowledges that he has read this General Release of Claims, that he has been advised that he should consult with an attorney before he executes this general release of claims, and that he understands all of its terms and executes it voluntarily and with full knowledge of its significance and the consequences thereof.

6. This General Release of Claims shall take effect on the eighth day following Executive’s execution of this General Release of Claims unless Executive’s written revocation is delivered to the Company within seven (7) days after such execution.

EXECUTIVE

| By: | Xxxxxx Xxxxx | |

| 16 |