Contract

[***] indicates material that has been omitted pursuant to a Request for Confidential Treatment filed with the Securities and Exchange Commission. A complete copy of this agreement, including redacted portions so indicated, has been filed separately with the Securities and Exchange Commission.

IROKO PHARMACEUTICALS (LUXEMBOURG) SARL

and

ASPEN PHARMACARE HOLDINGS LIMITED

EXCLUSIVE SUB-LICENSE AGREEMENT

6 DECEMBER, 2007

| 1. | PARTIES |

1 | ||||

| 2. | INTERPRETATION |

1 | ||||

| 3. | RECORDAL AND INTRODUCTION |

6 | ||||

| 4. | SUSPENSIVE CONDITIONS |

8 | ||||

| 5. | GRANT OF RIGHTS |

8 | ||||

| 6. | DURATION |

10 | ||||

| 7. | MERCK DISTRIBUTION TERM |

10 | ||||

| 8. | BULK SUPPLY TERM |

10 | ||||

| 9. | TRANSITIONAL UNDERTAKINGS |

11 | ||||

| 10. | BEST EFFORTS TO COMMERCIALISE |

12 | ||||

| 11. | MARKETING AUTHORISATIONS |

12 | ||||

| 12. | PRODUCTS LABELLING, PROPRIETARY RIGHTS AND TRADEMARKS |

13 | ||||

| 13. | LICENSE FEE/TAX |

14 | ||||

| 14. | SUPPLY AND MANUFACTURE OF THE PRODUCTS |

16 | ||||

| 15. | SUPPLY AND MANUFACTURE OF THE SUPPOSITORIES, ALDOMET® (METHYLDOPA) 125MG TABLETS AND SRC PRODUCT |

16 | ||||

| 16. | ASPEN WARRANTIES |

17 | ||||

| 17. | IROKO WARRANTIES AND UNDERTAKINGS |

17 | ||||

| 18. | INDEMNITIES |

18 | ||||

| 19. | SAFETY AGREEMENT AND BUSINESS CONTINUITY PLAN |

20 | ||||

| 20. | ETHICAL STANDARDS AND HUMAN RIGHTS OF XXXXX |

00 | ||||

| 00. | ETHICAL STANDARDS AND HUMAN RIGHTS OF ASPEN |

21 | ||||

| 22. | CONFIDENTIALITY |

22 | ||||

| 23. | BOARD OF MANAGERS |

23 | ||||

| 24. | GOVERNING LAWS AND JURISDICTION |

25 | ||||

| 25. | TERMINATION |

26 | ||||

| 26. | EFFECT OF TERMINATION |

27 | ||||

| 27. | ADVERSE EVENTS AND FORCE MAJEURE |

27 | ||||

| 28. | NATURE OF RELATIONSHIP |

28 | ||||

| 29. | NOTICES |

28 | ||||

| 30. | AFFILIATES AND ASSIGNMENT |

29 | ||||

| 31. | GENERAL |

29 | ||||

| 32. | COSTS |

30 | ||||

| 33. | NOMINEE AND CONSEQUENT GUARANTEE |

30 | ||||

| APPENDICES | ||

| APPENDIX A - | PRODUCTS | |

| APPENDIX B - | SUPPOSITORIES AND ALDOMET® (METHYLDOPA) TABLETS 125MG AND SRC PRODUCT | |

| APPENDIX C - | PLAN, PROCEDURES AND TIME LINES FOR THE TRANSFER OF THE MARKETING AUTHORISATIONS FROM MERCK TO ASPEN, ITS AFFILIATES AND/OR THE THIRD PARTY LICENSEE/S | |

| APPENDIX D - | PACKAGING FEE | |

| APPENDIX E - | FORMULA FOR THE DETERMINATION OF THE QUARTERLY LICENSE FEE | |

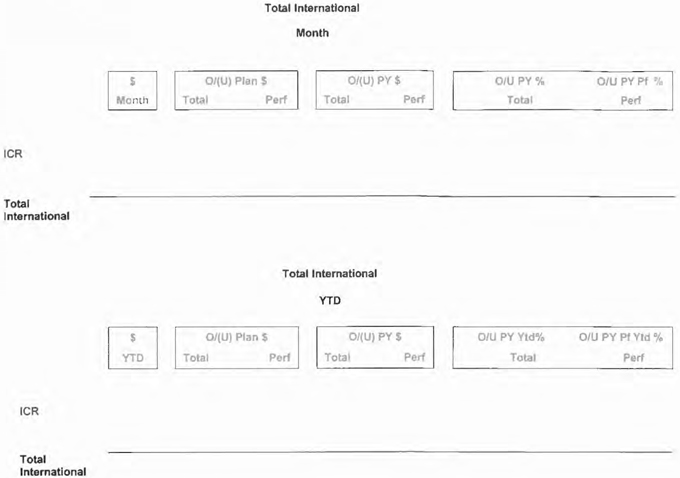

| APPENDIX F - | TEMPLATE TERRITORY PRO-FORMA INCOME STATEMENT OF THE BUSINESS ACTIVITY | |

| APPENDIX G - | TEMPLATE TERRITORY MONTHLY REPORT ON SALES ACTIVITY | |

| APPENDIX H - | MANUFACTURING PROVISIONS | |

| APPENDIX I - | LIST OF PRIORITY COUNTRIES | |

| APPENDIX J - | SAFETY AGREEMENT | |

| APPENDIX K - | TERMINATION IN THE EVENT OF IROKO LAUNCHING A NEW VARIANT (VIDE CLAUSE 25.5) | |

EXCLUSIVE SUB-LICENSE AGREEMENT

| 1. |

PARTIES | |||||

| 1.1. | ASPEN PHARMACARE HOLDINGS LIMITED | |||||

| Registration No. 1985/002935/06; and | ||||||

| 1.2. | IROKO PHARMACEUTICALS (LUXEMBOURG) SARL | |||||

| 2. | INTERPRETATION | |||||

| In this Agreement – | ||||||

| 2.1. | clause headings are for convenience and shall not be used in its interpretation; | |||||

| 2.2. | unless the context clearly indicates a contrary intention – | |||||

| 2.2.1. | an expression which denotes – | |||||

| 2.2.1.1. | any gender includes the other genders; | |||||

| 2.2.1.2. | a natural person includes an artificial person and vice versa; | |||||

| 2.2.1.3. | the singular includes the plural and vice versa; | |||||

| 2.2.2. | the following expressions shall bear the meanings assigned to them below and cognate expressions bear corresponding meanings – | |||||

| 2.2.2.1. | “ADVERSE EVENT” means any untoward medical occurrence in a patient or clinical investigation subject, temporally associated with the use of the PRODUCT, whether or not considered related to the PRODUCT. An ADVERSE EVENT for the purposes of this AGREEMENT can therefore be any unfavourable and unintended sign (including an abnormal laboratory finding), symptom, or disease (new or exacerbated) temporally associated with the use of the PRODUCT. It also includes failure to produce expected benefits (i.e. lack of efficacy), abuse or misuse; | |||||

| 2.2.2.2. | “AFFILIATE/S” means, in relation to one person, any other person which is controlled by, under common control with, or controls the other. Without limiting the generality of the foregoing, a company shall be deemed to have control of another if (directly or indirectly) it owns a majority of the voting shares of or is entitled (directly or indirectly) to appoint a majority of the directors of the other company. “Control” means the ability to determine the policies and/or management of a person, whether through the ownership of securities, by contract or otherwise; | |||||

| 2.2.2.3. | “AGENCY” or “AGENCIES” means any governmental regulatory authority involved in granting approvals for the MANUFACTURING or COMMERCIALISATION of the PRODUCTS in the TERRITORY and any other equivalent authority (or any successor organization of any such entity) elsewhere; | |||||

Page 1

| 2.2.2.4. | “AGREEMENT” means the agreement set out in this document, incorporating the Appendices hereto; | |||||||

| 2.2.2.5. | “APPLICABLE LAWS” means all or any: | |||||||

| • statutes, subordinate legislation and common law, | ||||||||

| • regulations, | ||||||||

| • ordinances and bylaws, and | ||||||||

| • directives, codes of practice, circulars, guidance notes, judgments and decisions of any competent authority, | ||||||||

| compliance with which is mandatory in relation to the subject matter of this AGREEMENT; | ||||||||

| 2.2.2.6. | “ASPEN” means ASPEN PHARMACARE HOLDINGS LIMITED, Registration Number 1985/002935/06, a company duly registered and incorporated in accordance with the company laws of the Republic of South Africa and having its registered office at Xxxxxxxx 0, Xxxxxxxxxx Xxxx, Xxxxxxxxx Xxxxx, Xxxxxxxx, Xxxxxxxxxxxx, Xxxxxxxx of South Africa; | |||||||

| 2.2.2.7. | “BOARD” means the Board of Managers set up by the parties to oversee the COMMERCIALISATION of the PRODUCTS in the TERRITORY. | |||||||

| 2.2.2.8. | “BUDGET” means the budget developed and approved by the BOARD for the upcoming calendar year, including reasonably detailed projections of revenues, expenses, cash flow and profit or loss, and all assumptions underlying same; | |||||||

| 2.2.2.9. | “BULK SUPPLY TERM” means (on a PRODUCT by PRODUCT, country by country basis) the period between (i) the termination of the MERCK DISTRIBUTION TERM; and (ii) the date of the commencement of the MANUFACTURING TERM; | |||||||

| 2.2.2.10. | “BUSINESS DAY/S” means any day other than a Saturday, Sunday or official public holiday in the Republic of South Africa and/or the Grand Duchy of Luxembourg, as the case may be; | |||||||

| 2.2.2.11. | “CONTROL” means either the ownership of more than 50% (FIFTY PERCENT) of the ordinary share capital of IROKO carrying the rights to vote at general meetings or the power to nominate a majority of the board of directors of IROKO; | |||||||

| 2.2.2.12. | “COMMERCIALISE” or “COMMERCIALISATION” means all of the operations required for the promotion, distribution, marketing and/or sale of the PRODUCTS in the TERRITORY; | |||||||

| 2.2.2.13. | “CONDITIONS” means the suspensive conditions to this AGREEMENT as set out in clause 4; | |||||||

| 2.2.2.14. | “CONFIDENTIAL INFORMATION” means any information including, but not limited to, information regarding a PARTY’S past, current and future | |||||||

Page 2

| services and products, research and development plans and results, customers, sales and operating information, marketing plans and strategies, cost and pricing information, data, media, know-how, designs, drawings, specifications, source codes, technical information, concepts, reports, methods, processes, techniques, operations, devices and like, future projections, business plans, software, listings, holdings, alliances, investments, financials, transactions and general business operations, label claims, patents, copyrights, trade secrets, information relating to or underlying such intellectual property rights and other proprietary information, sketches, models, inventions, apparatus, equipment, algorithms, information technology systems and programs, software source documents, formulae, research and development, clinical data, experimental work, design details and specifications and other technical information relating to past, current, future and proposed products and services, engineering data, financial information, procurement requirements, purchasing and manufacturing information, customers and customer lists and profiles, business forecasts and sales, marketing and merchandising plans and data, future projections, fee schedules, stock ownership and all materials prepared on the basis of any of the foregoing, whether or not the foregoing information is patented, tested, reduced to practice, or subject to copyright; | ||||||

| 2.2.2.15. | “DISTRIBUTION TRANSFER DATE” shall have the meaning ascribed thereto in clause 7.1; | |||||

| 2.2.2.16. | “EFFECTIVE DATE” means the 1st (FIRST) BUSINESS DAY after the fulfilment of the CONDITIONS; | |||||

| 2.2.2.17. | “HEAD LICENSE” has the meaning ascribed thereto in Clause 3.3. | |||||

| 2.2.2.18. | “IFRS” means International Financial Reporting Standards as promulgated by the International Accounting Standards Board and as adopted by ASPEN as its accounting standard; | |||||

| 2.2.2.19. | “IROKO” means IROKO PHARMACEUTICALS (LUXEMBOURG) SARL, a société à responsabilité limitée formed under the laws of the Grand Duchy of Luxembourg and having its registered office at 00, Xxxxxxxxx Xxxxxx Xxxxxxxx Xxxxxxxxx, X-0000, Xxxxxxxxxx, XXXXXXXXXX; | |||||

| 2.2.2.20. | “IROKO DATA” means all knowledge, know-how or other proprietary information and material in relation to the PRODUCTS (whether or not patentable) including, but not limited to, substance, formulations, techniques, methodology, manufacturing process, equipment, data, reports, source of supply, patent position, business plans, research and test results relating to the PRODUCTS owned, developed or used by, or licensed to, IROKO, and those which may belong to third parties for use of which IROKO has made sufficient arrangements; | |||||

| 2.2.2.21. | “IROKO LLC” means Iroko Pharmaceuticals, LLC, a limited liability company formed under the laws of the State of Delaware, USA, and a shareholder of IROKO. | |||||

| 2.2.2.22. | “LICENSE FEE PERIOD” means (on a PRODUCT by PRODUCT, country by country basis) the calendar quarter calculated from the commencement date of the BULK SUPPLY TERM and each consecutive calendar quarter thereafter; | |||||

Page 3

| 2.2.2.23. | “MANUFACTURE” or “MANUFACTURING” or “MANUFACTURED” or “MANUFACTURES” means, as applicable, all the production, the procurement of all or any raw materials, excipients, API’s and other inputs of whatever nature, warehousing, quality control testing (including in-process and release) and release of the PRODUCTS; | |||||

| 2.2.2.24. | “MANUFACTURING TERM” means (on a PRODUCT by PRODUCT, country by country basis) the period between (i) the termination of the BULK SUPPLY TERM; and (ii) the 6th (SIXTH) anniversary from the signature date plus the earlier of (x) two years or (y) the time necessary to complete the technical transfer of the MANUFACTURING process to new third party manufacturers; | |||||

| 2.2.2.25. | “MARKETING AUTHORISATIONS” means any license or approval of any AGENCY necessary for the MANUFACTURE, PACKAGING, export and/or COMMERCIALISATION of the PRODUCTS in the TERRITORY; | |||||

| 2.2.2.26. | “MERCK” means, collectively, Merck & Co., Inc., a corporation organized under the laws of the State of New Jersey and Merck and Company, Incorporated, a corporation organized under the laws of the State of Delaware; | |||||

| 2.2.2.27. | “MERCK FEE” shall have the meaning ascribed thereto in clause 3.7.1; | |||||

| 2.2.2.28. | “MERCK DISTRIBUTION TERM” means (on a PRODUCT by PRODUCT, country by country basis) the period between (i) the EFFECTIVE DATE; and (ii) the commencement of the DISTRIBUTION TRANSFER DATE; | |||||

| 2.2.2.29. | “NET SALES” means, for each PRODUCT in each country in the TERRITORY, the applicable gross invoice amounts for the sale of the PRODUCT, during the relevant period, less reasonable and customary deductions for the following with respect to the PRODUCT, all determined in accordance with IFRS consistently applied: (i) all trade, cash and quantity credits, discounts, refunds and rebates other than early pay cash discounts; (ii) credits or allowances for returns, recalls, rejections, damages to or destruction of the PRODUCT, retroactive price reductions, and charge backs; (iii) sales or excise taxes, including such amounts which are to be paid on the basis of the sales price; and (iv) bad debts written off; | |||||

| 2.2.2.30. | “PACK”, “PACKED”, “PACKING” or “PACKAGING” means the filling, primary and secondary packaging and labelling of the PRODUCTS into sales packs and the procurement of all or any raw materials, packaging materials and other inputs of whatever nature relevant thereto; | |||||

| 2.2.2.31 | “PARTIES” mean the parties to this AGREEMENT and “PARTY” shall mean any one of them; | |||||

| 2.2.2.32. | “PRIORITY COUNTRIES” means those countries set out in Appendix I in respect of which ASPEN shall be obliged to use its best endeavours to COMMERCIALISE, or procure the COMMERCIALISATION of (as the case may be) the PRODUCTS; | |||||

Page 4

| 2.2.2.33. | “PRODUCTS” means the products described in Appendix A; | |||||

| 2.2.2.34. | “QUARTERLY LICENSE FEE” means that amount calculated in accordance with the provisions of Appendix E; | |||||

| 2.2.2.35. | “REGULATORY COSTS” means reasonable direct costs and indirect costs, including but not limited to, license fees associated with change applications and retention/renewal, regulatory agency fees; courier fees; photocopy fees; translations; notarisations; CPP’s, samples of product and/or printed for submission, manpower/resource costs, consulting fees, bio-studies, new methods and their validation, stability data and other work done directly with the PRODUCTS pursuant to procuring transfer of applicant, manufacturer, packer and laboratory; | |||||

| 2.2.2.36. | “SIGNATURE DATE” means the date of signature of this AGREEMENT by the PARTY signing last in time; | |||||

| 2.2.2.37. | “SPECIFICATIONS” means the specifications and testing methods for the PRODUCTS, their active pharmaceutical ingredients and excipients as set out in the MARKETING AUTHORISATIONS, including, for the avoidance of doubt, packaging and labelling specifications; | |||||

| 2.2.2.38. | “SRC PRODUCT” means lndocin® (Indomethacin) Sustained Release Capsules 75mg as is set out in Appendix B; | |||||

| 2.2.2.39. | “SUPPOSITORIES” means those PRODUCTS set out in Appendix B; | |||||

| 2.2.2.40. | “TERM” means the period commencing on the EFFECTIVE DATE and terminating on the 50 (FIFTIETH) anniversary of the EFFECTIVE DATE; | |||||

| 2.2.2.41. | “TERRITORY” means the entire African continent, the entire South and Central American continents, including the islands of the Caribbean (excluding Puerto Rico as it is considered part of North America), Ireland, the United Kingdom, Australia and New Zealand, and the entire Asian continent (excluding China (other than Hong Kong), Japan, Pakistan, Korea, any US territories (i.e. Guam) and Sri Lanka (the latter only insofar as it relates to Aldomet®); | |||||

| 2.2.2.42. | THIRD PARTY SUB-LICENSEE/S” means those third party sub-licensee/s appointed to COMMERCIALISE the PRODUCTS in accordance with the provisions of this AGREEMENT; | |||||

| 2.2.2.43. | “TRADEMARKS” means those trademarks which are applied for, owned and/or registered in the name of IROKO and/or its AFFILIATES in the TERRITORY which are or which may, from time to time, be used in the COMMERCIALISATION of the PRODUCTS and all related industrial or intellectual property, trade dress, designs, labels, labeling, house marks, logos and other indices of ownership; | |||||

| 2.2.2.44. | “WORLDWIDE MANUFACTURING AND SUPPLY AGREEMENT” means the Manufacturing and Supply Agreement which Pharmacare Limited and IROKO will enter into contemporaneously with this AGREEMENT pursuant to which Pharmacare Limited will MANUFACTURE and supply the PRODUCTS to IROKO in the territory thereunder and the PRODUCTS for their COMMERCIALISATION in the TERRITORY pursuant to the terms of this AGREEMENT. | |||||

Page 5

| 2.3. | should any provision in a definition be a substantive provision conferring rights or imposing obligations on any PARTY, effect shall be given to that provision as if it were a substantive provision in the body of this AGREEMENT; | |

| 2.4. | any reference to an enactment, regulation, rule or by-law is to that enactment, regulation, rule or by-law as at the SIGNATURE DATE, and as amended from time to time; | |

| 2.5. | when any number of days is prescribed, such number shall exclude the first and include the last day, unless the last day falls on a day other than a business day, in which case the last day shall be the next succeeding business day; | |

| 2.6. | any schedule to this AGREEMENT shall form part of, and be deemed to be incorporated in, this AGREEMENT; | |

| 2.7. | where any term is defined within a particular clause, other than the interpretation clause, that term shall bear the meaning assigned to it in that clause wherever it is used in this AGREEMENT; | |

| 2.8. | the use of the word “including” or “includes” followed by a specific example/s shall not be construed as limiting the meaning of the general wording preceding it and the eiusdem generis rule shall not be applied in the interpretation of such general wording or such specific example/s; | |

| 2.9. | the expiration or termination of this AGREEMENT shall not affect those provisions of this AGREEMENT which expressly provide that they will operate after any such expiration or termination or which of necessity must continue to have effect after such expiration or termination, notwithstanding the fact that the clauses themselves do not expressly provide for this; | |

| 2.10. | in its interpretation, the contra proferentem rule of construction shall not apply (this AGREEMENT being the product of negotiations between the PARTIES), nor shall this AGREEMENT be construed in favour of or against any PARTY by reason of the extent to which any PARTY or its professional advisors participated in the preparation of this AGREEMENT; | |

| 2.11. | any reference to days (other than a reference to business days), months or years shall be a reference to calendar days, months or years, as the case may be; and | |

| 2.12. | recordals shall be binding on the PARTIES and are not merely for information purposes. | |

| 3. | RECORDAL AND INTRODUCTION | |

| 3.1. | IROKO LLC has acquired the IROKO DATA and the exclusive rights to COMMERCIALISE the PRODUCTS on a worldwide basis from MERCK, provided, however, that MERCK shall continue to COMMERCIALISE the PRODUCTS on a PRODUCT by PRODUCT, country by country basis during the MERCK DISTRIBUTION TERM. In connection with such acquisition, IROKO LLC and MERCK entered into a supply agreement whereby MERCK is obligated to supply and provide a safety stock of the PRODUCTS to IROKO LLC, on a PRODUCT by PRODUCT, country by country basis, in finished PACK until the MARKET AUTHORIZATION is transferred, and in bulk PACK until at least March 20, 2009, with such PRODUCTS having a minimum remaining shelf life which will enable the viable COMMERCIALISATION thereof in the TERRITORY. | |

Page 6

| 3.2. | The IROKO DATA is of a form and nature sufficient to procure the transfer of the MARKETING AUTHORISATIONS from MERCK to IROKO LLC for the COMMERCIALISATION of the PRODUCTS in the TERRITORY. | |||

| 3.3. | IROKO has entered into an “Exclusive Head License Agreement” (the “HEAD LICENSE”) with IROKO LLC pursuant to which IROKO LLC has granted to IROKO (1) the right to use the IROKO DATA and MARKETING AUTHORIZATIONS in, inter alia, the TERRITORY for the purpose of procuring (either through its own or its AFFILIATES’ endeavours or through the endeavours of THIRD PARTY SUB-LICENSEES) the COMMERCIALIZATION of the PRODUCTS and (ii) the right (either through its own or its AFFILIATES’ endeavours or through the endeavours of THIRD PARTY SUB-LICENSEES) to receive PRODUCTS in bulk from MERCK for the purpose of causing them to be PACKED and COMMERCIALIZED in, inter alia, the TERRITORY and (iii) the right (either through its own or its AFFILIATES’ endeavours or through the endeavours of THIRD PARTY SUB-LICENSEES) to MANUFACTURE and PACK the PRODUCTS for the purposes of their COMMERCIALIZATION in, inter alia, the TERRITORY. | |||

| 3.4. | Pursuant to the HEAD LICENSE, IROKO now wishes to sublicense such rights to ASPEN, in the TERRITORY. | |||

| 3.5. | ASPEN undertakes to use its best endeavours, in cooperation with IROKO, to procure the transfer of the MARKETING AUTHORISATIONS, in accordance with the timelines as set out in Appendix C in the PRIORITY COUNTRIES, from MERCK to ASPEN, its AFFILIATES and/or the THIRD PARTY LICENSEE/S and thereafter to COMMERCIALISE the PRODUCTS or procure the COMMERCIALISATION thereof (as the case may be) exclusively in the TERRITORY. For countries other than the PRIORITY COUNTRIES, at its first meeting the filing strategy will be agreed by the BOARD on a country by country basis or such later date as agreed by the PARTIES in writing, and for such countries where the PARTIES determine a submission is required, the PARTIES shall use their best endeavours to submit the filings therefor by 15 March 2008. | |||

| 3.6. | IROKO shall be responsible for procuring the transfer of the MARKETING AUTHORISATIONS outside of the TERRITORY from MERCK and for the COMMERCIALISATION of the PRODUCTS in those countries (excluding the Territory) where it holds rights to COMMERCIALIZE the PRODUCTS. | |||

| 3.7. | Subject to the terms and on the conditions set out in this AGREEMENT and in consideration for ASPEN’s payments pursuant to Clause 13.1, IROKO is prepared to grant to ASPEN- | |||

| 3.7.1. | during the MERCK DISTRIBUTION TERM, and after, and in consideration of, the payment of the license fee pursuant to clauses 13.1.1. and 13.1.2 hereunder, the right to receive an amount equal to 50% (FIFTY PERCENT) of the net profits generated by MERCK on account of the COMMERCIALISATION by MERCK of the PRODUCTS in the TERRITORY plus an amount equal to 50% (FIFTY PERCENT) of all or any damages paid by MERCK consequent upon a breach by MERCK of its obligations arising from or related to the PRODUCTS in the TERRITORY, relevant to the subject matter of this AGREEMENT (collectively the “MERCK FEE”); | |||

| 3.7.2. | during the BULK SUPPLY TERM, the rights to receive the PRODUCTS in bulk from MERCK for the purposes of causing them to be PACKED and COMMERCIALISED in the TERRITORY; | |||

Page 7

| 3.7.3. | during the MANUFACTURING TERM, the rights to MANUFACTURE and PACK the PRODUCTS exclusively for the purposes of their COMMERCIALISATION in the TERRITORY; and | |||

| 3.7.4. | during the TERM, an exclusive license to use the IROKO DATA and the MARKETING AUTHORISATIONS in the TERRITORY for the purpose of procuring (either through its own or its AFFILIATES’ endeavours or through the endeavours of the THIRD PARTY SUB-LICENSEES) the COMMERCIALISATION of the PRODUCTS in the TERRITORY; | |||

| provided, however that no conveyance of ownership is granted to ASPEN and all right, title and interest in and to the IROKO DATA, TRADEMARKS and the MARKETING AUTHORISATIONS, and any other proprietary rights contained therein, shall be retained by the owner thereof. | ||||

| 4. | SUSPENSIVE CONDITIONS | |||

| 4.1. | This AGREEMENT is subject to the fulfilment of the CONDITIONS by no later than 20 February 2008. | |||

| 4.1.1. | that ASPEN obtains the written approval, to the extent necessary, of the Exchange Control Department of the RSA Reserve Bank pursuant to the Currencies and Exchanges Act, 9 of 1933 to the contents of this AGREEMENT; | |||

| 4.1.2. | that ASPEN obtains the written approval, to the extent necessary, of the South African Department of Trade and Industry to the contents of this AGREEMENT. | |||

| 4.2. | ASPEN shall use its best commercial endeavours to procure the fulfilment of the CONDITIONS and shall keep IROKO regularly informed of its progress in fulfilling the CONDITIONS. | |||

| 4.3. | ASPEN shall be entitled to extend the time period for the fulfilment of the CONDITIONS for a maximum period of 30 (THIRTY) days on written notice to IROKO given at any time prior to the expiry for the time period for the fulfilment thereof. | |||

| 4.4. | If the CONDITIONS are not timely fulfilled (but subject to clauses 4.2 and 4.3)- | |||

| 4.4.1. | the whole of this AGREEMENT shall have no force or effect; and | |||

| 4.4.2. | no PARTY shall have any claim against the other PARTY in terms of this AGREEMENT. | |||

| 5. | GRANT OF RIGHTS | |||

| 5.1. | During the MERCK DISTRIBUTION TERM, and after the payment of the license fee pursuant to clauses 13.1.1. and 13.1.2 hereunder, IROKO shall pay to ASPEN the MERCK FEE, which shall be paid no later than 10 Business Days after the end of each calendar quarter. | |||

| 5.2. | During the BULK SUPPLY TERM, IROKO shall cause MERCK, pursuant to its supply agreement with IROKO LLC, to deliver to ASPEN the PRODUCTS in bulk for the purposes of causing them to be PACKED and COMMERCIALISED in the TERRITORY. Notwithstanding the aforesaid, the SUPPOSITORIES and the SRC PRODUCT will be MANUFACTURED and PACKED pursuant to the provisions of clause 15.1. | |||

Page 8

| 5.3. | During the MANUFACTURING TERM, IROKO grants to ASPEN and ASPEN hereby accepts the rights to MANUFACTURE and PACK the PRODUCTS exclusively for the purposes of their COMMERCIALISATION in the TERRITORY. Notwithstanding the aforesaid, the SUPPOSITORIES and the SRC PRODUCT will be MANUFACTURED and PACKED pursuant to the provisions of clause 15.1. | |||

| 5.4. | During the TERM, IROKO hereby grants to ASPEN, and ASPEN hereby accepts, subject to the terms and on the conditions set out in this AGREEMENT, an exclusive sub-license to use the IROKO DATA and MARKETING AUTHORISATIONS in the TERRITORY for the purpose of procuring (either through its own or its AFFILIATES’ endeavours or through the endeavours of THIRD PARTY SUB-LICENSEES) the COMMERCIALISATION of the PRODUCTS in the TERRITORY. | |||

| 5.5. | After the MERCK DISTRIBUTION TERM - | |||

| 5.5.1. | ASPEN shall COMMERCIALISE or procure the COMMERCIALISATION of the PRODUCTS in the PRIORITY COUNTRIES, and in those parts of the TERRITORY as determined by the BOARD; and | |||

| 5.5.2. | the BOARD will determine which of ASPEN, its AFFILIATES or THIRD PARTY SUB-LICENSEES will COMMERCIALISE the PRODUCTS in which part/s of the TERRITORY and the terms and conditions pertaining to such COMMERCIALISATION. | |||

| 5.6. | ASPEN shall not use or apply the IROKO DATA and/or MARKETING AUTHORISATIONS for any purpose whatsoever, other than in connection with the PRODUCTS and as provided in this AGREEMENT. | |||

| 5.7. | ASPEN undertakes that it will not, without the prior written consent of IROKO- | |||

| 5.7.1. | COMMERCIALISE the PRODUCTS outside of the TERRITORY; | |||

| 5.7.2. | supply the PRODUCTS to any third party which it and/or its AFFILIATES have reason to believe may COMMERCIALISE the PRODUCTS outside of the TERRITORY. | |||

| 5.8. | IROKO shall have the exclusive rights to use the IROKO DATA for the purposes of COMMERCIALISING the PRODUCTS in those countries (excluding the TERRITORY) where it holds rights to COMMERICIALIZE the PRODUCTS and reserves all rights not explicitly granted herein. | |||

| 5.9. | Except as otherwise provided herein, IROKO hereby irrevocably undertakes that it will not, during the TERM, without the prior written consent of ASPEN – | |||

| 5.9.1. | use the IROKO DATA for the purposes of COMMERCIALISING the PRODUCTS in the TERRITORY or allow its AFFILIATES and/or any third party to use the IROKO DATA for such purposes; | |||

| 5.9.2. | supply the PRODUCTS to any third party which it and/or its AFFILIATES have reason to believe may COMMERCIALISE the PRODUCTS in the TERRITORY; | |||

| 5.10. | no conveyance of ownership is granted to ASPEN herein and all right, title and interest in and to the IROKO DATA, TRADEMARKS and the MARKETING AUTHORISATIONS, and other proprietary rights contained therein is retained by the owner thereof. | |||

Page 9

| 6. | DURATION | |

| Notwithstanding the SIGNATURE DATE, this AGREEMENT shall endure for the TERM, unless terminated earlier in accordance with the provisions hereof. | ||

| 7. | MERCK DISTRIBUTION TERM | |

| 7.1. | After the EFFECTIVE DATE, MERCK shall continue to COMMERCIALISE the PRODUCTS on a PRODUCT by PRODUCT, country by country basis, on IROKO LLC’s behalf until such date as (i) the MARKETING AUTHORISATIONS (on a PRODUCT by PRODUCT, country by country basis) are transferred from MERCK to IROKO LLC (or its designee); and (ii) MERCK and IROKO LLC mutually agree, such date to be no later than 30 (THIRTY) days after the applicable transfer date on a PRODUCT by PRODUCT, country by country basis (each, the “DISTRIBUTION TRANSFER DATE”). On a PRODUCT by PRODUCT, country by country basis in the TERRITORY, from and after and in consideration of the payment by ASPEN of the license fee pursuant to clauses 13.1.1. and 13.1.2. until the DISTRIBUTION TRANSFER DATE on a PRODUCT by PRODUCT, country by country basis, IROKO shall pay to ASPEN the MERCK FEE. The MERCK FEE shall be paid quarterly, in United States Dollars, within 10 (TEN) BUSINESS DAYS after the expiration of each calendar quarter, together with a report reconciling the amounts so paid. For each country in the TERRITORY, ASPEN and/or the THIRD PARTY SUB-LICENSEE/S shall undertake the COMMERCIALISATION of the PRODUCTS for such country upon the respective DISTRIBUTION TRANSFER DATE. | |

| 7.2. | ASPEN shall be entitled, at all reasonable times, either directly or through its duly authorised agents, to undertake an inspection and/or audit of all or any of IROKO’S reports, books of account and the like in an endeavour to verify the MERCK FEE or any component thereof and IROKO shall give ASPEN and/or its duly authorized agents, its full co-operation in this regard and shall procure that IROKO LLC provide such information as ASPEN may reasonably require to verify the computation of the MERCK FEE. The authorised agents or representatives of ASPEN shall, however, prior to conducting any such inspection and/or audit, enter into a “confidentiality and lock-out agreement” in a form reasonably acceptable to IROKO that would require the agent or representative to maintain confidentiality of the information obtained and desist from trading in the securities of IROKO for a period specified therein. | |

| 7.3. | Should ASPEN dispute the MERCK FEE or any component thereof, then the PARTIES shall enter into negotiations in good faith with regard to agreeing the MERCK FEE or, failing such agreement within 10 (TEN) days after the commencement of such negotiation, either PARTY shall be entitled to refer the dispute/disagreement for determination by an independent auditor appointed by agreement between the PARTIES, in writing, or failing such agreement within 5 (FIVE) days after either PARTY has required such referral, appointed by the President for the time being of the South African Institute of Chartered Accountants (or his successor-in-title) if IROKO requests such an appointment, or appointed by the then President of the Luxembourg lnstitut des Reviseurs d’Entrepises (or his successor-in-title), if ASPEN requests such an appointment. Such auditor shall act as an expert and not as an arbitrator and his decision shall, save for any manifest error, be final and binding on the PARTIES. | |

| 8. | BULK SUPPLY TERM | |

| 8.1. | With effect from each DISTRIBUTION TRANSFER DATE, IROKO shall use its best commercial endeavours to procure that MERCK delivers to ASPEN, its AFFILIATES or any third party packer appointed by the BOARD the PRODUCTS in bulk, in that quality and according to that quantity as are necessary to procure their COMMERCIALISATION | |

Page 10

| in the TERRITORY in accordance with the provisions of this AGREEMENT. ASPEN shall advise IROKO of its requirements of the PRODUCTS in bulk and IROKO shall timely cause orders to be placed with MERCK for such PRODUCTS to the extent reasonably consistent with past orders. | ||||

| 8.2. |

ASPEN, its AFFILIATES or the third party packer (as the case may be) shall PACK the PRODUCTS received from MERCK in bulk in accordance with the SPECIFICATIONS (insofar as they relate to PACKAGING), APPLICABLE LAWS and Good Manufacturing Practice for their COMMERCIALISATION in the TERRITORY. | |||

| 8.3. |

In the event of ASPEN and/or its AFFILIATES attending to PACK the PRODUCTS so supplied by MERCK in bulk, it/they shall be entitled to a PACKAGING fee calculated on a [***] basis, determined in accordance with IFRS, and payable in accordance with Appendix D. The BOARD shall determine whether a third party packer shall PACK the PRODUCTS so supplied by MERCK in bulk and the terms and the conditions applicable thereto. | |||

| 8.4. |

ASPEN shall pay MERCK, in full, for the PRODUCTS supplied, in bulk, to ASPEN and ASPEN shall be solely liable for all costs and expenses associated with the delivery thereof to an address in the Republic of South Africa as is nominated, from time to time, by ASPEN. | |||

| 8.5. |

In respect of the PRODUCTS to be supplied by MERCK in bulk, IROKO shall provide MERCK, or shall cause MERCK to be provided, with a written rolling 24 (TWENTY FOUR) month forecast of its requirements, the first 6 (SIX) months of which shall constitute a firm order. MERCK shall deliver such firm order (provided it is consistent with the most recent forecasts) to IROKO LLC or its designee, Ex Works (INCOTERMS 2000), MERCK’S manufacturing plant, at which time title shall pass to IROKO or its AFFILIATES, and IROKO is to notify MERCK (or shall cause MERCK to be notified) of any defects within 45 (FORTY FIVE) days thereof. Payment for the PRODUCTS in bulk is to be made to MERCK within 60 (SIXTY) days of delivery. | |||

| 9. | TRANSITIONAL UNDERTAKINGS | |||

| 9.1. |

Within 30 (THIRTY) days of the EFFECTIVE DATE, IROKO shall be obliged to deliver or cause to be delivered to ASPEN copies of the registration files for all of the MARKETING AUTHORISATIONS for the PRODUCTS and all other documentation as may be reasonably required by ASPEN. | |||

| 9.2. |

IROKO shall use its best commercial endeavours to undertake or procure the undertaking of all necessary actions, with the utmost dispatch and good faith, to – | |||

| 9.2.1. |

facilitate the transfer of the MARKETING AUTHORISATIONS from MERCK to ASPEN, its AFFILIATES and/or the THIRD PARTY LICENSEE/S; | |||

| 9.2.2. |

facilitate the PACKING of the bulk PRODUCTS by ASPEN, its AFFILIATES and/or third party packers; and | |||

| 9.2.3. |

facilitate the MANUFACTURE and PACKING of the PRODUCTS by ASPEN, | |||

| including without limiting the generality of the foregoing, procuring that MERCK provides ASPEN with all reasonable co-operation in this regard. Each PARTY undertakes to sign or procure the signing of all and any documents necessary to give effect to the registration and maintenance of the MARKETING AUTHORISATIONS, to procure the PACKING of the PRODUCTS supplied in bulk by MERCK and/or the MANUFACTURE and PACKING of the | ||||

| *** | Portions of this page have been omitted pursuant to a request for confidential treatment and filed separately with the Securities and Exchange Commission. |

Page 11

| PRODUCTS by ASPEN, upon the request therefor. The provisions of this clause 9.2 shall, where applicable, apply mutatis mutandis to the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or SRC PRODUCT. | ||

| 9.3. | Both PARTIES hereby undertake to use their respective best endeavours to procure the transfer, on a PRODUCT by PRODUCT, country by country basis, of (i) the MARKETING AUTHORISATIONS from MERCK to ASPEN, its AFFILIATES and/or the THIRD PARTY SUB-LICENSEES; (ii) the approval in accordance with the APPLICABLE LAWS pertaining to ASPEN as the packer of the PRODUCTS; (iii) the approval in accordance with the APPLICABLE LAWS pertaining to ASPEN as the manufacturer and packer of the PRODUCTS; and (iv) the approval in accordance with the APPLICABLE LAWS of new printed PACKAGING for the PRODUCTS. The provisions of this clause 9.3 shall, where applicable, apply mutatis mutandis to the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or SRC PRODUCT. | |

| 10. | BEST EFFORTS TO COMMERCIALISE | |

| For the duration of the BULK SUPPLY TERM and the MANUFACTURING TERM, ASPEN shall use its best efforts to COMMERCIALISE or procure the COMMERCIALISATION of the PRODUCTS in the PRIORITY COUNTRIES. | ||

| 11 . | MARKETING AUTHORISATIONS | |

| 11.1. | As soon as is practically possible after the EFFECTIVE DATE, ASPEN and IROKO shall do all things reasonably necessary, with the utmost dispatch and good faith, to procure (i) the transfer of the MARKETING AUTHORISATIONS in the TERRITORY from MERCK to ASPEN, its AFFILIATES and/or the THIRD PARTY SUB-LICENSEES; (ii) the approval in accordance with the APPLICABLE LAWS pertaining to ASPEN as the manufacturer and packer of the PRODUCTS; and (iii) the approval in accordance with the APPLICABLE LAWS of new PACKAGING for the PRODUCTS, all in accordance with the procedures and time lines set out in Appendix C . | |

| 11.2. | Notwithstanding the provisions of clause 11.1, in the event of the existing MARKETING AUTHORISATIONS requiring further work to be undertaken thereon in order to procure their transfer to ASPEN, its AFFILIATES and/or the THIRD PARTY SUB-LICENSEE/S, the PARTIES shall take all necessary steps to cause the necessary further work to be undertaken and shall cooperate in the utmost good faith to that end. IROKO will use its best commercial endeavours to procure the consent of MERCK for any technical work requiring MERCK’s consent. | |

| 11.3. | All or any reasonable fees, costs and expenses incurred by ASPEN and/or IROKO and mutually agreed to by the PARTIES in procuring (i) the transfer of the MARKETING AUTHORISATIONS to ASPEN, its AFFILIATES and/or the THIRD PARTY SUB-LICENSEE/S and/or associated with any further work which requires to be undertaken in order to procure such transfer; (ii) the approval in accordance with the APPLICABLE LAWS pertaining to ASPEN as the manufacturer and packer of the PRODUCTS; and (iii) the approval in accordance with the APPLICABLE LAWS of new PACKAGING for the PRODUCTS, shall be deemed to be REGULATORY COSTS. The provisions of this clause 11.3 shall, where applicable, apply mutatis mutandis to the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or SRC PRODUCT. | |

| 11.4. | After the transfer of the MARKETING AUTHORISATIONS to ASPEN, its AFFILIATES and/or the THIRD PARTY SUB-LICENSEES, ASPEN will be solely responsible for maintaining all MARKETING AUTHORISATIONS in the TERRITORY. All or any fees, costs or expenses incurred and paid by ASPEN in so maintaining the MARKETING AUTHORISATIONS shall be deemed to be a REGULATORY COST. | |

Page 12

| 11.5. | Should additional data be required for the purposes of obtaining and/or maintaining the MARKETING AUTHORISATIONS, then the PARTIES shall meet and undertake negotiations in good faith to determine an appropriate method to obtain such additional data. The costs and expenses incurred in obtaining the said additional data shall be deemed to be a REGULATORY COST. | |

| 11.6. | Upon the expiration or earlier termination of this AGREEMENT, ASPEN shall, at IROKO’S cost, promptly take all necessary actions, with the utmost dispatch and good faith, to facilitate the transfer of the MARKETING AUTHORISATIONS from ASPEN to IROKO or its designee(s). ASPEN undertakes to sign all or any documents necessary to give effect to such re-registration of the MARKETING AUTHORISATIONS upon IROKO’S request therefor. | |

| 12. | PRODUCTS LABELLING, PROPRIETARY RIGHTS AND TRADEMARKS | |

| 12.1. | After the MERCK DISTRIBUTION TERM, the PRODUCTS, including the PACKAGING, sold in the TERRITORY shall bear the TRADEMARKS. The format and quality of the PRODUCTS packaging and the quality and content of the PRODUCTS packaging inserts, labels and promotional material relating to the PRODUCTS shall be the responsibility of ASPEN upon IROKO’S approval (which shall be within 21 (twenty-one) working days of receipt of such request from ASPEN) and shall meet the requirements of the MARKETING AUTHORISATIONS . Notwithstanding the aforesaid, where IROKO is, pursuant to the APPLICABLE LAWS, obliged to affix its marks/names to any PRODUCTS packaging, then the same shall be affixed in the manner as is required by the APPLICABLE LAWS. | |

| 12.2. | ASPEN agrees not to claim or to assert any rights of property in or to the TRADEMARKS or the goodwill associated therewith in the TERRITORY and will take no action which may destroy, damage or impair in any way the ownership or rights of the owner thereof in and to such TRADEMARKS in the TERRITORY. ASPEN shall not register in its own name, or on behalf of any other person, any trademark, trade name, brands, labelling, designs or other indicia of ownership imitating or conflicting with or resembling the TRADEMARKS in the TERRITORY, and shall not associate the TRADEMARKS with any article, other than the PRODUCTS to be COMMERCIALISED by ASPEN pursuant to this AGREEMENT, and shall at the request, cost and expense of IROKO do all such acts and things and execute all such documents as IROKO shall, acting reasonably, consider necessary or proper for the protection and maintenance of the TRADEMARKS in the TERRITORY. | |

| 12.3. | ASPEN shall give immediate notice to IROKO of any known or presumed counterfeits, copies, imitations, simulations of, or infringements upon, the TRADEMARKS in the TERRITORY or any other infringement or other act or unfair competition against the TRADEMARKS in the TERRITORY and shall, at IROKO’s cost and expense, give IROKO its full co-operation in the protection of the TRADEMARKS in the TERRITORY. | |

| 12.4. | IROKO undertakes, at its cost and expense, to maintain or cause to be maintained the TRADEMARKS in the TERRITORY throughout the TERM. | |

| 12.5. | Where IROKO requires the PACKAGING to reflect a language other than the English language (“other language”), IROKO shall supply ASPEN with the relevant translation for such packaging, prior to ASPEN PACKING the PRODUCTS with PACKAGING that reflects the other language. | |

Page 13

| 12.6. | ASPEN acknowledges that all intellectual property in the packaging design, TRADEMARKS, labelling, package insert and artwork supplied by IROKO to ASPEN pursuant to this clause 12 is owned or licensed by IROKO and shall remain IROKO’S property following any termination of this AGREEMENT for any reason, and that nothing in this AGREEMENT grants to ASPEN any right, title or interest in the ownership of such intellectual property. ASPEN will take all reasonable precautions to ensure the protection of IROKO’S rights in such intellectual property and further acknowledges that any improvements thereto shall also be the sole and exclusive property of IROKO. For the avoidance of doubt the provisions of this clause 12.6 apply only to the packaging design, TRADEMARKS, labelling, package insert and artwork supplied by IROKO to ASPEN pursuant to this clause 12 and not to packaging designs, trademarks, labelling, packaging inserts and/or artwork developed, devised or owned by ASPEN and/or its AFFILIATES. | |||

| 13. | LICENSE FEE/TAX | |||

| 13.1. | For the grant of the exclusive license rights in respect of the IROKO DATA and the rights to COMMERCIALISE the PRODUCTS in the TERRITORY, ASPEN shall pay to IROKO – | |||

| 13.1.1. | a once-off license fee for the exclusive rights to COMMERCIALISE the PRODUCTS in the TERRITORY for the amount of US$10,274,400.00 (TEN MILLION TWO HUNDRED SEVENTY FOUR THOUSAND AND FOUR HUNDRED UNITED STATES DOLLARS); | |||

| 13.1.2. | a once-off payment for the knowledge and know-how in relation to the IROKO DATA for the amount of US$2,568,600.00 (TWO MILLION FIVE HUNDRED SIXTY EIGHT THOUSAND AND SIX HUNDRED UNITED STATES DOLLARS); and | |||

| 13.1.3. | the QUARTERLY LICENSE FEE for the ongoing maintenance and use of the IROKO DATA and the COMMERCIALISATION of the PRODUCTS in the TERRITORY. | |||

| 13.2. | For purposes of calculating the QUARTERLY LICENSE FEE set forth in clause 13.1.3, from the EFFECTIVE DATE all sales of products containing indomethacin and/or methyldopa sold by ASPEN in the TERRITORY (other than those such products sold by ASPEN in South Africa by public tender) shall be included in the NET SALES computation. | |||

| 13.3. | Those amounts set out in clauses 13.1.1 and 13.1.2 shall be due and payable within 7 (SEVEN) days of the date of the fulfilment of the CONDITIONS and will be paid – | |||

| 13.3.1. | without deduction or set-off unless ASPEN is required to withhold any amount by law; | |||

| 13.3.2. | by electronic transfer in immediately available funds; and | |||

| 13.3.3. | into a bank account nominated by IROKO, in writing, from time to time. | |||

| 13.4. | The QUARTERLY LICENSE FEE shall be due and payable by ASPEN within 30 (THIRTY) days of the end of each LICENSE FEE PERIOD together with a report to IROKO (in the form of Appendix F) reconciling the amounts so paid . | |||

| 13.5. | The QUARTERLY LICENSE FEE will be paid - | |||

Page 14

| 13.5.1. | in United States Dollars (the actual rate of currency conversion shall apply in all circumstances where it is necessary for ASPEN to convert currency for the purpose of paying the QUARTERLY LICENSE FEE); | |||

| 13.5.2. | without deduction or set-off unless ASPEN is required to withhold any amount by law; | |||

| 13.5.3. | by electronic transfer in immediately available funds; and | |||

| 13.5.4. | into a bank account nominated by IROKO, in writing, from time to time. | |||

| 13.6. | After the MERCK DISTRIBUTION TERM, ASPEN shall, within 15 (FIFTEEN) calendar days after each month, provide to IROKO a territory report on sales activity (in the form of Appendix G hereto) for each PRODUCT in each country in the TERRITORY. | |||

| 13.7. | After the MERCK DISTRIBUTION TERM, ASPEN shall, within 30 (THIRTY) calendar days after each month, provide to IROKO a territory pro-forma income statement of the business activity undertaken throughout the TERRITORY (in the form of Appendix F hereto) that includes the determination of the QUARTERLY LICENSE FEE and such other financial information as is requested by IROKO, from time to time, acting reasonably. Such pro-forma income statements shall show information in United States Dollars and shall include the activity of the relevant month and the year-to-date results on a calendar-year basis. | |||

| 13.8. | IROKO shall be entitled, at all reasonable times, either directly or through its duly authorised agents, to undertake an inspection and/or audit of all or any of ASPEN’S reports, books of account, manufacturing facilities and the like in an endeavour to verify the QUARTERLY LICENSE FEE or any component thereof and ASPEN shall give IROKO and/or its duly agents, its full co-operation in this regard. The authorised agents or representatives of IROKO shall, however, prior to conducting any such inspection and/or audit, enter into a “confidentiality and lock-out agreement” in a form reasonably acceptable to ASPEN that would require the agent or representative to maintain confidentiality of the information obtained and desist from trading in the securities of ASPEN for a period specified therein. | |||

| 13.9. | Should IROKO dispute the QUARTERLY LICENSE FEE or any component thereof, then the PARTIES shall enter into negotiations in good faith with regard to agreeing the QUARTERLY LICENSE FEE or, failing such agreement within 10 (TEN) days after the commencement of such negotiation, either PARTY shall be entitled to refer the dispute/disagreement for determination by an independent auditor appointed by agreement between the PARTIES, in writing, or failing such agreement within five (5) days after either PARTY has required such referral, appointed by the President for the time being of the South African Institute of Chartered Accountants (or his successor-in-title) if IROKO requests such an appointment, or appointed by the then President of the Luxembourg lnstitut des Reviseurs d’Entreprises (or his successor-in-title), if ASPEN requests such an appointment. Such auditor shall act as an expert and not as an arbitrator and his decision shall, save for any manifest error, be final and binding on the PARTIES. | |||

| 13.10. | Where any withholding tax may be reduced as a consequence of the application of the Luxembourg/South African Double Tax Agreement (“DTA”), IROKO may qualify for relief under the DTA. To so obtain relief under the DTA, ASPEN will be required to approach the South African Revenue Services on behalf of IROKO to obtain the necessary withholding certificate to reduce any withholding tax payable. | |||

Page 15

| 13.11. |

IROKO hereby warrants that it qualifies for tax relief under the DTA and that it can supply the documentation, if any, necessary for obtaining such withholding certificate. | |||||

| 14. |

SUPPLY AND MANUFACTURE OF THE PRODUCTS | |||||

| 14.1. |

For the MANUFACTURING TERM, Pharmacare Limited, an Affiliate of ASPEN, shall MANUFACTURE and PACKAGE the PRODUCTS (other than, initially, the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or SRC PRODUCT) for COMMERCIALIZATION (1) by IROKO in those countries (other than the Territory), where it holds rights to COMMERCIALIZE the PRODUCTS and (2) by ASPEN in the TERRITORY, all in accordance with the WORLDWIDE MANUFACTURING AND SUPPLY AGREEMENT and the provisions of Appendix J. | |||||

| 14.2. |

The PARTIES undertake, in the utmost good faith, to do all things necessary to ensure that after the expiry of the MANUFACTURING TERM, there is a continuous supply of the PRODUCTS for the purposes of their COMMERCIALISATION in the TERRITORY and, to this end, they shall be obliged to appoint a third party manufacturer to MANUFACTURE and PACKAGE and supply the requisite quantity and quality of the PRODUCTS. | |||||

| 14.3. |

IROKO will use its best endeavours to procure that all documents, data or information which ASPEN, acting reasonably, requires to MANUFACTURE and PACK the PRODUCTS is provided to it as soon as is practically possible and no more than 30 (thirty) days after the SIGNATURE DATE. | |||||

| 14.4. |

Notwithstanding any other provision of this Agreement, the PARTIES may, by written agreement, procure the MANUFACTURE of the PRODUCTS by ASPEN and/or its AFFILIATES and the PACKING of the PRODUCTS by a third party in circumstances where it will be to the PARTIES’ mutual best interests to do so. | |||||

| 15. |

SUPPLY AND MANUFACTURE OF THE SUPPOSITORIES, ALDOMET® (METHYLDOPA) 125MG TABLETS AND SRC PRODUCT | |||||

| 15.1. |

Subject to clause 15.2, until such time as the BOARD elects for ASPEN to MANUFACTURE and PACK (or procure that one or more of ASPEN’S AFFILIATES MANUFACTURES and PACKS) the SUPPOSITORIES and/or SRC PRODUCT, and ASPEN accepts such appointment, the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or SRC PRODUCT shall be MANUFACTURED and PACKED by a third party (“the third party manufacturer”) appointed by IROKO. The PARTIES shall procure that the said third party manufacturer supplies the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or SRC PRODUCT directly to ASPEN, its AFFILIATES and/or the THIRD PARTY SUB-LICENSEE/S on terms and conditions acceptable to ASPEN, acting reasonably. ASPEN shall pay the third party manufacturer directly for the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or SRC PRODUCT. | |||||

| 15.2. |

In the event of ASPEN being in a position to procure an alternative supply of the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or SRC PRODUCT, which comply with the APPLICABLE LAWS, more cost effectively than those being supplied by the third party manufacturer, from time to time, then ASPEN shall have the right to source the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or SRC PRODUCT from the alternative supplier and IROKO shall render to ASPEN all necessary and reasonable support and assistance in this regard. | |||||

Page 16

| 16. |

ASPEN WARRANTIES | |||||

| 16.1. |

ASPEN hereby warrants that – | |||||

| 16.1.1. |

during the BULK SUPPLY TERM, where it PACKS the PRODUCTS, it will do so strictly in accordance with – | |||||

| 16.1.1.1. |

the SPECIFICATIONS (insofar as they relate to PACKAGING); | |||||

| 16.1.1.2. |

APPLICABLE LAWS; | |||||

| 16.1.1.3. |

the requirements of the MARKETING AUTHORISATIONS; and | |||||

| 16.1.1.4. |

Good Manufacturing Practice; | |||||

| 16.1.2. |

subject to the provisions of clause 14.4, during the MANUFACTURING TERM, it will MANUFACTURE and PACK the PRODUCTS (other than the SUPPOSITORIES, ALDOMET® (METHYLDOPA) TABLETS 125MG and/or the SRC PRODUCT) strictly in accordance with – | |||||

| 16.1.2.1. |

their SPECIFICATIONS; | |||||

| 16.1.2.2. |

APPLICABLE LAWS; | |||||

| 16.1.2.3. |

the requirements of the MARKETING AUTHORISATIONS; and | |||||

| 16.1.2.4. |

Good Manufacturing Practice; | |||||

| 16.1.3. |

the execution, delivery and performance by ASPEN of this AGREEMENT and the consummation of the transactions contemplated herein are within ASPEN’S corporate powers. Subject to the fulfilment of the CONDITIONS, this AGREEMENT is a legal, valid and binding obligation of ASPEN, enforceable against ASPEN in accordance with its terms; and | |||||

| 16.1.4. |

it owns 100% (ONE HUNDRED PERCENT) of the capital stock/share capital of Pharmacare Limited. | |||||

| 16.2. |

Notwithstanding the aforesaid, ASPEN makes no representations or warranties (whether express or implied), other than those set out in clause 16.1, and WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, ASPEN MAKES NO REPRESENTATION OR WARRANTIES, WHETHER EXPRESS OR IMPLIED, OF MERCHANTABILITY, FITNESS OF THE PRODUCTS FOR A PARTICULAR PURPOSE, NON-INFRINGEMENT OF THIRD PARTY INTELLECTUAL PROPERTY RIGHTS, OR REGARDING THE SCOPE, VALIDITY OR ENFORCEABILITY OF THE MARKETING AUTHORISATIONS, IROKO DATA, TRADEMARKS OR ANY OTHER INTELLECTUAL PROPERTY RELATING TO THE PRODUCTS WHICH ARE TO BE USED TO MANUFACTURE AND/OR COMMERCIALISE THE PRODUCTS IN THE TERRITORY. | |||||

| 17. |

IROKO WARRANTIES AND UNDERTAKINGS | |||||

| 17.1. |

IROKO warrants to ASPEN that: | |||||

| 17.1.1. |

the execution, delivery and performance by IROKO of this AGREEMENT and the consummation of the transactions contemplated herein are within IROKO’S corporate powers and have been authorised by all necessary corporate action on the part of IROKO. This AGREEMENT is a legal, valid and binding obligation of IROKO, enforceable against IROKO in accordance with its terms; | |||||

Page 17

| 17.1.2. | to its knowledge, the IROKO DATA will be sufficient, without the necessity of ASPEN undertaking further work thereon, to transfer all MANUFACTURING, PACKING and MARKETING AUTHORISATIONS in the TERRITORY from MERCK to ASPEN, its AFFILIATES and/or the THIRD PARTY SUB-LICENSEE/S; | |||

| 17.1.3. | the grant of the rights to ASPEN pursuant to this AGREEMENT will not infringe the rights of any third party; | |||

| 17.1.4. | IROKO has the right, free and clear of any liens, encumbrances or claims by third parties to use the IROKO DATA and to sub-license the same to ASPEN on the terms and subject to the conditions set out in this AGREEMENT; and | |||

| 17.1.5. | neither ASPEN or its AFFILIATES shall incur any liability, loss, damages or other claim of whatever nature or description flowing from and arising out of the MANUFACTURE, PACKING and/or COMMERCIALISATION of the PRODUCTS in the TERRITORY, insofar as such MANUFACTURE, PACKING and/or COMMERCIALISATION took place prior to the EFFECTIVE DATE, and without limiting the generality of the aforegoing, any liability, loss, damages or other claims, of whatever nature, in relation to product liability claims, product recalls, product returns and/or customer complaints. | |||

| 17.2. | IROKO undertakes to ASPEN that – | |||

| 17.2.1. | it will procure timely and full compliance with all of the obligations arising out of or flowing from all or any agreements concluded between IROKO LLC and MERCK (“the IROKO/MERCK Agreement”) relevant to the subject matter of this AGREEMENT; | |||

| 17.2.2. | it shall, at its cost and expense, use its best commercial endeavours to do all things necessary to procure that MERCK fully complies with all of MERCK’s obligations arising out of or flowing from the IROKO/MERCK Agreement and that, against request, it shall appraise (or procure that ASPEN be so approved), ASPEN, in writing (or procure that ASPEN be so appraised), of MERCK’s said compliance or lack thereof (as the case may be). | |||

| 17.3. | IROKO hereby represents to ASPEN (which representation ASPEN hereby relies upon) that during the MERCK DISTRIBUTION TERM, MERCK has an obligation to supply the PRODUCTS in bulk to IROKO LLC. | |||

| 18. | INDEMNITIES | |||

| 18.1. | IROKO shall indemnify and hold ASPEN harmless from and against all liability, damages, losses and/or expenses (including, without any limitation, reasonable attorney’s fees and expenses) of any nature whatsoever and howsoever arising suffered, incurred and/or paid by ASPEN arising out of any negligent acts or omission by IROKO or a breach by IROKO of the provisions of this AGREEMENT, including without limiting the generality of the aforegoing, a breach by IROKO of its warranties given under this AGREEMENT. | |||

| 18.2. | ASPEN shall indemnify and hold IROKO harmless from and against all liability, damages, losses and/or expenses (including, without any limitation, attorney and own client costs) of any nature whatsoever and howsoever arising suffered, incurred and/or paid by IROKO arising out of any negligent acts or omission by ASPEN or a breach by ASPEN of the provisions of this AGREEMENT, including without limiting the generality of the foregoing, a breach by ASPEN of its warranties given under this AGREEMENT. | |||

Page 18

| 18.3. | ASPEN agrees to give notice to IROKO of the assertion of any claim, or commencement of any suit, action or proceeding in respect of which indemnity may be sought under 18.1 promptly after receipt of notice from a third party of the assertion of such claim or the commencement of such suit, action or proceeding. In the event indemnification is sought by ASPEN, notice shall be given as soon as reasonably possible but within five business days after it becomes aware of any legal action being instituted indicating in such notice at least the nature of the event, action or state of facts for which indemnification is sought. IROKO shall be entitled at its own cost to participate in or, to the extent that it shall wish to do so, to assume and control the defence with its own counsel of any such claim, suit, action or proceeding . If ASPEN elects to participate in such defence, it shall be liable for its own legal costs and other expenses subsequently and reasonably incurred by ASPEN in connection with such defence in the event that ASPEN determines that representation of both parties by the same counsel would be inappropriate due to an actual or potential conflict of interest between them. Whether or not IROKO elects to assume the defence of any claim, suit, action or proceeding, it shall not be liable for any compromises or settlement of any such claim, suit, action or proceeding effected without its consent, which consent shall not unreasonably be withheld. The parties agree to co-operate to the fullest extent possible in connection with any third party claim, suit, action or proceeding for which indemnification is or may be sought under this agreement. | |

| IROKO agrees to give notice to ASPEN of the assertion of any claim, or commencement of any suit, action or proceeding in respect of which indemnity may be sought under 18.2 promptly after receipt of notice from a third party of the assertion of such claim or the commencement of such suit, action or proceeding. In the event indemnification is sought by IROKO, notice shall be given as soon as reasonably possible but within five business days after it becomes aware of any legal action being instituted indicating in such notice at least the nature of the event, action or state of facts for which indemnification is sought. ASPEN shall be entitled at its own cost to participate in or, to the extent that it shall wish to do so, to assume and control the defence with its own counsel of any such claim, suit, action or proceeding. If IROKO elects to participate in such defence, it shall be liable for its own legal costs and other expenses subsequently and reasonably incurred by IROKO in connection with such defence in the event that IROKO determines that representation of both parties by the same counsel would be inappropriate due to an actual or potential conflict of interest between them. Whether or not ASPEN elects to assume the defence of any claim, suit, action or proceeding, it shall not be liable for any compromises or settlement of any such claim, suit, action or proceeding effected without its consent, which consent shall not unreasonably be withheld or delayed. The parties agree to co-operate to the fullest extent possible in connection with any third party claim, suit, action or proceeding for which indemnification is or may be sought under this Agreement. | ||

| 18.4. | ASPEN agrees to indemnify and hold harmless IROKO against all product liability claims arising out of a breach by ASPEN of its warranties in clause 16 or a breach of the provisions of this Agreement by ASPEN, and IROKO agrees to indemnify and hold harmless ASPEN against all product liability claims arising out of a breach by IROKO of its warranties in clause 17 or a breach of the provisions of this Agreement by IROKO. Both the indemnity by ASPEN and the counter indemnity by IROKO given under this clause 18.4 are given, mutatis mutandis, on the same basis as set out in clause 18.3. Without limiting the ordinary meaning of the words “product liability” such words include the liability imposed on the seller, manufacturer or supplier of a product for physical damage, injury or harm (whether consequential or otherwise) caused to a consumer, user or any other person affected by a defect in the product. | |

Page 19

| 18.5. | In the event that IROKO makes any payment pursuant to its indemnification obligations under this agreement, all rights of ASPEN to pursue any claim to receive payment or other consideration from any other third party which may be liable with respect to such claim, suit, action or proceeding for which indemnification was provided, shall be deemed to have been unconditionally and irrevocably ceded to IROKO. ASPEN shall execute and deliver such instruments and agreements and take such other action as may be required to effect such cession to IROKO. This clause 18.5 shall apply mutatis mutandis with regard to the indemnity by ASPEN pursuant to clause 18.4. | |||

| 18.6. | Neither party (“offending party”) shall under any circumstances whatsoever (even if advised of a possibility of such damages) be liable for any indirect, special or consequential loss or damage sustained by the other party howsoever caused, including whether or not caused by the negligence of the offending party, its agents or employees or arising out of contract, delict, negligence, strict liability or otherwise, but excluding, however, any loss or damage arising out of fraud or wilful misconduct of the offending party. | |||

| 19. | SAFETY AGREEMENT AND BUSINESS CONTINUITY PLAN | |||

| 19.1. | The PARTIES have negotiated and agreed a Safety Agreement which is annexed hereto, marked Appendix J. The Safety Agreement includes, inter alia, procedures for the receipt, investigation, recordal, communication and exchange between the PARTIES of ADVERSE EVENTS reports, pregnancy reports and any other information concerning the safety of the PRODUCTS. The Safety Agreement is in accordance with and allows the PARTIES to fulfil their obligations pursuant to the APPLICABLE LAWS. The Safety Agreement is a part of this AGREEMENT and shall be signed by the PARTIES contemporaneously with the signature of this AGREEMENT. | |||

| 19.2. | ASPEN shall, within 30 (THIRTY) days of the EFFECTIVE DATE, provide IROKO with its business continuity plan, which plan shall be reasonably satisfactory to IROKO. If not so satisfactory, ASPEN and IROKO shall, with the utmost dispatch and good faith, negotiate a plan that shall substantially meet IROKO’S reasonable objections. | |||

| 20. | ETHICAL STANDARDS AND HUMAN RIGHTS OF IROKO | |||

| 20.1. | Unless otherwise required or prohibited by the APPLICABLE LAWS, IROKO warrants to ASPEN that, to the best of its knowledge, in relation to the performance of its obligations in terms of this AGREEMENT – | |||

| 20.1.1. | it does not employ engage or otherwise use any child labour in circumstances such that the tasks performed by any such child labour could reasonably be foreseen to cause either physical or emotional impairment to the development of such child; | |||

| 20.1.2. | it does not use forced labour in any form (prison, indentured, bonded or otherwise) and its employees are not required to lodge papers or deposits on starting work; | |||

| 20.1.3. | it provides a safe and healthy workplace, presenting no immediate hazards to its employees. Any housing provided by IROKO to its employees is safe for habitation. IROKO provides access to clean water, food, and emergency healthcare to its employees in the event of accidents or incidents at the IROKO’S workplace; | |||

| 20.1.4. | it does not discriminate against any employees on any ground (including race, religion, disability or gender); | |||

Page 20

| 20.1.5. |

it does not engage in or support the use of corporal punishment, mental, physical, sexual or verbal abuse and does not use cruel or abusive disciplinary practices in the workplace; | |||

| 20.1.6. |

it pays each employee at least the minimum wage, or a fair representation of the prevailing industry wage, (whichever is the higher) and provides each employee with all legally mandated benefits; | |||

| 20.1.7. |

it complies with the laws on working hours and employment rights in the countries in which it operates; | |||

| 20.1.8. |

it is respectful of its employees right to join and form independent trade unions and freedom of association. | |||

| 20.2. |

IROKO shall ensure that it has ethical and human rights policies and an appropriate complaints procedure to deal with any breaches of such policies. In the case of any complaints, IROKO shall report the alleged complaint and proposed remedy to ASPEN. | |||

| 21. |

ETHICAL STANDARDS AND HUMAN RIGHTS OF ASPEN | |||

| 21.1. |

Unless otherwise required or prohibited by the APPLICABLE LAWS, ASPEN warrants to IROKO that, to the best of its knowledge, in relation to the performance of its obligations in terms of this AGREEMENT – | |||

| 21.1.1. |

it does not employ engage or otherwise use any child labour in circumstances such that the tasks performed by any such child labour could reasonably be foreseen to cause either physical or emotional impairment to the development of such child; | |||

| 21.1.2. |

it does not use forced labour in any form (prison, indentured, bonded or otherwise) and its employees are not required to lodge papers or deposits on starting work; | |||

| 21.1.3. |

it provides a safe and healthy workplace, presenting no immediate hazards to its employees. Any housing provided by ASPEN to its employees is safe for habitation. ASPEN provides access to clean water, food, and emergency healthcare to its employees in the event of accidents or incidents at the ASPEN’S workplace; | |||

| 21.1.4. |

it does not discriminate against any employees on any ground (including race, religion, disability or gender); | |||

| 21.1.5. |

it does not engage in or support the use of corporal punishment, mental, physical, sexual or verbal abuse and does not use cruel or abusive disciplinary practices in the workplace; | |||

| 21.1.6. |

it pays each employee at least the minimum wage, or a fair representation of the prevailing industry wage, (whichever is the higher) and provides each employee with all legally mandated benefits; | |||

| 21.1.7. |

it complies with the laws on working hours and employment rights in the countries in which it operates; | |||

| 21.1.8. |

it is respectful of its employees right to join and form independent trade unions and freedom of association. | |||

Page 21

| 21.2. |

ASPEN shall ensure that it has ethical and human rights policies and an appropriate complaints procedure to deal with any breaches of such policies. In the case of any complaints, ASPEN shall report the alleged complaint and proposed remedy to IROKO. | |||

| 22. | CONFIDENTIALITY | |||

| 22.1. | For the purposes of this clause 22, each PARTY is sometimes referred to as a “Disclosing Party” in its capacity as the party providing information to the other PARTY hereunder, and as a “Receiving Party” in its capacity as the PARTY receiving information from the other PARTY hereunder. | |||

| 22.2. | Subject to clauses 22.5 and 22.6 and save as required by any law or by any regulatory body to which a Receiving Party is subject, during the period of this AGREEMENT and for five years after termination of this AGREEMENT, the Receiving Party shall: - | |||

| 22.2.1. | keep the CONFIDENTIAL INFORMATION confidential and ensure that proper and secure storage is provided for all the CONFIDENTIAL INFORMATION; | |||

| 22.2.2. | not expressly or impliedly, directly or indirectly disclose or allow to be disclosed any of the CONFIDENTIAL INFORMATION to any other person other than with the prior written consent of the Disclosing Party or in accordance with clauses 22.3 and 22.4; and | |||

| 22.2.3. | not expressly or impliedly, directly or indirectly (and whether for its own benefit or the benefit of any other person) use and/or exploit or allow to be used and/or exploited any of the CONFIDENTIAL INFORMATION for any purpose other than the proper performance of its obligations under this AGREEMENT or any other written agreement in connection with the business between the PARTIES. | |||

| 22.3. | During the term of this AGREEMENT, the Receiving Party may disclose the CONFIDENTIAL INFORMATION to its or its AFFILIATES’ employees and/or professional advisers to the extent that it is necessary for the purpose of this AGREEMENT or any other AGREEMENT current from time to time in connection with the business between the PARTIES (“the Recipient”). | |||

| 22.4. | The Receiving Party shall procure that each Recipient is made aware of and complies with all the Receiving Party’s obligations of confidentiality under this AGREEMENT as if the Recipient was a party to this AGREEMENT. The Receiving Party shall be responsible for the compliance or non compliance of the Recipient with the obligations of confidentiality under this AGREEMENT. | |||

| 22.5. | The obligations contained in clauses 22.2 to 22.4 shall not apply to any CONFIDENTIAL INFORMATION which:- | |||

| 22.5.1. | as at the EFFECTIVE DATE is, or at any time after the EFFECTIVE DATE, comes into the public domain other than through any unlawful act or omission or any breach of this AGREEMENT or any other confidence by the Receiving Party or any Recipient; | |||

| 22.5.2. | can be proved by the Receiving Party to have been known (other than through any unlawful act or omission or any breach of this AGREEMENT or any other confidence by the Receiving Party or any Recipient) to the Receiving Party prior to it being disclosed by the Disclosing Party to the Receiving Party; | |||

Page 22

| 22.5.3. |

subsequently comes lawfully into possession of the Receiving Party from a third party; or | |||

| 22.5.4. |

can be proved by the Receiving Party to have been developed independently by the Receiving Party other than from information disclosed by the Disclosing Party or disclosed in breach of any of the obligations contained in clauses 22.2 to 22.4 or of any other confidence or pursuant to any unlawful act or omission . | |||

| 22.6. |

Upon termination of this AGREEMENT, each party shall, at the other PARTY’S direction, either return or destroy all of the other PARTY’S CONFIDENTIAL INFORMATION which it has in its possession or under its control. | |||

| 22.7. |

In addition to that information set out in clauses 22.5.1, 22.5.2, 22.5.3 and 22.5.4, ASPEN shall have the right (subject only to the limitations of the APPLICABLE LAWS) to disclose CONFIDENTIAL INFORMATION relevant to the PRODUCTS and/or the COMMERCIALISATION thereof to medical insurers, medical practitioners and/or other distributors of the PRODUCTS in the TERRITORY, on a need to know basis and to the extent required, provided, however, that the recipient of such CONFIDENTIAL INFORMATION shall agree, in writing, to be subject to confidentiality obligations no less stringent than those set forth herein. | |||

| 23. |

BOARD OF MANAGERS | |||

| 23.1. |

Composition: | |||

| In order to oversee the COMMERCIALISATION of the PRODUCTS in the TERRITORY, the PARTIES shall, promptly following the EFFECTIVE DATE (but no later than 10 (TEN) days thereafter), set up the BOARD. Each of IROKO and ASPEN shall appoint the Co-chairs of the BOARD (each, a “CO-CHAIR”). In the case of IROKO, the CO-CHAIR shall be the [Vice President of Commercial Affairs] (or his/her successor-in-title) or an officer senior to that individual and, in the case of ASPEN, the CO-CHAIR shall be the Commercial Executive: International Operations (or his/her successor-in-title) or an officer senior to that individual. Thereafter, following consultations between the two CO-CHAIRS regarding the proposed composition of the BOARD, including the number of individuals who shall sit on the BOARD and the areas of expertise to be represented on the BOARD, each CO-CHAIR shall appoint an equal number of BOARD members. Each PARTY shall have the right, from time to time, after consultation with the other PARTY, to remove any individual appointed by it to the BOARD, including a CO-CHAIR, and to appoint new BOARD member(s) to replace those who shall have been removed by it or who shall have resigned. The number of members of the BOARD may be enlarged or reduced from time to time by mutual decision of the CO-CHAIRS, so long as each PARTY shall retain the same number of members on the BOARD. The BOARD may appoint committees from among its members, which committees may be assisted by persons from outside the BOARD. The committees shall report to the BOARD. | ||||

| 23.2. |

Role of Board: | |||

| The BOARD shall be responsible for overseeing the COMMERCIALISATION of the PRODUCTS in the TERRITORY. To that effect, it shall adopt, annually, no less than 60 days prior to the beginning of each calendar year, a strategic plan (“PLAN”) intended to optimize sales of PRODUCTS in the TERRITORY. ASPEN shall have sole responsibility for carrying out such PLAN and for regularly reporting on its execution to the BOARD, not less often than at each meeting of the BOARD. | ||||

Page 23

| The PLAN shall cover the following areas (each, an “AREA”): regulatory matters, supply chain, quality assurance, sales and marketing (including without limiting the generality of the aforegoing which of ASPEN, its AFFILIATES or the THIRD PARTY SUB-LICENSEES will COMMERCIALISE the PRODUCTS in which part/s of the TERRITORY), product development and finances and shall include the BUDGET for the upcoming calendar year. | ||