AUTOMATIC REINSURANCE AGREEMENT

Exhibit 10.6

AUTOMATIC REINSURANCE AGREEMENT

NUMBER : 2509-09AY10

between

AMERICAN LIFE AND SECURITY CORPORATION

0000 0 Xxxxxx, Xxxxx 000

Xxxxxxx, Xxxxxxxx 00000

(The Ceding Company)

and

OPTIMUM RE INSURANCE COMPANY

0000 Xxxxx Xxxx Xxxxx, Xxxxx 000

Xxxxxx, XX 00000

(The Reinsurer)

Respecting policies described in SCHEDULE B, issued by AMERICAN LIFE AND SECURITY CORPORATION and reinsured on an Automatic and Facultative YRT basis from August 1, 2009.

|

ARTICLE 1 |

: |

||

|

|

|

|

|

|

|

|

1.1. |

Automatic Reinsurance |

|

|

|

1.2. |

Facultative Reinsurance |

|

|

|

1.3. |

Currency |

|

|

|

1.4. |

Capacity of Agreement |

|

|

|

|

|

|

ARTICLE 2 |

: |

||

|

|

|

| |

|

|

|

2.1. |

Automatic Reinsurance |

|

|

|

2.2. |

Facultative Application For Reinsurance |

|

|

|

|

|

|

ARTICLE 3 |

: |

||

|

|

|

| |

|

|

|

3.1. |

|

|

|

|

3.2. |

Facultative Reinsurance on Policies Otherwise Subject to Automatic Reinsurance |

|

|

|

3.3. |

All Other Facultative Reinsurance |

|

|

|

3.4. |

Liability Limitations |

|

|

|

|

|

|

ARTICLE 4 |

: |

||

|

|

|

| |

|

|

|

4.1. |

Face Amount Basis |

|

|

|

4.2. |

Net Amount at Risk Basis |

|

|

|

4.3. |

Supplementary Benefits |

|

|

|

4.4. |

Minimum Reinsured Risk Amount |

|

|

|

|

|

|

ARTICLE 5 |

: |

||

|

|

|

| |

|

|

|

5.1. |

Life Premiums |

|

|

|

5.2. |

Standard Risks |

|

|

|

5.3. |

Substandard Risks |

|

|

|

5.4. |

Term Riders |

|

|

|

|

|

|

ARTICLE 6 |

: |

||

|

|

|

| |

|

|

|

6.1. |

Allowances |

|

|

|

6.2. |

Premium Taxes |

|

|

|

|

|

|

ARTICLE 7 |

: |

||

|

|

|

| |

|

|

|

7.1. |

THE COMPANY’S Forms, Rates and Procedures |

|

|

|

7.2. |

Inspection of Records |

|

|

|

7.3. |

Errors and Omissions |

|

|

|

7.4. |

Reserves |

|

|

|

7.5. |

Reporting |

|

|

|

7.6. |

Confidentiality |

|

Table of Contents (Continued) | |||

|

|

|

| |

|

ARTICLE 8 |

: |

||

|

|

|

| |

|

|

|

8.1. |

Reinsurance Premiums |

|

|

|

8.2. |

Billing |

|

|

|

8.3. |

Late Payment |

|

|

|

|

|

|

ARTICLE 9 |

: |

||

|

|

|

| |

|

|

|

9.1. |

Change Information |

|

|

|

9.2. |

Reductions |

|

|

|

9.3. |

Increases |

|

|

|

9.4. |

Reinstatements |

|

|

|

9.5. |

Conversions |

|

|

|

9.6. |

Underwriting Reassessment |

|

|

|

9.7. |

Terminations |

|

|

|

9.8. |

Policy Replacement |

|

|

|

9.9. |

Cash Values |

|

|

|

9.10. |

Policy Loans and Dividends |

|

|

|

9.11. |

Reduced Paid Up and Extended Term |

|

|

|

9.12. |

Recapture |

|

|

|

|

|

|

ARTICLE 10 |

: |

||

|

|

|

| |

|

|

|

10.1. |

Claims Liability |

|

|

|

10.2. |

Notice |

|

|

|

10.3. |

Authorization for Payment |

|

|

|

10.4. |

Adjusted Amounts |

|

|

|

10.5. |

Payment |

|

|

|

10.6. |

Contest |

|

|

|

10.7. |

Punitive Damages |

|

|

|

|

|

|

ARTICLE 11 |

: |

||

|

|

|

| |

|

|

|

11.1. |

Principle |

|

|

|

11.2. |

Arbitrators |

|

|

|

11.3. |

Matters in Dispute |

|

|

|

11.4. |

Procedures |

|

|

|

11.5. |

Decision |

|

|

|

11.6. |

Applicable Laws |

|

|

|

|

|

|

ARTICLE 12 |

: |

||

|

|

|

| |

|

|

|

12.1. |

Payment of Claims |

|

|

|

12.2. |

Notice to OPTIMUM RE |

|

|

|

12.3. |

Expenses |

|

|

|

12.4. |

Right to Offset |

|

|

|

|

|

|

ARTICLE 13 |

: |

DEFERRED ACQUISITION COST TAX | |

|

Table of Contents (Continued) | ||||

|

|

|

|

| |

|

ARTICLE 14 |

: |

|||

|

|

|

|

| |

|

|

|

14.1. |

Duration | |

|

|

|

14.2. |

Parties to the Agreement | |

|

|

|

14.3. |

Written Agreement | |

|

|

|

14.4. |

Change of Control/Assignment | |

|

|

|

14.5. |

Compliance | |

|

|

|

14.6. |

Signatures | |

|

|

|

|

| |

|

| ||||||

|

SCHEDULE A |

: |

RETENTION AND REINSURANCE LIMITS | ||||

|

|

|

| ||||

|

SCHEDULE B |

: |

PLANS REINSURED | ||||

|

|

|

| ||||

|

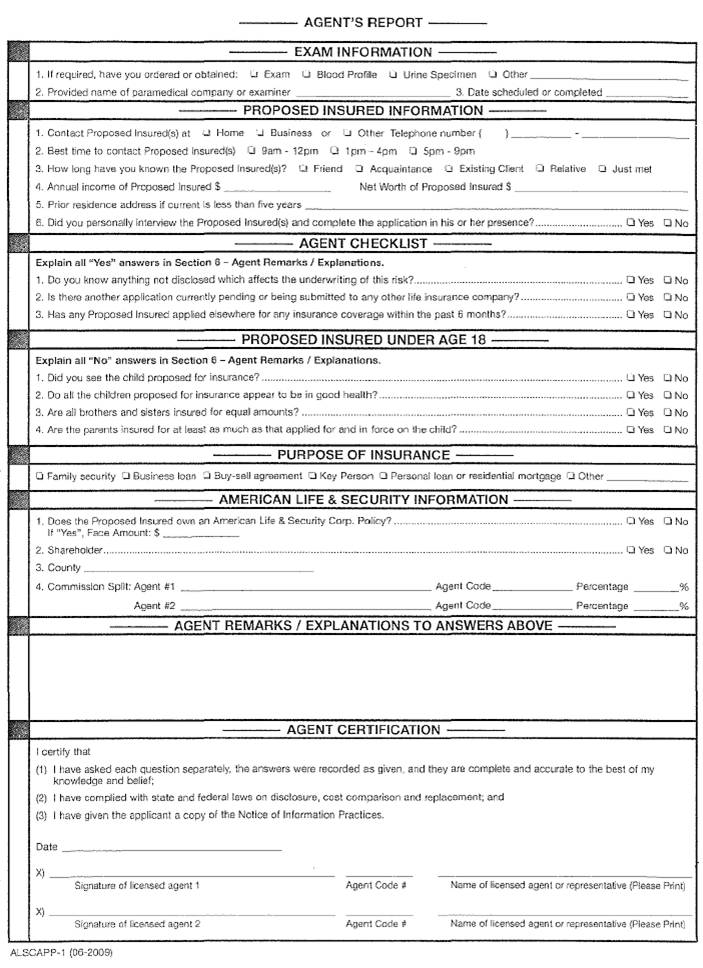

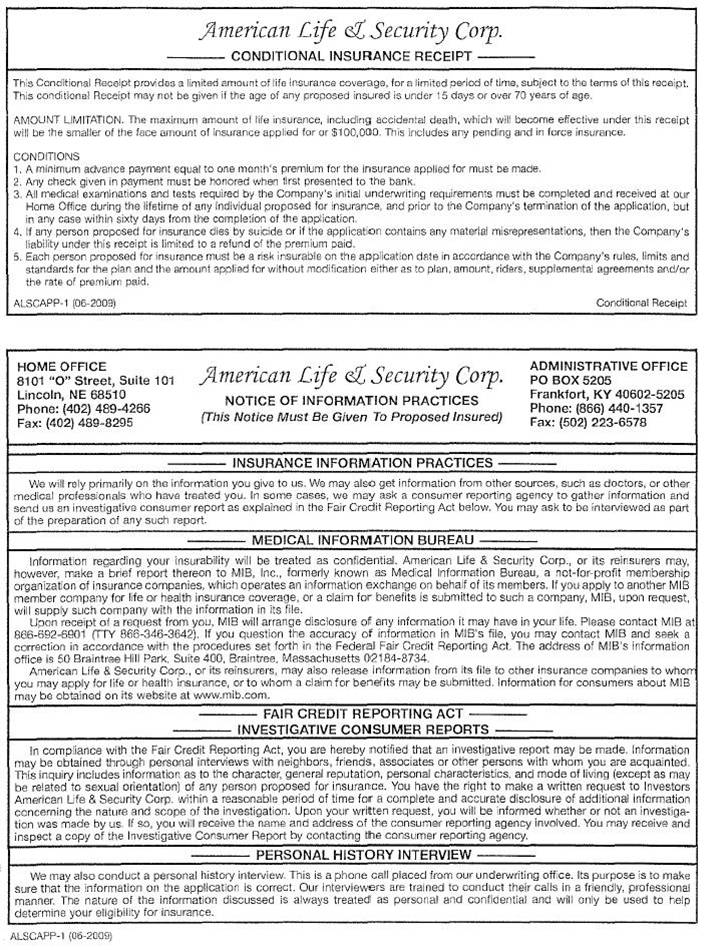

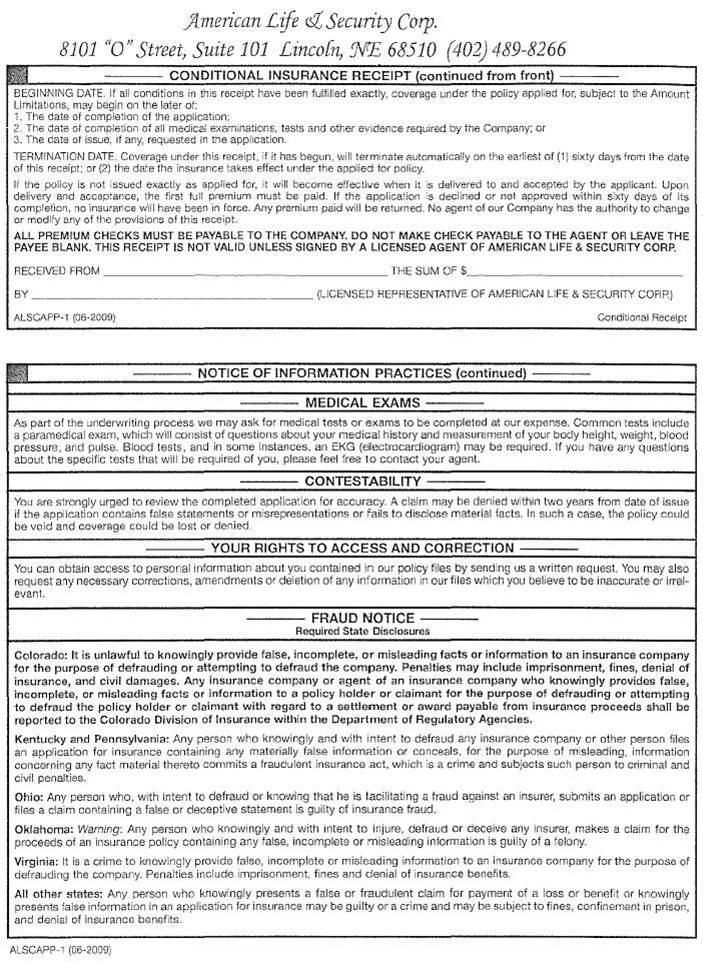

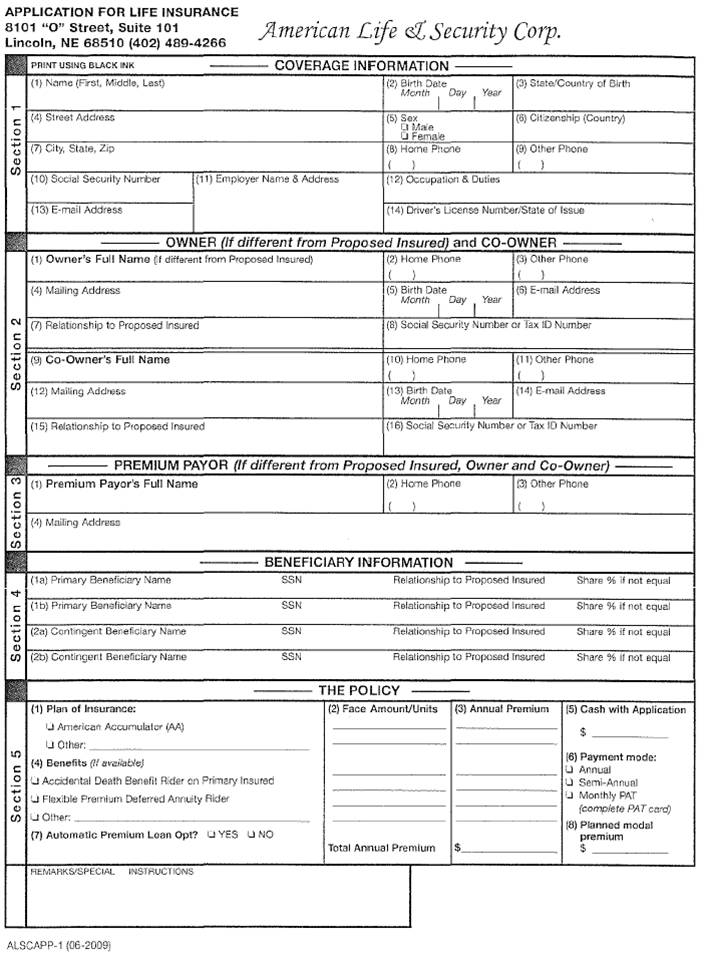

SCHEDULE C |

: |

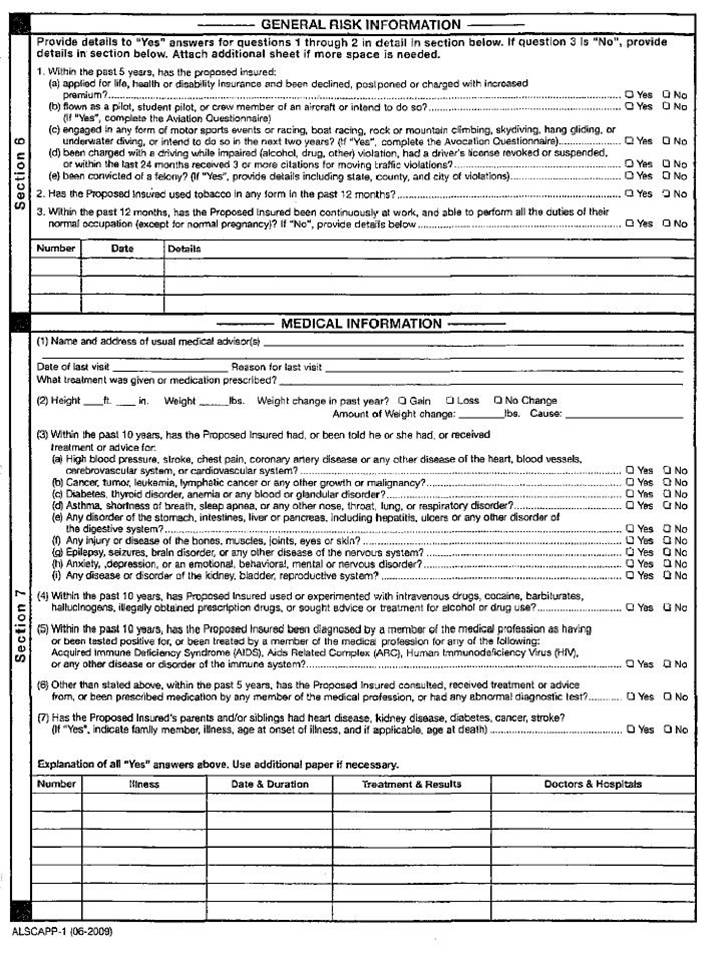

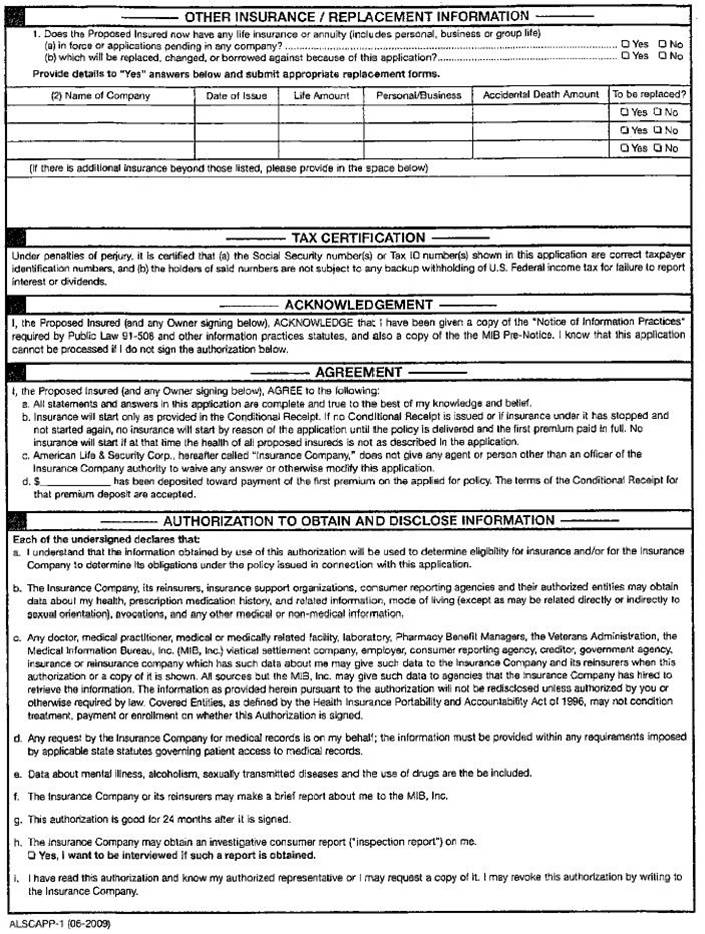

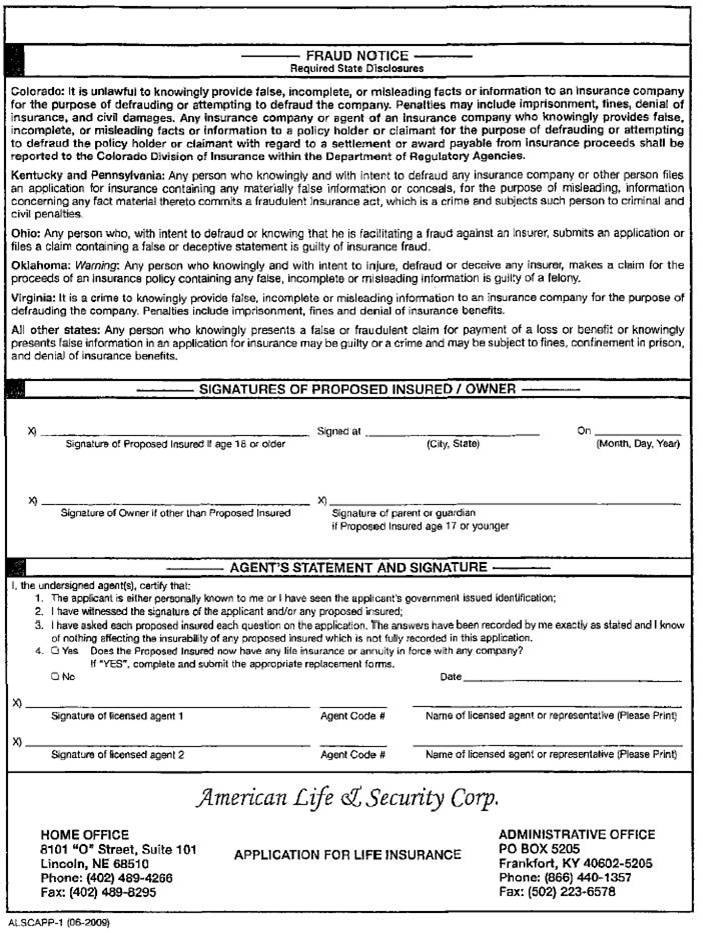

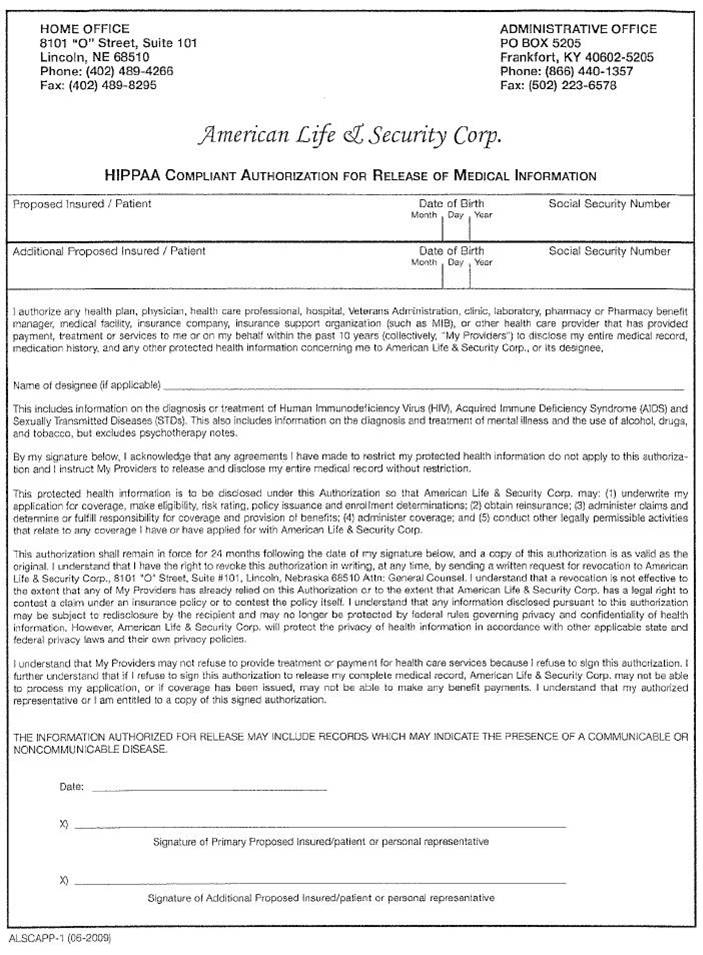

LIFE APPLICATION (FORM #ALSCAPP-1 (06-2009)) | ||||

|

|

|

| ||||

|

SCHEDULE D |

: |

AGE AND AMOUNT REQUIREMENTS | ||||

|

|

|

| ||||

|

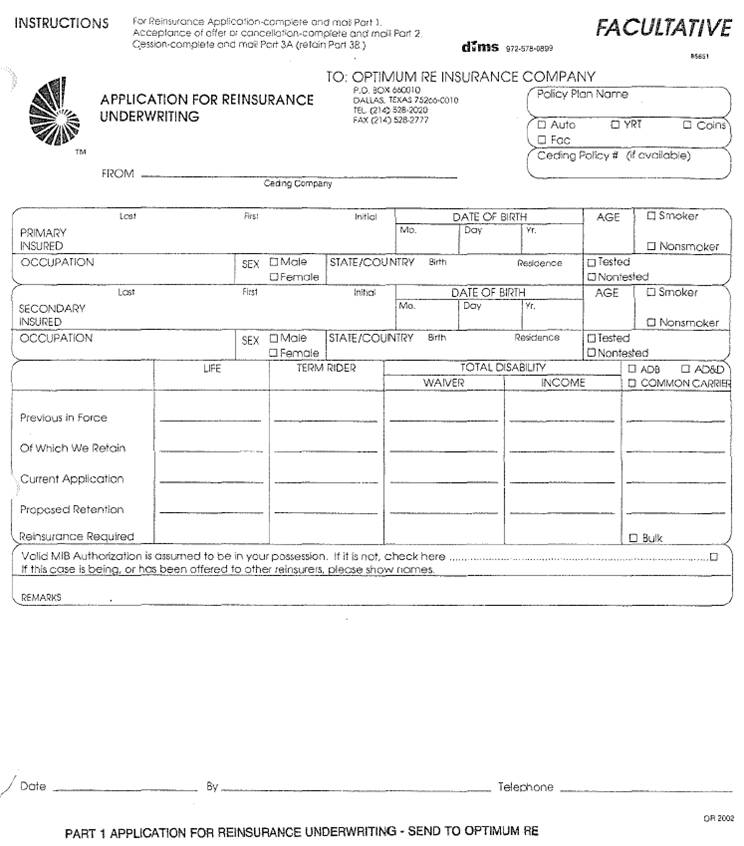

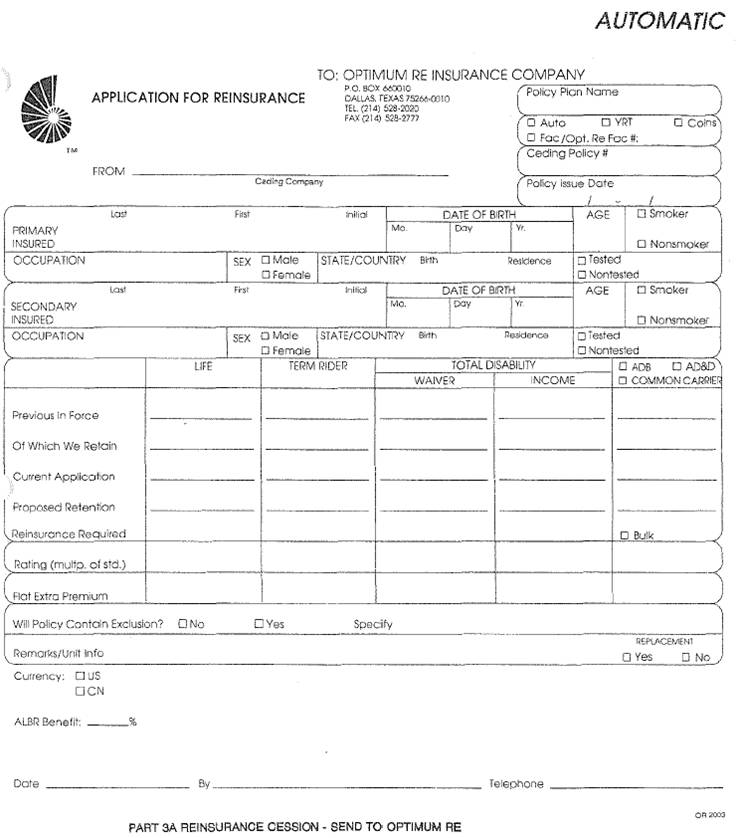

SCHEDULE E |

: |

PART |

1 |

- |

REINSURANCE APPLICATION | |

|

|

|

|

|

|

| |

|

|

|

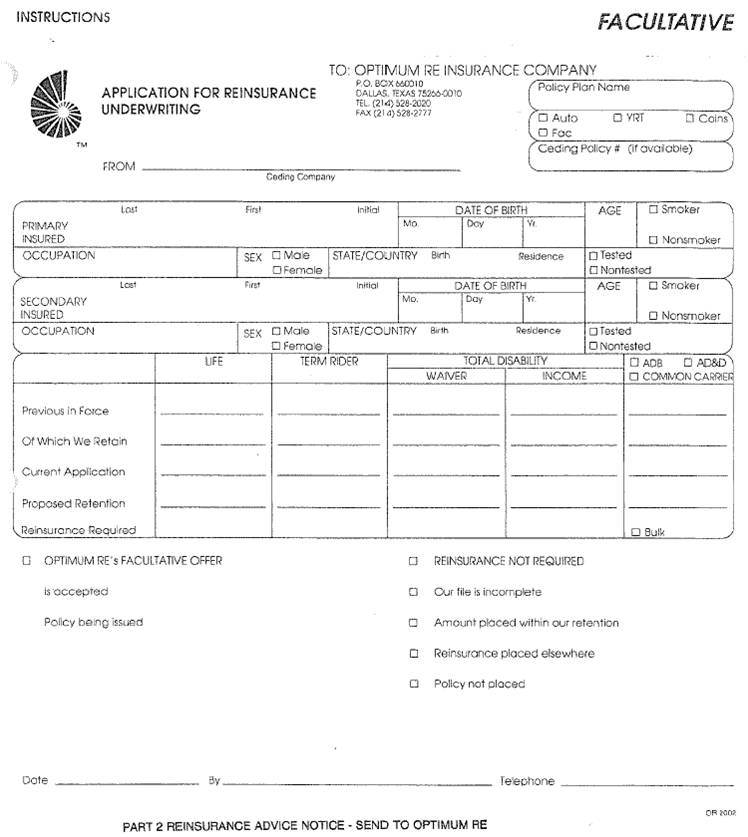

PART |

2 |

- |

REINSURANCE ADVICE NOTICE | |

|

|

|

|

|

|

| |

|

|

|

PART |

3 |

- |

REINSURANCE CESSION FORM | |

|

|

|

|

|

|

| |

|

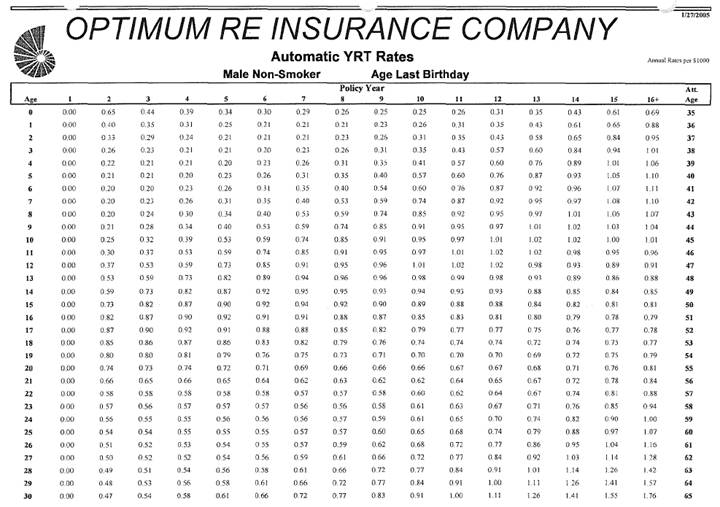

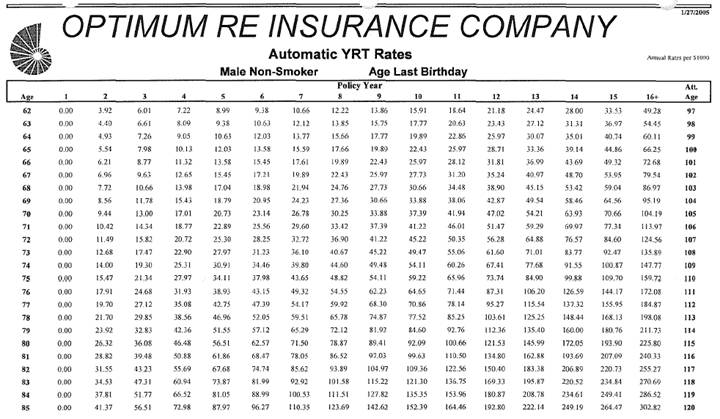

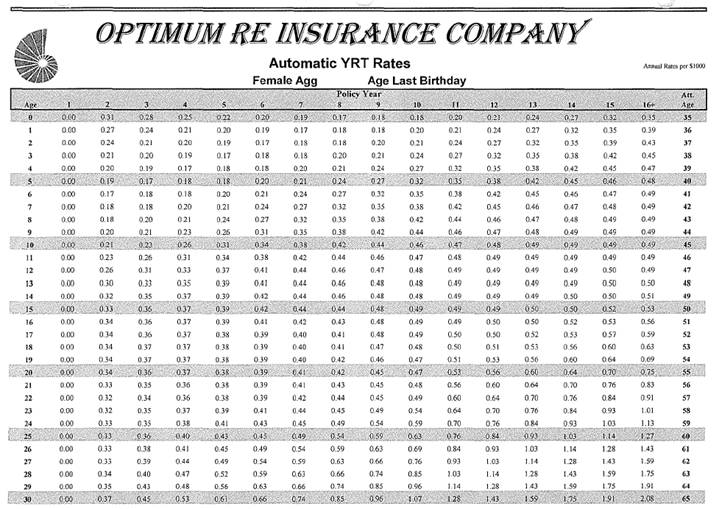

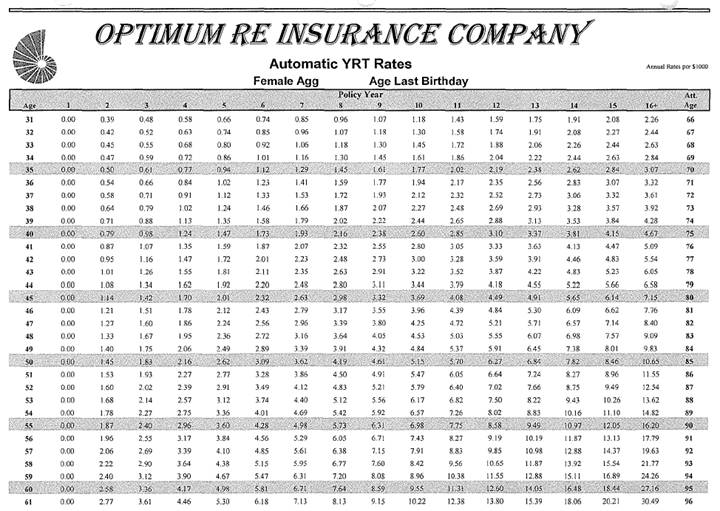

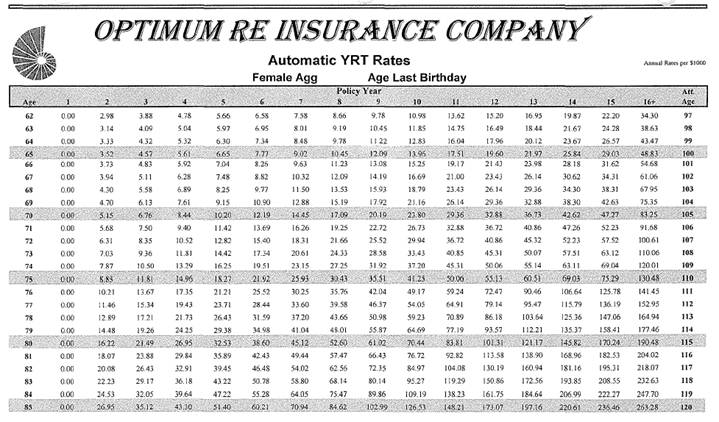

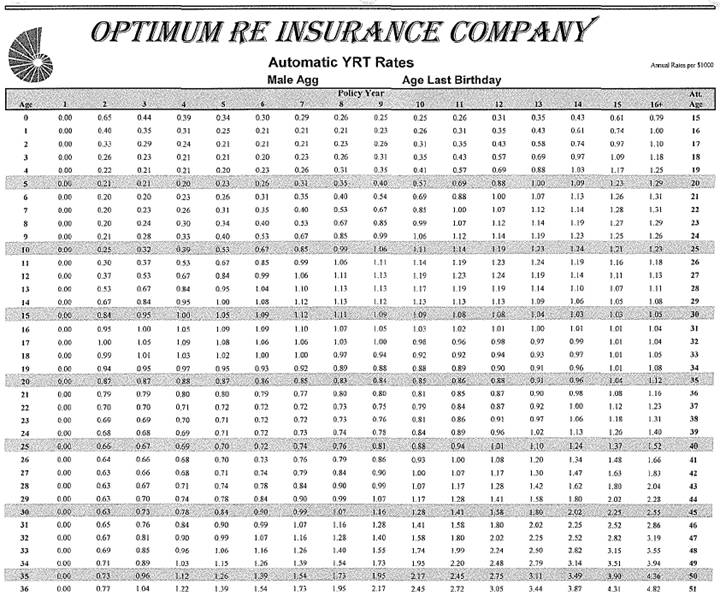

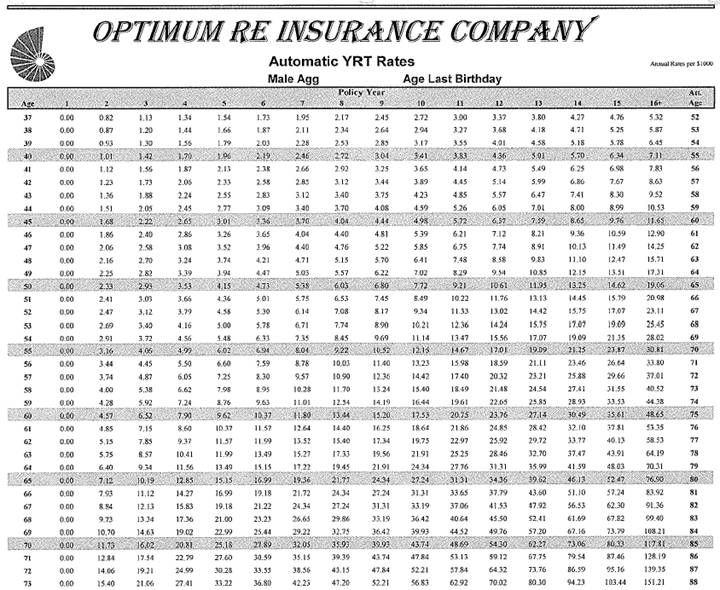

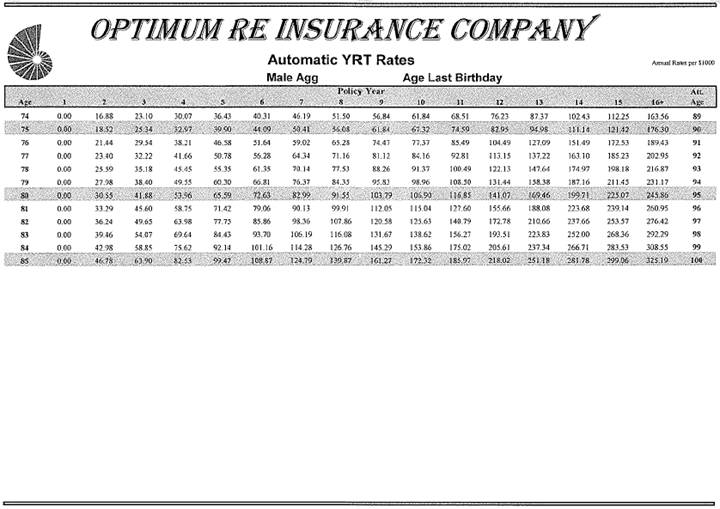

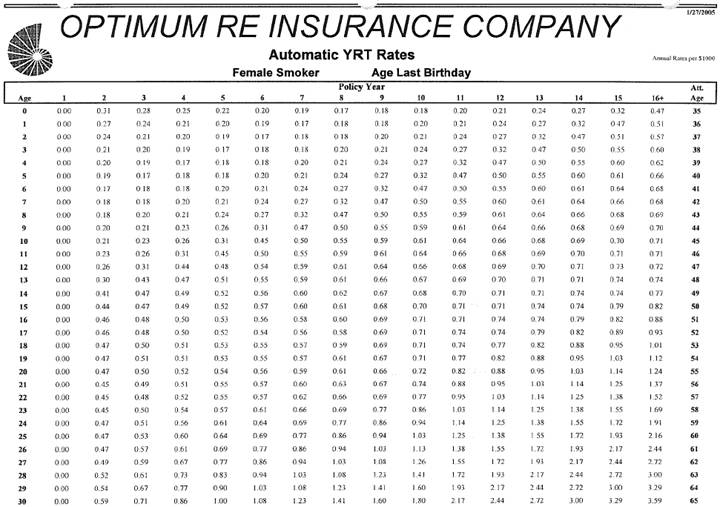

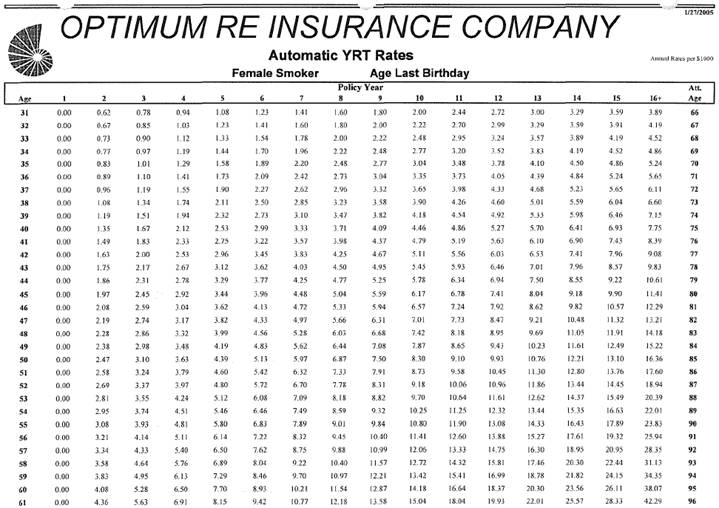

SCHEDULE F |

: |

YRT RATES | ||||

|

|

|

| ||||

|

|

|

PART |

1 |

- |

MALE NONSMOKER |

979.00 |

|

|

|

|

|

|

|

|

|

|

|

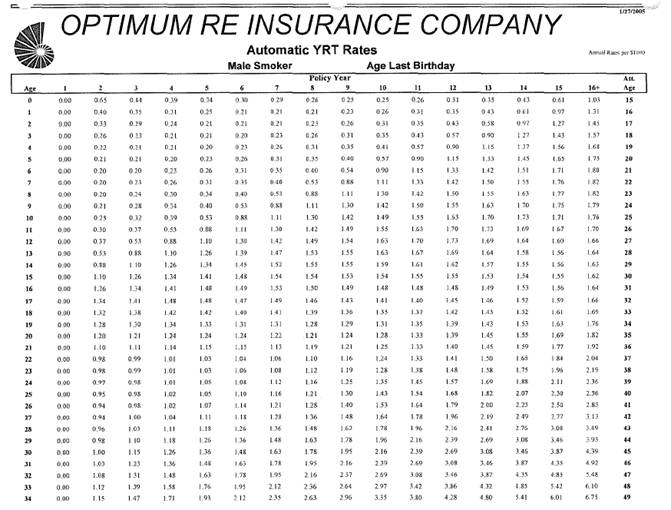

PART |

2 |

- |

MALE SMOKER |

980.00 |

|

|

|

|

|

|

|

|

|

|

|

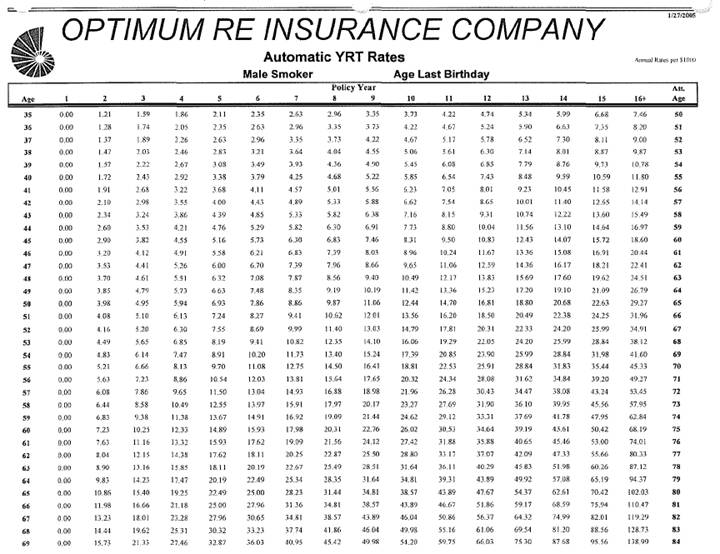

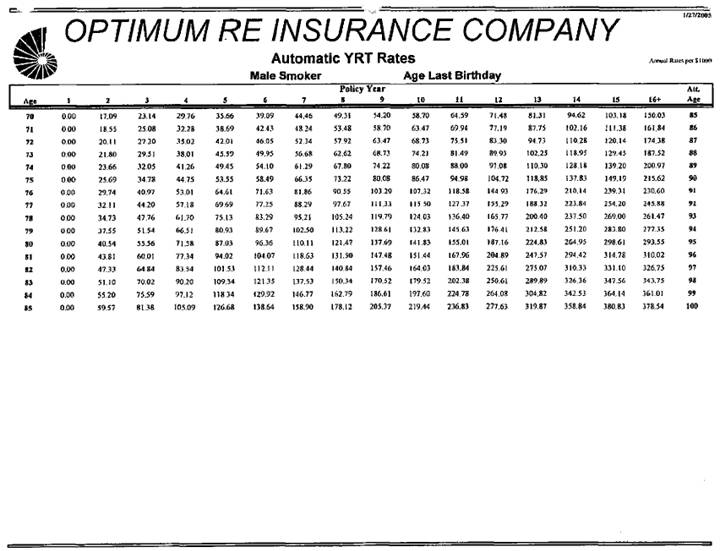

PART |

3 |

- |

FEMALE NONSMOKER |

981.00 |

|

|

|

|

|

|

|

|

|

|

|

PART |

4 |

- |

FEMALE SMOKER |

982.00 |

By this Agreement, AMERICAN LIFE AND SECURITY CORPORATION, a corporation organized under the laws of the State of Nebraska, hereinafter referred to as “THE COMPANY”, and OPTIMUM RE INSURANCE COMPANY, a corporation organized under the laws of the State of Texas, hereinafter referred to as “OPTIMUM RE”, mutually agree to reinsure on the following terms and conditions.

DEFINITION OF TERMS USED IN THIS AGREEMENT

|

Automatic Reinsurance |

Shall mean reinsurance which must be ceded by THE COMPANY in accordance with the terms of this Reinsurance Agreement, and must be accepted by OPTIMUM RE. |

|

|

|

|

Compensatory Damages |

Shall mean the amounts awarded to compensate for the actual damages sustained, and not awarded as a penalty, nor fixed in amount by statute. |

|

|

|

|

Facultative Reinsurance |

Shall mean reinsurance which THE COMPANY has the option to cede and OPTIMUM RE has the option to accept or decline. |

|

|

|

|

Insolvency |

Shall mean the legal incapacity of a company to operate as declared by a court of competent jurisdiction. |

|

|

|

|

Jumbo Risk |

A jumbo risk is one where: |

|

|

|

|

|

a.) the amount of Life insurance inforce, including any amounts to be replaced, as stated on the application or signed amendment, if any; |

|

PLUS |

|

|

|

b.) the new amount of Life insurance applied for in all companies; |

|

|

|

|

|

exceeds the jumbo Limit specified in Schedule A. |

|

| |

|

|

|

|

|

Amounts to be replaced cannot be deducted from the amount of Life insurance inforce. |

|

|

|

|

|

Amount of Life insurance is defined as the sum of the highest amounts of death benefit over the duration of each individual and group policy for this insured. |

|

|

|

|

Policy |

Shall mean the contract(s) of insurance issued by THE COMPANY in respect of which reinsurance is applied for and/or placed in whole or in part. |

DEFINITION OF TERMS USED IN THIS AGREEMENT (Continued)

|

Punitive Damages |

Shall mean the damages awarded as a penalty, the amount of which is not governed, nor fixed by statute. |

|

|

|

|

Reinsurance Cession |

Shall mean the insurance transferred to OPTIMUM RE by THE COMPANY on a policy. |

|

|

|

|

Reinsurance Cession Form |

Shall mean the document outlining the particulars of the Reinsurance Cession such as name, date of birth, date of policy, plan, amount of policy, risk class, and reinsurance premium amount. |

|

|

|

|

Statutory Penalties |

Shall mean the amounts which are awarded as a penalty, but fixed in amount by statute. |

ARTICLE 1 — REINSURANCE CEDED AND ACCEPTED

1. 1. Automatic Reinsurance

On policies or riders covering U.S. or Canadian residents on plan(s) indicated in SCHEDULE B, when THE COMPANY retains its maximum retention as outlined in SCHEDULE A, THE COMPANY will automatically cede to OPTIMUM RE all excess coverages on Life and OPTIMUM RE will automatically accept these cessions up to the automatic reinsurance limits specified in SCHEDULE A for the portion of the alphabet covered by OPTIMUM RE. Acceptance of policies over the automatic reinsurance limit are subject to Article 1.2.

The following risks are not eligible for automatic coverage:

|

A. |

A risk exceeding the automatic reinsurance limit, as specified in SCHEDULE A; |

|

|

|

|

B. |

A jumbo risk, as defined in the Definition of Terms; |

|

|

|

|

C. |

A risk where the complete underwriting evidence according to THE COMPANY’s published requirements, as specified in SCHEDULE D, has not been obtained; |

|

|

|

|

D. |

A risk where THE COMPANY’s normal underwriting standards were not applied; |

|

|

|

|

E. |

A policy not containing both a standard contestable period and a standard suicide exclusion; |

|

|

|

|

F. |

A risk where the substandard rating assessed by THE COMPANY exceeds Table 8 (300%), or its equivalent on any flat extra premium basis; |

|

|

|

|

G. |

A risk exceeding age 70; |

|

|

|

|

H. |

Any cession to be ceded to OPTIMUM RE at an effective date different from the original issue date of the policy; |

|

|

|

|

I. |

Conversion or replacement of policies where OPTIMUM RE is not the original reinsurer; |

|

|

|

|

J. |

A risk which has been currently or previously submitted to any reinsurer for underwriting assessment by THE COMPANY; |

|

|

|

|

K. |

A risk in which an MIB was not run on the application. |

1.2. Facultative Reinsurance

All cases not eligible for automatic coverage may be submitted to OPTIMUM RE facultatively.

1.3. Currency

Reinsurance will be in U.S. dollars. Any other currency requires specific agreement between THE COMPANY and OPTIMUM RE.

1.4. Capacity of Agreement

The maximum amount of reinsurance OPTIMUM RE will accept on a YRT basis under this Agreement is $4,000,000 per Life using the rates in SCHEDULE F.

This amount will be reduced by any amount already ceded to OPTIMUM RE under this or any other Agreement.

ARTICLE 2 - PROCEDURES TO EFFECT REINSURANCE

2.1. Automatic Reinsurance

When the initial premium on a policy eligible for automatic reinsurance has been received by THE COMPANY, THE COMPANY shall, without delay, complete and send a Reinsurance Cession Form (SCHEDULE E, PART 3) to OPTIMUM RE.

2.2. Facultative Application For Reinsurance

When facultative reinsurance is being applied for, THE COMPANY shall complete a Reinsurance Application Form provided by OPTIMUM RE (SCHEDULE E, PART 1) and send it along with any and all information it has on the risk; including specifically but not limited to, copies of the physicians’ statements, inspection reports, and other papers bearing on the insurability of the risk, even if this information is received after the final assessment of the risk. THE COMPANY shall clearly indicate the amount of risk it wishes to reinsure, including any benefit.

Upon completion of underwriting, OPTIMUM RE shall promptly notify THE COMPANY of its decision and classification of the risk.

Any offer made by OPTIMUM RE will be valid for 90 days unless OPTIMUM RE accepts, in writing, a request to extend this period.

A. Upon acceptance of OPTIMUM RE’s offer of facultative Reinsurance, THE COMPANY shall complete and send to OPTIMUM RE a Reinsurance Advice Notice (SCHEDULE E, PART 2).

B. When the initial premium on a policy that involves facultative reinsurance is received by THE COMPANY, THE COMPANY will complete the same procedure as for Automatic Reinsurance in Article 2.1.

C. If THE COMPANY does not accept OPTIMUM RE’s offer for reinsurance, THE COMPANY shall complete and send to OPTIMUM RE a Reinsurance Advice Notice (SCHEDULE E, PART 2).

ARTICLE 3 - LIABILITY

3.1. Automatic Reinsurance

For automatic reinsurance under this Agreement, the liability of OPTIMUM RE shall commence and end simultaneously with that of THE COMPANY.

Prior to placement of the Policy with the insured, the liability of OPTIMUM RE is limited to:

A. The lesser of:

i) THE COMPANY’s liability under the Policy or Conditional Receipt, whichever applies, minus:

The COMPANY’s full normal retention for a standard risk at the Life insured’s age, less the total of all amounts currently retained by THE COMPANY on the Life insured under other policies.

ii) The automatic reinsurance limit in this Agreement as described in SCHEDULE A.

B. In no case shall OPTIMUM RE’s liability on that Life exceed $100,000.

3.2. Facultative Reinsurance on Policies Otherwise Subject to Automatic Reinsurance

When an underwriting assessment is requested, on policies otherwise subject to automatic reinsurance, OPTIMUM RE’s automatic liability, as specified in Article 3.1., is extended without charge until the first of the following dates:

A. Another reinsurer’s offer is accepted;

B. 48 hours (2 working days) after OPTIMUM RE has declined the case;

C. 7 working days after OPTIMUM RE’s final assessment of the case; if not a decline;

D. 60 days after the application date.

Under facultative reinsurance, OPTIMUM RE’s liability will begin when OPTIMUM RE has been advised that its offer is accepted and the case has been placed unless the offer is standard in which event OPTIMUM RE’s liability will be the same as on automatic business. For cases ceded to OPTIMUM RE, OPTIMUM RE’s liability shall end with that of THE COMPANY.

3.3. All Other Facultative Reinsurance

When an underwriting assessment is requested on a policy not otherwise reinsured automatically by OPTIMUM RE, OPTIMUM RE’s liability will begin when the following conditions have been met:

A. OPTIMUM RE’s unconditional underwriting offer has been accepted;

B. Such acceptance has been communicated to OPTIMUM RE in accordance with Article 2.2.A., in the time frame designated by OPTIMUM RE, during which such offer is valid; and

C. The policy has been placed.

For cases ceded to OPTIMUM RE, OPTIMUM RE’s liability shall end with that of THE COMPANY.

OPTIMUM RE’s liability may be more limited than described in this Article 3, as provided in specific Articles of this Agreement.

ARTICLE 4 - REINSURANCE AMOUNT AT RISK

4.1. Face Amount Basis

When the reinsurer is participating in the accumulation of surrender values on a policy, or when there are no surrender values on a policy, the reinsurance amount shall be based on the face amount of the policy.

The overriding principle involved is that OPTIMUM RE and THE COMPANY will each continue to insure their original proportionate share of the initial face amount.

When the reinsurer does not participate in the surrender values on a policy, as in reinsurance based on YRT or cost of insurance rates, the reinsurance amount at risk shall be based on the death benefit less a fund which represents the savings element in the policies.

The overriding principle involved is that OPTIMUM RE and THE COMPANY will each continue to insure their original proportionate share of the net amount at risk.

Net Amounts at Risk will be defined as follows:

A. Insurance With Cash Values

1. Scheduled Face Amount and Cash Value

Amounts at risk will be projected for 10 year intervals (or until there is a scheduled change in face amount if less than 10 years). Cash values will be used to represent the fund at the end of an interval, and amounts at risk for each intervening year will be interpolated on a straight line basis.

2. Variable Face Amount or Variable Cash Value

The amount at risk applicable to each policy year will be the projected amount at risk at the beginning of that policy year. Amounts at risk will be projected for five year intervals. Where an actual amount at risk diverges from an originally projected amount at risk by more than 10%, THE COMPANY may re-establish the projected schedule at the next policy anniversary for future amounts at risk. If the schedule is not amended, the existing established schedule will be used for determining premium and claims liabilities.

B. Insurance Without Cash Values

This category should include policies where the cash values never exceed 10% of the face amount.

The amount at risk applicable to each policy year will be the face amount applicable at the beginning of the policy year.

The amount at risk applicable to each policy year will be the face amount projected to be applicable at the beginning of that policy year. Face amounts will be projected for five year intervals. Where actual face amounts diverge from the originally projected face amounts by more than 10%, THE COMPANY may re-establish the projected schedule at the next policy anniversary for future face amounts. If the schedule is not amended, the existing established schedule will be used for determining premium and claims liabilities.

Supplementary Benefits, such as but not limited to the Waiver of Premium Benefit and the Accidental Death Benefit, shall not be reinsured under this Agreement.

4.4. Minimum Reinsured Risk Amount

The minimum reinsured risk amount shall be $1,000. In the event that the reinsured risk amount reduces below the minimum, THE COMPANY will automatically recapture the risk on that policy anniversary.

ARTICLE 5 - REINSURANCE PREMIUMS

5.1. Life Premiums

Until further notice, the reinsurance premiums based on the applicable reinsurance amount at risk as described in Article 4 and SCHEDULE B, shall be at the rates described in Articles 5.2. and 5.3.

OPTIMUM RE reserves the right to review and modify these reinsurance premiums.

5.2. Standard Risks

Reinsurance premiums for standard risks are calculated using the rates shown in SCHEDULE F.

5.3. Substandard Risks

The substandard extra reinsurance premium rate per $1,000 for one table (25% mortality) is 25% of the standard rate. The extra reinsurance premium for additional tables is the corresponding multiple of the extra reinsurance premium for one table.

When a flat extra premium is charged by THE COMPANY, a flat extra reinsurance premium is paid at the same rate and for the same period.

5.4. Term Riders

If applicable, Term Riders may be reinsured by OPTIMUM RE on the same terms and conditions as the base plan, subject to Article 7.1. For riders where OPTIMUM RE reinsures the base policy, the cession fee, if any, will be waived; otherwise the appropriate fee will apply.

Substandard Spouse or Child Term Riders may not be reinsured under this Agreement.

6.1. Allowances

There are no allowances payable on the standard and substandard Life reinsurance premiums based on the YRT rates in SCHEDULE F.

Allowances on Flat Extra Premiums

|

On permanent (6 years or more) flat extra premiums: | ||

|

| ||

|

1st year |

: |

75% |

|

|

|

|

|

Renewals |

: |

10% |

|

|

| |

|

On other flat extra premiums : |

10% each year | |

6.2. Premium Taxes

OPTIMUM RE shall not reimburse THE COMPANY for state premium tax or any other tax levied on THE COMPANY.

ARTICLE 7 - GENERAL PROCEDURES

7.1. THE COMPANY’s Forms, Rates, and Procedures

THE COMPANY will furnish OPTIMUM RE with at least two copies of its application forms, policy and rider forms, contingent insurance receipt, premium scales and any other document that can affect OPTIMUM RE’s liability and will keep OPTIMUM RE informed of any changes therein.

In addition, THE COMPANY will advise OPTIMUM RE of any changes to its procedures and rules that may affect OPTIMUM RE’s liability such as, but not limited to, age and amount underwriting requirements, policy settlement and reinstatement rules.

Compliance with this Article shall be a condition precedent to the liability of OPTIMUM RE.

7.2. Inspection of Records

OPTIMUM RE shall have the right to inspect, make copies of, or reproduce, at any reasonable time, at the office of THE COMPANY, all books and documents relating to reinsurance under this Agreement.

7.3. Errors and Omissions

It is expressly understood and agreed that if failure to comply with any terms of this Agreement is shown to be unintentional and the result of administrative errors or omissions on the part of either THE COMPANY or OPTIMUM RE, both THE COMPANY and OPTIMUM RE shall be restored to the position they would have occupied had no such error or omission occurred. It is understood, however, that THE COMPANY shall be liable for amounts not reported for reinsurance due to the practice of consciously performing a limited alpha index search on their applications. This article shall not be construed to initiate OPTIMUM RE’s liability if any conditions of Article 3.2., 3.3., and 7.5. are not met.

This provision shall apply only to oversights, misunderstandings or clerical errors relating to the administration of reinsurance covered by this Agreement and not to the administration of the insurance provided by THE COMPANY to its insured. Any negligent or deliberate acts or omissions by THE COMPANY regarding the insurance provided are the responsibility of THE COMPANY and its liability insurer, if any, but not that of OPTIMUM RE.

Furthermore, the deviating party will undertake to identify, through a prudent review of its records all other errors and omissions of the same or similar category and correct them within a mutually negotiated time frame.

If seven (7) years have elapsed since the error or oversight occurred, there will not be rectification as above, unless both OPTIMUM RE and THE COMPANY agree to such rectification.

7.4. Reserves

OPTIMUM RE will establish appropriate reserves in accordance with the Standard Valuation Law in effect in Texas, on the portion of policies reinsured, and in force, as reported to OPTIMUM RE under this Agreement.

7.5. Reporting

THE COMPANY shall promptly report all transactions to OPTIMUM RE. In particular, but not limited to, new business and terminations.

Should THE COMPANY encounter, or expect to encounter, delays in reporting its business; it shall promptly:

1. Notify OPTIMUM RE of the situation; and

2. Present OPTIMUM RE with a plan of action to correct the situation, including a time frame to solve the problem.

OPTIMUM RE, upon receipt of the above, may request that THE COMPANY:

1. Make modifications to the plan;

2. Pay estimated premiums for the duration of the reporting problem; and/or

3. Report larger individual exposures manually, until the situation is resolved.

In any case where the above is not met, or if the plan is not accepted by both OPTIMUM RE and THE COMPANY, or when the plan is not adhered to; OPTIMUM RE reserves the right to deny liability on claims or limit refunds of reinsurance premiums.

7.6. Confidentiality

THE COMPANY and OPTIMUM RE agree that Customer and Proprietary Information will be treated as confidential. Customer Information includes, but is not limited to, medical, financial, and other personal information about proposed, current, and former policyowners, insureds, applicants, and beneficiaries of policies issued by THE COMPANY. Proprietary Information includes, but is not limited to, business plans, mortality and lapse studies, underwriting manuals and guidelines, applications and contract forms. Furthermore, the specific terms and conditions of this Agreement, cannot be disclosed to any other party for competitive use, unless prior written approval is obtained.

Customer and Proprietary Information will not include information that:

a. is or becomes available to the general public through no fault of the party receiving the Customer or Proprietary Information (the “Recipient”) ;

b. is independently developed by the Recipient;

c. is acquired by the Recipient from a third party not covered by a confidentiality agreement; or

d. is disclosed under a court order, law or regulation.

The parties will not disclose such information to any other parties unless agreed to in writing, except as necessary for retrocession purposes, as requested by external auditors, as required by court order, or as required or allowed by law or regulation.

THE COMPANY acknowledges that OPTIMUM RE can aggregate data with other companies reinsured with OPTIMUM RE as long as the data cannot be identified as belonging to THE COMPANY.

ARTICLE 8 - ACCOUNTING AND BILLING

8.1. Reinsurance Premiums

The reinsurance premiums are due on the policy issue date and every subsequent anniversary date of the policy and payable to OPTIMUM RE on an annual basis regardless of how premiums are paid to THE COMPANY.

8.2. Individual Cession Billing

OPTIMUM RE will submit every month, to THE COMPANY, a listing of new business, changes and terminations, and a statement of amounts payable.

The net balance is due to OPTIMUM RE within 30 days of receiving the statement. If a balance is due to THE COMPANY, OPTIMUM RE will remit its payment with the statement.

8.3. Late Payment

Any overdue balance bears interest from the end of a 30-day period following receipt of the monthly billing.

The interest for the period from 30 to 60 days will be the then current annual prime interest rate of the XX Xxxxxx Xxxxx Bank, Dallas, Texas calculated on a monthly basis.

For each additional month, after 60 days that a balance remains unpaid, interest will be calculated using the above annual rate plus 2%.

The payment of reinsurance premiums shall be a condition precedent to the liability of OPTIMUM RE under this Agreement. If any premium remains unpaid for more than 60 days after the due date, OPTIMUM RE may send to THE COMPANY a formal demand for immediate payment. If THE COMPANY does not comply with this demand within 30 days, then OPTIMUM RE may cancel any unpaid reinsurance cessions for nonpayment of premium; however, any unpaid premiums to the time of cancellation would be due with interest.

THE COMPANY will not force cancellation under the provisions of this Article solely to circumvent the provisions regarding recapture in Article 9.12., or to transfer the reinsured policies to another reinsurer.

ARTICLE 9 - CHANGES AND ADJUSTMENTS

9.1. Change Information

THE COMPANY will keep OPTIMUM RE informed of any changes or adjustments affecting a reinsured case. If a change affects either premiums or allowances, or amount at risk, THE COMPANY will provide OPTIMUM RE with the necessary information to complete a modified Reinsurance Cession Form.

9.2. Reductions

If a policy is changed in any way that results in a reduction in the amount of insurance on any policy, the amount of reinsurance on that policy will be reduced proportionately.

If a Life has multiple policies and one or more are terminated or reduced, the reinsurance on remaining policies for that same Life that are reinsured under this Agreement will not be reduced to allow THE COMPANY to fill its retention.

If more than one reinsurer has a cession on that policy, each reinsurer’s cession will be reduced proportionately.

9.3. Increases

If an increase in insurance is requested on an existing policy that is reinsured with OPTIMUM RE, underwriting evidence, satisfactory to OPTIMUM RE, will be obtained for OPTIMUM RE’s approval. This does not apply to increases on automatic cessions where all automatic conditions specified in Article 1.1. are met.

Any such increase shall be subject to the same contestable period and suicide clause that a newly issued policy contains.

9.4. Reinstatements

If a policy automatically reinsured with OPTIMUM RE lapses and is subsequently reinstated under THE COMPANY’s regular rules, the reinsurance will be automatically reinstated for the same amount, subject to all automatic conditions specified in Article 1.1., upon receipt by OPTIMUM RE of written notice of the reinstatement. All other reinstatement requests shall be submitted to OPTIMUM RE for its approval before THE COMPANY can reinstate such policy.

THE COMPANY shall pay all reinsurance premiums in arrears for the same period THE COMPANY received premiums in arrears under its policy, including interest, if any.

9.5. Conversions

Conversions are not applicable or reinsured under this Agreement.

9.6. Underwriting Reassessment

If, on facultative cases, following the consideration of new underwriting evidence, THE COMPANY agrees to reassess the risk, then THE COMPANY shall request a new underwriting assessment from OPTIMUM RE.

9.7. Terminations

At termination of a policy, other than death, all premiums and allowances, excluding cession fees, are adjusted pro rata for the period of coverage.

In the event of termination by death, there will be no adjustment of premiums.

9.8. Policy Replacement

If a policy replacement results in new reinsurance with OPTIMUM RE, then OPTIMUM RE will benefit from a full contestable period and suicide exclusion starting from the new policy commencement date as provided by the law of the state in which the policy is issued.

If a policy reinsured with OPTIMUM RE is replaced by a policy on a plan reinsured with another reinsurer, THE COMPANY shall maintain the coverage with OPTIMUM RE up to the existing amount.

Policy replacement to an Annual Renewable Term product will not be reinsured under this Agreement unless specifically agreed to by OPTIMUM RE.

9.9. Cash Values

OPTIMUM RE will not participate in the payment of cash values.

9.10. Policy Loans and Dividends

OPTIMUM RE will not participate in policy loans or dividends.

9.11. Reduced Paid Up and Extended Term

If a Reduced Paid Up or Extended Term option is selected by the policyholder, OPTIMUM RE will continue to reinsure its proportionate share of the policy.

For policies where OPTIMUM RE does not participate in surrender value accumulation, reinsurance premiums will be calculated on a point and scale basis using the YRT rates in SCHEDULE F and the Net Amount at Risk will be calculated according to Article 4 and SCHEDULE B.

9.12. Recapture

Recapture will not be permitted under this Agreement unless explicitly approved by OPTIMUM RE, except as stated in Article 4.4.

10.1. Claims Liability

OPTIMUM RE will be liable to THE COMPANY for the benefits reinsured hereunder to the same extent as THE COMPANY is liable to the insured for such benefits, and all reinsurance will be subject to the terms and conditions of the policy under which THE COMPANY is liable. OPTIMUM RE will also be liable for its proportionate share of interest on payment of the claim at the usual interest rate allowed by THE COMPANY.

10.2. Notice

THE COMPANY will give OPTIMUM RE prompt notice of any claim. Copies of notification, claim papers and proofs will be furnished to OPTIMUM RE within ten (10) working days of having been received by THE COMPANY.

For risks where OPTIMUM RE reinsures the Life portion, but not the Waiver of Premium Benefit, THE COMPANY will notify OPTIMUM RE of any Waiver of Premium disability claim that occurs within the two (2) year contestability period. The intent of the notification is to allow OPTIMUM RE the opportunity to review the Life risk to ensure that the contestability feature of the policy is not jeopardized.

10.3. Authorization for Payment

On automatic Life cases, except when the claim occurs in the contestable period, OPTIMUM RE will accept THE COMPANY’s decision on claim payment of amounts up to THE COMPANY’s automatic reinsurance limit as specified in SCHEDULE A.

On all claims which occur in the contestable period, or on facultative cases, or when the amount exceeds that described above, THE COMPANY must obtain OPTIMUM RE’s non-binding opinion regarding the reinsurance liability prior to acknowledgment of its liability to the claimant.

10.4. Adjusted Amounts

In the event the amount of insurance provided by a policy reinsured hereunder is increased or reduced because of a misstatement of age or sex established after the death of the insured, OPTIMUM RE will share in the increase or reduction in the proportion that the liability of OPTIMUM RE bore to the total liability under the policy immediately prior to such increase or reduction.

10.5. Payment

On death claims, OPTIMUM RE will pay its share in a lump sum to THE COMPANY without regard to the form of claim settlement. OPTIMUM RE is not responsible for usual claim expenses that THE COMPANY incurs in claim settlement such as compensation of employees and routine investigative expenses.

10.6. Contest

THE COMPANY will advise OPTIMUM RE of its intention to contest, compromise or litigate a claim or rescind a contract involving reinsurance. If, after reviewing the complete file, OPTIMUM RE agrees in writing with THE COMPANY’s intention, then OPTIMUM RE agrees to pay a share of the expenses incurred by THE COMPANY in contesting or investigating a claim on a reinsured policy or in rescinding a reinsured policy, in proportion to the respective liabilities of OPTIMUM RE and THE COMPANY. Compensation of officers and employees of THE COMPANY is not deemed a claim expense.

If OPTIMUM RE declines to be a party to a claim contest, OPTIMUM RE will discharge any and all liability by payment of its full share of the claim to THE COMPANY according to the terms and conditions of this Agreement.

10.7. Punitive Damages

OPTIMUM RE will not participate in punitive, compensatory or statutory damages or penalties which are awarded against THE COMPANY as a result of an act, omission or course of conduct committed solely by THE COMPANY in connection with the insurance reinsured under this Agreement.

11.1. Principle

The parties express their formal intention to resolve any differences arising from the interpretation or execution of this Agreement in accordance with equity and usage rather than according to strict legal rules. Any difference that cannot be resolved by the parties shall be submitted to arbitration by written notice sent by one party to the other. The location for arbitration shall be Dallas, Texas.

11.2. Arbitrators

There shall be three disinterested arbitrators who shall be officers or retired officers of Life insurance or reinsurance companies other than the parties to the Agreement or their subsidiaries. The arbitrators shall be disinterested parties and cannot be jurists, present or former employees of one of the parties or their affiliate or therefore related to the management of one of the parties or their affiliates. Each of the parties shall appoint one of the arbitrators and these two arbitrators shall select the third. In the event that either party should fail to choose an arbitrator within thirty days after the other party has given notice of its arbitrator appointment, that party may choose two arbitrators who shall in turn choose a third arbitrator before entering arbitration.

Any arbitrator who does not perform his duties, or resigns, will be replaced by the party who originally selected that arbitrator.

11.3. Matters In Dispute

The parties will state together or separately the subjects in dispute and submit them in writing to the arbitrators along with the necessary documents.

11.4. Procedures

The arbitrators must themselves establish the procedure to be followed: they are exempt from any judicial formality or rule. They can adjudicate and are empowered to act as mediators. They shall decide how the arbitration costs are apportioned.

11.5. Decision

The award rendered by the majority, must be in writing, give the reasons for the decision and be signed by each arbitrator. The parties agree to abide by the decision rendered and to consider the award as final and binding on both parties.

11.6. Applicable Laws

Should there be improprieties in the arbitration process or if one of the parties objects to the implementation of the arbitration process, the laws of the State of Texas shall then apply.

ARTICLE 12 - INSOLVENCY

12.1. Payment of Claims

In the event of insolvency of THE COMPANY, all claims under this Agreement will be paid by OPTIMUM RE directly to THE COMPANY, its liquidator, receiver or statutory successor. OPTIMUM RE’s share of claims will be paid without diminution because of the insolvency of THE COMPANY, provided that all reinsurance premiums have been duly paid and subject to Article 12.4.

OPTIMUM RE shall be liable only for the claims actually paid by THE COMPANY to the insured or its beneficiary on amounts reinsured and shall not be or become liable for any amounts or reserves to be held by THE COMPANY on policies reinsured under this Agreement.

12.2. Notice to OPTIMUM RE

In the event of the insolvency of THE COMPANY, the liquidator, receiver, or statutory successor of THE COMPANY will give written notice of a pending claim against THE COMPANY on any policy reinsured, within a reasonable time after the claim is filed in the insolvency proceedings. While the claim is pending, OPTIMUM RE may investigate and interpose, at its own expense, in the proceedings where the claim is to be adjudicated, any defenses which it may deem available to THE COMPANY or its liquidator, receiver, or statutory successor.

12.3. Expenses

The expenses incurred by OPTIMUM RE will be charged, subject to court approval, against THE COMPANY as expenses of liquidation to the extent of a proportionate share of the benefit which accrues to THE COMPANY as a result of the defenses undertaken by OPTIMUM RE. Where two or more reinsurers are involved and a majority in interest elects to defend a claim, the expenses will be apportioned in accordance with the terms of the reinsurance agreements as if the expenses had been incurred by THE COMPANY.

12.4. Right to Offset

In the event of the insolvency of either OPTIMUM RE or THE COMPANY, any amounts owed by OPTIMUM RE to THE COMPANY and by THE COMPANY to OPTIMUM RE with respect to this and all other Reinsurance Agreements between OPTIMUM RE and THE COMPANY, shall be offset against each other with the balance to be paid by the appropriate party.

ARTICLE 13 - DEFERRED ACQUISITION COST TAX

THE COMPANY and OPTIMUM RE mutually agree to the following pursuant to Section 1.848-2(g)(8) of the Income Tax Regulations issued December 29, 1992 of the Internal Revenue Code of 1986.

1. The Party with net positive consideration for the Agreement(s) for each taxable year shall compute specified policy acquisition expenses without regard to the general deductions limitation of Section 848(c)(1).

2. THE COMPANY and OPTIMUM RE agree to exchange information pertaining to the amount of net consideration as determined for all reinsurance agreements in force between them to ensure consistency or as may otherwise be required by the Internal Revenue Service.

3. THE COMPANY will submit a schedule to OPTIMUM RE by May 1st of its calculation of the net consideration for the preceding calendar year. This calculation shall be accompanied by a statement signed by an officer of THE COMPANY stating that THE COMPANY will report such net consideration in its tax return for the preceding calendar year.

4. OPTIMUM RE shall advise THE COMPANY if it disagrees with the amounts provided and OPTIMUM RE and THE COMPANY agree to amicably resolve any difference. The amounts provided by THE COMPANY shall be presumed correct if it does not receive a response from OPTIMUM RE at the latest 30 days after receipt by OPTIMUM RE of these amounts or by May 30th of the current year.

14.1. Duration

This Agreement will be effective on and after August 1, 2009. It is unlimited in duration but may be amended by mutual consent of THE COMPANY and OPTIMUM RE. It may be terminated as to new reinsurance by either party giving a 90-day written notice to the other. Termination as to new reinsurance does not affect existing reinsurance that will remain in force until termination of THE COMPANY’s policy.

14.2. Parties to the Agreement

This is an agreement solely between THE COMPANY and OPTIMUM RE. There will be no legal relationship between OPTIMUM RE and any person having an interest of any kind in any of THE COMPANY’s insurance, or between OPTIMUM RE and any other reinsurer, or between OPTIMUM RE and any other third party.

14.3. Written Agreement

A. Entirety

This Agreement shall constitute the entire agreement between THE COMPANY and OPTIMUM RE with respect to the business reinsured hereunder. There are no understandings between THE COMPANY and OPTIMUM RE other than as expressed in this Agreement.

B. Amendments

Any change or modification to the Agreement shall be null and void unless made by amendment to the Agreement and signed by both parties.

C. Waiver

A waiver of any provision(s) of this Agreement shall constitute a waiver only with respect to the particular circumstance for which it is given and not a waiver for any future circumstances.

D. Severability

If any section or provision of this Agreement is determined to be invalid or unenforceable, such determination will not impact or affect the validity or the enforceability of the remaining sections or provisions of this Agreement.

14.4. Change of Control/Assignment

Neither THE COMPANY nor its liquidator, receiver, or statutory successor will, without the prior written consent of OPTIMUM RE, sell, assign, transfer, or otherwise dispose of this Agreement, or any interest in this Agreement, by voluntary or involuntary act.

14.5. Compliance

THE COMPANY represents that to the best of its knowledge and belief it is, and shall use its best efforts to continue to be, in substantial compliance in all material respects with all laws, regulations, and judicial and administrative orders applicable to the business reinsured under this Agreement, including but not limited to, privacy laws and the maintenance of an effective anti-money laundering policy, (collectively, the “Law”). Neither THE COMPANY nor OPTIMUM RE shall be required to take any action under this Agreement that would result in it being in violation of the Law, which shall include requirements enforced by the U.S. Treasury Department Office of Foreign Assets Control and Terrorist Financing Act. THE COMPANY and OPTIMUM RE acknowledge and agree that a claim under this Agreement is not payable if payment would cause OPTIMUM RE to be in violation of the Law. Should either party discover a reinsurance payment has been made in violation of the Law, it shall notify the other party and the parties shall cooperate in order to take all necessary corrective actions.

14.6. Signatures

In witness of the above, this Agreement is signed in duplicate, at the dates and places indicated.

|

FOR |

: |

AMERICAN LIFE AND SECURITY CORPORATION |

|

DATE: |

9/8/09 |

|

SIGNATURE: |

/s/ Xxxx X. Xxxxxx |

|

|

|

| ||

|

|

|

| ||

|

PLACE: |

LINCOLN, NE |

|

NAME: |

XXXX X. XXXXXX |

|

|

|

| ||

|

|

|

| ||

|

WITNESS: |

[ILLEGIBLE] |

|

TITLE: |

CEO |

|

FOR |

: |

OPTIMUM RE INSURANCE COMPANY |

|

DATE: |

Sept. 4th, 2009 |

|

SIGNATURE: |

/s/ Xxxxx Xxxxxxxx |

|

|

|

| ||

|

|

|

| ||

|

PLACE: |

DALLAS, TEXAS |

|

NAME: |

XXXXX XXXXXXXX |

|

|

|

| ||

|

|

|

| ||

|

WITNESS: |

/s/ [ILLEGIBLE] |

|

TITLE: |

PRESIDENT |

SCHEDULE A

RETENTION AND REINSURANCE LIMITS

AMERICAN LIFE AND SECURITY CORPORATION

|

|

|

LIFE |

|

|

|

|

|

THE COMPANY’S Retention |

|

|

|

Limit per Life |

: |

$65,000 |

|

|

|

|

|

Automatic Reinsurance |

|

|

|

Limit per Life |

: |

* 6.15 X’s THE COMPANY’s retention to a maximum of $400,000 in excess of THE COMPANY’s retention |

|

|

|

|

|

Facultative Reinsurance |

|

|

|

Limit per Life |

: |

$4,000,000 |

|

|

|

|

|

Jumbo Limit |

: |

$4,000,000 |

|

|

|

|

|

Minimum Cession |

: |

$5,000 |

|

|

|

|

|

Portion of Alphabet |

|

|

|

Reinsured by OPTIMUM RE |

: |

A - Z |

*Policies will be underwritten by Investors Heritage Life Insurance Company

SCHEDULE B

PLANS REINSURED

·MODIFIED WHOLE LIFE PLAN (FORM #ALSC-001 (05-09))

DEATH BENEFIT PATTERN

·ISSUE AGES 0-20:

DEATH BENEFIT WILL BE LEVEL

·ISSUE AGES 21-65:

DEATH BENEFIT WILL DECREASE BY $3,000 PER YEAR PER UNIT FOR 20 YEARS AND WILL THEN REMAIN LEVEL

·ISSUE AGES 66-80:

DEATH BENEFIT WILL DECREASE BY $5,000 PER YEAR PER UNIT FOR 4 YEARS AND WILL THEN REMAIN LEVEL

SCHEDULE D

AGE AND AMOUNT REQUIREMENTS

[POLICIES WILL BE UNDERWRITTEN BY INVESTORS HERITAGE LIFE INSURANCE COMPANY]

American Life & Security Corporation

Age-Amount Medical and Non-Medical Requirements

|

INITIAL |

|

AGE | ||||||||

|

AMOUNT |

|

0-35 |

|

36-50 |

|

00-00 |

|

00-00 |

|

61-80 |

|

-0- to $50,000 |

|

Non-medical |

|

Non-medical |

|

Non-medical |

|

Non-medical |

|

Paramedical HOS |

|

$50,001 to $55,000 |

|

Non-medical |

|

Non-medical |

|

Non-medical |

|

HOS |

|

Paramedical HOS |

|

$55,001 to $99,999 |

|

Non-medical |

|

HOS |

|

HOS |

|

Paramedical HOS |

|

Paramedical HOS |

|

$100,000 to $250,000 |

|

HOS Saliva Test |

|

Paramedical HOS Blood Profile |

|

Paramedical HOS Blood Profile |

|

Paramedical HOS Blood Profile |

|

Paramedical HOS Blood Profile |

|

$250,001 to $300,000 |

|

Paramedical HOS Blood Profile |

|

Paramedical HOS Blood Profile |

|

Paramedical HOS Blood Profile |

|

Paramedical HOS Blood Profile |

|

Paramedical HOS Blood Profile |

|

$300,001 to $500,000 |

|

Paramedical HOS Blood Profile |

|

Paramedical HOS Blood Profile EKG |

|

Paramedical HOS Blood Profile EKG |

|

MD Exam HOS Blood Profile EKG |

|

MD Exam HOS Blood Profile EKG |

|

$500,001 to $1,000,000 |

|

MD Exam HOS Blood Profile EKG |

|

MD Exam HOS Blood Profile EKG |

|

MD Exam HOS Blood Profile EKG |

|

MD Exam HOS Blood Profile EKG |

|

MD Exam HOS Blood Profile EKG |

|

$1,000,001 plus |

|

Consult Underwriting |

|

Consult Underwriting |

|

Consult Underwriting |

|

Consult Underwriting |

|

Consult Underwriting |

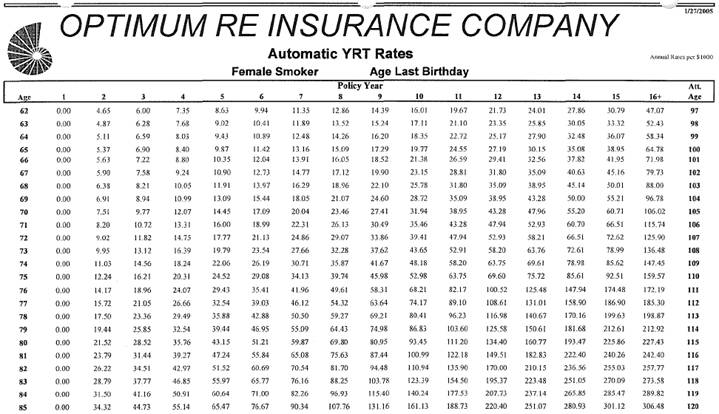

SCHEDULE F

YRT RATES

AUTOMATIC YRT RATES AGE LAST BIRTHDAY

(Non refundable in the year of Death)

OPTIMUM RE will not pay any allowances on these YRT rates.

|

|

PART 1 - MALE NONSMOKER |

|

979.00 |

|

|

|

|

|

|

|

|

|

|

|

PART 2 - MALE SMOKER |

|

980.00 |

|

|

|

|

|

|

|

|

|

|

|

PART 3 - FEMALE NONSMOKER |

|

981.00 |

|

|

|

|

|

|

|

|

|

|

|

PART 4 - FEMALE SMOKER |

|

982.00 |

|

|