OFFICE LEASE Millich Commercial, LLC a California limited liability company as “Landlord” and Arteris, Inc. a Delaware corporation as “Tenant”

Exhibit 10.4

Millich Commercial, LLC

a California limited liability company

as “Landlord”

and

a Delaware corporation

as “Tenant”

SUMMARY OF BASIC LEASE TERMS

| SECTION (LEASE REFERENCE) |

TERMS | |||

| A. (Introduction) |

Lease Reference Date: |

July 17, 2017 | ||

| B. (Introduction) |

Landlord: |

Millich Commercial, LLC, a California limited liability company | ||

| C. (Introduction) |

Tenant: |

Arteris, Inc., a Delaware corporation | ||

| D. (Section 1.21) |

Premises: |

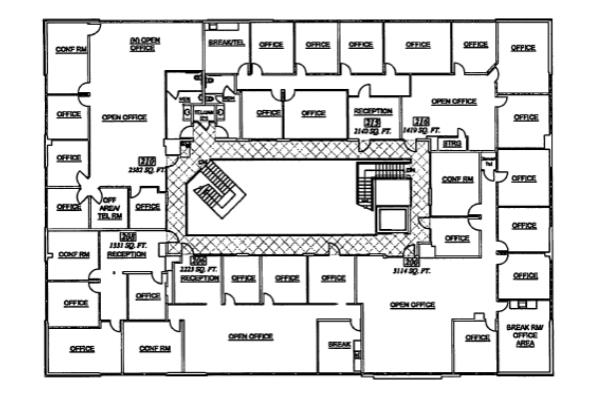

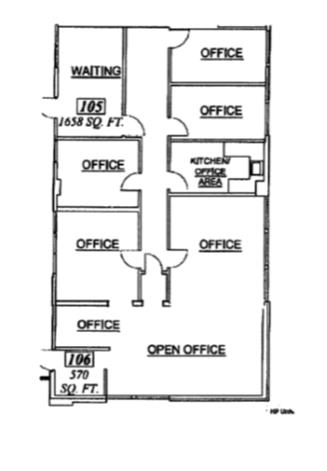

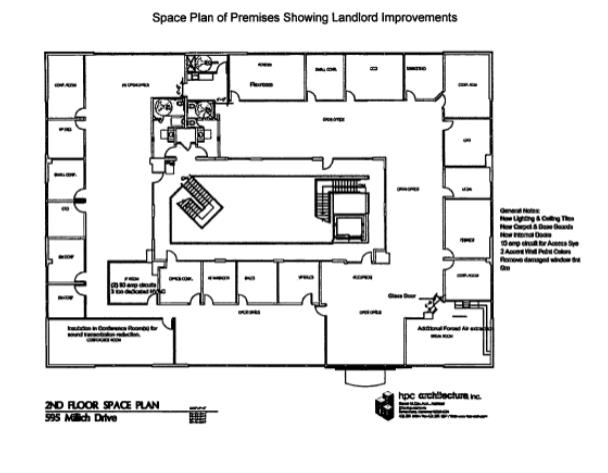

That area consisting of approximately 12,609 rentable square feet, the address of which is ▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, within the Building as shown on Exhibit B. | ||

| E. (Section 1.22) |

Project: |

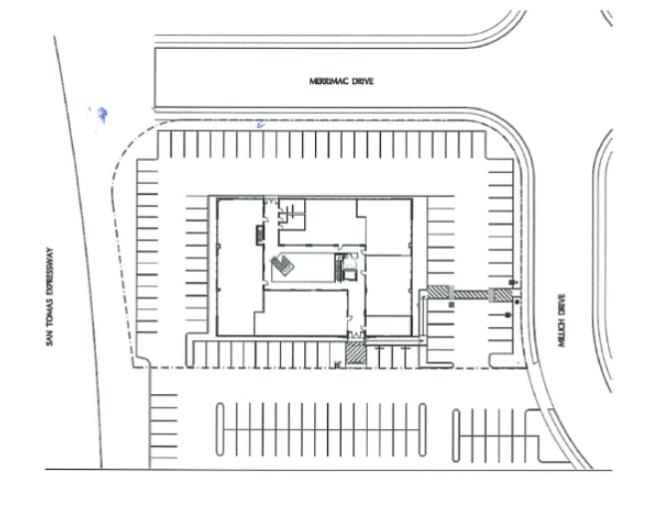

The land and improvements shown on Exhibit A consisting of one building the aggregate area of which is approximately 24,281 rentable square feet. | ||

| F. (Section 1.7) |

Building |

The Building and the Project are one and the same. | ||

| G. (Section 1.32) |

Tenant’s Share: |

51.93% | ||

| H. (Section 4.6) |

Tenant’s Allocated Parking Stalls: |

Forty five (45) unreserved parking stalls | ||

| I. (Section 1.28) |

Scheduled Commencement Date: |

September 1, 2017 | ||

| J. (Section 1.18) |

Lease Term: |

Sixty nine (69) full calendar months | ||

| K. (Section 3.1) |

Base Monthly Rent: |

Commencement Date – month 18—$37,827.00 Month 19 – 30—$38,961.81* Month 31 – 42—$40,130.66 Month 43 – 54—$41,334.58 Month 55 – 66—$42,574.62 Month 67 – expiration date—$43,851.86

*Subject to the terms and conditions of Article 2.2(b) below. | ||

| L. (Section 3.3) |

Prepaid Rent: |

$38,961.81 | ||

2

| M. (Section 3.5) |

Security Deposit: |

$43,851.86 | ||

| N. (Section 4.1) |

Permitted Use: |

General Office | ||

| O. | Intentionally Omitted |

|||

| P. (Section 8.1) |

Operating Expense Base Amount: |

Operating Expenses paid or incurred by Landlord during calendar year 2018 | ||

| Q. (Section 9.1) |

Tenant’s Liability:

Insurance Minimum: |

$2,000,000 per occurrence and $3,000,000 in the aggregate | ||

| R. (Section 1.3) |

Landlord’s Address: |

c/o Briggs Development Corporation Attn: ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | ||

| S. (Section 1.3) |

Tenant’s Address: |

Before the Commencement Date: ▇▇▇ ▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ Attention: CFO From and after the Commencement Date: At the Premises Attention: CFO | ||

| T. (Section 15.13) |

Retained Real Estate Brokers: |

Landlord’s Broker—▇▇▇▇ ▇▇▇▇▇▇▇▇▇ and ▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇, CBRE, Inc. Tenant’s Broker – None | ||

| U. (Section 1.17) |

Lease: |

This Office Lease includes the Summary of the Basic Lease Terms, the Lease, and the following exhibits and addenda: Exhibit A (site plan of the Project), Exhibit B (diagram of Premises), Exhibit B-1 (diagram of Temporary Space), Exhibit C (Description of Landlord Improvements), and Exhibit D (Rules and Regulations). | ||

The foregoing Summary is hereby incorporated into and made a part of this Lease. Each reference in this Lease to any term of the Summary shall mean the respective information set forth above and shall be construed to incorporate all of the terms provided under the particular paragraph pertaining to such information. In the event of any conflict between the Summary and the Lease, the Summary shall control.

3

This Office Lease (“Lease”) is dated, for reference purposes only, as of the Lease Reference Date specified in Section A of the Summary of Basic Lease Terms (“Summary”), and is made by and between the party identified as Landlord in Section B of the Summary and the party identified as Tenant in Section C of the Summary.

ARTICLE 1

DEFINITIONS

1.1 General. Any initially capitalized term that is given a special meaning by this Article 1, the Summary, or by any other provision of this Lease (including the exhibits attached hereto) shall have such meaning when used in this Lease or any addendum or amendment hereto unless otherwise clearly indicated by the context.

1.2 Additional Rent. The term “Additional Rent” is defined in Section 3.2.

1.3 Address for Notices. The term “Address for Notices” shall mean the addresses set forth in Sections R and S of the Summary; provided, however, that after the Commencement Date, Tenant’s Address for Notices shall be the address of the Premises.

1.4 Agents. The term “Agents” shall mean the following: (i) with respect to Landlord or Tenant, the agents, employees, contractors and invitees of such party, and (ii) in addition with respect to Tenant, Tenant’s subtenants and their respective agents, employees, contractors and invitees.

1.5 Agreed interest Rate. The term “Agreed Interest Rate” shall mean that interest rate determined as of the time it is to be applied that is equal to the lesser of (i) the higher of five percent (5%) in excess of the discount rate established by the Federal Reserve Bank of San Francisco as it may be adjusted from time to time, or ten percent (10%) per annum, or (ii) the maximum interest rate permitted by Law.

1.6 Base Monthly Rent. The term “Base Monthly Rent” shall mean the fixed monthly rent payable by Tenant pursuant to Section 3.1 which is specified in Section K of the Summary.

1.7 Building. The term “Building” shall mean the building in which the Premises are located which Building is identified in Section F of the Summary, the rentable area of which is referred to herein as the “Building Rentable Area.”

1.8 Commencement Date. The term “Commencement Date” is the date the Lease Term commences, which term is defined in Section 2.2.

1.9 Common Area. The term “Common Area” shall mean all areas and facilities within the Project that are not designated by Landlord for the exclusive use of Tenant or any other lessee or other occupant of the Project, including, without limitation, the parking areas, access and perimeter roads, pedestrian sidewalks, landscaped areas, trash enclosures, recreation areas and the like.

1.10 Intentionally Omitted

1.11 Effective Date. The term “Effective Date” shall mean the date the last signatory to this Lease whose execution is required to make it binding on the parties hereto shall have executed this Lease.

1.12 Event of Tenant’s Default. The term “Event of Tenant’s Default” is defined in Section 13.1.

1.13 Hazardous Materials. The terms “Hazardous Materials” and “Hazardous Materials Laws” are defined in Section 7.2E.

4

1.14 Insured and Uninsured Peril. The terms “Insured Peril” and “Uninsured Peril” are defined in Section 11.2E.

1.15 Law(s). The term “Law(s)” shall mean any judicial decision, statute, constitution, ordinance, resolution, regulation, rule, administrative order or other requirement of any municipal, county, state, federal or other governmental agency or authority having jurisdiction over the parties to this Lease or the Premises, or both, in effect either at the Effective Date or any time during the Lease Term.

1.16 Lease. The term “Lease” shall mean the Summary and all elements of this Lease identified in Section U of the Summary, all of which are attached hereto and incorporated herein by this reference.

1.17 Lease Term. The term “Lease Term” shall mean the term of this Lease, which shall commence on the Commencement Date and, unless sooner terminated pursuant to this Lease, shall continue for the period specified in Section J of the Summary.

1.18 Lender. The term “Lender” shall mean any beneficiary, mortgagee, secured party, ground or underlying lessor, or other holder of any Security Instrument now or hereafter affecting the Project or any portion thereof.

1.19 Operating Expenses. The term “Operating Expenses” is defined in Section 8.2.

1.20 Permitted Use. The term “Permitted Use” shall mean the use specified in Section N of the Summary, and no other use shall be permitted.

1.21 Premises. The term “Premises” shall mean that space described in Section D of the Summary that is within the Building.

1.22 Project. The term “Project” shall mean that real property and the improvements thereon which are specified in Section E of the Summary, the aggregate rentable area of which is referred to herein as the “Project Rentable Area.”

1.23 Private Restrictions. The term “Private Restrictions” shall mean all recorded covenants, conditions and restrictions, private agreements, reciprocal easement agreements, and any other recorded instruments affecting the use of the Premises and/or the Project which exist as of the Effective Date or which are recorded after the Effective Date.

1.24 Real Property Taxes. The term “Real Property Taxes” is defined in Section 8.3.

1.25 Rent. The term “Rent” or “rent” shall mean, collectively, Base Monthly Rent, Additional Rent and all other payments of money payable to Landlord under this Lease, whether or not such payments are specifically denominated as rent hereunder.

1.26 Rentable Area. The term “Rentable Area” as used in this Lease shall mean, with respect to the Premises, the rentable square feet set forth in Section D of the Summary, and, with respect to the Project, the rentable square feet set forth in Section E of the Summary (subject to reformulation pursuant to Section 1.32 below). Landlord and Tenant agree that (i) each has had an opportunity to determine to its satisfaction the actual area of the Project, the Building and the Premises, (ii) all measurements of area contained in this Lease are conclusively agreed to be correct and binding upon the parties, even if a subsequent measurement of any one of these areas determines that it is more or less than the amount of area reflected in this Lease, and (iii) any such subsequent determination that the area is more or less than shown in this Lease shall not result in a change in any way of the computations of rent, improvement allowances, or other matters described in this Lease where area is a factor.

5

1.27 Rules and Regulations. The term “Rules and Regulations” shall mean the rules and regulations attached hereto as Exhibit D and any amendments or supplements thereto and any additional rules and regulations, all as may be adopted and promulgated by Landlord from time to time.

1.28 Scheduled Commencement Date. The term “Scheduled Commencement Date” shall mean the date specified in Section I of the Summary.

1.29 Security Instrument. The term “Security Instrument” shall mean any ground or underlying lease, mortgage or deed of trust which now or hereafter affects the Project (or any portion thereof), and any renewal, modification, consolidation, replacement or extension thereof.

1.30 Summary. The term “Summary” shall mean the Summary of Basic Lease Terms executed by Landlord and Tenant that is part of this Lease.

1.31 Tenant’s Alterations. The term “Tenant’s Alterations” shall mean all improvements, additions, alterations and fixtures installed in the Premises by or for the benefit of Tenant following the Commencement Date which are not Trade Fixtures.

1.32 Tenant’s Share. The term “Tenant’s Share” shall mean the percentage obtained by dividing Tenant’s Rentable Area by the Project Rentable Area, which, as of the Effective Date, is the percentage identified in Section G of the Summary. In the event Landlord constructs other buildings on the Project, Landlord may, in Landlord’s sole discretion, reformulate Tenant’s Share, as to any or all of the items which comprise Operating Expenses, to reflect the rentable square footage of the Premises as a percentage of all rentable square footage of the Project. In the event Tenant’s Share is reformulated in accordance with this Section 1.32, Landlord shall promptly provide Tenant notice of such reformulation, together with a written statement showing in reasonable detail the manner in which Tenant’s Share was reformulated and a list of all items of Operating Expenses which will be accounted for using the reformulated percentage. Any items of Operating Expenses to which the reformulated share is not applied shall be accounted for using the original Tenant’s Share set forth in Section G of the Summary.

1.33 Trade Fixtures. The term “Trade Fixtures” shall mean (i) Tenant’s inventory, furniture, signs, business equipment and other personal property, and (ii) anything affixed to the Premises by Tenant at its expense for purposes of trade (except replacement of similar work or material originally installed by Landlord) which can be removed without material injury to the Premises unless such thing has, by the manner in which it is affixed, become an integral part of the Premises.

ARTICLE 2

DEMISE, CONSTRUCTION, AND ACCEPTANCE

2.1 Demise of Premises/Temporary Space.

(a) Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, for the Lease Term upon the terms and conditions of this Lease, the Premises for Tenant’s own use in the conduct of Tenant’s business together with (i) the non-exclusive right to use the number of Tenant’s Allocated Parking Stalls within the Common Area (subject to the limitations set forth in Section 4.6), and (ii) the non-exclusive right to use the Common Area for ingress to and egress from the Premises. Landlord reserves the use of the exterior walls, the roof and the area beneath and above the Premises, together with the right to install, maintain, use and replace ducts, wires, conduits and pipes leading through the Premises in locations which will not materially interfere with Tenant’s use of the Premises. The Premises have not undergone an inspection by a Certified Access Specialist (“CASp”) to determine whether or not the Premises meets all applicable construction-related accessibility standards pursuant to California Civil Code Section 55.51 et. seq. Accordingly, pursuant to California Civil Code § 1938(e), Landlord hereby further states as follows: “A Certified Access Specialist (CASp) can inspect the subject premises and determine whether the subject premises comply with all of the applicable construction-related accessibility standards under state law.

6

Although state law does not require a CASp inspection of the subject premises, the commercial property owner or lessor may not prohibit the lessee or tenant from obtaining a CASp inspection of the subject premises for the occupancy or potential occupancy of the lessee or tenant, if requested by the lessee or tenant. The parties shall mutually agree on the arrangements for the time and manner of the CASp inspection, the payment of the fee for the CASp inspection, and the cost of making any repairs necessary to correct violations of construction-related accessibility standards within the premises”. Landlord shall have the right (but not the obligation) to obtain a report from a CASp, and, in the event that Landlord does so, and such report provides that the Project is in compliance (or any issues of non-compliance are corrected), then, as between Landlord and Tenant, (regardless of whether the claim is brought by any third party, including a subtenant or invitee of Tenant) such report, upon delivery to Tenant shall be conclusive that Landlord has complied with any obligation relating specifically to matters covered by the CASp as of delivery (and exclusive of any improvements made by Tenant) pursuant to California Civil Code sections 55.52 and 55.53. Landlord and Tenant agree that if Tenant requests or performs a CASp inspection of the Premises, Building or Project, then (i) Tenant shall pay the fee for such inspection, (ii) Tenant shall reimburse Landlord upon demand for the cost of making any repairs necessary to correct violations of construction-related accessibility standards to the Premises, Building and/or Project; and (iii) if Tenant commissions an inspection by a CASp, Tenant (a) will not provide Landlord with a copy of such report unless specifically requested in writing by Landlord; (b) shall be responsible for any and all consequences resulting from the commissioning of such inspection, including, but not limited to, implementing, managing and performing any and all repairs, improvements and/or modifications to the Premises, Building, Project or Common Areas related to addressing and/or correcting any violations disclosed by such inspection; and (c) shall indemnify, defend and hold Landlord harmless from and against any and all losses, liabilities, damages, costs and claims that may be made against Landlord by any party claiming that Landlord had knowledge of a non-compliance of the Premises, Building, Project or Common Areas with applicable laws as a result of such inspection. Notwithstanding clause (ii) of the immediately preceding sentence, Landlord may elect to require Tenant to implement, manage and/or perform such repairs, improvements and/or modifications in lieu of Landlord performing such and requiring reimbursement from Tenant.

(b) In the event the Premises is not ready for occupancy on September 1, 2017 (the “Temporary Space Commencement Date”), Landlord agrees to provide to Tenant and Tenant shall have the right to use, subject to the terms and provisions of this Article 2.1(b), approximately 2,228 rentable square feet commonly known as Suites 105 and 106 and located on the first (1st) floor of Building (the “Temporary Space”), as such Temporary Space is shown on Exhibit B-1 attached hereto and incorporated herein, as temporary office space. If applicable, the Temporary Space shall be made available to Tenant commencing on the Temporary Space Commencement Date and shall expire at 11:59 p.m. Pacific Time on the day immediately preceding the Commencement Date (the “Temporary Space Termination Date”). Tenant accepts the Temporary Space in its “AS IS, WHERE IS” condition and shall not be entitled to make any alterations, improvements or modifications to the Temporary Space, provided that Tenant may install telephone and data cabling to the Temporary Space upon receipt of Landlord’s consent, which consent shall not be unreasonably withheld. Prior to the Commencement Date, Tenant shall remove or cause to be removed from the Premises all telephone, data, and other cabling and wiring (including any cabling, wiring, control panels or sensors associated with any wi-fi network serving the Temporary Space, audio/visual system, electronic communication system or security system, if any) existing in, or serving, the Temporary Space installed by or caused to be installed by Tenant (including any cabling and wiring, installed above the ceiling of the Temporary Space or below the floor of the Temporary Space) and all debris and rubbish related thereto, and such similar articles of any other persons claiming under Tenant, and Tenant shall repair at its own expense all damage to the Temporary Space and Building resulting from such removal. During Tenant’s occupancy of the Temporary Space, all terms and provisions of this Lease shall apply to Tenant’s use and occupancy of the Temporary Space (excluding, however, Tenant’s obligation to pay Base Monthly Rent and Additional Rent with respect to the Temporary Space) as if the Temporary Space was considered part of the Premises; provided, however, Landlord shall have no obligation to make any alterations, improvements or modifications to the Temporary Space, or provide any allowances or rent credits with respect thereto. Tenant agrees to remove all furniture and other personal property from the Temporary Space on or prior to the Temporary Space Termination Date and vacate and surrender same to Landlord in the same condition as received. Should Tenant continue to occupy the Temporary Space past the Temporary Space Termination Date, Tenant shall be in holdover of the Temporary Space,

7

subjecting Tenant to the terms and provisions of Article 15.3 of this Lease with respect to the Temporary Space; provided, however, such tenancy shall be a tenancy at sufferance and rent payable for any such tenancy shall be (a) Six Thousand Six Hundred Eighty Four Dollars ($6,684.00) for the first thirty days; and (b) Ten Thousand Twenty Six Dollars ($10,026.00) per month for each month thereafter.

2.2 Commencement Date.

(a) The Scheduled Commencement Date shall be only an estimate of the actual Commencement Date, and the Lease Term shall begin on the first to occur of the following, which shall be the “Commencement Date”: (i) the date Landlord offers to deliver possession of the Premises to Tenant following substantial completion of all improvements to be constructed by Landlord pursuant to Section 2.3 except for punchlist items which do not prevent Tenant from using the Premises for the Permitted Use, or (ii) the date Tenant reenters into occupancy of all of the Premises after having vacated pursuant to Section 2.8. Notwithstanding the foregoing, the actual Commencement Date shall not be earlier than September 1, 2017. Promptly following the delivery of possession of the Premises by Landlord to Tenant, Landlord shall deliver Tenant written confirmation of the Commencement Date and such other terms as Landlord shall determine appropriate; provided, however, failure to deliver such written confirmation shall not affect the Commencement Date.

(b) Notwithstanding anything in this Lease to the contrary, Tenant (upon no less than five (5) business days’ notice to Landlord) shall have the unilateral right to occupy those certain portions of the Premises (as applicable, instead of the entire Premises) (1) in which Landlord has substantially completed the improvements required pursuant to Article 2.3 below and determined that such portion of the Premises is prepared for occupancy, both as Landlord reasonably determines; and (2) for which Tenant has received a temporary certificate of occupancy, in which event, (i) the Commencement Date shall not be deemed to have occurred until determined pursuant to Section 2.1(a) but such tenancy and occupancy by Tenant shall be subject to all terms and conditions of this Lease notwithstanding that the Commencement Date has not yet occurred, and (ii) Tenant’s Base Monthly Rent due and owing under this Lease shall be pro-rated on a per square footage basis until the Commencement Date occurs.

(c) Reference is herein made to those certain improvements, additions and/or alterations being constructed by Landlord to the Common Area (the “Common Area Improvements”). A list of all Common Area Improvements planned as of the Lease Reference Date is attached hereto as Exhibit E. Notwithstanding anything in this Lease to the contrary, in the event the Common Area Improvements are not substantially completed by September 1, 2017, and the remaining Common Area Improvements to be performed directly and materially adversely impact Tenant’s use and enjoyment of the Premises, the Base Monthly Rent otherwise due and owing under this Lease shall be $23,995.10 until the earlier of the date on which the Common Area Improvements are substantially completed or the remaining Common Area Improvements to be completed no longer directly and materially adversely impact Tenant’s use and enjoyment of the Premises.

2.3 Construction of Improvements. Landlord shall construct certain improvements that shall constitute or become part of the Premises if required by, and then in accordance with, the attached Exhibit C. Except as specifically provided in Exhibit C and this Section 2.3, Landlord shall have no obligation whatsoever to in any way alter or improve the Premises. Tenant acknowledges that it has had an opportunity to conduct, and has conducted, such inspections of the Premises as it deems necessary to evaluate its condition. In addition, Landlord shall deliver the Premises to Tenant with all building systems in good working order. Except as otherwise specifically provided herein, Tenant agrees to accept possession of the Premises in its then existing condition “as-is”, including all patent and latent defects. Tenant’s taking possession of any part of the Premises shall be deemed to be an acceptance by Tenant of any work of improvement done by Landlord in such part as complete and in accordance with the terms of this Lease, subject to Landlord’s obligations, if any, under Exhibit C.

2.4 Delay in Delivery of Possession. If for any reason Landlord cannot deliver possession of the Premises to Tenant on or before the Scheduled Commencement Date, Landlord shall not be subject to any liability therefore, and such failure shall not affect the validity of this Lease or the obligations of Tenant

8

hereunder, but, in such case, Tenant shall not be obligated to pay Base Monthly Rent or Tenant’s Share of Operating Expenses until the Commencement Date has occurred; provided, however, if Landlord cannot deliver possession of the Premises to Tenant on or before the date (“Outside Commencement Date”) that is ninety (90) days following the Scheduled Commencement Date, Tenant shall have the right, as its sole and exclusive remedy, to terminate this Lease by providing Landlord with written notice thereof within five (5) days following the Outside Commencement Date (provided, however, in the event that Landlord’s failure to deliver possession of the Premises to Tenant on or before the Outside Commencement Date is attributable, in whole or in part, to any action or inaction by Tenant or Tenant’s Agents or by reason of any causes beyond the reasonable control of Landlord (“Force Majeure Delay”), the Outside Commencement Date shall be extended for the period of delay attributable to the action or inaction by Tenant or Tenant’s Agents in question and/or the Force Majeure Delay in question, as applicable). In the event Tenant provides Landlord with written notice of termination within such five (5) day period, this Lease shall terminate upon such notice and Landlord shall promptly return to Tenant any deposits made by Tenant to Landlord under this Lease. In the event Tenant fails to provide Landlord with written notice of termination within such five (5) day period, this Lease shall continue in full force and effect.

2.5 Early Occupancy. If Tenant enters or permits its Agents to enter the Premises prior to the Commencement Date with the written permission of Landlord, it shall do so upon all of the terms of this Lease (including its obligations regarding indemnity and insurance), and, except as provided below, Tenant shall pay Base Monthly Rent and all other charges provided for in this Lease during the period of such occupancy. Provided that Tenant does not interfere with or delay the completion by Landlord or its agents or contractors of the construction of any tenant improvements, and provided that Landlord has possession of the Premises, Tenant shall have the right to enter the Premises up to fourteen (14) days prior to the anticipated Commencement Date for the sole purpose of installing furniture, trade fixtures, equipment, and similar items, and Tenant shall have no obligation to begin paying Base Monthly Rent or other charges based solely on its installation of these items. Tenant shall be liable for any damages or delays caused by Tenant’s activities at the Premises, and Section 10.3 shall apply to Tenant’s activities. Prior to entering the Premises Tenant shall obtain all insurance it is required to obtain by the Lease and shall provide certificates of said insurance to Landlord. Tenant shall coordinate such entry with Landlord’s building manager, and such entry shall be made in compliance with all terms and conditions of this Lease and the Rules and Regulations attached hereto.

2.6 No Roof Rights. In no event shall Tenant have any rights whatsoever to use all or any portion of the roof of the Building, it being understood and agreed that Landlord expressly reserves the right to use (and/or permit others to use) the roof of the Building in its sole and absolute discretion.

2.7 Delays Caused by Tenant. There shall be no abatement of rent, and the ninety (90) day period specified in Section 2.4 shall be deemed extended, to the extent of any delays caused by acts or omissions of Tenant, Tenant’s agents, employees and contractors, or for Tenant delays as defined in any work letter agreement attached to this Lease, if any (hereinafter “Tenant Delays”). Tenant shall pay to Landlord an amount equal to one thirtieth (1/30th) of the Base Monthly Rent due for the first full calendar month of the Lease term for each day of Tenant Delay. For purposes of the foregoing calculation, the Base Monthly Rent payable for the first full calendar month of the term of this Lease shall not be reduced by any abated rent, conditionally waived rent, free rent or similar rental concessions, if any. Landlord and Tenant agree that the foregoing payment constitutes a fair and reasonable estimate of the damages Landlord will incur as the result of a Tenant Delay. Within thirty (30) days after Landlord tenders possession of the Premises to Tenant, Landlord shall notify Tenant of Landlord’s reasonable estimate of the date Landlord could have delivered possession of the Premises to Tenant but for the Tenant Delays. After delivery of said notice, Tenant shall immediately pay to Landlord the amount described above for the period of Tenant Delay.

2.8 Termination of Existing Lease. Landlord and Tenant are party to that certain Standard Office Lease dated November 23, 2015 (“Suite 206 Lease”), for certain premises located in the Building commonly known as Suite 206 (“Suite 206”). Tenant shall vacate and surrender possession of Suite 206 in the condition required by the Suite 206 Lease no later than 11:59 pm, Pacific Time, three (3) days following receipt of written notice from Landlord to do so (the “Surrender Date”), provided that Tenant shall not be

9

required to vacate and surrender Suite 206 prior to 11:59 p.m. Pacific Standard Time on July 7, 2017. The Suite 206 Lease shall terminate as of the earlier of (a) Tenant’s vacation and surrender of possession of Suite 206; and (b) the Surrender Date. Tenant’s failure to timely surrender possession and vacate Suite 206 pursuant to this Section shall be (i) deemed a holdover in possession of Suite 206 pursuant to Section 25 of the Suite 206 Lease; provided, however, such shall be a tenancy at sufferance and not a month-to- month tenancy; and (ii) a Tenant Delay.

2.9 Option to Expand.

(a) During the initial sixty nine (69) month term of this Lease (but not during any extension of the term), Tenant shall have the one time right of offer (“Right of Offer”) to lease any space which becomes vacant on the first floor of the Building or which Landlord determines will become vacant on the first floor of the Building, after Tenant occupies the Premises (the “Additional Premises”). Tenant’s rights with respect to any portion of the Additional Premises that is vacant as of the date of this Lease shall not apply until after Landlord has entered into a final and binding lease agreement for such portion of the Additional Premises. Prior to leasing any portion of the Additional Premises, Landlord shall give Tenant written notice of its intent to lease such portion the Additional Premises (a “Landlord Notice”). Tenant shall have thirty (30) days after Landlord has given a Landlord Notice in which to provide Landlord with written notice (an “Election Notice”) of its election to exercise its right to lease all of the offered portion of the Additional Premises (Tenant shall not have the right to elect to lease part of the offered portion of the Additional Premises). Tenant shall pay Base Rent for the Additional Premises at the “Market Rate” (as defined below). If Tenant timely and properly delivers and Election Notice (a) the commencement date of Tenant’s lease of such portion of the Additional Premises shall be the date on which Landlord offers to tender possession to Tenant; (b) possession shall be delivered in “as is” condition, without representation or warranty, and Landlord shall not be required to make any modifications or alterations to the Additional Premises or provide Tenant with a tenant improvement allowance; (c) such portion of the Additional Premises shall be automatically added to the “Premises” and be a part thereof for all purposes under this Lease other than Landlord’s obligation to make improvements pursuant to Exhibit C; (d) the term of the Lease (i) for the Additional Premises shall be coterminous with the Term for the Premises if no tenant improvement allowance for the Additional Premises is provided by Landlord and if Landlord is not required to perform any tenant improvements to the Additional Premises; or (ii) shall be extended such that the expiration date of the Lease is the last day of the sixtieth (60th) full calendar month after the Additional Premises commencement date if Landlord provides a tenant improvement allowance for the Additional Premises or is required to perform any tenant improvements to the Additional Premises; (e) as of the Additional Premises commencement date, Tenant’s Share and Tenant’s Allocated Parking Stalls shall be appropriately adjusted to reflect the addition of the Additional Premises; and (f) concurrently with Tenant’s delivery of the Election Notice Tenant shall pay Landlord (i) prepaid rent for the first month of its lease of the Additional Premises; plus (ii) an additional security deposit, which shall be added to the Security Deposit (as defined below), such that the total Security Deposit held by Landlord is an amount equal to one hundred percent (100%) of the last calendar month of the Lease term (as extended pursuant to this Section). All of the other terms and conditions pertaining to the lease of the Additional Premises shall be agreed to by Landlord and Tenant within ten (10) business days after Landlord receives Tenant’s written notice. If Landlord and Tenant are unable to agree on such terms and conditions within the ten (10) business day period, Tenant’s right to lease the Additional Premises shall automatically expire and Tenant shall have no further right to lease the Additional Premises. All of the terms and conditions for the lease of the Additional Premises shall be satisfactory to Landlord, in Landlord’s sole discretion. If Tenant does not give Landlord written notice of its election to lease such portion of the Additional Premises within thirty (30) days after delivery of a Landlord Notice, Landlord shall thereafter be free to lease such portion of the Additional Premises to a third party on any terms and conditions that Landlord shall select, with no further obligation (except for notice as provided below) to Tenant related to such portion of the Additional Premises. In the event that Landlord offers any space to Tenant pursuant to this right of offer and Tenant does not lease the space, the space so offered shall no longer be subject to this right of offer and thereafter Landlord shall not be obligated to offer said space to Tenant. Landlord shall attempt to provide Tenant with courtesy notice upon obtaining a third party offer for such Additional Premises that is acceptable to Landlord. Notwithstanding the foregoing, Landlord’s failure to provide such notice shall not provide Tenant with any rights or recourse and Tenant shall not have any right to the Additional Premises resulting from such courtesy notice. Tenant shall not have the right to exercise the

10

right of offer granted in this section, at any time that Tenant has subleased all or any portion of the Premises or at any time Tenant is in default (beyond any applicable notice and cure period) as defined in the Lease. This right of offer shall be subject to the prior and existing rights of the other tenants in the Project to lease any portion of the Additional Premises, including, but not limited to, any tenant who has the legal right or option to renew or extend its lease.

(b) The term “Market Rate” shall mean the annual amount per rentable square foot that a willing, comparable tenant would pay and a willing, comparable landlord of a similar office building would accept at arm’s length for similar space, giving appropriate consideration to the following matters: (i) annual rental rates per rentable square foot; (ii) the type of escalation clauses (including, but without limitation, operating expense, real estate taxes, and CPI) and the extent of liability under the escalation clauses (i.e.. whether determined on a “net lease” basis or by increases over a particular base year or base dollar amount); (iii) rent abatement provisions reflecting free rent and/or no rent during the lease term; (iv) length of lease term (to be determined by Landlord in accordance with (a) above, in Landlord’s sole discretion); (v) size and location of premises being leased; (vi) the amount of any tenant improvement allowance; and (vii) other generally applicable terms and conditions of tenancy for similar space.

(c) If Tenant exercises the Right of Offer, Landlord shall determine the Market Rate by using its good faith judgment. Landlord shall provide Tenant with written notice of such amount within ten (10) business days after Tenant delivers its Election Notice to Landlord. Tenant shall have five (5) business days (“Tenant’s Review Period”) after receipt of Landlord’s notice of the rental rate within which to accept such rental. In the event Tenant fails to accept in writing such rental proposal by Landlord, then such proposal shall be deemed rejected, and Landlord and Tenant shall attempt to agree upon such Market Rate, using their best good faith efforts. If Landlord and Tenant fail to reach agreement within five (5) business days following Tenant’s Review Period (“Outside Agreement Date”), then each party shall place in a separate sealed envelope their final proposal as to the Market Rate, and such determination shall be submitted to arbitration in accordance with subsections (i) through (v) below.

(i) Landlord and Tenant shall meet with each other within three (3) business days after the Outside Agreement Date and exchange their sealed envelopes and then open such envelopes in each other’s presence. If Landlord and Tenant do not mutually agree upon the Market Rate within one (1) business day of the exchange and opening of envelopes, then, within three (3) business days of the exchange and opening of envelopes, Landlord and Tenant shall agree upon and jointly appoint a single arbitrator who shall by profession be a real estate broker or agent who shall have been active over the five (5) year period ending on the date of such appointment in the leasing of commercial buildings similar to the Premises in the geographical area of the Premises. Neither Landlord nor Tenant shall consult with such broker or agent as to his or her opinion as to the Market Rate prior to the appointment. The determination of the arbitrator shall be limited solely to the issue of whether Landlord’s or Tenant’s submitted Market Rate for the Additional Premises is the closest to the actual Market Rate for the Additional Premises as determined by the arbitrator, taking into account the requirements for determining Market Rate set forth herein. In addition, Landlord or Tenant may submit to the arbitrator with a copy to the other party within three (3) business days after the appointment of the arbitrator any market data and additional information such party deems relevant to the determination of the Market Rate (“RR Data”), and the other party may submit a reply in writing within two (2) business days after receipt of such RR Data.

(ii) The arbitrator shall, within three (3) business days of his or her appointment, reach a decision as to whether the parties shall use Landlord’s or Tenant’s submitted Market Rate and shall notify Landlord and Tenant of such determination.

(iii) The decision of the arbitrator shall be final and binding upon Landlord and Tenant.

(iv) If Landlord and Tenant fail to agree upon and appoint an arbitrator, then the appointment of the arbitrator shall be made by the presiding judge of the Superior Court for the County in which the Premises is located, or, if he or she refuses to act, by any judge having jurisdiction over the parties.

11

(v) The cost of the arbitration shall be paid by Landlord and Tenant equally.

(d) Such portion of the Additional Premises shall be leased to Tenant pursuant to an amendment to this Lease, which Landlord and Tenant shall execute promptly once all business terms for the Additional Premises have been agreed to. The consequence of Landlord and Tenant not being able to agree on the terms and conditions of the lease amendment shall be that Landlord shall have no further obligation to lease such portion of the Additional Premises to Tenant and Tenant shall have no further obligation or right to lease such portion of the Additional Premises from Landlord pursuant to this section.

ARTICLE 3

RENT

3.1 Base Monthly Rent. Commencing on the Commencement Date and continuing throughout the Lease Term, Tenant shall pay to Landlord the Base Monthly Rent set forth in Section K of the Summary.

3.2 Additional Rent. Commencing on the Commencement Date and continuing throughout the Lease Term, Tenant shall pay the following as additional rent (the “Additional Rent”): (i) any late charges or interest due Landlord pursuant to Section 3.4; (ii) Tenant’s Share of Operating Expenses as provided in Section 8.1; (iii) Landlord’s share of any Transfer Consideration received by Tenant upon certain assignments and sublettings as required by Section 14.1; (iv) any legal fees and costs due Landlord pursuant to Section 15.9; and (v) any other sums or charges payable by Tenant pursuant to this Lease.

3.3 Payment of Rent. Concurrently with Tenant’s execution of this Lease, Tenant shall pay to Landlord the amount set forth in Section L of the Summary as prepayment of rent for credit against the first installment(s) of Base Monthly Rent. All rent required to be paid in monthly installments shall be paid in advance on the first day of each calendar month during the Lease Term. If Section K of the Summary provides that the Base Monthly Rent is to be increased during the Lease Term and if the date of such increase does not fall on the first day of a calendar month, such increase shall become effective on the first day of the next calendar month. All rent shall be paid in lawful money of the United States, without any abatement, deduction or offset whatsoever (except as specifically provided in Sections 11.4 and 12.3), and without any prior demand therefore. Rent shall be paid to Landlord at its address set forth in Section R of the Summary, or at such other place as Landlord may designate from time to time. Tenant’s obligation to pay Base Monthly Rent and Tenant’s Share of Operating Expenses shall be prorated at the commencement and expiration of the Lease Term.

3.4 Late Charge and Interest. Tenant acknowledges that late payment by Tenant to Landlord of Rent under this Lease will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which is extremely difficult or impracticable to determine. Such costs include, but are not limited to, processing and accounting charges, late charges that may be imposed on Landlord by the terms of any Security Instrument, and late charges and penalties that may be imposed due to late payment of Real Property Taxes. Therefore, if any installment of Base Monthly Rent or any payment of Additional Rent or other rent due from Tenant is not received by Landlord in good funds by the date that is three (3) business days after its due date, Tenant shall pay to Landlord an additional sum equal to five percent (5%) of the amount overdue as a late charge; provided, however, such late charge shall be waived for the first late payment of Rent in any calendar year provided Tenant makes such payment within three (3) business days after receipt of written notice. The parties acknowledge that this late charge represents a fair and reasonable estimate of the costs that Landlord will incur by reason of late payment by Tenant. In no event shall this provision for a late charge be deemed to grant to Tenant a grace period or extension of time within which to pay any rent or prevent Landlord from exercising any right or remedy available to Landlord upon Tenant’s failure to pay any rent due under this Lease in a timely fashion, including any right to terminate this Lease pursuant to Section 13.2C. If any rent remains delinquent for a period in excess of thirty (30) days then, in addition to such late charge, Tenant shall pay to Landlord interest on any rent that is not paid when due at the Agreed Interest Rate following the date such amount became due until paid.

12

3.5 Security Deposit. Concurrently with its execution of this Lease, Tenant shall deposit with Landlord the amount set forth in Section M of the Summary as security for the performance by Tenant of its obligations under this Lease, and not as prepayment of rent (the “Security Deposit”). Landlord may from time to time apply such portion of the Security Deposit as is necessary for the following purposes: (i) to remedy any default by Tenant in the payment of rent; (ii) to repair damage to the Premises caused by Tenant; (iii) to clean the Premises upon the expiration or sooner termination of the Lease; and/or (iv) to remedy any other default of Tenant to the extent permitted by Law, including, without limitation, on account of damages owing to Landlord under Section 13.2, and, in this regard, Tenant hereby waives any restriction on the uses to which the Security Deposit may be put contained in California Civil Code Section 1950.7. In the event the Security Deposit or any portion thereof is so used, Tenant agrees to pay to Landlord promptly upon demand an amount in cash sufficient to restore the Security Deposit to the full original amount. Landlord shall not be deemed a trustee of the Security Deposit, may use the Security Deposit in business, and shall not be required to segregate it from its general accounts. Tenant shall not be entitled to any interest on the Security Deposit. If Landlord transfers the Premises during the Lease Term, Landlord may pay the Security Deposit to any transferee of Landlord’s interest in conformity with the provisions of California Civil Code Section 1950.7 and/or any successor statute, in which event the transferring Landlord will be released from all liability for the return of the Security Deposit. If Tenant performs every provision of this Lease to be performed by Tenant, the unused portion of the Security Deposit shall be returned to Tenant (or the last assignee of Tenant’s interest under this Lease) within fifteen (15) days following the expiration or sooner termination of this Lease and the surrender of the Premises by Tenant to Landlord in accordance with the terms of this Lease. If this Lease is terminated following an Event of Tenant’s Default, the unpaid portion of the Security Deposit, if any, shall be returned to Tenant two (2) weeks after final determination of all damages due Landlord, and, in this respect, the provisions of California Civil Code Section 1950.7 are hereby waived by Tenant.

ARTICLE 4

USE OF PREMISES

4.1 Limitation on Use. Tenant shall use the Premises solely for the Permitted Use specified in Section N of the Summary and for no other purpose whatsoever without the prior written consent of Landlord, which consent may be withheld and/or conditioned by Landlord in its sole and absolute discretion. Tenant shall not do anything in or about the Premises which will (i) cause structural injury to the Building, or (ii) cause damage to any part of the Building except to the extent reasonably necessary for the installation of Tenant’s Trade Fixtures and Tenant’s Alterations, and then only in a manner which has been first approved by Landlord in writing. Tenant shall not operate any equipment within the Premises which will (i) materially damage the Building or the Common Area, (ii) overload existing electrical systems or other mechanical equipment servicing the Building, (iii) impair the efficient operation of the sprinkler system or the heating ventilating or air conditioning (“HVAC”) equipment within or servicing the Building, or (iv) damage, overload or corrode the sanitary sewer system. Tenant shall not attach, hang or suspend anything from the ceiling, roof, walls or columns of the Building other than photographs, projectors, whiteboards, and the like typically hung in similar office environments or set any load on the floor in excess of the load limits for which such items are designed nor operate hard wheel forklifts within the Premises. Any dust, fumes, or waste products generated by Tenant’s use of the Premises shall be contained and disposed so that they do not (i) create an unreasonable fire or health hazard, (ii) damage the Premises, or (iii) result in the violation of any Laws. Tenant shall not change the exterior of the Building or install any equipment or antennas on or make any penetrations of the exterior or roof of the Building. Tenant shall not commit any waste in or about the Premises, and Tenant shall keep the Premises in a neat, clean, attractive and orderly condition, free of any nuisances. If Landlord designates a standard window covering for use throughout the Building, Tenant shall use this standard window covering to cover all windows in the Premises. Tenant shall not conduct on any portion of the Premises or the Project any sale of any kind, including, without limitation, any public or private auction, fire sale, going-out-of-business sale, distress sale or other liquidation sale.

13

4.2 Compliance with Regulations. Tenant shall not use the Premises in any manner which violates any Laws or Private Restrictions which affect the Premises. Tenant shall abide by and promptly observe and comply with all Laws and Private Restrictions. Tenant shall not use the Premises in any manner which will cause a cancellation of any insurance policy covering the Premises, the Building, Tenant’s Alterations or any improvements installed by Landlord at its expense or which poses an unreasonable risk of damage or injury to the Premises. Tenant shall not sell, or permit to be kept, used, or sold in or about the Premises any article which may be prohibited by the standard form of fire insurance policy. Tenant shall comply with all reasonable requirements of any insurance company, insurance underwriter or Board of Fire Underwriters which are necessary to maintain the insurance coverage earned by either Landlord or Tenant pursuant to this Lease.

4.3 Outside Areas. No materials, supplies, tanks or containers, equipment, finished products or semi-finished products, raw materials, inoperable vehicles or articles of any nature shall be stored upon or permitted to remain outside of the Premises.

4.4 Signs. Tenant shall not place on any portion of the Premises any sign, placard, lettering in or on windows, banner, displays or other advertising or communicative material which is visible from the exterior of the Building without the prior written approval of Landlord. All such approved signs shall strictly conform to all Laws, Private Restrictions, and any sign criteria established by Landlord for the Building from time to time, and shall be installed at the expense of Tenant. Tenant shall maintain such signs in good condition and repair, and, upon the expiration or sooner termination of this Lease, remove the same and repair any damage caused thereby, all at its sole cost and expense and to the reasonable satisfaction of Landlord. Landlord shall place Tenant’s name adjacent to the door to the Premises using Building standard suite signage at Landlord’s sole cost and expense. Landlord shall also place Tenant’s name in the Building’s lobby directory and suite signage, at Landlord’s sole cost and expense. Any changes to Tenant’s name shall be paid for by Tenant, at Tenant’s sole cost and expense. Subject to Tenant obtaining any required governmental permits, Tenant shall be entitled to place its name on the exterior of the Building (“Exterior Signage”), at Tenant’s sole cost and expense. Landlord shall have the right to approve the size, design, location and color of Tenant’s name on the Exterior Signage, in Landlord’s reasonable discretion. Tenant shall maintain its name in good condition, at Tenant’s sole cost and expense. Prior to the termination of the Lease, Tenant shall remove its name from the Exterior Signage and repair any damages caused by such removal. Except with respect to a Permitted Transfer, if at any time Tenant has assigned this Lease or has subleased fifty percent (50%) or more of the usable square feet in the Premises, Landlord shall have the right, at Landlord’s option, at any time, upon not less than ninety (90) days advance written notice to Tenant, to require Tenant to permanently remove its name from the Exterior Signage and to repair any damage to the Exterior Signage caused by such removal, at Tenant’s sole cost and expense. From and after the date of such removal, Tenant shall no longer have the right to the Exterior Signage. Tenant shall reimburse Landlord for all costs and expenses associated with modification of any signage within ten (10) days after demand from Landlord.

4.5 No Light, Air or View Easement. Any diminution or shutting off of light, air or view by any structure which may be erected on the Project or any lands adjacent to the Project shall in no way affect this Lease or impose any liability on Landlord.

4.6 Parking. Tenant is allocated and shall have the non-exclusive right to use the non-exclusive parking spaces located within the Project from time to time, for its use and the use of Tenant’s Agents, in common with other tenants of the Project, the number of allocated parking spaces set forth in Section H of the Summary, the location of which parking spaces may be designated from time to time by Landlord. Tenant shall not at any time use more parking spaces than the number so allocated to Tenant or park its vehicles or the vehicles of others in any portion of the Project not designated by Landlord as a non-exclusive parking area. Tenant shall not have the exclusive right to use any specific parking space. If Landlord grants to any other tenant the exclusive right to use any particular parking space(s), Tenant shall not use such spaces, provided that Tenant’s parking allocation under this Lease is not reduced. Tenant shall not park or store vehicles at the Project for more that (24) hours without the Landlord’s written consent in Landlord’s sole and absolute discretion. Such unauthorized vehicles may be towed at Tenant’s expense. Landlord reserves the right, after having given Tenant reasonable notice, to have any vehicles owned by Tenant or Tenant’s Agents utilizing parking spaces in excess of the parking spaces allowed for Tenant’s use to be towed away at Tenant’s cost. All trucks and delivery vehicles shall be (i) parked in such areas as Landlord may designate from time to time, (ii) loaded and unloaded in a manner which does not interfere with the

14

businesses of other occupants of the Project, and (iii) permitted to remain on the Project only so long as is reasonably necessary to complete loading and unloading. In the event Landlord elects or is required by any Law to limit or control parking in the Project, whether by validation of parking tickets or any other method of assessment, Tenant agrees to participate in such validation or assessment program under such rules and regulations as are from time to time established by Landlord.

4.7 Rules and Regulations. Landlord may from time to time promulgate such Rules and Regulations applicable to the Project and/or the Building as Landlord may, in its sole discretion, deem necessary or appropriate for the care and orderly management of the Project and the safety of its tenants and invitees. Such Rules and Regulations shall be binding upon Tenant upon delivery of a copy thereof to Tenant, and Tenant agrees to abide by such Rules and Regulations. If there is a conflict between the Rules and Regulations and any of the provisions of this Lease, the provisions of this Lease shall prevail. Landlord shall have the right, from time to time, to modify, amend and enforce the Rules and Regulations in a non- discriminatory manner, provided that such modification and revisions are uniformly applied to all tenants within the Building. Landlord shall not be responsible for the violation by any other tenant of the Project of any such Rules and Regulations.

4.8 Telecommunications. The use of the Premises by Tenant for the Permitted Use specified in Section N of the Summary shall not include using the Premises to provide telecommunications services (including, without limitation, Internet connections) to third parties, it being intended that Tenant’s telecommunications activities within the Premises be strictly limited to such activities as are incidental to general office use.

4.9 Occupant Density. Tenant shall maintain a ratio of not more than one Occupant (as defined below) for each one hundred ninety (190) square feet of rentable area in the Premises (hereinafter, the “Occupant Density”). If Landlord has a reasonable basis to believe that Tenant is exceeding the Occupant Density, upon request by Landlord, Tenant shall maintain on a daily basis an accurate record of the number of employees and contractors that are present in the Premises (collectively “Occupants”). Landlord shall have the right to audit Tenant’s Occupant record and, at Landlord’s option, Landlord shall have the right to periodically visit the Premises without advance notice to Tenant in order to track the number of Occupants working at the Premises. For purposes of this section, “Occupants” shall not include people not employed by Tenant that deliver or pick up mail or other packages at the Premises, employees of Landlord or employees of Landlord’s agents or contractors. Tenant acknowledges that increased numbers of Occupants causes additional wear and tear on the Premises and the Common Areas, additional use of HVAC, electricity, water and other utilities, and additional demand for other Building services. Tenant’s failure to comply with the requirements of this section shall constitute an Event of Tenant’s Default and Landlord shall have the right, in addition to any other remedies it may have at law or equity, to specifically enforce Tenant’s obligations under this section. Nothing contained in this section shall be interpreted to entitle Tenant to use more parking spaces than the number permitted by this Lease.

4.10 Landlord Charging Stations. Landlord may have previously installed or may elect to install in the future electric vehicle charging stations at the Project for the use of persons working at the Project who drive electric vehicles (“Landlord Charging Stations”). Landlord may elect in its sole discretion to permit only certain persons working at the Project to use the Landlord Charging Stations, and Landlord reserves the right, in its sole discretion, to determine, who will have the right to use the Landlord Charging Stations. If Landlord permits Tenant to use the Landlord Charging Stations, neither Tenant nor any employee, agent, contractor or invitee shall have the right to use the Landlord Charging Stations prior to the execution by such party of a written agreement prepared by Landlord governing such person’s right to use the Landlord Charging Stations (the “Electric Vehicle Charging Agreement”). The terms and conditions of the Electric Vehicle Charging Agreement shall be acceptable to Landlord, in Landlord’s sole discretion. Landlord and Tenant acknowledge that for purposes of Tenant’s indemnity of Landlord set forth in this Lease, the use of the Landlord Charging Stations by Tenant Parties shall constitute a use of the Project by Tenant. The cost of installing, operating, maintaining and repairing the Landlord Charging Stations may be included in Operating Expenses. Tenant acknowledges that the provisions of this Section shall not be deemed to be a representation by Landlord that Landlord will install or continuously maintain during the term of this Lease Landlord Charging Stations, and Landlord shall have the right without liability to Tenant, in Landlord’s sole

15

discretion, not to install Landlord Charging Stations (if none now exist), to increase or decrease the number, type or location of Landlord Charging Stations from time to time or, at any time, to eliminate all of the Landlord Charging Stations. Tenant’s obligations under this Lease are not contingent or conditioned upon the ability of Tenant Parties to use the Landlord Charging Stations or upon the existence of Landlord Charging Stations.

4.11 Storage. Tenant may use, in common with other tenants of the Project, a reasonable amount of the storage space located in the basement of the Building. There shall be no charge for such storage space during the initial sixty nine (69) month Lease term. Tenant acknowledges that the storage space is not secure, is used in common with other tenants of the Project and such other tenants shall have access to Tenant’s property when accessing the storage space. Landlord shall have no liability for loss or damage to Tenant’s personal property located or stored in the storage space.

ARTICLE 5

TRADE FIXTURES AND ALTERATIONS

5.1 Trade Fixtures. Throughout the Lease Term, Tenant may provide and install, and shall maintain in good condition, any Trade Fixtures required in the conduct of its business in the Premises; provided, however, if the installation of any Trade Fixtures will necessitate the making of any Tenant’s Alterations, then Tenant shall not be permitted to make such installation unless and until the applicable Tenant’s Alterations have been approved by Landlord pursuant to Section 5.2. All Trade Fixtures shall remain Tenant’s property.

5.2 Tenant’s Alterations. Construction by Tenant of Tenant’s Alterations shall be governed by the following:

A. Tenant shall not construct any Tenant’s Alterations or otherwise alter the Premises without Landlord’s prior written approval, which approval may be withheld and/or conditioned by Landlord in its sole and absolute discretion. Notwithstanding the foregoing, Tenant may make non structural alterations to the inside of the Premises (e.g., paint and carpet, communication systems, telephone and computer system wiring) without Landlord’s consent, but upon at least ten (10) days prior written notice to Landlord, that do not (i) involve the expenditure of more than $10,000 in the aggregate in any calendar year or more than $40,000 over the Lease Term, (ii) affect the exterior appearance of the Building, (iii) affect the Building’s electrical, plumbing, HVAC, life, fire, safety or security systems, (iv) affect the structural elements of the Building or (v) adversely affect any other tenant of the Project. In the event Landlord’s approval for any Tenant’s Alterations is required, Tenant shall not construct the Tenant’s Alterations until Landlord has approved in writing the plans and specifications therefore, and such Tenant’s Alterations shall be constructed substantially in compliance with such approved plans and specifications by a licensed contractor first approved by Landlord. All Tenant’s Alterations constructed by Tenant shall be constructed by a reputable licensed contractor (approved in writing by Landlord) in accordance with all Laws using new materials of good quality.

B. Tenant shall not commence construction of any Tenant’s Alterations until, as applicable, (i) all required governmental approvals and permits have been obtained, (ii) all requirements regarding insurance imposed by this Lease have been satisfied, (iii) Tenant has given Landlord at least five (5) days’ prior written notice of its intention to commence such construction, and (iv) if requested by Landlord, Tenant has obtained contingent liability and broad form builders* risk insurance in an amount reasonably satisfactory to Landlord if there are any perils relating to the proposed construction not covered by insurance earned pursuant to Article 9.

C. All Tenant’s Alterations shall remain the property of Tenant during the Lease Term but shall not be altered or removed from the Premises. At the expiration or sooner termination of the Lease Term, all Tenant’s Alterations shall be surrendered to Landlord as part of the realty and shall then become Landlord’s property, and Landlord shall have no obligation to reimburse Tenant for all or any portion of the value or cost thereof; provided, however, Landlord expressly reserves the right to require Tenant to remove

16

any Tenant’s Alterations requiring Landlord’s consent hereunder, prior to the expiration or sooner termination of the Lease Term by providing Tenant with written notice thereof prior to or upon such expiration or sooner termination. Notwithstanding the foregoing, if Tenant requests in writing a determination from Landlord at the time it requests Landlord’s consent to a Tenant Alteration whether or not Landlord will require removal of such Tenant Alteration, Landlord shall so notify Tenant in writing concurrently with its granting of consent to such Tenant Alteration (if Landlord so consents thereto). Landlord’s failure to so notify Tenant shall be deemed Landlord’s election to require removal of such Tenant Alteration and restoration of the Premises to its prior condition.

5.3 Alterations Required by Law. Tenant shall, at its sole cost and expense, make any alteration, addition or change of any sort to the Premises, the Building and the Project, that is required by any Law because of (i) Tenant’s particular use or change of use of the Premises; (ii) Tenant’s application for any permit or governmental approval; (iii) Tenant’s construction or installation of any Tenant’s Alterations or Trade Fixtures; or (iv) an Event of Tenant’s Default Any such alterations, additions or changes shall be made by Tenant in accordance with and subject to the provisions of Section 5.2. Any other alteration, addition, or change required by Law which is not the responsibility of Tenant pursuant to the foregoing shall be made by Landlord (subject to Landlord’s right to reimbursement from Tenant specified in Section 5.4).

5.4 Amortization of Certain Capital Improvements. Tenant shall pay as part of Operating Expenses in the event Landlord reasonably elects or is required to make any of the following kinds of capital improvements to the Project and the cost thereof is not the responsibility of Tenant pursuant to Section 5.3: (i) capital improvements required to be constructed in order to comply with any Laws (including compliance with any Hazardous Materials Laws, other than where such compliance is necessitated by reason of the particular use of Hazardous Materials by any tenant or related party or in connection with the remediation of any contamination caused by any tenant or related party, which matters are governed by Section 7.2 below) not in effect or applicable to the Project as of the Effective Date; (ii) modification of existing or construction of additional capital improvements or building service equipment for the purpose of reducing the consumption of utility services or Operating Expenses; (iii) replacement of capital improvements or building service equipment existing as of the Effective Date when required because of normal wear and tear; and (iv) restoration of any part of the Project that has been damaged by any peril to the extent the cost thereof is not covered by insurance proceeds actually recovered by Landlord up to a maximum amount per occurrence of ten percent (10%) of the then replacement cost of the Project. The amount included in Operating Expenses with respect to each such capital improvement shall be determined as follows:

A. All costs paid by Landlord to construct such improvements (including financing costs) shall be amortized over the useful life of such improvement (as reasonably determined by Landlord in accordance with generally accepted accounting principles) with interest on the unamortized balance at the then prevailing market rate Landlord would pay if it borrowed funds to construct such improvements from an institutional lender; and

B. The annual amount included in Operating Expenses shall be amortized once such improvements are completed until the first to occur of (i) the expiration of the Lease Term (as it may be extended), or (ii) the end of the term over which such costs were amortized.

5.5 Mechanic’s Liens. Tenant shall keep the Project free from any liens and shall pay when due all bills arising out of any work performed, materials furnished, or obligations incurred by or at the direction of Tenant or Tenant’s Agents relating to the Project. If Tenant fails to cause the release of record of any lien(s) filed against the Project (or any portion thereof) or its leasehold interest therein by payment or posting of a proper bond within ten (10) days from the date of the lien filing(s), then Landlord may, at Tenant’s expense, cause such lien(s) to be released by any means Landlord deems proper, including, but not limited to, payment of or defense against the claim giving rise to the lien(s). All sums disbursed, deposited or incurred by Landlord in connection with the release of the lien(s) shall be due and payable by Tenant to Landlord on demand by Landlord, together with interest at the Agreed Interest Rate from the date of demand until paid by Tenant.

17

5.6 Taxes on Tenant’s Property. Tenant shall pay before delinquency any and all taxes, assessments, license fees and public charges levied, assessed or imposed against Tenant or Tenant’s estate in this Lease or the property of Tenant situated within the Premises which become due during the Lease Term, including, without limitation, Tenant’s Alterations and Trade Fixtures. If any tax or other charge is assessed by any governmental agency because of the execution of this Lease, such tax shall be paid by Tenant. On demand by Landlord, Tenant shall furnish Landlord with satisfactory evidence of these payments.

5.7 Wi-Fi Network. In the event Tenant desires to install wireless intranet, Internet and communications network (“Wi Fi Network”) in the Premises for the use by Tenant and its employees, then the same shall be subject to the provisions of this Section (in addition to the other provisions of this Article 5). In the event Landlord consents to Tenant’s installation of such Wi-Fi Network, Tenant shall, in accordance with Section 5.8 below, remove the Wi Fi Network from the Premises prior to the termination of the Lease. Tenant shall use the Wi Fi Network so as not to cause any interference to other tenants in the Project or with any other tenant’s communication equipment, and not to damage the Project or interfere with the normal operation of the Project and Tenant hereby agrees to indemnify, defend and hold Landlord harmless from and against any and all claims, costs, damages, expenses and liabilities (including attorneys’ fees) arising out of Tenant’s failure to comply with the provisions of this Section, except to the extent same is caused by the negligence or willful misconduct of Landlord and which is not covered by the insurance carried by Tenant under this Lease (or which would not be covered by the insurance required to be carried by Tenant under this Lease). Should any interference occur, Tenant shall take all necessary steps as soon as reasonably possible and no later than three (3) calendar days following such occurrence to correct such interference. If such interference continues after such three (3) day period, Tenant shall immediately cease operating such Wi Fi Network until such interference is corrected or remedied to Landlord’s satisfaction. Tenant acknowledges that Landlord has granted and/or may grant telecommunication rights to other tenants and occupants of the Project and to telecommunication service providers and in no event shall Landlord be liable to Tenant for any interference of the same with such Wi Fi Network. Landlord makes no representation that the Wi Fi Network will be able to receive or transmit communication signals without interference or disturbance. Tenant shall (i) be solely responsible for any damage caused as a result of the Wi Fi Network, (ii) promptly pay any tax, license or permit fees charged pursuant to any laws or regulations in connection with the installation, maintenance or use of the Wi Fi Network and comply with all precautions and safeguards recommended by all governmental authorities, and (iii) pay for all necessary repairs, replacements to or maintenance of the Wi Fi Network.

5.8 Removal of Cabling, Wiring and Wi-Fi Network. Upon expiration or termination of this Lease, Tenant shall, if requested by Landlord and without expense to Landlord, remove or cause to be removed from the Premises all telephone, data, and other cabling and wiring (including any cabling, wiring, control panels or sensors associated with the Wi Fi Network, audio/visual system, electronic communication system or security system, if any) existing in or serving the Premises installed for, by or caused to be installed by or for Tenant (including any cabling and wiring, installed above the ceiling of the Premises or below the floor of the Premises) and all debris and rubbish related thereto, and such similar articles of any other persons claiming under Tenant, as Landlord may, in its sole discretion, require to be removed, and Tenant shall repair at its own expense all damage to the Premises and Building resulting from such removal.

5.9 Electrical Vehicle Charging Stations Installed by Tenant. Under certain circumstances Section 1952.7 of the California Civil Code (“Section 1952.7”) may permit Tenant to install electric vehicle charging stations (“Tenant Charging Stations”) in the Project’s parking area. In the event Section 1952.7 does permit Tenant to install Tenant Charging Stations and Tenant elects to install Tenant Charging Stations, the Section of the Rules and Regulations attached hereto that is entitled “Electric Vehicle Charging Stations” shall apply to the Tenant Charging Stations.

18

ARTICLE 6

REPAIR AND MAINTENANCE

6.1 Tenant’s Obligation to Maintain. By taking possession of the Premises, Tenant shall be deemed to have accepted the Premises as being in good, sanitary order, condition and repair. Tenant shall, at Tenant’s sole cost and expense, keep the Premises and every part thereof in good condition and repair, damage thereto from causes beyond the control of Tenant and ordinary wear and tear excepted. Tenant shall upon the expiration or sooner termination of this Lease hereof surrender the Premises in the condition described in Section 15.2. Except as specifically provided in an addendum, if any, to this Lease, Landlord shall have no obligation whatsoever to alter, remodel, improve, decorate or paint the Premises or any part thereof and the parties hereto affirm that Landlord has made no representations to Tenant respecting the condition of the Premises or the Building except as expressly herein set forth.

6.2 Landlord’s Obligation to Maintain. Landlord shall repair and maintain, in reasonably good condition, except as provided in Sections 11.2 and 12.3, the following: (i) the structural components of the Building, (ii) the Common Area of the Building, and (iii) the electrical, life safety, plumbing, sewage and HVAC systems serving the Building, installed or furnished by Landlord. It is an express condition precedent to all Landlord’s obligations to repair and maintain that Tenant shall have first notified Landlord in writing of the need for such repairs and maintenance. The cost of such maintenance, repair and services shall be included as part of Operating Expenses unless such maintenance, repairs or services are necessitated, in whole or in part, by the act, neglect, fault or omission of Tenant or Tenant’s Agents, in which case Tenant shall pay to Landlord the cost of such maintenance, repairs and services within ten (10) days following Landlord’s written demand therefore. Tenant hereby waives all rights provided for by the provisions of Sections 1941 and 1942 of the California Civil Code and any present or future Laws regarding Tenant’s right to make repairs at the expense of Landlord and/or to terminate this Lease because of the condition of the Premises.

6.3 Control of Common Area. Landlord shall at all times have exclusive control of the Common Area. Landlord shall have the right, exercisable in its sole and absolute discretion and without the same constituting an actual or constructive eviction and without entitling Tenant to any abatement of rent, to: (i) close any part of the Common Area to whatever extent required in the opinion of Landlord’s counsel to prevent a dedication thereof or the accrual of any prescriptive rights therein; (ii) temporarily close the Common Area to perform maintenance or for any other reason deemed sufficient by Landlord; (iii) change the shape, size, location and extent of the Common Area; (iv) eliminate from or add to the Project any land or improvement, including multi-deck parking structures; (v) make changes to the Common Area, including, without limitation, changes in the location of driveways, entrances, passageways, doors and doorways, elevators, stairs, restrooms, exits, parking spaces, parking areas, sidewalks or the direction of the flow of traffic and the site of the Common Area; (vi) remove unauthorized persons from the Project; and/or (vii) change the name or address of the Building or Project. Tenant shall keep the Common Area clear of all obstructions created or permitted by Tenant. If, in the opinion of Landlord, unauthorized persons are using any of the Common Area by reason of the presence of Tenant in the Building, Tenant, upon demand of Landlord, shall restrain such unauthorized use by appropriate proceedings. In exercising any such rights regarding the Common Area, (i) Landlord shall make a reasonable effort to minimize any disruption to Tenant’s business, and (ii) Landlord shall not exercise its rights to control the Common Area in a manner that would materially interfere with Tenant’s use of the Premises without first obtaining Tenant’s consent, which consent shall not be unreasonably withheld, conditioned or delayed.

ARTICLE 7

WASTE DISPOSAL AND UTILITIES

7.1 Waste Disposal. Tenant shall store its waste either inside the Premises or within outside trash enclosures provided by Landlord

19

7.2 Hazardous Materials. Landlord and Tenant agree as follows with respect to the existence or use of Hazardous Materials in, on or about the Project: